MARKET OUTLOOK

FUND I PORTFOLIO REVIEW

FUND II UPDATE AND STRATEGY

STATE OF THE ALLIANCE

LONG-TERM GROWTH forecasts remain strong despite recent headwinds CANAPI SWEET SPOT: B2B and B2B2C fastest growing segments of the market

Bank-Fintech partnerships more mature, complex, and important than ever before

WHY BANKS STRUGGLE WITH PARTNERSHIPS

GOVERNANCE FRAMEWORK

of banks struggle with governance and defining a structured process for how partners interact with the bank 78%

PARTNER IDENTIFICATION

lack an early understanding of a prospective partner’s reputation, tech strength, ability to scale, and strategy 64%

ONBOARDING have difficulty onboarding partners due to legacy architecture, outdated processes, and poor oversight 53%

Source: EY-Parthenon U.S. Banking Strategic Partnerships Survey

TIME TO

INVESTING Entering new era of productivity for startups and incumbents

THAN SAAS IN YEAR 1 CANAPI PORTCOS ALREADY TAKING ADVANTAGE OF PRODUCTIVITY GAINS

CANAPI THEMATIC AREAS OF FOCUS

AI, ML, AND DEVOPS

CYBERSECURITY

DATA INFRASTRUCTURE

BUSINESS INTELLIGENCE AND ANALYTICS

CLIMATE AND SUSTAINABILITY

MARKETING AND CRM

strategic

FINTECH FOCUS

Firmly committed to financial services and fintech

HORIZONTAL FOCUS

Growing focus on horizontal software with high applicability to Canapi LPs

DEMAND FOR CAPITAL > SUPPLY OF CAPITAL

GROWTH AT ALL COSTS (capital efficiency, unit economics)

WAVE OF NEW COMPANY FORMATION AT EARLY STAGE

VALUATIONS MIXED BY STAGE BUT DOWN ~50% FROM PEAKS AT GROWTH

Source: Pitchbook-NVCA Venture Monitor

Exuberance and high valuations

$90M IN FUND I RESERVES to double down on best companies PATIENCE IN FUND II 82%, $505M in dry powder

• Data analytics and AI

• Digital marketing tech

• Consumer fintech

• Payments

• InsurTech

• WealthTech

• Real Estate Tech

• Core banking tech

• Capital markets tech

• Enterprise blockchain and DLT

• RegTech

• Cybersecurity

• ID management and fraud detection

• , , and adopted by dozens of LPs to strengthen identity, risk, and fraud programs

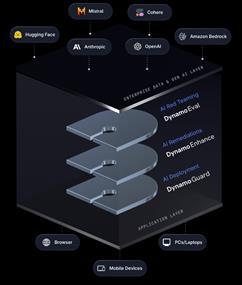

• and are at forefront of deploying AI safely and responsibly in financial services

• serves 20+ Canapi LPs who rely on their software to better serve their construction and CRE customers

• has set new compliance standard for SMBs; heading towards 1,000 customers following record quarters

• in active dialog with at least 10 Canapi LPs to leverage its SMB accounting and banking data APIs across

• has partnered with some of the largest banks in the world on its international credit data product

• making banks safer and more resilient while growing faster than any company of its size in our portfolio

• created a marketplace for transferable renewable energy tax credits, providing opportunity for our LPs to access a new capital markets product

Note: Asset Class, Codat, Elpha Sescure, MakersHub, DynamoFL, Crux, ModernFi, and Island are Fund II investments

22 OF 28 PORTCOS PARTNERED WITH LP

100+ COMMERCIAL AGREEMENTS

66% OF LPs PARTNERED WITH PORTCOS

The Canapi Alliance has been a significant growth driver for our Fund I companies

~$70M

AGGREGATE REVENUE ADDED to portcos through Alliance partnerships

STRONG AND GROWING TEAM TO TAKE ADVANTAGE OF PIPELINE

TOM DAVIS General Partner San Francisco

DANIELLE DAVID PARKS Head of Talent New York

Jun Guo Fund Manager

Richard Miller Vice President

WE WILL CONTINUE TO SCALE OUR TEAM IN 2024

Peter Underwood General Partner

Euphoric environment driven by low interest rates has given way to slightly more rational private markets

