Working for more than 15 years in the Charlotte real estate market and leading the highly experienced RE/MAX Executive office in Ballantyne, Tiffany Johannes has a proven record of successful negotiations and conducting her business with professionalism and integrity. As an expert adviser, Tiffany is committed to making the home buying and selling process smooth and to serving as a tenacious advocate for her clients.

• Five Star Award Winning Real Estate Agent 7 Years Running Ranking in the Top .002% of 17,050 REALTORS ®

• America’s Top 100 Real Estate Agents In NC 2018, 2019

• 100 Most Influential Real Estate Agents 2016

• Best Real Estate Company “Best of Winner” 2017

• Charlotte Regional REALTOR ® Association Member

• CMLS Board of Directors 2011, 2019

• Charlotte Regional REALTOR ® Association Board of Directors 2017-2021

• Realtor Care Day Chair 2018

• Housing Opportunity Foundation Board Member 2009-Present

• Charlotte Regional REALTOR ® Association 2016 Committee Chair of the Year

• NAR Director since 2022

• NC REALTORS ® State Director since 2022

• Canopy President 2023

• Graduate Realtor Institute • Strategic Pricing Specialist • Certified Home Selling Expert

• Certified Home Buying Expert • Certified Distressed Property Expert • Short Sale Foreclosure

• Strategic Negotiating Specialist

Tiffany and her team are truly amazing!!

We have bought a few properties and now we have sold a home with Tiffany’s help. Tiffany & Mary made the whole sale experience smooth and simple. They are very professional, honest & very knowledgeable in Real estate. I would definitely recommend Charlotte Home Experts to everyone. Thank you!!!

Zillow review

Since 1998, RE/MAX Executive has been known for exceptional client care, innovative marketing ideas, and cutting edge technology. Our affiliated businesses, Executive Title, Executive Insurance, and Executive Home Lending provide valuable resources for home buyers and sellers, so you can experience a smoother transaction from start to finish.

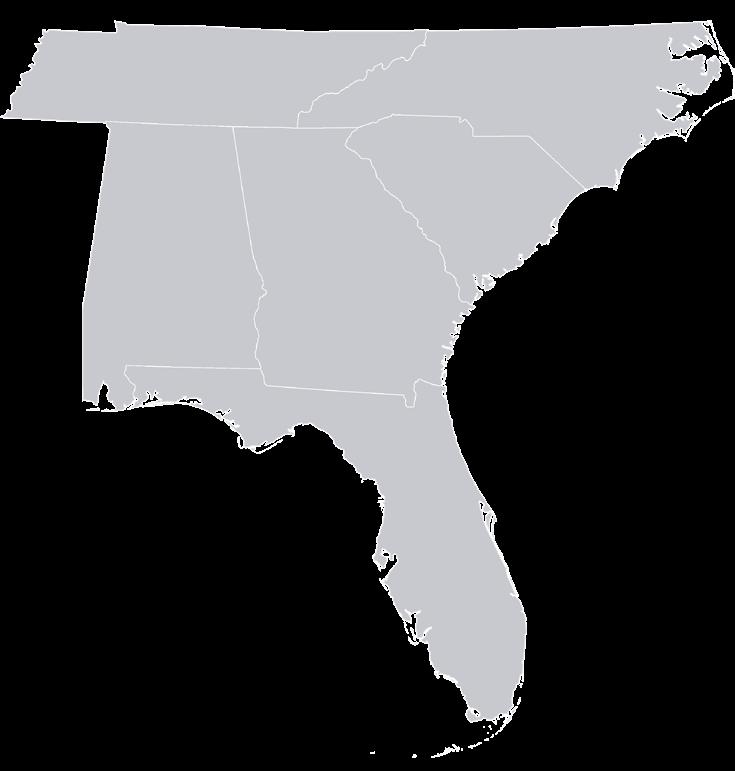

Customer satisfaction is reflected in our high, industry-leading rate of repeat and referral business. With over 5,559 transactions and over $2.5 billion in closed sales in 2022, we are the #1 RE/MAX in the Southeast!

