Bringing Capitalism Back. Bringing Capitalism Back.

Gallup recently released a poll that should serve as a warning siren for every investor, executive, and entrepreneur in America: support for capitalism has fallen to its lowest level since they began measuring it In the very country that once defined the free market as both a moral and practical foundation for prosperity, fewer Americans than ever before say they believe in it.

More than a number, that statistic is a reflection of a cultural turning point The same system that has lifted billions out of poverty, rewarded innovation, and built the greatest engine of human progress in history is being doubted, misrepresented, and even vilified Yet the problem isn’t that capitalism has failed - it’s that too many of its practitioners have stopped standing up for it

Entrepreneurs know courage Every founder who has risked everything to start a business understands what it means to take a leap into the unknown, to face uncertainty, to bet on themselves and their ideas That same courage is now needed from every investor, executive, and business leader in America not just to build companies, but also to defend the system that makes building possible in the first place

We need courage in the boardroom or the marketplace, and in the public square. It takes courage to put your name and reputation behind capitalism when it’s unpopular It takes courage to say that profit, when earned through voluntary exchange and value creation, is moral. And it takes courage to model what principled capitalism looks like, to live it, speak it, and demonstrate it.

Because there are better and worse ways to be a business leader. Doing business well goes beyond avoiding fraud or theft:

It means living up to the moral principles that make capitalism good

It means respecting individual agency, i e the right of people to choose their own work, trade, and purpose.

It means practicing mutual cooperation: creating situations where everyone involved can benefit

It means focusing on real value creation: producing goods and services that improve lives, not manipulating systems or exploiting loopholes.

It means championing meritocratic opportunity rewarding talent, effort, and innovation wherever it’s found

And it means embracing bottom-up experimentation trusting that the best solutions often come from the people closest to the problems These are the daily practices of principled business. When we embody them, we make the economic system of capitalism a moral one, a way of life that honors human dignity and rewards creativity and contribution

That’s why Capitalists for Capitalism exists: to highlight those who are living these values and to encourage others to do the same. And it’s why I’m so excited for the 2nd Annual Principled Business New York Summit, which is already shaping up to be twice the size of our first. This year, we’re bringing together hundreds of investors, executives, and entrepreneurs from around the world who are committed to building and defending capitalism the right way, through principled leadership and value creation.

If Gallup’s numbers show us the problem, the Principled Business community is the solution Capitalism doesn’t defend itself: it depends on us, its practitioners, to do that.

So to every reader, my challenge is simple: Be courageous. Speak up. Build boldly Live out the principles that make capitalism good And join us at the Summit to stand shoulder to shoulder with others doing the same The future of capitalism depends on the courage of those who believe in it enough to defend it.

Written by: Alexander McCobin

Capitalism doesn’t defend itself It depends on those who practice it to stand up for it Yet too many business leaders today are silent. They are proud capitalists in private, but hesitant to say so publicly. In an age when Gallup reports that approval of capitalism is at its lowest level ever recorded in America, that silence has a cost

The free market has lifted billions out of poverty, fostered unprecedented innovation, and rewarded those who create real value; however, those facts don’t speak for themselves anymore The narrative around capitalism is being rewritten in universities, on social media, and even in the halls of government The system that built the modern world is being painted as immoral, exploitative, or outdated, and the people who know better are too often absent from the debate

It’s time for business leaders to show courage

Entrepreneurs already embody a special kind of courage: the willingness to take risk, to fail publicly, and to persist in the face of uncertainty That same spirit is needed not only to build companies, but to preserve the system that allows those companies to exist When founders, investors, and executives speak up for capitalism, they’re not defending a political ideology they’re defending the moral foundation that makes voluntary cooperation, innovation, and prosperity possible

Courage in this context means more than posting about capitalism on LinkedIn or donating to a think tank. It means openly modeling what principled capitalism looks like. It means being willing to say, without apology, that profit earned through value creation is good, that business, done right, is a moral force It means treating employees, customers, and investors not as tools or obstacles, but as partners in mutual benefit

Capitalism needs leaders who can show the world that this system is built on respect for individual agency, not exploitation; on consent, not coercion; on creativity, not control When we live those principles in our own organizations, when we create environments where merit, innovation, and cooperation thrive, we demonstrate the moral beauty of capitalism more powerfully than any op-ed or policy paper ever could

Yet it still takes courage to do that publicly It means being willing to be misunderstood, to face criticism, and to take a stand in a cultural climate that often rewards conformity over conviction. That’s the same courage that built businesses in the first place: the courage to bet on truth and perseverance over comfort and approval

At this moment in history, the greatest threat to capitalism isn’t regulation or competition: it’s apathy. It’s the unwillingness of good business leaders to speak up for the system that has given them, and billions of others, the freedom to create and prosper

If capitalism is to endure, it needs champions. It needs entrepreneurs who are proud to be capitalists, executives who make decisions guided by principle, and investors who allocate capital not only to grow returns but to advance the values that make growth possible In short, capitalism needs courage. Your courage.

Written by: Alexander McCobin

Chamath Palihapitiya said it best at this year’s All-In Podcast Summit: we are standing at a crossroads between a New Dark Age and a New Renaissance It was a powerful framing and a timely one The world feels precarious: wars, cultural division, institutional decay, and the erosion of confidence in business, technology, and even truth itself; however Chamath’s point and the underlying message of the Summit was that the outcome depends on what kind of leaders step up next

What I would add is this: if there is to be a New Renaissance, it will not come from politicians, bureaucrats, nor social activists It will come from capitalists - principled capitalists - who create and lead with courage and conviction.

That spirit was alive on stage throughout the Summit

Dave Ricks, CEO of Eli Lilly and Company, shared the story behind the development of GLP-1 drugs, which are revolutionizing treatments for diabetes, obesity, and metabolic disease He spoke not only about science and market demand, but about foresight, the courage to invest in the next frontier of human health before others saw it. He even predicted the next crisis such drugs could help solve: neurodegenerative disease It was a powerful reminder that progress happens when business leaders act on opportunity long before consensus forms

Cathie Wood of ARK Investment Management followed with an unflinching case for optimism She laid out the extraordinary progress unleashed by capitalism over the last century, from computing and biotechnology to space and artificial intelligence Her thesis was clear: when markets are free and entrepreneurs are empowered, innovation compounds Every technological revolution is ultimately a moral one too, because it expands human potential and prosperity.

Alex Karp, CEO of Palantir Technologies, brought that point back to first principles He warned that innovation must not become morally unmoored Technology, he said, must be used to defend the values of a free society, not to impose them on others, but also to protect the conditions that allow free people to flourish. His words reflected a deep truth: capitalism is also about preserving the civilization that makes progress possible

And of course, Elon Musk, a living symbol of that ideal, reminded everyone that the future will not be built by him alone, but by any entrepreneur willing to take risks, challenge orthodoxy, and create. His vision, spanning space, AI, and energy, was not mere spectacle; it was a call to arms for builders everywhere

Through these speakers, the All-In Summit revealed its deeper theme: the New Renaissance will require an elevation of capitalism itself, not cronyism or corporatism, but true capitalism grounded in principle

Chamath himself touched on this near the end He recalled that at the turn of the last century, America’s “business barons” were unashamed to be capitalists and they built not only companies but communities. They didn’t apologize for creating wealth; they used it to build the foundations of modern prosperity Today, however, making money is often treated as morally suspect Many business leaders feel pressured to downplay profit or signal virtue instead of living it Chamath called for reversing that trend to make it good again to start a business, to make money, to create value. That’s not greed: that’s civilization-building

And that’s exactly what principled capitalists are doing today Despite the noise, despite the pessimism, a New Renaissance is already forming in boardrooms, startups, and venture funds led by those who see business not as exploitation, but as creation

At Liberty Ventures, we see this every day with investors, executives, and entrepreneurs who are building the future, guided by the principles that make capitalism moral and sustainable: respect, cooperation, value creation, meritocracy, and freedom

If we want a New Renaissance, we must earn it. And it will be built once again by courageous capitalists.

