FINANCE Issue The

A meeting space solution. 404PORTLAND.COM • BOOKINGS @ 404PORTLAND.COM 2,500 ft 3 Total Space / 1,500+ ft 3 Meeting Room • Catering Kitchen Portable Bar/Serving Table • Tables & Chairs Provided (or Bring Your Own) Off Street Parking Capacity for 50+ Vehicles • Large Outdoor Space Available for Rent

YOUR CAREER. ENGINEERED HERE. www.mcclurevision.com | 573.814.1568

ROSTLANDSCAPING.COM 2450 Trails W Ave., Columbia, MO 65202 Quality in every aspect. THREE DIVISIONS, ONE GOAL Superior Irrigation (573) 875-5040 Superior Garden Center (573) 442-9499 Rost Landscaping (573) 445-4465

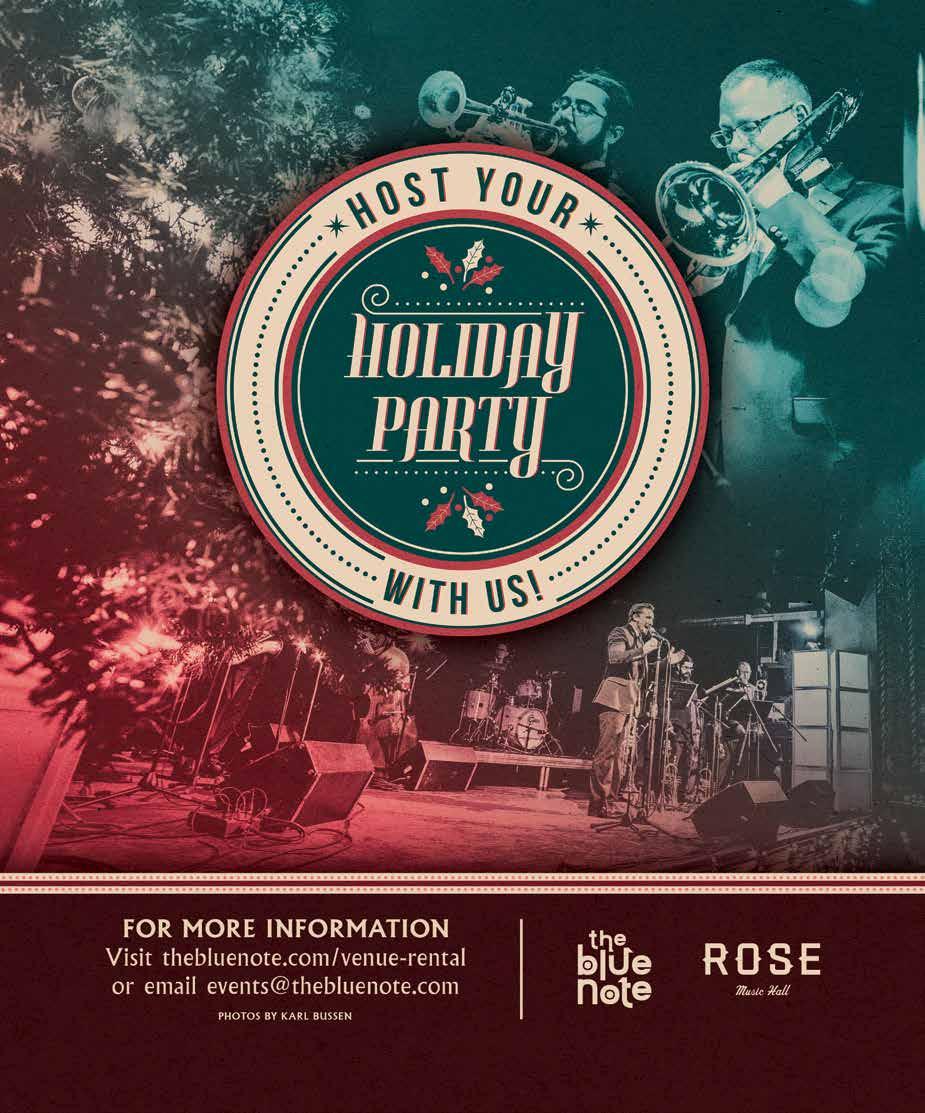

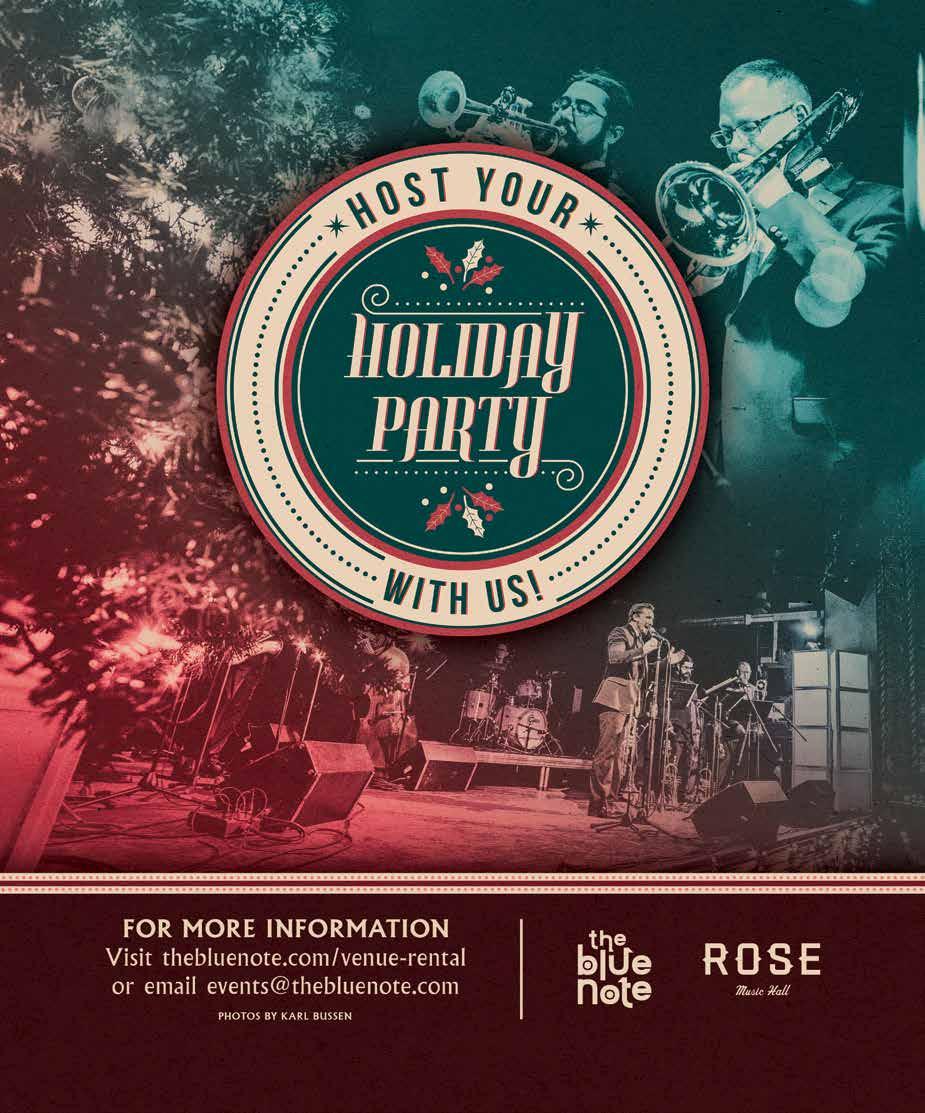

BILL CHARLAP TRIO Sunday, November 13, 2022 • Murry's HOLIDAY TIME! ÉTIENNE CHARLES' CREOLE CHRISTMAS Sunday, December 4, 2022 • The Blue Note JAZZ SERIES TICKETS MAKE A GREAT GIFT FOR YOUR FAVORITE CONCERTGOERS! NEXT UP! OUR FUN-FILLED COAST-TO-COAST ANNUAL CAMPAIGN BEGINS ON “GIVING TUESDAY” • NOVEMBER 29 HERE’S YOUR CHANCE TO SUPPORT YOUR FAVORITE JAZZ SERIES EDUCATION School of Music University of Missouri

A 3-year contract is required. Monthly package price is good for one year and thereafter increases $20 each year during the contract term. If you cancel any of the services within the 3-year term, an early termination fee may apply. Does not include standard installation fee ($99.95, more if special work is needed). Package price also does not include the following recurring monthly charges: (i) local broadcast station surcharges; or (ii) taxes, franchise fees and other amounts required by law to be collected or paid. Mediacom Business Advanced Data Security requires Mediacom Business Internet for additional monthly charge. Bundle Mediacom Business Wi-Fi service ($15/mo.) with Advanced Data Security ($15/mo.) for $20/mo. For 1 year; thereafter, the standard rate of $15/mo. shall apply for both services. For more information go to: MediacomBusiness.com/total-solution-bundle. © 2022 Mediacom Communications Corporation. All Rights Reserved. CONNECTIVITY BUILT FOR BUSINESS 60 Mbps INTERNET Business-grade speed with unlimited usage. BUSINESS PHONE High-quality calling to keep your team communicating. BUSINESS W i -Fi Ideal for data-hungry customer devices. ADVANCED DATA SECURITY Stay protected and connected with innovative features. CALL TODAY 866-393-4847 A MONTH $ 149 95 Running a business is a tough task. Mediacom Business’ robust network functions as your I.T. department and strategic partner, so you can stay focused on the business at hand.

move, and then pivot

What to say about nances in the nancial issue? is year…everything! It’s crazy to me that during COVID, our business (Columbia Marketing Group and COMO Magazine) actually thrived. It wasn’t until this year that we experienced any serious nancial impact from COVID. Partnerships changed. Banking partners changed. Paper prices (if you can even get it) are skyrocketing! Postage prices increased. e cost of doing everything increased as did our commitment to nding a way to still serve our customers and our community.

However, one really good thing came from this. is gave us the opportunity to critically look at what we had and pivot as needed. We dove into our business model in a way that we have been putting o for years. We found ways to innovate and bring much more content to you on a regular basis using our digital properties that aren’t tied to the cost of paper and postage. We are adding new brands and events and have hired sta to help make this happen. Soon, we will even have new o ces.

