The ClUB WelcoMe to

We are delighted to bring you the latest edition of our Club magazine, centred around the profound theme of legacy.

Legacy is not just about the wealth we accumulate, but the values, memories, and impact we leave behind for future generations.

In this issue, we feature an inspiring interview with our good friends and clients, Mark and Alistair Spooner, who share their personal journey and insights on creating a lasting legacy through their family business. Carolyn speaks to us both about our vision for the future and what legacy means to us.

Additionally, we have an exclusive conversation with Hanli Prinsloo, founder of the I AM WATER Foundation, whose work in ocean conservation serves as a remarkable example of a legacy dedicated to protecting our planet.

Furthermore, we explore the pressing issue of threats to intergenerational wealth and provide you with our top tips for safeguarding your financial legacy, ensuring that your hard-earned assets benefit your loved ones and support your values.

We hope you find this edition insightful and empowering as you consider the legacy you wish to create.

Enjoy! Mike & Al

Meaning Legacy the of

by Nicola Craxton

The concept of “legacy” encompasses a multitude of interpretations depending on the context in which it is used.

Legacy embodies not only material possessions such as wealth, property, and cherished belongings intended for future generations, but also intangible aspects like values, actions, and achievements, aimed at leaving a profound and enduring imprint on society. Take, for instance, the inspiring legacy of Rob Burrow, whose legacy will live on through the awareness, support and funds he raised for MND, or the impactful activism of figures like David Attenborough.

Moreover, legacy extends beyond individual contributions to encompass cultural traditions and customs passed down through generations, serving as a means of preserving heritage and identity. A vivid example is my mother’s treasured recipe book brimming with memories from my childhood, a cherished heirloom handed down from her own mother.

In many cases, the sentimental value attached to these legacies far outweighs their material worth, underscoring the profound emotional resonance they hold. Ultimately, “legacy” encapsulates the essence of inheritance, or lasting impact, prompting reflection on the legacy one wishes to leave behind and the measures required to ensure its meaningful preservation and transmission. So, it begs the question:

What legacy will you leave, and how will you ensure its rightful continuation?

SUPPORTING YOUR LEGACY THROUGH EFFECTIVE FINANCIAL ADVICE

Good financial advice considers more than just your finances

Realising the Dream & Laying the Foundation

Understanding your goals and formulating a tax efficient plan for your future income & your legacy

Annual planning meetings

Encouragement from a team who cares as much about your financial future as you do

A voice of realism – firm but fair when needed – having your best interests at the centre of everything

Support, Understanding & Encouragement

Access to the team for second opinions, important decisions and life transitions

Educating your whole family on financial aspects to ensure continuation of your legacy

An accountability partner to guide and support

Unlimited access – giving you peace of mind at all times

Knowing you and not just your financial affairs

the nuts & Bolts

Regular reviews of your plan & your goals

Tax efficient estate plan

Tax efficient savings strategy

Programme of education on legislative changes to keep you up to date

Guidance during tax season

Proactive & not reactive advice

YOUR LEGACY

YOUR INVESTMENT BLUEPRINT

A strategy tailored to your individual needs with active investment management

A range of risk levels suited to your future and your legacy plans

Access to alternative investments allowing your portfolio to reflect your values

Investment webinars & access to industry experts to give you a deeper understanding

Threats to Intergenerational wealth

by Oly Voice

In today’s fast-paced world, keeping family wealth safe for future generations can be quite the challenge. While building and growing your assets is important, protecting them from potential threats is just as important.

In this article, we’ll dive into the main issues that can affect family wealth and share some smart strategies to keep your assets secure. From effective tax planning to tackling the risks brought by social changes, staying informed and prepared is the key to safeguarding your family’s financial future.

Multi-Generational Inheritance Tax

So, what is the current situation? Inheritance tax (IHT) is a familiar part of the UK tax system. It’s generally charged at a hefty flat rate of 40% on all of your assets above your Nil Rate Band (£325,000 per individual) on death. But there is an associated risk– generational inheritance tax. This can have a significant impact on family wealth as it passes down the generations.

Generational inheritance tax happens when an estate is taxed multiple times as it moves between generations. This might take place when money passes to your children, and then on to their children and so on. This could mean that your children, and even your grandchildren, might face an additional inheritance tax bill over and above that which you’ve paid already. The outcome is that up to a staggering 60% of your estate’s value could be lost over time.

Let’s assume that a couple have a net worth of £2.7m and they want to leave the money to their child. The estate will have to pay inheritance tax on this money, reducing the amount the child receives.

If we also assume that the beneficiary of the estate, their child, is 50-60 years old, married with children and already financially secure, the receipt of that inheritance has just significantly exacerbated the inheritance tax liability on their Estate.

Let’s look at John and Mary’s situation and see how generational inheritance tax impacts future generations.

Meet Mary & John

They have one child Alice. Alice is married with two children. John & Mary have a £2.7m net worth

Alice is married with children

They are financially well off with a net worth of £2m

Alice’s adult children

First Generation Inheritance Tax

Upon John & Mary’s death, Alice will be able to claim 2 x £325k Nil Rate Band (NRB).

Estate Value:

£2,700,000

Less NRB: £650,000

Taxable Estate: £2,050,000 Estate taxed at 40% IHT = £820,000 tax bill

Remaining Estate: £1,880,000

to be passed onto Alice and her family.

Their Estate is now inflated by £1,880,000 and worth £3,880,000.

Second Generation Inheritance Tax

This means when the original inheritance is eventually paid to Alice’s children, it will be taxed again at 40%.

£1,880,000 x 40% =£752,000.

This means the family has essentially paid £1,572,000 tax on the original inheritance.

Paid by John & Mary’s Estate: £820,000

Paid by Alice’s Estate: £752,000

It is important to mention that, because the estate is valued at £2.7 million, John & Mary have fully lost their entitlement to the Residence Nil Rate Band (RNRB). The full workings of the RNRB are beyond the scope of this article, however, it is technical in nature and has many caveats and exceptions.

This is a problem that is fairly simple to solve yet very few people have thought about it.

A potential solution to this situation is to draft a Deed of Variation. This is a legal document that allows changes to be made to the distribution of a deceased person’s Estate, often to redirect assets from one beneficiary to another. A Deed of Variation has many uses, however, in this particular situation it can help mitigate the second tranche of inheritance tax payable.

If Alice decides that she does not need the inheritance she can draft a Deed of Variation to redirect her entitlement to her children, instead of inheriting it herself and then passing it on to her children when she dies. Although the amount of Inheritance tax payable on the original Estate will not change, through varying the entitlement, she could save the family’s Estate £752,000 in inheritance tax.

If Alice wishes to retain some control over the assets, she can redirect the inheritance into a trust rather than giving it directly to her children. This arrangement allows the children to benefit from the inheritance while protecting the assets from being squandered or mismanaged. Additionally, it provides a layer of protection against marital breakdowns, financial difficulties, and potential claims by creditors or ex-spouses.

These are just a couple of many strategies that can be used to mitigate multi-generational inheritance tax. If this is a concern of yours, please come and speak to us.

Intergenerational planning encompasses a broader range of issues than just inheritance tax planning. Overleaf we take a look at some of those concerns which could potentially affect you and your family.

Social issues

It’s easy to overlook the various, more personal challenges to preserving family wealth. Here are some critical questions to consider:

What will happen to my wealth if my children get divorced?

What would I want for my family if I weren’t here tomorrow?

Should they enjoy it now, or should they save it for future generations?

How do I want my family to use my wealth?

Do I want my children’s partners to have any influence over my wealth and how my money is used?

Should my wealth be used to support my grandchildren?

What will happen if my partner remarries?

These challenges can potentially be far more costly than any inheritance tax bill, both financially and emotionally, yet we rarely give them the same level of consideration or attention.

Divorce of children

Divorce is a difficult subject, but one that shouldn’t be ignored, especially considering that around 42% of marriages end in divorce. This issue becomes particularly important in the context of estate planning, especially when it comes to preserving intergenerational wealth.

One major concern is that assets can end up in unintended hands over time. For instance, let’s say parents give their married daughter £100,000 to help her and her husband buy their first home. If the marriage later dissolves, that £100,000 gift becomes part of the marital estate, which is then divided between the couple.

