NAVIGATING UNCHARTED WATERS

There is no doubt that at this point of the COVID-19 pandemic we are venturing into unknown and potentially very dangerous seas. But as the Bay emerges from lockdown to the challenges of the terrifying new world we are coming to grips with, there have also been many inspiring examples amongst the devastation of rising unemployment and imperilled businesses.

By DAVID PORTER

For example, Tauranga’s Downtown CBD, which has for some time struggled to attract customers, is now beginning to flicker back to life as customers return.

Sally Cooke, spokesperson for Downtown Tauranga asserts the Downtown will survive.

“But how well it survives and how quickly it reboots will depend on how successfully the message gets through to our residents to really shop local and support our retail community,” she said.

“We really need that to happen now. Our retailers have to pay rent and support staff. With no tourists, or not a lot, we really need to rely on that local community to keep us going.”

KPMG Tauranga managing partner Glenn Keaney told Bay of Plenty Business News that the firm had been working closely with clients, especially with the smaller companies, to help them get through the crisis. “We’ve been helping ensure they can get the government support they are entitled to and work with them on cash flows and budgeting,” he said.

He noted that a lot of companies didn’t want to burden themselves with more debt, so a key role had been to ensure they developed robust cash flow forecasts and had range of scenarios to meet a variety of outcomes.

He also noted that requests for change management projects were rising.

The difference technology makes

Technology Investment Network (TIN) founder and managing director Greg Shanahan told Bay of Plenty Business News he was impressed by the number of strong technology companies that had emerged in the Bay, such as Robotics Plus, and noted the strong funding infrastructure for new companies that had emerged with venture capital fund Oriens Capital, and early stage fundraiser groups Enterprise Angels and WNT Ventures, providing a good nucleus for growth.

“We are finding across New Zealand that growth has spread more and expanded into the regions in recent years.”

In terms of how the increasing strength of tech companies could help New Zealand survive COVID-19, he contrasted the pandemic with the previous Global Financial Crisis a decade ago.

“One reason COVID-19 is quite different compared to the GFC is the export factor,” he said.

There were now a lot more tech companies, including many successful operations in New Zealand. While the GFC was largely a banking crisis, COVID-19 has literally shut down large parts of the globe.

“A lot of tech companies are businessto-business. They’re often focused on supplying mission-critical infrastructure to other business, not relying on enduser customers. They’re more resilient and less influenced by a downturn than 10 years ago.” – Greg Shanahan

“But a lot of tech companies are business-to-business,” he said. “They’re often focused on supplying mission-critical infrastructure to other business, not relying on end-user customers. They’re more resilient and less influenced by a downturn than 10 years ago.”

What that meant was that – despite the current air travel downturn and other lockdowns, New Zealand was less isolated.

Buying an income is genius. We

Tech companies were in a really strong position to supply export markets, said Shanahan.

“I think New Zealand could come out of this in the end with a lot of relative advantages.”

“In the ICT sector, you don’t always have to put something on a pallet in Long Beach, California and ship it. You’ve got companies providing services in the cloud.” Currency differences meant also that, despite revenues dropping, there could be significant increases for some exporters. And there were New Zealand companies such as Fisher and Paykel that had their own manufacturing facilities in North America (or elsewhere).”

CONTACT INFORMATION

PUBLISHER

Alan Neben

Ph: (07) 838 1333

Mob: 021 733 536

Email: alan@bopbusinessnews.co.nz

EDITOR

David Porter

Mob: 021 884 858

Email: david@bopbusinessnews.co.nz

PRODUCTION

Copy/Proofs/Graphic Design

Times Media – Clare McGillivray

Ph: (09) 271 8067

Email: clare@times.co.nz

ADVERTISING INQUIRIES

BUSINESS DIRECTOR

Pete Wales

Mob: 022 495 9248

Email: pete@bopbusinessnews.co.nz

Bay of Plenty Business Publications specialises in business publishing, advertising, design and print media services. www.bopbusinessnews.co.nz

EDITORIAL:

News releases/Photos/Letters: david@bopbusinessnews.co.nz

GENERAL INQUIRIES: info@bopbusinessnews.co.nz

Bay of Plenty Business News has a circulation of 8000, distributed throughout Bay of Plenty between Waihi and Opotiki including Rotorua and Taupo, and to a subscription base. www.bopbusinessnews.co.nz

Bay of Plenty Business Publications 210/424 Maunganui Road, Mount Maunganui, 3116

Iwas fortunate to have once had the pleasure of working for the late Mike Moore in the latter period of his term as director general of the World Trade Organisation.

Mike was old-school Labour. He left school young, took up an apprenticeship, became involved in union politics, and by 23 was the youngest MP ever elected to Parliament. He suffered a number of severe illnesses in his life, but soldiered on. He put his hand up to serve briefly as prime minister before the 1990 election won by National.

He eventually won a term at the WTO, which suited his considerable talents and expertise. Mike was undoubtedly one of the brightest people I have ever known, with a near photographic memory and a great generosity and capacity for kindness.

And though he had what his staff sometimes found to be an excess of unique ideas

– not all of which could be followed through at the speed he preferred – he was an original and inspiring thinker and deeply knowledgeable on trade matters.

He eventually served very capably as ambassador to the US until he was cruelly felled by the stroke that ended his career and led to his untimely death this year at the age of 71. He was basically one of the good guys, who I had the greatest respect for and found to be a fair and caring man. May he rest in peace.

The current turmoil, and the recent toppling as opposition leader of Simon Bridges by his fellow Bay politician Todd Muller, again brought to mind that Mike was a big supporter of the “loyal opposition”.

The concept lies at the heart of the British parliamentary system we have inherited. Basically parties in power should be regularly subjected by the opposition to transparent in-

quisitorial scrutiny. But they should also be generally supported by their new opposition when positions are exchanged. The ultimate loyalty is to the betterment of the country, not the individual party. Those whose ideas were deemed worthy by the public could expect to eventually get a shot at power without the need for a violent overthrow of government, as seen in some countries that lack a fair electoral system. We are already starting to see signs of global unrest as tensions rise. We are fortunate to live where we do.

The challenges that brought mirror those experienced by people around New Zealand,who found themselves creating makeshift home offices as Kiwis were forced into isolation to combat COVID-19.

Josh and his wife isolated with their one-year-old son.

“We’ve got a two-bedroom house… there wasn’t any separation and my son kept jumping on my lap trying to watch videos online. My boss might not be too impressed with the search history…. Hickory Dickory Dock, Twinkle Twinkle Little Star,” he laughs.

“For several weeks it became our new normal – juggling work commitments in our bubbles, with family, kids and pets.”

While Josh and his colleagues got to grips with working from home, there was one consideration they didn’t have to worry about: their jobs.

“Management made everyone feel supported and able to focus on work rather than worrying about their jobs or the firm,” said professional support advisor Catherine Bryant.

That sentiment was echoed by her colleagues.

“I’m so proud of the way this has all been handled and the confidence the firm had in us to get through this,” solicitor Kirsty Dibley said.

“I felt reassured the firm was coping well and a lot of that came from [Chief Executive] Jon Calder addressing everyone every Friday over MS Teams. He was really transparent in terms of how we were

doing. He told us ‘If you’re quiet with work, don’t worry about that’.”

The firm was resolute that it wouldn’t take the wage subsidy.

“I’m incredibly proud of the fact that [our management and governance team] backed themselves not to need the wage subsidy,” Josh said.

Instead, partners chose to reduce

drawings and absorb the impact, preserving the team and preparing the firm for recovery. There have been no redundancies, no wage cuts. Staff were given an Easter bonus and an internet allowance.

