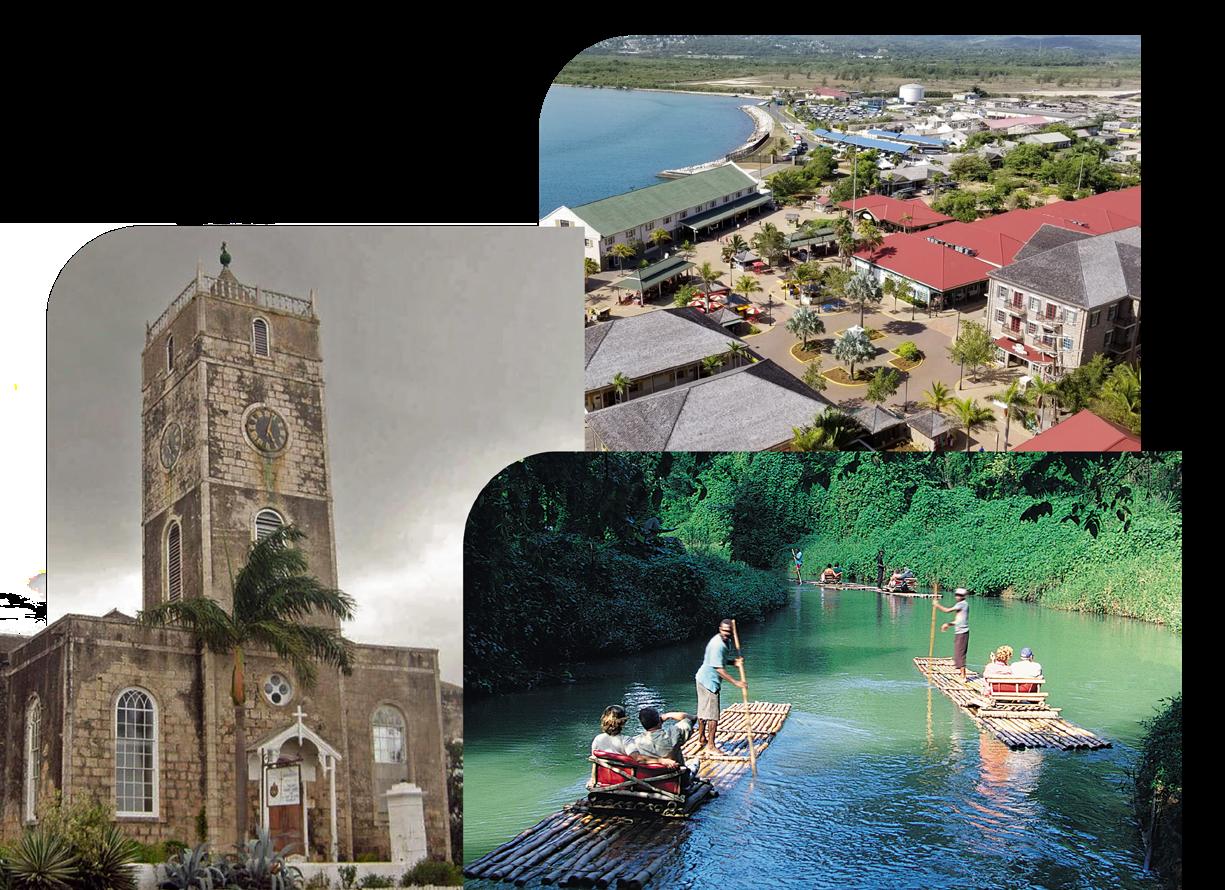

Located on Jamaica’s northern coast, Trelawny is a parish rich in heritage, natural beauty, and cultural significance. Anchored by the historic town of Falmouth, which is renowned for its Georgian architecture, Trelawny boasts a legacy shaped by Maroon resilience, sugar-estate history, and vibrant postemancipation communities. The parish is home to the ecologically important Cockpit Country, the Martha Brae River, and some of Jamaica’s most distinctive landscapes. Trelawny is also the home of the first ever piped water supply system in the Western Hemisphere and is the birthplace of global sprinting legends, such as Usain Bolt. Today, Trelawny blends its deep historical roots with modern development, emerging as a hub for tourism, agriculture, and cultural pride. Its unique character and enduring contributions make it a fitting backdrop for conversations on regional growth, resilience, and future-focused transformation.

As I reflect on my two-year term as President of the Caribbean Actuarial Association (“CAA”), I can only say — wow, what a journey! It has truly been my privilege and honour to serve and lead the CAA. Chairing the Board, guiding our strategic direction, and driving action on our goals have not been without challenges and a significant investment of time. Yet, it has been an incredibly rewarding and educational experience — one that I will always treasure and that has undoubtedly enhanced my professional experience and knowledge.

Throughout this term, the Board was steadfast in ensuring prudent financial management of your funds. We have maintained close oversight of CAA spending, developed guidelines to prioritise travel subsidies, and are currently reviewing our investment policy and strategy. Each expenditure was made with a single focus — how best to support our members, promote professional development, and advance actuarial science across the Caribbean.

Key projects that received funding from the CAA over the past 2 years, include:

• The development of indigenous mortality tables under Phase II of the Caribbean Mortality Tables Project – led independently by Stokeley Smart and his team;

• The SMART Tables Project, which provides an actuarial methodology for quantifying damages in personal injury and loss of earnings - led independently by Stokeley Smart and his team;

• A partnership with the Society of Actuaries (SOA) to create an Excel/VBA Toolkit for graphing ERA5 weather data for the Caribbean; and

• Collaboration with the Caribbean Institute of Meteorology and Hydrology (CIMH) to analyse weather related data sourced from physical instruments as compared to ERA-5 data sourced from satellites.

Support has also extended to launching the CAA Actuarial Science Scholarship which broadens the suite of scholarships offered to students at accredited Caribbean universities offering actuarial science, and the CAA Research Grant designed to encourage innovation and academic advancement in the actuarial field.

With the dedication and hard work of our Life and Technical Steering Committees, the CAA published an IFRS 17 Discount Rate Guidance Note, actively participated in regional regulatory discussions, and contributed to consultations such as the Central Bank of Trinidad & Tobago’s Draft Liquidity Guidelines. These initiatives underscore our commitment to technical excellence, collaboration, and balanced regulation in shaping the financial reporting landscape for insurers.

The CAA continues to strengthen partnerships with organisations such as the International Actuarial Association (IAA), Society of Actuaries (SOA), International Association of Black Actuaries (IABA), Caribbean Association of Insurance Regulators (CAIR), Caribbean Association of Pension Supervisors (CAPS), Institute of Chartered Accountants of the Caribbean (ICAC), and others — all with the goal

of promoting the exchange of knowledge and expertise. We proudly raised our visibility by attending and presenting at major conferences and publishing a special edition CAA newsletter highlighting our impactful activities and representation at the IAA.

No less important has been the tireless work of our various committees — Banking, Communication, Common Standards, Governance, Pensions, Social Security, Membership Support, and Property & Casualty — each playing a vital role in advancing the work of the Association.

Our progress rests on a solid governance structure supported by effective policies, guidelines, standards and by-laws that are continuously refined to elevate the professionalism of the CAA. We recently adopted two new Actuarial Practice Standards (APS 7 and APS8), Election Procedures & Guidelines, a Fit & Proper Questionnaire for those seeking to represent the CAA in an official capacity, ensured compliant registration and filing of CAA Inc. annual returns and tax returns, automated critical back-office operations and refreshed the content and overall flow of our website. Collectively, these efforts have strengthened operational efficiency, and they are expected to support the timely production of our audited financial statements.

My heartfelt thanks go to all who have volunteered their time and expertise — committee members and my fellow Board colleagues: Simone, Nicola, Rohan, Varsha, Ryan, Glennfor, Nikita, and Adolex. I am deeply grateful for your commitment, insight, and generosity in advancing the actuarial profession across our region.

A special note of appreciation goes to Betty, our Administrative Manager, who will conclude her service with the CAA at the end of 2026. As we gather in her home country of Jamaica for the 2025 CAA Conference, it is fitting to express our heartfelt thanks for her unwavering dedication over the past 13 years. Betty has been our constant — keeping us organised, connected, and moving forward — and her contribution to the CAA is immeasurable.

Finally, I extend my deepest gratitude to Simone Braithwaite, our Immediate Past President, and to all Past Presidents who laid the foundation upon which we continue to build. To Nicola Barrett, the President-Elect, thank you for your incredible support and partnership throughout my term. I have every confidence that Nicola and the incoming Board, will bring fresh energy, insight, and vision to lead the CAA into an even brighter future.

It has been an honour to serve you all. Thank you for the opportunity to lead, to learn, and to give back to this exceptional community.

Please take the time to attend the 2025 Annual General Meeting, if eligible, and for additional information on the CAA and its activities, please go to https://www.caribbeanactuaries.com/.

JUDY VEiRA PRESIDENT, CAA

(DEC 2023 - DEC 2025)

It is with immense pleasure that I welcome you to the 35th Annual Caribbean Actuarial Association Conference in the beautiful land of my birth and place that I call home, Jamaica.

Our 2025 conference theme – Future-Proofing the Present –embodies the duality of dealing with today’s issues while also planning for the issues of tomorrow. It is our vision that this conference will inspire participants to help create a future that is representative of the resilience of Caribbean people by using our collective knowledge, skills and resources to prepare our communities to thrive in a new social, economic, and physical environment.

The last time the CAA conference was held in Jamaica was in 2018. In the seven years that have elapsed since then, something unprecedented happened – two catastrophic Category 5 hurricanes made landfall in the Caribbean. The first was Hurricane Dorian which hit Bahamas in 2019, followed by Hurricane Melissa which hit Jamaica, more recently, in 2025. The estimated damages and losses caused by these two hurricanes amounted to approximately US$12.2 billion, equivalent to 27% of Bahamas’ 2018 GDP and 41% of Jamaica’s 2024 GDP.

Hurricanes Dorian and Melissa both had one thing in common. They underwent what is called rapid intensification (“RI”) which resulted in their significant strengthening over just a single day, right before they made landfall. One of the primary factors contributing to RI of hurricanes is extraordinarily warm seas which gives hurricanes the energy required to rapidly strengthen. Studies show that natural warming of the atmosphere alone cannot explain the rate of sea warming that we are observing presently, and that human-induced global warming is one of the key factors contributing to this alarming sea warming. The data also shows that because there are significantly warmer seas in the Caribbean region, RI of hurricanes is becoming more prevalent during the Atlantic hurricane season, which means that it is likely that we will see increased incidences of monstrous hurricanes making landfall in the Caribbean and along the coasts of the Americas in the future.

This is a sombre reminder that the risks that we thought would materialise in the region in the distant future are with us today. It is also why this year’s conference theme – Future-Proofing the Present – is more relevant now than when we selected it earlier this year.