Assuming a 50/50 split of assets, the husband would walk away with £50,000, plus any appreciation in the asset’s value. This outcome is far from ideal, as the parents likely intended for their gift to benefit their child.

Unfortunately, scenarios like this are all too common. They can occur with gifts made during one’s lifetime, as in the example above, or with inheritances received upon death.

Prenuptial agreements (prenups) are legal documents which can be a potential solution and an effective tool to mitigate the risk of assets ending up in unintended hands during a divorce. By outlining the division of assets in advance, a prenup can specify that gifts or inheritances received by one spouse remain their separate property, protecting them from division. However, they are not entirely foolproof and must be carefully drafted and meet all legal requirements to be enforceable. If you would like more information about prenups you should seek legal advice.

Trusts are another way for further protecting assets and keeping them out of the marital estate.

Remarriage

Among the various topics we cover in our estate planning discussions, one of the most difficult is the potential for your spouse to remarry or have a new partner if you pass away. This subject is often uncomfortable and therefore frequently avoided. However, it’s important to give it the attention it deserves.

Statistics show that over 60% of men and 20% of women enter into a new relationship within two years of losing their spouse. Considering these figures, it is prudent to address remarriage in your estate planning discussions.

A spouse’s remarriage can create complications for your intended inheritance plans, as we will explore in the following examples.

Meet Mary & John

They have one child Alice.

John passes away and leaves his entire estate to Mary

A year later

Mary meets and marries Tom

A few years later...

...Mary and Tom decide to divorce. In the divorce settlement, Tom is entitled to half of the marital assets which includes a portion of the inheritance Mary received from John. In the absence of a prenup or trust, Tom could be entitled to half of their combined Estate.

In the absence of a prenuptial agreement or trust, in a divorce settlement Tom may be entitled to half of their combined estate. This could mean that Tom receives a significant portion of John’s original estate, which was intended for Alice. As a result, the inheritance intended for Alice is reduced, and Tom, who has no direct connection to John or Alice, benefits from the estate.

In this example, had Mary passed away before divorcing Tom, Alice could have been left in an even more precarious position if Tom had decided to write her out of his Will completely.

Both of these outcomes could lead to significant emotional and financial impact for Alice and could be avoided with careful legacy planning.

These are just a few examples of how safeguarding family wealth across generations presents a myriad of challenges, from hefty inheritance taxes to social and marital issues that can undermine well-laid plans. By recognising these potential threats and applying strategic measures, you can better protect your assets and ensure they serve the intended purpose for future generations.

While we’ve outlined various strategies to help protect your family’s wealth, we recognise that there is no one-size-fits-all solution. Each family’s situation is unique, and it’s important to tailor these strategies to fit your specific circumstances.

Mark & Alistair Spooner

Directors of Jelmac Property Group

Nicola had the pleasure of speaking with two remarkable clients of ours, brothers Mark and Alistair Spooner, who are at the helm of a longstanding family business. Passed down through multiple generations, their company has thrived by maintaining a strong commitment to family tradition and innovation. They were kind enough to share their journey, the challenges they’ve faced, and how they continue to shape the future of their legacy with us.

CAN YOU SHARE THE STORY OF HOW YOU BOTH GOT INVOLVED IN THE FAMILY BUSINESS.

Alistair: So, we are 4th generation in terms of the family business. It was originally a construction company, set up at the end of the last century. However, really it took off after the Second World War when our grandfather and his brother set up an office just outside Coventry and set about rebuilding much of the city. The running of the business was kept very much to those in control; with the AGMs held around the dining

table with tea and biscuits our only update, so growing up we didn’t know much about it. It was only back in the 2000s when we had to sort out our grandmother’s estate, as our father and Grandfather had died, that we learned more about the business and just how complex it had become. Between 2005 and 2008 while we were both working in other companies it was agreed the business needed to be reviewed and consolidated. Initially, I left where I was to help split the business between five families. With the help of our company secretary, Frank, and Mark acting as consultants, the split was finally agreed in February 2009. At this time Mark joined full-time and we took over running the property investment side of the business, which had been run as a side product of the construction company. Although this was during the recession, in hindsight it was a great time to join as we had to learn very quickly. We brought a fresh view and business sense into it and since then, we’ve grown the business quite substantially and diversified into other areas such as removals, small developments and self-storage.

Mark: We didn’t consider joining the family business because it was managed by our two uncles on our cousin’s side. With our mother being an only child, it wasn’t something that we had thought much about. This was great for us as it allowed us to pursue our own careers during our 20s. We gained fantastic commercial experience and a solid grounding in

different industries.

Around 20 years ago, the family business had grown too large to be managed by just the two brothers. There were too many family members involved, and it was becoming unwieldy. The decision to split the business was a significant turning point. Alistair was in a position to join the business in 2008, taking charge from our side, which was great as we still held quite a big shareholding in the original business. The timing was good for me. I had missed out on a director’s role at the company I was working for, which was subsequently bought by a big private equity firm. This occurred at the height of the 2008 financial crisis, so in 2009, after the business had been split, I decided to join.

We brought an ethos into the business that reflected our personalitieswe’re pretty competitive but we’re very approachable and relationshipdriven. The key thing we did when the recession hit in 2009, was focus on working closely with our existing client base and ensuring cash flow. It’s hard to believe it’s been 15 years - we often forget to celebrate these milestones because it’s been such a whirlwind. Despite the initial challenges, we worked well together because of our differences. We’re not even alike in appearance, as you can see, and it took some time to adjust to working together. However, we’ve since divided the responsibilities between us,

We brought an ethos into the business that reflected our personalities

For the first 12 months, it was about survival

Vital Statistics...

NAME: Alistair Spooner

LIVE:

52 years old, live in Berkhamsted with my family

FAVOURITE BOOK:

Auto Express weekly car magazine

FAVOURTIE APP: WhatsApp

THREE WORDS THAT DESCRIBE YOU: Determined, Competitive, Approachable

ensuring we don’t step on each other’s toes which helps bring harmony to the working relationship.

Alistair: In those first few years, because we’re not experts in every area of the business, we built up relationships with experts who were skilled where we weren’t. A lot of property investment firms were and are still run in a very old school way, whereas we are very proactive. In the marketplace we are seen as being approachable, good landlords, and people enjoy working with us because we are efficient and responsive.

WHAT WERE THE INITIAL CHALLENGES YOU FACED WHEN YOU TOOK OVER THE BUSINESS?

Mark: There were lots of different aspects to the company. It had a big construction arm, the property arm (that we were involved in), a couple of farms, and it had been under invested. I don’t want to say poorly run, but because the construction side was so large, it had been neglected. It needed management, controls and people with ideas to take it to the next step. There were also some serious debts outstanding, so processes that allowed us to bring money in as well.

This was during one of the worst recessions (2008/2009) that certainly, in my career, I’ve ever seen! So, we were micromanaging and trying to do deals with people and bring cash in. It was literally like starting a new business but with a neglected old business that had been left to just tick over. It turned

out to be a great opportunity and we learned very quickly how to choose the right type of clients and manage with the partners and relationships that we had. For the first 12 months, it was about survival and keeping everything afloat.

Alistair: It was a very challenging year, not quite as challenging as COVID, but challenging! We were just starting out; we didn’t know anyone out there and the first letters we received were from tenants telling us they couldn’t

afford to pay the rent. Our approach was to meet our tenants, chat through their situation and look for ways to help them out. Thankfully, there were some that we could find solutions for.

WHAT DOES THE CONCEPT OF LEGACY MEAN TO YOU IN THE CONTEXT OF YOUR FAMILY BUSINESS?

Mark: I think my perspective has shifted a bit as my kids have grown older. I’ve got three children, and the eldest has one more year at university. Five years ago, I hadn’t given much thought to the future. But my son, who’s studying business and has completed a year-long placement, has developed a real interest in the field. He’s quite fascinated by numbers, which is encouraging. Our plan is just like the family plan and similar to what our cousins have done in their construction arm - let the kids go off, find themselves, and gain experience. Meanwhile, we’ll continue pretending we’re still young while staying involved in running the business. In about 5 to 10 years, we’ll probably

have to discuss what comes next. The more time I invest in the business, the more personal it feels, especially when you’ve built something like the self-storage business from the ground up. Ideally, I’d love to see some of the next generation come on board, but the challenge is keeping it going. Our family has survived because we’ve adapted over the last hundred yearsour great-grandfather was a bricklayer, our grandfather an architect, and his brother an engineer. The business evolved from house building to contracting, commercial properties, doctor’s surgeries and then we’ve moved into warehousing, and now self-storage. We essentially need to keep reinventing ourselves.

