URBAN ATLANTA

Atlanta, GA | 6 properties | 404,424 sf | 2.6 years walt

BRITTON

BOBBY

404.460.1652

404.663.0402

Atlanta, GA | 6 properties | 404,424 sf | 2.6 years walt

BRITTON

BOBBY

404.460.1652

404.663.0402

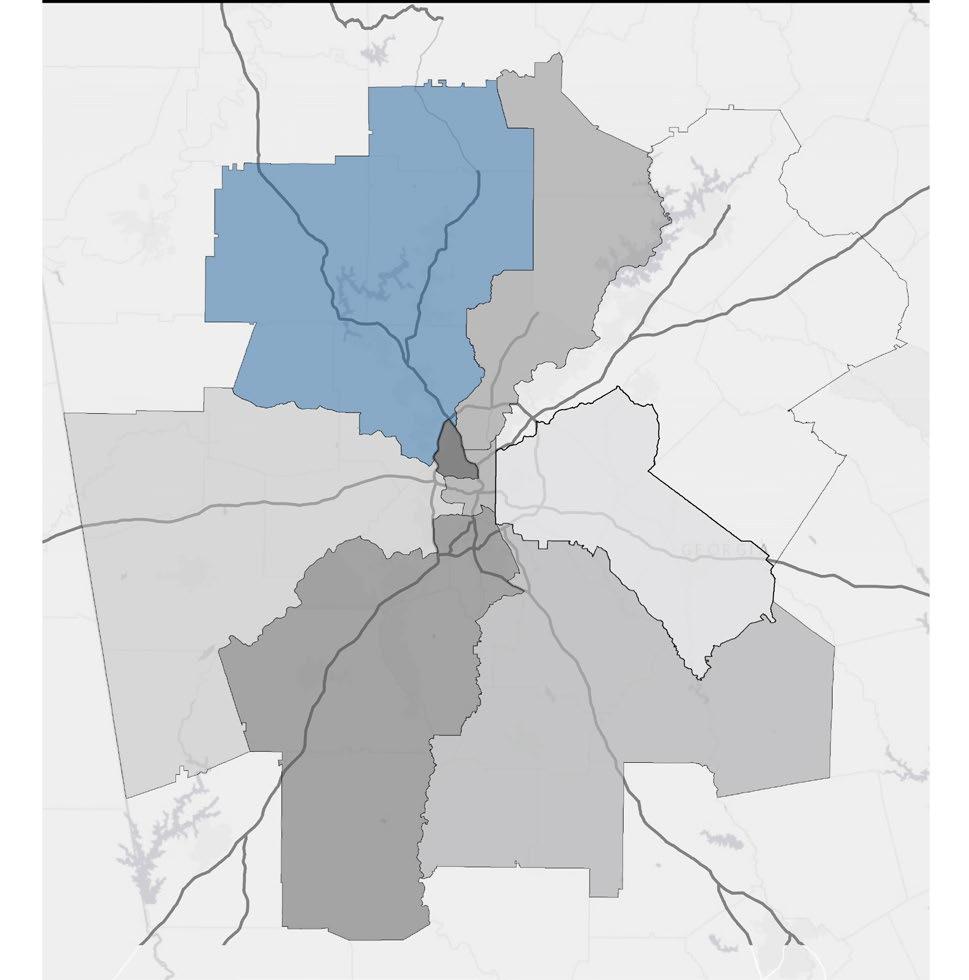

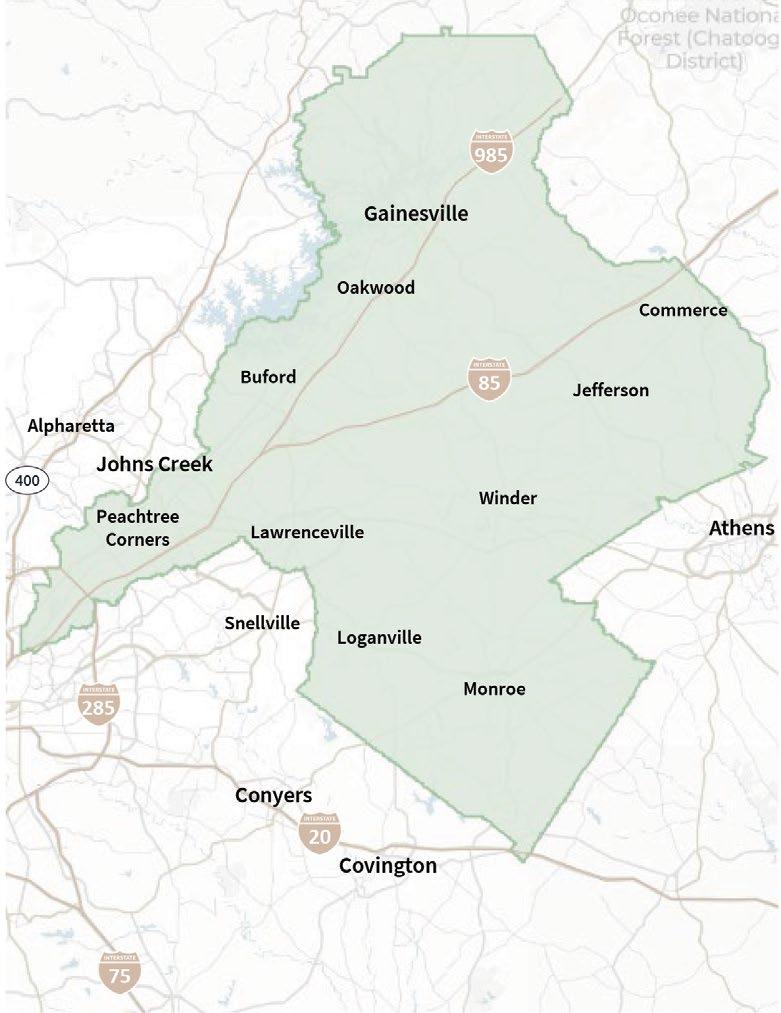

On behalf of the ownership, Jones Lang LaSalle America, Inc. (“JLL”) has been exclusively retained as the sales representative for the Urban Atlanta Portfolio (the “Portfolio”). The Portfolio comprises six (6) properties spanning 404,424 SF of multi-tenanted shallow-bay industrial space located in irreplaceable infill locations. Strategically positioned within the sought-after Northeast, Northwest, and Chattahoochee industrial submarkets of Atlanta, the Portfolio benefits from superior connectivity and adjacency to Atlanta’s core population centers.

