PLAIN SAILING

CHEMICAL TANKER DEMAND

OVERTAKES SUPPLY

PACKAGING ADDRESSES CIRCULARITY

KEEPING TANKS CLEAN AND WORKING

TERMINALS READY FOR TRANSITION

CHEMICAL TANKER DEMAND

OVERTAKES SUPPLY

PACKAGING ADDRESSES CIRCULARITY

KEEPING TANKS CLEAN AND WORKING

TERMINALS READY FOR TRANSITION

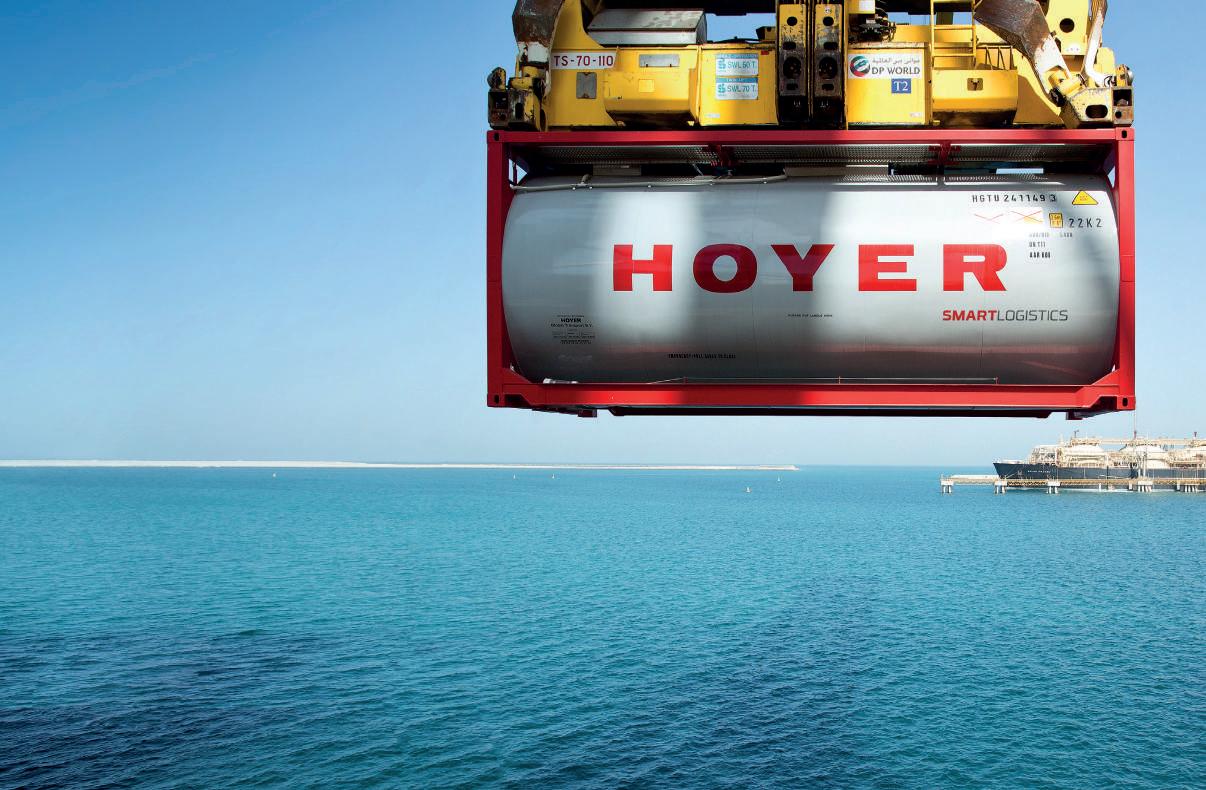

As one of the world‘s leading logistics services providers in handling and transporting liquid products, we are the first point of contact for the chemicals, gas, mineral oil and foodstuffs industries. By road, rail and sea, from road tankers to IBCs, from equipment leasing to intelligently networked Smart Tanks, we will find the optimum solution for you.

We do this by using our expertise to pioneer our own new pathways that take you forward in a customised way. How can we help you?

www.hoyer-group.com

When I first entered the door in Tavistock Street and took up my desk at HCB, almost 30 years ago now (how time flies when you’re having fun!), I had been engaged primarily to write about the bulk marine business of moving chemicals and gases. At that time, the industry was in pretty poor shape and was coming under increasing pressure to take action to put a halt to the seemingly endless litany of oil spills.

I arrived not that long after the Exxon Valdez ‘disaster’ in Alaska; the spill was not all that large by the standards of the day and there was plenty of evidence that the cleanup operation had caused at least as much environmental damage as the oil spill itself. Still, pictures of oiled seabirds flashed around the world’s news outlets and the message was clear: tanker shipping was bad for the environment. (There are echoes here in the rather disproportionate response to the derailment earlier this year in East Palestine, Ohio, which as far as we know caused no deaths or serious injuries but managed to catch the attention of the news channels.)

The promulgation of the Oil Pollution Act of 1990 (OPA 90) in the US in the aftermath of the Exxon Valdez incident did little in the short term to stem the tide, though it did make the idea of double hulls for tankers a safety benchmark, despite safety concerns at the time. The loss of Khark 5 in the Atlantic followed swiftly after, then there was Mega Borg, Haven, Katina P, Braer, Sea Empress, Erika and so many, many more. Each time, there was a public uproar and a lot of talk about

tightening regulations so that this sort of thing could not happen again. But it did.

Following on from OPA 90, tougher action by port state control regimes, the arrival of the SIRE and CDI tanker inspection schemes and a shift in the attitudes of (some of) the major charterers did have an effect, as shown by ISU’s salvage data.

But I fear now that all that progress is being undermined by conflict. Since Russia’s invasion of Ukraine, most countries aligned with the ‘west’ have put in place embargoes against trading with Russia. But with Russia being a major exporter of oil and gas, there are plenty of countries in the non-aligned camp that are only too happy to continue doing business with Moscow. The result of that is that there is now a growing ‘grey’ or ‘dark’ fleet of tankers, often at the older end of the age range, moving around the world with their AIS turned off.

Clearly, there is enough business for this dark fleet, especially when it can also take advantage of demand from those countries already under embargoes (usually at the instigation of the US), such as Iran, Venezuela and Cuba. But who knows what condition these ships are in – and are they even insured?

It is hard to know what to do about it but the lesson is clear: if too much of the world is under embargo, a parallel trading world exists and it has little interest in matching up to the environmental standards of the west. It will be interesting to see what happens when – as seems inevitable – there is another oil spill.

Peter Mackay

Peter Mackay

+44 (0) 7769 685 085

+44 (0) 203 603 2113

+44 (0) 20 3603 2103

REGULATORY HARMONISATION WAS very much in the air thirty years ago, not least since the deadline for European Community member states to apply ADR to domestic as well as international transport was approaching fast. But, as the pages of the June 1993 issue of HCB revealed, there was still plenty of disharmony around.

For instance, the UK had based its own domestic regulations on the UN Model Regulations but, at that time, ADR was still some way off aligning with the UN and the UK found itself having to do more work than other states to amend its own provisions. The UK was to take advantage of the provision in the ADR Agreement for states to put in place derogations when deemed necessary, particularly as regards the continuing use of the Emergency Action Code on the orange-coloured plates rather than the Hazchem codes used in ADR.

Dr Norbert Müller, who was then risk prevention officer at Thyssen Haniel Logistic, explained a significant derogation from ADR in Germany, which could easily be overlooked; this was found in Appendix B.8 of the German road transport regulations, GGVS, and applied not only to domestic transport but also to international traffic moving into, out of or through the Federal Republic. Appendix B.8 contained two lists, one identifying 248 very dangerous substances and articles, whose carriage in excess of specified limits was restricted to rail and inland waterway; the second list included 12 substances (including, of interest to today’s market, hydrogen) that were route-restricted. In effect, what this meant was that any consignment involving List I substances arriving at the German border would have to switch from

road to rail or inland waterway. This had drawn criticism from other states, which felt that the requirement was inconsistent with ADR and also with the contract establishing the Single European Market, mainly on the basis that the choice of the 248 substances and articles in List I seemed to be arbitrary.