What I have learned is that while the daily life of a business owner is not unlike a roller coaster, the key is to keep your eyes on the horizon. Learn, pivot, move forward. Our “forward” will include introducing new events for all of our readers. Pets, home renovations, makers, the Titan Awards as well as a conference for small business owners are all being added to the 2023 lineup.

We dove into our business model in a way that we have been putting off for years.

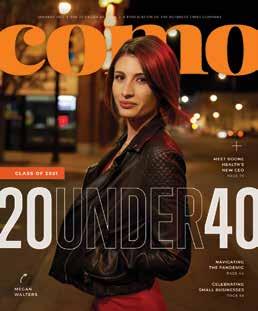

THE COVER

Brad Roling, Market President — Columbia, Mid America Bank

Photo by Anthony Jinson

Photo by Anthony Jinson

COMO Magazine is coming out of covid (heck, even long covid) stronger than ever before. I can’t wait to show you what we have in store for you. My baby is growing up.

COMOMAG.COM 11

Letter from the Publisher Learn,

ERICA PEFFERMAN PUBLISHER

ON

COMO RenoCreatures CONFERENCE 2022 Small Business & MAGS COM O MAKERS Makers MAKE R S MARKET

SILVER SPONSORS LaBrunerie Financial Boone County Millwork Cripps & Simmons LLC. St. Croix Hospice Automotive Specialist Sydenstricker Nobbe BOOTH SPONSOR Truman VA Hospital BRONZE SPONSORS Commerce Bank Central Bank Hawthorn Bank Cedarhurst Senior Living Fast Yowi Angelo’s Pizza & Steak House Boone Electric Cooperative Tryps Children’s Theater AssuredPartners COMMUNITY SPONSORS Real Property Group Savvi Formalwear Sumits Hot Yoga Lakota Coffee Company 44 Stone 44 Canteen Room 38 Broadway Hotel 11Eleven The Roof Body Recovery Coffee Zone Bud’s Classic BBQ Pierpont General Store Lizzi & Rocco’s Liberty Family Medicine Thank You, Columbia! Special thanks to our sponsors: 2022 Presenting Sponsor Gold Sponsors Platinum Sponsors FOR SUPPORTING THE FIGHT TO END ALZHEIMER’S.

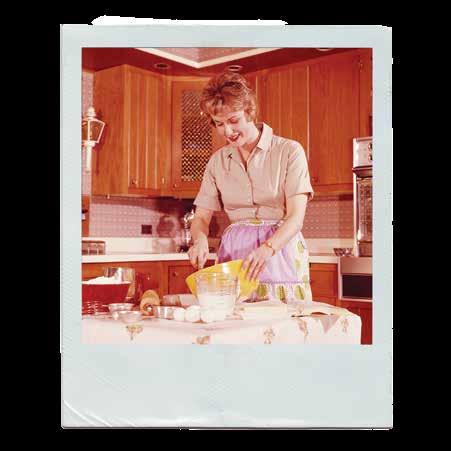

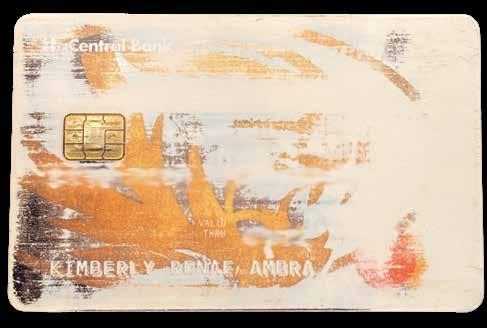

Photo of the infamous debit card.

Numbers have been digitally blurred — don’t steal my credit!

If this issue taught me anything, it’s that I’m doing everything nancially wrong. HA!

Around 15 years ago, my soon-to-be20-year-old son lost his rst tooth. As I was in the middle of ful lling my tooth fairy duties, with my hand under his pillow to retrieve the tooth, he sits up from a dead sleep and says, “Why are you stealing my tooth fairy money?” I was so ustered, I dropped the tooth and that thing has NEVER been found.

Is that who my children think I am?! Not the one who has loved and protected them since birth, but a tooth fairy money stealer?! HA! Okay sorry, but that story has stuck with me, and I had to share. Moving on. (Kind of.)

At 41 years young, I’m still living in the “treat yourself” mentality, and I just don’t see that ever changing. I’m stuck between “I need to save money,” and “You only live once.”

Maybe someday I’ll jump on the Dave Ramsey train. But for now, I am who I am. I’m more of a swipe-and-pray kind of gal — so much so that I am kind of famous for the current state of my debit card. at thing has been used and abused and it shows. It’s a soldier that’s been through many battles. It’s been lost and left behind but has always pulled through.

My debit card is a conversation starter. No one understands how it still works. Everyone has questions (and concerns) when they see me pull it out. It’s become somewhat of a challenge I WILL WIN. I refuse to replace that thing before its expiration date in January. So close!

I’m stuck between “I need to save money,” and “You only live once.”

Now that I have two children in college and am in the midst of planning my oldest’s wedding — maybe I wish I would have done things a little di erently. Planned a little more. Saved a little more. But we live and learn. And it’s never too late. How lucky are we to live in a community with so many opportunities! is issue is packed full of nancial opportunities. I personally was inspired by Central Bank’s ProsperU program. I now know who should be on my nancial team. So maybe, just maybe, there is hope for me afterall.

I have so many friends who are in the nancial industry, and I am sure you are reading this and cringing. I guess if anyone is interested in a project, you know where to nd me.

Whichever side of “I need to save money,” or “ You only live once,” you nd yourself on, I hope you enjoy this issue. For those savers out there, I am sure this may pique your interest more than the other side. And for the spenders… call me.

I would love to hear from you! What should we talk about in upcoming issues? Feel free to share, Kim@comomag.com.

KIM AMBRA EDITOR

COMOMAG.COM 13 Letter from the Editor Adulting is hard.

XO,

President Erica Pefferman Erica@comomag.com

EDITORIAL

Publisher | Erica Pefferman Erica@comomag.com

Editor | Kim Ambra Kim@comomag.com

Copy Editor | Ryan Shiner

DESIGN

Creative Director | Kate Morrow Kate@comomag.com

Photo Director | Sadie Thibodeaux Sadie@comomag.com

Senior Designer | Jordan Watts Jordan@comomag.com

CONTRIBUTING PHOTOGRAPHERS

Lana Eklund, Anthony Jinson, Drew Piester, Sadie Thibodeaux

CONTRIBUTING WRITERS

Kim Ambra, Candice Ball, Alicia Belmore, Lauren Sable Freiman, Jules Graebner, Jodie Jackson Jr., Amanda Long, Michelle Terhune, Jennifer Truesdale, Emmi Weiner

Director of Operations

Amy Ferrari Amy@comomag.com

MARKETING

Director of Sales | Charles Bruce Charles@comomag.com

OUR MISSION

To inspire, educate, and entertain the citizens of Columbia with quality, relevant content that reflects Columbia’s business environment, lifestyle, and community spirit.

CONTACT

Business Times Holdings, LLC 18 S. Ninth St. Ste 201, Columbia, MO 65201 (573) 499-1830 comomag.com /wearecomomag @wearecomomag

SUBSCRIPTIONS

Magazines are $5.95 an issue. Subscription rate is $39 for 12 issues for one year or $69 for 24 issues for two years. Subscribe at comomag.com or by phone.

COMO is published every month by Business Times Holdings, LLC. Copyright Business Times Holdings, LLC 2022. All rights reserved. Reproduction or use of any editorial or graphic content without the express written permission of the publisher is prohibited. Education Issue The Elizabeth Herrera KEEP AN EYE OUT FOR RECENT ISSUES AT LOCAL STOCKISTS AROUND TOWN! Dr. Jennifer Sutherland DC, FASA, Webster Certified Dr. Ashley Emel DC, CACCP, Webster Certified 2516 Forum Blvd. #102 (573) 445-4444 compass-chiropractic.com Chiropractic Care Acupuncture Pregnancy Wellness Child Wellness Massage Therapy MAKE LIFE MORE ENJOYABLE!

Representing Voices from All Different Walks of Life.

Kris Husted

Senior Content Editor

NPR

Beth

Jacobs Property Management

Morton

Director

Turning Point

Chief Executive Officer

Suzanne Rothwell

President

Advancement Division

College

Megan

President

Burrell

of

of

Nathan Todd

Business

Wende Wagner

COMOMAG.COM 15 Advisory Board

We take pride in representing our community well and we couldn’t do what we do without our COMO Magazine advisory board. Thank You!

Bramstedt Associate Pastor Christian Fellowship Church Heather Brown Strategic Partnership Officer Harry S Truman VA Hospital Chris Cottle Walk Manager Alzheimer’s Association Greater Missouri Chapter Nickie Davis Executive Director The District, Downtown CID Alex George Owner Skylark Bookshop Executive Director Unbound Book Festival Author Chris Horn Reinsurance Manager Shelter Insurance Barbra Horrell Consultant Horrell Associates Jeremiah Hunter Assistant Police Chief Commander Investigations Bureau Columbia Police Department