Written by: Michelle Bernier

At the All-In Summit, Elon Musk shared candid updates on the projects consuming most of his time The conversation covered Optimus, Tesla’s humanoid robot, advances in AI hardware, and Starlink’s direct-to-phone connectivity What stood out was not just the scope of these ventures but Musk’s insistence on tackling problems from first principles, building infrastructure when none exists, and preparing from day one to operate at scale

Optimus: Human-Level Dexterity at Scale

Musk called Optimus “the biggest product ever” if successful He highlighted 3 hurdles that set it apart from other robotics efforts: achieving human-level manual dexterity, developing an AI brain that navigates and comprehends reality, and building a supply chain for human-sized robots from scratch

Human-level dexterity remains the defining challenge. Hands, with their complex mix of joints, tendons, and muscles, allow for everything from delicate tasks like threading a needle to forceful motions such as swinging a bat Reproducing that flexibility in robotics is enormously difficult, yet essential if Optimus is to be generalized Tesla is not waiting for suppliers to catch up Every motor, gearbox, and controller is being engineered internally Even the actuators (26 in each arm) are custom-built because no market-ready options exist Musk projected that once annual production hits 1 million units, marginal cost could fall to between $20,000 and $25,000. The broader lesson for business leaders is clear: when the infrastructure for innovation is missing, create it yourself

AI Hardware: A 40x Jump

Alongside robotics, Musk detailed Tesla’s next-generation chip, AI5, co-developed with the company’s software teams Compared with the current AI4, the new chip promises 8 times more computing power, 9 times more memory, and 5 times more memory bandwidth, while natively supporting functions critical to modern machine learning This integration is expected to push Tesla’s self-driving capabilities to levels 2 to 3 times safer than human drivers

This pursuit underscores Tesla’s refusal to rely on off-the-shelf solutions By designing hardware and software in tandem, the company ensures performance gains that competitors cannot easily replicate

Turning to SpaceX, Musk confirmed a $17 billion spectrum purchase to enable Starlink satellites to connect directly with mobile phones This initiative requires handset modifications, satellites equipped to handle those frequencies, and close collaboration with handset makers over a two-year rollout Musk framed the vision that users should be able to stream video anywhere on their phones, with no distinction between terrestrial and satellite connectivity

The ambition reflects a broader strategy of global reach achieved by solving deeply local technical and regulatory challenges Across these projects, Musk’s message is less about vision than about execution Solve the hardest problem rather than work around it. Build supply chains when none exist. Design software and hardware together to extract every ounce of performance And always prepare for scale, because breakthroughs only matter if they reach millions.

For entrepreneurs and executives, the takeaways are practical as much as inspirational. Musk demonstrates that the future is shaped by leaning into the obstacles others avoid His remarks at the All-In Summit were a reminder that the hardest paths often lead to the most transformative results.

Written by: Michelle Bernier

At the All-In Summit, Uber CEO Dara Khosrowshahi offered a clear look at where he believes transportation is heading and how Uber plans to lead it. His remarks spanned the company’s current strengths and its future bets, from the fundamentals of safety and cost, to the vast potential of autonomy, aerial mobility, and delivery innovation.

Dara made it clear that safety is the first hurdle every autonomous vehicle must clear “We have a certain safety case that we want to make sure our partners adhere to,” he said. That emphasis reflects how Uber now evaluates every new technology: it must demonstrate reliability through data before earning widespread use.

At the same time, the economics are shifting fast Hardware once priced at $20,000 to $30,000 now sells for a few hundred dollars. Those falling costs remove a key barrier to scale, opening a realistic path for large autonomous fleets to operate profitably

Power of a Platform

Dara dismissed the idea that Uber needs to own the vehicles on its network If you look at the end state, all of these cars are going to be financed,” he explained He envisions a structure similar to global hotel brands, which manage demand while property owners supply the physical assets. Financial firms will purchase and finance vehicles, while Uber will coordinate the marketplace that keeps them in motion

He argued this approach allows fleet owners to extract more value from each car “Instead of a pickup 15 minutes away for a 10-minute ride, you’re going to get a pickup three minutes away. That means higher utilization, more revenue per car, per day.” Faster pickup times and denser demand through Uber’s platform translate to higher utilization, meaning more revenue per vehicle each day It’s a model built to expand without weighing the company down with physical assets

Uber is already integrating autonomous vehicles into its network, with Waymo cars picking up riders in Austin and Atlanta Dara said “Customers who experience the product rate it highly and use it again” Rather than competing with autonomous operators, Uber is positioning itself as their distribution engine If a company wants to maximize the revenue of its robotaxis, Dara says “We are your ticket to the maximization of that revenue.”

Dara is also looking beyond the street grid Uber is investing in electric vertical takeoff and landing aircraft (eVTOLs) and drone delivery systems, technologies he sees as essential to breaking through urban congestion. “Our transportation infrastructure is only expanding in two dimensions Traffic keeps getting worse, yet the third dimension is available,” Dara said By moving people and goods through the air, Uber hopes to relieve the groundlevel bottlenecks that limit today’s growth.

On the ground, the company is experimenting with sidewalk delivery robots and suburban drones Robots excel at short trips under a mile, while drones can quickly cross larger gaps without road congestion. Dara believes combining the two could eventually cover more than half of Uber’s delivery demand, especially for groceries and prepared food

Even with these aggressive bets, Uber is funneling substantial capital back to shareholders The company recently announced a $20 billion stock buyback Dara explained the reasoning “In the past 12 months, we had over $8 5 billion in cash flow. The business is growing top line 18 percent and bottom line 35 percent. We have enough capital to be aggressive in AV and at the same time return value to shareholders ”

He also confronted concerns about automation displacing drivers. “For the next five years, the number of robot cars coming onto the platform are not going to be displacing people,” he said Rising demand and natural turnover, he explained, will offset the introduction of robotaxis in the near term. Over a longer horizon, he acknowledged that workforce disruption poses a broader societal challenge. Uber is already experimenting with new types of work, including AI data labeling, to help create alternative income streams for its earners.

Dara’s message positioned Uber as a platform built to orchestrate the future of transportation rather than own it outright. By combining advances in autonomy, aerial systems, and delivery robotics with a marketplace that keeps vehicles and earners productive, he framed a path for scaling mobility in every direction while keeping the company light enough to adapt as the landscape shifts.

Highlights from our global community of investors, executives and founders advancing principled capitalism

was recently featured in NextTech Today, where he explored how AI is reshaping communication and redefining leadership Read his full piece here

Keith Williams and the Center for Independent Employees celebrated a major victory in Ohio helping teachers in the Continental School District secure independence from the OEA This marks CIE’s first OEA removal in Ohio and their 43rd nationwide

Amit Singh, CEO of NearStar Fusion, delivered a high-level talk on fusion energy at George Mason University’s Mason Enterprise

Spoke at the Executive Roundtable with Liberty Ventures featuring Alexander McCobin, Robert Begley and Verne Harnish

Shared that MOST will lead the Central Asia Pavilion at the Singapore FinTech Festival 2025, showcasing regional startups and positioning Central Asia as a rising hub of innovation

She joined the We Made This Political podcast with Lura Forcum and Lauren Hall, sharing an engaging conversation on her work and highlighting projects like RAFT for America and UNDIVIDE US Movie Full podcast here

She was featured on the Sunbeam Chats Podcast, where she shared her journey as an attorney, angel investor, and founder, discussing career pivots, global work experiences, and empowering women entrepreneurs through Root to Rise Full interview here

She participated in a Gwinnett Chamber Foundation event, where she spoke with entrepreneurs about building a lasting legacy.

He represented AmityAge as a moderator at ChainCamp 2025, helping foster collaboration and Bitcoin adoption across Czech and Slovak communities.

