The Central Highlands is a robust region that sits at the heart of Queensland’s resources and agricultural sectors.

Spanning almost 60,000km2 , the Central Highlands region is just short of the size of Tasmania.

It includes a significant portion of Australia’s largest coal reserve, the Bowen Basin and is strategically located to service Australia’s newest mining province, the Galilee Basin Coal mining is a staple ingredient in the region’s economy, even during softer global markets

Sustained by irrigation sourced from water storage on the Nogoa and Comet rivers, the Central Highlands is also characterised by thriving farming industries, including beef, cotton, grapes and citrus

Major freight routes intersect the region, including the northsouth link between Charters Towers and northern New South Wales, identified as the inland transport alternative between Cairns and Melbourne.

Pristine natural attractions, such as Carnarvon Gorge and the Sapphire Gemfields, are driving an emerging tourism market.

A population of just under 29,000 with a median age of 33 help underpin the Central Highlands’ economic strength of a skilled, locally-based workforce

▪ Population growth of 0.5% per year from 2006 to 2016

▪ Forecast population growth of 1.1% per year from 2016 to 2026

▪ A population of 39,364 people by 2036

The estimated resident population in Central Highlands as at 30 June, 2016 is 28,783 people Between 2006 and 2016 the Central Highlands (estimated resident) population increased by 1,518 people (5 6%), with an average annual compound population growth of 0 5% between 2006 and 2016 Central Highlands population peaked at 29,820 in 2013 and began to experience a decline thereafter

Queensland Government population projections, 2015 edition (medium series) were released in April 2016

Between 2016 and 2036, the population of Central Highlands is projected to increase by 7,211 people The average annual projected population growth between 2016 and 2026 of 1 1% is lower than the average growth rates experienced over the previous 10 years (1 7%)

Source: ABS (2017c)

▪ The 30 to 49 year age group is projected to experience the largest increase in population from 2016 to 2036 (1,708 people)

▪ A lower rate of population growth than the broader Central Queensland SA4 region and Queensland

Source: QGSO (2016a)

Source: QGSO (2016)

For each five year period from 2016 to 2036, the annual average population growth in Central Highlands is projected to gradually decline The annual average population growth in Central Queensland SA4 (comprising the Banana, Central Highlands, Gladstone, Livingstone, Rockhampton and Woorabinda Local Government Areas) and Queensland are projected to remain steady

Average annual population growth in Central Highlands is estimated to be lower than the surrounding Central Queensland SA4 and broader Queensland projections

Population Projections by Age Cohort – Central Highlands

▪ Average annual growth of the nonresident population of 3.1% has outpaced resident population growth of 0.5% from 2006 to 2016

▪ The non-resident population is expected to fall and stabilise at 3,000 by 2022

The estimated non-resident population in Central Highlands as at 30 June, 2016 is 3,150 people The average annual non-resident population growth between 2006 and 2016 of 3.1% is significantly higher than the resident population growth over the same period at 0 5%

Between 2016 and 2021, the non-resident population of Central Highlands is projected to decrease by 340 people When combined with the forecasted resident population growth, total full-time equivalent population growth in Central Highlands between 2016 and 2021 is projected to increase by 1,580 people (average annual growth of 0.9%).

Source: ABS (2017b) and QGSO (2018a) Source: QGSO (2018b)▪ Central Highlands comprises a younger population when compared to Queensland

▪ The 60 to 69 year old age group has experienced the most growth from 2011 to 2016

The following demographic section is based on Place of Usual Residence data obtained from the 2016 ABS Census, the latest data available The 2016 ABS Census was held on 9 August 2016 and data from the 2016 Census was from mid-2017

Analysis of the age structure of Central Highlands residents in 2016 compared to Queensland shows there is a larger proportion of residents aged less than 15 years (24.7%, compared to 19 4% in Queensland) Central Highlands also comprises a higher proportion of 25 to 59 year olds than Queensland (51.5%, compared to 46.8%). Conversely, the proportion of retirees (those aged 60 years and over) in Central Highlands (12 1%) is lower than Queensland (20 8%)

Source: ABS (2017a)

Between 2011 and 2016, the Central Highlands population decreased by 713 people. The largest changes in age structure in this area between 2011 and 2016 were in the age groups:

• 35 to 49 (-473 persons);

• 15 to 19 (-330 persons); and

• 60 to 69 (+264 persons)

Source: ABS (2017a)

▪ When compared to Queensland, Central Highlands comprises a larger proportion of Aboriginal residents, as well as a higher proportion of residents born in Australia

Analysis of the Indigenous status of Central Highlands residents in 2016 compared to Queensland shows that there is a higher proportion of Aboriginals in Central Highlands (4 0%, compared to 3 2% in Queensland) Overall, the local Indigenous population accounts for 4 3% of the total Central Highlands population, which is slightly higher than Queensland (4 0%)

Source: ABS (2017a)