Measures were put in place to maintain the strong, collegial culture the firm has worked hard to build. There was daily communication between teams, virtual morning teas, and CEO updates each week.

The unwavering support was symptomatic of the firm’s commitment to its culture. This is something the firm’s partners have always valued above all else and that Jon has championed since he took up his post as Chief Executive in 2016.

“Our structure with our partner-

ship board and our senior leadership team comprising managers and partners, has proven highly effective in managing the challenge of COVID19,” said Jon.

“But underpinning that has been our culture, which puts our people front and centre. Alongside other values, we’re incredibly focused on providing our people with a great working environment and the support they need to succeed not only in their roles, but to thrive professionally and personally.”

Leading New Zealand investment bank Craigs Investment Partners (Craigs) has emphasised its commitment to keeping its head office in the Tauranga CBD. And it has just announced a new strategic alliance with global bank JP Morgan (JPM), which managing director Frank Aldridge told Bay of Plenty Business News would enable Craigs to maintain its independence, but improve its global network and local offerings.

By DAVID PORTER

“We retain 100 percent ownership of Craigs, and we are 100 percent committed to keeping our head office in Tauranga,” he said.

Craigs announced the re-purchase of Deutsche Bank’s 49.9 percent interest in their business late last year.

Aldridge said the alliance with JPM was unrelated to COVID-19, though the timing was expected to be helpful in strengthening its global ties and position.

Commitment to staff ownership

“It was definitely our intention when we bought back the Deutsche Bank stake to be a fully staff-owned firm,” he said.

“We’ve had discussions with a number of parties and JPM was a standout for us.

From a New Zealand perspective it was very important we kept our independence. And they don’t have an operation here, aside from a small custody business. We are effectively going to be their New Zealand branch.”

Strategic strengths

The strategic alliance brings together the deep geographical expertise and strong corporate relationships of Craigs in New Zealand, with JPM’s global corporate advisory and equity capital markets experience.

“We are excited to be forming a strategic alliance with Craigs,” said Robert Bedwell, chief executive officer, JPM Australia and New Zealand.

“This reaffirms our commitment to delivering our full range of local and global capabilities to Australasian clients and elevates our offering for New Zealand-based clients.”

Aldridge said it was good for Craigs and for New Zealand that one of the biggest global banks wanted to work with them.

“It’s good for our staff and our clients.”

Broader range of products

While the alliance brings benefits to Craigs’ corporate and private wealth clients, there will be no change to the business structure, the operations or management team leading the firm and service to clients would remain seamless, said Aldridge.

The opportunity to work closely with JPM would help Craigs offer an even broader range of financial products and services, and significant investment opportunities for clients.

Aldridge said there were several key touch points in the deal. One was in the firm’s institutional equities business. Craigs will get JPM’s global flows into New Zealand and would direct its own international flows back through JPM.

JPM is a leader in Mergers and Acquisitions, Equity Capital Markets and Debt Capital Markets, as well in Equity Sales and Sales Trading. Coupling their franchise strength and expertise with Craigs’ leading private wealth and investment banking business in New Zealand solidifies the alliance as a market-leading offering, the companies said in a statement.

“We will also be partners in terms of any M&A and large trades involving New Zealand.”

And a third element was the expected impact on Craigs’ private wealth business, which accounts for 80 per cent of its revenues and profits.

“We’re really looking to try and evolve and access JPM’s products and services in private banking components globally, to bring these back to our clients in New Zealand.”

Aldridge said that the impact of COVID-19 had not changed Craigs’ decision-making process.

New office space considerations

In terms of office relocations, Aldridge confirmed a recent newspaper report that Craigs planned to go ahead with a long-discussed move to larger premises in Tauranga’s downtown.

Property development and investment company, Willis Bond & Co has plans to develop the 4300 sq m site at 82-98 Devonport Rd, which is currently the subject of a conditional sale and purchase agreement with the owner, Tauranga City Council. Craigs was reported as a likely anchor tenant.

Aldridge reaffirmed to the Bay of Plenty Business News that the firm was committed to finding new premises within the Tauranga CBD and would be wanting naming rights.

“We’re still going through a due diligence process on what we need and how we do it,” he said, adding that the Devonport Rd site was “the one we’re focusing on right now”.

This

is a tough time, but I’m sure we’ll come through it.”

– Frank Aldridge

The new norm is unknown

Craigs has 170 staff in Spring Street and a further 50 in Red Square. But Aldridge said a new build was realistically two-and-a-half years away.

“We have a plan catering for growth out to 2025,” he said.

“We’re firmly centred on head office being in Tauranga, and we want to get us all back together in a purpose-build environment.

“But what is the new norm? We got 540 people [nationally] working from home in four days prior to lockdown.

“I think there is going to be a new norm, but I don’t quite know what that is. It’s still too early to say what is going to happen. Nobody really knows and we won’t see for the next three to nine months.”

But he said that anecdotally, it seemed as if New Zealand and Australia were not bad places to be in at the moment.

“This is a tough time, but I’m sure we’ll come through it.”

When lockdown hit, it plunged Tauranga’s Trustpower Baypark into a strange new world. The Bay’s biggest events centre could no longer carry out anything resembling business as usual under the strict terms of the government’s new rules.

“Before lockdown we were hosting in excess of 350+ events a year with 1.7 million people enjoying our activities annually,” said Business Development Manager Gillian Houser.

But Trustpower Baypark wants the Bay – and New Zealand – to know that it is back and looking forward to welcoming people into all its venues and has refocused to introduce a number of new virtually focused business lines.

“We are confident that in ‘short time’ we can again claim the status of Hub of Entertainment for Tauranga and Bay of Plenty.”

All the venue’s teams are excited about getting back into action, she said, as, before COVID-19, 2020 had been shaping up to be an outstand-

ing year of activities.

The pandemic effect has been dramatic with all events cancelled or postponed from the time of lockdown until the end of June.

Some meetings have now been confirmed for June and from July activities will increase with a positive outlook for the later months of the year.

Many favourite Trustpower Baypark events will be back and the venue emphasised that it is mostly local businesses providing activities for the community of Tauranga.

But the past weeks haven’t been idle. During lockdown there has been considerable activity taking place with teams researching new initiatives, adapting and finding opportunities amongst the challenges.

Basically – as with many busi-

nesses – the focus has been on thinking differently about how services are delivered to enrich the lives of the community and creating a new normal.

New virtual creative concepts

An innovative creative concept has been developed with Trustpower Baypark’s new campaign for Virtual Meetings to “Bring your events online”. The range of onsite and offsite services now includes: Remote Presentation, Video Conferencing, Web Streaming and

Hybrid Conferences. The Virtual Meeting services also include purpose-built studios to ‘broadcast standard’ offering competitive packages to enable clients to continue to stay connected to their audiences.

With Video Conferencing, a team can be located onsite and interact with other teams or presenters offsite. Video conferencing service provides a two-way form of communication – providing clients with connectivity from the onsite meeting or event to single or multiple world-wide

You don’t have to be too much of a salty seadog to know that if you’re heading into uncharted waters, with a forecast for plenty of storms ahead, you don’t want to be in a leaky boat. Likewise, to successfully navigate the economic times ahead businesses need to ensure their IT platform is secure and reliable.

From a technology perspective, focus should be on the following:

• Reliability – IT equipment needs to work and be suitable for business (not home) use. All hardware should be maintained, with security and firmware patches applied regularly. Equipment

> BY TONY SNOW

Tony Snow is chief executive and co-founder of Stratus Blue. He can be contacted at Tony@stratusblue.co.nz.

should also be monitored so issues can be pre-empted or jumped on quickly should they arise.

• Security – Ensure data and systems are secure. Accurate data is essential to ensure businesses run effectively not to mention the reputational or financial damage that could result

should systems be compromised. Business grade antivirus software must be used and kept up to date.

