GEORGIA COMMUNITIES FIRST SPRING 2024 CONNECT 2024 Where Banking Meets Brilliance LEAD Beyond the Bank

Meet Scott. Scott

Let

Is your community bank thriving?

works hand-in-hand

community banks in the Southeast to find ICBA member benefits that help

goals.

with

them achieve their bank’s

new ways to

with bankers,

spending time in the great outdoors, hiking, camping, and adventuring.

When he’s not exploring

connect

he’s

Scott help you explore all the many options ICBA has to offer your community bank. Learn more at icba.org/membership

John McNair President & CEO john@cbaofga.com

Lori Godfrey

Executive Vice President and Chief of Staff, Government and Regulatory Relations lori@cbaofga.com

Kristi Greer

Senior Vice President Professional Development kristi@cbaofga.com

Lindsay Greene

Senior Vice President

Member Services lindsay@cbaofga.com

Cassie Cornell

Assistant Vice President Digital Strategy and Professional Development Marketing cassie@cbaofga.com

Becky Soto

Assistant Vice President

Professional Development and LEAD Board becky@cbaofga.com

Connie Shepard

Assistant Vice President Professional Development and Member Engagement connie@cbaofga.com

Ellen Shea, CMP Director of Association Services ellen@cbaofga.com

Gwen Lanaghan Staff Accountant gwen@cbaofga.com

2 CBA CONNECT A Homecoming 3 L.E.A.D. - Develop Our Members 4 TopGolf Highlights 6 ICBA Capital Summit Highlights 8 Upcoming 2024 Advocacy Events 10 2024 Clay Shoots 12 2024 Legislative Session Wrap-Up 16 CONNECT 2024 Where Banking Meets Brilliance 20 LEAD - Leadership Education Advocacy Development 21 An Interview with Mike Underwood, Senior Vice President, Commercial Lending Peach State Bank, LEAD Division Chair 23 LEAD Board 24 LEAD Board Visits the Federal Reserve Bank of Atlanta 26 2024 CBA Advanced BSA: AML./CFT Officer School 28 Scholarship Winners 30 Beyond the Bank: Angela C. Woodard Compliance to Craftmanship CONTENTS 32 Education Buzz: The Lost Art of Handwriting 34 Upcoming Programs 35 Popular Schools and Conferences 36 Roundtable Advice for Professional Development 37 Addressing the Talent Gap 38 Cyber Risk Summit 40 LEAD On - A Community Bank Leadership Retreat for All Bankers 41 Tech Talk 42 Recession Proofing 44 Choosing a Deposit Network and Maximizing its Value for Your Bank 46 Increase Net Interest Income and Win More Deals! 48 They’re Not Bad Loans, They’re Just “Out of Favor” 49 Summer & Fall Sponsorship Oportunities 51 CBA’s 2024 Preferred Service Providers Community Bankers Association of Georgia 1640 Powers Ferry Road SE, Building 28, Suite 100, Marietta, GA 30067-1425 (770) 541-4490 or (800) 648-8215 • Fax (770) 541-4496 | www.cbaofga.com • cba@cbaofga.com

CBA STAFF ADVOCACY stay connected @company/ cbaofgeorgia @CBAofGeorgia @CBAGeorgia pr O fessi O n A l D e V el O pment sp O tlights member ser V i C es Day 40 of the session….Sine Die! CBA LEAD Board visits the FHLB Atlanta pg.12 pg. 24

FEATURES Spring 2024

On the cover: CONNECT 2024 Where Banking Meets Brilliance; LEAD Beyond the Bank

CBA CONNECT A Homecoming

There is something truly special about the feel of a community banking convention. Having been a part of many such gatherings over the years, I’ve come to see them as more than just events; they’re like reunions where everyone speaks the same language of ambition and dedication. Whether we’re tackling the complexities of finance education, enjoying the laid-back atmosphere away from the stiff suits, or connecting deeply under the banner of “CONNECT,” these conventions are where I feel most at home. As we dive into the CONVENTION issue, I’m thrilled to share the unique aspects that make these events so special:

• Education: CBA has mastered the art of delivering a balanced, cutting-edge curriculum on topics like lending, operations, and technology, all within a tight schedule. Our broad array of events is tailored to remain relevant and engaging, offering deep insights into the banking industry. You’re guaranteed to leave with actionable insights.

John McNair President & CEO Community Bankers Association of Georgia

John McNair President & CEO Community Bankers Association of Georgia

• Atmosphere: Swap your business wear for comfortable resort wear and get ready for a gathering that feels like coming home. More than a conference, CONNECT is a homecoming, with a casual vibe that encourages socialization alongside professional engagement.

• Connect: Aptly named, these conventions excel in building meaningful connections, enriching both personal and professional lives. Since branding our convention as CONNECT, we’ve created an unparalleled environment for forging deep connections with peers and leaders across the industry. It’s about learning, laughing, and engaging in a fantastic setting.

As we gear up for the June edition of CBA CONNECT, I can’t help but invite everyone to join in. Whether you’re a seasoned banker or a newcomer, these conventions promise valuable insights and a renewed passion for community banking. If you haven’t registered yet, join us for this extraordinary gathering. You’ll leave energized and inspired about the future of community banking!

2 | www.cbaofga.com | Spring 2024

FROM THE PRESIDENTS DESK

Neil Stevens President & CEO

Oconee State Bank, Watkinsville 2023-2024

CBA Chairman

L.E.A.D. - Develop Our Members

In this article, we will cover the last of the Four Focus Items outlined during my term as Chairman – Developing Others. In previous issues of Georgia’s Communities First, we covered three of the four focus items – Loving Our Members, Equipping Our Members, and Affirming Our Members. I encourage you to read my message in those issues if you have not already done so.

In this issue, we will discuss what it means to Develop Our Members. Developing Our Members might sound a lot like Equipping Our Members but it’s bigger than that. Think about a bodybuilder. To develop themselves, they must first have the proper equipment. Barbells, dumbbells, pull up bars, ropes, medicine balls, and the like. They must receive training on how to use the equipment in a way that promotes muscle growth and avoids injury. That takes time, discipline, and focus. The reality is that one can have all the right equipment and receive the best available training and game plan, but muscles will not develop without a good nutritional foundation. If you don’t provide those muscles with the proper food, they won’t grow in the most effective way. Developing Our Members is like providing constant fuel for their trained and prepared muscles.

I can share mounds of research that proves to develop consistently winning teams – teams that win now, and in the future – isn’t merely about assembling the smartest or hardest working people. In fact, it’s not about those strategies first and foremost at all. The key to consistent high performance with a team (including The Community Bankers Association and your bank) is to make sure the collective voice of the team is greater than the voice of any one member, including the leader. This is the way that every member of the team knows they add important value and that value, when forged together with the value of everyone else on the team, has a compounding effect that cannot be matched by any one member.

As CBA members, it is important that we engage in positive debate to make our association and our industry better, all while remaining committed to loving, equipping, affirming and developing each other. While it might seem contrary, this posture demonstrates that good teamwork is a collective, evolving effort. All have value. All can and should participate. This is the foundation of both individual and team development. While there may be no “I” in team, each team is made up of many “I’s” who are inextricably linked to their own well-being and their desires to be valuable and fulfilled. If each “I” on the team doesn’t believe they matter, and their participation is not valued, they may disengage, which could negatively impact the productivity of the team. It’s our job as a CBA body to make sure each “I” develops and is firmly convinced that their “I,” when added to the other “I’s” on the team, makes an impact and is necessary for the team to excel. Yes, there is no “I” in team. But there are always “I’s” in every team wIn. If we are to wIn as Georgia’s premier trade association, we must lock arms and do it together! Every “I” counts!

As we close, let’s continue to place emphasis on the Four Focus Items for the 2023/2024 term:

L-Love Our Members

E-Equip Our Members

A-Affirm Our Members

D-Develop Our Members

If we L.E.A.D. well, The Community Bankers Association will remain elite for years to come.

It has been a true pleasure serving as your Chairman. Thank you.

Sincerely,

Neil Stevens

Spring 2024 | Georgia Communities First | 3

CHAIRMAN’S CORNER

TOPGOLF HIGHLIGHTS

Lots of smiles and friendly competition at the 2024 CBA Topgolf Showdown, held on April 25 at the new Topgolf in Buford.

The fundraiser for CBA’s Advocacy efforts brought together bankers and partners for an afternoon of golf, food, refreshments, prizes and networking.

Lori Godfrey, EVP, Government and Regulatory Relations at CBA, provided an update on the 2024 Georgia Legislative Session and current issues affecting the community banking industry.

Special thanks to our sponsors and to all who came out to support the event.

The next Topgolf will be held August 8th in Atlanta from 3:00 pm - 6:00 pm.

Congratulations to the winners!

1st Place Team

Ronnie Sieber, Shazam

Alex Jernigan, Shazam

Brad Serff, The First Bank

John McNair, CBA of Georgia

2nd Place Team

Mark Bailey, United Healthcare

Bryan Palmer, United Healthcare

Thomas Bostwick, Finosec

Will Allison, Finosec

Mike Sale, The Commercial Bank

Lowest Score – Special Prize

Thomas Adelaar, Embassy National Bank

4 | www.cbaofga.com | Spring 2024 ADVOCACY

Spring 2024 | Georgia Communities First | 5 ADVOCACY Don’t Miss the Next TopGolf Showdown!

2024 ICBA

Capital Summit April 28-May 1 Highlights

CBA staff, member banks, and several vendor partners teamed up to join ICBA’s Capital Summit in Washington, DC last week to advocate for community bankers across the nation. Top issues discussed include calling for credit union hearings, supporting rural America, reigning in regulatory overreach, and opposing credit card routing mandates. The complete lobby card on priority issues is available on the ICBA website. Georgia bankers visited with the following members of Congress (or their staff) in addition to meeting with Senator Jon Ossoff and staff from Senator Raphael Warnock’s office:

Rep. Rick Allen

Rep. Mike Collins

Rep. Barry Loudermilk

Rep. Andrew Clyde

Rep. Austin Scott

Rep. Sanford Bishop

Rep. Drew Ferguson

Rep. Nikema Williams

In addition to lobbying on the Hill, bankers heard featured remarks from Dave Fishwick, whose story inspired the Netflix hit “Bank of Dave”; House Financial Services Vice Chairman French Hill (R-Ark); FDIC Chairman Martin Gruenberg; and Consumer Financial Protection Bureau Director Rohit Chopra.

Thank you to James-Bates-Brannan-Groover-LLP, Newcleus, IntraFi, SHAZAM, and Federal Home Loan Bank of Atlanta, for your sponsorship of the ICBA Capital Summit.

6 | www.cbaofga.com | Spring 2024 ADVOCACY

COMPETE WITH THE

SHAZAM believes smaller financial institutions like yours shouldn’t lose out just because you don’t have the resources of a national megabank. That’s why we deliver flexible, cost-effective network and processing technology that helps you compete against the biggest dogs on the block. All fully backed by the kind of unmatched technical expertise and personal support that unleashes your power to make a big impact in your community.

Spring 2024 | Georgia Communities First | 7 ADVOCACY

shazam.net

2024

ADVOCACY EVENTS

2nd Annual CBA Day at the Braves Outing Benefitting CBA’s Advocacy Efforts

August 24, 2024 @ 7:20 pm | Hank Aaron Terrace Braves vs Washington Nationals

Thanks to our sponsors:

Atris Technology | CRI | Elliott Davis | First National Bankers Bank | Genesys Technology Group | Integris | James Bates

Brannan Groover LLP | ServisFirst Bank | SHAZAM | WIPFLI

Town Hall Talks are a multi-location Grassroots alternative to a Day at the Dome for you to meet your legislators in person. We are proud to be partnering with NFIB to host these “Town Hall” style events where attendees will have the opportunity to engage your legislators in a Q&A session and hear their perspectives on legislative issues that may impact community banks. Attendees will be presented with CBA & NFIB updates, programs, insights on the upcoming legislative session, and most importantly, meet & greet legislators.

Bankers, we encourage you to invite any small business clients to join and attend these Town Hallswith you. Regional information, networking, refreshments, and legislative updates at three locations around the state.

THANK YOU TO OUR SPONSORS

8 | www.cbaofga.com | Spring 2024 ADVOCACY UPCOMING

Charlie Curry Memorial Tournament

Thursday, September 26

9:00 AM - 4:00 PM (EDT) Wynfield Plantation

5030 Leary Road

Albany, GA 31721-8659

United States

IN MEMORY OF CHARLIE CURRY

In early 2018, the Georgia community banking industry lost a dear friend and passionate advocate, Mr. Charlie Curry of First State Bank of Randolph County, Cuthbert. In addition to his overall involvement with the Association, its Board of Directors and annual events, Charlie was an avid sportsman and often attended and supported CBA’s Advocacy Fundraising Clay Shoots. Therefore, the CBA Board of Directors unanimously decided to name this event in his honor. We are pleased to present the Charlie Curry Memorial Clay Shoot.