One of our primary objectives for this conference was to attract a diverse conference delegation. We sought to achieve this by having more sessions and increasing the breadth of the session offering on the conference programme. In furtherance of this objective, we recruited over 50 speakers from various industries with representation from the Caribbean, North America, Central America, South America, Europe, and Africa. These speakers bring with them deep experience in their respective fields and strong Caribbean linkages. I’d like to express my heartfelt gratitude to each of our 2025 conference speakers for graciously offering to share their knowledge and insights on our platform. Armed with a cadre of speakers, we were able to have more sessions at this year’s conference than any other CAA conference in the recent past.

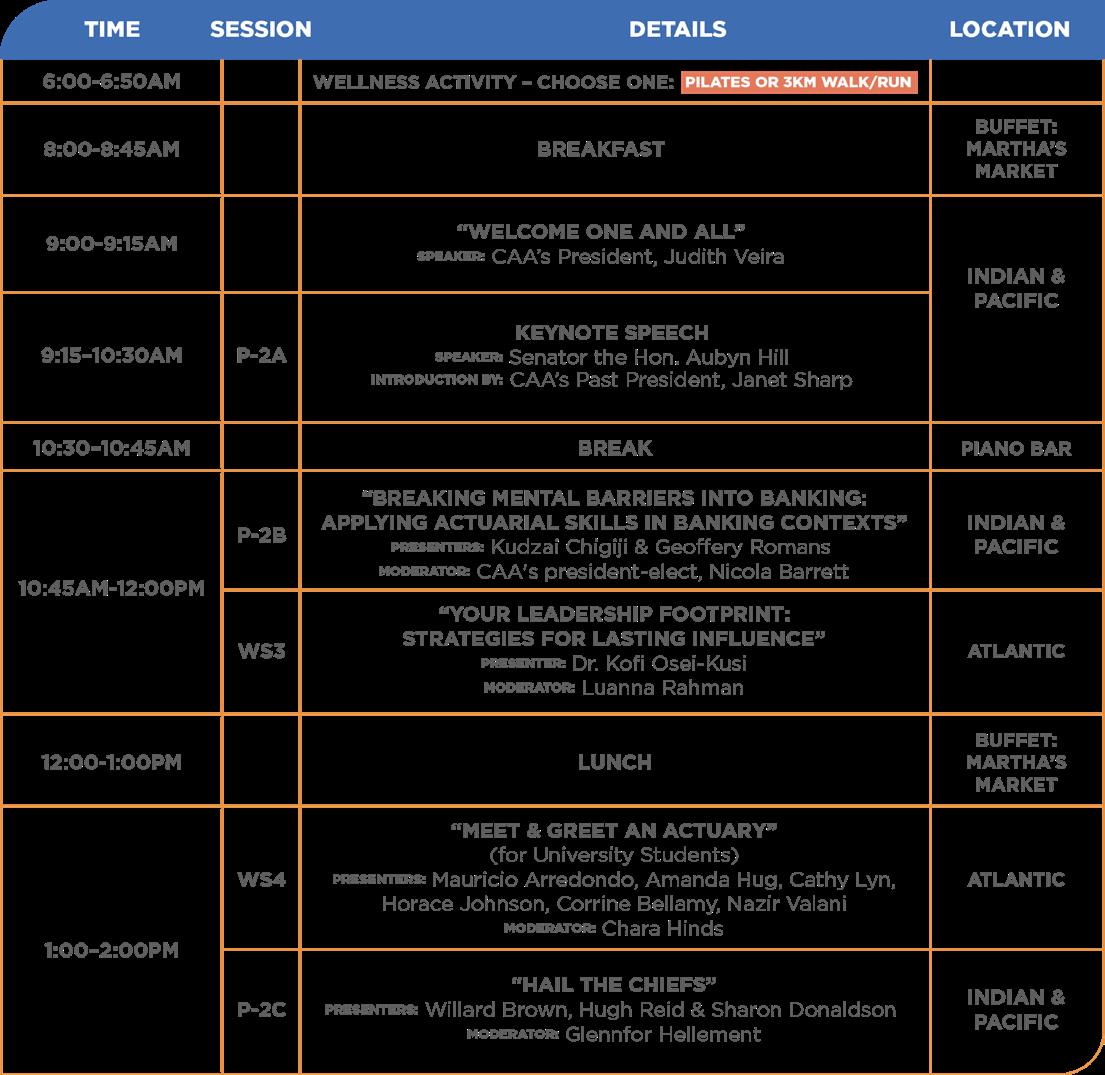

On the first day of the conference, we have:

• The customary actuarial professionalism course which includes a Caribbean twist on a popular course format developed by the Society of Actuaries;

• A roundtable discussion with the presidential representatives of various actuarial associations in attendance at the conference; and

• Leadership and self-development sessions that professionals at any level can use to elevate their careers.