In 10 to 15 years, I’d love to see two or three of the next generation involved - there are eight grandchildren among the three of us siblings. In terms of the legacy, we’d feel a bit guilty if we decided to sell it all in 10 years, which is something we certainly don’t want to do. Initially, we planned to set up the self-storage business with a 10-year plan to sell, but it’s become complementary to

our property business. We’re the landlords, we run it as a business, and it’s integrated so well that our legacy would be to keep our three businesses going as long as possible. The real challenge will be whether any of the next generation want to join us!

Alistair: In today’s world, information on businesses is only a few online searches away, and as we are business owners, our children can see and know a lot more about the family business. There was no or very little information around for us 40 years ago. I think my view is: go to school, go to university if you want to, but get out there and gain experience. Set up your own business, try something, fail, test the marketplace. If that doesn’t work try something else, and then come back and bring a new vision. Technology is massive for the next generation and I’m sure everything will have changed again in the next 5 to 10 years but it will be fresh impetus as well. We have options, but ultimately, we see ourselves as guardians for the next 10 years and what we want to do is to leave the business in a state that is well

positioned for them to come in and add to it.

HOW DO YOU BALANCE MAINTAINING THE TRADITIONS OF THE FAMILY BUSINESS WHILE ALSO PURSUING INNOVATION?

Alistair: Good question. We’re always willing to look at new ideas or products and will then either try them or present and discuss them in our monthly board meetings between the four of us. You’ve got to keep pace with the market and neither of us is afraid of change. In terms of brand-new innovation though, I do like to let the ‘big boys’ take the hit on the research, product development and trials. Once I know it works, then I’m like right, now we go and put that into all our stores.

Mark: These board meetings sound very official, but really, they’re family meetings. Our sister is involved, and our company secretary has been with us since the start. It’s a discussion along the lines of business and family. To prove that we are sentimental, only to show that we’re actually not…we’ve always kept one of our grandfathers’ favorite buildings in Banbury, which we probably don’t really need as a business as it’s not strategic. However, we’ve held on to it because

it’s a legacy from him and means something to all of us. On the flip side, perhaps we’re not too sentimental as in an AGM five or six years ago we announced that we had sold everything in Daventry. Our mother, who grew up in Daventry, was upset and reminisced on how those were the only buildings she remembered as she used to visit them as a child. We wish she’d mentioned that before we sold it!

We have stayed around the areas that traditionally our grandfather and uncles were involved in because we are originally from the Northamptonshire area. So, when we first took the portfolio, all the agents were trying to get us to sell everything and invest within the M25. But actually, we’ve stuck and grown the business through our traditional family areas.

HOW DO YOU MANAGE POTENTIAL CONFLICTS

OR DISAGREEMENTS BETWEEN YOURSELVES IN A PROFESSIONAL SETTING?

Mark: Wow! That’s a good one. I think it helps having our very experienced company secretary who is like our referee. His line is “I will give you my advice. Take it or leave it. I won’t side with anyone, but I’ll give you my opinion”. We don’t battle as much

Vital Statistics...

NAME: Mark Spooner

AGE:

We’re twins, so we’re the same age… but I’m older!

FAVOURITE BOOK:

I’m quite into historical books, so a bit weirdly everything that happened a few hundred years ago - English history books, medieval times etc.

FAVOURTIE APP:

I love Google Maps because I hate getting stuck in traffic and I’m obsessed about getting anywhere quickly.

THREE WORDS THAT

I

think we both bring energy and enthusiasm.

as we used to. Five or six years ago we had different views and visions on some parts of the business, and we certainly had some debates about the removals and self-store business. Our sister is also a brilliant calming influence on us because she’s a director, but only comes in once or twice a month and she’s very good at defusing just about anything.

Alistair: She knows us quite well! Up until COVID we had a number of clashes. But it was healthy because you’d walk away, let off steam, and then in the morning you come back and go “OK yeah, I see what you’re trying to say”. At the end of day, we’re trying to achieve the same thing. Our mother never wanted us to work together, and I think if we’d started in our 20’s it would have been a different story. As it was later in life, and we were both settled, it’s worked.

Mark: The other big mantra we’ve got, and this is very much a family trait, is that we’re not entrepreneurs. We see ourselves as custodians of the business that’s been passed down through the generations. Our grandfather was all about fairness and leaving, not a legacy, legacy sounds a bit grand but ultimately about always being fair. We’ve come to an agreement that the business comes first, and neither of the two of us are bigger than the business, ultimately it boils down to family values.

WHAT STRENGTHS DO YOU EACH BRING TO THE COMPANY, AND HOW DO THESE COMPLEMENT EACH OTHER?

Alistair: Well, I’m definitely more of a details person than Mark. Coming from a marketing background, I look at a building as a product. How does it look in the marketplace and how can we make that product most attractive to sell. I will spend a bit more time looking at that element whereas Mark is impulsive and would probably say: “Right, get on with it”. I like to know all the information before I make a decision, whilst Mark will tend to bulldoze in there, so it works quite well.

Mark: We split the responsibilities very clearly and both run different sides of the business. I have always looked at trying to get the projects and deals done. Coming from my background I always looked at where we’re trying to get to, how we get to it and then I might cause a bit of carnage doing it, but we get there.

I think we both bring energy and enthusiasm. We’re both very self-driven and competitive, and we like targets. Over the last 15 years we’ve achieved the targets that we and the family have set, and we’ve also had a bit of fun along the way.

Alistair: We play devil’s advocate for each other, and if we disagree, we let the other think it through overnight. Sometimes the view changes but either way it’s good to have someone to knock ideas against. At the end of the day, we are both trying to achieve the same thing.

HOW DO YOU MAINTAIN A HEALTHY WORK LIFE BALANCE GIVEN THAT YOU ARE FAMILY MEMBERS WORKING TOGETHER?

Alistair: We’re very lucky we can manage our own time now and we are both very much into sport, which is great. We love tennis and golf etc. We play in a number of charity and corporate golf days which is a great time to build relationships with suppliers and clients. Three of the buildings we bought in Berkhamsted came about through these golf days!! I know our wives think we just disappear off to have a bit of fun, but we actually get quite a bit of networking done on the golf course. Being able to set four or five hours aside can be really beneficial. It’s how we found ourselves owning a hotel!

Mark: We have managed to find the balance as we now have people running the businesses day-to-day. We both go to the gym on a Friday morning and don’t have to be in the

office every day. We still do quite a bit together as a family. We’ll organise a couple of events every year and our sister’s quite good at pulling everyone together. I think we’ve just got the scale in the business now and we don’t need to do what we did 15 years ago where we were rolling our sleeves up, getting involved in everything.

HOW DO YOU CELEBRATE YOUR SUCCESSES BOTH BIG AND SMALL?

Mark: It’s a good point, occasionally we have a beer down at the local pub on a Friday.

Alistair: They’ve just shut it, so we’ve obviously not celebrated enough, have we?

Mark: We tend to spend a lot of time together – working and playing golf, so that feels like enough. We’ve celebrated some anniversaries. Five years ago, we celebrated our 10th anniversary, and we all went away as a family. We also have an annual meeting at Wimbledon.

Alistair: Saw Mike there this year actually!

Mark: So, note to us, we need to celebrate more!

WHAT ARE YOUR GOALS FOR THE FUTURE?

Mark: We are literally at the point now where we have run out of spare

development land. Alistair is finishing the last project next month. Our next challenge is where we expand our business next. Do we start afresh somewhere else, or do we just improve what we’ve got? We’re trying to double the size of the self-store over the next 5 to 10 years. We’ve got four sites now and we would like to get it to 6 to 8 in the next 5-6 years. Our biggest problem is finding sites.

Alistair: We are open to opportunities that arise. So, it’s good that we have the ability to be flexible and to make a quick decision on it, as opportunities do come up. It can be fun.

