2024

2024

Spudsy offers sweet potato puffs as a guilt-free, crunchy, and tasty snack. By upcycling sweet potatoes, Spudsy transforms unwanted waste into high-quality products with environmental value. These snacks are also gluten-free, vegan, kosher, and plant-based, aligning with their goal of providing a healthy and delicious snack option (Spudsy).

Spudsy operates in the niche market of upcycled snack foods. They have raised $3,300,000 from three main investors. The primary investor is KarpReilly, a private investment firm in Greenwich, Connecticut, focusing on small to midsize growth companies. Spudsy is also supported by Pepsico Greenhouse Collaborative Accelerator, which invests in sustainable startups in the food and beverage sector. The third investor is Stage 1 Fund, a venture capital firm in Anaheim, California, that invests in food & beverage, beauty & wellness, apparel, and retail services sectors (Pitchbook).

Ashley Rogers founded Spudsy in Southern California in 2018, transforming an idea into a brand that has saved approximately 1,500,000 “ugly” sweet potatoes. Rogers, with nearly a decade of experience in the CPG space, has founded three companies. In 2013, she launched Buff Bake, a line of nut butters and cookies. After successfully growing and scaling Buff Bake over four years, she sold the company and started Spudsy. Rogers wanted to entrepreneur a brand that didn’t compromise on sustainability, nutrition or taste (Voyage LA).

Spudsy is a snack company that upcycles sweet potatoes to create their crunchy midday snack.

As vegan, gluten-free, kosher, and non-GMO snacks, Spudsy caters to healthconscious consumers who seek clean and nutritious snack options.

By aligning its product offering with environmental values, Spudsy strengthens its brand appeal and captures a dedicated market segment committed to supporting sustainable practices.

Spudsy Sweet Potato Puffs are the brand’s original line of sweet and savory puffed snacks. Spudsy puffs bring classic flavors to your diet with flavors like Vegan Cheese and Cinnamon Churro. The snacks are gluten-free, non-GMO, vegan, plant-based and allergen friendly.

Spudsy is on a mission to #SaveTheSpud and upcycle imperfect sweet potatoes into yummy snacks — saving approximately 150,000 ugly spuds with every truckload of finished product. Spudsy aims to create a snack that tastes good while helping reduce food waste.

Spudsy Sweet Potato Puffs are made of healthy, upcycled ingredients. These ingredients include a blend of rice flour, pea protein, sweet potato flour, tapioca starch, sunflower oil, vegan cheddar seasoning, tapioca syrup solids, salt, rice flour, natural flavoring, lactic acid, and extracts of paprika.

Spudsy Sweet Potato Puffs are available in various packages. On Spudsy’s website, a 6-pack costs $19.99, a 12-pack costs $39.99, and a 24-pack costs $35.99. On Amazon, a single four-ounce bag costs $3.99, while on Sprout’s website, the same bag is priced at $4.99.

Spudsy products are distributed in more than 10,000 doors across the nation, in retailers including Whole Foods Market, Sprouts, Natural Grocers, Wegmans, CVS, select Kroger stores and more as well as on Amazon and Spudsy.com.

Spudsy Sweet Potato Puffs are crafted from healthy, upcycled sweet potatoes, making them both nutritious and eco-friendly. Their sustainable ingredient sourcing benefits the environment, and they are conveniently available for purchase online and in stores.

Eco-friendly and conscious of the environment

Baked, not fried

Vegan/plant-based/gluten-free/non-GMO

Available in stores and online

Contains protein

All natural flavors

Supports sustainability by reducing food waste, allowing consumers to make environmentally responsible choices while enjoying their snack. In a world of excess and hyper production, customers can feel part of the solution, not part of the problem.

Baking instead of frying results in lower fat content, making it a healthier choice. This feature appeals to customers mindful of their calorie intake or those seeking healthier alternatives to traditional fried snacks.

Caters to a wide range of dietary preferences and restrictions, offering a safe and inclusive snack option for health-conscious consumers who prioritize natural, wholesome ingredients in their diet.

Provides convenience and flexibility, allowing consumers to purchase the product through their preferred shopping method, whether they prefer the immediacy of in-store purchases or the ease of online ordering.

Keeps consumers feeling fuller for longer, and contributes to a balanced diet, especially for those looking to snack with sustenance.