Meanwhile, France had set up a special council to review domestic controls on the transport of dangerous goods, partly in response to an incident in January 1993 at a railfreight yard in the Rhône valley in which six 80,000-litre petroleum tank cars derailed on a defective piece of track; three of them caught fire and, while there was no loss of life, burning gasoline flowed into the sewers causing considerable damage to nearby homes.

France’s Transport Ministry discovered to its chagrin that SNCF, the French rail operator, had no formal dangerous goods training for its personnel, other than for those involved in handling radioactive material, and was therefore ill-prepared to deal with incidents such as these. That was despite the fact that it was transporting some 20m tonnes of dangerous goods every year, around 80 per cent of which fell under Class 3. IMO was also struggling, specifically with the proposed liability convention for the carriage of hazardous and noxious substances (HNS) by sea. Drafting work had already taken years but IMO’s Legal Committee, which discussed the draft convention in March 1989, identified several problems that were proving intractable. It had been hoped to adopt a final text in 1994 but it now seemed 1997 was a more likely target – 26 years later we still await that final text.

TANKTERMINALTRAINING is offering a one-day on-site or online Early Warning System training course for marine tank storage terminals and refineries, to prevent and mitigate disorder and risk based on four universal laws of physics:

• Information is preserved and cannot be divorced nor erased from our physical reality

• Information deficit (shortage) = Entropy (disorder) (by definition)

• The law of Requisite Variety (Ashby’s Law)

• Functionality of dynamic, living systems (terminals) depend on the quality and quantity of information (feedback).

Marine storage terminals and refineries that fail to effectively implement information process and internal control systems are likely to face an information deficit at some stage, resulting in degraded performance. Understanding how information deficits result in entropy or disorder is critical if you want to operate an effective and safe business.

We train people how to detect potential information deficit (shortage) and predict vulnerability. Accessing the quantity and quality of information is needed to verify the potential level of exposure to risk by scientific method.

We have tested this warning methodology worldwide successfully. Terminal managers, supervisors and staff can be instructed and trained how to work with this systemic approach to understand possible information gaps by applying the Law of Requisite Variety, as follows:

• A situation can only be controlled if the variety of the controller matches the variety of the situation to be controlled

• Requisite Variety is the capacity of a living system, including an organisation and society, to respond to risk

• A storage terminal generates tremendous variety and tries to control it in its own way through checklists, regulations and laws

• If variety is not matched, systems will spin out of control (entropy or disorder)

• It is impossible to control for every variable so most variety is absorbed through relationships with other systems

• It means that, in risk management, only enough variety in a system can absorb or control risks originating from outside variety

• By using feedback, this information is fed into the system to allow the system to adjust and learn constantly

• It is impossible to control all risks as systems fluctuate by information from constantly changing variety in a non-linear environment. Information reduces uncertainty

• Human variety, environmental variety, social variety, regulatory variety change all the time and thus can only be governed by the use of real-time feedback (information).

Each living system needs to maintain and develop an internal requisite variety to be able to absorb ‘outside’ variety. This means having the people with the combined knowledge, experience, expertise, influence, equipment, tools, etc. to do so, using all relevant information as attenuators, to damp variety and variety generators to build variety. Health and safety improvement is created by adding variety in the form of personal protective equipment (PPE), gas detectors, etc – i.e by information. Ethics and corporate social responsibility are requisites that work as information feedback loops and are risk attenuators. The Automation Paradox: when demand increases enough in response to lower prices, employment goes up with automation, not down.

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

FLEET • AN UNUSUAL ALIGNMENT OF MARKET CONDITIONS HAVE PUSHED UP FREIGHT RATES IN THE CHEMICAL TANKER SECTOR BUT OPERATORS ARE STRUGGLING TO GROW THEIR FLEETS

TODAY’S CHEMICAL TANKER market is unusual. Freight rates are very high at present, and staying firm as the year unfolds. Demand for chemical tanker capacity, certainly in tonne-mile terms, is strong and the improved product tanker market has tempted swing tonnage back into the clean products sector.

Historically, conditions such as these would be a signal for investment in new tonnage in the chemical sector. Attracting capital does not seem to be a problem and borrowing is still relatively cheap in real terms. Furthermore, the outlook seems strong too: chemical tankers will have a role to play in the energy transition, both in the supply of raw materials and in the transport of new cargoes

such as liquid organic hydrogen carriers (LOHCs), as well as methanol and biofuels. Finding yard space is a little more difficult, with many of those shipbuilders who would typically be in the market for chemical newbuildings already busy with containerships and LNG carriers. As a result, those slots that are available carry something of a premium. Nonetheless, it would seem that the current supply/demand balance, allied to an optimistic medium-term outlook, would support investment in new chemical tanker construction.

That this is not the case has little to do with market fundamentals, however. The International Maritime Organisation (IMO), as an agency of the UN, is taking seriously its

remit to promote and implement the UN Sustainable Development Goals. As part of that, it is looking at ways to keep the seas cleaner than they now are but also to look at ways in which the carbon emissions from maritime activities can be reduced.

Already IMO has introduced new limits on sulphur oxide emissions from smokestacks, which caused a major shift in refinery activity, not least since refiners had been using bunker fuels as a sulphur sink for decades; this action also opened up a new market for exhaust scrubbers. IMO has also brought in new ways to measure vessel efficiency and fuel economy, which have not always worked well in the chemical tanker sector but are encouraging slow steaming – which effectively reduces overall fleet capacity.

The EU has also included shipping in its Emissions Trading System, which will come into effect next year and, over the course of three years, progressively increase the proportion of emissions covered by the scheme. Odfjell says that it will pass on this cost to its charterers, which will encourage them to prioritise energy- and emission-

efficient alternatives for the transport of their products, which suggests that the scheme may meet its aim of altering some behaviour patterns.

IMO is now considering where to go next in the quest for a carbon-neutral shipping industry – and this is discouraging investment in new tonnage. Chemical tankers can – and often do – last a long time; tankers equipped with stainless steel tanks last the longest, and not just because their tanks do not corrode; they are pricier to begin with than coated tonnage, which makes it more cost-effective to look after them properly. Even the major chemical tanker specialists have ships on their books that are over 25 years old.

That means that any new ships ordered today, which will probably not be delivered until 2025 at the earliest, will probably still be operating in 2050 and will likely need to meet incrementally stringent emissions reductions targets. It is difficult for vessel owners to justify the significant costs of building new ships when they cannot be sure of the long-term viability of those ships.

Uncertainties over the future course of emissions reduction measures by IMO have therefore had something of a dampening impact on newbuilding activity. According to Stolt-Nielsen, the chemical tanker orderbook stands at some 5.4 per cent of the active fleet, a historically low level; the company also expects demolition activity to pick up and, indeed, to outstrip deliveries of new tonnage in 2025.

These signs are good for operators. Stolt-Nielsen notes that its return on capital employed (ROCE) for 2022 was 11 per cent, around double its 20-year historical average. If that level of return could be guaranteed, it might support some speculative ordering, although over the long term owners need to achieve returns in excess of the cost of capital.

Stolt Tankers reported revenues of $415.5m for its first fiscal quarter of this year, to end February, representing a slight increase over the previous period. As the company had signalled in its 2022 year-end figures, strong

demand for contract of affreightment (COA) renewals, particularly in the deepsea sector, boosted freight revenues. The company reports that COA rates were up by 16.3 per cent, though volumes were slightly down as it continued to take a firm stance on renewals. Spot volumes increased as a result, though rates in the spot market dropped by 6.2 per cent.

First quarter operating profit came in at $87.1m, up from $78.2m in the fourth quarter 2022 and $25.0m in the first quarter 2022, reflecting the improvement in deepsea freight revenue. Bunker prices continued to fall, though this was partly offset by a drop in bunker surcharge income as well as by higher port charges.

“The average rate increase on contract renewals by Stolt Tankers in the first quarter was approximately 50 per cent, a significant improvement over the fourth quarter’s 30 per cent rate increase,” says Niels G StoltNielsen, CEO of parent company Stolt-Nielsen Ltd. “In pushing hard for improved terms, a number of contracts were not renewed, but we continue to see most of those contract volumes resurface in the spot market, where we have been able to fix at higher rates –negotiations continue. With a continued favourable supply/demand balance expected in the chemical tanker markets during the coming years we should see continued firmness in our segment.”

Odfjell Tankers likewise reports that 2023 started with the same firm market trends that characterised the latter half of 2022.

