MAY/JUNE 2024 £10 PLUS The story behind Nando’s Working for Sir Richard Branson Can you bootstrap... ...a billion-pound business? Funding the growth of your business

Business Leader

The digital bank for entrepreneurs, by entrepreneurs.

We’re transforming business growth with personalised business banking services and fast, flexible financing ranging from £250,000 up to tens of millions.

Quick access to cash Get funded faster

Highly customisable solutions Tailored to your future

A transparent process Meet key decision-makers

Experts that understand growth

A dedicated business partner to fast-track your success

Visit us at oaknorth.co.uk

BOLDER THINKING NEEDS

BOLDER BANKING

EDITOR’S LETTER

Can you bootstrap a billionpound business? That is the question on the cover of this edition of Business Leader, which focuses on how to fund the growth of a business. Bootstrapping is a word that can be traced back to the 1800s and the phrase “pull oneself up by the bootstraps”. This was used to mock claims that were impossible or absurd, such as pulling yourself up by your own bootstraps, which is not physically possible. But today it has a new meaning – to build a business using only your own resources.

The origins of the phrase imply that to build a business in this way – certainly to one worth £1bn or more – is an absurd ambition. But there are founders who have done it. In this edition we look at businesses that were built without external investment, such as Dyson, Gymshark and Specsavers. Some of these borrowed money early on – Bet365, for example, took out a loan against its betting shops to fund the launch of its online business. Borrowing

EDITORIAL

Graham Ruddick – Editor-in-chief graham.ruddick@businessleader.co.uk

Sarah Vizard – Deputy editor-in-chief sarah.vizard@businessleader.co.uk

Andrew Lynch – Assistant editor andrew.lynch@businessleader.co.uk

Josh Dornbrack – Editor of businessleader.co.uk josh.dornbrack@businessleader.co.uk

James Cook – Digital editor james.cook@businessleader.co.uk

Patricia Cullen – Senior business reporter patricia.cullen@businessleader.co.uk

Alice Cumming – Editorial assistant alice.cumming@businessleader.co.uk

Mark Shillam – Chief sub-editor mark.shillam@businessleader.co.uk

may fall outside the most extreme definition of bootstrapping, but building a business in this way is still a remarkable achievement. For those looking to launch or build their own business, the fact that others have bootstrapped their way to success makes the idea seem more accessible somehow. It also provides benefits in the long term. For example, Josh Bayliss, chief executive of Virgin Group, says that working for one shareholder – in this case the Branson family – allows him to focus on long-term targets.

But not taking on investment may mean growing slower – or not at all. And you may miss out on the advice and wisdom that the best investors can offer. I was struck in our recent podcast interview with Jozsef Varadi, the founder of Wizz Air, about the strength of his partnership with the US private equity firm Indigo, who backed the airline at the start and is still an investor 20 years later. Varadi described his relationship with William Franke, the boss of Indigo, as like a father and son.

That is why this edition of Business Leader

Lee Irvine – Head of multimedia/video lee.irvine@businessleader.co.uk

SALES

George Buckingham – Commercial director george.buckingham@businessleader.co.uk

DESIGN/PRODUCTION

Phable Ltd – www.phable.io

MARKETING

Minty Nott – Head of marketing minty.nott@businessleader.co.uk

EVENTS

Melanie Shah – Head of events melanie.shah@businessleader.co.uk

also explores the stories behind businesses that took a different path to funding. We look at the rise of Nando’s, the growing wave of venture capital firms looking to invest outside London and share some tips on how to pitch your to investors from entrepreneur Alex Depledge, who estimates she has pitched more than 500 times.

We round off with some questions from you – the readers – for Richard Harpin, the owner of Business Leader, about getting investment. Richard founded and built HomeServe with external investment before selling it for £4.1bn. A final note. I want to say thank you for all your support and feedback since launching the new Business Leader. It has been remarkable. This is just the start…

Editor-in-chief Graham Ruddick

CIRCULATION

Adrian Warburton – Circulation manager adrian.warburton@businessleader.co.uk

MANAGEMENT

Andrew McLaughlan – CEO andrew@businessleader.co.uk

EDITORIAL ENQUIRIES: editorial@businessleader.co.uk

GENERAL AND ADVERTISING ENQUIRIES: info@businessleader.co.uk

© 2024 Business Leader is published by Business Leader Limited. Registered in England & Wales. Company no 08070514.

04 /// MAY/JUNE 2024

CONTENTS

EXPERTS

11 TOM BEAHON

How to build a career you’ll love

12 STEVEN SWINFORD

On Sir Keir Starmer’s house-building plans

14 SZU PING CHAN

Brits need to stop apologising and love success

16 EMMA JONES

Government should go hard and fast on procurement

17 NIKI TURNER-HARDING

How to attract and retain a multigenerational workforce

18 ED SMITH

Why you need to find your point of difference

20 JAKE HUMPHREY

Lessons from across the pond

22 ZARA NANU

Narrowing the unfinished business of pay gaps

23 CASPAR LEE

Beware the swing of the social media pendulum

24 CATHERINE BAKER

How to manage emotions under pressure MAY/JUNE 2024 CASE STUDIES

28 BOOTSTRAPPING

How Specsavers, Dyson and Dell built their businesses without external funding

34 SOLE CONTROL

Virgin Group’s CEO on working under Sir Richard Branson

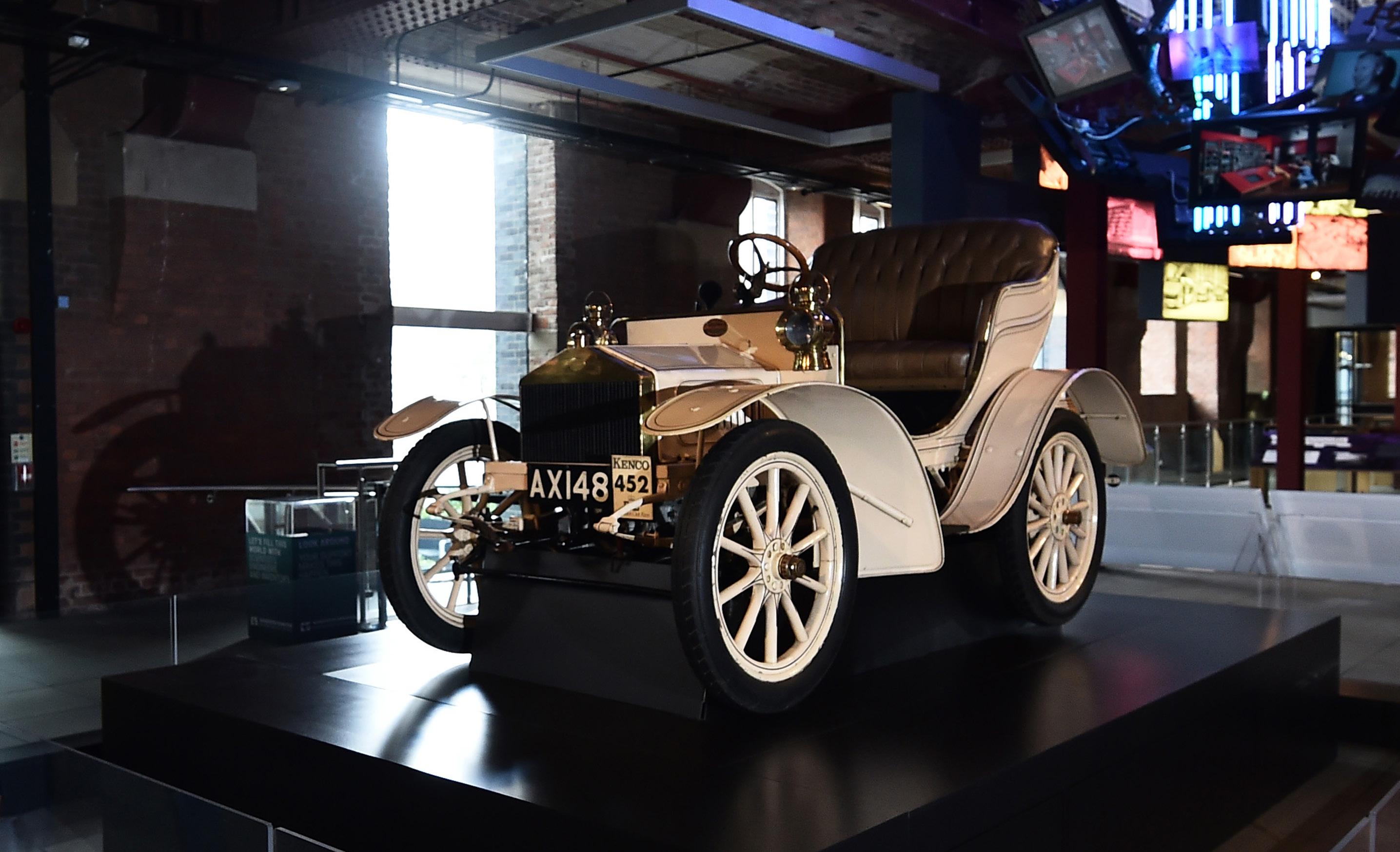

38 THE RISE OF NANDO’S

The spicy story of its international success

42 SCALE-UP LENDING

OakNorth Bank on backing fast-growing businesses DEEP DIVES

44 VENTURE CAPITAL

Why the UK industry isn’t working

50 THE PITCH FROM HELL…

… and how to avoid it

54 VIEW FROM THE NORTH

Manchester’s place as a hotspot for the gaming industry

INSPIRATION

60 ASK RICHARD

Five readers pitch their questions at our owner, Richard Harpin

62 LESSONS FROM ANOTHER FIELD

Big Zuu on his mould-breaking success story

67 SECRET SAUCE

Innocent Drinks on the fruits of its cultural success

68 MY BIGGEST CHALLENGE

Ella Mills on how she overcame illness to found Deliciously Ella

70 AGAINST THE GRAIN

How one firm is helping companies expand into Africa

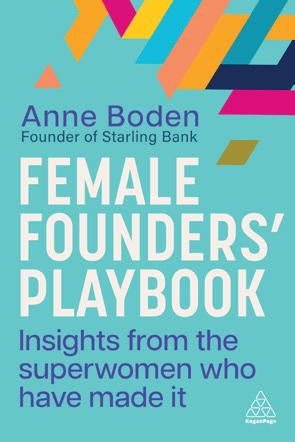

72 BOOKSHELF

Starling Bank’s founder offers tips from her funding journey

74 MEMBERSHIP

Find out how to join Business Leader

78 DEBRIEF

Inspiration to take on your funding journey

BUSINESS LEADER /// MAY/JUNE 2024 /// 05 WELCOME IMAGE CREDIT: Getty Images

68 XX

72 38

stories Growth

Inside the fast-growing medium-sized businesses driving the UK economy

01

The prefab disruptor Tony Wells, Merit

Almost a decade ago Tony Wells had an epiphany after realising he couldn’t grow his off-site manufacturing and construction business, Merit. “I announced to the management team that whatever we’d done in the past was wrong,” says Wells from the firm’s base in Cramlington near Newcastle. “We ripped up the business plan and went back to first principles: if we had a clean sheet, how would we do it?” he explains. “I couldn’t find a business model that was scalable.” Wells, 59, an electrical and controls engineer, took on the business with his wife Kirsty in 2002.

