Frozen Pork Meat from Brazil: An In-Depth Look at Production, Trade & Quality

Introduction : Buy Frozen Pork Meat from Brazil

Brazil is among the world’s leading producers and exporters of Buy Frozen Pork Meat from Brazil. Within that, frozen pork Ear has become a strategic product, with strong demand abroad, evolving quality standards, and growing export volumes. This article dives into all aspects of frozen pork heart meat from Brazil: how it's produced, regulated, its market dynamics, quality & safety, challenges, and future prospects.

1. Overview: Brazil’s Pork Industry

Brazil has been steadily expanding its pork production and exports over recent years, building infrastructure, improving sanitary practices, and diversifying destinations. Some key facts:

• In 2023, Brazil broke its pork export record: shipments (fresh + frozen + processed) reached about 1.229 million tonnes.

• The export revenues in 2023 came close to US$ 2.818 billion, up ~9.5% from 2022.

• In 2024, exports grew again: ~1.352 million tonnes in total were exported, a ~10% growth over 2023. Revenue surpassed US$ 3 billion for the first time.

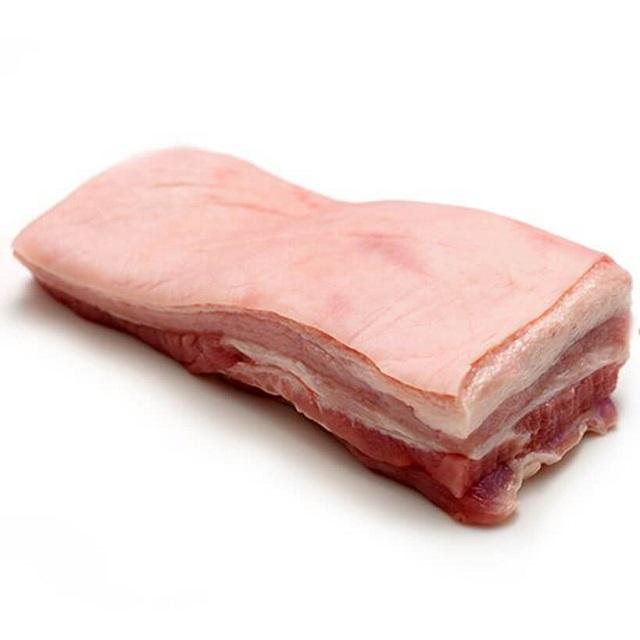

Frozen pork leg skinless is a major type of product within this cuts, non‐cuts, frozen carcass, etc. Among exported pork, frozen meat "other than cuts or carcasses" represents the bulk of volume/value.

2. What is Buy Frozen Pork Meat from Brazil (versus Chilled or Fresh)

To appreciate Brazil’s role, it’s useful to understand what “frozen pork collar boneless ” means in this context:

• Fresh or chilled meat refers to pork that is cooled (but not frozen) and kept just above 0°C. Shelf life is shorter; transport is more challenging.

• Frozen pork is pork stored / transported at or below a freezing point (commonly -18°C or lower), often produced via blast freezing or quick freeze methods to preserve texture, moisture, flavour and reduce microbial growth.

• Frozen helps in long‐distance export; in many destination markets, frozen pork is acceptable and sometimes preferred because it ensures food safety and shelf stability when supply chains are long.

Frozen pork knuckles whole from Brazil covers various types:

• Buy Frozen Pork Meat from Brazil “other than cuts or carcasses” these may be industrial use, by‐products, trimmed meat etc. This category dominates in both volume and value.

• Frozen cuts or carcasses, frozen hams, shoulders, etc. These represent smaller shares but are often higher value.

3. Production and Supply Chain in Brazil

Brazil’s pork production system involves:

• Breeding and Farming: Pig farms located mostly in southern, southerneast, and central regions (states like Santa Catarina, Rio Grande do Sul, Paraná). These states are major hubs.

• Feed: Grains, soy, corn, etc., are used in feed. Costs of feed are key components of production cost and can fluctuate with global commodity prices.

• Slaughterhouses & Processing Plants: Certified abattoirs follow sanitation, animal welfare, freezing infrastructure. To export, plants must meet both domestic sanitary regulations (Brazilian state & federal) and requirements of destination countries.

• Freezing / Cold Chain: The freezing stage (often blast freezing or quick freeze) is critical. After slaughter, meat must be processed quickly and frozen to preserve quality. Cold chain (storage, transport) must be tightly controlled to avoid thaw edges, “cold spots”, or partial thawing.

• Packaging, Logistics & Export: Frozen products are packaged in ways that safeguard them against freezer burn, temperature changes, contamination. Export shipments go via sea freight, sometimes air for high-value cuts. Regulatory documentation (health certificates, origin, traceability) are required.

4. Export Volumes & Key Markets

Brazilian frozen pork Ribs has seen strong international demand and has been expanding in both volume and market diversity.

Recent Trends:

• Export volumes in 2024: about 1.352 million tonnes of pork in total exported.

• For 2025, through early to mid year, exports have continued to increase. For example, in March 2025, exports rose ~26.6% year-over-year to ~116,300 tonnes of pork (frozen/fresh/processed) bringing in US$278 million, a ~44.2% revenue increase.

Top Exporting Brazilian States:

• Santa Catarina is by far the leading exporter of frozen pork cuts (and of frozen pork in general) in 2023, ~53.9% of total exports by volume came from there.

• Other important states: Rio Grande do Sul, Paraná, Mato Grosso, Mato Grosso do Sul.

