A group of kiwifruit growers seeking action against the government for the introduction of Psa in 2010 are now considering taking their case to the Supreme Court after a recent Court of Appeal decision ruled the Crown was immune from any claims of negligence.

By RICHARD RENNIE

The decision is the latest in the long-running court saga initially between 200 growers, including Seeka – a significant grower, but also representing the post-harvest sector - and the Crown.

The case kicked off in 2017 with a negligence claim and ultimately compensation being sought from the Crown. It moved to the Court of Appeal after the High Court ruled the Crown was negligent and breached its duty of care allowing Psa into New Zealand.

The Crown appealed the ruling, and growers in turn cross-appealed over the Crown’s failure to inspect the pollen believed to have contained the Psa bacteria.

The Court of Appeal allowed the Crown appeal, but dismissed the cross-appeal.

Kiwifruit Claim spokesman John Cameron said the next step to the Supreme Court was an inevitable one, but the

The key thing from the appeal is that there was no doubt MPI’s actions were behind Psa coming to New Zealand.”

– John Cameron

group had 20 working days to determine the strength of its case and move on.

The action is being underwritten by LPF, which will charge a success fee of 20 percent of any reward in compensation paid, up to $500 million. Beyond a $500 million award, the LPF percentage would fall to 10 per cent of the additional award. Estimates are the Psa outbreak cost the economy $800 million.

“The key thing from the ap-

peal is that there was no doubt MPI’s actions were behind Psa coming to New Zealand,” said Cameron.

“That to us is justification to take the information to court and have it verified.”

The Court had agreed the pollen had been the most likely pathway into the country, sparking the infection. However, it found the Crown has statutory immunity, precluding it from any liability for alleged negligence.

Vague policy factors around pollen

It also determined there were vague policy factors around the pollen’s importation. This meant it would not be “fair, just and reasonable” to impose a duty of care on the relevant staff of the Ministry of Agriculture and Fisheries (as it was at the time).

Cameron said from a grower’s perspective, he was very satisfied both courts have ac-

knowledged MAF’s actions were responsible for the disease coming to New Zealand.

He said in turn that had resulted in a welcomed improvement in the country’s biosecurity laws and policies.

He also took heart that the Court of Appeal decision had not been a quick one, taking about a year to be determined.

“The fact it has taken 13 months to come out with this decision implies it was by no means black and white, there

must have been a bit of variation in opinion there.” Michael Franks, Seeka’s chief executive said it would be up to the company’s claims committee to determine if Seeka would also take the case to the next stage. However, he said he was pleased growers would not have to pay any further money to enable that to happen. If the case proceeds, a Supreme Court ruling could be more than a year away.

PUBLISHER

Alan Neben

Ph: (07) 838 1333

Mob: 021 733 536

Email:alan@bopbusinessnews.co.nz

EDITOR

David Porter

Mob: 021 884 858

Email:david@bopbusinessnews.co.nz

PRODUCTION

Copy/Proofs/Graphic Design

Times Media – Clare McGillivray

Ph: (09) 271 8067

Email: clare@times.co.nz

ADVERTISING INQUIRIES

BUSINESS DIRECTOR

Pete Wales

Mob: 022 495 9248

Email:pete@bopbusinessnews.co.nz

Bay of Plenty Business Publications specialises in business publishing, advertising, design and print media services. www.bopbusinessnews.co.nz

EDITORIAL:

News releases/Photos/Letters: david@bopbusinessnews.co.nz

GENERAL INQUIRIES: info@bopbusinessnews.co.nz

Bay of Plenty Business News has a circulation of 8000, distributed throughout Bay of Plenty between Waihi and Opotiki including Rotorua and Taupo, and to a subscription base. www.bopbusinessnews.co.nz

Bay of Plenty Business Publications 210/424 Maunganui Road, Mount Maunganui, 3116

We are fortunate to be living in a fertile, temperate land, in moated isolation during the COVID-19 pandemic. But we have been reminded that when a global crisis strikes, we can be as vulnerable as anyone in the world,

Kiwis are unlikely to experience the plague of locusts in which swarms of insects the size of cities continue to ravish crops across tracts of East Africa.

Nor will we see the extremes of poverty and dysfunction in some countries that will continue to undermine their efforts to fight COVID-19.

We are by no means in the clear. Lockdown was easy –we are hardly a fractious and rebellious population – yet. But locking down is nowhere near as difficult as reopening the economy is going to be.

We have to ensure the government reaches out and listens to the business community and doesn’t become consumed by the delusion that only politicians and bureaucrats know best.

After getting used to delivery trips with essential worker family members through near empty streets for five weeks, I was startled to again encounter traffic jams when I ventured into Tauranga’s Downtown CBD the day the country moved to Level 3. Now, more than ever, is a time to take care.

It was apposite that lockdown coincided with Anzac Day.

Although, to my shame, I seldom attend the Dawn Parade, I hold dear the victims of the appalling wars in which New Zealanders have given their lives, limbs and sanity.

It takes only a brief exposure to the terrifying images on the History Channel to appreciate the horrific, wasteful experiences of soldiers and civilians alike.

The most poignant lockdown moment for me came when delivering my student daughter back from her essential job, doing 12-hour night shifts in a packhouse.

And when we reached our own cul de sac, a couple had quietly organised their kids to paint giant poppies on the street and set up a handmade shrine to hear the Last Post and Reveille. And there we neighbours assembled in silence, young and old - safely apart, come together in remembrance.

Let’s keep taking care of one another.

I confess I hadn’t really taken in the proposal of observing Anzac Day at dawn outside homes, rather than in large public groups. But as I drove home in the darkness, preoccupied with my own concerns, I was stunned to notice that virtually every driveway I passed had a householder or two, or three, stationed outside – a seemingly unending Dawn Parade of respect.

Financial markets have staged a remarkable recovery since the depths of the sell-off a month ago. This is in no small part due to the actions of central banks and governments who have steadfastly undertaken market intervention in order to reduce market volatility, underpinning financial assets.

Whilst it seems inevitable that the world economy will enter a period of recession, the level of intervention should make for a quicker recovery. The market over the past few weeks has taken a positive cue from this and is focusing on the economic rebound. It

may be that the recent rally has also been partly driven by a fear of “missing out” on the lower market prices. What seems beyond doubt is that the post-pandemic world will be quite different from pre-crisis, as suggested below.

A more nationalistic approach to supply chain and procurement was starting to emerge before COVID-19. The post-pandemic reality of tighter border controls and social-distancing will have a negative impact on globalisation. This may lead to higher prices, but will encourage the use of technology and innovation to reduce costs per unit.

Social-distancing has increased the realisation that faceto-face connections are not always crucial.

Social-distancing has increased the realisation that face-to-face connections are not always crucial. Remote-working, online education, tele-medicine, Zoom-socialisation, will all become more normalised. This should

> BY BRETT BELL-BOOTH

Investment Adviser with Forsyth Barr Limited in Tauranga, and an Authorised Financial Adviser. Phone (07) 577 5725 or email brett.bell-booth@forsythbarr.co.nz.

play into the hands of companies with a focus on cloud computing products, e-commerce and cyber security.

Retailers who have a robust online presence should really benefit over those who do not. Bulk providers may increasingly bypass wholesalers/ retailers and go direct to the consumer, who will also start buying in bulk. Warehousing,

logistics, freight and trucking should all be sectors that benefit, should this trend play-out.

Cash is king in this environment and those companies with strong balance sheets, low debt and access to cash will be in a good position to buy out their distressed competitors. Investors will need to understand who are likely to be the winners – and sadly – those who are likely to be the losers.