• Business Continuity – how long can businesses work without IT systems or data? How much will it cost businesses in terms of time, safety, reputation and lost revenue if critical systems

cannot be accessed? Core data (including mailboxes) should be backed up as a minimum and businesses should have a business continuity plan to ensure they know the processes required and likely timescales for restoration of systems.

Business owners and managers are generally pretty

destinations.

An event or presentation can also be streamed onsite directly to a client audience. A one way broadcast that allows the audience or team to connect from wherever they may be, reaching team members, delegates or business clients safely and effectively, said Houser.

Streamed Hybrid Conferences will allow a worldwide audience to view a client team onsite to interact with other presenters at any location. This is a combination of web streaming and video conferencing – effectively an online conference, says Trustpower Baypark.

And planning is also underway to introduce the concept of drive-in concerts and movies to Trustpower Baypark and will be announced as government restrictions on mass gatherings are lifted.

Challenges over timing

The main difficulty since the re-opening has been to provide dates/space for the number of events that have been post-

poned, given that 2020 was already at a premium for bookings. Venue organisers are working closely with clients to maximise all the venue space possible.

It may take some time to return to how things were, but for now the focus at Trustpower Baypark is to keep customers and staff safe in Level 2 and in order do to this COVID19 protocols are in place for all events.

The premises have been thoroughly cleaned and an anti-microbial fog has been applied throughout to provide long-lasting protection. This sterilising product remains active on all surfaces for up to three months.

The company has also introduced a high level regime focused on increased hygiene procedures, physical distancing and contact tracing.

For more information connect directly with the Business Development team on 07 577 8591, email events@ bayvenues.co.nz. or link to the Virtual Meetings page on www.trustpowerbaypark.co.nz. – David Porter, editor

smart and most should have a reasonable idea about where they see their businesses heading in the current climate.

However, from a technology standpoint, it’s important to take a breath and go back to the fundamentals.

Businesses should ask themselves whether their current technology platform supports their current business vision.

What was right two months ago might now be completely wrong. Businesses might feel comfortable addressing these questions themselves; however, they’ll also likely find talking through options with

their technology partner or trusted technology advisor helpful.

Go back to basics. Businesses must ensure they have fundamentally sound and fit for purpose IT infrastructure in place.

Also, they should take a bit of time to stop and assess business governance, process and practice. With solid foundations underpinning each business combined with a fluid mindset they’ll be in a position to not just navigate the tempest but adapt and grow as opportunities present themselves over the coming weeks and months.

While it is too early to be making conclusive assessments about the commercial property sector as a result of the game-changing COVID-19 pandemic, we’ve settled the argument about the need for physical office space.

Ultimately, the trends that evolve over the coming years will be all about our people – He tangata, He tangata, He tangata – and society’s ongoing need for physical interaction.

Work is more than just meetings and production. It’s the inspiration, the spark, the No.8 wire, the grey area that exists in-between.

Occupiers are looking for the workplace to create this social fabric. The workplace is the glue. COVID-19 has simply been a catalyst to take us “back to the future”. Many of the innovations we will see shouldn’t come as a surprise.

It is the future we have been talking about over the past five years, but haven’t seen widely implemented because businesses have been too busy in growth mode – and vacancy rates have been at a record low.

But the time for change and a shift in the narrative has come. Pre-COVID-19, many businesses faced resistance from within the workplace when trying to implement technology changes.

Teams were reluctant to adopt these technologies and yet, now we’re all experts on Microsoft Teams (launched

2017), Slack (2013), Google Hangouts (2013) and Skype (2003).

Health impacts, social disruption and catastrophic fallout aside, this unprecedented viral catalyst has unwittingly provided the generational shift that the office market has been needing.

The flight to quality, the difference between A and B grade office stock, the difference between good and great –now becomes a significant gap and our sudden new reality.

What does this mean for commercial property?

See attached table (right)

The fall and rise of coworking

There has been a lot of commentary about this sector –with many polarising views about its success.

The naysayers will tell you this is the end of the road for the coworking model, and for a time they may be right.

We are likely to see some short-term pain as casual/ monthly members drop this expense almost immediately.

However, the global coworking players have been evolving their offerings into more long-term (two to three years) opportunity for enterprise solutions.

Effectively putting them into direct competition with many major landlords for

Cost conscious decisionmaking – and more options

More flexible tenure – once bitten, twice shy

Health conscious – safety of talent and place

Choice – giving options to a more mobile workforce

Office workspace – focusing on the main pillars of business

Simple, done well – and with no frills

Revised spending patterns –local, proud and embracing new business

larger tenancies. The coworking solution comes fully fitted out, with flexible lease terms and activation space – many of the trends that major landlords are going

• Pressure on net rental levels – but tenants may be happy to spend more to get security and safety.

• Competition with sub-lease space from distressed tenants – resulting in higher incentives for new space or a contribution to tenant fit out.

• A demand for shorter term leases – or multiple leases on a single premise.

• Break options will become a more popular ask – perhaps landlords can introduce appropriate costs to reflect.

• Within the physical environment there will be added requirements for cleaning, temperature checks, 100% fresh air, some physical distancing, etc.

• But the time to complete new leases may extend (and have extra cost), as tenants look to involve insurers and other specialists in lease negotiations.

• Hub and Spoke is back in a new form – Core + Flex. Conventional or “core”space is mixed and matched with supplementary/adaptive flexible space we’re calling “flex

• Spoke options often have additional cost saving benefits such as fringe rents vs CBD –or the addition or temporary “flex”space when required.

• Not only will tenants want multiple locations for health reasons, there will also be much more mobility due to our adoption of technology.

• More focused businesses will require less resource – and therefore a reduced office space footprint for most occupiers.

• A change in design language will also become apparent as workplaces offer small (paperless) desks, but with more flexible space.

• Perhaps we will also see the rise of new materials for interior designers with antibacterial products.

• SaaS – Space as a Service. It is there to provide the social fabric for collaboration and innovation.

• Greenstar and NABERSNZ ratings will become the benchmark tools.

• No longer the need for on-site yoga or farmers’ markets with add-ons pared back. Just a great (local) coffee shop, public green space and a good bar.

• Supporting local businesses will see different retail solutions around office premises.

• Growth of new companies who fill the void from those that go under – and those that benefit from the new booming sectors in a post COVID-19 world.

to be dealing with over the coming years.

A final thought for fun

What are we going to be wear-

ing when we get back to work? Will we continue the casual attire we have become accustomed to at home and will this be the end of the necktie? Or will we embrace traditions of

our previous generation and take more pride in our attire and bring back the three-piece suit?

www.bayleys.co.nz/workplace/ articles/insights

A

Investment Market Update for the quarter ended 30 April, 2020

> BY BRETT BELL-BOOTH

Investment Adviser with Forsyth Barr Limited in Tauranga, and an Authorised Financial Adviser. Phone (07) 577 5725 or email brett.bell-booth@forsythbarr.co.nz.

OVID-19 has undoubtedly been the most dramatic “black swan” or unexpected shock since the 9/11 terrorist attack. The threat has rapidly shifted from an outbreak in China, where the principal economic concern was the impact of Chinese manufacturer shutdowns on the rest of the world, to a global pandemic.

Governments around the world responded. In many countries all but non-essential businesses have been closed. The economic and financial landscape has seen a dramatic shift. Interest rates have plunged. Policies to protect jobs and businesses have been enacted, but they still won’t prevent sizeable layoffs. The outlook for corporate earnings is highly uncertain. Many companies have suspended earnings guidance, with little clarity over the medium-term.

