Carolinas Telco Federal Credit Union (CTFCU) has been serving members across the Carolinas since 1934. We offer membership to those employed with or retired from one of our current Select Employer Groups (S.E.G). Additionally, members of the NC Consumers Council (NCCC) or other approved associations are eligible to join. Those who live, work, worship, or attend school in select areas of Mecklenburg County, NC; Wake County, NC; Gaston County, NC; Richland County, SC; and surrounding areas, deemed underserved for financial services by the National Credit Union Administration (NCUA.), can become CTFCU members. Immediate family, household members, friends, and co-workers of current CTFCU members can also qualify for credit union membership.

MISSION & VISION

CORE VALUES

LETTER FROM THE PRESIDENT & BOARD CHAIRMAN

COMMITMENT TO OUR MEMBERS

EXPANDING MEMBER BENEFITS

VALUED MEMBER RESPONSES

SUPPORTING OUR COMMUNITIES

CTFCU CHARITABLE IMPACT

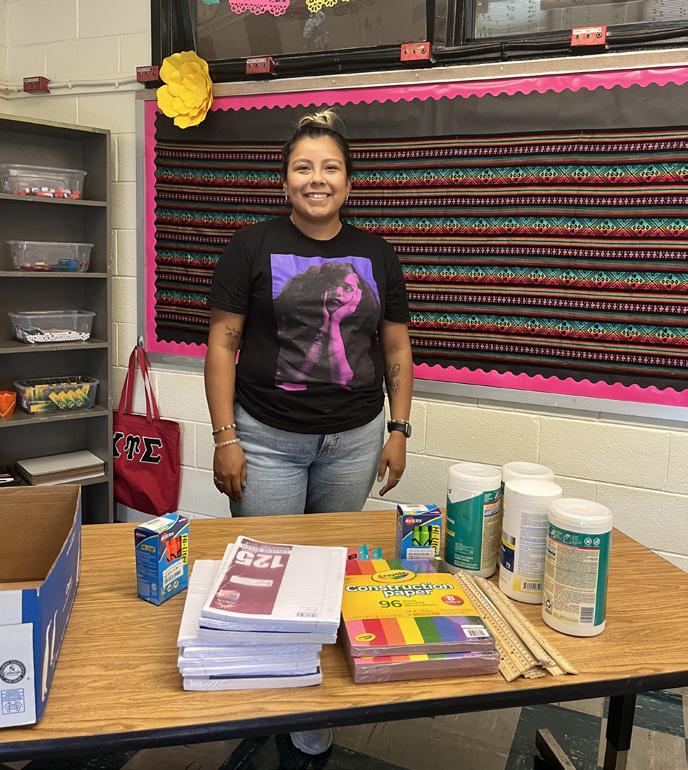

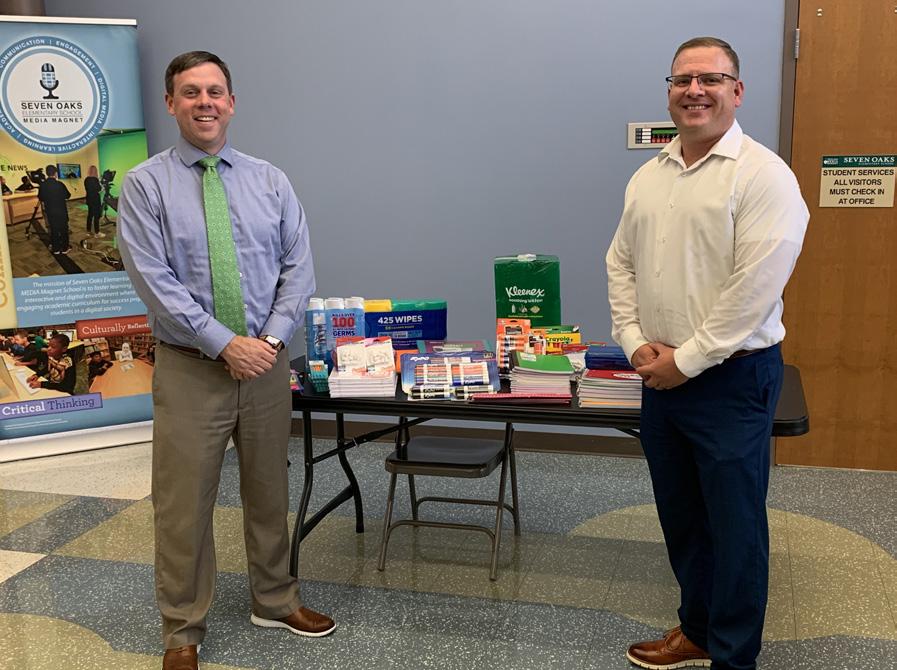

SCHOOL SUPPLY DRIVE

CTFCU LEGACY SCHOLARSHIP

BOARD OF DIRECTORS

SENIOR MANAGEMENT TEAM

SUPERVISORY COMMITTEE

TREASURER’S REPORT

FINANCIAL HIGHLIGHTS

Deliver valued solutions for all our members’ financial needs — whatever their stage in life.

We will be recognized for anticipating and delivering financial solutions that meet our members’ needs and promote their financial well-being now, and in the future.

MEMBER COMMITMENT: Focus on improving the financial lives of our members by offering best in class products through fast and efficient channels.

ACCOUNTABILITY: Hold ourselves as well as teammates accountable at the highest level. Feel empowered to reach out for assistance.

COLLABORATION: Leverage our collective intelligence and work together in the pursuit of extraordinary results.

INTEGRITY: Approach every situation in an honest, ethical and transparent manner.

RESPECT: Treat others as we would like to be treated.

Carolinas Telco Federal Credit Union (CTFCU) completed another successful year in 2022, showing impressive performance across the organization in several categories. Total Assets increased by approximately $39 million, reaching another record-setting level of approximately $599 million as of December 31, 2022. Thanks to the continued trust placed in us by you, our members, the credit union realized significant growth in several key areas. Net loans receivable increased by $73,922,246 million, member shares grew by $3,100,979, and our net worth ratio remained steady at 13.00%. The credit union realized one of our most productive years from a net income perspective earning $3,008,542 for the twelve months ending December 31, 2022. Best of all, approximately 2,600 individuals took the step to become CTFCU members, choosing us over other financial institutions, for this, we’re truly grateful.

Delivering on our mission to provide valued solutions for all our members’ financial needs was never more important than in 2022. We saw

Chris Dickman President/CEO