Midwest Newsroom Amanda Jacobs Owner

Darren

Program

David Nivens

Midwest Computech

Vice

Columbia

Steen Vice

Behavioral Health La Toya Stevens Director

Communications for the Division of Inclusion, Diversity and Equity University

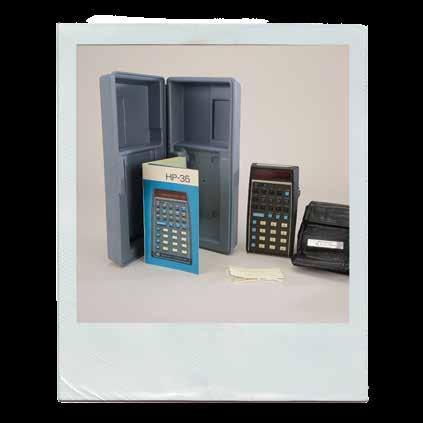

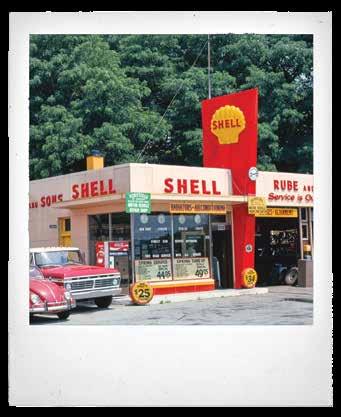

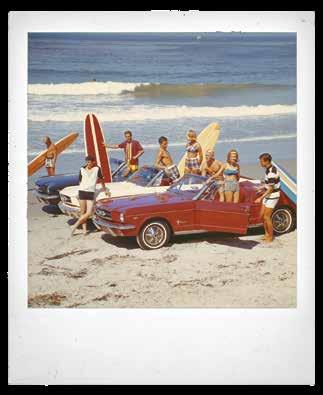

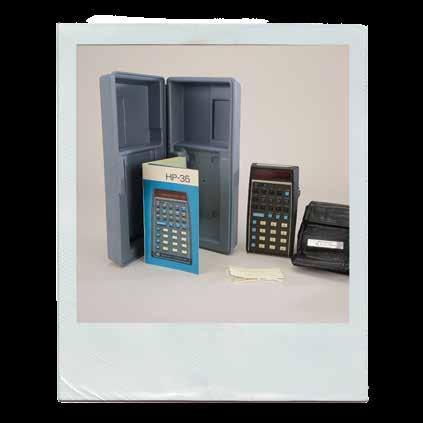

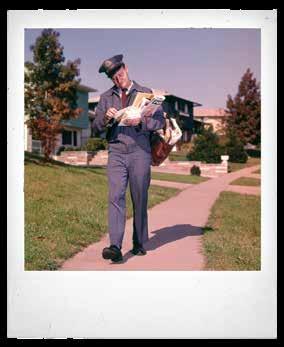

Missouri-Columbia

Services Specialist First State Community Bank

Director of Philanthropy The Missouri Symphony

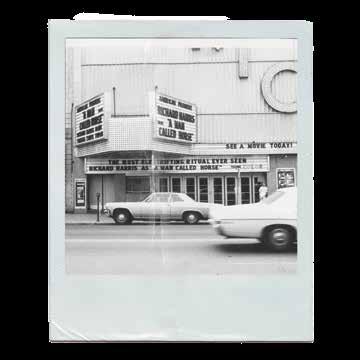

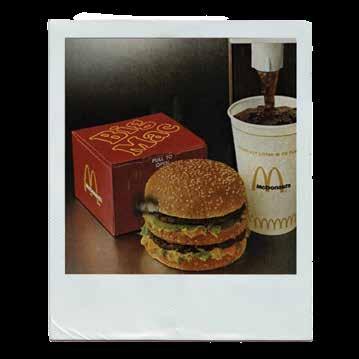

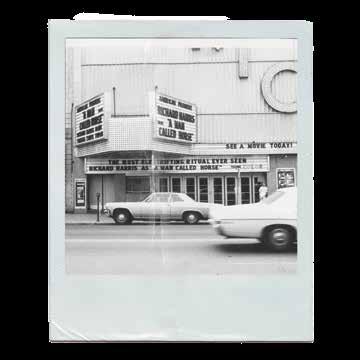

77 BUSINESS UPDATE Accounting Plus has grown from a spark to a shining star during their 30 years of business. IN THIS ISSUE The Finance Issue 11 Publisher’s Letter 13 Editor's Letter 15 Meet COMO's Advisory Board LIVING 21 ART & CULTURE Beautifying the Community 25 WELLNESS Money 101 27 HOMES Building Homes the Right Way 38 GOURMET Rolling in With Baja-Midwest Fusion 45 STYLE Styled Strands 49 FRIENDS & FAMILY Your Financial A-Team WORKING 63 CLOSER LOOK 64 BRIEFLY IN THE NEWS 67 MOVERS & SHAKERS 68 CELEBRATIONS Live on Air 74 NONPROFIT SPOTLIGHT Community is the New Currency 80 BUSINESS UPDATE A Financial Pillar 83 PYSK Brad Roling 97 THE LAST WORD Blast from the Past FEATURES 52 HOUSING RELIEF Boone County awards federal dollars to help stave off evictions. 56 PLANNING FOR THE UNTHINKABLE Putting a premium on protecting your assets. 86 SEARCH AND RESCUE COMO residents weigh in on priorities for spending $12.6 million in American Rescue Plan Act funding. 92 COMMUNITY BENEFITS OF INFLATION How sales tax pay for city projects.

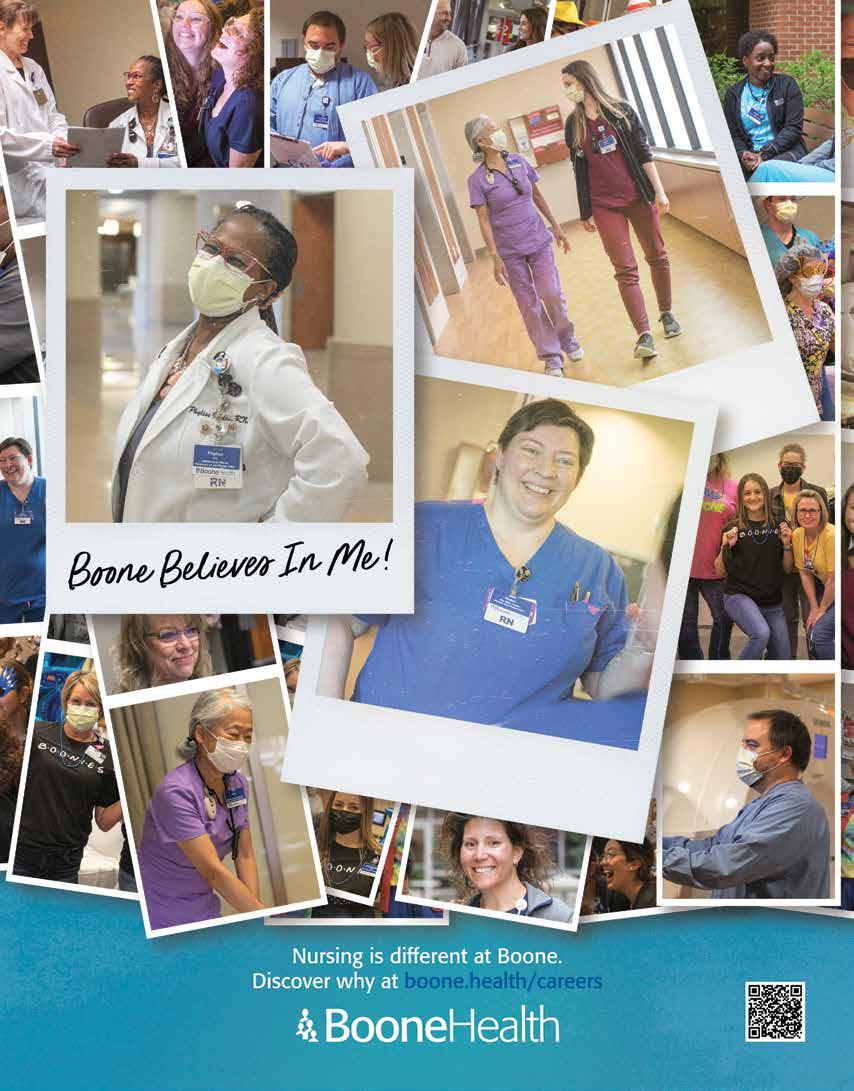

WE’LL BE THERE FROM THE START

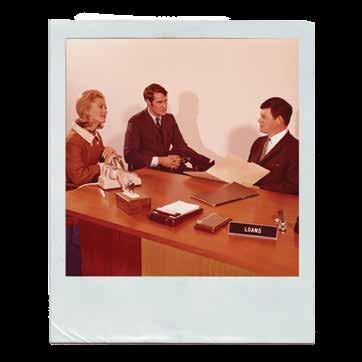

When you’re ready to commit, Central Bank is there. Whether you’re finally chasing down your dreams and need a loan or are looking for support and guidance to help keep your business afloat, we’re here for you. Our team of business bankers will work with you to find customized solutions to help you reach your goals — and then set new ones. Because that’s how we do business better.

Are you ready for the next chapter in your business? Consult your business banking team today to discover how we do business better.

WE DO BUSINESS BETTER Member FDICcentralbank.net

ROLLING IN WITH BAJA-MIDWEST FUSION

George Nickols is living the dream “slinging tacos” to the masses.

BUILDING HOMES THE RIGHT WAY

Jake Bruton builds to help save the planet and save homeowners money.

HOUSING RELIEF

Boone County awards federal dollars to help stave off evictions.

COMOMAG.COM 19 52

38

27

Living

Photo by Michael Spillers

20 THE FINANCE ISSUE 2022 1111 E. BROADWAY, COLUMBIA • (573) 875-7000 • THEBROADWAYCOLUMBIA.COM FOOD, DRINKS, AND LODGING -we have it all! BOOK YOUR HOLIDAY PARTY WITH US! woodhaventeam.org Gift Card Drive We raise funds all year long to make sure everyone we support gets a little something for their birthday and has an extra special gift during the holidays, too! Give the gift of love and let them know you are thinking of them! Woodhaven is so grateful for our staff and many supporters — you’re the reason we can change so many lives! Scan the QR code to donate and help make someone’s holiday extra special.

Beautifying the Community

The Loop showcases local artists and promotes civic pride.

BY EMMI WEINER

BY EMMI WEINER

The Loop began its street art project back in 2021.

“I went back to my hometown, and I was walking downtown, and they had big art billboards,” said Carrie Gartner, executive director of e Loop. “ ey had lined them up all along this one particular alley and I thought, well, that looks like a great idea.”

e project features works from about 10 artists and graphic designers each year. e works are displayed in parking lots along Business Loop 70 and are visible from the street.

“We've been working a lot with makers and we have so much space and parking lots on the street,” Carrie said. “We felt we could really showcase their work nicely.”

One does not need to go out and seek art; it is part of the everyday landscape, helping build a sense of community.

On July 13, Carrie received a call from artist Chris Foss that his painting was missing from in front of e Senior Center. A community e ort to nd the painting started. Local tech business, Gravity, helped pull security camera footage from local businesses. A Facebook post was made. Dive Bar immediately stepped up.

“Between everyone pulling their camera footage and the photo and Dive Bar doing some heavy-duty sleuthing, by the end of the day we had it back!” Carrie said.

“Our organization is funded mainly through property assessments and sales tax. We get grant funding for various projects,” Carrie said. “Every dollar we receive we pump back into the street.”

e street art project is one of the more visible projects the Loop does, with an allocated budget of $2,000 from the general

budget. Artists are given $700 and designers are given $400 for their contributions e submission period for the project will open in early 2023 for next year's series. From there, the artists are provided with the plywood and a special sealant to create the pieces. Graphic designers get to see their work in print. While artists do not have to be local, most pieces selected are from Columbia residents.

