Project proudly supported by

Project proudly supported by

Central Highlands Development Corporation with project funding support from Central Highlands Regional Council, engaged Infinitum Partners together with National Property Research Co, to develop a Workforce Development and Accommodation Strategy.

With continued and sustained challenges facing the region, particularly workforce retention and attraction, coupled with ongoing housing issues, the time is right to look anew. It is acknowledged that much work and research has been completed by numerous bodies and organisations over the past five years. This strategy presents an opportunity to investigate and learn from the past and better understand the on-ground insights that have not been gathered before. The result is beyond a report but rather a true action plan that focuses on outcomes and recommendations that will address both the current and the emerging issues in region. The focus of the strategy is on workforce,accommodation, childcare and lifestyle. Each focus area is interconnected and therefore four strategic pillars have been adopted to underpin the work:-

The team has delivered the project over three stages:-

1. Environmental Scan and Analysis

2. Let’s Talk

– Engagement on-ground

3. Project Action Plan

This report is a consolidation of each of the stages and their outputs.

SECURING THE WORKFORCE

ACCOMMODATING THE WORKFORCE

AIDING THE WORKFORCE

SECURING THE WORKFORCE

ACCOMMODATING THE WORKFORCE

AIDING THE WORKFORCE

CQ Rural Source: CHDC 1

PROTECTING LOCAL ASSET VALUES

2

The development of this Workforce Development and Accommodation Strategy encompassed a comprehensive approach, drawing upon diverse data sources and stakeholder engagement techniques to ensure a nuanced understanding of the region's needs and challenges.

Leveraging statistical insights from reputable sources such as the Australian Bureau of Statistics (ABS) and the Queensland Government Statistician's Office (QGSO), alongside real estate market analysis from CoreLogic, provided a robust foundation to inform discussion. Importantly, whilst a desktop analysis and interrogation provides a good understanding of historic trends and reported inputs, it is the valuable perspectives gleaned from surveys and one-on-one interviews that ensures a more holistic assessment of the situation. To uphold confidentiality, survey responses were aggregated while still allowing for meaningful analysis of trends and patterns.

In addition to engaging with mining and agricultural companies directly to understand their workforce and accommodation requirements, discussions were held with childcare operators, school teachers, principals, local valuers and local builders to capture a broader spectrum of insights. These conversations yielded intriguing observations, particularly regarding the attraction and retention of team members in addition to a perceived lack of amenity and lifestyle offerings in the region.

One-on-ones noted the following:-

• Retention and attraction is a challenge for all and not specific to a sector or even skill-type;

• Accommodation is not fit-for-purpose and is in short supply, especially rentals;

• Despite land availability, construction costs have slowed for new residential builds;

• The region is not positioning itself well in offering the affordable lifestyle that does exist;

• The Royalty Tax is impacting the region and not just mining sector but confidence in other sectors as well;

• Access to childcare remains a complex issue and is holding back staff on maternity leave to return to work and for existing capacity of centres to be maximised;

• Lifestyle factors such as hours for retail, restaurants, general amenity such as community events and attractions is lacking and is impacting on the ability to retain and attract, especially in such a competitive market. Surveys

3 Citrus Farm, Source: CHDC

One-on-OneInterviews RoundTable Sessions

The Central Highlands region in Queensland has a permanent population of 28,000 set within a vast and diverse landscape encompassing an area near the size of Tasmania. The region plays a pivotal role in Queensland's economy, with agriculture, mining, and tourism serving as key industries.

The region is a significant contributor to Queensland's economy, with an annual GRP of nearly $7 billion. The area's fertile soil supports the production of crops like cotton, sorghum, and wheat, as well as cattle grazing, contributing to the state's agricultural output. The region's extraction of mineral resources, particularly coal, fuels Queensland's energy sector and drives economic growth. These mining activities provide employment opportunities and economic growth for local communities, contributing to the region's prosperity now and in the future.

In addition to its economic significance, the region boasts a rich tapestry of 16 diverse communities, each contributing uniquely to the region's vibrancy and vitality. These communities, ranging from small rural towns to bustling urban centres, form the backbone of the region's social fabric, fostering a sense of belonging and interconnectedness among its residents.

Tourism also plays a vital role, with attractions such as the Carnarvon Gorge and the Sapphire Gemfields drawing visitors from around the world to experience the region's natural wonders, cultural heritage and the chance to fossick for a beautiful gem. More recently, the region is proving its strength as an attractor to young couples and families looking to buy an affordable home and build a career in a safe and familyoriented region.

4

Map of Central Highlands Local Government Boundary with key towns identified. Insert is context within broader state of Qld Source: CHDC

Disadvantage

Score: 996 (1000 average)

TOTAL POPULATION 28,311 5,546,051 (Qld total) POPULATION GROWTH RATE 1.9% for Emerald - 0.3% for balance LGA (1.5% for Qld) LABOUR FORCE 69% participation 66% (Full time) 24% (Part time) 2041 POPULATION 29,571 (medium series) +1,260 people (predominately in Emerald) AVERAGE RESIDENT AGE 34 years 38 years (Qld Av.) AVERAGE WEEKLY INCOME $1,011 (person) $787 (Qld Av. Person) $2,095 (household) $1,675 (Qld Av. household) TOP INDUSTRIES 1. Mining 2. Agriculture, forestry, fishing 3. RetailTrade 4. Education and training 5. Accommodation and food services 6. Health care and social assistance UNEMPLOYMENT RATE 3.2% 3.7% (Qld Av.)

SEIFA

LGA

NON-RESIDENT WORKERS 5,135 (2023) + 7.4% 4,780 (2022) OUTPUT $15.5B (24.36% all Central Qld) GRP $6.782B 5

MEDIAN

$520 (QLD Av.)

OWNERSHIP

MEDIAN PRICE House $285,000 $610,000 (BRIS Av.) Vacant Lot $37,000

RENTAL

PRICE

$350 3 bed house

HOUSING TYPES

86%

–

Apartment – 5% Other – 1.5% Average 2.6 people per dwelling Average 3.3 bedrooms LOTS REGISTERED 2023 – 12 2022 – 9

LOT SIZE Current – 747m2 2012 – 648m2 423m2 (SEQ 2019)

Detached –

Semi-detached

6% Flat/

MEDIAN

TYPE

– 41% Owned outright 22% Owned mortgage 28% QLD Av.: Renters – 33.1% Owned – 63.5% DWELLING SALES 2023 – 811 2022 – 822 Total Dwellings 14,097 RESIDENTIAL BUILDING APPROVALS 2023 – 35 2022 – 46 6

Renters

• Central Highlands, in particular Emerald, is experiencing growth (1.9%) higher than the Qld average (1.5%). This growth is compounded by growth in the non-resident population at 7%.

• This growth has placed pressure on all accommodation options from traditional residential through to rentals through to workers. When the non-resident growth rate is high, further pressure is placed on other accommodation such as short-term accommodation options from motels, hotels through to occupying private rentals. The pressures are different in the different towns with Emerald being the most affected, followed by Blackwater, Capella and Springsure.

• Unemployment in the region, 2.2% (Emerald), 4.3% (Rest of Central Highlands) remains one of the lowest in the country, let alone the State, yet employment opportunities continue to remain strong with broad vacancies across all industries.

• Attracting new talent to region, in a competitive job market, in a tight housing market with little to no rentals is difficult, if not impossible. Couple this with a known and proven childcare shortage again challenges the ability to retain and recruit.

• Early Childhood Education and Care is a complex issue. Whilst further interrogation will assist, there is a staffing issue at present which is inflating “vacancies”. Waitlists are strong and there is a need to accommodate more spaces for the 2538 residents who are between the 0-5 cohort.

• Properties continue to be available for sale across the region and remain affordable when compared to income (below 30%). This is compared with a much lower availability of properties for rent. The demand for rentals is high given the current rental vacancy rate is between 0.5% - 1.2% against the healthy vacancy rate of 2.5%.

• New build has slowed across commercial, retail and residential due to construction cost ($2200/m2 - $4000/m2). These figures, particularly for housing are inflated by circa $1,000/m2 when compared to SEQ. As a result, the cost of housing construction continues to place many challenges in front of the community where supply, finance and valuation contribute to the shortage of all types of accommodation. New supply is not keeping up with demand now and in the future (and has not historically) and without new build the rental and short-term accommodation issue will further deteriorate and vacancies will continue.

7

Emerald’s population has grown 1.9% per annum compared with the balance of Central Highlands LGA at a decrease of 0.3%. Emerald’s growth is set to continue. This permanent growth is compounded against a 7% growth in the non-resident workforce. On any givenday the region is supporting 30% extra workers.

To achieve a healthy rental market of 2.5% vacancy rate, 48 additional rentals are required in Emerald, 14 in Blackwater and 5 in Capella. The currency vacancy rate is between 0.5% - 1.2% across the whole region. A regional Build-to-Rent scheme using modern methods of construction could be an opportunity.

