December 2025

Quarterly Market Update Q4 2025

Section 1:

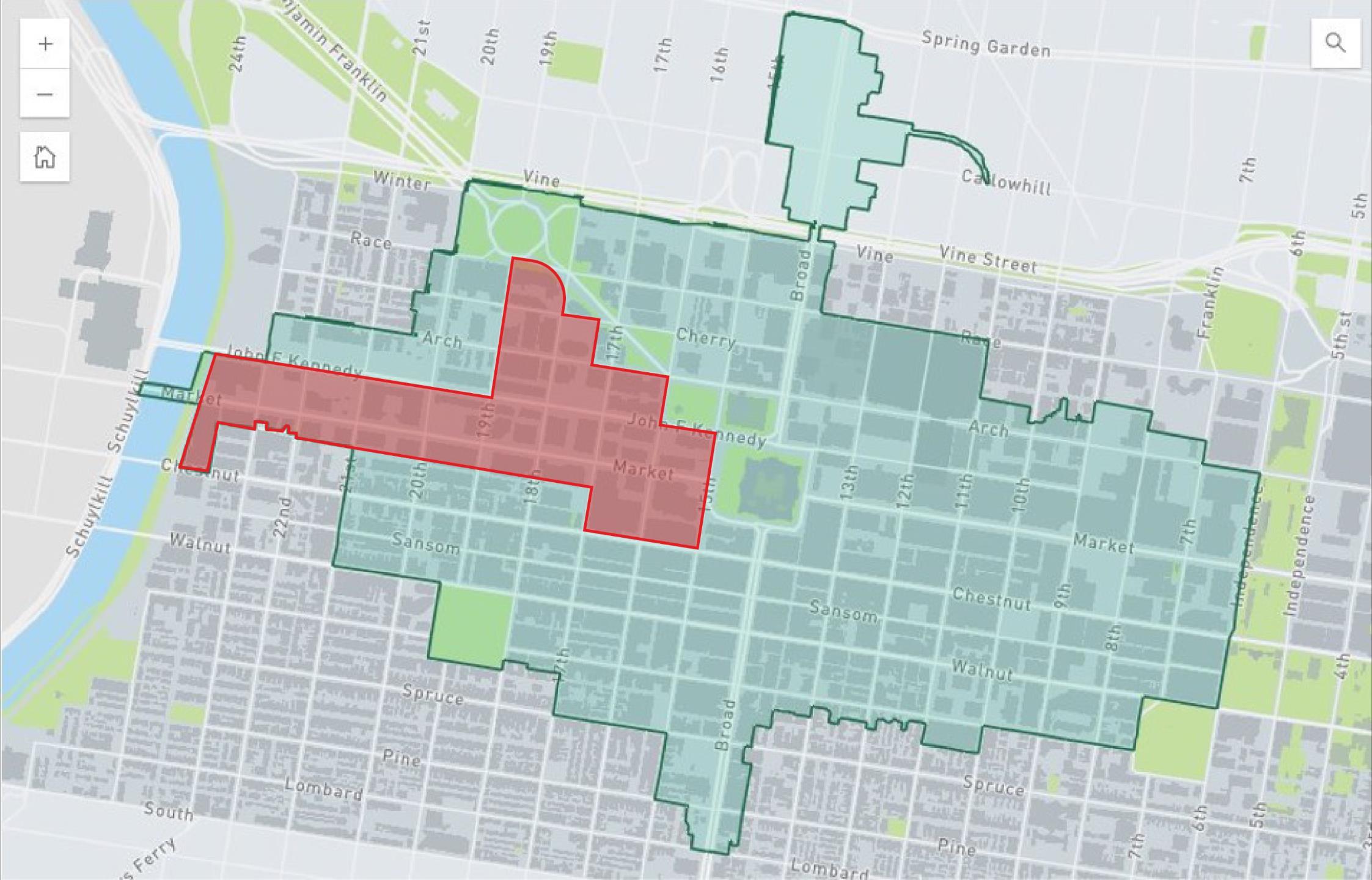

Center City District boundaries

Section 2: West Market office district

Center City District Boundaries

3 Key

Takeaways

Expansions and new-to-market deals announced Encouraging activity in office and life sciences

Q4 2025 office occupancy 78.2% Up 0.9% QoQ

SEPTA challenges pull-down RTO rate Regional rail and trolley fixes are on the way

The amount of office space leased within CCD boundaries increased by a remarkable 44% year-overyear, buoyed by several large inbound and expansion deals. Total office vacancy is hovering at 22.5%.

