EDITOR’S LETTER

HCB normally steers away from politics but these days there seems to be so much politics going on it’s hard not to engage.

Since the 2008 crash, voters in democratic countries have – quite understandably – begun to reject traditional politics. Unfortunately, what that has meant is that traditional politicians have, in some places, been replaced by idiots. Riding the wave of populism, they are giving us a return to protectionism, stronger border controls and a likely trade war.

That must be a concern to anyone with a grasp of history, raising memories of the 1920s and 1930s and their culmination in a devastating global war. Any repeat of that outcome would be even more destructive with today’s weaponry.

Nowhere is this position more evident than in the UK, with its impending exit from the EU. As Brexit comes closer – we are little more than six months away – it is alarmingly apparent that the UK government has no idea how the UK’s relationship with the EU will look.

To understand this, we have to go back to politics. There has been a schism within the Conservative Party for decades over Europe. Previous prime ministers – Thatcher and Major in particular – managed to face down the anti-European lobby and hold the party together. The 2016 referendum on EU membership was David Cameron’s attempt to do the same –and it failed spectacularly. Not only did it deliver a result that has divided the country but it has made the schism within the Conservative Party even deeper.

The same rift between pro- and anti-Europeans within the party still exists; the anti-Europe faction insists on a ‘hard’ Brexit, which appears to mean a clean break with the EU; the pro-

Europeans want some (as yet ill-defined) relationship with the EU. With a weak prime minister in Theresa May, this rift is unlikely to be healed and no compromise seems to be within reach.

It is becoming more likely that this will result in a ‘no deal’ Brexit. Some anti-Europeans seem perfectly happy with this idea but industry is getting extremely itchy about what it could mean – and there seem to be few fall-back options in place.

Coming closer to home, the Department for Transport has at least confirmed that the UK will continue to apply ADR and RID to the domestic transport of dangerous goods. This is probably not even on the radar of politicians – especially the clueless transport secretary Chris Grayling – but at least our civil servants are on the case.

More immediately, there are deep concerns over border controls and the transport of all goods between the UK and EU. After a meeting with Mr Grayling last month, where representatives of the Road Haulage Association raised those concerns, they came away with the impression that there are no credible contingency plans on place; “He is out of touch and lacking in key information,” one of the RHA members told the Daily Telegraph

Meanwhile, of course, businesses in the UK and their logistics partners are having to try and plan for the unknowable. Whichever way Brexit unfolds it will undoubtedly increase complexity in the supply chain for all manner of goods and add costs, which will inevitably end up with the consumer.

So hang on to your hats: it’s going to be a bumpy ride over the winter!

Peter Mackay

UP FRONT 01 WWW.HCBLIVE.COM

CONTENTS

VOLUME 39 • NUMBER 09

List of major steel drum producers 27 News bulletin – steel drums 32

INDUSTRIAL PACKAGING

Dump those drums Latest kit from Flexicon 34

diary

SAFETY

Log

Not in vain

CSB’s learnings on start-up risks

UP FRONT

Letter from the Editor 01 30 Years Ago 04

Learning by Training 05

View from the Porch Swing 06 Deal or no deal

What Brexit might mean for industry 08

STORAGE TERMINALS

What’s in the tank?

Terminals in a zero-carbon economy 13

Pros and cons

What to expect at TSA conference 18 Sink or swim

A&A addresses flood risks 20

Once in a lifetime Odfjell sells up in Rotterdam 22

News bulletin – storage terminals 23

STEEL DRUMS

Global goodies Greif expands around the world 25 Keep the faith Skolnik under new leadership 26

Investing in Selters Schütz adds to capacity 35

TANKS & LOGISTICS

Sohar, so good JTS expands in Oman, UAE 36

AdBlue – what’s new?

Storage Partners on a special supply chain 38

Joining forces

Transporeon, TMI agree merger 40 News bulletin – tanks and logistics 41

CHEMICAL DISTRIBUTION

That was the year that was Biesterfeld enjoys successful 2017 43 Trust Bodo Bodo Möller adopts ISO 37001 44 Seal that deal Maroon secures succession 45 News bulletin – chemical distribution 46

COURSES & CONFERENCES Training courses 48 Yes we can IATA promotes competency-based training 50

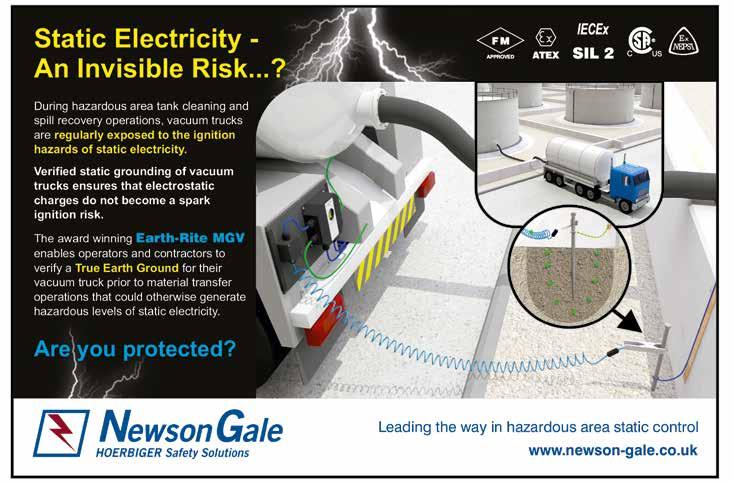

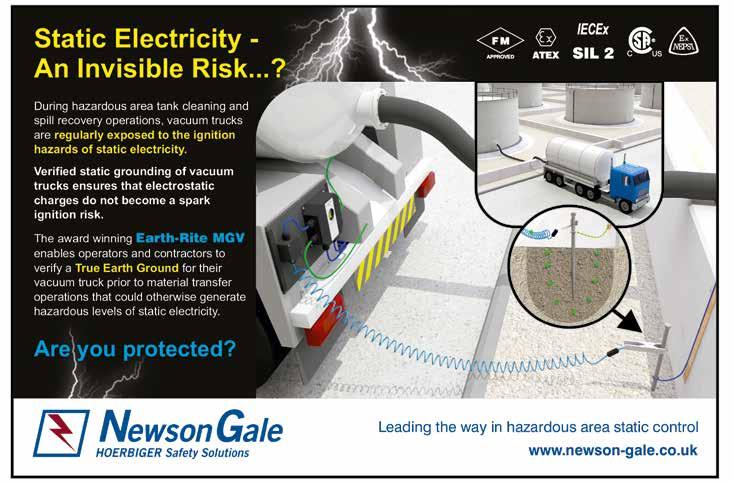

the expert Newson Gale on static hazards

on the line

NCEC on telephone response

A limit on bags

Cefic advice on flexibags

REGULATIONS

Ready or not

VCA looks at post-Brexit regulations

All over the world

COSTHA hears about rule changes

BACK PAGE

Not otherwise specified

Peter Mackay

Email: peter.mackay@hcblive.com Tel: +44 (0) 7769 685 085

Deputy Editor

Sam Hearne

Email: sam.hearne@hcblive.com Tel: +44 (0) 208 371 4041

Managing Director

Samuel Ford

Email: samuel.ford@hcblive.com

Tel: +44 (0)20 8371 4035

HCB Monthly is

Commercial Manager

Newall

Email: ben.newall@hcblive.com Tel: +44 (0) 208 371 4036

Campaigns Director

Craig Vine

Email: Craig.Vine@hcblive.com Tel: +44 (0) 20 8371 4014

by

NEXT MONTH

The Europe issue

talks digitisation

RID/ADR/ADN update

Shortsea shipping market

Reporting back from Fecc Congress

Media

Managing Editor

Email: stephen.mitchell@hcblive.com Tel: +44 (0) 20 8371 4045

While the

and

in good faith and every effort is made to check accuracy,

in HCB are

should verify facts and

directly with

can accept no responsibility in this respect.

sources before acting upon them, as the

2059-5735

Cargo Media Ltd Marlborough House 298 Regents Park Road, London N3 2SZ www.hcblive.com

UP FRONT 03 WWW.HCBLIVE.COM

Editor–in–Chief

published

Cargo

Ltd.

information

articles

published

readers

statements

official

publisher

ISSN

Ben

Stephen Mitchell

Associate Editor Brian Dixon Designer Natalie Clay Conference

52

Incident

53

56 Ask

58 Voice

59

60

62

68

72

EPCA

30 YEARS AGO

A LOOK BACK TO SEPTEMBER 1988

Thirty years ago, HCB notched up a significant milestone: 100 issues since it was first published in January 1980. Things were a bit easier for the staff in those days: no website to feed, no social media, no weekly newsletter. So all the congratulatory editorial coverage was poured into a bumper issue, with several articles by leading figures in the industry looking back at the progress that had been made in recent years in improving safety in the transport of dangerous goods by all modes.

