SECOND QUARTER 2024

Q2 2024

SECOND QUARTER MARKET OBSERVATIONS

“Office sale transaction volume remains depressed with cap rates continuing to increase with PSF shift and a tight lending environment.”

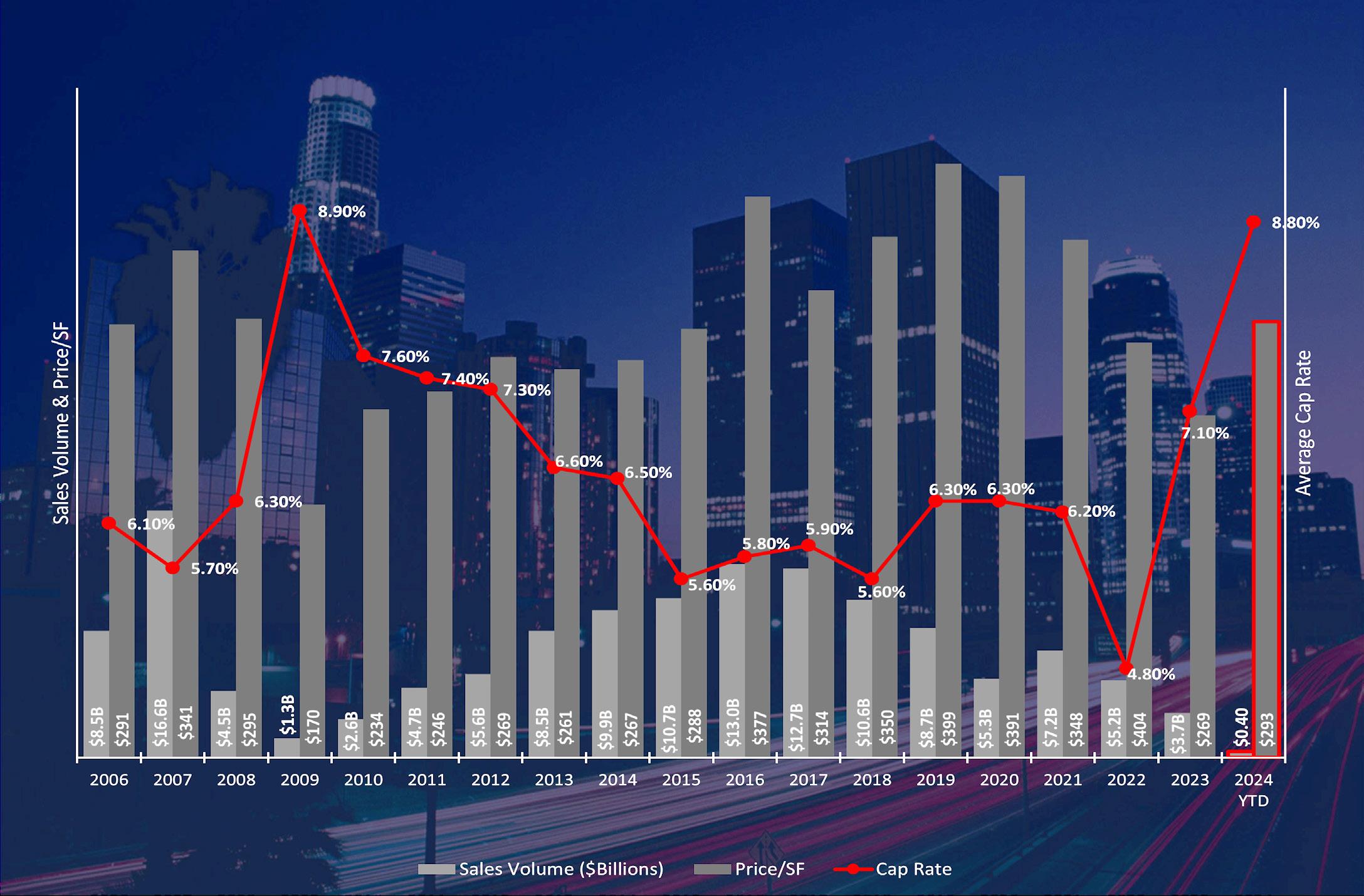

• Southern California Office Transaction Volume through Q2 2024 totaled $510 million dollars, down 66.4% from the same period last year ($1.5 billion).

• Southern California Average Cap Rates for all transactions through Q2 2024 averaged 8.8% increasing from 8.0% from the same period last year (+80 bps).

• The Average Per Square Foot sale price for office properties in Southern California in Q2 2024 was $230/sf, up 20% from the same time last year.

• Private family-office/regional operators represented roughly 57.5% of the buyer’s profile through through Q2 2024, with User/ Other capital accounting for less than 35.1%.

SALES FORECAST INDICATORS

• Debt is not readily available for office. Lenders are selective only considering best in class high quality assets in growth markets for top tier sponsors.

• New perm loans on Class-A stabilized office assets at 50-55% LTC with fixed interest rates in the mid 6% to 7% range, highly dependent on profile.

• Light value-add office assets in the SOFR+ 500s spread range up to 60-65% LTC and opportunistic office assets in the SOFR+ 500s and up, if financeable at all.

• Southern California Office Net Absorption is down -433,000 square feet in 2024 YTD versus -876,583 square feet in 2023.