He sat down with Frank Clement, VP of Strategic Partnerships at America’s Christian Credit Union, exploring how values-aligned banking can drive positive change Full podcast here

Copy Editor

Key Account Manager

Key Account Manager

Major Giving Consultant

Copywriter

Senior Back-End

TypeScript (AWS

Serverless, PostgreSQL)

Senior Back-End

Python

Senior Back-End

Python (Flask, PostgreSQL, AWS)

Senior Mobile iOS Swift

Senior Full-stack

Node/React

Lead AI Engineer

And more

Software Engineer

Technical Support Agent

Product Manager (GenAI)

TATO

Chief of Staff

People Operations Analyst

Associate

Written by: Michelle Bernier

Living Capitalism’s Principles

F L Cuvo, capitalism represents opportunity. It hose with vision and drive to build from the p As a former hockey player, he saw how competition and hard work shape

Now as an entrepreneur, he sees m as freedom of choice for both business nd customers Athletes get to choose the that deliver the most value. Entrepreneurs mpete by delivering something better

Started Best Dam Tape

nched Best Dam Tape after years on the key players depend on tape, yet most underperform He knew athletes needed g stickier, cleaner, and more durable Best pe was built to solve that problem But mission is broader. He wants athletes and eurs to chase their goals with confidence, heir equipment will hold up under pressure

Logan’s philosophy for building Best Dam Tape reflects the values he absorbed through sport He applies the principles of free enterprise every day. Compete by raising the bar, not by cutting corners. Stand behind the value you deliver, and don’t make excuses when the standard slips. Success, he believes, comes from creating opportunities, for athletes who depend on reliable gear, for partners who share the same vision, and for anyone willing to work hard to win their place in the market

Ice, Hard Lessons

Like any venture, the road hasn’t been smooth For every surge of pride when a pro or a young player chooses Best Dam Tape over a legacy brand, there have been setbacks that tested his resolve Production bottlenecks, tight budgets, and inevitable moments of doubt demanded discipline just as grueling as a playoff run Logan views these challenges the way athletes see a tough season: training for resilience.

Looking Beyond the Ice

The horizon for Best Dam Tape stretches far past hockey rinks Logan envisions a standard-setting brand recognized across sports that demand reliable, high-performance gear. Ultimately, the mission is about proving that dedication to craft, persistence through setbacks, and an insistence on quality can elevate a startup to compete against established giants

In the end, Logan Cuvo is selling tape and also showing that the principles that shaped him as an athlete, i.e. fair competition, accountability, and relentless pursuit of improvement, can define a business just as powerfully as they once defined his game

Written by: Michelle Bernier

For Zachary Silva, capitalism is about creating the future you want to see. He views business as the best way to make an impact and to turn ideas into reality That belief was rooted early in his upbringing His father ran a business, modeling both the risks and rewards of entrepreneurship His mother offered a different kind of encouragement, pointing to Bill Gates, then the world’s wealthiest person, and reminding him that autism was no barrier to achievement. That message stuck: entrepreneurship is possible for everyone, including those with differing abilities

Why He Chose Entrepreneurship

Zachary decided to pursue entrepreneurship both as a personal calling and as a rebellion against society’s tendency to underestimate autistic and differentlyabled people Building businesses gave him independence, influence, and the chance to challenge expectations His ventures reflect his mission to prove what is possible when talent and determination are given the right platform

Living the Principles

Zachary has built 2 companies and 1 nonprofit around this vision Catenactio helps talented creators connect with major movie studios Hotstreak Games gives casino gamers options to compete directly against each other beyond poker. Divergent Tide, his nonprofit, trains autistic and neurodiverse entrepreneurs to build businesses and support themselves

Each effort ties back to the principles of liberty, accountability, innovation, and value creation He uses entrepreneurship not only to grow companies but also to create opportunities for others who are often overlooked

Lessons from the Journey

The path has not been smooth Zachary has seen businesses fail, just as he watched his father go through the same. Even Catenactio nearly collapsed before he turned it around Those experiences forced him to learn resilience, strict budgeting, and how to build lean startups They also laid the groundwork for Hotstreak.Games, which now stands as his most efficient and fastest-growing company The lessons learned from failure gave Zachary the discipline to manage success

The Vision Ahead

Looking forward, Zachary envisions Hotstreak Games transforming underused casino slot floors into competitive esport arenas He believes casinos need fresh ways to engage players and he sees esports as the natural evolution His experience with Catenactio and relationships with major studios position him to secure high-profile intellectual property to fuel the platform.

Zachary Silva is building companies but more than that, he is building a proof point for principled capitalism, showing how entrepreneurship can create prosperity and inclusion at the same time

Written by: Michelle Bernier

Capitalism, at its best, drives innovation Glennon Simmons believes it is the only system that rewards those who take risks to create real value. “I believe that creating value for customers in a competitive market is a key driver of innovation,” Glennon explains That sense of purpose (solving problems and being accountable to results) has refined his path as an entrepreneur

Glennon’s belief in the power of innovation led him to found Portable Diagnostic Systems, a company born from the turbulence of the COVID-19 pandemic As saliva testing became a routine part of daily life, he saw both the promise and the limitations of existing diagnostic tools Many testing systems were centralized, costly, and inaccessible to those outside major healthcare networks. Glennon recognized that technology could bridge those gaps. His company’s mission is to deliver lab-quality diagnostics wherever they’re needed, combining artificial intelligence with microfluidic engineering This approach enables reliable, rapid testing in places like pharmacies, schools, and even private homes, thus transforming the accessibility and affordability of healthcare.

For Glennon, business is not a solitary pursuit but a conversation with the market “Making a sale is a collaborative effort,” he says. That collaboration begins with listening The company’s growth has been guided by understanding what customers actually need, not what the technology merely can do This ongoing dialogue has allowed Glennon and his team to refine their tools to meet the shifting demands of a fast-paced marketplace

The entrepreneurial path has been anything but smooth. Glennon is candid about the difficulties that come with transforming scientific breakthroughs into commercial realities Technical challenges, regulatory hurdles, and the constant pressure of funding are part of the terrain Yet, he describes the journey as deeply rewarding, especially when he sees the direct impact of his work in the hands of customers Each success represents not only a validation of his vision but also a reaffirmation of the principles that drive him: persistence, creativity, and responsibility.

Looking forward, Glennon’s vision for Portable Diagnostic Systems is ambitious and humane He wants to make highquality diagnostic testing as common and accessible as a home thermometer. “Our goal is to save lives, improve patient outcomes, and empower communities,” he says By moving diagnostics closer to patients (i e into clinics, ambulances, and living rooms) his company is redefining how healthcare can reach those who need it most

In every respect, Glennon’s story illustrates a form of capitalism grounded in service and ingenuity. It’s a reminder that markets, when guided by empathy and vision, can become engines for both personal fulfillment and public good Glennon’s journey reflects that balance where innovation meets impact, and entrepreneurship becomes a force for better health and a stronger society.

SAY YOUR IDEA OUT LOUD. SAY YOUR IDEA OUT LOUD.

Written by: Camilla Chellapermal

Shawn David Nelson, founder and CEO of Lovesac, opens his podcast Let Me Save You 25 Years with a story about the unlikely innovation that put his company on the map In the early 2000s, he and his team discovered that compressing their massive foam-filled sacs into duffel-sized bags made them not only easier to ship but suddenly marketable online. Lovesac stumbled into being “internet-able,” years before e-commerce became the defining channel for bigticket retail “We didn’t realize how powerful it was,” Shawn admits, reflecting on the trend he wishes he had leaned into harder

Two decades later, that experience shaped his decision to pivot the company again, this time around its modular Sactionals line, spotting a direct-to-consumer wave driven by digital-first brands like Warby Parker, Casper, and Tesla Lovesac purged its product catalog, wrapped itself around the Sactionals platform, and grew from $60 million to nearly $700 million. Shawn calls this practice “connecting the context”: seeing the bigger forces at play, aligning with them, and letting the momentum carry the business forward

It’s a theme that resonated deeply with his guest, Alexander McCobin, founder of Liberty Ventures and former CEO of Conscious Capitalism Alexander has built his career on helping leaders think in systems: capitalism itself, he argues, being the most transformative context of all “Over the last 200 years, humanity has flourished thanks to the radical idea that people should voluntarily produce and trade with one another,” Alexander said His mission now, through Liberty Ventures, is to back businesses that make the world freer and more prosperous while creating long-term value.