Charles “Chuck” Harwell Memorial Tournament

Thursday, October 24

9:00 AM - 4:00 PM (EDT) Burge Plantation

44 Jeff Cook Road Mansfield, GA 30055

United States

IN MEMORY OF CHARLES “CHUCK” HARWELL

In 2020, we lost our dear friend and colleague, Charles “Chuck” Harwell. Chuck was a CBA board member who always supported this event as well as all of our Advocacy events year after year. Chuck was truly passionate about ensuring community banks had a voice at the Capitol and staying engaged in lobbying for our industry. Therefore, your CBA family would like to respectfully memorialize Chuck, for what he stood for, and meant to his family, friends, and the community he impacted. We are pleased to present the Charles “Chuck” Harwell Memorial Clay Shoot.

10 | www.cbaofga.com | Spring 2024 ADVOCACY

C orner GENERAL COUNSEL

UPDATE ON PROPOSED CHANGES TO STATEMENT OF POLICY ON BANK MERGER TRANSACTIONS

By: Doroteya N. Wozniak

In March 2024, the Federal Deposit Insurance Corporation’s (“FDIC”) Board of Directors proposed revisions to its statement of policy (“SOP”) on bank merger transactions which if approved would replace the current SOP. The proposed revisions can be found here: https://www.federalregister.gov/ documents/2024/04/1 9/2024-08020/ request-for-comment-on-proposedstatement-of-policy-on-bank-mergertransactions.The SOP was last revised in 2008.

The proposed changes to the SOP are expected to result in increased scrutiny for bank mergers across the U.S. Some of the notable changes are FDIC’s intent to (i) consider the views of relevant regulators regarding the resulting insured depository institution’s (“IDI”) ability to meet the convenience and needs of the community, and (ii) evaluate whether the resulting IDI will be able to better meet the convenience and the needs of the community to be served. The “better than current” standard will likely analyze benefits to the community through higher lending limits, greater access to existing products and services, introduction of new or expanded products or services, reduced prices and fees, increased convenience in utilizing the credit and banking services and facilities of the resulting IDI, or other means.

Under the proposed SOP, the FDIC’s approach in assessing the competitive effects of any bank merger transaction is expected to be much broader than under the current rules. The FDIC also expects that where any divestiture of assets is needed for a merger to be approved, such divestiture must be completed before consummation of the merger. The proposed SOP also creates policy against non-compete agreements with employees of the divested entity. Overall, the proposed changes to the SOP indicate FDIC’s intent to focus on factors that have not been determinative in merger applications in the past. The comment period expires on June 18, 2024. For any questions about the FDIC’s proposal, please reach out to a member of your James Bates Brannan Groover LLP Financial Institution Group team.

Spring 2024 | Georgia Communities First | 11

ATHENS 1 Press Place Suite 200 Athens, GA 30601 ATLANTA 2827 Peachtree Road, NE Suite 300 Atlanta, GA 30305 MACON 231 Riverside Drive Suite 100 Macon, GA 31201 Doroteya N. Wozniak Atlanta Office dwozniak@jamesbatesllp.com Michael N. White Athens Office mwhite@jamesbatesllp.com Corrie E. Hall Macon Office chall@jamesbatesllp.com T. Daniel Brannan Atlanta Office dbrannan@jamesbatesllp.com

Have a topic you would like to see covered in “General Counsel Corner?” Email us at generalcounselcorner @ jamesbatesllp.com legal news and updates for Cba members “General Counsel Corner,” a recurring column featuring legal news and information of interest to CBA members, is brought to you by James Bates Brannan Groover LLP. Visit us at jamesbatesllp.com

2024 LEGISLATIVE SESSION WRAP - UP

The 2024 session of the Georgia General Assembly began on January 8 and adjourned sine-die in the early morning hours of March 29 to complete the second year of the biennial session. The forty “working days” of the session seemed to fly by in many respects, but for financial institutions, it was one of the toughest we’ve had in years.

CBA tracked 420 individual pieces of legislation that had some impact on our community banks as part of this two-year lawmaking session. Compounding the sheer volume of bills is that nothing is ever truly “dead” until the final gavel falls. Legislators saw their measures hi-jacked, gutted, and loaded with new language to resurrect otherwise lifeless legislation before the clock ran out. Add to the mix that 2024 is an election year and you’ve got a recipe for chaos.

There are several positive outcomes to report from a potentially damaging session. Your advocacy team was at the Capitol daily during session, working diligently to manage and mitigate the onslaught of proposed new policies. In several instances, CBA advocated for specific legislation and created opportunities to advance items where none existed before.

Day 3 of the session. Wrapped up the day by attending the ICBA ThinkTECH Accelerator Program.

Session is also a great time for CBA to raise the profile of community banks among lawmakers and promote the critical role you play in their districts. The connections we make are invaluable. Based on a social media post, CBA contacted a legislator involved in FinTech and innovation. We discussed the ICBA Think Tech Accelerator and the new Atlanta ICBA office during our meeting. We will tour ICBA offices with this legislator in the coming weeks. In another instance, a legislator asked about CBA’s connections with Asian banks. This legislator

is involved in the Assembly Atlanta movie studios; we are working together to host a town hall talk with legislators, studio executives, small business caterers, and community banks.

Later this year, CBA will resume our town hall talks. We will be host these jointly with NFIB in three locations in north, middle, and south Georgia. These events are a great way for your advocacy staff and our members to make connections with different legislators. Off-season grassroots advocacy is critical to in-session success. These events are intended for anyone that works at your bank and your customers. Our goal is two fold: educate the industry about the legislative process and educate lawmakers about the industry. We strive to include legislators from the local area so they can dialogue directly with their constituents. We encourage you to bring a friend to one of our Town Hall Talks. Dates will be posted soon.

Some of the bills that CBA was tracking that passed and are

awaiting signature of the Governor include the following:

• Department of Banking & Finance’s Housekeeping Bill signed 4/23/2024. Effective 7/1/2024.—HB 876 is the Department’s housekeeping package. Since July 2023, the Association worked closely with the Department to make non-controversial statutory changes to modernize and streamline Georgia’s banking code.

As it relates to community banks, the bill changes code sections relating to bank formations, notices and filings with the Secretary of State, the definition of “subsidiary”, and the Merchant Acquirer Limited Purpose Bank Act. For a full summary of substantive changes, click here.

These statutory changes are accompanied by regulatory changes that are vetting through the rulemaking process. The Department generally aims to initiate the rulemaking process in early June with an effective date of early July to coincide with the July 1 effective date of HB 876.

In a world of chaos, the Department’s annual housekeeping bill is as close to a sure thing as you can get. CBA is grateful for the strong leadership and steadfast approach of Commissioner Kevin Hagler and Deputy Commissioner Bo Fears. We also appreciate legislative sponsors Bruce Williamson and John Kennedy for shepherding the measure through the process. The Department’s Housekeeping bill was signed into law on April 23, 2024 and becomes effective July 1, 2024.

12 | www.cbaofga.com | Spring 2024 ADVOCACY

Day 32 of the session. The Senate passed the Department’s housekeeping bill with a vote of 48-0.

• Department’s FY25 Budget signed 5/7/2024. Effective 7/1/2024. —While most state employees will receive a cost-ofliving adjustment within the FY25 budget, Financial Institution Supervision examiners at the Department are also eligible for a targeted $2,000 bonus. The budget adds funds for two new examiners within the non-depository section to address increased workload. Click here to see the Department’s final budget, which totals about $14 million in state dollars in both AFY24 and FY25.

The Association has worked extensively with Commissioner Kevin Hagler to promote increased funding for the Department, especially after the Commissioner reported that examiner

turnover has doubled in just four years. With the salary for Georgia’s bank and credit union examiners lower than in surrounding states, the Department is losing valuable talent and experience, which threatens the industry.

In October 2023, CBA’s Board of Directors voted to make Department funding a top priority. CBA understands the importance of a dual banking system and what role the Department plays in this system.

The Association has worked extensively with Commissioner Kevin Hagler to promote increased funding for the Department. CBA’s Board of Directors voted in our strategic planning session to make funding for the Department a top priority as our Board understands the importance of a dual banking system and what role the Department plays in this system.

• C-PACE signed 4/25/2024. Effective immediately.— Commercial Property Assessed Conservation, Energy, and Resiliency (C-PACE) is a public-private partnership that is intended to enable commercial building owners to invest in their property. Under these programs, a private lender finances energy-saving building upgrades and is repaid via a special assessment added to the property’s tax bill.

In 2022, C-PACE legislation was introduced; however, the bill did not crossover during the session. CBA and other trade groups representing financial institutions objected to the bill as drafted and worked with several proponents of the bill during the off session to discuss the topic and explore potential alternatives that would mitigate our concerns.

ADVOCACY

April 23, 2024 The Department’s Housekeeping Bill Signed into law.

ADVOCACY

In 2023, the issue resurfaced as HB 206 and reflects changes made by the proponents to mitigate the concerns of our industry. On the last day of the 2023 session, an amended SB 145 lost for the 2023 session and included five different pieces of legislation including C-PACE. This session, HB 206 was still eligible for a vote and ultimately passed with the changes that CBA and others advocated for during this process.

• Georgia Firearms Industry Nondiscrimination signed 4/22/2024. Effective 7/1/2024. —Merchant category codes (MCCs) are short numbers that credit card companies use to classify purchases. Ever wonder how your credit card knows how to give triple cash back at a gas stations? MCCs are behind all of it.

HB 1018 prohibits a financial institution from using an MCC specific to firearms or one that would single out firearms retailers from other types of retailers. It also prohibits entities from creating a registry of firearms owners or firearms.

While the legislation was modeled after a bill passed in Mississippi, CBA and others in the banking community worked with the author to correct several items that would have been problematic for Georgia’s financial institutions.

• Adult Abuse, Neglect, and Exploitation Multidisciplinary Team vetoed on 5/7/2024. —HB 1123 establishes an Adult Abuse, Neglect, and Exploitation Multidisciplinary Team in each judicial circuit. It also creates the Elder Justice Coalition. CBA worked with the author to ensure the Association is included in the Coalition.

• Georgia Squatter Reform Act signed 4/24/2024. Effective immediately.— HB 1017 addresses the issue of squatters through the criminal trespass code, rather than through magistrate court as is currently the case. This change allows police to take action directly under certain conditions to remove the squatter in a timely fashion.