Employee volumes within CCD boundaries during typical office hours are around 68% of prepandemic levels.

Leasing Activity by Quarter (Class)

Leasing has accelerated in the second half of 2025, thanks in part to signed expansions from existing tenants and new-tomarket tenants planting flags in Center City. The flight to quality remains pronounced, with leasing in Class B space representing less than five percent of all activity in Q3.

Source: CoStar

Leasing Activity by Quarter (Direct/Sublease)

Direct deals still account for over 90% of all space leased throughout 2025, though Q3 2025 was a sizeable jump in sublease space taken relative to prior quarters. The bulk of sublease space was leased by Stateside Vodka at 1100 Ludlow, which is establishing their new corporate headquarters on East Market by taking 34,200 square feet formerly leased to Square, the parent company of CashApp.

Significant Deals (Q3-Q4 2025)

Eli Lilly

2300 Market

International pharmaceutical company Eli Lilly chose 2300 Market by Breakthrough Properties as their newest Lilly Gateway Labs location in November 2025. The company will occupy 44,000 square feet capable of supporting six to eight early-stage companies. Philadelphia joins San Francisco, San Diego, Boston, Shanghai and Beijing as Gateway Labs location.

Datavault AI

One Commerce Square

Datavault AI, an AI-driven asset management platform, signed a lease to bring their East Coast corporate operations to 23,000 square feet within One Commerce Square. Headquartered in Beaverton, OR, Datavault CEO Nathan Bradley “fell in love” with Center City’s diversity of professional sectors and proximity to major universities.

Significant Deals (Q3-Q4 2025)

Stateside Vodka

1100 Ludlow

Local beverage company Stateside Vodka signed an 11-year, 34,200 square foot lease at 1100 Ludlow, bringing the building to nearly full occupancy. Stateside considered several locations across the Greater Philadelphia region and ultimately landed on East Market to move their corporate operations from suburban Feasterville to Center City.

KPMG

1735 Market

In November, KPMG signed a deal at 1735 Market to expand their footprint by 25% to 122,000 square feet, reversing their decision to downsize just two years ago. Citing an increase in client demand and 56% growth in office attendance, KPMG's footprint now spans four floors and reflects their long-term commitment to Center City.

Significant Deals (Q3-Q4 2025)

Horn Williamson

One Commerce Square

In December, construction law firm Horn Williamson increased their office footprint by 50%, taking the entire 32nd floor inside One Commerce Square. Horn Williamson signed a 10-year lease, consolidating their prior two floors at Two Penn Center to one within a Trophy-class asset.

Cira Centre

& Co.

McKinsey & Co. have signed a 12year lease extension at Cira Centre and are planning to renovate their 27,684 square feet of office space for future flexibility and efficiency. Cira Centre is well positioned as a central hub along the East Coast, and the company has nearly doubled its Philadelphia head count over the last decade.

Significant Deals (Q3-Q4 2025)

Thermo Fisher Scientific

The Curtis Thermo Fisher Scientific and Bio Labs recently announced a partnership to open the Advanced Therapies Collaboration Center within The Curtis Building. A company spokesperson cited Philadelphia’s role as “the birthplace of CAR-T cell therapy and the home of Spark Therapeutics and gene therapy” as reasons they opted to invest in this market over others.

Starr Insurance

Duane Morris Plaza

New York-based Starr Insurance increased their Center City footprint by 66%, as the company recently signed a lease for the entire top floor of 30 S. 17th Street in the Duane Morris Building. Starr is moving from 1601 Market to 30 S. 17th ahead of a major renovation project announced by Oaktree Capital Management, the owner of the Duane Morris property.

Vacancy by Class

Vacancy rates across building classes remain steady throughout 2025. Trophy and Class B, which comprised a smaller proportion of total space compared to Class A, slowly ticked up by 0.5% and 1.1%, respectively, during the past quarter.

Source: CoStar

Absorption by Class

Absorption was positive across all three building classes in Q3 2025 for the first time since mid-2024. Gains were relatively modest, but representative of a strong quarter of leasing activity marked by such notable inbound deals such as Eli Lilly, Datavault AI, and Stateside Vodka.

Source: CoStar

Return to Office

CCD Boundaries – Weekdays 8 a.m.-6 p.m.

Across CCD's boundaries, non-resident workers (across all sectors) are present during the workday at rates similar to 2024 levels. November historically sees lower office attendance due to the beginning of the holiday season, but SEPTA’s ongoing Regional Rail issues have hampered what was strong returnto-office rates between July and September in Center City.