The conversation turned naturally to the legacy of Milton Friedman, who famously argued that the sole purpose of business is to maximize profits for shareholders While that doctrine dominated boardrooms and business schools for decades, Shawn and Alexander point to its shortcomings Both champion the stakeholder model, in which employees, communities, and the environment are as much a part of the equation as shareholders.

John Mackey, founder of Whole Foods and a mentor to Alexander, helped crystallize this idea in the book he coauthored, Conscious Capitalism As Shawn explained, Lovesac requires its leaders to read the book: “We want to be held accountable to these ideals.” Far from being charity, Alexander emphasized, conscious capitalism is about building healthier ecosystems that in turn create more durable profits

Shawn pressed Alexander on where the next contextual wave might come from Unsurprisingly, artificial intelligence dominated their discussion “There’s going to be so much productivity unleashed from AI,” Alexander said. “The bigger question people will ask is: what values are driving it? What is this being used for?”

Shawn drew a sobering parallel to the rise of the internet Ignoring AI, he argued, would be like ignoring e-commerce in the 1990s. But in contrast to that earlier wave, he believes the AI era will put a premium back on the human side of business: trust, empathy, and character may soon become a leader’s only durable competitive edge.

“If what Alexander is saying is right,” Shawn mused, “then the value a human has to offer is more intrinsically related to being human than ever before ”

The conversation took a personal turn when Alexander asked how Shawn was preparing his own children for that reality Shawn described small but deliberate practices At restaurants, he never orders for his kids Even if it takes 3 tries, they must look the server in the eye, speak clearly, and advocate for themselves “It’s painful when they’re young,” he laughed, “but there’s great value in making them speak up.”

He also spoke about the grounding role of his faith community, which provided both moral framework and social capital when he moved his family across the country. “Just being part of something bigger than yourself,” Shawn said, “is invaluable ”

These stories underscored the larger point: if AI and automation strip away rote tasks, then the future belongs to those who can lead, persuade, and connect. The irony, as Shawn noted, is that a generation raised behind screens may find those skills harder to master That gap, he believes, is where opportunity lies for parents, teachers, and business leaders alike

Alexander pointed to Angel Studios, a Utah-based company Liberty Ventures backed, as a model of connecting the context By crowdsourcing feedback from viewers before producing films, the studio not only secured a ready-made audience but tapped into a backlash against Hollywood’s overreliance on algorithms and sensationalism In a market saturated with titillation, family-friendly content became its own counter-trend

For Shawn, it was the perfect example of how entrepreneurs can align their own values with broader cultural trends - or ‘anti-trends’ - and ride both to scale “Sometimes you already have a good product,” he said. “But if you can tweak it to align with a bigger trend, that wave can carry you further than you ever imagined ”

The episode closed with Alexander’s core advice: take the next step, even when uncertain. Shawn recalled launching Liberty Ventures with a bold retreat on Richard Branson’s Necker Island - a costly gamble that paid off when Shawn himself signed up as the first participant “Life is always about taking the next step,” Alexander reflected “Just start moving in the direction you want to.”

For Shawn, the story illustrated how risks and serendipity intertwine By putting himself out there, Alexander created the very conditions for opportunity to arise Connecting the context, in other words, begins with having the courage to draw the first line.

The Liberty Ventures Founder Fellowship is a unique program for pre-seed to Series A startup founders. Unlike traditional accelerators, LVFF is an ongoing relationship providing long-term strategic guidance, advisors, investor access, and a supportive community. In exchange for up to 5% advisory equity, founders gain access to Liberty Ventures' vast network and resources.

A principled path for founders building scalable businesses.

Learn Lessons from Top Investors

Get Invited to Quarterly Summits

Receive Partner Invitations

Written by: Camilla Chellapermal

On a small farm in a town of 3,500, Zach Oehlman learned his earliest lessons in business. Farming was, as he recalls, “the purest form of capital markets in the world ” Each day demanded an understanding of operations, sales, and finance By 8 years old, he was steering tractors across fields, and by 12, after the sudden loss of his father, he was running the family farm.

Those early years shaped the foundation of who he is today He learned about hard work, consistency, and keeping his word. This ethic carried him through college, where he earned a degree in finance and business administration; however, on entering the professional world, Zach confronted the familiar barrier of without connections or pedigree, no firm was eager to hire him Instead of giving up, he drove 200 miles a day to work unpaid in Chicago For 2 years, Zach poured himself into jobs that didn’t pay, believing that credibility and experience were worth the sacrifice

That determination opened doors He joined a boutique valuation firm, learned the intricacies of finance, and then, after 18 months, he landed his dream job at one of the top valuation firms in the world He quickly distinguished himself, tackling the hardest assignments and publishing his research. Yet success inside a prestigious firm didn’t feel like the ultimate destination He realized he wanted to build wealth on his own terms

So Zach left He bought rental properties, acquired a company in Arizona with almost no money down, and flipped it for twice its value within a year It was a turning point: the discovery that capitalism wasn’t just about personal gain, but about creating, growing, and scaling ventures that generated value He soon launched an investing community that expanded from a local network of hundreds to a national group of over 30,000 Over the past 15 years, he’s held daily calls 5 days a week with these investors and guided more than 10,000 consultations, ultimately designing his own F O S M framework to help others scale their businesses.

What makes Zach stand out is not just his business acumen but the philosophy he’s built around it. For him, a prosperous society can only exist within the foundation of trust; however to build trust, one must learn the principles and values that create this trust To Zach, capitalism begins with the core tenet of respect for individual agency: the freedom to pursue goals and exchange value He worries that when the principles of capitalism are hidden, it will be demonized by those who don’t have access to information and cause people to lose faith in it, seeing only exploitation rather than empowerment To counter that, he created Learn and Grow Rich, a platform where he freely shares the principles of capitalism and provides everyone with a pathway to prosperity

Zach says “I do this because I realize to really live in a free market, I need everyone else in the free market to be prosperous so that I can be prosperous”. Zach lives by the principles of capitalism by giving away his intellectual property, knowledge, software, and frameworks “The information that creates the context called capitalism” he explains, “can stay alive through the sharing of the information and implementation of the ideas”

This belief in open access has carried into his leadership at Liberating Humanity and the Child Liberation Foundation For Zach, financial success is a means to greater ends: fighting exploitation, funding missions that protect children, and empowering communities. He wants to show entrepreneurs that wealth is not simply about accumulation but about using influence to reshape society for the better

Even with this drive, Zach is candid about the pitfalls of ambition For years, he defined himself by profit and expansion Today, he urges business leaders to avoid that trap. “Don’t let your business success become your identity,” he says. His own life now includes time for writing, motorcycle rides, travel, and dinners with his wife - experiences his earlier self might have sacrificed in the name of growth

Zach’s journey from the rows of a family farm to the boardrooms of finance and now to global philanthropic efforts, reflects the arc of someone who sees capitalism as both a tool and a responsibility He has built prosperity through persistence, shared it through mentorship, and now channels it into causes that extend beyond himself.

For Zach, the heart of capitalism is not competition for scarcity but the expansion of possibility When entrepreneurs share knowledge and resources, they grow businesses and also help create a society where more people can live freely, fully, and with dignity.

Written by: Camilla Chellapermal

For Corvas Brinkerhoff, art has always been more than spectacle From his early days co-founding Meow Wolf, he saw how immersive environments could change people by awakening something deeper At Meow Wolf, audiences discovered worlds that felt limitless, and Corvas noticed how those experiences stirred creativity, vulnerability, and self-reflection

That realization became the seed for his next venture, Submersive Rather than framing its projects as attractions, Corvas envisions them as spaces designed to transform state of mind. Submersive is an exploration of how art, science, design, and technology can converge to expand awareness “I started asking: What if we designed experiences not just for entertainment, but as tools for transformation? What if instead of just being wowed, people left with a deeper connection to themselves, to each other, and to the larger systems we’re a part of? That’s the seed of Submersive.”

