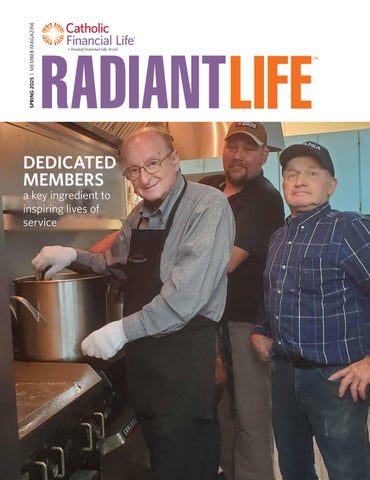

DEDICATED MEMBERS

a key ingredient to inspiring lives of service

a key ingredient to inspiring lives of service

Board of Directors

John Borgen, Hubertus, WI

President and CEO

Amy Bellows, Eagan, MN

Corporate Secretary

Sandra Dempsey, Menomonee Falls, WI

Jim Gibbons, Lake Elmo, MN

Mike Giffhorn, New Berlin, WI

Coral Grout, Winchendon, MA

Jim Hunsanger, DeWitt, MI

Joe Kopinski, Greenfield, WI

Kari Niedfeldt-Thomas New Brighton, MN

Bill O’Toole, Pleasant Prairie, WI

Jeff Pedretti, Rochester, MN

Bill Stone, Brookfield, WI

Jeff Tilley, Franklin, WI

Jim Wensel, Rice, MN

Spiritual Director

Archbishop Emeritus Jerome E. Listecki Milwaukee, WI

At Trusted Fraternal Life, we are united by a higher purpose: to be a source of light, instruments of peace, and beacons of hope. This purpose is captured beautifully in the prayer we recite at monthly meetings.

We ask God to:

“... Help us to be light where there is darkness, channels of peace in places of division and leaders who bring hope to all in need ...”

We know that members like you make this prayer a reality.

From building beds for children to providing meals for the hungry, your acts of service are the threads that strengthen the fabric of our communities. Just read through the pages of this Radiant Life issue and you’ll get a sense of the good that can come when you consciously and deliberately care for others.

This past January, we welcomed Catholic United Financial based in St. Paul, Minnesota, to the Trusted Fraternal Life family, joining Catholic Financial Life, Degree of Honor and Woman’s Life. Together, we are stronger than ever, with over 215,000 members working to make a difference.

Many of us are familiar with the ancient wisdom found in Ecclesiastes 4:12: Where one alone may be overcome, two together can resist. A three-ply cord is not easily broken.

Our collective strength enables each brand to do more than ever. We are well-positioned to fulfill our higher purpose—with our members leading the way. Together, we can accomplish even greater things in the future— grounded in faith, service and love for others.

God Bless,

John T. Borgen President and CEO

Your acts of service are the threads that strengthen the fabric of our communities.

En Trusted Fraternal Life, nos une un propósito mayor: ser una fuente de luz, instrumentos de la paz y señal de esperanza. Este propósito se resume maravillosamente en la oración que decimos en reuniones mensuales.

Le pedimos a Dios: “... Ayúdanos a ser luz donde hay oscuridad, canales de paz donde hay división y líderes que llevan esperanza a todos los necesitados...”

Sabemos que miembros como tu hacen realidad esta oración.

Desde construir camas para niños hasta proporcionar comidas para los que pasan hambre, tus actos de servicio son los hilos que fortalecen la red de nuestras comunidades. Tan solo lee las páginas de esta edición de Radiant Life y tendrás una idea del bien que puede resultar cuando consciente y deliberadamente te preocupas por los demás.

En enero, recibimos a Catholic United Financial de St. Paul, Minnesota, a la familia de Trusted Fraternal Life, uniéndose

No se nos debería pasar por alto que después de que Jesús fuera bautizado por Juan el Bautista, como se nos describe en Mateo 3, inmediatamente es puesto a prueba en el desierto. Es sobre estos 40 días de Jesús en el desierto sobre los que reflexionamos durante los 40 días de Cuaresma, un tiempo de ayuno, oración y limosna—un período en el que Jesús se preparó para el trabajo que tenía por delante.

Y al igual que Jesús se preparó para Su ministerio, nosotros deberíamos dedicar tiempo deliberadamente a preparar y anticipar la Pascua mediante la participación activa en el tiempo de Cuaresma.

Recuerdo que, de niño, mi madre me asignó la tarea de limpiar el polvo antes de que vinieran invitados a casa. Cumplí mi tarea con diligencia quitando el polvo de los bordes de todas las mesas y repisas. Pero no pasó mucho tiempo para cuando mis amigos del barrio me invitaron a jugar un partido de béisbol. Así que dejé el trapo y salí corriendo con el bate y la pelota.

