Introduction to Stock Market Analysis Techniques

Stock market analysis techniques are essential for assessing and predicting market movements. By utilizing various approaches, investors and analysts can make informed decisions to maximize returns and mitigate risks.

Fundamental Analysis

Financial Statements & Ratios

Assessing a company's financial health using balance sheets, income statements, and key financial ratios.

Economic Indicators

Qualitative Factors

Evaluating macroeconomic data to understand the overall market and industry trends.

Examining management quality, market competition, and industry dynamics that affect a company's operations.

Technical Analysis

1 Candlestick Patterns

Identifying price trends and reversals using candlestick chart patterns.

2 Indicators & Oscillators

Using indicators like MovingAverages, RSI, and MACD to gauge market momentum and overbought/oversold conditions.

3 Chart Patterns

Recognizing formations like head and shoulders, triangles, and flags to predict future price movements.

Quantitative Analysis

Data-Driven Models

Utilizing statistical and mathematical models to derive insights from historical market data.

Algorithmic Trading

Implementing algorithms to execute trades based on predefined rules and analyses.

High-Frequency Trading

Employing sophisticated algorithms to execute a large number of orders at extremely rapid speeds.

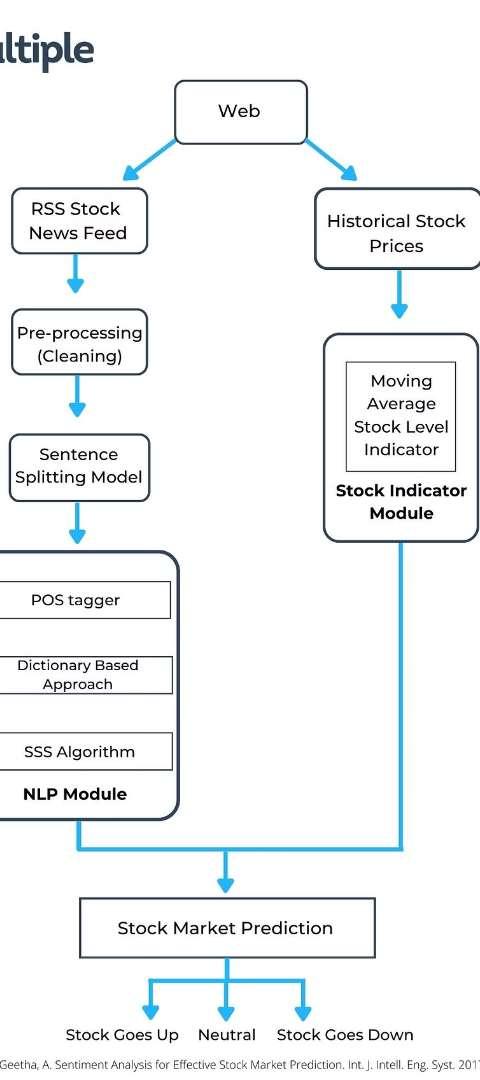

Sentiment Analysis

1 Social Media Monitoring

Utilizing AI tools to analyze sentiments expressed on social platforms, providing insights into public opinion on stocks.

2 News & Headline Analysis

Assessing news articles and headlines to gauge the overall market sentiment and its potential impact on stock prices.

3 Analyst Reports

Studying analyst reports to understand market consensus and investor sentiment towards specific stocks.

Market Trend Analysis

Trend Identification

Spotting upward, downward, and sideways trends in stock and market prices.

Pattern Recognition

Recognizing recurring price patterns to forecast future market movements.

Growth Potential

Evaluating sectors and industries with potential for growth or decline.

Risk Management Strategies

Diversification

Spreading investment across various assets to reduce risk.

Stop-Loss Orders

Automatically selling securities if they reach a predetermined price to limit losses.

Hedging

Using financial instruments to offset potential losses in existing investments.