SPECIALIST PRIME PROPERTY FINANCE

WHY WE WERE FOUNDED

CapitalRise is a leading specialist prime property finance company. It is the only dedicated funding provider focussing uniquely on prime property developments across London and the South East.

Projects have been located across Prime Central London locations including Mayfair, Notting Hill, Belgravia, Chelsea and Knightsbridge, Prime Outer London such as Wimbledon, and the Prime Home Counties including the Wentworth Estate, Surrey and Marlow. Since its inception in 2016, CapitalRise has originated loans against over £1bn of prime property assets.

Uma Rajah

CEO & FOUNDER

• Co-founded CapitalRise in 2016.

• 17yrs FinTech experience specialising in online lending.

• Experience in scaling up businesses.

• Cambridge University: Engineering, INSEAD, MBA

Alex Michelin FOUNDER

• Founded Finchatton in 2001 and Valouran in 2023.

• Delivered over £2bn in prime residential development across 120+ projects globally.

• Nottingham University: Economics

Andrew Dunn FOUNDER

• Co-founded Finchatton in 2001 and founded luxury country house developer, Earlsgate, in 2015.

• Delivered over £2bn in prime residential development across 120+ projects globally.

• Exeter University: Politics

CapitalRise was founded in 2016 to provide finance to prime property developers. Our founders, as developers themselves, had first-hand experience of being poorly served by incumbent lenders.

This heritage means that the business possesses extensive experience and deep expertise in real estate development, especially within the prime property market. It also means we understand the needs of our borrowers, and can speak the same language.

We are the lender built by developers.

EXECUTIVE SUMMARY

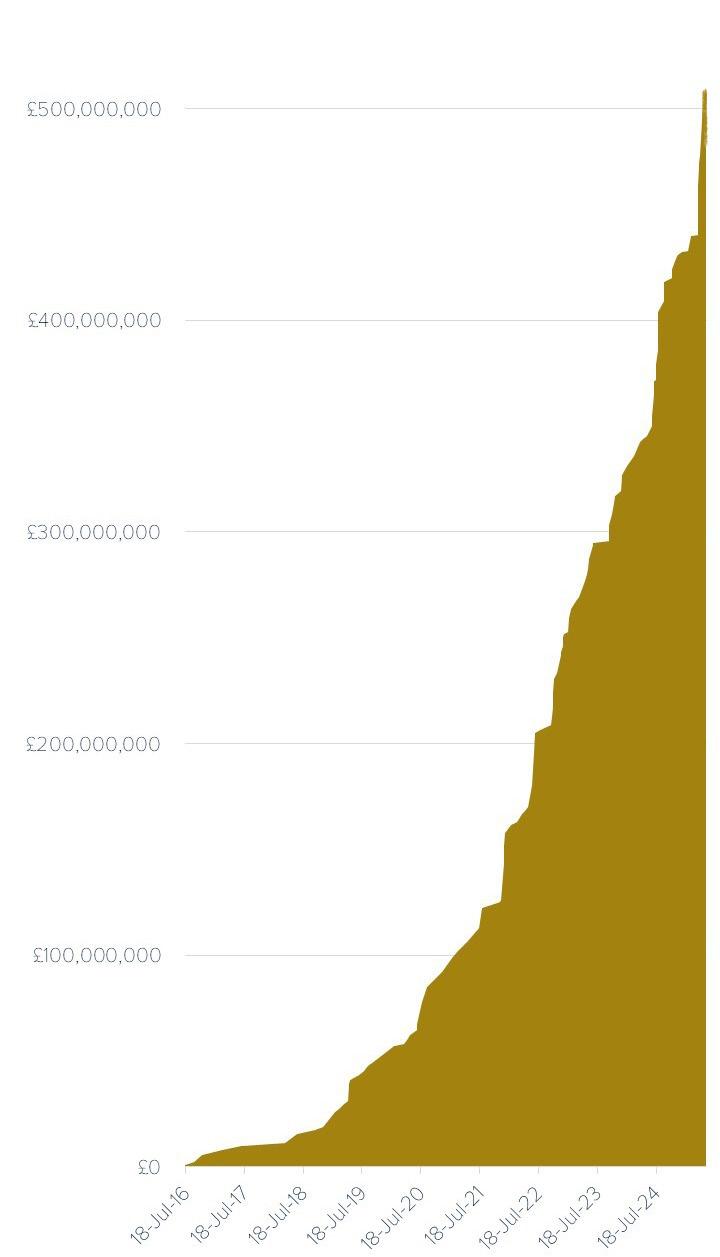

Cumulative Lending

There is huge opportunity in the lending market, driven by high borrower demand in Prime areas, due to the withdrawal of mainstream lenders.

