Reimagining the real estate experience for all Page 11 DECOMMISSIONING

Anne Tolley acknowledges the business community Page 5 ULTRA

Freddie Bennett dreams BIG Page 15

Reimagining the real estate experience for all Page 11 DECOMMISSIONING

Anne Tolley acknowledges the business community Page 5 ULTRA

Freddie Bennett dreams BIG Page 15

Investment specialists share their views on the 2024 investment landscape and explain why their offerings may best suit those investors looking to build wealth. Pages 6-9

Te Whare Wānanga o Awanuiārangi (Awanuiārangi) has awarded a Distinguished Fellowship in Education to Adrienne von Tunzelmann at its annual graduation ceremony at Te Mānuka Tūtahi marae in Whakatane on 10 May.

In front of more than 220 graduands, their whanau and supporters, Awanuiārangi Council and staff, as well as notable guests, Adrienne was conferred the Distinguished Fellow-

janet.oshea@tallpoppy.co.nz

ship in Education by Council chairperson, the Hon. Justice Layne Harvey, and Distinguished Professor Linda Tuhiwai Smith.

Justice Layne Harvey said that Awanuiārangi is honoured to acknowledge Adrienne and celebrate her lifetime of achievement through this award.

“Over many years of public and governance service, Adrienne’s contribution to community development has been signifi-

cant and we congratulate her on this well-deserved recognition.

“Adrienne was a long serving and well-respected member of Te Mana Whakahaere o Awanuiārangi (the Council of Te Whāre Wānanga o Awanuiārangi) from 2005 to 2019, providing important community perspectives and governance experience. Since 2019, she has been a highly valued independent adviser > Continuedonpage5

JoiningCredit:Availablefrom6Mayto23June2024.New customersonlyona24-monthbusinessbroadbandSmart FibreofHyperfibreplan.Repayableifyouleaveearly.$13.04 excl.GSTmodemshipping,nonstandardinstallationandearly exitfeesapply.FreestaticIPAddressincluded.Broadband notavailableeverywhere.Excludesanyotherchangeswhere applicable.Non-transferableorexchangeableandnonredeemableforcash.T&Csapply.

The success of House of Science is a testament to the power of community support. Sponsors’ and volunteers’ time and resources have helped this charitable trust grow from its Western Bay of Plenty roots and spread its impact throughout the country.

House of Science was born out of a need to address the alarming trend of students entering secondary school with little to no exposure to science.

House of Science NZ is led by Chris Duggan and her dedicated local team, provide science kits to 43 primary and intermediate schools in Tauranga and Western Bay of Plenty.

By equipping primary and intermediate schools with science resources, creating hands-on learning opportunities that enhance children’s scientific literacy, House of Science exposes them to a wide range of learning and career paths.

Currently, the kits cover 42 scientific topics and can be booked like a library system.

The schools’ membership fee covers ten per cent of the cost to deliver the service; the remainder is through local individuals and

corporate sponsors who sponsor a kit of their choice.

Each science kit is a comprehensive resource, including a teacher manual with all necessary background information, equipment, and instructions. It is delivered to schools fortnightly, used by students under the guidance of their teachers, and then collected for cleaning and replenishment by dedicated volunteers at the branch base.

House of Science Business Development Manager Sandra Kirikiri acknowledges the immense support from the Tauranga and Western Bay communities, emphasising the crucial role they play in their operations.

“Our kits program are a way to ensure the next generation is exposed to high-quality and diverse areas of science. By removing the barriers to learning science, we aim to see more students return to the area for

jobs in areas such as horticulture, agriculture, engineering, or marine science,” says Kirikiri.

Rotary Club Te Papa is one of the top volunteer groups in Tauranga and Western Bay of Plenty’s House of Science branch.

Simon Ellis says the Rotary Club of Te Papa thinks literacy, numeracy and science are vital and having these kits in schools is extremely beneficial.

“We have rosters of volunteers to check and replenish the kits each fortnight,” says Ellis, “We do deliveries and collections, and there is nothing better than having the kids run up to you to see what kit you’re bringing into school.”

“They really fall in love with science through these kits, as it shows them science isn’t just for the brainy kids and it often ignites an unknown passion. These kits should be everywhere.”

House of Science has flour-

electricalservicesbusiness,operatingintwo distinctmarkets:industrialandresidential, hasearneditsglowingreputationand communitystandingthroughitsservice excellence.

SimonEllisofRotaryClubTePapa restockspartofaHouseofScienceKit.

ished over the last decade. The efficient system ensures that each member school, with an average of 249 students, benefits from a House of Science Kit, usually used by three teachers and 73 students each time it’s booked.

TECT recently funded $30,000 towards the operating costs of House of Science’s Western Bay of Plenty branch.

House of Science started in Tauranga and now has 20 branches around the country with 700+ member schools. This equates to a third of all primary, intermediate and Kura Kaupapa schools in New Zealand being exposed to key science experi-

ences and development. The kits are also available in te reo

Every year, the social return on investment is for every dollar invested into the programme, it delivers $10.20 of measurable good to New Zealand through increases in academic achievements, improved mental health and increased STEM achievements.

These kits are building a stronger future for local children and can only do as much as the limited number of kits allow. House of Science aim to be in every school across the region and the country to continue benefiting future generations.

Renownedforquality,expertiseand unparalleledresults,thebusinesshasa provenrecordofsuccess.Duetoitsprime centrallocationintheNorthIsland,the companyenjoyseasyaccessibilitytolucrative markets.

PUBLISHER

Alan Neben, Ph: 021 733 536

Email: alan@bopbusinessnews.co.nz

EDITORIAL

Alan Neben, Ph: 021 733 536

Email: editor@bopbusinessnews.co.nz

PRODUCTION – Copy/Proofs/Graphic Design

Clare McGillivray

Email: clare@bopbusinessnews.co.nz

ADVERTISING

Pete Wales, Mob: 022 495 9248

Email: pete@bopbusinessnews.co.nz

ELECTRONIC FORWARDING

EDITORIAL

News releases/Photos/Letters: editor@bopbusinessnews.co.nz

GENERAL ENQUIRIES

info@bopbusinessnews.co.nz

Bay of Plenty Business News has a circulation of 8000, distributed throughout Bay of Plenty between Waihi and Opotiki including Rotorua and Taupo, and to a subscription base.

Bay of Plenty Business Publications

309/424 Maunganui Rd, Mt Maunganui, 3116

Bay of Plenty Business Publications specialises in business publishing, advertising, design, print and electronic media services.

In case you missed last month’s edition

> By DAVID PORTER

There has been a groundswell of support from potential candidates as Tauranga gets ready for its first democratic city council election since 2019. Then the entire council was sacked after the abrupt resignation of new mayor Tenby Powell.

The replacement of the council by four election commissioners was by no means popular, despite the wrangling and disaffection shown by the ousted council.

The flood of candidates suggests that there is a considerable appetite for a return to democratic elections in Tauranga, despite – or as a result of – the experience of living with commissioners.

And lead commissioner, and former BOP News Business columnist Anne Tolley undoubtedly did herself and her colleagues few favours by suggesting that some of the commissioners should stay on in an advisory position to “help” the soon to be elected new council understand and

carry out its duties. Her suggestion was quickly rejected.

So what are we to make of the new council elections, scheduled for July?

First, let us acknowledge that in many sections of the community the commissioners were welcomed as at least getting things done, rather than seemingly being in a state of constant conflict with each other.