Más tarde, cuando mi madre me preguntó si había terminado de limpiar, dije: “Oh, sí, mamá”. Con una expresión de duda en el rostro, movió una lámpara y otros objetos pequeños de una de las mesas; levantó la pequeña alfombra decorativa de encaje, conocida como tapete; y allí estaba la prueba de mi

a Catholic Financial Life, Degree of Honor y Woman’s Life. Juntos somos más fuertes que nunca, con más de 215,000 miembros trabajando para hacer una diferencia.

Muchos de nosotros conocemos la sabiduría antigua que hay en Eclesiastés 4:12:

Donde una persona sola pueda ser superada, dos personas juntas pueden resistir. Un lazo de tres hilos no se rompe fácilmente.

Nuestra fuerza colective permite a cada marca hacer más que nunca. Estamos en una buena posición para lograr nuestro propósito principal, con nuestros miembros liderando el camino. Juntos, podemos lograr cosas todavía más grandes en el futuro, basándonos en la fe, el servicio y el amor al prójimo.

Que Dios te bendiga,

John T. Borgen Presidente y director general

mal desempeño al limpiar los muebles: debajo del intrincado tejido del tapete había un innegable patrón de polvo.

La lección que mi madre me explicó con mucha paciencia fue que, aunque es muy poco probable que un invitado mire debajo de un tapete en busca de polvo, el punto principal de mi triste defensa, estamos obligados a prepararnos lo mejor posible para que un invitado entre en nuestro hogar.

Durante este tiempo de Cuaresma y Pascua, e incluso más allá, los animo a que desempolven un poco su vida para reconocer a Jesucristo, el huésped que habita en el corazón de cada creyente por medio de la fe (Efesios 3:17). La Santa Escritura nos dice, tanto en Deuteronomio 31:8 como en Hebreos 13:5, que Él nunca nos desamparará ni nos dejará.

Aun así, un poco de limpieza puede ayudarnos a mirar de nuevo con asombro Su gracia y amor por nosotros.

¡Bendita Pascua!

Muy Reverendo Jerome E. Listecki

Arzobispo Emérito de Milwaukee Director espiritual de Catholic Financial Life

It shouldn’t be lost on us that after Jesus was baptized by John the Baptist, as described for us in Matthew 3, we find him immediately tested in the wilderness. It’s these 40 days of Jesus’ time in the desert that we reflect upon during the 40 days of Lent—a time of fasting, prayer and almsgiving— a time when Jesus prepared for the work ahead.

And just as Jesus prepared for His ministry, we should deliberately take time to prepare and anticipate Easter through active participation in the season of Lent.

I remember as a child, my mother assigned me the chore of dusting before guests came to our home. I dutifully performed my chore by dusting around the edges of every table and shelf. But it wasn’t long before I heard my neighborhood friends calling me to join them in a game of baseball. So, down with the dust rag and out the door with my bat and ball I ran.

Later, when my mom asked if I completed the dusting, I said, “Oh, yes, mom.” With a look of doubt on her face, she moved a lamp and other small items from one of the tables; she lifted the small, lacy decorative mat, known as a doily; and there was evidence of my poor dusting performance—mirroring the intricately woven doily was an undeniable dust pattern.

The lesson my mother patiently explained to me was that even though a guest was highly unlikely to look under a doily for dust—the main point in my dismal defense—we are obligated to prepare our best for a guest to enter our home.

During this Lenten and Easter season, and even beyond, I encourage you to do some dusting in your life to acknowledge Jesus Christ, the guest who dwells in the hearts of every believer through faith (Ephesians 3:17). Holy Scripture tells us in both Deuteronomy 31:8 and Hebrews 13:5 that He will never forsake or abandon us. Even so, a little dusting can help us look anew in awe of His grace and love for us.

A blessed Easter!

We are obligated to prepare our best for a guest to enter our home.

Most Reverend Jerome E. Listecki Archbishop Emeritus of Milwaukee Catholic Financial Life, Spiritual Director

If you have dependents—or loved ones who you want taken care of after you die—life insurance is critical. This coverage helps ensure your lost income doesn’t translate to tangible material losses for your family once you’re gone.

But how much life insurance is enough? The answer can change over time, and it’s important to answer correctly.

You may be underinsured with life insurance coverage if…

1. Your only life insurance coverage is through your employer.

While some life insurance is certainly better than none at all, if your only coverage is through your employer, you may not have enough. Employer plans generally offer very limited coverage (like a year’s worth of your salary, maybe two), which is unlikely to be enough to meet your family’s needs if you have any significant debts or children whose college educations you’re hoping to help fund.

Furthermore, life insurance offered through your employer is usually contingent on you keeping your job, so if you leave your position for any reason, the coverage ends.

Finally, buying an individual policy gives you access to different types of life insurance policies, including permanent life insurance, which has living benefits you can use while you’re alive.