SERVING THE CAROLINA SANDERSON, SC

ASHEVILLE, NC

CHARLOTTE, NC

CORNELIUS, NC

DENVER, NC

FORT MILL, SC

GEORGETOWN, SC

GREENVILLE, SC

HENDERSONVILLE, NC

INDIAN LAND, SC

LELAND, NC

MARS HILL, NC

MINT HILL, NC

MOORESVILLE, NC

MYRTLE BEACH, SC

OAK ISLAND, NC

PAWLEYS ISLAND, SC

RALEIGH, NC

SPARTANBURG, SC

WAYNESVILLE, NC

WILMINGTON, NC

YORK, SC

Welcome to the exciting journey of finding your new home—a journey where dreams take shape and the joy of homeownership becomes a reality. At RE/ MAX Executive, we understand that buying a home is one of life’s most significant milestones, and our agents are dedicated to guiding you through every step with care and expertise.

The process begins with understanding your unique desires and needs. Your RE/MAX Executive agent listens closely to envision the home that fits your life and dreams, ensuring your search is tailored and meaningful.

Navigating the financial landscape is your next step, and our agents are here to connect you with trusted mortgage professionals. With pre-approval, you’ll approach the home search with clarity and strength, knowing what you can afford and ready to make a move when you find “the one.”

Your agent’s local knowledge and extensive network open the door to a variety of homes, possibly including those not yet marketed. When you find that special place, they will help you craft an offer that is both compelling and smart, informed by a deep understanding of the market.

The commitment of your RE/MAX Executive agent extends beyond the offer acceptance. They stand by you through inspections and negotiations, ensuring your interests are always at the forefront. And as closing day approaches, they manage the complexities, coordinating with all parties to ensure a smooth transition.

At RE/MAX Executive, we’re more than agents—we’re your partners in this significant life event. From the initial meeting to the moment you hold your new keys, we’re here to ensure your path to homeownership is as seamless and joyful as possible.

Purchasing a home is one of the most significant financial decisions you’ll make in your lifetime. Proper preparation is crucial to ensure a smooth and successful home-buying experience. Here are some useful tips to help you get ready.

• Obtain a Credit Report: You can request a free annual credit report from the three major credit bureaus: Equifax, Experian, and TransUnion.

• Review for Errors: Ensure there are no discrepancies or errors on your report. If you find any, dispute them immediately.

• Understand Your Score: A higher credit score can lead to better mortgage rates. If your score isn’t ideal, consider waiting and working on improving it before purchasing.

• Determine Your Budget: Calculate how much home you can afford. Consider all monthly expenses, not just the mortgage.

• Save for a Down Payment: Aim for a down payment of 20% to avoid private mortgage insurance (PMI). However, there are loan programs available that require less, including loans that offer 100% financing. Working with a professional, you are guided through the prices to ensure you are aware of all the options available..

• Consider Closing Costs: These are additional fees and can range from 2% to 5% of the home’s purchase price.

• Pay Down Debt: Lenders look at your debt-to-income ratio. Reducing your debt can improve this ratio and your chances of getting a favorable loan.

• Avoid New Debt: Don’t make large purchases or take on new debt before buying a home. This can impact your credit score and loan approval.

PAY BILLS ON TIME

REDUCE DEBT TO LESS THAN 25% OF CREDIT LIMIT

KEEP LONG STANDING ACCOUNTS OPEN

DIVERSIFY TYPES OF CREDIT USE CHANGE BANK ACCOUNTS

APPLY FOR NEW CREDIT MAKE LARGE PURCHASES CO-SIGN OTHER LOANS

Fiduciary duty is a legal obligation to act in the best interests of our clients. When you choose us, you’re not just getting an agent; you’re gaining a partner bound by six crucial responsibilities:

1. LOYALTY

2. OBEDIENCE

3. DISCLOSURE

4. CONFIDENTIALITY

5. REASONABLE SKILL & CARE

6. ACCOUNTING

At RE/MAX Executive, these fiduciary duties are not just legal obligations; they’re the foundation of our relationship with you. We are here to make your real estate journey smooth, successful, and tailored to your unique needs.

Navigating the intricate art of negotiation is one of the core strengths of our agents. We understand that securing the right property at the right price is paramount.