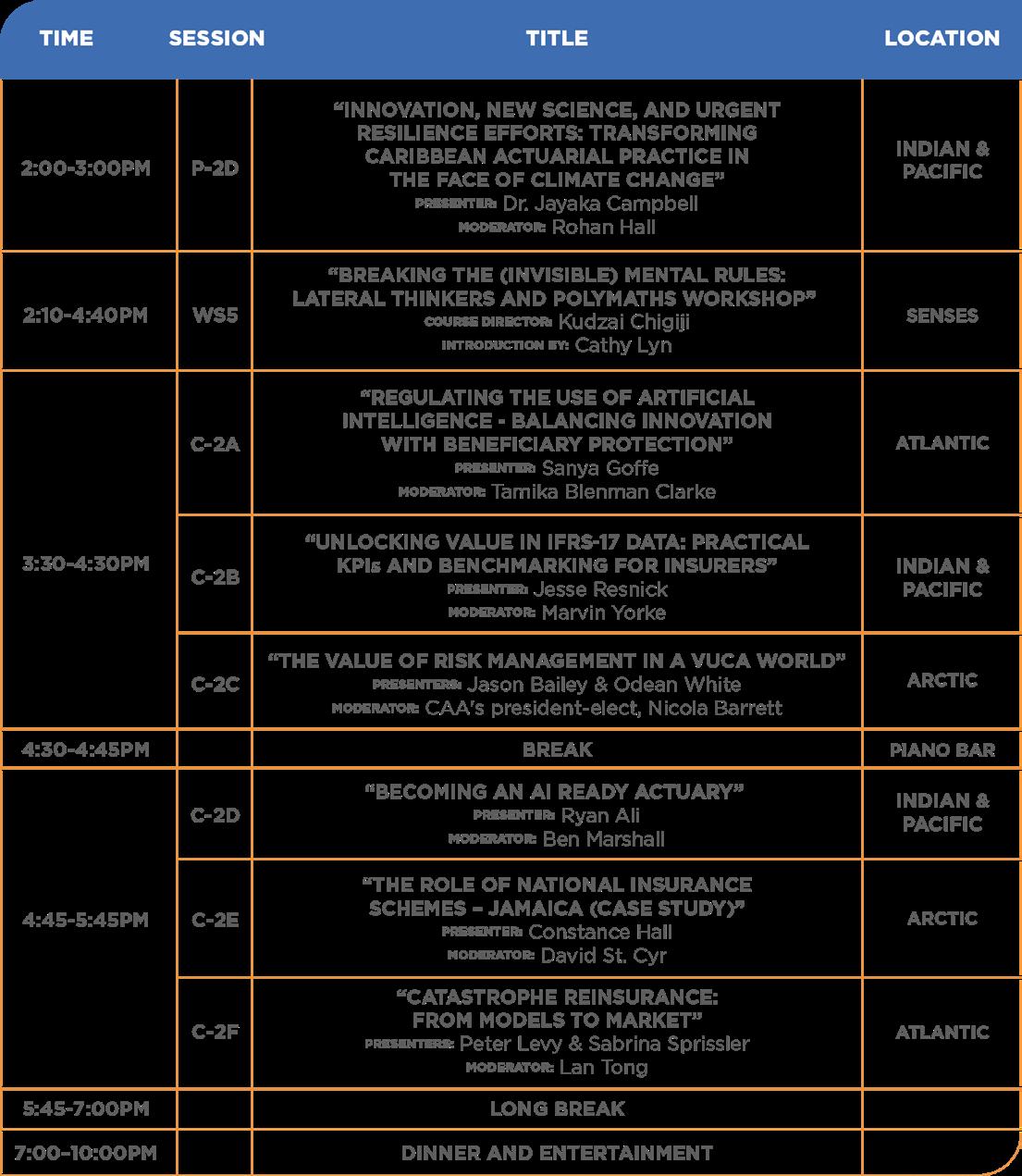

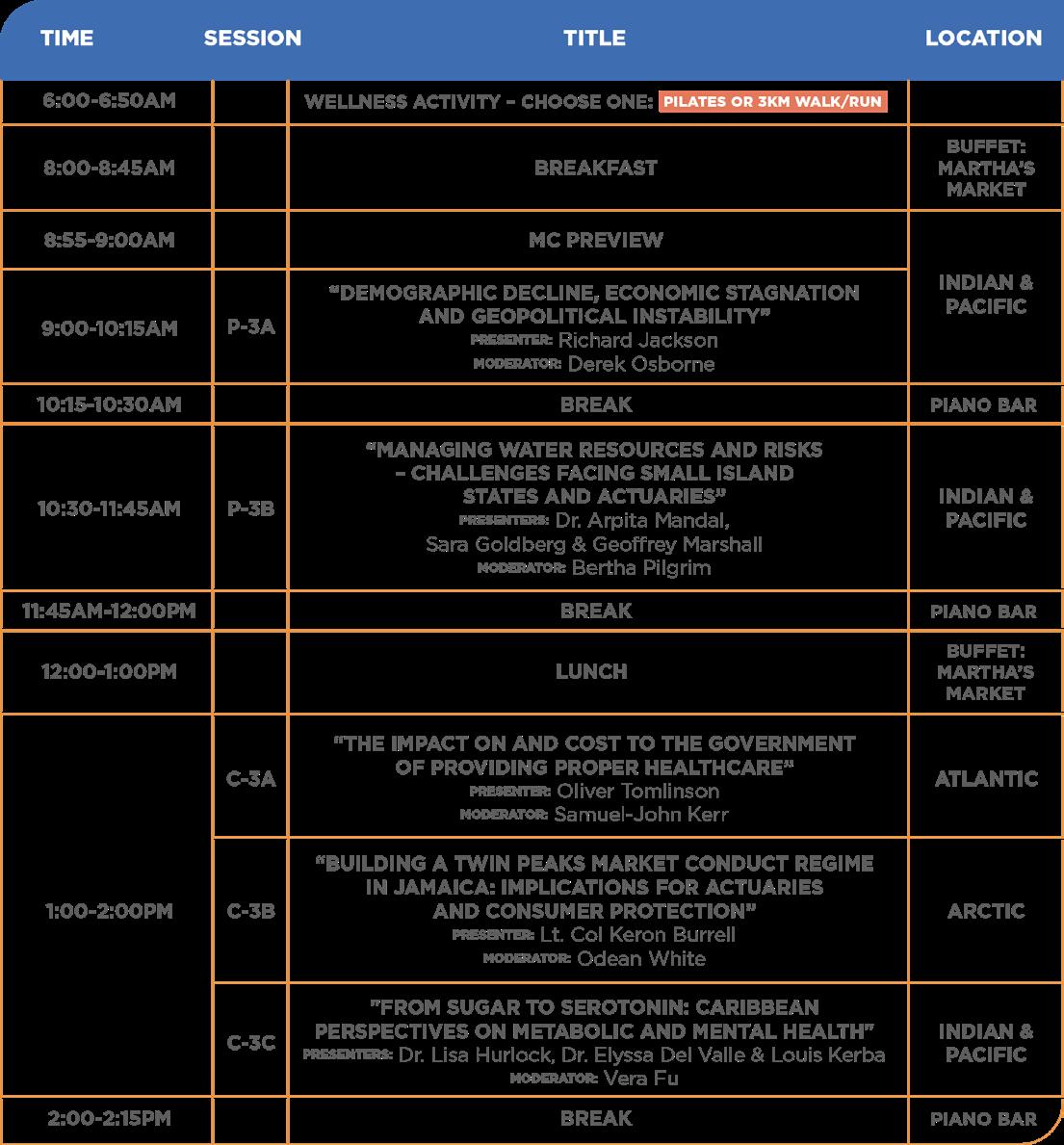

While on the second and third conference days, we have:

• An opening keynote speech from Senator the Hon. Aubyn Hill, Jamaica’s Minister of Industry, Investment & Commerce;

• The technical sessions, including 5 plenary sessions, 12 concurrent sessions, and workshops which cover a wide range of practice areas and topics that are extremely important to the small island developing states that comprise the Caribbean region – topics such as building climate resilience, catastrophe risk management and sustainable development; and

• A closing motivational speech by a renowned transformational leader in Jamaica.

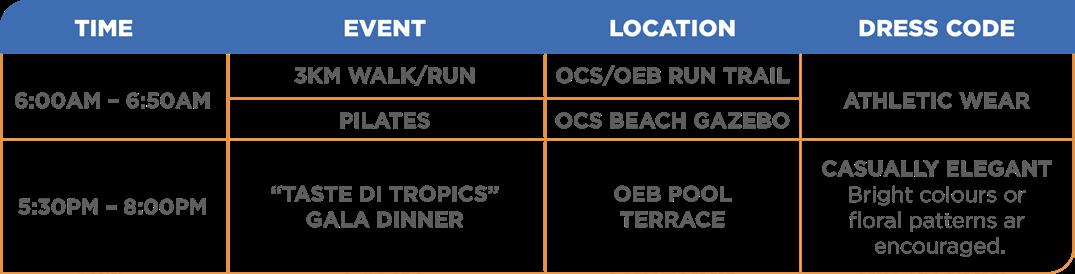

Throughout the conference, we also have curated morning wellness sessions and evening social events which I encourage conference delegates to participate in to enjoy the full conference experience.

Measuring what matters, I’m happy to report that at the time of writing this message, we have over 250 delegates registered for the in-person conference with over 50 areas of interest represented, signifying that we have broadly met our objective of having a delegation that is reflective of diversity in numbers.

I’m truly proud of what we have achieved with this conference in Jamaica. We lost about two weeks of productivity in our planning activities at a very crucial juncture due to the impacts of Hurricane Melissa on Jamaica, yet we were still able to pull through, drawing on inspiration from the words of Voltaire, “perfect is the enemy of good”, to make the conference a reality.

My sincere appreciation goes out to each of our conference planning committee members who, despite their primary responsibilities, volunteered and poured themselves into planning this conference over the last nine months. Without their dedication and their resilience in the face of adversity, this conference simply would not have been possible.

I would also like to specially thank our 2025 sponsors, including the sponsors that have continued to support the CAA’s conferences over the years, and our new sponsors that have come on board after recognising the value that the CAA and the actuarial profession can bring to their organisations.

In closing, my humble ask of each delegate is to make full use of this conference. I encourage you to connect with each other in meaningful ways and to share your ideas and experiences so that this conference will be ultimately storied as the genesis of important initiatives that will go on to safeguard the future of our communities in the region.

Thank you and have a great conference!

Yours sincerely

STUART SOUTH, FSA 2025 CAA CONFERENCE CHAIR

Hurricane Melissa left its mark on Jamaica, testing the strength of our communities and infrastructure. Yet, in the face of adversity, Jamaicans have shown remarkable courage and unity. Recovery is underway in Jamaica, but there is still work to do—and every contribution makes a difference.

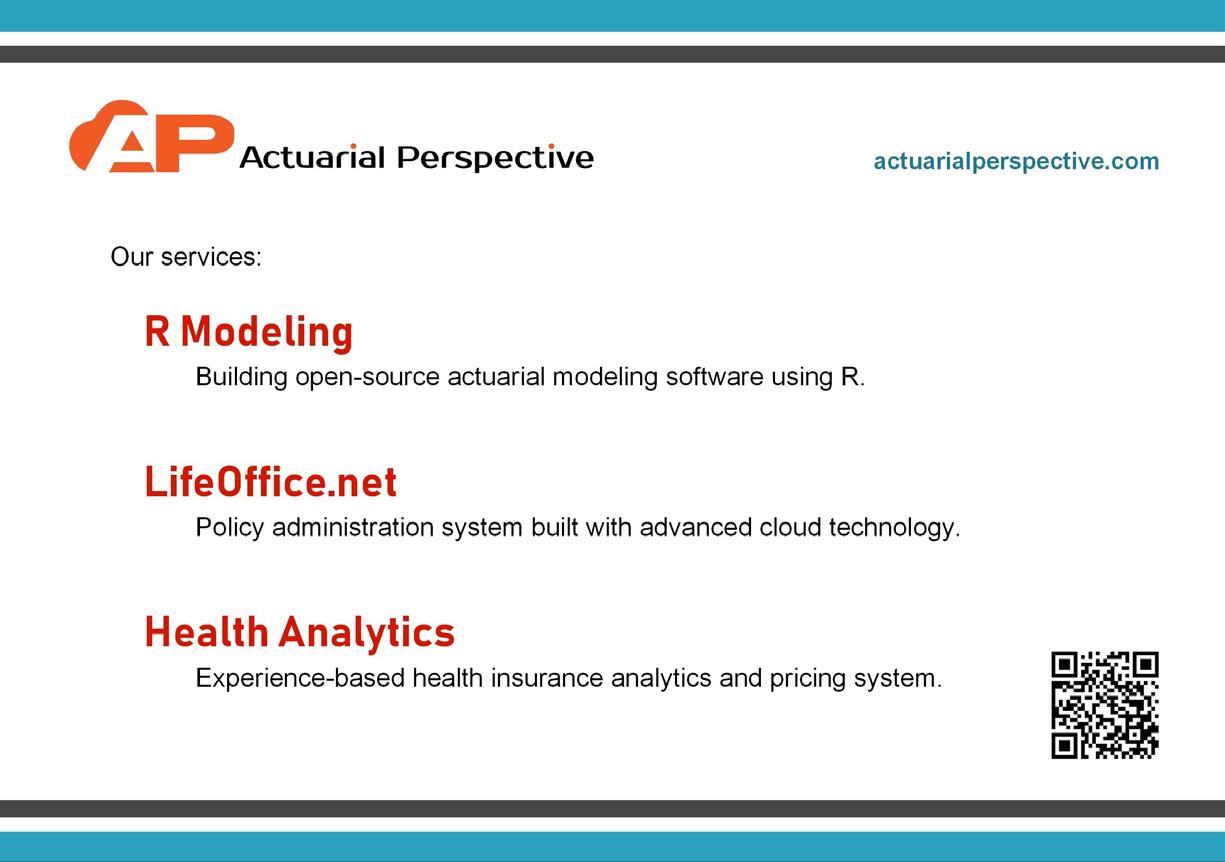

Scan the QR code to join the effort. Your support will help to restore homes, rebuild lives, and create a stronger, more resilient Jamaica for the future.

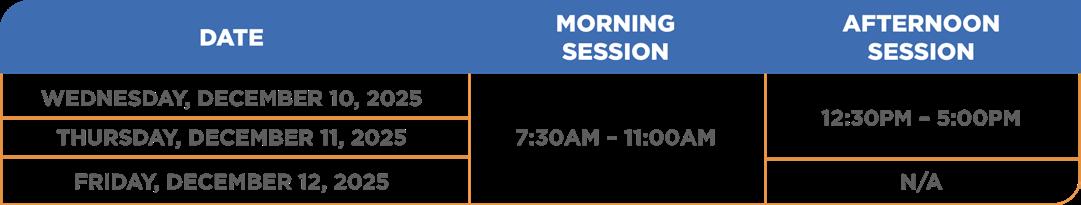

The Conference Secretariat is located in the Mediterranean Boardroom of the convention centre at the Ocean Coral Spring resort and will be operational during the following hours:

Participants are encouraged to register and collect their conference packages from the Conference Secretariat at their earliest convenience.

There is a free, user-friendly conference app provided to us by RGA. The app will provide the schedule, speaker information, sponsor information, and more. Scan the QR code below to download the app:

OR Download the app directly

Search: RGA Global Events

Log in to the app using the credentials below:

Username: Password: CAA2025

The email address that you used to register for the conference

Participants are encouraged to use the “Ratings & Reviews” feature to rate and review each session.

Wednesday December 10, 2025

Thursday, December 11, 2025

Friday, December 12, 2025

WIFI

Complimentary Wi-Fi is available in the Ocean Coral Spring convention centre for all attendees. Please use the information below to connect.

Network: Convention Centre

Passcode: groupsCC

SESSION SPOTLIGHT

Wednesday, December 10, 2025: Presidents’ Roundtable

This dynamic session brings together leaders from the world’s leading actuarial bodies for an open dialogue on the profession’s future. Hear insights on global trends, emerging challenges, and collaborative strategies shaping actuarial practice. Join the conversation that connects vision, leadership, and innovation across borders.

Thursday, December 11, 2025: Innovation, New Science, and Urgent Resilience Efforts: Transforming Caribbean Actuarial Practice in the Face of Climate Change

Climate change is rewriting the rules of risk. With disasters like Hurricane Melissa widening the protection gap, actuaries must move beyond traditional models and lead with innovation that turns science into action through climate-resilient solutions and partnerships. The time for transformation is now.

Friday, December 12, 2025: Managing Water Resources and Risks – Challenges Facing Small Island States and Actuaries

Small island states are on the frontlines of water scarcity, flooding, and climate-driven extremes. This session dives into the urgent need for innovative solutions and crossdisciplinary collaboration.