Getting a raise is almost always a good thing, but if you’re making significantly more income today than when you first bought your life insurance policy, you may find yourself underinsured. A higher income usually comes with associated lifestyle changes, and learning how to live with less is likely the last thing your loved ones will want to do if you depart unexpectedly.

3. Your stay-at-home spouse doesn’t have life insurance.

If your stay-at-home spouse doesn’t have life insurance coverage, you’ll want to consider purchasing a policy. Even if he or she doesn’t have an income that would need replacing, valuable services like childcare would need to be paid for if something happened.

As every parent knows, having a child is expensive—in fact, a Lending Tree study shows that in 2023, raising a child costs more than $21,000 per year on average. (And that’s before you factor in college.)

All of which is to say, if you’re a new parent or you brought an additional child into your family, it’s a good time to review your life insurance coverage and ensure you have enough to meet your dependents’ long-term needs, including food, shelter and education, until they’re of age. Given the high cost of childcare (and the precarious financial position of an underinsured single parent), even one child can increase your life insurance needs significantly.

Paying the mortgage is one of the most pressing financial needs for any family—and more pressing, still, for a newly widowed spouse. If you purchased a new home since you first got your life insurance policy, you may find that you need more coverage to help ensure your loved ones can successfully pay down that debt. After all, moving is never fun, especially in the face of a tragic loss.

While it can feel overwhelming to determine how much life insurance coverage you need as your financial situation changes over time, it’s also well within your power to ensure you’re sufficiently covered. Your representative can easily conduct a quick needs assessment to identify how much coverage you need.

It’s worth your time. Because a half hour of work today can translate to years’ worth of financial stability in the future.

Sources: Life Happens. Used with permission.

There’s no reason to wait to purchase the Term Life Insurance protection you’ve been thinking about.

We offer an instant decision online application for Term Life Insurance for ages 18-55 up to $500,000 in coverage . With a quick phone call to your representative, you’ll know in minutes if you’re approved, denied, or referred to underwriting. And when you’re approved, you’ll know the premium amount and can sign electronically. Just like that, you’ll have Term Life Insurance and protection for your family’s financial future!

Contact your representative today or call (800) 965-2547.

• Term Life Insurance can be converted to permanent life insurance with Trusted Fraternal Life at any time during the level term period or the contract anniversary following the insured’s 75th birthday, whichever comes first. Conversion is subject to the age and minimum face amount requirements of the permanent plan.

• Like all life insurance policies, this policy has exclusions, limitations, reduction of benefits, and terms under which the contract may be continued in force or discontinued. For costs and complete details of coverage, contact your representative or call (800) 927-2547.

Term Life Insurance ICC20 TRM (30), ICC20 TRM (30) SPN, 2020 TRM FL (30) and 2020 TRM FL (30) SPN.

Catholic Financial Life is a Trusted Fraternal LifeTM brand. Life Insurance products issued by Trusted Fraternal Life, Milwaukee, WI. Not available in all states.

Seguro de vida:

Contar con un seguro de vida es fundamental si tienes dependientes, o simplemente seres queridos a quienes deseas cuidar después de tu fallecimiento. Esta cobertura ayuda a garantizar que tu pérdida de ingresos no se convierta en pérdida de materiales para tu familia cuando tú ya no estés.

Pero, ¿cuánto seguro de vida es suficiente? Esa es una pregunta cuya respuesta puede cambiar significativamente a lo largo de la vida, y es importante responderla correctamente.

Tu cobertura de seguro de vida podría ser insuficiente en si…

1. Tu único seguro de vida es el que ofrece tu empleador.

Si bien contar con un seguro de vida a través de tu empleador es mejor que no tener ninguno, este tipo de cobertura suele ser limitado. Los planes empresariales generalmente ofrecen una cobertura muy limitada (equivalente a uno o dos años de salario), que probablemente no sea suficiente para cubrir las necesidades de tu familia si tienes deudas importantes o hijos cuya educación universitaria esperas poder financiar.

El seguro de vida que ofrece tu empleador suele estar sujeto a que tu conserves ese empleo, así que, si dejas tu puesto por cualquier motivo, se termina la cobertura.

Por último, comprar una póliza individual te da acceso a distintos tipos de seguros de vida, entre ellos el seguro de vida permanente, que también brinda beneficios que puedes utilizar en vida.

2. Tus ingresos aumentaron.

Recibir un aumento de sueldo siempre es una buena noticia, pero si hoy en día ganas considerablemente más que cuando compraste tu seguro de vida, podrías tener un seguro insuficiente. Un mayor ingreso suele implicar cambios en el estilo de vida, y lo último que querrían tus seres queridos es verse obligados a reducir drásticamente su nivel de vida si te marchas de forma inesperada.