236 new dwellings are required to be provided on ground in Emerald to meet current growth. This equates to nearly 60 to be built per annum over next four years. This compares with the current rate of new dwelling builds of on avg 10 per year across the entire region. (Note cost of constructions makes this near impossible in current conditions and based on traditional methods).

Cost of construction for residentialnew build is between $2200m2 and $2600m2. This would mean that a 200m2 house would see a build cost of $520,000.00 with the total land component at $675,000.00. This represents a significant premium over the established house median in Emerald of $360,000 and therefore affects the viability of a new build market.

At least 300 new beds are required now to service the nonresident workforce. This is likely to grow to an additional demand of around 800 across the next five years. The former Agricultural College has been identified as a potential site as has expansion at existing accommodation such as Pritchard Road.

Currently 29% of the CH population is able to be accommodated in childcare based on total cohort of 0-5 year olds. There is a total of 734 licensed spots for 2,548 children. It is noted that due to current staffing issues, no centre is operating at their full licensed capacity. This compares with the Qld average of 53% who are able to be accommodated. The region is short 616 childcare spaces. The ability to deliver this is dependent on affordable construction and will not happen without retention and recruitment of skilled labour and accommodation and incentives to bring educators to region.

8

Central Highlands (CH) opens its arms to all those who work, visit and play in region. While there is a concerted effort and goal to foster growth for the permanent resident workforce, it is imperative to adopt a pragmatic approach and recognise that significant evolution in the workforce composition will not occur in the foreseeable future.

Given the diverse array of business models and the varied life stages of individuals, it is essentialto explore opportunities that cater to these distinct needs. Both Fly-In-Fly-Out and Drive-In Drive-Out workforce arrangements are, and will continue to be, integral components of our future. Thus, ongoing support and the establishment of a balance between resident and non-resident workers is crucial.

It's important to note that while mining is one of the primary employers in the region, other sectors, including agriculture and government administration, also rely on a non-resident workforce. Failing to recognise the interdependence between these different models will jeopardise the long-term stability of the CH communities. Put simply, sustainable growth hinges on the synergy between both workforce approaches.

Our primary challenge arises from the intricate interplay of various factors, such as education, childcare and housing, necessary not only to sustain but also to expand, assist, and support the workforce. Overcoming this challenge cannot rest solely on the shoulders of one sector; rather, it demands unprecedented collaboration among all levels of government and the private sector in the region. Undoubtedly though, urgent government interventionis required to change the trajectory and streamline action on ground as soon as possible. CHDC, CHRC and the Resources Roundtable are committed to exploring and facilitating solutions for the greatergood of the region.

9 Emerald CBD, Source: CHDC

CHDC to establish the Workforce and Accommodation Collective (WAC) to deliver and monitor the agreed priorities and continue to drive the broader recommended actions. Membership will include members of the already established Resources Roundtable as well as other businesses, institutions and CHRC. The State Government will also be invited to participate. The WAC will meet monthly and communicate outcomes publicly.

TIMEFRAME:- The first meeting of the group will be held in May 2024.

CHDC to partner with major property portfolio holders (both public and private sector) to actively review housing stock and seek opportunities to release surplus supply, encourage redevelopment and/or commitment to new development. Initial priority on available stock that could be used to house keyworkers such as Childcare, Education and Health workers in Blackwater.

TIMEFRAME:- Reviewto commence 1 April 2024. Opportunities to support Blackwater to be identified by 30 May 2024.

CHDC to develop and launch an Expression of Interest from developers /builders to support the“12 in 12 ” campaign which will see at least 12 new builds across the region within 12 months. CHDC to work with key property owners, government and companies to also develop other incentives that may support the new build (traineeships, materials, additional grants for first home buyers). Land (as identified in Action 2) would be across the region in all towns and nominated by both government and private sector.

TIMEFRAME:- EOI to launch by 1 May 2024.

TIMEFRAME:- CHRC to consider appropriate inclusions in the upcoming budget by June 2024 and meeting with Blackwater Town Centre owner by 30 June 2024. ACTION

CHDC has identified a funding source to create a new Full Time Equivalent (FTE) for a Future Skills Facilitator. The position will be tasked with the coordination and collaboration between education systems, government, and industry sectors across the region. The role will initially review current Regional Training Organisations (RTO)s and certification offerings for the region with a focus on skills shortages such as early childhood and construction. The role will also engage directly with the CH VET Network and Indigenous groups to ensure the region is gaining access to the right programs and schools to industry pathways.

TIMEFRAME:- Funding proposal to be finalised an application sought by June 2024.

CHDC to engage with and develop business case to expand the Childcare Leadership Alliance (CLA) into the Central Highlands Region with focus on Blackwater as the first priority area. CLA to be formally invited to address the WAC at its first meeting in June 2024. The WAC with the CLA would be utilised to investigate whether additional centres are needed, where and how they should be developed.

TIMEFRAME:- CLA discussions to commence by 1 June 2024. Business Case to be finalised by 1 September 2024.

Capital investment (such as CHRC capital budget and trunk infrastructure delivery) to be directedto areas of highest need. Initial investment should be directed to significant park upgrades in Blackwater (Dempsey Park), new park in Emerald (Devonport Street) and engagement directly with the owner of Blackwater Town Centre on its upgrade and expansion of hours of operation through the State Government to enable Sunday trade for supermarket.

COLLABORATION ACCOMMODATION ACCOMMODATION

4 – BUILD 12 IN 12 ACTION 5 – CHILDCARE ALLIANCE ACTION 6 – CAPITAL INVESTMENT

FUTURE

10

1 – ESTABLISH W.A.C

CHILDCARE LIFSETYLE ACTION 2 – PROPERTY REVIEW ACTION

ACTION 3 –

SKILLS FACILITATOR WORKFORCE

ACTION 7 – INVESTMENT INCENTIVES

CHDC to review and consolidate all known current incentives and outline suggested new incentives and/or amended policy to support investment in region.

Review should include CHRC’s Regional Economic Development Incentives as well as rates on nonprincipal place of residence and other potential opportunities for support directly from major employers or suppliers.

TIMEFRAME:- Reviewto be completed by 30 May 2024.

LIFSETYLE

ACTION 8 – FAIRER AIRFARES

CHDC to develop position paper to work directly with the airlines to find solutions on reducing the cost of airfares and expanding regional subsidy schemes for residents. Monitoring of new fleet and its impact on costs and availabilityof flights to also be undertaken and improvements to be appropriately communicated to community.

TIMEFRAME:- Position Paper to be finalised by 30 June 2024 and roundtable held through WAC in July 2024.

ACTION 10 – SMALL BUSINESS FRIENDLY

CHDC together with CHRC to engage with local Small Businesses to discuss benefits of the CHRC joining the Small Business Friendly Program. Based on general agreement from local businesses on the benefit of the program, CHRC will prepare and lodge application to join the Small Business Friendly Program and commit to the Program Charter.

TIMEFRAME:- Engagement with Subject Matter Experts (SMEs) by 30 May 2024 and application prepared for briefing to CHRC by 30 June 2024.

ACTION 9 – TALENT ATTRACTION

ATTRACTION

Ensure that the Talent Attraction Campaign is considerate of the findings of this work and is timed appropriately. Stage 1 to be focused on placing the region on the radar and then Stage 2 to target identified areas of need.

TIMEFRAME:- Ongoing.

COLLABORATION

11

COLLABORATION

Potential land identified in Action 2 as well as EOIs from Action 3 to be used to develop a Regional Build-to-Rent Scheme. Land to be identified across the region and firm proposals sought from EOI respondents. Pilot BTR scheme to be confirmed from a feasibility perspective and ‘if viable’scheme deliveredin region in 2025.

TIMEFRAME:- Proposals to EOI respondents sought by 30 August 2024. First Pilot BTR, if feasible, to be identified and delivered by 1 March 2025.

– SHUTDOWN COORDINATION

Through the WAC, coordinate and acknowledge the need for fit-for-purpose accommodation across the region. Identify appropriate sites for additional village style accommodation in the right locations across the region including expansion of existing in-town locations such as Pritchard Road. Facilitate the required community conversation and necessary engagement with community to balance the need for different forms of accommodation.

TIMEFRAME:- Appropriate sites to be identified by 30 September 2024.

ATTRACTION

CHDC with support from the Resources Roundtable, to develop a Shutdown Coordination Calendar. The calendar will be developed as a soft copy prior to seeking proposals from software developers to pilot a platform-based Bowen Basin Mines Calendar.

TIMEFRAME:- Soft copy Calendar by 30 July 2024. Proposals to be sought by 30 September 2024 and decision made on next steps by 1 December 2024. ACTION 12

CHDC to seek proposals from software developers to develop a proof-in-concept real-time occupancy of mining accommodation across the region. Understanding real-time vacancy would substantially improve efficiency and availability with opportunity to free up other in-demand accommodation such as motels and hotels in town. If the proof-in-concept is viable, then funding to be sourced to develop further.