And Powell, despite his military background and

strong presentation during his election campaign was quickly proven to be ineffective at securing agreement amongst the councillors. More to the point, the commissioners obviously were not obliged to go through the enormous checks and balances provided by a large group of councillors who could be for or against any proposal.

We should be grateful to the current council bureaucracy, which has provided an easily accessible list of potential candidates, together with their email and/or phone contacts. Bluntly, there is no excuse for not quizzing the candidates about what they are offering.

Arguably, the key roles that any mayor must play in a local body are to both provide leadership and to balance that with the ability to secure consensus amongst a majority of councillors for the hoped for advancement of the community.

Interestingly, as of writing on the last day for candidates

to apply, we had a total of eight candidates for mayor and more than 40 candidates for election to the various districts. That suggests a pent-up demand for a return to a more democratic election process.

Amongst the mayoral candidates, Mahe Drysdale, an elite rower and descendant of a former mayor, as well as Maori recording artist Ria Hall, had become front runners. But that was early days and there are now a number of candidates for the office. Interestingly, but not surprisingly, the council candidate list includes a number of faces from the ousted council. Some of them, no doubt, wish to make it clear that the installation of the commissioners was a mistake and that they can do better. It remains to be seen whether this is the case.

I would urge all electors to read about and wherever possible question the motives and intentions of all candidates for office in Tauranga whose actions may affect you.

Make a more sustainable choice while enjoying excellent range, power ful acceleration, and exceptional quietness

Featuring a cutting-edge hybrid power train, the NX 350h Premium and Limited delivers outstanding fuel efficiency without sacrificing per formance

The NX 450h+ F Spor t offers the versatility of extended electric driving for a greener commute and unparalleled driving experience with its advanced plug-in hybrid system

The Tauranga City Council Commissioners would like to take this opportunity to thank the business community for the strong support businesspeople have provided for the many initiatives the Council has progressed under our governance.

> By ANNE TOLLEY, TAURANGA COMMISSION CHAIR

We appreciate that there has been a significant cost involved for city businesses as a result of the changes made to commercial rates

on some long-overdue investments in infrastructure and community facilities.

Anne Tolley

The message we have received is that the sector is not only supportive of investment which will address the city’s severe housing deficit, road congestion issues and the facilities we need to make Tauranga a better place to live, but is prepared to pay its fair share of the costs involved, providing that clear benefits will be delivered for the wider community.

The long-term plans adopted during the Commission’s tenure each set-out a clear action and investment plan to address the city’s needs, while carefully considering the financial cost, both for the organisation and for ratepayers. We think we have got the right balance of priorities and it was encouraging to see the response to the Tauranga Business Chamber’s survey last month, which showed strong support for maintaining the Council’s

current strategic and investment direction.

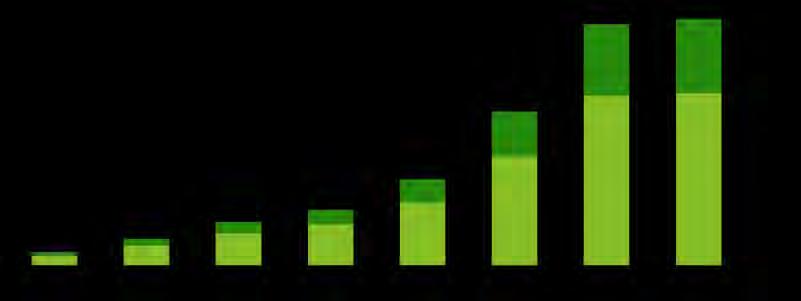

As an aside which speaks to the business sector’s desire to see progress being made, the following graph provides an interesting insight into Council investment in the city, with a noticeable increase in capital expenditure over the past three years.

Also as an interesting aside, city partners and Council celebrated the progress the city has made, and is making, at a function in early-May. There was a lot of commentary from those attending about the current and planned investment in Tauranga, with a clear indicator being the seven cranes that are now dotted around the city centre – far more

than anyone could remember seeing before and confirmation that the more than $2 billion being invested by private and public interests will bring the revitalisation this area so badly needs.

This was a particularly positive event and it was heartening to get some great feedback that the Council’s commitment to Te Manawataki o Te Papa – the redevelopment of the civic Precinct –is continuing to instil investment confidence in the private sector.

This will be my last Bay of Plenty Business News column as Commission Chair, because our role will become largely ceremonial after the last Council meeting of our tenure on 10 June. That being the case, I would also like

> Continued frompage1

to Te Mana Whakahaere, and continues to serve on the Finance, Audit and Risk Committee and the Joint Board with Te Puna Ora o Mataatua.

“On behalf of the Council, I would like to thank Adrienne for her almost 20-year service to Awanuiārangi. It’s particularly fitting that we acknowledge the important role she has played in shaping this institution as we

send off our latest cohort of graduates with best wishes for the next steps in their journeys.”

Upon receiving her award, Adrienne said that it has been a tremendous privilege to support and serve the Wānanga.

“I am proud to have received this honour from such a prestigious institute of indigenous educational and academic excellence.

“Being of service to the Wānanga has been a privilege

and a joy. I have gained far more than I could possibly give, and I am most certainly the richer for the opportunities offered me by my roles with the Awanuiārangi Council.

“One of my greatest rewards has been working alongside people passionately committed to scholarship, to advancing the interests of Māori and to the success of all their students. This is something I will always cherish.”

to thank the Bay of Plenty Business News and its publishers for providing the opportunity to communicate so directly with the business sector on the many issues of importance over the last three-and-a-half years.

Best wishes to all of you for a successful and professionally rewarding future. Remember that the elected council which will lead the community through the next four years will depend on the community’s input – so make sure you vote and make sure you tell everyone you know to vote as well. We have a great city – let’s make it even greater, a place we can all be proud of and that future generations will want to live, work, learn and play in.

By Simon Bradley, Wealth Management Adviser at Jarden in Tauranga.

As humans we tend to stick to what we know. We like the familiarity of products and brands that we trust and feel comfortable with. When it comes to investing, people exhibit behaviour that is no different.

’Home country bias’ refers to the unconscious behavioural instinct that results in investors overweighting asset allocation to their local region. This bias means investors can be exposed to high geographical concentration risk and potentially rely on a small subset of companies to generate their returns.

Let’s take New Zealand as an example. In our equity market, the largest 10 companies make up over 60% of the listed market in terms of size. Compare this to the MSCI All Country World Index (ACWI), and the top 10 stocks make up approximately 18%.

For New Zealand retail investors, home country bias is real. According to a Morningstar KiwiSaver report published in 2023, the average KiwiSaver investor has 37% of their assets exposed locally, and 63% internationally. Compare that to the NZ Super Fund which has 15% of its assets exposed to New Zealand versus 85% of assets invested offshore.

New Zealand has traditionally been a market where companies pay their shareholders a healthy share of profits in the form of dividends. In 2023, when interest rates moved sharply higher globally, New Zealand became less attractive to foreign investors who could get returns of 5% or more from investing in US gov-

ernment bonds. As a result, the New Zealand equity market experienced heavy foreign outflows as those investors sought returns closer to home with less perceived risk-taking.

There are of course two sides to every argument. Investing globally isn’t without risks.

In buying offshore shares, you are introducing currency risk as well as increasing the geopolitical risk you are exposing your investments to.