Kicking off those articles, editor Mike Corkhill recalled that, less than a year after HCB opened for business, keen readers were worried that it would have covered everything by the time 1980 was out. But, as we know, things don’t necessarily work out like that. Just in terms of regulation, there had been an extensive revision of ADR and RID to bring them into line with the UN model, and the US, through the fabled HM-181 rulemaking, was heading in the same direction.

In fact, so dramatic had been those changes that Mike felt able in September 1988 to report that most of the pundits corralled into giving their opinions felt that the regulations were nearing their final form and that “only fine-tuning remains”. We can laugh now, but then they didn’t have lithium batteries to worry about in those far-off days.

Consultant Hugh Martin did in fact have plenty of ideas for making the IMDG Code more user-friendly, many of which came to fruition when IMO revamped the Code some years later to fit the UN model. John Cox, former secretary of the ICAO Dangerous Goods Panel, felt the Technical Instructions were working well and that the focus

should swing towards compliance, as recent serious incidents in Boston and Nashville and over Mauritius had shown what could happen if the regulations were ignored.

Herbert Kennard (‘HJK’ to HCB readers) highlighted the difficulty in maintaining modal harmonisation, using the recently adopted provisions for IBCs to show how different regulatory bodies could take very different approaches, despite the existence of a UN model to follow. This would, he predicted, cause problems in European transport when both road and sea legs were involved.

Consultant Bob Lakey, looking at the transport of chemicals in bulk by sea, said that the adoption of Marpol Annex II – which at that time had been in place for just over a year – was “a truly remarkable feat” that would provide both economic and environmental benefits. It also stood the test of time – at least until GHS came along and forced industry to take a close look at some of the provisions.

Helmut Gerhard, managing director of WEW (now part of Thielmann), provided a lucid explanation of the multifarious offerings that could fall under the broad definition of ‘tank container’, still a relatively new concept in international trade although one that, through its promise of safety and reliability, held out the promise of playing a considerable role.

Harri Mostyn, chief dangerous goods officer at PIRA, wondered if there were a better alternative to the UN performance testing regime for packagings; as it was now being taken up by the US and had also been used as the model for new IBC provisions, he thought not.

HCB MONTHLY | SEPTEMBER 2018 04

LEARNING BY TRAINING

By Arend van Campen

OBSOLETE BUSINESS MODELS

A few days ago I received an email from an old friend in the cargo inspection business. He sent me a link to a report which was issued by the Dutch Human Environment and Transport Inspectorate. It was titled: ‘Heavy Fuel Oil for Sea-going vessels, On Road Fuels for West Africa, blended in the Netherlands’.

When analysing fuel oil used for bunkers for vessels, waste oil had been used as blending material and PCBs were found in some of the samples taken. In the Road Fuels section of the report a statement was made that pygas, containing a benzene percentage of over 40 per cent, was used as blendstock for gasoline; light cycle oil (LCO), with a high aromatic and sulphur compound content including polycyclic aromatic hydrocarbons (PAHs) also related to carcinogens, was used as a blendstock to create diesel. The report talked about noncompliance with REACH, SOLAS and MARPOL.

The reason why I am writing this today is that those who may have read my previous columns will immediately understand that something is not right about such a practice. The first rhetorical question I ask is this: “Is blending hazardous materials threatening life and environment good or bad?” You already know the answer.

Without being judgemental I wanted to write something about actually controlling or managing such practices. Would a trader who blends such compounds still be able to control or manage potential risks and effects? Would he or she be able to control the risks of being found out? Again you will know the answer to these questions.

This report can therefore be considered as a non-manageable risk or a so-called non-linear effect driving the trading, shipping and storage business into entropy (disorder). If anyone involved in facilitating such

blends believes that this can be controlled and managed he or she is mistaken, because it directly renders vulnerable anyone allowing this harmful practice.

Let’s talk for a moment about winners and losers. Winners are the traders, the ports, storage terminals, inspection companies, shipping agents, additive suppliers, refiners, waste terminals, transport and shipping companies. Losers are people, human and non-human life, the environment, social cohesion, society and those who know that something wrong is going on, but in order to keep their jobs, must stay quiet. Blending is therefore only possible when everyone profiting won’t speak about it. Blending toxic and hazardous materials may not be illegal, but the main question is this; is it moral? Is it responsible to expose people and the environment? You already know the answer to that question.

Our conscience cannot be switched off. Remorse cannot be escaped. This is a scientific fact. Regulating this obsolete business model will not change it. It needs to be replaced. In systems science we speak about negative interdependent business models, benefiting some at the cost of others. These costs, which may not be listed on the final invoice, are also known as negative externalities. From now on, let’s start including them as the true cost of doing business.

This is the latest in a series of articles by Arend van Campen, founder of TankTerminalTraining. More information on the company’s activities can be found at www.tankterminaltraining.com. Those interested in responding personally can contact him directly at arendvc@tankterminaltraining.com.

UP FRONT 05 WWW.HCBLIVE.COM

FROM THE PORCH SWING

PUT YOUR MONEY WHERE YOUR MOUTH IS

Dear Air Carriers,

I hear that you are interested in reducing the number of undeclared Dangerous Goods packages offered to you. If you are serious about this, read on. I think we can dramatically reduce the number of unintentionally undeclared DG shipments. I also have a separate suggestion for those caught intentionally offering DG undeclared, but public hanging isn’t likely to make a comeback as a regular method of punishment, so this letter is about the ‘Un-Un’s’, the unintentionally undeclared shipments.

As background, you should know that I’ve had customers unintentionally offer DG undeclared, and get caught, which is how they became my customers. Their first reaction, without exception, has been “that stuff isn’t hazardous”, usually, but not quite always, followed by “I can buy it in a grocery store”. The goods shipped undeclared were common sizes of lithium batteries or aerosols. So, a

quick and dirty root cause analysis leads me to believe that if the public knew these kinds of retail products are Dangerous Goods, they wouldn’t ship undeclared.

Of course, it’s more than a bit much to ask air carriers to educate the public around the world about the regulatory difference between personal transport from retail establishments and commercial airline transport. But rather than try to educate everyone, we do have many, many great opportunities to educate a significant portion of the public, those who fly as passengers. And likely, those who can afford to fly regularly are more likely to be in positions of influence at their jobs.

Now, I do realize that some of you are cargo-only carriers, but bear with me, and remember you are sometimes in conferences or trade associations with the passenger carriers, who are perhaps more likely to listen to you than to me. And you are the ones that suffer most from un-un shipments.

Passengers often - heck, probably usually - bring DG with them when they fly. Not just lithium batteries and aerosols, but perfumes, colognes, hand sanitizers, and other personal items as well. Sure, certain amounts of these personal care items are allowed in checked luggage, carry-ons, or both. But that doesn’t mean that they aren’t DG, it just means that they’re ‘allowed’ or ‘permitted’ DG.

It’s this crucial distinction that makes all the difference in whether the passenger learns what’s DG, or, whether they remain with a misconception that leads to un-un. Simple changes could easily teach passengers about what’s really DG. For example, when checking in, a passenger could be asked “do you have more than the allowed 70 ounces of personal care dangerous goods, such as batteries, perfumes, or aerosols”, instead of the typical “do you have any DG”. The latter question, when answered “NO”, and receiving no later correction when bags are inspected, reinforces in passengers’ minds that personal

HCB MONTHLY | SEPTEMBER 2018 06

items are NEVER (emphasis added) DG. The former question though, instills in the passenger the idea that their aerosols or fragrances or computers/tablets/phones might possibly be DG.

Again, what my customers have told me about why they committed a violation can be relevant. One customer, whose company had shipped aerosols un-un, lamented that he’d flown on vacation two weeks before, and no one had told him that the aerosol sunscreen in his luggage was DG. The implication is that if he’d been told it was DG, albeit ‘allowed’ DG, he wouldn’t have committed an un-un violation when he returned to his workplace.

An objection that has been raised to this approach is that it may “frighten” the passengers, who may then choose a different air carrier that ‘doesn’t allow DG in the hold’. First, I’m not convinced that passengers will suddenly become afraid of their personal articles. But, more importantly, second, if all passenger carriers started communicating

the regulations more effectively, and at the same time, there would be no alternative airlines that are ‘less frightening’.

So, that’s it. If all air carriers work together to make sure that passengers understand that although their DG is allowed, it is still DG, then when those passengers get back to work, they can stop offering those things as un-un. All it requires is a bit of cooperation and coordination amongst yourselves. Are you truly serious about reducing unintentionally undeclared shipments being offered? Show us.

Sincerely, A DG consultant not afraid to lose some business as violations decrease.

This is the latest in a series of musings from the porch swing of Gene Sanders, principal of Tampa-based WE Train Consulting; telephone: (+1 813) 855 3855; email gene@wetrainconsulting.com.

UP FRONT 07

LIVE WEEKLY MONTHLY BRINGING NEWS AND ANALYSIS OF THE DANGEROUS Subscribe todayfor just£1 38 1980-2018 YEARS www.hcblive.com

IF THE PUBLIC KNEW SOME RETAIL PRODUCTS ARE DANGEROUS GOODS, THEY WOULDN’T SHIP UNDECLARED

DEAL OR NO DEAL

in international transport. These are not EU instruments in any case, and steps are in hand to make the necessary changes to legislation, referring directly to the agreements rather than to the EU Directive that mandates their implementation.