TIMEFRAME:- Proposals to be sought by 30 October 2024. Proof-in-concept by 15 December 2024.

As members of the Regional Activators Alliance CHDC to ensure that the region is represented in the Move to More campaign. CHDC to understand investment requirement and ensure appropriate budgeting to cover cost if benefit is identified.

TIMEFRAME:- 1 December 2024.

COLLABORATION

CHDC together with CHRC to coordinate and better promote access to available funding opportunities for community groups across the region. Encourage major employers to partner with and sponsor community activities and events. A centralised webpage on CHDC’s website to direct community members to the opportunities such as Grant Finder, Company Community Partnership Schemes, Council Sponsorship Opportunities.

TIMEFRAME:- Centralised webpage to be published by 1 February 2025. ACTION 16

ACCOMMODATION ACCOMMODATION

– REGIONAL

– FIT-FOR-PURPOSE

– MOVE

ACTION 11

BUILD-TO-RENT ACTION 14

ACCOMMODATION ACTION 15

TOMORE CAMPAIGN

– COMMUNITY SUPPORT

12

COLLABORATION ACCOMMODATION ACTION 13 – ACCOMMODATION MANAGEMENT

The establishment of the Workforceand Accommodation Collective (WAC) has been identified as the number one action and priority for this strategy. The WAC signifies a pivotal step towards addressing crucial issues surrounding workforce and accommodation within the region especially in our key Emerald and Blackwater communities.

Facilitatedby Central Highlands Development Corporation (CHDC), the WAC will be responsible for and accountable to, implementation of the strategy, driving, reporting, and monitoring actions as identified. The success of the strategy will squarely rest on the actions being realised and this cannot rest with any single stakeholder. The WAC will convene monthly with each meeting documented and resulting in a communication that is published on the CHDC website for all to see.

With a collaborative approach at its core, the WAC will draw expertise and representationfrom various stakeholders. Members will include representatives from established groups such as the Resources Roundtable, CH VET Network, major employers together with CHRC and importantly community champions including at least one for Emerald and Blackwater.

The WAC will enact meaningful change through the identified actions to enhance the well-being of all the communities and workplaces across the region.

Meetings will be held monthly, will rotate between Emerald and Blackwater. The first meeting of the WAC will be held in May 2024.

13 Resources Roundtable Workshop, 27 February 2024 Source: CHDC

The Workforce and Accommodation Collective will host its first meeting in May 2024.

14

In assessing the present landscape of our region's workforce development and accommodation needs, it is imperative to start with a comprehensive overview of what the published data tells us, ground-truthed with local insights. This section serves as a foundation for understanding the dynamics at play which have informed the development of the actions identified. The following pages offer a snapshot of key indicators that influence the region's economic vitality, social fabric, and housing and childcare needs. A more in-depth analysis and insights can be found in the detailed report prepared by National Property ResearchCo, available in Attachment 1.

The following pages encapsulate the region's current condition, shedding light on critical areas such as population growth, workforce composition, industry dynamics, and housing market trends. Population growth serves as a barometer of community expansion and directly impacts demand for housing, infrastructure, capital investment and essentialservices. Additionally, understanding the nuances between resident and non-resident workforce trends is pivotal for tailoring employment initiatives and accommodation solutions to meet diverse needs.

The analysis is comprehensive as it also provides an understanding of land and house sales, construction costs, rental vacancy rates, and childcare availability. The purpose is to present a holistic view of the housing market's health and its implications for workforce retentionand attraction.

Known platforms such as ABS Data, Queensland Government Statisticians Office, Core Logic are just some that have been utilised to understand the recorded data. However, reported data is often lagging in time census or does not reflect the true state on-ground especially given the impact of COVID-19 to the region. This is why the insights gained directly through interviews has been crucial in understanding the actual on-ground challenges as well as opportunities.

15

Emerald has and will continue to grow. By 2041 Emerald will support an additional est. 2400 people. Growth continues in the main to be Young Families (30-44 years)

The rest of the CH LGA will however, based on no intervention, see a continued decline of around 1000 residents based on current projections.

These projections are likely to be conservative as they were calculated in a near pandemic environment with the full knowledge of high interstate and international migration, rising metro house prices and at a time when coal prices and demand were considered low.

Source:ABS,QGSO & The NPR Co.

*2022 figures arebasedon currentpopulation estimates. All other totals and market sharedataprojections.

PopulationProjections byBuyerProfile(Left)& ProjectedChangein PopulationbyAgeGroup(Number- Left,MarketShare-Right) 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 2022* 2026 2031 2036 2041 2046 2022* 2026 2031 2036 2041 2046 Emerald SA2 Rest of Central Highlands LGA Total Population 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2022* 2026 2031 2036 2041 2046 2022* 2026 2031 2036 2041 2046 Emerald SA2 Rest of Central Highlands LGA Share of Total Population

16

Central Highlands LGA’s total full-time equivalent population, is comprised of both the total resident population and the total non-resident workers on shift.

Non-resident population is the number of flyin/fly-out or drive-in/drive-out (FIFO/DIDO) workers who are living in the area of their workplace temporarily, and who have their usual place of residence elsewhere. This group includes employees, contractors and associatedsub-contractors employed in construction, production and maintenance at mining and gas industry operations and projects, renewable energy projects and resource-relatedinfrastructure. This number does not include other nonresidentialworkforce such as those in the agricultural sector.

As per Table 3 QGSO’s forecast for 2023 was 4,430 against a recorded 5,135; a difference of 705 workers. The current recorded number is already above that projected for 2026. Based on further insights gained it is likely that growth in the mining sector and therefore nonresident is likely to increase over the coming five years.

Central Highlands LGA Full-Time Equivalent Population by Town & Resident Status Location Locality ResidentPopulation Non-ResidentWorkerson Shift Full-TimeEquivalent Population 2022 2023 % Change 2022 2023 % Change 2022 2023 % Change In Town Blackwater 4,675 4,710 0.7% 1,990 1,915 -3.8% 6,665 6,625 -0.6% Bluff 235 235 0.0% 265 260 -1.9% 500 495 -1.0% Capella 990 975 -1.5% 50 105 110.0% 1,040 1,080 3.8% Emerald 14,380 14,640 1.8% 405 525 29.6% 14,785 15,165 2.6% Springsure 745 720 -3.4% 75 25 -66.7% 820 745 -9.1% Tieri 725 755 4.1% 605 635 5.0% 1,330 1,390 4.5% Other towns 1,350 1,335 -1.1% 20 15 -25.0% 1,370 1,350 -1.5% Rural Areas 5,260 5,190 -1.3% 1,370 1,655 20.8% 6,630 6,845 3.2% Total 28,360 28,560 0.7% 4,780 5,135 7.4% 33,140 33,695 1.7%

Source: Queensland Government Statistician’s Office

17

Share of Resource Industry Workforceby Employment (Left) & Resident Status (Right): Bowen Basin LGAs June 2022 41% 51% 38% 38% 40% 59% 49% 62% 62% 60% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Central Highlands

Only) Bowen

Total Share of Resource Industry Labour Force Employees Contractors 49% 50% 25% 58% 35% 51% 50% 75% 42% 65% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Central

Share of Resource Industry Labour Force Local Resident Non Resident Source: Queensland Government Statistician’s Office 18

Banana Isaac Whitsunday (Bowen

Basin

Highlands Banana Isaac Whitsunday (Bowen Only) Bowen Basin Total

Catchment 2011 2016 2021 # Industry % # Industry % # Industry % Emerald 1 Mining 23% 1 Mining 20% 1 Mining 19% 2 Retail trade 10% 2 Retail trade 12% 2 Retail trade 11% 3 Construction 10% 3 Education and training 9% 3 Education and training 9% 4 Education and training 8% 4 Health care and social assistance 7% 4 Health care and social assistance 8% 5 Accommodation and food services 7% 5 Accommodation and food services 7% 5 Accommodation and food services 7% - All Other Industries 44% - All Other Industries 45% - All Other Industries 45% Rest of Central Highlands LGA* 1 Mining 30% 1 Mining 30% 1 Mining 28% 2 Agriculture, forestryand fishing 20% 2 Agriculture, forestryand fishing 22% 2 Agriculture, forestryand fishing 23% 3 Construction 7% 3 Education and training 7% 3 Accommodation and food services 7% 4 Accommodation and food services 7% 4 Accommodation and food services 6% 4 Education and training 6% 5 Education and training 6% 5 Retail trade 5% 5 Construction 6% - All Other Industries 31% - All Other Industries 29% - All Other Industries 31% Source: ABS & The NPR Co. 19