Tu pareja que se dedica al hogar no tiene seguro de vida.

Si tu pareja se dedica al hogar y no tiene un seguro de vida, deberías considerar comprarle una póliza. Aunque no genere ingresos directos, realiza labores valiosas, como el cuidado de los niños, que tendría un alto costo si hubiera que pagar a alguien para cubrir esas responsabilidades en tu ausencia.

Como bien saben todos los padres, criar a un hijo es costoso. De hecho, un estudio de Lending Tree revela que en 2023 el gasto anual promedio por hijo supera los $21,000. (Y eso sin contar la universidad).

Es decir, si acabas de ser padre o madre o has incorporado otro hijo a tu familia, es un buen momento para revisar tu cobertura de seguro de vida y asegurarte de que tienes suficiente para cubrir las necesidades a largo plazo de tus dependientes, como alimentación, vivienda y educación, hasta que alcancen la mayoría de edad. Dado el costo elevado del cuidado infantil (y la vulnerabilidad financiera de un padre o madre con un seguro insuficiente), incluso un solo hijo puede aumentar significativamente tus necesidades de seguro de vida.

Pagar la hipoteca es una de las necesidades financieras más urgentes para cualquier familia, y más aún para un cónyuge que acaba de enviudar. Si adquiriste una nueva propiedad desde que compraste tu seguro de vida, es posible que necesites ampliar tu cobertura para garantizar que tus seres queridos puedan pagar con éxito esa deuda. Después de todo, mudarse nunca es algo agradable, especialmente ante una pérdida trágica.

Aunque puede resultar abrumador determinar cuánta cobertura de seguro de vida necesitas a medida que tu situación financiera cambia con el tiempo, también está en tus manos asegurarte de que tu seguro sea suficiente. Tu representante puede fácilmente realizar una evaluación de necesidades rápida para determinar la cobertura ideal para ti.

Vale la pena dedicarle tiempo a esto. Porque media hora de trabajo hoy puede significar años de estabilidad financiera en el futuro.

Fuentes: Life Happens. Todos los derechos reservados. Utilizado con autorización.

No hay motivo para esperar a comprar la protección de un Seguro de Vida a Término en el que has estado pensando.

Ofrecemos una aplicación en línea de decisión instantánea para un Seguro de Vida a Término para edades de 18 a 55 años con una cobertura de hasta $500,000. Con una llamada a tu representante, sabrás en minutos si fuiste aprobado, rechazado o remitido a suscripción. Y cuando seas aprobado, sabrás el monto de la prima y podrás firmar electrónicamente. ¡Así de fácil, tendrás un Seguro de Vida a Término y protección para el futuro financiero de tu familia!

Comunícate con tu representante hoy o llame al (800) 965-2547.

Avisos importantes

• El Seguro de Vida a Término puede ser convertido a un seguro de vida permanente con Trusted Fraternal Life en cualquier momento durante el período de término nivelado o el aniversario del contrato posterior al cumpleaños número 75 del asegurado, lo que ocurra primero. La conversión está sujeta a los requisitos de antigüedad y monto nominal mínimo del plan permanente.

• Como todas las pólizas de seguro de vida, esta póliza tiene exclusiones, limitaciones, reducción de beneficios y términos bajo los cuales el contrato puede continuar vigente o discontinuarse. Para conocer los costos y detalles completos de la cobertura, comunícate con tu representante o llame al (800) 927-2547.

Seguro de Vida a Término ICC20 TRM (30), ICC20 TRM (30) SPN, 2020 TRM FL (30) and 2020 TRM FL (30) SPN.

Catholic Financial Life es una marca de Trusted Fraternal Life™. Productos de seguros emitidos por Trusted Fraternal Life. No disponible en todos los estados.

Submit your best photo for the theme: Our Family Traditions. Showcase activities that highlight your cultural heritage, love for a sports team, or cherished family moments. Every entry receives a commemorative gift. Photos will be judged on quality and theme alignment. Winners in youth (under 18) and adult categories will be featured in the Fall 2025 Radiant Life magazine. Prizes: $75 for first place, $50 for second, and $25 for third.

To enter the contest, please visit cfl.org/photocontest

The deadline to submit an entry is August 25, 2025.

The photo contest honors Joe’s 41-year career with Catholic Financial Life and celebrates his love of photography!

As a member of Catholic Financial Life, you have access to value-added member benefits for you and your family, including scholarships, educational resources, contests, and family-friendly activities at discounted prices. Visit cfl.org/memberbenefits for a complete list of member benefits.

Making wise financial decisions for you and your loved ones just got easier! The Financial Wellness Hub offers easy-to-understand videos, articles and financial tools to help you gain the knowledge you need to confidently make financial decisions.