CAN YOU SHARE AN ANECDOTE THAT HIGHLIGHTS YOUR WORKING RELATIONSHIP?

Alistair: A couple of years ago, Mark was away on holiday, and an Architect friend of mine was working on a building across the road from our offices. We were chatting about our building, and I sent him the floorplan. My friend kindly drew up a scheme to convert the office into flats. It was during a time when Mark was saying, “The best building we’ve ever bought is this office” - he’s based outside Berkhamsted, and it worked perfectly because his kids could

walk in, and then they could all head home together. So, I got my friend to design how to convert the office into six flats and I sent it to Mark.

Mark: I was very shocked! The thing is, it was a bloody good idea, but he’ll do that when I go away. I’ll come back, and he’ll have changed the layout in the kitchen, created a new entranceway or done something equally quirky. He just does things like that.

Alistair: I don’t like to stand still. I’m always thinking, “What can we do next?” I can’t do anything more at home now - my wife would kill me! But sometimes, you look at something and think, “There’s a better way to do this.” and if it improves things, why not crack on and get it done?

It’s a pity, it was a really nice scheme!

Top Tips for protecting your financial legacy by

Oly Voice

Get your affairs in order

Ensure that all of your financial, health and legal matters are in order. This includes having a Will, Lasting Power of Attorney and any other documents necessary to protect your legacy.

Think about how you use your money

Money built up in a pension is outside your estate for inheritance tax purposes. This means you can leave behind a pension without your loved ones paying inheritance tax on it.

As strange as it may sound, you don’t have to use your pension to fund your retirement, and it might be better to deploy other pots of savings to fund your lifestyle. That way, you are using up funds that are likely to attract an inheritance tax liability first, whilst retaining funds which might not be liable in future (eg pension funds). *

*There are rules around inherited pensions and it’s best to seek advice around your particular situation.

Gifting

Each year you’re allowed to give away a total of £3,000 in assets or cash as a gift – free from inheritance tax. It’s completely up to you who the money goes to, as long as the gift doesn’t exceed £3,000. You can also carry forward the previous year’s allowance if it has gone unused.

Another option is to make tax-free gifts from your surplus income, allowing unlimited gifts to individuals or trusts without incurring inheritance tax. These gifts must come from regular income, such as earnings, defined benefit pensions, rental income, and dividends, rather than capital. Withdrawals from savings, investments, and defined contribution pensions don’t qualify, as they are considered capital.

If you want to give away larger amounts, and aren’t able to gift from surplus income, there is nothing stopping you. However, these gifts will only be completely free of inheritance tax if you live for at least seven years from the date you make them. It’s important to note that the rules surrounding gifting are complex, so if you are considering gifting large sums, you should seek advice.

Take out insurance

If you are in a situation where you’re not yet ready to gift, a great way of covering your IHT liability immediately is by taking out a whole of life (WOL) insurance policy. A whole of life policy guarantees that an insurer will pay out a lump sum to the beneficiaries of your estate on second death which can then be used to cover the IHT bill.

Set up a trust

As mentioned before, setting up a trust can allow you to start inheritance tax planning while retaining some control as a trustee over who can benefit and when. If the money is to be distributed at a later date, then it can be held in a suitable investment until then. However, the rules are complex, and if this is something you’re interested in, you should seek advice.

Leave money to a worthy cause

Is there a charity close to your heart? If you’re willing to donate at least a tenth of your estate, the government will reduce your inheritance tax rate from 40% to 36%. It’s a way of making a difference to a worthy cause and means any potential inheritance tax bill is lower. The part of your estate you donate to a registered charity is also exempt from inheritance tax.

Business relief

Investing in companies that qualify for business relief (BR) can effectively reduce your inheritance tax (IHT) liability. Unlike gifts or trusts, which require seven years to become IHT-exempt, shares in BR-qualifying companies or investments become exempt after just two years, provided they are still held at the time of the investor’s death. Additionally, if you own your own company, your shares may also qualify for business relief, provided the company meets certain criteria.

Go on a spending spree

Not everyone believes in leaving behind a big inheritance. After all, it’s your hard-earned wealth. So, rather than leave it behind and risk the tax man getting his hands on it, you could always spend it now. As the saying goes, you can’t take it with you. So, if you’ve got a bucket list, start ticking things off! This article is intended for informational purposes only and does not constitute financial advice. The information provided is based on current laws and regulations, which may change over time. It is important to consult with a qualified financial adviser or tax professional to obtain advice tailored to your individual circumstances before making any financial decisions related to inheritance tax. Carrington Wealth Management cannot provide legal advice.

Q A&

Alistair Candlish & Mike Hodges

Carolyn sat down with Carrington’s directors, Mike Hodges and Alistair Candlish, to chat about their vision for the company’s future. The discussion touched on the significant changes that have shaped Carrington’s journey, what legacy means to them both, and how they are inspiring the next generation.

WHAT DOES LEGACY MEAN TO YOU?

Alistair: I think it is something that you can look back on and be proud of. To be able to say that you have no regrets and that you’re pleased with whatever happened to create that legacy.

Mike: For me it probably means a few different things depending on what you apply it to – the business and then your personal life.

On the business front, you want to be proud of what you’ve done, what you’ve stood for and how you have behaved. You’d hope that you’ve had a positive influence on people and had an impact. I want to be able to look back on something I’ve created and go “Yeah, that was good. I enjoyed the ride, and it (the business) had a positive impact on the people who came into contact with it.”

In terms of my personal legacy, it’s about the people you touch in your lifetime, your family and friends. Hopefully you’ve left things in an OK state for when you’re not here, and maybe you’ve taught them a thing or two that they can disregard and some other things that they might take on board. But ultimately, I want the people left behind to be in a sound place.

CAN YOU SHARE YOUR LONG-TERM VISION FOR THE COMPANY?

Mike: The vision for the company has always been about putting the client at the centre of the business and looking after the people that have been good enough to trust us. That extends not only to our clients but to the team we’ve built around us as well. The central pillar is about continuing to provide really good, personal

advice to people we enjoy spending time with.

Alistair: In terms of vision, we want to continue being a quality firm. Focusing on the client and helping them achieve all the things they want to achieve. It’s important to mention the staff because we’ve got fantastic people working here. Most of the team have been with us for an awfully long time, and you want to make sure that they can also sit back afterwards and say “I was part of that vision. I enjoyed being part of the journey and I’m proud of how the company has done, I have no regrets”. Getting all of that right should help the long-term plan, which is to continue to move the business forward.

Mike: Over the next 5 to 10 years, we are looking to continue to grow the company at a sustainable pace. We want to look at how we can innovate and continue to find ways to support our clients, outside of the traditional advice realm, on their journey. The idea is to keep striving to be at the forefront of our industry and to create a company everyone wants to be a part of… part of our Club. We don’t use traditional marketing methods or cold calling; we meet all our new clients through existing client and professional referrals. We’ve always felt this was the best approach, and we like the fact that there is one degree of separation, making the relationship more personal from the outset.

HOW DO YOUR PERSONAL VALUES ALIGN WITH THE COMPANY’S MISSION?

Mike: I think our personal values are pretty straightforward. We want to make sure people are looked after properly. We value honesty and trust and try to do things well and in the right way. Above all, we want to make what we do fun. We want everyone to enjoy coming into the office and to find satisfaction in their job.

Alistair: We try to be as generous as we can be. We aim to be fair and kind, that’s just how we are as individuals, and we apply that in business as well. We’re not ones for having a load of confrontation, we’d prefer to keep everything open and to make sure people are happy and feel supported.

HOW DO YOU CULTIVATE MENTORSHIP AND PLAN FOR THE NEXT

GENERATION?

Alistair: I think this is something we do naturally…it happens by osmosis. We’ve always had a very open structure at Carrington. I think this encourages curiosity and engagement. So, on top of the more formal exam pathway, it’s about getting everyone involved in the decision making, asking for their ideas, opinions and input. We (Mike and I) are not planning to stop

advising anytime soon; however, we feel comfortable in the knowledge that the senior team are more than capable of taking up the reins in our absence. They’ve all been working with our clients for 10+ years, so they get the ethos, which ensures continuity of our vision.