Analysis of the country of birth of Central Highlands residents shows a higher proportion of residents born in Australia (76.0%, compared to 71.1% in Queensland). The top 10 countries of birth for Central Highlands residents include Australia, New Zealand, England, Philippines, South Africa, India, Zimbabwe, Papua New Guinea, United States of America, and Germany

Source: ABS (2017a)

▪ Population growth in Central Highlands is being driven by arrivals from overseas, as well as other intrastate locations such as Rockhampton and Isaac

Of the 28,002 people living in Central Highlands, 15,749 (56 2%) also lived in Central Highlands five years ago. The largest migration of residents to Central Highlands over the five year period from 2011 to 2016 from outside of the LGA were from residents who had previously lived overseas (724 people, or 2 6% of total Central Highlands residents), followed by residents from Rockhampton (452 people, or 1 6% of total Central Highlands residents) The largest migration of residents to Central Highlands from outside of Queensland were from Tweed in New South Wales (31 people, or 0 1% of total Central Highlands residents)

Source: ABS (2017a)

▪ Central Highlands has half the proportion with a need for assistance as Queensland (2.6% vs 5.2%)

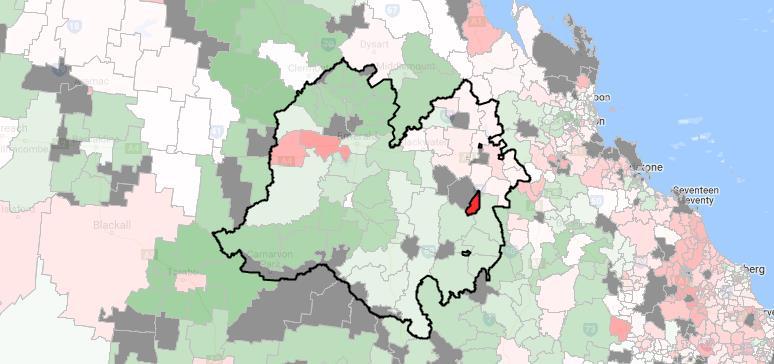

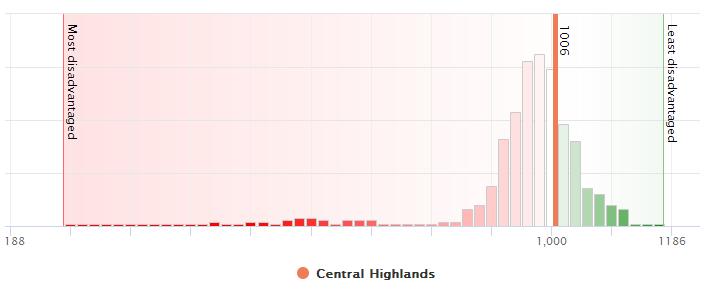

▪ The SEIFA Index of Disadvantage for Central Highlands is 1,006 and is in the top 28% of least disadvantaged LGAs in Australia.

Of the 28,002 people living in Central Highlands, 717 people (2 6%) have a need for assistance due to a profound disability, long term health condition or age. This is half the proportion of the population in Queensland with a need for assistance reflective of a younger population profile in Central Highlands

Socio Economic Indexes for Areas (SEIFA) is a suite of indexes that have been created by the Australian Bureau of Statistics (ABS) from social and economic Census information Each index ranks geographic areas across Australia in terms of their relative socio-economic advantage and disadvantage This report presents information from the Index of Relative Socio-economic Disadvantage (IRSD), a general socio-economic index that summarises a range of information about the economic and social conditions of people and households within an area This index includes measures of relative disadvantage only and is not evidence of relative advantage

The SEIFA index of disadvantage for Central Highlands (R) is 1,006 The local government area index of Central Highlands (R):

• Ranks 393 out of 544 local government areas with SEIFA scores in Australia

• There are 151 local government areas which are less disadvantaged, and

• There are 392 local government areas that are more disadvantaged

Source: ABS (2017a)▪ ‘Tieri’ is the least disadvantaged locality in Central Highlands (1,092)

▪ The most disadvantaged localities are ‘The Gemfields’ (788) and ‘Willows’ (828)

Of 60 suburbs and localities located within Central Highlands with a resident population, the least disadvantaged suburb is Tieri (1,092) and the most disadvantaged suburb is The Gemfields (788) followed by Willows (828).

▪ Central Highlands residents predominantly hold Certificate qualifications

▪ The largest increase in qualifications from 2011 to 2016 was for residents with Graduate Diplomas and Graduate Certificates

▪ A greater proportion of Central Highlands residents do not hold qualifications when compared to Queensland

Analysis of the qualifications of the population in Central Highlands compared to Queensland shows 7 8% of Central Highlands residents with a Bachelor degree or higher, compared to 14.7% in Queensland. A higher proportion of Central Highlands residents hold a Certificate qualification (18 8%) compared to Queensland (17 2%)

Overall, 31.0% of the population hold educational qualifications, and 57.0% hold no qualifications, compared with 38 9% and 52 4%, respectively for Queensland

Source: ABS (2017a)

The largest changes in the qualifications of the population of Central Highlands between 2011 and 2016 are in those with:

• No Qualifications (-1,363 persons);

• Graduate Diplomas and Graduate Certificates (+53 persons); and

• Postgraduate Degrees (+38 persons).