Boasting a diverse and granular tenant base of 46 tenants (8,232 SF avg. suite size), the Portfolio demonstrates 2.6 years of weighted average remaining lease term and a 15% mark-to-market opportunity. Three of the six assets are located in the Northeast submarket (44% of portfolio SF), with the balance located in the Northwest submarket (42%) and the Chattahoochee submarket (14%). On average, the Portfolio is located just 5.5 miles away from I-285 providing direct access to Atlanta’s major thoroughfares.

Atlanta’s industrial market remains one of the strongest in the nation and is underpinned by robust demographic growth in addition to its close proximity to America’s major population centers (80% of Americans reachable in a 2-day drive). In terms of tracked tenant demand, Atlanta has approximately 49 million SF of active requirements in the market ranking third nationally. This demand has materialized with 1H 2025 leasing volumes reaching 21.4 million square feet, on pace for the fifth best year in Atlanta history.

portfolio highlights

6 PROPERTIES

93.6% OCCUPANCY

2.6 YEARS PORTFOLIO WALT

404,424 SQUARE FEET

$4.3M YEAR 1 NOI

ATLANTA infill locations

• The Portfolio consists of six irreplaceable light industrial assets, each infill to their community and growing in demand due to supply constraints driven by lack of new product

• As older, obsolete industrial product is increasingly demolished or redeveloped for adaptive uses, the Portfolio offers investors the unique opportunity to own institutional quality assets while still having significant mark-to-market upside

• Stable in-place tenancy and balanced expiration schedules mitigate downside risk, enabling investors to selectively carry out leasing strategies throughout their desired hold period

• The assets comprising the Portfolio are mission critical for their respective tenants, limiting the risk of tenant turnover

• The Portfolio provides future ownership an opportunity to acquire irreplaceable real estate located in Atlanta’s major population nodes in addition to offering significant yield growth potential through the embedded 15% mark-to-market

• All assets are located in close proximity to major logistical thoroughfares such as I-85, I-75, and I-285, connecting the properties to the greater Atlanta MSA and delivering exceptional access to the surrounding affluent neighborhoods and multiple growing residential nodes

o Average distance to I-285 is 5.5 miles

• The Portfolio’s strategic location provides its tenants with crucial last-mile delivery capabilities for their operations within the Atlanta MSA

• Tenants still need to be located ‘in town’ and close to dense population centers, driving demand for product such as the subject Portfolio

• Exceptionally maintained, in-demand institutional quality warehouse product with no major immediate capital improvements needed

• Premier light industrial assets that have been kept in pristine condition

• Attractive buildings featuring masonry construction and generous column spacing, ideal for infill industrial tenants with warehouse needs

• Majority of tenants on NNN leases, further adding to the institutional quality of the portfolio and its tenant base

• Tenant demand remains strong with nearly 49M SF of active requirements

• 21.4M SF of leases were signed in 1H 2025

o 66% were new deals

o On pace to be 5th best year in Atlanta history

• Development continues to taper off with under construction volumes down 49% year-over-year

o Only 15 starts have kicked off through 1H 2025, less than the first-half yearly average from 2016-2024

• Rents for sub-120K SF space have grown at a 10.5% CAGR over the past 5 years while vacancy for this size segments remains well below the Atlanta wide rate (65% lower)

o Expected supply constraints will continue to push market rents

• Nearly 1M SF of net absorption on average per quarter over the past 3 years

o 2Q 2025 net absorption of 1.6M was second best quarter over the same period

• Construction volumes continue to decline, with 0 SF of proposed supply

o SF under development has fallen nearly 9x over the past 2 years

• 5.0% submarket vacancy for product 120K SF or less (47% less than the submarket wide rate)

• $11.63 PSF average rental rate for product 120k SF or less (78% greater than the submarket wide rate)

• Nearly 700K SF of net absorption on average per quarter over the past 3 years

o 2Q 2025 net absorption was third highest among all Atlanta submarkets

• Construction volumes continue to decline, with 0 SF of proposed supply

o SF under development has fallen over 2x over the past 2 years

• 5.7% submarket vacancy for product 120K SF or less (51% less than the submarket wide rate)

• $10.87 PSF average rental rate for product 120k SF or less (54% greater than the submarket wide rate)

• One of the tightest submarkets in Atlanta with only 412K SF delivered since 2023 (3.7% of inventory)

o 0 SF of proposed supply over that same period

• 5.3% submarket vacancy for product 120K SF or less (18% less than the submarket wide rate)

o Submarket wide vacancy rate has compressed 2.8% since YE2024 to 6.5%

• $8.43 PSF average rental rate for product 120k SF or less (31% greater than the submarket wide rate)

The replacement costs for institutional quality, infill Atlanta industrial properties are just over $220 per square foot, reflecting the irreplaceable value of the properties that make up the Atlanta Infill Portfolio. Rising land values in the Atlanta area, estimated at $585,000 per acre, contribute to these costs. This increase is driven by the city’s growing population, which has propelled Atlanta to become the 8th largest metro area in the US, surpassing Philadelphia and Phoenix. Furthermore, the scarcity of available land due to the rise in adaptive reuse projects and the popularity of these locations further drives up replacement costs. The construction costs alone to build quality industrial product total $119 PSF, out pricing many developers before adding on the additional land, leasing, and financing costs. $220 psf