While a strong New Zealand dollar is good when buying offshore shares, it will diminish offshore returns when repatriating your investment back into New Zealand dollars. It’s very difficult to successfully predict the international flows of capital and currency movements. It is however possible to buy New Zealand dollar hedged funds to help mitigate this currency risk.

Offshore investing can also increase the tax complexity of an investor’s portfolio. It’s important to seek tax advice when you are considering making offshore investments.

As New Zealanders, we are patriotic people who are famed for our ingenuity and ability to think outside the box. There is perhaps a sense from local investors that we desire our best and brightest companies to perform on the global stage and by investing capital into those companies, that we’re along for the ride.

Whilst it feels comfortable to invest in companies well known to us as New Zealanders, it’s a big wide world out there and

Whilst it feels comfortable to invest in companies well known to us as New Zealanders, it’s a big wide world out there and limiting yourself to only investing in New Zealand can also limit expected returns.”

limiting yourself to only investing in New Zealand can also limit expected returns.

To take the example of the NASDAQ

100, the US stock exchange where most of the world’s technology giants are listed, over the past 5 years the NASDAQ 100 index has delivered a total return of 160% whereas the NZX 50 Index has returned just 15%.

As history has taught us, markets do inevitably get derailed by geopolitical events, terrorism, and pandemics. These types of events can prompt investors to question their investment strategy. Rather than reacting to market movements, any changes to your investment strategy should typically only be made as a result of changes to your own personal circumstances.

A well-balanced diversified portfolio not only invests across different asset classes but also places importance on where those assets are listed and what geographical exposure they have.

While it’s known that investing is a great way to get ahead, when you’re considering investing, it can feel like there are too many options to choose from… so much so that it can seem overwhelming.

Do you opt for a conservative bank term deposit knowing that your nest egg can be locked away for an extended period, do you invest in shares to try and time the market, or is an investment in property the answer, despite the current high interest rates for borrowing and the tenancy challenges it may present?

Not only can it be hard to choose the right option, but the entire investment industry can seem full of complicated jargon, with many options requiring skills, data, time, and expertise. To top it off, some companies require you to have a huge lump sum before you can even get started and then they lock up your money, making it difficult to access funds when you need them.

If you’ve got a nest egg and are looking for investment options, then First Mortgage Trust (FMT) could be for you.

WHY MORE THAN 6,500 INVESTORS CHOOSE FMT:

Easy to understand

FMT’s investment model pools your funds with those of others, with FMT actively managing the fund to ensure it works hard for you without undue risk. They do

this primarily by providing loans to NZ property owners seeking finance on a first mortgage basis. Income is derived from these loans and distributed or reinvested quarterly (after fees, expenses, and tax are deducted) based on your preference.

FMT is renowned for protecting capital and providing consistent, steady returns. The Risk Indicator rating at FMT is 1 (on a scale from 1 to 7), indicating a low level of risk with stable returns. It’s important to note that no investment is completely risk-free. The Risk Indicator is a tool introduced by the Government to assist investors in understanding the volatility of returns from different managed funds. FMT has earned the rating of 1 by delivering consistent returns. They have never lost any investor’s capital ever and while past performance is not a reliable indicator of future performance, FMT is proud of its track record and committed to maintaining it.

New Zealand owned, operated, and focused

Living, working, and investing here means the FMT team know the markets and trends firsthand. Additionally, their

skilled team of experts undertake their own research, leverage their networks, and seek advice from industry experts as required.

Unlike mainstream bank term deposits, your money isn’t locked away for a specific term. FMT provides a simple withdrawal process that normally makes your funds available within a few days.

At FMT, they operate an 0800 number with ‘real people’ who can provide the answers you need, when you need them.

Some investors have been with them since they started in 1996 and testify to investment returns that continue to please.

It’s simple to get started, and you only need a minimum requirement of $500 to get underway. Thereafter, minimum top-up investments of $100 (or more) can be made via lump sums or as regular contributions to suit you and your investment goals.

CEO Paul Bendall says, “We strive to provide peace of mind in investing. We want our investors to feel reassured that their money is in steady hands.

“We know these are uncertain times, and people are cautious, especially when it comes to investing and deciding what to do with their nest egg and savings. Living costs and inflation are high, which can be hard for savers. We understand this, and that’s why we are pleased to have delivered consistent investment returns. Because of our track record and the peace of mind we provide, many of our investors invest more with us and recommend us to their friends and family.”

To learn more about investing with FMT, visit fmt.co.nz or give their friendly team a call on 0800 321 113.

Property Brokers’ regional manager for the Bay of Plenty and South Waikato, Simon Short, believes this is very much a time for investors to look to property for wealth building.

“The market is showing positive signs of rebound and there will be an increase in that activity as the year progresses,” he predicts. “Our markets are always influenced by simple economics, supply and demand; with the availability of funding and increased lending appetite expected to rise as 2025 draws closer we believe there will be a momentum shift toward real estate investment in all sectors.”

Simon suggested we talk to his team to get a sense of the market from his specialists on the ground. We spoke to three of his team members who specialise in commercial, industrial, agriculture and horticulture property investment.

Sales consultant Rich Graham says commercial real estate (CRE) can be a very lucrative investment offering numerous benefits to investors.

Diversification is a key benefit – commercial real estate offers a unique risk profile that can help mitigate volatility in other investments, such as stocks and bonds. You can also invest across various sectors, such as office, retail, or industrial, each with different risks and returns.

Commercial properties often have longer lease agreements than residential properties, providing a more stable and predictable income stream. This can be particularly appealing for investors seeking regular cash flow. He also points out the potential for appreciation – over time, commercial properties can appreciate in value, which can significantly enhance one’s net worth. There are also tax benefits for CRE investors.

Commercial leases often include rent escalations tied to inflation, which means the income from these properties can keep pace with the rising cost of living, protect-

ing your purchasing power.

To get started, you’ll need to conduct market research and financial analysis, establish funding options, conduct due diligence, and seek professional advice.

“You’ll need to consider risks such as market fluctuations, property management obligations, and liquidity requirements,” says Rich.

In conclusion, he believes investing in commercial property can be a powerful way to grow wealth, provided you conduct thorough research, understand the risks, and manage your investments wisely.

Philip Hunt, the company’s commercial and industrial consultant in Tauranga’s fast-growing Tauriko industrial area, is adamant that industrial remains the sector’s darling. He says there’s still huge interest from large tenants wanting to be located in Tauriko. However, he has noticed a slowing in their making of commitments due to current economic conditions.

Enquiries remain very strong, as evidenced by the increase in the size of his Tauriko-based team to four. “Businesses are still desperate to locate to Tauriko, particularly now the roading and infrastructure are well in place,” he says.

He notes that stock levels are good, so there are options available for businesses, big or small. But he warns that the days of large annual rent increases are gone for the moment. His advice to landlords now: “Love your tenants and look after them. Wise landlords are doing all they can to retain their tenants,” he suggests.

Philip’s team estimates that well over 50% of their business activity at Tauriko is directly or indirectly Port-related. He continues to praise the Port of Tauranga for its foresight.

According to Property Brokers’ Ian Morgan, the agricultural sector is experiencing a notable decline in quality produce worldwide, making it an attractive proposition for investors. However, experts caution that rural property investment is a longterm endeavour.