Provides a healthier and safer snacking option, free from artificial additives and chemicals, which appeals to consumers who prioritize natural ingredients and seek to avoid artificial substances in their diet. Product Feature

Spudsy’s upcycled sweet potato puffs cater to a diverse range of dietary needs and preferences by being vegan, plant-based, gluten-free, and non-GMO, while also containing protein to support muscle maintenance and satisfaction. The use of all-natural flavors enhances their appeal to health-conscious consumers avoiding artificial additives. Spudsy’s commitment to sustainability through upcycling sweet potatoes resonates with environmentally conscious consumers, making it an ideal choice for those who prioritize both nutrition and environmental responsibility in their snacking options.

The global potato snack market is estimated to reach US $93.11 billion in 2024 and is projected to expand at a CAGR of 3% to climb to a value of US $126.12 billion by 2034. The market is expanding steadily due to growing consumer demand for packaged and convenient snack products across the world (Fact.MR).

The market is witnessing a surge in premium and gourmet offerings, catering to consumers seeking sustainability and clean label initiatives. Environmentally conscious consumers prioritize eco-friendly packaging and clean ingredient lists.

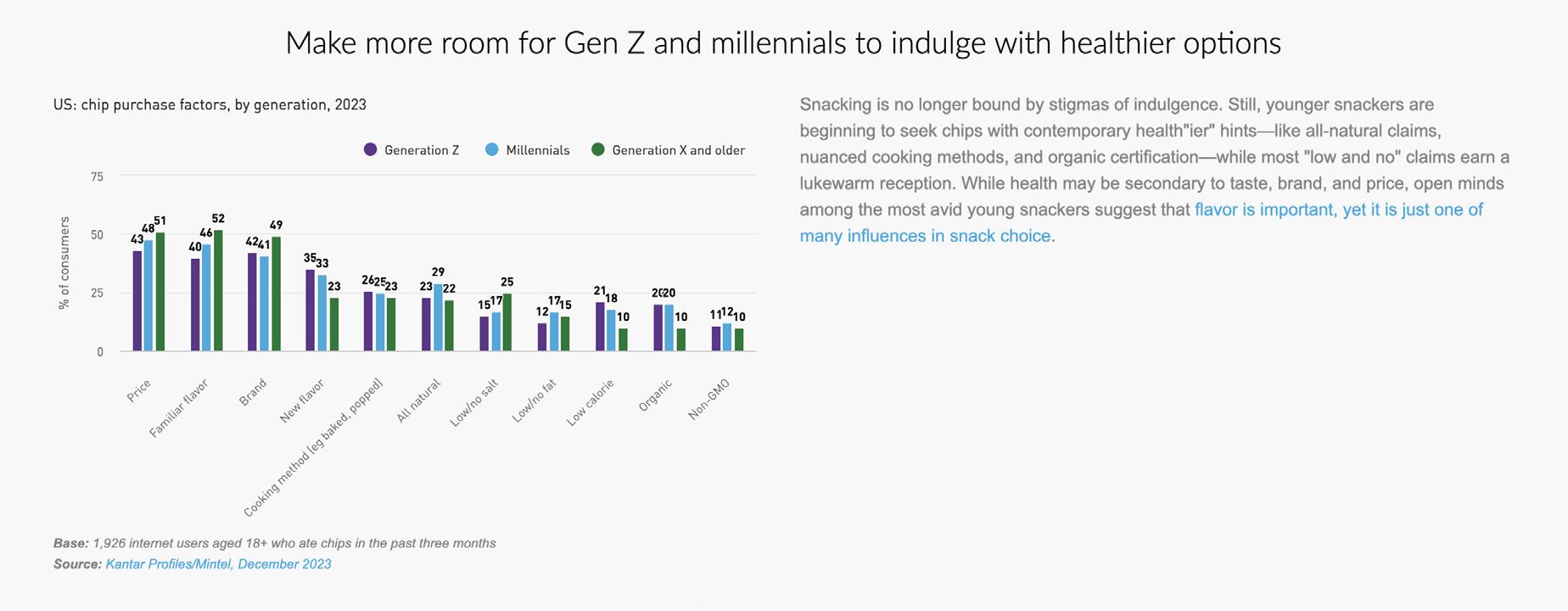

Brands of all sizes should stay on the offensive: 44% of category participants have switched brands because of cost, demonstrating the resilience of the category, yet the potential vulnerability of its players (Mintel).