the effects of rising inflation taking a tremendous toll on our members’ financial health. Americans from all walks of life experienced increased costs for necessities, including housing, groceries, energy, and transportation. The Federal Reserve took aggressive steps to combat inflation by raising its benchmark interest rate several times throughout the year. Suddenly, the prices of nearly everything increased for all consumers, placing many in a precarious financial position. Our Board of Directors and Sr. Management Team took decisive action to assist our members in the wake of these developments. In response, we increased dividend rates on our deposit products, including regular savings, CDs, and Rewards checking. We created a new High Yield Savings account featuring higher tiered rates which in turn provides a more productive way to save while also having the flexibility to shift funds with no penalty. Even as the market dictated we charge higher loan rates, we took a measured approach, increasing our borrowing rates at a more modest pace than some of our peers.

Larry W. Davis Board Chairman

We thank our dedicated Board of Directors, management team, and employees for their tireless efforts. Most importantly, we continue this important work on behalf of our many members.

— Larry W. Davis

On top of putting money back into your pockets, our credit union introduced new programs that add more value than ever to your CTFCU membership. For the first time in our history, all credit union members can access their funds without a fee at over 30,000+ ATMs nationwide through our new partnership with the CO-OP Network. Whether you’re across town or traveling for work or pleasure, you’re never far from your money! Next, our relaunched Member Rewards loyalty program (previously called Relationship Rewards) benefits members who bring more of their banking business to CTFCU. All members are automatically enrolled and can earn loan discounts, CD bonuses, fee waivers, and much more.

Always with an eye on the future, we are working to create a credit union our members can be proud of. This includes significant investments in our employees and infrastructure to prepare for future expansion. CTFCU hired new employees in our branch network, member support, IT, and several other vital areas to support our current and future growth. In addition, we opened a back-office location in Charlotte, NC, to provide greater service capacity for our initiatives and new lines of business.

We have witnessed how the COVID-19 pandemic hastened the need for mobile-first innovation, and our team has answered the call. In addition to upgrading our internal IT capabilities, we were one of the first credit unions in our market to launch an artificial intelligence-powered bot, providing 24-7 service to our members. EVA, our Expert Virtual Assistant, can help our members find answers to product questions, navigate online banking, and even locate the nearest ATM. Our team remains committed to leveraging these new technologies to give you more value as a credit union member.