Top Five Industries of Employment by Catchment

Occupations of Employment by Catchment Catchment 2011 2016 2021 # Occupation % # Occupation % # Occupation % Emerald 1 Technicians & Trades 21% 1 Technicians & Trades 19% 1 Technicians & Trades 19% 2 Machinery Operators & Drivers 18% 2 Machinery Operators & Drivers 16% 2 Machinery Operators & Drivers 15% 3 Clerical & Admin 14% 3 Professionals 14% 3 Professionals 14% 4 Professionals 13% 4 Clerical & Admin 13% 4 Labourers 12% 5 Labourers 10% 5 Sales 11% 5 Clerical & Admin 11% 6 Managers 9% 6 Labourers 10% 6 Managers 10% 7 Sales 8% 7 Managers 10% 7 Sales 10% 8 Community & Personal Service 6% 8 Community & Personal Service 8% 8 Community & Personal Service 9% Rest of Central Highlands LGA* 1 Machinery Operators & Drivers 23% 1 Machinery Operators & Drivers 19% 1 Managers 20% 2 Managers 20% 2 Technicians & Trades 18% 2 Machinery Operators & Drivers 20% 3 Technicians & Trades 17% 3 Managers 15% 3 Labourers 16% 4 Labourers 13% 4 Labourers 12% 4 Technicians & Trades 15% 5 Clerical & Admin 9% 5 Professionals 11% 5 Professionals 9% 6 Professionals 9% 6 Clerical & Admin 11% 6 Clerical & Admin 8% 7 Community & Personal Service 5% 7 Sales 7% 7 Community & Personal Service 7% 8 Sales 4% 8 Community & Personal Service 7% 8 Sales 5% Source: ABS & The NPR Co. 20

Historical (Left) & Current Unemployment Rates as at Jun-23 (Right) by Catchment

The unemployment rate for the region reflects sound economic fundamentals and a labour force that is well below full employment reflecting the current economic cycle. Despite this, even during periods of low demand, unemployment rates in Emerald have rarely been above 4.0%. What is also evident is that the current unemployment rates are below those during the resource boom and could create a new record low in the coming months/years.

Source: ABS & The NPR Co.

Source: ABS & The NPR Co.

0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% Dec-10 May-11 Oct-11 Mar-12 Aug-12 Jan-13 Jun-13 Nov-13 Apr-14 Sep-14 Feb-15 Jul-15 Dec-15 May-16 Oct-16 Mar-17 Aug-17 Jan-18 Jun-18 Nov-18 Apr-19 Sep-19 Feb-20 Jul-20 Dec-20 May-21 Oct-21 Mar-22 Aug-22 Jan-23 Jun-23 Unemployment Rate Emerald Rest of Central Highlands LGA Full Employment 2.2% 4.3% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Emerald Rest of Central Highlands LGA Unemployment Rate Full Employment

21

Housing tenure has remained quite consistent throughout the past three Census periods, with owner occupiers trending sidewards, occupying 53% of local dwellings within the Central Highlands LGA in both 2011 and 2021. Whilst this sentiment is generally also true for Emerald alone, it has experienced a slight rise in renters, who have increased from a 42% share in 2011 to a 44% share in 2021. More recent property buyer origin data suggests that rental occupants have continued to rise in Emerald, with investors making up a growing share of property sales of late. This has come on the back of a combination of record low vacancy rates, still belowpeak sale prices and growing non-resident workforce numbers.

0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 2011 2016 2021 2011 2016 2021 2011 2016 2021 2011 2016 2021 2011 2016 2021 2011 2016 2021 2011 2016 2021 2011 2016 2021 Emerald Rest of Central Highlands Emerald Rest of Central Highlands Emerald Rest of Central Highlands Emerald Rest of Central Highlands Houses Semi-detached, Townhouses etc. Flat or Unit/Apartments Other Total Occupied Private Dwellings Owned Outright Owned With a Mortgage Rented Other Changes in Dwelling Structure & Tenure by Census Period & Catchment

ABS & The NPR Co

Source:

22

Three and four bedroom households account for a largely unchanged 75% share of occupied private dwellings throughout the Central Highlands LGA, despite the fact that one and two person households continue to account for a dominant 59% share of private dwellings.

At a high level, this suggests that there is potential for acceptance of smaller, higher density accommodation providing for more one and two bedroom product. Source:

Changes in Dwelling Structure by Number of Bedrooms (Left) & Persons Resident (Right) by Census Period & Catchment 0 1,000 2,000 3,000 4,000 5,000 6,000 2011 2016 2021 2011 2016 2021 Emerald Rest of Central Highlands LGA Total Occupied Private Dwellings None One Two Three Four Five Six or more 0 1,000 2,000 3,000 4,000 5,000 6,000 2011 2016 2021 2011 2016 2021 Emerald Rest of Central Highlands LGA Total Occupied Private Dwellings One Two Three Four Five Six or more

ABS & The NPR Co. 23

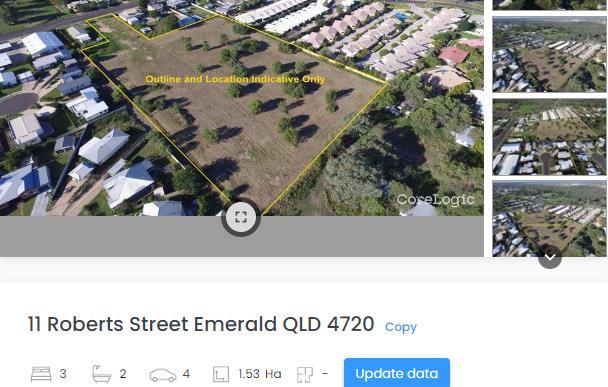

CHRC is currentlyundertaking a land supply study investigating availability of residential, commercial and industrial land. Whilst this work will provide more detailed analysis, the high-level summary for residential land is as follows:-

As at September 2023, in Emerald, there is approximately 280 lots approved not yet developed on of which 43 have operational works approval. These lots are in addition to the current vacant registered lots. This number is in the order of 80 (some are on market, many are not).

The town has three major estates with future developmentpotential as residential lots are approved.

• MARANDAHEIGHTS – Stage 11 – currently selling with 19 lots registered and available. Balance of the estate circa 80 lots is yet to be endorsed and registered.

• NOGOA RISE – 30+ vacant lots owned by council – 12 “on market” across stages 3 (11 lots) and 4 (23 lots) to go.

• MAYFAIR RIDGE - Stages 9 and 12 approved not yet developed – circa 110 lots. Have not proceeded due to cost of extending Lauren Drive.

Also note that Central Highlands Community Services has a Housing Study underway and near completion.

24 Mayfair Estate, Emerald, Source: Qld Globe

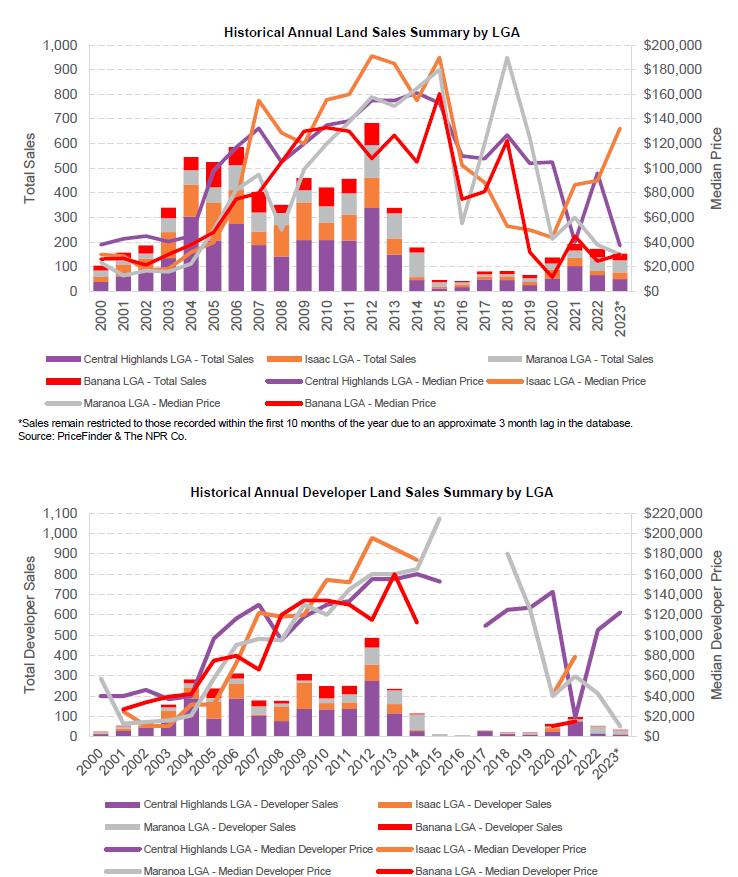

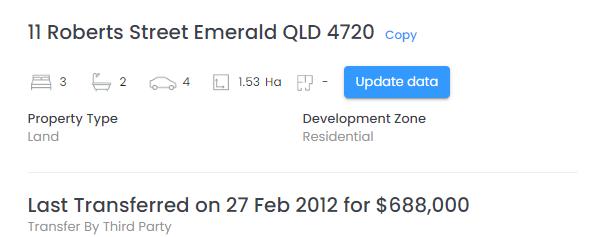

HistoricalAnnual HouseSalesSummarybyCatchment

Since 2000 Emerald has accounted for 37% of all established house sales recorded within the Central Highlands LGA as a whole. In Emerald during the resource boom, annual house sales peaked in 2011 at 406 sales, whilst the median house price peaked a year later at $460,000, circa $300,000 cheaper than Moranbah.