Our skilled negotiators leverage their expertise and market insights to advocate fiercely on your behalf. Whether it’s securing a competitive offer or facilitating a seamless transaction, we are dedicated to achieving the best possible outcomes for you.

Generally, it is recommended that you get pre-qualified for a loan before you start viewing homes with the serious intention of buying. The pre-approval process involves meeting with a lender and authorizing them to examine your current financial situation and credit history. On the basis of this examination the lender will provide you with a document that details how much you can borrow to buy a home.

Payment History

Amounts You Owe

Length of Your Credit History

New Credit You Apply For

Types of Credit You Use

• Last two months of bank statements

• Last two months of retirement and 401K statements

• Last 30 days of pay stubs

• Award letters for Retirement Income, Social Security, Disability Income and SSI

• Last two years 1040 Federal Income Tax Returns

• Last two years of Federal Corporate and/or Partnership Tax Returns

• Last two years of W-2 forms

• Copy of Driver’s License

• For Military: Statement of Service (with reenlist eligibility) and Military ID

• If you have rental property income, bring a copy of all lease agreements

With a pre-approval letter in hand, you can confidently search for homes within your budget. Sellers are more likely to consider offers from pre-approved buyers since there’s a higher likelihood of the sale going through.

• Location

• Budget

• Size & Layout

• Future Resale Value

• Age & Condition of the Property

• Energy Efficiency

• Local School Districts

• Property Taxes

• Homeowners Association (HOA)

• Future Development

• Natural Disasters

• Commute & Transportation

• Local Amenities

• Noise & Surroundings

• Growth Potential

Once you find a home you love, your agent will help you make a competitive offer based on comparable homes in the area and current market conditions. The seller might accept your offer, reject it, or make a counteroffer. Your agent will guide you through the negotiation process to ensure you get the best deal possible.

Decide how much you’re willing to offer based on the home’s value and market conditions.

Decide on any conditions or contingencies you want to include in your offer, such as a home inspection or financing.

Decide on how much earnest money to offer, which acts as a sign of your commitment.

Put together a formal written offer that includes more than just the price. It might also detail terms, contingencies, and other conditions.

Once your offer is made, the seller may accept, counter, or reject it. Be prepared for some back-and-forth negotiation.

Due diligence, in the context of buying a home, refers to the process of thoroughly investigating and evaluating a property before finalizing the purchase. It’s a precautionary step to ensure that the buyer is fully informed about the property’s condition, legal status, and any other pertinent details.

• Protection: Due diligence protects the buyer from potential pitfalls or hidden issues that might not be immediately apparent.

• Informed Decision: It ensures that the buyer has all the necessary information to make an informed decision about the purchase.

• Value Assessment: Through due diligence, a buyer can determine if the property is worth the asking price.

• Legal Safety: It ensures that there are no legal encumbrances or disputes related to the property.

• PROPERTY INSPECTION

• TITLE SEARCH

• NEIGHBORHOOD RESEARCH

• REVIEW OF DOCUMENTS

• ENVIRONMENTAL CHECKS

• FINANCIAL ASSESSMENT

• ATTORNEY ENGAGEMENT

In the due diligence phase, your agent facilitates a smooth experience by:

• Thorough Research: Comprehensive property research guides negotiations.

• Strategic Communication: Your advocate in negotiating favorable terms.

• Expert Analysis: Analyzing inspections and advising on repairs or concessions.

• Navigating Legalities: Handling complex paperwork, deadlines, and legal aspects.

• Transparent Guidance: Keeping you informed and explaining intricate details.

• Creative Problem-Solving: Finding solutions for smooth deal progression.

We leverage our industry knowledge to help you achieve your goals during this negotiation phase.

• The home inspection process starts with your agent providing you trusted licensed inspectors.

• Licensed inspectors review every detail of the home from the foundation to the roof, capturing detailed photos in their reports.

• These reports will form the foundation for negotiation, and your agent will guide you through this process, ensuring you’re well-informed and confident every step of the way.

• A licensed home inspector is a generalist who does not open walls. They will often refer you to a system specialist, like an HVAC technician if they see an indication of a larger issue.

• Your agent is experienced and connected with a vast network of vendors, which they can tap into to address concerns and gather quotes for repairs.