Wells knew he couldn’t match the economies of scale of the construction giants, but he was always a fan of Clayton Christensen, the American academic who developed the theory of disruptive innovation.

“We looked at disruptive business models because disruptive small company business models normally win against incumbents,” he says. “We were doing tier one, two and three contracting. You could see that over the long term, you wouldn’t make any money out of tier two and three. We just stopped doing that.”

Sales dropped like a stone. “I had sleepless nights,” recalls Wells, “but it was the right choice.” Dealing directly with the ultimate client – tier one – without the subcontracting tiers paid off. Merit turned over £88.4m last year, against £60.2m in 2022, and enjoyed a profit of £8.2m. It now employs 350

people, mostly at the 270,000 sq ft site in Northumberland.

Today, Merit’s prefabricated pods are used across the healthcare, pharma, bioscience, battery manufacturing and semiconductor sectors. It has constructed Halley VI research station modules for the British Antarctic Survey project, units for the Harrods luxury department store in London, clinical laboratories for the Moderna

biotech firm in Oxfordshire and even a community hospital at Berwick.

“In our little way, we’ve got something which is fundamentally better,” Wells says, citing the speed at which Merit completed the Autolus Therapeutics biotech lab at Stevenage, Hertfordshire. “That would normally take a five-year build from inception to use. We did it in 22 months.”

Timing is one element of Wells’ formula for success, sustainability and costs are the others. “The climate crisis presents an opportunity,” says Wells. “We banned gas from our buildings in response to Greta Thunberg’s UN speech and realised that once you drive that innovation, you can create sustainable buildings without an increase in costs and using less energy.”

And those costs? “The industry spends £3bn on estimating – and it’s 98 per cent wrong,” Wells says. “We’ve come up with a parametric cost model that’s eliminated estimating from our business. We design from a ‘don’t draw what you can’t afford’ mentality.”

With the landscape littered with the hulks of so many collapsed modular housing builders, Wells’ embracing of disruption is laying the foundations for a prefab future.

06 /// MAY/JUNE 2024

Keep the customer satisfied

Dan Beckles and Monty George, Furniturebox

Salisbury school friends Monty George (right) and Dan Beckles (left) used a tech-savvy focus on customer service to create a digital furniture retailer that expects to turnover £27m this year.

“I used to do a lot of eBay trading from around the age of 12,” says George. By 16, he was selling anything from touchscreen tablets to watches. In the sixth form, George spotted an opportunity to sell furniture. As Beckles was about

03

Shows that must go on Jennifer Davidson, Sleek Events

Jennifer Davidson doesn’t think she is doing anything out of the ordinary at Sleek Events, which will turn over £22m this year against £15.8m a year earlier. “When I tell someone we are going to deliver, we deliver,” explains Davidson, 39. “A lot of companies are so big and couldn’t care less.”

Sleek’s beginnings in 2014 were modest. Davidson, who read business studies with German and Spanish at Bournemouth University, was working freelance in events when a client asked if she would go in-house and find an agency.

“I decided to build one instead and it’s been a very happy relationship,” she says.

That client was Amazon Web Services (AWS). Davidson’s

to study economics at Loughborough University, George made him an offer.

“I said: ‘Do you fancy taking a year out and seeing if the furniture thing can work? And then if it doesn’t you can go off to uni?’ – and here we are nine years on,” recalls George, now 27.

They started with online marketplaces – eBay, Amazon and Tesco Direct – and channels such as Wayfair, B&Q and The Range. “There’s a massive opportunity for us to establish our brand and to bring our core values to customers in

40 full-timers and 60 freelancers will soon spend six days setting up for the AWS London Summit, hosting almost 20,000 people at the ExCel centre in Docklands.

As for everyone in events, the past decade has been a game of two halves for Sleek. “Pre-Covid we didn’t pitch for work – everything was word of mouth,” recalls Davidson. Sleek’s startling growth was recognised in The Sunday Times Fast Track 100, where it

the market,” says Beckles, 26. “The limitation with marketplaces is that you’re beholden to them.”

They also wanted to break the mould with their customer service.

The company offers next-day delivery until 8pm in the UK, explains Beckles, 26, while it customer service teams are available seven days a week. Its Trustpilot score is 4.9 out of five, based on almost 7,000 reviews.

Less than 18 months ago, Furniturebox moved to a new 88,000 sq ft fulfilment centre off the M4 near Chippenham, Wiltshire, to allow the business to grow.

Beckles and George initially ran a tight ship as they bootstrapped the business selling value furniture. “We were fighting for every pound,” says George.

Turnover in the year to the end of July 2022 stood at £15.9m, up almost 400 per cent on 2019. With an expansion into the US, the pair will face new pressures.

“We want to grow quickly,” says George, “but we don’t want it to be at the detriment of losing everything we have: the team, the structures and the culture we have in place.”

came in at number 19. “Then we went down to six staff, including myself,” says Davidson, 39. “We didn’t bother pitching for virtual events – no one was passionate about it.”

Following Covid, the business was able to regain some of its momentum.

“We’ve actively made a point of pitching for clients,” she reveals. They include PayPal and Pernod Ricard. Davidson hires staff who won’t run out of steam. “I don’t want to sell Sleek. Eventually I want to turn it into an employee-owned business.” She is also proud that Sleek has not had to rely on investment. “I never had a loan. It’s all mine, which makes it easier to give away,” Davidson says. “It’s never really been about the money though. I get a kick out of seeing the team in action on-site.”

Reporting by Andrew Lynch

MAY/JUNE 2024 /// 07

02

GROWTH STORIES BUSINESS LEADER ///

Are you ready to transform your company into a giant? Discover the 8 secrets to building a £billion business Grow your business with leading entrepreneur Richard Harpin Join the Business Leader Growth Workshop businessleader.co.uk/grow

MAY/JUNE 2024 /// 09 IMAGE CREDIT: Getty Images /// Advice and analysis from the leading figures in their field /// EXPERTS BUSINESS LEADER /// 11 Tom Beahon How to build a career you’ll love 18 Ed Smith Why you need to find your point of difference 12 Steven Swinford Sir Keir Starmer’s housebuilding plans 20 Jake Humphrey Lessons from across the pond 14 Szu Ping Chan Brits need to stop apologising 22 Zara Nanu Narrowing the unfinished business of pay gaps 16 Emma Jones Government should go hard and fast on procurement 23 Caspar Lee Beware the swing of the social media pendulum 17 Niki Turner-Harding How to retain a multigenerational workforce 24 Catherine Baker How to manage emotions under pressure 18

15 CATEGORIES

SENIOR JUDGING PANEL

THE UK’S ONLY SCALE-UP AWARD PROGRAMME

START YOUR ENTRY NOW #SUA24

BECOME AN AWARD-WINNING BUSINESS IN 2024

Passion, optimism and humour: how to build a career you will love

TOM BEAHON

Before I co-founded Castore when I was 26, I had one “real” job, which was in finance. I am not naturally a numbers person but I did make a point of being the first to arrive in the office every day and doing my best at whatever task I was given. Despite my lack of obvious talent, senior people appreciated my approach to work and would give me advice on where I could improve.

Given that many readers of this article will be leaders with people at the start of the careers in their teams, I want to share the key aspects of what I learnt and hope some people will find these points worth sharing with their most ambitious young colleagues.

No substitute for hard work

When I look at people who have risen to leadership positions, the common theme is their work ethic. They generally work harder, sweat the details and care more than anyone else. This is not just true in business but in any walk of

life. If you want to be really good, you must be willing to work very hard. Don’t believe anyone who tells you otherwise.

Passion is key to everything

The only way you will be capable of dealing with the inevitable setbacks that come with any significant endeavour is if you are truly passionate about what you are doing. I love sports and thrive on the competitiveness, intellect and resilience required to build a global brand, so running Castore isn’t work for me. Before you do anything else, find your passion. After that, everything becomes a lot easier.

You either win or you learn

At the start of your career, many things are out of your control and you’re unlikely to find your perfect job at the first attempt. Rather than letting setbacks get you down, use them as

opportunities to refine your approach and learn what your strengths and weaknesses are. The one thing you can always control is your attitude. When you wake up every morning you have a decision to make: are you going to coast through the day, or will you be a positive influence on those around you? Having a good attitude every day will get you further than any technical skill or talent.

Be entrepreneurial

Anyone working within a company at any level can have an entrepreneurial mindset. If you want to get ahead, having one will undoubtedly accelerate your progress. Take the initiative, make a process more efficient or do something that improves a customer experience. Constantly challenge yourself and others to think and do things differently for your company. Don’t expect to get noticed straight away but persist and you’ll get more responsibility and opportunities. As a founder, my favourite people are those who bring me solutions and new ideas.

Kindness is a superpower

The best advice is often the simplest and always treating people with respect is a lesson I learnt very early. There’s not only a practical benefit to this – you never know when you’ll be dealing with people again – but a personal one. It makes work a lot more enjoyable if you’re kind and caring towards colleagues whether they’re above or below you in the hierarchy. Courtesy costs nothing and smiling every day goes a very long way in business and life.

Tom Beahon is the co-founder and chief executiive of the sportswear brand Castore

BUSINESS LEADER /// EXPERT IMAGE CREDIT: Getty Images, Adobe Stock MAY/JUNE 2024 /// 11

///

/// FOUNDERS

Starmer is constructing plans for a huge expansion of housebuilding

STEVEN SWINFORD

hat will be the biggest change if, as expected, Sir Keir Starmer wins the general election? For all their apparent differences, the approaches of Labour and the Tories are remarkably similar when it comes to the traditional electoral battlegrounds.

WBoth offer the same tax cuts, both warn of years of constraints on public spending to come and both will face the same seemingly intractable challenges as they attempt to bring down NHS waiting lists.

The point on which they diverge the most is on a policy usually deemed too unglamorous for the cut and thrust of an election campaign, but one that is of huge national importance:

Starmer’s keynote speech at the Labour party’s annual conference last September attempted to thrust the issue centre stage. Labour, he said, would “bulldoze” the planning restrictions that have held Britain back for generations. His party would “fight the blockers” as it sought to restore the dream of home ownership for millions of people.

The Labour leader has put the war on nimbies at the heart of his campaign. Nothing is off the table. The green belt, green fields, new towns… all sites are up for consideration as Starmer seeks to “get Britain building”.