The experiences Submersive creates are crafted to act as catalysts. Some visitors leave with a sense of wonder, others with catharsis or relief Many describe a heightened sense of connection The aim is to recalibrate, to give people a moment where they feel more alive, more open, and more present

That sense of intentionality extends to how Corvas runs the company itself. His background at Meow Wolf taught him that the most ambitious visions rely on people as much as ideas “If your primary offering is cultural and experiential, then the people behind it are the foundation. You have to choose them carefully and care for them deeply ” Equally important, he says, is thinking clearly about capital. Where Meow Wolf had to learn hard lessons about financing, Submersive is taking a more deliberate path: aligning the right kind of investment with long-term vision, rather than chasing growth for its own sake. Sustaining impact, he explains, means moving beyond novelty and building something that resonates long after the initial encounter

Looking ahead, Corvas imagines 2 horizons for Submersive. The first is physical: creating a global network of cultural sanctuaries, spaces that offer more than relaxation, inviting transformation through immersive design The second is scientific: using that network to push forward an understanding of how light, sound, temperature, touch, and movement can be orchestrated to support human wellbeing. For him, multi-sensory design is a frontier not only for creativity but for health

At its core, Submersive is an experiment in possibility. Corvas sees it as a way to expand what cultural spaces can do and how they can help people reconnect with themselves and with each other It’s a continuation of a journey he’s been on since Meow Wolf, but with a new focus: not just creating worlds to step into, but creating worlds that help us step more fully into our own lives

Written by: Zussel Ramos

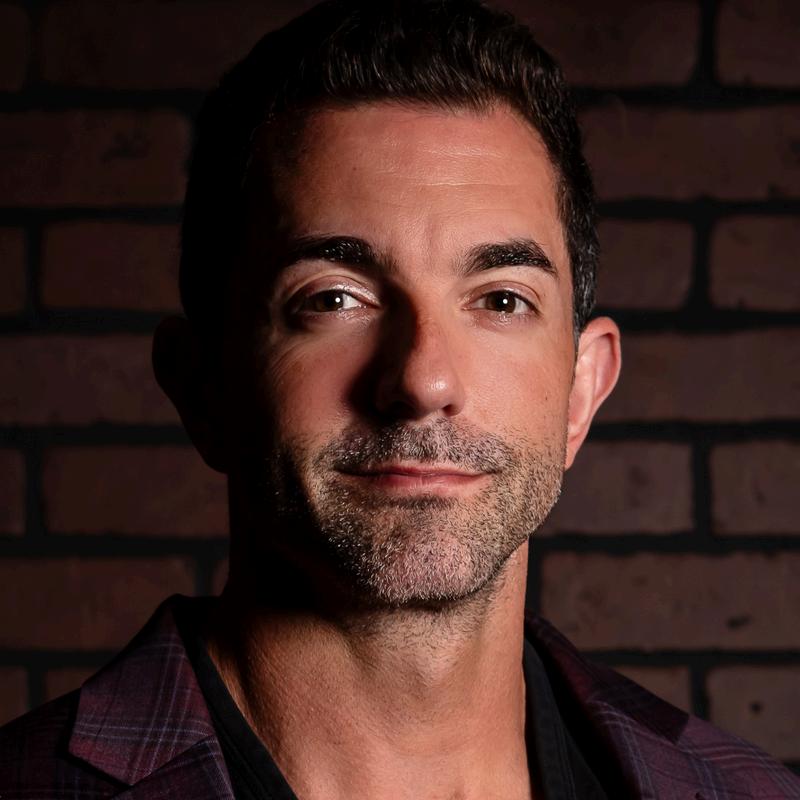

Chris Fronda is no stranger to building. With a background in physics and mechanical engineering, he has worked with Apple, NASA, and Pfizer He founded his first company at 26, and has since lived the full arc of entrepreneurship. His latest venture, however, might be his most ambitious

At LogicTry, Chris is creating a global expert network designed to restore logic and critical thinking back to decision-making in business, media, and public discourse

The premise is straightforward: experts should be visible, credited, and compensated, especially at a time when AI tools and superficial commentary often eclipse genuine expertise

“We’re scaling a network of a thousand subjectmatter experts around the world. The goal is simple: more logic, less noise ”

LogicTry elevated people rather than replacing them, ensuring that human insight remains central while giving experts proper recognition It envisions a marketplace where decisions are strengthened by authentic knowledge rather than automated shortcuts and algorithms

For Chris, this reflects capitalism at its most constructive While not flawless, he sees it as the most effective system yet for rewarding innovation and effort, particularly when incentives are aligned and creativity has room to flourish

“Capitalism isn’t perfect. But it’s one of the best systems we’ve created, because it rewards innovation, hard work, and value creation ”

Chris is not defending the status quo. He is doing something better by working to improve it LogicTry is one expression of that ambition

Written by: Camilla Chellapermal

When Simone Collins talks about capitalism and liberty, to her, they are conditions that allow human progress to unfold. “Humanity cannot flourish if it becomes stagnant,” she explains. Evolution, she believes, doesn’t stop with biology and carries through culture, technology, and the ideas we pass down In that view, capitalism and liberty act as engines of change Protecting them is central to how civilization adapts

For Simone and her husband, Malcolm, these beliefs aren’t just theory. Their marriage itself grew out of shared entrepreneurial instincts When Simone reached out to Malcolm on the dating app OKCupid in 2012, her first message was about the startup he was building Business became a foundation for their relationship, and within a year they were cofounders, running a startup together that eventually took them through a 500 Startups accelerator batch. From there they raised a search fund, acquired a company with offices in the United States and Peru, and expanded into a portfolio of ventures Alongside those efforts, they co-authored 5 books, including a Wall Street Journal bestseller on governance, founded a nonprofit, and launched a podcast!

While many couples hesitate to mix love and work, Simone sees their partnership as a continuation of something deeply human For most of history, marriage was an alliance: a way for people with shared values and goals to pursue projects too large to tackle alone She believes reviving that vision (where commitment is both personal and practical) could strengthen not just families, but entire societies

The couple’s shared projects today center on human development and the future of civilization. Their investments focus on companies working in advanced reproductive technologies, gene editing, and related fields that could shape how humanity survives the disruptions ahead “Founders who are trying to tip the scales toward long-term flourishing need as much support as possible,” Simone says.

The urgency they feel comes from demographic data that, in their view, is being ignored at society’s peril Fertility rates across the developed world are in freefall. That shift, Malcolm warns, is driving countries toward what he calls “dependency ratio cascades” or moments when too few workers remain to support retirees and social safety nets collapse When those crises hit, tax burdens may rise so sharply that both individuals and companies flee, leaving hollowed-out economies behind.

To the Collinses, this is a looming reality. They’ve been speaking with policymakers, national leaders, and private groups to stress that while fertility decline cannot be reversed in the near term, countries can prepare themselves in ways that soften the blow. They argue that delay only ensures deeper suffering

Malcolm frames the stakes in stark terms. “Who controls the future of humanity will be decided within our generation,” he says He points out that the rare populations maintaining high fertility while embracing technology will be disproportionately influential. Meanwhile, artificial intelligence has introduced an entirely new form of non-human intelligence into the equation which is something no previous generation has faced Humanity’s future will depend on how these intelligences are integrated into society

At the same time, global politics is fracturing along cultural and ideological lines Malcolm describes 2 emerging camps: one, a centralized urban monoculture aligned around bureaucratic global governance; the other, a decentralized alliance of cultures intent on preserving autonomy and resisting homogenization. The Collinses see themselves as part of the latter, backing projects and products that keep power distributed and cultural diversity alive

The scope of their vision is immense, stretching from fertility rates to AI to the survival of liberty itself Yet for Simone, it comes back to the same principle that drew her to Malcolm more than a decade ago: a belief that human flourishing depends on those willing to build As she and Malcolm continue to invest, write, and advocate, their work is shaped by a desire to navigate the crises of today, and also, to leave behind a civilization resilient enough to keep evolving.

