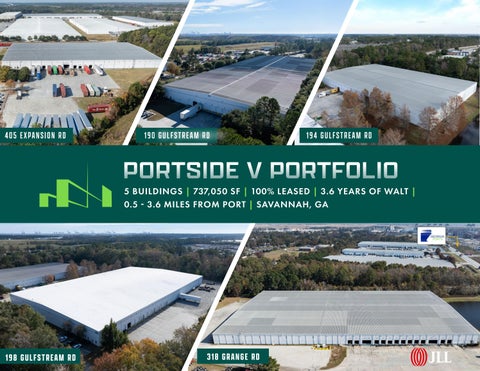

5 BUILDINGS | 737,050 SF | 100% LEASED | 3.6 YEARS OF WALT | 0.5 - 3.6 MILES FROM PORT | SAVANNAH, GA

On behalf of the ownership, Jones Lang LaSalle America, Inc. (“JLL”) has been exclusively retained as the sales representative for Portside V Portfolio (the "Portfolio"). Totaling 737,050 SF, The Portfolio is comprised of five (5) buildings in irreplaceable infill locations that are positioned an average of 2.2 miles, or around a 5 minute drive, from the Port of Savannah, North America’s largest single-terminal container facility.

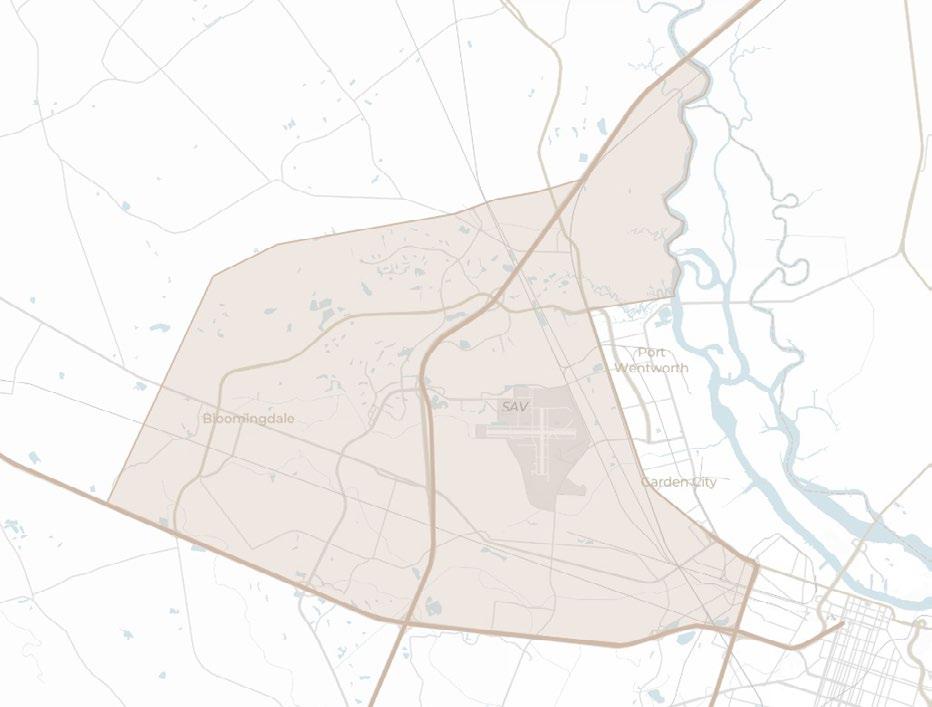

These properties are located in the Dean Forest submarket – Savannah’s largest submarket which boasts a 4.4% vacancy rate and only 625K square feet under construction (less than 1% of existing inventory). The Portfolio is 100% leased to five (5) tenants with 3.6 years of weighted average lease term and weighted average in-place rents of $6.39 PSF. With the Port only one to two truck-turns away, and its premier Dean Forest submarket location, the Portside V Portfolio is positioned as one of Savannah’s leading industrial portfolios.