Your agent acts as the bridge between you and the home inspector, making sure the inspection process is smooth and straightforward.

An independent appraisal is conducted during this phase, and the lender selects the appraiser. This ensures that the amount the buyer is paying is in line with the property’s actual worth. Lenders also require an appraisal to ensure that the loan amount they’re providing doesn’t exceed the value of the property, which serves as collateral for the mortgage.

Proximity to amenities, schools, and other essential services. LOCATION

Total square footage and number of bedrooms and bathrooms. SIZE

Age of the home, structural integrity, and the state of major systems. CONDITION

Renovations or improvements made to the property.

Whether the local market is hot (favoring sellers) or cold (favoring buyers). MARKET TRENDS

Title insurance is a type of insurance policy that protects homeowners and lenders from financial loss due to defects in the title of a property. A title refers to the legal right to own, possess, use, control, and dispose of a property.

• Protection from Past Issues: Unlike other insurance policies that protect against future events, title insurance protects against claims for past occurrences. These can include errors in public records, unknown liens, or claims of ownership by others.

• Peace of Mind: It ensures that the buyer is obtaining a property free from undisclosed encumbrances or rights, providing peace of mind in the purchase.

• Title Search: Before issuing a policy, the title company will conduct a title search. This involves reviewing public records to identify any issues or defects with the title.

• Issuance of Policy: Once the title search is complete and any identified issues are resolved, the title insurance policy is issued. There are typically two types of policies:

• Owner’s Policy: Protects the homeowner from defects in the title.

• Lender’s Policy: Protects the lender’s financial interests in the property.

• One-time Premium: Title insurance is unique in that it requires a one-time premium payment, typically at closing, rather than monthly premiums.

• Financial Protection: Protects against potential financial loss due to title defects.

• Legal Defense: If a claim is made against the title, the title insurance company will defend the homeowner in court and cover the associated legal fees.

• Coverage Duration: An owner’s policy lasts as long as the homeowner or their heirs have an interest in the property.

Homeowners Insurance is required by almost all lenders, so while that may not be optional for you, Home Warranties are. If you’ve got older appliances or systems, Home Warranties can be a great way to help control and anticipate the cost of replacing them.

REQUIRED by Lender

Covers STRUCTURES On the Property

Can pay INJURY OR DAMAGES you or family members cause others

Covers APPLIANCE breaks caused by normal wear-and-tear.

Covers SYSTEM failures, like HVAC or Water Heaters

Covers Fire, Smoke, Lightening, Windstorm, or Hail Damage

Covers Damages from Vandalism or Theft

REQUIRES ADDITIONAL COVERAGE Covers FLOOD Damage

REQUIRES ADDITIONAL COVERAGE Covers Mudslide and Earthquake Damage

DEPENDS ON CAUSE

Sudden freezing of plumbing, heating, air conditioning, or appliance

These generalizations are based on industry experience and are not specific guarantees of coverage from any insurance or warranty provider. ALWAYS read the specific coverages before accepting a policy.

The day of your closing can feel overwhelming, which is why having a RE/MAX Executive agent there to help guide you through the process is so important. We’ve know what to expect and what to look out for, so all you need to worry about is remembering what day to take out the trash.

Before the official procedures, buyers conduct a last inspection of the property to ensure it’s in the agreed-upon condition.

At the closing location (often a title company or attorney’s office), buyers and sellers review and sign essential legal documents. These documents detail the terms of the loan, property transfer, and associated costs

Buyers finalize their down payment and cover closing costs, which include various fees like loan origination, title searches, and appraisal fees.

Once all documents are signed and payments made, the property’s ownership is officially transferred to the buyer, and the deed is recorded in local records.

With the formalities completed and keys in hand, buyers can now move into their new home!

Also known as a Cape Cod, this style has a deep pitched roof and clean, simple design. Dormers can be added to a pitched roof to add windows or usable space on the upper level.

Also called a split entry, this home style typically has two short sets of stairs running up and down from the point of entry. It may or may not have living space at entry level.

Also referred to as a bungalow, a single-level house is known for a long, low design with all or most living space on ground level. Most have a basement level which may be finished into additional living space. A lower level walk-out includes a door to the exterior.