Mike: Promoting from within has always been part of our growth plan. If you look at everybody in key positions, they’ve come up through the ranks. This means that the core team know the values of the business - they understand the DNA, it’s ingrained. At the moment we have a great group of youngsters, including some new hires, who are working their way up through the company. It’s very exciting. So, in terms of succession planning, we’re doing it organically.

WHICH DECISIONS DO YOU BELIEVE HAVE HAD THE MOST SIGNIFICANT IMPACT ON SHAPING THE COMPANY’S CURRENT SUCCESS?

Mike: I think there have been a couple of key moments, which have depended on embracing change.

The first was completely redefining/ reinventing our business model and

deciding to only deal with a select number of clients. This has meant that we’ve not had to shoehorn our clients into a monetized service or let clients go due to minimum entry points. It has also enabled us to focus on delivering a high level of bespoke service to all our clients.

The other pivotal point was the two of us getting together, that was massive. Al, having you join when you did, had a big impact on the future success of the business. Similarly, having you both, Carolyn and Nicola, from the start, and later Mo, provided enormous support because you understood the philosophy and were 100% committed to my vision. Your presence gave me confidence, knowing you would challenge me while also having my back.

Alistair: Carrington was 14 years old in August, and we’ve come such a long way from a one room office, where we had to run around London to use meeting rooms. Moving into our own purpose-built office with meeting rooms and a shared dining table was exciting and a clear indication to us that we were grown up now and not just working above the corner shop! I believe this move, despite initially seeming daunting due to the significant financial commitment, ultimately propelled us forward.

Say yes, more than you say no.

Carolyn: Is there anything you’d change if you could?

Mike: Yeah, couple of things. How long have you got?

Alistair: We could have done without the global pandemic, but unfortunately that was out of our control.

HOW DO YOU BALANCE THE DEMANDS OF LEADERSHIP WITH PERSONAL LIFE AND WHAT ADVICE WOULD YOU GIVE TO PEOPLE AT THE START OF THEIR CAREERS?

yourself out there or it will pass you by. Say yes, more than you say no. The other thing is to try and be lucky. Luck is big in business. If you smell an opportunity, then you’ve got to go for it. Even if you’re unsure, say yes and give it a try.

Mike: I’d also say, look forward – you can learn from the past, but you can’t change it – so keep your sights on the road ahead. Surround yourself with younger people – a bright, young team – it keeps you modern and relevant.

Mike: It’s important to find balance. When your name is across the door it’s hard to tune out of what is going on. Even when you’re out doing something else, you might be on the golf course, it’s hard to tune out, your mind is always thinking about the business – how are we doing? How is the team doing? It’s natural as you’ve put everything into your company, but don’t lose sight of your personal family situation as well, because you do need a balance.

Alistair: Be Curious. Work hard. Rest. Take some risks. Be bold. Get

WHAT PERSONAL ACHIEVEMENTS ARE YOU MOST PROUD OF AND HOW DO YOU HOPE TO BE REMEMBERED?

Mike: Probably some of my league hundreds.

Carolyn: Is that golf or cricket?

Alistair: Both!

Mike: Well, I think creating longevity in the business. Working with the same people for such a long time and creating an environment that they want to be in. Seeing people flourish and achieve their potential, that’s personal. That’s a great achievement and something I’ll remember.

Alistair: I don’t think you ever would have expected to hire two university grads at the same time, to then find yourself going to their wedding years later! So that’s something fun, and an extension of what you’ve just said, which is working with the same people over an extended period of time – it’s very rare in any business.

We don’t tend to take ourselves very seriously, and enjoy taking the mickey out of everyone, but mainly ourselves. Being able to laugh, being approachable and, for always having an open door.

Mike: I don’t often sit back and reflect on the milestones –perhaps something I should do more often! Winning Adviser Firm of the Year was pretty surreal. But I find that I’m always looking and moving forward – onto the next thing, onto the next worry. I think I’m always in a perpetual state of worry.

Alistair: I’ll put it on his tombstone “I’m not worried anymore”.

Mike: And “Why the heck am I here? I prefer that table over there”. That should be my epitaph too.

the £motion Money of

by Nicola Craxton

What emotions does money evoke in you?

Do you view it pragmatically, as a means to cover expenses and indulge in luxuries, or do you approach it cautiously, always mindful of scarcity and comparison with others?

Indeed, money is messy and capable of stirring up a whirlwind of feelings that, if left unchecked, can strain relationships and fracture families. Let’s take a closer look at these emotional complexities and equip ourselves with practical strategies for navigating them.

Encountering significant sums of money, whether through sudden acquisition or deliberate generosity, can trigger unanticipated emotional responses. Psychologist Stephen Goldbart introduced the concept of Sudden Wealth Syndrome (SWS), describing the intense psychological stress that often accompanies windfalls like lottery wins, unexpected inheritances, or the sale of a cherished business.

While feeling apprehensive or overwhelmed in the face of such profound change is normal, SWS intensifies these emotions, clouding judgment and impeding daily functioning. Recognisable symptoms may include heightened anxiety leading to depression, feelings of unworthiness or guilt, social isolation stemming from fear of others’ reactions, identity crises, and paralysing indecision regarding financial management.

A healthy approach to managing newfound wealth involves grounding oneself in core values and beliefs while seeking guidance from trusted financial experts. It’s crucial to strike a balance between enjoying the benefits of your money, while setting boundaries to safeguard long-term prosperity. Seeking professional assistance is advisable if you suspect you’re experiencing symptoms associated with SWS.

Conversely, deciding how to distribute one’s wealth can be equally challenging. Effective wealth transfer requires meticulous planning, clear communication, and a forward-thinking mindset. Whether passing assets to children, grandchildren, or charitable causes, thoughtful preparation can...

preserve financial legacies and foster family harmony.

With over 70% of household wealth in the UK held by individuals over 50, and an estimated £5.5 trillion set to transition between generations over the next three decades, proactive measures become imperative.

Here are some strategies to consider:

Assemble a trusted team build a trusted team of advisers who understand your family’s unique needs and aspirations. Rely on their expertise to confidently navigate complex financial matters. 1. 2. 3. 4. 5.

Establish a comprehensive plan in consultation with your financial adviser, ensuring wills, trusts, and powers of attorney align with your wishes and accommodate changing family dynamics and tax laws.

Engage family members in open discussions about your plans for your wealth transfer, addressing values, expectations, and financial goals to alleviate misunderstandings and encourage meaningful conversations.

Prioritise financial literacy emphasise financial literacy by educating the younger generation on responsible wealth management and providing resources to empower their informed decision making.

Cultivate a legacy by passing down family history, values, and philanthropic ideals, instilling a sense of stewardship and responsibility in younger generations.

Preparing for intergenerational wealth transfer requires dedication and foresight. By prioritising communication, education, and professional guidance, families can navigate this process successfully while preserving their financial heritage for generations to come. Remember, each family's journey is unique, so tailor your approach to reflect your values and aspirations.

Hanli Prinsloo

Freediving is an underwater activity that relies on breath-holding rather than the use of breathing equipment such as scuba gear. Hanli Prinsloo is a South African eleven times freediving record holder, an ocean conservationist and a keynote speaker. We were fortunate to get the opportunity to speak to Hanli about her greatest passion, the ocean.

TELL US A BIT ABOUT YOURSELF AND YOUR CAREER TO DATE.

I grew up on a horse farm outside of Johannesburg. My dad was a horse whisperer, so my love of animals and the wilderness started early on. After school I moved to Sweden to study, which wasn’t an obvious choice for somebody who loves the ocean, but my passion kind of started there. Johannesburg is very far from the closest ocean, and although I loved swimming underwater and pretending to be a mermaid with my sister, I hadn’t really spent a lot of time in the sea. On moving to the West Coast of Sweden I made a friend who was a freediver. He invited me to go diving in the fjord, and not knowing what I was getting myself in for, I said “sure, whatever that means”.

From that first experience, I just absolutely fell in love with freediving. My first few years of competitive freediving was all done in Sweden, so that really set the tone for my cold-water acceptance. I studied documentary filmmaking, and in my 20s I worked as a social political filmmaker, whilst competing.