It also seems likely that the UK will find a way to remain involved with the European Chemicals Agency (ECHA) on some basis, which will enable UK-based manufacturers to obtain the necessary registrations to allow them to place chemical substances on the EU market.

IN SIX MONTHS’ time, the UK will – barring a last-minute change of heart – remove itself from the EU. Even at this late stage, there is considerable uncertainty about the future relationship between the UK and the EU, its biggest trading partner, and that uncertainty is causing problems for industry on both sides of the divide.

There are a few things that are known; the UK will continue to apply the ADR Agreement and RID to the road and rail transport of dangerous goods within the country as well as

Pretty much everything else is up in the air. We are still no clearer on issues such as:

• The nature or terms of any trade agreement between the EU and UK

• The nature or terms of any customs agreement between the EU and UK

• The collection of VAT on goods moving between the EU and UK

• The ability of haulage companies on both sides to move goods between the EU and UK

• The status of the land border between Ireland (EU) and Northern Ireland (UK)

It is worth stressing that the current

impasse has nothing whatsoever to do with trade or economics; it is an inevitable outcome of the long-standing schism within the UK’s ruling Conservative party between pro- and anti-Europe factions. The vote on Brexit was former Prime Minister Cameron’s attempt to bridge that divide; not only did it fail to achieve that target, the schism remains and has perhaps even deepened. It is certainly making it difficult for the government to agree its position in discussions with EU over the terms of the divorce.

KNOWN UNKNOWNS

In this article, HCB has attempted to look at how (or if) those important issues are likely to be resolved and illustrate some of the the problems that will be faced post-Brexit by industries and logistics service providers on both sides of the English Channel.

Trade associations have mostly been lobbying hard for a ‘soft’ Brexit, which would retain some of the benefits of EU membership, and have been working hard to try to highlight the issues. They are also trying to prepare their own members for whichever future awaits.

A recent survey by Close Brothers Asset Finance asked 900 businesses about their plans for Brexit. When asked whether they

HCB MONTHLY | SEPTEMBER 2018 08

BREXIT • WITH THE UK’S DEPARTURE FROM THE EU LOOMING EVER CLOSER, UNCERTAINTY OVER THE NATURE OF ANY FUTURE RELATIONSHIP IS MAKING LIFE DIFFICULT FOR ALL THOSE ENGAGED IN TRADE

had started planning for the various possible outcomes of Brexit, 47 per cent said ‘yes’. “This kind of forward thinking is typical of the enterprise shown by UK’s SMEs,” says Neil Davies, chief executive of Close Brothers Asset Finance. “It clearly demonstrates that in the absence of certainty, businesses have taken it upon themselves to assess the impact leaving the EU will have on the supply chain, which for many businesses exposed to Europe is critical.

“Every sector we polled had some level of export dealings with Europe, which demonstrates clearly just how entwined we are with the continent and how important it’s going to be to ensure the movement of goods isn’t disrupted, both in the short and long term.”

The negotiations surrounding customs and trade are a source of trepidation for any UK company with trade links in the EU. A recent white paper published by the UK government details proposals for “a free trade area for goods” and a “facilitated customs arrangement” which aim to make cross-border trade as frictionless as possible post-Brexit. However, the rifts within the ruling Conservative party in the UK mean that it is far from certain that such proposals will come to fruition.

With this in mind, the Freight Transport Association (FTA) recently said that, if the UK wants to leave the customs union and the EU single market after Brexit, solutions need to be agreed on both the fiscal security and safety side of customs.

There are two points raised by the FTA. The first is the need for a complete security and safety waiver that will remove the need for entry and exit summary declarations. The second is the negotiation of a Mutual Recognition Agreement for Authorised Economic Operator (AEO) status, which will enable companies that are accredited on one side to benefit from the same easements on the other side.

Businesses with AEO status voluntarily meet a wide range of criteria, work in close cooperation with customs authorities to ensure supply chain security and are entitled to enjoy benefits throughout the EU. To qualify for AEO status, businesses must be able to demonstrate that they have both the policies and physical arrangements

required to guarantee that the goods have been transported securely and are properly accounted for. To qualify for the linked status of Authorised Economic Operators (Customs) (AEOC), businesses must currently be able to show at least three years’ experience of meeting customs obligations.

The white paper suggests that where a good reaches the UK border and the destination can be robustly demonstrated by an AEO, it will pay the UK tariff if it is destined for the UK, and the EU tariff if it is destined for the EU. However, the usefulness of any such AEO scheme is dependent on mutual recognition.

Any end-to-end process for the import or export of goods can only work if both the countries of consignment and destination are in agreement.

Currently, the government’s white paper cannot guarantee that AEO status granted in the UK will be recognised by the EU. Without mutual recognition through a full political agreement with the EU, the trusted traders concept would have little value and would not provide ‘frictionless trade’ as the white paper currently suggests.

WORKING TOGETHER

On 9 August, Chris Grayling MP, secretary of state for transport, hosted a road haulage

round table with professional representatives, the Department for Transport (DfT) and other government departments to consider plans for Brexit, including a no deal scenario.

Reflecting on the meeting, Kevin Richardson, chief executive of the Chartered Institute of Logistics and Transport (CILT) said: “Logistics and transport are key to our citizens’ freedoms, security and national prosperity, and frictionless borders are essential. All must now play their part; inaction is not an option, and everyone should collaborate on creating the most effective and efficient solutions for our future outside the EU, as a significant global player.”

During the meeting, CILT requested that the government provides clarity on plans and timelines to assist businesses in their contingency planning. Furthermore, requests were made to conduct research and assess logistics capacity against the demands of the nation under different scenarios, so that major gaps, risks and the implications for private and public sector investment can be determined. This should include assessments on access to non-UK EU labour on which the profession is heavily dependent. Clearly there is not much time for such research to be undertaken.

“It is imperative that we work together to get a solution that ensures that our supply »

UP FRONT 09 WWW.HCBLIVE.COM

chains continue to operate without friction,” says Richardson. “Although we should be prepared for a no deal scenario, CILT will continue to highlight the disruption that such a situation will present to both UK and EU businesses and societies.

“The Institute has been consistent in its advice to government through our Brexit round table meetings, select committee responses and our involvement in advisory groups. One area that CILT has been advocating for many months is the importance of AEO accreditation as a means of supporting international supply chains in customs applications and processing.”

CUTTING TIES

The European Chemicals Agency (ECHA) is the body that administers the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), an EU regulation that aims to improve the protection of human health and the environment from the risks that can be posed by chemicals, while enhancing the competitiveness of the EU chemicals industry.

One of the most pressing questions being asked by small and medium sized enterprises

(SMEs) is: ”will the UK still be covered by REACH after Brexit?”

Back in 2016 when the result of the EU referendum was announced, It became obvious that there are two options with regard to REACH and the UK. One is that the UK could choose a new status of a non-EU country that is a part of the European Economic Area (EEA) and the single market, termed the ‘Norway model’. The other option is for the UK to choose to be part of the European Free Trade Area (EFTA) and be outside the single market but with free trade agreements, like Switzerland. The key difference between the two options is that REACH does apply in Norway but not in Switzerland.

As no mutual agreement has yet been struck between the UK and EU, by 30 March 2019 the UK will no longer have direct access to ECHA and its database and will no longer be able to participate in its regulatory and enforcement coordination. The UK will no longer have a legal obligation to maintain a national helpdesk to provide UK-based companies with advice and assistance in fulfilling their obligations under the EU chemical legislation.

With negotiations still underway, it cannot be determined what the ultimate impact

of the withdrawal will be on ECHA or the economic operators within the EU. However, ECHA has stated that the withdrawal will significantly reduce the Agency’s cooperation with UK authorities.

The Chemical Business Association (CBA) has commented on the Prime Minister’s commitment “to explore the terms on which the UK could remain part of EU agencies such as those that are critical for the chemicals, medicines and aerospace industries.” The Prime Minister said that the UK would negotiate ‘associate membership’ of ECHA.

“The term ‘associate membership’ requires further clarity before industry can begin to make commercial and investment decisions based on a settled regulatory framework,” says Peter Newport, chief executive of CBA. “The industry has already invested many millions of pounds in complying with these regulations, which form a central contractual term in commercial agreements for the supply of chemicals to EU markets.

Regulatory compliance is the key to market access. Without it there can be no trade.”

The uncertainty caused by Brexit has already had an impact on the chemical supply chain with some companies taking matters into their

HCB MONTHLY | SEPTEMBER 2018 10

own hands. CBA is aware of some member firms setting up subsidiary companies in EU member states in order to have a legal entity that can register with ECHA and place substances on the market within the EU.

NEW RULES

With negotiations currently underway, the UK has hinted that it is taking an active role in shaping new EU VAT regulations by 2020. “The government aims to keep VAT processes after EU exit as close as possible to what they are now,” according to Mel Stride, financial secretary to the Treasury.