404,424 Total Portfolio SF

CONSTRUCTION COST $585,000 PER ACRE EST. LAND COST

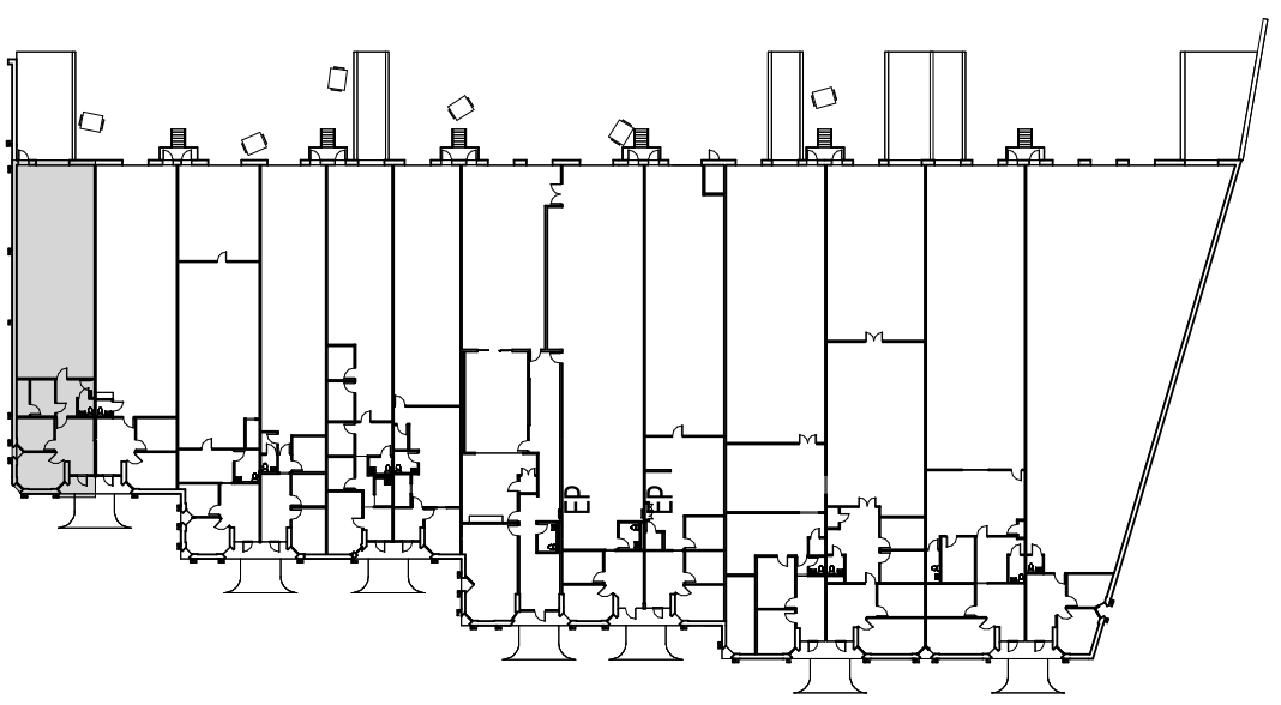

Under 2 miles from I-285, this property is located in Highlands Park, one of Atlanta’s premier, ultra-infill industrial parks, benefiting from close proximity to Atlanta’s densest population pockets. To that end, there are over 210,000 people with a 5-mile radius of Rubicon Business Center with a median household income of $98k – 13% greater than the Atlanta average. This infill location is surrounded by a strong consumer base that fills a niche of highly desired yet difficult to find product type for a wide variety of tenants.

While land value in the metro Atlanta area remains high, and as the already scarce Atlanta infill industrial product continues to be adapted for other uses, the supply and demand dynamic for this kind of product will continue to benefit properties like Rubicon Business Center.

Rubicon Business Center is 86% leased to 17 tenants with no single one occupying greater than 14% of the property, offering day-one cash flow stability. The remaining three suites, averaging 5,402 SF, provide investors with embedded leasing upside at a location with a proven track record.

Lightning Protection Systems, LLC

Suite: 1602 | Size: 2,525

LXD: 11/30/2026

www.atlantalightning.com

Lightning Protection Systems, LLC designs, installs, and maintains lightning protection and grounding systems for commercial, industrial, and residential facilities. With a focus on safety, code compliance, and long-term system reliability, the company serves clients throughout the Southeast from its Atlanta base

Gorilla Sales Company

Suite: 1605 | Size: 2,425

LXD: 4/30/2026

www.gorillatough.com

Gorilla Sales Company markets and distributes heavy-duty adhesives, tapes, sealants, and other products under the Gorilla® brand. Known for durability and versatility, Gorilla products are sold through major retailers and to professional contractors nationwide.

NAFTA Tools, Inc.

Suite: 1603 | Size: 3,025

LXD: 9/30/2027

www.naftatools.com

NAFTA Tools, Inc. is a tool distribution and supply company specializing in industrial-grade hand tools, power tools, and equipment for professional contractors and tradespeople. The company supports customers with competitive sourcing, rapid fulfillment, and a diverse catalog of products.

1600 & 1800 wilson way

ETI Solid State Lighting, Inc.

Suite: 1606 | Size: 2,425

LXD: 2/29/2028

www.etissl.com

ETI Solid State Lighting, Inc. is a manufacturer of energy-efficient LED lighting products for residential, commercial, and industrial applications. The company’s offerings include fixtures, retrofits, and lighting components designed for performance and sustainability.

Bemis Manufacturing Company

Suite: 1604 | Size: 2,425

LXD: 4/30/2028

www.bemismfg.com

Bemis Manufacturing Company is a global manufacturer of plastic products for both consumer and commercial markets, best known for its innovative toilet seats and custom plastic components. Headquartered in Sheboygan Falls, Wisconsin, the company serves industries including healthcare, industrial, and plumbing.

Zurix Building Solutions, LLC

Suite: 1607, 1608 | Size: 8,050

LXD: 5/31/2028

www.zurixroof.com

Zurix Building Solutions, LLC is a commercial roofing contractor specializing in roof installation, repair, and maintenance services for industrial and commercial buildings. The company emphasizes quality workmanship and durable materials.

&

Apex Tool Group, LLC

Suite: 1609 | Size: 3,460

LXD: 10/31/2026

www.apextoolgroup.com

Apex Tool Group, LLC is one of the world’s largest manufacturers of professional hand and power tools, serving industries from automotive to construction. Its portfolio includes well-known brands such as Crescent®, GearWrench®, and Weller®.