Timecharter equivalent earnings for the first quarter came in at $30.8m, slightly down on the $31.7m recorded in the fourth quarter of 2022 but well ahead of the year-earlier figure of $22.4m. Volumes carried increased again, despite a lower number of revenue days.

With strong rates in the product tanker sector, swing tonnage was kept out of the chemical markets, which were supported by

longer trading distances as a result of the displacement of Russian product.

During the quarter, Odfjell took delivery of one newbuilding on timecharter and concluded orders for two 26,000-dwt stainless steel ships for delivery in first half 2026. It also declared purchase options on two vessels on charter, Pacific Endeavor (now Bow Endeavor) and Bow Capricorn, which has been on bareboat charter. Odfjell sold one of its older ships, the 2004-built Bow Santos, at the end of the quarter for delivery at the end of this month.

Given the current market situation, with very strong demand for chemical tanker capacity at the same time as a lack of any significant increase in capacity in the short term, it is not surprising that freight rates are high. But there are still plenty of investors looking to tap the rewards available at present. That has prompted a surge in secondhand values, with broker Clarkson recently estimating that prices for five-year-old tankers are around 95 per cent of the cost of a newbuilding – if only space could be found for newbuildings. In some markets, secondhand ships are attracting a premium over newbuilding prices, so eager are investors to get in on the action. One way to get secondhand ships to start earning quickly is to enter them into a pool and it is noticeable that some of the major operators in that business, such as Womar, have seen a lot of action with vessels coming in and out of their pools. On the other hand, Odfjell has sharply reduced the number of pools it operates, preferring to keep the earnings for itself.

For all those reasons, there have been a lot of changes to the fleet list this year, which appears on the following two pages. As ever, it should be noted that there is a substantial amount of double-counting of individual ships, so the sum of all the fleets will not give an accurate account of the global chemical tanker fleet. Some vessels will have been counted in their owner’s fleet, in a manager’s fleet and possibly in a pool fleet as well. Furthermore, the tables do not include owners with just one or two ships, and tend to ignore

domestic fleets of very small tankers in China, Japan and, to some extent, South Korea. There is also the question of where to draw the line between pure chemical tankers and those product/chemical carriers that meet IMO II specifications, which are generally of the ‘MR’ size of around 50,000 dwt. At present, most of those product/chemical carriers, which represent the bulk of the swing tonnage that can work in both clean petroleum products and easy chemicals, will be engaged in the product trades, since freight rates in that sector are also firm and working in petroleum presents fewer challenges than chemicals. However, were the product tanker market to collapse, many might find themselves touting for business in the chemical or vegoil trades.

The simplest way to find the ‘core’ chemical tanker fleet is to look at cargo tank construction, as those vessels with stainless

steel tanks are simply too expensive to bother with the petroleum trades. A quick scan of the largest stainless steel fleets shows that the leading chemical tanker operators are still MOL Chemical Tankers, Odfjell and Stolt Tankers (although the latter does not give an exact indication of its stainless steel tankage). Coming up quickly, though, are Fairfield Chemical Carriers, which has recently taken delivery of a number of newbuildings and has more still to come, Hansa Tankers and MT Marine. Womar also has a growing stainless fleet in its dedicated pool.

Another fleet to watch is Denmark-based Uni-Tankers, which has recently announced moves into larger ships; while it does have some stainless steel tankage, its core fleet is MarineLine coated. Its compatriot Christiania Shipping, which operates the former Herning fleet, is also on a growth path, again focusing primarily on MarineLine-coated vessels.

Demonstration is inhere the employees of the technical department of GEFO in front of M/T “Traviata” after the new classification. Slim high-rising bow, bow bulge like a whale to reduce fuel consumption and reduce exhaust gases, 14 stainless steel tanks.

One tanker of the fleet of 150 tankers belonging to GEFO.

(a) not updated in this year's list (b) international fleet only (c) Teflon

been tested and optimised to reduce the required draught and weight. By using two rudder propellors with comparatively small dimensions, HGK Shipping has managed to achieve outstanding load capacity and ideal shallow-water operations. As a result, the two sister vessels are able to carry a load weighing 160 tonnes in a draught of just 1.00 metre and still be fully operational and manoeuvrable. The hulls were built by Severnav in Romania and HGK Shipping’s turnkey partner, the De Gerlien van Tiem shipyard in the Netherlands, fitted the ships out and made them ready for service.

In addition to the low-water performance the design offers, the new tanker vessels are setting new standards in terms of sustainability. They are equipped with highly efficient diesel-electric drive systems, which reduce CO2 emissions by up to 30 per cent compared to conventional vessels of a similar size that are currently in service. Emissions of particulate matter and other polluting substances have also been significantly reduced.

All the new vessels introduced by HGK Shipping during the last two years have also been planned and completed so that they can use future fuels or H2 and these latest arrivals are no exception. The hulls are designed with two empty areas or void spaces, which can be equipped with storage solutions and the necessary technology for using alternative energy sources at a later date.

IN EARLY MAY, HGK Shipping held a naming ceremony for its latest newbuildings, Courage and Curiosity, which are now working for charterer Covestro on the Rhine network. The two sisterships, designed by HGK’s own ship design centre, represent the pinnacle of the fleet’s recent development and are another indication that the company continues to pursue its strategy of providing forward-looking and tailor-made vessels for its customers.

“We want to create sustainable and reliable transport chains in conjunction with our customers,” explains Norbert Meixner, business unit director, liquid chemicals at

HGK Shipping. “The Courage and Curiosity are enabling us to take a huge leap forward in this respect. Thanks to the vessels’ design, which allows us to use different drive systems, we’ve set another milestone for inland waterway services, but also in our role as a partner for industry in the joint battle against greenhouse gas emissions.”

The two inland tank barges are, HGK says, among the most modern and innovative vessels afloat. The hulls of the shallow-water vessels, which are 93 metres long and 10.5 metres wide, have a very bulky and lightweight design with an unusual stern and bow shape. All the components installed on board have

Such considerations are of great importance to charterers, especially in the chemical world. “We’re not only able to organise our supply chains on the river Rhine in a more reliable way with the two new vessels, but already make them more sustainable too,” says Dr Uwe Arndt, head of logistics, EMLA at Covestro. “When we re-equip them to use renewable energy sources in future, we can take an important step along the road towards climate neutrality and the circular economy. We’re looking forward to continuing to follow this course together with HGK.”

www.hgk.de

INLAND SHIPPING • COVESTRO IS ALREADY TAKING ADVANTAGE OF THE SUSTAINABILITY AND PERFORMANCE IMPROVEMENTS PROVIDED BY HGK SHIPPING’S LATEST NEWBUILDINGS

The two partners plan to develop the demonstration vessel by 2028; the challenges are less in the cargo containment and handling area but more in the way hydrogen will be released from the carrier to power the fuel cells that will drive the ship. This means having a dehydrogenation unit onboard, again using technology already developed by Hydrogenious LOHC.

THE CONUNDRUM FACING those who are pushing forward the energy transition is how best to move hydrogen from its point of renewable production to its end users. One thing is clear: moving hydrogen in bulk is going to be expensive and technically challenging, with safety issues that will need to be addressed.

There are, though, alternatives, which each involve further processes at both ends of the supply chain. And as long as these are also powered by renewable energy, and the means of transport are likewise decarbonised, the material delivered to the user is carbonneutral. Ammonia is a clear front-runner as a carrier for hydrogen, with an already well established supply network, but it too has some safety issues. Others are looking at reusable vectors in the form of liquid organic hydrogen carriers (LOHCs).

One of those, Hydrogenious LOHC – which has the backing and support of Vopak – has recently signed a memorandum of understanding with HGK Shipping, one of Europe’s leading inland waterway operators, with the goal of developing a scalable solution to use LOHCs to help make hydrogen available as a source of energy on a large scale. The Hydrogenious LOHC technology uses benzyl toluene as a carrier, which is relatively safe to handle and can be transported and stored at ambient pressures and temperatures.

Fundamental to the project will be the availability of suitable shipping capacity and the two companies plan to embark on a development project, ‘HyBarge’, next year,

leveraging the experience of using fuel cells fed by hydrogen released from LOHCs in other shipping and onshore applications.