Source: ABS (2017a)

Highlights

▪ Approximately 23.0% of Central Highlands residents earn $1,500 per week or more

▪ Central Highlands comprises a higher proportion of couple families with children than the Queensland average

Analysis of individual income levels in Central Highlands in 2016 compared to Queensland shows that the median weekly income is higher for local residents when compared to the broader state; $843 vs $660.

Overall, 23 1% of persons earn a low income (less than $400 per week) and 23 0% earn a high income ($1,500 or more per week), compared to 28.4% and 15.1%, respectively in Queensland

Source: ABS (2017a)

Central Highlands comprises a higher proportion of couple families with children (51 1%) when compared with Queensland (42 5%), and a lower proportion of couple families with no children (36 6%) compared with Queensland (39 4%)

Overall, 11 1% of families are one parent families, and 1 2% are other families, compared with 16 5% and 1 6%, respectively for Queensland

Source: ABS (2017a)

▪ Rented dwellings represent the highest proportion of dwelling tenure in Central Highlands

▪ While ‘Caravan, cabin, houseboat’ dwellings comprise a significantly higher proportion of dwellings in Central Highlands than Queensland, separate houses are still the dominant dwelling type in the region

Analysis of the housing tenure of dwellings in Central Highlands in 2016 compared to dwellings in Queensland shows there is a larger proportion of rented dwellings or dwellings under other tenure types This is reflective of the large non-resident workforce in the region, who are renting or living in various short term accommodation arrangements

Overall, 45 6% of dwellings are owned outright or with a mortgage, 34 6% are being rented and 6 3% are other tenure types, compared to 58 6%, 31 3% and 2 0%, respectively in Queensland

Source: ABS (2017a)

As at 2016, there are 10,713 separate houses in Central Highlands; 1,657 medium density dwellings, 6 high density dwellings, 938 caravans, cabins or houseboats and; and 38 other dwellings

There is a significantly higher proportion of ‘Caravan, Cabin, Houseboat’ dwellings in Central Highlands (6 8%) compared to Queensland (2 1%) This can be attributed to the large number of non-residents staying in employer-provided accommodation while working in the region

Source: ABS (2017a)

▪ Within the Central Highlands workforce, the Mining sector comprises the largest number of employees

▪ The Mining sector experienced the largest increase in jobs from 2011 to 2016

▪ The Construction sector experienced the largest decrease in jobs from 2011 to 2016 and as a result dropped from being the second largest employing sector in 2011 to sixth largest in 2016

The following graphs illustrate the profile of employed people whose place of work is located within Central Highlands This includes residents and non-residents

The total employment estimate for Central Highlands as at the 2016 Census is 17,019 jobs The ‘Mining’ sector comprises 6,079 jobs, followed by the ‘Agriculture, Forestry & Fishing’ sector (1,791 jobs) and the ‘Retail Trade’ sector (1,184 jobs)

Source: REMPLAN (2017)

Between the 2011 and 2016 Census periods, there was a net increase of 309 jobs in Central Highlands, building on the 16,710 jobs in 2011

Source: REMPLAN (2017)

▪ The Central Highlands has a total workforce of 17,019, with 68.1% of workers residing locally

▪ Mining is the largest employer of both the resident (21.9%) and nonresident (65.2%)

Highlights

▪ The unemployment rate has increased from 2.4% in 2009 to 4.5% in 2017

▪ The Central Highlands workforce is dominated by Machinery Operators and Drivers and Technicians and Trades Workers

The unemployment rate in Central Highlands in 2017 was 4.5%. From 2009 to 2017, the unemployment rate in Central Highlands has ranged from a low of 2 4% in 2009 to a peak of 5.0% in 2015.

Compared to the Central Queensland SA4 and State averages, Central Highlands has a higher proportion of ‘Technicians and Trades Workers’ and ‘Machinery Operators and Drivers’

▪ Workers in Central Highlands are predominantly in the 25 to 44 year age group

▪ As with residents, Central Highlands workers typically hold Certificate qualifications

▪ A larger proportion of the Central Highlands workforce hold no qualifications when compared to the Central Queensland SA4 and Queensland

The workforce age profile for Central Highlands shows a higher proportion of workers in the 25 to 44 year age group compared to the Central Queensland SA4 and State benchmarks

Workers in Central Highlands have a lower representation of graduate qualifications (Bachelor Degree and higher) when compared to the Central Queensland SA4 and State averages A higher proportion of workers have Certificate or No Qualifications in comparison to these benchmark areas

Source: ABS (2017)

Source: ABS (2017)

Source: ABS (2017)

Source: ABS (2017)

Highlights

▪ A large proportion of the Central Highlands workforce are nonresident workers

▪ The Central Highlands workforce generally travels by car (either as driver or passenger) to work