As the peak mining construction phase came to pass and the industry transitioned towards the less labour intensive operational phase, demand for housing plummeted and so did values. The downturn was prolonged and it wasn’t until 2017 that the median house price had bottomed at $245,000 in Emerald. Importantly, since bottoming in 2017, volumes and median house price growth in both catchment regions have grown at a much more sustainable rate.

Despite stable annual growth since 2017, the 2023 median house price in Emerald ($360,000) remains $100,000 lower than the previous market peak in 2012. Part of this response has been the ability for more fit-for-purpose benefits of mining specific accommodation heightened through the capacity to provide a buffer against these types of extreme market cycles in the future.

$0 $42,500 $85,000 $127,500 $170,000 $212,500 $255,000 $297,500 $340,000 $382,500 $425,000 $467,500 $510,000 0 50 100 150 200 250 300 350 400 450 500 550 600 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023* 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023* Emerald Rest of the LGA Median Price Total Sales Total Sales Median Sale Price Central Highlands LGA Median Sale Price *Sales remain restricted to those recorded within the first 10 months of the year due to an approximate 3 month lag in the database. Source: PriceFinder & The NPR Co.

25

Central Queensland Historical Vacancy Rates

0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar-22 May-22 Jul-22 Sep-22 Nov-22 Jan-23 Mar-23 May-23 Jul-23 Sep-23 Nov-23 Vacancy Rate Tight Vacancy Rate Healthy Vacancy Rate Weak Vacancy Rate Central Queensland Vacamcy Rate Note – Central Queensland comprises Banana LGA, Central Highlands LGA, Gladstone LGA, Rockhampton LGA, Woorabinda & Livingstone LGA.

Source: SQM Research

26

Source:SQM Research

Central Highlands LGAVacancy Rates by Key Postcode

Low residential vacancy rates is a common theme throughout the entire Central Highlands LGA. In general terms, each of the four key postcodes have seen their vacancy rates trend within the tight range since February 2022. Notably, the 4720 postcode has recorded tight vacancy rates for 52 months in a row dating back to September 2019, whilst the 4702 postcode has experienced an even longer period (72 months) of tight vacancy rates which extends back to January 2018.

As at the end of December 2023 all four postcodes recorded tight vacancy rates, ranging between 0.5% (Emerald) and 1.2% (Capella). Conventional market theory suggests that the logical flow on effect of such tight vacancy rates will be continued rental price growth. For the Central Highlands LGA, this is likely to place rising pressure on housing affordability – an issue that will be furthered compounded by the current lack of future housing supply due to construction industry constraints and costs.

ar ul ov acanc ate i t acanc ate ealt acanc ate ea acanc ate merald lac ater a ella u vale

ar ul ov ar ul ov ar ul ov ar ul ov ar ul ov ar ul ov ar ul ov ar ul ov

27

With low vacancy rates has come strong rental price growth. Between December 2019 and December 2023, the median weekly rental rate for units within the 4720 postcode has increased by 46%, from $248 to $361. Despite such considerable growth, from a housing share of income perspective, the median weekly rental rate for a unit in the 4720 postcode remains well and truly affordable, at a circa 15% of the typical local weekly household income. Notably, the turnover rate of rental units has declined of late, falling by 22% from 454 in 2019 (pre Covid-19) to a new cyclical low of 354 in 2023. However, this is not unique to the unit rental market, with a decline in turnover of all rental property types observed since the onset of Covid19, due to the combination of constrained supply, rising rents meaning more people are staying in the same rental for longer.

$0 $55 $110 $165 $220 $275 $330 $385 $440 $495 $550 0 50 100 150 200 250 300 350 400 450 500 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Median Weekly Rental Rate Total New Bonds 4720 New Unit Bonds Rest of Central Highlands LGA New Unit Bonds 4720 Median Unit Rental Rate Central Highlands LGA Median Unit Rental Rate

& The NPR

Source: RTA

Co.

28

Central Highlands LGAHistorical Workers Accommodation Village Capacity & Non-Resident Workers on Shift

The relationship between the two variables tracked is more complex than presented. There is a contingent of the non-resident DIDO and/or FIFO workforce who are allocated a permanent room/bed within certain workers accommodation villages, as to avoid ‘hot bedding’. This means that even when these workers are not staying within the village, their room/bed is unoccupied awaiting their return on the following swing. Note this also applies to leave / long service leave.

This highlights the need to retain a sizeable buffer between the combined Workers Accommodation Village capacity and the nonresident workforce population, acknowledging that the non-resident population figure shown only accounts for workers on shift at any one point in time, rather than the total non-resident workforce.

Accordingly, this figure ignores additional workers not on shift, but who will also require a room/bed upon their return to work. It also does not take into account shut-downs.

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Non-Resident Workers on Shift 2,315 2,350 2,840 2,680 3,225 4,835 5,585 4,740 3,380 3,955 3,150 3,360 4,045 4,375 3,890 4,105 4,775 5,140 Total Workers Accomodation Village Capacity 2,330 3,155 2,890 3,680 3,995 5,075 5,860 7,210 5,590 5,365 5,835 5,910 5,925 6,535 6,240 6,215 6,470 6,535 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 5,500 6,000 6,500 7,000 7,500 8,000 NonResident Population &/or Workers Accommodation Village Capacity

Source: QGSO & The NPR Co

29

The average annual ratio of Workers Accommodation Village Capacity to total non-resident population has been 1.38.

The flow-on effect for the traditional housing market is one where rental vacancy rates have generally tightened during periods where this ratio has trended downwards and have softened during periods of higher ratios.

Of note, this ratio has remained below this long term average since 2022, with a clear ongoing trend of a narrowing gap between the two variables shown in the previous chart.

As of 2023, the Workers Accommodation Village Capacity Ratio reached just 1.27, which is its lowest point since 2012 (1.05), at the height of Australia's resource boom.

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 WAVs to Non-Resident Worker Popualtion Ratio 1.01 1.34 1.02 1.37 1.24 1.05 1.05 1.52 1.65 1.36 1.85 1.76 1.46 1.49 1.60 1.51 1.35 1.27 Long Term Average Ratio 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 1.38 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 1.80 2.00 Workers Accommodation Village Capacity (WAVs) to Nonresident Population Ratio

30

Source: QGSO & The NPR Co

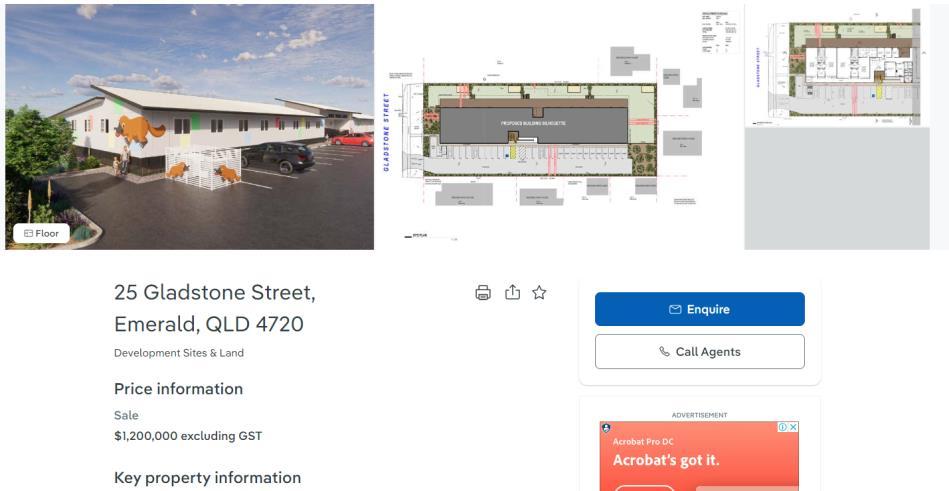

Across 19 centres,there is a total of 734 licensed spots for children between 0-5 years. However, there is at least 32 vacancies known within these licensed spots mainly due to staff shortage with at least 7 FTE shortage today.

The total cohort of children in region aged 0-5 is 2548 – meaning that 29% of that cohort could be accommodated by the total licensed spaces. In reality, this is actually less given current vacancies. This compares with the Queensland average of 53% of spots for the accommodated cohort.

Based on the evidence and assumptions, the region requires an additional 616 spots to support the 0-5 cohort.