“We want to successfully introduce the maritime LOHC drive technology to the especially high safety requirements of inland waterway shipping within the HyBarge project,” says Øystein Skår, general manager of Hydrogenious LOHC Maritime. “HGK Shipping will be the ideal partner in this respect. We’ll also use the expertise that we’ve gained during the last two years in developing LOHC powertrains for commissioning/service operation vessels.” Dr Daniel Teichmann, founder of Hydrogenious LOHC, adds: “Decarbonised mobility solutions and transport operations along the sensitive network of rivers in Europe can become reality using existing infrastructure, thanks to our safe LOHC technology.”

“Introducing the demonstration vessel could be more than just a milestone in achieving climate-neutral inland waterway shipping –the same could be true for industry, which will depend on energy sources such as hydrogen to decarbonise its operations,” says Steffen Bauer, CEO of HGK Shipping. “Hydrogenious’ LOHC technology has enormous potential for use, particularly when compared to other hydrogen derivatives. However, what is more important is that it doesn’t need any special tank technology, with the result that this LOHC can be made available within the existing infrastructure both on land and on the water.”

The use of an LOHC such as benzyl toluene also contributes to the circular economy. The oil is loaded with hydrogen at a point where renewable energy is available, then shipped to the user where the hydrogen is stripped from the carrier by dehydrogenation; the ‘discharged’ carrier material can then be returned to the initial point to be used again, something that can be done several hundred times.

www.hydrogenious.net

www.hgk.de

LOHC SHIPPING • HGK SHIPPING IS TEAMING UP WITH HYDROGENIOUS LOHC TO ESTABLISH A SUPPLY CHAIN AT SCALE TO FEED HYDROGEN ACROSS EUROPE BY INLAND WATERWAY VESSEL

Uni-Tankers has announced what it calls a “major expansion” of its stainless steel chemical tanker fleet, which will add five modern ships to its fleet. Firstly, it will take ownership of the 12,500-dwt Marex Noa, which it has had on timecharter; two sisterships will be built for the same owner in Japan for 2024/2025 and placed on long-term timecharter with Uni-Tankers.

In addition, Uni-Tankers has contracted long-term charters with a Norwegian owner for two 19,990-dwt, 2016/17-built chemical tankers; they will be delivered into the Uni-Tankers fleet in the summer and renamed Swan Atlantic and Swan Pacific.

“We are excited to announce this significant expansion of our stainless-steel fleet,” says Per Ekmann, CEO of Uni-Tankers. “With these new vessels, we will be able to provide even greater service to our clients around the world.” uni-tankers.com

Tristar Group and Norstar Group have formed a new joint venture, Norstar Chartering Services, to charter and commercially operate chemical and clean product tankers. The new company is headquartered in Dubai with regional offices in the US and Singapore; Olav Ekeberg, a partner in Norstar, has been appointed CEO.

Both partners in the joint venture already have a presence in the liquids shipping business. Eugene Mayne, CEO of Tristar, says: “This latest business decision will strengthen the group’s maritime logistics division which owns and/or operates more than 30 chemical, oil, and gas tankers and bulk carriers trading globally, mostly with energy majors.”

“Norstar specialises in chemical and product tankers and the transport of high-risk cargoes,” adds Chris Bonehill, co-owner of Norstar Group. “Tristar Group, as a leading global

energy logistics service provider, is a great strategic partner for Norstar to grow its existing business and potentially expand into other energy transition midstream activities. Both our companies and our customers will benefit significantly from the joint venture.” www.norstarshipping.com www.tristar-group.co

Purus Marine has ordered four 45,000-m3 LPG carriers from Hyundai Mipo for delivery in 2025 and 2026, with options on two further ships. The scrubber-fitted newbuildings will be dual-fuel ammonia-ready and, the company says, will primarily be used to carry ammonia to supplement the company’s focus on low-carbon maritime transport and infrastructure systems.

Purus Marine was established in 2020 with funds from EnTrust Global and has built up a fleet of more than 60 vessels in the gas shipping, containerships and offshore wind farm support sectors. purusmarine.com

Toro Corp, established in 2021 as a tanker spin-off from dry bulk and containership owner Castor Maritime, has entered the LPG market for the first time with the acquisition of four 5,000-m3 Japanese-built vessels, three built in 2015 and one in 2020. Toro is due to take delivery in the second and third quarters of this year and will finance the $70.7m deal with cash on hand.

“We are very excited to announce our entry into the LPG shipping market in our first transaction as a newly independent company,” says CEO Petros Panagiotidis. “The en bloc acquisition of four LPG vessels will create a diversified fleet of tankers and LPG vessels, strengthening our position in the energy transportation business and building further our exposure in the shipping industry. We believe that the fundamentals of the LPG shipping sector are attractive with positive future prospects. We intend to continue looking for further opportunities to renew, grow and diversify our fleet with the addition of

high-quality tonnage.”

www.torocorp.com

Maersk Tankers is building on its in-house expertise to offer a new voyage management service to shipowners, which aims to deliver greater economic and environmental efficiency in day-to-day operations.

Petredec Global, recently carved out of Petredec to operate the group’s LPG tankers, is the first company to sign up to the service. Tom Lush, head of commercial shipping at Petredec Global, explains why: “It is not through technological advances alone that the industry’s environmental goals will be achieved. Collaboration and leveraging the expertise of other leaders in the industry will be key. We welcome this partnership with Maersk Tankers as an example of this.”

Maersk Tankers will initially take over the voyage management of seven of Petredec Global’s owned LPG carriers. The service includes day-to-day vessel operations, fuel

optimisation and claims handling, covering full post-fixture support from the time the vessel is fixed for a voyage, through its successful execution, to the closure of the voyage books.

Petredec Global has recently begun taking delivery of six 93,000- m3 VLGCs building at Jiangnan Shipyard. The first, Harzand, is the largest LPG tanker the yard has built. All six will are being fitted with dual-fuel propulsion and are designed to emit 23 per cent less CO2 than conventional equivalents, while also generating a 25 per cent premium on the spot market. The series is due for completion in early 2024, by which time Petredec will have 26 VLGCs in its fleet.

maersktankers.com

www.petredec.com

Christiania Shipping has ordered two 13,000-dwt stainless steel chemical tankers from Murakami Hide for delivery in the second half of 2025. “This is in line with our strategy – both in terms of adding more vessels in this size to our fleet, as well as expanding further on our relations in Japan,” says CEO Fridtjof Eitzen. The new ships will be the largest in the company’s fleet, which operate mainly on trades between northern Europe and West Africa, as well as intra-Mediterranean.

www.christianashipping.com

Terntank is finding willing charterers for its lower-emission product tankers, with Neste signing timecharters on two additional newbuildings. The 15,000-dwt tankers are designed with foldable suction sails (left) and dual-fuel engines enabling the use of e-methanol as fuel, which is produced with Power-to-X technology using captured carbon and renewable energy. Their innovative design and onboard emission reduction technologies will further reduce Neste’s environmental

impact and emissions of shipping. They are due for delivery from CMHI Jinling Shipyard in 2025/26.

“Together with our partners, we are scaling up our renewable and circular solutions production capacity,” says Lauri Helin, vice-president, logistics and operations, oil products at Neste. “Our partnership with Terntank supports our commitment to sustainability, particularly our target towards reducing emissions across our value chain. With these vessels we continue to reduce the emissions and environmental impacts of transportation. We are delighted to partner with Terntank.” terntank.com

Exmar has reported first quarter revenues of $65.7m, up from $24.7m a year ago, with EBITDA increasing from $1.3m to $24.1m. Net profit came in at $19.2m, compared to a loss of $7.7m a year ago. The improvement reflects different contracts concluded last year together with continuing favourable market conditions. Exmar’s shipping division delivered a 4 per cent increase in revenues and a 35 per cent improvement in EBITDA, mainly due to higher rates for all vessel sizes.

In the midsize LPG tanker market, which is where Exmar is strongest, rates remained firm during the first quarter but, while demand remains stable, there is less certainty over the short-term outlook due to the large number of newbuildings scheduled for delivery by end of the year. New environmental restrictions may also put some downward pressure on older ships, Exmar says.