US Med-Equip, LLC

Suite: 1610-1611 | Size: 8,790

LXD: 6/30/2027

www.usme.com

US Med-Equip, LLC provides medical equipment rental, sales, and asset management services to hospitals and healthcare providers nationwide. The company offers a range of devices including respiratory, neonatal, and infusion equipment

EAGLERISE E&E, INC.

Suite: 1612 | Size: 4,525

LXD: 7/31/2027

www.useaglerise.com

Eaglerise E&E, Inc. manufactures and supplies power electronics, LED drivers, transformers, and related components to lighting and electrical equipment manufacturers. The company operates globally with a focus on energy efficiency and quality standards.

Hydromax USA, LLC

Suite: 1613 | Size: 6,400

LXD: 8/31/2027

www.hydromaxusa.com

Hydromax USA, LLC delivers infrastructure inspection services, including water, wastewater, and natural gas system assessments. Using advanced technology and data analytics, the company helps utilities and municipalities manage critical assets.

Elsner’s Superior Flooring, Inc.

Suite: 1803 | Size: 11,140

LXD: 6/30/2026

Website: N/A

Elsner’s Superior Flooring, Inc. is a full-service flooring contractor offering sales, installation, and maintenance of carpet, hardwood, tile, and specialty flooring for commercial and residential projects.

Maloney and Sons, LLC

Suite: 1805 | Size: 7,830

LXD: 2/28/2030

www.maloney-and-sons.com

Maloney and Sons, LLC provides specialized trucking and logistics services, focusing on heavy haul and oversize load transportation. The company serves customers across multiple states with a reputation for reliability and safety.

highlights - rubicon business center | | 1600 & 1800 wilson way

QM3 Utility Services, Inc.

Suite: 1806 | Size: 6,325

LXD: 8/31/2027

www.qm3us.com

QM3 Utility Services, Inc. offers utility locating, mapping, and damage prevention services to protect underground infrastructure. Serving municipalities, contractors, and utility providers, the company prioritizes accuracy and safety in field operations.

Atlanta Coffee Supply Group, LLC

Suite: 1809, 1810 | Size: 10,175

LXD: 9/30/2028

www.lakehousecoffee.com

Atlanta Coffee Supply Group, LLC operates as Lakehouse Coffee & Tea, supplying freshly roasted coffee, premium teas, and beverage equipment to cafes, restaurants, and hospitality businesses. The company offers both wholesale and direct-to-consumer sales.

Next Technology LLC

Suite: 1811 | Size: 3,150

LXD: 12/31/2027

www.next.llc

Next Technology LLC designs and delivers technology integration solutions including IT infrastructure, audiovisual systems, and workplace technology deployments for commercial clients. The company supports projects from design to installation and ongoing support.

Pinnacle Maintenance Services, Inc.

Suite: 1601 | Size: 2,525

LXD: 8/31/2028

www.pinnaclemaintenanceservices.com

Pinnacle Maintenance Services provides janitorial and maintenance services for retail, medical, corporate, and other property types.

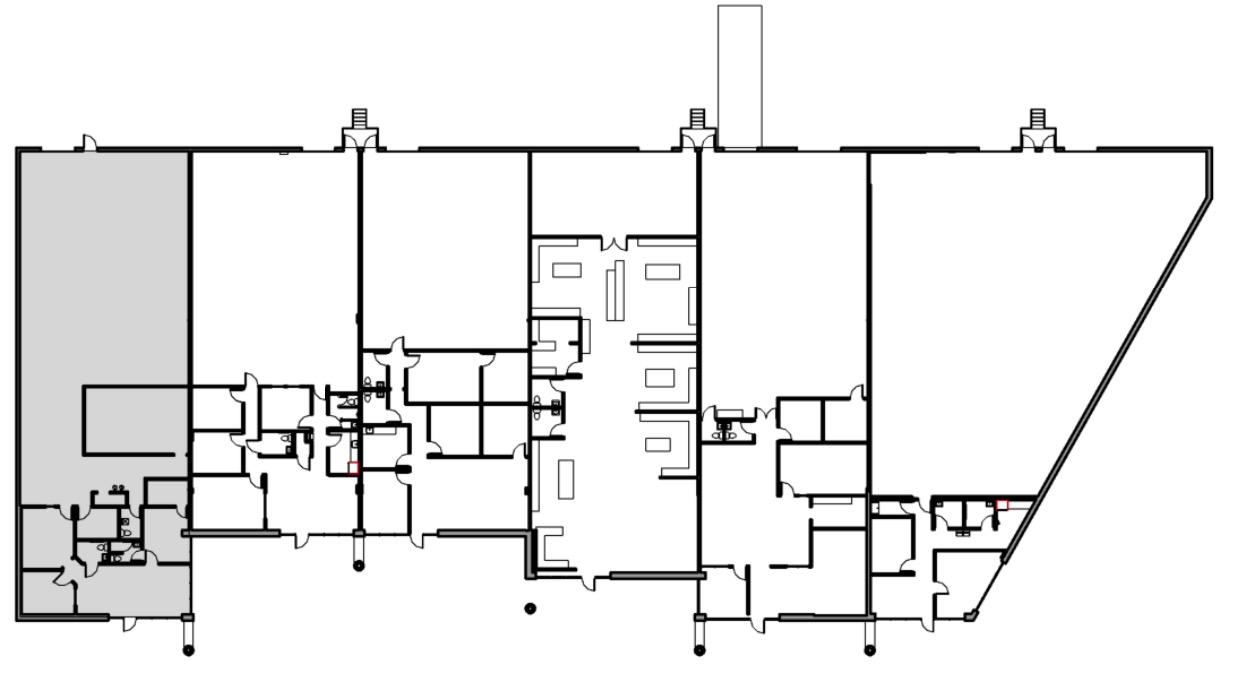

Located off of Peachtree Industrial Boulevard and centrally positioned between some of Atlanta’s most affluent cities such as Johns Creek and Peachtree Corners, Corporate Way’s tremendous location provides tenants easy access to Atlanta’s premier suburbs. With over 205k people within a 5-mile radius, the property’s immediate consumer base demonstrates a strong demographic profile including a median household income of $122k – 42% greater than the Atlanta average.