• Opportunity to acquire assets in irreplaceable infill locations below replacement cost

• 100% leased to 5 tenants with 3.6 years of WALT

• Rising land values are estimated at $490,000 per acre ($35 PSF) for infill locations due to the scarcity of developable parcels near the Port.

• The replacement costs for institutional quality, infill Savannah industrial properties exceed $162 per square foot

» Construction costs alone total $78 PSF.

» $19 PSF in soft costs

» $12 PSF financing costs

» Developer profit of $18 PSF

• Average of 2.2 miles, or a ~5-minute drive, to the Garden City Terminal

• Easy access to the I-95 interchange & I-16 interchange

• Five (5) building logistics portfolio

• Total square footage of 737,050 SF

• 51.69 Acres

• Built between 1997-2008

• 98%/2% office ratio

• 21’ – 28’ minimum clear heights

• 109’ – 162’ concrete truck courts

• 60 mil Reinforced TPO & Standing seam metal roofs

• 62 dock-high doors with 60 mechanical levelers

• 8 drive-in doors

• 80% of properties have a trailer parking or IOS component

• 103 auto parks

• LED/Fluorescent Lighting

• ESFR/Wet Sprinklers

737,050 SF 5 Buildings

0.5 - 3.6 Miles From Port

100% Leased To 5 Tenants

• For 2025, Savannah once again led the nation in net absorption as a % of inventory (5.0%)

» Net absorption across Savannah totaled 7.9M SF, with the Dean Forest submarket accounting for virtually all of the Q4 Absorption

• Record setting net absorption of 22.2M SF in 2024 (1st in the nation) which included the Hyundai Metaplant. This marked the fourth consecutive year in a row of 10M+ SF of net absorption

» Exceeded Atlanta’s 14.3M SF of net absorption by 55%

» Led country in net absorption as a % of inventory (15.3%) in 2024

• 43.1M SF of net absorption since 2023, equal to 28% of current market inventory

• Robust leasing activity with 10M+ SF of deals signed in 2025

• In 2025, Class B leasing activity increased significantly, with move-ins up 144% YoY

• Rents have surged by 44% since 2021, reflecting an annual growth rate of 10.9%

• 2025 completions down over 90% year-over-year

• Construction activity continues to taper, with volumes down 32% year-over-year and 67% below 2023 levels

» This, combined with resilient tenant demand, is expected to moderate the MSA’s vacancy rate

• 24.2M SF in tenant demand through 2025, third in the country as a % of total inventory

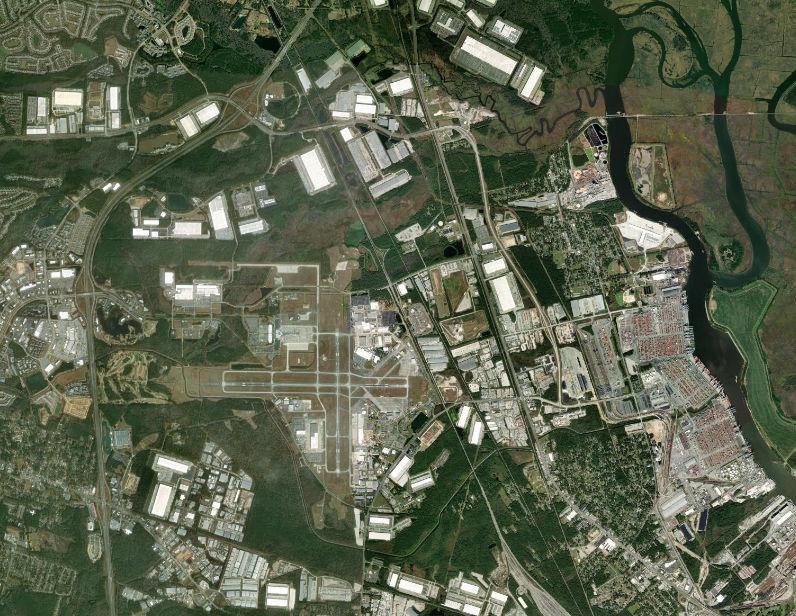

• Largest and most active submarket with over 70M SF of industrial space

• Nearly as large as all other submarkets combined

• Proven tenant demand with over 8M SF absorbed since 2023

• Immediate proximity to the Port of Savannah and Savannah’s major arterial thoroughfares

• Third highest average asking rents at $7.36 PSF

• 4.4% vacancy rate

• Only 625K SF under construction – less than 1% of existing submarket inventory

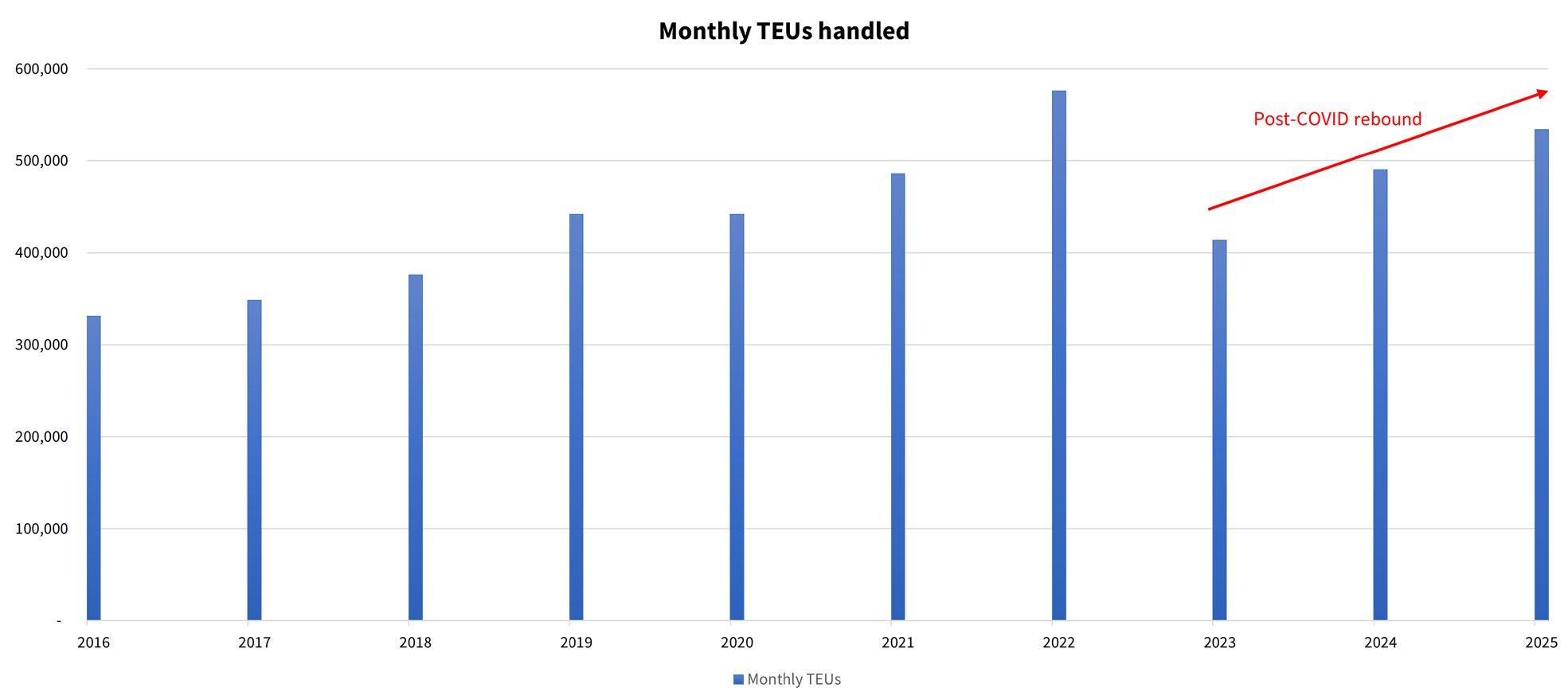

• The Port of Savannah is the #1 fastest growing container port in the nation and is the #3 busiest port in the U.S.

» Garden City Terminal is the #1 largest and fastest growing container terminal in North America

• The Georgia Ports Authority’s market share has increased 3.5% over the past decade

» The GPA handles 1 of every 8 TEUs in the U.S.

• FY2025 was the Port's second busiest year on record

» The Port of Savannah handled 534,037 TEUs in August, a 9% year-over-year increase and the third-highest month in its history.

• GPA estimated 12 million TEU capacity by end of year 2035 - projected to pass the Port of NY/NJ to become the highest volume East Coast port

• Largest single container terminal in the U.S. with 37 weekly port calls and more with future expansion

• Lowest cost of occupancy amongst top volume ports

• Most westerly port on the Atlantic seaboard with direct access to 80% of U.S. population via two-day drive

• One of the most well-connected U.S. ports to a diversity of world markets, yet unencumbered by a singular market (i.e. China)

• As manufacturing continues to move/diversify outside of China, Savannah stands to benefit from this diversification over west coast ports

• $4.5B infrastructure projects planned to reach a capacity of 12 millions TEUs by 2035

• Current: Two major expansion projects

» Garden City West Terminal Expansion: 100 acres of additional outdoor container storage and a new truck gate lane with connector road

» Ocean Terminal Renovation: Currently rebuilding docks to provide 2,800 linear feet of berth space with an 8-crane fleet

◊ Phase 2: Pave and expand gate facilities to increase overall annual TEU capacity by over 2 million by 2027

• Recently Completed: Savannah Harbor Expansion Project (SHEP) and the Mason Mega Rail Terminal (MMRT)

» SHEP: Deepened canal to 47’, allowing vessels to carry 16,000+ TEUs

» MMRT: 97k SF of new rail and 10 new CSX/Norfolk Southern working tracks

◊ Increased the Port of Savannah’s rail lift capacity by 2 million TEUs annually

◊ Expecting to fuel the near-doubling of the Savannah industrial market by 2035

In comparison to the top 10 largest ports by TEU volume, the Port of Savannah has the lowest average asking rent and the fastest drive time out of the port

The industrial market in Savannah is experiencing remarkable growth, fueled by record cargo volumes at the Port of Savannah, strategic infrastructure investments, and extensive logistical connectivity. This growth is directly tied to the port's exceptional performance and planned expansion capabilities. The Port of Savannah's expansion plan represents one of the largest port infrastructure investments in U.S. history, estimated at over $4.5 billion invested. Renovations to the Garden City Terminal Berth 1 and Terminal West yard have recently completed and added roughly 2.5 million in annual TEU capacity. Phase I of the Ocean Terminal berth and container yard renovations will be complete in 2027, with Phase II expected to deliver by mid-2028, adding a combined 2 million TEUs per year. Longer-term plans call for the Savannah Container Terminal on Hutchinson Island to open by 2030, which will add three additional big ship berths and an estimated 3.5 million TEUs of annual capacity. By 2035, the Port of Savannah is expected to be a 12 million-TEU capacity port. This expansion will cement Savannah's position as the premier gateway for containerized cargo on the East Coast. These port expansion initiatives are complemented by the Georgia Ports Authority's significant investment in intermodal infrastructure. Mason Mega Rail Terminal is the largest

on-terminal intermodal facility in North America, handling 42 trains per week and moving over 540,000 containers annually. The facility leads the nation in speed-to-rail performance, connecting cargo from vessel to departing train in just 19-24 hours with dual access to Norfolk Southern and CSX railroads.

In terms of market performance metrics, Savannah's dominance is clear. The market ranked first nationally in tracked tenant demand as a percentage of inventory in 2022, 2024, and 2025, with a second-place ranking in 2023. In 2024 alone, Savannah achieved 22.2 million square feet of net absorption, representing a 71% year-over-year increase and ranking first among all national markets. This momentum has accelerated in 2025, with Savannah leading all U.S. markets in net absorption as a percentage of inventory at 5.0% for the second consecutive quarter and achieving 7.9 million square feet of total net absorption.

318 GRANGE RD

TENANT Davis Brothers Logistics, LLC

RBA 195,000

LCD 8/1/2025

LXD 10/31/2030

Built on trust and expertise, Davis Brothers Logistics provides efficient, cost-effective solutions for project cargo, warehousing, export packaging, and trucking across the continental US and Mexico. Since 2018, the company has completed over 400 projects serving more than 35 locations.

190 GULFSTREAM RD

TENANT Lone Star Transportation, LLC

RBA 175,000

LCD 12/15/2014

LXD 12/31/2029

Lone Star Transportation is a premier logistics company delivering flatbed, heavy haul, dry van, and warehousing services across 48 states, Canada, and Mexico. With top CSA safety scores and modern equipment, the company provides reliable freight delivery and comprehensive logistics solutions throughout North America.

194 GULFSTREAM RD

TENANT Savannah Surfaces, Inc.

RBA 100,800

LCD 9/1/2025

LXD 11/30/2030

With 30 years of experience, Savannah Surfaces is a premier natural stone and porcelain supplier serving distributors across North America. The company sources materials globally from Europe, Asia, and the Americas, specializing in unique products at competitive prices. Their knowledgeable staff works with architects and design professionals to deliver exceptional outcomes for residential and commercial projects.

405 EXPANSION BLVD

TENANT Longyuan Forwarding Inc. d/b/a American New Logistics

RBA 116,250

LCD 5/1/2024

LXD 6/30/2029

Established in 2008, ANL provides comprehensive door-to-door logistics services, including ocean freight LCL/FCL, customs brokerage, and international multimodal transportation. With nearly 17 years in business, ANL operates 11 direct subsidiaries worldwide and averages 35,615 TEUs annually. ANL prides itself on cargo safety, reliability, and transportation efficiency.

198 GULFSTREAM RD

TENANT AA Heritage Solutions, LLC

RBA 150,000

LCD 11/1/2016

LXD 12/31/2027

AA Heritage Solutions is a private transportation company based in Savannah, GA, providing a wide range of logistics services to meet the diverse needs of clients.

The Port of Savannah plays a vital role in both the regional and national economy. With immediate access to I-16 (East/West) and I-95 (North/South), 80% of the U.S. population is reachable within a two-day drive. The Port handled 5.7M TEUs in FY2025 positioning it as the 3rd busiest gateway in the nation. Georgia Port Authority (GPA) has estimated TEU capacity at the Port will reach 12M by 2035 to match the rapid expansion in container trade (4.3% compounded annual growth over past 5 years). As a part of this expansion project, GPA is adding 100 acres of outdoor container storage and a new truck gate lane with a connector road to the Garden City West Terminal in addition to renovating the Ocean Terminal docks to provide 2,800 linear feet of berth space with an 8-crane fleet.

#1 Largest single-terminal container facility in the nation | #3 Busiest gateway in the nation

5.7M TEUS

Handled in FY2025 (8.6% INCREASE OVER FY2024) 1 of 8 TEUs in the U.S. are handled by the GPA

47’ Depth 2 container terminals

12 Million TEU capacity by end of 2035 (GPA estimate)

Savannah is recognized as one of the most important transportation/logistics hubs in North America due to its connectivity to a network of sea, rail, air, and road operations

The Georgia Ports Authority (GPA) is created in response to the post-WWII economic boom. 1945

1948

1958

5.7 Million

Handled in FY 2025 9% increase over FY 2024 2 Major Thoroughfares

• The Port of Savannah consists of two terminals — Garden City and Ocean Terminal

• The Port of Savannah is the 3rd busiest container gateway in the U.S. and the fastestgrowing major port nationally

24 hour Vessel to rail cargo time

• Savannah enjoys uninterrupted access to every major destination east of the Mississippi via two Class I railroads, CSX and Norfolk Southern

• Western most port on the East Coast, allows for the quickest route to Midwest via sea-to-rail

• I-95 provides Savannah access to the entire Eastern Seaboard

• I-16 creates a direct link to the Atlanta population center

The GPA acquires land on the Savannah River creating the Garden City Terminal to handle bulk and general cargoes and later containerized cargo.

The GPA purchases the Ocean Terminal, which will later become a RO/RO terminal, handling primarily automobiles and wheeled heavy equipment.

1992 Harbor widened at Port of Savannah to 500 ft.

1995

Port of Savannah is chosen as primary port of entry for the 1996 centennial Olympic games.

2001 The GPA moves more than 1 million TEUs for the first time ever.

2003 Savannah’s port becomes the fourth busiest in the country.

2019 The Port of Savannah moves a record-breaking 4.5 million TEUs.

2021

November – The Mason Mega Rail project is completed, allowing the port to build and receive six 10,000 ft. long trains simultaneously.

2021 December – The Port of Savannah moved a record-breaking 5.6M TEUs, and container trade in leapt to 20% - the fastest rate of growth in 20 years.

2022

2022

2023

March – The GPA announces the completion of the Savannah Harbor deepening project, which added 5 ft. in depth to the shipping channel.

August - The port handles more than 575,500 TEUs in August, setting an all-time trade record

Spring – Berth 1 expansion project completed – increasing on-dock capacity by 25% and allow Savannah to simultaneously serve four 16,000 TEU vessels, as well as 3 additional ships.

8 new ship-to-shore cranes were added to Garden City Terminal, bringing the total to 38.

35 Minute Direct flight to ATL

• Savannah/Hilton Head International Airport is the 2nd busiest airport in the state

• Gulfstream Aerospace Corporation is the largest private employer in Savannah

2024

In 2024, the Georgia Ports Authority completed a $262 million improvement project at the Port of Brunswick. This project included the addition of new warehousing and processing facilities, along with an expansion of 122 acres dedicated to Roll-on/Roll-off (Ro/Ro) cargo storage. 2023

At Savannah’s 200-acre Ocean Terminal, ongoing renovations to berths and container yards aim to accommodate two large container ships simultaneously, offering a 2 million TEU annual capacity. The project includes an order for eight additional cranes, with renovations to the first berth scheduled for completion in 2025.

Estimated completion date of the Brampton Road Connector, which will link Garden City Terminal to I-516 and will extend the Jimmy Deloach Parkway from I-95 to I-16. 2025

2028

An additional 6 container cranes will be added to the Garden City Terminal, bringing the total to 42 container cranes in place.

• $7.6 billion EV manufacturing facility in Bryan County & second largest economic development project in Georgia history

• The 3,000-acre “Metaplant America” is adjacent to I-16 with 17 million square feet contained within an electric vehicle assembly plant and an electric vehicle battery plant

» 30 GWh assembly facility came online in January 2025 and is Hyundai’s first exclusively electric vehicle plant in the U.S. with the capacity to manufacture 300,000 vehicles per year

» The site employs 8,500 people with an average salary of $58,105

• Multiple Tier One suppliers (see table below) have announced plans for production plants to support Metaplant operations

» Investment figures nearing $2B

» Over 5,000 new jobs

» New suppliers will further expand tenant demand in Savannah

• Approximately another $1 billion is anticipated to be invested by non-affiliated Hyundai Motor Group suppliers in connection with the Project in other locations

• All cars will be shipped out via the Port of Brunswick

Hyundai is emblematic of major global and national corporations now recognizing Savannah as a mission-critical operating location, propelling Savannah’s status as one of the major commercial hubs of the Southeast.

Seoyon E-HWA | Savannah (Chatham County)

• Nearly 24.2M SF of active tenant requirements compared to 4.3M SF of space under construction (5.6x)

1 ST IN THE NATION for net absorption (as a percentage of inventory)

*Represents Available Warehouse & Distribution

5.3M TEUS

2 ND IN THE NATION for tenant demand (as a percentage of inventory) 156.1M SF Industrial inventory (up 110.5M SF since 2013)

Handled through Nov. 2025 (on pace for 2nd best year on record)

4.3M SF W&D space under construction (-55.0% YoY)

• Strong correlation between TEU volume and occupied industrial space. Based upon forecasted TEU growth and the current demand ratio of 41 SF per TEU, Savannah industrial market is poised for significant expansion

• By 2035, the GPA projects total capacity to reach 12M TEUs, with Import TEUs expected to be +/- 6M, translating to 119 MSF of additional industrial demand (excluding the Hyundai Metaplant)

SAVANNAH PORT IMPORT TEU VS. OCCUPIED WAREHOUSE SF

OF ADDITIONAL WAREHOUSE SPACE NEEDED TO MATCH DEMAND 110% 119M SF

FORECASTED GROWTH OF IMPORT TEUS

Over the past 20 years, the Port of Savannah has increased its annual amount of containers handled by 177% (measured as twenty-foot equivalent units, or TEUs) now placing it as the 3rd busiest port in the U.S. On top of containers, the Port of Savannah and neighboring Port of Brunswick handle numerous other types of cargo.

Rolling 12-month TEU volume approaching all-time highs

• Construction starts continue to decline off the post-pandemic high

• 2H 2025 starts down 63% compared to 2H 2024 and 91% compared to 2H 2022

• Tenant demand remains strong with 61 unique tenants seeking over 24 million SF

» This is 1.5x greater than all vacant space on the market and 5.6x greater than all warehouse and distribution space currently under construction

• Rent in Savannah has grown at a CAGR of 8.7% since 2020

• GreenStreet forecasts continued rent growth due to favorable market demand and supply dynamics

*Tenant's obligation to pay for Controllable Expenses on a per rentable square foot basis in any calendar year shall not exceed one hundred eight percent (108%) of Tenant's obligation to pay for Controllable Expenses on a per rentable square foot basis

*One 5-year extension option at the greater of $5.78 PSF and Fair Market Value provided 6-9 months notice

9/1/27$517,870 4.00%$5.14 9/1/28$538,585 4.00%$5.34 9/1/29$560,128 4.00%$5.56 9/1/30$582,533

*Tenant's obligation to pay Tenant's Proportionate Share of Operating Expenses that are not Uncontrollable Expenses (herein "Controllable Expenses") shall be limited to a six percent (6%) per annum increase over the amount the Controllable Expenses per square foot for the immediately preceding calendar year

*One 5-year extension option at the greater of $7.81 PSF and Fair Market Value provided 9-12 months notice

8/1/27$1,364,345 3.75%$7.00 8/1/28$1,415,508 3.75%$7.26 8/1/29$1,468,589 3.75%$7.53 8/1/30$1,523,661 3.75%$7.81

*Tenant shall not be obligated to pay for Controllable Operating Expenses on a per rentable square foot basis in any year to the extent they have increased by more than 7% per annum on a per rentable square foot basis, compounded annually, on a cumulative basis beginning 1/1/2027

1Per the Clear lease, TT is obligated to pay a Monthly Fixed Operating Expense (FOE) reimbursement, a portion of which is allocated for capital repairs/replacements. The Monthly FOE escalates 4.0% annually on lease anniversary. TT reimburses its pro-rata share of Property Taxes.

1Per the Clear lease, Tenant is obligated to pay a Monthly Fixed Operating Expense (FOE) reimbursement, a portion of which is allocated for capital repairs/replacements. 2Capital Reserves for 405 Expansion Blvd ($0.15 PSF) do not begin until the expiration of the in-place lease (6/30/2029)

CHRIS TOMASULO, SIOR Vice Chairman chris.tomasulo@jll.com 770.330.3263 BENNETT RUDDER Executive Managing Director bennett.rudder@jll.com 404.960.0080

Managing Director bobby.norwood@jll.com 404.460.1652 LEASING CONTACTS

RYAN HOYT, SIOR Executive Managing Director ryan.hoyt@jll.com 404.200.7737

BOBBY