“It is always about timing, and presently, the agri sector looks very attractive with quality produce diminishing globally. But rural is a long game, and the investor needs to be clear about this.”

However, investors must be aware of the immediate challenges associated with rural investments. In addition to weather-related challenges, market volatility and fluctuating commodity prices add another layer of complexity to the investment landscape. Looking beyond the immediate hur-

dles, the agri sector is poised for substantial future growth. “Opportunities will be plenty, and the agri sector is well poised to deliver results in the future,” he affirms.

Ian advises investors to adopt strategic approaches, such as spreading investments across various crops and regions, embracing sustainable farming practices and leveraging advances in agricultural technology.

With the right timing and a focus on sustainability and innovation, rural investments can yield significant long-term benefits. For investors ready to embrace the long game, the rural property market offers a promising horizon filled with potential growth and profitability.

Property Brokers has a wealth of specialist knowledge and offers fullservice real estate across residential, commercial/industrial/rural and property management.

JaimeeThomsenandRohanGraaffareInvestment AdviserswithCraigsInvestmentPartners.Theyshare twogoldeninvestmentrulesandtheirviewonthe roleofagoodfinancialadviser.

hangeistheonlyconstantin life.Asaresultofchangesin yourpersonalsituationand challengesfaced,theneedsandreliance onyourmoneywillevolveovertime. Lifedoesn’tmoveinastraightline,soit paystohavesoundfinancialobjectives andagoodfinancialadvisertohelpyou movetowardsyourendgoal.When investingwebelievetherearetwo importantrulestoalwayskeepinmind. Followingtheseshouldsetyouupwell tosucceed.

1.Anygoodadviserwilladvise youtodiversify.

Afundamentalruleofinvestingisnot puttingallyoureggsinonebasket. It’sthesimplestyetmosteffective waytoinsulateagainstriskandhelp investorsweatheranystorms.This meanslookingatallyourinvestment assetsandyourexposuretoriskineach ofthem.Diversificationcouldmean lookingatacombinationofcash,bonds, equitiesaswellaslistedandunlisted funds,togettherightblendofassetsfor eachinvestor’sportfolio,saysCraigs InvestmentAdviserJaimeeThomsen.

decisionandone thatweworkcloselywith ourclientstodetermine therightbalance.New Zealandersaretraditionally veryexposedtothe propertymarketandas recenttimeshaveshown, anyassetcanexperience fluctuationsinvalue.It’s crucialtospreadyourrisk andcoveryourbases, ratherthanbeingtoo concentratedinone particularasset.

2.Haveagoodinvestmentstrategy andsticktoit.

AsCraigsInvestmentAdviserRohan Graaffexplains,thissecondrulemight soundsimple,butitcanbemuchharder tofollowinpractice.

“Settingastrategyinvolvesmore thanchoosingadiversifiedportfolioof investments.It’saplanofactiontailored totheindividualforthegoodtimes andhardtimes.It’saconsistentand disciplinedapproachwhichmanages risk,focusesonthedeterminedtime horizon,ensuresthatinvestmentsare suitablydiversified,andadaptsto marketchangesovertime.”

It’safairlycommon misconception,but theroleofagoodadviser isnottotryandpredictthe pathoffinancialmarkets. It’saboutconstructing yourportfolioinawaythat growsyourwealthbased onyourgoals,needsand riskappetiteandissturdy enoughtowithstand changingmarket conditions.

“Asinvestmentadvisersweoftenactas gatekeeperstoprotectagainstirrational ideasortradesresultingfromshort-term marketfluctuationstohelpyoustay oncourseandkeepyourinvestment portfolioalignedwithyourplan, regardlessofwhatisgoingonaround you.Someseeusastheirmoneycoach, aneducatororabusinesspartner.”

CraigsInvestmentPartnersisoneof NewZealand’slargestinvestment advisoryfirms,withover180qualified InvestmentAdvisersacross19branches inNewZealand.JaimeeThomsenand RohanGraaffareInvestmentAdvisers atCraigsInvestmentPartnersTauranga branch.ContactJaimeeorRohanforall yourinvestmentneedstohelpnavigate currentmarketconditions.

JaimeeThomsen P 079277978

E jaimee.thomsen@craigsip.com

RohanGraaff P 079277865

E rohan.graaff@craigsip.com CRAIGSIP.COM

Electric vehicles (EVs), including hybrids and plug-in hybrids, had a favourable financial treatment up until 1 April 2024. The clean car discount which was in place until 31 December 2023, and no road user charges (RUCs) before 1 April 2024, contributed to a sustained increase in the number of EVs on our roads over the last three years.

However, their attraction from a financial perspective has now been reduced, which is reflected in the statistics from the March quarter of 2024 which show a flattening of the number of EVs on our roads after the previous sustained growth. (See graph)

For context, it is worth noting that as at 31 March 2024 , there are 5,781,885 registered vehicles in New Zealand, of which 3,634,925 are passenger cars/ vans.

The RUC system was introduced in 1977 to help governments with paying for the cost of maintaining our roads. While petrol vehicles have a fuel tax levied at the pump, diesel has uses beyond public roads and therefore it is not appropriate to levy a roading tax at the point of purchase. The RUC system traditionally has

BY ANDREA SCATCHARD

applied to diesel vehicles and is levied based on distance travelled and vehicle type.

Initially, electric vehicles were exempted from paying RUCs as a way of encouraging the purchase of EVs in preference to new petrol or diesel vehicles. It was always intended that once the number of EVs reached 2% of the total light vehicle fleet, RUCs would be imposed on EVs. This target has now been met and thus the Government has discontinued the RUC exemption.

From 1 April 2024, fully electric vehicles are required to pay RUC of $76 per 1,000km and plug-in hybrids will pay at the rate of $38 per 1,000km (the lower amount reflects that some fuel excise duty is paid when petrol is purchased).

There is no doubt that this will increase the cost of running an EV. If the EV is a business vehicle,

the extra costs should be a deductible expense (but may need to be apportioned for private use if the owner is a sole trader or for some small private companies).

If you have company EVs that are provided to employees that are subject to FBT, nothing changes at this point – the same formula for calculating the FBT still applies. If you are reimbursing employees that use their own EVs for work travel, and use the Inland Revenue mileage rates to calculate the amount that can be paid tax-free, again at this stage nothing changes – the Inland Revenue mileage rates that were last refreshed in May 2023 still apply:

For more information on how the two tier reimbursement system works, please refer to our June 2023 Tax Alert article.

Typically, Inland Revenue issues mileage new rates around May/June each year, so we anticipate some new rates being released shortly. Remember that for reimbursements the new rates apply from the date that they are released, so you should be prepared to update systems and possibly the amount you

reimburse to staff from that date. The rates are intended to reflect the cost of running the different types of vehicles, so with the increase in the relative cost of running EVs, we would expect to see much less variance between the tier two rates in future. While it would be a welcome taxpayer-friendly concession, there may not be enough of an increase in running costs to warrant a single tier two rate for all vehicle types. If this all sounds quite complex, please seek assistance from your accountant or tax adviser.

Andrea Scatchard is a Tax Partner at Deloitte, based in the Bay of Plenty. She can be contacted on ascatchard@deloitte.co.nz

Whilst restructuring and redundancies are never pleasant, for many organisations they have become necessary to survive in such a challenging financial and business landscape.

The ultimate goal of any restructuring process is to make a business more efficient, productive and competitive.