Policymakers have responded

Central banks have cut interest rates, provided liquidity to the banking system so banks can continue to lend to businesses, and have started or continued buying bonds to help stabilise credit markets.

Governments have provided a range of support measures including wage subsidies to workers forced to stay at home, loans for banks to encourage financial support for businesses, mortgage holidays, and some tax relief. Looking forward, a number of governments are already planning to accelerate and expand investment in infrastructure as a key policy platform to help the economic recovery.

Defensive markets and sectors have led the rebound

Policymaker responses kicked off a rally in asset prices. From late March, equity and bond prices have recovered sharply. Positive momentum was sus-

From late March onward, aggressive responses by central banks and governments around the world shored up financial markets.

tained as lockdown measures across countries have (so far) proven effective in containing the virus’s spread. Lockdown restraints are now starting to be lifted.

The rebound in equity markets has been led by higher quality, defensive stocks. New Zealand’s outperformance reflects the defensive nature of many of the leading companies on our market. Healthcare companies like Fisher & Paykel and EBOS, consumer staples such as a2 Milk, electricity utilities, and telecommunications, will all be more resilient through an economic downturn than most.

The US market is similarly defensive, dominated by large technology companies like Microsoft, Amazon, Alphabet (Google) and Apple, and consumer staples like Johnson & Johnson, Walmart, and Procter & Gamble.

More cyclical sectors – like energy, financials, and materials – that are more exposed to the level of economic activity have lagged.

A word that has been used

Sometimes the best way to talk about how to do something well is to start with how not to do it. Here are a few thoughts on the common mistakes I see people make when they buy a business. Economic uncertainty makes the impact of these mistakes greater. So, if you are buying a business please try and avoid them.

Do not pay too much for the business. This sounds simple, but sometimes it’s hard to do. For the same reason you might bid extra at a house auction (you may love the location and the implied lifestyle etc) people can talk themselves into paying too much for a business.

Competition between other interested parties is not always as visible at a house auction, but the pressure of other buyers being in the wings can also have an impact. Now you need to do more homework than you would have otherwise done on the true value of the business and its ongoing profit potential.

Not having enough funding

We are going to see more business failures in the next six months due to the lack of appropriate credit facilities than we will because they were bad businesses. This not the time to commit all your resources and mortgage yourself to the hilt when buying. You need to keep some powder dry and

You need to keep some powder dry and allow room for further uncertainty. You can count on things not going exactly to plan – and having a war chest of funds gives you room to manoeuvre.”

allow room for further uncertainty. You can count on things not going exactly to plan – and having a war chest of funds gives you room to manoeuvre. Some businesses will struggle simply because of a relatively small thing such as a change in supplier credit terms. For example, if the suppliers change from 20th of the month following for payment to seven days because you are a new owner. Previously a business had up to 50 days free credit – now that is only seven. If your customers are not going to pay you any earlier then there is a cashflow gap that either you or a bank must meet. Unfortunately, some people will not be able to.

a lot recently is “unprecedented”. These are unprecedented times. There hasn’t been a global pandemic since the 1918 Spanish Flu, and the world is a very different place today than it was back then.

The result is a tremendous amount of uncertainty as to how economies and companies will fare.

Will there be a second wave of the virus? What damage is being done to economies while in lockdown? How many jobs will be lost? How many businesses will fail? Will a vaccine or medical treatment be found, and, if so, when? Forecasters are grappling with a very broad range of possible outcomes over the next few years. What will a recovery look like? V, U, W, L?

A rapid recovery is described as ‘V’ shaped – a sharp downturn followed by an equally sharp upturn. A ‘U’ is a longer period at the bottom before activity picks up gradually. The most pessimistic are ‘W’, a double dip or an initial recovery that doesn’t prove sustainable, or ‘L’ where economic activity falls sharply and remains low for an extended period.

More volatility potentially ahead – be prepared

There is no doubt that actions from governments and central banks have stabilised financial markets. We think the market lows are most likely behind us. But there is still plenty of uncertainty, and as we’ve seen

over the past few months, sentiment can change quickly. There is potential for further market volatility ahead. The past few months do reaffirm some important messages for investors. We don’t believe it’s possible to consistently time or predict shortterm movements in markets. Markets oscillate between greed and fear. And they do not need a positive economic backdrop to bounce – markets expect a “less bad” outlook today than they did in March. The low returns on offer from cash and bonds will continue to encourage investors into equities.

We all prefer positive news over negative. Investors generally feel better when markets go up, and it can be disconcerting when they go down. But unfortunately volatility is something investors will always have to bear. The key is managing your response to it. Working with your Forsyth Barr Investment Adviser to formulate and stick to an investment plan with clear objectives is one of the best ways to do so.

This column is general in nature and is not personalised investment advice. This column has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. Disclosure Statements for Forsyth Barr Authorised Financial Advisers are available on request and free of charge.

Investigate whether past results are repeatable

Another reason that a buyer could struggle is that the business model is no longer valid i.e. past results are not repeatable. Just like you will give a house a solid spruce up prior to sale this happens to many businesses as well.

If you come in as a buyer and expect things to continue that same upward trajectory (and your finance depends on that happening) it can be challenging. Sometimes the reason the vendor is selling will be purely due to retirement. However often it can be a combination of that and the industry getting harder, new competitors taking

> BY TOM BESWICK

Director at Ingham Mora Chartered Accountants in Tauranga, is a business advisor who specialises in buying and selling businesses. He can be contacted on 027-5744- 019 or tom@inghammora.co.nz

market share, or customer demand softening.

Too many businesses get the key from the vendor and that is the last they see of them. This exposes the business to risk as there is no continuity of ownership.

This can cause issues for clients, staff, and suppliers. I am convinced many buyers do not explore ways to incentivise vendors to stay and assist in the business longer well enough. They fail because they bought a lifestyle dream, but

it turned into a nightmare. We all know people who have decided to leave busy jobs and buy a business here.

Of course, for many it does work. However, if the rosetinted glasses were on and the dreams of lifestyle and location influenced the price paid then this can be a problem. Not only does overpaying become a problem – the non-financial impact of a struggling business is very real (i.e. stresses on the family due to long hours and uncertain

income). Above all, lack of listening to advice, and then failing to act on it in my view is the biggest ender of businesses. Kiwis like to go it alone – we are often slow to ask for help. Too many end up in liquidation that could have been avoided, had action been taken earlier. If you or a client is thinking of buying a business, then helping them avoid some of these mistakes will go a long way to helping them succeed in these uncertain times.

The world has changed. We are not talking summer to winter, we are talking ice age. In fact, I would suggest that while we have witnessed the impact on human health, we have not even glimpsed the tip of the economic and social iceberg that is coming over the horizon.

> BY NATHAN BONNEY

Nathan Bonney is a director of Iridium Partners. He can be reached at nathan@iridium.net.nz or 0275-393-022

have previously discussed the counter-cyclical relationship between the economy and franchising and why the unique traits of this economic iceberg will lead to a new growth of franchising. It should be noted, not all are going to benefit, and we are already seeing glimpses of what successful will look like as we move into this new economic and social environment.

As always, those that change and adapt will prosper, those that do not, will not survive.

Franchise models that were able to continue to trade online during shut-down or by being an essential service benefitted from the initial environmental change, but moving forward, genetic sequencing of the suc-

cessful franchise species will have similar characteristics.

Best systems likely to be more successful

Having the best burgers, coffee or retail offering will not equate to survival or dominance of the species.

Unquestionably, as unemployment increases, an increased number of people will look towards franchising as their Plan B.

Many would have spent considerable time as employees learning fantastic skill sets, suited to performing a role or job function. They will not be looking at a franchise to learn a task, they’ll be looking at a franchise to buy and develop a business. However, their abil-

ity to run or manage a business may be non-existent.