CONFERENCE CHAIR

Stuart South (Conference Chair & Registration Sub-Committee Chair)

CONFERENCE TREASURER

Tamika Blenman Clarke (Conference Treasurer)

SUB-COMMITTEE CHAIRS

Adolex Grant (Technical Sub-Committee Chair)

Bari-Ann Bryant (Booklet Sub-Committee Chair)

Conrad McKellop (Transportation Sub-Committee Chair)

John Robinson (Programme Sub-Committee Chair)

Kathryn Myers (Tokens Sub-Committee Chair)

Nikhil Asnani (Sponsorship Sub-Committee Chair)

Shanique McPhail (Social Events Sub-Committee Chair)

CONFERENCE COMMITTEE MEMBERS

Abigail McLean

Alicia Ganess

Chenille Mundell

Corrinne Bellamy

D’Andre Forbes

Daniel Brown

David Henlin

Jaheim Miller

Jaleel Robinson

Jo-Gianna Hall

Justine Powell

Luken Lewin

Michael Young

Mikhail Francis

Shani-Kay Lawson

Shayna Stennett-Jones

Sydnie McDermott

Angelita Graham, FCIA, AccBD, MBA, FSA, is a Partner at Mercer Canada, where she leads more than 500 colleagues and advises organizations on complex workforce, pension, and risk matters. Known for her steady leadership and practical, forward-looking approach, she brings clarity, collaboration, and strategic insight to complex challenges facing clients and teams alike.

Angelita’s actuarial path began at the University of the West Indies, where she earned her undergraduate degree in Mathematics. Early in her journey, she was influenced by the mentorship of the Hon. Daisy Coke, OJ, CD, a pillar of the Caribbean actuarial community whose guidance helped shape Angelita’s sense of purpose and commitment that would guide her career. After completing postgraduate studies in the UK, she continued her professional journey in Canada, where she has built the majority of her career and established a longstanding record of leadership, innovation, and commitment to helping organizations and people thrive.

For nearly two decades, Angelita has contributed to the Canadian actuarial profession through a range of volunteer roles, beginning with the CIA’s Committee on Continuing Education in 2008. Her work has spanned education, governance, professional standards, and public interest initiatives, reflecting her dedication to strengthening the profession and supporting its evolution. In 2020, her longstanding service was recognized with the CIA Award of Excellence.

Beyond her professional contributions, Angelita also lends her expertise to the broader community. She serves on the Board of Governors of the Royal Ontario Museum and is ViceChair of the Audit and Finance Committee, providing oversight and stewardship to one of Canada’s leading cultural institutions.

In July 2025, Angelita became President of the Canadian Institute of Actuaries. In this role, she is focused on advancing the CIA’s leadership on issues that matter to Canadians and the profession alike. Her priorities include elevating the Institute’s contributions to public policy, strengthening the development of future actuaries, and ensuring the profession remains well-positioned to address emerging risks and opportunities. She is also an advocate for integrating new technologies, including artificial intelligence and predictive analytics into actuarial practice in ways that support innovation while upholding the profession’s core principles.

A champion for continuous learning and broad perspectives, Angelita encourages aspiring actuaries to remain curious, open to challenges, and willing to step into experiences that stretch their thinking. She believes these qualities help cultivate leaders who are both resilient and grounded in purpose.

Angelita envisions a profession that embraces innovation with confidence while remaining anchored in rigour, integrity, and service to the public interest. She sees actuaries playing an increasingly influential role in addressing complex societal challenges, from climate risk to financial security, through data-driven insights and ethical leadership.

• Daisy McFarlane-Coke, Stephen Smit, Franz Alcindor, and Denise Radix begin early discussions on forming a Caribbean actuarial body.

• First official meetings take place, establishing the groundwork for a formal association.

• A vision emerges for a unified regional actuarial community.

• CAA gains admission to the International Actuarial Association.

• Development of actuarial practice standards begins.

• Growth in scholarship and student support initiatives.

• Increasing visibility of Caribbean actuaries on the global stage.

• First Hybrid CAA Conference

• Creation of the Model Actuarial Student Programme.

• Launch of new task forces addressing emerging regional needs.

• Publication of IFRS17 Discount Rate guidance paper.

• Ongoing contributions to SMART table development and Caribbean Mortality Tables

• Introduction of the CAA Research Grant in honour of Denise Radix.

• The CAA stands on a strong foundation prepared to evolve as the region undergoes demographic, technological, and climate-related change.

• Opportunities expand for actuaries to support national planning, financial security frameworks, disaster readiness, and social protection systems.

• Constitution and governance instruments are developed.

• Early collaboration with regional regulators begins.

• Foundations established for professional standards and regional cooperation.

• First CAA Conference held in 1991, fostering regional dialogue.

• First conference hosted by Curaçao.

• Growth in CAA committees, including banking, climate change, and discount rate guidance.

• Increased regional membership and student engagement.

• Exam refund programme implemented, strengthening student support.

The next fifteen years present an important opportunity for the CAA to broaden its influence, strengthen its visibility, and deepen its value to the region. Our progress toward the 50-year milestone will be shaped by relevance, evolution, mentorship, and expansion.

Future relevance depends on the profession’s ability to adapt its skillset to meet the region’s changing needs. Caribbean actuaries will require stronger capabilities in climate risk modelling, ESG integration, data science, AI literacy, and clear communication. A long-term regional strategy supported by international collaboration will help ensure that our technical skills remain valuable and responsive to emerging risks.

A sustainable future requires a strong and diverse talent pipeline. Strengthening outreach in secondary schools and universities, expanding access to learning resources, and offering meaningful mentorship experiences will help support emerging actuaries. Group based mentorship supported by digital platforms can deepen connection and broaden access to guidance across the region.

Evolution reflects how the profession grows in influence and presence. As the Caribbean faces increasing climate volatility, demographic change, and technological transformation, actuaries can help guide national planning, social protection reform, and long-term resilience strategies. The next stage of evolution calls for a more visible and engaged profession that contributes actively to public dialogue, policy development, and regional problem solving.

Expansion involves extending actuarial thinking into new areas where it can contribute to regional development. Over the next fifteen years, the CAA can work more closely with institutions involved in financial stability, climate adaptation, public health planning, social protection, and data quality. These collaborations create opportunities for actuaries to support resilience planning, economic security, and national development while strengthening the profession’s visibility and demonstrating its wider value.

The bridge to fifty years reflects a shared commitment to growth, relevance, service, and regional resilience.

Partner with Swiss Re to navigate complexity with clarity. Our innovative underwriting and claims solutions empower you to optimize processes, manage risks, and unlock growth opportunities, ensuring long-term success in a dynamic market.

Move forward in life with Swiss Re’s expertise today!

Life (re)insurers face shifting markets, evolving trends, and increasing regulation — but within every change lies opportunity.

With Moody’s AXIS™️, actuaries can model, forecast, and analyze with confidence — turning complexity into clarity and risk into resilience.

Because those who understand risk don’t fear change — they shape it. Future-proof your

Read now: Unlock insights. Amplify performance.

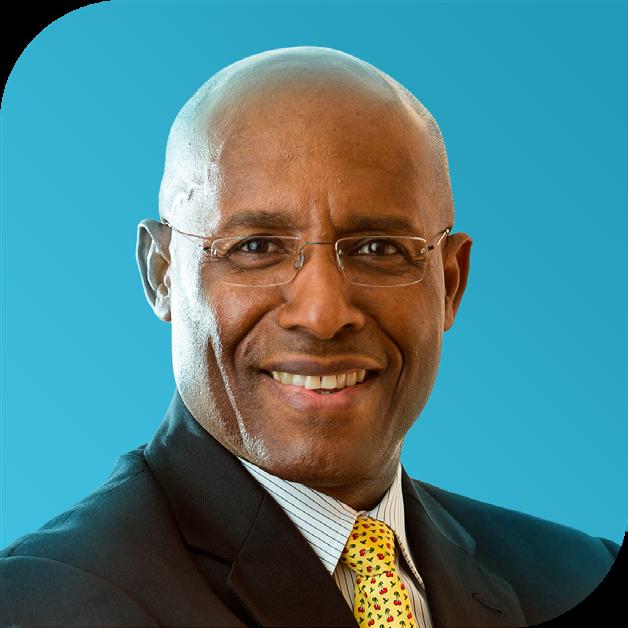

KEYNOTE SPEAKER

Minister Aubyn Hill has over 35 years of working experience in the private sector. As an international banker, he has lived in nine countries and done business in more than 125.

With an MBA from Harvard Business School, Senator Hill spent 21 years as a banker in the Middle East. Starting in 2002, he also led the management team which completed the successful turnaround of one of the largest banks in the Caribbean, National Commercial Bank Jamaica Limited (NCB). In 19 months, Aubyn and his team moved NCB’s stock price from J$5.51 when he joined to J$31.70.

After The Most Honourable Andrew Holness was returned as Prime Minister in a landslide election on September 3, 2020, he invited Senator Aubyn Hill to join his cabinet in the Ministry of Economic Growth and Job Creation.

On January 11, 2022, Prime Minister Holness reshuffled the Cabinet and appointed Minister Hill as Minister of Industry, Investment and Commerce. Minister Hill has responsibility for 20 agencies and departments.

Minister Hill has a firm interest in facilitating, enabling and encouraging small and large Jamaican businesses to grow, create good Jamaica jobs and be profitable. His focus is on growing exports exponentially and securing greater local and foreign direct investments into the Jamaican economy.

SPEAKERS ALSO INCLUDE: MARK

LISA WADE AND NIKITA GIBSON

Ryan Ali is a Senior Manager in PwC Canada’s Risk Modelling Services practice, specializing in actuarial transformation and advanced analytics. With extensive experience in life insurance and risk management, Ryan has led initiatives that include integrating artificial intelligence into actuarial workflows, with focus on model governance and regulatory compliance. Ryan is passionate about leveraging these emerging technologies to enhance actuarial decision-making.

Marcus Bosland is the Chief Operating Officer of Colina Insurance Limited, a life and health insurer in The Bahamas. He previously served as the Company’s Resident Actuary for 17 years.

A Fellow of the Society of Actuaries, Marcus graduated with distinction from the University of Waterloo (Ontario) with a joint honours degree in Actuarial Science & Economics. Marcus also holds a Master of Business Administration from Edinburgh Business School.

He is currently the Deputy Chair - Life & Health of The Bahamas Insurance Association and serves on the boards of the National Health Insurance Authority and CPCH Bahamas Limited.

He is a past-President of the Caribbean Actuarial Association and the current Chair of its Governance Committee.

Horace Johnson has over 35 years of local and regional experience in the actuarial profession, in the areas of life insurance, pensions, group life and health insurance, enterprise risk management, general insurance and product management.