There is political logic behind Starmer’s positioning. Labour’s psephologists have pored over the polling and established that the principle of backing housebuilding is popular.

The vast majority of people are in favour of development when it is not in their backyards.

More specifically, it matters in the seats that Labour is targeting. Housing is the top issue in a quarter of the party’s 100 most winnable seats, particularly a swathe across Middle England that is likely to be pivotal to Labour’s chances of winning the election.

But Starmer’s decision to focus on planning is also one borne of necessity. If Starmer wins the election, his fiscal room for manoeuvre will be severely constrained. The Tories are planning an Autumn Statement that is likely to include significant pre-election giveaways in the form of tax cuts.

The Office for Budget Responsibility, the fiscal watchdog, is drafting increases in public spending of just one per cent a year after 2025. When protected areas such as the NHS and education are removed from the equation,

it means significant cuts to other departments. Economists have already warned there will be a new era of austerity.

While both the Tories and Labour have signed up to these bleak – and some argue, unrealistic –public spending profiles, neither party has spelt out where the axe would fall. Their political interests in this are perversely aligned. What party would be willing to go to the polls hailing a programme of tax rises or spending cuts?

In the absence of financial firepower, supply measures such as planning reform have become critical to Starmer’s hopes of growing the economy, and he needs to do this without increasing public spending.

The Labour leader’s hopes of weaponising planning as an issue have been helped by the seemingly eternal psychodrama of the Conservative Party around the issue. The past 14 years have seen revolt after revolt within the party, with the free-market aspirations of some Tory MPs coming up against the desire of others – particularly in southern England –

12 /// MAY/JUNE 2024

IMAGE CREDIT: Getty Images, Adobe Stock

/// POLITICS ///

‘The green belt, green fields, new towns… all are up for consideration as Starmer seeks to “get Britain building”’

to protect their constituents from what is seen as unnecessary development. That tension has culminated in a series of mass rebellions.

In December 2022, two months into his premiership, Sunak abandoned plans for mandatory housebuilding targets for local authorities, making them advisory instead. Planning experts warned that at the stroke of a pen the government had just cut the number of homes likely to be built every year by as much as 77,000.

At the end of last year, the government went further, announcing that councils will no longer be forced to set aside greenfield land to meet future housing need. Councils were also given

an exemption from building new homes on prime agricultural land.

Experts say that the government now appears to be on course to miss its own target for housebuilding. When Boris Johnson won the general election in 2019 he recommitted to an annual target of 300,000 homes a year “by the mid-2020s”.

To date the government has consistently fallen short. In 2019-20 there were 248,591 “net additional dwellings”, a figure which fell to 217,754 in 2020-21. This was attributed to a slowdown in the building sector because of the pandemic. In both 2021-22 and 2022-23 the figure was fewer than 235,000 homes a year.

Sunak has pledged to “protect” green spaces, saying instead that new houses will be built in “great cities” rather than “concreting over the countryside”. Senior Conservatives are privately – and in some cases publicly – lobbying him to take a more forthright approach.

Amid the Tory climbdowns and divisions, Starmer has spied an opportunity. The Labour leader has pledged to build 1.5 million homes during the next parliament, primarily by reinstating the mandatory housebuilding targets the Tories are preparing to scrap.

Starmer also announced plans to build a string of new towns and said that Labour would be willing to build further houses on low-quality areas of the green belt, which he described as “grey belt”.

The Conservatives responded by pointing out that 233,000 homes a year have been built under successive Conservative governments on average, compared to 170,000 under Labour. The Conservative Party also announced plans to build more on brownfield sites in cities and the government recently said that it wants to “turbocharge” development in Cambridge, with up to 250,000 homes built in the next 20 years.

The Tories are also preparing their own offer on home ownership, although – unsurprisingly given the party’s internal divisions – it is unlikely to focus on planning. Instead they want to focus on cutting the overall cost of home ownership for first-time buyers in a bid to appeal to younger voters.

A variety of options are under consideration from both parties, including much longer fixed-term mortgages that reduce the amount of money that is needed for a deposit. Stamp duty reductions are also on the table.

As we enter the final furlong before the general election is called, housebuilding and home ownership have never been more relevant. For generation rent, it could prove to be a truly significant moment, whoever wins.

Steven Swinford is political editor of The Times

BUSINESS LEADER /// EXPERT MAY/JUNE 2024 /// 13

NSorry, but Brits need to stop apologising and love success

o bragging please, we’re British. Self-deprecation is in our DNA, but our inherent discomfort with lauding achievement is holding back the economy. There’s a danger that a nation which prefers reluctance to enthusiasm is actually missing out on vital opportunities.

Some attribute this to tall poppy syndrome; successful entrepreneurs are an easy target for the jealous and the cynical. Others believe it’s a more fundamental trait of how we do business here in the UK.

I believe it’s a bit of both. For one thing, as a nation we just can’t stop apologising. A 2015 YouGov poll of more than 2,500 people in the UK and US suggested that Brits are 50 per cent more likely than Americans to say sorry for things that aren’t their fault, for example when they sneeze or someone else bumps into them. This isn’t so much of a problem in day-to-day life, but it can be detrimental in business.

“[Self-deprecation] is an endearing quality, don’t get me wrong, but when it comes to doing business there’s a danger it might be taken at face value,” says one US executive.

A 2023 Ipsos Mori poll found that Britain is a nation of “satisficers” rather than “strivers”, with one in two (51 per cent) of us satisfied with our lot. Less than a third (30 per cent) said they wanted to achieve more. Brits also favour “quiet luxury” and “discreet consumption”, preferring not to own or do things that might display their wealth.

This does not mean Brits are not confident about their ideas. Adam Marshall, the former director general of the British Chambers of Commerce, says too many of us are not

SZU PING CHAN

shouting about our achievements.

Marshall, who describes himself as “American as apple pie” despite spending his whole professional life here, says there are clear differences between the two countries. In the US, he suggests, success is celebrated and failure is understood, whereas in the UK success is kept quiet and failure is something that should be avoided.

“My concern about celebrating success in Britain is that you see two varieties: the ‘brash businessman’ who doesn’t care what anyone else thinks, or the ‘tall poppy’ who ends up getting cut down by others, ” adds Marshall

The feeling that it could all go wrong is something even the best of us can’t shake. A decade ago, the actress Olivia Colman

admitted she found it hard to deal with newfound adulation. “It’s slightly scary, that tall poppy syndrome,” she said in an interview with The Guardian. “It could all go wrong. I don’t know. It’s weird.”

Colman’s acting talents went on to earn her

‘Britons love an underdog but all too often we expect them to stay that way’

14 /// MAY/JUNE 2024

/// ECONOMICS ///

multiple Oscars. “It’s genuinely quite stressful. This is hilarious, I got an Oscar!” were the first words she uttered after taking the stage to collect her award. True to form, “sorry” came seconds later.

There’s a broader point here. Britons love an underdog but all too often we expect them to stay that way. Even our sporting heroes are expected to remain humble. It means those who break the mould are left worrying they will be seen as arrogant.

Don’t get me wrong, being self-aware has its bonuses and we can’t change what’s in our DNA. However, we must do more to highlight success or other people in the business world won’t even attempt to achieve what Colman has in the arts sector. Otherwise our poppies won’t have a chance to grow at all.

Why is this? Perhaps fear of failure plays a role. A study published by the Organisation for Economic Co-operation and Development (OECD) showed budding British entrepreneurs were twice as likely to avoid starting a business compared with their US counterparts because they feared they would not succeed.

Americans, on the other hand, have turned failure into an enterprise. Elon Musk, who co-founded Tesla and owns the social media site X, was once the world’s richest man. He also holds the Guinness World Record for the largest loss of personal fortune in history after shares in the electric carmaker plunged in 2022.

Speaking about his roller-coaster journey, Musk insisted: “Anything which is significantly innovative is going to come with a significant risk of failure. You’ve got to take big chances in order for the potential for a big positive outcome. If the outcome is exciting enough, then taking a big risk is worthwhile.”

It’s worth remembering that some of the world’s biggest companies stemmed from failure. YouTube, which is now owned by Google, began life as an online dating site. Users were encouraged to “Tune in, Hook up” and women were even offered $20 to upload videos of themselves. Nobody did and the owners pivoted to a video-sharing strategy.

Today, there is a whole industry in America that celebrates failure through conferences, as well as dozens of books on the subject. There’s even a name for it: failure porn.

Social media doesn’t help. The constant comparisons with others on Instagram and TikTok living what looks like their best lives can trigger social anxiety driven by the fear

of missing out, all of which can breed anger and resentment.

I know what you’re thinking: the media also plays its part. You have a point, but there is an element of supply and demand. I’ve written about economics for more than 15 years and recession stories have always done better than tales about the booming economy.

Some of the most high-performing stories are about job losses. We celebrate success but are always looking for failure. Isn’t it time we all stopped looking over our shoulders and ask what’s next rather than what could go wrong?

There’s another risk to our constant fear of failure and denigration of success. Marshall believes the consequences of constantly diminishing the very people we should look up to is that young people and entrepreneurs are left without role models.

“There’s sometimes a lack of attention from

financiers when it comes to potential deals and opportunities,” he says. “If success is celebrated, then more money can flow to businesses because they become visible, they become known. We miss out by not celebrating success.” After all, the next generation can’t be what it can’t see.

Szu Ping Chan is economics editor of The Telegraph

BUSINESS LEADER /// EXPERT MAY/JUNE 2024 /// 15

/// START-UPS ///

Government should go hard and fast on SME procurement

EMMA JONES

One of the most tangible things any government can do to support its start-up, early stage and small business community is to buy from it.

Public procurement represents a third of all government spending and a 10th of the whole economy. It’s a powerful tool that, if used strategically, could have an important impact on the UK’s innovation pipeline.

Buying from start-ups injects government money into the sector. This is because its contracts are reliable and firms that work on them must improve efficiency and productivity when selling to larger clients. The government also settles invoices quickly, offering cash flow to suppliers.

It’s a powerful way to help the digital business community evolve and use lessons from innovative firms to solve public sector problems. This benefits not just the SMEs themselves but the wider community, saving

taxpayers’ money along the way.

When Matt Hancock was minister for the Cabinet Office in 2015, he set a government target to spend £1 in every £3 with SMEs by 2020. This equated to an extra £3bn a year for small and medium-sized firms. That target was missed, but a firm commitment to increase public sector spend with SMEs was established.

Fresh SME-focused frameworks are also in play, such as the one awarded to Sodexo, which aims to spend £100m with SMEs to supply sustainable food and drink to various parts of the public sector procurement departments. Efforts such as this encourage bids from SMEs.

The UK is about to take the next step on this path with the introduction of the Procurement Act this autumn. The aim, according to the government, is to “shake up our outdated system and improve the way procurement is done, so that every pound goes further for our public services”.