Source: Forsyth Barr Global Round-up, 16 April 2020. This column is general in nature and is not personalised investment advice. This column has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. Disclosure Statements for Forsyth Barr Authorised Financial Advisers are available on request and free of charge.

Kiwibank is committed to making a real, positive impact where it matters for New Zealanders and New Zealand so we’re working hard to keep our people, our customers, and the New Zealand economy safe and financially secure during these unprecedented times.

By EDDIE STOCKS, Regional Manager Waikato/ BOP, Kiwibank

New Zealand has a stable economy and a history of weathering global financial challenges well.

Our central bank and government are doing what they can to minimise the economic impact for Kiwis, and the New Zealand public has responded responsibly to the

lockdown. Here at Kiwibank we’re playing our part too. We know small and medium businesses are the backbone of the New Zealand economy. We know in this current environment cashflow is an issue for many, so we have a resilience and recovery programme to support our customers.

Options available to our business banking customers are changing your loans temporarily to Interest

Only, Temporary Overdraft Facilities, Loan Repayment Deferrals, and the Business Finance Guarantee Scheme. (Criteria does apply, and this is only open to current Kiwibank customers. If you bank elsewhere, you need to approach your own bank).

If you need assistance, we suggest you visit our website in the first instance or call your relationship manager.

We are also working to ensure

our own staff can continue to work safely and productively.

Our call centre staff do have to go into an office everyday, but everyone else in business banking are working from home but with access to all bank systems to ensure they can still do the vital work they do for you, our customers. Please visit our website for more information. www.kiwibank.co.nz/ business-banking/

There’s no shortage of great ideas in New Zealand. But for an innovative bunch, we’re not the best at realising the full potential of our innovations, particularly when exporting them.

At James & Wells, we can identify your competitive edge, offer business strategies for specific markets and help you own and leverage your intellectual property to ensure no one steals the fruit of your labour.

The City Leaders Forum is a well-attended ritual of the business calendar. This year’s lunch turned into an online event with the onset of COVID-19. Below the three speakers give us their thoughts on the impact and implications

of the virus on the city and the region.

By TODD MULLER, National MP for Bay of Plenty

Ithink there’s been remarkable collective discipline through the lockdown. New Zealanders by and large saw what was happening overseas, and thought, “we’ll put our best foot forward” and they did.

In terms of the health response, the government has done a pretty good job, helped by the advantages of isolation and being able to close our borders. And they have provided relatively clear and effective communication.

But on the economic side, the government has not been focused enough on the balance sheet stress of small business in particular. An understandable focus has been on wages, but that’s only a part of their costs. The government has a complete lack of understanding of how small and medium-sized businesses work. The SMEs – especially in the Bay of Plenty – are going to be what helps lead us out of the pandemic downturn.

It’s hugely important to get ourselves back into a situation where demand is stimulated in New Zealand. But we cannot grow our country out of this hole if we are wholly reliant on creating things to buy and sell domestically.

The way we really get out of this is to get export-oriented businesses back on their feet.

The government’s view that the recovery will be state-led is wrong. It’s got to be business-led and typically by export-oriented businesses.

If we can get their demand increasing and their capacity stood up to meet an increasing demand, then that flows through to all the service industries that are domestically focused, but provide support to all those exporters.

Many of our exporters have strong relationships around the world.

Where it makes sense, we’ve got to move very quickly to the point where we can have an open bor-

By DAVE COURTNEY, Chief Grower and Alliances Officer, Zespri International

New Zealand’s kiwifruit industry is known for its collaboration and amidst the uncertainty of COVID-19, this season’s efforts have been no different.

It was very positive to see that even with the challenges imposed by COVID-19 on the industry it was able to start earlier than it ever has in terms of shipping fruit to market, with our first chartered reefer ship leaving Tauranga Harbour for Tokyo and Kobe in late March.

As a food producer and an essential service, the industry has taken its ability to continue operating through the Level 4 lockdown seriously, with new measures developed and enhanced hygiene practices in place, to keep staff safe while working to deliver the season’s kiwifruit.

This positive trend has con tinued, with more trays of fruit picked, packed and shipped com pared to previous seasons, and they have also arrived in markets earlier than in previous seasons.

At the time of writing, the industry had already packed almost half of the estimated crop for the season, with almost a quarter of the total crop shipped to Zespri’s major markets with Japan, China and Europe all successfully receiving fruit. In total we’re expecting a crop of around 600,000 tonnes

der with Australia and start a much easier flow of people and goods between the two countries.

We need to be really innovative in how we get our business people back to China and some of those other Asian countries early.

Yes, the border might be closed for broader back and forth travel. But in the short and medium term, we’ve got to create an environment where we can get our business leaders back up in those countries with appropriate protections.

I think the fact we seem to be getting COVID-19 to manageable levels can give us the confidence to be able to have those conversations with the respective governments.

Our export supply chain is working with essential export businesses – of which primary produce is a large part. They have had to change their onshore supply chains, but the demand for our food and fibre is robust.

Yes, there is still significant risk to our markets if some of those export economies slump to such a de-

gree that high value food products and even high quality commodities have a softening of demand.

But those markets include countries that are currently closed to much of Europe and the US, so we need to get up there as soon as possible. Ending the lockdown will only work in an enduring way if people can be sensitive and apply common sense. Sooner or later we are going to go back to work in an environment where we will have to maintain physi cal distance and hygiene.

The government needs to be more focused on imbedding in these principles, not by believing it will ultimately find the right formula and checklist to follow.

There are a number of businesses that unfortunately will find the next period incredibly difficult and some will find it impossible to exist in the way they are currently set up.

We’ve got to look at what you can do with and for those people to

worth of Zespri SunGold and Green.

Early sales in our markets like China and Japan have been positive, and though it’s early in the season, we have seen strong demand for fresh produce across other key markets.

We’ve also had Zespri Red back in local supermarkets following the Zespri board’s decision to commercialise this variety last year. Zespri Red has also returned to Singapore this season, and we have just delivered our newest variety to Japanese consumers for the first time.

In terms of sales there is still a long way to go, with just more than five percent of the crop sold at the time of writing. While the positive start has been great, we recognise that given how quickly the world changes in response to COVID-19, there will be ongoing challenges for the rest of the 2020 selling season.

have the confidence and the assurance to have another go – to either restart their business, or recommence in a different way.

We need to focus on how we can assist people to reimagine another career with effective training and support provided to people who need it.

By GARRY WEBBER, Mayor, Western Bay of Plenty

In early February, when I was asked to speak at the 2020 City Leaders Lunch, COVID-19 wasn’t on many people’s radar. However, by the time of the event, March 20, it surely was and when I was asked to pen this update for the Bay of Plenty Business News on April 17, its full impact had really hit home.

The nation and our region has been dealt a body blow that is going to be felt for a long time, despite the encouraging news the lockdown is being gradually eased.

Our council is working really hard to identify the part we can play in the national process of rebuilding communities. Since central government announced its $50 billion funding package, our staff have worked tirelessly to submit a list of 16 projects at a total cost of $515 million bid to the Crown Infrastructure Partners Fund. That bid is testament to our commitment to help provide an immediate stimulatory kick start effect to our local economy.

For each project to be considered, we had to show that it would create local jobs, was shovel-ready, would provide a public benefit, modernise the economy and be worth at least $10 million.

As a well-managed provincial council and member of the SmartGrowth group, the Western Bay of Plenty District Council is recognised as well-managed and has a track record of working con-

structively in partnership with others.