Of the 17,019 jobs in Central Highlands, 11,598 workers (68.1%) also live in the region. Approximately 31 9% of workers (5,421 workers) in Central Highlands live outside of the region. This is significantly higher than the Central Queensland SA4 (12.5%) and is indicative of the large proportion of non-resident workers in the region

Source: ABS (2017)

Over 98 7% of the Central Highlands workforce use the following methods to travel to work Approximately 65 9% of workers travel by car (either as driver or passenger), 6 2% work from home and 5 6% of workers use the bus

Source: ABS (2017)

Output data represents the gross revenue generated by businesses / organisations in each of the industry sectors in a defined region

Highlights

▪ Mining contributes 61.2% of total output in Central Highlands

▪ The Mining sector contributes 57.6% of total valueadded for Central Highlands

The output generated by the Central Highlands regional economy is estimated at $8 191 billion

Source: REMPLAN (2017)

Value-added data represents the marginal economic value that is added by each industry sector in a defined region. Value-added can be calculated by subtracting local expenditure and expenditure on regional imports from the output generated by an industry sector, or alternatively, by adding the Wages & Salaries paid to local employees, the gross operating surplus and taxes on products and production Value-added by industry sector is the major element in the calculation of Gross Regional Product

The total value-added by the Central Highlands regional economy is estimated at $3 524 billion

Source: REMPLAN (2017)

Highlights

▪ Of the total $1.362 billion of local expenditure in Central Highlands, the Mining sector contributes 59.9%

▪ The Mining sector contributes 84.6% of total regional exports in Central Highlands

Local Expenditure data represents the value of intermediate goods and services purchased by local industry sectors within the region A high level of local expenditure on intermediate goods and services proportionate to total output is indicative of well-developed local supply chains and also that any expansion in this sector would typically deliver broad based benefits for the region’s economy

The total local expenditure estimate for Central Highlands is $1 362 billion

Source: REMPLAN (2017)

Regional Exports

Regional Exports data represents the value of goods and services exported outside of the region that have been generated by industry sectors within the region The following graph depicts the contribution to total regional exports generated by each of the industry sectors ranked from highest to lowest

The total regional export estimate for Central Highlands is $5 620 billion

Source: REMPLAN (2017)

Highlights

▪ The Mining sector contributes 65.7% of total Central Highlands regional imports

▪ At the 45 industry sub-sector level, the top five key drivers in terms of regional exports, employment, valueadded and local expenditure on goods and services are:

– Livestock, Grains & Other Agriculture

– Mining

– Education & Training

– Accommodation & Food Services

– Construction

Regional Imports

Regional Imports data represents the value of goods and services imported into the defined region by businesses / organisations in each of the industry sectors. Another way of defining imports is as an outflow of money from the region The following graph depicts the contribution to total regional imports generated by each of the industry sectors ranked from highest to lowest

The total regional imports estimate for Central Highlands is $3 305 billion

Source: REMPLAN (2017)

Taking into consideration potential import replacement opportunities as well as current contributions to the regional economy in terms of employment, value-added and local expenditure on goods and services (backward linkages), key propulsive industries sectors have been identified In order to understand the contributions of industry sectors in more detail, the general 19 industry sector classification has been broken down to the 45 industry sub-sector level The following key propulsive industry sub-sectors have been identified as the key drivers of the Central Highland region’s economy:

• Livestock, Grains & Other Agriculture

• Mining

• Education & Training

• Accommodation & Food Services

• Construction

▪ Employment data refers to employed people whose place of work is located within Central Highlands, which includes residents and nonresidents. It is based on the ABS 2016 Census Place of Work data

▪ At the 45 industry sector level, the largest employer in the region is ‘Mining’ comprising 5,871 jobs, accounting for 34.5% of total Central Highlands jobs, followed by ‘Livestock, Grains & Other Agriculture’ (1,662 jobs), with the third largest employer being ‘Retail Trade’ (1,184 jobs)

▪ At the 45 industry sector level, the largest exporter in the region is the ‘Mining’ sector ($5.268 billion).

Employment is a key social outcome of economic development; employment data represents the number of people employed by businesses/organisations in each of the industry sectors in Central Highlands The total employment estimate for Central Highlands is 17,019 jobs The key propulsive industries contribute 10,012 jobs or 58 8% of total jobs in Central Highlands

Livestock, Grains & Other Agriculture (1,662)

Mining (5,871)

Education & Training (1,132)

Accommodation & Food Services (1,010)

Construction (337)

Other (7,007)

Regional Exports

Regional Exports represents the value of goods and services exported outside of the Central Highlands region that have been generated by local businesses/organisations Another way of defining exports is as an inflow of money into the region

The total regional export estimate for the region is $5.620 billion. The selected sectors contribute $5 268 billion (93 7%) of total regional exports

Livestock, Grains & Other Agriculture ($365.061 Million)

Mining ($4,735.696 Million)

Education & Training ($35.410 Million)

Accommodation & Food Services ($58.119 Million)

Construction ($73.651 Million)

Other ($351.613 Million)

Source: ABS (2017)▪ At the 45 industry sector level, the largest industry sector in terms of value-added is the ‘Mining’ sector ($2,002.867 billion), followed by ‘Property Services’ ($252.876 million), with the third largest sector being the ‘Livestock, Grains & Other Agriculture’ sector ($171.317 million)

▪ At the 45 industry sector level, ‘Mining’ is the highest contributor in terms of local expenditure ($810.949 million), followed by ‘Livestock, Grains & Other Agriculture’ ($109.879 million) and ‘Construction’ ($63.632 million), with the ‘Construction Services’ sector ($56.334 million) the next highest contributor

The total value-added estimate for Central Highlands is $3 524 billion The selected sectors contribute $2.430 billion (69.0%) of total value-added.