Member Rewards Program (PerkSpot)

Visit cfl.org/myaccount to login or set up an account to access member benefits.

Members may receive savings of up to 70 percent at hundreds of national and local merchants in categories such as travel, restaurants, entertainment, electronics, health and wellness. Members may also suggest the addition of their favorite merchants or promote their own small business through our Member Rewards Program.

Members can receive a 35 percent first-year discount on membership with one of the most trusted identity theft protection providers.

There are seven hidden black Radiant Crosses throughout the magazine, just like the one you see here. Correctly identify the location of at least four of the crosses and we’ll enter you in a drawing to receive a $25 gift card. Please note: the Radiant Cross above doesn’t count!

The submission deadline is June 28.

Submit your answers:

cfl.org/radiantcrossgame

Radiant Cross Game

Catholic Financial Life

Attn: Marketing

1100 W. Wells St. Milwaukee, WI 53233

Be sure to include your name, address, phone number, email address and the locations of the Radiant Crosses. Good luck.

Drivers across the United States are being bombarded with fraudulent text messages claiming to come from toll operators like E-ZPass.

These messages threaten fines for unpaid toll fees and aim to steal personal and financial information. Security experts warn that these scams are becoming more sophisticated.

Recently, the Massachusetts Department of Transportation (MassDOT) issued an alert about a smishing campaign targeting users of its EZDriveMA tolling program. Victims who click the links in these texts are asked to provide credit card details and, in some cases, verify a one-time password sent via SMS or authentication apps.

Similar scams have been reported in other states, including Florida, Texas, California, Colorado, Connecticut, Minnesota, Wisconsin and Washington. These phishing attacks often involve realistic-looking websites that mimic official toll authority sites but only function on mobile devices, making them even more convincing to unsuspecting users.

According to Ford Merrill, a security researcher at SecAlliance, the volume of toll-related phishing attacks surged after the New Year. This spike coincides with updates to commercial phishing kits developed by cybercriminal groups. These kits now include templates designed specifically to impersonate toll operators in multiple states.

Merrill notes that these kits, sold widely in underground markets, are part of a larger trend. Criminals have used similar tactics to impersonate shipping companies, tax agencies, and immigration services, often targeting individuals new to a country or in vulnerable positions. The ultimate goal is to steal payment card details, add them to mobile wallets, and make fraudulent purchases or launder money through shell companies.

To protect yourself from these scams:

• Verify the source: Avoid clicking links in unsolicited text messages. Instead, visit the official website of your toll provider directly

• Enable multi-factor authentication (MFA): Use MFA for online accounts to add an extra layer of security

• Monitor your accounts: Regularly review bank and credit card statements for unauthorized transactions

• Report scams: Notify your local toll authority and file a report with the Federal Trade Commission if you receive suspicious messages

As these scams grow more sophisticated, staying vigilant is essential. By understanding how these phishing schemes operate, you can better protect yourself and your personal information.

Source: KnowBe4.com. Used with permission.

Hay siete íconos negros de Radiant Cross ocultos en toda la revista, como el que ves aquí. Identifica correctamente la ubicación de al menos cuatro de los íconos y participa en una rifa para ganar una tarjeta de regalo de $25. ¡Recuerda que el ícono de Radiant Cross de esta página no cuenta!

Envia tus respuestas:

Radiant Cross Game

Catholic Financial Life

Attn: Marketing 1100 W. Wells St. Milwaukee, WI 53233 cfl.org/radiantcrossgame

Asegúrate de incluir tu nombre, domicilio, número de teléfono, dirección de correo electrónico y la ubicación de los íconos de Radiant Cross. ¡Buena suerte! La fecha límite es el 28 de junio.

Como miembro de Catholic Financial Life, tu y tu familia tienen acceso a beneficios de valor agregado, incluidas becas, recursos educativos, concursos y actividades familiares a precios reducidos. Visita cfl.org/memberbenefits para obtener una lista completa de los beneficios para miembros.

¡Tomar decisiones financieras sabias para ti y tus seres queridos ahora es más fácil! El Centro de Bienestar Financiero ofrece videos fáciles de entender, artículos y herramientas financieras. Podrás aprender todo lo que necesitas para tomar decisiones financieras con confianza.

Nótese que solo los videos están disponibles en español.

Visita cfl.org/myaccount para iniciar sesión o crear una cuenta y acceder a los beneficios para miembros.

Los miembros pueden recibir ahorros de hasta el 70 por ciento en cientos de comercios nacionales y locales en categorías como viajes, restaurantes, entretenimiento, electrónica, salud y bienestar. Los miembros también pueden sugerir la incorporación de sus comercios favoritos o su propio negocio a través de nuestro programa de Recompensas para Miembros.

Los miembros pueden recibir un descuento del 35 por ciento en su primer año de membresía con uno de los proveedores más confiables de protección contra el robo de identidad.