He entered the actuarial profession with Eckler Partners and moved onto Sagicor Life Jamaica Ltd, where he also held leadership and management roles in Product Development, Underwriting, Claims and Risk Management. After leaving Sagicor, he has provided actuarial consulting services to clients in Jamaica and the Caribbean.

In January 2022, he joined the University of the West Indies (Mona Campus) as an Adjunct Senior Lecturer in the Department of Mathematics and was promoted to the position of a full-time Lecturer effective August 1, 2022.

He holds a BSc degree in Mathematics from UWI (Mona) and is a Fellow of the Society of Actuaries. He also earned certifications in ALM, Advanced ALM and ERM from Nexus Risk Management (Canada). He is an Ordinary Member of the Caribbean Actuarial Association (CAA), having served as Secretary/Treasurer (200711) and Chairman of the Life Insurance Committee (2016 – 2021).

Lusani Mulaudzi is a distinguished Public Interest Actuary, Independent NonExecutive Director, and Lecturer. With a career spanning various leadership roles, he has served as the CEO of a Healthcare Administrator and Managed Care Organization, and as a Healthcare Actuary for a major Healthcare Administrator and Managed Care Organization.

Lusani has also worked as an actuarial consultant for a leading insurance company in South Africa. His expertise extends to governance, where he holds independent non-executive directorships at several private insurance companies and is the Public Interest Actuary appointed by the Actuarial Society of South Africa. In 2020, Lusani joined the University of Cape Town as a lecturer and now heads its actuarial section.

Beyond his professional achievements, he is deeply involved in community development and has, in the past, held leadership positions in community development organisations. Notably, he served as the President of the Actuarial Society of South Africa from 2020 to 2021. Lusani’s career reflects a strong commitment to both his profession and community service.

Kyle Rudden is a consulting actuary and accountant with over 30 years’ experience in financial services, governance, and policy. He is a former President of the Institute of Chartered Accountants of Trinidad & Tobago (ICATT), a former Director of the Central Bank of Trinidad & Tobago, and a former Director of the Trinidad & Tobago Stock Exchange (TTSE). He also served as President of the Caribbean Actuarial Association and currently chairs its Technical Steering Committee. An international speaker on actuarial and accounting issues, he has worked extensively across emerging markets. He has authored articles on investments, insurance and pensions legislation in the English-speaking Caribbean and has advised the Government of Trinidad & Tobago on pension reform and policy since 1997.

Sahib Singh Khosla is a Chartered Actuary and senior consulting professional with 15 years of experience across insurance, pensions, and banking in Africa.

He serves as Vice-Chair of Kenya’s Ministerial Multi-Agency Taskforce on the Actuarial Bill, Immediate Past President of the Actuarial Society of Kenya, and Council Member of the TISFD Africa Regional Council.

Recipient of the IAA’s Geoffrey Heywood Award, Kenya’s Head of State’s Commendation (HSC), and Top 40 Under 40, Sahib champions actuarial innovation, social-risk governance, and ESG disclosure frameworks - advancing financial resilience and inclusion. He also lectures, fostering next-generation actuarial leadership.

Lan Tong is Director of Product Training at Moody’s, leading the global AXIS Training Program from CANADA. With over 20 years of experience—including life insurance pricing, valuation, and actuarial audits—Lan is a recognized AXIS Actuarial Software educator and advocate. She has trained hundreds of actuaries across the Globe, including the Caribbean islands, helping build regional modeling expertise in AXIS.

A Fellow of both the Canadian Institute of Actuaries and the Society of Actuaries, Lan actively shapes the profession through her work on SOA committees, including the North America Employers Council, exam development teams, the Fellowship Admission Course as well as the Associate Professionalism Course.

LEADERSHIP FOOTPRINT: STRATEGIES FOR LASTING INFLUENCE” WORKSHOP

“YOUR

Dr. Kofi Osei-Kusi serves as President & Co-founder of the Pan-African Leadership Institute, an executive education institute with executive students and alumni in over 53 countries across Africa, the Caribbean, Europe, North America, South America, Middle East and Asia.

He serves as Chancellor of GH Schools, including oversight of Ghana’s fastest growing media college, GH Media School. He also serves as Executive President of the Osei-Kusi Foundation, a provider of educational scholarships to young people living with disabilities in Ghana.

Kofi was named as one of Africa’s 100 Most Impactful Change Makers by Humanitarian Awards Global in 2023. In the same year, he was named as one of 100 Most Influential People in Ghana at the 100 Most Influential People in Ghana Awards by the African Chamber for Trade and Business Executive Magazine. He is listed as one of Ghana’s high achievers, leaders, influencers, and professionals in the “Who’s Who in Ghana” directory.

He holds a Doctor of Transformational Leadership Degree from Bakke Graduate University, USA, and an Executive MBA from the University of Ghana Business School.

He is a published author of 18 personal development books, including “10 Quality Decisions Every Young Person Must Make”, “The Power of Self-Confidence” “Secrets to Workplace Success and Promotion” and “The Living Wisdom Bible”.

Kofi’s mission in life is to inspire, educate, coach, and challenge established and emerging leaders so they can lead effectively, maximize their human potential, and create meaningful change.

He is happily married to Jackie, and they are blessed with four lively children

President, Board of Directors, Colegio Nacional De Actuarios

He holds a degree in Actuarial Science from the Instituto Tecnológico Autónomo de México (ITAM), a Master’s in Economics from the Centro de Investigación y Docencia Económicas (CIDE), and a Specialization in Macroeconomic Indicators of the Mexican Economy from the Interactive Museum of Economics (MIDE). He has complemented his academic background with studies in Behavioral Economics, Economic Development, Social Mobility, Public Policy and Evaluation, as well as in Economic and Insurance History.

He currently serves as General Director of the Centro de Evaluación para Intermediarios (CEI). Previously, he was Head of Sector Development at the Mexican Association of Insurance Institutions (AMIS) and Actuarial Consultant on Social Security and Private Pensions at Consultores Asociados de México (CAMSA).

He is a member of the Colegio Nacional de Actuarios (CONAC), where he serves as President of the Board of Directors for the 2025–2027 term, and of the Asociación Mexicana de Actuarios (AMA). He is also a founding partner and coordinator of the Financial Inclusion Initiative of the Academia Nacional de Evaluadores de México (ACEVAL), and a member of the National Technical Committee on Social Security of the Instituto Mexicano de Ejecutivos de Finanzas (IMEF). In addition, he serves as a member of the Competency Management Committee for the Insurance Sector in Mexico, endorsed by CONOCER.

He has taught at ITAM, the Autonomous University of Yucatán, and La Salle University, among other institutions. He is currently an adjunct professor at the Universidad Cristóbal Colón in Veracruz and at the Faculty of Sciences of the National Autonomous University of Mexico (UNAM), where he is also a member of the Academic Committee of the Bachelor’s Degree in Actuarial Science and of the Academic Committee on Actuarial Science of the Academic Council for the Area of Physical-Mathematical Sciences and Engineering.

Corrinne Bellamy is a Fellow of the Society of Actuaries (2010) and Vice President, Pensions Actuarial at Sagicor Group Jamaica. Her journey in Jamaica started with her study at the University of the West Indies, Mona campus after which she spent the next 21 years holding various roles at Sagicor Jamaica. She serves as a Board member of the National Insurance Fund of Jamaica, SOA Exam supervisor for Jamaica and is also a member of the CAA’s Pensions Committee.

Corrinne is Trinidadian and married with two beautiful children and enjoys event logistics, travelling and, of course, partying!

Amanda Hug is a Director in WTW’s Insurance Consulting & Technology practice, where she leads the New York office of life actuaries and supports clients in the transformation, analytics and litigation spaces. She previously worked at MassMutual as Chief of Staff to the CFO, among a variety of product development roles.

During Amanda’s 2020-2023 term on the SOA Board of Directors, she chaired the Governance and Policy Committee and Task Force for Evolving the FSA Pathway. She also served as a member of the Strategic Plan Task Force and as

a Board Liaison for the Young Professionals Advisory Council and the Diversity, Equity & Inclusion Committee. Amanda is a past President of the Actuaries’ Club of Hartford & Springfield and the Actuaries’ Club of Boston. She graduated first in her class with an MBA from the University Chicago Booth School of Business and summa cum laude from Wheaton College (IL).

Amanda enjoys adventure travel and has been lucky enough to swim on the edge of Victoria Falls, cross paths with the big five in South Africa and hike the W trek in Patagonia. As a committed Christian, she holds a Master in Divinity from Gordon-Conwell Theological Seminary and is active in her local church in New York City.

Having over 40 years’ experience in the global actuarial consulting field, working in England, Jamaica and Canada with both local and multinational clients Cathy truly appreciate different jurisdictions, language, culture and socio-economic conditions.

She has been instrumental in bringing together a number of eminent global speakers to explore, discuss and share key themes in “Diversity of Thought”, a platform to open minds and doors to more diverse and innovative job opportunities within and away from traditional actuarial fields.

Cathy is an active volunteer aimed at empowering the actuarial profession, by enabling our thought leadership with critical thinking to produce research, diversity of thought, competence, and the integrity that raises recognition and status for actuaries. The goal is as Jon Spain says for individual actuaries and the actuarial profession to thrive in the public interest.

Nazir Valani is Chairman of three companies, Valani Global, JSCP and MSA Research. Valani Global/JSCP is a global actuarial consulting firm that operates in Canada, the US, the Caribbean, Asia, Australia and Europe.

Nazir has a Gen AI for Business: Driving Growth and Competitive Advantage, from Rotman School of Management, and a Society of Actuaries Certificate for the International Financial Reporting for Insurers (IFRI).

Before starting Valani Global, Nazir was Partner & National Leader at KPMG for the Canadian Actuarial Practice.

Nazir received the Society of Actuaries President’s award in 2018 and was featured in their “Society of Achievers” video. He was recognized as one of the global leading actuaries in 2015.

Nazir has been on three not-for-profit Boards, including the Society of Actuaries – Board Member 2020 to 2023, and was Chair of International Committee for 1 year.

Kudzai Chigiji is a Fellow of the Institute and Faculty of Actuaries, and a Fellow of the Actuarial Society of South Africa; with two actuarial science degrees and a Masters in Development Finance from the UCT GSB and holds a MBA from the University of Oxford Said Business School, Balliol College.

Her experience spans life insurance, management consulting, healthcare (funders, providers and big pharma clients) and banking (pricing, data analytics and leading an intrapreneurial digital banking team in one of South Africa’s large banks).