Livestock, Grains & Other Agriculture ($171.317 Million)

Mining ($2,002.867 Million)

Education & Training ($102.442 Million)

Accommodation & Food Services ($65.624 Million)

Construction ($87.441 Million)

Other ($1,094.060 Million)

The following graph shows the value of intermediate goods and services purchased by industry sectors within Central Highlands The total local expenditure estimate for Central Highlands is $1 362 billion The selected sectors contribute $1 014 billion (74 5%) of total local expenditure.

Livestock, Grains & Other Agriculture ($109.879 Million)

Mining ($810.949 Million)

Education & Training ($10.218 Million)

Accommodation & Food Services ($19.313 Million)

Construction ($63.632 Million)

Other ($347.619 Million)

The industry sectors may not necessarily make the largest contributions to the region’s economy at present, however due to well-developed local supply chains these sectors have a significant capacity to deliver broad based economic benefits for the region.

Source: REMPLAN (2017)

Source: REMPLAN (2017)

Highlights

▪ Central Highlands accounts for 21.1% of the Central Queensland SA4 GRP

▪ The region accounts for 1.1% of Queensland’s GRP

▪ The ‘Mining’ sector imports $2.131 billion (69.3%) of goods and services for input to production from the rest of Australia, the ‘Construction’ sector imports $196.112 million, accounting for 6.4% of industry imports, and the ‘Agriculture, Forestry & Fishing’ sector imports $165.443 million from outside of Central Highlands

Source:REMPLAN (2017)

Central Highlands accounts for:

• 21.1% of Central Queensland SA4 and 1.1% of Queensland’s GRP

• 21.0% of Central Queensland SA4 and 1.2% of Queensland’s output

• 21.5% of Central Queensland SA4 and 1.2% of Queensland’s value-added

• 33.0% of Central Queensland SA4 and 5.3% of Queensland’s regional exports

• 30.0% of Central Queensland SA4 and 3.3% of Queensland’s regional imports.

Imports reflect demand in the area’s economy for goods and services not supplied locally and therefore represent ‘Gaps’ in local supply chains Imports from the rest of Australia may indicate opportunities for import replacement, increased value-adding and supply chain development Supply of these goods and services is currently feasible in the Australian context and may provide a guide to realistic, high value strategic opportunities to further develop the local economy The total replacement of imports with local production is improbably however it may be possible to capture a proportion of this escape expenditure

Total imports by industry sectors in Central Highlands from the rest of Australia are estimated at $3 073 billion

Source: REMPLAN (2017)

▪ Industry sectors within Central Highlands import

$453.942 million from the ‘Exploration & Mining Support Services’ sector, $306.893 million from the ‘Professional, Scientific & Technical Services’ sector, and $233.343 million from the ‘Financial & Insurance Services’ sector from the ‘rest of Australia’

In order to identify potential gaps within the region, REMPLAN data has been applied at the 45 industry sector level. The local industry sectors import a total of $3.073 billion of goods and services from the rest of Australia, conversely industry sectors in the rest of Australia supply $3 073 billion of goods and services to the local industries as part of the process of production

Source: REMPLAN (2017)

Highlights

▪ The Development Register outlines projects that can be sourced. As such, it does not capture all of the investment in the region.

▪ Mining investment projects account for $7.6 billion of total investment projects in the Central Highlands

▪ Total project investment, including projects outside of the Central Highlands Region of Significance, currently stands at $69 billion

Based on available information, there is currently $8.8 billion in known major project investment currently underway or planned for short term development in Central Highlands

Mining and energy projects account for $8.5 billion of known projects, while roads account for $88 7 million

Moreover, known projects that are located outside of the Central Highlands Region of Significance that will still have significant economic benefits to the region approximate $69 billion

▪ Investment in road infrastructure is a major component of project investment

▪ CHRC is playing an active role in community infrastructure development, particularly in supporting the upgrade to Emerald Airport

Major rail investment projects include the new $15 million Blackwater Aquatic Centre

The 2017 NDRRA or Natural Disaster Relief and Recovery Arrangements is a joint funding initiative between Commonwealth and State Governments to provide disaster relief to communities affected by natural disasters Central Highlands is spending $50 million under this initiative on affected roads in the LGA