Our company, Enterprise Nation, works to

connect small businesses to the government’s tier one suppliers. There are currently 39 strategic suppliers that are in receipt of government spending (such as Babcock, Deloitte and Vodafone). These larger suppliers are being asked to integrate more small firms in their supply chains. This means smaller companies can focus on delivering a quality product or service, leaving the established operators to produce bids and deliver account management once the contract is won.

To aid this, we are working to help tier one companies identify suitable SME providers, onboard them and deliver supplier-readiness training. The aim is to ensure smaller firms are “fit to supply” when it comes to having appropriate policies and protections, for example having clear net-zero intentions.

A good example of this is when the IT firm 848 Group partnered with Deloitte Digital to build a mobile app and customer relationship management platform for the Driver and Vehicle Standards Agency. It meant the DVSA could replace several of its older systems with the new platform. Some of its main business processes – onboarding service providers, and scheduling field service work and bookings –also became more efficient once all the systems had been integrated.

If done correctly, the public sector benefits from purchasing from diverse and innovative businesses such as 848 that produce clever, creative and cost-effective solutions. SMEs then gain an advantage from the professionalism and scale that come from partnering with larger clients.

It’s clear the government is prioritising spending more with SMEs, but we need to go harder and faster in order to make 2024 the year that achieved the 33 per cent target.

Emma Jones is the founder and chief executive of Enterprise Nation, the small business support platform

000 /// JANUARY 2024 IMAGE CREDIT: Getty Images

16 /// MAY/JUNE 2024

How to attract and retain a multi-generational workforce

here are currently five generations working side by side in the UK labour force. Thanks to an ageing population, the cost-of-living crunch and changing attitudes to retirement, businesses are supporting staff whose core cultural references span everything from The Beatles to ChatGPT.

TToday’s multi-generational hiring market is a win for diversity, but it creates complex attraction and retention challenges. How can small and medium-sized companies be all things to all cohorts? And how can they cost effectively deliver on each age group’s preferences and priorities?

While it’s easy to focus on pitfalls, stereotypes and preconceptions, different demographics can still successfully coexist and collaborate. Each segment contributes singular strengths, perspectives and experience to the workplace. So, what elements do you need to take into consideration to take advantage of a synergistic solution to the UK’s widening skills gap?

Align policies and benefits

When age-diverse workforces are the norm, businesses need to deliver pay and benefits packages that satisfy everyone from graduates to grandparents. For example, while generous

salaries, flexibility and work-life balance are universally valued, recent LinkedIn data shows young workers prioritise career advancement (36 per cent) and skills development (34 per cent). Within this cohort, corporate purpose counts. The Deloitte Global 2023 Gen Z and Millennial report found that “Zoomers” want to be morally and ethically aligned with their employers and for their role to drive change.

At the other end of the spectrum, senior staff look for stability and age-inclusive workplaces. Think solid pensions, health MOTs and flexible working arrangements. Increasingly popular phased retirement plans allow staff gradually to step back from their roles, while companies retain expertise and facilitate knowledge transfer to their wider teams.

Mid-lifers, particularly women over 50, are the fastest-growing section of the working population. This time-poor generation of carers – tending to parents, toddlers and teenagers –require support to keep the plates spinning and thrive personally and professionally. Benefits need to include menopause policies, flexible work options, mental health and wellbeing schemes and career sabbaticals.

Commit to career-long learning

With working lives now extending to more than 50 years, companies need professional development plans that endure. Done well, these lifelong learning programmes keep key skills sharp, boost staff retention and create vital intergenerational connections.

According to research from the Transamerica Institute, employers most often use job training (46 per cent), mentorships (36 per cent), and professional development opportunities (32 per cent) to promote continuous advancement and foster a multi-generational workforce.

Communicate effectively across the generations

While every generation contributes unique skillsets and strong points, they also labour under stubborn and divisive stereotypes: boomers are out of touch; gen X can’t handle change; millennials are work-shy snowflakes.

To build respect and boost productivity, introduce initiatives that develop collaboration and understanding. These could include:

• Normalise success at any age, challenge age-linked value. Reward behaviours that champion an age-inclusive culture.

• Consider workshops that bring colleagues together to find team-based solutions and share experience and expertise.

• Implement intergenerational mentoring programmes that foster knowledge exchange, skills development and shared objectives. Upend traditional dynamics by allowing younger employees to guide senior colleagues.

• Create age-diverse teams of colleagues with different outlooks, approaches, and experience levels. Committing to a clear organisational purpose can nurture community spirit and achieve common goals.

To navigate seismic shifts such as the AI revolution and green transition, businesses need all hands to the pump. Through proactive recruitment, effective communication and employee support, organisations can build cohesive and age-inclusive workforces equipped for the challenge.

Our candidate pool has never been richer, wider or more diverse, but to unlock its firepower, we must take front-footed routes to engagement, rewards and retention – and make multi-generational management a key priority.

Niki Turner-Harding is country head, UK and Ireland, at Adecco

BUSINESS LEADER /// MAY/JUNE 2024 /// 17 EXPERT NIKI TURNER-HARDING /// TALENT MANAGEMENT ///

/// MAKING DECISIONS ///

Everyone is in favour of a point of difference, but only after it has worked

ED SMITH

oliticians cling to how messages “land” in focus groups and polls, businesses to market research, and creatives to recent hit successes. Whatever the sector, the impulse is the same: to discover and understand what’s working right now for other people.

PBut the crucial part of that sentence isn’t “what’s working” but “other people”. Because you aren’t other people and the fact it’s working for them doesn’t mean it will work for you –still less that you should be relinquishing your own unique perspective along the way. “If I’d asked people what they wanted,” quipped Henry Ford, “they’d have said a faster horse.”

Five years ago, I co-founded the Institute of Sports Humanities (ISH). The inspiration came from two personal experiences. First, when I’d been made captain of my professional cricket team, I looked around for a university leadership programme that could help prepare me for the position, but failed to find one.

Second, a decade or so later and now working inside academia, I felt that sport was wrongly positioned inside university bureaucracies. It was often stuck in a silo, unable to break free

from its academic origins in physical education. There was so much “sports science” and so little “sports humanities”.

My vision for ISH was to help leaders in sport (both on and off the field) by encouraging the interplay of theory and practice, unifying different academic tools in an inter-disciplinary approach and by viewing sport within the context of wider culture. While there are always technical and scientific strands to sports leadership, I’ve never seen a solely technical or scientific approach turn out to be successful. Sport is played by human beings and entertains human beings. If you forget those two facts, you’re moving away from the essence of the whole enterprise.

Inevitably, when founding the Institute, we soon encountered pressure from academic insiders to reconsider and retreat into the triedand-tested “sports science” space. If I’d been a more reasonable person, I’d have flipped.

However, ISH was lucky to have the support of the sports entrepreneur Andrew White and the educationalist (and then University of Buckingham vice-chancellor) Sir Anthony Seldon, who were both prepared to take a different approach. We wanted to encourage the most interesting conversations at the intersection of elite sport and academia –everything else would flow from that.

If we’d followed what everyone else was doing, ISH wouldn’t have found its voice. Five years on – while it still feels like very early days – ISH has educated captains, coaches, technical directors and business leaders from across all leading sports. (In the opening round of the 2024 first-class cricket season, one ISH student was bowling at another – with the batsman going on to make 335 not out in his first game as club captain.)

Differentiation, however, comes with a very important “but”. If the motivation to deviate from the consensus crowd is political expedience or just PR, then the contrast will only be skin deep. Differentiation at philosophical level should drive a USP, not the other way around. Trying to be different for the sake of it is already trying too hard.

While I’ve never liked the saying “too clever by half” (instead, the greater threat is “too stupid by far”), there is something useful in the phrase’s implied warning. Exaggeration shouldn’t be allowed to impinge on effectiveness. It also calls to mind Nicolas Chamfort’s aphorism: “Having lots of ideas doesn’t mean you’re clever, any more than having lots of soldiers means you’re a good general.”

There is a parallel here between interesting projects and interesting people. When a person self-consciously strives to be different or eccentric, it’s usually boring. When people are different or eccentric due to a naturally distinct way of seeing things, they are usually interesting. (Genuine eccentrics, after all, think it is “normal behaviour” that is strange.) Though he exaggerated the case, C.S.Lewis put this brilliantly: “Even in literature and art, no man who bothers about originality will ever be original: whereas if you simply try to tell the truth…you will, nine times out of 10, become original without having noticed it.”

Differentiation has important implications for building effective teams. A team or group isn’t likely to achieve collective distinctness if they are all alike individually. Diversity of background is only part of the point here (and the lesser part). Instead, it’s the

18 /// MAY/JUNE 2024

IMAGE CREDIT: Getty Images

‘A team or group isn’t likely to achieve collective differentiation if they are all alike individually’

diversity of habits and outlooks that is more fundamental. If you’re hiring people whose world views are comparable, then you’re not adding much value to the whole. However, hiring people with personal intellectual conviction is always going to expand the collective bandwidth and creative tension. What if we turn the challenge towards our

own lives: are we in the right places and around the right people to give ourselves the best chance of achieving personal differentiation?

A novelist friend, someone with no interest in sport, once posed an important question when I was in my late 20s about cricket that I couldn’t answer:“Can you play cricket significantly differently from other professional players?”

The answer (which I didn’t admit but knew deep down to be true): not differently enough to justify extending the commitment.

My friend’s question emboldened me not to continue with my playing career (I retired from cricket at 30) to the detriment of other possibilities (even though I’d have to start over and begin further down the ladder).

It’s not only cautiousness that prevents us from doing something different and interesting. Another risk is getting too comfortable.

Ed Smith is director of the Institute of Sports Humanities and author of Making Decisions

BUSINESS LEADER /// EXPERT MAY/JUNE 2024 /// 19

Lessons and habits UK business owners can learn from across the pond

When I interview guests on my High Performance podcast who are from the US, I notice their different approach to life and business.

I love talking to fellow British entrepreneurs or discussing success stories, but I sometimes get the feeling they’re focused on what the podcast can do for them. However, when I speak to guests from across the pond they

have a real mindset of collaboration and encouragement. When we finish interviewing these guests and they head for the door, their parting comment is: “If there’s anything I can do for you, let me know.” I feel that in American society it’s ingrained in them to lift each other up and celebrate the successes of another person, company or project. I think we need to be much better at doing that in the UK. We’ve made more than 300 episodes of

20 /// MAY/JUNE 2024 JAKE HUMPHREY IMAGE CREDIT: Getty Images /// HIGH PERFORMANCE ///

High Performance. Despite the incredible conversations we’ve had, I’ve never been more excited than I was before interviewing Robin Sharma, who wrote The 5AM Club. His entire life and business is built on how he can help as many people as possible. His new book, The Wealth Money Can’t Buy, talks about fortune in a way that many people don’t. We all think of wealth as our assets, the size of our house and the money that’s in our bank account. Sharma talks about wealth as personal growth, creating your craft, community, and the wealth that comes with family.