“We love to talk about Columbia as an artistic community,” Carrie said. “Unless we as a community buy art from artists, we are not an artist community, and the artist cannot survive.”

To learn more about the selected artists and the pieces themselves, you can view the project map on The Loop's website at theloopcomo.com.

ART & CULTURELiving

THANK YOU TO OUR SPONSORS: Save the date for the 10th annual Pawject Runway Canine Fashion Show! In addition to adoptable dogs strutting their stuff on the catwalk, we will also be showcasing local artisans in a Holiday Makers Market. Come shop local and sample hors d’oeuvres while benefitting a great cause! Tickets are $50, and include an amazing swag bag valued at $75! Thursday, December 1 | 6-9 PM Bur Oak Brewing Company Shopping: 6:00 pm | Fashion Show: 7:30 pm & HOLIDAY MAKERS MARKET ARE PLEASED TO PRESENT Scan the QR or visit tinyurl.com/pawjectrunway to purchase tickets!

Where good friends meet for good times! shilohcomo.com The New Phone: (573) 875-1800 | 402 East Broadway Columbia, MO 65201 Tuesday through Saturday 11:00am - 12:00am | Sunday 11:00am - 5:00pm | Monday - Closed Big Screen TVs Menu with $10 & $12 Lunch Meals Home of weekly Tiger Talk on KTGR Same great Patio, Ribs, and Wings! New New New

24 THE FINANCE ISSUE 2022 Just Hear Those Sleighbells Jingling HORSE DRAWN CARRIAGE RIDES 4:00—7:00pm Saturdays & Sundays November and December through Christmas Eve. Come experience the magic of the holidays in Downtown Columbia! Find information on all events at discoverthedistrict.com Big Enough to Serve, Small Enough to Care! (573) 355-4368 RAVEHOMESMISSOURI.COM Rave Homes is a family owned business that has been building throughout the Midwest for over 35 years. CUSTOM RESIDENTIAL CONSTRUCTION COMMERCIAL CONSTRUCTION LAND DEVELOPMENT

Money

Central Bank’s ProsperU program helps pave the way to financial wellness.

BY CANDICE BALL PHOTO BY SADIE THIBODEAUX

Whether you’re a college student, working parent, or recent retiree, everyone can bene t from a little help with their nances.

Since June 2019, Central Bank’s ProsperU program has o ered practical nancial assistance and information to individuals and businesses.

ProsperU o ers 1-on-1 consultations and in-person classes on rotating topics such as “College Planning 101” and “Tackling Your Debt.” e program also provides numerous electronic resources, including Zoom meetings and streaming presentations.

ProsperU's mission is to meet community needs. “We were talking about how we could be the best community bank we could possibly be,” Central Bank of Boone County marketing director Mary Wilkerson said.

Her team started brainstorming the best way to o er nancial resources and information where they’re not always readily available, and ProsperU was born.

“For us, the program had to be as accessible as possible, so that people could feel comfortable with getting the information they need,” Mary said. “Even in our wildest dreams of what it could be, the real magic of ProsperU happened because of Sarah Moreau.”

ProsperU director Sarah Moreau said it’s common for people to feel overwhelmed when it comes to getting their nances in order. Additionally, she said it’s natural to be uncomfortable about asking for guidance.

“ at’s kind of the big thing about ProsperU,” she said. “Meeting people where they are. We make mistakes. So what? When you know better, you do better. It’s about progress, not perfection, when it comes to your nances.”

Sadie ibodeaux, photo director at COMO Magazine, knows the feeling.

“I had started taking a hard look at my nances, and I realized that I wanted to be saving more, and I didn’t really know how to do that. People have always said ‘just make a budget, just make a budget,’"

- Sarah Moreau, ProsperU Director

she said. "So I listed all my expenses, but I didn’t know what to do past that.” Sadie had heard good things about ProsperU, so she decided to give it a shot.

Sadie emailed Sarah to explain her predicament and schedule an appointment to meet. While she wasn’t quite sure what to expect from the program, Sadie says she's been pleasantly surprised with her experience.

“It’s just blown my mind. Sarah helps me look at money di erently. I’m in my second month of actively budgeting, so it hasn’t been that long, but she immediately changed my perspective on money and helped me set up a budget in EveryDollar.”

Sadie agreed the power of ProsperU lies in large part with its director.

“Sarah is just very kind,” Sadie says. “She never judged me. She just said, ‘It's okay! Nobody ever told you, and if nobody ever told you, how can you know?’”

To get involved with ProsperU, visit the program’s website (centralbank.net/ prosperu) to register for classes, schedule a one-on-one consultation, and access electronic resources.

COMOMAG.COM 25

101

"When you know better, you do better. It's about progress, not perfection, when it comes to your finances."

Sarah Moreau, ProsperU Director

WELLNESSLiving

THANK

True North held its annual Men as Allies Breakfast Fundraiser on September 8th, 2022 at the Country Club of Missouri.

More than $67,000 was raised and will be used to support survivors of domestic and sexual violence in our community!

To give or to learn about other ways to support True North visit TrueNorthofColumbia.org

Special thanks to our table captains: Brandon Banks, Dr. Courtney Barnes, L.C. Betz, Jon Class, Denny Douglas, Will Echelmeier, Glen Ehrhardt, Dr. Ashley Emel, First State Community Bank, Robert Flynn, Matt Garrett, Angie Gentry, Chad Gooch, Greg Grimes, Brad Jenks, Ryan Martin, Mike Middleton, Kerri Roberts, Lee Russell, Keith Schawo, Laura Schemel, Wendy Wiederhold

SPONSOR

ALLIES

26 THE FINANCE ISSUE 2022

YOU! COFFEE SPONSORWELCOME

PRESENTING SPONSOR CORPORATE

Building Homes the Right Way

Jake Bruton builds to help save the

and save

BY JENNIFER TRUESDALE

Photo by Byler Media

planet

homeowners money.

HOMESLiving

“You get out what you put into it.”

Aarow Building focuses on eco-friendly homes built to stand the test of time — while remaining cost e ective.

“Our construction methods don’t add much to the cost of the build – maybe 5-10%,” Jake Bruton, president and chief builder at Aarow Building, said. He added owners of his builds are realizing a savings of half on utilities. is is achieved through a building approach that values “durability, energy e ciency, and architectural signi cance. If we combine these three things, and we make it so people want to live in the home, are comfortable in it, and they want to preserve it because of its beauty, we’ve done the best possible thing we can for the world,” Jake says. “And not waste building materials on something that’s going to have to be replaced in 45 years.”

Artist Turned Builder

Jake is a Columbia native and owns Aarow with his wife, Rebecca. Owning a construction company was not originally in his life plans.

“I am the second-generation owner, and this is our 39th year in business,” Bruton said. “I bought the company from my parents in 2007. Prior to that, I had worked for them a lot grow-

Photo by Michael Spillers

28 THE FINANCE ISSUE 2022

HOMESLiving

ing up, went to school at MU and got a degree in ne art and made a living as an artist for a while, and then my parents convinced me to come back to work for one job, and they said, ‘By the way, when this job is over, we’re retiring and we’re going to sell the business to someone who works for us.’ Well, I was the only employee, so I got suckered into buying the business.”

Jake dove into the business, but he had a learning curve. He says he spent the rst ve years just learning how to run a business. In 2013, he began researching construction litigation.

“I was [...] trying to gure out why other builders got sued and what I might be doing wrong that would cause me to get sued. I realized that to build a house to code, you’re really doing the absolute minimum that you can do for quality, health, and comfort, and most builders were getting sued because of water,” Bruton said. “Water gets in through windows, roof leaks, poor design causes water to come in, and I decided immediately that we were going to build much more durable homes and that was going to be one of our focuses, because we wanted to walk away from [a build] knowing that it wasn’t going to have problems. We didn’t want anybody to be able to point to one of our homes and say 'You did that wrong'. You can build a high-performance house that will be more durable, healthier, and more energy e cient, and in the end, way more comfortable.”

Jake is too busy nowadays to strap on his toolbelt. He co-hosts the “Unbuild It” podcast with an architect and a professor of building science at Yale, he creates weekly videos for a website teaching people how to run a construction business, consults with manufacturers, and does a lot of public speaking. e professional development of his sta also is a priority; he has ve employees and loads of subcontractors.

“My team is amazing. If I didn’t have them, I couldn’t do this. e crew we have right now is amazing, and so are our subcontractors. I have a goal that everyone I work with to be as good as they can be,” Jake says. It’s not uncommon for his employees to grow enough to go out on their own as subcontractors. So, he’s constantly losing sta but simultaneously gaining subcontractors.

COMOMAG.COM 29

HOMESLiving

Gaining Control

Aarow Building looks at ways it can make the “control layers” of the home more e cient. Control layers include air ow and mechanicals.

“We start with control of air ow in the home. Air leakage is the rst way you lose e ciency. By creating a very well air-sealed home, we maintain the air we’ve invested in with heating and cooling,” Jake says.

One way he controls air ow is by using only triple-glazed windows from Europe. ey have more than twice the “R value” of American-made windows. Wikipedia de nes R value as “a measure of how well a two-dimensional barrier, such as a layer of insulation, a window or a complete wall or ceiling, resists the conductive ow of heat.” e higher the R value, the more energy e cient it is. American-made windows average an R value of four, while European windows have an R value of 10.

“Next, [we consider] the mechanical design and energy e cient appliances. Windows, insulation, air sealing, and mechanicals are one line item on the budget,” Jake explains. We can spend a lot less money on mechanicals (HVAC) if you let us spend more money on the other three, because a well-sealed home is less likely to need high-capacity mechanicals.”

30 THE FINANCE ISSUE 2022

“My team is amazing. If I didn’t have them, I couldn’t do this.”

Photo by Michael Spillers

HOMESLiving

Jake points to his home as an example. He built the 4,300-square-foot residence as he does his other builds. He said the HVAC system cost was about half of what the cost would have been for a code-built house of the same size. He realizes about $150 per month in savings on his electric bill.

“ e average home in the U.S. is 2,260 square feet; the average energy usage for that house is about the same as what our house uses, and our house is twice the size. Our homes use half the electricity — I could put more into my mortgage if I know I’m saving $200 per month on electricity.”

You won’t nd a lot of concrete in Aarow’s builds due to how much its production contributes to global warming. ey also don’t use a lot of spray insulation for the same reason.