Returning to South Africa I wanted to bring these two passions together. I started I AM WATER, the ocean conservation non-profit organisation.

The vision for I AM WATER was to see how we could bring together conservation and human growth. So, not looking at people as being the problem and conservation being the goal, but rather finding ways to bring them together in a lasting way that effected a behavioural change.

It’s about opening up the ocean space for more South Africans to have access to it. This is central and has continued to be the thread that weaves through everything we do.

WHAT KEEPS YOU BUSY THESE DAYS?

I started I AM WATER in 2010 and today we work with thousands of children every year. Having partnered with the Department of Education, we have established teams that work directly with the schools. The organisation is now so mature that we train organisations to offer Ocean Connection Methodology in other regions. We have also recently taken this global, training teams in Argentina, Ecuador, Galapagos, and later this year we are heading to India, Hong Kong and Los Angeles.

The organisation requires a lot of sustainable fundraising and I travel a great deal as a keynote speaker, but

in 2015/ 2016 clients of mine started sharing their dreams of doing what I do - diving with whale sharks, sperm whales, mantas and dolphins. I was happy to share recommendations as it’s important to know where not to go – you need to steer clear of where they feed the whale sharks, and where there are too many boats or areas that have captive dolphins etc. Eventually my clients said, can’t you just take us!

So, always up for a challenge, Peter (my husband) and I were like, let’s start a travel company! We started I AM WATER Ocean Travel with the same goal of offering transformational ocean experiences, but to paying clients. We began by running trips to Mexico, Madagascar, Mozambique and Niue in the South Pacific. We also did trips to Ecuador and Indonesia, offering exceptional freediving experiences for our clients. The proceeds of these trips going straight back into the non-profit.

Off the back of these adventures, clients would return home wanting to continue with the sport, asking for equipment recommendations. However, after two decades of competitive freediving and teaching, I found that I couldn’t recommend any gear that met the standards that I wanted to be held accountable for – sustainable, durable and highly functional, yet beautiful. Once again, thanks to our combined experience, Peter as a competitive swimmer and mine as a freediver, we were able to bring our ideas to life with the backing

it’s just sharing what I love and seeing somebody really

ex-

perience the ocean for

the first time.

of a couple of our clients. And so that’s how our latest venture Agulhas Ocean was born.

Agulhas is a worldwide freediving and ocean exploration brand, creating sustainable, beautiful high-performance equipment for any ocean user - whether you’re a snorkeler, freediver or scuba diver - the equipment crosses all ocean fields. Once again, this gets us closer to our goal of making the ocean a more accessible place, but without having a negative impact through the equipment we use.

I’ve always found myself coming up against these problems that we have a capacity to solve. So, I’m solving the problem of South Africans having access to the ocean through I AM WATER, and giving travellers sustainable interactions with big ocean creatures, and now through sustainable equipment.

Today, these three things keep me busy enough.

WHAT DO YOU FIND MOST SATISFYING ABOUT WHAT

YOU DO? AND WHAT IS MOST FRUSTRATING?

Oh, that’s easy. The most satisfying thing is seeing people open their eyes underwater for the first time and fall in love with the ocean.

Whether it’s a grade seven student or a 45-year-old woman who never thought she would get into surfing or diving, or a client on one of our trips; it really doesn’t matter who it is, it’s just sharing what I love and seeing somebody really experience the ocean for the first time.

From the Foundations perspective, the most frustrating aspect is constantly fundraising for something that’s so important. I think that anybody who works in a non-profit will probably share that feeling. The impact of our programme is measured and reported annually, yet we must continually prove our worth in order to raise funds. There are so many businesses out there that bring no good to the world, yet they don’t have to explain their bottom lines. I find that frustrating and a breach of integrity on the side of humans.

HAVE YOU SEEN A MARKED IMPROVEMENT IN MARINE APPRECIATION AND CONSERVATION AS A RESULT OF THE WORK YOU’RE

DOING?

Oh, absolutely. A study done by the University of North Carolina Wilmington tested both the increase in conservation mindedness and ocean literacy, as well as the increase in Social-Emotional Learning. Social-Emotional Learning refers to

“Our Blue Planet may be divided by continents, but it is united by oceans.”

Hanli Prinsloo, Founder of I AM WATER

somebody feeling (amongst other things) more of a sense of ownership, a sense of place and a sense of the impact their actions have, as well as a marked increase in self-esteem.

Our programme embodies all of that and it’s really embedded in what we do with the children. They have an understanding of what the ocean challenge is, they believe that they can make a difference and there is a willingness to want to be responsible for it.

It’s a simple thing, but at the end of the day each child makes a promise to the ocean, and they receive a certificate that reminds them of their promise. We go back months after the workshop, and the children still remember their promise, and they’re still acting towards it. The experience they have is so powerful that it causes this pivotal behaviour change illustrating SocialEmotional Learning.

WHAT CONCERNS YOU THE MOST ABOUT OCEAN PRESERVATION?

If you’d asked me ten years ago, I probably would have said that I feel concerned about what they call the Armageddon of the oceansoverfishing, habitat loss due to human population, plastic in the ocean etc. A challenge we’ve been facing for a long time.

But I believe climate change is the greatest challenge to the planet we live on, and it affects the ocean as much as anything on land. The ocean regulates our water cycle, and it provides more than 50% of the oxygen we breathe, so anything that destabilises the well-being of the ocean destabilises life on earth.

We cease to protect it at our peril. Death of large marine animals,

overfishing of the oceans and the captivity of large marine life are all close to my heart. However, I believe the greatest destabilising effect is climate change which is affecting ocean temperatures, sea life, water cycles and the oxygen in the ocean.

ARE YOU A GOAL SETTER?

I think I’m more visionary than goal setter, and I’d probably do better to set more goals. But the vision for this year is to continue to keep growing the foundation, to restart our ocean experience trips, and then to see our exploration business grow and for more people have access to sustainable equipment.

In terms of goals, the Senegalese poet, Baba Dioum, said “you protect what you love”, and I truly still believe that. That’s why my goal is to have everybody fall in love with the ocean.

IF YOU COULD MAKE ONE WORLDWIDE LAW, WHAT WOULD IT BE?

One worldwide law… for everywhere around the world to stop extracting any

Vital Statistics...

JOB TITLE

Freediver and Ocean Entrepreneur

BORN/ LIVE/ FAMILY

I was born outside of Johannesburg. I live in Kalk Bay, Cape Town with my husband, Peter and our two small children.

FAVOURITE DIVE SPOT

The Cape Town Kelp Forests

WHAT QUOTE DO YOU LIVE BY?

“In the end we will conserve only what we love; we will love only what we understand; and we will understand only what we are taught.” Baba Dioum

WHICH FAMOUS PERSON MOST INSPIRES YOU?

It’s slightly clichéd but am I am a huge fan of our late Nelson Mandela.

FAVOURITE BOOK

Susan Casey’s Voices in the Ocean

FAVOURITE APP

Spotify

WHAT THREE WORDS BEST DESCRIBE YOU?

Creative, Passionate, Adventurous

life from the ocean. Just like that, drop it, pull up the nets, just stop harvesting the ocean in every single way. That would be a fun law.

WHAT ONE CHANGE COULD WE ALL MAKE THAT WOULD HAVE THE BIGGEST IMPACT?

I think that the one change needs to be a mindset shift. I don’t believe making one change such as: I’m not going to use plastic or I’m only going to eat sustainably caught fish or behave responsibly when it comes to carbon emissions etc, is enough. All of those things are good but it’s the mindset that will permeate all of those actions and make a difference. So, if we could all do one thing, it’s to wake up in the morning and remember that we’re a living animal on a living planet, and every single one of our decisions and actions matter. That would be the one thing.

CAN YOU SHARE YOUR MOST MEMORABLE EXPERIENCE? CONVERSELY MOST FRIGHTENING EXPERIENCE.

I’ve been so lucky to have incredible experiences, from freediving with super pods of sperm whales in Sri Lanka, where they’re clicking and talking all around you, to swimming side by side with an enormous tiger shark and understanding that intelligence and your position within their ecosystem.

However, I had an experience recently that was deeply touching. I was seven months pregnant with our little girl, we had travelled up to Mozambique and I had the opportunity to dive with the bottlenose dolphins that I have been swimming with for over 15 years. This resident pod and I know each other very well.