Written by: Camilla Chellapermal

For Aleksey Matyushev, progress has always come from a willingness to experiment. That idea shaped his early career in aerodynamics and today, defines the company he co-founded, Natilus After nearly 2 decades in aviation, Aleksey is convinced that the industry needs more than incremental updates it needs a reimagining of how aircraft are built, how they perform, and how they fit into a world with rising demand and evolving needs

Aleksey’s entry point into aviation was through design At Piper Aircraft, he was entrusted with guiding aerodynamics on projects like the PiperJet Altaire and the M600, experiences that grounded him in the realities of production while also exposing the limitations of traditional aircraft models Later, at Kratos Defense, he took on the challenge of military UAV systems, refining the skills that would prepare him to rethink not just a single project, but the entire direction of aviation Consulting for defense programs further reinforced a conviction: there was room, albeit urgent room, for something new

That conviction became Natilus. Founded with the goal of developing blended-wing-body (BWB) aircraft, the company has set its sights on solving problems that legacy manufacturers are struggling to address Major production slowdowns have led to an estimated shortage of 15,000 aircraft over the next 20 years In Aleksey’s view, that gap is an opening for a newcomer with the flexibility to experiment and deliver.

Aleksey’s mission is to develop aircraft that are not only hyper-efficient, but purpose-built for the economics of modern air transport The BWB design Natilus is advancing offers significantly lower fuel burn, greater payload capacity, and lower operating costs. Those advantages appeal as much to airlines as to the Department of Defense, where the ability to reduce personnel requirements for contested logistics and resupply could be transformative

Behind the technical promises is a worldview that shapes Aleksey’s approach. He sees capitalism as the system that allows ideas like Natilus to exist in the first place For him, the freedom to create and experiment is the core driver of progress In markets under pressure to improve efficiency and sustainability, Natilus represents a test of whether innovation can still break through in an industry dominated by established players

Aleksey’s commitment to experimentation is deeply lived It has defined every stage of his career from refining jet aerodynamics to challenging long-held assumptions about how aircraft should be built With Natilus, that mindset has evolved into a vision that is both ambitious and grounded: creating aircraft that meet the economic realities of airlines and freight operators while also addressing the environmental demands of the future In Aleksey’s view, the skies are not fixed, they are open to reinvention and Aleksey is intent on showing the world just how far that reinvention can go

Written by: Camilla Chellapermal

When Christian and Johannes speak about liberty, they do so from very different starting points Christian, an economist with a PhD, traces his path through the study of human action. For him, liberty is inseparable from the freedom to exchange, create, and build without coercion As he immersed himself in the Austrian School of economics, the conviction grew that societies thrive when individuals are free to pursue their ideas and enterprises on their own terms.

Johannes, a psychotherapist steeped in Jungian psychology, arrived at liberty through another door entirely His work taught him that healing often begins when individuals recognize and release the unconscious forces binding their will Psychological freedom, he discovered, is as essential to human flourishing as political and economic liberty. When people are unshackled internally, they are able to contribute more authentically to their communities

Together, the two found that their disciplines of economics and psychology converged on the same truth that freedom is the condition under which people grow, innovate, and thrive. That conviction is now the heartbeat of the Sovereign Scholars University Project.

Christian and Johannes want to establish a private, Classical Liberal university in the United States, rooted in the Western intellectual tradition and informed by the values of the Judeo-Christian heritage Their aim is to preserve the enduring strengths of a liberal arts education (i.e. philosophy, rhetoric, economics, psychology, and science) and also, to pair them with practical fields such as entrepreneurship, leadership, and personal development

They are acutely aware of the current state of higher education, where rising costs and ideological narrowing have left students burdened with debt yet underprepared for life beyond the classroom By contrast, Sovereign Scholars’ first program, a Bachelor in Modern Liberal Arts, is designed to form independent thinkers: men and women capable of engaging the wisdom of the past while shaping the challenges of the future

The project’s promise lies in its balance of rigorous academics coupled with the cultivation of character and practical competence. Christian and Johannes see this as the path to renewing higher education’s cultural role.

Unlike many universities that rely heavily on state funding, Sovereign Scholars is deliberately structured as a for-profit initiative. For Christian and Johannes, this may have been a financial choice but most of all, it was a philosophical one. They believe that education should be accountable to students, families, and supporters rather than shifting political winds

In practice, that means building lean operations, keeping administrative costs low, and focusing resources on academic quality They contend that tuition should be reasonable and transparent, reflecting both the costs of excellence and respect for students’ investment in their future Capitalism, as they see it, is about risk, responsibility, and accountability to those who freely choose to engage.

Launching a university demands networks, resources, and voices willing to shape discourse. Christian and Johannes are actively seeking partners, in particular investors who see education as cultural legacy, scholars and public intellectuals who can help refine curricula, and allies committed to building institutions that last

They describe the project in organic terms, as planting an oak that will stand for generations Education, in their eyes, is not a short-term endeavor but a cultural cornerstone By founding Sovereign Scholars, they hope to restore the roots of liberty, heritage, and human dignity, and in doing so, set the stage for a renewal that extends well beyond the classroom

For Johannes and Christian, liberty is more than an academic subject: it is a lived commitment And with Sovereign Scholars, they are working to ensure that freedom takes root in minds and communities for decades to come.

Written by: Camilla Chellapermal

When Matt Holmes first set out to buy a home with his mother Pam, his stepfather, and his girlfriend, he thought it would be challenging but manageable Between them, the family had decades of experience in finance, construction, and real estate. Matt had worked as an investment banker, Pam had managed operations at GE Capital, and his stepfather had been building homes for more than 30 years On paper, they seemed like the ideal team to navigate a purchase.

The reality was anything but

Every step of the process was slow, complicated, and filled with gaps in the system What should have been a moment of family triumph felt more like an endless negotiation against red tape. Matt remembers the shock of realizing that if a group with their collective expertise found cobuying nearly impossible, then ordinary families without that background would likely give up before they even started

That frustration sparked an idea, and later, a company. Matt co-founded CoBuy to make co-ownership a real, accessible path to building wealth

To Matt, he saw this mission as a test of whether capitalism is truly working “Capitalism should reward value creation and hard work,” he says. “But when home prices are more than 7 times income, and wages stay flat, the American Dream gets locked away behind barriers most people can’t cross ”

Home equity has long been the most powerful driver of household wealth in the United States, but for younger generations, the ladder feels broken. 80% of renters still aspire to own, yet two-thirds worry they never will. Matt believes capitalism needs new infrastructure: tools and systems that make ownership possible again for regular people

That’s what CoBuy is building. Its platform, Co-ownerOS™, gives groups of friends, couples, and relatives the ability to pool resources, structure their ownership properly, and manage the full life cycle of a shared home What was once a tangle of legal, tax, and financial risks becomes a clear and navigable process

Matt is quick to point out that the company itself is run on the same principles he believes should guide capitalism CoBuy only builds tools that co-owners truly need because the team has lived the entire co-ownership journey themselves. There are no government subsidies or gimmicks propping up the business. Growth comes from groups choosing their platform because it saves them from costly mistakes and helps them build equity

Equity also extends to the team. When Ferhat Bilgiç joined as technical co-founder, after previously scaling a multiplayer game to hundreds of thousands of users, he received meaningful ownership in the company “That’s meritocracy in action,” Matt explains “Deliver value, capture value, share value ”

It’s a philosophy that has shaped how CoBuy grows. Customers often become advocates, paying annually before the company even markets to them Weekly product releases reflect a small team moving with urgency Every part of the business ties back to Matt’s belief that capitalism should function as a system that rewards contribution, not just capital.