Aarow typically builds all-electric homes. Jake expects electricity to cost the same or be cheaper in the long run, while he expects natural gas to stay the same or increase. He says there’s no argument for natural gas unless you just have to have a gas replace.

Jake uses an architect based out of Boston, Steve Bazcek, for many of his home designs. “He is probably the best energy e ciency architect in America, and he’s reasonably priced,” says Jake. “ e majority of the time, we’re contracted before the design process begins. e energy e ciency aspect is too complex to retro t to existing plans. It needs to be integrated rather than applied.”

Quality Over Quantity

Aarow has built fewer than 25 homes since 1995, and they’ve built just 10 in Columbia since Jake bought the company in 2007.

Aarow brings in earnings from renovations and additions, but the focus has moved over the last few years to new builds as much as possible. Aarow also has an o ce in Kansas City, where all of the builds will be new.

“We don’t have a grand design for the future beyond wanting to continue to do right by the planet and by our customers.”

Photos by Byler Media

COMOMAG.COM 31

HOMESLiving

32 THE FINANCE ISSUE 2022 PACKAGES AVAILABLE Half Day | Full Day | Full Weekend (with cottage) ASecretPlaceEvents.com 15663 Graff Drive, Jamestown MO | Phone: 816-833-6505 Be enchanted by the beauty and serenity of our French-inspired gardens. INCLUDED IN ALL WEDDING PACKAGES: Bridal Party Cottage Groomsmen Preparation Area Ceremony Arbor 200 Padded White Chairs Reception Tables Lighting & Electricity Outdoor Sound System Multiple Restroom Facilities Parking Attendants NOW BOOKING 2023! AND WE HAVE A FEW SPOTS OPEN FOR 2022! Here to provide excellent service. 2412 Forum Blvd, Suite 101, Columbia | 573-874-1122 | Fax: 573-340-1465 | JandULaw.com The choice of a lawyer is an important decision and should not be based solely upon advertisements. Ben Brammeier Associate Rob Temple Associate Alyysha Cox Paralegal Nathan Jones Partner Ernie Ueligger Partner Rylie Grove Assistant Emily Camden Paralegal Katie Jackson Sr. Paralegal WILLS & TRUSTS PERSONAL INJURY WORKERS’ COMP BUSINESS LAW FAMILY LAWOUR TEAM IS YOUR TEAM.

WHAT THE HOME PROS KNOW

SHAUN HENRY ATKINS

ANNE TUCKLEY

ANNE TUCKLEY

SHAUN HENRY ATKINS

ANNE TUCKLEY

ANNE TUCKLEY

HOME JAKE BAUMGARTNER BAUMGARTNER’S FURNITURE

JACOB

PORTER ROST LANDSCAPING

GET COMFY & COZY WITH FALL HOME ESSENTIALS

By Jake Baumgartner Find more at baumgartners.com

By Jake Baumgartner Find more at baumgartners.com

IIt’s here. The crisp promise of fall. You know it’s here when you open the door in the morning to let the dog out and you have to grab a throw blanket because it’s cold. That bite in the air that tells you that the changing of the guard is happening. The dog days of summer have finally passed and the brief coolness of fall is here. This is the time that many people look inward to their home after a summer of entertaining outside. As winter approaches and the days get longer, there are four main things you can do to prepare your home for the cold.

Use warm colors in your upholstery. Colors with the names of Cinnamon, Cocoa, Mocha Latte, etc. will provide a sense of warmth and nurturing to your interior space. If you feel the need to be inspired, Baumgartners has hundreds of samples to look through to find the one that not only fits your personality but that of your home.

A fall must-have for those mugs of hot tea and a good book is the perfect reading spot. A comfy chair and matching ottoman pair up nicely to make sure you can snuggle in and enjoy a great book while the weather turns cold outside.

JAKE BAUMGARTNER

FURNITURE

What corner or nook of your house is begging for a cozy makeover?

No fall is complete without a cozy throw blanket. Accessories like rugs and throw pillows and blankets not only add a comforting and nurturing feel to a room but also provide comfort and warmth for those cool fall days.

Lastly, lighting. A great floor lamp not only brightens up the room for those

WHAT THE HOME PROS KNOW

Jake essentially grew up in the furniture industry, as he is the fourth generation involved in Baumgartner’s Furniture. Working very closely with his father, Alan, Jake has been devoted to the stores full-time since 2004. His greatest enjoyment, however, still comes from working closely with the customers. He is married to Sarah, and they have two active boys, Noah and Laine. Jake received his degree in finance from Saint Louis University.

(573) 256-6288

long, dark fall days, but provides an aesthetically pleasing glow to a room you’ve already outfitted with the perfect upholstery, chair and ottoman pair, throw pillows and a blanket.

Whatever the mood or look you’re looking for, let the trained staff at Baumgartner’s help you find it. Sitting in a chair, touching the fabric, looking at the lamps all helps guide your decisions as you prepare your home for a perfect fall.

BAUMGARTNERS.COM

BAUMGARTNER’S

SPONSORED CONTENT

FALL PROJECTS STILL UNDERWAY

By Shaun Henry Find more at AtkinsInc.com

There are a lot of things that I love about fall. Bonfires, fall tree colors, tailgating, the approaching holiday season and plenty of other outdoor activities with the family. Although, I am certain I will soon miss the fun in the sun on a warm summer day, I try to enjoy as much time outdoors as I can in the fall of the year. Cool brisk mornings and mildly warm afternoons are my favorite! For the lawn and landscape, here are some things going on yet this fall:

GOOD LAWN CARE PRACTICES NOW WILL CARRY OVER TO NEXT SPRING

• For cool season lawns, now is the time to fertilize, core aerate and add soil amendments (lime, gypsum, organics) as needed to improve your soil and your stand of turf.

• Broadleaf weed control for those perennial weeds can still be applied if needed to reduce competition for space and resources with your turf.

• We recommend finishing up any seeding by mid-October to allow enough time for seedlings to mature before we see a heavy frost but if you still have bare spots, seed when you have to. Watering during the warmer part of the day will help keep soil temperatures up and speed up germination and establishment of your new grass. Core aerating the lawn can continue until the grounds freezes though.

• Keep on mowing. Although growth of your turfgrass will slow, continuing to mow will help keep and even improve your turf’s density. As temperatures cool, you can now get away with lowering your cut height without as much risk for turf injury.

SHAUN HENRY

ATKINS

• Keep the leaves off the lawn as best you can to avoid suffocation of your turf. Matted down leaves will smother the grass and create bare spots for next spring. Regular mowing will help chop those leaves up too.

• Winterize that sprinkler system when you’re done using it for the season to avoid freeze damage this winter.

LANDSCAPE MAINTENANCE

IN OCTOBER

• Now is a great time to transplant new deciduous trees and shrubs. Depending on where you live, you may want to protect the trunks of your new trees with wire or plastic guards. Deer rubs on a young tree can often kill the tree or at least cause enough damage to create issues for the tree for the rest of its life.

• If it’s still dry, you may need to continue to water your evergreens.

• Dormant feeding of your landscape plants can begin later this month. After a difficult summer, replenishing lost nutrition and promoting recovery and new growth for the next season, a fall feeding may be one of the most

THE HOME PROS KNOW

A Columbia native, Shaun Henry found a home at Atkins in 2000 when he started his career as a turf technician. Shaun holds a commercial applicator’s license through the Missouri Department of Agriculture and is a member of the National Association of Landscape Professionals, the Mid-America Green Industry Council, and the Missouri Green Industry Alliance. Shaun strongly believes in the importance of a great customer experience where the Atkins staff knows their clients and anticipates their needs accordingly.

Shaun is an MU alumnus and has a degree in plant science.

573-874-5100 ATKINSINC.COM

beneficial things you can do for your landscape plants. Soil testing can provide a guide for your plants’ fertility needs.

• Removing leaf litter and dead plant materials will not only keep your beds neat and tidy, it can also remove fungal disease spores that can infect your plants next season. Collecting and discarding this material is a good management practice for the fall.

We hope you have a wonderful Autumn and enjoy the fall colors and all of nature’s wonder. Remember, no matter what you decide to do with your lawn and landscape this season or next, we’re here to answer any questions you might have about your property. That’s what friends and neighbors do. Thank you for your continued trust in our team.

WHAT

SPONSORED CONTENT

LANDSCAPE LIGHTING: A BRIGHT SPOT IN YOUR OUTDOOR SPACES

By Jacob Porter Find more at rostlandscaping.com

WHAT THE HOME PROS KNOWJACOB PORTER

L

andscape lighting has been a popular addition to outdoor spaces for several years. Over these years, lighting systems have improved in regards to technology, durability, and ease of installation. Low voltage, LED lighting systems have become the most desired option. LED systems offer the same benefits of spot lighting your landscape and added security while adding the ability to customize your lighting setup. Adding lighting to your new or existing outdoor spaces can add value and security, therefore, it is an option you should consider adding.

Adding a lighting system to your landscape and hardscape areas have several benefits. The obvious benefits of landscape lighting are accenting certain features of the landscape or shining light on your pathways and patios at night. This allows you to enjoy your outdoor spaces long after it gets dark. One of the advantages that landscape lighting provides that is often overlooked is security. Adding lighting to areas of your landscape that are hard to cover with your house lights can add to the security of your home. Extending the lights further from the house can keep potential intruders away. Along with these benefits, another benefit I want to discuss are the multiple options that are available with LED lighting systems that allow you to customize your setup the way you want it.

When designing a lighting system, there are different types of systems to consider. We typically break it down into three categories: Standard On / Off, Zone Dimming, and Zone Dimming Color. The on / off system is just as it sounds and is the most basic. The lights can be turned on or off by using a timer, photo eye or by manual operation. The zone dimming

Jacob comes from the small town of California, Missouri. With his plant science degree from MU and six years with Rost, he enjoys creating exciting outdoor spaces for his clients. Watching these creations come to life is only one highlight of being a designer for Rost. When he is not designing, he loves spending time with his wife and kids, tournament bass fishing, and doing a little bit of woodworking.

(573) 445-4465

systems are a step up by allowing you to adjust the brightness of the lights. This type of system also allows you to separate lights into different zones, giving the ability to adjust the brightness or turn on and off only certain groups of lights. The Zone dimming color system has all of the features of the zone dimming, but also give the options to change the colors of the lights. This is a great feature around the holidays or to show your team spirit. Both types of zone dimming systems can also be controlled by your smartphone or tablet.