While Pepsico Inc. continues to own more than half of the market with powerhouse FritoLay brands like Lays and Ruffles, private label potato chips went on the offensive in 2023 (Mintel).

In 2023, convenience stores saw a big increase in snack sales, growing faster than supermarkets and other mass retail channels. While more than 4 in 10 agree that chips are part of the shopping routine, growth in convenience stores reinforces the idea that many buy snacks on impulse (Mintel).

While flavor remains crucial for driving chip consumption, addressing the evolving role of snacks in balanced nutrition is essential. Brands should focus on incorporating healthier options, such as better oils or vegetable bases, to meet the growing demand for snacks that fit into a broader range of dietary needs and occasions.

Brands must effectively message and position themselves towards consumers, as brand loyalty is faltering now more than ever in the potato snack space.

While potato snack shopping is part of almost half of snackers’ shopping routine, brands should meet snackers where they are and when needs arise, with single-portion, portable, flavorful, and craveable options that can transition from impulse purchase to the shopping list.

What do we know about consumer trends in general?

Americans are beginning to spend again, with some 51 percent of consumers reporting a desire to splurge and indulge themselves in a fit of post-pandemic revenge spending.

The pandemic ushered in an unprecedented level of channel switching and brand loyalty disruption. Fully 39 percent of them, mainly Gen Z and millennials, deserted trusted brands for new ones.

Consumers likely would choose more environmentally friendly options if they were available. At the moment, however, sustainable products are hard to find and generally more expensive.

What do we know about consumer trends related to Spudsy?