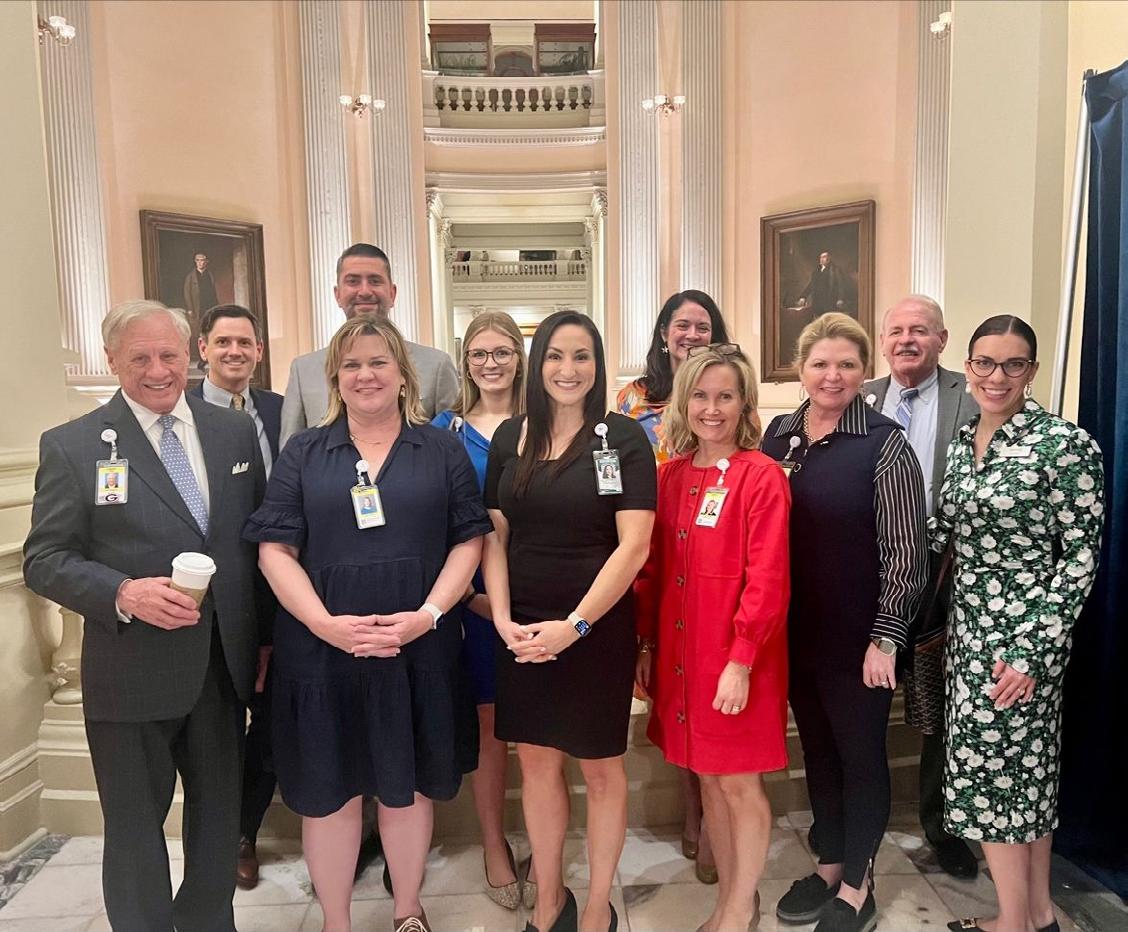

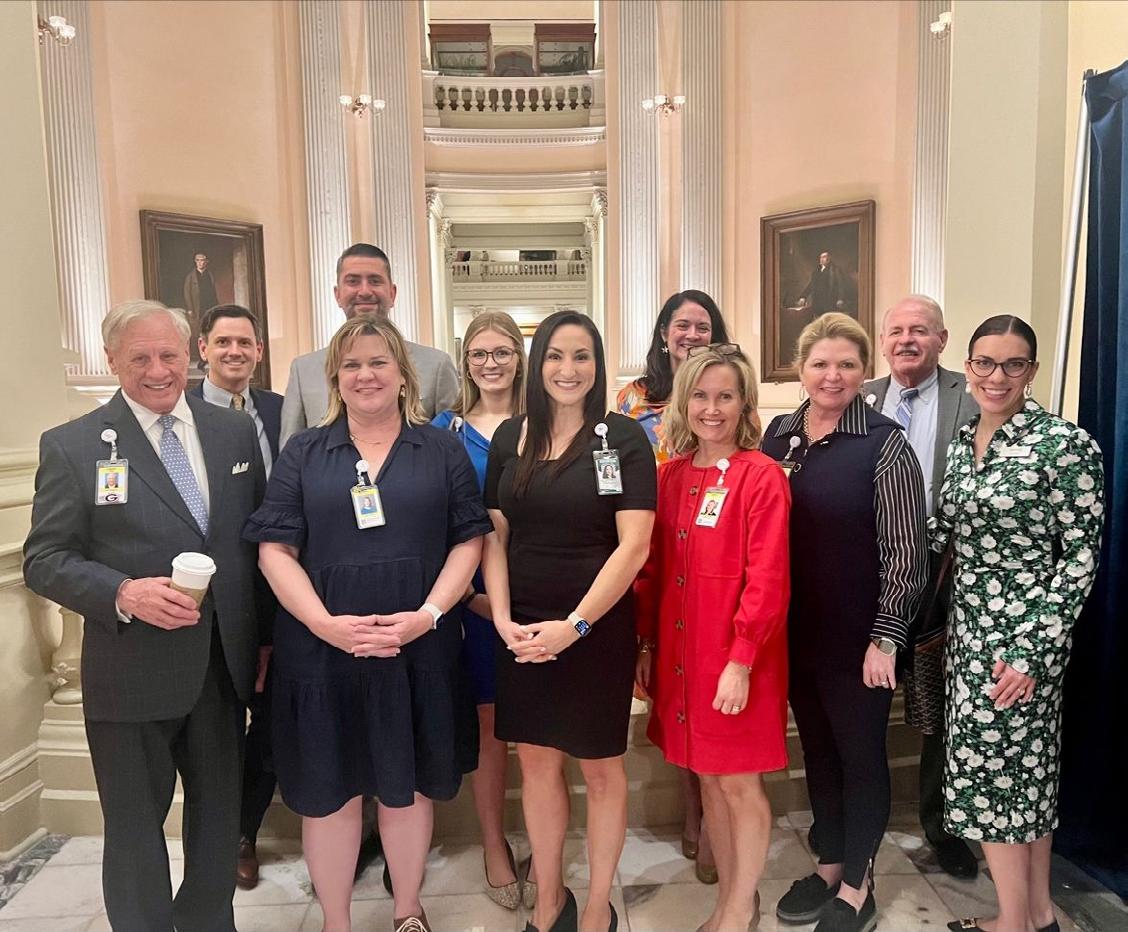

Day 28 of the session. The ladies of the financial institutions sector representing your interests on crossover day. Our team is all about relationships…just like our community banks. I’m proud to work with these ladies each day during session.

Day 16 of session. We met with Rep. Long Tran to discuss economic opportunities in his district and how community banks can help. Thank you toAbdul Mohdnor of Metro City Bank for joining us in our conversation.

• Photo ID for Deed Filings signed 5/2/2024. Effective immediately except part 1 which is 1/1/2025. —HB 1292 requires the clerks of the superior court to obtain a photo ID for individuals who present deeds or other instruments for recording in an effort to reduce fraudulently recorded deeds. CBA worked with the author to exempt federally insured financial institutions and credit unions and their affiliates.

The Senate Judiciary Committee further amended it to include language from SB 474. It addresses the issue of unsolicited residential purchase offers, especially related to elder and vulnerable homeowners. It requires the purchase offer to clearly disclose that the offer may or may not be the fair market value of the property; it renders certain contracts accompanying unsolicited offers from unlicensed individuals void. CBA worked with the author to ensure the definition of “financial institutions” includes both state- and federally-chartered institutions.

• Increase Statewide Ad Valorem Exemption for Tangible Personal Property signed 5/6/2024. Effective immediately. —HB 808 increases a statewide ad valorem tax exemption for tangible personal property from $7,500 to $20,000 in a tiered manner over several years. During presentations, this was categorized as an onerous tax that unfairly burdens small business owners.

• Uniform Commercial Code Modernization Act of 2024 signed 5/6/2024. Effective 7/1/2024. —HB 1240 updates and modernizes various statutes in the commercial code relating to commercial transactions to maintain uniformity in this state’s statutes governing commercial transactions as recommended by the National Conference of Commissioners on Uniform State Laws. It establishes commercial law for transactions involving digital assets, adds a new article pertaining to electronic records, and adds a new article pertaining to transitional provisions.

14 | www.cbaofga.com | Spring 2024

• Central Bank Digital Currency signed 5/6/2024. Effective 7/1/2024. —HB 1053 prohibits governmental agencies from using central bank digital currency as payment and from participating in testing the use of such currency.

Some of the bills that CBA was tracking were defeated or did not pass this session due to various reasons include the following:

• Remote Online Notary

• Earned Wage Access

• Georgia Consumer Privacy Protection Act

• Cash Overpayments by Merchants

• Tort Reform

• Restriction and Seal of First Offender Status

• Motor Vehicle Title Loans

• Mobile Homes as Real Property

• Equality in Financial Services Act

• Peach Save Plan

While CBA and others in the financial services industry provided testimony in opposition to the House Study Committee on Credit Card Fees, a study committee is ultimately a better option than a bill that is signed into law. CBA hopes that the study will provide clarity on all aspects of a credit card transaction and perhaps the impact on community banks will not be as detrimental as first thought.

The financial services industry on this topic includes Georgia Bankers Association, Georgia’s Own Credit Union, League of Southeastern Credit Unions & Affiliates, Vystar Credit Union, Global Payments, Visa, Mastercard, Electronic Transactions Association, Electronic Payments Coalition, and American Transaction Processors Coalition.

Study Committee on Credit Card Fees—The Resolution creates a House Study Committee on Credit Card Fees on State Sales and Excise Tax and their impact on Georgia merchants and consumers. The committee will explore various subjects, including the purpose and allocation of credit card swipe fees, the role of merchants in addressing fraudulent transactions, the volume of fraud liability imposed upon merchants through chargebacks, the impact of swipe fees on low-income consumers, the anti-competitive nature of payment card

marketplace, and the ability of merchants to communicate tax amounts based on information already provided as part of the transaction.

The following members will serve on the study:

• Four members of the House of Representatives, including the Chairman of the House Banks and Banking Committee and the Chairman of the Technology and Infrastructure Innovation Committee

• Six nonlegislative members:

• One retail payments expert from a motor fuel or general retailer

• One banking industry expert

• One consumer member or consumer advocate

• One payment-processing expert from a processing company

• One restaurant owner-operator or representative from the restaurant industry, and

• One small business owner or operator or a small business representative

The committee is expected to meet there or four times during the summer and fall. It must submit its findings to the legislature no later than December 1. The findings may recommend legislation, which could be introduced and considered in the 2025 session.

While CBA stands firm in its position that a solution should be sought at a federal level, the Association will be active in the study committee process.

Now that the session is behind us, our focus will be handing out PAC contributions prior to the election and participating in the study committee on credit card fees. The Board and Advocacy Committee will also determine priorities for 2025. It is never too early to start laying the groundwork for another successful legislative session.

Spring 2024 | Georgia Communities First | 15 ADVOCACY

Day 40 of session. All in all, I’d say the session was a success. Now, brace yourself for an election year. Things are just heating up.

Day 40 of the session….Sine Die! What a session! Ups, downs, and all arounds.

Get ready for an exhilarating journey into the future of banking with CONNECT 2024, the Community Bankers Association of Georgia’s (CBA) premier annual convention and mini-trade show. Set in the stunning paradise of The Ritz-Carlton in Amelia Island from June 5-9, this event promises to ignite innovation, inspire action, and intensify networking like never before!

Kick-Start with High Impact

Thursday, June 6: Fuel up with a scrumptious breakfast before jumping into a high-energy welcome kickoff. Get ready to be moved by the morning keynote from Austin Hatch, whose breathtaking saga of survival and victory encapsulates the theme “GRIT: How can we Thrive in the Midst of Adversity?” Austin’s tale is not just heard; it’s felt deeply, energizing every attendee with a renewed zest to conquer challenges.

Power-Packed Sessions and Stellar Networking

The excitement continues to build with a series of powerhouse sessions led by industry titans like David Ruffin and David Peterson, who will decode the complexities of loan growth, credit risk, and the fintech revolution. These insights are designed not just to be heard but to be leveraged, transforming your approach to banking in today’s volatile environment.

Social Highlights and Unforgettable Moments

Friday and Saturday: As the week progresses, the energy amplifies! Revel in keynotes from motivational guru Matt Booth and leadership luminary Chancellor Sonny Perdue, who will redefine the basics of success and the essence of unity, respectively. Breakout into sessions that challenge the status quo, like Chad Jones’ deep dive into innovation in relationship banking.

The social highlight is undoubtedly CBA’s Ultimate Beach Party on Friday afternoon, providing a perfect mix of relaxation and networking.

Saturday evening’s Chairman’s Party promises to be a spectacular send-off with a live performance from Georgia’s own Kinchafoonee Cowboys. Dance the night away, forge new friendships, and create memories that will last a lifetime.

16 | www.cbaofga.com | Spring 2024

Austin Hatch GRIT: How can we Trhive in the Midst of Adversity?

Matt Booth Basically Incredible

Chancellor Sonny Perdue UNITY: Bringing People Together

Kinchafoonee Couwboys

CBA’s Ultimate Beach Party

Amplify Community Bankers Voices at the Capitol Call for Silent Auction Items

Support your advocacy team by participating in our silent auction—your opportunity to showcase your institution’s community spirit and generosity. Your contributions will not only raise funds for CBA’s advocacy efforts but also highlight your commitment to the banking community’s growth and success. This event supports our advocacy efforts, helping to educate legislators about the vital issues facing our banks. Your participation means more than just the chance to win great items—it supports a cause that ensures a thriving environment for community banks across the state. Join us for an evening of camaraderie and contribution to our mission. Thank you for your invaluable support!

Be There: Where Banking Meets Brilliance

Prepare yourself for a convention packed with insightful sessions, unparalleled networking, and unforgettable social gatherings. CONNECT 2024 is not just an event; it’s a pivotal experience that will empower, enlighten, and entertain.

Join us in making banking history at Amelia Island. Secure your spot at CONNECT 2024—where banking brilliance meets beachside bliss. Be part of something bigger. Be part of CONNECT 2024

For more information, registration details, and to contribute to the silent auction, visit CBA’s CONNECT 2024 event page. Dive into the future of banking—where every moment promises to be as enriching as it is thrilling!