I want to share a few of the key tips from our interview. The first thing I learned is not being a resentment collector. Sharma sees resentment as an energy, and any time you’re using that energy, it removes it from a different area of your life that you could apply it to.

That leads to the second point he made, which is that other people’s success is your success.

I think this is a really powerful concept for everyone reading this column. No matter what industry you’re working in, if there’s a business or a person in that sector that is doing amazing things, have this idea that their success is yours. Why? Because they are adding to your industry. Not only that, but if they can do incredible things, then you can do incredible things too.

The next thing that he spoke about was working on your craft. This is making sure that every single day you do something that moves you closer to the person that you want to be.

He also talks about choosing the people around you. Everyone reading this will have their own way of hiring people. My method is to not go through a lengthy interview process as the chances of the perfect person being available at that moment are slim. Instead, I love the idea of collecting and meeting people on my journey, and then trying to find a way to work with them.

Sharma has two big lessons in this space. The first is to think about the people who are in your life who are not just business associates – partners, loved ones and really close friends. You spend a lot of time with them. So when you meet someone for the first couple of times, ask yourself a very simple question – could I sit and have 10,000 dinners with this person? If the answer is yes, then they definitely deserve a place in your life. If the answer is no, then you need to ask yourself whether they’re the sort of person you should be investing your time with and using your energy on. Sharma also made the point that you’ve got a choice

– you can be happy or you can hang out with toxic and negative people. You don’t get to do both.

He also spoke about hard work, which is connected to a philosophy which he calls APR –absolute personal responsibility. It doesn’t mean that things aren’t going to happen. It stresses that you’re responsible for how you respond to certain situations or challenges.

Sharma talks about money because money is one of the key drivers of wealth. He has spent his life surrounded by money masters, working with some of the biggest global CEOs,

the cemetery?

He also reveals that money masters are comfortable with being ridiculed. You can do exactly what the other 95 per cent of people are doing in the world, but you will get the same results as those 95 per cent. If you want to stand out, if you want to be different, if you want to create something distinct, find the five per cent of whatever it may be that people aren’t bothered with or occupied by and focus in on that space. Yes, it’s the five per cent that will bring the criticism, it will bring the ridicule, it will bring the naysayers. Your

‘I love the idea of collecting people and meeting people on my journey, and then trying to find a way to work with them’

billionaires and elite sportspeople. You think of a well-known entrepreneur on the planet and Robin Sharma is more than likely going to be their personal mentor. Sharma says he has worked with hundreds of them and that at the end of their days they would trade every single penny they’ve ever earned to possess physical wealth. So when we talk about success in business, we must not compromise on taking the time to ensure we have a healthy lifestyle where physical and mental wellness is at its core. What’s the point of being the richest person in

job is to become comfortable with that. The final quality that Sharma talks about when building successful businesses is that good habits beat IQ. People talk so much in business about intellect or what your qualifications on a piece of paper are, but it’s so often good habits that are the real game changers.

Jake Humphrey is the host of the High Performance podcast and co-founder of Whisper Group

BUSINESS LEADER /// MAY/JUNE 2024 /// 21 EXPERT

Incorporating ethnicity pay gap analysis

Let’s narrow the divide on the unfinished business of pay gaps ///WOMEN IN BUSINESS ///

espite its very existence, there seems to be no resolution to the UK’s gender pay gap –the difference between what men and women earn – and we know these figures because of transparency legislation.

DSince 2017, the law requires companies with 250 employees or more to reveal their gender pay gap annually. This year marks a significant milestone as we see the gap narrowing to its smallest margin so far. However, with women still earning 91p for every £1 that men earn, is that progress?

The gender pay gap can be misunderstood and often misreported as some talk about equal pay, others about equality and many about average

gaps. Equal pay for equal value is about men and women receiving identical compensation for jobs that demand similar levels of skill, effort and responsibility. The legal framework for this is governed by the Equality Act 2010, which aimed to strengthen anti-discrimination.

Although the legislation focuses on average wages, it fails to address the nuances of equal pay and pay equity, and masks deeper inequalities within organisations. One question stands unanswered before business leaders: if progress to equality is slow, how can we catalyse genuine improvement?

The path to bridging the gender pay gap extends beyond mere compliance, requiring a proactive and comprehensive approach from businesses:

This provides a more granular view of pay disparities, unearthing inequities that intersect with gender, fosters a more equitable workplace and a commitment to inclusivity;

Enhancing transparency of pay practices

Offering employees clear insights into pay structures to promotes a culture of trust and openness. This encourages dialogue around pay equity and can prevent potential disputes; Adopting gender-neutral job evaluations

Assessing roles free from gender bias and accounting for occupational segregation ensures compensation is equitable. Recognising and rectifying gender biases in certain professions can ensure more balanced pay structures; Fostering continuous improvement culture

Cultivating an environment where pay practice feedback is acted upon can drive sustainable progress. Engaging employees in discussions about pay equity and diversity solidifies a firm’s dedication to these principles;

Insight-driven, strategic decision-making

Utilising data analytics to understand the root causes of pay gaps can shape more effective strategies. By analysing trends, companies can gauge the effectiveness of their initiatives and adjust approaches accordingly.

Beyond the moral obligation, companies that prioritise pay equity and diversity stand out as leaders in ethical business practices, enhancing their brand reputations. Furthermore, research shows that diverse and equitable workplaces are more innovative, productive and profitable. Despite the reduction in the gender pay gap, true equity remains elusive and achieving it requires transcending basic legal compliance. By adopting a holistic and strategic approach, businesses can address this, unlock the full potential of their workforce, advance equality and contribute to the broader societal good.

Zara Nanu is a serial entrepreneur and member of the Women’s Leadership Board at Harvard Kennedy School

22 /// MAY/JUNE 2024 IMAGE CREDIT: Adobe Stock

ZARA NANU

Tomorrow’s teens could have a longer attention span thanks to social media

CASPAR LEE

When the printing press was invented in the 15th century, there were concerns among some about the negative effect that excessive reading could have on young people. Fast forward 500 years and we saw a similar reaction to the invention of the television. Parents and teachers alike were worried about the impact of too much TV on children’s social and cognitive development. In 2005 YouTube came along, and these worries ramped up still further.

YouTube generates much of its revenue from advertising. This means the more time users spend on the platform, the more money it makes. It does not have much of a say on what specific content its creators make, instead it has an algorithm that rewards creators with views when they keep their audience engaged for longer. These views result in more advertising money, which YouTube and the creators split.

For creators to get more views, the first step is to get as many people clicking on their thumbnails – the preview image on a video – as possible. The second step is keeping viewers watching for as long as possible. The first step

is measured as click-through rate, or CTR, and the second as average watch time.

When I was building my YouTube channel, all creators needed to focus on was CTR. This meant creating videos that were referred to as clickbait, because the more clicks a video got, the more it was served to viewers. You could title your video “I can’t believe this happened”, accompany it with a thumbnail picture of your mouth wide open and hit one million views.

Over time, the algorithm started penalising clickbait. YouTube realised that when viewers felt tricked, they spent less time on the platform, which affected advertising revenue. Creators also realised that if people clicked their videos but only watched for a few seconds, or skipped through entirely, it would hurt their business more than having fewer people clicking but watching for longer.

This encouraged creators to deliver on their thumbnail and title promises, and optimise every second of their videos. They started using retention editing, with more cliffhangers than CSI: Crime Scene Investigation, giving viewers little chance to click away. Creators even started cutting out pauses between words to maximise every moment of their content.

The king of high watch time is American YouTuber MrBeast. His meteoric rise led to thousands of copycat creators who believed that the secret to success was to edit videos and act exactly like him. This resulted in an abundance of homogeneous content, usually involving too much shouting and filming Lamborghinis in strange locations. But this missed the real reasons why he was so successful: his originality, work ethic,

content investment and creative genius.

Yes, the MrBeast-ification of YouTube videos did boost view times and revenues for several creators, but it also made me question whether a generation of kids would only want to watch videos that fulfilled their quick-hit content needs. Like the worried parents during the rise of the printing press and popularisation of TV, I thought attention spans and cognitive abilities were only going one way.

However, this year the pendulum is swinging back towards the creation of more cerebral, less hyperactive content. Algorithms are discovering that viewers spend more time watching content that doesn’t numb their minds. MrBeast has now started to lengthen his videos and shout less.

Another place where this trend is taking hold is on TikTok, the exemplar of short-form content. Videos were initially limited to 15 seconds, increasing to 60 seconds in 2017 and now it allows up to 10 minutes. Longer-form, less-edited clips are popular as audiences click away from cheap editing tricks. The very algorithms designed to keep me watching are learning that the only way to do so is by offering more valuable content. This means surfacing videos to me that allow me to relax, watch something meaningful and maybe even grow my cognitive abilities just as if I was reading a book or watching a documentary.

So I’m going out on a limb: the teens of tomorrow might actually have longer attention spans than the ones of today. In fact, perhaps they will have to care for us poor millennial and Gen Z souls still stuck at the wrong side of the pendulum swing.

Caspar Lee is the co-founder of Influencer.com and Creator Ventures

BUSINESS LEADER /// EXPERT IMAGE CREDIT: Getty Images MAY/JUNE 2024 /// 23 /// ENTREPRENEURS ///

CATHERINE BAKER /// SUSTAINING

PERFORMANCE ///

Under pressure? Control your emotions, shift your mindset and self-talk

Iwas privileged to give a talk recently at King’s College, Cambridge, where I asked the audience to reflect on a couple of questions that evening: when you’re feeling under pressure, how do you respond? And what do you say to yourself?

In the Q&A session afterwards, one of the audience members asked why I had chosen to focus on that area. My response? Elite sport can teach us some brilliant lessons around how we manage our emotions and respond to pressure. It is precisely these moments that are built into the fabric of how elite sport operates.

Pressure itself is just as real away from elite sport and, whatever the environment, increased pressure drives an emotional response. We all have feelings, even those who like to pretend they do not. Our emotions can help our performance, but they can also hinder it, and our ability to manage them is critical to sustained, long-term performance.

Some of the high-pressure situations commonly faced by those in business include taking on a new role, spearheading or pushing through significant change, scaling up a business and pitching for much-needed funding. In any of these scenarios, we can let the pressure get to us and get hijacked by our emotions, impacting adversely on our performance both in the moment and in the long term.

Or we can flip the script and learn how to use our emotions to our advantage, enabling us to achieve our potential and sustain our performance. So, what are the lessons that elite sport can teach us about handling and managing pressure?

