Castle Keep Realty aims to provide personalized attention and comprehensive guidance throughout the real estate journey

Alyse was born and raised in Newport, Rhode Island. Her life experiences growing up in Newport fostered her inspiration to pursue a career in the legal field. While working and raising a family, Alyse obtained her Juris Doctor from Roger Williams University. Learn more about Alyse on our website at Castlekeeprealtynpt.com

Cesar was born in Lisbon Portugal, but relocated to Newport RI in 1985. Cesar career started in hotel management out of college, that laied the foundation for his transition into the Real Estate Cesar has always enjoyed building relationships and helping people meet their goals. Learn more about Cesar on our website at Castlekeeprealtynpt.com.

Asa is known to many of our clientele as a property manager as well as a realtor. A graduate from URI, he was born and raised in Newport and has been building his career steadily since graduating in 2019. Outside of real estate you will often find Asa on the golf course or at the gym. Learn more about Asa on our website at Castlekeeprealtynpt.com

Our Buyers Agents are here to assist you!

The buying experience can often feel daunting due to the numerous contingencies and regulations that must be followed. At Castle Keep Realty, we are committed to strong communication by guiding you through every step of the process. We will clarify state and federal housing laws, and carefully review disclosures and details related to your purchase. A key aspect of the process is the requirement for every buyer to sign an exclusive Buyers Representation Agreement. This legally binding contract establishes our relationship and enables agents to show you properties and provide valuable services throughout your buying journey.

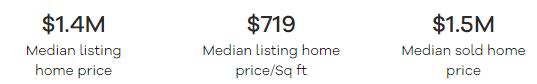

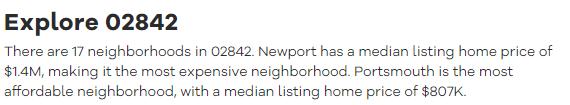

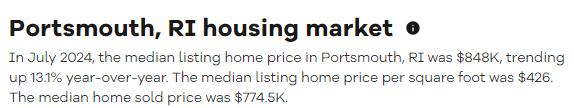

Castle Keep Realty agents will also prepare buyers by reviewing with you the average timeline for house hunting, mortgage approval and closing. With that, we will review the current market trends, and how this can impact your purchase experience. We will review estimated potential out of pocket costs, and how Castle Keep can provide you further value by providing estimates and work time lines for items such as repairs that need to be addressed immediately

Castle Keep Agents are dedicated to understanding your needs and preferences throughout your buying journey. We will identify your non-negotiables, comprehend your budget, and, if necessary, connect you with reliable lender resources. Our goal is to consistently provide you with housing options that align with your requirements based on the current market availability.

Our agents are skilled negotiators who will assist you in securing your desired property at the best possible price. Together, we will develop a tailored negotiating strategy. To facilitate this, we will provide you with a comparative market analysis before you make an offer. We will guide you in crafting appealing offers for sellers, clarify common contingencies, and implement strategies such as escalation clauses to gain a competitive edge. With your needs and desires in focus, we will construct a compelling offer that has a strong chance of acceptance.

Agency: A relationship between two parties (agent) who acts for or represents another under the authority of the latter

Agent: A person who is authorized to act in the best interest of a principal/client, and is obligated to place the principals interest before the interest of any other party

Appraisal: A written analysis of the estimated value of a property, prepared by a qualified appraiser

Buyer Broker Agreement: An agreement that specifies the duties and the scope of services a buyers representative agrees to provide to the buyer

Closing & Closing Costs: A meeting in which a sale of a property is finalized by the buyer and seller signing associated documents and the closing costs are paid. Closing Cost are the fees, costs, taxes associated with the purchasing of a property. This includes the borrowing of money, the preparation of necessary paperwork that finalizes the sale etc. The total amount of closing costs will vary depending on location, property type, price and complexity of the transaction

Commission: The fee charged by a broker or agent for providing services related to a real estate transaction such as marketing the property, bringing the parties together and negotiating the purchase contract

Deed: The legal document conveying title to a property

Earnest Money Deposit: This is a deposit made by the potential home buyer to show that he or she is serious about purchasing the property

Escrow: An account that holds deposits or documents that will be dispersed once a property closes. Example: An earnest money deposit is held in escrow by a broker, bank or other party until the transaction is closed

Fiduciary Duties: The term fiduciary is defined as relating to or involving confidence of trust. Fiduciary duties are determined by state law - but generally include: Confidentially, undivided loyalty, obedience, reasonable care and diligence, full disclosure and accounting

Good Faith Estimate: An estimate of closing costs associated with the purchase of a property provided by a lender.

Home Warranty: A guarantee for mechanical systems and appliances, but not the structure, against repairs not covered by homeowners insurance - coverage is for a specific time.

LTV (Loan to Value) The ratio of the amount of a mortgage loan to the appraised value or sales price of the property mortgage, whichever is lower

Mortgage Insurance: A policy that insures the lender against loss caused by a mortgagors default on a mortgage

PMI: Private Mortgage Insurance is coverage provided by a private mortgage insurance company to protect lenders against loss if a borrower defaults. Coverage is usually required for a loan with a loanto-value percentage in excess of 80%

Points: A point is one percent of the amount of the mortgage. At closing, Lenders sometimes charge borrowers a percentage of the loan amount equal to the number of points to cover the lenders costs. Sometimes borrowers pay high points in exchange for a lower interest rate

Pre-Approval vs. Pre-Qualification: A pre-Qualification is an estimation of what a purchaser can afford - vs A pre-Approval, is a written commitment issued by a lender after a comprehensive analysis of the creditworthiness of the applicant

Purchase & Sales Agreement (P&S) this is a contract that is legally binding that sets forth the terms of the sale, establishes the rights and obligations of the parties involved, and specifies the actions to be taken in order to close the sale.

Realtor: this identifies a real estate agent who is a member of the National Association of REALTORS and subscribes to it’s strict code of ethics