Reflecting on the process, the weeks leading up to a restructure cause a significant mental and emotional load. Businesses often put their focus and energy into the planning and facilitation of conversation stages, with less emphasis often given to the final step of re-building teams. Re-energising your team following a restructure and keeping your remaining employees engaged, motivated and productive is critical to the process and should not be overlooked. We all understand the risk around the loss of key team members as the ‘unintended’ fallout following a process of change. A proactive, hon-

BY KELLIE HAMLETT

est and consistent approach to positively contribute to the team wellbeing and culture is key.

Here are some practical tips to help begin the process of re-engaging and re-focusing individuals and teams who have just been through change:

Consistent communication – restructuring can bring about a complex set of emotions for all involved. Communication is key; have an “open door” policy and “walk the floor” as a leader,

ensuring you are a visible and accessible. This allows staff to voice their concerns and ask questions. Sharing information regularly and consistently will restore calm, rebuild trust and confidence, and fill the void for negative speculation.

Recognise reactions –Employee feelings can range from fear to relief. Remaining employees may feel guilty that they were able to keep their jobs, whilst some may feel anger. Provide a safe space and sufficient time for your team to come together and talk about the after-effects and recognise how each individual is feeling. Acknowledge that the restructure was difficult but necessary for the ongoing stability of the organisation.

Creating clarity – Effective leadership is critical post a restructure. Employees may be unsure what they are responsible for and who they report to. Take time to provide clarity, to reduce role conflict and stress. Ensure everyone is “on the same page”

and provide clarity about their contribution to the organisational purpose.

Rebuild trust – A mix of formal and informal team-building activities will all go a long way to creating a healthy and happy team culture. Team building activities, social events, and shared experiences can help to foster camaraderie and a sense of community.

Resilient mentoring and leadership – Work to ensure that your employees can trust the company and leadership as consistent, resilient and dependable, along with being committed to developing both the team and a culture of continued excellence.

Re-address workload demands – Often departed employees’ responsibilities are shared out amongst those remaining, causing extra pressure. Coaching, mentoring and training is critical here to retain your top talent. Present these additional tasks as opportunities for learning and growth.

If your company has had to reduce headcount in order to remain viable, it is key to think about how to bring your new team together. How you treat your people during tough times matters.

It’s actually the recovery and beyond which is the most beneficial and influential factor rather than the process itself.

These processes are often a necessary part of the evolution of business – they are challenging to go through, emotional and disruptive for all. The key element to rebuilding is how well you look after your people, to recover and grow post-restructure. This is where the value is added and will determine the success around your process of change.

Talent ID are Recruitment Specialists and can support you through your recruitment process. Please feel free to talk to us about this by calling 07 349 1081 or emailing kellie@talentid.co.nz

Susan Northey and Janet

O’Shea have a combined 28 years of experience working in real estate in Tauranga. As business owners for Tall Poppy, they are turning the tide on the sector and reimagining the real estate experience for all – championing fairness and transparency for their clients and their growing team.

Janet launched Tall Poppy Tauranga South agency in 2017, while Susan bought the Tauranga Central agency in 2018. Having worked with other agencies, Janet says she was impressed with Tall Poppy’s genuine commitment to a consumer-driven approach.

“For me, real estate has always been about the connections you build with the people you are working with, from your clients to your fellow team members.

“Being able to nurture a strong team culture within real estate is almost unheard of, but the modern business model offered by Tall Poppy enables us to work alongside each other without the fierce competition seen in many traditional offices,” she says.

Tall Poppy Real Estate was launched in 2012, putting the fairness back into real estate. The brand had been relatively unknown in the area when Janet and Susan first came on board as franchise owners, and they say the growth they have seen

BY JANET O’SHEA AND SUSAN NORTHEY

in recent years speaks volumes about the business model’s dedication to fairness and customer satisfaction.

Last year, Tall Poppy was awarded Canstar Blue’s Best Rated Real Estate Agents of 2023 - the only independently-reviewed award as voted for by real Kiwi consumers.

“Agencies will often talk about their awards and achievements, but many of these are not based on transparency or the opinions of real consumers – we are proud and grateful to see independent recognition for putting our clients at the forefront,” says Janet.

Susan says it was important for her to work within a dynamic environment that could support real change and progress. Tall Poppy was one of the first agencies to implement a digital-led approach, bucking many of the

trends within the sector, things Susan says have seen their sustained growth.

“The great thing is that the model allows us to be dynamic with our business. It means we can make improvements quickly, implementing positive changes for our sellers, buyers, and agents.

“The traditional agencies often can’t and won’t move as quickly, and now definitely have more competition from a bespoke agency like ours.”

Susan says support for the ongoing development of her team has been pivotal.

“I love that we can offer our team members an amazing and evolving induction, quality referrals and ongoing support of their business; we have worked hard to ensure the continued success of our people – something made possible with the wider support of the Tall Poppy team,” she says.

“For us both, it has always been about the people – our consumers and team alike – and with the values of transparency at Tall Poppy, we have the support to build businesses aligned with this,” says Janet.

Janet O’Shea and Susan Northey are Principals at Tall Poppy Real Estate, Tauranga. They can be contacted: Janet O’Shea - 021 872 072 janet.oshea@tallpoppy.co.nz Susan Northey - 027 576 0499 susan.northey@tallpoppy.co.nz

Upgraded operations are well underway at Whakatane Mill Limited’s (WML) paperboard mill following the businesses official grand re-opening celebrated back in March. The initial months of the year were spent installing new stateof-the-art machinery, as well as upgrading its facilities, and since its re-opening WML is now fully equipped to service its local and global customer chain with premium quality board products.

Customers from across the globe attended the in-person event alongside numerous local and government officials, such as Minister of Manufacturing and Small Business, Andrew Bayly and Local MP Dana Kirkpatrick.

Representing more than mere upgrades to facilities, over NZD$100m worth of private funding has been poured into the business, ensuring the growth and prosperity of both the mill and the local Whakatane community for years to come.

On the day of the grand re-opening, guests were invited to take a tour through the mill to view the new machinery upgrades which will enable WML to produce an additional 50,000 tonnes of premium folding box boards, along with improved environmental and energy systems to further embed the business’ long-term success. The upgrade seeks to increase WML’s total production capacity of up to 200,000 tonnes of premium fold-

ing box board in the future. WML is the only folding box board producer in the Australian/New Zealand geography.

The grand re-opening event is a stark contrast to the uncertain future that the business faced only three years ago where an unfortunate closure was looming over WML. Since acquiring the business, the new owners have invested significantly in the mill’s capabilities, committing to its successful future and the continued prosperity of Whakatane’s local economy.

Executive Chairman of Whakatane Mill Limited Ian Halliday, conveyed the immense pride he had in re-opening the business, setting its course for a fruitful future. “Looking back to when we first acquired the mill, and to where the business is at now, it’s incredibly fulfilling. We have invested heavily in upgrading the business as we always believed in its potential, and to see it now come to fruition is truly rewarding. As the largest private employer in Whakatane, with 80 years of exporting history, we are proud to see the mill step forth into its next evolution.

“We want to thank our team, commercial partners and local contractors who helped with the upgrade, along with our customers who continue to partner with us. We remain committed to further advancements, ensuring a bright future for our business and community alike.”

We love the Western Bay.

And we’re proud of what we’re achieving together to make your place just that. Your Place.