Corporate Way benefits from 40’ x 40’ column spacing, dock-high and drive-in doors, and a higher office finish complementing tenant preferences for properties in this location. Further, the average suite size of 6,662 SF provides an optimal footprint for tenants seeking a last-mile presence in one of Atlanta’s stronger demographic pockets.

The 2-mile radius surrounding the property totals 1.1M SF of industrial product and demonstrates strong metrics including positive net absorption over the trailing twelve-month period and only 77k SF of available space (7.1% of total inventory). Additionally, 0 SF have been delivered since 2019 highlighting the scarcity of developable land in the immediate area.

Suite: B | Size: 8,450

LXD: 1/31/2028

www.shop.sheffieldop.com

Sheffield Office Products offers an extensive product range including stationery, office furniture, technology accessories, and breakroom essentials. With decades of experience, Sheffield Office Products serves clients across industries, focusing on personalized service, competitive pricing, and fast delivery to help businesses operate efficiently and professionally.

Suite: I | Size: 10,796

LXD: 12/31/2027

www.eskola.com/

Eskola LLC is a national commercial roofing and waterproofing contractor offering full-envelope solutions to sectors spanning education, healthcare, infrastructure, government, and industrial markets. Eskola has accelerated its growth through key acquisitions (e.g., Frontier Roofing, BBG Contracting Group, Keating Roofing, and J.R. Jones Roofing), expanding to approximately 22 locations across 11 states including the Southeast and Southwest. Sheffield Office Products, Inc.

Suite: C | Size: 8,103

LXD: 3/31/2028

www.atec.com

ATEC USA, Inc. is a specialty contractor offering architectural design, engineering, electrical services, structural steel fabrication, informational kiosks, and metal works. Serving commercial, industrial, and infrastructure sectors, the company supports projects typically ranging from $1 million to $10 million in contract size.

Suite: D | Size: 5,633

LXD: 7/31/2028

www.en.sterilance.com

SteriLance Medical Inc. is an established precision medical device manufacturer specializing in capillary blood collection tools and insulin pen needles designed for everyday self-care, particularly in diabetes management. The company’s product portfolio includes gamma sterilized safety lancets, surgical scalpels, alcohol prep pads, and pen needle devices built with user safety, comfort, and reliability in mind.

Suite: E | Size: 5,633

LXD: 7/31/2027

www.cjinternational.com

C J International, Inc. is a full-service U.S. customs brokerage and international freight firm focused on delivering personalized, expert logistics services from customs entry, duty drawback, and cargo insurance to air/ocean freight and freight forwarding, serving importers and exporters across key U.S. hubs.

Suite: G | Size: 5,287

LXD: 4/30/2030

www.rentokil.com/us

Rentokil North America is the U.S. and Canadian division of Rentokil Initial plc, a FTSE 100 company and global leader in pest control and hygiene services. The company provides integrated pest management solutions to commercial and residential clients across all major industries.

Suite: H | Size: 4,697

LXD: 4/30/2030

www.callzenair.com

Riley Foster Enterprises, Inc is a specialized HVAC and refrigeration contractor based in Suwanee, Georgia. Founded in 2015, the company provides expert installation, maintenance, and repair services for air conditioning and refrigeration systems.

Suite: F | Size: 5,633

LXD: 9/30/2030 www.cavanna-usa.com

Cavanna Packaging USA Inc. serves as the North American subsidiary of Italy’s Cavanna Packaging Group – an established, family-owned innovator since 1960 in turnkey flow-wrapping and cartoning machinery. Based in Duluth, Georgia, it designs, assembles, and distributes automated packaging systems tailored for single pack and multi pack applications across the food, confectionery, frozen, pharmaceutical, and non food industries.

Only 0.1 miles away from Cobb Parkway and 2.6 miles from the I-75 & McCollum Parkway interchange, the major Northwest Atlanta thoroughfares, Cobb International’s deep infill location provides tenants unimpeded access to all of Atlanta’s northwest suburbs.

Cobb International benefits from 40’ x 40’ column spacing, dock-high and drive-in doors, and an optimal office finish of 33%. Average suite size at the property totals 4,753 SF providing preferred suite configuration for a large swath of tenants seeking a last-mile presence in one of Atlanta’s stronger demographic pockets.

The property is 93% leased to ten distinct tenants who demonstrate a WALT of 2.1 years. In addition to the already stable cash flow, the property presents a near-term mark-to-market opportunity of 19% providing investors strong yield potential at an infill location with limited nearby availability (98.5% leased rate within 2-mile radius).

Red’s Kitchen Sink, LLC

- 1610 & 1620 cobb

Suite: 1610C-1 | Size: 4,440

LXD: 1/31/2027

www.redskitchensink.com

Red’s Kitchen Sink, LLC is a boutique health and wellness brand based in Kennesaw, Georgia, specializing in plant-based personal care and nutritional products such as wild-crafted sea moss gel, herbal hair formulas, and skin care blends.

Analia Home Health Center Services, LLC

Suite: 1610C-2 | Size: 3,698

LXD: 12/31/2026

www.analiahhcs.com

Analia Home Health Center Services, LLC is a Conyers, Georgia based in-home healthcare provider specializing in skilled nursing, medical aide, and companionship services for medically fragile children and adults.

Alliance Pacific Corporation, Inc.

Suite: 1610C-3 | Size: 3,662

LXD: 6/30/2026

www.asg-usa.net

Alliance Pacific Corp is a logistics company that provides a wide range of specialized shipping and forwarding services for both import and export clients. They have been in business for over five decades and work with a global network of partners.

Suite: 1620C-5 | Size: 4,500

LXD: 10/31/2028

www.choq.com

Choq LLC is a Texas-based limited liability company that specializes in providing a range of health and wellness products aimed at enhancing vitality and overall well-being. Choq, LLC.

W&L Design Group, LLC

Suite: 1610C-4 | Size: 4,000

LXD: 1/31/2028

Website: N/A

Sugarloaf Interactive LLC

Suite: 1620C1-2 | Size: 4,000

LXD: 7/31/2029

Website: N/A

highlights - c1610, 1620 cobb

Universal Pneumatic and Electric Group, Inc.