▪ The three largest mining projects account for $2.909 billion

▪ The two key energy projects in the LGA total $900 million

In addition to the projects within the region there are a number of major projects at various stages of development in the adjoining regions to Central Highlands that have the capability of providing added benefit to the LGA These include $62 1 billion in mining, $4.2 billion in roads and $2.8 billion in rail. The largest of these projects is the Carmichael Mine valued at $16 5 billion followed by China Stone Coal Project ($6 7 billion), Kevin’s Corner ($6 billion) and South Galilee Coal Project ($4.2 billion). There is also the Galilee IGCC Power Station valued at $1 250 billion

▪ Separate house approvals have accounted for approximately 69.6% of total dwelling approvals from 2006-07 to 2016-17

▪ The value of nonresidential approvals has generally accounted for approximately 44% of the value of total building approvals

There were 17 new dwelling approvals in 2016-17, an increase of 6 dwellings over the previous 12 months, comprising 17 houses and no “other” (unit) dwellings Dwelling approvals peaked in 2012-13 at 422 approvals Since then the volume of approvals have experienced a significant decrease caused by trends in global mineral prices that affected the economy of Central Highlands Over the 10 year period from 2006-07 to 2016-17, separate house approvals have accounted for approximately 69.6% of total dwelling approvals. The highest levels of unit approvals occurred in 2011-12 (46% of total approvals)

The total value of building approvals during 2016-17 is $44 3 million The value of residential building approvals peaked in 2012-13 at $235 9 million The value of ‘non-residential’ approvals has generally accounted for approximately 44% of the value of total building approvals

Source: ABS (2017) Source: ABS (2017)▪ Before 2015, larger projects of more than 50 lots have generally accounted for the majority of approvals

▪ The largest number of lot approvals occurred in 2008 with a total of 879 approvals

Between 2008 and 2017 the highest number of annual approvals occurred in 2008 at 879, with 80% of the lot approvals being in larger projects of more than 50 lots Due a the fall in global mineral prices, the housing market has slowed in Central Highlands leading to next to no new lot approvals from 2015.

Highlights

▪ The number of lot registrations peaked in 2013 with 648 registrations

▪ 2016 saw the lowest number of lot registrations, with only 13 total lot registrations recorded

Lot registrations is the final stage of development of new lots There is generally a time lag between lots being approved and lots being registered The total number of lot registrations in Central Highlands has increased between 2016 to 2017 Since 2014, the volume of registrations has significantly declined.

aLots on a standard formatplan intended for detached dwellings,including lots intended for detached dwellings in a communitytitle scheme.

b Lots on a building formatplan or standard formatplan thatrepresentattached dwellings within a communitytitle scheme.

Urban lots (60m2 to <2,500m2) have consistently accounted for the majority of standard residential lot registrations from 2008 to 2017 Unit & Townhouse lot registrations have on average represented 24 7% of residential lot registrations

▪ The total number of lot sales peaked in 2010 with 342 sales

▪ The median price for vacant land was $66,500 and for house & land packages was $255,000 as at June 2017

There were a total of 34 new lot sales in the year to June 2017 within Central Highlands, of which 65% were vacant land sales Vacant land sales have traditionally accounted for the majority of new lot sales within the region, with house and land package lots generally accounting for approximately 25.8% of sales.

The median sales price of vacant land has been decreasing since 2014 after peaking in 2013 at $160,000. The median value of packaged house and land sales has also decreased since 2013.

1Mayinclude resales ofvacantland.Excludes intermediate vacantland transactions relating to developer house and land package sales.

2 Includes lots as a componentofa developer house and land package in addition to subdivided lots containing an existing dwelling.

Source:QGSO(2018c)

There were a total of 342 new and established detached and attached dwelling sales in the year to June 2017 within Central Highlands, of which 88% were detached house sales Detached housing sales have accounted for the majority of dwelling sales activity within the region, accounting for approximately 83% of all dwelling sales over the last decade.

Both the detached and attached dwelling markets experienced a peak in median sales price in 2013, at $440,000 and $370,000, respectively. The median sales price for both detached and attached dwelling markets have since been in a state of decline

Highlights

▪ Within Central Highlands, four bedroom houses are experiencing the highest rental rates, followed by three bedroom product for all dwelling types (houses, units/flats and townhouses). Two bedroom units/flats provide the lowest rental option.

▪ Rents dropped alongside the Rockhampton and Gladstone Regions from June 2012 to December 2016; this can be attributed to a reduction in demand for short term accommodation in Central Highlands.

Regional data has been sourced from the Queensland Residential Tenancies Authority for median rental data from June Quarter 2012 to December Quarter 2017 for:

• Units/Flats – two and three bedroom;

• Houses – three and four bedroom; and

• Townhouses – three bedroom

Median rents in Central Highlands declined continuously before stabilising by June 2015

Since June 2017, there has been minor evidence of recovery occurring in unit and flat rental prices

Highlights

▪ The Tourism sector contributes 2.5% of total Central Highlands output

▪ The ‘Accommodation & Food Services’ sector contributes 66.8% of total tourism related output

Tourism is not identified as a separate industry sector in the National Accounts data, instead tourism is an amalgam of activities across various industry sectors such as retail, accommodation, cafes & restaurants, and cultural & recreational services The Tourism Module in REMPLAN estimates the total value of tourism for the local economy

Tourism Output

The estimated output generated by tourism for each industry sector has been deducted and consolidated into a separate tourism sector The total output estimate for Central Highlands is $8.191 billion, with Tourism contributing $202.415 million.