So, when we say, ‘our job as a Council is to do our best for the community’, we really mean it.

That’s why the important things we’re focusing on right now will keep us ahead of the curve.

Not only for today but to also meet the future needs of our children and children’s children.

Things like playing a greater role in providing affordable, accessible, and appropriate housing, growing authentic Te Tiriti based relationships, and building and maintaining infrastructure that responds to community needs.

But we’re also conscious of the challenges that lie ahead, and understand the pressures everyone is under – affordability, cost of living, and inflation. Council is not immune to these challenges, and we’re committed to striking a balance that benefits everyone.

So, when we looked at how much it was going to cost to deliver things next year, and in subsequent years, compared to when we last budgeted for them in 2021, we realised it was going to cost a lot more.

And we knew that it wasn’t acceptable to be passing on all these costs to you.

Which is why we’ve worked incredibly hard to develop the best possible picture for our District, now and into the future.

This meant balancing the impact of things outside of our control, like increased inflation and interest rates, with the things that we can control, our rates and debt levels.

We’ve done the hard yards, working out how we can reduce and smooth the costs over the next 10 years –thinking about where we can sweat our assets, and timing our projects in a way that will reduce those costs.

We’ve also gone through our budgets with a fine-tooth comb, identifying areas where we can save without compromising essential services.

But we’ve got some big challenges in the infrastructure space – in particular the Katikati outfall pipe and Te Puke Wastewater Treatment Plant – and will continue to work through how we’re going to deliver our roading contracts in the next 10 years.

We also want to make sure we don’t lose sight of making the Western Bay a better place to live from what you’ve told us you want in the past. Things like the Te Puke Swimming Pool and Waihī Beach Library.

To strike this balance, we’re proposing a 13.6% rate increase for the coming year, but trust us, every dollar is going toward making our community even better.

While it may mean waiting longer for some projects, we want to reiterate that we’ve made these decisions to try and keep more money in your pocket. We’re dedicated to delivering on our promises while ensuring financial prudence for the long term.

If needed in the future, we can accommodate the additional debt required as our balance sheet is in a good position which gives us the option to borrow. However, we’ll do so with careful consideration to ensure it doesn’t put us in a tough spot later.

So, before we develop this picture we want to see if it’s one you can imagine and are happy with.

A picture that includes spending less on some roading upgrades and walkway/cycleway projects to reduce the impact on rates, improving the way we fund community facilities, and permanently closing Te Puna Station Road.

No matter your views, we hope you will put yourself in the picture and join the kōrero. Because together we can make our community the best it can be.

That’s our commitment to you.

We hope you can picture it. haveyoursay.westernbay.govt.nz/LTP

James Denyer, Western Bay Mayor and Councillors

There’s a new phrase that has entered the vernacular of international franchising. It started in the United States, but it’s now used in franchising discussions in the United Kingdom, Australia and soon, no doubt, New Zealand. That phrase is: “Responsible Franchising”.

The phrase originated from a report and recommendations made by the International Franchise Association (IFA). IFA is the largest membership organisation for franchisors, franchisees and franchise suppliers in the world. Based in the United States where franchising, and in particular franchise sales, are governed by the Franchise Rule, a federal regulation overseen and enforced by the Federal Trade Commission (FTC).

A review of the Franchise Code prompted the IFA to produce the report identifying five core practices of Responsible Franchising.

IFA’s core practices of responsible franchising include

1. Setting clear goals and expectations during the pre-sale period so that franchisors and franchisees are aligned in terms of their long-term relationship.

2. Connecting prospective franchisees with the right opportunity through due diligence and validation of all parties in the franchise sales process.

3. Ensuring that franchisors and franchisees commit to their respective operational obligations to protect both the brand and the franchisee’s equity in their business.

4. Focusing collectively on driving unit economics and profitability for all parties.

5. Embracing collaboration among the franchisor and franchisees through open communications with franchise advisory councils and independent franchisee associations when modifying standards to respond to changing market forces and consumer preferences.

In summary, the IFA believes that one of the most crucial ways to improve franchising outcomes is by enhancing the franchise sales process before a franchise agreement is signed.

I read into this that there is a perceived issue that franchisees are purchasing franchises

whilst being either ill-equipped, ill-informed or misaligned with the brand that they are buying into. Research has indicated this is in spite of the Franchise Code, whose stipulations include franchisors being required to provide Franchise Disclosure Documents (FDDs) with very detailed information on a number of areas – referred to as Articles. The research further identified that FDDs are not being read, are too long, or too complicated by either legal jargon or financial models.

The assertion is potential franchisees are not doing their homework or due diligence, or perhaps are unaware of the available tools to conduct due diligence on a franchise opportunity.

So, what’s the relevance for New Zealand and franchising?

In New Zealand, we don’t have any franchise specific legislation. I share the view it’s difficult to see that it does anything other than add cost and complexity. Whilst I’m not a lawyer, I am yet to hear a commercial implication of franchising raised which is not covered by existing New Zealand legislation.

This means we have a simpler,

and perhaps more user-friendly legal framework around franchising. In my view this produces documentation and information that is easier to understand and again, more user friendly. From reading the Responsible Franchising report, this appears to be one of the over-arching objectives.

In addition to the legal framework, other factors contribute to why I think we already have a culture of Responsible Franchising in New Zealand. We have a competitive but small market for franchisees, combined with a very high ratio of franchisors and franchisees to population. Good operators and brands flourish, the less so fade and or suffer public scrutiny in again, a small media market.

Another factor is that New Zealand Banks are conservative; several have a focus on franchising. They tend to know the brands well, do thorough due diligence on the part of their customers and generally understand SME business as it’s so prevalent in our economy.

Critically, versus being compelled to comply with a Franchise Code, in New Zealand franchisors

BY NATHAN BONNEY

can voluntarily join the Franchise Association of New Zealand. To do so they must comply with the Code of Practice and Code of Ethics. These include providing a Franchise Disclosure Document, and franchisee safety provisions such as a 14-day cooling off period after a franchise agreement is signed. FANZ is also a great provider and incubator of education for both franchisees and franchisors. The Codes and their provisions lift the standard for both FANZ members and non-members.

The proof is in the data. Consecutive franchise surveys report very low levels of complaints and disputes between franchisees and franchisors.

I think that indicates a culture of Responsible Franchising is already alive and well in New Zealand.

Nathan Bonney is a director of Iridium Partners. He can be reached at nathan@iridium.net.nz or 0275 393 022

* IFA Responsible Franchising Report

AI is not just a buzzword or hype. It is incredibly powerful technology that is already transforming business processes, improving customer experiences and enhancing businesses competitive edge.

In addition to the content generation capabilities of the Large Language Models (LLM) such as ChatGPT, Copilot and Bard, AI can help you automate tasks, analyse data, generate insights, and create new value.

AI can also help you solve complex problems, innovate faster and adapt to changing markets and customer needs.

Whether you are a multinational listed company or a local SME, AI can provide incredible benefits for you and your teams.

That being said, AI is not a silver bullet that you can simply plug and play. AI requires careful planning, preparation and implementation. AI also requires a culture of learning, collaboration, and experimentation.

AI is not a one-off project, but a journey that requires ongoing commitment and investment which can help your organisation elevate itself, its customers and its suppliers to new levels.

Before you embark on your AI journey, you need to assess your current state and your desired outcomes. You need to ask yourself some key questions, such as:

• What are your business goals and challenges?