Should Britain wish to remain inside the EU VAT area, it will continue to be bound by rules set in Brussels that are policed by the European Court of Justice. The other option is to leave the EU VAT regime, which will require infrastructure to impose VAT at borders, similar to the situation at the Swiss-German border. While it might seem an obvious choice for UK consumers, the former breaks one of Prime Minister Theresa May’s fundamental negotiating red lines and so, as with the state of customs, uncertainty still remains.

The implications of exiting the EU without a deal in place would be detrimental for many sectors, particularly road haulage.

The Haulage Permits and Trailer Registration Act gives the UK a legal framework for hauliers to operate in the EU if they need permits or registrations.

The Road Haulage Association (RHA) is concerned that this Act is not enough to allow free passage to UK lorries travelling abroad within the EU if a no-deal Brexit is realised and has been campaigning relentlessly for the UK to strike a deal that maintains free access across borders. “A no-deal Brexit would be a disaster for business,” says Richard Burnett, chief executive of RHA. “Relying on permits would be like a step back in time and would mean a very limited number of UK trucks working abroad, so many firms relying on cross-border haulage won’t survive.”

According to Burnett, “the Dover Strait handles 10,000 lorries each day and processing them is currently seamless. The stark reality is that if customs are put in place, it will take an average of about 45 minutes to process one truck on both sides of

the Channel. If that happens then the queues of HGVs in Kent will make the jams seen in the summer of 2015 appear as little more than waiting for the traffic lights to change.”

If a customs agreement is not put in place in March 2019, hauliers will be faced with the prospect of coming to the UK and having to wait days or even weeks before they can return home, which will be a huge deterrent to them making the journey at all.

On top of customs problems, hauliers would be required to hold a European Conference of Ministers of Transport (ECMT) permit for lorries to carry good internationally, as the EU

Community Licenses that currently allow lorry movement within the EU will cease to be valid when the UK exits the EU. In the 12 months to June 2018, 3.5 million road goods vehicles travelled from Great Britain to Europe, with 2 million of these being foreign-registered vehicles. Needless to say, the increased bureaucracy will cause a massive disruption to cross-border trade.

BORDER CONTROL

Perhaps the most intractable problem concerns the land border between the UK and the rest of the EU – that between Northern Ireland and the Republic of Ireland. The border has been frictionless for people since the Irish Free State was formed in 1922 but it was a customs point for goods until both the UK and Ireland joined the EU. Few want to go back to the pre-EU days, when smuggling was a good source of revenue for the various sectarian groups involved in violence in Northern Ireland and such a move would also threaten the 1998 Good Friday Agreement, which finally ended the violence.

Extensive negotiations to avoid a hard border between the Republic of Ireland and Northern Ireland have been held but, as the departure date looms ever closer, important steps still have to be taken by both governments to ensure a seamless transition. HCB

UP FRONT 11 WWW.HCBLIVE.COM

“LOGISTICS AND TRANSPORT ARE KEY TO OUR NATIONAL PROSPERITY AND FRICTIONLESS BORDERS ARE ESSENTIAL”

WHAT’S IN THE TANK?

the UK and Ireland, says it recognises the need for decarbonisation and the focus on road transport as a major contributor to this goal. However, TSA says, the strategy raises several significant concerns for the bulk liquid storage sector, and more widely for the downstream oil industry.

THE CURRENT POSITION

THE PUSH FOR decarbonisation is gathering pace, nowhere more rapidly than in Europe. Governments are planning to phase out liquidfuelled vehicles within the lifetime of many of those currently at work and, according to a recent study by Wood Mackenzie, we can expect to see global peak oil demand in around 2036.

The massive reduction in the use of gasoline and diesel in particular, along with the concomitant increase in demand for electricity generation, raise serious questions about the future structure of the downstream oil industry. That applies most obviously

to refiners but also to bulk liquids storage terminals. The reduction in refinery capacity in Europe over the past decades means that independent bulk liquids terminals have taken on an increasingly important role in managing fuel supply security. But what future do they have if those fuels are to be withdrawn?

The UK government released details of its decarbonisation strategy in July this year. The Road to Zero – Next steps towards cleaner road transport and delivering our Industrial Strategy sets out the future needs of the country and the steps that will be taken to move towards zero tailpipe emissions. The document does not, though, address the question of how the transition will impact the existing fuel supply infrastructure.

The Tank Storage Association (TSA), which represents bulk liquids storage terminals in

Bulk liquid storage in the UK is an essential part of the fuels supply chain, providing an interface between sea, road, rail, inland barge and pipeline logistics. The tank storage sector provides many of the raw materials and finished products required to ensure that the UK economy thrives and that energy needs are met. The UK is a net importer of both diesel and aviation fuels, which are imported to, and distributed from, bulk liquid storage facilities.

Hydrocarbons account for more than 60 per cent of the volumes of bulk liquids stored at TSA member sites and provide the infrastructure necessary to support the UK demand for transport fuels. UK businesses also rely on these facilities for the export of bulk liquids, including gasoline. Import facilities also provide greater resilience within the supply chain by ensuring flexibility to »

STORAGE TERMINALS 13 WWW.HCBLIVE.COM

DECARBONISATION • WHAT DOES THE FUTURE HOLD FOR THE DOWNSTREAM OIL INDUSTRY IN A WORLD MOVING AWAY FROM HYDROCARBONS? TSA RESPONDS TO THE UK GOVERNMENT

WHAT ROLE WILL TERMINALS PERFORM IF THERE ARE NO LIQUID FUELS GOING INTO TOMORROW’S ROAD VEHICLES?

meet demand, particularly in periods where domestic supplies of transport fuels cannot be guaranteed.

All industrial facilities are subject to continuous maintenance and improvement to ensure that they are efficient, meet the demands of their customers and are compliant with relevant legislation and standards. Financial performance is measured against the returns that those investments make, which ultimately determines viability. Without careful consideration and planning regarding the impacts of decarbonisation, assets that are required to meet current and near-term demand may no longer be viable for owners and investors – impacting on energy security, as well as those businesses that rely on the import and export of bulk liquids in the chemical, agricultural and food markets.

SWITCH TO ELECTRICITY

Electrification is an important aspect of the UK strategy for decarbonisation, particularly for shorter journeys carried out in urban areas and in hybrid vehicles for longer journeys. The government’s strategy sets

out how it intends to encourage the installation of electric charging points both in domestic dwellings and within the existing retail network.

Careful consideration must be given to the logistics for installing charging points on the existing retail network – the number of charging points and their nature (for example fast chargers) will have a significant impact on how and if these can be installed, TSA notes.

All charging points, and access and egress to them, will be required to comply with the current industry best practice as described in the Energy Institute ‘Blue Book’. Where space is available to install charging points, in many instances separate feeds will be required for the site, which will necessitate obtaining the appropriate planning consent and wayleaves.

Legislating sites to provide charging points without providing access to funding may also result in many existing retail sites closing, particularly in rural areas where the demand will be highest.

Emerging technologies should also be considered, for example e-fuels and Power to Liquid (PtL), which are carbon-neutral and can utilise existing infrastructure and

vehicles, TSA says. Consideration must be given to these alternatives, which may have less impact on the environment, economy and required investment within the supply chain as part of the overall strategy. Fuels Europe recently published a vision for 2050, which looked at different viable energy sources that collectively could be developed to meet government targets.

HOLE IN THE POCKET

Any move away from existing liquid fuels will also have a major impact on the UK government’s income. The duty paid on fuels, either as import duty or fuels duty paid by the consumer, is a significant contributor to the UK economy. For all fuels this is estimated to be £28.2bn for 2018-2019, a large proportion of which represents duty paid on road fuels. It would appear that the government has not considered how the loss of this income will be addressed during the transition towards full decarbonisation. At present, electric vehicles enjoy lower per-mile costs than conventionally fuelled vehicles but, if the current level of duty is to be maintained there will have to be some movement in electric power prices.

“We ask that the UK government fully engages with all those businesses engaged in the supply of transport fuels to the UK market and provides appropriate opportunities for formal consultation as necessary,” TSA says.

It is, of course, not just the government that will lose money; terminals are highly reliant on hydrocarbon fuels for occupancy and income and, if those fuels are to be replaced, terminal operators will need to find other cargoes to fill their tanks. Given that any investment in new storage capacity has a long payback period, terminal operators are right to be nervous about the future. What level of capacity will be appropriate? Where should those tanks be located? What other services will need to be provided to meet the very different future needs of industry, consumers and the country at large?