Over time, the truly successful franchise brands will be those that have the best systems. Everything from how they manage a recruitment process, how they take someone with no business experience and train, to how they support and develop franchisees to grow their businesses. Better systems also include protecting the brand, and looking forward at the challenges and opportunities.

Capital is a critical component and generally, the more capital intensive a franchise model, the more challenging it is to grow that system. We are seeing a rise in interest in lower investment level franchising. But it is not only the

Capital is a critical component and generally, the more capital intensive a franchise model, the more challenging it is to grow that system.”

absolute numbers involved, it is the ability to borrow, fund and produce a return on investment.

Franchise systems that can accommodate different funding and capital arrangements and/or produce super returns on investment levels will be more successful.

These could involve any combination of mixed capital models, the rise of the traditional co-operative structure,

Has staying connected ever been as important as it has over the past couple of months? Entertain the thought of what the lockdown would have been like without internet and mobile connections. Technology meant we could keep our sense of togetherness despite being physically apart and it made the recent adversities we’ve faced as a nation bearable.

Different ways of working and living

Lots of us made new habits during lockdown.

Podcasts, TV streaming and House Party quizzes kept people entertained and sane. New Zealand households set internet consumption records in April, each using almost 500 gigabytes of data, up around 30 per cent from February. The 700,000 households with fibre used on average enough for 12 hours of video conference calls a day.

Businesses that had to shut during lockdown kept in touch on what the ”new normal” would mean for their operations and contactless ways of trading were thought up at lightning speed using new apps and online selling.

Good for morale

Once people adjusted to working from home, our workplace leaders stepped up. Regular video messages kept us in the loop, while one-onone and team calls kept us focused and clear about our duties. Technology allowed us to collaborate virtually. The morning team meetings or Zoom call kept us to regular schedules, providing some much needed structure. We missed our colleagues, but technology kept us connected and engaged. Businesses adapted

As the nation went into lockdown and businesses adapted and reshaped their working practices, 2degrees’ unlimited mobile plan gave its business customers the freedom to operate out of hastily set-up home

preferred funding arrangements with banks, through to crowd funding and social capital investment schemes.

We have seen an immediate swing away from bricks and mortar businesses towards mobile and work from home.

Suddenly having premises and a lease has become a potential and significant burden. Conversely, those without premises, and associated cost, have fared reasonably well.

However, there will always be businesses that require a physical presence. Models that do not tie a franchisee to a traditional extended period lease, and or models that are able to provide a flexible rental or property model for franchisees, will unquestionably be favoured in the short-term and benefit from growth. And these will potentially be more robust

and successful over time. Hamburger chains selling bread and milk and high-end restaurants delivering cook your own food boxes are perhaps extreme examples of the now almost cliched “pivot” approach to diversifying income streams and even the concept of the business.

I would suggest the need for franchisors to protect income will encompass both the aforementioned change in product or delivery model at a unit level and perhaps more importantly, their need to insulate and diversify income. This will often be intrinsically linked to the franchisees income. This may involve multibrand and multi-concept ownership, or vertical integration including distribution outside the franchise system. It might be cold outside. But do not worry, the franchise business model won’t just survive the cold, some will adapt and thrive in it.

offices and reach out to their colleagues as often as necessary without worrying about exceeding their data or call minutes limit.

2degrees’ Business Choice Unlimited Plan for mobile includes unlimited data, text and call minutes plus free hotspotting for just $35 per team member per month, when shared with 10 employees.

This plan has already allowed 2degrees customers across all types of operations – from offices and retailers to tradies and delivery services – the freedom to set up new ways of working.

Mobile connectivity for all types of business

All 2degrees mobile plans come with New Zealand Carryover Data and are open term – that means no more locked-in contracts.

Troubleshooting is easy with a New Zealand-based business support call centre, with dedicated phone and in-person account managers.

And for those businesses with

sister offices in Australia, there’s free daily business roaming, plus unlimited calls and texts to NZ and Australia.

Keeping costs down for Kiwis

2degrees has been fighting for fair for Kiwi businesses since 2009, and are committed to making access to communication simple and affordable for New Zealanders.

The Business Choice Unlimited Plan gives their business customers an easy, affordable way to enjoy unlimited data, calls and text, to keep their businesses connected. Visit 2degreesbusiness.co.nz to find out more about how they can help your business, or call them on 0800 022 249.

This Special Focus underlines the enormous creativity that the Bay of Plenty has displayed in its responses to the exceptional circumstances we have all found ourselves in.

As we note on the cover, we are all entering uncharted territory now.

As the lockdown has slowly reduced in severity levels, businesses have been quick to adjust their ways of doing business to the greatly altered circumstances.

But we need to continue to take care of ourselves and of each other unless we slip back, as has been the case in many countries around the world. By uncharted we mean that the “new normal” is, of course, not what we are preparing for. None of us knows what that normal will be. We may be entering an era where change is a much more visible part of everyday life and business than it has ever been. And that it will be

a continuously evolving process. The companies in this feature – each in their different categories – display the leadership, adaptability and strength that is needed in these troubled times.

And importantly, they offer examples that can inspire and guide us all as we navigate and manage the challenging economic times ahead.

Above all, their stories reflect the enormous kindness and community spirit that has been a hallmark of the business response to the pandemic. And they reflect the generally collaborative approach that has always been a strong element of the Bay of Plenty business community.

Be safe.

– David Porter, Editor

Covid-19 has created new challenges for all businesses and the Hotel Armitage and Conference Centre is no exception.

However, we believe in every challenge there is opportunity and the chance to evolve, adapt and become a stronger business for it.

One of our core values, our team spirit, has been tested and strengthened. It is the determination and support of our staff that makes us resilient and able to focus on reconnecting with our guests.

At the Hotel Armitage, we believe first and foremost in caring for each other, it is the essence of hospitality. Our focus has always been on keeping our guests and staff safe.

The hotel has remained opened throughout the lockdown period, giving us the opportunity to work with Government agencies to provide accommodation for those in need in our community.

Our well-established stringent Health and Safety Plan, in accordance with the Ministry of Health’s

guidelines, assures the safety of our guests and staff.

We saw the low occupancy rate as an opportunity to continue the final stage of our room renovations.

The hotel has been transforming over the last few years and we are able to see the progress pay off in the positive feedback we have been receiving.

Guests that stayed during lockdown appreciated our generously sized bedrooms and balconies.

We have increased our offerings with flexible rate reductions on our already best prices to encourage guests to book directly with us.

Hopefully, New Zealanders will continue to support #lovelocal campaigns nationwide and choose to book directly with hotels to support the tourism industry getting back on track.

With flexible offers which include long-stay weekly rates, there has never been a better time to book direct and rediscover Tauranga.

While our inhouse restaurant

was required to close temporarily, we adapted by offering contactless room service and Uber Eats. Our soon-to-be reopened restaurant will follow the three S’s guideline of seated, separated and single server.

Our large conference rooms are perfect for maintaining physical dis-

tancing and we have great deals available for the coming months when larger group can once again congregate.

We would love to hear from you to discuss how we can be of assistance for your next holiday, business trip, event or community support.

In relation to accounting there are three key areas we think are important to help businesses navigate the tough times ahead:

1. Managing taxes – unfortunately the IRD has not forgiven any taxes due. However, there is now additional flexibly on how you pay these off. The IRD now has discretion to write off interest and penalties – once the original tax is paid. If ever unsure about what tax to pay first – choose PAYE. If you are going to have a problem paying, then make sure you involve your accountant. The rules are no different whether talking to the IRD, your bank (or even your partner). If something is going wrong – talk about it. The accountant should help you get the message right with the IRD and bank.