Ten cuidado con estafas de peajes por mensajes de texto

Los conductores en EE. UU. están siendo bombardeados por mensajes de texto fraudulentos que aparentan ser de operadores de peajes como E-ZPass.

Estos mensajes amenazan con multas por falta de pago de peajes y buscan robar información personal y financiera. Los expertos en seguridad advierten que estas estafas son cada vez más sofisticadas.

Recientemente, el Departamento de Transporte de Massachusetts (MassDOT) emitió una alerta sobre una campaña de smishing dirigida a los usuarios de su programa de peajes EZDriveMA. A las víctimas que hacen clic en los enlaces de estos textos se les piden los datos de su tarjeta de crédito y, en algunos casos, que verifiquen una contraseña de un solo uso que se envía por mensaje de texto o mediante aplicaciones de autenticación.

Se han reportado estafas similares en otros estados, como Florida, Texas, California, Colorado, Connecticut, Minnesota, Wisconsin y Washington. Estos ataques de phishing suelen implicar páginas web reales que imitan los sitios oficiales de las autoridades de peaje, pero que solo funcionan en dispositivos móviles, lo que las hace aún más convincentes para los usuarios desprevenidos.

Según Ford Merrill, investigador de seguridad de SecAlliance, el volumen de ataques de phishing relacionados con el peaje aumentó después de año nuevo. Este incremento coincide con actualizaciones en los kits comerciales de phishing desarrollados por grupos de ciberdelincuentes. Estos kits ahora incluyen modelos diseñados específicamente para hacerse pasar por operadores de peajes en varios estados.

Merrill señala que estos kits, muy vendidos en mercados clandestinos, forman parte de una tendencia más amplia. Los delincuentes han utilizado tácticas similares para suplantar la identidad de empresas de envíos, agencias tributarias y servicios de inmigración, a menudo con el objetivo de captar a personas recién llegadas a un país o en situación vulnerable. El objetivo final es robar datos de tarjetas de pago, agregarlos a billeteras digitales y realizar compras fraudulentas o lavar dinero a través de empresas fantasma.

Para protegerte de estas estafas:

• Verifica la fuente: evita hacer clic en enlaces de mensajes de texto que no hayas solicitado. En su lugar, visita directamente el sitio web oficial de tu proveedor de peajes.

• Activa la autenticación multifactor (MFA, por sus siglas en inglés): utiliza la MFA en las cuentas en línea para añadir una barrera de seguridad adicional.

• Controla tus cuentas: revisa periódicamente tus estados de cuenta bancarios y de tarjetas de crédito para detectar transacciones no autorizadas.

• Reporta las estafas: notifica a tu autoridad local de peajes y presenta una denuncia ante la Comisión Federal de Comercio si recibes mensajes sospechosos.

Dado que estas estafas son cada vez más elaboradas, es esencial mantenerse alerta. Al comprender cómo operan estos esquemas de phishing, podrás protegerte tu y tu información personal mucho mejor.

Fuente: KnowBe4.com. Utilizado con autorización.

Catholic United Financial, located in St. Paul, Minnesota, officially became a brand of Trusted Fraternal Life on January 1, joining Catholic Financial Life, Degree of Honor and Woman’s Life in the family of brands.

The merger of Catholic United Financial with Trusted Fraternal Life represents a significant milestone toward building the NextGen fraternal benefit society, serving more “Main Street” families, and making an even greater community impact across the country.

Trusted Fraternal Life is now the sixth-largest fraternal in the United States (there are about 70 fraternals in the country) with nearly $3 billion in assets and over 215,000 members.

For more details, visit trustedfraternallife.org

Trusted Fraternal Life has maintained an “A” insurance financial strength rating with a stable outlook from the Kroll Bond Rating Agency (KBRA), a global, full-service rating agency.

The agency’s report states that the rating reflects Trusted Fraternal Life’s ability to effectively manage reserves that are well balanced between annuities and life insurance and are supported by a conservative, high-quality, fixed-income investment portfolio.

The report further mentions how strong governance and the recent mergers with Woman’s Life Insurance Society and Catholic United Financial have strengthened Trusted Fraternal Life’s position as a leader in fraternal consolidation, increasing reserve balances and providing operational efficiencies. Given Trusted Fraternal Life’s strong leadership team and risk-adjusted capital position, KBRA believes Trusted Fraternal Life’s financial strength can withstand a range of stress scenarios.

“This independent rating affirms our financial strength and our ability to deliver on the promises we make to our members—to be there for them through every stage of life,” said President and CEO John Borgen.

Factored alongside Trusted Fraternal Life’s financial strength, the report noted the organization has earned recognition as a Top Workplace for 11 consecutive years and achieved a milestone in 2024 by becoming the first and only company to receive the Southeast Wisconsin Award for Social Responsibility.