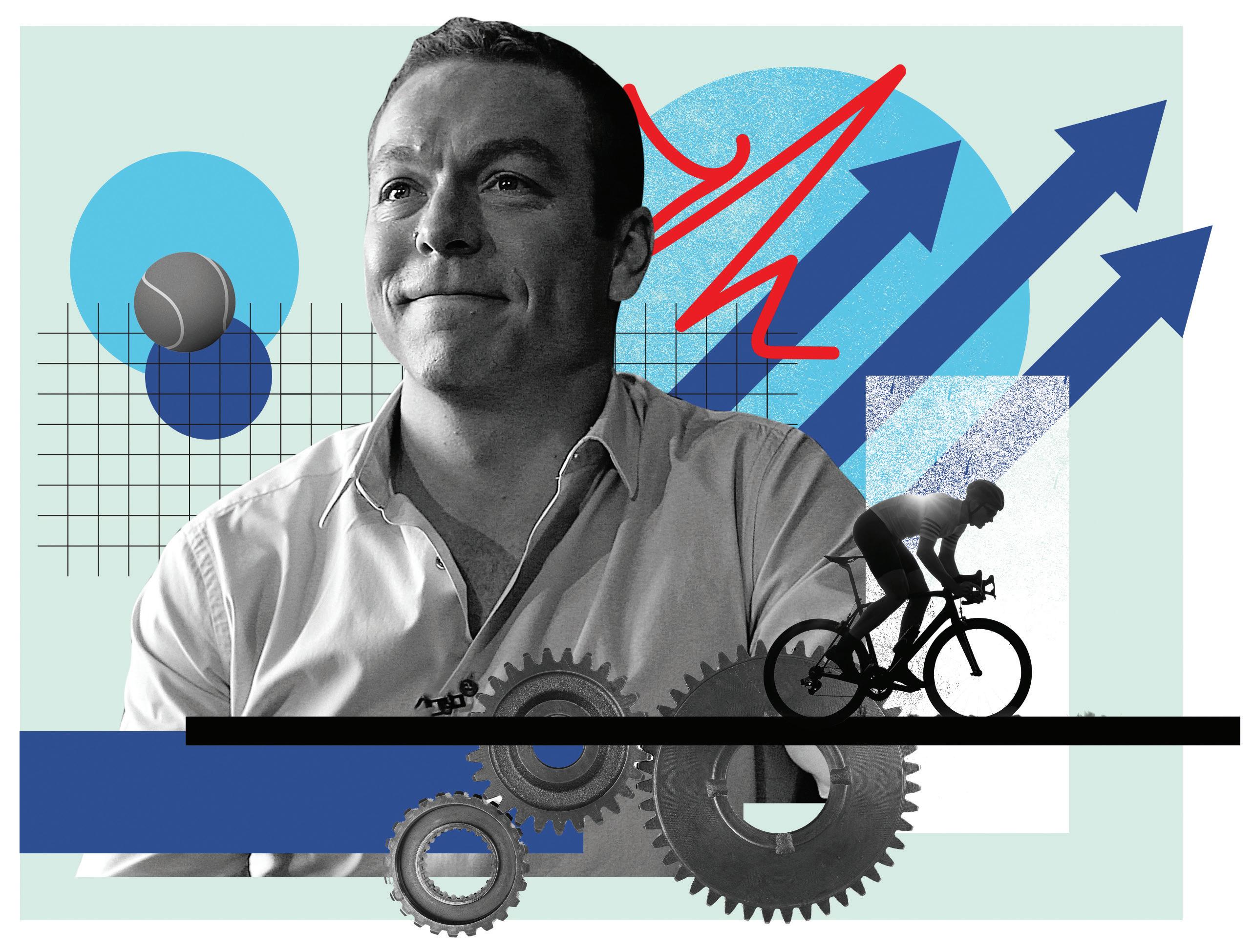

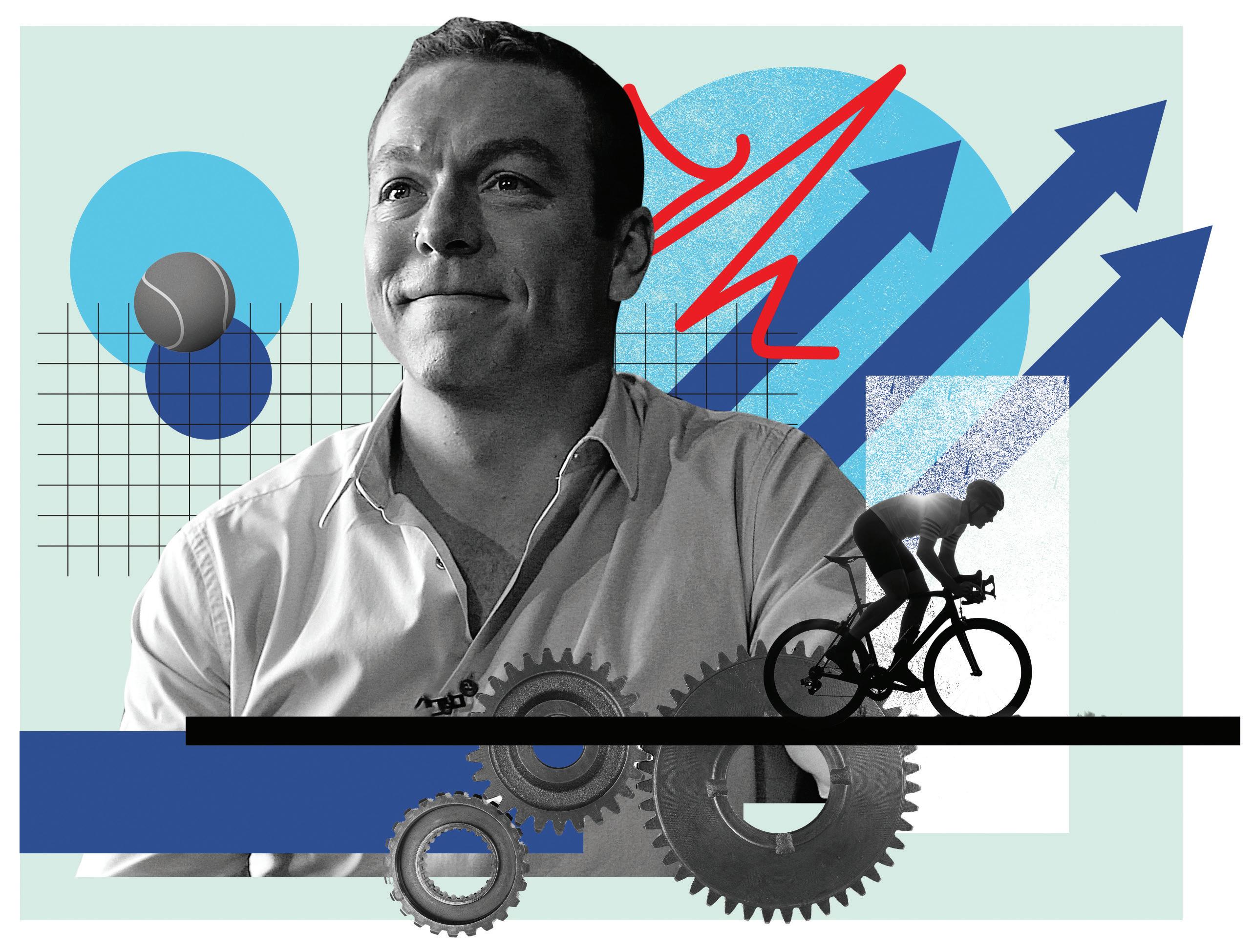

Step one: Own it

The clear lesson that the field of sports psychology has shown during the past 20 years is the importance of recognising that emotions play a part in performance. The key is to own that response. In my book Staying the Distance, I tell the story of the cyclist Sir Chris Hoy and the moment when he realised that he needed to own, and develop, this area of his performance. He was already successful – he had won a world title and an Olympic silver medal – but he knew he could do better. He realised that, due to the circumstances surrounding one race in particular, this element was holding him back.

Elite sport has accepted that an emotional response to pressure is normal. This means you can build an ability to deal with it – and even leverage it – to drive positive performance over a sustained period.

Step two: A shift in mindset

The answer to dealing with pressure lies in a simple change in mindset. Elite sport – and the sports psychologists who operate in this field – work hard at helping athletes adopt a “challenge”, as opposed to a “threat”, mindset. By doing this, it enables us to move our neural activity away from the amygdala (which triggers our flight, fight or freeze response) to the pre-frontal cortex, which is responsible for executive planning and control. That will mean you are alert, ready and excited, rather than tense, agitated or worried. This doesn’t mean attempting to cancel out all reactions but instead being focused on discarding the unhelpful emotions, while keeping, generating and leveraging the more helpful ones.

‘Who do you think you spend most of your time talking to? For most people, it’s themselves’

This is backed up by research from Harvard Business School, conducted by associate professor Alison Wood Brooks. The experiment focused on people executing various activities that generated pre-performance anxiety: doing maths problems in front of others, public speaking and karaoke singing. Some of the individuals were encouraged to reframe their anxious sentiments as excitement. The results demonstrated that harnessing the feelings caused by anxiety and using those same sensations positively, turning them into excitement, had a beneficial effect on performance.

Step three: Self-talk

Self-talk is an accepted focus area in the world of sport, so it always amazes me that it’s not more widely discussed in the fields of business and leadership. Who do you think you spend most of your time talking to? For most people, it’s themselves.

One of the first pieces of research on this area in the world of elite sport was carried out by performance psychologist Jim Loehr, when he brought together a group of elite tennis players

24 /// MAY/JUNE 2024

for a week-long experiment. He asked them all to voice their self-talk during both training and matches throughout the week and recorded it. He condensed the recordings for each player to a five-minute reel and asked them to listen to it.

The results? They were shocked by the negativity in their comments. “I’m rubbish,” said one. “My forehand is awful,” said another. “I shouldn’t be on this court,” said a third. Off the back of this exercise, Loehr and his players spent time working on changing their self-talk to language that was much more positive and constructive. Accordingly, the results flowed in a more positive way.

The Harvard research referred to above reinforces this point. Participants were assigned phrases and told to tell themselves, either

“I am calm” or “I am excited”. Just the use of the latter phrase had a positive impact on their state of mind and their performance.

The trick here is to experiment and see what might work for you. It could be a word, phrase, or even a question that works best. Danny Kerry, coach of the GB women’s hockey team that won gold at the Rio Olympics in 2016, asks himself “where am I?” and “where do I need to be?” to make sure he is in the right place. I know of other leaders who use sticky notes or similar as visual reminders to help them stay in a challenge mindset. So, let’s consider those questions I posed at the start again. When you’re feeling under pressure, how do you respond? And what do you say to yourself? Take the time to consider both and you may find

you start to understand yourself and how you can manage pressure more effectively.

Catherine Baker is the founder and director of Sport and Beyond and author of Staying the Distance

BUSINESS LEADER /// EXPERT MAY/JUNE 2024 /// 25 IMAGE CREDIT: Getty Images

Some see a mountain to climb.