These questions are not specific to the UK. Terminal operators across Europe and, increasingly, in the rest of the world are now trying to find answers. HCB www.tankstorage.org.uk

HCB MONTHLY | SEPTEMBER 2018 14 STORAGE TERMINALS

PROS AND CONS

PREVIEW • THIS YEAR’S TSA CONFERENCE WILL DISCUSS CHALLENGES FACING THE STORAGE SECTOR IN THE UK, WHILE THE EXIBITION WILL OFFER A RANGE OF IDEAS TO HELP MEET THEM

THE TANK STORAGE Conference and Exhibition, the UK’s leading event for the bulk liquid storage sector, will take place on 27 September this year, once again at the Ricoh Arena, Coventry. The conference sessions will feature presentations from government, regulators and industry experts on topics of interest for those working in this sector, while the associated exhibition will offer space to more than 60 vendors to show their wares to a large and interested audience.

The event will begin with an introduction by Paul Denmead, recently installed as president of the Tank Storage Association (TSA), followed by a keynote presentation on trade imbalances and the impact on European storage from Giacomo Boati, director of HIS Markit Oil Markets, Midstream and Downstream Consulting. Other topics to be addressed during the conference include cybersecurity

and mental health in the workplace, led by Sarabjit Purewal of the Health and Safety Executive and independent consultant Jamie Walker, respectively. Both topics will provide a springboard for further discussion.

AROUND THE HALLS

During breaks in the conference, delegates will be able to wander the exhibition hall overlooking the hallowed pitch at the Ricoh, home to both Coventry City FC and Wasps RUFC. Among those hoping to attract buyers will be systems and engineering technology consultancy Frazer-Nash, which will be discussing how it helps the bulk liquids storage sector to develop, enhance and protect its critical assets, systems and processes.

The company offers technical solutions to the problems and challenges facing the sector and aims to deliver safe and effective

bulk liquids storage operations for its clients. Frazer-Nash supports companies’ asset management through integrity, subsidence, fitness-for-service assessments, obsolescence management and helping to improve processing efficiency of a terminal’s assets.

With safety a key focus in the tank storage sector, Frazer-Nash’s safety, risk and reliability services help to assure design compliance of tanks through code assessments and adference to environmental standards. The company has extensive experience in developing safety cases for clients across safety-critical industries. With more than 800 employees, Frazer-Nash works from a network of nine UK and three Australian locations.

When it comes to safety concerns, working at height is quite literally an accident waiting to happen. IFC Inflow, a liquid loading equipment and safe tanker access specialist, will present its fall prevention systems at this year’s TSA exhibition. IFC is a Basildon-based company whose mission is to keep workers safe when accessing road and rail tankers, tank containers and the tops of vehicles used for fluid distribution.

Founded in 1987, IFC began by specialising in plant installations where it installed high-volume liquids transfer equipment.

HCB MONTHLY | SEPTEMBER 2018 18

Progressing forward some years, it sensed increased demand for gantries and safety cages that could keep workers from falls while working in hazardous locations like the tops of tankers. What resulted was a wide range of items, designed in the company’s Essex headquarters and installed in more than 30 countries around the world.

“It’s a sad fact that in 2018, workers are still suffering injuries and even death when working on the tops of tankers or in any truckbased activity,” says Kiran Shaw, director of IFC. “We take a lot of pride in knowing that our safe access systems are becoming the standard for companies who don’t want to wait for a fatality before they act.”

According to recent government statistics, 35 workers were killed by falling from a height at work in 2017. This figure is just one less than the 36 that were killed by moving vehicles and, although safety in the UK has generally increased, manufacturing, agriculture and construction are still the most dangerous industries for workers.

FUTURE-PROOFING

A decline in the number of young people applying for jobs across the fuel storage and distribution sector has become more and more prevalent in recent years. Lincolnshirebased Reynolds Training Services (RTS) will use the TSA exhibition to highlight its new apprenticeships for bulk liquids terminal technicians and the associated qualification that accompanies it.

Internships such as the ones offered by RTS are a proven way to entice young people into skilled labour roles such as technicians and engineers. On 27 June this year, RTS hosted TSA’s ‘SHE’ meeting at the CATCH facility in Stallingborough, where its managing director John Reynolds provided an overview of the progress that has been made in relation to development of the apprenticeship for operational personnel in the bulk liquids warehousing sector. The company has laid out a work-based learning guide that includes competences that need to be achieved by anyone being trained for the occupation, with the first cohort planned to start in 2019.

Concrete Canvas Ltd, which is exhibiting at TSA for yet another year, will be previewing its

award-winning products Concrete Canvas™ (CC) and Concrete Canvas Hydro™ (CCH), both of which have seen growth in sales in the petrochemical and oil and gas sectors. CCH has become the material of choice for projects at tank storage sites both across the UK and globally.

CC is part of a revolutionary new class of materials called Geosynthetic Cementitious Composite Mats (GCCMs). GCCMs consist of a three-dimensional fibre matrix filled with a specially formulated cement mix and backed with PVC. CCH uses the same innovative material technology, with an added thermally weldable geomembrane backing for full impermeability. CC is primarily used for erosion control applications, while CCH is specifically designed for containment.

Notably, CCH was used for the largest UK bund-lining project to date. A 5mm thick variant of CCH (CCH5) was specified for the project at the SemLogistics Ltd oil storage facility in Milford Haven, west Wales. It involved laying 4,000 m² of the material in bunds surrounding two of the facility’s tanks in separate phases between 2014 and 2016. The flexibility of CC and CCH products means that they can be used for a variety of uses outside their core applications and across multiple sectors. These include use in sectors such as temporary works, pipe protection, mining vent walls, tunnel lining and cable protection.

INSPECTION IS KEY

Eddyfi Technologies, which recently acquired M2M, will be previewing its Amigo 2 inspection device. The rugged unit takes advantage of TSC alternating current field measurement (ACFM) technology, able to detect cracks with accurate length and depth.

The Amigo 2 is capable of inspecting a wide range of geometrics through thin metallic and non-conductive coatings several millimetres thick. Although primarily used for above-water inspection projects, Amigo can also be used in shallow-water applications and splash zone weld inspection with the use of underwater probes.

The Amigo 2’s ability to detect the presence of small cracks poses a major benefit over competitive devices; locating small defects early means less work is required to fix it in terms of manpower, equipment and time, which translates into a significant cost saving. Amigo 2 can support a wide variety of singlesensor probes as well as multi-channel array probes. In order to make its products as accessible as possible, these products are available for sale, lease, rent or as part of Eddyfi’s on-site inspection.

HCB will report back on the TSA conference and all the news from the exhibition hall in the November issue. Full details of the event can be found at www.tankstorage.org.uk/ conference-exhibition/. HCB

STORAGE TERMINALS 19 WWW.HCBLIVE.COM

SINK OR SWIM

THE UK IS becoming more susceptible to extreme weather and businesses are being forced to view flooding as a growing concern – one that needs to be better understood and mitigated against. For organisations storing and transporting hazardous goods, extra risk is attached to rising waters, which could lead to pollution, litigation and downtime.

From the floods of 2015/2016 to the heavy snow much of the UK experienced last winter, factors such as climate change and urbanisation are leaving increasing numbers of businesses at risk. Just one of the storms from 2015/2106 – Desmond – cost the UK

economy around £5bn; a huge amount of money that filtered down to the bottom-line of businesses across the UK. From lost days due to staff being unable to get into work, to long-term damage to assets such as stock, equipment and machinery, even businesses that didn’t suffer directly may have been hit by disruption to their supply chain.

More than ever before, a proper understanding of the likelihood of flooding, regular maintenance of assets at risk and the implementation of appropriate flood plans should be taken seriously, to limit damage and the potential of negative environmental

impact. The latter is of particular concern for businesses dealing with hazardous substances where the risk goes beyond operational issues to a duty of care to prevent pollution and keep people safe.

MAKE A PLAN

A Flood Risk Assessment (FRA) will help businesses assess the likelihood of a flooding event so that they can decide how best to protect themselves. In the short term, businesses can sign up the Environment Agency’s flood alert service, which will provide notification when adverse weather conditions are on the horizon.

Adler & Allan has developed a Flood Risk Mapping Platform, FloodMarshal™, which draws on live and historic data to provide an accurate and immediate assessment on the probability of flooding.

Business that find themselves at risk should enlist the support of a local flood responder.

If flooding does strike, they will have the expertise and equipment to help lessen the impact and be able to provide clean-up and pollution prevention services afterwards so that

HCB MONTHLY | SEPTEMBER 2018 20

FLOOD RISKS • ALAN SCRAFTON OF LEADING FLOOD RESILIENCE PROVIDER ADLER & ALLAN EXAMINES HOW TO PROTECT THE TERMINAL AND KEEP THE ENVIRONMENT FREE FROM POLLUTION

businesses can get back up and running again as quickly as possible.

Key to reducing the risk of damage is the implementation of a regular inspection and maintenance regime for assets. In bulk liquids terminals, tanks and bunds are vital to containing hazardous substances so it is essential that they are kept in good order. Where substances are stored on site, drains should be clear and, for fuels in particular, separators must be kept clean and fully operational so that in the event of a flood any excess water can flow away safely.

Responsible businesses understand the challenges of a changing environment and know that preparation is essential to mitigating the risks to business continuity. That includes having local first response measures such as A&A Soakbags™ and appropriate spill kits are on site. Further, permanent flood defences will make the site more resilient to rising water levels.