The company is continuing with its fleet renewal programme, having declared newbuilding options on two 46,000-m3 LPG/ ammonia carriers and selling its 2002-built carrier Bastogne during the quarter. exmar.be

TANK CLEANING • THE SEARCH FOR SUSTAINABILITY IN THE TANK DEPOT SECTOR LEADS INEVITABLY TO THOUGHTS OF REDUCING WATER CONSUMPTION. STC REVEALS HOW IT IS GOING ABOUT IT

THANKS TO INNOVATIVE recycling techniques, Stolt Tank Containers (STC) is keeping water, energy and detergent usage to a minimum during the cleaning of its tank containers. STC has been trialling new processes at its cleaning depots to recycle water and energy, as well as minimise the need for additives and detergents. This is resulting in significantly less waste, lower costs and a more planet-friendly tankcleaning operation.

STC’s Moerdijk terminal in the Netherlands is an excellent example. A new system recently installed at the depot is expected to reduce wastewater discharge by 70 per cent and retain the remaining wastewater for reuse at a temperature of 23°C so it does not require as much energy to reheat.

Wastewater from tank container cleaning processes is being drained into the STC depots’ wastewater installations, where it is processed via state-of-the art technology for re-use. This involves the separation of oils and

fats, physical chemical treatment, biological treatment and enhanced effluent polishing, incorporating ultra-filtration, nano-filtration, active carbon absorption and sand filtration. Following that process, the water is clean enough to drink – and certainly clean enough to use all over again for cleaning the next tank container of its chemical residue.

The overall result of this is that the use of fresh water at the Moerdijk depot will be reduced by some 21,000 m3 per year; discharge of wastewater into the public sewer system will fall by a similar volume to some 9,000 m3 per year.

In addition to the use of water, the other main input to the cleaning process is the heating of water to perform high-pressure cleaning, dissolve product residue and flush the resulting waste; this all requires a lot of energy. The optimal temperature for cleaning tank containers is about 85°C, while water

coming out of the mains is typically around 11°C, so there is a lot of work to be done to get the water up to temperature.

STC has now invested in special rotating heat exchangers at the Moerdijk depot, as a result of which it can recover a large proportion of the thermal energy in the wastewater that has been used for tank container cleaning. This provides a starting point of 23°C (instead of 11°C), meaning there’s 12°C less water heating to do. That results in a huge saving in natural gas consumption. In addition, this transfer of heat cools the wastewater to a point where it enables the oil fat separator to operate more efficiently.

Moerdijk’s consumption of natural gas is expected to fall by 57,000 m3 per year, saving 37,000 kg of carbon emissions. That is equivalent to one year of household gas consumption for every one of the depot’s 45 employees.

The re-usable water that comes out of Moerdijk’s enhanced filtration system is very low in salts and minerals. This soft water does not require additives prior to being re-heated in the boilers and reduces the amount of detergent needed for effective cleaning. As a result, STC expects to reduce chemical consumption by around 2,000 kg a year at Moerdijk.

Following the trial, this innovative system will be rolled out to other STC cleaning depots around the world.

www.stolt-nielsen.com

The Mouvex® B200 Flow Control oil-free screw compressor delivers high flow rates in a rugged design that’s lighter than competitive models. The “plug-and-play” installation requires no drive shaft, as well as no mounting bracket and is fully coated for corrosion resistance. The B200 delivers all of this with a 3 year warranty.

See how much faster you can unload: mouvex.com/B200

tough to achieve by 2030, as Wiklund explains: “Our goal is aggressive, especially since the technology to achieve it does not currently exist. But development is moving forward by leaps and bounds and should have come far enough to achieve the goal by 2030.”

The investment that is involved will include building custom charging infrastructure that will enable drivers to charge their vehicles while loading or unloading. “When we haul large loads, these take about an hour to load or unload, which gives sufficient time to charge enough to get to the next station, where the opportunity to charge again will be available,” Wiklund says. This will mean that the trucks will not have to make extra stops to fill their tanks, as is the case with diesel-powered vehicles, and will make the fleet more productive. That will reduce costs and the overall environmental impact, adding to the search for sustainability.

WIBAX HAS SET itself a very ambitious target: to run a fully electrified fleet, fully powered by self-produced and renewable electricity, by 2030. The Sweden-based logistics provider runs a fleet of vehicles delivering chemicals and biofuels to the Nordic market, an area with a strong focus on environmental protection, but this latest programme will call for some new systems that are not yet available.

However, as CEO Jonas Wiklund stresses, Wibax has been pushing the boundaries of what is possible in the logistics sector since its inception and it has worked for greater sustainability on all levels to ensure its business structure can be maintained well into the future.

“As we own the entire logistics chain, we are responsible for making it as sustainable as possible, from several perspectives. Our Swedish terminals are largely carbon-neutral and the next step is to implement more sustainable road transport. This is where you can make the biggest difference,” says Wiklund. There are haulage companies already using electric vehicles, but only a few are using electric power for heavy goods vehicles; Wibax has worked with Scania to come up with a viable solution. At the same time, though, the company does not want to put a heavier burden on an already stressed electricity supply network so the second part of its ambition – to produce its own electricity – is equally important. That goal, though, will be

Indeed, Wiklund believes that economic and environmental sustainability should go hand in hand if sustainability is to be truly achieved. Therefore, all of Wibax’s investments are favourable from both perspectives. “If environmental sustainability is not justifiable from an economic perspective, it will be too great a challenge to maintain a sustainability mindset in the long run,” he says. “By developing solutions that are both environmentally and economically sustainable, we can ensure that sustainability work continues. Increased fuel costs, alongside the fact that there is a limited amount of oil, could become problematic for the transport industry in the long run.

“Oil is a finite resource and, regardless of how you look at its environmental impact, the shortage of it will significantly affect the transport industry. A substitute, for example electric vehicles, will make it easier for the industry in the future,” Wiklund concludes.

“Our investments enable sustainability work that is good for both the environment and the company’s finances. We have had tough growth targets from the start – and it is through achieving these targets that the real change happens.”

www.wibax.com

ELECTRIFICATION • WIBAX IS ALREADY RUNNING ELECTRICPOWERED TRUCKS BUT NOW WANTS TO GO ALL OUT AND GET RID OF DIESEL TRUCKS ALTOGETHER BY THE END OF THIS DECADE

Storage of Chemicals under class 3,6 8,9 & Non-regulated

Drum / IBC Filing

Temp controlled storage

Transloading from ISO-ISO/ Flexi & Road Tankers

ISO tank cleaning , storage & repair depot alongside thru Road tanker cleaning

Blending and Heating Tanks

Chemical logistics, a division of Goodrich, has grown rapidly over the years and now boasts of an impressive list of customers

Chemical logistics' activity segments include equipment adjuncts such ISO Tanks, Swap Tanks, Lined Tanks and a state of the art storage and distribution facilty loated at the Free Trade Zone in Jebel Ali

ISO TANKS Chemical carriage (hazardous & non-hazardous)

Tailormade solutions specific to the need

T11 ISO Tanks with capacities between 24 KL to 26 KL

T14, T20, T22 & T50 Tanks are available on dedicated basis.

Dedicated Technical Team to provide support in all situations and contingencies

SOC Tank Management

Complete End to End Logistics

SWAP BODY TANKS for carriage of higher payloads

DIGITALISATION • THERE IS A LOT GOING ON IN THE DIGITALISATION OF THE TRANSPORT CHAIN. INTERMODAL TELEMATICS PROVIDES AN UPDATE ON SOME CURRENT MAJOR DEVELOPMENTS

INTERMODAL TELEMATICS (IMT), which specialises in the development and provision of telematics tools and services for the intermodal transport sector, had a lot to talk about during the Transport Logistic show in Munich last month.

Firstly was the launch of the Rochester Level sensor, RL22-Ex, which is used together with the third-party Rochester Level Gauge to create a digital level sensing solution for tank containers and tank wagons, measuring and monitoring the liquid level inside the tank and wirelessly transmitting those values to an IMT communication and location terminal (CLT/ HCT), which, in turn, transmits the sensor data to the IMT platform where it can be accessed remotely via IMT’s web application. This helps increase visibility during transport and improve operational efficiency.

When installed on a tank, the RL22-Ex measures liquid level by connecting to a compatible Rochester level gauge, and is

installed on the magnetic coupling plate through a special sensor housing. This probe is connected by cable to a digital sensor with a display. Therefore, an existing Rochester analog level gauge can be converted to a digital readout by replacing the analog dial with the IMT probe. This allows the RL22-Ex to read and store measured liquid levels. If the client chooses to work wirelessly, it is possible to connect the RL22-Ex wirelessly to a Wireless Display (WD19-Ex).