Suite: 1620C6-7 |Size: 11,200

LXD: 3/31/2027

Website: N/A

Universal Pneumatic & Electric Group, LLC (UPE Group) is a Kennesaw, Georgia–based industrial equipment supplier specializing in pneumatic, electrical, and control systems for commercial and manufacturing applications.

Founded in 2009, the company operates from its headquarters at 1620 Cobb International Blvd.

Lidan Inc.

Suite: 1610C6-7 | Size: 6,120

LXD: 2/28/2031

www.lidaninc.com

Lidan Inc. is a New York–headquartered life-sciences innovator specializing in polymer-based biopharmaceuticals, medical devices, and consumer healthcare products. Lidan’s products are distributed across multiple healthcare channels, reinforcing its position as a reliable, science-driven manufacturing partner.

More North America Corporation

Suite: 1620C-3 | Size: 2,800

LXD: 4/30/2027

www.more-oxy.com

More North America Corporation is the U.S. division of an international metallurgy technology provider, based in Kennesaw, Georgia. The facility offers engineering and technological packages for the steel industry delivering turnkey solutions, spare-parts supply, component repair, process support, and field service to North American steelmakers.

RAD Marketing LLC

Suite: 1610C-5 | Size: 4,400

LXD: 2/28/2027

www.radmaa.com

RAD Marketing & Advertising LLC (branded as RADMAA) is a high-energy marketing and promotional firm specializing in face-to-face, in-person campaigns supporting energy deregulation services across the U.S.

Located 1 mile from the Jimmy Carter Blvd & I-85 N interchange and 4 miles from the I-85 & I-285 interchange, 1750 Young Court features one of the best locations in Atlanta with quick access to the city’s major arterial roads. With 261k people within 5 miles of the property, Young Court caters to one of Atlanta’s densest population nodes which includes cities such as Norcross, Chamblee, Peachtree Corners, and more.

Young Court is centrally located within one of Atlanta’s densest industrial hubs, which features over 22 million square feet of industrial space within a two-mile radius. The significant presence of institutional owners such as Prologis, W.P. Carey, and Link Logistics underscores the premier, institutional quality of this location.

Young Court is 100% leased to three tenants with a WALT of 3.2 years providing investors with stable cash flow from a quality tenant roster which includes Olé Mexican Foods (53% of RBA). The property also benefits from a sizeable mark-to-market opportunity of 49%, with the majority of this upside already captured through Olé Mexican Food’s executed lease extension ($6.25 PSF → $12.50 PSF; commences 1/1/2026).

tenant highlights - 1750 young court

KILIM USA CORP

Suite: 1750A | Size: 18,056

LXD: 2/28/2030

www.kilim.com

Kilim USA Corp is a leading textile and rug wholesaler specializing in authentic, high-quality Turkish rugs and decorative floor coverings. Serving both retail and wholesale markets, the company offers an extensive product line that blends traditional craftsmanship with modern designs. With its U.S. headquarters located in Young Court, Kilim USA supports a robust distribution network and maintains long-term relationships with design professionals, retailers, and consumers nationwide.

Kinko Trading Corporation

Suite: 1750B | Size: 9,827

LXD: 9/30/2027

Website: N/A

Kinko Trading Corporation is a trading and distribution company supplying a wide range of consumer and commercial products. The company’s operations focus on efficient supply chain management, competitive sourcing, and dependable fulfillment to meet the needs of retail and wholesale customers.

Mexican Foods, Inc.

Suite: 1750C, 1750D | Size: 31,117

LXD: 12/31/2028

www.olemex.com

Ole Mexican Foods, Inc. is one of the largest Hispanic-owned food companies in the United States, producing a full line of authentic Mexican food products including tortillas, chips, and specialty foods. Founded in 1988, the company distributes its brands—such as La Banderita and Xtreme Wellness—nationwide to grocery chains, foodservice providers, and specialty retailers.

Minutes from the heart of downtown Atlanta, ideally positioned within 2 miles of I-285 as well as proximity to Buckhead, Midtown, and the Northwest suburbs, South Atlanta Road provides exceptional access to Atlanta’s consumers and business communities.

The property is located in the Chattahoochee Industrial submarket which has historically been one of Atlanta’s best performing submarkets. To that end, the Chattahoochee Industrial submarket demonstrates a vacancy rate of 6.5% as of 2Q 2025, second lowest in Atlanta, which is 32% lower than the Atlanta wide rate of 9.6%.

South Atlanta Road is 100% occupied by 4 tenants with a WALT of 3.9 years. In-place rents are just 5% below market, providing investors with market cash flow and minimal turnover risk. Nearly half of the building is occupied by 1-800-got-junk through 10/31/2030. Their commitment to the location is evident, as they expanded their footprint by 77% in July 2025.

tenant highlights - 4938 south atlanta road

1-800 Got Junk?

Suite: 100 & 600 | Size: 27,762

LXD: 10/31/2030

www.1800gotjunk.com

1-800-GOT-JUNK? is a leading franchised junk removal company that provides full-service hauling for both residential and commercial clients. Founded in 1989 by Brian Scudamore in Vancouver, Canada, the company’s business model focuses on making junk removal easy, professional, and customer-friendly.

Suite: 400 | Size: 12,139

LXD: 8/31/2027

www.juneaucc.com

Juneau Construction Company is a leading, privately held commercial general contractor headquartered in Atlanta, Georgia, with additional offices in Miami and Tampa, Florida. Founded in 1997, the firm has delivered a diverse portfolio of projects across education, multifamily, hospitality, and commercial sectors.

MOMENTUM-NA, Inc.

Suite: 800-900 | Size: 12,220

LXD: 12/31/2029

www.momentumna.com

Momentum-NA, Inc. is a brand experience and environmental design firm specializing in creating immersive retail, showroom, and trade event spaces for global brands. The company offers full-service capabilities from design and engineering to fabrication and installation, helping clients create engaging customer touchpoints.