Others, a chance to scale.

Businesses who bank with us see things di erently. However you see your business growing, we’ll support you – from start-up to IPO and beyond – connecting you to new markets, new insights and new possibilities. Search Grow with HSBC

Issued by HSBC UK Bank plc, 1 Centenary Square, Birmingham, B1 1HQ, United Kingdom. ©HSBC Group 2024. All Rights Reserved. AC64582

MAY/JUNE 2024 /// 27 /// Discover the real stories behind success and failure /// CASE STUDIES BUSINESS LEADER /// 28 Bootstrapping The founders who built their business without external funding 34 Sole control Virgin Group’s CEO on working under Sir Richard Branson 38 Supersizing Nando’s The spicy story of its global growth and success 42 Scale-up lending OakNorth Bank on backing fast-growing businesses 34 IMAGE CREDIT: Rory Lindsay

The bootstrapped businesses best

The founders who grew their business without bringing in external investors and how they did it

JAMES

COOK, ALICE CUMMING & ANDREW LYNCH

The founders of some of the world’s most successful companies started out by bootstrapping – building their business using just personal finances or operating revenue. This allowed the founders to retain 100 per cent ownership and control of the business for as long as possible – and some still have it.

Although bootstrapping a business can limit your resources, it can encourage speed and focus, says Deniz Ucbasaran, professor of entrepreneurship at Warwick Business School. “Entrepreneurs can also become creative,” she adds. “As they say, necessity is the mother of invention.”

Here are the businesses that did bootstrapping best...