2. Improve your knowledge – businesses also need to improve their level of financial understanding. We have already seen some businesses that relied on current sales to pay last month’s bills. Sometimes this was done out of necessity, but also a lack of financial literacy played a part. Many business owners need to learn how to read their financial reports so they can make good decisions and plan with greater confidence.

3. Ask for help – we have all been in information overload, particularly business owners who are working through all the support packages that have been released. The Government and IRD have been making changes so quickly that there is more grey area then there usually is in the tax rules. It is important to read the conditions you are agreeing to. If you are not sure – ask for help.

We will provide trusted advice to local business owners and investors. Some clients will need help understanding all the new rules, help with an IRD negotiation, help getting more bank funding or just a sympathetic ear.

While businesses will need accounting help, Ingham Mora will also be here to provide focused business advice and assistance too. The two key areas where businesses need the most assistance is with optimising their cashflow and business planning for the uncertain times ahead.

Business Planning – If you fail to plan, you’re planning to fail

Every business has been impacted in some way by Covid-19, and every business should have a plan to deal

with the fallout. A plan will help businesses reset their futures by reviewing their response and assessing the true impact on their business. A plan should set realistic goals to strengthen every aspect of the business.

A plan should have a high-level budget, details of necessary recovery finance, key opportunities and vulnerabilities, most critical challenges, risks and mitigation strategies. It should set annual and 90-day goals and actions. This will give businesses the best chance of recovery.

Businesses should know their cash – where it comes from and where it goes to. One of the most important

ways for businesses to improve and recover is to shorten their cash conversion cycle.

In other words, get their cash quicker. There is also a big difference between profit and cash and business owners should have a handle on this.

Profit is what they pay tax on; cash is the oxygen their businesses need to survive.

Profitable businesses can, and do, go broke at times like these. Businesses need to be looking at how they can maximise their cashflow using strategies to get paid quicker, reduce stock or work in progress or by negotiating better payment terms with their suppliers.

Now is not the time to be slow or lenient on debt collection. Like-

wise businesses need to be very careful about re-ordering stock –can they operate with less stock or are there items that are likely to be in short supply?

Other areas to assist cashflow include capitalising on the many tax concessions available right now and looking at different interest and debt repayment arrangements with their banks.

Businesses should be forecasting their cashflow out six months and beyond and reviewing and updating their forecasts weekly.

Survive and thrive

In terms of what we are doing differently – we are making a conscious effort to spend more time than ever talking to our clients and providing support and assistance with free resources and regular webinars. An accountant that you trust and who has time for you can be a real difference maker.

We are a firm backed by experience, enabling us to provide expertise across the life cycle of a business. We are a full service from tax to business advice, and believe there is no one better equipped to provide you with the advice and coaching your business needs than the one that knows your numbers.

Make sure your business is ready to survive the impact of Covid-19 and thrive. Give our team at Ingham Mora a call today.

By EDDIE STOCKS, Regional Manager Waikato/BOP, Kiwibank

New Zealand has a stable economy and a history of weathering global financial challenges well. Our central bank and government are doing what they can to minimise the economic impact for Kiwis, and the New Zealand public has responded responsibly to the lockdown.

Here at Kiwibank we’re playing our

part too. We know small and medium businesses are the backbone of the New Zealand economy.

We know in this current environment cashflow is an issue for many, so we have a resilience and recovery programme to support our customers.

Options available to our business banking customers are changing your loans temporarily to Interest Only, Temporary Overdraft Facilities, Loan

Kiwibank is committed to making a real, positive impact where it matters for New Zealanders and New Zealand so we’re working hard to keep our people, our customers, and the New Zealand economy safe and financially secure during these unprecedented times.

Repayment Deferrals, and the Business Finance Guarantee Scheme. (Criteria does apply, and this is only open to current Kiwibank customers. If you bank elsewhere, you need to approach your own bank).

If you need assistance, we suggest you visit our website in the first instance or call your relationship manager. We are also working to ensure our own staff can continue to work safely and productively.

Our Call Centre staff continue to go into the office everyday, and under Level 2, Relationship Management staff are back in the office on a split-week basis to ensure complete coverage for our customers. We look forward to hearing from you if you need us. Buy Local means bank local too.

Please visit our website for more information. www.kiwibank.co.nz/ business-banking/

Small and medium businesses are the backbone of the New Zealand economy – we’re here to support you through this difficult time.

If your business needs support, our team of specialists are here for you. kiwibank.co.nz/business

We will get through this together Mā te Manaakitanga tātau e kōkiri whakamua.

With a number of substantial projects underway across the Bay of Plenty, Rotorua, Waikato and Auckland, iLine Construction is clear in its plans to forge ahead and remains cautiously optimistic in its outlook despite the uncertainty that COVID19 has caused.

As a reliable and trusted main contractor specialising in Project Planning, Design and Build, Cost Management and Construction, iLine continues to remain positive during this unprecedented time. Working hard behind the scenes the company has leveraged its strong reputation to secure a robust forward workload across the Commercial, Residential and Industrial sectors.

While no company is resistant to the effects of a global pandemic, iLine Construction co-director Elton Verran says, “We are lucky in that we are the main contractor of choice

for many and have been fortunate enough to secure some great new projects as a result of years of hard work with local developers and strong relationships with existing clients”.

iLine Construction has a foot in the door in certain sectors that have been relatively unaffected, which has given the company a degree of confidence. Elton says, “On the whole our Region and the work that we’re doing across residential accommodation and kiwifruit supply chain is still very strong”. He says, “We’re finding that people are still thinking ahead. Yes there has been a stall period, but we’re carrying on where we left offfull steam ahead and back into a new sense of normality”.

The key to New Zealand’s success in reducing the spread of COVID-19 has been a huge team effort from the community. That same energy

is now needed to boost the country’s economic recovery. iLine Construction co-director Paul Hammond says, “The reality is that there have been shockwaves through the industry and a reduction of confidence in the marketplace. As a result some clients have decided to hold fire and assess the impacts over the next few

months, but they remain optimistic”. He says, “The next phase for us is about promoting confidence and regeneration across the construction industry and New Zealand as a whole”.

For more information on iLine Construction visit iline.co.nz or call 07 571 0527.

The level of inquiry throughout Lockdown Level 4, 3 and more recently Level 2, has been surprisingly positive.

By far, the majority of the activity our office is experiencing is from within the Tauriko Industrial Estate. Interestingly, leasing and sales activity is as buoyant and strong now as it was pre-lockdown. Land sales/inquiry continues with some opportunities available. There will be no “fire sales” though, due to the scarcity of industrial land lots for sale.

The Covid-19 challenge reinforces our company policy of getting and remaining close to our clients, landlords and tenants.

1. What do businesses (landlords and tenants) need to know to successfully navigate the economic times ahead?

During lockdown, the volume of our communications with clients was significantly more than usual and the nature of these communications fell within the realm of negotiations and support as we liaised with landlords and tenants for successful outcomes.

Many of our communications stemmed from our approach to “front foot” or lead communications. Market updates and commentary were issued from our office and personal support calls were made to our clients while our team worked cohesively using our mantra of “client care”.

As a result, we have seen our landlords and tenants communicating at an unprecedented level, with the common goal to resolving and challenges and keeping businesses operating.

2. What are our plans to navigate these waters?

Ensuring we continually facilitate

Antony Lee (BProp, MRICS, MPINZ)

Commercial & Industrial Specialist

Licensed Agent (REAA 2008)

Antony joins the team in 2020. Raised in the Mount and Tauranga he started his working career in a family construction business before attending university to study architecture, property and law.