“This recognition underscores our commitment to our associates and our dedication to creating a positive social impact,” said Borgen. “It also aligns with our vision to engage more people to enjoy financially secure, purposeful lives.”

Members have a chance to join us at the 2025 Fraternal Celebration!

In a world that often lacks inspiration, our members continue to inspire us!

For the first time ever, members from Catholic Financial Life, Degree of Honor, Woman’s Life and Catholic United Financial will gather as one united fraternal family.

Together, we will celebrate member impact and achievements, deepen connections, and explore how we can strengthen communities and secure financial futures for generations to come.

September 26-28, 2025

Baird Center | Milwaukee, Wisconsin

Featured Guests

Keynote Speaker: Becca Stevens

Entertainment Headliner: Charlie Berens

Colin Cloud, Matt Havens and Jimmy Yeary

Enter our drawing to attend the celebration if you‘re:

• Passionate about serving others

• Open to meeting like-minded people

• Eager to be inspired and impact more lives for good

Enter by April 30, 2025 at trustedfraternallife.org/drawing

Winners will be notified by May 31, 2025.

Space is limited so enter today!

Visit trustedfraternallife.org/drawing or scan the QR code.

We want to feature your chapter activity in the Radiant Life magazine and on social media. Please email high-quality photos and a descriptive write-up to memberengagement@cfl.org.

Chapter 150 – Neillsville, WI, volunteered at the Neillsville Fire and Rescue Team’s Steak Feed. More than 1,100 meals were sold and $11,000 was raised to support the Neillsville Fire and Rescue Team, with matching funds received from Catholic Financial Life.

Chapter 48 - Beaver Dam, WI, presented the Dodge County Pregnancy Support Center with a $1,000 check at the Pregnancy Support Dinner. Catholic Financial Life provided matching funds.

Chapter N441 – Westport, MA, presented a $500 check to the Case School District Theater Booster Club to help fund the theatrical club’s upcoming competition in Boston. Good luck theater students!

Chapter 11 – Wisconsin Rapids/Stevens Point, WI, presented a match fund check for $500 to St. Adalbert’s from the annual picnic where members worked various booths and sold raffle tickets.

Chapter 261 - Cross Plains, WI, shopped for clothes to donate to the Giving Tree Clothing Drive.

Chapter 306 – Milwaukee SE, WI, volunteered at the Ozaukee County Walk to End Alzheimer’s, assisting with registration and donations. They also participated in the 2-mile walk, honoring lives lost to Alzheimer’s.

We want to share your chapter’s service projects with other members. Send your details and high-quality photos to memberengagement@cfl.org.

It was nearly 40 years ago that a unique tradition was born at St. Anne Church, now called Saint Francis de Sales, a French Parish in Bristol, Connecticut. A group of volunteers gathered to make and sell meat pies (tourtières) to help keep the doors of the church open to church members and the community.

The labor of love continues to this day, most recently with members from Chapter N373, New Britain, Connecticut, rolling up their sleeves to help.

“This has been an ongoing tradition since the ‘80s,” said chapter member Pierrette S. “Our chapter joined in 2018 to help. It’s a lot of work, but it’s for a very worthwhile cause.”

A group of retirees from ages 60 to 96 joyfully and tirelessly worked together to prepare the ingredients for the three-day pie-making event. The group split into teams to prep the ground pork, potatoes, onions and spices, while others stirred the meat and rolled the dough. From there, more than 900 pies were filled, baked, and sometimes sold the moment they came out of the oven!

“We listen and sing along to French music and that makes the days go fast,” said Pierrette. “The most enjoyable part of our work is doing something good for the church.”

The fruit of their effort, along with matching funds from Catholic Financial Life, resulted in more than $9,000 donated to the Parish!

But the immeasurable benefit is the amazing camaraderie the volunteers experienced and the fulfillment that comes from doing good things that help hold the fabric of society together.

Chapters gather to celebrate membership anniversaries

Chapter 1051 - Saint Henry, IN, celebrated 50- and 75-year membership anniversaries, followed by a delicious meal and refreshments.

Chapter 274 - Rubicon, WI, celebrated 25-, 50-, and 75-year member anniversaries with a buffet dinner. A collection was taken for St. Vincent de Paul, raising $279 from the group.

Chapter 318 - Mequon/Cedarburg, WI, honored Jean S. on her 75th membership anniversary with dinner and a social.

Chapter 88 - Madison, WI, hosted a spring celebration to honor members celebrating 25, 50, and 75 years of membership.

Jesus calls us to a life that values and serves others. There are endless opportunities to perform acts of service in your community once you start to look for them. Here are some recent Impact Team initiatives to inspire you!

We were beyond blessed to see the fruits of our labor! —Gerald H.