By using IMT’s open and free API, this telematics solution can be effortlessly integrated into any existing Transport Management System (TMS). This allows monitoring of the actual versus expected fill rate of a tank container or rail wagon. By combining geoposition data from IMT’s main gateway (CLT20-Ex) and the modular, extensible IMT web portal, complex business rules can be implemented. This allows alert notifications to be limited to certain

circumstances, for example, alert notifications configured only when the level changes outside loading or unloading zones.

The RL22-Ex is ATEX IIC certified and can therefore be used with the transport of hazardous and non-hazardous liquids in all sectors. The sensor can be updated wirelessly with new firmware via the IMT Communication and Location Terminal (CLT/HCT), no matter where the container or rail car is located, at any time of day.

Also announced during the Transport Logistic show was an extended collaboration with Peacock Container, which is to install IMT’s telematics systems across a significant part of its 20,000-strong tank container fleet. IMT says this is a major step forward as Peacock is the first leasing company to apply its systems without direct demand from its customers.

The added value for Peacock’s customers is that they will be able to activate IMT’s telematics services at any given moment without any investment in hardware or installation and with no waiting time. This brings a lot of added value, as customers cannot only monitor their tank container and cargo instantly but, based on the started implementation of artificial intelligence (AI) on the IMT platform, also the actual loading status, the moment of loading/ unloading, the duration of heating, the moment the tank container is cleaned, and much more.

“We are thrilled to collaborate with IMT to bring the latest telematics solutions to our customers,” says Jesse Vermeijden, managing director of Peacock (pictured opposite). “This collaboration marks a significant milestone in our partnership, and we are confident that our customers will benefit greatly from this added value.”

The collaboration with Peacock mentions the implementation of AI and this is something that IMT is now investigating in great detail in partnership with its customers. AI has been coming for some time but, IMT says, the global launch of ChatGPT, an advanced

language generation model developed by OpenAI, has prompted a huge acceleration in its uptake. The potential of AI, big data and machine learning, as well as the long-term and short-term benefits for the railcar and tank container markets, is no longer a distant future but is happening right now. IMT is developing algorithms and machine learning tools to generate meaningful insights and a solid foundation of information.

Just ten years ago, IMT notes, there were many labour-intensive day-to-day tasks in the tank container and rail tank car sectors. Nowadays, what used to be a manual task for operators, which consumed a huge amount of time and effort to do correctly, and thus to manage as well, can now be supported by AI. The transition towards smart sensor technology has greatly alleviated pressure on operators, because measurements are taken and relayed automatically and continuously.

A telling example in the AI telematics field

is the full/empty status of an asset. Sending the full or empty status directly to the TMS avoids manual input, increases the speed of information and gives an operator the ability

to deploy the fleet even more efficiently, through early signalling of available tank containers or rail wagons.

www.intermodaltelematics.com

DIGITALISATION • TELEMATICS PIONEER NEXXIOT HAS LINED UP A NEW PARTNERSHIP AND INTRODUCED AN AI-ENABLED SYSTEM TO GIVE ITS CUSTOMERS EVEN GREATER VISIBILITY

NEXXIOT HAS SET up a partnership with project44 to accelerate the process of digitalisation in supply chains through the use of sensor and network insights. The partnership will leverage the TradeTech specialisation of Nexxiot with project44’s end-to-end visibility platform, allowing customers to integrate conditional and location data with the largest supply chain network in the world. At present, the partners say, shippers, cargo owners and supply chain participants lack the critical asset intelligence and insight they need, exposing them to unacceptable risks, lack of visibility and insufficient process control. This partnership between project44 and Nexxiot will add vital real-time asset-level monitoring to enhance project44’s Movement platform by improving data-driven assurances on safety, security and compliance. It gives joint customers enhanced data using carrier milestones, signals, and historical

performance with precise GPS tracking. Additionally, project44 and Nexxiot customers now have capabilities to drive advanced risk management strategies on order and inventory health.

“At project44, we strive to provide the most comprehensive supply chain visibility for all of our customers, and combining forces with Nexxiot is a huge step towards that goal,” says project44 founder and CEO Jett McCandless. “This partnership enhances the insights of our Movement platform with essential real-time asset level tracking, benefitting everyone with the new standard in actionable insights.”

Nexxiot is also pressing ahead with its TradeTech development, launching a new AI-enabled product, Scope AI, to provide a conversational interface into Nexxiot’s unique data on locations, status, conditions of cargo, and supply chain events like delays. Scope AI

extracts and presents key insights from the billions of data points generated every month by Nexxiot’s Edge and Globehopper devices traveling on all major trade lanes, and provides answers to queries.

“Nexxiot is always focused on delivering more value to our clients,” says Ákos Maróy, Nexxiot’s Chief Data Officer. “Scope AI makes it possible for clients to gain immediate insights into the status of their transport assets based on real-time data from the fleet. We are determined to make our clients’ lives easier by adding a simple, intuitive verbal interface to display the data generated by our sensors and gateways. We did this to offer asset intelligence and combine it with shipment intelligence in a way that’s never been experienced before. We do this to better deliver on our mission to increase certainty and make clients’ operations easier, safer, and cleaner.”

Nexxiot has also signed up a major new customer in the shape of Ermewa, one of the leading European rail car leasing firms. Ermewa, which has a fleet of more than 45,000 rail cars, will integrate Nexxiot’s Asset Intelligence technology to its existing telematics portfolio and will now be able to use Nexxiot’s cloud for advanced real-time Asset Intelligence and detailed performance metrics around location, utilisation, mileage, shocks and other significant events that affect maintenance, transport quality, and safety. Nexxiot, as an IoT technology partner to Knorr-Bremse, is a driving force behind the digitalisation of train sub-systems to optimise their maintenance and ensure fleet uptime is maximised.

“Our customers are requesting increased access to railcars as part of their strategic plans to move cargo from road to rail. We commit to making sure their needs are met with efficient maintenance processes, driven by the best digital monitoring capabilities available today,” says Peter Reinshagen, managing director of Ermewa. “Partnering with Nexxiot enables Ermewa to offer an additional level of maintenance control that ultimately benefits our clients in terms of fleet availability and transport quality.” nexxiot.com

containers and other equipment that comply with international rules and standards.

The Code calls for effective interaction between the shipper, who is responsible for specifying requirements for the type of equipment suitable for the cargo intended to be carried, and the container operator in providing units that satisfy such requirements, meet applicable safety and manufacturing standards, and are clean. Faulty and badly maintained units may have as serious ramifications as incorrect and deficient packing of cargo inside the units.

“Engagement with governments and industry groups representing the diverse mix of supply chain stakeholders is one of our primary goals,” explained TT Club’s Peregrine Storrs-Fox. “Through communication and understanding of the safety issues comes a wider implementation of the CTU Code and

other best practices aimed at cargo and environmental safety. To this end we urge regulatory and advisory bodies as well as associations to unite with us in spreading the good word.”

The group has been working with IMO for some time, contributing to aspects of the CTU Code and other regulatory recommendations, but there remains an element of concern that governments may not effectively be communicating agreed IMO requirements and advisory information within their jurisdictions. Lars Kjaer of the WSC explained: “We want to make sure that governments as well as industry are promoting the CTU Code and its best practices to all parties in the CTU supply chain around the globe.”

Ultimately, though, it is those that pack containers that have the primary responsibility for ensuring cargo integrity and safety, and those responsibilities are laid out clearly in the CTU Code. Chris Welsh, secretary-general

of GSF said in Amsterdam: “In many modern international supply chains there are multiple ‘hand-offs’ where cargo is passed variously from manufacturers, suppliers, distributors, warehouses, consolidators, forwarders and logistics operators to shipping lines. Ultimately, however, it is the responsibility of the shipper as the party causing the transport of the CTU unit to demand and control compliance with proper packing standards, and to specify the type of equipment needed for the cargo. This is a responsibility clearly set out in the CTU Code. It cannot be negated or ignored irrespective of the complexity of the logistics chain.”

This industry group is seeking to communicate to all stakeholders through governmental and industry events. Progress is being made in increasing awareness of the CTU Code and linking with other organisations to deliver improved safety and sustainability in the international supply chain.

common objectives. Both Feique and ADIF share the idea that having an efficient rail freight transport system would significantly contribute to improving the competitiveness of Spanish chemical and derivatives manufacturing plants.