The way dolphins work in the wild is that they have an immense respect for the pregnant female - it’s a matriarchal society. And I don’t know if you’re aware, but dolphins through their echolocation can scan and see through not only water, but through physical objects in the water. It’s how they hunt fish in the sand using their sonar.

And so, as I was getting off the boat these dolphins surrounded me, initially clicking and scanning because they’re saying hello, but then I noticed how their behaviour changed. They started circling closer and they were clicking and scanning and looking at my belly and the baby inside. Scientists believe that through their interaction they’re communicating to the baby, as they do with their own species.

The dolphins came in very close in a protective kind of way, to shield me and the little human I was carrying inside of me. It was one of the most phenomenal and memorable experiences I’ve ever encountered –being very pregnant, surrounded by these highly intelligent animals, aware of the emotional connection we share with them.

In terms of frightening experiences, with my level of experience and risk management, by the time I’m in the water and feel uncomfortable, it’s probably too late.

Honestly, it’s a bizarre thing to share, but the only time I’ve really felt scared and, in a situation where I was unsure if I’d make it, was because of a creature that doesn’t even have a backbone! I was stung by a blue bottle jellyfish in Mozambique, and I’d built up a sensitivity that caused a weird reaction - all my glands got really swollen. We were on a boat in the middle of the ocean, and I felt very vulnerable and terrified. So, when people ask me what the most dangerous creature in the ocean is, well, for me it’s a jellyfish.

Even though I have a vast amount of ocean experience, I have a huge respect for the water, and I manage risk accordingly.

WHAT IS NEXT?

Cape Town, because when people think of Cape Town they think of the mountain, of the wine and great food and the cultural experience; and then the ocean is sort of there for the backdrop of photographs. I think that is such a shame because it really is for me some of the best diving in the world. So, we’re looking forward to hosting diving trips here, where you can have the mountain and the food and everything else, but the focus is on the ocean.

We will also be arranging a surfing/ diving/ teaching trip to Baja California in Mexico at the end of the year. The marine reserves have the most amazing

every single one of our decisions and actions matter

biodiversity - we just we love it there. It’s also a great place for families, which is good as things have changed slightly since our last visit…we’re now a merry travelling band of four!

WHAT DOES LEGACY MEAN TO YOU?

Legacy, for me, has to be doing something that’s greater than ourselves and leaving it better, whatever that looks like. You know, in raising our children, nobody’s perfect but we try to do things slightly better than our parents did. Similarly in building businesses and organisations we should work towards doing the same. So, it’s a big goal, but I think legacy is all about leaving things a little bit better than we found them.

If you would like to find out more about Hanli and the I AM WATER foundation, book a life changing trip or make a donation to support the fantastic work the team are doing, please click here

Planning for & Managing your DiGitaL legacY

In the digital age, our online presence has become an integral part of our lives. As such, planning for your digital legacy can be as important as organising your physical estate. A digital legacy encompasses all your online accounts, digital assets, and electronic data. Here are some considerations to ensure your digital legacy is managed according to your wishes:

1. Inventory of Digital Assets

Begin by creating a comprehensive list of your digital assets. This may include:

• Email accounts

• Social media profiles

• Banking and financial accounts

• Subscriptions and memberships

• Digital photos and videos

• Cryptocurrency holdings

• Online businesses or blogs

Document the login details, passwords, and any necessary security questions for these accounts. Keep this list updated and share it with someone you trust, your Digital Executor.

Our digital ‘Notes on Life’ planner is an ideal place to start this list. Download your copy here. Always remember to password protect your document or store it somewhere secure.

STEP, a professional body Alistair is a member of, has put together a digital legacy scorecard. This resource rates cloud service providers on their legacy provisions and offers links to more information, specific to that provider. To access this scorecard, click here.

2. Appoint a Digital Executor

Designate a trusted person to act as your digital executor. This person will be responsible for managing and closing your digital accounts in line with your instructions. You will need to ensure they have access to your inventory of digital assets and any other necessary information.

3. Legal Considerations

Speak with your solicitor to include your digital assets in your will. This ensures that your wishes are legally binding and provides clear instructions for your digital executor. Take note of the Terms of Service for various platforms, as some accounts may not be transferable after death.

4. Access and Security

Store your digital asset inventory in a secure yet accessible manner. Consider using a password manager, we use SecureSafe, that allows you to grant access to your digital executor upon your death. Ensure that the storage method is protected against unauthorised access.

5. Social Media and Email Accounts

Decide what should happen to your social media and email accounts. Most platforms offer options for memorialisation, deletion, or transfer of control. Specify your preferences for each account to avoid any misunderstandings.

6. Financial Accounts and Cryptocurrencies

Ensure that your financial accounts, including online banking and investment accounts, are accounted for in your estate planning. For cryptocurrencies, make sure to provide detailed instructions on accessing your digital wallet, as losing this information can result in the loss of your assets.

7. Digital Assets with Emotional Value

Think about what you would like to happen to your digital photos, videos, and other personal files. You might want these shared with family and friends or archived for future generations. Provide clear instructions on where these files are stored and how they should be accessed and used.

8. Online Subscriptions and Memberships

List all your online subscriptions and memberships. Indicate whether these should be cancelled or transferred. This can prevent unnecessary charges and simplify the process for your heirs.

In conclusion, planning your digital legacy is important in today’s interconnected world. By taking these steps, you can rest assured that your digital life will be handled with care and according to your wishes after your death. This not only helps protect your digital assets but also provides peace of mind for your loved ones during a difficult time.

Round up

What the carrington team have been up to this year

It has been another bumper year at Carrington. Over the past twelve months, we have grown the team by welcoming some new faces, we have celebrated office milestones, and we witnessed an impressive number of bucket list achievements and goals reached.

Milestones

This year, we celebrated Oly and Georgie’s first anniversary at Carrington, while Marissa completed five-year’s and is now planning a bucket list trip to Japan and South Korea for her milestone sabbatical. A special shoutout goes to Carolyn, Nicola and Mo who completed 17, 14 and 13 years respectively. There were no trips planned, just a few extra grey hairs. It’s also been a year of big birthdays, including a few thirtieths and a fortieth. Thanks to all the cake, it’s possible a few extra (mile)stones were added to the team waistlines too!

Welcome to the Team

In June and July, we welcomed Charlie di Lorenzo and Lucas Fildes. Lucas has joined Mo and the investment team as an analyst, whilst Charlie has joined Stephen’s client relationship team. Both have slotted right into Carrington and are valued additions to the team.

Professional Goals

We’ve been a studious group to say the least, adding to quite a substantial list of qualifications! Here is the roundup...

Oly passed the Financial Planning Process exam in April and is currently

completing coursework for Retirement Income Planning, which will take him one step closer to becoming a Chartered Financial Planner. Georgie too is only a few exams away from becoming Chartered. Having successfully completed the Investment Planning and Discretionary Investment Management exams; she now has the Financial Planning Process exam in her sights. Lucas, having just got his feet under the desk, passed his Investment Principals and Risk exam which is part of his Diploma qualification. While Charlie is sitting the Financial Services, Regulations and Ethics exam this month, the first of his Diploma qualification journey.

Also, this year Marissa will be completing her Diploma in Office Management. We wish everyone taking exams or advancing their knowledge, the best of luck.

Lastly, Stephen, our Head of the Client Relationship Team, has been appointed Carrington’s Compliance Officer. This was a goal of Stephen’s since joining the team, so we are very happy he has achieved this.

Awards

We are thrilled to announce that we have been named one of the Financial Times’ Top 100 Financial Adviser firms. This award is unique, as firms cannot nominate themselves; instead, winners are selected based on their performance across various factors. The ranking is determined through a scoring system that uses data from a leading analytics and insights provider. We are honoured to be included in the 2024 list!

Industry News

In May, Mo was invited to join a roundtable discussion hosted by Citywire in partnership with Orbis Investments to discuss multi-asset portfolios for the future.

They discussed opportunities in the inflationary environment and touched on AI and the recent performance of tech stocks.

"Your story is the greatest legacy that you will leave to your friends. It’s the longest-lasting legacy you will leave to your heirs.”