A Better Student Loan Experience.

Simple & Clear Process.

Apply in 3 minutes and find out instantly if you are approved.

You’re In Control.

Choose from flexible repayment options to make your payments work for you

We’re Here To Help.

Use our tools, resources and top-notch customer service team to help you save along the way.

Spring 2024 | Georgia Communities First | 17 SPOTLIGHT

©2024 College Ave. All Rights Reserved collegeave.com/cbaga

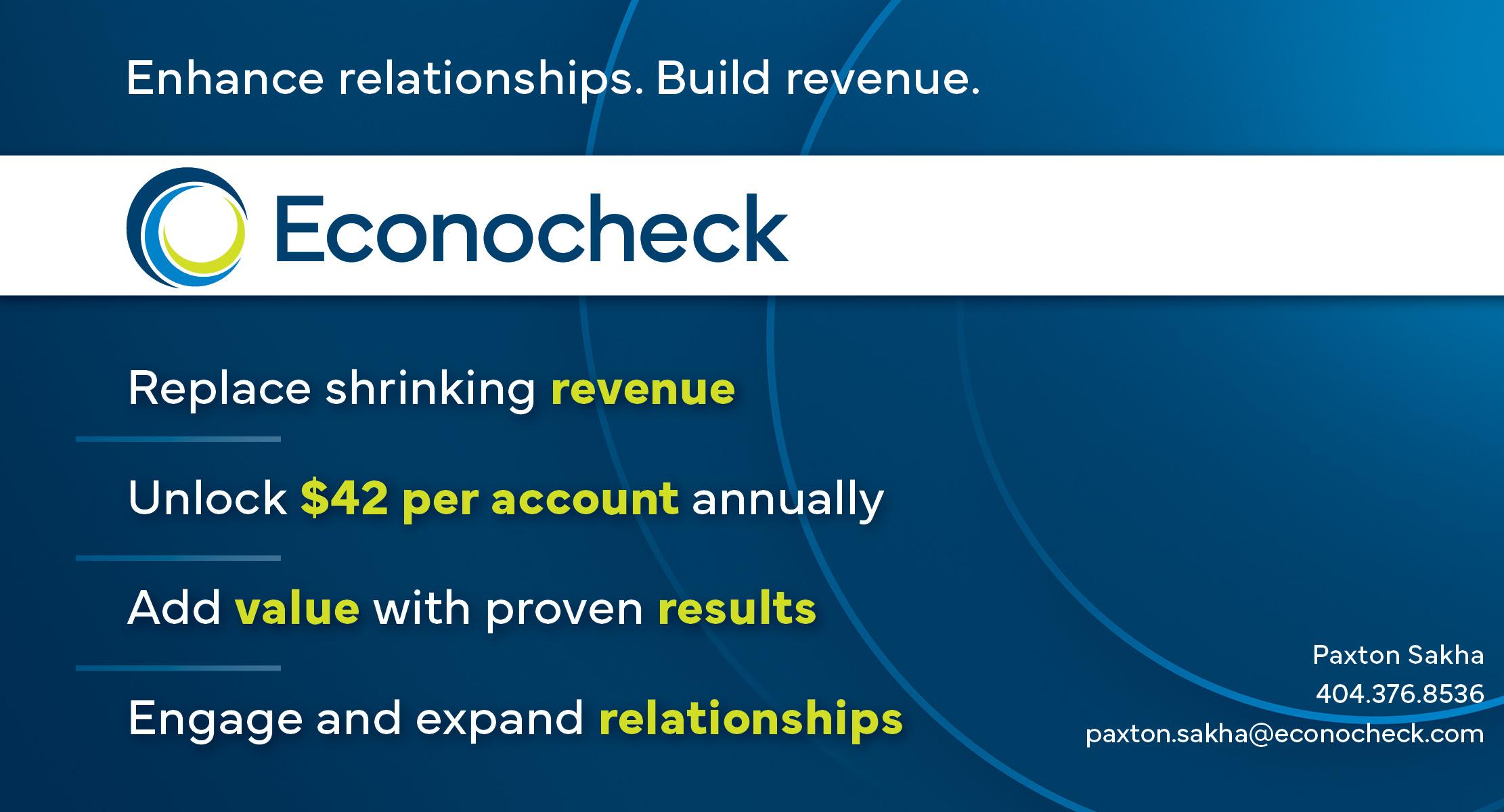

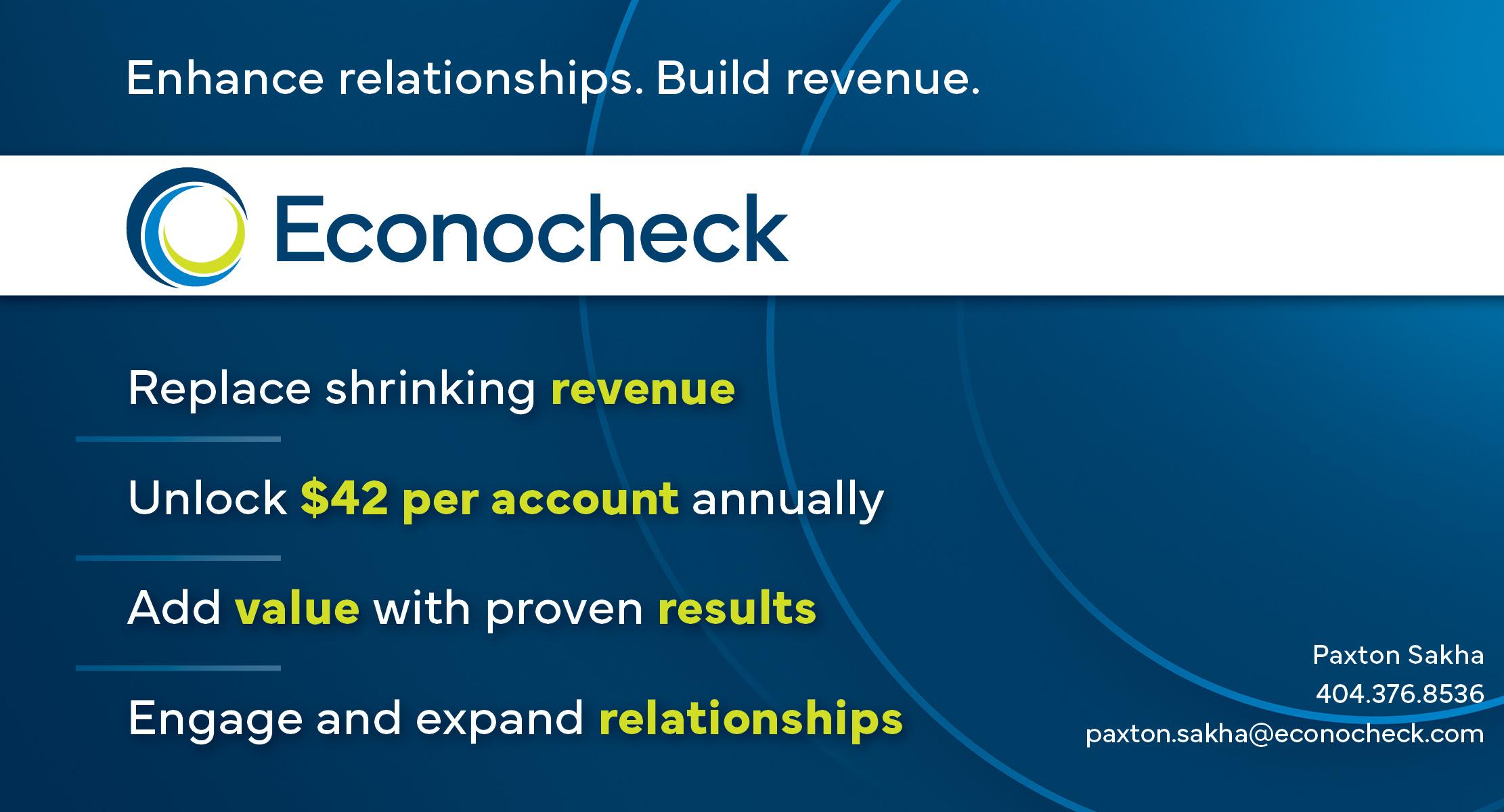

18 | www.cbaofga.com | Spring 2024 https://www.econocheck.com/ SILVER LEVEL GOLD LEVEL THANK YOU TO OUR PREFERRED SERVICE PROVIDERS DIAMOND LEVEL PLATINUM LEVEL BRONZE LEVEL THANK YOU TO OUR SPONSORS Thursday Breakfast Friday Cash Prize Bottled Water Name Badges Thursday Keynote Speaker Thursday Continuous Coffee Saturday Night Entertainment WiFi Thursday Cash Prize Snack Bags Convention Totes Swag Item Thursday Night Hosted Beer & Wine Co-Sponsors

Appreciation Reception & Dinner Co-Sponsor Chairman’s Reception & Dinner Co-Sponsor Board Meeting Gift & Refreshments 60-Second Commercial Board Appreciation Reception & Dinner Co-Sponsor Chairman’s Reception & Dinner Co-Sponsor 60-Second Commercial

Appreciation Dinner & Reception Co-Sponsor Thursday Night Desserts Co-Sponsor Friday Breakfast Thursday Room Drop Thursday Promo Items Chairman’s Reception & Dinner Co-Sponsor 60-Second Commercial Thursday Night Desserts Co-Sponsor Friday Keynote Speaker Friday Room Drop Friday Beach Party Co-Sponsors Saturday Cash Prize Saturday Breakfast Saturday Keynote Speaker Saturday Promo Items General Sponsors