Public market focus on margins and profitability has driven growth companies to prioritize efficiency and unit economics, with investors moving towards early-stage opportunities

Investors shifted from new investments to supporting portfolio companies, and investment pace decreased throughout the market

Low margin (e.g., consumer, lending) businesses have been forced to focus on unit economics or go out of business

Many healthy businesses have emerged with rightsized teams, and improved operating cultures

Investments happening at more normalized multiples, with increased time to get know founders, markets, and diligence before investment

Quarterly VC-backed IPO Index and DeSPAC Index values versus S&P 500 (rebased to 100 in 2019)

NEARLY 20% OF ROUNDS WERE DOWN IN 2023

Percent of all rounds that were down rounds in a given quarter

Q1 2018 – Q4 2024

Source: Pitchbook-NVCA Venture Monitor

Source: Carta

At a certain scale, margins matter, and profit does too

Key words at Morgan Stanley’s 2024 Tech, Media, and Telecom Conference

Transcript search

Source: Alphasense, Morgan Stanley, Fintech Monthly, April 2024

REVENGE OF THE PROFITABLE

Includes 180+ fintech companies worldwide

Metrics represent NTM figures from CapIQ Market data as of April 4, 2024

Source: Morgan Stanley, Fintech Monthly, April 2024

The public markets are saturated with low growth companies, and the bar is high to enter

Source: Morgan Stanley, Springing into New Technology Equity Markets, April 2024

Multiples have returnedto more normalized levels

FINTECH: FORWARD REVENUE MULTIPLES

Median Estimates of NTM Revenue

SOFTWARE: FORWARD REVENUE MULTIPLE

Median Estimates of NTM Revenue

Source: Morgan Stanley, Fintech Monthly, April 2024

Source: Morgan Stanley, Springing into New Technology Equity Markets, April 2024

BUYING ENVIRONMENT

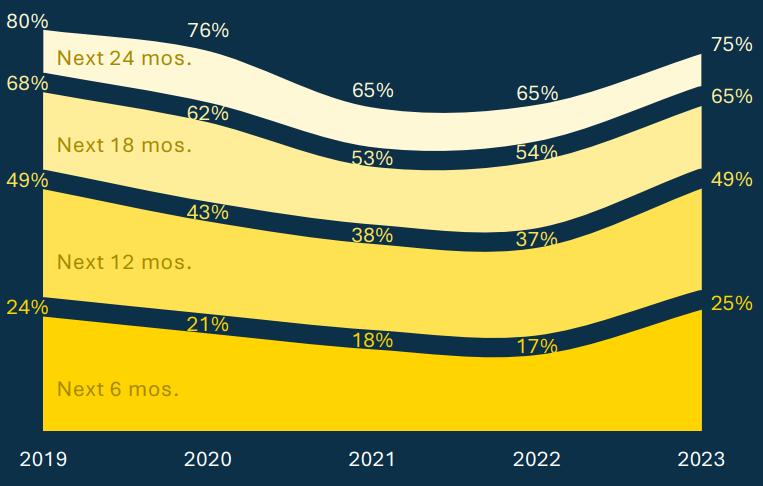

Enterprise software spending environment remains robust:

CIO software budgets projected to rise in 2024 across many spending categories

CEO confidence steadily climbing from 2022 lows

PROJECTS WITH THE LARGEST SPEND INCREASE IN 2024

PUBLIC MARKET PERFORMANCE

Public software earnings have been strong and resilient:

87% Beat consensus in Q4

56%

Guided above consensus for Q1

IPO market cautiously open:

• Recent IPOs encouraging more to file

$6.5B

Net new ARR added in public cloud software

• Investors more receptive to growth software tech names

• Bar remains high to go public

Source: Morgan Stanley, Pitchbook, public company filings, Altimeter

VCs are starting to pick up the pace, we expect this to accelerate further this year as startups run out of cash