“In every way I have shown you that by hard work of that sort we must help the weak, and keep in mind the words of the Lord Jesus who himself said, ‘It is more blessed to give than to receive.’ ”—Acts 20:35

This verse holds true for the 26 men from St. Joseph Parish in Conway, Arkansas, who traveled to McGehee, Arkansas, to help the less fortunate and disabled.

During their visit, they completed various home repair projects, including building wheelchair ramps, fixing toilets and staircases, and restoring water to a home.

The seed money they received from Catholic Financial Life was used to purchase materials and supplies to help with their projects.

“Most of the people we served that weekend were either widowed, disabled or elderly with no family to help,” said team member, Gerald H. “Many of us guys had moving encounters with recipients. Lots of tears, hugs and thank-yous.”

One elderly man had a damaged roof that if left unfixed, would have resulted in his insurance company cancelling his policy. “We not only provided much-needed repairs but also brought hope and comfort to this man,” said George.

Organize Your Own Impact Team! Let us help you do good things in your community. Gather a team to put on a service project or fundraiser. We’ll provide the resources you need to get started, T-shirts and $150 in seed money. Then you and your Impact Team can get busy doing good things. Go to cfl.org/impactteams for service ideas and information on how to get started.

The most gratifying part about this project was watching the students work together. —Morgan E.

Hoping to bring warmth and comfort to those who need it most in the winter season, this team of students from St. Joseph’s Youth Ministry in Conway, AR, worked together to make 12 fleece tie blankets.

Workers volunteering at the homeless shelter sent us a text telling us the meal was delicious.

—Diane H.

Even in the cold weather, our members continue to make a difference! This Impact Team from LaCrosse, WI, cooked a hot meal for the homeless that was served at the local warming shelter.

We loved seeing their smiling faces! They asked us to come back next year! —Betty C.

Residents at a nursing home in Appleton, WI, have asked this Impact Team to return next year for another round of card-making and games! The team helped residents assemble Christmas card kits and served festive punch and cookies—spreading holiday cheer all around.

To celebrate Catholic Schools Week earlier this year, we recognized three amazing teachers through our annual Give Back Contest. The three winning teachers were selected for the positive impact they’ve made in the lives of their students and their communities. Each winner received a $500 cash prize and the schools were awarded a $4,000 donation from Catholic Financial Life.

St. Maria Goretti Catholic School | Madison, WI

Sarah has dedicated 17 years to teaching first grade at St. Maria Goretti Catholic School. “She goes above and beyond to give her first graders a thorough, well-rounded and fun education rooted in Catholic identity,” said Nicole L., who nominated Sarah.

The St. Maria Goretti community came together to surprise Sarah with the news of her win after their annual 8th Grade vs. Staff volleyball game.

St. George Catholic School | Linn, MO

For more than 55 years, Bob has taught social studies and religion to junior high students. His commitment to education has impacted generations of families— from grandparents to parents, and now their children. “Mr. Maranowski’s unwavering dedication to Catholic education for an extraordinary 55 years has profoundly impacted countless lives. His legacy extends far beyond the classroom,” said Principal Grellner, who nominated Bob.

The St. George community had the honor of sharing the wonderful news with Bob after morning Mass.

St. Sebastian Catholic School | Milwaukee, WI

Mary teaches physical education for K4-8th grade students and has been a teacher for 28 years at St. Sebastian. Her dedication to developing the whole child—spiritually, emotionally and physically—is a big reason why the community at St. Sebastian nominated her for the Give Back Contest. “Mary teaches not only sports and fitness but also values like kindness, inclusiveness, empathy and compassion. She reflects Catholic values by fostering an environment where students engage with one another respectfully and lovingly,” said Principal Immen, who nominated Mary.

The St. Sebastian community came together for a surprise assembly to announce the exciting news!

1100 W. Wells Street

Milwaukee, WI 53233

There’s no reason to wait to purchase the term life insurance protection you’ve been thinking about.

We offer an instant decision online application for term life insurance for ages 18-55 up to $500,000 in coverage.

With a quick phone call to your representative, you’ll know in minutes if you’re approved, denied or referred to underwriting.

And when you’re approved, you’ll know the premium amount and can sign electronically. Just like that, you’ll have term life insurance and protection for your family’s financial future! Contact your representative today or call (800) 965-2547.

• Term Life Insurance can be converted to permanent life insurance with Trusted Fraternal Life at any time during the level term period or the contract anniversary following the insured’s 75th birthday, whichever comes first. Conversion is subject to the age and minimum face amount requirements of the permanent plan.

• Like all life insurance policies, this policy has exclusions, limitations, reduction of benefits, and terms under which the contract may be continued in force or discontinued. For costs and complete details of coverage, contact your representative or call (800) 927-2547.

Milwaukee, WI. Not available in all states.