Board

Board

Exhibitors

Wyatt Licht

Wyatt Licht

Spring 2024 | Georgia Communities First | 19

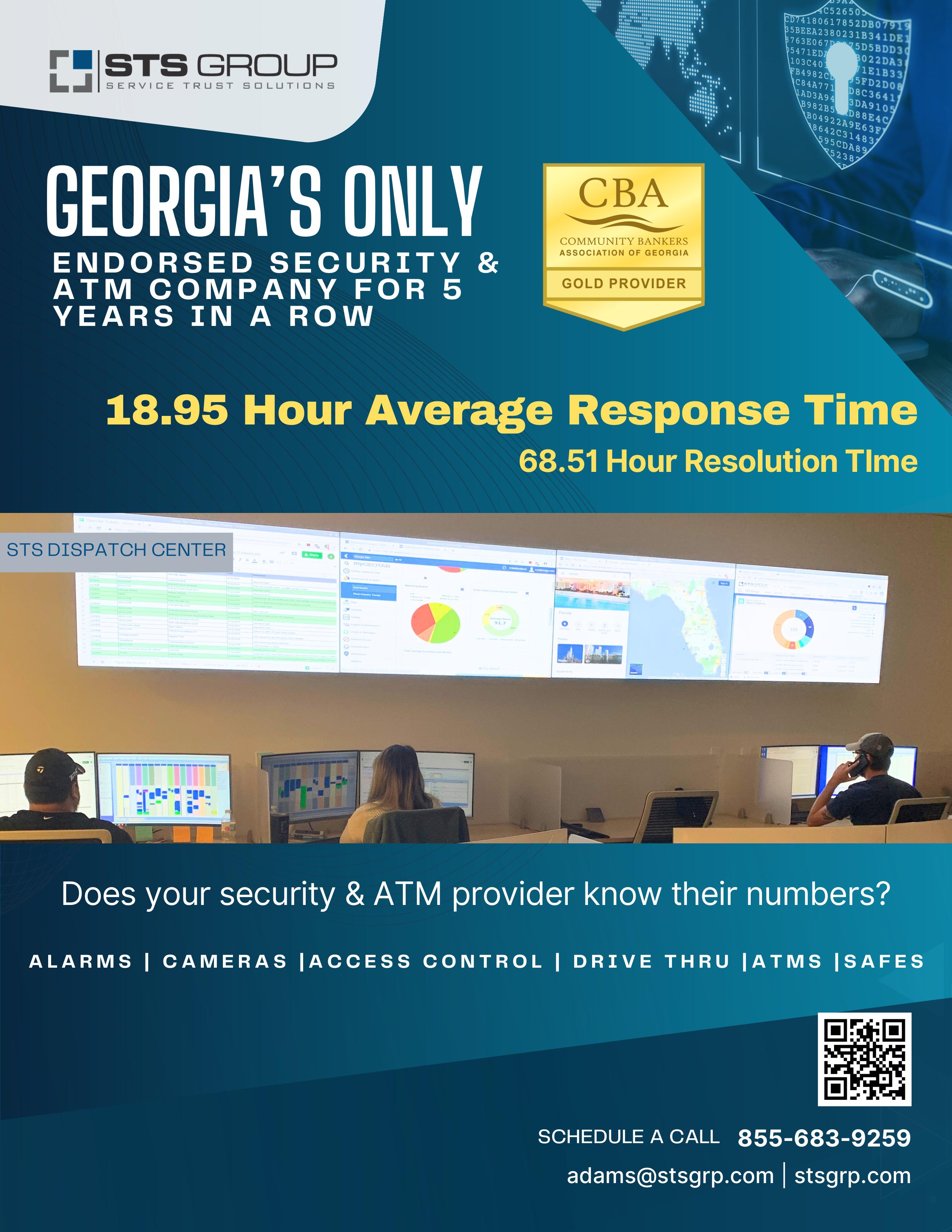

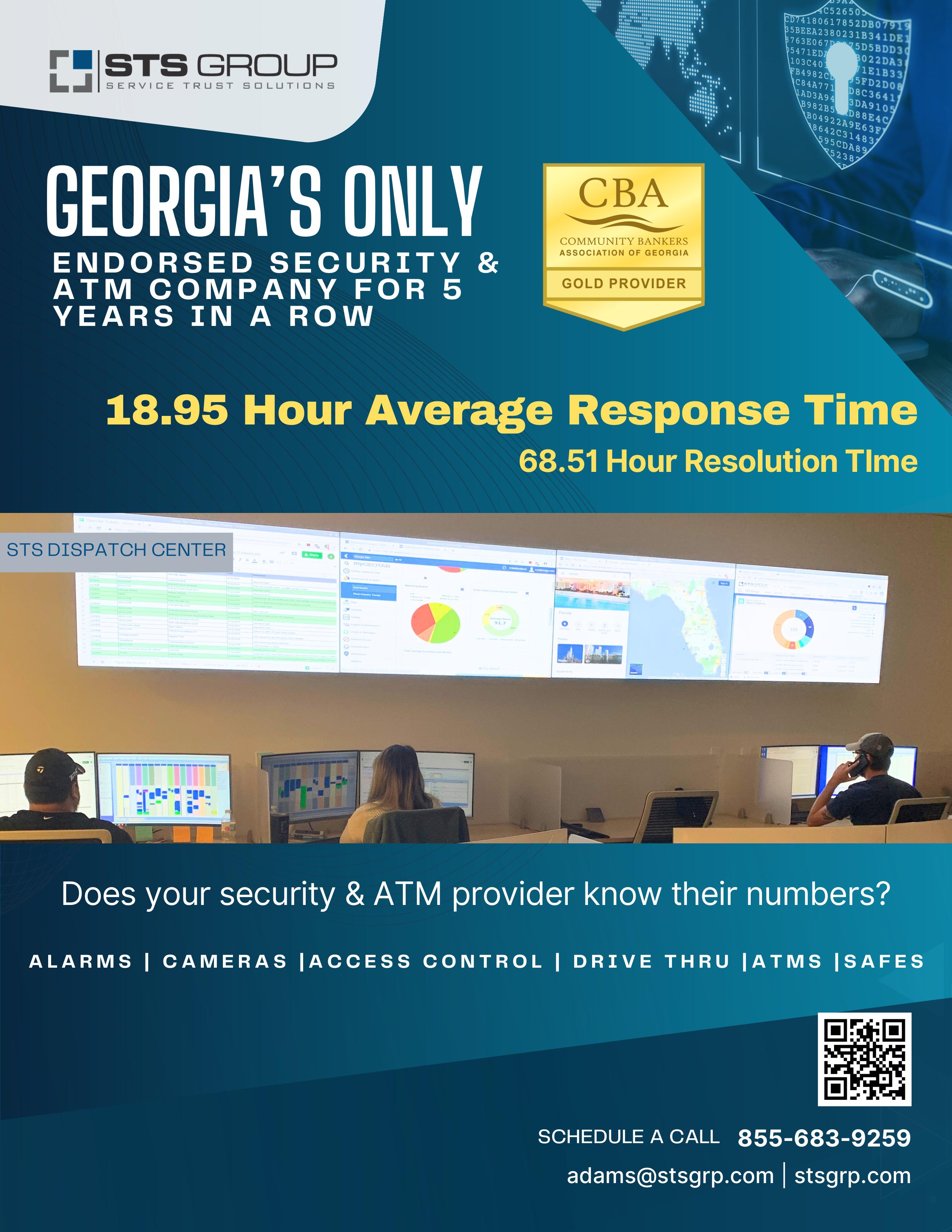

Booth Company Exhibitor Name City, State Category 31 360 View Joyce Colin Franklin, TN CRM & Marketing 23 ACG Phil Winn Alpharetta, GA ATMs, TCRs, Field Service 35 Agent IQ Kris Nuss Austin, TX Fintech 34 American Security & Privacy Geritt Guillaume Bingham Farms, MI Cyber Security Services 29 Atris Technology Michael Simmons Gainesville, FL IT/Fintech Software 10 BHG Financial Rachel Thornton Syracuse, NY Lending 36 Cabretta Capital Jesse Speltz Roswell, GA Tax Credit Syndicator 3 Capital Partners CDC Tim Souther Atlanta, GA Financing- SBA Lender 6 Core10 Laura Day Franklin, TN Fintech 4 DCI Paul Mestre Hutchinson, KS Core Processing / Digital Banking 32 DeNyse Companies Amy Baillie Douglasville, GA Signage 21 Eclipse Brand Builders Joel Thompson Suwanee, GA Building Designers/Consultants 28 Econocheck Paxton Sakha Atlanta, GA Retail/Business Checking Strategy 7 Executive Insurance Agency Ryan Sower Stockbridge, GA Insurance 24 Finosec Zach Duke Alpharetta, GA Cybersecurity & Governance 2 Five by Five Funding Sarah Golden Atlanta, GA Mortgage Banking 14 Genesys Technology Group Drew Kessler Peachtree Corners, GA Bank Consulting 30 Gulf Coast Business Credit Stuart Wrba Atlanta, GA Accounts Receivable Financing 17 Holtmeyer & Monson Arne Monson Memphis, TN SBA Lending 18 ICBA Scott Brown Prattville, AL Trade Association 19 ICBA Securities Jim Reber Memphis, TN Securities 12 Integris Cameron Loughery Atlanta, Georgia Managed IT Services 16 IntraFi Danny Capitel Arlington, VA Financial Services 9 Kasasa Tess Bechel Austin, TX Financial Technology/Marketing 8 Newcleus JR Llewellyn Greensboro, GA Compensation & Executive Benefits 22 Point to Point Environmental Mark Faas McDonough, GA Environmental Consulting 27 Quilo Don Shafer Lakeside, MT Fintech 25 QwickRate Melissa Wallace Marietta, GA Bank Analytics, Liquidity, Loan 15 SHAZAM Alex Jernigan Des Moines, IA Payment Solutions, Core Provider 26 Strunk Dan Roderick Atlanta, GA Loan Pricing 11 STS Group Adam Stephens Madison, AL Security and Technology 1 The Plateau Group Cameron Howard Crossville, TN Insurance Products 20 Travelers Amy Barnes Alpharetta, GA Insurance Company 13 Vericast Janine Ciranni Charlotte, NC Check Products & Marketing Solutions 5 Warren Averett Jeff Burleson Birmingham, AL CPA and Advisors 33 Works24 Corporation Philip Edwards Clayton, NC Marketing & Advertising Booth Company Exhibitor Name City, State Category 31 360 View Joyce Colin Franklin, TN CRM & Marketing 23 ACG Phil Winn Alpharetta, GA ATMs, TCRs, Field Service 35 Agent IQ Kris Nuss Austin, TX Fintech 34 American Security & Privacy Geritt Guillaume Bingham Farms, MI Cyber Security Services 29 Atris Technology Michael Simmons Gainesville, FL IT/Fintech Software 10 BHG Financial Rachel Thornton Syracuse, NY Lending 36 Cabretta Capital Jesse Speltz Roswell, GA Tax Credit Syndicator 3 Capital Partners CDC Tim Souther Atlanta, GA Financing- SBA Lender 6 Core10 Laura Day Franklin, TN Fintech 4 DCI Paul Mestre Hutchinson, KS Core Processing / Digital Banking 32 DeNyse Companies Amy Baillie Douglasville, GA Signage 21 Eclipse Brand Builders Joel Thompson Suwanee, GA Building Designers/Consultants 28 Econocheck Paxton Sakha Atlanta, GA Retail/Business Checking Strategy 7 Executive Insurance Agency Ryan Sower Stockbridge, GA Insurance 24 Finosec Zach Duke Alpharetta, GA Cybersecurity & Governance 2 Five by Five Funding Sarah Golden Atlanta, GA Mortgage Banking 14 Genesys Technology Group Drew Kessler Peachtree Corners, GA Bank Consulting 30 Gulf Coast Business Credit Stuart Wrba Atlanta, GA Accounts Receivable Financing 17 Holtmeyer & Monson Arne Monson Memphis, TN SBA Lending 18 ICBA Scott Brown Prattville, AL Trade Association 19 ICBA Securities Jim Reber Memphis, TN Securities 12 Integris Cameron Loughery Atlanta, Georgia Managed IT Services 16 IntraFi Danny Capitel Arlington, VA Financial Services 9 Kasasa Tess Bechel Austin, TX Financial Technology/Marketing 8 Newcleus JR Llewellyn Greensboro, GA Compensation & Executive Benefits 22 Point to Point Environmental Mark Faas McDonough, GA Environmental Consulting 27 Quilo Don Shafer Lakeside, MT Fintech 25 QwickRate Melissa Wallace Marietta, GA Bank Analytics, Liquidity, Loan Reviews 15 SHAZAM Alex Jernigan Des Moines, IA Payment Solutions, Core Provider 26 Strunk Dan Roderick Atlanta, GA Loan Pricing 11 STS Group Adam Stephens Madison, AL Security and Technology 1 The Plateau Group Cameron Howard Crossville, TN Insurance Products 20 Travelers Amy Barnes Alpharetta, GA Insurance Company 13 Vericast Janine Ciranni Charlotte, NC Check Products & Marketing Solutions 5 Warren Averett Jeff Burleson Birmingham, AL CPA and Advisors 33 Works24 Corporation Philip Edwards Clayton, NC Marketing & Advertising Booth Company Exhibitor Name City, State Category 31 360 View Joyce Colin Franklin, TN CRM & Marketing 23 ACG Phil Winn Alpharetta, GA ATMs, TCRs, Field Service 35 Agent IQ Kris Nuss Austin, TX Fintech 34 American Security & Privacy Geritt Guillaume Bingham Farms, MI Cyber Security Services 29 Atris Technology Michael Simmons Gainesville, FL IT/Fintech Software 10 BHG Financial Rachel Thornton Syracuse, NY Lending 36 Cabretta Capital Jesse Speltz Roswell, GA Tax Credit Syndicator 3 Capital Partners CDC Tim Souther Atlanta, GA Financing- SBA Lender 6 Core10 Laura Day Franklin, TN Fintech 4 DCI Paul Mestre Hutchinson, KS Core Processing / Digital Banking 32 DeNyse Companies Amy Baillie Douglasville, GA Signage 21 Eclipse Brand Builders Joel Thompson Suwanee, GA Building Designers/Consultants 28 Econocheck Paxton Sakha Atlanta, GA Retail/Business Checking Strategy 7 Executive Insurance Agency Ryan Sower Stockbridge, GA Insurance 24 Finosec Zach Duke Alpharetta, GA Cybersecurity & Governance 2 Five by Five Funding Sarah Golden Atlanta, GA Mortgage Banking 14 Genesys Technology Group Drew Kessler Peachtree Corners, GA Bank Consulting 30 Gulf Coast Business Credit Stuart Wrba Atlanta, GA Accounts Receivable Financing 17 Holtmeyer & Monson Arne Monson Memphis, TN SBA Lending 18 ICBA Scott Brown Prattville, AL Trade Association 19 ICBA Securities Jim Reber Memphis, TN Securities 12 Integris Cameron Loughery Atlanta, Georgia Managed IT Services 16 IntraFi Danny Capitel Arlington, VA Financial Services 9 Kasasa Tess Bechel Austin, TX Financial Technology/Marketing 8 Newcleus JR Llewellyn Greensboro, GA Compensation & Executive Benefits 22 Point to Point Environmental Mark Faas McDonough, GA Environmental Consulting 27 Quilo Don Shafer Lakeside, MT Fintech 25 QwickRate Melissa Wallace Marietta, GA Bank Analytics, Liquidity, Loan Reviews 15 SHAZAM Alex Jernigan Des Moines, IA Payment Solutions, Core Provider 26 Strunk Dan Roderick Atlanta, GA Loan Pricing 11 STS Group Adam Stephens Madison, AL Security and Technology 1 The Plateau Group Cameron Howard Crossville, TN Insurance Products 20 Travelers Amy Barnes Alpharetta, GA Insurance Company 13 Vericast Janine Ciranni Charlotte, NC Check Products & Marketing Solutions 5 Warren Averett Jeff Burleson Birmingham, AL CPA and Advisors 33 Works24 Corporation Philip Edwards Clayton, NC Marketing & Advertising Booth Company Exhibitor Name City, State Category 31 360 View Joyce Colin Franklin, TN CRM & Marketing 23 ACG Phil Winn Alpharetta, GA ATMs, TCRs, Field Service 35 Agent IQ Kris Nuss Austin, TX Fintech 34 American Security & Privacy Geritt Guillaume Bingham Farms, MI Cyber Security Services 29 Atris Technology Michael Simmons Gainesville, FL IT/Fintech Software 10 BHG Financial Rachel Thornton Syracuse, NY Lending 36 Cabretta Capital Jesse Speltz Roswell, GA Tax Credit Syndicator 3 Capital Partners CDC Tim Souther Atlanta, GA Financing- SBA Lender 6 Core10 Laura Day Franklin, TN Fintech 4 DCI Paul Mestre Hutchinson, KS Core Processing / Digital Banking 32 DeNyse Companies Amy Baillie Douglasville, GA Signage 21 Eclipse Brand Builders Joel Thompson Suwanee, GA Building Designers/Consultants 28 Econocheck Paxton Sakha Atlanta, GA Retail/Business Checking Strategy 7 Executive Insurance Agency Ryan Sower Stockbridge, GA Insurance 24 Finosec Zach Duke Alpharetta, GA Cybersecurity & Governance 2 Five by Five Funding Sarah Golden Atlanta, GA Mortgage Banking 14 Genesys Technology Group Drew Kessler Peachtree Corners, GA Bank Consulting 30 Gulf Coast Business Credit Stuart Wrba Atlanta, GA Accounts Receivable Financing 17 Holtmeyer & Monson Arne Monson Memphis, TN SBA Lending 18 ICBA Scott Brown Prattville, AL Trade Association 19 ICBA Securities Jim Reber Memphis, TN Securities 12 Integris Cameron Loughery Atlanta, Georgia Managed IT Services 16 IntraFi Danny Capitel Arlington, VA Financial Services 9 Kasasa Tess Bechel Austin, TX Financial Technology/Marketing 8 Newcleus JR Llewellyn Greensboro, GA Compensation & Executive Benefits 22 Point to Point Environmental Mark Faas McDonough, GA Environmental Consulting 27 Quilo Don Shafer Lakeside, MT Fintech 25 QwickRate Melissa Wallace Marietta, GA Bank Analytics, Liquidity, Loan Reviews 15 SHAZAM Alex Jernigan Des Moines, IA Payment Solutions, Core Provider 26 Strunk Dan Roderick Atlanta, GA Loan Pricing 11 STS Group Adam Stephens Madison, AL Security and Technology 1 The Plateau Group Cameron Howard Crossville, TN Insurance Products 20 Travelers Amy Barnes Alpharetta, GA Insurance Company 13 Vericast Janine Ciranni Charlotte, NC Check Products & Marketing Solutions 5 Warren Averett Jeff Burleson Birmingham, AL CPA and Advisors 33 Works24 Corporation Philip Edwards Clayton, NC Marketing & Advertising