28 /// MAY/JUNE 2024

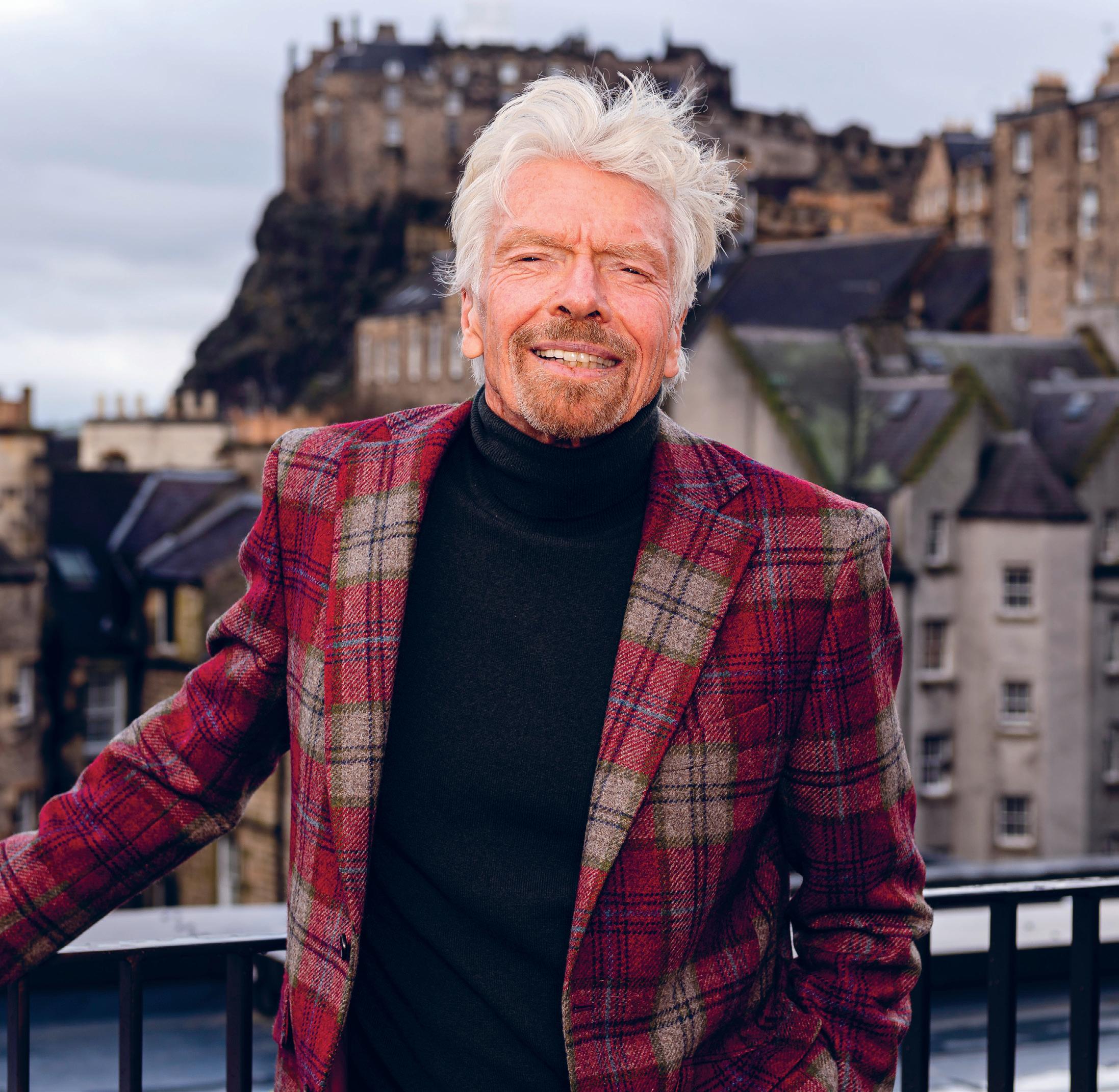

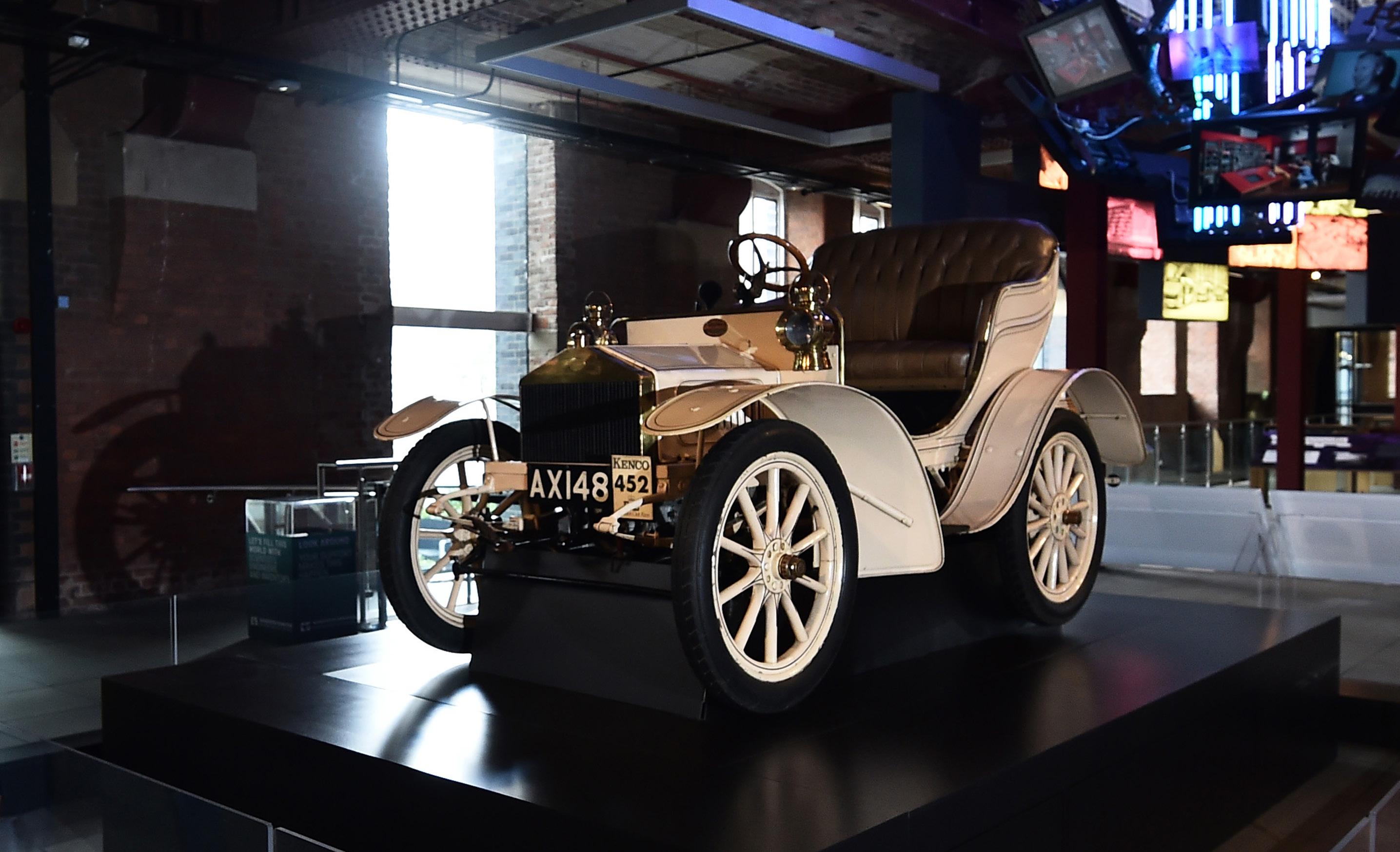

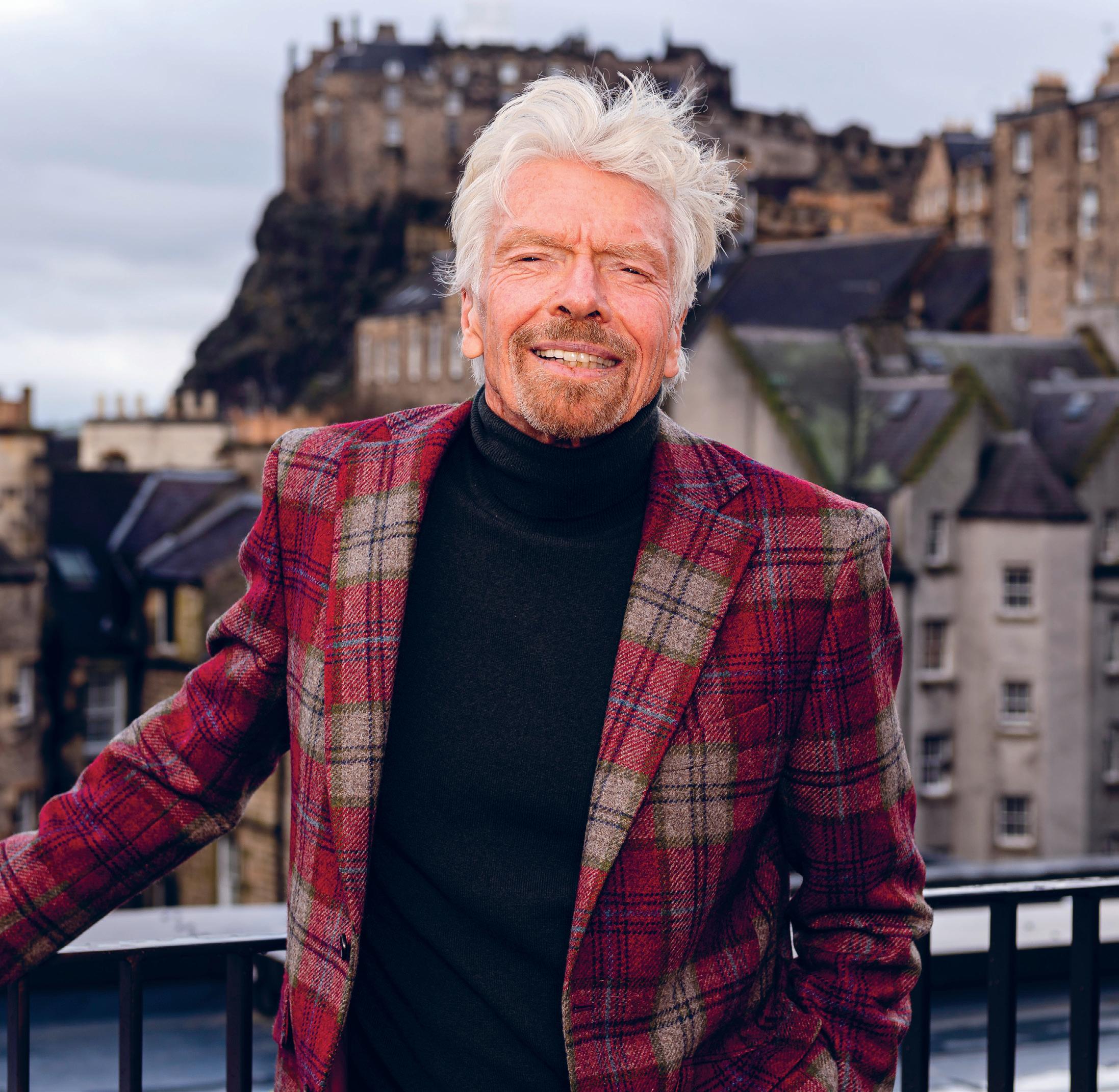

Virgin Group

Sir Richard Branson’s business empire began when he dropped out of school aged 16 to launch Student, a magazine for young people

He sold almost £5,000-worth of print advertising in its first run of 50,000 copies in 1968, later growing its circulation to 100,000.

In 1970, Branson turned the magazine into a mail-order record retailer, opening his first store in 1971. Using the store’s revenues, he co-founded Virgin Records with Nik Powell in 1972. Virgin’s first release, Mike Oldfield’s Tubular Bells, sold more than five million copies and, aided by controversial signings such as the Sex Pistols, Branson grew his estimated net worth to £5m by 1979.

With forays into air travel, space travel, gyms, banking, telecoms, media – and even a failed attempt to rival Coca-Cola – the Virgin

Group now consists of more than 40 companies across 34 countries which employ more than 70,000 people (see page 35). Although Virgin has attracted high-profile partners and investors to work on its different ventures, including Stagecoach in trains and One-2-One in mobile, the Branson family still own 100 per cent of the main business and brand.

Writing in the US magazine and website Entrepreneur, he said: “Our partnerships turn out best when we find an investor who takes a minority stake in a venture and provides capital and support, but leaves us to run the business and hire key employees. When you are evaluating a proposed partnership, do not focus only on the capital you need to kickstart your business.”

RANKINGS

MAY/JUNE 2024 /// 29

Gymshark

When Gymshark sold a 21 per cent equity stake in 2020 it achieved unicorn status – a business valued at $1bn or more – having previously raised no external funding.

The fitness apparel brand was founded by Ben Francis, right, in 2012 while at Aston University and bootstrapped from his bedroom while he worked as a delivery driver for Pizza Hut across Birmingham. Gymshark started out dropshipping supplements, meaning it was selling online without owning or operating the locations where its products were made or stored. On an episdoe of the How Success Happens podcast, Francis said: “Because we were dropshipping, we didn’t need sales because we didn’t really have any costs.”

However, costs began to increase once the firm pivoted to manufacturing fitness apparel. Using the money he earnt as a delivery driver, Francis bought a sewing machine and screen printer and spent the next two years making athleticwear by hand.

The company got its big break after spending £3,000 to set up a stand at a fitness expo,

which Francis quit his job and dropped out of university to attend. After the event, the website was inundated with orders and went from generating £300 a day in revenue to £30,000 in 30 minutes. Gymshark spent the next couple of years attending fitness expos around the world, building the brand.

Today, the company employs more than 900 people, has customers across 230 countries and boasts a social media following of more than 18 million.

Bet365

Denise Coates, left, began her career working in her father’s bookmaking firm, Provincial Racing. She was initially employed in the cashiers’ department but, after leaving university, worked there as an accountant. She eventually becoming managing director of the small chain of shops in 1995.

In January 2000, Coates purchased the domain name Bet365.com for £20,000 and launched it as an online betting site the next year. It started with just 12 employees, one of whom was Coates’s brother John, who she convinced to join as co-CEO. The two of them met with numerous private investors but failed to secure investment, instead borrowing £15m from RBS in a loan secured against the family’s betting shop estate.

Coates recalls working round the clock from a Portakabin in the car park of one of her father’s shops in Stoke-on-Trent to build the company.

Speaking to The Guardian, she said: “You

start a 24/7 business and you work 24/7. When you’re not here [in the office], you take calls in the middle of the night, regularly – that’s how the early days were.”

By 2005, the online gambling brand had become so successful that Provincial Racing was sold to betting shop chain Coral for £40m and the RBS loan was repaid. Today, Bet365, which is still 93 per cent owned by the Coates family, has more than 90 million customers and more than 7,000 employees worldwide. Its revenues reached £3.39bn in 2023.

In 2018, the firm announced plans to expand to the US following a ruling that allowed states to regulate sports bettting.

When Coates was awarded a CBE for services to the community and business in 2012, she reflected on the firm’s beginnings.

“We mortgaged the betting shops and put it all into online. We knew the industry required big startup costs but we gambled everything on it.”

30 /// MAY/JUNE 2024

Hargreaves Lansdown

Peter Hargreaves, below, has a claim to greatness he thinks has gone unrecognised: that he and his business partner, Stephen Lansdown, are the only entrepreneurs to have built a FTSE 100 company without borrowing a penny.

The pair founded Hargreaves Lansdown in Bristol in 1981 and by the time they floated 25 per cent of the equity in May 2007, it was valued at £800m. After peaking on the FTSE 100 with a value of almost £9bn, the funds supermarket has been relegated to the FTSE 250 and is now worth £3.3bn.

The business began in Hargreaves’s front bedroom. “We were exceedingly mean when we started,” admits the 77-year-old Lancastrian billionaire. “We had one borrowed desk, one second-hand desk and we bought a desk because we had a secretary and we didn’t think we should sit her at a sloppy desk. We never spent a penny where a halfpenny would do.”

Being in financial services allowed growth without the large-scale investment a sector such as manufacturing might demand. All the same, says Hargreaves, they didn’t have “silly overheads”. “We didn’t buy expensive office equipment. We didn’t have flashy offices.”

So why the public offering? “Stephen did want to take some money off the table, which is always wise. I didn’t. And then we had a third very important member of the team, Theresa Barry [marketing director]. She was the deciding factor.

“She said that if we were a public company, our accounts were made public and we had outside shareholders, we would be more challenged. And quite rightly so.”

Home

Bargains

British variety store chain Home Bargains was founded in Liverpool as a single store called Home and Bargain in 1976. Its founder, Tom Morris, is a third-generation shopkeeper whose parents’ approach was to sell products at the best possible price. If Morris’s parents could not source products at the right price, they, along with Morrris and his six siblings, made them themselves.

Home Bargains has operated under these guiding principles ever since, keeping many of its processes in-house. This includes product sourcing and IT development.

Growing conservatively and organically over the years meant that despite a £3.6bn valuation in 2019, the chain was debt-free and owned many of its stores.

Today, it is one of the UK’s largest privately owned companies. Home Bargains has more than 500 stores and more than 22,000 staff, while revenues for the year ending June 2023 hit just under £3.8bn. Despite its growth, it remains family-run and family-owned.

Specsavers

Doug and Mary Perkins, above, founded Specsavers in 1983 using some of the proceeds from selling a previous small chain of opticians, which meant they didn’t need external finance. Nevertheless, they kept the business lean. For the first three months, they had just two members of staff and used a ping-pong table for a desk.

In 1984, Specsavers launched in Guernsey amid a change in regulations that allowed professional opticians to advertise their products and services. Specsavers took advantage by providing a joint venture partnership. Opticians would be based in their own shops, own half the business and keep store profits, while Specsavers took a management fee for marketing, shop fittings, auditing, training and other support.

By reinvesting profits, the chain expanded to Ireland in 1990 and opened its 350th UK store in 1999. Today Specsavers has more than 4,000 partners and a total turnover of £3.55bn. Specsavers remains family-owned and has never considered selling equity.

RANKINGS MAY/JUNE 2024 /// 31

River Island

Fashion brand River Island was established in east London in 1948. Founder Bernard Lewis sold fruit, then knitting wool and eventually women’s clothing. One of the UK’s first vertical fashion retailers, River Island began in-house design and production in the 1940s.

Its first design, a white, lace-trimmed blouse with capped sleeves, was sold in 1950. Lewis’s three brothers joined the firm, then known as Lewis Separates and, by 1955, it had nine stores. Lewis said the family had nonetheless benefitted from “some wonderful, first-class executives”.

In 1965, the then 70-store empire rebranded as Chelsea Girl, before eventually becoming River Island in 1988. Today, the firm also offers menswear, childrenswear and pet collections, but its products are still designed in-house. Its turnover rose 11.6 per cent year on year to £825.8m in 2022. However, operating profits at the family-owned firm dropped 90 per cent.

Dyson

In February 1979 Sir James Dyson, right, was booted out of the company that produced his Ballbarrow – a barrow with a sphere – and he lost his patent and his business.

“I learned the importance of having absolute control of my company and not undervaluing it,” he recalls in his 2021 memoir, Invention: A Life. “I was determined not to let go of my own inventions, patents and companies.”

For the next 15 years Sir James lived in debt while he worked on a prototype for a bagless vacuum cleaner. Not just one prototype, it took him 5,127 to design a satisfactory model that he could license. At a time when you could buy a vacuum cleaner for £40, Sir James sold his for £199. And they have sold in their tens of millions. “A lot of entrepreneurs never charge enough,” Sir James, 77, told BBC Radio 4. “And if you don’t make money, you go bust.”