Source: REMPLAN (2017)

Tourism output has been estimated to be $202.415 million. The following graph shows the gross revenue generated by businesses and organisations in Central Highlands to service demand generated by tourists to the area.

Source: REMPLAN (2017)

Highlights

▪ The Tourism sector contributes 6.6% to total Central Highlands employment

▪ The ‘Accommodation & Food Services’ sector contributes 77.8% to total tourism related employment

The employment generated to service demand from visitors for each industry sector has been estimated through applying industry profiles from the Australian Bureau of Statistics Tourism Satellite Account and consolidated into a separate tourism sector Tourism is estimated to account for 1,117 jobs (6 6%) of the total 17,019 jobs in Central Highlands

Source: REMPLAN (2017)

Employment Attributable to Tourism

The total tourism related employment estimate for Central Highlands is 1,117 jobs. The following graph shows the number of jobs in each industry sector in the region which service demand generated by tourists to the area.

Source: REMPLAN (2017)

Distribution of Tourist Dollar

Highlights

▪ For each dollar spent by a tourist in Central Highlands, it is estimated that typically $0.67 is spent on ‘Accommodation & Food Services’

▪ Central Highlands typically has more domestic day visitors to the region than domestic overnight and international visitors.

For each dollar spent by a tourist in Central Highlands, it is estimated that typically $0.67 is spent on ‘Accommodation & Food Services’, $0 09 is spent on ‘Transport, Postal & Warehousing’, and $0.09 is spent on ‘Ownership of Dwellings’.

Source: REMPLAN (2017)

The visitor profile provides data for Central Highlands for a four year average to 2016.

The following data has been sourced from Tourism Research Australia, Local Government Area Profile, 2016 for Central Highlands. Within Central Highlands, the average length of stay for international visitors is 23 nights, while the average length of stay of domestic overnight visitors is 4 nights Domestic overnight visitors spend an average of $450 per trip and $113 per night, compared to $712 and $31, respectively for international visitors

▪ During each year from 2010-11 to 2015-16, passenger numbers through Emerald Airport have typically peaked in the June/July period

▪ The six months to December 2017 has seen a total of 105,742 passengers through the airport

Passengers

Source: CHRC (2018)

*July

▪ 3,144 businesses operating in Central Highlands

▪ The largest number of registered businesses are in the ‘Agriculture, Forestry & Fishing’ sector

▪ The total number of ‘Agriculture, Forestry & Fishing’ businesses grew by 14 from 2015 to 2017.

As at June 2017, there are 3,144 businesses operating in Central Highlands The largest number of registered businesses are in the ‘Agriculture, Forestry and Fishing’ sector (1,229), followed by ‘Construction’ (388)

Source: ABS (2018a)

Between 2015 and 2017, the number of registered businesses in Central Highlands has decreased by 95 registered businesses The ‘Construction’ sector experienced the largest decline in business numbers (-54), followed by the ‘Other services’ sector (-21) The ‘Agriculture, Forestry and Fishing’ and ‘Transport, Postal and Warehousing’ sectors both experienced the (equal) largest increase in business numbers from 2014 to 2016 (14 each)

Source: ABS (2018a)

Highlights

▪ Owner/operator businesses account for the highest proportion of Central Highlands registered businesses

▪ Businesses with a turnover of less than $50,000 account for the highest proportion of Central Highlands registered businesses

Between 2015 and 2017, the largest change occurred for businesses that employ 5 to 19 staff, increasing 6.3% from 313 in 2015 to 320 in 2017. Businesses which do not employ any staff (i e owner/operator) account for the highest proportion (63 1%) of Central Highlands registered businesses

Source: ABS (2018a)

Turnover

From 2015 to 2017, the largest change in businesses by turnover was for businesses turning over between $50,000 and $100,000, decreasing from 474 in 2015 to 393 in 2017, a decrease of 17 1% The largest proportion of businesses by turnover is businesses turning over less than $50,000, accounting for 22 5% of Central Highlands businesses in 2017 The $200,000 to less than $500,000 range accounts for the second highest proportion of businesses (20 6%)

Source: ABS (2018a)

Highlights

▪ The total number of registered businesses in Central Highlands decreased by 2.9% from 2015 to 2017.

▪ No registered businesses in Central Highlands employ 200 staff or more

▪ The number of businesses with turnover of between $2 million and $5 million increased by 11.7% between 2016 and 2017

▪ The increase in labour force from 2013 to 2014 can be attributed to an increase in employed people (586 people) and a decrease in unemployed people (-80 people)

The estimated number of people employed in Central Highlands in 2017 is 15,540 people Since 2009, the labour force has decreased by 1,983 people; the number of employed people has decreased by 2,270 people and the number of unemployed people has increased by 287 people

Source: Department of Jobs and Small Business (2018)

Source: Department of Employment (2016)

Jobs growth rate identifies the annual change in the number of people employed within the region Employment growth since 2008/09 peaked between 2013/14 and 2014/15 at an increase of 586 jobs

The Central Highlands Development Corporation is the lead economic and tourism development agency in the Central Highlands.