LEAD LEAD

LEADERSHIP EDUCATION ADVOCACY DEVELOPMENT

Step into the forefront of community banking leadership with the LEAD Division of the Community Bankers Association of Georgia. Established in 1979 as the Young Bankers section to share educational and legislative updates with bank executives, it has evolved into the LEAD Division, a hub for networking and professional development.

The LEAD Division is pivotal in advancing future financial leaders and promoting initiatives like the Julian & Jan Hester Memorial Scholarship, which supports the academic pursuits of students linked to the community banking sector. Additionally, the division spearheads fundraising for the CBA’s Advocacy Fund, enhancing political advocacy for community banks.

Members also benefit from comprehensive leadership training through the annual LEAD On conference and the quarterly Community Bank Leadership Academy, preparing them for future industry challenges. This vibrant division empowers members to maximize their CBA membership, boosting both their professional growth and the community banking landscape. The LEAD board encourages our members to foster employee growth by sharing these valuable learning and networking opportunities.

20 | www.cbaofga.com | Spring 2024

SPOTLIGHT

LEAD LEAD

An Interview with Mike Underwood Senior Vice President Commercial Lending Peach State Bank

LEAD Board Division Chair

How did the Leadership Group start? What was it named?

• The Leadership Group came out of the original “Youngs Bankers Section” of the Community Bankers Association in 1995. At the time, we did not feel the name reflected who we were, and we had been discussing that for a couple of years prior. I was the Chairman in 1995 and we decided to take on this topic during our planning session for the year. The name Leadership Division came out of our knowing that we were all future leaders in our respective banks and decided that should be our new name. So, we sent out ballots to 284 member banks at that time to vote in favor of changing the name. We had to have a 2/3’s majority vote to make that happen and somehow, we made it happen.

• The Leadership Division is about growing and learning to become better bankers and community leaders. Bankers have always taken the lead in our communities in making it a better place than we had found it.

What is your fondest memory of the Leadership group, now known as the LEAD Board?

• The friendships with other bankers that have been made. When we started in the Leadership Division, our three sons were small. Meeting other bankers and their families with kids the same age was priceless and lifelong friendships have been made over the years. These friendships lead to good discussions about other’s respective banks and their communities and how we can become better together. As the Word says, “Iron sharpens Iron”.

Why do you serve on the LEAD Board?

• The educational programs we receive at our times together keep us up to date on new regulations, updated technologies, and better practices. Plus, the added benefits of interacting with other bankers and glean from them how they do certain practices at their banks.

How has the LEAD Board impacted your professional career?

• I think knowing other bankers has been invaluable. Being able to call other bankers for different types of help is critical at times. We are community bankers and we learn to lean upon one another to figure out how to do business better. Our business is providing financial services to our customers, and we know that we can provide that service much better than any of the regional and national banks that are in our markets.

Spring 2024 | Georgia Communities First | 21 SPOTLIGHT

LEAD LEAD

The LEAD Board continues to thrive and bring about opportunities to increase awareness of our great industry. The leaders who serve on the board continue to share their passion for their careers and helping rise up the next generation of community bankers.

“As a former banker and LEAD Board member, I am honored to serve alongside our leadership bankers. Each time we meet, I get to observe the success of their hard work and commitment and I am thankful for their continued enthusiasm to promote grass roots advocacy, fundraising and awareness of rewarding career paths in our industry.”

Kristi Greer, SVP -Director of Professional Development

“As a banker, I can see firsthand how vital community banks are to their local citizens and businesses. My involvement in the CBA LEADS committee allows me to be a part of ensuring that community banks continue to exist and prosper.”

Kasey Blackburn, SVP, Family Bank, Pelham

“As someone who has worked in community banking for many years, I have seen firsthand the incredible impact that community banks can have on individuals, families, and small businesses. Community banks play a crucial role in promoting local economic growth and prosperity by offering tailored financial solutions, educational programs, and a strong commitment to community development.

For more than a decade, I have been fortunate enough to serve on the LEAD Board of the Community Bankers Association of Georgia, an organization that advocates for the interests of community banks. Through collaboration, advocacy, and a shared dedication to making a positive difference, the CBA has given me invaluable opportunities for growth, learning, and building relationships with other community bankers throughout Georgia.”

Chris Cochran, SVP, Commercial Loan Officer, Affinity Bank, Atlanta

“Serving with CBA of Georgia has been an important part of my banking career. For me the most impactful aspects of CBA are the educational offerings, networking opportunities and the ability to be a voice for the community banking industry by participating in the PAC/PR activities.

Through these activities, CBA fosters and promotes a strong community bank atmosphere that focuses on the positive impact community banking has across the state of Georgia. I shudder to think about what our state’s economy and many of our local towns would look like without our community banks driving the economic engine of local growth.”

Kyle D. Ray, Senior Vice President, Director of Branch Services, Builtwell Bank

Spring 2024 | Georgia Communities First | 23

SPOTLIGHT

LEAD BOARD VISITS THE

CBA’s Leadership Engagement aims to promote the advancement of tomorrow’s financial industry leaders while encouraging meaningful relationships between CBA and its members.

On Wednesday, April 10, our LEAD Board held an in-person meeting at the Federal Reserve Bank of Atlanta. Our meeting focused on putting together plans to support the LEAD board initiatives including Membership & Talent Management, Professional Development & Advocacy. The LEAD Board is passionate about engaging our members to gain the full benefits of membership. Therefore, they are working together to inform our entire membership of the association’s services and program offerings all while creating fundraising efforts to support advocacy. Be on the look for a new community banking t-shirt to help us to increase awareness of our great industry. CBA’s President/CEO, John McNair shared insight on the associations efforts and how we can provide value to our bankers through the enhanced services that we provide. During the meeting, we had the privilege of receiving an industry update from Reggie Chever, Regional Executive of the Federal Reserve Bank. Reggie’s time with the board allowed us to discuss topics about price stability, employment and labor trends, and outreach that supports knowledge gathering to understand the economy. We closed the meeting by taking a tour of the Federal Reserve, learning the history, seeing the innovation of robots moving money from one area to the next, and receiving shredded money as a token of remembrance for our time. We are grateful to John Douglas and his team at the Federal Reserve for hosting our meeting and sharing their hospitality with us. The LEAD Board would also like to thank Jessie Englert, TIB for sponsoring the LEAD Board dinner on Tuesday evening.

24 | www.cbaofga.com | Spring 2024

SPOTLIGHT

Acquiring and retaining new customers is more challenging than ever. Loyalty is hard-won in an environment brimming with choices. To stand out, a smart and targeted strategy is a necessity.

• Multichannel marketing campaigns boast an 18.96% engagement rate, far outpacing single-channel efforts 2

• Combining digital with direct mail synergy can skyrocket household response rates by 39 % 3 Vericast elevates your financial institution’s deposit acquisition strategy with actionable insights and proven methodologies. Learn how at Vericast.com/Acquisition or email contact@vericast.com

Spring 2024 | Georgia Communities First | 25 DID YOU KNOW? 48% OF PEOPLE ARE OPEN TO SWITCHING BANKS OR USING MULTIPLE FINANCIAL SERVICES 1

Stand out as their first choice for meeting their financial needs in a crowded market.

Vericast Financial Services TrendWatch report 2 Mikalauskas, Edvardas, “What is omnichannel marketing? Examples, tips & tools,” omnisend, April 24, 2023 3 Vericast, Client Campaign Analysis Benchmarking, Q4 2023 © 2024 Vericast Corp. All rights reserved. CS3071

I have attended the Advanced BSA School for the last 2 years and will be attending it again this year in August. It is a great school for anyone whether you are just dipping your toes in BSA or need a refresher course. The first year I attended I was only 2 months into my new role in BSA and had very minimal knowledge of it, but Dianne Barton is a wonderful teacher, and I was able to understand it and get some great takeaways. Last year I picked up a little more and this year I’m sure will be no exception. If you are on the fence about going... Go, you won’t regret it!

Misty Folker Banking Service Specialist & Training Coordinator Bank of Newington

I look forward to attending CBA’s Advanced AML/BSA Compliance School each fall. Kristi, Becky and Dianne do an exceptional job in providing us with subject matter experts and leaders in the field to teach. The fun and energetic vibe that they provide keeps us all engaged the entire week. Thank you, CBA team, for providing us with a successful week full of learning and engagement!

Tasha

Deese

Assistant BSA Officer

American Commerce Bank

CBA’s Advanced BSA School is a premier course in Bank Secrecy Act and Anti Money Laundering. The knowledge you gain from the school to combat Money Laundering and Terrorist Financing is unsurpassed. The ability to network with other professionals in the industry helps expand available resources to make my own BSA/AML/CFT program stronger.

Matthew Lynch, CAMS BSA AML OFAC Officer Peach State Bank

26 | www.cbaofga.com | Spring 2024

Why I chose to attend CBA’s Advanced BSA School?

I chose to attend CBA’s Advanced BSA/AML Compliance School because the instructors/ facilitators provide the most current and relevant information, and tools, tools and more tools, that the attendees can take back to their respective banks and begin using. I’ve attended the class for several years, and it’s like going back home to attend a family reunion. I look forward to seeing the bankers I’ve come to know over the years.

Why CBA Advanced BSA School is a great school?