Along with the different types of systems, the durability and ease of installation of

modern LED lighting systems have also improved. The low voltage systems allow us to install lights and wires in existing landscape without burying underground hubs and pipes that would normally disturb landscape plantings. This also makes for an easier process of adjusting and moving lights as the landscape grows.

The benefits of an outdoor lighting system along with the updated technology and features makes for a great addition to any landscape. If you are considering making changes to your outdoor spaces, landscape lighting should be a feature that is on your list.

ROST LANDSCAPING

ROSTLANDSCAPING.COM

SPONSORED CONTENT

AN ALTERNATIVE TO THE OPEN ROAD

By Anne Tuckley Find more at AnneTuckleyhome.com

There is something magical about the wide open road. Whether it be the endless opportunities for unplanned adventure or a carefully planned excursion, the vastness of the highway is invigorating. It is this desire for adventure and exploration that leads many to invest in an RV, but like many great plans, for some, the investment becomes more of a lawn decoration. Rather, I should say, it becomes a very expensive lawn decoration.

Now unused RVs, especially ones in good condition, can always be sold, but for many, the nostalgia of the dream still exists and parting ways with the motorized vehicle isn’t seen as an option. So what should you do with your new lawn ornament? Get creative!

Playhouse: Have young children? Turn your RV into a clubhouse. Decorate the inside, store toys, and snacks and let your child have their dream playhouse. Older kids can even camp out in it. This is a great temporary solution since you do not have to fully convert the RV, so it could always be used as originally intended in the future.

Library: Always longed to have your own library but lacked the space? Rip out the cabinet doors and convert the RV into a truly unique library. Convert a dining bench into a reading nook and bring out a beverage cart to store beautiful glasses, teas, liquor, etc.

Guest Suite: Give yourself some space from overnight guests by turning the RV into a boutique guest suite. You can even list it as a vacation rental property and make some bonus money!

Closet: Short on closet space? Convert your RV into a fashionable dressing room. While not beneficial for everyday

THE HOME PROS KNOW

TUCKLEY HOME

Anne has been in the interior design industry for more than 20 years and has resided in metropolitan cities ranging from NYC to Houston while honing her skills. Her specialties are interior design and home staging with a focus on unique perception. Anne graduated with a BFA in fine arts with a concentration in design and illustration. She has extensive experience in designing new construction as well as remodeling and conceptualizing out-of-the-box ideas. She ensures cutting-edge design and superb customer service.

E. BROADWAY SUITE 1043 COLUMBIA, MO, 65201 (573) 639-1989

functioning, an outside closet is an ideal spot to store your formal attire such as dresses, suits, purses, etc.

Office: In need of a home office? Turn it into your own office space! The table works perfectly for a desk, cabinets are excellent for storage, counters are perfect

for much needed coffee, and there is even a bed should you need a quick catnap!

Man cave or she-shed: Reclaim your basement by sending your hubby outside to his own, portable man cave, or escape yourself into your own relaxation or crafting oasis.

ANNE

WHAT

4250

ANNETUCKLEYHOME.COM

SPONSORED CONTENT

Rolling his vibrant food truck all over town, George Nickols is living the dream “slinging tacos” to the masses.

BY AMANDA LONG | PHOTOS BY DREW PIESTER

BY AMANDA LONG | PHOTOS BY DREW PIESTER

GOURMETLiving

Originally from Baja, California, George Nickols, the proprietor and chef de cuisine for Lilly’s Cantina, grew up in a big family with a distinct heritage — Mexican American and English-German.

“Southern California is a treasure trove of ethnic diversity when it comes to people and cuisine, including in my own family. It is a special place to grow up and learn about cooking because there is so much diversity — Mexican, ai, Chinese, Korean...,” George said. “And food trucks are everywhere out there. People love them!”

George has always been involved in food and cooking, but not always formally.

“All my friends growing up had parents that cooked. Everybody cooked. I would go to one friend's house and his mom might be Korean and another friend might serve Brazilian fare,” he said.

It was during this integral part of George's childhood revolving around food that he started picking up methods, recipes, and inspiration from his grandmother, aunts, and other family members.

“Growing up, everyone always hung out in the kitchens. Families — mothers, brothers, sisters, aunts, uncles, cousins — and there would always be a central gure who would be cooking and preparing food,” George said.

George moved to Columbia in 2008, bringing his love for diverse food culture with him. He was working in car

sales when he began seeking a career change and literally set the wheels in motion for the future of Lilly’s Cantina. “I was always very interested in the food truck business since it gives one more freedom than starting a brick-and-mortar facility.”

At the time, Columbia's food truck scene was less robust than it is today, and George was anxious to get the ball rolling and join the movement. According to IbisWorld.com, the U.S. food truck industry continues to gain popularity, especially as outdoor dining has become more common in the wake of the COVID-19 pandemic. ere are approximately 30,156 food truck businesses in the U.S. as of 2022, an increase of 8.2% from 2021, totaling nearly $1.4 billion in revenue. e rst step for George, toward Lilly's Cantina, was purchasing a food truck that he found in Milwaukee. He then drove the truck to Houston, and had it completely rebuilt by Houston-based Chef Units, a manufacturer specializing in producing new, custom-built, and renovated food trucks, trailers, and concession stands.

40 THE FINANCE ISSUE 2022 GOURMETLiving

e process took approximately one year, but George said the result was worth the wait. In 2014, after picking up his new custom food truck, he procured the appropriate permits and licenses for food trucks and food service in Columbia.

“And the next thing you know, we’re slinging tacos!” he says laughing.

e truck is named after George’s daughter, Lilly, a Hickman High School sophomore who works on the truck part-time.

Lilly’s Cantina specializes in what George calls “Baja-Midwest fusion,” with avors originating from his Southern California and New Mexico roots and international travels, but with a midwestern twist.

e food truck menu o ers a combination of tacos, quesadillas, burritos, and nachos as well as vegetarian options that can be included or substituted in any of the menu items. Every plate includes made-from-scratch ingredients such as slow-marinated meats, fresh salsas and sauces, all served with accompaniments of shredded cheese, ripe tomatoes, diced onions, cilantro, and limes.

e Lilly’s Cantina taco menu also highlights a selection of seafood. e Mahi-Mahi tacos are cooked with red cabbage, served with cilantro-lime sauce, and placed on warm corn or our tortillas. Lilly’s also o ers shrimp or lobster tacos.

e burritos weigh in at approximately two pounds each and are chock-full of good stu wrapped in a warm, fourteen-inch our tortilla. George says his most popular burritos are the Garbage and the OG Cali.

COMOMAG.COM 41 GOURMETLiving

“Growing up, everyone always hung out in the kitchens. Families – mothers, brothers, sisters, aunts, uncles, cousins –and there would always be a central figure who would be cooking and preparing food.”

« George Nickols

"Garbage" is a nod to the sheer number of ingredients in this burrito — 11 to be exact. It's stu ed with chicken, beef, lettuce, red sauce, sour cream and cheese. e OG Cali is lled with marinated beef, house-made chips, rice, beans, Pico de Gallo, and the house-made roja sauce made with a mixture of Mexican peppers. e Lilly’s Cantina menu also o ers chicken, carnitas, beef and veggie nachos and quesadillas.

George says there's an o -menu item patrons ask for so often he "might as well add it to the menu at this point." e ai Chicken Rooster is a Korean-inspired version of e Rooster, a burrito starring chicken, rice, beans, Pico de Gallo, lettuce, and cheese. “People’s palates here are little di erent than they are in southern California. I’m surprised they like it.”

George works daily with fellow chef Chris Jones, who brings 10 years of food service industry to the table. “We were introduced by a friend, and then he randomly came wandering in three years ago,” says George. Chris makes and prepares all the cold food which includes Pico de Gallo, guacamole, and fresh sauces.

Lilly’s Cantina can be found serving its delicious o erings at various locations around COMO, including Veterans United Home Loans, Harry Truman Memorial Veterans Hospital, Boone County Health Department, ompson Center for Autism and Neurodevelopmental Disorders, and Cooper’s Landing. You can also nd them rolling up to local festivals such as Food Truck Palooza in Centralia, Street Food rowdown in Ashland, or e True/False Film Fest in Columbia.

e food truck operates independent of any power source so there is no need for electric plugs or extension cords, making Lilly’s Cantina a prime choice for catering events

George says he has no plans for a brickand-mortar location or expansion of any kind, as he stays quite busy enough. “I love what I do, and I hope to keep doing it forever and ever.”

Upcoming Lilly's Cantina locations can be found on their Facebook page (@lillyscantinacomo) or visit foodtruckyourself.com, a website that provides the location of local food trucks.

42 THE FINANCE ISSUE 2022 GOURMETLiving

COMOMAG.COM 43 Bloomington, IL 2101368 Phyllis Nichols, Agent 1006 West Boulevard N | Columbia, MO 65203 573-443-8727 | phyllis.nichols.g15k@statefarm.com Here’s the deal: When you go with State Farm®, you get a local agent that can deliver Good Neighbor service at surprisingly great rates. Give me a call. Like a good neighbor, State Farm is there ® Individual premiums and budgets will vary by customer. All applicants subject to State Farm® underwriting requirements. PICK THE RIGHT TEAM. MOVE BETTER. FEEL BETTER. SIMPLY LIVE BETTER! WATERROWING ADDITION NEW! WILSONSFITNESS.COM2902 FORUM BLVD. (573) 446-3232 l 2601 RANGELINE (573) 443-4242 GROUP FITNESS INDOOR POOL HOT STUDIO PERSONAL COACHING

44 THE FINANCE ISSUE 2022

Styled Strands

BY KIM AMBRA | PHOTOS BY LANA EKLUND

You don’t have to look far to see the ever-growing trend of hair braiding. ough hair braiding can often be found trending online or in pretty much every show on television, the history of hair braiding is rich and deep.

e oldest evidence of hair braiding goes back about 30,000 years: e Venus of Willendorf, a female gurine estimated to have been made around 28,000-25,000 B.C.E., is depicted with braids in her hair.

By the Bronze and Iron Age (1200-500 B.C.E.), many people in Asia, the Eastern Mediterranean and North Africa, were depicted in art with braided hair or

beards. In some regions, braids were even considered a means of communication and social status.

History shows braids were often used to de ne tribes, social status and other societal classi cations. is tradition of hair braiding has been passed down through the ages, and today braids are a way to celebrate and honor one’s ancestral roots as well as express personality and style.