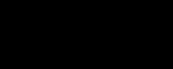

There is development approval secured for two additional centres within Emerald for 225 spaces. Whilst these are DA approved, the developers who gained the approvals are not childcare operators and both sites are for sale. Further in the current market constructioncost and staffing will make the developmentsdifficult to come to fruition without additional intervention measures to support and underwrite development.

Count of Childcare Centres With & Without Vacancy - Excluding Exclusively Before & After School Care LGA Total Childcare Centres Total With Vacancies Without Vacancies Unknown Central Highlands 9 5 3 17 Banana 8 3 0 11 Isaac 6 7 0 13 Maranoa 10 0 0 10 Total 32 16 3 51 Total,Known LicensedChildcare Spotsas Share of0-5 Population Catchment Estimated TotalNumber of Day care Spots for Kids Aged 0 - 5* TotalPopulation Aged 0 - 5 in 2022 % of Population Able to be Accommodated in Day care Spots Central Highlands LGA 734 2,548 29% Banana LGA 305 1,201 25% Isaac LGA 567 1,978 29% Maranoa LGA 335 1,076 31% Total 1,941 6,803 29% TotalCount of 0 - 5 Year Old'sUsing Childcare Spots in QLD As a Share of 0 - 5 Population (June 2022) Catchment Estimated TotalNumber of Kids Aged 0 – 5 Utilising Care TotalPopulation Aged 0 - 5 in 2022 % of Population Able to be Accommodated in Day care Spots Queensland* 197,830 371,246 53% *Includes Centre-basedandFamilyDaycare but excludes OutsideSchoolHours Care&In HomeCare. Source: The NPRCo., QGSO & AustralianGovernmentDepartmentof Education 31

• The Queensland Workforce Strategy from the Qld Workforce Summit identified the need to support delivery of the school to work transitions.

• One of the programs identified, was the creation of the Regional School Industry Partnerships (RSIP) and the appointment of dedicated regional managers across the State. There is now a Manager, RegionalSchool Industry Partnerships Program (CQR)Central Queensland.

• The RSIP program is to be centrally led and coordinated but regionally implemented and managed, to strengthen localised school-industry partnerships and school to work transitions.

• RSIP managers, are responsible for:

▪ scanning and reviewing skills data to create a regional priority skills infographic and profile;

▪ developing and enacting localised action plans for building and strengthening schoolindustry partnerships;

▪ driving regional reference groups to enable stakeholder collaboration, and ▪ promoting broader stakeholder engagement initiatives to promote student and school leaver participation in school-based apprenticeships and traineeships

• For the Central Highlands region, the careerpathway of students post year 12 tells an interesting narrative with the nearly 50% entering the workforce full-time or part-time

• The percentage of students with a School–based Apprenticeship and Traineeship shows strong participation rates however noting that the Apprenticeships have significantly dropped since 2020.

• The percentage of students with a Certificate II or higher has also been very consistent, with a minor fluctuation, but remaining above 90% throughout the five-yearperiod. This is considerably higher than surrounding LGAs for Central Highlands.

• Significant opportunity for additional Gateway to Industry School Programs to be rolled out in region in addition to continuation of needed Cert II and Cert III for both current demand such as Early Childhood Education and Future Demand-Advanced Manufacturing.

• The Future Skills Facilitatoridentified by the CH VET Network Feasibility Study could work closely with the Regional Manager to identify and implement LGA specific solutions.

32 Source: Department of Education

33

In alphabetical order

After the Bell

Acumentis PropertyValuers - Emerald

Bentleys

Blackwater North State School

Blue Moon Property

BHP /BMA

Borilla Community Kindy

C&K Blackwater

Central Highlands Development Corporation Board

Central Highlands Regional Council (various teams)

CH Vocational Education Training (VET) Network

Clinton Adams & Co Real Estate

Construction Skills Qld

Corbett Homes

Costa

Coronado Global / Curragh

Department of Education

Duke Housing

Emerald OSHC

Emerald Star Hotel

Energy Skills Qld

Ensham

First Five Years

Glencore

HWC Building Contractors

Jellinbah

Kestrel

Qantas

QBuild

Sojitz Blue

Village National Group

Westpac

Yancoal

34

• Since December 2023, active engagement has been held with key stakeholders who have a focus / interest on workforce development and accommodation.

• Surveys were issued to mining companies and childcare operators to better understand the current state, barriers and anticipated growth. These survey results were never intended to be published, but rather used in an aggregatedmanner to help ground-truth the insights gained through published reports and documents.

• One-on-one interviews were held with over 40 participates across employers, childcare, retailers, realestate, financial institutions and government. These interviews provided significant localised insight to better understand where direction needed to be focused.

• From this engagement, four focus areas having been interrogatedin more detail. These being workforce, accommodation, childcare and lifestyle.

• Whilst hundreds of further interviews and insights could have been gatheredand covered, including a broad range of other topics such as aged care and health, it is considered that for the purpose of these focus areas, the initialengagement has been comprehensive to inform the actions. Further engagement including the community are anticipated as part of the action plan implementation.

FOCUS AREA 1 WORKFORCE

FOCUS AREA 2 ACCOMMODATION

FOCUS AREA 3 CHILDCARE

FOCUS AREA 1 WORKFORCE

FOCUS AREA 2 ACCOMMODATION

FOCUS AREA 3 CHILDCARE

35

FOCUS AREA 4 LIFESTYLE

In October 2019, all operating coal producers were invited to attend the inaugural Central Highlands Resources Roundtable (CHRR). Outcomes of value to the group, which continues to meet on a regular basis, include:

▪ Building industry and Council relations

▪ Networking

▪ Information sharing

▪ Identifying collaborative projects

▪ Collective advocacy

In addition, key topics of interest are:

▪ Workforce (skills, FIFO, career perception)

▪ Liveability

▪ Infrastructure planning

▪ Local supply

▪ Community spend

▪ Air travel (routes and fares)

▪ Industry promotion (locally and regionally)

▪ Rehabilitation(cross sector opportunities)

▪ Regional transformation (automation)

▪ Post-mine futures

▪ Local DisasterManagement Group emerging issues, such as bushfire season risks.

In November 2023, a Statement of Commitment was agreed, signed with a focus on five guiding principles including to actively collaborate and engage in projects that we believe will drive beneficial growth. These include, but are not limited to; recruitment, skills development, childcare, housing, procurement, regionalinvestment and transformation.

The CHRR have been key contributors to this strategy and the actions identified.

36 Central Highlands Resources Roundtable Workshop 27 February 2024 Source: CHDC Above:- Statement of Commitment Signing November 2023 : Source: CHDC Below:- Resources Roundtable Workshop 27 February 2024 Source: CHDC

37

• As previously highlighted Central Highlands has (and historically had) a low unemployment rate.

• At the same time, there are significant vacancies across the region and across sectors. No sector is immune which does make any attraction strategy challenging but also potentially a huge opportunity on the basis that the accommodation to support new workers is addressed.

• Efforts should be concentrated on jobs that are needed that will make a material difference to other aspects of boosting the region’s attractioni.e. childcare, construction and health workers.

• Researchincluding that from Regional Australia Institute says that enticing people to relocate to a regional area for a new job often comes down to one thing: lifestyle.

• Evidence has identified that the permanent movers to region are couples such as one in education / or council and one in mining, or alternatively it is a younger family who are attracted for primary school years.

• Move to More is an organisationof which CHDC is an alliance member. Further opportunity does exist to ensure that the alliance membership is supporting and showcasing the region.

• The researchand insight has identified a significant gap emerging in the region’s access to Gateway to Industry Schools programs and VET opportunities. Further collaboration with providers is needed and the CH VET Network have identified similar gaps.

• The separate Talent Attraction body of work will be important to demystify some perceptions in the region such as the transient work force as well as looking to target families and couples –showcasing the region as an opportunity where buying a home and building a careergo hand in hand.

38 Family enjoying the outdoors, Source: CHRC

• The CH Vocational Education & Training Network (CH VET Network) is a reference group that exists in the Central Highlands and Coalfields region of Central Queensland.

• The group meets informally however regularly and is made up of RTOs, apprenticeship services and government agencies with the following schools :-

Blackwater SHS Glenden SHS Moranbah SHS

Capella SHS Emerald SHS Springsure SS

Capricornia SDE Emerald CC

Clermont SHS Marist College

Dysart SHS Middlemount CS

• The network are aware and continue to identify the gaps in providing VET programs within the schools and ensuring RTOs are providing programs needed to meet the demand in region.

• The network were a driver in the development of the feasibility study for the Future Skills Facilitator. They identified that the role would be to develop and promote an innovative and sustainable model for multi-school vocational education training and workforce development. Key areas that were identified included Energy Generation/ Agriculture, Agribusiness/Mining, Resources/Tourism, Hospitality/Health and Community Services industries.

• Staff movements within the VET Network do impact the group’s stability. The Future Skills Facilitatorwould therefore play a huge role in keeping the network alive and active and following through with identified program opportunities.