A two-story home has two full levels of living space. A traditional two story will have a ground level with an often equally sized floor directly above. Often you will find living space on the ground level, with the main suite and additional bedrooms on the second floor. There may also be a basement level. A Colonial is a type of two-story home with equal windows on the front upper and lower level.

An owned unit in a large property complex that consists of many individual units. Often has a fee that covers shared monthly expenses for the upkeep of the building and facilities.

An owned unit in a row of houses all attached to one another. Often has an association fee that covers shared monthly expenses for the upkeep of the exterior and any shared facilities.

Also called a semi-detached, this home has two single-family dwellings that are separated by one common wall and have mirror image layouts. Twin homes typically have two separate street addresses and can be owned by two different homeowners. Since outdoor maintenance is the responsibility of the homeowners, it is important to consider shared expenses that may need to be addressed, such as house siding, windows and upkeep of common spaces like the yard or shared driveway.

A duplex is a home consisting of two separate dwellings that are either side by side or stacked on top of each other. They typically have identical layouts or a mirror image of each other. A duplex typically has one street address with unit numbers and one property owner.

Bedrooms: 2+ 3+ 4+

Bathrooms: 1+ 2+ 3+ 4+

Dedicated Office Space: Yes No

Central Air Conditioning: Yes No

..................................................................................... ....................................................................................

Garage: 1-car 2-car 3+ car Attached Detached None .....................................................................................

Kitchen Features: Gas Stove/Cooktop Gas Oven Microwave Dishwasher

Walk-In Pantry Eat-In Kitchen

Updated Countertops Fully Renovated

..................................................................................... ....................................................................................

Bedroom Features: Walk-in Closet Master Bathroom

Bathroom Features: Double Vanity and Sinks Bathtub Double Shower

....................................................................................

Additional Indoor Features: Gas Fireplace Wood Fireplace

Mudroom Main Level Laundry

Alarm System Smart-Home Tech

Mounted TV or Sound System Wiring

Dedicated Dining Room Basement

....................................................................................

Outdoor Features:

Yard Space Wooded Lot Balcony

Pool Fence Shed

Balcony or Deck

Outdoor Entertaining Area

When you’re ready to make an offer, your RE/MAX agent will prepare the required paperwork and negotiate the purchase price and terms on your behalf, but there are a few things you’ll need to do as well:

1. Purchase insurance. You are required to purchase homeowners insurance if you have a mortgage. Make sure you purchase enough to fully cover your home and your belongings in case of a total loss.

2. Get a home inspection. Inspections generally cost hundreds of dollars but will bring to light any major issues or concerns with the home. The purchase agreement can be contingent on the outcome of the inspection, so if you don’t like what you find you can withdraw the agreement and keep looking.

3. Determine the status of utilities. In a traditional home sale, with sellers as occupants, you’ll want to check on the status of the utilities required by the home. Outstanding invoices for items such as water, gas and electric should be paid in full by the owners before closing. You will also want to have the services transferred to your name for billing. In a foreclosure or vacant home sale, in which the water has been turned off, contact the city to turn the water back on and check for broken or damaged pipes.

Your RE/MAX agent is a great resource. Don’t hesitate to ask for a referral if you’re looking for a:

• Mortgage Lender

• Inspector/Appraiser

• Moving Company

• Insurance Provider

• Contractor

• Landscaper

Preparing your taxes as a first-time homeowner can be, well, taxing. You will have a number of new tax considerations, including new deductibles such as mortgage insurance and property tax to claim. If you’re not sure what you’ll be eligible to claim, consider visiting a tax consultant or visit IRS.gov.

By familiarizing yourself with these homebuying basics, you’ll be better equipped to make informed decisions and a wise investment.

1. Amortization. The length of time allotted to paying off a loan – in homebuying terms, the mortgage. Most maximum amortization periods in the U.S. are 30 years, but options vary. Consult your mortgage lender to determine what is right for you.

2. Balanced market. In a balanced market, there is an equal balance of buyers and sellers in the market, which means reasonable offers are often accepted by sellers, and homes sell within a reasonable amount of time and prices remain stable.