Kylie Phillips, cosmetologist and color specialist at local salon MK Lush, has a front-row seat to today's hair braiding trends and styles. Kylie attended the Davis Hart Cosmetology Institute during

her junior and senior year of high school, graduating from both high school and cosmetology school at the same time. She then went on to complete a six-month associate program at MK Lush salon.

Upon entering MK Lush, located in the heart of the North Village Art District, you are met with rich, vibrant colors, and smiling faces. Stylist and founder of MK Lush, Micki Kliethermes, said that her desire to build her own business was largely inspired by her belief in self-love/self-care.

From there, I was able to have a sit down with Kylie to dive deeper into her career and love of hair braiding.

COMOMAG.COM 45

Local cosmetologist Kylie Phillips discusses the salon industry, career goals and the art of hair braiding.

STYLELiving

Kim Ambra: How did you manage attending both high school and cosmetology school at the same time?

Kylie Phillips: I had to be at Davis Hart Career Center in Mexico at 8 a.m. where I would start class with all the other cosmetology students. I left there at about 10:45 a.m. which would give me just enough time to grab some lunch and be back at the high school by noon to finish out my day before going to whatever activity I had going on after school. I did that for two years and then I graduated from the cosmetology program one week before I graduated high school.

KA: Why did you choose to work at MK Lush salon?

KP: They offer an associate program which allows newer stylists to really focus and continue your education without feeling like you're in a class setting. It allows you to work hand in hand with a more experienced stylist and get that experience that you didn't get in school to ask all of the questions.

KA: Growing up, did you always know you wanted to do this for a career?

KP: No! Actually my family and I were at dinner one night, and one of the ladies with us started casually french braiding my sister's hair. I found myself just staring at it because I couldn’t figure it out. I watched her do it over-and-over again. From there, I taught myself how to braid on others and myself. I think that’s where it all started.

KA: What would you say that you enjoy most about your career?

KP: My favorite part is just how rewarding it is to be able to see the difference that you make in everybody's day to day life that you come in contact with.

KA: What has been the most surprising thing to you about your career or this industry as a whole?

KP: Just how much growth the industry has had and how many different things you can specialize in. I wish that people would realize the

46 THE FINANCE ISSUE 2022 STYLELiving

importance and the opportunity for continuing education because we have to invest in ourselves to be able to perform what you're asking us to perform.

KA: Talk to me about the trend of braids and what all the hype is about.

KP: Personally, I'm more intrigued whenever I see somebody who has a whole head of knotless braids. It is so gorgeous! And I love the fact that with braids, you can change it up. It also allows so much imagination with the hair, you can add in color, texture, length, etc. Maybe someone was not blessed with hair

that they love. This gives them the opportunity to transform their hair into something that they absolutely love and are proud of.

KA: Is there a certain hair type that works best or are you able to work on all types and styles?

KP: I've pretty much gotten to the point where I can work with any hair type, but more textured hair is a lot easier to work with just because the hair is used to bending and maneuvering in different directions.

KA: Do you have any advice for first time clients that are wanting to experiment with braiding?

KP: Don’t turn away a stylist who wants to do a consultation with you first because likely they are just trying to make sure that they can provide you with the best service that they possibly can.

KA: It’s kind of like an art project…

KP: It really is. And every single person is different. I mean, I never come into work and do the same thing and that keeps it exciting. I meet new people every single day. I get to create relationships with people. I get to sit here and do what I love and listen to some spicy tea all day long!

COMOMAG.COM 47 STYLELiving

48 THE FINANCE ISSUE 2022 Community Strong. You keep banking. We’ll keep building. Strong communities are built by strong people. Banking is about more than deposits, loans and checking. It’s about changing lives. Come discover the difference! www.fscb.com/communitystrong Member FDIC

BY LAUREN SABLE FREIMAN

As the old saying goes, “You’re only as good as the company you keep.”

When it comes to your nances, that rule of thumb rings true. Surrounding yourself with a team of experts from ve key professions — law, insurance, banking, nancial planning, and accounting — will set you up for nancial success.

“ e timing is di erent for everyone, but ultimately, at some point in your life, you should be working with all of those professionals,” says Nathan Jones, partner and estate and business law attorney at Jones & Ueligger. “Your life dictates the order you begin working with them, but ultimately people are best served by having relationships with all those professionals. If you’re missing one, you’re missing out on having a full nancial plan.”

COMOMAG.COM 49

The ultimate list of professionals you want on your side.

FRIENDS & FAMILYLiving

FINANCIAL PLANNING

A certi ed nancial planner is likely one of the rst professionals that comes to mind when considering your nancial team. While a nancial planner can certainly work with clients on growing wealth, a nancial planner does much more than investment planning and wealth management.

“Because money and nances a ect all areas of life, a quali ed planner should be able to advise on budgeting and cash ow, risk management, tax and estate planning, generational nancial education, and wealth transfer,” says Greg Brockmeier, nancial advisor and investment consultant at Brockmeier Financial Services.

Because every client’s nancial situation and planning needs are di erent, Greg uses a variety of tools to determine a set of goals and objectives for each client. rough this process, he is often able to uncover potential nancial concerns and obstacles, and then work with the rest of the client’s nancial team to remedy or accommodate those issues.

“ is cooperative partnership allows the client to have a team of professionals dedicated to their speci c needs and goals.”

LAW

People spend a lifetime growing their wealth through employment earnings and investments, so it makes sense to have a plan for the future of those assets. at’s where a legal professional comes in. As an estate planning attorney, Nathan Jones works with clients to develop wills, trusts, powers of attorney and other legal documents that protect their hard-earned assets today, and in the future.

“ ese documents are designed so people have a plan, so everything they’ve worked for their entire life will go to the people and organizations they love,” Nathan says. “We want it to be set up to do that as efciently and e ectively as possible, so all of those documents are put together in an estate plan.”

As an attorney who specialized in estate planning, Nathan has an expectation he’ll work with other professionals to prepare a plan that is best for his client.

“In my line of work, if someone has a nancial planner and an estate planner, but they aren’t communicating, they don’t get as much out of each as they could,” he said.

“It’s important to make sure that each knows what is going on.”

BANKING

Having an established relationship and a high-level of trust with a banker is advantageous when assembling a team of nancial planning pros. A good banker is a trusted advisor who is often a key part of many major life milestones, like buying a house. With an understanding of your assets, a banker can advise clients on thenancial decisions and investments that make the most sense.

“We take pride in making sure we know where our clients are in their stage of life and making sure they’re making good nancial decisions,” said Jay Alexander, community bank president at e Bank of Missouri.

While a banker is your go-to professional for things like home and business loans, they can also be a trusted advisor who has the knowledge and experience to guide and support clients and their nancial health.

“It is very common for us to be a part of a larger nancial team and part of that collaborative e ort between professionals,” Jay said. “You need good professionals around you for the things that will happen in your life and we work closely with that team to help clients accomplish their goals.”

50 THE FINANCE ISSUE 2022

Greg Brockmeier

Nathan Jones

Jay Alexander

FRIENDS & FAMILYLiving

INSURANCE

A home is typically one of the biggest investments you’ll make in your lifetime, and it’s important to protect it. Although insurance is oftentimes an afterthought, a proactive and informed insurance agent is an important part of any nancial team.

“From the obvious risks associated with your home and automobiles, to the more complex coverages of life and health insurance, the right insurance broker can ensure you and your family are su ciently protected when losses occur,” says Matt Nivens, insurance broker at AssuredPartners/Naught-Naught Agency. Your insurance agent will typically work closely with other professionals on your team. Matt said he often works with lenders or realtors on insurance for a new home, or to provide the proper insurance documentation required for a home closing.

“Having a solid working relationship with other nancial professionals is a crucial part of providing exceptional service to a client.”

ACCOUNTING

As you assemble your team of nancial professionals, a certi ed public accountant is an important piece of the puzzle. When working as part of your nancial planning team, a CPA does so much more than prepare tax returns.

“Having a good CPA is about watching your income taxes and planning and being proactive instead of reactive to be able to avoid surprises,” says John Weaver, CPA at Williams-Keepers. “A good CPA is doing more than just your tax return, they are helping you plan and providing value.”

With the help of a CPA, you can plan things like investments, sales of stock and IRA distributions, and eliminate any unwelcome surprises during tax season.

“Being engaged with a CPA, though it will cost you more, will generally result in more value and save you more money over the long haul,” John says. “ e biggest thing is being proactive. If we only see each other in February or March to do a tax return, the ship has sailed, and you’re just rolling the dice to see how the year will look.”

JAY ALEXANDER

SET YOURSELF UP FOR SUCCESS

As you assemble an A-team of legal, accounting, banking, nancial planning and insurance specialists, Jay suggests keeping an eye out for the mark of a true professional.

“ ey’re accessible when the client needs them,” he says. “To help clients in the best way possible, all of these professionals should be accessible, and have the knowledge and experience necessary to help guide the client.”

COMOMAG.COM 51

“You need good professionals around you for the things that will happen in your life and we work closely with that team to help clients accomplish their goals.”

Matt Nivens

John Weaver

FRIENDS & FAMILYLiving

52 THE FINANCE ISSUE 2022

Housing Relief

Boone County awards federal dollars to help stave off evictions.

BY JODIE JACKSON JR.

An average of nearly $1 million a week is flowing from the State Assistance for Housing Relief Program to help Missouri renters and homeowners stave off eviction or foreclosure, as well as catch up on delinquent utility bills.

The pandemic-related program is intended to battle financial hardship from unemployment and accumulating rental arrears.

As of September 27, 2022, Boone County renters and homeowners accounted for 3,439 successful SAFHR applications totaling some $10.6 million. The figures from the SAFHR online dashboard are updated weekly. The most-recent update showed a weekly average of $989,647 distributed throughout the state.

The Missouri Housing Development Commission, based in Kansas City, administers the rental relief program in partnership with select local agencies in most counties.

MHDC public information administrator Brian Vollenweider said the rental assistance program prevented more than 60,000 evictions and promoted long-term stability through wraparound services provided by nonprofit partners.

Some of those services include legal counseling, housing counseling, mediation and other social services.

“The purpose of the SAFHR program is to prevent eviction and foreclosure and promote long-term housing stability,” he said. The program’s related Housing Assistance Fund has prevented more than 2,500 foreclosures.