Kudzai Chigiji was the Chair of the Actuarial Society of South Africa’ Banking Committee from January 2018 to December 2021 and was the Secretary of the IAA Banking Working Group from September 2016 to September 2018. In her role as the Banking Chair, she led the team in creating the Banking Fellowship Principles subject, and revising the Applications/Advanced subject. She also led the ASSA team’s efforts in building the collaboration between ASSA and IFoA to provide the IFoA with its first Banking Fellowship subjects in a turn-key arrangement. She has also been a member of the IFoA’s Finance and Investment Board since August 2019, representing the interests of the association within banking. She was a member of the IFoA Council from 2022 to 2024, after which she was selected to be a member Non-Executive Director on its Unitary Board.

She serves as an Independent Non-Executive Director to Letshego Bank Namibia, a digital bank listed in Namibia. She sits on the Audit and Risk Committee and Chairs the Social, Ethics and Sustainability Committee as well as the ICT and Cyber Risk Governance Committee within this entity.

She also now works in early-stage investments and continues to consult within healthcare and insurance focused venture studios.

“PRESIDENTS’ ROUND TABLE” SPEAKERS ALSO INCLUDE: MAURICIO ARREDONDO AND AMANDA HUG (SEE PAGE 29)

Barry Franklin currently serves as President of the Casualty Actuarial Society and has more than 40 years of professional experience in a variety of actuarial and risk management leadership roles. He recently founded Upstate Actuarial, a boutique risk management and actuarial consulting firm, after retiring as Chief Actuary for Zurich North America. Previous roles include Chief Risk Officer for Zurich North America, Director of Corporate Risk Consulting for Towers Watson, Group Managing Director for Aon Global Risk Consulting, and Partner & Consulting Actuary with EY.

Barry is a Fellow of the Casualty Actuarial Society, Chartered Enterprise Risk Analyst and Member of the American Academy of Actuaries. He has been an active CAS volunteer for many years, serving on the CAS Board of Directors and Executive Council as well as numerous CAS committees and task forces. Barry holds a Bachelor of Science degree from Northern Illinois University, with a major in Probability & Statistics and a minor in Economics.

Angelita Graham, FCIA, AccBD, MBA, FSA, is a Partner at Mercer Canada, overseeing over 500 colleagues and providing advisory services on workforce, pension, and risk challenges. With her steady leadership and strategic insight, she facilitates collaboration and clarity in addressing complex client issues. Her actuarial journey commenced at the University of the West Indies with a degree in Mathematics, where she was mentored by Daisy Coke, a significant figure in the Caribbean actuarial community. After obtaining postgraduate qualifications in the UK, she continued her career in Canada, establishing a notable record of leadership and innovation.

For nearly twenty years, Angelita has actively contributed to the Canadian actuarial profession through various volunteer roles, including her involvement with the CIA’s Committee on Continuing Education since 2008. Her extensive work in education, governance, professional standards, and public interest initiatives underscores her commitment to advancing the profession, culminating in the CIA Award of Excellence in 2020 for her dedicated service.

In addition to her professional roles, Angelita contributes to the broader community as a member of the Board of Governors at the Royal Ontario Museum and serves as Vice-Chair of the Audit and Finance Committee. In July 2025, she was appointed President of the Canadian Institute of Actuaries, where she prioritizes enhancing the Institute’s leadership in public policy, developing future actuaries, and integrating new technologies like artificial intelligence into actuarial practices.

As a proponent of continuous learning, Angelita inspires aspiring actuaries to remain curious and embrace challenges. She envisions a profession that confidently adopts innovation while adhering to the principles of rigor, integrity, and public service. She advocates for actuaries to take on a pivotal role in addressing societal challenges, leveraging data-driven insights and ethical leadership for issues ranging from climate risk to financial security.

Mike is a former President of the Canadian Institute of Actuaries, a former President of the Society of Actuaries and is the 2026 President of the International Actuarial Association.

Mike Lombardi is also President of MLBC, which provides consulting services to insurance companies with respect to business strategy, M&A opportunities, reinsurance, and actuarial advice. He also provides technical advice to insurance regulators and conducts expert witness assignments. Mike is on the Board of Directors for Foresters Financial, a multinational insurance company operating in USA, UK, and Canada.

Prior to forming MLBC, Mike was Executive Vice President, European Acquisitions at Reinsurance Group of America (RGA). In this role, he was responsible for identifying, pricing, as well as executing acquisition opportunities in Europe. Mike held various other positions during his years at RGA, including Chief Risk Officer for the company’s Global Financial Solutions Division as well as Chief Pricing Actuary for the International Division. As Chief Pricing Actuary for the International Division, he was responsible for developing nontraditional, (financial reinsurance) opportunities worldwide, working together with the country managers and a dedicated team of business specialists to complete reinsurance transactions. Before joining RGA, Mike was the Managing Principal at Tillinghast (now Willis Towers Watson) of the company’s Canadian life and property-casualty insurance practice. During his 18 years with that firm, he specialized in mergers and acquisitions, demutualization, financial reporting, actuarial reserve reviews, and embedded value.

Mike is a Fellow of the Society of Actuaries (FSA), a Fellow of the Canadian Institute of Actuaries (FCIA), a Certified Enterprise Risk Analyst (CERA) a Member of the American Academy of Actuaries (MAAA), and has an ICD.D designation from the Institute of Corporate Directors.

Patricia Matson is a Partner in the Farmington, Connecticut office of Risk & Regulatory Consulting, LLC (RRC), an affiliate of RSM US LLP. She has 30 years of experience providing consulting services to insurance companies on topics such as financial reporting, product development and pricing, Enterprise Risk Management and ORSA, economic capital, transaction advisory, reinsurance, model governance and validation, actuarial process redesign, and postretirement benefit valuations. She currently leads the risk and regulatory consulting team, which includes oversight of regulatory consulting projects, risk-focused examinations, control assessments and testing, rate and rule applications, captive reviews, ERM and ORSA reviews, and other special projects.

Before joining RRC, Tricia was a Vice-President at MassMutual, where she was responsible for leading the design, build and implementation of an enterprise-wide economic value and economic capital framework and was involved in liquidity risk management and the development of the Company’s Own Risk and Solvency Assessment (ORSA report). Prior to that she was a principal at a Big 4 accounting firm.

Tricia is the current President of the American Academy of Actuaries. She previously chaired several Academy committees on financial reporting and risk management. She also previously chaired the Actuarial Standards Board.

Marjorie is a leader within the financial services sector. She serves as a board member in for-profit and nonprofit sectors and is an external member of the Prudential Regulation Committee of the Bank of England. As an adviser and consultant, she supports financial and educational institutions in governance and strategy.

Marjorie made history as the first person of colour and youngest President of the UK’s Institute and Faculty of Actuaries, in nearly 200 years. Her executive career includes roles as Chief Strategist for Liberty Group and Chief Risk Officer for Old Mutual’s African operations.

A passionate advocate for diversity, equity, and inclusion, Marjorie conducts research on inclusive leadership and its impact on workplace outcomes. She is an actuary and holds a Sloan Masters in Leadership and Strategy from London Business School.

Marjorie is also an author. Her book, Empowered Evolution, debuted at #1 on Amazon’s Knowledge Capital list, guiding readers to shift their mindset, discover meaning, and thrive with momentum.

Judy Veira is an independent consulting actuary with Trinity Consulting Ltd., based in St. Vincent & the Grenadines, providing actuarial services to private employer and government-related pension plans in the region, including services related to plan design, plan terminations, pension reform, valuations, plan administration and preparation of trust deeds & plan documents. Additionally, she has many years of experience in the social security field, primarily with the National Insurance Services of St. Vincent and Turks & Caicos Islands

Her actuarial work experience began with Manufacturers Life, CANADA and Towers Perrin, New York & Pittsburgh.

She is a Fellow of the Society of Actuaries and graduate of the University of Western Ontario and has completed Levels 1 and 2 of the Chartered Financial Analyst program.

Judy is the President of the CAA (2023-2025), a member of the social security committee, served on the CAA’s executive council (2017- 2019), Chairman of the Board for the Bank of St. Vincent & the Grenadines and obtained the Chartered Director (C. Dir.) designation (2020).

PLENARY SESSION

“SELF-ANALYSIS

AND SELF-DISCOVERY”

Dr. Jacqueline Coke-Lloyd is a transformational leader, visionary strategist, and one of Jamaica’s most respected business and leadership development experts. As Managing Director of Make Your Mark Group (MYMG), she has dedicated more than 30 years to strengthening leadership capacity, elevating workforce productivity, and building high-performance organizations across Jamaica, the Caribbean, and internationally. Recognized as a trailblazer in leadership development, industrial relations, and organizational transformation, she has guided major strategic change initiatives across both the public and private sectors.

A proud alumna of the University of Technology, Jamaica (UTech), Dr. Coke-Lloyd was honoured as an Outstanding Alumni during the institution’s 60th Anniversary celebrations. She also completed specialized professional training at the International Labour Organization’s Training Centre in Turin, Italy, and is certified as a Mediator and Job Readiness Trainer.

Dr. Coke-Lloyd’s career includes a distinguished ten-year tenure as CEO of the Jamaica Employers’ Federation (JEF), where she influenced national policy, negotiated critical labour reforms, and championed initiatives that enhanced workforce competitiveness. She founded the Young Entrepreneurs Association of Jamaica (YEA), spearheaded the Caribbean’s first Youth Employment Network (YEN) in partnership with global agencies, and conceptualized major leadership platforms such as the Middle Managers’ Conference and the Business and Personal Etiquette Conference.

Internationally, Dr. Coke-Lloyd has represented Jamaica and the Caribbean region in over 50 countries, negotiating international labour relations agreements, conventions, and policies related to employer, employee, and business development. She was elected to serve on influential international boards, including the International Labour Organization (ILO) and the Caribbean Employers Confederation (CEC), strengthening the region’s presence and voice in global labour and development dialogue.

She continues to lend her expertise locally, serving on several boards such as Sagicor Group Jamaica, Process Technology and Solutions, Grateful Faces Charity, EBA Limited, and Transformed Life Church. An accomplished author, wife, and mother of three, Dr. Jacqueline Coke-Lloyd remains deeply committed to leadership development, youth empowerment, and national transformation—continuing to inspire leaders and organizations to make their mark with excellence.

“BREAKING MENTAL BARRIERS INTO BANKING” PLENARY SESSION

Geoffery Romans is the Chief Risk Officer (CRO) of Barita Financial Group Limited, bringing more than 20 years of experience across banking, securities, and investment management. He holds an MBA (Master of Business Administration) and completed all requirements for the ASA (Associate of the Society of Actuaries) designation in 2013. His professional qualifications include CFCI (Certified Financial Crime Investigator), FMVA (Financial Modeling & Valuation Analyst), and CBCA (Certified Banking & Credit Analyst).

Before joining Barita, Geoffery spent over two decades with Scotiabank, culminating in his role as Regional Director of Market Risk for the English Caribbean. In this capacity, he oversaw market and liquidity risk across more than 14 jurisdictions—including Trinidad & Tobago, Barbados, Cayman Islands, Bahamas, and Turks & Caicos—supporting treasury activities, trading operations, ICAAP programs, and regulatory engagement. His earlier roles at Scotiabank spanned liquidity risk, interest rate risk, balance sheet management, market risk analytics, and insurance reporting, providing him with broad, multi-disciplinary exposure to financial-sector risk.