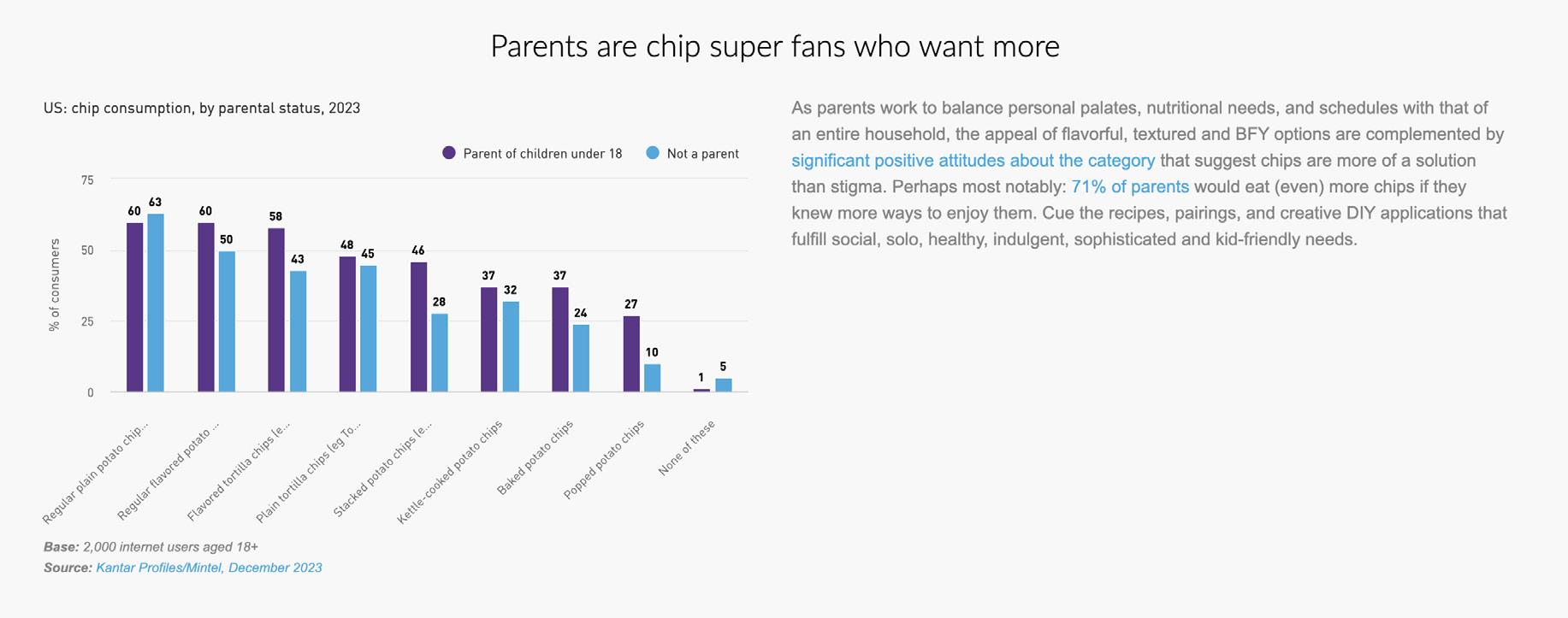

Parents are a prime target for flavor innovation. 44% of parents regularly experiment with new chip flavors, highlighting the need for snacks that provide a distinct and engaging experience in a familiar, kid-friendly format (Mintel).

Consumers are seeking snacks for functional purposes such as increasing energy, serving as meal replacements, and providing more nutrient-dense options. Americans are searching for the healthiest mid-day snack to fill them up until dinner time.

Over 30% of snackers aged 18-34 report snacking on healthy foods this year. They prioritize positive nutrient claims such as high protein, added nutrients, clean labels, and organic options more than older snackers.

Flavor is still a necessity when people report choosing their designated snack. Even as snacking grows more functional, snackers still want to enjoy their snacks. Flavor is by far the most important selection driver for snacks.

Adults aged 55+, are more likely than younger snackers to view snacks primarily as a treat or indulgence (see Snacking Motivations), and are substantially less likely to agree that it’s healthier to snack throughout the day than to eat three regular meals.

Snacking is no longer just a convenient solution to hunger. It is also a way to fulfill our emotional needs throughout the day. Mintel’s research shows that seven out of 10 US consumers snack to relax. For Millennials, the emotional appeal is even stronger, with two in five snacking to relieve stress and boredom.

With a significant focus on health, snacks that offer high protein, added nutrients, clean labels, and organic options are increasingly favored, particularly by those aged 18-34. However, flavor remains the most crucial factor in snack selection, highlighting the importance of taste in consumer preferences. Opportunity will be found in a product that does not sacrifice taste for nutrition.

Snacking serves as an emotional comfort, with many using it to relax and alleviate stress or boredom. By understanding the emotional reasons why people snack, brands and retailers can create snacks and snacking experiences that are more meaningful and relevant to consumers.

Uglies is a direct competitor to Spudsy Sweet Potato Puffs, with a similar focus on upcycling. Similar to Spudsy, Uglies leans into the “imperfect” quality of the upcycled snack through brand messaging. The company uses “the ugly truth” to relay fast facts about food waste and how their product helps to curb it. Slightly less expensive than Spudsy products, Uglies can be purchased on Dieffenbachs.com, Amazon, local grocery stores, and Faire.com. They are primarily sold in bulk packages: a four-pack of six-ounce bags costs $24.99, a 12-pack of two-ounce bags costs $24.99, and a 24-pack of two-ounce bags is priced at $45.99. Uglies offers seven flavors, including Sea Salt, BBQ, Salt & Vinegar, Jalapeno, Cheddar & Sour Cream, and Sweet Potato.

Similar to Spudsy, which uses discarded potatoes, Pulp Pantry creates snacks from organic vegetable “scraps.” Founded by Kaitlin Mogentale, Pulp Pantry offers a line of veggie chips made from organic upcycled ingredients, including fiber leftover from juiced vegetables. Recently, they introduced “Trashy,” a new line of chips available for preorder and expected in August 2024. Trashy comes in flavors such as Jalapeno Lime, Spicy Barbecue, Salt n Vinegar, and Sea Salt. A 16-pack costs $31.99, and a 32-pack is priced at $49.99. The brand also offers merchandise with preorders, and can be purchased from its own website. Trashy is a newer line than Spudsy, and does not have the advantage of being sold in groceries.

RIND stands out in the upcycled snack market as a fierce competitor due to its diverse selection of snacks. It has a wider variety of upcycled snack options than Spudsy, including gummy snacks, trail mix, chips and crisps, and granola all with multiple flavor choices. The mission is similar, as it is to help consumers snack better and do better by eating the whole fruit, which maximizes nutritional value and minimizes food waste. Their products are packed with more vitamins, antioxidants, and fiber, while also being zero waste. RIND’s apple crisps are priced at $6.33 for one bag, $37.99 for six bags, $68.40 for twelve bags, and $96.90 for eighteen bags, catering to different purchasing preferences. They are available through many leading retailers such as Whole Foods, Kroger, Target, Thrive Market, CVS, gopuff, Walmart, and more.

Popchips indirectly competes with Spudsy by catering to the same health-conscious consumer base but offering different types of products without the upcycled element. Popchips are popped, not fried, providing a low-fat, crunchy snack available in flavors like Sea Salt, BBQ, and Sour Cream & Onion. They are known for their light, crispy texture and are well-received as a healthier alternative to traditional potato chips, costing around $3 - $4 per bag. Both Popchips and Spudsy appeal to similar consumer demographics, including young professionals, families, and health-conscious individuals who prioritize better-for-you snack options. Both brands are positioned at a premium price point compared to traditional snacks, targeting consumers willing to pay more for healthier, high-quality products.

LesserEvil offers a variety of snacks such as popcorn, paleo puffs, and grain-free options made with organic, non-GMO ingredients, though not upcycled. The brand takes away from Spudsy sales, as both brands emphasize clean, simple ingredients without artificial additives and position themselves as premium snack brands, appealing to consumers willing to pay more for higher quality products. Available in similar retail channels, including health food stores, grocery stores, and online retailers, they compete for the same shelf space and consumer attention.

Hippeas offers organic chickpea puffs that are vegan, gluten-free, and packed with protein and fiber, appealing to the same demographic that values Spudsy’s plant-based and gluten-free sweet potato puffs. Available in flavors such as Vegan White Cheddar, Sriracha Sunshine, and Bohemian Barbecue, Hippeas provides a variety of tasty options that compete for the same taste-conscious market, targeting consumers willing to pay more for healthier snacks. Additionally, both brands have similar website designs that emphasize vibrant, eye-catching visuals and a playful, engaging approach to branding and marketing, highlighting their shared strategy in appealing to the same consumer base.

The competition by both direct and indirect sources make it clear that Spudsy won’t be able to separate their products by just promoting eco-friendly initiatives, as all three main competitors do the same. It will also be difficult to face indirect competition based on factors such as price, variety and establishment. These products either offer similar snacks as Spudsy at a better price, offered in wider variety, or are better-known. All providing more obstacles for Spudsy to overcome.

Spudsy is perceived as a healthy alternative to traditional cheese puffs, appealing to healthconscious consumers and those with dietary restrictions. According to customer reviews on Amazon, Spudsy’s audience appreciates the taste, quality, and health benefits of the puffed snack. Customers often mention that Spudsy puffs taste remarkably similar to cheese puffs, offering a crunchy texture with a subtle sweet potato and cheddar flavor, making it an excellent dairy-free option. Despite some complaints about expiration dates and value, the product maintains a high average rating of 4.4 out of 5 stars on Amazon.

An Amazon review highlights Spudsy as “a great plant-based snack and is crazy addictive.” Additionally, a review by The Allergy Chef involved feedback from multiple kids, who praised the product for its crunchy texture and robust flavor, with one describing it as a “classy version” of a cheese puff. On SocialNature.com, Spudsy holds a rating of 4.5 out of 5 stars, further solidifying its positive brand image. This consistent positive feedback reflects Spudsy’s success in delivering a satisfying and health-conscious snacking experience.

One Amazon reviewer commented, “Unfortunately three of my four local Whole Foods have stopped carrying them, and I fear they will soon disappear from the last WF as well. Please don’t take them away, Amazon!” Spudsy should engage with Whole Foods to address product availability, enhance its distribution channels, and promote online purchasing options to ensure customers can consistently access their products

Spudsy’s sweet potato puffs are highly valued by consumers with celiac disease and lactose intolerance, indicating a strong market segment that appreciates the product’s allergen-free attributes.

Despite dietary restrictions, customers find Spudsy’s puffs delicious and comparable to popular snacks like Cheetos, suggesting that the product successfully combines health benefits with taste.

There is a concern about the product’s value for money, with some customers feeling that the portion size is insufficient for the price, especially when compared to similar snacks like Popchips. Pricing strategies might need to be reassessed, as the perceived high cost relative to portion size could deter repeat purchases despite the product’s positive reception.

References