Methodology note: These data are provided by Placer.ai using anonymized samples of cell phone locations. A recent change by Placer.ai in its categorization of what constitutes a visitor and an employee have resulted in employee volumes decreasing and visitor volumes increasing as the platform more accurately determines who is traveling regularly for employment.

Source: Placer.ai

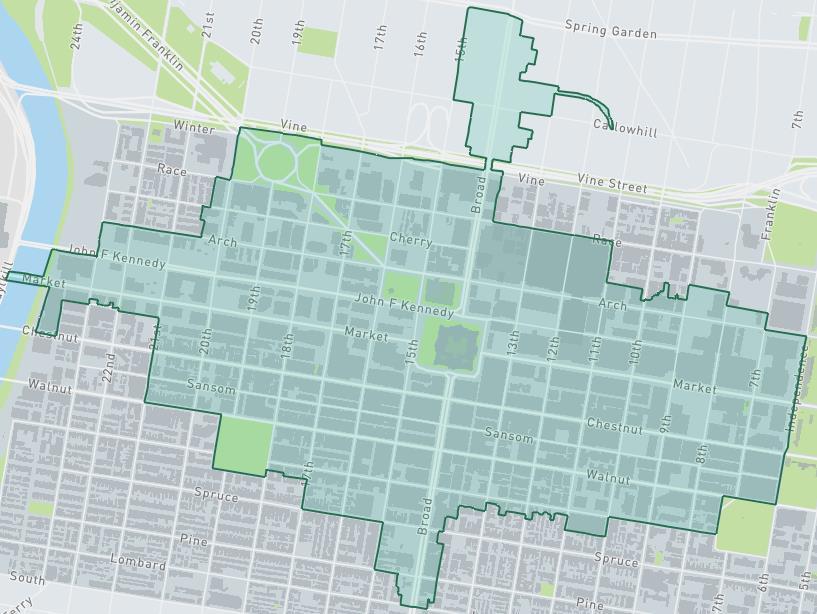

West Market Office District

West Market Office District – Recent Retail Leasing

Cake and Joe

1735 Market

1,200 s.f.

This will be the third location for South Philadelphia-founded Cake and Joe, which operates in Pennsport and Fishtown. This brings a much-needed coffee and food offering to the primary office corridor.

MOTW Coffee & Pastries

2101 Market

3,000 s.f.

MOTW Coffee & Pastries will be moving into the former American Heritage Credit Union space on the ground floor of 2101 Market Street.

Rhythm & Spirits

1617 JFK

3,500 s.f.

Rhythm & Spirits, an Atlantic City mainstay, has opened a new restaurant and bar within One Penn Center, serving residents, workers, and commuters.

Revolution Taco Express & Pagano’s

Comcast Concourse

TBD

As workers have returned to the Comcast Campus, the Concourse is undergoing a refresh with new dining options on the way.

West Market Office District – Conversions

1701 Market Complete

300,000 s.f.

Now called 17 Market West, the building welcomed its first tenants at the beginning of May even as the full build-out of amenity spaces is ongoing.

Three Parkway Complete

174,000 s.f.

PMC Property Group has delivered residential units in the low-rise portion of the building previously occupied by Drexel. The high-rise remains a wellleased office building with tenants including GrubHub.

West Market Office District – Conversions

Ten Penn Center Proposed

675,000 s.f.

PMC Property Group closed on Ten Penn Center for $30 million in early November. PMC has not publicly shared its plans for the property, but it is a prime candidate for residential conversion similar to other projects within PMC’s portfolio.

1232 Chancellor In Progress

12,000 s.f.

Center City Development purchased the 12,000 s.f. former office building from JacobsWyper Architects for $1.75 million in September. The developer has proposed the relatively small office building will be a prime candidate for a boutique apartment conversion.

West Market Office District

Employee Recovery – 2024 Average

While the rate of return is not as high within the West Market office district as it is across the more diversified CCD area overall, 2025 rates of RTO had been outpacing 2024 levels through July, until concurrent SEPTA budgetary and equipment issues have slowed the momentum within the office district.

Methodology note: These data are provided by Placer.ai using anonymized samples of cellphone locations. A recent change by Placer.ai in its categorization of what constitutes a visitor and an employee have resulted in employee volumes decreasing and visitor volumes increasing as the platform more accurately determines who is traveling regularly for employment.