• Bank lending to SME property developers fell by 49% from £9.7bn in January 2017 to £4.9bn in November 2024, our research revealed. This offers an opportunity for alternative lenders – such as CapitalRise – to fill this funding gap.

• £500m+ in gross lending to date against over £1bn+ of property value, with over £280m repaid in capital and returns. Loans were at an average term of 16 months, with an average LTV of 64%.

• CapitalRise’s key credit principles offer its investment partners a robust platform with rigorous risk management techniques, to deploy capital into loans that provide appropriate risk-adjusted returns.

• CapitalRise closed £174m of loans in the 12 months to June 2025.

• £2bn+ in transaction underwriting experience and Founders invest their own capital into every loan.

£519m

Total loan facilities closed

£1.2bn

Value of properties funded 64%

Average exit LTV

£286m

Capital and returns paid to investors 9.26% p.a.

Average investment returns paid in 2024

16 months

Average term length

WHY BORROWERS COME TO US

LOWER FINANCING COSTS

Our model allows us to offer lower rates than traditional sources

TAILORED SOLUTIONS

We provide flexible terms and are able to fund complex projects

FAST DECISION MAKING

Receive terms within 48 hours

BEST IN CLASS SERVICE

We value long-term relationships – our expert team is always available

ROBUST CAPITAL SOURCES

A diverse and robust range of institutional funding lines; around £500m to deploy with quality borrowers this year

PRODUCT RANGE: BESPOKE FINANCE SOLUTIONS

CapitalRise offers end-to-end solutions to cover all stages of a development project. Our flexible, bespoke financing allows us to support a wide variety of borrower needs.

Fixed + variable rates available

No upper limit on £/sq.ft. or capital value

Loan size: £1-20m

BRIDGING DEVELOPMENT MEZZANINE

PRODUCT RANGE: BRIDGING

USE(S)

• Purchase

• Refurbishment

• Refinance

• Finish & Exit

LTV

Up to:

• 75% (gross)

• 70% (net)

• 0.85% - 0.95% PCM

• 2% arrangement fee

• No exit fee TYPICAL BORROWER RATES

PRODUCT RANGE: DEVELOPMENT

USE(S)

• Ground-up development

• Refurbishment

• Conversion

LTGDV / LTC

• Airspace Up to:

• LTGDV: 70%

• LTC: 85%

TYPICAL BORROWER RATES

• 5.75 - 6.5% (over base)

• 2% arrangement fee

• 1% exit fee

TYPICAL TERM

• Up to 36 months

•

PRODUCT RANGE: MEZZANINE

USE(S)

• Top-up development finance

• Reduce equity contribution

LTV / LTC

Up to:

• LTV: 75%

• LTC: 90%

TYPICAL BORROWER RATES

• 11.75% (over base)

• 2% arrangement fee

• 1% exit fee

TYPICAL TERM

• Up to 36 months

LOAN PORTFOLIO BREAKDOWN

Data from inception (2016) to January 2025

GEOGRAPHICAL SPLIT

WHO CAN WE LEND TO?

PRIME PROPERTY DEVELOPERS

PRIME PROPERTY INVESTORS

CapitalRise provides finance for a variety of property projects across the South of England. Projects must have a compelling business plan and be in a good location with strong demonstrable demand. We can provide loans for commercial purposes, but do not provide regulated mortgages against a primary residence.

CENTRAL LONDON LOANS

Cheyne Walk, Chelsea South Eaton Place, Belgravia Park Street, Mayfair

Chesham Street, Belgravia Academy Gardens, Kensington Gloucester Road, Kensington

OUTER LONDON LOANS

Kemsley Court, Ealing (airspace)

Sydenham Hill, Southwark

Grove Park, Camberwell

Broghill House, Wimbledon

Jack Straw’s Castle, Hampstead

Ealing Park Tavern (mixed use)

LOANS OUTSIDE LONDON

Marlow Hills, Buckinghamshire Pine Trees, Wentworth Estate Bodens Cottage Ascot

Colchester, Essex (26 new-build units)

Ascott u/ Wychwood, Cotswolds

Hill Brow, Hove

NOTES