He has spent much of his career working in Auckland in entertainment, hospitality, and predominantly property development and investment with the industry’s leading private firms and Auckland Council. Accolades include awards with past projects by the NZIA, NZ Property Council and Building Institute. He has also led the establishment of building and resource management consent precedents in the past

successful relationships. Securing strong landlord and tenant relationships from day 1 – from the commencement of a lease to the end including assisting tenant businesses into new premises as they outgrow their existing.

Landlords need to understand their tenant’s business and be prepared to work with them through challenging times.

My Leasing and Sales Team will be facilitating such relationships for any new leases we negotiate.

3. What is our business doing differently?

Networking will be critical in this market. In managing all transactions our Commercial Team will ensure we utilise our strong networks in the areas of finance, legal advice and property management.

We will “trouble shoot” by cre-

decade.

As a specialist in large, complex and multifaceted acquisitions and disposals he has been involved in transactions with NZX and ASX listed entities and has excellent relations with local, national and international corporates. He is also well versed in syndication models and distressed asset sales.

Antony is a devoted property professional with a ‘can do’ reputation. He is proud of his experience in all areas of sales, leasing, and property management. With professional memberships with RICS, PINZ, and tertiary qualifications his clients will be assured of his commitment to maintaining the best service standards already provided by Ray White Commercial. He loves living in the

atively finding solutions for tenants and landlords alike.

Some outside the box thinking will be required. Of note is the strong small businesses tenants that have come to us (during and post-lockdown!) to secure their own premises, some realising that with the equivalent of the rental they already pay, they may be able to purchase their own premises.

4. How can business reach us?

Our Ray White Commercial Team offers strong and effective customer service. Awarded Top Office (Internationally) for Customer Service for three years running, our cohesive team offers strong experience in sales, leasing, industrial unit developments, legal, property management and body corporate.

We pride ourselves on our ability to assist all our clients with their

Bay and is enthusiastic about becoming further involved in the business community here.

Contact Ant on 021 564 864 or antony.lee@raywhite.com

property requirements and any challenges they may be facing.

Contact Philip Hunt or a member of the Commercial Team to talk about your property plans.

Ariana Iti Administrator

Licensee Salesperson (REAA 2008) Ari is a successful professional with a wealth of transferable skills gained throughout being in the sales industry.

Ari has joined us at Ray White Commercial Tauranga from a combined administrative and licensed salesperson role. As Administrator to our team of six licensed salespeople, knowing the industry well, Ari puts the best procedures in place to get the best possible outcome. Implementing a strong marketing eye and business-minded approach leading to successful outcomes is the way Ari ensures our commercial clients receive the best service. Contact Ari on 07 928 0000 and ariana.iti@raywhite.com

Many of us are looking at ways to reduce costs, especially any fixed costs or overheads and we are being forced to question all of the financial decisions we make to ensure that we still have a business in the future. While this doesn’t apply to all business decisions, your office space can and should be, totally flexible.

Gone are the days when you negotiate a long term lease for attractive terms.

At Basestation we believe in offering all our residents and casual members the best rate, all the time. We offer desk and office space from one hour to monthly terms.

Our ‘family’ comprises industries and sectors from IT, venture capitalists, charities, social enterprises to accountants, creatives, and educa-

tion providers. We are proud to have supported innovative companies such as SwipedOn who have now moved on to do so much good in the world.

Does the idea of being able to work from home a few days a week, with the option to get out and be socially reconnected in a space that offers the best coffee in town (true fact), along with fast Wi-Fi sound appealing?

Basestation could be your answer

Basestation was founded back in 2014, before coworking was barely a ‘thing’ in New Zealand, and we are the largest business-focused coworking space in Tauranga. Our founders had a vision that coworking would help combine the productiv-

ity and professionalism of an office space with a sense of community that brings entrepreneurs together.

A desk, team space, or office at Basestation could be the best call you make as we enter a new way of working.

We are so confident that we want to offer you a FREE trial so you can experience the support, collaboration, bonding, and warm welcome that Basestation offers.

Check out our website (basestation.nz), call us, or even better pop in and chat with Courtney or Steven. They would love to show

you around and if you plan it right, your visit might coincide with one of our shared lunches or free coffee mornings!

Win a FREE week of desk space at Basestation for you and a friend! Simply follow our Facebook page, Instagram account and join our mailing list. That gives you three entries in the draw! A winner will be announced each week of June.

Covid-19 has taught us that you should always expect the unexpected in business. Plan for it and disrupt your business before something else does.

Many businesses do not even have a good website, and it is so vital in these times to boost marketing and showcase who you are as a business.

Your email address must be your own brand as it looks professional and re-enforces the brand identity.

Even a well done single-page website can look awesome, get the message across and persuade clients to do business with you.

Technology is so flexible so it is easy allow people to book and pay for appointments online, automatically put that in calendars, to develop new ideas and features, or to setup eCommerce shops that are easy to manage and affordable.

We are scaling up, taking on more local freelancers to help us meet the demand and developing new systems and products to service the

What a fantastic Bay of Plenty business community we have.

Look around, and you will notice the wide and varied types of businesses that operate in the Bay of Plenty, a region that is recognised as one of the top regions of Aotearoa to live, work and play.

It’s no wonder that so many people from all countries, cultures and professions call The Bay home.

The Smarter Business Event 2020 originally scheduled for Wednesday 18th March, 2020 was over a year in the making.

From event concept, to discussions with knowledgeable business people about feasibility, format, promotion, pricing etc. it was a long and well thought out planned event, designed with one purpose: to bring Bay wide businesses together for a day to meet, network, learn from great speakers and do business.

For an inaugural unproven event, support from the business community was fantastic.

The Smarter Business Event 2020 ticked several boxes that appealed to businesses:

1. Great speakers from Xero, Institute of Directors and Collab Digital.

2. Affordability with potential high return on investment for each business.

3. Simple format, easy to attend.

And then COVID-19 hit.

public and was a ticketed only event with all attendees being traceable and trackable through registration.

However, things quickly started to unravel within 24 hours of the event date as media intensity grew around COVID-19 and business owners, managers and attendees became increasingly nervous about attending an event where shaking hands was now seen as a health risk where once it was supposed to be the norm.

result, a miracle, the event remains intact to be rescheduled to later in 2020.

And that brings me back to what a fantastic Bay of Plenty business community this is.

I was heartened by the overwhelming and unanimous support from event attendees, sponsors, speakers and suppliers to postpone to a later date to ensure the event can proceed safely and successfully in the future.

4. The event had scale with over 100+ businesses attending from 30+ industry categories ensuring a wide variety of connections.

5. Locally based and easy to access. It was all GO!

Taking Ministry of Health guidelines, the event ticked all the boxes in terms of being compliant and able to proceed at the time.

The Smarter Business Event had an attendance of less than 500 people, it was not open to the general

Still, we pressed on with installing hand-santiser stations, health and safety hygiene protocols and guidelines around food purchasing and safe practices.

An abrupt halt to the event 24 hours out could not have been more perfectly timed for maximum chaotic impact and a wild scramble. Two days of intensity followed to salvage over a year’s worth of hard work. The

I’m hoping that the future date will be mid-October, 2020 and my sights are set on helping businesses across the Bay get connected, get business going and learn from great business leaders and industry specialists.

With the encouraging news developing so far around New Zealand’s COVID-19 active cases, we are looking good to get things cranking again really soon. – Pete Wales

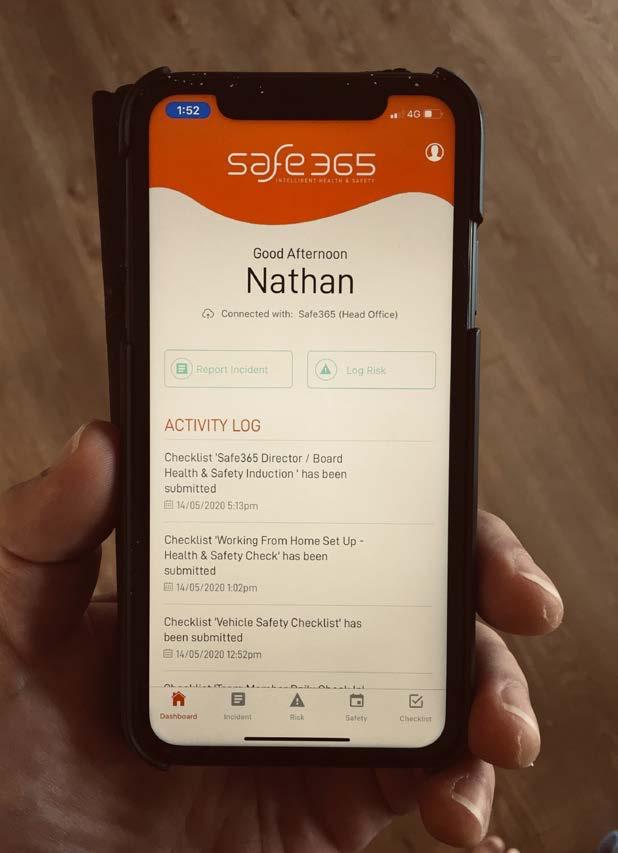

Bay of Plenty employers are obligated to ensure they are taking steps to prevent the spread of COVID-19 in addition to managing the pre COVID19 myriad of health, safety and well-being risks at

Trying to solve these challenges using traditional paper reporting is problematic.

Firstly, it relies on workers and their supervisors being able to locate and fill out the various reporting forms. Records get lost, destroyed, require double handling and filing, limiting the quality and accuracy of data being captured from the site.

Going digital can be a game changer. In fact, to help businesses with adopting digital safety tools, kiwi business Safe365 is offering Bay of Plenty companies, in any industry, its free “COVID-19” plan – which gives access to the Safe365 smartphone app and performance console for companies with up to 200 workers for 6 months, at no cost.

Safe365 has been used by over 3,500 businesses across many industries including construction contractors, schools, gyms, retail stores, transport companies, utility contractors, professional services, local government and health related organisations like

pharmacies, hospitals, dentists and medical centres and many more.

The platform also provides an innovative governance and assurance system that allows companies to rapidly measure and benchmark their health, safety and well-being maturity, understand gaps in capability and provides practical tools and resources to make improvements.

The platform provides visibility of continual improvement and also provides a reporting tool to make it easy to communicate health and safety insights to the business’ leaders.

With a looming global recession, enhanced health and safety requirements and pressure on revenue and profitability, businesses need to strive for greater cost effectiveness, efficiencies, productivity gains and ways to transact their business while meeting safety requirements in this ‘new normal’.

For many clients, COVID-19 has been a catalyst to “go digital” and they have selected Safe365 because it is so simple to use, requires minimal implementation and is incredibly cost effective.

If you’d like to know more, want to sign up or trial the software, visit Safe365’s website: www.safe365global.com or send us an email sales@safe365global.com.

Ryan + Alexander are regional recruitment specialists formed in, and focused on, the Bay of Plenty.

Co-director Bernadette RyanHopkins says the job market had already been shifting, so while the current situation might seem daunting, new opportunities are out there. They may just look different.

“We have seen a shift over the past decade to more of a gig economy,” she says. “The world of work has been changing.”

A gig economy is a job market characterised by a prevalence of short term, temporary or contract roles. Contract and temporary work opportunities are likely to rise locally as businesses work to establish their new ‘norm’.

Employers may be looking to establish a new team or reconfigure their existing one after an uncertain period in recent months.

They may need to change their attraction strategy, offering flexible hours or working from home options.

If redundancies become inevitable, Ryan + Alexander provides a programme to support team members facing this change in circumstances.

Job seekers can also seek support from Ryan + Alexander in career coaching, interview skills, curriculum vitae writing, and help with telling their story in the most effective way to prospective employers.

Working in markets as diverse as the United Kingdom, China and Italy, Ryan + Alexander co-director Kiri Bur-

ney “a Waikato farm girl at heart” and her Rotorua-raised business partner are entirely focused on matching Bay of Plenty employers with exceptional people.

They have placed many outstanding people since opening their boutique agency in Tauranga in 2016.

The directors of Ryan + Alexander say the biggest change that employers may see is more applicants for a role than they would have previously due to the global pandemic.

“It’s our role to help clients and candidates to navigate the changing market over the coming uncertain months, through the good times and not so good times.

“Because of our primary industry base, the Bay of Plenty region

is better placed than most to come through intact by adapting and innovating in the way that this region is so well known for.”

You can get in touch with any of the Ryan + Alexander team via the website ryanandalexander.co.nz or contact Bernadette Ryan-Hopkins directly on bernadette@ryanandalexander.co.nz

What do businesses need to know about insurance to successfully navigate the economic times ahead?

Levi: It’s important for business owners to have honest and open conversations with their brokers. The more we understand about your business and its critical risks the better we can find a solution.

Paul: Many businesses will be going through substantial changes. A reduction in assets, lower turnover and profit margins or a change in products and services. If your broker suggests cover should just be ‘rolled over’ or ‘renewed as expiring’ they are simply not doing their job.

Rob: Insurance is a reactive marketplace. Having a proactive broker in your corner means they can work with you to modify your cover, ensuring that the protection remains relevant and cost effective.

What are your plans to navigate these waters?

Rob: Our business model is based on quality advice, service and value for money. We talk to our customers about their unique risks and present them with a variety of options to offset them via a range of insurance products.

Paul: We dedicate quality time to each customer and complete a detailed review of their past, present and future needs. Then we engage with numerous providers to generate competition for their business.

Levi: When you look after your customers, everything else takes care of itself. Our commitment over the coming months is to help each customer as much as possible. Our clients have unique businesses and we believe they should be treated as such. They deserve the best quality advice, service and value we can offer.

What are you doing differently?

Paul: Our major difference is that we are actively involved with and help customers through the entire claim process. We each manage our own customer portfolio but we can call on the skills and experiences of each other. Between us we have over 50 years of insurance experience and a range of generational viewpoints.

Levi: Everything we do is customer centric. There is no hard sale from any of us. It’s about allowing customers to make informed decisions.

Rob: The one thing we are lacking is a bit of gender diversity, which is something we are actively looking to address in the coming months.

Covid-19 has disrupted business to such an extent that companies have had to review every detail of how they work, both so they can work during lock down and to survive the economic impact that is to follow.

Covid-19 has accelerated digital transformation (use of new, fast and frequently changing technology) like no CEO or CTO has been able to do for years. Every business needs to carefully assess their use of technology to ensure it is efficient, cost-effective and ensures business continuity.

If you have not already done so, migrating business applications to the cloud has many benefits. Your employees get the latest versions of

software, easily updateable and with better collaboration built-in, and you save money.

Moving voice calling online using VOIP is also an excellent option, as it offers many productivity and customer satisfaction advantages over old systems. Greater mobility, call recording, voicemail to email transcription, automated attendants, messaging with music on hold and a whole range of useful features become easy and cheap to implement.

A vendor audit can help you find where you are overspending. You may have contracts for landline, mobile phone, broadband, office software, storage and backup, and

IT Support. Reviewing these may allow you to streamline what you are doing, save costs and allow a single point of contact for all your technology needs.

That is so important to avoid the blame game where one technology provider blames the other and leaves you in the middle.

A Managed Service Provider (MSP) such as Bit4Bit will review the existing contracts to determine where solutions can be improved.