The Broader Vision

Matt sees the housing crisis less as a failure of markets than as a failure of infrastructure. “Right now, 61 million Americans co-own homes without resources or tools,” he says “That’s $9 trillion in real estate managed through chaos ” Thousands more groups form every day, hoping to buy together, but most run into barriers that stop them cold

By giving those groups proper governance protocols, legal frameworks, and operational tools, CoBuy transforms fragile arrangements into secure, wealth-building partnerships And while CoBuy’s first focus is residential real estate (i e the foundation of household finances), Matt’s ambitions extend further. He envisions a future where the same infrastructure supports ownership of many different types of assets, creating new opportunities for wealth building across society

“When the sharing economy meets the ownership economy with the right infrastructure,” Matt says, “you finally open doors that should never have been closed in the first place ”

For Matt and Pam, that’s the heart of the work. What began as a frustrating family home purchase has grown into a mission to restore pathways to wealth creation Their story is both personal and profoundly economic: a reminder that capitalism, when grounded in fairness and real value, can still deliver on its promise

Written by: Camilla Chellapermal

Kevin Koharki has spent years at the crossroads of finance and education, first as a banker and then as a professor Today, he’s become the person top organizations call when they need their teams to not just glance at financial statements but truly understand them. The result? Smarter decision-making, tighter alignment with leadership goals, and in some cases, organizational transformation

One global defense company learned this firsthand when Kevin worked with its engineers By walking them through how budgets connected to the company’s larger mission, he revealed misalignments that had gone unnoticed The discovery was significant enough to prompt a restructuring of R&D spending, and the company now sends him across the world to help other divisions do the same A leading bank has already brought him in twice Law firms, CPA firms, and even groups that link government officials with private industry have also turned to him for guidance

What Kevin offers goes beyond “finance for non-financial people ” He has a knack for making financial literacy matter to whoever is in the room, whether that’s a Fortune 50 board member, a young associate, or an incoming intern For executives, that might mean sharper advocacy for budgets or strategy shifts. For junior staff, it often means building the confidence to read and interpret financial documents that otherwise felt off-limits The universal lesson is that understanding the numbers changes how people participate in shaping outcomes

When it comes to capitalism, rather than lionizing excess, Kevin believes capitalism functions best when people inside organizations understand the levers that drive it He’s witnessed the evolving workplace dynamic where human expertise combines with artificial intelligence, and is of the opinion that financial fluency is a critical part of thriving in that environment.

Kevin believes that when people at every level of an organization can interpret financial information with clarity, they become more persuasive advocates, whether they are defending a project budget or proposing a new idea. And organizations benefit when employees stop treating finance as a specialized language only a select few can read

From banking halls to defense labs, the evidence of his impact keeps growing. It is clear that his message is reshaping companies behind closed doors: when people understand the financial backbone of their organizations, they serve both their leaders and their missions more effectively

Written by: Michelle Bernier

When Louis Camassa bought his first domain name in 1998, the Internet was still the digital frontier. Few people understood what a URL even was, but Louis saw possibility The domain, lccreations com became a symbol He renews it to this day as a reminder that taking action creates opportunity, but that only quality action turns potential into progress That belief became the foundation for everything that followed, from his first cold calls to local businesses, to growing an agency that hit $500,000 in revenue in less than 2 years

Louis believes capitalism creates the freedom to solve real problems During the pandemic, he helped scale a SaaS platform that processed millions of health services for companies like Uber and Blue Apron He saw how markets reward resilience In his view, capitalism turns ideas into impact that extends beyond individual success. It is the system that transforms creativity and effort into outcomes that improve lives

The early days of e-commerce offered Louis a front-row seat to a revolution While still in college, he ran a small digital consultancy and once received a call from an executive at the Yellow Pages looking to understand “this Internet stuff.”

After Louis explained search optimization, the executive responded confidently: “We’re in every home in America That’s never going to change ”

That certainty didn’t age well In every era, Louis says, convenience decides the winners It powered the rise of online shopping, ride-sharing, home-sharing, and even dating apps What was once dismissed as unsafe or impractical has now become everyday behavior Today, 17% of all retail transactions happen online, half of marriages begin through apps, and entire industries have redefined ownership and access.

Louis believes a similar shift is unfolding right now Just as marketplaces once pulled product discovery away from standalone websites, AI agents are about to pull it from search Platforms like ChatGPT, Perplexity, and Gemini will soon handle decision-making, from comparing options to managing payments. Consumers won’t scroll or compare: they’ll ask, and the agent will act

This shift, he says, will happen faster than most expect because convenience always accelerates adoption. The brands and investors who position themselves before the wave crests will capture the next era of growth

Louis has seen what happens when investors chase momentum instead of foresight During his time scaling a SaaS platform through major acquisitions, he watched many pour resources into today’s giants while overlooking those quietly preparing for tomorrow’s disruption The real winners, he says, recognize who’s shaping the next channel of distribution before it becomes obvious

For founders, his advice is grounded in experience Having guided over 150 startups, Louis learned that progress without clarity often leads to waste Moving fast isn’t enough - understanding why you’re moving matters more The businesses that succeed are the ones that obsess over product-market fit early, because no amount of marketing spend can repair a misaligned product

From buying a domain when few saw its value to helping scale digital ecosystems that serve millions, Louis’s journey reflects a steady commitment to forward motion His story is about recognizing patterns, acting decisively, and understanding that clarity drives lasting success.

For Louis, capitalism remains a force for creation It’s the platform that turns curiosity into enterprise, and enterprise into impact. And just like that first domain name he still renews, it’s a reminder that the future rewards those willing to act before everyone else sees the opportunity

Written by: Michelle Bernier

John Tillman has spent decades building organizations, leading businesses, and championing the principles that define a free society His latest venture, BeKynder, aims to bring those values into the digital age through something simple and timeless: kindness.

John’s path to entrepreneurship began with a fascination for politics and policy; however, his real transformation came when he started his first business. That experience shaped his belief that free enterprise, not government, is the best engine for human progress “Capitalism works because it rewards service,” John says. “When you serve others well, you are rewarded quickly and repeatedly When you serve them poorly, you are punished the same way That sharpens your purpose ” He believes this feedback loop makes capitalism not only efficient but moral “Our system is based on persuasion and consent,” he explains “Government systems often lack accountability. If you’re unhappy with a government service, there’s no real place to go to complain, and no competitive alternative In business, there always is ”

For John, this is the foundation of what he calls “the American Miracle ” , a system where anyone, regardless of background, can rise by taking responsibility for their own life. “All it requires is a willingness to work and be accountable That’s what makes America different ”

John’s entrepreneurial focus shifted when he noticed a growing divide in public life. “The media and politicians profit from conflict,” he says “But in our daily lives, we get along fine I wanted to focus on what connects us ” That insight led to BeKynder, a platform designed to encourage people to share acts of kindness

The idea started with a small experiment. John began anonymously buying drinks for strangers at airport and hotel bars “The reaction was always the same: joy,” he says “The recipient felt it, and so did I ”

One evening in Little Rock, he ordered a drink for a stranger at a Marriott bar. The bartender, smiling, asked if he’d like to “be kind” again A woman nearby overheard the exchange and joined the conversation When John mentioned he was looking for a designer, she replied, “I’m a UI/UX designer ” That woman, Eny Hathaway, soon became his co-founder, along with Jordan Schneider. “That’s when BeKynder really began,” John says. “A business was born that night,” John says

BeKynder’s mission is to make kindness visible The platform allows users to share positive acts that inspire others to do the same. John sees this as a way to shift the culture. “I want BeKynder to reshape the American narrative,” he says. “To help people focus on kindness, forgiveness, and our shared humanity ”

He believes this cultural shift is essential for America’s future “Our divisions are real, but our capacity for kindness is greater,” he says. “If we can redirect attention to the things that make us better neighbors, we can achieve our 21stcentury greatness ”

John doesn’t see BeKynder as separate from his long-held defense of capitalism. It is an extension of it. “Capitalism is built on agency, consent, and collaboration,” he says “Those are the same principles BeKynder promotes Kindness is voluntary It is an act of service It creates value ”

He points out that every act of kindness has tangible and intangible returns “When you buy a drink for someone, change a flat tire, or help an elderly neighbor, you create joy But you also create value You strengthen the bonds that make free societies work ”

John views BeKynder as a natural bridge between capitalism and community “The best businesses serve others well,” he says “BeKynder helps people do that in everyday life ”

In the end, his vision circles back to a simple and ambitious idea: to remind people that the strength of free enterprise lies not only in competition, but also in compassion “When people choose to serve others, whether through business or kindness, they build stronger communities. That’s the essence of liberty.”