39 CH Vet Network member with students Source: CHDC

• Workforce will continue to grow and majority are actively recruiting.

• Vacancies are across all professions from Administration to IT through to Skilled Operators.

• Workforce averaged out will increase approximately 20%.

• The 7 on 7 Rostermeans that FIFO/DIDO will remain the dominant share of the workforce and is likely to increase over the coming years due to shortage of accommodation and also business models that do rely on a higher contractor workforce.

• Camp style accommodation is the current shortfall. Ideally looking to secure 300 beds within the year.

• Shutdowns do affect accommodation and often mean that local motels/ hotels will be used to accommodate workers brought in.

• Royalty Tax is not just hurting the mining industry but the region at large. It affects the overall livelihood of the region and the ability for organisations (particularly the mines) to make bigger investment decisions.

• Different business models for different mines and therefore different views as it relates to other support required such as childcare and education.

• For some mines the business model has a strong desire to grow their permanent workforce in region howeverit is recognisedthat both access to housing, childcare and housing do make it difficult to convince the full families relocation.

40 Mining Equipment, Source: CHDC

• Teacher attraction and retention is difficult and does rely on follow-through from practicum opportunities and the region is often known for its “Beginner School” status for the public system.

• There are staff members who can’t return to work due to lack of Childcare availability.

• All schools in CH are deemed a 4 point school, except for Rolleston and Bauhinia. This means that any teacher incentives are the same for those in Emerald as for those at Anakie, Duaringa, Comet, Bluff, Springsure, Blackwater etc. Understood that the point system is under review by Department of Education.

• The incentives scheme for regional teachers being approx. $1200 per year is the same as it has been for the last at least 15 years. Again, it is understood that this is under review. Noting this incentive is the same whether you teach in Emerald, Duaringa or Blackwater.

• Department of Education own 45 properties and privately rent additional properties. All properties are full with no vacancies. The teachers run and manage the housing portfolio. In Blackwater accommodation for upcoming student teachers doing their practicum was recently secured with the assistance of Jellinbah.

• Cert III Early Childhood Education is not being offered for Year 11’s in 2024. Seven Year 12 students are completing the course this year. The cessation of this offering will have a flow-on effect to staffing in centres in the future.

• Closure of the Ag College has meant that the Cert II in Agriculture is no longer offered. The High School has created a subject Agricultural Services to meet demand from students who want to participate.

• “Coast to Country” tours run by universities offering to explore regional towns has been successful in the past and is being run again this year. Continued support of these tours does make a difference to potential recruitment.

• For Blackwater the amenity of the town has been suffering. From the shopping centre to the parks everything looks tired and rundown. Many feel that investment is not made in the town and this then in turn affects attractiveness for new residents but also ongoing lifestyle choices to keep kids entertained.

of

41

Blackwater High School Source: Department

Education

• Like many other employers, Council is consistently recruiting for a range of vacancies of which there are around 100.

• Key areas of shortage and difficult to fill positions include water network operators and skilled labour/plant operators.

• Some members of council are fully remote and some members of staff are FIFO/DIDO as are skilled contractors used on major projects.

• There is around a 20% turnover consistent with other industries.

• For key positions, council does have a housing policy offering discounted rent which is for different periods of time dependent on location in region. Those staff continuing post the subsided rental find it difficult to get private rentals.

• Council has 60 owned properties (for staff members), of which 15 are vacant, although these are pre-allocated for roles currently being recruited. Council does also rent further properties privately through open market.

• Council also, in concert with the State, manage around 90 properties used for social and affordable housing as well as aged care.

• Council is open to exploring opportunities within its own property portfolio to contribute to new housing supply and better utilisation of existing stock.

CHRC Main Administration Building Source: CHRC 42

• Significant and major producer including citrus and grapes which is exported as high-quality produce predominantly to the Asian markets.

• The sector relies heavily on a non-resident workforce who predominantly come to region from overseas.

• Two key work areas including picking and manufacturing.

• Each year approximately 850 workers come into region, stay in region for around nine months of the year, and spend thousands locally at supermarkets, shops and eateries.

• Workforce from overseas are favoured givenreliability, consistency and work ethic.

• The workforce is due to grow by approximately 300 over the next two to five years.

• Consolidated on-farm accommodation is preferred, enabling centralised kitchens and communal spaces where workers cook, using locally bought produce, and engage with each other.

• Permanent office team are all locally based and live in region. Further growth in the office team expectedover the next five years with at least 5-10 new FTEs required.

• Team are still transitioning into region and looking forward to opportunities to engage further with community and expand their community partnerships program to coverCH region.

Costa Manufacturing Emerald Source CHDC 43

CHDC to establish the Workforce and Accommodation Collective (WAC) to deliver and monitor the agreed priorities and continue to drive the broader recommended actions. Membership will include members of the already established Resources Roundtable as well as other businesses, institutions and CHRC. The State Government will also be invited to participate. The WAC will meet monthly and communicate outcomes publicly.

TIMEFRAME:- The first meeting of the group will be held in May 2024.

ACTION 9 – TALENT ATTRACTION

Ensure that the Talent Attraction Campaign is considerate of the findings of this work and is timed appropriately. Stage 1 to be focussed on placing the region on the radar and then Stage 2 to target identified areas of need.

TIMEFRAME:- Ongoing.

CHDC has identified a funding source to create a new FTE for a Future Skills Facilitator. The position will be tasked with the coordination and collaboration between education systems, government, and industry sectors across the region. The role will initially review current RTOs and certification offerings for the region with a focus on skills shortages such as early childhood, health and construction. The role will also engage directly with the CH Vet Network and indigenous groups to ensure the region is gaining access to the right programs and schools to industry pathways.

TIMEFRAME:- Funding proposal to be finalised an application sought by June 2024.

ACTION 10 – SMALL BUSINESS FRIENDLY

CHDC together with CHRC to engage with local Small Businesses to discuss benefits of the CHRC joining the Small Business Friendly Program. Based on general agreement from local businesses on the benefit of the program, CHRC will prepare and lodge application to join the Small Business Friendly Program and commit to the Program Charter.

TIMEFRAME- Engagement with SMEs by 30 May 2024 and application prepared for briefing to CHRC by 30 June 2024.

CHDC to engage with and develop business case to expand the Childcare Leadership Alliance (CLA) into the Central Highlands Region with focus on Blackwater as the first priority area. CLA to be formally invited to address the WAC at its first meeting in June 2024. The WAC with the CLA would be utilised to investigate whether additional centres are needed, where and how they should be developed.

TIMEFRAME:- CLA discussions to commence by 1 June 2024. Business Case to be finalised by 1 September 2024.

TIMEFRAME:- 1 December 2024. ACTION

As members of the Regional Activators Alliance, CHDC to ensure that the region is represented in the Move to More campaign. CHDC to understand investment requirement and ensure appropriate budgeting to cover cost if benefit is identified.

ACTION 3 – FUTURE SKILLS FACILITATOR

ACTION 5 – CHILDCARE ALLIANCE

– MOVE TOMORE CAMPAIGN

44

15

ACTION 1 – ESTABLISH WAC

Investing in a new position known as a Future Skills Facilitatoris identified as a key action in this strategy aimed at addressing the evolving landscape of work and education. This role will play a criticalrole in not only identifying emerging skill demands and designing relevant training programs, but also in building networks and connections across various stakeholders.

The Future Skills Facilitatorwill act as a bridge between educational institutions, employers, government and other relevant parties, facilitating collaboration and knowledge exchange. By fostering these connections and networks, the facilitatorensures that training programs are aligned with industry needs and that individuals have access to the resources and opportunities necessary for continuous learning and skill development. This proactive approach to skill development positions organisations, and therefore the region, to better equip the workforces for the challenges and opportunities of tomorrow's economy, rather than simply reacting to changing demands.

Collaboration with key stakeholders such as the CH VET Network and major employers across all sectors is essentialfor the effectiveness of a Future Skills Facilitator. The CH VET Network provides a platform for aligning vocational education and training (VET) programs with industry needs, ensuring that educational initiatives are relevant and responsive to changing skill requirements. Through collaboration with major employers, the Future Skills Facilitatorcan gain valuable insights into industry trends, specific skill demands, and emerging technologies, allowing them to tailor training programs accordingly. This partnership fosters a symbiotic relationship where education providers produce job-ready graduates, and employers have access to a skilled workforce capable of driving innovation and growth.

Investment in a new position like a Future Skills Facilitatoris a strategic imperative for the region to thrive in the face of technological disruption and economic diversificationand transformation.

Funding application to be lodged by 30 June 2024.

45 Drone testing with Marist College Source: CHDC

46

• Post-2012 resources boom, and government supported (UDLA) housing and infrastructure, land production and sales have dropped off a cliff. The issue is systemic to the regions and not just CH.

• 87% of all housing is detached housing (and increasing).