THE PROBLEM OF WATER

Water ingress can contaminate product, particularly in the case of fuels. When water gets into a fuel storage system, both the fuel and the tank itself are put at risk. The water introduces microbial bacteria to the system and this contamination almost always leads to the corrosion of the metal parts of the tanks and the associated dispensing equipment. This corrosion will produce sludge, which will then contaminate the fuel; if contaminated fuel is used in an engine, it can lead to the degradation of parts.

The age of the tank has no bearing on potential damage - new tank systems seem to be equally as susceptible as old. Problematic levels of rust and sludge have been seen as a result of microbial contamination in as little as 6 to 12 months.

Apart from regular maintenance, protective coatings and linings will provide an additional barrier, helping to stop leakage, water ingress

and corrosion, while extending asset life –a useful step whether flooding is an issue or not.

Since 1988 the UK has been subject to at least one major flood every year, with the risk, severity and frequency on an upward trend, leaving more of us likely to suffer on a regular basis. At the moment, as many as 500,000 commercial properties are located in flood affected areas. For many it’s not a case of ‘if’ flooding happens, but ‘when’.

Adler & Allan offer a 360° flood resilience service, providing businesses with support before, during and after a flood, including access to the latest innovations in flood data mapping and the very best flood mitigation measures. Should the worst happen, A&A is able to deliver 24/7 emergency response and clean-up, 365 days a year thanks to its nationwide team. For more information, visit: http://flood. adlerandallan.co.uk/. HCB

STORAGE TERMINALS 21

ONCE IN A LIFETIME

Goldberg’s exit process “is still ongoing” and that further announcements will be made during the third quarter.

FAMILIAR TERRITORY

KOOLE TERMINALS BV has jumped at the chance to acquire a major bulk liquids terminal in Rotterdam, northern Europe’s largest port. The opportunity arose after Odfjell Terminals BV announced it was considering selling the terminal after its financial partner, Lindsay Goldberg, said earlier this year that it was looking to divest its 49 per cent stake.

Odfjell Terminals (Rotterdam) (OTR) has been in recovery mode for the past five years after a number of incidents led to it being closed by Dutch environmental authorities for remedial work; the process of reintroducing tanks to service is nearing completion but, says Odfjell, more investment is needed to complete the rehabilitation of all its 1.6m m3 of tank storage capacity.

“This is a landmark transaction for us,” says Kristian Mørch, CEO of Odfjell SE.

“We have been working hard to restore profitability at OTR during the past years and the terminal is now ready for the next step of development, which will require significant investments. We are therefore pleased to have Koole as the potential purchaser. Koole has great ambitions for the terminal and we are confident in their ability to realise the value potential this business represents. Following a sale of OTR, Odfjell will have a network of seven tank terminals worldwide. We remain committed to our tank terminals business and will allocate capital for growth of Odfjell Terminals in the years to come.”

Frank Erkelens, CEO of Odfjell Terminals, adds: “OTR is well positioned to continue with building a successful future on the fundaments of its strategic location in the Port of Rotterdam, its unique capabilities, its top quartile safety performance and its strong organization. On behalf of Odfjell Terminals, I pay tribute to all the stakeholders of OTR for their continuous support. Odfjell Terminals remains focused on providing best in class safety and service performance to our respected customers across our terminal network.”

Odfjell SE will receive around $100m as its net proceeds from the $155m cash transaction and expects to record a book loss of some $100m. Odfjell also says that Lindsay

Koole Terminals is no stranger to Rotterdam. It has two terminals in the Pernis area of the port, in which it has recently been investing heavily. It has expanded biodiesel storage and block train handling capacity at its Koole Terminals Minerals (KTM) facility, which will allow customers to centralise their biodiesel and diesel storage requirements at one well-equipped site.

“KTM will be the first terminal operator in ARA to offer block train capabilities of this magnitude and could become a serious competitor to the Hamburg port, which is currently the only high-throughput diesel block train distribution location amongst the larger ports in North West Europe,” says John Kraakman, Koole Terminals’ CEO. Work is expected to be completed later this year. The quay at KTM was recently extended to open the terminal up to Suezmax tanker calls.

Koole has also completed construction of 33 new stainless steel tanks at its Pernis terminal in Rotterdam, adding some 52,000 m3 of new capacity. The work makes the site the largest provider of stainless steel tankage in the ARA region, Koole says. The terminal provides access by truck, train and barge and is designed to serve a variety of markets, including high-density products. HCB www.odfjell.com www.koole.com

HCB MONTHLY | SEPTEMBER 2018 22

ACQUISITION • IT IS NOT OFTEN THAT THE OPPORTUNITY ARISES TO ACQUIRE A MAJOR TERMINAL IN ROTTERDAM. ODFJELL’S DESIRE TO DIVEST ITS FACILITY IS GOOD NEWS FOR KOOLE

NEWS BULLETIN

STORAGE TERMINALS

OILTANKING SHEDS BIO PLANT

Oiltanking has agreed to sell the biodiesel plant at its Amsterdam terminal to Greenergy. The facility was built in 2010 to process vegoils but was never commissioned. Greenergy plans to convert the plant to process waste oils rather than vegoils, in order to meet growing demand for waste-based biofuel in the UK and Europe. The two parties have struck a long-term storage contract for raw materials and biodiesel.

“Oiltanking will also be investing into its own infrastructure in order to accommodate Greenergy’s logistical needs. As Greenergy’s logistical partner we are proud to become an integral part of this green sustainable supply chain,” says Jan Willem van Velzen, managing director of Oiltanking Amsterdam (above). www.oiltanking.com

CLH BUYS INTO MEXICO

Spain’s CLH has agreed to acquire a 60 per cent share in Mexican company HST, which is building a near-100,000-m3 oil products storage terminal in the Valle de México, due to

open in 2020. The terminal will have pipeline connections and is located conveniently for road and rail access for the distribution of fuels to the country’s largest market.

José Luis López de Silanes, president of the CLH Group, says the deal “constitutes a new step forward in the company’s process of internationalisation and one which enables us to continue to move forward in the American continent”.

The project will be the fifth international operation for CLH, following on from investments in the UK, Ireland, Oman and Panama. “The emerging opportunities for the development of infrastructure in Mexico are strengthened by the liberalisation process of the energy sector and the growing level of consumption that the country is experiencing,” says the company.

www.clh.es

TOPOLOBAMPO PICKS SEMPRA

Sempra Energy’s Mexican subsidiary Infraestructura Energética Nova (IEnova) has

won a public tender organised by the Integral Port Authority of Topolobampo to build and operate a marine storage terminal to handle imports of fuels, chemicals and other liquids in the state of Sinaloa. IEnova will be responsible for the full implementation of the project, valued at some $150m, which is due to commence operations late in 2020.

“The Topolobampo project will facilitate access to additional international fuel supplies and help meet growing demand in Mexico,” says Joseph A Householder, president/COO of Sempra Energy. “IEnova’s success in developing new energy infrastructure is contributing to Mexico’s economic growth, creating jobs and diversifying energy supply while benefitting millions of Mexican energy consumers.” www.sempra.com

PBF BUYS NJ ASSETS

PBF Logistics has reached agreement with Crown Point International to acquire CPI Operations LLC, including its storage facility and other idled assets on the Delaware River near Paulsboro, New Jersey. The terminal has some 4m bbl (635,000 m3) of tank capacity, of which half is heated, an Aframax-capable jetty, and rail and truck loading racks. It is also close to PBF Energy’s Paulsboro refinery.

PBF says it is paying a total of $107m for the assets and plans to invest another $8.5m over the coming two years to enhance capabilities. The transaction is due to close this year.

“The acquisition of the East Coast Storage Assets will be immediately accretive and will strategically position the Partnership for the upcoming IMO low-sulphur fuel specification change in 2020 by adding significant marineaccessible storage assets to our portfolio that are capable of handling a range of material from finished petroleum products and residual fuel oils to heavy, high-sulphur refinery feedstocks,” says Matt Lucey, PBF Logistics’ executive vice-president. www.pbflogistics.com

WWW.HCBLIVE.COM STORAGE TERMINALS 23

AMID CLOSES ONE DEAL

American Midstream Partners (AMID) has closed the sale of its marine products terminalling business to institutional investors advised by JP Morgan. The deal includes the Harvey and Westwego terminals in New Orleans and a third facility in Brunswick, Georgia. The sale is part of AMID’s programme to divest non-core assets.

The sale of its refined products terminal business in Texas and Arkansas to DKGP

Energy Terminals has, though, not completed as a result of “extensive federal regulatory approvals delays”. AMID says it will look for alternative buyers. DKGP was established earlier this year as a 50/50 joint venture between Green Plains Partners and Delek Logistics Partners specifically to acquire the terminals.

www.americanmidstream.com

FASTER CRUDE EXPORTS IN TEXAS

Enterprise Products Partners has announced plans to build an offshore crude oil export terminal off the Texas coast. The planned terminal will be able to load VLCCs without

the need for lightering vessels. FEED work has already started and regulatory permitting applications are being prepared.