3. Bridge financing. A short-term loan designed to “bridge” the gap for homebuyers who have purchased their new home before selling their existing home. This type of financing is common in a seller’s market or when life events happen and affect timing, allowing homebuyers to purchase without having to sell first.

4. Buyer’s market. In a buyer’s market, there are more homes on the market than there are buyers, giving the limited number of buyers more choice and greater negotiating power. Homes may stay on the market longer, and prices can be stable or dropping.

5. Closing.* This is the last step of the real estate transaction, once all the offer conditions outlined in the Agreement of Purchase and Sale have been met and ownership of the property is transferred to the buyer. Once the closing period has passed, the keys are exchanged on the closing date outlined in the offer.

6. Closing costs. The costs associated with closing the purchase deal. These costs can include legal and administrative fees related to the home purchase. Closing costs are additional to the purchase price of the home.

7. Comparative market analysis. A Comparative market analysis (CMA) is a report on comparable homes in the area that is used to derive an accurate value for the home in question.

8. Home inspection. The home inspection is performed to identify any existing or potential underlying problems in a home. This not only protects the buyer from risk, but also gives the buyer leverage when negotiating a purchase price.

9. Condominium ownership. A form of ownership whereby you own your unit and have an interest in common elements such as the lobby, elevators, halls, parking garage and building exterior. The condominium association is responsible for maintenance of building and common elements, and collects a monthly condo fee from each owner based on their proportionate share of the building.

10. Contingencies. This term refers to conditions that have to be met in order for the purchase of a home to be finalized. For example, there may be contingencies that the mortgage loan must be approved or the appraised value must be near the final sale price.

11. Deposit. An up-front payment made by the buyer to the seller at the time the offer is accepted. The deposit shows the seller that the buyer is serious about the purchase. This amount will be held in trust by the agent or lawyer until the deal closes, at which point it is applied to the purchase price.

12. Down payment. The down payment is the amount of money paid-up front for a home, in order to secure a mortgage. In the US, down payments typically range from 3.5% to 20% of the home’s total purchase price. Down payments less than 20% of a home’s purchase price may require mortgage loan insurance. The selling price, minus the deposit and down payment, is the amount of the mortgage loan.

13. Equity. The difference between a home’s market value and the amount owed on the mortgage. This is the portion of the home that has been paid for and is officially “owned.”

14. Fixed-rate mortgage. A fixed-rate mortgage guarantees your interest rate for a predetermined amount of time.

15. Home appraisal. A qualified professional provides a market value assessment of a home based on several factors such as property size, location, age of the home, etc. This is used to satisfy mortgage requirements, giving mortgage financing companies confirmation of the mortgaged property’s value.

16. First-time homebuyer assistance. Various programs exist across the US to help first-time homebuyers. Consult your mortgage lender for options you might want to consider or options for which you might qualify.

17. Land survey. A land survey will identify property lines. Simply put, it helps define what is yours and what isn’t. It is not required to purchase a house, but it is recommended and may be required by the mortgage lender. A land survey is important if issues arise between neighbors or the municipality, should the owner wish to make changes in the future involving property lines.

18. Seller’s market. In a seller’s market, there are more buyers than there are homes for sale. With fewer homes on the market and more buyers, homes sell quickly in a seller’s market. Prices of homes are likely to increase, and there are more likely to be multiple offers on a home. Multiple offers give the seller negotiating power, and conditional offers may be rejected.

19. Mortgage pre-approval. A mortgage pre-approval helps buyers understand how much they can borrow before going through the mortgage application process. Allows you to make an immediate offer when you find a home, since you know how much you’ll be approved for this lender, and locks in the current interest rate for a period of time, insulating you against near-term rate increases.

20. Title insurance. Title insurance is a policy designed to protect both yourself and your mortgage lender from financial loss or damages caused by potential title defects such as code violations or legal complications. Requirement of title insurance varies, so check with your RE/MAX agent for more information regarding your specific situation.

21. Mortgage loan insurance. If your down payment is less than 20% of the purchase price of the home, mortgage loan insurance may be required. It protects the lender in case of payment default. Contact your mortgage lender if you have questions.

22. Offer. An offer is a legal agreement to purchase a home. An offer can be conditional on a number of factors, like financing or the home inspection. If the conditions are not met, the buyer can cancel their offer.