In his current role, Geoffery leads enterprise-wide risk management for the Cornerstone and Barita Group, including the securities dealer, merchant bank, and asset-management businesses. He contributes to risk governance as Chair of the Cornerstone Group Non-Financial Risk Committee and is an active member of multiple Asset–Liability Committees (ALCO). His technical expertise spans Basel III capital and liquidity standards, asset–liability management (ALM), stress testing, IFRS 9 modelling, valuation analysis, off-balancesheet fund risk frameworks, and enterprise risk governance. He works closely with Boards of Directors and executive leadership to support capital planning, scenario development, and strategic decision-making.

Geoffery is also active in sector-wide development. He serves as Chair of the Jamaica Securities Dealers Association (JSDA) Risk Committee, and is a long-standing member of the University of the West Indies (UWI) Mathematics Industry Advisory Board, contributing to academic–industry alignment and regional talent development. His past governance roles include Chair of the Scotiagroup Model Validation Committee and Trustee of the Scotiabridge IRA Board.

He is a graduate of the University of the West Indies with First Class Honours in Mathematics (Actuarial Science option), earning multiple academic distinctions—including the Harold Chan Scholarship, Merville Campbell Prize, Dean’s List honours, and nomination for Valedictorian. His professional performance has been similarly recognized, receiving Scotiabank’s Best of the Best – Top Individual Performer Award twice, along with several other corporate excellence awards.

Geoffery maintains a strong interest in advancing the use of actuarial science, quantitative finance, and data-driven risk analytics within capital markets and emerging-market financial systems, with a focus on strengthening governance, resilience, and long-term financial-sector stability.

Willard is currently the Chief Executive Officer with direct responsibility for insurance operations of Sagicor Life Jamaica (SLJ ) Limited and Latin America and spans over thirty years in the insurance, and pensions industries.

Willard is a Director of Employee Benefits Administrator, Sagicor Insurance Brokers, Sagicor Pooled Investment Funds, Sagicor Panama and Sagicor Costa Rica.

Willard is currently the Chief Executive Officer with direct responsibility for insurance operations of Sagicor Life Jamaica (SLJ ) Limited and Latin America and spans over thirty years in the insurance, and pensions industries.

Willard is a Director of Employee Benefits Administrator, Sagicor Insurance Brokers, Sagicor Pooled Investment Funds, Sagicor Panama and Sagicor Costa Rica.

He has a BSc in Mathematics and Computer Systems (Upper Second Class Honours) from The University of the West Indies and is a Fellow of the Society of Actuaries.

Willard is married to Paulette and has three (3) children.Willard is currently the Chief Executive Officer with direct responsibility for insurance operations of Sagicor Life Jamaica (SLJ ) Limited and Latin America and spans over thirty years in the insurance, and pensions industries.

Willard is a Director of Employee Benefits Administrator, Sagicor Insurance Brokers, Sagicor Pooled Investment Funds, Sagicor Panama and Sagicor Costa Rica.

He has a BSc in Mathematics and Computer Systems (Upper Second Class Honours) from The University of the West Indies and is a Fellow of the Society of Actuaries.

Willard is married to Paulette and has three (3) children.

Ms. Sharon Donaldson is Group Managing Director for General Accident Insurance Company Jamaica, Trinidad & Tobago and Barbados. She served as MD for GAJ from 2008 until May 2025 when she assumed the role of Group Chief Executive Officer.

Ms. Donaldson is a Certified Chartered Accountant, (ACCA), and an Attorney-atLaw and the holder of an LLB Law degree from the University of London and an MBA from the University of Bangor, Wales.

She previously served as Financial Controller, General Manager and Company Secretary for General Accident Jamaica for several years. Ms. Donaldson is a director of several companies including Musson (Jamaica) Ltd. Eppley Limited, 138 Student Living Limited to name a few. She is passionate about teaching and in addition to her corporate role she finds time to lend her services to the Norman Manley Law School and Richmond Academy as a course Director.

She is a transformative leader with vast knowledge in the insurance industry. She is regularly sought out to provide guidance to the industry on several critical areas affecting its operation. Ms. Donaldson brings to the roles a strong foundation in corporate governance and strategic leadership. She is the immediate Past President (IPP) of the Insurance Association of Jamaica (IAJ).

Ms. Donaldson is the newly elected President of the Liguanea Club and hold the role of President of the Insurance Association of Jamaica (ICAJ).

She actively engages in lawn tennis as part of her exercise routine. She is an all-round sports enthusiast and served as President of the Jamaica Netball Association for several years. One of her favourite sayings is a quote from Nelson Madela “when the possible is not the answer, the impossible is…”

Hugh Reid is currently Managing Director, JN Life Insurance. Hugh has also served in several senior management roles with Scotiabank, Victoria Mutual, and the National Housing Trust.

Hugh has a MSc in Accounting and a BSc in Economics from the University of the West Indies and is a Fellow of the Chartered Association of Certified Accountants in the UK as well as a Fellow of the Life Management Institute in the US. He serves on several boards including the University of the Commonwealth Caribbean and the Insurance Association of Jamaica to name just a few.

“INNOVATION, NEW SCIENCE, AND URGENT RESILIENCE EFFORTS”

Dr. Jayaka D. Campbell is a Senior Lecturer in the Department of Physics at the University of the West Indies, Mona Campus, and a member of the Climate Studies Group Mona (CSGM). He serves as Programme Coordinator for the MSc in Renewable Energy and Undergraduate Coordinator, roles in which he has quadrupled graduate completion rates from an average of 2 to 8-10 students annually.

With degrees in Electronics, Applied Physics, and Climate Modelling, Dr. Campbell is a computational physicist specializing in atmospheric sciences. His research generates high-resolution regional climate projections tailored to the Caribbean’s small island nations and topography. He examines how climate change and variability impact key economic and social sectors including agriculture, water, energy, and public health.

Dr. Campbell’s work bridges climate science and policy. He co-authored the Caribbean section of the State of the Climate 2024 report and contributed to the World Weather Attribution rapid analysis of Hurricane Melissa, findings that were presented at COP30. His collaboration with Oxford University on the Jamaica Systemic Risk Assessment Tool (J-SRAT) helps the Jamaican government prioritise climate-resilient infrastructure investments. With approximately 40 peer-reviewed publications with 1,650+ citations by researchers worldwide, Dr. Campbell’s work informs climate science and policy across the Caribbean and internationally.

His current research includes leading the Caribbean Development Bank’s Climate STRIDES (Systems, Techniques, and Resources for Improved Decision-Making, Education, and Sustainability) project, which builds climate resilience through improved decision-making systems and capacity building. He actively supervises 6 MPhil/PhD students whose research spans renewable energy feasibility studies, including analysis of Jamaica’s largest photovoltaic-plus-storage system, to examining climate change impacts on groundwater resources in Saint Elizabeth, Jamaica’s most agricultural parish.

Like many before him, Dr. Campbell (or Jay to his friends) credits his success to the support of his family, friends, and the guidance of his mentors.

“DEMOGRAPHIC DECLINE, ECONOMIC STAGNATION AND GEOPOLITICAL INSTABILITY”

Richard Jackson is an internationally recognized authority on global aging and retirement policy. He is president of the Global Aging Institute, a nonprofit organization dedicated to improving understanding of the economic, social, and geopolitical challenges created by population aging in the United States and around the world. He is also a senior adviser to The Terry Group, an actuarial consulting firm. Richard is the author or co-author of numerous policy studies, has spoken at dozens of conferences in Asia, Europe, Latin America, and the United States, and is widely quoted in the media. He holds a Ph.D. from Yale University.

Sara Goldberg is Fellow of the Society of Actuaries (SOA), and immediate past Secretary/Treasurer of the SOA having served two terms on its Board of Directors. She has volunteered for the SOA over the years since becoming a Fellow in 2009, in particular in its international, research, and analytics initiatives and was founding chair of its Catastrophe & Climate research program. Sara is also currently a delegate for the International Actuarial Association’s Water risk task force as part of their Resources and Environmental Forum.

Sara is a VP and Actuary with Reinsurance Group of America (RGA) in US Individual Markets, located in Boston and also serves as a subject matter expert in climate risk and other emerging risks. Prior to joining RGA, she led the insurance go-to-market as Director in PwC’s Climate Risk Modeling practice. Sara previously worked for Gen Re, performing a variety of global roles, starting with establishing the Mortality and Longevity competence centers and leading various experience studies. She went on to serve as Regional Chief Actuary for east Asian markets and ultimately headed Global Products & Analytics.

PLENARY SESSION

Experienced Senior Lecturer with a demonstrated history of working in the higher education industry. Skilled in Water Resource Management, Geography, Cartography, Geomatics, and HEC-HMS, SWAT. Strong education professional with a Ph.D from IIT Kharagpur and Post Doc focused in Hydrology and Water Resources Science from Physical Research Laboratory, Ahmedabad, ISRO DST.

Geoffrey Marshall is currently the Deputy Managing Director at the Water Resources Authority of Jamaica, and has worked in Water Resources for over 15 years. He completed his M.Sc in Hydrology at New Mexico Tech in 2005, and has served as the head of the License and Regulation Section and Research, Planning and Investigation Section prior to becoming Deputy Managing Director. His current focus is on isotope hydrology, karst hydrology and impacts of saline intrusion on coastal limestone aquifers in Jamaica.

MOTIVATIONAL SPEECH: “FUTURE-PROOFING THE PRESENT”

Rochelle Cameron is an accomplished attorney-at-law with an impressive 25year tenure at the Jamaican Bar who has garnered extensive experience in both the public and private sectors, Rochelle began her legal journey as a Prosecutor in the Jamaican Courts. Subsequently, she transitioned to the corporate arena, serving as a Vice President of Legal and Regulatory and Company Secretary for one of the Caribbean’s major Telcos. Notably, Rochelle’s expertise extends beyond the legal reaim. She has held leadership roles in Human Resources

and Public Relations, showeasing her versatility and multidimensional copabilities In times of crisis and organizational transformation, Rochelle has consistently demonstrated calm, collaborative, and decisive leadership. Her ability to navigate challenging situations has earned her a reputation as an expert business strategist.

Recognizing the importance of people development, Rochelle Is deeply committed to fostering an enabling environment where everyone can tap into their brilliance. As the founder and CEO of Prescient Consulting Services Limited, she leads a team of professionals in the development and execution of business, legal, people, and communications strategies. Rochelle has also co-founded Ready to Emerge Limited, an organization dedicated to personal and professional development Through this initiative, she continues to empower individuals to unlock their full potential.