Key Markets:

• Philippines: In recent years, the Philippines has become Brazil’s largest single destination for pork exports, overtaking China. In 2024, the volume to the Philippines increased more than 100% over the same period in 2023.

• China: Historically Brazil’s top market, but in recent data volumes to China have declined. China is still important for frozen pork trade.

• Japan: Rising demand; shipments grew significantly.

• Chile, Singapore, Hong Kong and others. Some growth to Latin American and Asian markets.

Product Types & Trade Patterns:

• The largest category exported is “frozen pig meat other than cuts or carcasses.” This includes processed meat or meat for further processing. It accounts for the great majority of export tonnage and revenue in frozen pork exports.

• Frozen cuts, hams, shoulders, etc. have smaller volume shares but are important for value, especially in markets that demand premium cuts.

5. Quality, Safety & Regulations

To successfully export and maintain reputation, Brazil has been working on quality, safety, traceability, and compliance with importing countries' standards.

Sanitary Regulation & Inspection:

• Brazilian federal agencies (e.g. MAPA Ministério da Agricultura, Pecuária e Abastecimento) oversee animal health, slaughterhouse inspections, certifications.

• Export plants need international sanitary certificates; facilities are audited by importing countries.

Freezing / Cold Chain Standards:

• Meat must be quickly frozen to avoid microbial spoilage; freezing also slows enzymatic activity that can degrade meat quality.

• Transport and storage must maintain consistent low temperatures (commonly -18°C or below). Temperature variations degrade quality.

Food Safety Concerns & Controls:

• Control and monitoring of pathogens (e.g. Salmonella, Listeria, etc.).

• Control of antibiotic use in pig farming (some importing countries require documentation that no prohibited antibiotic residues are present).

• Traceability: being able to trace meat from farm to slaughterhouse to export; this is increasingly demanded by importers.

Certifications & Compliance:

• Halal certification: Some Brazilian frozen pork exporters also offer Halal for markets where needed (though for pork itself Halal is not applicable, but for other products).

• Compliance with EU, US, Japan, China, and other destination country rules: e.g. animal disease status (absence of certain diseases), facility hygiene, packaging, labeling.

6. Economic Impacts & Benefits

Frozen pork Leg exports bring multiple benefits for Brazil.

• Foreign exchange earnings: with revenues crossing US$3 billion in exports in 2024, pork contributes significantly to Brazil’s trade balance.

• Rural employment and regional development: Pork production clusters in southern Brazil help drive local economies, create jobs in farming, processing, logistics.

• Supply chain improvements: Investment in cold chain infrastructure, better processing, logistics supports other parts of the food industry.

• Global competitiveness: Brazilian producers benefit from relatively lower input costs (land, feed, labor in some cases), scale, and experience in global livestock production.

• Market diversification: As export destinations expand, Brazil reduces dependence on any single market (e.g. China). This can buffer against demand shocks or trade policy changes.

7. Challenges & Risks

Even with strong growth, there are multiple challenges for frozen pork loins meat exports from Brazil.

1. Disease Risks & Biosecurity

o Animal disease outbreaks (e.g. swine diseases, though so far African Swine Fever (ASF) has not been reported in commercial herds in Brazil, but risk is always present globally).

o Cross‐border disease monitoring impacts export markets: importers may suspend imports if disease found.

2. Regulatory Barriers

o Different countries have different sanitary, labeling, packaging standards. Meeting them can be costly.

3. Logistics & Infrastructure

o Port delays, customs clearance, cold storage capacity in Brazil and abroad.

o Transport infrastructure (roads, rail) especially from inland farms to export facilities.

8. Sustainability, Animal Welfare & Environmental Concerns

Given increasing global scrutiny, these aspects are becoming more important.

• Animal Welfare: Ensuring pigs are raised, transported, and slaughtered under humane conditions. Some importers require audits or certification (e.g. third party animal welfare certs).

• Feed Sourcing: Soy and corn are key feed inputs. Soy expansion has been associated with deforestation in parts of Brazil. Producers and government are under pressure to ensure deforestation-free supply chains.

• Greenhouse Gas Emissions: Livestock contributes greenhouse gases (methane, nitrous oxide). Producers are exploring mitigation (better feed, manure management, energy efficiency).

• Water Use, Waste Management: Managing water use on farms, treating waste and runoff, ensuring environmental compliance.

• Certifications & Branding: Sustainability certifications, branding for “responsibly produced pork”, organic, antibiotic-free, etc., could open premium markets.

9. Future Trends & Opportunities

What seems likely or possible for frozen pork shoulder boneless from Brazil in coming years:

1. Further Market Diversification

o Continued growth in Southeast Asia, Latin America, Middle East, East Asia as demand for protein rises.

o Possible new markets to open or expand: Mexico, Vietnam, African markets.

2. Upgrading Product Mix

o Higher value cuts, more processed pork products (sausages, value-added items) rather than raw frozen meat.

Frozen pork meat feet from Brazil is a major, growing force in global meat trade. With strong export volumes, increasing demand, and improvements in quality and regulatory compliance, Brazil is in a favorable position. However, to sustain growth, it must manage disease risk, ensure cold chain integrity, address environmental and animal welfare concerns, and navigate trade barriers.

For importers, Brazilian frozen pork tail offers advantages: scale, competitive pricing, improving standards. For Brazilian producers, focus on quality, sustainability, diversification, and efficiency will help maintain competitiveness.