Central Highlands Development Corporation (CHDC) is a not-for-profit organisation, proactively supporting regional economic growth and tourism. Our primary role is to facilitate, coordinate and promote economic and tourism development initiatives and opportunities in the Central Highlands region

This role is further reflected in the CHDC’s core business goals:

1. Advocate for sustainable regional and economic growth

2. Proactively market and promote the Central Highlands as a “region of choice”

3. Enhance workforce development

4. Support business development, innovation and capacity

5. Support community organisations to develop skills and knowledge

6. Sustain, refresh and grow our organisation

Business and community partnerships are critical to the delivery of these goals If you have any queries about the economic profile, the Central Highlands region, or any issues related to regional economic growth, do not hesitate to contact the CHDC via the details below

Central Highlands Development Corporation

PO Box 1425, Emerald QLD 4720

T (07) 4982 4386

F (07) 4982 4068

E enquiries@chdc com au

W www.chdc.com.au

This economic profile has been prepared by REMPLAN in partnership with the CHDC All figures and data presented in this document are based on data sourced from the Australian Bureau of Statistics (ABS), and other government agencies Using ABS datasets, the regional economic modelling software ‘REMPLAN Economy’, has been applied to generate industrial economic data estimates This document is provided in good faith with every effort made to provide accurate data and apply comprehensive knowledge However, REMPLAN does not guarantee the accuracy of the data nor the conclusions drawn from this information

(07) 5689 1499 / (03) 5444 4788

www remplan com au

Throughout this profile a series of abbreviations has been utilised These are summarised below

ABS Australian Bureau of Statistics

CH

CHDC

CHRC

Central Queensland SA4

GRP

Central Highlands

Central Highlands Development Corporation

Central Highlands Regional Council

Central Queensland Statistical Area Level 4

Gross Regional Product

LGA Local Government Area

M2

Square Metres

QGSO Queensland Government Statistician’s Office

QLD Queensland

RTA Residential Tenancies Authority

TRA Tourism Research Australia

Australian Bureau of Statistics (2017a) “Australian Census of Population and Housing 2016” Australian Bureau of Statistics, Canberra

Australian Bureau of Statistics (2017b) “Building Approvals, Australia, August 2017” Australian Bureau of Statistics, Canberra

Australian Bureau of Statistics (2017c) “Regional Population Growth, Australia, 2015-16” Australian Bureau of Statistics, Canberra

Australian Bureau of Statistics (2018a) “Counts of Australian Businesses, including Entries and Exits, Jun 2015 to Jun 2017” Australian Bureau of Statistics, Canberra

Australian Bureau of Statistics (2018b) “Labour Force, Australia, Detailed – Electronic Delivery, Cat. No. 6291.0.55.001, Dec 2017” Australian Bureau of Statistics, Canberra

Central Highlands Development Corporation (2017) “Central Highlands Development Register – December 2017” Central Highlands Development Corporation, Emerald

Central Highlands Regional Council (2018) “Emerald Airport Traffic Data July 2010 to February 2018”

Central Highlands Regional Council, Emerald

Department of Jobs and Small Business (2018) “Small Area Labour Markets publication – December Quarter 2017” Australian Government, Canberra

Queensland Government Statistician’s Office (2016a) “Projected Population (Medium Series), by Local Government Area, Queensland, 2011 to 2036” Queensland Government, Brisbane

Queensland Government Statistician’s Office (2016b) “Projected Population (Medium Series), by Five-Year Age Group and Sex, by Local Government Area, Queensland, 2011 to 2036” Queensland Government, Brisbane

Queensland Government Statistician’s Office (2018a) “Bowen Basin: Full-time Equivalent (FTE) Population Estimates, by Local Government Area (LGA) and Selected Urban Centres and Localities (UC/Ls), 2017”

Queensland Government, Brisbane

Queensland Government Statistician’s Office (2018b) “Bowen Basin: Non-resident Population Projections, by Local Government Area (LGA), 2017 to 2024” Queensland Government, Brisbane

Queensland Government Statistician’s Office (2018c) “Residential Land Development Activity Profile, accessed March 2018 – Central Highlands Regional Council” Queensland Government, Brisbane REMPLAN (2017) “REMPLAN Modelling and Analysis System” REMPLAN, Bendigo – REMPLAN utilises the following sources:

• 2016 ABS Census Journey to Work Employment Data;

• 2014/2015 ABS National Input Output Tables; and

• June 2017 ABS Gross State Product.

Residential Tenancies Authority (2018) “Median Rents Quarterly Data” Queensland Government, Brisbane

Tourism Research Australia (2017) “Local Government Area Profiles, 2016 – Central Highlands” Australian Government, Canberra