Written by: Michelle Bernier

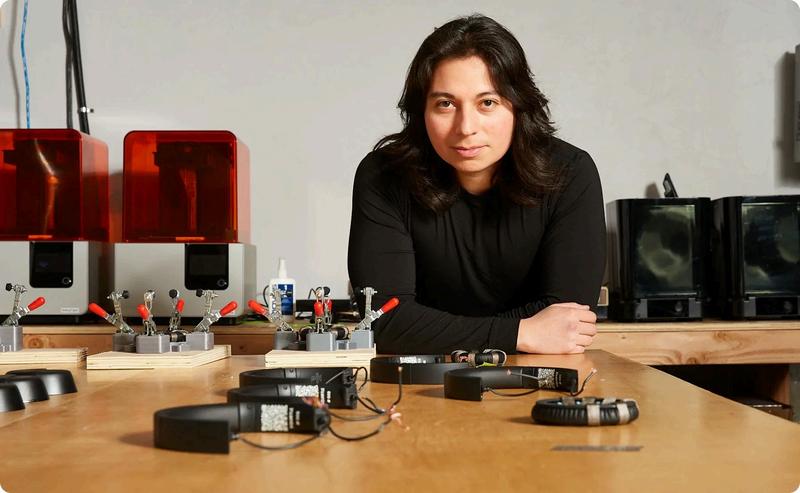

Ramses Alcaide founded Neurable with the goal of making brain-computer interface technology practical and accessible His work is reshaping how people interact with devices, how companies think about user experience, and how industries approach health, productivity, and defense

Ramses’s journey into neurotechnology began at home

Growing up around family members with neurological conditions, he developed a conviction that science could bridge the gap between human intention and digital experience That conviction carried him into neuroscience and engineering, and eventually into founding Neurable. The company designs a platform that translates brain activity into actionable insights (interpreting focus, intention, and emotion) so that other companies can embed these capabilities into their own devices.

Rather than produce a single gadget, Neurable has concentrated on building the infrastructure that makes brain-computer interfaces broadly usable It’s an approach that has attracted partnerships across consumer electronics, wellness, and defense, proving the technology belongs well beyond research labs

Neurable’s first consumer partnership was with Master & Dynamic The headphone company integrated Neurable’s AI technology into their products and saw its sales triple. That early success demonstrated the commercial potential of neurotechnology outside of academic and medical settings

Since then, Neurable’s pipeline has grown rapidly. Agreements include a large opportunity with MeSpace in the future-of-work sector worth tens of millions in recurring revenue, a forthcoming partnership with Audeze expected to generate more than $7 million annually, and collaborations with global names like HP and Renpho. On the government side, Neurable has already secured a $15 million contract with the U.S. Department of Defense, with further projects underway for Air Force applications

The brain-computer interface market is drawing attention from investors and corporations worldwide Neuralink has raised billions of dollars in funding, and Synchron has raised over $150M. In contrast, Neurable has carved out its place by focusing on revenue traction and partner adoption rather than sheer fundraising

With consumer electronics firms and defense agencies both in its portfolio, the company is navigating the space with a mix of commercial discipline and scientific credibility

Ask Ramses about his priorities, and he returns to the same themes: technology must deliver measurable value, partnerships must scale, and the end goal should always be solving real problems. That mindset, equal parts researcher and entrepreneur, is what drives Neurable’s steady progress

Projections put Neurable at $39 million in revenue by 2026, with $153 million expected the following year Those forecasts are linked to signed contracts, active negotiations, and a growing roster of OEM partners. With adoption spreading across both consumer technology and military programs, the path from niche use to widespread deployment is becoming clearer.

What Ramses has built reflects a blend of personal mission and commercial rigor By grounding neuroscience in products people and institutions can use today, he has steered Neurable into a position where advanced science meets everyday utility His story shows that innovation is about making sure breakthroughs reach the world in ways that matter

Written by: Alexander McCobin

When the U.S. government recently became a shareholder in Intel, it signaled a philosophical shift in how America views the relationship between business and the state For most of its history, the U S has championed a system rooted in free-market capitalism; however, the federal government’s move into equity ownership blurs the line between public policy and private enterprise. To understand why this matters, it’s worth examining the different systems this approach resembles, and what it might mean for America’s economic future

In a capitalist system, the means of productionfactories, companies, and resources - are owned privately. Individuals and firms make decisions based on market signals, prices, and profit motives The role of the state is limited to protecting property rights, enforcing contracts, and maintaining the rule of law.

Capitalism works not because it is perfect, but because it is decentralized Millions of people pursuing their own goals coordinate through voluntary exchange, leading to innovation, efficiency, and progress When a business succeeds, it does so because it has created real value for others. When it fails, it makes room for better ideas.

For nearly 250 years, this has been the American model: an imperfect but remarkably successful experiment in economic freedom.

Socialism is the opposite It places ownership and decision-making in the hands of the state. Under socialism, the government owns or controls the means of production and redistributes wealth to achieve social equality. Markets give way to plans; competition is replaced by bureaucratic allocation

The intent of socialism is often moral (fairness and equality) but the results have historically been devastating Without profit and loss to guide decisions, efficiency collapses Without private ownership, innovation stalls. And without voluntary exchange, freedom erodes

Fascism occupies a middle ground between capitalism and socialism, but in practice, it combines the worst of both. Businesses remain privately owned, but they are heavily directed by the state to serve “national interests ” The government chooses winners and losers, sets production goals, and often controls prices or labor practices

While fascism is typically associated with 20th-century dictatorships, the underlying idea of private property under state direction, can take subtler forms Whenever the government dictates industrial priorities or allocates capital for political aims, it moves in this direction, even if the rhetoric sounds benign.

State capitalism is not full socialism nor fascism. It’s a hybrid model in which the government acts as both regulator and investor, owning stakes in major companies, influencing markets, and steering strategic industries while still maintaining a nominally private economy

This is the model practiced in China, where the state holds partial ownership in “private” firms and directs investment through political objectives rather than consumer demand It’s a system that can mobilize resources quickly but often at the cost of efficiency, competition, and individual freedom.

When the U S government took an ownership stake in Intel, even under the justification of “national security” or “strategic competition,” it stepped away from traditional capitalism and toward state capitalism The motive may be understandable, i.e. securing semiconductor supply chains, but the precedent is dangerous. Once the government becomes both rule-maker and market participant, impartiality erodes The state can no longer referee the game fairly when it also owns a team

For most of its history, America’s prosperity has come from keeping markets free and government limited Publicprivate partnerships, subsidies, and regulations have existed before, but outright ownership in private firms crosses a new threshold

Capitalism thrives on voluntary exchange and competition. State capitalism thrives on political discretion and bureaucratic control One rewards innovation and consumer choice; the other rewards lobbying and political alignment

America’s entry into state capitalism might seem pragmatic today, but if left unchecked, it risks becoming permanent And once markets depend on political favor rather than consumer satisfaction, the moral and economic foundations of capitalism begin to erode

The U.S. doesn’t need to become socialist or fascist to lose its capitalist soul. All it takes is enough “temporary” interventions that never end True capitalism requires courage: the courage to let markets work, to allow failure, and to trust in freedom over control The Intel deal should remind us how fragile that balance really is Fascism: Private Ownership, Political Control

Written by: Paul H Jossey