Rochelle’s dynamic personality shines on the stage as a keynote speaker at local and international events. With her unique Adrenaline Roch’ style, she blends passion, high-energy, and humour to deliver engaging presentations on serious topics. Her ability to captivate audiences makes her an exceptional communicator.

“COPING

WITH THE DEMANDS OF PROFESSIONAL LIFE”

Eric Scott is an accomplished finance and corporate governance leader with over 25 years’ experience across banking, investments, and retail. Eric is a Director of the Public Accountancy Board and the Jamaica Stock Exchange, and Chair of its Corporate Governance Committee and is the immediate Past President of the Institute of Chartered Accountants of Jamaica.

Mr. Scott is also a passionate wellness coach and health researcher dedicated to promoting holistic health solutions. As founder of The Vitality Project, a private research initiative, he focuses on integrating traditional healing practices with modern wellness technologies. Through this work, he provides guidance on lifestyle change management and corporate wellness programmes, empowering individuals and organisations to adopt healthier, more sustainable habits and fostering a culture of proactive heath management.

“THE JOURNEY TO FELLOWSHIP” SPEAKERS ALSO INCLUDE: CATHY LYN (SEE PAGE 30) AND PATRICIA MATSON (SEE PAGE 33)

Nikhil Asnani is a Consulting Actuary at Valani Global, specialising in the implementation of actuarial modeling solutions using Moody’s/GGY’s AXIS actuarial software. Before joining Valani Global, he was Assistant Vice President at Guardian Life Limited (Jamaica). He led the actuarial team in various roles: pricing, product development, valuation, financial reporting, in-force management, and administration for life insurance and annuity products.

Nikhil earned his Bachelor of Science (Hons.) in Actuarial Science from the University of the West Indies. He holds several professional designations, including Fellow of the Society of Actuaries, Fellow of the Canadian Institute of Actuaries, and Chartered Financial Analyst. Additionally, he has obtained the International Financial Reporting for Insurers (IFRI) Certificate issued by the Society of Actuaries.

Anthony Lucero is a Senior Associate in Retirement Actuarial Consulting at Willis Towers Watson (WTW). Following his graduation from St. John’s University in New York City, he became an Associate of the Society of Actuaries (ASA) in 2019. He has served on the Board of Directors of the Organization of Latino Actuaries (OLA) since 2022, now serving as OLA President for the 2025 term. Now based in his home state of California, Anthony enjoys traveling, singing, playing piano, and cooking (especially taking on his family’s Mexican food recipes). He is fluent in English and Spanish.

Shayna, is the Assistant Vice President of the Corporate Actuarial Department of Sagicor Life Jamaica. She has over 19 years of experience in the insurance industry including life and annuity valuation, asset liability management and financial reporting. She brings a vast amount of experience to the industry and has been integral in the IFRS 17 setup and implementation for the Sagicor Life entity. In her current role she has oversight for actuarial valuations, asset management, capital management and financial reporting which she finds rewarding.

Shayna holds a BSc (First Class Honors) from the University of the West Indies in Actuarial Science and she is qualified as a Fellow of the Society of Actuaries. Beyond her corporate role, she is deeply involved in her church and enjoys working with young people providing guidance and insight.

Sanya Goffe is a Partner at the law firm Hart Muirhead Fatta in Jamaica, specialising in pensions, corporate, capital markets and intellectual property law. She leads national advocacy for pension reform and financial inclusion as President of the Pension Industry Association of Jamaica and brings a Caribbean voice to global dialogue through the World Pension Summit Advisory Board. She also serves on the boards of NCB Financial Group, Jamaica Producers Group and the National Insurance Fund. An Eisenhower Fellow (2020) and IWF Leadership Fellow (2025), Sanya has been recognised locally and internationally for her leadership in law and pensions.

Jesse Resnick, FSA, FCIA, is an Actuary at MSA Research based in CANADA. MSA Research is a widely recognized leader in insurance industry analysis and benchmarking, bringing together insurers, reinsurers, consultants, regulators, and other stakeholders to advance understanding and decision making across the sector. With prior experience at Sun Life and Moody’s, Jesse brings deep expertise in actuarial modeling and insurance financial reporting. Outside of work, Jesse enjoys running, gardening, and spending time with his family and friends, often with music playing in the background.headquartered in Jamaica, with operations extending across the Caribbean, North America, Central America, Latin America, Bermuda, and Europe. Additionally, he serves as the Quality Review Partner for audits led from the Bahamas and Trinidad. “UNLOCKING

“THE VALUE OF RISK MANAGEMENT IN A VUCA WORLD”

Jason Bailey, Head of Risk at GraceKennedy Limited—a leading Caribbean conglomerate spanning Financial Services and Fast-Moving Consumer Goods— is a transformational leader specializing in navigating risk within a Volatile, Uncertain, Complex & Ambiguous world. In this role, he leads enterprise risk management initiatives across the group’s diverse portfolio, navigating the complexities inherent in managing risk across multiple business lines and regulatory environments. His approach to risk management is both strategic and meticulous, leveraging rich experience across dynamic business landscapes.

As a seasoned professional, Jason excels in crafting and executing comprehensive Enterprise Risk Management (ERM) and Compliance Programs specifically tailored for complex organizations. His expertise is evident through his proficiency in:

• Designing and implementing robust risk frameworks, risk appetite and tolerances statements, policies, and procedures.

• Conducting quantitative and qualitative risk assessments focused on key and emerging risks.

• Integrating Enterprise Risk Management with Strategy and Performance.

• Effectively leveraging technology for efficiency gains.

Jason’s immediate journey prior to joining GraceKennedy includes pivotal roles that underscore his deep understanding of the financial sector, such as Manager, Risk & Compliance at VM Wealth Management Limited and Manager, Enterprise Risk Management – Strategic & Operational Risks at Sagicor Group Limited. This background provides him with a critical perspective on how actuarial concepts intersect with strategic and operational risk, particularly in managing financial stability and regulatory compliance across diverse business lines.

Jason is a distinguished alumnus of the University of the West Indies, Mona, where he earned his Master of Science in Enterprise Risk Management with Distinction. Crucially for this audience, he also holds a Bachelor of Science in Mathematics with Actuarial Science emphasis and an Associate of Science in Computer Information Science, both achieved Magna Cum Laude from Northern Caribbean University

Mr Odean White is the Chief Risk Officer at the Bank of Jamaica and the Founder/CEO of Risk Institute of the Caribbean Ltd. (RICA), a consultancy firm that provides curated risk management products and services to individuals and organizations.

With a career spanning over two decades in the public and private sectors and academia, Mr. White is a transformational leader who has a wealth of knowledge and expertise in risk management, policy development and strategic planning.

A proud graduate of the University of the West Indies, Mona campus, Mr White holds several international certifications in corporate leadership, strategic planning, risk and financial management. Throughout his career, he has held several senior leadership positions at leading local and international financial intuitions. He is passionate about, and actively involved in mentoring/equipping others to navigate an increasingly complex and rapidly changing world.

Mr. White is a sports enthusiast who enjoys spending quality time with family and friends. He is a Justice of the Peace, a pastor, a teacher, a husband and a father.

“THE

Constance is an Actuary and a Principal of Eckler Jamaica Limited. She is a Fellow of the Society of Actuaries, a Fellow of the Conference of Consulting Actuaries, an Enrolled Actuary, a Member of the American Academy of Actuaries, a Member of the Caribbean Actuarial Association (CAA) and a Director of the Pension Industry Association of Jamaica (PIAJ).

Constance has over 35 years of professional experience throughout the United States, the Caribbean and Latin America. Her work encompasses social security, employee health and welfare benefits, retirement plans and general insurance. She consults in both the public and private sectors to a clientele that spans all areas of business.

Over a long career, Constance has conducted myriad training sessions for Administrators and Trustees, counselling for plan members - large and small groups and individuals, and public sessions.

Constance is a graduate of the University of the West Indies and Kingston Technical High School. She is married, with two children. In her rare free time, she enjoys experiencing different cultures, mainly through travelling, walking and reading.

“CATASTROPHE

Peter is a chartered insurance professional who has been part of Jamaica’s general insurance industry for over 40 years, and has served as the Chairman of the Board of EduFocal Limited since 2012.

In 2013, Peter was appointed Vice-President of the Insurance Association of Jamaica (IAJ), and chaired the Association’s General Insurance Committee. From 2018-2020 he was the President of IAJ and continues to serve on their Board of Directors.

A beloved leader, Peter is the Managing Director of Jamaica’s #1 General Insurance Company, the British Caribbean Insurance Company (BCIC). He combines strong technical skills with the goal of always delivering outstanding value for BCIC’s customers. He has been deeply involved in the creation of many innovative and customer-centric products such as Diamond Max for drivers over 55 years old, and the Minimax collision benefit for third party policies. His transformational management style has significantly contributed to the growth and empowerment of his team, and has led to BCIC being the most profitable general insurance company in Jamaica in 2017 and 2019.

Under his leadership. BCIC has sustained enviable levels of growth in both revenue and profit, and has continued to innovate. BCIC refunded 50 million dollars to customers when the pandemic limited their driving, the only company in its markets to do so. In 2022, BCIC was assigned a Financial Strength Rating of B++ (Good) by international credit rating agency AM Best.

Peter is the leader of BCIC’s digital transformation initiatives, as he continues to make BCIC a disruptive industry leader that is agile and adaptable to the constantly changing insurance landscape.

Sabrina Sprissler joined Guy Carpenter in 2021 to lead Guy Carpenter’s Latin American and Caribbean (LAC) actuarial team and is responsible for services centred around reinsurance optimization, technical pricing, capital and profitability analysis.

Prior experience includes heading up the actuarial team for LAC at Willis Re and 9 years at Munich Re where she gained a wide range of experience including life reinsurance, accumulation risk management, Cat modelling as well as Property treaty underwriting, specifically Latin America and Caribbean focused.

Sabrina is a member of the German Actuarial Association (Deutsche Aktuarvereinigung e.V.) and of the Caribbean Actuarial Association.

“THE IMPACT ON AND COST TO THE GOVERNMENT OF PROVIDING PROPER HEALTHCARE”

Oliver joined Canopy in February of 2022. Prior to this, he was the CEO of the JN Life Insurance Company from its inception in 2013 and impressively led that company for over seven years. Oliver has worked in the financial industry for the past 25 years with leadership and managerial experience in remittances, foreign exchange trading and life insurance. Before starting in the private sector, he worked as an educator, specialising in Mathematics and Deaf Education.

Adding to his accomplishments, Oliver is a Director and Past President of the Insurance Association of Jamaica (IAJ), has served as a member of the Private Sector Organisation of Jamaica (PSOJ) Executive Council and is currently an Adjunct Lecturer at the Joan Duncan School of Entrepreneurship, Ethics and Leadership (JDSEEL) at the University of Technology (UTECH).