• Large detached housing of 3–4-bedroom dwellings dominates the accommodation in the region (75% overall, unchanged 2011-2021).

• However, 59% share of dwellings are occupied by only 1-2 people.

• Housing (for those that can obtain it) in the LGA is ‘affordable’ with mortgages below 30% median household income.

• Data provided by Council for building approvals and lot creations shows a significant further slowing post-COVID. A key contributor is supply chain issues and increases to construction material costs making the cost of building a new (conventional) home in markets like Emerald cost prohibitive. Refer to local builder insights.

• Delivering new residentialallotments is also cost prohibitive. Median land prices are $152,500 and the cost to bring a vacant residentiallot to market in Emerald is over $100,000.

• Currently, only 1 in 10 vacant land sales are lots below 800m2 .

• Vacancy rates are concerningly low (0.5% - 1.2% in CH), reflecting an uptick in rental prices but not to the detriment of affordability. Emerald needs 48 additional rental properties to move into a health vacancy rate of 2.5%. Blackwater needs 14.

47

There is not enough diversity in the accommodation product to cater for the demand.

This means that accommodation types expected for other use is not available.

• Example – due to shortage at mining specific accommodation,mines have pre-allocation held in hotels/motelsusing up capacity in the short-term accommodationmarket for medium-term stays.

• Example – CHRC are privately renting dozens of properties to house staff. Without CHRC owned properties being available for council team members, the private rental market is utilised compromising other businesses and new renters getting into the region and rental market. This is a similar situation for the State Government.

• Example – Mining stock in communities. Some stock is vacant and others not fit-for-purpose and others being used by singles. This would be in the order of around 80 properties.

Whilst established sales are strong,they significantly outweigh the properties available for rent.

48 Aerial of Emerald Source: CHDC

• New residential building has slowed and is likely to continue to slow.

• Whilst wages are strongand trades in the region are well-paid, the cost of materials (especially concrete and steel) continue to impact build price and thereforeend valuation.

• The cost to build a high quality, 4 bedroom home with a 200sqm floorplan would likely be circa $520,000. Adding this to the 2023 median land price would see a total housing cost of $672,500, which is an 87% or $312,500 premium over the 2023 median house price.

• Given slowdown of new builds, comparative market sales have been affected. New established sales are on the increase with more existing product coming onto market.

• Banks and valuers are looking for a rate per m2 of around $2200 - $2400 or below to ensureservicing and end valuation.

• To activate the private sector, capital options and further incentives would be required.

• The new build market is likely to requirea combination of non-traditional approaches,such as a private property trust, in addition to other levers like further incentives for first homeowners who undertakea new builder.

49 Construction activity in Emerald, Source: CHDC

• There are a range of products and builders now on market that are taking advantage of technology to streamline construction and supply of accommodation to market.

• Options exist that may also provide an interim solution that is still fit for purpose but does not erode the local asset value.

• CHDC has written to and is in discussions with the office of the QLD Public Works Ministerto discuss expansion of Modern Method of Construction (MMC) into the region to support new build including State Government housing. A suggestionhas also been made that Emerald is nominated as a location to establish a Rapid Accommodation and Apprentice Centre (RAAC).

• Non-traditional methods should be actively sought to deliver a range of accommodation styles across the region from short-term, to key worker, permanent new builds as well as childcare centres. Companies are keen to meet and explore different delivering methods across the region.

50

CHDC to establish the Workforce and Accommodation Collective (WAC) to deliver and monitor the agreed priorities and continue to drive the broader recommended actions. Membership will include members of the already established Resources Roundtable as well as other businesses, institutions and CHRC. The State Government will also be invited to participate. The WAC will meet monthly and communicate outcomes publicly.

TIMEFRAME:- Call for membership by 1 May 2024 and group formalised for first meeting in June 2024.

CHDC to partner with major property portfolio holders (both public and private sector) to actively review housing stock and seek opportunities to release surplus supply, encourage redevelopment and/or commitment to new development. Initial priority on available stock that could be used to house key-workers such as Childcare, Education and Health workers in Blackwater.

TIMEFRAME:- Reviewto commence 1 April 2024. Opportunities to support Blackwater to be identified by 30 May 2024.

CHDC to review and consolidate all known current incentives and outline suggested new incentives and/or amended policy to support investment in region. Review should include CHRC’s Regional Economic Development Incentives as well as rates on non-principal place of residence and other potential opportunities for support directly from major employers or suppliers.

TIMEFRAME:- Reviewto be completed by 30 May 2024.

Potential land identified in Action 2 as well as EOIs from Action 3 to be used to develop a Regional Buildto-Rent Scheme. Land to be identified across the region and firm proposals sought from EOI respondents. Pilot BTR scheme to be confirmed from a feasibilityperspective and if viablescheme delivered in region in 2025.

TIMEFRAME:- Proposals to EOI respondents sought by 30 August 2024. First Pilot BTR, if feasible, to be identified and delivered by1 March 2025.

CHDC to develop and launch an Expression of Interest from developers /builders to support the“12 in 12 ” campaign which will see at least 12 new builds across the region within 12 months. CHDC to work with key property owners, government and companies to also develop other incentives that may support the new build (traineeships, materials, additional grants for first home buyers). Land (as identified in Action 2) would be across the region in all towns and nominated by both government and private sector.

TIMEFRAME:- EOI to launch by 1 May 2024.

ACTION 12 – SHUTDOWN COORDINATION

CHDC with support from the Resources Roundtable, to develop a Shutdown Coordination Calendar. The calendar will be developed as a soft copy prior to seeking proposals from software developers to pilot a platform-based Bowen Basin Mines Calendar.

TIMEFRAME- Soft copy Calendar by 30 July 2024. Proposals to be sort by 30 September 2024 and decision made on next steps by 1 December 2024.

ACTION 1 – ESTABLISH WAC ACTION 2 – PROPERTY REVIEW ACTION 4 – BUILD 12 IN 12

ACTION 7 – INVESTMENT INCENTIVES ACTION 11 – REGIONAL BUILD-TO-RENT

51

ACTION 13 – ACCOMMODATION MANAGEMENT

CHDC to seek proposals from software developers to develop a proof-in-concept real-time occupancy of mining accommodation across the region. Understanding real-time vacancy would substantially improve efficiency and availability with opportunityto free up other in-demand accommodation such as motels and hotels in town. If the proof-in-concept is viable, then funding to be sourced to develop further.

TIMEFRAME:- Proposals to be sought by 30 October 2024. Proof-in-concept by 15 December 2024.

ACTION 14 – FIT-FOR-PURPOSE ACCOMMODATION

Through the WAC, coordinate and acknowledge the need for fit-for-purpose accommodation across the region. Identify appropriate sites for additional village style accommodation in the right locations across the region including expansion of existing in-town locations such as Pritchard Road. Facilitate the required community conversation and necessary engagement with community to balance the need for different forms of accommodation.

TIMEFRAME:- Appropriate sites to be identified by 30 September 2024.

52

The "12 in 12" campaign is a bold initiative aimed at tackling the pressing housing shortage across Central Highlands. With the goal of constructing 12 new homes within a span of 12 months, this campaign is set to shift the region's approach to housing development. By leveraging innovative solutions to address the cost of housing, 12 in 12 aims to make significant strides towards alleviating the housing crisis while promoting diversity in construction methods.

Expressions of interest will be sought from a wide spectrum of builders, ranging from those employing traditional build methods to those utilising cutting-edge modern methods of construction techniques. This inclusive approach ensures that the campaign embraces diversity in building practices while encouraging creativity and innovation in the construction industry.

Local Builders will be incentivisedto participate with additional weighting provided to ensure the protection of local assets. Growth of local employment by other builders will also be seen favourably to help drive down the cost of construction. The cost is the main barrier to new builds and therefore a key component of the campaign will be the donation of vacant land (valued at its market rate) as well as other potential bonuses. Of particular note is the provision of incentives for builders who commit to constructing homes for key workers at a discounted rate, thereby addressing the critical need for affordable housing for essentialmembers of the community.

At its core, the 12 in 12 campaign represents a collaborative effort bringing together builders, developers, and community stakeholders, to pave towards a more sustainable and inclusive housing landscape in Central Highlands. Through the implementation of innovative solutions and the provision of targetedincentives, the campaign aims to not only build new homes faster but also fostera sense of community and opportunity for all residents in and wanting to call the region home.

Expression of Interest for the “12 in 12” campaign to launch by 1 May 2024.

53 Construction in Emerald Source: CHDC

54

• The challenge with early childhood education and care is not new and comes down to two matters:-

Staffing, and Availability of spaces to accommodate demand

• The actual “true vacancy” remains complex to determine, an issue across the whole of the Bowen Basin and it would take significant work to develop and directly engage with the community on the requirements.

• Current vacancies are actually inflated, as the existing centres are not at full capacity due to rooms being closed due to staffing shortages.