Benjamin Franklin

He was also invited back to judge the Fund Manager of the Year Awards for a sixth consecutive year. This year Mo was responsible for judging the: UK All Companies, UK Smaller Companies, UK Equity Income, India, China and Asia ex-Japan” categories. It seems he’s made quite the name for himself in the industry!

Bucket Lists and Goals

This year, alongside achieving professional goals, many team members also checked off personal bucket

list items and goals. Firstly, Rachel, a devoted “Swifty” was thrilled to secure Taylor Swift concert tickets. In the weeks leading up to the show, she treated us by enthusiastically singing Taylor’s greatest hits in the office! She is also halfway to achieving her goal of attending all four tennis Grand Slams – she’s now saving for the Australian Open and the US Open. Meanwhile, Alistair embarked on a fantastic sailing trip this summer. Skippered by Captain Rob Sterry, Al and the deckhands set sail around the warm Mediterranean waters, from Antibes to Portofino and back. Sadly, there were no whales spotted this time! Shortly after, Alistair swapped the sea for the mountains as he embarked on a final bike ride across the Alps from Annecy to the French Riviera. He put together a full race report upon his return, which can be found on our website.

Mike has been working on his handicap and competed in the wellknown Cyril Gray and Halford Hewitt tournaments this year.

Mo and his family embarked on their annual road trip across Europe. This year journeying to the South of France, through Italy, Switzerland, and Germany, covering

an impressive 3,200 miles—which is actually one of their shorter trips! While staying in Menton, France, Mo took an early morning stroll up a nearby mountain. On the summit he found himself alone and under the very close scrutiny of French soldiers on the Italian/ French border. Needless to say, he hotfooted it back down the mountain to breakfast!

Stephen has been making a positive impact on the environment by embracing his green thumb, planting a personal record of 36 pots and baskets on his balcony garden this summer!

Georgie is eagerly anticipating her trip to Japan in November, which has been on her bucket list for some time. She is especially looking forward to visiting during the Maple Season to witness the vibrant autumn colours.

Carolyn’s goal is a little longer-term as she gets a step closer to buying a holiday home in Spain. An exciting venture she can hardly wait to enjoyrelaxing poolside with a much-loved Aperol spritz in hand! We hope we get an invite but, in the meantime, we are looking forward to vicariously experiencing Ali and Cecily’s long overdue sabbatical as they head off

on a South American adventure later in the year. Lastly, a long-standing bucket list ambition, Nicola has signed up to the Cape Town Cycle Race early next year. Maybe not the toughest, but it’s certainly got to be one of the most beautiful races in the world, she can’t wait!

Health

We often share the various physical challenges we undertake each year. Hitting our fitness goals and staying active is important, and we enjoy supporting each other when taking on these challenges.

This year Oly and Ali took on the adidas Manchester Marathon. They both spent many a lunch break training for the race and it paid off. Oly ran a sub-4-hour marathon and

Ali finished in 03:35:00. Great job guys, London next?!

Recently, two teams of Carrington’s finest athletes competed in Fortem’s annual charity darts competition. Last year the Carrington teams took home the first-place prize and the wooden spoon, making us the 3-year wooden spoon holders…quite the achievement! This year they worked hard to retain their titles, but we were not so lucky!

The Citywire Charity run took place in July. Ali, Oly and Lucas represented Carrington this year. The competition talk in the office was stiff and bets were placed…on the day it looked like Lucas was going to take the (team) win, however, lurking just behind him, Ali sprinted past him in the last few meters to take the victory. It’s a good thing we do this all for charity!

Community

We were invited to participate in the

Ecologi Zero beta group, placing us among the first firms to trial their new carbon footprinting tool. After conducting a detailed analysis of our 2023 expenditure, we successfully offset our CO2 emissions through a renewable wind energy project in Brazil.

In September, we renewed our commitment to the Women in Finance Charter. Having first signed the pledge in 2018, we remain dedicated to promoting women in senior positions and across the financial services industry.

This coming year is sure to be as busy as the last. For all our news, market insights and updates head over to the blog on our website.

Book review

by Nicola Craxton

“Stop telling yourself you’re not qualified, good enough or worthy. Growth happens when you start doing the things you’re not qualified to do.”

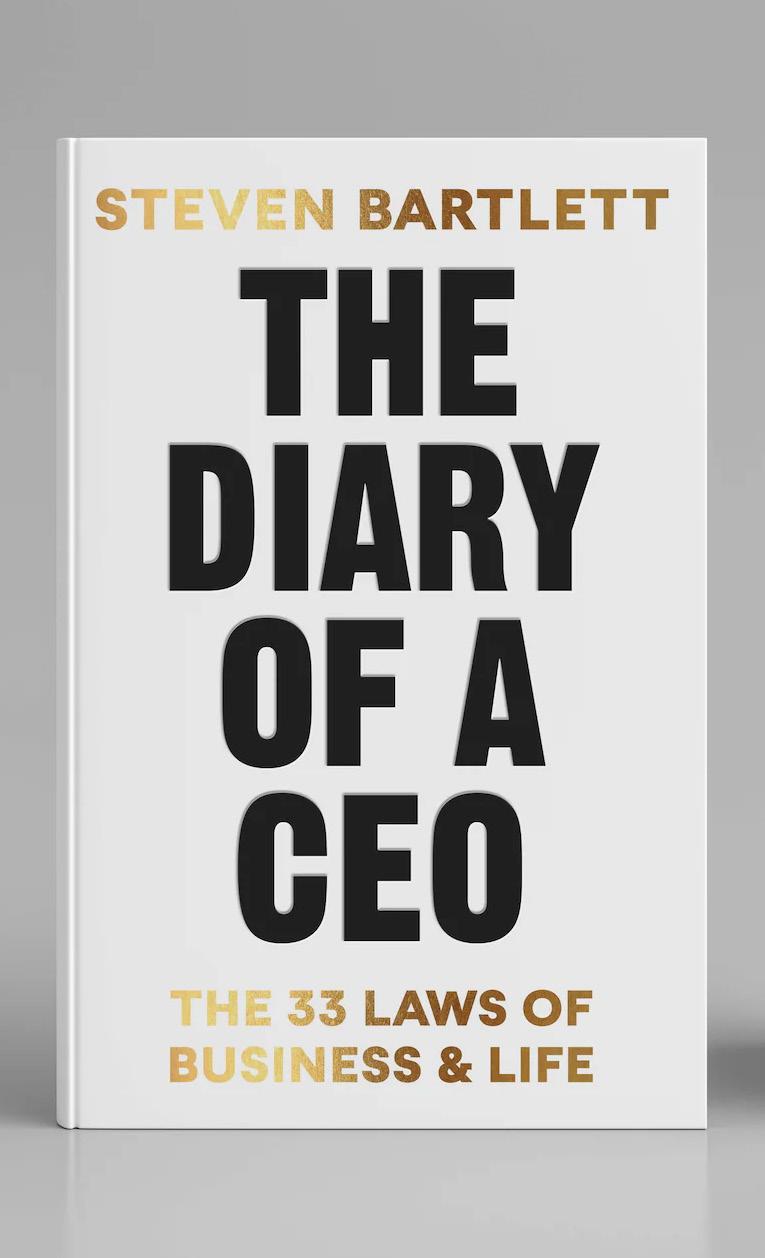

The Diary of a CEO: The 33 Laws of Business & Life

by Steven Bartlett

I must confess that I arrived a bit late to the Steven Bartlett party. I was completely unaware of his podcast or previous business triumphs, however, I found myself, the reader, introduced to his entrepreneurial prowess, podcasting mastery, and role as a luminary on Dragon’s Den right from the opening pages. I have to admit his personal horn blowing left me feeling rather cold. Despite this, I found myself thoroughly enjoying the rest of the book.

Bartlett’s writing style is refreshingly straightforward and impactful, devoid of unnecessary fluff and superfluous waffle. Seamlessly combining cutting-edge research, personal anecdotes, and captivating narratives he guides the reader towards redefining success and unlocking their full potential.

Emphasising that his book transcends mere business strategy, Bartlett delves into timeless principles - fundamental laws that endure beyond transient trends. It caters not only to entrepreneurs but to anyone on a quest for personal growth.