“On the heels of our second successful loading of a VLCC at the Texas City terminal, we are now planning to expand our capabilities to load crude oil faster and more cost efficiently,” says AJ ‘Jim’ Teague, CEO of Enterprise’s general partner. “Given the long-term outlook for growing supplies of US crude oil production, increasing global demand requiring super tankers, and the future limitations of Gulf Coast port and lightering capacities, we are confident this project will be embraced and supported by both domestic and international customers.”

www.enterpriseproducts.com

CRUDE EXPORT PROJECT FOR TALLGRASS

Tallgrass Energy is to build a new crude oil terminal, Plaquemines Liquids Terminal (PLT), in a joint project with Drexel Hamilton Infrastructure Partners and, in a public/private partnership, the Plaquemines Port & Harbor Terminal District.

The terminal, which is permitted for up to 20m bbl (3.18m m3) of capacity, will be linked to Cushing by a new 30-inch pipeline to be built by Tallgrass. The terminal is expected to be fully operational by mid-2020 and will be able to handle Post-Panamax tankers; Tallgrass says it anticipates building a separate offshore pipeline extension to give the option to load VLCCs, beginning in 2021.

www.tallgrassenergylp.com

ARCLIGHT EYES TLP TAKEOVER

ArcLight Energy Partners has made an offer to take full control of TransMontaigne Partners, through a merger with an ArcLight subsidiary. The all-cash offer is subject to the approval of the Conflicts Committee and holders of a majority of the outstanding common units in TransMontaigne Partners.

ArcLight Capital Partners acquired TransMontaigne’s general partner and a 20 per cent holding in the partnership in 2016.

www.transmontaignepartners.com

MORE TANKS FOR SEABROOK

Seabrook Logistics, the 50/50 joint venture between Magellan Midstream Partners and LBC Tank terminals, is to add nearly 110,000 m3 of additional capacity for crude oil and condensate at its terminal in Texas (left). A new dock will be added, capable of handling Suezmax tankers.

“With increased crude oil production in the Permian Basin and other prolific regions, demand for crude oil storage and export capabilities continues to grow in the Houston Gulf Coast area,” says Michael Mears, Magellan’s CEO. John Grimes, LBC’s group COO, adds: “With the expansion of the Panama Canal and the growing role of the US in increased flows of oil, this is an important development for our project and for the success of our customers.”

Following the expansion, the Seabrook terminal will offer some 490,000 m3 of tankage capacity with two docks for Aframax and Suezmax tankers. There is space available for further expansion of storage capacity up to 870,000 m3, if demand warrants the work.

www.magellanlp.com

HCB MONTHLY | SEPTEMBER 2018 24 STORAGE TERMINALS

GLOBAL GOODIES

MANUFACTURING • GREIF HAS MARKED ONE MILLION DRUMS PRODUCED AT ITS SAUDI PLANT AND ENHANCED ITS OFFERINGS IN ARGENTINA, THE US AND SINGAPORE

GREIF REPORTS THAT it has shipped the one-millionth steel drum produced at its recently opened facility in Jubail, Saudi Arabia. Manufacturing both tighthead and open-top units with or without internal coatings and with gauges ranging from 0.8 mm to 1.2 mm, the Jubail plant, Greif says, can supply drums “using tailor-made solutions that allow automatic loading onto chemical filling lines”. Moreover, as a “specialist supplier to the chemical sector” across Saudi Arabia and other GCC states, the facility “is strategically located in close proximity to major customers, allowing for 24-hour, seven-days-per-week operations and supply, providing potential operational efficiencies for these customers”. “Our team is fully engaged and working every day to provide solutions that improve our customers’ operational efficiency and profitability,” says Europe, Middle East and Africa (EMEA) regional manager Abdennour El Mosor. “Greif strategically located this plant close to key customers to ensure a reliable, quality service that meets or exceeds their expectations. Reaching this significant milestone is key for our business.”

IN-TRANSIT PROTECTION

Sticking with drums, Greif reports that its Latin American operations have now improved the design of the shipping sleeves it employs to protect finished units during transport. “Our plan is to expand the new designs across the region,” says Luciano Levitin, Greif LATAM’s senior sourcing and supply chain director. “This is the result of the hard work of the LATAM sourcing and supply chain team to drive this across the region, providing excellent customer service to our customers.”

Meanwhile, the company has also introduced new branding for the fleet of trucks and trailers it uses to deliver products from its San Juan and Tigre facilities in Argentina. “These new trailers offer customers improved logistical capabilities, including increased load capacity, protecting the products during transport and safe loading and unloading of the trailers,” Levitin notes.

IBCS AND MORE

Further up the packaging mix, Greif has added a new blow moulding machine at its intermediate bulk container (IBC) facility in Alsip, Illinois.

This, the company reveals, will double its current IBC production capacity within the US Midwest. Furthermore, thanks to its use of automated

systems, the new machine “will improve the consistency of the products that are produced, improve the quality of the product and minimise potential contamination”.

“As Greif continues to grow in the IBC marketplace, it is imperative that we are able to meet our customers’ demands for product,” says Gaylord Benner, vice-president and Midwest general manager. “This new blow moulder increases our capacity in the Midwest region and creates the production flexibility to provide our customers with more true value.”

At the other end of the spectrum, Greif Singapore has expanded its plastics jerrycans range with the addition of two new 20-litre and 25-litre models. Boasting “a unique lightweight design for improved handling and transportation”, the new jerrycans are imbued with “an effective anti-glug system [that] provides a consistent, fast and safe flow of product” and are each fitted with a “light yet robust” tamper-evident PlastiCap screwcap closure. “The expansion of [the jerrycan] portfolio will definitely further enhance our leading position in the market as a strategic supplier with the most comprehensive product range,” says Singapore-based key account manager Gezali Rasidi. HCB www.greif.com

STEEL DRUMS 25 WWW.HCBLIVE.COM

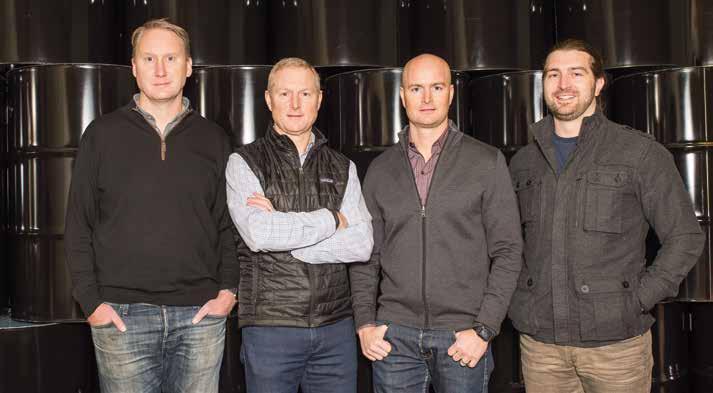

KEEP THE FAITH

THE PAST FEW months have seen a number of key management changes at Chicagobased steel drum manufacturer Skolnik Industries, with erstwhile president and CEO Howard Skolnik becoming board chairman and Dean Ricker moving to the post of president. At the same time, Jon Stein, a former business unit manager at Van Leer who most recently served as vice-president of sales and marketing at reconditioning giant Industrial Container Services, has now joined the company as its new sales manager.

However, despite this shuffling of the pack, Skolnik’s commitment to production quality, unit integrity and customer service remains undented. “Skolnik Industries has always positioned itself as the industry leader

in design and innovation,” Ricker says. “To sustain this position, we employ an on-site staff of engineers that work hand-in-hand with our customers, taking conceptual ideas or complicated material requirements and modelling a functional drum design while ensuring requirements are met for UN recommended performance regulations.”

OPEN LINES

“A priority for Skolnik Industries is to keep our reputation beyond reproach by keeping open lines of communication with top management when needed and a staffed customer service department that treats every customer as if they were our only customer,” he continues. “Skolnik Industries is also known by our customers for being very responsive to sales inquiries, with an experienced and engaged sales staff that provides a quick and knowledgeable response.”

Often described as a ‘boutique manufacturer’, Skolnik serves a diverse

range of customers and industries, including “packaging distributors, military suppliers, energy contractors, chemical manufacturers and winemakers”, with a broad array of standard and bespoke carbon and stainless steel designs that range from seamless and crevice-free drums to 7A Type A units for the handling of radioactive materials. This, Ricker says, seems unlikely to change significantly for the foreseeable future.

“Steel drums remain as a strong competitive option in the industrial packaging arena. Steel drums and pails are easy to fill and handle and also offer superior resistance to impact or puncture. Their functionality, combined with their recyclability, make them a workhorse of the dangerous goods community,” he continues, noting that the company will happily refer any customers in need of drum collection or reconditioning services to an appropriate member of the US Reusable Industrial Packaging Association (RIPA).