VENTURE FIRMS ARE CALLING MORE CAPITAL 3-month average in total capital called crossed back over to $1B

Source: Carta, SVB

GROWING MOUND OF CASH-HUNGRY STARTUPS

Share of U.S. startups running out of runway by date

On average, valuations remain historically high across all stages

Median U.S. seed pre-money valuations ($M)

Source: Pitchbook-NVCA Venture Monitor (as of 12/31/2023)

EARLY-STAGE (SERIES A/B)

Average U.S. early-stage pre-money valuations ($M)

LATE-STAGE (SERIES C/D)

Average U.S. late-stage pre-money valuations ($M)

WHO:

• Buzziest sectors (AI, Cyber, etc.)

• Best-in-class financial metrics

• Clear category leaders

• Veteran management teams

MARKET ENVORONMENT:

• Still very high prices

• Consensus behavior

• Founder friendly

OUR APPROACH:

Very selective, very high bar, willing to engage if we can do the work and receive proper access

WHO:

• All other software sectors

• Attractive financials, more normalized

• Well-positioned in market, but not #1

• Talented, less experienced operators

MARKET ENVORONMENT:

• Down, structured, and bridge rounds

• Less attention

• Investor friendly

OUR APPROACH:

Opportunity to do extensive diligence and get in at a much more attractive price than the past few years

24

MONTHS OF RUNWAY ON AVERAGE

85% OF CAPITAL HAS MORE THAN 12 MONTHS OF RUNWAY

71% OF CAPITAL HAS MORE THAN 18 MONTHS OF RUNWAY

$90M REMAINING RESERVES FOR FOLLOW-ON INVESTMENTS

TRACTION

GTM AND BUSINESS DEVELOPMENT

TALENT STRATEGY

Pipeline Development and Strategy

Vendor Management Playbook

Messaging and Pitch Refinement

Canapi Spotlights and Conversations

Communities and Networking

Talent Acquisition Support

Strategic People Support

BUDGETING AND FUNDRAISING

Financial Planning and Budgeting

Fundraising Assistance

REGULATORY STRATEGY

Regulatory Guidance and Strategy

Strategic Planning

KPI Monitoring

Exit Planning

NOT AN EXHAUSTIVE LIST… WE ADAPT AND MEET OUR PORTCOS WHERE THEY NEED US

SBIC Fund

2019 Vintage

Sibling Fund

2019 Vintage

$534.8M fund size

$381.0M invested to date

20 portfolio companies

$119.3M fund size

$84.6M invested to date

Note: Fund I data as of Q1 2024. Portfolio company Finxact was sold in Q2 2022, Able was sold in Q1 2024.

Note: Data as of 3.31.2024. Numbers may not foot due to rounding. Numbers in millions. Combined Fund I Carrying Value & Realized Value includes the Able (sold Q1 2024) and Finxact (sold Q2 2022).

Early-stage bets remain early; they will take time to season

Although revenue growth slowed, we’re seeing it pick up again

We maintain a pool of resources to doubleand triple-down on the best companies

Historically, small portion of portfolio will generate large percentage of returns

Sales cycles are long, but partnerships are sticky and provide strategic value to banks

$753M Closed

Total fund size; closed in November 2023,announced in December 2023

$112M Invested

Capital invested across eight investments to-date

$43M Reserved

Fungible reserves held for existing investment

Fund II closed in November 2023. We remain excited about the opportunity.

$461M Remaining to Deploy

Before any recycling, after accounting for estimated fees and expense over fund life

Note: Fund II data as of Q1 2024

>82% Dry Powder

Remaining to Deploy + Reserves / Total Commitments less fees and expenses

Lead or co-lead majority of deals. Opportunistically co-invest alongside top tier VCs.

Target board representation on all led or co-led deals.

Double- and triple-down on winners. Buy up through pro-rata and secondary.

Round sizes and valuations have come down. Continue to run a concentrated portfolio strategy, but one that has 25-35 investments.

Venture style growth degraded in quality. Balance high-potential, strategic venture growth with traditional growth deals that have more downside protection.

Exit value of companies down in the near-term. Target specific seed stage opportunities to balance our portfolio and capitalize on lower entry points.

Actively pursue a wider, more diverse range of businesses that impact traditional banking technologies but also expand into adjacent industries.

• Strong founders with big visions, operating in meaningful markets

• Clear ability to recruit top-tier team

• Leverage expertise to target areas untapped by other investors

• Seek businesses with more revenue traction at Series A, ideally greater than $1M in ARR growing 100%+

• Clear long-term applicability to our Alliance partners

• >50% of Canapi’s deals have been early stage; well positioned for continued execution

• Jr. team resources experienced at evaluating early-stage opportunities; have team we need to source and invest

• Building more robust processes around sourcing to compete as market competition intensifies

• Further standardize diligence and decisioning processes to allow us to move faster for deals where we have strong conviction

• Still focused on top line growth, but looking for trends towards profitability: Top line needs to be 30%+, but some business models will be profitable, and all business models will have impressive unit economics

• Qualitative and quantitative customer feedback, with clear success distributing through proven channels

• Both great entrepreneurs and operators throughout the business

• Enterprise subscription contracts with clear demonstration of upsells and seat usage over time

• Investing heavily in our team; Hired Tom Davis as a GP, adding a VP and Associate in San Francisco and a VP and Associate in DC

• Building a more traditional sourcing machine; sophisticated lead-gen processes and deal tracking

• Implemented formal portfolio review processes; help companies earlier into the tenure of our investments

• Further leverage Canapi’s network to get deeper on markets and management teams prior to investing

• Bank spend on GenAI projected to grow to $85B per year by 2030

• Transformational technology that collapses time needed to process information and data

• Enables net new customer and employee experiences

• Buyer urgency and expanding tech budgets

• Infra. layer is default global

• 75% of CROs believe that cybersecurity is greatest nearterm risk facing banks

• Average cost of security breaches continues to rise

• In a difficult macro setting, Deloitte survey suggests banks reduced cyber budgets as percent of total revenue

• Executives must keep customers and employees safe while balancing budgets

• Fraud continues to top the list of focus areas for our banks

• Attack vectors continue to evolve, from new technologies like deepfakes to age-old problems like check fraud

• Solutions increasingly harnessing new technologies to not only combat, but prevent fraud

• Deep sector knowledge gives Canapi an advantage

YOU’LL HEAR MORE TODAY

Round: $11.5M Series A

Check: $5.0M

Ownership: 18.4%

Round: $100.0M Series C

Check: $36.4M

Ownership: 11.3%

Round: $4.5M Seed

Check: $1.0M

Ownership: 5.0%

Round: $15M Series A

Check: $7.5M

Ownership: 9.0%

MONTHS OF RUNWAY ON AVERAGE

Round: $19.5M Series A

Check: $12.0M

Ownership: 19.8%

Round: $4.25M Seed Ext.

Check: $400.0K

Ownership: 0.8%

Round: $20.0M Series A

Check: $15.0M

Ownership: 16.7%

95% of capital has more than 18 months of capital 115%

Round: $100.0M Series C & C-1

Check: $35.0M

Ownership: 2.2% Note:

Crux is an ecosystem for the energy transition, whose platform allows buyers, sellers, and intermediaries to transact and manage transferable tax credits

Stage: Seed Extension

Investment Date: September 8, 2023

Total Invested Capital: $400K

Rounds Participated In:

100s OF MILLIONS

dollars of credits already available on Crux’s transferable tax credit platform

Report detailing performance of the transferable tax credit market has become one of most-cited pieces in the space

$18.2M UPROUND a16z led recent Series A at a significant up round relative to our seed extension investment

Island is an enterprise browser company whose product gives organizational control, visibility, and governance over the browser experience

Stage:

Series C

Investment Date: September 27, 2023

Total Invested Capital: $35.0M

Rounds Participated In: 2 MOIC: 1.06x IRR: 15.1%

320% YoY Growth

Island experienced best-in-class growth last year and continues to execute on their robust pipeline of enterprise targets

Island's ability to replace legacy cyber and IT solutions is saving companies millions of dollars

5/10

Half of the Fortune Ten companies are Island customers, who are leveraging Island to improve security and productivity while reducing costs

Source: Company estimates

Island ARR Growth (FY)

ModernFi empowers banks to better serve their communities through its deposit network, which helps banks source deposits and sweep funds

Stage:

Series A

Investment Date:

July 28, 2023

Total Invested Capital: $12.0M

Rounds Participated In: 1 MOIC: 1x IRR: N/A

$361 Billion Dollars of AUM on the MDC Network, which ModernFi just won exclusive rights to become the reciprocal and sweep deposit network of choice for the MDC

MBCA selected ModernFi as their preferred partner, which covers 110 mid-size banks that collectively manage $70B in reciprocal deposits

CU Revenue Potential Source: Company estimates

$0 $20 $40 $60 $80 $100 $120

DynamoAI is an end-to-end privacy, security, and compliance platform powering enterprise AI adoption

Stage:

Series A

Investment Date: July 28, 2023

Total Invested Capital:

$7.5M

Rounds Participated In: 1 MOIC: 1x IRR: N/A

Dynamo was named one of CB Insights’ top 100 AI startups of 2023.Company was also selected for the Fintech Innovation Lab class of 2024

Paid customer engagements with enterprises spanning 5 different end-markets

$247B MARKET

Projected generative AI infrastructure-as-a-service market size by 2032 according to Bloomberg

Select Customer Engagements

SBIC II Fund

2022 Vintage

$275.4M fund size

$29.3M invested to date

6 portfolio companies

0.84x MOIC

N/M gross IRR

N/M net IRR

0.00x DPI

Note: Fund II data as of Q1 2024

Core Fund

2022 Vintage

Combined

C

$478.0M fund size

$83.2M invested to date

8 portfolio companies

$753.4M fund size

$112.5M invested to date

8 portfolio companies

1.00x MOIC

0.95x MOIC

N/M gross IRR

N/M net IRR

0.00x DPI

N/M gross IRR

N/M net IRR 0.00x DPI

ONE-ON-ONE SESSIONS WITH STRATEGIC PARTNERS

JAN. 2023 TO DATE

CURATED INTRODUCTIONS

BETWEEN LPS AND COMPANIES

INCEPTION TO DATE 600+

COMMERCIAL AGREEMENTS

BETWEEN LPS AND PORTCOS

INCEPTION TO DATE 100+

What are the types of fintech companies you would like to learn more about and/or you would like to be connected to?

Which services do you find most beneficial?

PERSPECTIVES ONIMPORTANT AND EMERGINGFINTECH TRENDS

VIRTUAL ANDINTERACTIVE FORUMS

(E.G., SPOTLIGHTS ANDPANELS)

INTRODUCTIONSTO PORTCOS AND PIPELINE COMPANIES #1 #2 #3

CYBER THREATS

2022 ALLIANCE SURVEY

AI IN BANKING

BANK VENDOR MGMT.

MODERNFI SPOTLIGHT PART I

WEALTH MGMT. OPP FOR BANKS

CANAPI COCKTAILS ABA Conference

ISLAND INVESTMENT OVERVIEW

MANAGING CRE RISK IN DOWNTURN

BLOCKCHAIN USE CASES MARKET UPDATE

VENDOR MGMT. PLAYBOOK GREENLIGHT SPOTLIGHT

LP UPDATE LETTER

FUND & PIPELINE UPDATE

PODCAST: GENE LUDWIG

GEN AI SURVEY

GREAT WEALTH TRANSFER

PODCAST: CHIP MAHAN

DEMYSTIFY VENDOR MGMT. (1)

FISERV DEVELOPER STUDIO

CANAPI COCKTAILS Digital Banking Conference

DYNAMO INVESTMENT OVERVIEW

DEMYSTIFY VENDOR MGMT. (2)

DYNAMO SPOTLIGHT

CANAPI COCKTAILS

Finnovate

NOVA INVESTMENT OVERVIEW

CAPITALIZE SPOTLIGHT

CANAPI COCKTAILS M2020

WEALTH

DEMO DAY

PODCAST: NEIL U. ALLIANCE SUMMIT

CRUX SPOTLIGHT FUND & PIPELINE UPDATE

MODERNFI SPOTLIGHT PART 2

CRUX INVESTMENT OVERVIEW

CRE PORTFOLIO

INTEL

MODERNFI INVESTMENT OVERVIEW

PODCAST: VETERANS

BANKER’S BREAKFAST Fintech Meetup

GREAT WEALTH TRANSFER

ISLAND SPOTLIGHT

CYBER THREATS

AI IN BANKING 2022 ALLIANCE SURVEY

GREENLIGHT SPOTLIGHT

GREENLIGHT SPOTLIGHT

MODERNFI SPOTLIGHT PART I

WEALTH MGMT. OPP FOR BANKS

LP UPDATE LETTER

FUND & PIPELINE UPDATE

PODCAST: GENE LUDWIG

GEN AI SURVEY

GREAT WEALTH TRANSFER

CANAPI COCKTAILS ABA Conference

PODCAST: CHIP MAHAN

ISLAND INVESTMENT OVERVIEW

NOVA INVESTMENT OVERVIEW

CANAPI COCKTAILS M2020

CAPITALIZE SPOTLIGHT

CAPITALIZE SPOTLIGHT

WEALTH

DEMO DAY

WEALTH DEMO DAY

PODCAST: NEIL U. ALLIANCE SUMMIT

BLOCKCHAIN USE CASES MARKET UPDATE

BANK VENDOR MGMT.

VENDOR MGMT. PLAYBOOK

DEMYSTIFY VENDOR MGMT. (1)

FISERV DEVELOPER STUDIO

CANAPI COCKTAILS Digital Banking Conference

DEMYSTIFY VENDOR MGMT. (2)

DYNAMO INVESTMENT OVERVIEW

CANAPI COCKTAILS

Finnovate Fall

CRUX SPOTLIGHT

CRUX SPOTLIGHT

MODERNFI SPOTLIGHT PART I ISLAND SPOTLIGHT

DYNAMO SPOTLIGHT

DYNAMO SPOTLIGHT

FUND & PIPELINE UPDATE

CRUX INVESTMENT OVERVIEW

BANKER’S BREAKFAST Fintech Meetup 2023

MODERNFI SPOTLIGHT PART 2

MODERNFI SPOTLIGHT PART 2

CRE PORTFOLIO INTEL

MODERNFI INVESTMENT OVERVIEW

PODCAST: VETERANS

GREAT WEALTH TRANSFER

MANAGING CRE RISK IN DOWNTURN ISLAND SPOTLIGHT

2022 ALLIANCE SURVEY

BLOCKCHAIN USE CASES

GREENLIGHT SPOTLIGHT

CYBER THREATS GREENLIGHT SPOTLIGHT

AI IN BANKING

AI IN BANKING

CYBER THREATS VENDOR MGMT. PLAYBOOK

MARKET UPDATE

LP UPDATE LETTER

FUND & PIPELINE UPDATE

MODERNFI SPOTLIGHT PART I

MODERNFI SPOTLIGHT PART I

WEALTH MGMT. OPP FOR BANKS

CANAPI COCKTAILS ABA Conference

ISLAND INVESTMENT OVERVIEW

PODCAST: GENE LUDWIG

GEN AI SURVEY

GREAT WEALTH TRANSFER

GREAT WEALTH TRANSFER

NOVA INVESTMENT OVERVIEW

PODCAST: CHIP MAHAN

CANAPI COCKTAILS M2020

CAPITALIZE SPOTLIGHT

CAPITALIZE SPOTLIGHT

WEALTH

WEALTH

DEMO DAY

DEMO DAY

PODCAST: NEIL U. ALLIANCE SUMMIT

FISERV DEVELOPER STUDIO

FISERV DEVELOPER STUDIO

DYNAMO INVESTMENT OVERVIEW

CRUX SPOTLIGHT

BANK VENDOR MGMT.

BANK VENDOR MGMT.

DEMYSTIFY VENDOR MGMT. (1)

CANAPI COCKTAILS Digital Banking Conference

DEMYSTIFY VENDOR MGMT. (2)

CANAPI COCKTAILS Finnovate Fall

DYNAMO SPOTLIGHT

DYNAMO SPOTLIGHT

CRUX SPOTLIGHT FUND & PIPELINE UPDATE

CRUX INVESTMENT OVERVIEW

BANKER’S BREAKFAST Fintech Meetup 2023

MODERNFI SPOTLIGHT PART 2

MODERNFI SPOTLIGHT PART 2

MODERNFI INVESTMENT OVERVIEW

PODCAST: VETERANS

CRE PORTFOLIO INTEL

GREAT WEALTH TRANSFER

MANAGING CRE RISK IN DOWNTURN ISLAND SPOTLIGHT

CRE PORTFOLIO INTEL ISLAND SPOTLIGHT

(does not include many smaller events) 6+

NETWORKING

BLOCKCHAIN USE CASES MARKET UPDATE

FISERV DEVELOPER STUDIO DEMYSTIFY VENDOR MGMT. (1)

DEMYSTIFY VENDOR MGMT. (2)

BLOCKCHAIN USE CASES MARKET UPDATE

FISERV DEVELOPER STUDIO DEMYSTIFY VENDOR MGMT. (1) DEMYSTIFY VENDOR MGMT. (2) DYNAMO INVESTMENT OVERVIEW DYNAMO SPOTLIGHT

BLOCKCHAIN USE CASES

BANK VENDOR MGMT.

FISERV DEVELOPER STUDIO

DEMYSTIFY VENDOR MGMT. (1) DEMYSTIFY VENDOR MGMT. (2)

DYNAMO INVESTMENT OVERVIEW DYNAMO SPOTLIGHT CRUX SPOTLIGHT

MODERNFI SPOTLIGHT PART 2 PODCAST: VETERANS

(2)

Explore exclusive information and materials on Canapi’s portfolio companies and request companies of interest

FINTECH WATCHLIST Access to Canapi’s pipeline and diligenced companies at your fingertips

Don’t miss out on upcoming conferences, events, and events in the Canapi network

PARTICIPANTS: Procurement, vendor management executives

PURPOSE: Share and resolve challenges facing FI procurement professionals

CISO COUNCIL

PARTICIPANTS: CISOs, C-level cybersecurity experts

PURPOSE:

Share and resolve cybersecurity challenges facing Alliance FIs

PARTICIPANTS:

Digital strategy and innovation, risk and compliance, info sec

PURPOSE: Improve knowledge of how to develop and deploy safe and secure GenAI

PARTICIPANTS:

Wealth management executives, COOs, strategy leaders

PURPOSE:

Share strategies and solutions for enhancing wealth capabilities

PARTICIPANTS:

Women in various roles across the Alliance

PURPOSE:

Foster empowerment, collaboration, and growth among women

Tangible solutions to shared challenges through collaboration

Expert insights and lessons on topics of community interest

Intros and demos by companies with new, exciting solutions

Bilateral conversations surface solutions to pain points, and we learn lots about the priorities of the banks.

Canapi Connect is available to all employees of our LPs.

Let us know if you’d like to set up accounts for colleagues so that they can review materials.

Let us know if there’s something that we can do better to serve you, whether an idea for a deep dive post, solutions search, or opportunity to meet with line of business or functional executives to share best practices.