After the signing of the new protocol, a high-level group has been set up whose purpose is to define the main lines of action of the Protocol and submit the plan for approval. This group, involving senior executives from both Feique and ADIF, will be able to pass on their recommendations to a central working group so that different actions can be agreed that will help to improve management in terms of quality, reliability and efficiency, and to analyse the current use of the existing rail infrastructure. That group will also look at establishing potential service provision agreements by ADIF.

As a result of this work, it will be possible to carry out an analysis and assessment and, where appropriate, proposals for improvement of the connectivity of the railway network with the factories and industrial estates of the chemical industry, along with the most important ports for the chemical industry and with national borders, all in the context of the Atlantic and Mediterranean Corridors. This will feed into identification of the priorities and plans for action, depending on the projected volume of demand for rail freight from the chemical industry.

SPAIN’S CHEMICAL INDUSTRY and its rail network operator have renewed their agreement, first signed in 2013, to collaborate in the promotion of the use of rail freight transport in the chemical sector. The renewal document was signed last month by Juan Antonio Labat, general director of the Business Federation of the Spanish Chemical Industry (Feique), and the president of the Railway Infrastructure Administrator (ADIF), María Luisa Domínguez. The agreement is part of ADIF’s ‘Strategic Plan 2030’ and will be in place until the end of 2030, with the option to be extended for another two years. ADIF, as part of its responsibility for the maintenance and operation of railway infrastructure under state jurisdiction, as well

as manager of its circulation and safety control system, has among its priority objectives the promotion of freight transport by rail and the development of intermodality, aspects that are considered by Feique as a priority for the sector due to its relevant role in achieving a more balanced and sustainable transport system.

The renewal of the collaboration protocol between Feique and ADIF envisages the implementation of a specific programme of actions to improve rail freight transport in the chemical sector, which will provide for deeper analysis and improvement of production processes and the management of freight transport by rail through multidisciplinary work groups that facilitate the achievement of

Within the framework of the collaboration agreement with Feique during the validity of the previous protocols, the chemical factories and logistics facilities have been addressed from the perspectives of nodal and operational analysis, as well as the options for improving the service in each of the facilities. In the meetings held between the chemical industry, railway companies and logistics operators, intermodal transport has been identified as a success factor in increasing the competitiveness of Spanish chemical and derivatives manufacturing plants, and the promotion of railway motorways and the development of new railway traffic between Tarragona and Portugal. www.feique.org

RAIL • WIDER USE OF RAIL AND INTERMODAL TRANSPORT CAN HELP IMPROVE THE COMPETITIVENESS OF SPAIN’S CHEMICAL INDUSTRY. THE TWO SIDES ARE TO CONTINUE TO WORK TOGETHER

The ability of combined transport to help in the modal shift from road depends above all on the transport policy framework, Bertschi says, with a number of measures available that would help competitivity. Firstly, there needs to be a consistently effective operational management of the international Alpine transit of trains on the Rhine-Alpine corridor, especially in light of impending renovation and construction work on the Rhine Valle Railway. Switzerland can play a leading role in this, with the support of Italy, which is reliant on that link.

Hupac would also like to see a temporary suspension of the annual reduction of subsidies for combined transport until the economic crisis eases, which would at least partly compensate for the loss of competitiveness so far this year. The sector must, though, recognise the pressure for a shift back to pure road transport and be able to continue the Rolling Highway, which is currently very busy, until 2028.

Finally, Hupac says, a transparent flow of data along the entire combined transport service chain helps to ensure that capacity is better used and that individual partners can plan better. Existing open systems such as DX Intermodal’s Data Hub must become the standard for all combined transport in Europe.

HUPAC GROUP LAST year carried 1,104,000 road consignments in combined road/rail and seaport hinterland transport, a 1.8 per cent decline compared to 2021. This fall reflected a series of problems: capacity bottlenecks in Germany; intensive rail work on the RhineAlpine corridor on an off through the year; operational inefficiencies; and, later in the year, a loss of freight volumes as a result of the economic slowdown in Europe, particularly for energy-intensive industries such as steel, chemicals and paper.

In addition, since January 2023, price increases for rail transport in Europe have been significantly higher than those for road transport. At the same time, as the industrial economy stagnates or declines, significant capacity is again available in road transport. This leads to a significant shift of transport

from rail to road. Hupac says that overall volumes are down again by between 10 and 15 per cent year-on-year in the first four months of 2023.

“The sum of negative factors such as the decline in traffic due to the economic situation, high rail costs, falling road freight rates and the chronic instability of the rail network represent a real risk of modal shift,” says Hans-Jörg Bertschi, Hupac’s chairman. Although the volume of combined transport in Europe fell significantly in the first quarter, the quality and reliability of the international rail infrastructure has hardly improved. Too many trains are still cancelled or delayed for days. “If the reliability of the rail infrastructure and the quality of combined transport do not improve, we can expect a further shift back to the roads in the coming months,” Bertschi adds.

Despite these problems, Hupac is continuing with its investment in new terminal capacity and IT systems, with a major terminal near Milan due in service in 2026 and other investments at Italian terminals at Piacenza, Novara and Busto Arsizio.

“We are convinced that our competitive, market-oriented combined transport products offer real added value for environmentally and climate-friendly logistics,” says CEO Michael Stahlhut. Compared to pure road transport, the Hupac network saved around 1.5m tonnes of CO2 in 2022, reduced energy consumption by 17bn megajoules and took 21m tonnes of goods off the roads. “Our long-term corporate strategy is part of the answer to the major challenges facing society, such as climate protection, energy transition and sustainable economic development. We will continue to focus on this in the current year,” Stahlhut adds.

www.hupac.ch

INTERMODAL • HUPAC HAS DEDICATED ITSELF TO SHIFTING FREIGHT OFF THE ROADS AND ONTO RAIL BUT LAST YEAR SAW SOMETHING OF A REVERSAL OF FORTUNE WITH PROBLEMS ON MANY FRONTS

VAN MOER GETS ITS COAT ON Hüni+Co and Van Moer Logistics are to offer a full service for tank container coating in Antwerp as from this summer. Under the terms of a new partnership, the two companies are extending their existing relationship, which already provides minor repairs for tank coatings, to include complete interior coatings. Until now, this was only possible at the Hüni+Co location in Friedrichshafen in southern Germany.

“With this cooperation, we are taking a big step forward. In future, our customers will also be able to have their tank containers serviced, repaired or recoated in the Van Moer workshops in Antwerp,” says Alexa Huni (below), managing director of Hüni+Co.

“We have been working successfully with Hüni+Co for years,” adds Jo van Moer, founder and CEO of the logistics service provider. “We are very pleased to be able to offer our customers further and more comprehensive services with this new cooperation.” Tank container operators and leasing companies based in the Antwerp region in particular will benefit from the proximity to the workshop, which will mean shorter transport routes, lower lead times downtimes and significantly lower (transport) costs.

For every enquiry and every order, Hüni+Co will handle the qualified preliminary tests as before, comparing the specific customer requirements and the technical prerequisites of tank containers and coatings. The specialists from southern Germany also prepare the quotations and take over the warranty. The Van Moer Logistics teams, which are comprehensively and continuously qualified by Hüni+Co, will initially only process ChemLINE 784, a function-specific corrosion protection coating that has been used for many years to protect tank container structures against a wide range of hazardous materials. In

a later phase, the service portfolio will be expanded to include other coatings from the Hüni+Co range.

www.hueni.de

www.vanmoer.com

Ermewa, parent company of Eurotainer, Raffles Lease, DEMI and subsidiaries in the rail sector, has been renamed Streem. Streem specialises in designing, optimising, financing and managing strategic assets for the global supply chain, offering customers safe, cost-efficient and environment friendly asset solutions. It has offices in more than 40 locations and more than 1,300 employees.

The move is an extension of the sale of Ermewa Group by French rail company SNCF in April 2021 to CDPQ, a Canadian pension fund management firm, and DWS Group, a leading asset management company based in Germany.

www.ermewa.com

Neele-Vat has acquired Otentic Logistics, which is active in the storage and transhipment

of raw materials for the food industry and the storage of dangerous goods, headquartered in Oosterhout, the Netherlands. “The activities of Neele-Vat and Otentic complement each other well,” says Cuno Vat, CEO of Neele-Vat. “We can now offer our customers an even broader service. And with the new location near our branches in Hazeldonk en Meer (Belgium) we have a good starting position to expand our services internationally, so that we can fulfil our ambitions to grow as a family business and to remain competitive.”