• What are the opportunities and risks of AI for your organisation?

• What are the data sources and quality that you have access to?

• What are the skills and capabilities that you need to develop, acquire or access from external sources?

• What are the ethical and legal implications of AI for your organisation?

• What are the cultural and organisational changes that you need to make?

These questions will help you identify your AI readiness level, which can range from basic to advanced. Depending on your level, you will need different strategies and actions to move forward. For example, if you are at a basic level, you might need to focus on improving your data infrastructure, building your AI

TECH TALK

BY ERIC SMITH

literacy, and exploring some use cases.

If you are at a more advanced level, you might need to focus on finding ways to measure impact to ensure you’re getting maximum return on your time and financial investment.

Once you have assessed your AI readiness, you can start preparing for AI adoption. This involves three main steps:

• Define your AI vision and strategy. You need to align your AI initiatives with your business objectives and prioritise the most impactful and feasible use cases. You also need to define your AI governance framework, which includes your ethical principles, policies, and standards.

• Build your AI team and capabilities. You need to assemble a cross-functional team that can deliver your AI projects and provide them with the necessary tools and resources. This doesn’t have to happen internally – outsourcing key tasks to organisations who are fully immersed in AI can save you time, and working with the right partner will make your journey more successful and impactful. You will need to upskill your workforce in any case, and prioritise a learning culture that encourages curiosity, experimentation, and feedback on everything you deploy.

• Implement and monitor your AI solutions. You need to follow a structured approach to develop, test, and deploy your AI solutions. You also need to monitor their performance, outcomes, and impacts

and make adjustments as needed.

Post-adoption: how to continue to benefit

AI is a game-changer for organisations that want to thrive in the digital age. Executed properly, an AI implementation project that starts your AI journey can bring previously unthinkable efficiencies and new opportunities at an affordable price and time commitment. By following the right steps and focusing on achieving better outcomes which you can measure and continue to improve, you can avoid getting stuck in your journey and reap benefits for your organisation.

Eric Smith is Chief Technical Officer at Stratus Blue. He can be contacted at eric@stratusblue.co.nz or 07 777 0010

Photography: Salina Galvan Photography

ONE TWO FIVE THREE FOUR EIGHT SIX SEVEN

ONEPaulBrljevich(TabakBusinessSales)&GarethWallis(TaurangaCityCouncil). TWOJaquiDonaghy&TrevorDonaghy(LoneStarTauranga). THREEPeterWren-Hilton&JacquiWren-Hilton (Wharf42Limited). FOURLoriLuke(AcornFoundation),AnneBlakeway(TaurangaCityCouncil),LouiseWalch&LisaPepper(CaleysBlinds). FIVEJudeSpicer(BurleyCastleHawkins),KarynGrindlay (ApexAdviceGroup)&RoseGilmore(StratusBlue). SIX MarkBeaudoin&WanitaWood(FirstCreditUnion). SEVENShaniaKeegan(BishoppAirportAdvertising),SimoneDavey&HollyOppers(TalentID). EIGHTFarranInglis(RCP)&RyanRussell(TaurangaCityCouncil).

Talent ID Recruitment has been supporting South Waikato businesses 17 years and now have a dedicated Recruitment Specialist for the region. Aleesha is a proud Taupō local whose role is to partner with businesses to support them through their recruitment and human resource functions. She joined Talent ID in March and is busy introducing herself, placing temps and recruiting roles, along with working on key HR projects. Most recently, Aleesha held a HR role for seven years for a manufacturing business in Taupō. Here she made the most of her Bachelor of Management Studies degree and found her passion for recruitment, onboarding and working with people to make a positive impact.

Simone is Talent ID Recruitment’s newest Recruitment Consultant. Working out of Tauranga, her role is to support employers and the business community to identify and bring top talent to their growing team. A month into the job, Simone is excited by the growth, expansion and development that she is seeing in Tauranga. Her career spans over 20 years both in NZ and overseas within the public, private and not-for-profit sectors performing HR generalist, internal and agency recruitment roles. She is fully qualified

with a bachelor’s degree majoring in Human Resources Management and a Diploma in Career Services.

Sharp Tudhope is happy to announce the addition of Alesha Evetts as Senior Associate to their family law team. With over 15 years of experience, Alesha specialises in complex relationship property, Trust, and estate claims and is excited to take on a leadership role in the team. Her arrival is part of plans to expand the family law team, and she will be sharing her knowledge and skills to achieve the best possible outcomes for the clients.

Stratum Consultants is pleased to announce the appointment of Matt Powdrell to its Board of Directors effective 1st April 2024. Matt joined Stratum Consultants in 2013 and has built a strong reputation in his field forming

longstanding partnerships with clients. His contributions have been integral to Stratum Consultants’ success, both in his roles as Branch Manager, advisor and partner to clients, and as a practicing Licensed Cadastral Surveyor. This appointment acknowledges Matt’s hard work and dedication to clients and the communities Stratum Consultants serve.

Sue Griffiths joins First Mortgage Trust as the newly appointed Lending Operations Manager. Sue says, “I am thrilled to join the FMT team, with whom I’ve had the pleasure of working with in the non-bank market over the past six years. I’m look forward to working with the team to help drive FMT’s growth strategy and to continue supporting the aggregators and mortgage advisers through ongoing education and training.”

“We are excited about the valuable skills and strategic insights she will bring, which will undoubtedly enhance

our lending operations and support our long-term growth objectives,” says Sam Burgess, Head of Lending at First Mortgage Trust.

George Wheelans also joins First Mortgage Trust as Business Development Manager in Christchurch. George will be expanding FMT’s presence and fostering new relationships throughout Canterbury. His background in finance, lending, and portfolio management, coupled with his connection to the local market, will be hugely beneficial to our team.

“His proven track record and comprehensive knowledge of the financial landscape make him an ideal fit for this role. We are confident that George’s expertise and connections will significantly contribute to our expansion efforts and strengthen our position in the Canterbury market,” says Sam Burgess, Head of Lending at First Mortgage Trust.

Mount Maunganui-based publisher Alan Neben is adamant the Bay of Plenty is ‘the’ place to be in New Zealand. He acknowledges times have been tough since Covid 19, but he say’s his team is super-excited about their newest project.

“We’ve been publishing BOP Business News Year Books for five years. But business in the Bay has changed plenty in that time.

“Our team wants us to reflect that evolution, so we decided to change things up in 2024.

“In August we’re launching BoP PLENTY magazine – we’re taking the best of our 100 People magazine and annual Year Book and meshing them together to produce one special new business magazine – a coffee-table business read – profiling high

performing businesses and people across the region.

“We’re really excited to be taking the best of our established titles and remodelling them,” he says.

BoP PLENTY will feature Bay businesses and businesspeople from all sorts of industries and all walks of life.

“We’re going to be telling amazing stories and featuring the personalities who make our business ecosystem the success story it is in 2024.”

Sales director Pete Wales is excited at the prospect of producing a stylish new product for local businesses: “If you’d like to promote yourself or your business in a uniquely local modern business magazine, then talk to us – we want to hear your story.”

Go to bopbusinessnews.co.nz/plenty-magazine or call Pete on 022 495 9248.

The world is getting smaller. The rise of technology combined with the fall of western economies means everything is being scaled-back. Budgets, forecasts, timescales, workforces and expectations are all being minimised, shrink-wrapped and shelved. But for those business owners who are willing to buck the trend, dream big and act bigger, the rewards await.