Additionally, our bid is part of a coordinated Bay of Plenty regional package that will support the economic recovery of New Zealand. The projects are consistent with our Long Term Plan, the SmartGrowth Strategic Plan and Urban Form and Transport Initiative (UFTI). Together they aim to de liver a step change in housing, transport and place-making for the sub-region’s communities.

Our top priority is the Rangiuru Business Park where we have applied for $134.8 million to open up the fully consented 148 ha Business Park, which will create economic opportunities for many years to come. It is significant in size and ready to start.

Second, is the Regional Healthy Housing Programme. This is an extension of the Healthy Whare project, which will allow more homes to be upgraded to be healthy, affordable and secure homes.

We have also applied for just more than $100 million for the Katikati Bypass, which is designated and we have done a lot of analysis on over the last four months

I’m hopeful that we will be successful, but I am also a realist and accept that we are competing with every other council, hospital board, education dept and private business and therefore nothing is in the bag. Accordingly we have

not made any promises to our communities to avoid over- promising and under-delivering. If successful in part and linked with the earlier announced $900 million Tauranga Northern Link, it would be a huge win for our district and will ensure that those who have been negatively impacted by COVID-19 will have an opportunity to get back into the workforce quickly and productively.

As Rahm Emmanuel said: “You never want a serious crisis to go to waste”, and it would be remiss of our council not to be part of the COVID-19 response that this government is offering to fund.

At SmartGrowth we have been working on strategic projects to lift our district out of its housing and congestion issues for more than 15 years. Now with this funding support from government, the time is right for us to throw of the shackles and take those brave decisions. It won’t be easy, but it is the right thing to do.

EY in Tauranga is helping Bay business owners access the support they need to make it through the crisis.

The Bay business community is managing a threat of a completely new scale.

Stressed business leaders are trying to get a grip on cashflow and maintain continuity while managing the effect of COVID-19 on their staff, customers and families.

It’s been great to see so many people finding smart new ways to keep operating –taking their businesses online or going local with their supply chains. Everyone is chipping in, helping each other and sharing knowledge.

While there’s a lot of government support measures, some business leaders are struggling to access it.

Overwhelmed by the volume of (often conflicting) information on mainstream and social media, they’ve been contacting the EY office in Tauranga for help with what to do: NOW, NEXT and BEYOND.

NOW: Stabilise your business

The immediate focus is on maximising cashflow and accessing support.

The good news is, the Government’s Business Continuity Package offers a variety of relief options.

If you haven’t applied for the Wage Subsidy Scheme and/ or the Essential Workers Leave Scheme, either because you’re still assessing the COVID-19 impact, or you aren’t sure if you qualify – we can help you to understand how this applies to your circumstances, confirm your eligibility and ensure you make a robust application. New tax measures will provide even more help. Tax payments can be deferred, interest charges can be remitted, low value assets can be written off, provisional tax thresholds have been lifted, and Research & Development tax incentives now have

Rachael Gemming, Associate Director – Tax

broader refundability.

If you’re making a loss right now, but you made a profit last year, you will soon be able to apply for a refund of tax paid in the previous year. We can also help with talking to Inland Revenue if you are worried about anything tax-related.

If you’re an importer, you may get an immediate boost by deferring Customs charges, including import GST.

If you’re an exporter, be aware that other countries offer a range of relief measures which we can provide details on too.

Get in touch and we’ll

connect with our global teams to see where you could get a cashflow boost.

NEXT: Get up and running

All businesses need to consider the new safe operation guidelines released by the Government. Ensuring staff and customers remain safe as New Zealand transitions through lower Alert Levels will be key.

If you are new to operating digitally or with contactless sales – you’ll need to consider the privacy implications of setting up a digital shop and complying with customer contact tracing requirements –we can help with this too.

It’s stressful not knowing how long restrictions will last, but we can start to think about what the next phase might look like as restrictions start to ease.

If you are a tenant and you’re not sure how to approach your landlord, do you need help to negotiate lease reductions or deferrals? When the wage subsidy runs out, how will you support your employees?

If you predict your busi-

ness will need additional cashflow, you can apply for bank funding under the Business Finance Guarantee Scheme, where 80% of your loan will be backed by the Government.

To apply, you’ll need the usual documentation for a bank loan plus you’ll need to show financial projections that model as accurately as possible, what your post-COVID-19 business might look like.

The Regional Business Partner Network are scaling up their existing advisory services so that more businesses can receive free support over the next 12 months.

As well as coaching for growth and innovation, you can get support with business continuity planning, finance and cash flow management.

BEYOND: Reimagine the future

You should also start to look beyond the current crisis.

This is an important moment for all of us to think about what our businesses, lives and societies might look like in a post-COVID-19 world – and what opportunities that might present.

If you’re making a loss right now, but you made a profit last year, you will soon be able to apply for a refund of tax paid in the previous year.

How will you scale back up and what barriers need to be overcome? Do you need to pivot your operations to serve the domestic market?

The risk for business leaders is that you will be consumed by the current crisis and simply focus on the NOW. But that won’t get you through. You need to focus on the NEXT before your competitors take the new ground. And you need to think about what your business model, supply chain and workforce might look like in the BEYOND. This is the time to create a new vision for the future – and not just for your business. Come and talk to us about what your business should be doing: NOW, NEXT and BEYOND. Contact Rachael on 027 215 8122 or Rachael. Gemming@nz.ey.com

How can you manage your cash flow today to restart growth tomorrow?

The Hon. Tim Groser is the founder of Groser & Associates. He was New Zealand’s Trade Minister for seven years. Prior to going into politics in 2005, he had been NZ WTO Ambassador and NZ Chief Negotiator in a number of international trade negotiations. He mostly recently served a term as NZ Ambassador to the US and Special Envoy to the Pacific Alliance.

By TIM GROSER

Trying to chart an economic path out of this global pandemic is, in the old phrase – “like throwing darts”. It depends critically on what assumptions one makes about the duration and depth of the public health crisis.

I have in mind, in particular, the non-trivial possibility of a serious “second wave” of the virus hitting the US and the other major economies later this year, before the cavalry (a vaccine) arrives out of global laboratories. A resurgence would really tip things economically over the cliff. It will therefore be the future pathway of the pandemic, not economic policy, which will determine whether we are going through a brutal short collapse of large parts of the global economy, with a recovery in 2021. Or whether we are facing something much, much worse. If it is the latter, old political nightmares – long forgotten in the expansion of the world economy over the last 70 years – may return.

But we cannot just wait passively to let events wash over us. We need to have a working hypothesis of how we proceed economically - as long as we balance this with sufficient humility to adjust it, perhaps radically, if events make nonsense of our working hypothesis.

My assumptions

• Most advanced economies will achieve greater and greater incremental success in suppressing the pandemic.

Some (Australia, NZ, Taiwan) may be stand-outs in suppressing the pandemic. Others will have to endure further brutal death rates amongst vulnerable cohorts of their populations. This assumption reflects the headline conclusion of a recent authoritative paper by a team of British medical scientists and modellers – “epidemic suppression is the only viable strategy at the current time”.

• But it remains deeply problematic whether large parts of the developing world will succeed in suppressing the pandemic. Most of them, large and small, have neither the public health infrastructure nor the economic resources to respond as have the major developed countries and China. I do not rule out terrible human suffering in some developing countries as we see what this wonderful antiseptic word “herd immunity” actually implies in practice.

• At best, the global economic recovery will be a long haul from here. A quick “V-shaped” recovery is, in my view, a fantasy propagated by Wall St millennials. Over the past three weeks, the S&P500 has staged a staggering 24 percent recovery (technically a bull market) from the lows of early March as 26 million Americans have filed for unemployment payments. Duh?

• The unprecedented display of fiscal and monetary firepower around the world will stabilise to a certain degree consumer expenditure in the major economies and prevent wholesale corporate slaughter. There will be no slow and steady recovery over the next

At best, the global economic recovery will be a long haul from here. A quick ‘V-shaped’ recovery is, in my view, a fantasy propagated by Wall St millennials.”

few years if this assumption proves wrong and massive parts of their private sector economies collapse. I will not even begin to think about the longer-term economic question of the implications of the massive expansion of global debt and who is going to pay for that. We in Australia and NZ are not going to escape this, but at least we started from a far sounder debt:GDP ratio than the major OECD economies.

A significant hit

One way or another, we are going to take a significant hit on trade. Yes, in terms of the public health issues, we have the inestimable benefit of the world’s largest moat and we have pulled up the drawbridge. Yet that will not stop the waves of a global recession and the associated massive downturn in global trade washing up violently on our shores.

It is certain that we will see

our export earnings dive in the next two-to-three months. That will be the inevitable consequence of supply side shocks (people unable to go back to work), massive disruption to logistics such as air and sea freight. My focus here is on the medium- and longer-term implications for our export economy.

The IMF and the WTO are competing with each other with dramatic estimates of the extent of the downturn in global trade flows. Whatever the magnitude of the hit turns out to be, it is going to be negative. No matter what our relative advantages are (and I am one of those who think we have many), we cannot escape the impact of a deep global recession or depression.

The key issue will be the extent and duration of the downturn in aggregate demand in our major trading partners and the impact this will have

on volumes and prices of our main exports to them. Our top six markets for exports of goods and services are (in order) – China, Australia, the EU, the US, Japan and Korea. Together they accounted in 2019 for some $60 billion of exports out of our total of $86 billion. Several of them have, to put it diplomatically, “distinctive” political reactions to COVID-19, but each of them has the resources and technical sophistication to climb out of the hole.

One very simple, high level conclusion is that the countries I am most worried about in terms of the human public health dimension (ie developing countries with few resources) do not therefore figure large in our international trade profile. But it would be the height of naivety to believe this deals with our trade problem.

With the intriguing – I

think real – possibility of a “trans-Tasman bubble” emerging from the (relatively) far superior data in our two countries, which may allow Australian tourists to arrive here, our services exports (largely tourism and education) will obviously take a terrible hit – particularly tourism.

With respect to education, it’s not inconceivable that we could in time develop quarantine protocols for students arriving for residential courses. In the minds of the students and their parents, the “safe haven” brand of New Zealand might well offset partially the gross inconvenience of two weeks’ quarantine.

Food exports are far more important. They account for 60-65 percent of our goods exports, depending on what definition is used. I suspect the volumes will hold up well – in the hierarchy of human needs outside times of war

I have been impressed, but not surprised, by the reaction of New Zealanders to this major crisis.”

when guns become more important than butter, nothing tops food as an essential item of consumption. Prices are quite another matter.

In 2007 international food prices went through the roof –there were food riots in many countries and export controls on rice and other commodities. That came to a shuddering halt in 2008/9 with the Global Financial Crisis. Recessions kill commodity prices – look at the bloodbath taking place now in global oil markets. I cannot see how, in time, the massive downturn in the global economy being forecast by the IMF and others will not impact negatively on our export prices.

FTA jewels in the crown

On the more positive side, we have FTAs in place with China (and separate complementary FTA agreements with Hong Kong and Taiwan

– not in the top six NZ export markets, but very significant in their own right), an FTA with Korea, and an FTA with Japan via CPTPP and an FTA with Australia (CER).

I thought finally we had nailed it with the US – but that was before President Trump pulled out of the TPP, which was then successfully reconfigured by the other TPP countries into CPTPP. In the current circumstances, these are jewels in the NZ Crown.

I was very pleased the coalition Government appears to have ignored political suggestions that we impose export taxes/export restrictions on our $5 billion log exports.

Quite apart from the utter perversity of deliberately putting barriers to our exports at a time when we need every export dollar we can get, it would have sent a terrible message to China, our most important export market, about New Zealand’s dependability and commitment to the FTA.

It is not a technical matter of what the legal provisions are – it is the political signal that matters.

Longer term we should of course be deeply concerned about the possibility of the world generally turning towards protectionism. This is not the place to explore that massively important geo-strategic question.

My view is that this is not “the end of globalisation”, but most certainly the balance will shift away from the era of hyper-globalisation to a more conservative view of the balance between ‘”efficiency” and “resilience”.

This will not destroy global supply chains, but it will certainly re-shape them. How far and how deeply depends on the depth of the global recession and the political consequences that flow from that.

Past lessons not forgotten

I think it is far too pessimistic to believe the world has completely forgotten the lessons of the last Global Depression, when the Hoot Smalley unilateral tariff hike of 1930 led to a series of retaliatory protectionist measures and, in the era of fixed exchange rates, “beggar-thy-neighbour” competitive exchange rate devaluations. This greatly deepened

the misery of the Depression.

There is today a clear and unpleasant whiff of that cordite in the international air (and that was apparent before we had heard of COVID-19) so we cannot take it for granted that rationality will prevail.

As Mark Twain observed, history does not repeat itself, but it does rhyme.

Again, I was pleased that a significant group of WTO Members including the EU, Canada, Australia and others joined a New Zealand/ Singapore initiative designed to commit each Government to keep global supply chains open during this most difficult period.

Behind this, we are rediscovering what I think privately most of us believed: although we are a much more ethnically diverse country than we were 50 years ago, we are a remarkably cohesive country with excellent institutions, a distinctly non-toxic political culture by any relative standards, and a great deal of self-discipline (the occasional idiots aside) amongst our diverse citizenry.

I have been impressed, but not surprised, by the reaction of New Zealanders to this major crisis.

As I have said to many people, if I could, in this crisis, magically tele-transport myself to any country in the world, which country would I choose? I would stay right here in Aotearoa.

1 – Imperial College COVID19 Response Team – ‘Impact of non-pharmaceutical interventions (NPIs) to reduce COVID-19 mortality and healthcare demand’.

The Covid-19 situation has the world focused on our physical health, with good reason. During this time of uncertainty, we also should be thinking about our “legal health”. A quick check you can do from the comfort of your own home, is to ask yourself:

• Do you have a Will? If so, is it still relevant and does it reflect your wishes?

• Do you have enduring powers of attorney? These are important documents that give you the ability to appoint another person (your attorney) to make decisions for you in the event that you can’t.

• Do you have a family trust? If so, are you aware that trust law is changing in January 2021? Now is a good time to do a “health-check” on your trust to ensure it is fit for purpose and will comply with the new law.

• Did your lockdown “bubble buddy” recently move in with you? If so, who owns the house? Do you need to think about a Contracting Out Agreement draft (which is the NZ version of a “pre-nup”) to protect yourself from a future claim?

Our team are still open for business and remote capable. We are ready to help you with a legal “health-check” if needed.

Contact us today. Ph: 07 928 2000 | Email: lawyers@st.co.nz

www.sharptudhope.co.nz

A snapshot of where the Bay business community is at, with thanks to the Tauranga Chamber of Commerce for its insights.

Prime Minister Jacinda Ardern has warned that overcoming COVID-19 in New Zealand would be a “marathon, not a sprint”. The same could be said of the region’s economic recovery, says Tauranga Chamber of Commerce chief executive Matt Cowley.

The announcement of an exit from Level 4 lockdown to a “recovery” state of Level

Get the expert help you need

Do you have a plan on how to best meet your future financial needs?

Ensuring that you have enough income to see you through retirement and are able to manage unforeseen changes in income can be a significant challenge, particularly in light of the current low interest rate environment and the economic effects of COVID-19.

At Forsyth Barr we have a dedicated team who can help you to plan, build and manage an investment portfolio to suit your needs.

Whether you need to maintain a certain level of income, or grow funds to help future generations reach their financial goals without the burden of debt, we can provide the expert help. Contact us for a free review of your investments in confidence and a no-obligation discussion on how we can help you achieve your future financial goals.

40 Selwyn Street, Tauranga. (07) 578 2737 forsythbarr.co.nz

3 this month was the starting line for many local businesses who were unable to trade for the five-week period. And so begins the process of recovery and adaption to an economic climate shaped by COVID-19.

For businesses looking to kickstart their own recovery, Cowley advises owners not to save their company on their own.

“It’s tough and businesses owners cannot be across everything,” he said.

“They should reach out for support, including their accountant, bank, business mentors, and any government-supported resources, such as the Chamber’s Regional Business Partner Network (RBP) programme.

“It is reassuring to bounce ideas off other knowledgeable people to assist in decision making.”

Helpline for recovery

Since lockdown began, the Chamber’s RBP programme, or Biz Hub helpline, has been in contact with nearly 600 businesses in the Bay, all seeking business advice, direction and support.

What began with queries regarding short-term cashflow issues and access to the wage subsidy, have shifted to a long-term focus – advice for businesses that can’t trade on how to diversify their offering, business continuity planning, marketing and sales training, and more.

Business advisor Kirstin Mead said:”People were really grateful to have this business support available, to be able to speak with an experienced business advisor who can help them get the right support for their business.”

Mead said there were a number of ways businesses can adapt, including digital transformation to allow for eCommerce, buying local as both a member of the public and also in a business-to-business capacity, and taking charge of the new ways of working around health and safety (eg social distancing) to be ready to hit the ground running when doors can fully open.

Chamber engagement co-ordinator Anne Pankhurst has been with the Chamber

As we cascade down the alert levels, our long-term view on the horizon should increase.”

– Matt Cowley

through a number of regional crises, including the Rena disaster and the Global Financial Crisis. Her advice to businesses looking to rebuild is to take the time to review and reset their business model.

“The recovery could be long and so doing business as it was, is likely to change,” she said.

“Those businesses that think strategically in this time will be best placed to come out of this crisis. Those that don’t expect to return to business as usual will recover quicker.”

Adapt to survive

But many local businesses profiled here and elsewhere in this issue have demonstrated just how flexible they can be. For example, Greerton retail business owner Robyn Parker was devastated when the doors of her craft store closed in March.

Uncertain about the future of her business, she found solace in attending regular webinars.

“Mentally, they helped a great deal, as I felt like we weren’t alone in this,” she said.

“The webinars helped me turn around our thinking to make the most of this time. I learnt how to use Zoom and FaceTime, and begun using video calling to help my cus-

tomers with their crafting problems.”

Taking her newly acquired digital skills to the next level, Robyn is working with website provider Zeald to develop an eCommerce site and has created an online community of her customers that she never imagined would be possible.

Mount Maunganui café

The General also saw trade turn down during lockdown.

Owners Malika Ganley and Aaron Winter have made the decision to also stay closed during Level 3, as it is not viable for their business to open, and hopes for the Level 2 announcement to be soon.

“There is no doubt it will affect the way our business was running [compared to] pre-COVID, but we are using this time to work on refining the business.”

The pair were granted capability funding through the RBP programme and are now working with business growth centre The Icehouse to review their current operations and plan for next steps.

“They have been encouraging, inspiring and have set us on a very direct course with where we need to be heading. This coaching is exactly what we needed and will play a big role in us hitting the ground running.”

Like individual businesses, the region also needs a plan to adapt to survive. Cowley said the Bay’s recovery would be a transition as the business community addressed the immediate crisis, while looking to reposition itself.

“For example, New Zealand’s border restrictions will restrict the country’s supply of international seasonal and skilled labour,” he said.

“We will have to use our existing labour force better, and make it easier for people to retrain to fill job vacancies. The region would benefit from coordinating supply chains as the border restrictions are causing air freight fees to increase for importers and exporters.”

The region would also benefit from reconsidering its long-term economic plan, he said.

We have taken the opportunity in this issue to meet the demands of the current business environment. As well as increasing our reach with more digital subscriber updates, we have included this directory of businesses who have asked to be part of our 2020 Business Community Support Network. These are businesses who are here to serve you. Our plea to you – please support them.

At Trustpower we’ve been in the fortunate position of being an essential service provider throughout the government’s response to COVID-19. And alongside many other businesses, we’ve also faced the challenges and opportunities that come with switching our business over to working from home in a short space of time, wherever possible.

Our top priorities over the last couple of months have been ensuring our teams have full support, not only for working from home, but from a safety and wellbeing perspective as well. What may have been easily achieved in the office, can be more challenging with our bubble buddies.

We’ve faced similar challenges to other businesses, in providing PPE at all of our sites, ensuring public safety and protecting our essential services workers over the last few weeks. Thankfully early on we pulled our Major Incidents Team together and managed to achieve some pretty extraordinary outcomes – we can’t thank our team enough for their unwavering support.

Our Technology & Delivery teams have been working round the clock to ensure our systems are stable, secure and user-friendly for working from home. Standing up a full “from home” telephony system was no small undertaking at such short notice, but we got it done. With the added impact of a 25-30 percent increase in ISP traffic, we’ve had some intense days.

Our customer needs have also been at the forefront of our COVID-19 response. Our vulnerable customers were the first ones we started calling early on, and this continues. We recognise that for some, our call is the only contact they may receive in a week, so we’ve created a regular check in call for many of these customers. We’ve heard some amazing stories,

customers

Traditionally we tend not to talk too much about the things we just get on with as a company, or as Kiwis really. But at a time like this, it’s important to share what we are doing, maybe as a gentle reminder to remember our elderly and vulnerable community members. We also need to thank our teams for the fantastic work they are doing day in, day out. It is also important to thank our customers and teams for their patience as we’ve navigated these very uncertain times together.

We mentioned being fortunate to be an essential service provider at a time like this, and we are conscious that we have many people to be thankful to and for. Many of the local businesses we generally frequent have been closed since lockdown started, so supporting them to get back up and running is super important. Helping with some free advertising spots in this directory is a great opportunity for us to say thank you to our local businesses. Kia kaha and hopefully we will see you again soon.

Jane

jane@coffix.co.nz Coffix Tauranga, 124 Willow Street

your investment objectives in confidence with one of our local Tauranga Authorised Financial Advisers.

578 2737 | 40 Selwyn Street, Tauranga www.forsythbarr.co.nz/contact/tauranga/

or email info@iridium.net.nz iridium.net.nz

By DAVID PORTER

The COVID-19 crisis has been tough for all businesses. But for some it has produced new and unexpected growth streams.

For Crest Commercial Cleaning (CrestClean) the increased focus on hygiene has had a significant positive impact. CrestClean Tauranga spokesperson James Smith told BOP Business News many existing customers have asked for increased cleaning frequencies.

“There’s a big focus now on not just having a clean workplace,” he said. “People are wanting reassurance the cleaning agents used are effective against COVID-19.”

CrestClean is New Zealand-owned, and locally owned and operated in each city. “We’ve launched a new sanitising service as a direct result of customers wanting a higher level of hygiene for their personnel,” said Smith. “The demand has been quite phenomenal and we can see this being a big growth area.

CrestClean’s Sanitising Service aims to protect workplaces against the flu, viruses and other viral illnesses that can rapidly spread in a workplace environment. Although much still remains about COVID19, cold or flu germs can live for up to 48 hours on surfaces like doorknobs and objects people touch with their hands. CrestClean notes that is important to take precautions to prevent employees from contracting and spreading any viruses or influenza.

Viruses, including COVID-19 and Influenza, are killed by the correct application of an effective sanitiser.

CrestClean recommends sanitising surfaces that people frequently touch with Anti-Viral Sanitiser regularly.

CrestClean personnel apply its Anti-Viral Sanitiser to specific surfaces that people touch, i.e. doorknobs, door push plates, kitchen areas, taps, microwave ovens, fridge doors, toilet buttons, soap dispensers, hand dryers, etc. The service is carried out at agreed periods, in addition to regular contract cleaning. “An anti-viral product is used to clean and wipe surfaces,” said Smith.

Smith said the sanitiser has a residual effect and it carries on working for a long time. Traces of sanitiser left on the surface will keep on killing any new pathogens that may land on the surface. “It works brilliantly on surfaces people frequently touch, such as door knobs, door push plates, doors, toilet buttons, soap dispensers and hand dryers,” he said.

“We believe cleaning and sanitising are going to be a big part of us all moving forward as a society. Hygienically cleaned facilities will help minimise the risks for people interacting at close quarters. “

Bumpzi, the creation of Tauranga-based digital marketing agency Quentosity, has come up with a solution for cafes, restaurants and takeaway businesses looking to operate under COVID-19 reducing alert levels.

Bumpzi is an online system that enables contactless, pre-ordered pick-ups from outside a café or eating place. A customer places an order by phone, then the café can view on a tablet. The order is created and the customer can then pick it up from a designated place outside the establishment.

Quentosity says the monthly cost can work out to be just one cup of coffee a day. The company, which specialises in creating digital apps, says Bumpzi can help such businesses get back up and running again.

Quentosity managing director Quentin Van Heerden also owns Q Cafe in Papamoa, which he said gave him an insight into what café owners needed

“We all want to resume serving coffee and food to customers, but it must be done in a way that’s safe, responsible and complies with the official guidance,” he said. “This is where Bumpzi can help every business owner who is desperate to get an income again, and the customer who has missed their daily cup of barista-made coffee. As a small business owner, I know the pain that others are going through right now. Making Bumpzi to be affordable is how I hope I’m helping, one Kiwi business owner to another.”

For more information about Bumpzi, see https://bumpzi.co.nz/

By NATHAN DOLMAN

As we watched the live stream from the New Zealand Government announcing the decision to reduce gathering sizes move into Level 4, our Tauranga Party Hire office phone ran red hot. But not for the right reasons. All our work for the foreseeable future was being either postponed or cancelled.

At the end of February, we had sat down to review the previous 12 months of business, look at how our first full financial year of trading was tracking, and set our goals for FY21. At that point, we never expected to watch our business disappear overnight, due to the impact of a worldwide pandemic.

The COVID-19 impact was heartbreaking to the point that we didn’t want to answer the phone. We had two choices at this point. Stand and take it, or look outside of the “norm” for the events we are used to working with. After all this is still an event, just not one with bright lights, music and a few drinks.

This quickly brought my partner Amy and I around the table to brainstorm on what life (both business and personal) was going to look like during

lockdown. In particular, discussions focused around how we could repurpose the assets of the business to continue to drive income, ultimately for the survival of our business. But also at the forefront of our minds was protecting the livelihood of our staff, who are an integral part of our business.

This brought us to thinking about who would need extra space to deal with the outbreak of COVID-19, and with the evolving restrictions being put in place around social distancing, which would impact the essential industries that continued to operate under Alert Level 4.

From this brainstorming and a few phone calls, came opportunities to provide marquees to create the drivethrough COVID-19 testing sites across the region, the extension of a number of meal rooms for kiwifruit packhouses across the BOP, as well as cover for supermarket customers lining outside up to enter the stores as the weather begin to deteriorate.

Suddenly, our phone was ringing red hot again, but this time for essential services wanting to book equipment.

Being a locally owned small business, we were able to be nimble, adapt our business quickly, and repurpose our

assets into areas that aren’t “normal” for an event company.

Doing this has allowed us to provide confidence to our team. While there are hard times ahead for not only us, but the entire business community, if we can continue to be nimble and flexible, there is always opportunity out there.

This will hopefully see us get safely out to the other side of these unprecedented times.

Nathan Dolman is a director of Tauranga Party Hire. He can be reached at nathan@taurangapartyhire. co.nz

A lot has changed in a few short weeks. Unfortunately, business and consumer confidence will not go back to pre-COVID-19 levels in a hurry. It will be a slow progression upwards as it always is after a major shock like this. Someone looking to buy a business may need to think about a few things differently.

Ihave some new questions that I think any prospective buyer should answer:

1. What do the historic results of the business mean now? Are they repeatable? Prior year results used to be considered a good guide for the future. There is no guarantee that all businesses will get back to those levels – indeed many unfortunately will not.

2. How has the business’ asking price been calculated? Historically the asking price is a function of prior year financial results x a multiple for risk (lower equals a higher multiple). There were often comparatives of what other businesses sold for that provided support for the value. This calculation may need to be adjusted to put more weight on future projections. Comparative sales may not be as meaningful. Understanding how reasonable the asking price is in the current market will be key.

3. If you buy it, how long before you get back to business as usual or at least to breakeven?

4. Is there still likely to be a core market for the product/ services? Businesses reliant on discretionary spend of all kinds will see a reduction. How much that may be is impossible to forecast. It is important this uncertainty is built into the sale price. It is also crucial that you do not just have one scenario of how the business may go but multiple. Things will not always go to Plan A – so it will be important to have Plan B and C ready and waiting.

5. Will the existing customers still be in business and if so, will they buy from you or from someone else? Can they pay you? How reliable is a customer’s payment history now in this new environment? Credit control will be a major area of focus moving forward and unfortunately there will be many stories of good businesses that are found

> BY TOM

BESWICK

Director at Ingham Mora Chartered Accountants in Tauranga, is a business advisor who specialises in buying and selling businesses. He can be contacted on 027-5744- 019 or tom@inghammora.co.nz

to be swimming naked when the tide went out (due to soft credit policies).

6. Is the business’ supply chain still as good as it was? Disruptions to stock supply and potentially significantly higher prices given the lower NZD are going to have a prolonged impact.

7. Can you get the enough finance to cope with multiple potential outcomes? Now is

Thousands of construction workers will be back on the tools from the end of COVID-19 Level 4, playing their “highly important” part in cranking up New Zealand’s economic wheel, said Classic Builders director and head Matt Lagerberg.

Classic Builders is one of the country’s largest home building companies and a major presence in the Bay. Lagerbeg said being given the green light to return to work under Level 3 has been a great relief.

“It has been a tough time for everyone in the construction industry - and others too - with income streams at a standstill and outgoings to service,” he said.

Staff were keen to get back out and get the wheels turning, said Lagerberg, who predicted a positive downstream impact.

Classic Builders has a staff of 260 covering the Bay of Plenty, Auckland, Northland, Christchurch, Queenstown, Wellington and Waikato.

“It’s great for the supply chain and breathes life into many small and medium-sized businesses. Bricklayers, labourers, electricians, plumbers, roofers, tilers, those involved in earthworks and drainage, and product suppliers… all represent subcontractors and suppliers relieved to be back at work.”

It’s great for the supply chain and breathes life into many small and medium-sized businesses.”

– Matt Lagerberg

The construction industry pumped more money into Tauranga and the WBOP’s economy than any other industry last year.”

– Nathan Watkins

He said Classic Builders had hundreds of homes underway and staff were eager to finish these so Kiwis could move into their new homes.

Classic Builders Tauranga regional manager Nathan Watkins said members of his team of 38 people – covering the Western Bay of Plenty – had been on site checking everything was in place so they could hit the ground running.

“The construction industry pumped more money into Tauranga and the WBOP’s economy than any other industry last year, so getting back to work is great news for us, our many subcontractors and suppliers and the local economy,” he said With a pipeline of scheduled work through to January 2021, the Tauranga and Papamoa Classic Builders branches had clients waiting patiently for their new homes, said Watkins.

Preparation for the return-to-work date had included liaising with the company’s subcontractor and supplier network to ensure all on-site requirements around health and safety were understood.

“The way we work is going to be quite different, but we are confident we can get the job done safely and deliver quality homes.”

We are very fortunate to be in this part of the world, in that we are likely to get back to a new “normal” sooner than most. It will mean that there are good opportunities around to buy businesses.”

not the time for most to borrow to a level that only is viable in your most optimistic scenario.

Banks will be more careful and there will be less competition for new business while they

hunker down. Banks are going to spend far more time wanting to understand all the factors above, before they put any of their own money at risk. They will ask for more security then in the past. Finance will take longer to receive – you will need a longer due diligence period than previously.

Banks will want to understand your recovery / buying plan and evaluate whether they think it is well considered and supported with strong assumptions to give them more confidence that your new business is a safe bet.

We are very fortunate to be in this part of the world, in that we are likely to get back to a new “normal” sooner than most. It will mean that there are good opportunities around to buy businesses. However, life as we knew it has fundamentally changed for a good while to come. I would recommend all business buyers tread carefully and get good advice as early as they can to maximise the likelihood of a successful outcome.

TABAK Business Sales recently celebrated its 20th year of business brokering with an anniversary function at the Tauranga Club.

Invited guests included many accountants, lawyers, bankers and other professionals who have supported TABAK during the past 20 years.

TABAK established itself as a boutique business brokerage two decades ago focusing on selling quality businesses to serious buyers. Kevin Kerr, a TABAK director, said he believed its success had been based firmly on sticking to TABAK’s specialist sector – business sales.

“We achieve outstanding results by selling only quality businesses that show sustainable future profits,” said Kerr.

“Our results speak for themselves – we sell 80 per-

cent of what we list and consistently achieve sales prices within 10 percent of the listing price. It’s that focus on quality that has set us apart from our competitors. The integrity that we bring to the valuation process is a key to achieving these above-average industry results.

“We strongly believe that establishing a fair market value is vital to the successful outcome of the sales process.”

Achieving long-term goals

Fellow director Paul Brljevich said that TABAK has a passion for helping people achieve their long-term goals.

“We focus on bringing a personalised approach where our whole team can work on a project in order to achieve the desired outcome for both the seller and buyer. Our credible

track record allows us to provide a superior service when it comes to selling a business.”

So what does the future hold for business sales over the next 12 months? The small business community is at the heart of New Zealand’s economy and COVID-19 has changed everything, said Kerr.

“Business owners will need to reassess their businesses and the industry they are involved in to navigate the uncertainty that lies ahead,” he said.

“There will be some businesses that will not open up, others that will struggle for a long period of time and some who are involved in shovel-ready projects that could return to normal. Yet for others they will decide to sell. It is this uncertainty that will present both opportunities and challenges. It is all about timing.”

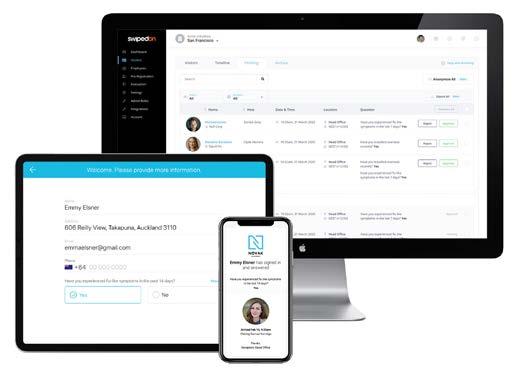

As we hopefully come out of COVID-19 lockdown and move beyond, business operators are being forced to rethink their norms. And one of the main areas impacted is the actual location of where we all work.

Work is a function not a place. A large proportion of the workforce are now working from home and are starting to get used to it. How is this going to play out going forward? Having proved the effectiveness of remote working, in the future, employees may demand it and employers will have to get more comfortable offering it.

There is also an unprecedented demand on business owners and operators to suddenly become technology experts. From the comfort of the new workspace (home) and with new work colleagues (partners and children) there

has been an introduction of technologies into businesses that may have never been used before – video conferencing, instant messaging, e-commerce etc.

This has opened the door to opportunities and different ways of thinking, tempered with frustration, new unbudgeted spend and risk-taking through increased security challenges.

New tools are being released to help with challenges and issues facing businesses, so this trend is set to continue in the short term, especially in contact tracing, transactional activities, click and collect and contactless delivery.

There is a risk of technology fatigue settling in. How are business owners supposed to keep up with it all and make sure the bills are being paid, while still looking after customers and generating an income? What should you prioritise when faced with so many options?

First, remember that while technology is important, it is just a tool to support your desired business outcomes. IT must serve a purpose and you don’t need to be a technology expert to know your business. There are a number of

> BY TONY SNOW

Tony Snow is chief executive and co-founder of Stratus Blue. He can be contacted at Tony@stratusblue.co.nz.

tools available and they are constantly being updated and competed with.

To use these tools successfully usually requires you to understand your current processes and then to look at how they could be made better. Can you automate it or eliminate certain processes?

Outside of these processes, a couple of considerations to focus on now are:

• Cybersecurity.

• IT infrastructure and data storage solutions.

• Collaboration and communication.

So, where to from here?

An assessment on how the key

New Zealand, at heart, is a nation of entrepreneurs. The tyranny of distance, added with the old number 8 wire mentality has created many a commercial endeavour. The economic and social conditions post COVID-19 will stimulate and feed this national inclination. For many the inclination will morph into franchising.

> BY NATHAN BONNEY

Nathan Bonney is a director of Iridium Partners. He can be reached at nathan@iridium.net.nz or 0275-393-022

Why we will see a growth in entrepreneurship

Entrepreneurship – the propensity for people to go into or create a business for themselves –tends to be anti-cyclical to the economy. This sounds counter-intuitive, but good times and full employment, coupled with a comfort level in the status quo, means fewer people are inclined to take the jump to business ownership.

At the other extreme end, which unfortunately we are now facing, with a recession and significant growth in unemployment as well as under-employment, many will have that push.

If the decision to go into their own business has been one of necessity, this will be highly desirable for many of them.

Resilience: the capacity to recover quickly from difficulties; toughness.” – Oxford Dictionary definition.

policies and processes within your business are working now and how they will work with the new norm is a good place to start

We have often seen busi-

nesses either paying for something they no longer use, paying for multiple tools that do the same thing, or not aware that the subscription to one thing offers much more than what they are using it for.

Many have also just kept bolting on applications and devices as they see fit.

This all results in a very inefficient technology stack with no or little planning. Assess technology governance, business process and tools now. Understand the demands that you will be faced with over the coming months to work out what to do next.

Also, importantly, the world has suddenly got a lot smaller. Globalisation of the labour market has suddenly ceased.

We are looking at a potentially massive social shift. Few people knew what WFH stood for, or even considered this an option a few months ago. As the workforce has had to come to terms with this new way of working, a great number of people will be reluctant to return to the daily commute, the stipulated hours and work environment.

Many have tasted having a greater control over one’s day,

The post COVID-19 recession will be very different to previous downturns. Interest rates are low, many would-be entrepreneurs have created equity in property and at this stage they have access to capital.

work and ultimately their own destiny, and will look at exiting the corporate world.

Why franchising will champion entrepreneurship

Growth of entrepreneurship and the growth of franchising will go hand in hand, and I suggest that franchising will both accelerate and take a starring role.

Franchising provides opportunities to use almost any existing skill set.

From cleaning to home loan brokerage, to building and hair styling, there is a franchise system that provides a traditional employee the opportunity to go into business for themselves applying their existing skill set.

A franchise system or framework provides the business tools, systems and support around a skill set, turning it from a job function to a business.

The business in a box approach means the incubation period for a start-up franchise business is likely to be shorter than a stand-alone and an established brand and marketing machine is likely to lead to a shorter period to break-even and beyond. Faster will translate to more growth.

The old franchise saying of being in business “for yourself, not by yourself”, has never rung truer.

The safety net and support of being in a franchise is no doubt being felt by many at the moment.

Not only have franchisors sought to support their franchisees, New Zealand’s franchise community has collaborated to seek out cross-industry solutions.

> BY DAVID MACASKILL

David Macaskill is a Senior Associate at James & Wells with expertise in all areas of intellectual property and a particular focus on Intellectual Property Strategy. He can be contacted at 07 957 5660 (Hamilton) or 07 928 4470 (Tauranga), and davidmacaskill@jamesandwells.com.

The shock of COVID-19 to the business community has been sharp and severe. The lockdown in New Zealand has challenged all businesses, and the evolving situation overseas is creating additional problems. We’ve seen a surge in clients seeking advice on how to manage their intellectual property (IP) portfolio to meet these challenges.

I’ve been working in the IP industry long enough to remember the economic shock during the 2008/2009 global financial crisis (GFC). It created significant pressures for established exporters and startups. While the COVID-19 situation is not the same as the GFC, there are similarities.

Many businesses across the country are currently questioning how they can respond to, and manage, the challenges that COVID-19 is having on our business.

There is no one-size-fitsall plan. Much depends on the business and its stage of development. Some industries, like healthcare, are ramping up,

while others have come to a screaming halt.

Irrespective of where you find yourself, considering the following issues when managing your IP portfolio will help you navigate your way through an economic crisis.

• Cash is King. Having cash on hand means you can meet your obligations, keep the doors open, retain key staff and continue to trade. With that in mind, businesses may be considering whether it is sensible to invest in assets, such as IP rights, or whether to delay this. For some, choosing not to invest will be the best option. However this depends on the cir-

cumstances and a variety of complex factors.

• Assess how existing IP rights relate to your business and if they are essential. This can highlight if an IP right is superfluous and does not require further investment. If a right captures your business’ competitive advantage, is it really worth letting it lapse to reduce short term spending? You should balance this question carefully.

• Have a contingency fund wherever possible. Being able to accommodate unplanned costs or variations will reduce stress and improve your chances of coming through this unscathed.

Is now a crazy time to be considering buying or selling a business?

Many people think that the answer to this question is obvious, however it’s not quite as simple and straight forward as some may perceive.

Yes, we’re in unprecedented times and unchartered waters, and there are obvious concerns around New Zealand’s economic future as a result of the COVID-19 crisis. However, as the famous quote of Benjamin Franklin says: “Out of adversity comes opportunity.”

Sadly, there’s no doubt that there is going to be some hardship and casualties ahead, but on the flip side, there are also going to be some amazing business opportunities.

More and more Buyers

After the Global Financial Crisis of 2008, people looked to take back control of their lives. Buying a job is about the most significant way to take back control – and this will

• Ensure you have good systems and communicate with your team. This includes thorough budgets, clear instructions on what costs can be incurred, and decision-making criteria for potential investment in IP rights. Know when the next actions for the rights in your portfolio are likely to be due and plan accordingly.

• Determine whether immediate action is necessary or if it can it wait. Your best option may be to delay filing an application or product launch. Failure to meet certain IP deadlines can result in the right lapsing. But deadlines can be extended in many circumstances so use extensions of time to delay costs or decisions.

• Pivot or partner. We’ve seen in the US that Ford has started producing respirators to meet local demand. Australian company Medtronic has

openly shared the IP rights to its portable ventilator and is rumoured to be partnering with Tesla. Closer to home, there are the distilleries who are changing from gin and whisky to hand sanitiser. Think outside of the box and adapt. Look for new partnerships where you can provide value to another company, who in return will help you. Or, change your focus to a different product or service.

• Revisit your IP strategy. If your business strategy changes, then so too must your IP strategy. Don’t be afraid to make hard decisions on investment in IP rights, but also be prepared to commit to continuing your existing plan or investing in a new one.

Understand how COVID19 will affect all the markets you operate in – don’t assume that what applies for New Zea-

land customers will also apply in other markets.

• Look after your team. The significance of people to a business is frequently talked about, however they are often overlooked as a form of competitive advantage. Communicate what is happening with the business, engage them on problem solving, and help with their personal challenges. You will need your team members to help the business survive during the crisis and to recover during the eventual market rebound.

Good businesses will survive and may even thrive during the COVID-19 pandemic. How you respond will determine whether you succeed or are left by the wayside. Getting input from a range of experienced sources will improve your decision making and outcomes.

Rhappen. In the $50,000 to $400,000 section of the market we will see a huge amount of activity – and LINK is already starting to see buyer enquiry levels increase significantly.

It’s not just at this level though. There will be more activity in the M&A market as businesses look for growth through strategic acquisitions, buying out competitors, and even amalgamations in the SME sector.

During the lockdown period, non-essential business owners have had the opportunity to address the well-known old problem of ‘working on their business’ as a result of being stuck at home and not being able to work ‘in the business’

Many of these businesses will come out of lockdown as better, smarter, leaner and more profitable operations.

Steven Matthews General Manager –

LINK Business Brokers Bay of Plenty linkbusiness.co.nz

ight now, many businesses are facing some very hard choices. There are lots of things an owner has no control over. One thing we can control is our attitude and how we decide to respond. Rather than retrench through the crisis, we can choose to look for the opportunities.

This is an opportunity for you to:

1. Take a leadership role in helping your team at their time of greatest need

2. Be pro-active in communicating with clients

3. Make a plan for a more sustainable and resilient business

For Ingham Mora, our opportunity was acquiring J B Lloyd Chartered Accountants on Mick Lloyd’s retirement. During the chaos of the lockdown, on April 1st, we merged our practices and rather than freeze hiring we took the opportunity to take on four great staff.

A smooth merge was supported by the

investment we had already made in cloud technology, which paid dividends and allowed us to swiftly migrate the new practice into the cloud so all clients had access to ongoing support.

In this stressful time, we know that having great support from your accountant will be a difference maker for many businesses. When business resumes with some ‘normalcy’ we are excited to be able to operate from two locations.

In addition to our current office in downtown Tauranga, we will also be in a new office at 7 Totara Street in Mount Maunganui. We are looking forwards to being back at the Mount and providing more options for our clients.

For accounting services or business advice contact Ingham Mora on 07 927 1200 or visit our website inghammora.co.nz.

There are many corporates who have already rolled out working from home programmes and these should have support mechanisms in place. While it is difficult to replicate best practice overnight, the following advice may be useful to individuals and teams going through these difficult times and asking staff to work from home.

Companies should take responsibility for the health and safety of their staff wherever they work, and in normal circumstances this would include a health and safety risk assessment through guidance to staff before working from home.