Credit Unions worldwide embrace the motto of “people helping people” to describe how we positively impact the communities we serve. In 2022, we delivered substantial and sustained positive community outcomes across our locations. As in years past, CTFCU supported college students with $1,500 per recipient through our CTFCU Legacy Scholarship. We sponsored individual classrooms and supported children throughout the Carolinas with our annual school supply drive. As further evidence of our commitment, 42 CTFCU employees donated 331 hours of service to 22 organizations in North and South Carolina. The credit union also gifted $66,230 to 23 charitable organizations, funding several deserving causes. These included supporting young people with disabilities, promoting educational opportunities for young women, and providing resources for children in foster care. Also, in December 2022, an employee-

We are working to create a credit union our members can be proud of. This includes significant investments in our employees and infrastructure to prepare for future expansion.

— Chris DickmanNorth Carolina, by Rebecca L Executive Support

led group collected 217 Christmas gifts for youths in several North Carolina Counties. This year, we are excited to expand our efforts for a greater social impact.

As we embark on CTFCU’s 89th year of operations, we are amazed and humbled by this organization’s progress. We thank our dedicated Board of Directors, management team, and employees for their tireless efforts. Most importantly, we continue this important work on behalf of our many members. Thank you for your continued support, and we are exceedingly grateful for your membership in this credit union.

Sincerely,

Chris Dickman- President and CEO Larry W. Davis- Board Chairman

Interdepartmental Training Session - Charlotte, NC

"Another Happy Member!" - Auto Buying Service

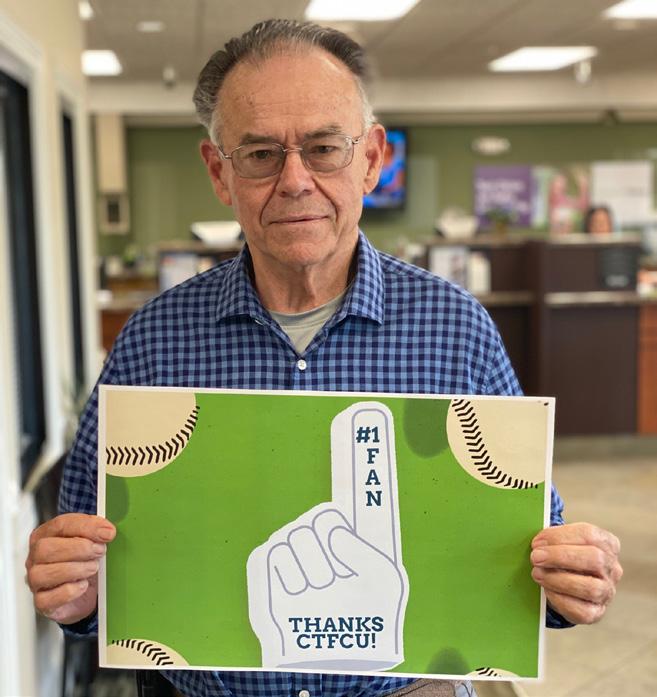

Military AppreciationBaseball Giveaway Winner

Super Bowl Senior Managment

"National Wear Red Day" for Heart Disease Awareness

In 2022, CTFCU served over 32,000 members. We had the opportunity this year to give back to our members through our Summer Swing Giveaway and Military Appreciation Baseball Giveaway. We came together as an organization to support causes we care about, by raising awareness for those who suffer from heart disease and breast cancer. On International Credit Union Day, we celebrated our members and spread the message of financial empowerment. These efforts help to fulfill our highest purpose, to be of service to our members and communities.

You spoke, and we listened! Now CTFCU members can access 30,000+ surcharge-free ATMs through the CO-OP network. No matter where you are, it's easy to locate an eligible machine! Use the simple locator on our website or log into online banking whenever you need to find a participating ATM.

Members are our MVPs, and we value your opinions on the service you receive from the credit union. In November 2022, we partnered with Member Loyalty Group (MLG) to help us collect our members' feedback through short email surveys.