GSK GROUP, LLC

Suite: 700 | Size: 6,053

LXD: 12/31/2028

www.us.gsk.com

GSK Group, LLC represents the U.S. operations of GSK plc, a global biopharma company with a mission to unite science, technology, and talent to get ahead of disease. The company’s U.S. division focuses on research, development, and distribution of products across therapeutic areas including infectious diseases, oncology, and immunology.

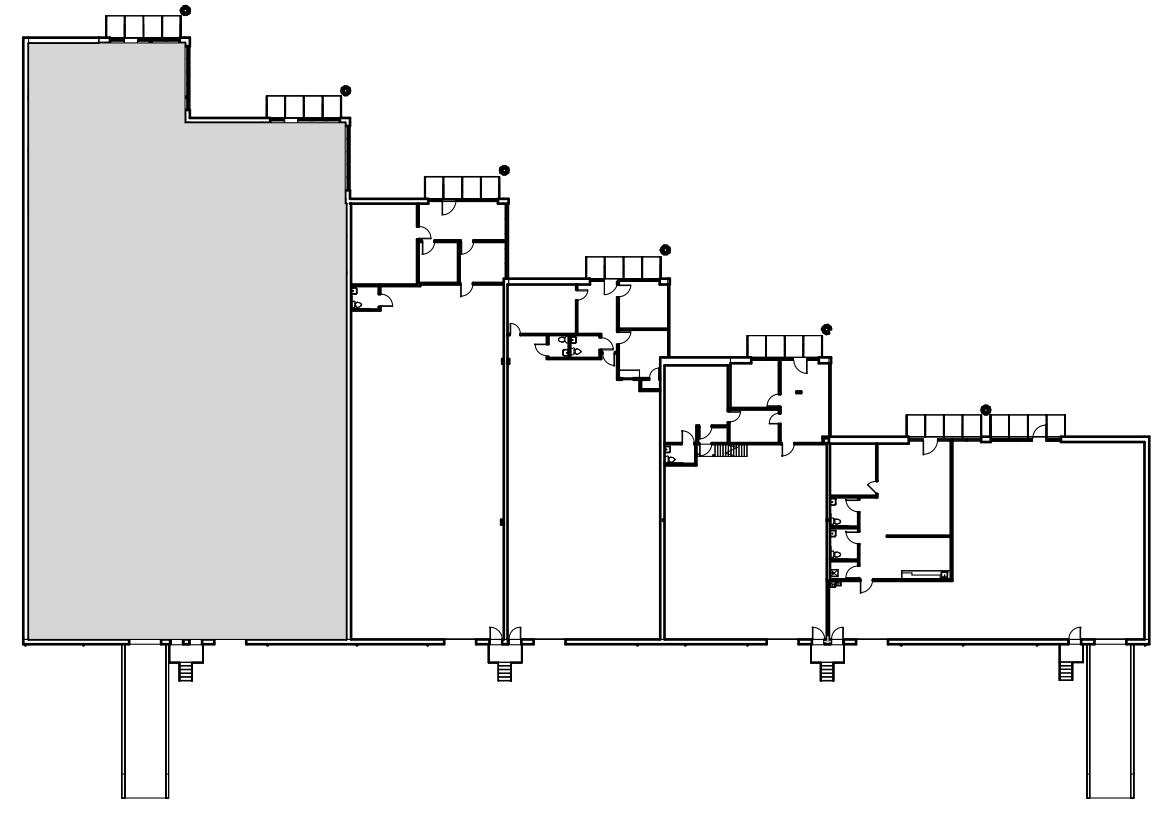

Situated in the heart of Peachtree Corners with frontage on Peachtree Industrial Boulevard, this property provides a strategic advantage for last-mile logistics and service companies. Its prime location offers exceptional connectivity to Atlanta’s major arterial road network, with I-85, Buford Highway, and Peachtree Parkway all less than four miles away. This access allows tenants to rapidly reach and serve the area’s dense population.

Renovated in 2008, this Property offers optimal configuration for a wide array of tenants with its varying suite sizes which are all equipped with dock-high doors and 20’ clear heights. The property is currently 100% occupied by four tenants which have occupied their respective space for over 5 years on average, demonstrating their commitment to the building and location.

The property is 100% occupied with a WALT of 2.2 years, presenting a near-term mark-to-market opportunity of 40%. Given the in-place tenants track record of renewing, combined with the strong demographic profile and accessibility of this location, a high probability of significant yield growth exists at this location.

Camp Woof of Norcross, LLC Maggie Lyon, Inc.

Suite: A1 | Size: 8,122

LXD: 4/30/2031 www.campwoof.com

Camp Woof of Norcross is a premier dog daycare company offering overnight boarding, self-service dog wash stations, and a retail pet supply boutique.

Suite: B-1 | Size: 25,138

LXD: 9/30/2027 www.maggielyon.com

Maggie Lyon Chocolatiers is a family-owned confectionery producer headquartered in Norcross, Georgia, specializing in gourmet truffles, toffees, caramels, and other artisan goods. For over 40 years, the company has maintained a flagship store at 6000 Peachtree Industrial Blvd while also serving wholesale and e-commerce customers nationwide.

Atlanta Sheetmetal Works, LLC

Suite: D | Size: 19,768 LXD: 4/30/2027 www.atlantasheetmetal.com

Atlanta Sheetmetal Works, LLC is a high-volume custom trim and metal fabrication shop serving commercial roofing contractors throughout the Atlanta metro area. Specializing in precision-made metal roofing components, the company focuses exclusively on trade clients, delivering accuracy, quality, and fast turnaround.

Sweet Science Fitness

Suite: A2 | Size: 5,111

LXD: 12/31/2030

www.sweetsciencefitness.com

Sweet Science Fitness is an Atlanta-based boxing gym that provides classes and personal training for all levels, from beginners to competitive amateur boxers. The club focuses on teaching the fundamentals of boxing for both fitness and skill.