CBA Advanced BSA/AML Compliance School is a great school because of Dianne Barton and the CBA Professional Development Team. They bring in excellent speakers to share what’s trending in the world of AML/CFT, as well as “hot topics.” Additionally, the networking is key, when you can share with your peers what works best for them in their respective roles. Networking provides an opportunity for participants to develop relationships with fellow bankers to be able to connect with them on personal and professional levels outside of the classroom.

Sherrie H, Williams, CACTS

AVP & Executive Assistant

Carver State Bank

“From the quality of speakers to the relationships made, this school has been a necessity to our bank’s BSA program. The school is a valuable resource for all current rules and trends in the everchanging world of BSA. The Community Bankers Association does a great job to ensure that this week is a beneficial use of our time away from the office.”

Jay Hales Vice President South Georgia Bank

CBA of GA’s Advanced BSA/AML/CFT School is the #1 attended program in the state of Georgia.

We are excited to host this year’s school on Amelia Island at the Omni Resort & Hotel.

Why should banks choose this educational program?

• Take aways – bankers leave with lots of tools and resources to support a sound Bank Secrecy Act policy.

• Receive expert knowledge that enables you to audit and update internal procedures

• Network and learn from your peers

• Enjoy a new location

Spring 2024 | Georgia Communities First | 27 SPOTLIGHT

Congratulations to the recipients of the Julian and Jan Hester Memorial Scholarship, awarded by the Community Bankers Association (CBA). Annually, four $1,000 scholarships are given to Georgia high school seniors for college or technical school. The scholarship honors Jan Hester and her father Julian, CBA’s long-time CEO. Applicants compete by writing an essay on community banks and their local benefits.

John McNair, CBA’s President & CEO, commended the winners for their academic and community achievements, noting the challenge judges faced due to the high quality of entries. Special thanks to the 2024 judges from various esteemed institutions. Learn more about the program and read this year’s winning essays.

Alyssa Swords, a Loan Processor/Customer Service Representative at Bank of Edison, has won the 2024 McNair Family Scholarship. Swords, currently studying accounting at Albany Technical College, was recognized for her commitment as an adult learner—a designation for individuals two years post-high school who work at least 25 hours weekly at a Georgia community bank. The $1,000 scholarship, honoring Nicholas R. Cimino, supports adult learners at community banks pursuing higher education. John McNair, President & CEO of the Community Bankers Association of Georgia, praised this year’s applicants for their dedication to balancing work and education.

28 | www.cbaofga.com | Spring 2024 SPOTLIGHT

Jackson Dowdy University of Georgia

Hannah Posey University of Georgia

Payton Beaver Berry College

Emalee Collins Georgia Tech

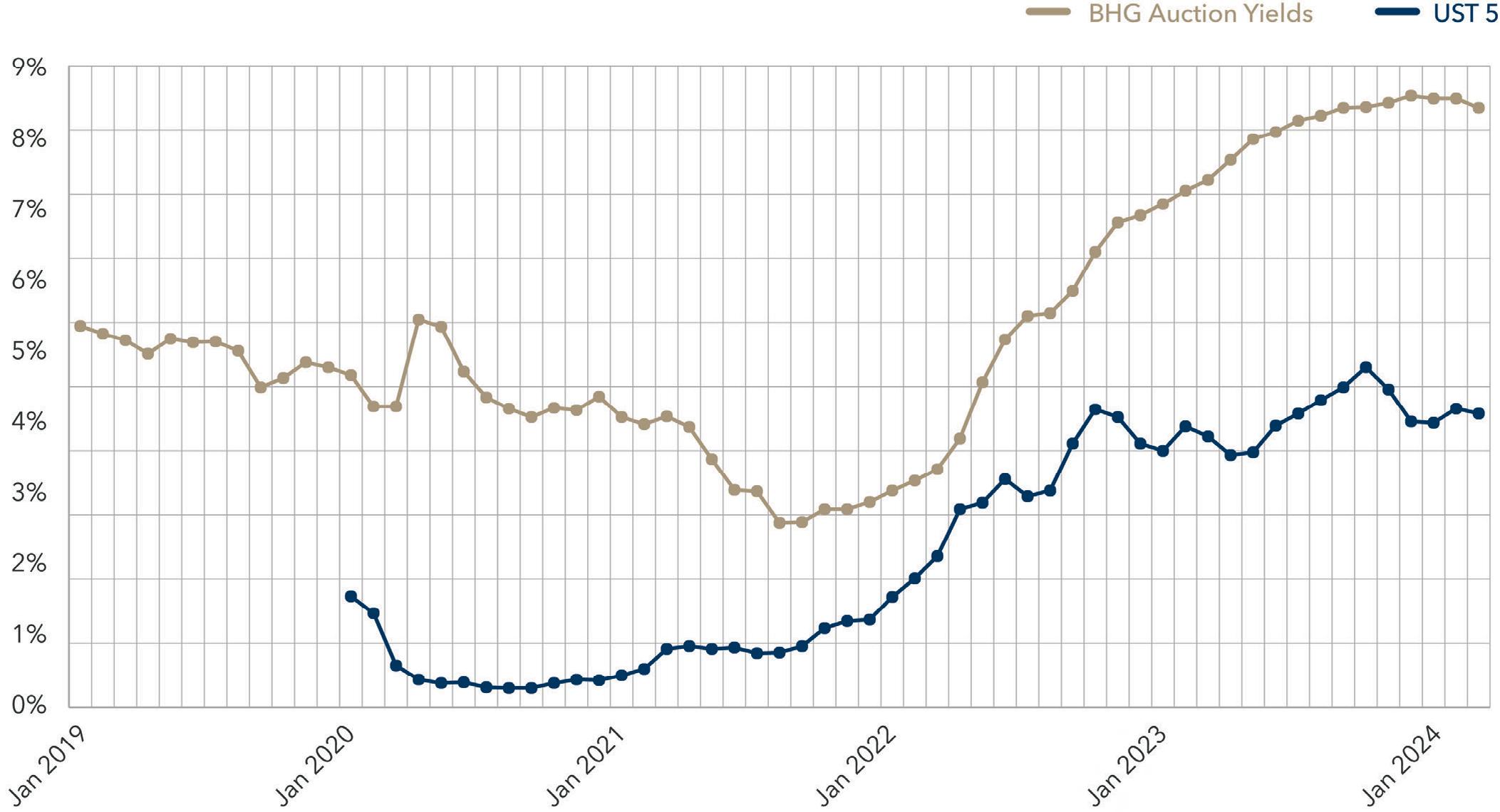

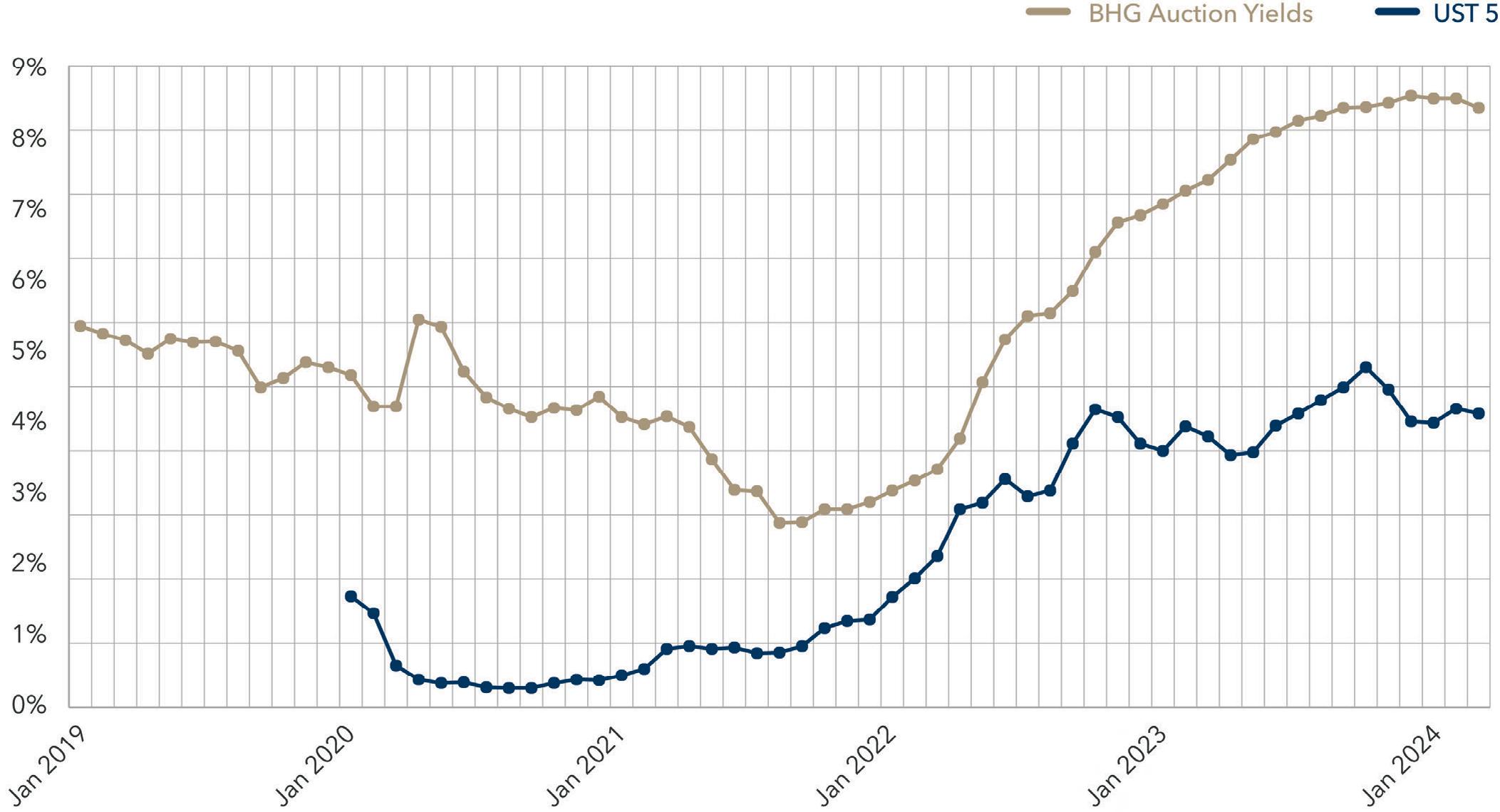

Beat Treasury yields by 375 bps with our low-risk credits

Lock in returns of up to 9% for your bank today

In Q1 2024, community banks purchased over $705 million of BHG’s low-risk credits. Our fixed 9% rates are much higher than 5-yr. Treasury yields, and our loans feature the highest credit quality in our history. Don’t wait for the Fed to lower rates. Expand your bank’s margins and interest income starting today.

Spring 2024 | Georgia Communities First | 29 SPOTLIGHT

Scan to learn more at BHGLoanHub.com Earn 9 % + Rachel Thornton 843.251.4223 rthornton@bhg-inc.com Contact your representative: OR

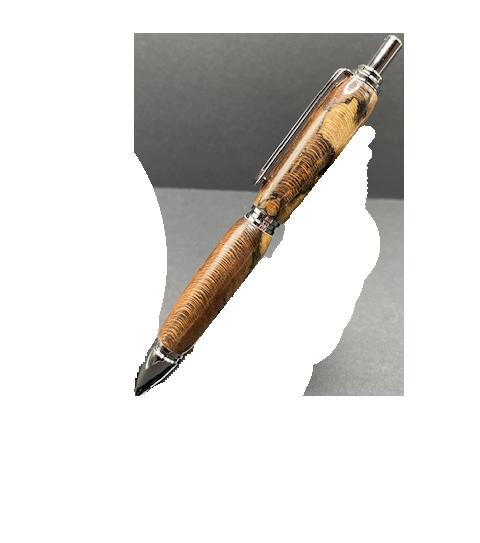

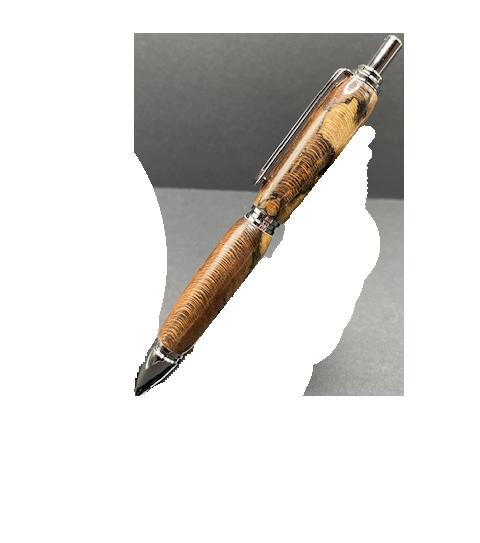

Beyond the Bank Angela C. Woodard

Compliance to Craftsmanship:

Meet the Banker Crafting Beautiful Handmade Pens

Meet Angela Woodard, CRCM, CACTS, a multi-talented banker at Planters First Bank, Hawkinsville. Angela is used to wearing multiple hats, working as AVP/Compliance Support Officer as well as BSA/ Compliance/CRA/OFAC officer. Beyond the bank, she wears the hat of a talented craftsman, creating beautiful and unique pens.