For the time being, the Otentic companies will continue to operate independently and under their own name.

www.neelevat.com

www.otenticlogistics.nl

Petrefuel Holdings, a subsidiary of Petredec Onshore, has agreed to acquire Royale Energy, one of the largest privately owned petroleum wholesale distributors in South Africa. Royale operates an extensive network of retail filling stations, a major fuel depot in Gauteng and three smaller depots. Royale operates mainly in

provinces of South Africa where Petrefuel is currently not active.

James Bullen, head of downstream at Petredec Onshore, says: “The South African liquid fuels landscape is currently being redefined following a number of significant domestic and international events over the past few years. We welcome the team from Royale Energy to Petrefuel and look forward to leveraging the combined strengths of the two businesses. Royale has made good progress over the past two decades and established itself as one of South Africa’s leading independent operators and its addition to the Petrefuel portfolio will add significantly to our current business.” petredec.com

Trimac Transportation has acquired American Industrial Partners Logistics (AIP), an Ohio-based provider of bulk transport, terminalling and warehouse services for the plastics, liquid chemicals, foodgrade and metal production industries. AIP’s main facility in Wapakoneta, Ohio is strategically located halfway between Cincinnati and the US-

Canada border crossing at Detroit/Windsor, and is also served by a CSX rail line. AIP brings with it a fleet of 13 tractors and 119 trailers, as well as other equipment.

“We are excited about this next step in our US growth,” says Matt Faure, president/CEO of Trimac. “We look forward to connecting our most recent acquisition of AIP Logistics with superior service with safety. The integration with a leading logistics company such as AIP will place Trimac in an excellent position for its continued growth and contribution to business partners and communities in this region.” www.trimac.com

Contargo has set up a new direct container barge connection between the seaports of Antwerp and Rotterdam and its multimodal terminal at Dourges in northern France (left). The service will run two rounds trips per week using two push barge units and will handle all types of container, including those with dangerous goods (though not Classes 1 or 7). Contargo can also organise pre- and oncarriage by road through its trimodal service. Transit time is 30 hours from Antwerp or 40 hours from Rotterdam.

“In order to meet market demand we have decided to expand our network to include the Dourges terminal, where we see great potential for development,” says Gilbert Bredel, managing director of Contargo Northern France. “This will be in addition to the regular services we have been providing for years now in Valenciennes, the most important terminal in the region for sea containers.”

www.contargo.net

Air Water Inc, the US subsidiary of Air Water Japan, has acquired UK-based M1 Engineering, which specialises in the manufacture of cryogenic road tankers and other equipment.

The move is a response to what Air Water perceives as an imminent need for more equipment to move hydrogen and other emerging energies.

“In what is M1 Engineering’s 50th year anniversary of trading, this transaction marks a historic milestone for the company,” says Jason Gill, managing director of M1. “We’re excited for the opportunity to collaborate and grow with the Air Water America team to further enhance our product offering in hydrogen as the European market continues to expand. This acquisition enables M1 to access greater resources, products, and technology that will continue the long tradition of superior quality and technology that the M1 brand represents.”

www.awi.co.jp

www.m1engineering.com

Peacock Container has expanded its tank container fleet to 20,000 units, having taken delivery of a composite unit built by Tankwell. This new tank improves Peacock’s ability to provide its customers with efficient and sustainable transportation solutions for bulk liquids and gases, the company says.

“We are thrilled to add this new tank to our fleet, as it represents a significant step forward in our commitment to sustainability,” says CEO Jesse Vermeijden. “We are constantly seeking innovative solutions to improve our fleet and provide our customers with the most efficient and sustainable transportation options.”

Peacock’s diverse fleet of tanks includes containers for bulk liquids, liquefied gases, cryogenic gases, and bitumen. This range of tanks enables Peacock to offer comprehensive transport solutions for its customers across a variety of industries, including chemicals, food, pharmaceuticals, and energy.

peacockcontainer.com

DIGITALISATION • BASF COATINGS HAS DEVELOPED AN IBC TRACKING SYSTEM THAT, IN PARTNERSHIP WITH THIELMANN AND NXTGN, WILL NOW GO ON TO FURTHER DEVELOPMENT

BASF COATINGS HAS developed a tracking system for intermediate bulk containers (IBCs),Tracingo. The company has now come to a joint development agreement with NXTGN Solutions, which already offers the ibc.digital platform for tracking IBCs and foldable large containers, and packaging supplier Thielmann, to further develop the solution for the location and level measurement of IBCs in the supply chain. The partners are also preparing the sensors for ATEX certification to enable their use in hazardous areas and to meet the most stringent safety requirements.

The solution is a patented technology based on the evaluation of acoustic signals and the connection of sensors to the Internet of Things (IoT). It enables the location, fill level, shock load, temperature and contamination data of IBCs to be accurately measured. The collected data is processed and displayed in a web-based dashboard. It provides users from the logistics sector with a reliable basis for making decisions on

saving and optimisation measures in their fleet management.

Forwarding companies and manufacturers of all types of liquids can use ibc.digital to track and document the location of their containers, their fill level and conditions in real time. This transparency enables optimised resource planning, customised maintenance and complete traceability. Further development of this existing solution through the use of the Tracingo tracking system will help customers achieve even greater transparency and efficiency, the three partners say.

“Digitalisation is one of our approaches for continuous growth and more efficiency,” says Harald Borgholte, divisional digital officer at BASF’s Coatings division. “We not only develop coating solutions, but also intelligent digital solutions that offer customers added value. In the cooperation with Thielmann and NXTGN, we serve a completely new industry:

logistics. I am pleased to see how a business model has emerged from a user problem in our units and how we are now working together as partners to bring the product to the next level.”

Tracingo started as a user-driven digital initiative from BASF’s Logistics division and became a digital venture of BASF Coatings. Logistics and Container Management at the Münster site worked hand in hand with the company’s Digital Incubation Unit, which specialises in identifying and validating digital business models. They tested prototypes under the special requirements of the chemical industry, carried out user tests and investigated the market for their product.

“Real-time tracking and monitoring of IBCs is key to meeting the ever-increasing demands for supply chain security, sustainability and efficiency,” notes Patrick Franke, managing director of NXTGN. “IoT enables us to overcome these complex challenges. The development of a marketable solution together with BASF and Thielmann reflects the technological expertise of all parties involved as well as our company motto: from sensor to business model.”

Thielmann and NXTGN have been working together for several years in the field of container tracking using IoT technology. As the initiator and user of the technical solution, BASF Coatings remains an important innovation driver in the project. As a consultant for digitalisation in medium-sized companies and an expert in the field of IoT, NXTGN will lead further product development. Thielmann, which says it is the world’s leading manufacturer of stainless steel containers, will contribute its know-how on IBCs and customer requirements and act as a sales partner.

Eycke-Christian Dörre, managing director, services at Thielmann, says: “We support our customers with optimal services such as the collection and delivery of containers, cleaning and maintenance. Supported by digital technologies, we are also addressing issues such as tracking and smart fleet management, so that the life cycles of our products are transparent for our customers and for us.”

www.nxtgn.de

www.thielmann.com

Internal and external cleaning are automated in accordance with industrial and certified standards, and disinfection by steam is also possible. When choosing this state-of-the-art facility, the logistics company attached particular importance to an energy-efficient, resource-saving cleaning process. According to Jens Enskat, managing director of cotac, “This IBC cleaning system increases our processing capacity by 30 per cent - with the same number of staff. It makes our colleagues’ daily work easier, and gives our customers even greater planning security.”

The cotac group is an integral part of the full-service portfolio of the Hoyer Group. Twelve locations at logistics hubs in Europe, Asia and the US now support the group’s transport logistics processes. Cotac offers globally uniform standards for tank cleaning, repair and depot services, and is regularly audited in accordance with DIN EN-ISO 9001 and the Safety and Quality Assessment for Sustainability (SQAS) scheme. Cotac’s technical services ensure the smooth, efficient and safe transport logistics of the Hoyer Group all around the world, Hoyer says.