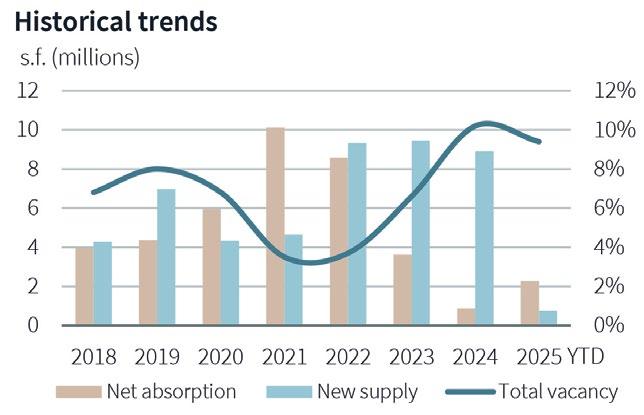

• With nearly 49M SF of active tenant requirements, demand is strong, despite a slight slowdown in absorption volumes

• Under construction volumes down 48.6% YoY as of 2Q 2025 (lowest first-half point since 2015). This, combined with strong tenant demand, is expected to support rent growth

204.9M s.f.

Existing Inventory

2.3M s.f. YTD Absorption 760,000 s.f. YTD Completions

• The Northeast submarket has seen significant activity so far this year. Year-to-date absorption has already surpassed 2024’s total net absorption by 1.4 million s.f., driven by mid-to-large-sized move-ins, including seven occupancies exceeding 100,000 s.f. Move-outs averaged roughly 20,000 s.f., while the largest vacancy this quarter was just under 97,000 s.f.

• After three years of massive new supply influx – two of which saw new supply far outpacing demand – completion and under construction volumes are down significantly. Speculative development accounts for 75% of under construction product, 35.3% of which is preleased. Only two projects have delivered so far this year, both ownerbuilt manufacturing facilities.

• Availability is at its highest point in recent years, up 60 bps YoY. Vacancy is up 70 bps YoY; however, rates decreased for the second consecutive quarter after peaking at 10.2% at the end of 2024. The Northeast submarket accounts for 29% of Atlanta’s bulk (500,000 s.f. and above) product vacancy, with 7.6 million s.f. vacant in this size segment.

• The Northeast submarket leads Atlanta in YTD leasing activity with 6.8 million s.f. of leases signed. New leases account for 67.5% of deals and are up 15% YoY. Large-block leases saw the biggest jump, up 74.1% YoY. Three new deals over 250,000 s.f. were signed this quarter, totaling 1.5 million s.f.

• Recent activity has been bolstered by Construction, Machinery & Materials, 3PL and Manufacturing industries. The submarket benefits from a growing population, proximity to high-income areas, and access to I-85, making it ideal for distribution up the East Coast.

75.4M s.f.

Existing Inventory -37,420 s.f. YTD Absorption

747,923 s.f. YTD Completions 3.3M s.f. Under Construction

• The Northwest submarket is in a state of transition, showing early signs of stabilization after a period of high vacancy and availability rates. While vacancy and availability rates remain elevated, they are decreasing - a byproduct of the submarket’s inventory size.

• Vacancy is down 220 bps YoY, and the Northwest holds the thirdsmallest volume of vacant space among Atlanta’s core submarkets at 8.7 million s.f. (only 3.5 million s.f. of which is in bulk product). Availability rates dropped 150 bps YoY, indicating stabilization well below the highs seen in 2022-2023 (nearly 18%).

• Absorption has been impacted by a new 200,000 s.f. vacancy at the close of Ql, flipping YTD absorption volumes negative. The largest vacancy this quarter was roughly 125,000 s.f. One large-block movein occurred, with the remainder of occupancies averaging 25,000 s.f.

• Development activity has slowed, with current construction volumes 2.4 million s.f. below the average of 5.7 million s.f. per quarter since 2021. While deliveries are up 4.4% YoY, under construction volumes dropped 23.7% YoY. No construction starts have occurred this year, with the only active project being SK Battery’s 3.3 million s.f. manufacturing facility. With no speculative projects underway, vacancy could potentially decrease as demand aligns with supply delivered in recent years.

• Leasing activity in the first half of the year was slower compared to the same period in 2024, with 3.0 million s.f. of deals signed-78% of which were new deals. However, new leasing activity has been increasing in deals under 100,000 s.f., with leasing volumes in this segment up 32.2% YoY.

11.1M s.f. Existing Inventory

• The Chattahoochee submarket has historically been an extremely supply constrained submarket with limited inventory. Since 2023, the submarket has delivered only 412s SF with zero SF of proposed supply over that same time.

• Since 2022, the submarket has witnessed nearly 500k SF of net absorption which represents 4.4% of total inventory.

• Given the minimal construction starts in the submarket, due to natural supply constraints, the vacancy rate has continued to compress and now sits at 6.5% - one of the lowest in all of Atlanta.

• The submarket’s infill locaiton and connetivity to some of Atlanta’s densest and most affluent population nodes have propelled this submarket to be one of the tigtest in Atlanta.

1. Seller will credit buyer for an amount equal to the remaining contractual rent abatement as defined in the lease agreements

2. Analysis real estate taxes come from ownership's 2025 budget and are escalated by 3.0% annually

*Denotes a signed LOI

PRIMARY

JIM FREEMAN Managing Director jim.freeman@jll.com

404.995.2399

BRITTON

DENNIS

BOBBY

MAGGIE

Jones Lang LaSalle Americas, Inc. or its state-licensed affiliate (“JLL”) has been engaged by the owner of the property to market it for sale. Information concerning the property described herein has been obtained from sources other than JLL, and neither Owner nor JLL, nor their respective equity holders, officers, directors, employees and agents makes any representations or warranties, express or implied, as to the accuracy or completeness of such information. Any and all reference to age, square footage, income, expenses and any other property specific information are approximate. Any opinions, assumptions, or estimates contained herein are projections only and used for illustrative purposes and may be based on assumptions or due diligence criteria different from that used by a purchaser. JLL and owner disclaim any liability that may be based upon or related to the information contained herein. Prospective purchasers should conduct their own independent investigation and rely on those results. The information contained herein is subject to change. The Property may be withdrawn without notice. If the recipient of this information has signed a confidentiality agreement regarding this matter, this information is subject to the terms of that agreement. ©2024. Jones Lang LaSalle IP, Inc. All rights reserved.

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500 company with annual revenue of $20.9 billion and operations in over 80 countries around the world, our more than 103,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape