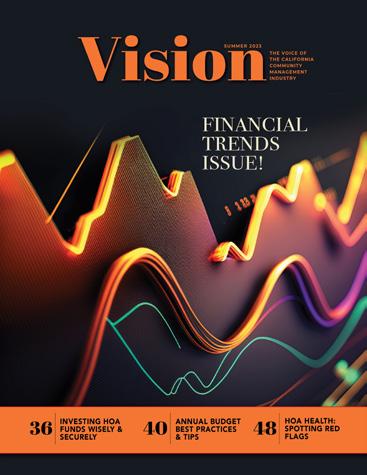

Vision SUMMER 2023 THE VOICE OF THE CALIFORNIA COMMUNITY MANAGEMENT INDUSTRY FINANCIAL TRENDS ISSUE! INVESTING HOA FUNDS WISELY & SECURELY 36 40 48 ANNUAL BUDGET BEST PRACTICES & TIPS HOA HEALTH: SPOTTING RED FLAGS

Summer 2023 • Vol. 32, no. 2

President & CEO tfreeley@cacm.org

Chief Editor lbertrand@cacm.org

Advertising mhurtado@cacm.org

| Thomas Freeley | 949.916.2226, ext. 315

| Lynette Bertrand | 949.916.2226, ext. 323

| Melissa Hurtado | 949.916.2226, ext. 318

Editorial Advisory Committee

Rob Buffington Gordian Staffing & East West Building Works

Andrew Hay, CCAM-ND.PM The Helsing Group, Inc., ACMC

Caroline McCormick, CAMEx, CCAM OMNI Community Management LLC, ACMC

Justin Sacoolas, CCAM Compass Management Group, Inc.

Lorena Sterling, CAFM Community Association Financial Services

Scott Swinton Unlimited Property Services, Inc.

Hamlet Vazquez, MCAM-HR Wilshire Terrace Co-Op

members, industry partners and supporters of the California Association of Community Managers.

Magazine content copyrighted 2023. All rights reserved. No part of this publication may be reproduced without written permission from CACM.

Opinions expressed by authors do not necessarily reflect the policies of CACM. Mention of any product or service does not constitute an endorsement by CACM. CACM assumes no responsibility for return of photos or art and reserved the right to reject any editorial or advertising materials. CACM does not assume responsibility for the accuracy of articles, events or announcements listed.

Please address comments and suggestions to: California Association of Community Managers, Inc. 23461 South Pointe Drive, Ste. 200, Laguna Hills, CA 92653 949.916.2226 | communications@cacm.org

Attention CACM members: Have you changed jobs or moved to a new location? Reach out to us at communications@cacm.org to update your profile so you don’t miss your next Vision magazine or any other important CACM communications.

2 Vision Summer 2023 | cacm.org

CACM

times annually

Vision Magazine is released digitally by

four

to

THE VOICE OF THE CALIFORNIA

COMMUNITY MANAGEMENT INDUSTRY

Vision

Do we know where you are? Follow us and stay up-to-date on industry news and info! Follow @CACMchat Talk to us about your association’s financial needs. We can help. We offer: • Financing for building repairs and capital improvements1 • Competitive fixed rates up to 15 years • Access to multi-million-dollar FDIC deposit insurance coverage with ICS® and CDARS®.2 Contact a Regional Relationship Manager today: 1. Subject to credit approval. 2. Terms and conditions apply. CDARS and ICS are registered service marks of IntraFi Network LLC. © 2023 Popular Bank. Member FDIC. www.popularassociationbanking.com Larry Hooper, VP 949.842.6161 LHooper@popular.com Kenneth L. Staley, VP 615.477.1480 KStaley@popular.com Southern California Northern California Grant Shetron, VP, CMCA, AMS, PCAM 510.406.3198 GShetron@popular.com

EDUCATION SPOTLIGHT: NEW COURSE, NEW INDUSTRY PARTNER DESIGNATION & MORE

NEW INDUSTRY COUNCILS PROVIDE UPDATE

UNDERSTANDING FINANCIAL STATEMENTS

By Hamlet Vazquez, MCAM-HR

A COMMUNITY MANAGER’S GUIDE TO MANAGING YOUR HOA’S RESERVE FUNDS

By Derek Eckert, RS,

PRA

TRANSFORMING APATHY INTO ENGAGEMENT

By Rob Buffington

THE NOT-SO-SURPRISING IMPACT OF RECESSION ON HOA COLLECTIONS

By Dee Rowe, CCAM

IS YOUR ASSOCIATION SECURELY INVESTED?

By Lorena Sterling, CAFM

RAINBOWS AND UNICORNS: THE DREAM OF A UTOPIAN HOA

By Scott Swinton

By Scott Swinton

ANNUAL BUDGET BEST PRACTICES AND TIPS

By Andrew Hay, CAMEx, CCAM-ND.PM

FINANCIALS 101: EXPLAINING THE BUDGET TO HOMEOWNERS

By Justin Sacoolas, CCAM

TOP FINANCIAL ITEMS TO REVIEW IN AN HOA

By Lorena Sterling, CAFM

WHAT’S CORPORATE WELLNESS?

By Michelle Hawkins

SPRING & SUMMER LOCAL MEMBER EVENTS PHOTO GALLERY

2023 EXECUTIVE LEADERSHIP SUMMIT PHOTO GALLERY

cacm.org | Vision Summer 2023 3 in this issue news bits Members in the News You Said It California Legislative Update Congratulations Managers New Individual Managers & Management Companies New Industry Partner Members Thank You Sponsors 6 16 20 22 35 47 60 4 14 58 President’s Message From the Roundtable Course Calendar departments on the cover FINANCIAL TRENDS ISSUE! In this edition we focus on the numbers that matter for HOAs. features

38

40

18 24 26 28 30 32 36 38

president’s message

Anyone disagree that our industry needs to be elevated? Community management is a growing industry. But as an industry, we’re a small community. As a community, we should help each other. Support each other. Guide each other. ELEVATE each other. Whether you work for a management company or direct hire of an HOA, help elevate your team members. Teach them through California-specific education. Support them through California-specific certification. Promote their hard work accomplishing their CACM certification to your clients by including this flyer in your board packets: Is Your Community Manager California Certified?

There are so many ways to elevate our industry, but it starts with elevating each other. Have you nominated anyone for a Vision Award? No? Why not? I know that you know someone that deserves to be nominated for an award. I’ve heard comments that we need to add a lot more awards. I think the Vision Awards should be viewed as a special recognition for work above and beyond. Yes, the application process takes a little time, as it should for a special recognition, but never let a process stop you from accomplishing a goal. The process isn’t a journey. The journey is the “why” that special someone should be recognized.

It’s impossible to summarize everything we are doing at CACM in an article or two, so reach out and ask any question about our expansion goals and accomplishments to date. Ask about the amazing Industry Partner Councils and how you could get involved in the associated local committees to help shape your local networking and educational events. Ask about the potential of being a CACM Board or committee member. Offer a suggestion on how we can help elevate you, or how you can elevate the industry.

Until I see you again, ELEVATE someone, and you’ll be elevating the industry.

Thomas Freeley, CAMEx, CCAM, President & CEO

4 Vision Summer 2023 | cacm.org

cacm.org | Vision Summer 2023 5 MANAGEMENT COMPANIES We are your best risk management asset CID Insurance Programs has successfully helped CACM Members with insurance & risk management protection for more than 23 years CACM Sponsored Insurance Programs f E&O Professional Liability f Employment Practices f Cyber Theft & Liability f Master Fidelity f Directors & Officers Liability f Business Office Insurance f Workers’ Compensation f Third Party Discrimination Phone: (800) 922-7283 Email: insurance@cacm.org www.cidprograms.com Don’t let business challenges bring you down...

members in the news

MRoland Team Participates in Annual Women Build Event with Habitat for Humanity

On May 3, 2023, MRoland Management Services closed the office for the day so 16 staff members could take part in their annual “give back” event. Every year for nine years running, the team raises funds and participates in a Woman Build event with Habitat for Humanity. The “MRoland Rockstars” initially got involved nine years ago when Woman Build came to the San Diego region because Habitat was a developer client of their urban development services division. Maggie Roland, CCAM loved that they allowed people who otherwise couldn’t own a home to buy one. It’s become a favorite teambuilding activity. Fundraising efforts typically start in April. Through developer donations and raffling off creative, employee-made gift baskets this year, the Rockstars raised over $10,000, and they helped paint the exterior of homes in Chula Vista. Way to go, Team

Associa’s Desert Resort Management Volunteers at Coachella Valley Rescue Mission

For the second time, Desert Resort Management staff lent a hand to the Coachella Valley Rescue Mission Volunteers served hot meals to residents in the dining hall and, behind the scenes in the kitchen, prepared three days’ worth of meals to feed people who might otherwise go hungry. The CVRM has opened its doors to homeless residents since 1971. The mission provides almost 350,000 meals annually, shelters thousands, and provides clothing, food, and resources to those who choose to stay elsewhere. DRM participated in this event as a part of Associa’s “Big Give Back,” a company-wide program where paid time off is offered to staff members to volunteer at qualifying local organizations.

6 Vision Summer 2023 | cacm.org

Hignell Companies Celebrates 75th Anniversary

In 2023, The Hignell Companies is celebrating a big milestone—turning 75! The company marked the anniversary with the creation of a new logo. The company was founded in 1948 by Fred Hignell, Jr. and his partner Floyd Strange by building more than 1,000 homes in 25 subdivisions, in addition to apartment and commercial projects. The company began offering management services for homeowner and property owner association boards in the 1980s. Read more about their history and services here.

JMJ Community Management, Inc. Opens a Second Office

Although relatively new to the scene, JMJ Community Management, Inc. is growing like wildfire. Jennifer Figgers, CCAM, founded the company in January 2023 after managing San Diego area communities for over 16 years because she saw a need for a more personalized level of service. She started the company with an office in Escondido to serve San Diego clients, and less than a year into operations, is expanding this summer with a second office in Menifee to better serve areas like Temecula, Murrieta, and Lake Elsinore. Congratulations to Jennifer and her team for a phenomenal first year.

After Managing for 30+ Years, Mindy Dent Transitions to the “Other Side”

Harvest Landscape scored a good one! After over 30 years managing associations, Mindy Dent , CCAM, decided to hang up the manager hat for now. Before you despair, she is not leaving the industry but chose to join Harvest to elevate their customer service. She provides the Harvest team with a unique perspective that will offer invaluable insight into the board and manager’s point of view. This new hire is yet another example of how Harvest Landscape thinks outside the box to add value and give stellar service. Please join us in congratulating Mindy on the new role.

cacm.org | Vision Summer 2023 7 members in the news

Jennifer Figgers

Berding | Weil is Victorious in Lawsuit Against San Diego Water Agency and Wins Prestigious Award

Several Berding | Weil attorneys received the highly sought-after CLAY (California Lawyers Attorneys of the Year) Award. Daniel Rottinghaus , Theresa Filicia , Carlotta Kirby, and Howard Silldorf, along with their co-counsels, received the award for their $79.5 million trial verdict against the City of San Diego’s water agency for illegal and unfair billing practices that harmed San Diego residents. The CLAY Awards recognize lawyers throughout California whose achievements “have a significant impact on the law, the legal profession, a particular industry, or the community.” The nomination process is highly competitive and is considered among the most prestigious awards for practicing lawyers in California.

Gordian Business Solutions Announces New Senior Vice President of Organizational Development

Gordian Business Solutions recently welcomed Doreen Tejeda, former Senior Vice President of Associa Northern California, as their new Senior Vice President of Organizational Development. With over 22 years of experience managing associations in California, she brings a wealth of knowledge and expertise to the Gordian team. And after working her way up the ranks from Community Manager to Senior Vice President during her time at Associa, she can relate to team members on all levels of the career ladder. Congrats to Gordian on your new hire and to Doreen on the new position.

PCM Promotes Joshua Thomas to Director of Community Management

Professional Community Management recently promoted Joshua Thomas to Director of Community Management. He has come a long way since starting as an administrative assistant in 2016. Prior to the promotion, Thomas was a manager in PCM’s office in Foothill Ranch. Markus Ashley, Vice President of Community Management for Professional Community Management, had this to say: “Joshua is an integral part of our Orange County management team and we are thrilled to elevate him to this key leadership position. His commitment to excellence, professionalism, and exceptional customer service make him the ideal choice to lead that office’s community management team.”

8 Vision Summer 2023 | cacm.org members

in the news

Doreen Tejeda

Joshua Thomas

Daniel Rottinghaus

Theresa Filicia

Carlotta Kirby Howard Silldorf

cacm.org | Vision Summer 2023 9 • Treasury Services • Web-Based Payment Portal • Integration Services • Operating and Reserve Accounts • Local Lockbox Processing • HOA Loans • Placement Services for Excess Reserves Your HOA Banking Specialist Give us a call today 844.489.0999 A Dedicated HOA Department Here For You Supporting Members of: www.HeritageBankofCommerce. bank Member FDIC

members in the news

Sarah Yesil Joins Flanagan Law, APC, as an Associate Attorney

Earlier this year, Flanagan Law, APC , welcomed Sarah Yesil as an Associate Attorney. She’s assisting with governing document restatements and general legal matters. Although she’s not exactly new to their team (she’s worked with them since 2021), she is new to their attorney roster and to attending industry events on behalf of the firm. So, if you see her at a future event, please extend congratulations and a warm welcome to this new member of our industry.

Collins Management, ACMC Expands into Marin County

With recent consolidation in the industry, Collins Management, ACMC recognized the need to expand its presence in the Marin market. This spring the company opened a new office in Novato at 7250 Redwood Blvd, Suite 300, adding to its existing corporate offices in Hercules and satellite offices in Walnut Creek and Brentwood. Although Collins Management has been serving communities in Marin for many years, the company wanted to establish a brick-and-mortar presence staffed with local professionals to provide the highest level of service possible. “We wanted to establish a bigger footprint in the Marin market to fill the void left by other firms leaving the market,” said CEO Paul Collins, CAMEx, CCAM. “We are confident that with our local presence and team of experienced professionals, we can provide Marin communities with the highest level of service possible.” Leading the charge in Marin is Jessica Roberts, CCAM, a Novato resident who has been named Marin Regional Manager. Roberts brings many years of experience providing white glove service to high-end communities, and she will bring that same level of service to the region. She will be supported by Melanie Malik, CCAMPM, Chief of Operations, who has many years of experience developing the Marin market for other management companies.

Teresa Agnew Joins Reconstruction Experts

Full-service general contractor Reconstruction Experts recently hired Teresa Agnew as Vice President of the California region. Agnew comes to the company with roughly 20 years of industry experience, most recently with Roseman Law. In her new role she supports the sales department and fosters HOA relationships. “Teresa is a well-respected leader who has both the industry experience and the necessary skills to support Reconstruction Experts of Johns Lyng USA during a time of tremendous growth,” said CEO Rich Whitten. “Her fresh perspective and people-first mindset will continue to foster growth and add tremendous value to our company.”

10 Vision Summer 2023 | cacm.org

Sarah Yesil

Teresa Agnew

Members Making Their Voices Heard

It’s been a busy spring with several CID bills coming up for hearings. CACM members Nicole Vanwig, CCAM, and Becky Jolly, CCAM, community managers with OMNI Community Management, LLC, ACMC both testified at committee meetings in favor of AB-1458. The bill, supported by CACM, would lower the quorum threshold to 20 percent upon failure to obtain quorum the first time around for board of director elections. Also recently testifying was Kelly Zibell, CCAM, former community manager and founder of Divergent Consulting Group, who spoke in favor of AB-648, the meetings by teleconference bill, which would authorize a board meeting or a meeting of the members to be conducted entirely by teleconference if the same conditions are satisfied that exist for teleconferencing under a state of emergency. We’re grateful for our members’ participation in the lawmaking process and volunteering their time to ensure that the community management industry’s voice is considered when new legislation is introduced.

CINC Offers Contract Management Automation

CINC Systems recently released RevStream, a tool that automates management contracts. RevStream allows management companies to automatically track all agreements, general ledgers, and expenses within CINC. While CINC has offered the automation of contracts via addendum billing for several years, the organization is now adding revised reporting capabilities to improve the experience for the executive. Through this feature, executives will see a clear view of where the bulk of their revenue generates and where they have missed an opportunity. One of the key benefits of RevStream is that it automates invoice creation. After services that should be billed are rendered, invoices are automatically created and posted, which allows management companies to get paid without having to ask. RevStream also offers addendum billing features. Itemized invoices and other billing features, such as per unit and assessment charges, are fully automated. “We understand that management companies have a lot to handle, and the details behind every relationship are extensive,” said Ryan Davis, Chief Executive Officer of CINC Systems. “That’s why we’ve created RevStream - to automate contract management and ensure that all billable work is accounted for and collected.”

River City and MasterCraft Join Forces

Northern California companies River City Restoration Inc. and MasterCraft Painting, Inc. have joined forces to offer multi-family and residential property maintenance. “We will now be known as River City Reconstruction and Painting,” the company said on social media. “All staff will be working side by side to offer combined wood repair and painting services for all your property’s needs. We are confident that we will have a smooth transition and that daily operations for our existing clients will continue uninterrupted.”

cacm.org | Vision Summer 2023 11 members in the news

Nicole Vanwig

Becky Jolly

Kelly Zibell

AND NOW FOR BABY NEWS…

Shelby Powell of Berding & Weil Welcomes a New Addition to the Family

Shelby Powell is the powerhouse behind many of Berding & Weil, LLP ’s phenomenal educational and networking events. However, you might not have seen this Business Development Executive in action lately, and for a good reason. On May 6, she and her husband, Jamison Powell, welcomed Lovitt Robinson Powell into their world. Weighing in at a healthy 7 lbs. 6 oz., Lovitt has already captured their hearts. We wish you and your growing family well, Shelby!

It’s Twins for IQV’s Daisy Ortiz

Daisy Ortiz, Sales and Marketing Manager for IQV Construction & Roofing, welcomed twin baby boys, Alonso Romeo, and Ray Julian, in late 2022. The boys were born on two separate days—Ray on Dec. 29 and Alonso on Dec. 30! Needless to say, it’s been double the fun for Daisy and her family. Congratulations!

Mommy Returns to the Office

Congratulations to Emily Hemphill of CitiScape

Property Management Group LLC, ACMC , on her return to the office after the arrival of baby Ikeena

Joo Young Hemphill. Ikeena was born last year, but we weren’t able to get our hands on a photo until recently. He’s a baby brother to his 11-year-old sibling.

New Baby Girl Arrives for Mosse Family

Congratulations to David Mosse, Business Development Manager at CM Squared, Inc. and his wife, on the recent arrival of Sage Siena Mosse, born two days late on March 19, weighing 7 lbs. 1 oz. and measuring 19 inches long. “Her big brother Banks loves his sister and we are all enjoying these early days,” said Mosse.

Don’t see your news listed? Update us at communications@cacm.org

12 Vision Summer 2023 | cacm.org members in the news

Shelby Powell

Lovitt Powell

Alonso Romeo and Ray Julian

Ikeena Joo Young Hemphill

The Mosse Family

cacm.org | Vision Summer 2023 13

from the roundtable

A MESSAGE FROM THE BOARD

In this edition of Vision Magazine, the focus is “Financial Trends in HOAs.” The current trend for the economy is moving toward a recession sooner than later. It is vital that we, as the consultants for our board of directors, can guide them through these times.

We all know that managing the HOA finances is critical to ensure the financial health of the communities. As HOA professionals, we must perform several vital financial tasks, including preparing budgets, understanding financial statements, and managing delinquent assessments.

The first essential financial task is preparing budgets. The budget is a detailed financial plan that outlines expected income and expenses for the upcoming year. It allows the board of directors and management to plan for maintenance and improvements and set reasonable fees for our homeowners. The budget should include all expenses, such as landscaping, utilities, and repairs, as well as any anticipated income, such as fees and rentals. We have all seen unexpected increases in expenses, like utilities, insurance, and labor costs, to name just a few. In addition, new legislation has increased costs for many communities. Hence, we need to leverage our experts to aid us in sharing the knowledge for success in future budgeting. We cannot be experts in everything, but we can be experts in consulting experts for budget guidance.

Another crucial financial task for the HOA professional is understanding financial statements. Financial statements provide a comprehensive overview of the HOA’s financial health, including income, expenses, and reserves. By regularly reviewing financial reports with your board of directors, the board and management can identify any issues and make informed decisions about spending and budgeting.

Managing delinquent assessments is also essential for the health of the HOAs. Delinquent assessments are fees that are past due. When homeowners fail to pay their fees, it can create a financial strain on the HOA and impact its ability to maintain the community. To manage delinquent assessments, HOAs should have a clear collection policy for handling late payments, including late fees and other penalties. It’s also imperative to communicate with homeowners about payment expectations and any consequences for non-payment as part of their annual disclosure packet. Recessions in the economy tend to have an impact with an increase in delinquency of assessments– keep an eye on the monthly reports so as not to be caught off guard if the upward “creep” starts to occur.

Our boards of directors, with our leadership, should strive for transparency and communication with homeowners about the financial matters of the association. Doing so can help build trust and ensure everyone is on the same page.

By partnering with the HOA experts that are preparing budgets, understanding financial statements, and managing delinquent assessments, our boards can ensure the community’s financial stability and provide a high quality of life for their residents.

One last thing - share a random act of kindness today!

14 Vision Summer 2023 | cacm.org

Powerstone Property Management, ACMC

HIGH RISE & LARGE SCALE

VESPERA

| PISMO BEACH, CA SEPTEMBER 21-22, 2023

In his first live in-person interview since the tragic collapse of Champlain Towers South, former community manager Scott Stewart will provide a firsthand account of the events leading up to the catastrophic event, the moment it occurred, and the ensuing aftermath. Drawing from his personal experience, Scott will offer a unique perspective and share valuable lessons learned, as well as steps that can be taken to prevent similar tragedies. This exclusive discussion is a must-attend for all community managers who want to learn about the impact of catastrophic loss and the necessary measures to avert such tragedies in the future. Scott’s story is one you don’t want to miss.

cacm.org | Vision Summer 2023 15

A DEEP DIVE INTO YOUR SPECIALTY. SUMMIT

TAKE

fellow managers from across California who specialize in high rise and large scale communities for this two-day summit. This event will offer ample networking time. CCAM, CAFM AND MCAM MEMBERS EARN 6 CEUS.

HIGH RISE LARGE SCALE PREMIER SPONSOR SESSION SPONSOR LUNCH SPONSOR BADGE SPONSOR BREAKFAST DAY 1 SPONSOR NETWORKING RECEPTION SPONSORS PREMIER SPONSOR BADGE SPONSOR NETWORKING RECEPTION SPONSORS CLICK HERE TO REGISTER BREAKFAST DAY 2 SPONSOR BREAKFAST DAY 1 SPONSOR BREAKFAST DAY 2 SPONSOR SESSION SPONSOR

RESORT

Join

THANK YOU SPONSORS

THE MANAGER’S STORY: Lessons

from Surfside

yousaid it!

We had a blast at the CACM Spring Forum in Orange County and in San Diego this week. It was fantastic discussing “Aging Infrastructure” with community managers who stopped by our booth. Keeping up with HOA maintenance is crucial for a thriving community, and we’re here to help. Contact us today!

— ProTec Building Services

— ProTec Building Services

What a fantastic day at the CACM OC Spring Lunch! We enjoyed connecting with like-minded individuals and learning from their expertise. Kudos to CACM for putting together such an informative and enjoyable event!

— Berding Weil

— Berding Weil

Before the day is over, I just need to say how excited I am that CACM has added additional focus on educational opportunities for our managers in the North Bay. This is definitely a growing market and I am very grateful that Megan Mutimer and I were able to support our manager friends today with informative discussions led by Laurie Harris CCAM, and Jeanne Grove.

CM

had an amazing time at the CACM Regional Forum earlier this week! Thank you for hosting such an educational event and allowing our team to exhibit!

— David Mosse, Business Development Manager at CM2

Thank you CACM and Natasha Fierro for coordinating a fun East Bay Spring Member Dinner last night. It was great to see all the managers that joined us! (Great restaurant suggestion John Rivera, CMCA)

— Kevin Reid, Business Development Professional, Recon360

16 Vision Summer 2023 | cacm.org

Squared, Inc. - Architectural Design & Consulting

Follow @CACMchat

— Megan Wright, Business Development Manager, Saarman Construction, LTD

Last night we were representing IQV Construction & Roofing at the CACM Top Golf event. We had so much fun last night, catching up with friends that I even forgot to golf ��

— Daisy Ortiz, Sales and Marketing Manager, IQV

— Daisy Ortiz, Sales and Marketing Manager, IQV

Construction & Roofing

We want to sincerely thank CACM, Tom Freeley, and his wonderful team for making the 2023 CACM Executive Leadership Summit an excellent, worthwhile event! It was such a pleasure getting to meet and connect in person with so many great and inspirational leaders in our industry in California! I very much look forward to the next opportunity to sponsor a CACM event and to see our new connections once again. We are also looking forward to new partnerships that will help bring the community association management industry to new heights in technology & efficiency!

#els23 #leadership #techstartup #hoamanagement #communityassociationmanagement #inspirationalleaders

— Christina Barkley, National Director of Client Development, Compliance View 360

This was an amazing experience to be a part of the legislative process. Thank you to CACM for the opportunity and also to CAI-CLAC for your support. Managers, get out there and talk to your legislators!!! Send emails asking them to vote yes on AB 648 when it comes to the assembly floor shortly. It’s a game changer!

Lastly, get involved with CACM and CLAC to help shape laws that make our jobs easier rather than harder. They make it easy to do and your voice can really make a difference.

— Kelly Zibell, CCAM, Divergent Consulting Group

Thank you

— Jeanne Grove, partner/owner, Kaufman Dolowich & Voluck, LLP

cacm.org | Vision Summer 2023 17 yousaid

it!

CACM for the opportunity to speak at the inaugural North Bay Spring Forum, on conflict resolution strategies in HOA’s.

#hoalaw

spotlight on spotlighteducation education

Get Involved with CACM Education

Are you looking to grow personally and give back to the industry? Then get involved with our education at CACM. There are multiple opportunities including joining as a volunteer instructor or as a speaker for an upcoming educational event.

We are looking for passionate and knowledgeable instructors to teach our professional development courses for HOA managers. Our courses cover a wide range of topics, including legal compliance, financial management, effective communication, and leadership development. We are looking

for instructors who can provide practical tips and strategies that HOA managers can apply to their work immediately.

Manager members who have a CCAM, CAFM or MCAM for at least 5 years are encouraged to join our most-talented teaching team.

We’re also looking for panelists for our Fall Regional Forums: Ask the Experts. The topic for the forums is “Building Community on a Shoestring.” If you have some ideas or insights on this subject matter, we welcome you to reach out to become a speaker.

Recertification Reminder

Do you need to know your recertification deadline? Or how many units you still need to earn? Find out by logging into your Status Report online. Log-in to the Member Portal, then click Certifications, then Status Report.

New Course Coming This Fall

We are also working on a new course offering on Lifestyle Amenities. Many communities offer various amenities and more of them are hiring Lifestyle or Recreation Directors. This course will be designed to help those in these positions, as well as any other staff member involved with events. The course will entail determining the cultural and demographics within a community, HR best practices for staffing and personnel, Lifestyle Committees, planning events and much more. The goal is to begin offering this course in late fall. Look for more information in the very near future!

18 Vision Summer 2023 | cacm.org

more information on

of these opportunities.

Please contact our Education Department at education@cacm.org for

either

New Industry Partner Designation Coming Soon

The Education Department has been busy working with the Industry Partner Council to create a new designation – CCIP, or otherwise known as California Certified Industry Partner. This designation was created at the request of our Industry Partner members as they, too, want to help elevate this industry.

As of now, the course requirements will entail taking three courses:

· HOA Core Principles – Industry Partners

· Enhance Your Professional Presence –Industry Partners

· Foundational Ethics

Industry Partners who pursue this certification will need to submit an application and fees as well as submitting three recommendations –just like those who have earned your CCAM or CAFM designations. We are very excited for this new designation and for the opportunity to provide California-specific education to our Industry Partners.

Missing A CEU? Law Journal Quiz May Help

Have you been frustrated to learn that you are short just one or two CEUs for recertification and had to apply for an extension? Well, look no further! The Education and Credentialing Department has brought back the Law Journal exam.

ENHANCE YOUR CAREER

Looking to grow your career? We’ve got the answer for you. CACM offers four specialty courses designed to help you advance in this industry. These specialty designations are New Development, Portfolio Management, High-Rise Management and Large-Scale Management. One specialty course is offered each quarter and the CEUs earned from taking a course goes not only towards the specialty designation but also towards your recertification.

Other requirements to earn your specialty designation are:

· Be a CCAM in good standing for two years

· Take the specialty course, Human Resource Management, and Risk Management

(NOTE: Pre-requisite of Insurance Principles or Advanced Insurance Principles course is needed prior to taking Risk Management)

· Submit your application and fees

· Complete a written narrative of about 700 words based on a prompt provided to you from CACM

The purpose of the narrative is for the candidate to demonstrate their knowledge in various situations based on the courses taken along with their experience in this industry.

For more information, please visit our website at www.cacm.org or email education@cacm.org.

How will this work? Simply read an issue of the Law Journal, pass an exam, and earn 1 CEU. A maximum of 4 CEUs can be earned per year. The cost for the exam will be $50. For more information, reach out to education@cacm.org.

cacm.org | Vision Summer 2023 19

SUMMER 2023 PAGE 12 REALITY RESERVESOF BORROWING DO’S AND DON’TS HOA POOL FOR RENTTHERE’S AN APP FOR THAT VIRTUAL MEETINGS HERE TO STAY POST COVID? PAGE ELECTRIFYING HOAS REQUIRES CAREFUL PLANNING PAGE PAGE THE GRASS ISN’T ALWAYS GREENER TURF CONVERSIONS THEY’RE NOT ALL EQUAL 10 RULES OF ASSESSMENTS

SUMMER 2023 LEGISLATIVE UPDATE: WHAT’S NEW IN HOA LAW

By Jennifer Wada, Esq.

By Jennifer Wada, Esq.

CID legislation abounds this year. Not only are there a significant number of bills that impact the management industry, but they are also high-stakes pieces of legislation that required extensive negotiations and advocacy. Some are good, and some are bad, but all will change how the management industry operates should they be enacted. Before we begin, an enormous thank you to the managers that traveled to Sacramento to testify before the legislature! Your stories informed legislators of what it is like “in the trenches.”

AB 572

Haney CIDs: Imposition of Assessments

This bill would prohibit the increase of a regular assessment on the owner of a deedrestricted affordable housing unit that is more than 5% greater than the regular assessment for the association’s preceding fiscal year, except those where 100% of the units are occupied or available at affordable costs to lower income and moderateincome households.

CACM opposes this bill because it would:

1) impose disproportionate financial burdens on homeowners who cannot afford to subsidize others, 2) create inequities and division within the community, and

3) undermine the ability of associations to raise the necessary funds to maintain the community.

Both in meetings and the Assembly hearing, CACM emphasizes that at a time of rising costs, with insurance increases of 1000% and mandatory balcony

inspections resulting in an overwhelming number of repairs, asking some owners to subsidize others is not sustainable or realistic. Concerns include that subsidizing owners won’t be able to pay the increased assessments, or the association won’t get the necessary approval for significant increases required to meet the financial obligations it has to its members. In addition, if associations can’t increase assessments enough to keep up with reallife inflation and service costs, the entire community, including below-market-rate owners, will suffer.

Several Assembly members acknowledged our concerns and encouraged the author and sponsors to work with us to address these issues. Whether there is a viable compromise is yet to be determined, but we continue to oppose this bill in its current form. AB 572 is now awaiting a vote on the Assembly floor. If approved, it will then head to the Senate.

20 Vision Summer 2023 | cacm.org

The key bills that we are focusing on include:

AB 1033 Ting – ADUs: separate sale or conveyance

This bill would allow a local agency to adopt an ordinance to allow the separate conveyance of an ADU or ADUs as condominiums. This means that ADUs could be separately conveyed from the primary dwelling, resulting in mini condominium complexes forming upon a former single-unit lot. The bill aims to increase density and expand homeownership opportunities for lowincome owners.

CACM opposes this bill because there need to be provisions that govern how this bill would work in a CID and how these new condo complexes would be managed and regulated in the context of the original, existing association. We have concerns that the bill would result in chaos and confusion in these communities. For example, what does this mean for voting rights? What about common area rights when amenities were designed for a lower health and safety target use? How are these units assessed? What entity is responsible for maintenance and enforcement? And there are many, many more questions.

We are in ongoing discussions with the author and sponsors, but we remain opposed. We are part of a broader opposition coalition that includes realtors, builders, bankers, title and escrow companies, and others. AB 1033 is at the Assembly Appropriations Committee.

AB

648

Valencia: CIDs: Meetings by Teleconference

This bill is co-sponsored by CAI and CACM. It would authorize a board meeting or a meeting of the members to be conducted entirely by teleconference, even when there is no declared state of emergency. We successfully got this bill to the Assembly floor, awaiting a vote. If the Assembly approves it, it will then move to the Senate.

The Center for Homeowner Association Law is opposed to this bill. One of their main allegations is that there is abuse when it comes to counting and tabulating ballots in a virtual context and that the “digital divide” prevents homeowners

from accessing virtual meetings. The Assembly Housing Committee appropriately pointed out that call-in features would still be allowed but also noted that a call-in option would not allow owners to witness ballot counting. They addressed this issue by creating an exception for meetings where ballot tabulation occurs. While we do not like that a physical location is required for ballot counting, having the ability to meet virtually for all other meetings is still better than the current law.

AB 1458

Ta: CIDs: association governance: member election

This bill is sponsored by CAI and supported by CACM. It states that for the election or recall of directors if an association fails to attain a quorum as required in the governing documents, the association can hold a subsequent meeting. At that meeting, the quorum necessary for a membership meeting is reduced to 20% of owners present in person, by proxy, or by secret written ballot.

The Assembly Judiciary Committee believes associations should notify owners that the quorum will lower if not achieved the first time around. Accordingly, they asked for an amendment to include a disclosure in the general notice of the election that if the association fails to receive a quorum, it can call a subsequent meeting at least 20 days after a scheduled election where the quorum will be 20% of members present in person, by proxy or secret written ballot. The committee also imposed an amendment that requires another general notice, no less than 15 days before the subsequent meeting, that includes the date, time, and location of the meeting, the list of candidates, and a statement that 20% of those present in person, by proxy or secret written ballot will satisfy the quorum.

CACM expressed that additional notice is an unnecessary use of resources since it is unlikely to have any effect. The committee and the Center for Homeowner Association Law continue to urge that this notice be individual notice, as opposed to general notice. We will continue to fight against any additional individual notice requirement.

The Center for Homeowner Association Law is opposed to this bill. They contend quorum requirements exist to ensure broad participation by owners, and because associations are “quasi-local governments,” allowing the election of board members by a small percentage of owners violates homeowner rights.

Oppositely, we argue that the inability to achieve quorum paralyzes the association from electing new board members and conducting business. The Center for HOA Law also argues that associations can petition a court or change their governing documents if they cannot achieve quorum. We have argued that both options are unrealistic, as the petition process is expensive and unnecessarily clogs an already overburdened court system. Also, to change your governing documents, you need a quorum that is often higher than the quorum for elections!

AB 1458 passed both the Assembly Housing and Judiciary Committees unanimously. It is now headed to the Assembly floor and will then move over to the Senate.

We are now just finishing the first house policy committees. Bills will soon transition to the opposite house, and the policy vetting process will start over again. Advocacy and negotiations will continue as we work to protect the management industry. If you would like to get involved in advocating for reasonable CID law, click here to learn more about how you can support CACM’s advocacy efforts.

cacm.org | Vision Summer 2023 21

Jennifer Wada, Esq., is an attorney, CACM’s legislative advocate and principal of Wada Government Relations in Sacramento.

Congratulations Managers

It is with great pride that we recognize managers who have taken the next step in their professional career by pursuing advanced educational opportunities. Congratulations to our newest Certified Community Association Managers (CCAM), Certified Community Association Financial Manager (CAFM), and Specialty Certificate recipients for the period of February 24, 2023 through May 19, 2023.

NEW CCAM s

Kim Albin, CCAM

Jordan M. Alcaraz, CCAM

Desiree Aubel, CCAM

Leanne Beck, CCAM

Stefany Bravo, CCAM

Erik Brewer, CCAM

Jeff Buck, CCAM

Mary A. Bullard, CCAM

Matt Chandler, CCAM

Michael Cirillo, CCAM

Adriana I. Diaz-Rocha, CCAM

Chelsea C. Dyer, CCAM

Yvonne Edwards, CCAM

Juli Elliott, CCAM

Lisa Y. Falcetti, CCAM

Sandra R. Garland, CCAM

Naz Hayath, CCAM

Janeth Hill, CCAM

Christine Holcombe, CCAM

Brennan M. Hovland, CCAM

Gail Hoy, CCAM

Jeana Jenkins, CCAM

Joshua A. Jones, CCAM

Alexandria M. Kubski, CCAM

Kelly Larson, CCAM

Cheryl Ann Lawer, CCAM

Stacy M. Lewis, CCAM

Spencer L. Mathey, CCAM

Sheena M. McGill, CCAM

Reina L. Nunez, CCAM

Tania J. Ortiz, CCAM

Megan Paladini, CCAM

Deedra H. Pfaff, CCAM

Narda M. Rangel, CCAM

Jessica R. Roberts, CCAM

Siera Robinson, CCAM

Kory S. Schoenke, CCAM

Brian K. Shrigley, CCAM

Andrea Sipos, CCAM

Annessa M. Sosa, CCAM

Kelsey Thum, CCAM

Salina Toland, CCAM

Marta H. Weisler, CCAM

Tera A. Willis, CCAM

Terry Wolfgram, CCAM

NEW CAFM

Heidi C. Celentano, CAFM

SPECIALTY CERTIFICATES

LARGE SCALE

Eric Kazakoff, CAMEx, CCAM-LS

Samuel L. McKee, CCAM-LS, CAFM

NEW DEVELOPMENT

Katie Alvarez, CCAM-PM.ND

Kimberley Flickner, CAMEx, CCAM-PM.LS.ND

Rashid Kassir, CCAM-ND

Veronica L. Treto, CCAM-ND

PORTFOLIO MANAGEMENT

Katie Alvarez, CCAM-PM

Rosie Galla, CCAM-HR.PM

Margaret Nelson, CCAM-PM

22 Vision Summer 2023 | cacm.org

achieving professional excellence

cacm.org | Vision Summer 2023 23

A WORD FROM THE NEW INDUSTRY PARTNER COUNCILS

We thank you for being dedicated members of CACM. As you all know, CACM has programs in place for managers to take courses and earn their CCAM certification to show their dedication to their responsibilities as a leader in the HOA industry. Over the years, we have witnessed the success of this program, and the benefits it has brought to all. It has greatly helped each of our community leaders gain the knowledge, understanding and comfort in their communication with board members, tenants, and co-workers on important topics including management responsibilities, HOA laws, available resources, ethics, and more. We commend you for your time in a position that requires so much patience and attention to detail, and we’re excited to share with you our plans to aid in your continued success.

Knowing the value brought to our communities, CACM decided to create a similar program for the vendors who support you, aka your Industry Partners. The initial step in this journey was putting together two separate Industry Councils, one in the Northern California market and one in the Southern California market.

In those council meetings, we had a nomination and voting process to select your IP Council Chair and Co-Chair positions.

We are happy to introduce your NorCal

Chair and Vice Chair: John Rivera, Director of Client Relations of CM Squared, and Megan Wright, Business Development Manager of Saarman Construction. We are also excited to introduce your SoCal Chair and Vice Chair: Chris Booth, Account Executive, Whitestone Industries and Brandy Arrington, Sales Representative, United Protection Industries, Inc.

The councils have reviewed and approved the California Certified Industry Partner program. This course and certification process will mirror that of the managers with the credits, course hours, and requirements. Our goal is to ensure your industry partners have the knowledge and skills to effectively assist you with your needs. The certification, referred to as the CCIP, serves to add an additional layer of honesty and trust on all sides.

Additionally, both the Northern and Southern Industry Partner Councils have added sub-committees in local regions to plan additional networking and educational opportunities in these sub-markets based on collective feedback from managers based in each location. These local committees are comprised of both managers and industry partners in these regions. These committees meet monthly. From roundtable discussions to educational luncheons, and fun outings to charitable volunteer work, we have many upcoming opportunities for you and your teams to join in on the fun.

Let us know what you would like to see!

24 Vision Summer 2023 | cacm.org

JOHN RIVERA

MEGAN WRIGHT

CHRIS BOOTH

BRANDY ARRINGTON

INDUSTRY PARTNER COUNCIL MEMBERS

SOUTHERN CALIFORNIA

Amanda Gray - Harvest Landscaping

Amber Welch - Sunwest Bank

Andy Henley - ProTec Building Services

Ashley Hibler – The Miller Law Firm

VICE CHAIR: Brandy Arrington - United Protection Industries

Brian Berce - Golden Alliance Insurance Agency

Brian Henry - Park West Landscape Management

Bridget Nigh - Behr Paint

Cang Lee - Tinnelly Law Group

Chet Oshiro – EmpireWorks Reconstruction

CHAIR: Chris Booth - Whitestone Industries

Christina Oridota - Enterprise Bank & Trust

Cory Neubauer - Roy Palacios Insurance Agency

Darren Seefeldt - Gordian Staffing

Elaine Gower – The Naumann Law Firm

Guillermo Amador, Sr. – Customized Guard Services & Systems

James McCormick - Delphi Law Group

Jeff Beaumont - Beaumont Tashjian

Jolen Zeroski – First Citizens Bank

Laura Thomsen - ServPro Team Brogden

Liron Shalom-Hickey - ServPro of Sorrento Valley

Mark Guithues - Community Legal Advisors

Matt Ober - Richardson | Ober

Mimi Cortes - Sax Insurance

Robert DeNichilo - Nordberg|DeNichilo

Scott Litman – Scott Litman Insurance Agency

Suellen Eichman - Eichman Insurance Agency

Teresa Agnew - Reconstruction Experts

NORTHERN CALIFORNIA COUNCIL

Ben Jonas - HUB International

Chris Lucas - Heritage Bank of Commerce

Donna Vingo - Westlake Royal Roofing Solutions

Jennifer Jacobsen - Baydaline & Jacobsen

CHAIR: John Rivera - CM Squared

Kevin Reid - Recon360

Lorena Gomez - Socher Insurance

Mandi Newton - Varsity Painting

Mark Owens - Reliant Construction Management

VICE CHAIR: Megan Wright - Saarman

Construction

Robert Buffington - Gordian Staffing

Scott Swinton - Unlimited Property Services

Sharon Pratt - Pratt & Assoc.

Sonia Bastidas Fuetsch - First Onsite Property

Restoration

Tara Poole - Precision Concrete Cutting

Terin Reeder-Atkins – A.S.A.P. Collection Services

Wendy Benner Miller - CAM Construction & Painting

Zer Iyer - Hughes Gill Cochrane Tinetti

cacm.org | Vision Summer 2023 25

UNDERSTANDING Financial Statements

By Hamlet Vazquez, MCAM-HR

Aboard of directors may be forgiving if, on a landscape walk, you can’t tell the difference between a Pothos and a Philodendron plant. But, on the other hand, if you don’t know if a pre-paid assessment is an asset or a liability, you may need to start job hunting. In writing an article on understanding financial statements, there are two challenges. The first is keeping it exciting. The second is speaking to a broad audience ranging from seasoned managers who are all too familiar with reading financial reports to newbies who maybe didn’t even realize they would need to know how to read a Financial Statement to be successful in this industry.

As professional managers, one of our primary responsibilities is to help ensure the financial health of the associations we manage, and the financial statement is vital to understanding the degree of that health. Knowing how to interpret financial information is akin to being a doctor assessing a patient’s health or a financial planner analyzing an individual’s financial health.

How, then, do we assess the financial health of an association?

At the most basic level, it starts with proper budgeting. If you don’t budget appropriately for the expenses that you know will be incurred and add some cushion, either by way of a contingency line item or a buffer in each significant line item such as utilities, then the financial health of your association will begin to suffer as soon as the first month of your fiscal year.

With that quick introduction out of the way, let’s look at a typical financial statement.

What is the Financial Statement?

A financial statement is a document that provides an overview of the association’s economic activities every month. It consists of several components that offer a snapshot of the association’s financial position, including income, expenses, assets, and liabilities.

Components of a Financial Statement

No matter the association, every financial statement includes at least the following two components:

BALANCE SHEET

The balance sheet provides a snapshot of the association’s financial position at a specific point in time. It consists of three main sections: assets, liabilities, and equity.

• Assets represent what the association owns, such as cash, accounts receivable, investments, and property.

• Liabilities represent what the association owes, such as accounts payable, loans, and other obligations.

• Equity is the difference between assets and liabilities.

The balance sheet helps assess the association’s financial stability and solvency by comparing its assets and liabilities to determine if equity has increased or decreased at a specific time.

INCOME STATEMENT

Also known as a profit and loss (P&L) statement, the income statement provides an overview of the association’s revenues, expenses, and net income (or loss) during a specific period.

26 Vision Summer 2023 | cacm.org

• It shows how much the association has earned from assessments, fines, and interest.

• It also reflects how much money was spent on various expenses such as utilities, landscaping, repairs, and staffing costs, to name just a few line items.

• To calculate the net income (or loss), subtract the total expenses from the total revenues. The figure arrived at indicates the association’s financial performance during that period.

Essential Items to Review in a Financial Statement

When reading a financial statement, there are several essential items to look for:

INCOME AND EXPENSES

Review the association’s income and expenses on the income statement to understand where the association’s money is coming from and how it was spent. Look for any significant changes or trends in revenues and expenses, and compare them to what was budgeted and to previous periods to identify any irregularities or areas that may require further investigation. It is often helpful for the manager to create a variance report for the board that explains in narrative form why the positive/negative variance exists.

For example, if payroll is significantly over budget, the variance report explanation may be, “This is partially due to California’s supplemental paid sick leave for Covid” or “Overtime has been greater than normal due to regularly scheduled staff calling out sick.” In addition, it’s helpful to include an explanation if the dollar amount is large or if the variance is significant as a percentage of the annual budget for that particular line item.

To illustrate, if you budgeted $1,000 for pest control and spent $800 by March, while $800 may seem small, you may want to explain why the first three months of the fiscal year used up 80% of the annual budget.

RESERVE FUNDS

It’s vital to check the association’s balance sheet for the reserve fund balance and compare it to the most recent reserve study update to ensure that the association has adequate reserves to cover major repairs or replacements of common assets like roofs, roads, plumbing, and pools.

AGING REPORT

Another crucial component to keep an eye

on is the association’s delinquency rate. The aging report will indicate assessments and fees that are past due. It also shows how delinquent the debts are. Given that assessments are the lifeblood of any association, it’s essential to review the aging report every month and follow up accordingly.

BAD DEBT V. ALLOWANCE FOR DOUBTFUL ACCOUNTS

Here, you’ll find an explanation of two terms that new managers and board members misuse or misunderstand most frequently:

BAD DEBT

Bad debt refers to accounts receivable deemed uncollectible and written off as a loss. In other words, it represents the portion of accounts receivable that the association has determined will not be collected and is therefore treated as an expense. Bad debts typically arise when homeowners fail to pay their assessments and cost-effective collection solutions have been exhausted. As a result, bad debts show up as an expense in the income statement of the homeowner’s association, which reduces the association’s net income.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

The allowance for doubtful accounts is a contra-asset account on the balance sheet of the homeowner’s association. It represents an estimate of the accounts receivable that may be uncollectable but still need to be identified explicitly as bad debts. It’s a journal entry based on the board’s assessment of the uncollectible accounts.

To establish the allowance amount, one should analyze historical data, current economic conditions, and specific circumstances related to the association’s accounts receivable. The adjustment aims to reflect a more accurate valuation of the debt on the balance sheet by reducing the gross amount of accounts receivable to the net amount expected to be collected.

In summary, bad debt is the actual amount of accounts receivable deemed uncollectible and written off as an expense. Conversely, the allowance for doubtful accounts is a guesstimate entry on the balance sheet to account for potential uncollectible accounts receivable that still need to be identified as bad debts. Both adjust for uncollectible debts but differ in timing and presentation in the financial statements.

Want to Learn More?

Suppose you want to learn more about understanding financials so you can better advise your clients. In that case, I encourage you to take the following CACM courses because it’s nearly impossible to fully explain or learn the ins and outs of financial statements via an article! And, if you could, it would be such a lengthy article that no one would read it.

So, if you are still confused or want to be better prepared to answer your board’s questions regarding your association’s financial statement, check out the following CACM classes: “Explaining Financial Statements,” “Budgeting for Community Managers,” “Reserves – What, Why, How,” “Assessment Collections,” and “Strategic Financial Planning.”

cacm.org | Vision Summer 2023 27

Hamlet Vazquez, MCAM-HR, is the General Manager at Wilshire Terrace Co-op in Los Angeles.

Knowing how to interpret financial information is akin to being a doctor assessing a patient’s health.

A COMMUNITY MANAGER’S GUIDE TO MANAGING YOUR HOA’S RESERVE FUNDS

by Derek Eckert, RS, PRA

Awell-funded reserve fund is essential for homeowners’ associations (HOAs) to ensure the long-term financial stability of their communities. Reserve studies help associations plan for common asset maintenance, repair, and replacement while providing a roadmap for adequate funding. However, not all managers understand how to manage reserve funds for the association’s long-term financial and physical health. In this article, we will discuss the concept of fully funded reserves, monthly assessments, reserve study review frequency, and the implications of borrowing from reserve funds.

FULLY FUNDED RESERVES: DEFINITION AND IMPORTANCE

A fully funded reserve means that an HOA has set aside 100% of the necessary funds to cover the estimated costs of maintaining, repairing, and replacing common assets over their expected useful life. Approximately one in 10 HOAs are fully funded. However, those not yet 100% funded should have a funding plan designed to get them there eventually.

Achieving a fully funded status is essential for several reasons:

FINANCIAL STABILITY

A fully funded reserve ensures that an association has the necessary funds to cover expenses, reducing the risk of special assessments or deferred maintenance. Special assessments are tough on communities, the members, and their community managers. Additionally, deferred maintenance is the most expensive way to pay for reserve projects, as it can cost as much as three times more when you finally get around to doing the task, which is possibly a life and safety hazard at that point.

FAIRNESS

What do reserves have to do with being fair? By adequately funding reserves, the association ensures that each homeowner pays their fair share of costs during their period of ownership. Remember that fairness extends beyond the current owners and applies to future owners. No future owner wants to buy into a community association only to get hit with a special assessment months later.

28 Vision Summer 2023 | cacm.org

PROPERTY VALUE PRESERVATION

Properly maintained common assets contribute to higher property values, benefiting all homeowners in the community. For example, our firm did a survey and found that on a square-foot basis, condominium homes in an association with solid reserves (over 70%) sold for 13% more than homes in a community with weak funding levels (under 30%). Those are compelling numbers when you consider that most homes in California sell for hundreds of thousands, if not million, and most HOA assessments are only in the hundreds of dollars per month.

MONTHLY ASSESSMENTS: ALLOCATING FUNDS TO RESERVES

The portion of monthly assessments allocated to reserves varies depending on factors such as the age and condition of shared assets, the reserve study findings, and the association’s financial goals. However, the general recommendation is that a condominium association allocate between 15% and 40% of monthly assessments to reserves to maintain a healthy financial status. Annually reviewing and updating the reserve study will help the association determine the appropriate allocation based on its specific needs. For example, an HOA that is 103% funded can likely allocate less than 40% of assessments to maintain a healthy reserve fund. But a community that is 65% funded should contribute as much as its budgetary limits allow.

RESERVE STUDY REVIEW FREQUENCY

In California, the Davis-Stirling Act requires an on-site reserve study every three years, with annual financial-only updates to meet reserve funding disclosure requirements. This yearly review helps the association:

• Adjust for changes in common asset conditions or estimated costs.

• Reevaluate the reserve funding plan based on actual expenditures and reserve contributions.

• Monitor the association’s progress towards achieving a fully funded reserve status.

• Provide the required disclosures to all owners and future purchasers of homes within the community.

BORROWING FROM RESERVES: RISKS AND CONSIDERATIONS

The Davis Stirling Act allows associations to borrow from reserves to meet short-term cash flow problems. While it may be tempting to borrow from reserve funds to cover unexpected expenses or budget shortfalls, this practice can have severe consequences for an association’s financial health. Borrowing from reserves can:

• Deplete the reserve fund, leaving the association unprepared for future common asset expenses.

• Create a reliance on reserve borrowing, masking underlying budget issues and delaying necessary financial adjustments.

• Result in special assessments or increased regular assessments to replenish the reserve fund, placing a financial burden on homeowners.

• Cause delays in significant repairs and replacements of components that could present a life and safety hazard, such as foundations, decks, and elevated walkways.

Before borrowing from reserves, an association should carefully weigh the risks and consider alternative funding options, such as implementing cost-saving measures, adjusting the budget, or levying a special assessment.

Additionally, before you borrow from reserves, you should contact your reserve specialist and financial manager to determine the immediate impact on the overall health of the reserve fund.

SUMMARY OF THE TIPS FOR MANAGING RESERVE FUNDS

Understanding the intricacies of reserve studies and their implications for an HOA’s financial health is crucial for longterm success. By striving for a fully funded reserve status, allocating an appropriate portion of monthly assessments to reserves, reviewing and updating reserve studies regularly, and cautiously approaching reserve borrowing, associations can avoid surprise expenses, make informed decisions, save money, avoid loans and special assessments, and protect property values. That makes proper management of the reserve fund a win for everyone.

cacm.org | Vision Summer 2023 29

Derek Eckert, RS, PRA, is the President of the Association Reserves’ Northern California division.

Reserve studies help associations plan for common asset maintenance, repair, and replacement while providing a roadmap for adequate funding.

Apathy TRANSFORMING INTO

Engagement

By Rob Buffington

In the HOA industry, we like to talk about our good HOAs and bad HOAs. Or, after a drink or two, our easy HOAs and that one ridiculous HOA. While there’s no question that there are different types of HOAs, the truth is that every HOA has challenges; the difference is whether you are experiencing positive engagement to balance out the problematic aspects.

As an HOA manager or executive, your main goal is to ensure that the community you manage runs smoothly and that residents are happy. One of the best ways to do this is by driving engagement within the community. This article provides some tips for HOA managers to drive engagement in the HOAs they manage. So, if you want to transform apathy into participation in the communities you work with, keep reading.

Communicate Effectively

One of the most essential things an HOA manager can do is to communicate effectively with residents. Keep them informed about community news and events, important updates, and changes to policies or procedures. Use multiple channels to communicate with residents, such as email, social media, newsletters, and community forums. Find what channel gets the best results and use it rather than relying solely on snail mail and posted notices. Regular communication helps to ensure that residents are aware of what’s happening in the community and how they can get involved.

Most people dislike HOAs because their only genuine interaction is when they receive a violation letter for a rule of which they were probably unaware or a collection and late fee notice for an assessment payment the owner didn’t realize they missed. Don’t let that be your first interaction with homeowners. While getting homeowners’ attention on more positive matters may be difficult, the extra upfront work will pay off down the road.

Create a Sense of Community

Creating a sense of community is crucial to driving engagement in an HOA. Encourage residents to get to know each other by organizing events such as block parties, potlucks, or game nights. Create shared spaces where residents can gather and socialize, such as a clubhouse or community garden. Building relationships and creating a sense of belonging will help residents feel more invested in the community and more likely to participate in events and activities. Convince your boards to establish a budget line item for holiday parties, community events, and refreshments for the annual meeting. A $25 gift card for the winner of a holiday lights contest can save the HOA countless headaches down the road.

Be Responsive

Homeowners’ biggest complaint when looking for a new manager is a perceived lack of responsiveness. While we understand the pace at which things move in an HOA, many homeowners do not. Taking the time to educate them and manage expectations can reduce complaints and help build rapport with homeowners.

30 Vision Summer 2023 | cacm.org

One of the simplest ways to do this is to respond to every email within one business day. A common mistake among overworked managers is to only respond to emails once there is something to report. However, a simple “I’ve received your email and have requested a bid from the vendor to present at the next board meeting in six weeks” can let people know that they are heard and manage expectations on when to expect resolution. Similarly, the more information you provide on what’s happening behind the scenes, the more understanding homeowners will be about delays.

Provide Opportunities for Involvement

If the only way a member can get involved is by serving on the board of directors, prepare for engagement and participation to suffer. Most members fear the time and energy commitment that being a board member takes, not to mention what it might do to their relationships with their neighbors. Providing other opportunities to help out in more minor ways is a phenomenal way to ramp up member involvement. Consider establishing committees, clubs, or groups that allow members to volunteer their time and talents without having to run for election.

Be Transparent

There will be times when members make requests that cannot feasibly be honored due to legal, financial, or other restrictions that the requesting owner needs to be made aware of. To them, the proposal to replace the rear park that borders a protected wildlife habitat slope with a community pool seems reasonable. So, when the

manager and board dismiss it with a laugh before closing the homeowner forum, they feel angry and upset.

Instead, when you find yourself in this situation, be transparent. Explain why the request is outside the association’s means to honor. When possible, direct them to outside resources such as building codes or insurance requirements that back up the board’s position. It’s the nature of the job to be the bearer of bad news, but how you bear that news can make all the difference.

Celebrate Successes

In a for-profit corporation, at least once a year, the CEO or President gives a speech in which they call out and celebrate the past year’s successes. In the United States, which is like a vast common interest development, the President gives the annual State of the Union address wherein they do the same. So, why don’t our non-profit homeowners’ associations follow suit?

Imagine if, in the annual budget package or at the annual meeting, the President included a message celebrating everything the board, committees, and association members accomplished over the past year before opening up the floor for the homeowner forum. Wouldn’t that make for a much more positive and peaceful discussion? Aren’t the members more likely to feel like their HOA is a great place to live if the community’s successes are acknowledged?

Address Concerns

One of the biggest reasons residents disengage from an HOA is because they feel their concerns are not being listened to or addressed. As an HOA manager, it’s crucial to take resident concerns seriously and address them promptly. Hold regular meetings with residents to discuss their concerns and provide updates on what actions the board is taking to manage them. Addressing concerns shows residents that their feedback is valued and encourages continued engagement.

Use These Simple Steps to Drive Participation

Driving engagement within an HOA is essential for ensuring the community runs smoothly, and residents are happy. By communicating effectively, creating a sense of community, providing opportunities for involvement, being transparent, celebrating successes, and addressing concerns, HOA managers can encourage residents to engage with the community and feel invested in its success.

cacm.org | Vision Summer 2023 31

Rob Buffington is the Owner of East West Building Works and President of Gordian Staffing, both of which are located in San Jose.

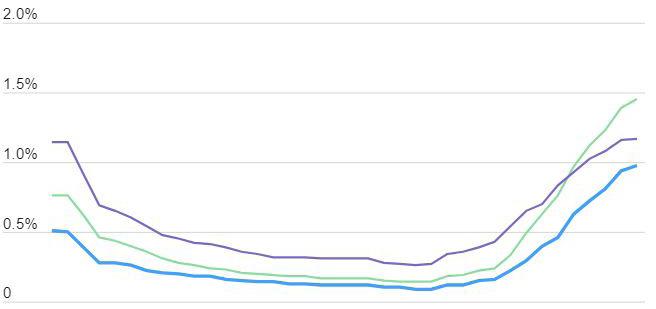

THE NOT-SO-SURPRISING IMPACT OF RECESSION ON HOA COLLECTIONS

Homeowners associations are essential for maintaining the integrity and value of communities. However, during a recession, these groups are often hit hard. With an increase in collection cases, combined with rising costs for using licensed collection services as the law now requires, many associations worry about making ends meet.

In this article, we’ll uncover the surprising impact of the recession on communities. From changes in laws governing collections to financial challenges, we’ll delve into the issues these groups face. We’ll also provide steps to help associations weather the storm and emerge stronger on the other side. So, if you’re a manager of one or more associations, buckle up – we’re about to take a deep dive into the world of HOAs during a recession. However, even well-seasoned management executives can benefit, as collection laws and best practices have shifted since the last recession, and technology is changing the collection game.

by Dee Rowe, CCAM

32 Vision Summer 2023 | cacm.org

CHALLENGES WITH COMMUNITY PARTICIPATION

A recession can have a significant impact on homeowners associations, but the biggest challenge is maintaining community participation during tough times. Not only do the financial strains make volunteering and donating harder for members, but the emotional toll of the recession can also lead to disengagement and apathy. This lack of involvement can create communication and decision-making obstacles for the association, hindering its ability to navigate economic turbulence. Moreover, when families need help making ends meet, paying dues or participating in fundraising efforts may be a low priority.

Encouraging community involvement is essential for managers of homeowners associations so clients persevere and thrive during a recession. Finding creative ways to incentivize participation and reenergize

members can make all the difference in maintaining the association’s vitality.

One way to accomplish this is to provide information on resources that may help financially challenged individuals, such as letting members know about COVID-19 state assistance programs or inviting a banker to an event to provide information to members on refinancing, investment, or other tactics that can ease their financial burden.

Another suggestion is creating committees or volunteer programs to collect and distribute food donations or assist community members with difficulty covering expenses. Provided a well-worded Committee Charter is adopted to govern the volunteers, such an action requires minimal association resources and shows those in hard times that their neighbors (and the board and management company) care.

FINANCIAL CHALLENGES

It’s no surprise that balancing the budget can be a significant challenge for HOAs during tough economic times. The recession can bring a range of financial challenges that make it difficult for members to pay assessments, and the emotional toll of the financial instability leads to apathy and disengagement. In addition, as fewer members pay dues on time, the strain on the operating budget grows.

The growing economic pressure often leads boards to increase assessments to cover the gap between costs and income. Not only do these increases in assessments make it even harder for homeowners behind on payments to catch up, but they also increase the burden on the members paying on time. The owners that pay on time can start to resent those that aren’t, as many boards and managers observed in the financial housing crisis of 2008. It’s a vicious emotional cycle with the potential to destroy community morale.

To mitigate this, managers and boards should focus on fair and equitable collections. For example, instead of immediately moving toward foreclosure, work with a licensed collection firm that works with debtors to find creative funding and payment plan solutions so that members pay down their debt without threats of losing their homes. Doing so has the additional benefit of collecting funds at the front end of the process vs. being paid at the back end of a foreclosure proceeding, as I learned when chatting with collections expert Mitch Drimmer of Axela Technologies, Inc.

CHANGES IN LAWS GOVERNING COLLECTIONS

In California, Senate Bill 908 became effective on January 1, 2021, indicating that any entity collecting money requires a license and background check. Since then, the Department of Financial Protection and Innovation clarified that routine collection of assessments is not consumer debt and is not subject to the licensing requirement. However, collections are still an area fraught with liability. In addition, case law is often not in favor of the collector. Therefore, using an affordable, reputable, licensed collection solution is a best practice.

Continues on page 34

cacm.org | Vision Summer 2023 33

RECESSION IMPACT,

Continued from page 33

However, this has yet to be the practice. Instead, management companies have traditionally done early-stage collections in-house to earn extra income. They are often hesitant to outsource for fear of losing the administrative income from collection actions, such as sending pre-lien and lien notices. But, believe it or not, there is a better way.

By using a non-predatory, licensed collection firm, management companies no longer have to employ staff to run reports, assess late fees, send notices, file pre-liens and liens, or take emotionally charged calls from angry debtors who feel they’re being targeted unfairly. The headache of high turnover of collection staff disappears as all calls get forwarded to the agency to protect the consumer’s rights under the Fair Debt Collection Practices Act (FDCPA)

As I discussed with James McCormick, Jr. of Delphi Law Group, LLP, while preparing for this piece, the management company and team are also protected from liability should a debtor file a suit claiming that their rights were violated or, even worse, open a fair housing claim stating such. Finally, some collection firms specializing in association collections structure their programs so that the management company benefits financially from the relationship in addition to the association the firm is collecting for.

STEPS TO WEATHER THE STORM

During difficult economic times, managers and management companies must take proactive steps to help members weather the storm. Here are some strategies that can help:

1. COMMUNICATE REGULARLY

Maintaining open lines of communication with members during a recession is essential. It is crucial to keep everyone informed of financial challenges and any progress made toward addressing them. Providing updates via email or social media can keep members engaged and connected. If your clients haven’t opted for electronic communications yet, recommend that they do so.

2. REDUCE COSTS WHERE POSSIBLE

When members are struggling financially, the HOA needs to minimize expenses where possible. This could mean negotiating better deals with service providers, cutting back on non-essential expenses, or finding ways to reduce energy consumption. It could also mean reducing collection costs by using licensed firms first and saving the high-ticket attorney fees for those rare cases when it’s unavoidable. If you need help finding a reputable collection service, check out CACM’s Industry Partner Directory.