Cius autatecus sequi di cum quisquo dipsae venisque prorrum rerit exerum nimodis eiuntot atistio. Nequis id mod qui officiam quatem est, sita ideribus sum lab inciis magnatis et utemod maio odi nobit veliate plab is est, inctiis poribea del inulpa doluptate voluptur? Quia vent aut ut omnis et quae odiaturestor maionsedita ipsunt, eaqui velest, omnim nihit et, optat ped ut aut veliquam iminum ea sinum culpa ipis moluptae. Um nam, accus, tem quatiorpora susam, tes doluptas illestibusci omnihitatum intur? Rem quatest es maio maio. Nem ant quate qui ius estion nonsequi voluptat.

Credit Union members can be randomly selected up to 4 times a year to participate, so be on the lookout for the survey invitation in your inbox. Providing your timely feedback helps us get to work immediately to improve your experience with us.

At Carolinas Telco Federal Credit Union, we're proud to offer our members access to FICO® Scores – the most widely used scores for determining creditworthiness.

We believe that knowledge is power, which is why we're providing FICO® Scores to our members. By reviewing your scores, you can better understand your credit profile and financial health. Accessing your score is easy – simply log into online banking, and it's right at your fingertips.

At Carolinas Telco Federal Credit Union, we're committed to helping our members achieve their financial goals. Offering access to FICO® Scores is another way we're empowering our members with better tools to build a stronger future.

Our new Expert Virtual Assistant. EVA is powered by artificial intelligence and is available to assist you any time of the day. She can answer product questions, help you navigate online banking, locate your closest ATM, and much more!

We are constantly striving to give our members the best service possible. EVA’s knowledge grows with every conversation, so you help her learn with every interaction.

To find EVA, click the "let's talk" button on the homepage.

With the launch of our new High Yield Savings account in late 2022, Carolinas Telco Federal Credit Union members can now take advantage of rising saving rates while still maintaining flexibility in accessing their funds.

With our High Yield Savings account, your savings will work hard, so you don’t have to! Our tiered interest rates allow you to earn more interest as your account balances grow. Unlike Certificates of Deposit (CDs), access your funds anytime, with no minimum time requirements. This easy-to-establish savings account can also operate as overdraft protection for your CTFCU checking account.

Are you making the most of your membership? The more you bank with us, the more perks you can earn. You could be eligible for free checks, fee waivers, loan discounts, and much more!

We received feedback through several communication channels, including social media, location reviews, and other messaging platforms. In 2022, we partnered with Medalia Group to launch our Member Vantage Program (MVP) survey system. Using the Net Promoter Score (NPS) framework, MVP will help us collect and take faster action on feedback, further improving our service delivery to benefit all CTFCU members.

Here are some of our favorite testimonials from 2022.

Extremely friendly staff at the Gastonia, NC, location. [They are] very knowledgeable about their products and services and make sure the members are in the most beneficial [products/services for their needs].

Cynthia W. | Gastonia Branch | ★★★★★

No improvement needed. I receive excellent service there, especially from Kim. They were especially helpful early this year when they helped me avoid being a victim of a big scam.

Randall S. | Crisman Branch | ★★★★★

Dondra and her team are the best. [They are] always friendly and go out of their way to help customers. There is no better place to do your banking, mortgage, auto loans, etc.

Carmen C. | Raleigh Branch | ★★★★★

I worked with Dustin and April for my new car loan, and they [were] absolutely amazing! It's no secret that it's a really tough time trying to buy a new car, and they were super patient with me while I searched for a new vehicle and then again waited for it to come in. Dustin was amazing in running a whole bunch of scenarios with me until we found just the right solution for me. I very highly recommend [them].

Danielle H. | Outlet Pointe Branch |Once again, the ladies at Carolinas Telco went above and beyond to make my loan/car-buying experience a quick and easy one! They were knowledgeable and available for me every step of the way.

Marta W. | Greenville Branch |

Cordelia made everything so easy on the refinance of my car loan. She kept me updated and reminded me of the items needed to expedite the loan. She is amazing!

William W. | Sharon Rd. Branch |

Jennifer is always warm and pleasant to work with. She shows genuine concern and passion for her customers and job. I always look forward to and love working with her for my banking needs.

NeeCole K. | Central Ave. Branch |

I have had a wonderful experience since I joined CAROLINAS TELCO. Everything and everyone [at the credit union] is wonderful, and I am happy to be a [member].

Rebecca L. | Crisman Branch |

My visit was especially time-sensitive and Kendrick was extremely knowledgeable and helpful. He delivered as promised a smooth and seamless experience. He is so personable while providing detail oriented excellent service. He reminded me the importance of adding my new vehicle to my insurance which he also assisted me with. My son who accompanied me and I truly enjoyed our visit. I look forward to visiting with Kendrick whenever I am at that branch in the future!