TRADE TARIFFS

On the whole, Ricker notes, “the market for steel drums has remained steady” of late, aided by “strong economic activity” in the US and abroad. However, there does appear to be one possible cloud forming in the shape of US trade tariffs. “While the ultimate impact of the tariffs remains unseen, we are continuing to see record price increases by the industry and negative impacts to the global supply chain,” he reports.

“The uncertainty of the impact of the tariffs has caused fear within our customers, supply chain issues in global markets and record price increases in raw material costs domestically,” he says. “The tariffs have also created a degree of uncertainty in the market, with some companies delaying expansion plans while awaiting a resolution.”

Nevertheless, Ricker remains upbeat about the future. “Skolnik Industries sees a continued demand for specialised packaging, with drums manufactured in carbon and stainless steel,” he states. “Over the next five years, we see a growing potential for dangerous goods applications of such specialised drums, with features that will support reusability while continuing to ensure safety.” HCB www.skolnik.com

HCB MONTHLY | SEPTEMBER 2018 26

MANUFACTURING • RECENT MANAGEMENT CHANGES HAVE NOT ALERTED SKOLNIK INDUSTRIES’ COMMITMENT TO PRODUCING HIGH QUALITY STEEL DRUMS

SKOLNIK INDUSTRIES PRIDES ITSELF ON ITS ABILITY TO DELIVER HIGH-QUALITY, BESPOKE DRUM DESIGNS

Algeria Greif (+213 414) 737 23

Argentina Greif (+54 11) 4715 1333

Australia Diversipak (+61 2) 9729 1588

Morris McMahon (+61 2) 9597 1988

VIP Packaging* (+61 3) 8326 9319

Austria Huber Packaging Group (+43 7229) 8789 50

Pirlo (+43 5372) 649 230

Belgium Greif (+32 3) 491 0657

Metalfuts (+32 4) 387 4904

Feraxo (+32 51) 46 01 50

Brazil Greif (+55 11) 5694 9700

Mauser do Brasil* (+55 11) 2168 055

Canada Greif (+1 905) 407 9931

Mauser* (+1 985) 624 5632

Chile Greif (+56 2) 351 0320

Rheem Chilena (+56 2) 557 2064

China Greif (+86 21) 539 65505

OMCE China (+86 398) 285 3686

Tianjin Datian (+86 2) 2256 95335

Wuxi Sifang (+86 1396) 186 0902

Colombia Greif (+57 1) 423 2240

Costa Rica Greif (+50 6) 272 4767

Czech Republic Greif (+420 47) 566 8952

STEEL DRUMS 27 WWW.HCBLIVE.COM

● ● ●

● ● ● ● ●

● ● ▲

● ● ▲ ▲

● ● ● ● ● ● ● ▲ ▲

● ● ● ▲

● ● ●

● ● ● ● ● ▲ ▲

● ● ● ● ▲

● ● ● ● ▲

● ● ● ● ● ▲

● ● ● ● ● ● ● ▲

● ● ● ● ●

● ● ▲

● ● ●

● ● ● ● ● ● ● ▲

● ● ● ▲

● ● ● ▲

● ● ● ● ●

● ● ● ● ●

● ● ● ● ●

● ● ●

● ● ● ● ▲ Denmark Greif (+45) 9627 2100 ● ● ● ● ● ● ▲ ▲ Egypt El Fath* (+203 44) 88733 ● ● ● ● Greif (+20 2) 588 1110 ● ● ● ● ● ▲ ▲ Fiji National Can (+679) 362 944 ● ● Finland Huber Packaging (+358 9) 759 591 ● ● ● ● France Avez (+33 3) 2075 6305 ● ● ● Greif (+33 2) 3518 2081 ● ● ● ● ▲ ▲ Huber Packaging (+33 2) 3518 2661 ● ● ● Mauser* (+33 1) 4940 7812 ● ● ● ● ● ● ▲ ▲ Germany Beckmann (+49 2382) 62 051 ● ● ● ▲ Blechwarenfabrik Limburg (+49 6431) 2990 ● ● ● ▲ Duttenhöfer (+49 6324) 5900 ● ● ● ● ● ● ● ▲ Greif (+49 2) 234701 5265 ● ● ● ● ● ● ▲ ▲ Hemeyer Verpackung (+49 5524) 851 13 ● ● ● ● ● ● ▲ Huber Packaging Group (+49 7941) 660 ● ● ● ● ● Kleeman (+49 6188) 7880 ● Key: ● – UN ● - Non UN ▲ – Available * – Drumnet member OUTPUT FROM SOME MAJOR STEEL DRUM PRODUCERS WORLDWIDE Lessthan20 litres 20to25 litres >25and <100 litres 100to <210 litres 210litres(opentop)210litres(tighthead)Above210litresInnerlinersRecyclingnetworkCountry Company

Mauser* (+49 2232) 781360

Muhr & Söhne (+49 2722) 6970

Müller (+49 7623) 9690

Rheinische (+49 221) 597 740

Wilhelm Schmidt (+49 6257) 82051

Schütz (+49 2626) 770

Siepe (+49-2273) 56921

SL Packaging (+49 5221) 994 440

Greece Greif (+30 210) 555 5527

Ferrosteel (+30 210) 2849 330

Guatemala Greif (+502) 633 1561

Hungary Greif (+36 34) 548 218

Huber Packaging Group (+36 96) 550 650

Pacsai (+36 92) 368 102

India Balmer Lawrie (+91 22) 2417 1489

Bharat Barrel & Drum (+91 33) 3292 3119

Mueller Unifab Packaging (+91) 265 264 3369

Pearson Drums & Barrels (+91 33) 2442 0112

Royal Stainless Steel Containers (+91 79) 2289 4731

Sivasakthi Engineering (+91 80) 2839 4980

Time Mauser* (+91 22) 2857 0302

Indonesia Poli Contindo Nusa* (+62 21) 4402 166

Alborz Chelic (+98 21) 2205 1600

Pachmas (+972 4) 625 0202

3F (+39 019) 560007

HCB MONTHLY | SEPTEMBER 2018 28

● ● ● ▲ ▲

● ● ● ● ● ● ● ▲

● ● ● ● ● ● ●

● ● ● ●

● ● ● ● ● ● ● ▲

● ● ●

● ● ● ● ● ● ● ▲

● ● ● ● ● ● ● ▲

● ● ● ● ● ▲

● ●

●

● ● ● ● ● ▲

● ● ●

● ● ● ● ●

● ● ●

● ● ●

● ● ●

● ● ●

● ● ● ● ● ●

● ●

● ● ● ▲

● ● Iran

● ● ● ● ● ● ● Israel

● ● ● ● ● ● ● ▲ ▲ Italy

● ● ● Galdram (+39 02) 9063 1521 ● ● ● ● ● ● ● ▲ ▲ Greif (+39 02) 95124 202 ● ● ● ● ● ▲ ▲ OMCE (+39 071) 791 101 ● ● ● ● ● ● ▲ ▲ Jamaica Greif (+1 876) 757 5205 ● ● ● Japan Daikan Corp (+81 6) 6466 4601 ● ● ● ● ● ● ▲ Japan Pail Corp (+81 6) 6535 1741 ● ● ▲ JFE Container (+81 727) 80 6100 ● ● ▲ Kyowa Yoki (+81 25) 274 0371 ● ● ● ● ▲ Maeda Manufacturing (+81 3) 5246 6301 ● ● ● ▲ Morishma Metal Ind (+81 43) 498 3551 ● ● ● ● ▲ Nagao Seikan (+81 737) 52 2591 ● ● ▲ Nippon Steel & Sumikin Drum Co (+81 3) 3681 7245 ● ● ● ● ● ● ▲ ▲ Key: ● – UN ● - Non UN ▲ – Available * – Drumnet member OUTPUT FROM SOME MAJOR STEEL DRUM PRODUCERS WORLDWIDE Country Company Lessthan20 litres 20to25 litres >25and <100 litres 100to <210 litres 210litres(opentop)210litres(tighthead)Above210litresInnerlinersRecyclingnetwork

Japan cont. Saito Steel Drum Industry (+81 45) 521 3881

Sanyo Steel Drum Industry (+81 86) 465 3680

Sinpo Kogyo (+81 3) 3861 5285

Toho Sheet & Frame (+81 3) 3274 6214

Tokyo Drum Manufacturing (+81 3) 3695 8511

Yamamoto Industries (+81 93) 681 2431

Jordan OMCE Jordan (+962 5) 381 3356

Kazakhstan Greif (+7 8327) 291 0390

Kenya Greif (+254 41) 200 1407

Korea, South Daesei Industrial (+82 2) 562 2800

Insung (+82 2) 2639 6711

Malaysia Greif (+60 12) 220 2255

SMI (+60 6) 351 6521

PGEO (+60 7) 251 4971

Stanta Mauser* (+60 3) 3341 0215

Mexico Greif (+52 777) 329 5954

Schütz Elsa (+52 555) 888 0875

Morocco Greif (+21 22) 2355 970

Imafu (+21 22) 356 991

Mozambique Greif (+258 21) 720 153

Netherlands Greif (+31 294) 238 338

Schütz (+31 168) 334 600