“This is Tauranga. You need to start lowering your expectations.”

I still recall one of the very first meetings, when I arrived in New Zealand three years ago. As far as motivational speeches go, it wasn’t exactly the Gettysburg address. I had landed in Aotearoa full of hopes, goals and dreams, but these ambitions were being cut down faster than a harvester moving through a field of tall poppies.

The message was clear: Now is not the time to dream big. Big dreams sound exciting and adventurous, but it’s safer to scale-down, knuckle-down and keep your head down. So that’s what I did.

Until, one day, when I was productively spending precious hours of my life sitting in a Bayfair traffic jam, the unexpected happened: I dared to dream big.

Then, to add insult to injury, not only did I dream big, but I started to take bigger actions. Finally, as my actions scaled up to meet my expectations, I started to encounter other people who were performing in the same way.

But the bigger my dreams became, the more people warned me that my business was about to turn into a nightmare. Was it time to get more realistic? In 2024, are big, bold business plans the stuff of fairytales?

Honey, I shrunk I dream

In a world where success is often measured by incremental gains and marginal improvements, dreaming and acting big is

a scary prospect. After all, why go for ‘big’ when ‘average’ will do just fine? You only need to look at politics, sports or corporate leadership to see that acting small is not only encouraged but rewarded.

Sure, it’s OK to talk a big game, but when most people would be happy to get a silver medal 10 times rather than spectacularly fail 9 times and pick up the gold once … taking the path of least resistance feels not only safer, but also a path more likely to be paved with gold.

The time for rebels, dreamers and loose cannons with a point to prove appears over. They’ve been analysed and optimised out of existence. The crazy hopes and wild “But what if we DID actually pull this off?” schemes have been ironed out by focus groups and A/B testing.

Take Apple, for example. In the infamous ‘Think Different’ commercial, Steve Jobs proclaimed, “Here’s to the crazy ones, the misfits, the rebels, the troublemakers, the round pegs in the square holes” .

That was in 1997, when Steve’s natural desire to dream and do big things put the struggling tech company on the path to greatness. But Apple’s meteoric growth over the past decade can be attributed to Tim Cook – a practical and pragmatic engineer – since taking over the helm in 2011. These days, an Apple developer wouldn’t dare to doodle a sketch on a napkin before first running it past a consumer survey

officer. Maybe Apple isn’t as sexy as it was once, but it’s a lot more profitable. Starving artist or middle of the road and rich? I know which the Apple shareholders would prefer.

When nothing matters more than the bottom line, perhaps the time for dreams is over. Jobs; da Vinci; Earhart; Barnum; Pearse; Hillary – are the visionaries consigned to the history books forever?

It would be a sensible idea, except for one issue: Statues are rarely built for people who follow sensible ideas.

The most significant breakthroughs and achievements often come from disproportionate actions and radical leaps of faith, just ask Elon Musk or Jeff Bezos.

But dreaming big isn’t just reserved for industry titans and visionary entrepreneurs. It’s a mindset that anyone can adopt to achieve extraordinary results in their personal and professional lives. Whether you’re striving to advance your career, launch a business, or pursue a lifelong passion, embracing the power of being radically different can propel you towards unprecedented success.

So how can you cultivate a visionary mindset in your own life?

Start by daring to dream without limits. Instead of setting goals based on what seems achievable or realistic, envision the ultimate outcome you desire and then multiply it by ten. Allow yourself to enter-

HIGH PERFORMANCE

tain the possibility of achieving far more than you ever thought possible.

Next, take massive action towards your grandiose goals. Break free from the constraints of conventional thinking and embrace unconventional strategies and approaches. Be willing to take calculated risks, challenge the status quo, and push beyond your comfort zone in pursuit of your dreams.

As the world gets smaller, dreaming big can not only be encouraged, but required, to stand out and make an impact.

But dreaming is not enough. Support, guidance and structure are needed to turn the dream into reality. Thankfully, that is where Tauranga steps up and steps into its zone of genius.

We are blessed with a growing network of dreamers, schemers, entrepreneurs and catalysts who want to make a difference. This isn’t where the dream comes to die … this is where it comes true. I believe we all have a responsibility to ensure dreaming is encouraged, and doing is enabled. This may sound crazy. And perhaps we are all a little crazy in this sunny corner of New Zealand. But, as Steve Jobs said, “The ones who are crazy enough to think that they can change the world, are the ones who do.”

Freddie Bennett is a Guinness World Record holder, bestselling author and leads New Zealand’s leading mastermind group for professionals: Professional Superheroes. He gets businesses unstuck, unshackled and unleashed. Freddie can be contacted at hello@freddiembennett.com

Alreadyseeinganincreaseinlocalcustom,DrMornéduPlessis hasn’tlookedbacksincemakingthedecisiontoworkwithFosters toopenasecondbranchoftheBaySkinCancerClinicatThe Village,Ōmokoroa.

Runningoutofspacetoworkinandlookingtoexpandhisbusiness ‘tothewest’,MornécameacrossTheVillageintheearlystagesof thepropertydevelopment.

“Beinganareathatwasunderservicedinourlineofwork,Ōmokoroa wasagoodlocation”saidMorné.“TheVillageconcepttickedour boxeswiththemixofretail,professionalservices,andhospitality, plusthebonusofaGPclinicsituatedcloseby.”

MeetingtheFostersdevelopmentteamandnotingtheirapproachto meetinghisbusinessrequirementsmadeiteasyforMornétocommit.

“Theproximityofparkingandlifttoourservicewereveryimportant, aswasnaturallightingwithintheoffice.Allourneedswere considered.”

InitiallysignedupforBuildingB,whichwaspitchedasamedical hub,changestothebuildingprogrammemeanttheclinichadtobe relocated.

“Fostersdevelopmentteamweresoquickwithasolution–andthat wastogiveuspartofleveloneinBuildingC.”

WithouthesitationIwould recommendFosters.The connectionsmadewiththeir keypeoplewasinvaluable. Ihadtheimpressionthat eachofthemhadavested interestinthesuccessof thisproject.

DrMornéduPlessis, BaySkinCancerClinic

Mornéismorethanpleasedwiththeresult.“Wehadstrongideas ofwhatwewanted.WiththerelocationtoBuildingC,Fosters developmentteamwereonestepaheadandhadthearchitects drawupadesign.Then,withsomeclevervalueengineering,they deliveredsimilaroutcomesatalessercost.Intheend,Ibelievewe gotabetterspace.”

Projectmanagementandcommunicationwasexceptional,adds Morné.

“Throughoutthedevelopmentprocess,fromconcepttobasebuildto fitout,ourFosterscontactswerealwaysapproachable.Theykeptus informedandwealwaysfeltwelcomeonsite.”

Andthevalueofworkingwithadeveloperandconstructionteam fromthesamecompany?“Ideal”saidMorné.“Havingafitout teamthathadaccesstothebasebuildinformationmadedelivery seamless.

“WithouthesitationIwouldrecommendFosters.Theconnections madewiththeirkeypeoplewasinvaluable.Ihadtheimpressionthat eachofthemhadavestedinterestinthesuccessofthisproject.”

Importantly,thefinalproducthasexceededhisexpectations.“Iam stokedwiththeresultsandmanypeoplehavecommentedonhow goodthenewcliniclooks.”