Patricia J. | Cornelius Branch |

[I] just opened an account here since my husband has been a member for several years. We received excellent customer service from Emily. She was knowledgeable, helpful, and extremely patient with our many requests. [I] took advantage of several services, including auto loan refinancing and personal accounts. Everything [was] simple and painless.

Sierra S. | Outlet Pointe Branch |

We pride ourselves on connecting with our community. This year we joined 23 organizations and provided over 300 hours of volunteer time company-wide. Some of the organizations we supported this year were Bright Blessings, First Gen Success, and Victory Junction. We came together to make a difference, and we look forward to the impact we can make together next year.

Holiday Toy Donation Drive

Lake Norman Chamber of Commerce Event

Lake Norman Chamber of Commerce Event

CTFCU Total Donations in 2022

$66,260

This year, we donated over 600 items to children across the Carolinas by partnering with organizations in the communities we serve. We also sponsored two classrooms to support local educators for the 2022-2023 school year.

We pride ourselves in giving back to our members and the communities we serve. Each year, starting October 1, credit union members can apply for our CTFCU Legacy Scholarship through our partnership with Carolinas Credit Union Foundation. We provide support to four degree-seeking members with scholarships of $1,500 each to cover tuition costs for the school year. Applicants not selected in the first round of consideration are automatically entered into the Carolinas Credit Union Foundation’s general scholarship application pool for various awards. Congratulations to the seven CTFCU members who received funds to continue their journey toward higher education!

Hometown: Greenville, SC

Hometown: Mooresville, NC

Layla

Spelman University

Hometown: Lancaster, SC

NC A&T State University

Hometown: Indian Land, SC

College of Charleston

Hometown: Charleston, SC

The Supervisory Committee is created by law and appointed by your Board of Directors to independently represent all members. We evaluate Carolinas Telco Federal Credit Union’s activities and operations to ensure soundness, compliance, and reliability and appraise internal controls’ adequacy. Our duties also include ensuring the performance of a comprehensive annual audit, administering Board of Directors elections, independently verifying member accounts, and objectively investigating formal complaints. Your Committee is currently composed of volunteers with career backgrounds in insurance, communications, and information technology.

Director A. Gentry III Committee Member Lugo Committee Member

Lugo Committee Member

To maintain these high standards and fulfill our financial and regulatory compliance responsibilities, we regularly meet to review all internal audit reports provided by the Credit Union’s internal auditors. To fulfill our audit responsibilities for 2022, we hired the accounting firm Doeren Mayhew, CPAs and Advisors, to conduct an independent, in-depth audit of Carolinas Telco Federal Credit Union’s operations and issue a report of their findings. We’re proud to announce their December 31, 2022, report showed the financial statements accurately represent the financial position of Carolinas Telco Federal Credit Union and conform with Generally Accepted Accounting Principles of the United States of America.

The National Credit Union Administration (NCUA), the regulatory agency for all federally chartered credit unions, performs periodic supervisory examinations. As of June 30, 2022, their last examination results confirmed that Carolinas Telco Federal Credit Union continues to be financially sound.

Carolinas Telco FCU experienced another year of positive results even though operating expenses remained elevated due to infrastructure investments and other costs. Net income from continuing operations totaled approximately $3.01 million. Other operating highlights include an increase in members shares of $3,100,979. Total memberships increased by approximately 3.39% when compared with the previous year. The credit union finished 2022 with 32,843 members.

$77,917,472

$3,008,542

2022 Net Income

$3,100,979

2022 Growth in Member Shares

13.00%

2022 Net Worth Ratio

Below are 2022’s financial highlights, when compared with 2021. These figures were obtained from financial statements, audited by the Doeren Mayhew firm.

CONDENSED STATEMENTS OF REVENUES, EXPENSES, AND DIVIDENDS

* For the year ended. // Above is certain information concerning the financial position and results of operations of Carolinas Telco FCU, as of the dates indicated. This data is derived from, and should be read in conjunction with, the audited financial statements of Carolinas Telco FCU.

CONDENSED STATEMENTS OF FINANCIAL CONDITION

WE THANK OUR TEAM MEMBERS FOR SUBMITTING THEIR PHOTOS FEATURING THE NATURAL BEAUTY OF THE CAROLINAS WE CALL HOME.