How did you get started in your pen hobby? During Covid, my husband and I were working from home, and I needed to “get out of the house” so I invaded his shop and began to do woodworking. By the end of the year, I had gravitated to woodturning on a lathespecifically pens.

that CA (known as Super Glue) is used as a finish for pens. I have also made key rings; light pulls and smartphone holders.

Hobby, business or both?

It’s funny, I started out as a hobby and wanted to give them away as gifts. I have made over 100 pens and the hobby became very expensive. When I shared pens on my Facebook page, friends started to ask about buying them. It amazes me that people want to buy my pens. It’s a fun way to help recoup some of the cost of supplies.

How did you learn? YouTube videos!

There is a large Pen turning community on Facebook and I have connected with people all over the U.S. I have learned so much from them along with a lot of trial and error.

Share about the process, and tools. With tools, you can go down many different rabbit holes! My husband bought a used/ non-working lathe and got it working. I have acquired a lot of turning tools and gadgets over the last few years.

The process can be lengthy depending on the material. I have used wood, acrylic, resin, and hybrid pen blanks. First, I decide what material to use, then pair it with the style of pen that works best with that material. The finish on the pen is determined by the material used. For wood pens, I often use a friction polish and other times I use CA finish. Most people are surprised to know

Favorite Pens: My favorite pen to make is anything that has special meaning to the person receiving it. I made some UGA pens for my brother and brother-in-law who are BIG Georgia fans. Part of the pen was made from an old seat from Sanford Stadium. I made a Marine pen for a special young man that was wounded in Afghanistan. I like to use wood from someone’s yard to add special meaning to their pen.

I started selling my pens in 2022, the year my dad passed away. His father immigrated from Greece when he was a young boy. My husband suggested I name my business Greek’s Arrow Woodturning based on the scripture Psalm 127:3-4. “Children are a heritage from the Lord, offspring a reward to him. Like arrows in the hands of a warrior are children born in one’s youth.” Every time I look at the name it reminds me to honor my heavenly Father as well as my earthly father in all that I do.

30 | www.cbaofga.com | Spring 2024

Any similarities of this hobby to banking? Working in the banking industry requires attention to detail. When you are dealing with people’s money and trying to provide information for the regulators you need to be diligent in all that you do. Making pens is very precise, I could fill up a 5-gallon bucket with my “non-precise” turnings. But like banking, I learn something new every day!

Do you or another community banker have a cool hobby? Email Lindsay Greene for a chance to be featured.

Spring 2024 | Georgia Communities First | 31 SPOTLIGHT

Download the report to start driving real growth.

Education Buzz: The Lost Art of Handwriting

CBA has implemented a brand-new training opportunity that is making a wave for our frontline bankers! This wave of customer service is promoting WOW Service. WOW service provides un-expected thoughtfulness to our community members. What are your banks doing to wow your customers. Let’s hear from Crystal Miller, the Customer Care Center Manager for BankSouth.

Kristi Greer Senior Vice President Director of Professional Development

Kristi Greer Senior Vice President Director of Professional Development

Community Bankers Association of Georgia

The Lost Art of Handwriting

On Valentine’s Day 2016 my grandfather gave my grandmother her Valentine’s Card. She told him to hold on and left the room. He thought she was going to get his card. Instead, she came back with the first Valentine’s Day card he had given her 65 years earlier when they were dating. Although my grandmother’s vision was almost gone, it didn’t matter. She had the message inside memorized. She recited his words back to him…word by word. That is how much his handwritten message had meant to her so many years ago.

Can you remember the last time you were given a card that included a handwritten message? A special envelope in the mail that was not a bill or junk mail. That card or letter probably stands out because they come so infrequently now. We now live in the world of emails, texts, and chat. Writing something down by hand using pen and paper seems so outdated and unnecessary. It is so outdated that you can hire a company to use AIDriven software to ‘write’ your handwritten notes for you.

So why should we bother with such an outdated practice? It is all part of that WOW experience of Customer Service discussed in the CBA Customer Service Excellence training by Josh Collins. Sending an automated letter thanking a customer is good customer service. Sending a card with a handwritten letter is excellent customer service. Discussing specific details to let the customer know you listened and care about their experience goes the extra mile. This and so many more Customer Service tips are discussed in this wonderful training session that every community banker should attend.

Crystal Miller, Vice President, Customer Care Center Manager, BankSouth

Crystal Miller, Vice President, Customer Care Center Manager, BankSouth

As manager of the Customer Care Center at BankSouth, each representative actively listens for opportunities to send one of these cards. It may be for an upcoming birthday, sorry you are under the weather or congratulations on the birth of your grandson, but it will be personal and related to conversation they have. I wish I could see each customer’s face when they get this in the mail and open a card that is full of so much thoughtfulness and customer service excellence it had to be written by hand.

32 | www.cbaofga.com | Spring 2024

PROFESSIONAL DEVELOPMENT

Spring 2024 | Georgia Communities First | 33 Get started today. 800.340.7304 www.holtandmon.com Small businesses count on your expertise. You can count on ours. Your customers have never needed capital more than they do right now. Plus you need to offset narrowing margins by increasing noninterest fee income. SBA and USDA lending is the perfect answer. And ICBA recommends just one provider to make the process hassle-free: Holtmeyer & Monson. Give customers exactly what they need, at no net cost to your bank. Closing SBA loans keeps doors open.

UPCOMING PROGRAMS

Our Compliance training is top notch! We continue to hear from our participants and are bringing new topics, new instructors, and even more value to support community bank’s compliance management systems. During quarter 2, we invited two new experts to bring experience and interactive exercises which gave our banks an opportunity to increase their knowledge while determining what they need to update.

Participants said:

“One of the best Compliance Management Systems training programs I’ve attended in close to 30 years of banking.” Lea Scott, First Port City Bank

“All of it was great!” Shaunna Davis, First Peoples Bank

“The whole program was very beneficial today.” Tonya Bryan, The Citizens Bank of Cochran

Don’t miss any of our upcoming training to stay updated on the changing requirements for banks.

September 25 & 26 - Building an Effective Fair Lending Program December 10 & 11 – Fraud & Regulation E

34 | www.cbaofga.com | Spring 2024

PROFESSIONAL DEVELOPMENT

POPULAR SCHOOLS AND CONFERENCES

CONNECT

6-8

Small Business Loan Data 1071 July 17

& Virtual

Cyber Risk Summit August 7-9 Jekyll Island, The Westin

Advanced BSA/AML Compliance School August 19-23

Amelia Island, Omni *New Location/Same great price!

Consumer/Retail Lending School

Commercial Lending Bootcamp

*New Instructor

1 – 4

*New Material & Case Studies October 22-24

Spring 2024 | Georgia Communities First | 35

Macon

June

Amelia Island, The Ritz CRA June 11-12

& Virtual

Macon

LEAD ON September 12-13 Savannah The Westin

Macon

Branch Leadership/Management Series September 17-18 & October 22-23

Macon

October

& Virtual

Powering Community Reinvestment icbacrasolutions.org CRA Education & Training CRA Support Services CRA Peer Group CRA Credit Opportunities

Macon

Roundtable Advice for Professional Development

CBA’s R.A.P. sessions provide our bankers with chances to connect and learn from peers in similar roles. We provide a range of professional growth opportunities.

• Compliance with Banker Regulatory Forum

April 17 & October 17

• ISO-Information Security

May 21 & Fall TBD

• Loan Operations

March 26 & September 5

• Bank Secrecy Act

February 22 & December 5

• Human Resources/Talent Development

March 1 & July 19 & October 18 & December 6

NEW – Georgia’s First Loan Operations RAP

We are so impressed with the bankers who came to the first Loan Operations RAP on March 26. Each participate brought information to share that supports the professional development of everyone in the program. Mark Westberry, SVP, Southeaster Bank shared, “I wanted you to know how much I enjoyed our meeting and look forward to participating with the group to hopefully share some of my experience with others but to also learn from them as well. The format was perfect and, in my opinion, your being the facilitator helped make the meeting the huge success that it was. The CBA is indeed fortunate to have someone such as yourself in your role, due to it is very evident that you love what you do.”

The group appreciated the training program and wants CBA to provide additional opportunities to support their roles, of course, we said yes! The next roundtable for your loan operations professional is scheduled for Thursday, September 5 in Macon. We have invited Richard Hamm, seasoned lending instructor, to facilitate our discussions & learning. Send questions to Kristi Greer to help us prepare.

PROFESSIONAL DEVELOPMENT

323,000 in Georgia. How is our industry investing in talent to ensure safe valuable professional development for human resource professionals. Julie Shadwick from Pineland Bank praised it as “one of the best HR conferences,” and April Mills from the Bank of Hazelhurst beneficial employees that

This year’s conference featured a comprehensive agenda addressing key challenges and opportunities in talent development. Topics included updates from the Georgia Department of Labor, FLSA salary status, compensation trends, mental health in the workplace, and strategies for fostering a supportive environment. Attendees also discussed benefits, training, and enhancing personnel policies.

We thank all attendees, speakers, sponsors, and exhibitors for their support. The conference serves as a platform for HR leaders to exchange ideas and best practices, essential for navigating the evolving landscape of HR management in banking. As we face a widening talent gap, initiatives like the CBA’s HR & Talent Development League are crucial for equipping professionals with the skills needed to sustain robust banking operations and a dynamic workforce. Consider joining our next event, R.A.P. (Roundtable Advice for Professional Development), on July 19th in Macon.

DESIGN-BUILD SOLUTIONS

Eclipse Brand Builders is an award-winning commercial design-build firm serving clients throughout the southeast. Eclipse’s in-house team has a proven track record providing turnkey solutions with guaranteed results.

eclipse your competition!

+ Full Service Design-Build

+ Architecture, Engeering & Interior Design

+ Construction Management

+ Site Selection & Market Analysis

+ Branding & Retial Design

Spring 2024 | Georgia Communities First | 37 PROFESSIONAL DEVELOPMENT

www.eclipsebrandbuilders.com | 678.894.4360

Cyber Fraud is real! You must attend this educational program to stay abreast and ready to prevent a cyber attack.

This event is perfect for those looking to deepen their understanding of cyber threats, learn from regulatory experts, and explore the latest in cyber risk management strategies. Engage in vital discussions on AI, third-party risk management, and more to ensure your institution stays secure and compliant in an ever-evolving digital landscape. Dive into this critical field to safeguard your organization’s future.

Add a professional designation to your signature line! Check out ICBA’s Education opportunities and certification programs!

Completing training with your community banker’s association, yes; that’s us, gives you a chance to earn continuing education credits that align with these professional certifications.

When selecting to register for a ICBA Education, please use our state association code. Using the code will alert ICBA to give back to Georgia through our alliance in supporting the community banking industry.

State Association Code: GA-CBA

38 | www.cbaofga.com | Spring 2024 PROFESSIONAL DEVELOPMENT

A Community Bank Leadership Retreat for All Bankers

Why should I grow my professional knowledge? Why not? If you aren’t learning you will get complacent in your work. Our leadership bankers are inviting you to join in setting learning goals and taking action to support ongoing professional development to increase your skills and career net worth!

We are Empowering Leaders to Lead ONward!

Join your fellow bankers to ignite and cultivate your professional leadership status. The LEAD ON retreat is planned to be highly interactive so you can create supportive teams while moving to a focused community bank leader.

Day 1 – with April Farlow

• Change Management: The banking world is changing rapidly with evolving customer expectations, regulatory demands, market trends, AI and increased fraud. Working proactively to problem solve and innovate is critical. This is a session designed to help bankers proactively embrace innovation and stay ahead of the curve for long term success in a highly competitive market.

• Listening Based Leadership: For community bankers, trust and credibility are paramount. Active listening helps the customer feel heard and understood, while also allowing the banker to assess risk and craft creative solutions to build relationships. Few people have ever taken a public listening class (rather they focus on public speaking classes). Leadership requires strong listening skills, and this session allows participants to practice a fundamental skill.

Day 2 with Lori Godfrey

• Community Bank Advocacy: As the financial industry rapidly evolves, how do we as leaders advocate to support a safe and sound banking portfolio? This session will encourage bankers to proactively work together to support each other and establish resources to protect the business. We will have fireside chats and roundtable discussions to create action plans.

40 | www.cbaofga.com | Spring 2024 PROFESSIONAL DEVELOPMENT

Who should attend:

Back by Popular Demand!