Other Mid-Missouri counties have accounted for the following totals:

Audrain County

$472,354

County

$1.1

Howard County

$95,934

Moniteau County

$234,101

County

totaling $3.4

Callaway County

COMOMAG.COM 53

182 applications awarded totaling

. Randolph

233 applications awarded totaling

million

20 applications awarded totaling

Cooper County 134 applications awarded totaling $495,421

70 applications awarded totaling

. Cole

1,161 applications awarded

million

242 applications awarded totaling $897,928

54 THE FINANCE ISSUE 2022

The SAFHR online dashboard does not provide a breakdown of how much of the county totals are for rental or mortgage assistance or utility costs.

Brian said the rental assistance program has provided more than $400 million in rent around the state and utility assistance and the HAF program has provided over $22 million.

“The majority of assistance provided to Boone County would be rental and utility assistance,” he said.

The program will end on September 30, 2025, or when funds have been exhausted. MHDC began administering the program in February 2021.

In Boone County and Columbia, MHDC partners for administering the rental relief program are Love Columbia, Salvation Army of Columbia and Jefferson City, and Central Missouri Community Action.

As part of the program, MDHC awarded $6.1 million to 38 SAFHR service agencies. Housing Stability Services Providers assist renters and homeowner households with housing counseling, case management and legal services, including assistance preparing and submitting SAFHR applications.

Through September 27, total SAFHR awards amounted to $364,127,383.

The payouts went:

• 49% for rent arrears

• 48% was paid for “forward” rent assistance

• 3% for utilities

When it comes to approving SAFHR applications, funds are paid directly to the landlord, with limited exceptions. The

MHDC processes all payments and issues all checks or electronic transfers.

The federal Consolidated Appropriations Act provided roughly $324 million in initial funding for the SAFHR Emergency Rental Assistance Program. The American Rescue Plan Act provided additional funding for the SAFHR rental assistance program (approximately $270 million) and the Homeowner’s Assistance Fund (approximately $138 million).

Brian noted outside of the SAFHR program, MHDC offers other state and federal programs through a network of nonprofit providers who can assist individuals and families with more extensive or ongoing needs.

Through the assistance of HUD Certified Housing Counseling Agencies, homeowners also have access to housing counseling to help ensure long-term stability.

He did not respond to a question asking whether the MDHC monitors or measures the success of SAFHR to see how many renters and homeowners are still in their homes after receiving assistance.

Applying and qualifying for SAFHR assistance is rather straightforward. Per U.S. Treasury guidelines, “one or more individuals within the household has qualified for unemployment benefits or experienced a reduction in household income, incurred significant costs, or experienced other financial hardship during or due, directly or indirectly, to the coronavirus pandemic.”

Renters apply for the program— or a landlord applies on behalf of the renter—to cover up to 12 months of rental assistance.

It’s possible to qualify for covering up to three months of “forward” rent and past due rent, not to exceed 12 months. After the renter applies, they provide an email for their landlord or property manage-

ment company so the program can reach out to get the housing providers’ information needed to complete the application, such as direct deposit information.

To qualify, a renter must be at or below 80% of the area median income limit. Agencies assistance with the process can help applicants calculate that figure, which varies from county to county.

To qualify for the HAF program, which can provide mortgage reinstatement—a one-time assistance paid directly to lenders—individuals must have experienced a financial hardship due to COVID-19 and have household income at or below 150% of the area median income.

While a landlord can apply for rental relief on a renter’s behalf, only the renter or homeowner can apply for utility relief. To date, the SAFHR for renters program has paid roughly $11.7 million in utility assistance.

“All utility assistance must be paid directly to the utility provider without exception,” Brian said.

Some utility companies helped educate customers about SAFHR. Spire Energy touted the program on its social media channels, website and customer newsletters. The SAFHR dashboard showed the total for utility assistance but does not break down the amount paid to each participating utility company.

“This type of detailed information would require a significant amount of time to provide and is not readily available,” Brian said.

Federal guidelines for housing relief funds allow from 10%-15% — depending on the specific fund—for administrative expenses.

“MHDC passes all administration to non-profit partners, using a minimal amount necessary to provide direct assistance,” Brian said.

COMOMAG.COM 55

The

rental

assistance

program prevented more than

60,000

evictions and promoted long-term stability through wraparound services provided by nonprofit partners.

Planning forthe Unthinkable

56 THE FINANCE ISSUE 2022

BY LAUREN SABLE FREIMAN

You’ve just nished installing a beautiful new pool, complete with an outdoor kitchen and luxurious patio area. You’ve added a room onto your home, or remodeled a bathroom. Or maybe you’ve traded in your old, beat up car for a brand new model. Who will you call rst to share the exciting news?

If Phyllis Nichols has any input, that rst call will be to your insurance agent.

“Keep the lines of communication open to make sure you’re covered properly at all times,” Phyllis says.

As a State Farm Insurance agent, there’s one phrase Phyllis dislikes and spends her days working to ensure her clients never have to utter it.

“I wish,” she says. “We hate that verbiage in insurance.”

By the time you need to rely on an insurance policy, it’s too late to go back and make sure you are properly insured. It’s why Phyllis wishes more people were aware of how important it is to keep your policies up-to-date.

COMOMAG.COM 57

Putting a premium on protecting your assets.

“Identity theft coverage has become really relevant lately because so many people have become exposed to hackers.”

Phyllis Nichols, State Farm Insurance agent

Review insurance annually.

Because life constantly changes, Phyllis stresses the importance of meeting with your insurance agent on an annual basis to review and share information about any updates to your home.

“It might sound like a job, but think about how many changes have happened in the past year,” Phyllis says. “Maybe one year it is repetitive, but maybe you remodeled a kitchen or a bathroom. We do our best to look for additional coverage to ll in the gap but we want to do that sooner rather than later so we can hit those what-ifs head on.”

Build the right plan.

A home is most likely one of the biggest assets you’ll ever own. Oftentimes, people don’t initially realize the quantity of personal items they own, and they fail to consider they would likely need and want to replace those items in the event of a loss.

“We try to encourage folks to annually take a home inventory,” says Phyllis. “Televisions, stereo equipment, linens, furniture, clothing, shoes.

“We’re all guilty of thinking we don’t have that much until we go to replace what we have, and it’s so much better to have an inventory to re ect on if a loss should occur.”

Phyllis provides clients with a home inventory booklet that keeps track of personal property.

“ e home inventory booklet divides inventory by room, so it breaks it down into more manageable parts,” she says. “It allows you to see what is important to you that you would want to replace if it was lost. It allows you to have the coverage to protect those dreams.”

If you have a mortgage on your property, Phyllis says the holder of the mortgage will often require a certain amount of coverage to protect their loan.

While some people choose a cash value policy, most select a replacement policy. Replacement policies provide for the replacement of items that have been lost after the deductible, or out-of-pocket cost, has been paid.

“ e price di erential is not that much, so most folks do choose a replacement policy,” Phyllis says.

Adding endorsements to an insurance plan is one way to customize the plan to provide the level of coverage that’s right for you. Endorsements can be added to policies to provide broader, more comprehensive coverage against certain events, like the backup of a sewer or drain, identity theft, an earthquake or HVAC issues.

“Identity theft coverage has become really relevant lately because so many people have become exposed to hackers,” Phyllis says. “It’s

58 THE FINANCE ISSUE 2022

“I know a lot of folks think floods are covered under their homeowners policy, but it is government mandated that it has to be a separate policy.”

easy to add an endorsement to your policy, so if someone tries to steal your identify you have a partnership with someone who will help.”

A personal articles policy is another type of policy that covers larger items like jewelry or artwork.

“We like to keep abreast of specialty things that we need to insure better,” Phyllis says. “Some items might be better served under a personal articles policy which would provide a lesser deductible than what's under the homeowners policy.”

It’s important to note some things are excluded from a homeowners policy. While an all-terrain or utility vehicle is covered by a homeowner’s policy while on the property itself, once it leaves the premises, it must be covered by an endorsement to the homeowners policy.

One of the biggest exclusions is ooding.

“I know a lot of folks think oods are covered under their homeowners policy, but it is government mandated that it has to be a separate policy,” says Phyllis. “It does cost a little more but it is always good to have broader coverage because you never know what Mother Nature might bring about.”

Control cost.

“ ere’s no denying that higher costs are a result of supply chain issues we’ve had, or in ation in general,” says Phyllis. “ ere’s a higher cost to replace property, whether it is a re or hail loss, or a burst water pipe. ose costs are being driven up because of what’s going on in the world today.”

Even though insurance costs have risen, there are ways to manage the costs and tailor a plan that ts your lifestyle and budget.

Phyllis suggests adjusting your plan’s deductible as a big way to save money. A higher deductible will likely translate to a lower insurance premium.

“If you take a higher deductible, if there is a loss you would share in more of the loss itself before the insurance kicks in, and that is one of the factors that helps decrease premiums,” she says.

If you have updated wiring or utilities, that could translate to a discount. Having a security system on the properly can also translate to a cost savings.

“De nitely let your agent know of any safety precautions you have for your home,” Phyllis says.

Regardless of your situation, there is likely an insurance solution that can be customized to work within your budget and your needs, and now is the time to explore those options.

“Your home is more than the four walls that surround you,” Phyllis says. “It has lots of personal property, it has your family, it has lots of memories housed there. It’s important to take the time out to think about whether you have appropriate coverage on the things you love so much, and you want to have it in place before you need it.”

COMOMAG.COM 59

callawaybank.com/hoot Watch the story to learn how The Callaway Bank team helped Kristen Graham-Brown during a time of need and an expansion into a new space. You deserve a locally owned and operated community bank that will be your financial partner. MEMBER FDIC | NMLS# 420268 VIDEO CHAT . TEXT . CALL » CONTACT US 7 DAYS A WEEK! callawaybank.com 573-657-0849 Ashland 573-447-1771 Columbia 573-642-3322 Fulton 573-676-5711 Mokane BACK THEY HAVE MY —

Kristen Graham-Brown,

Owner and Founder

Hoot Design

Company SCAN TO WATCH HER STORY. OCT_2022_COMO_HOME_MAG

SEARCH AND RESCUE

COMO residents weigh in on priorities for spending $12.6 million in American Rescue Plan Act funding.

LIVE ON AIR

KOPN Community Radio prepares to celebrate their 50th anniversary.

BENEFITS OF INFLATION

city

92 COMMUNITY

How sales taxes pay for

projects. 86

68