Joe has been practicing law for 19 years. Along with serving as CEO of Quinlivan & Hughes, he focuses his practice on Estate Planning, Business, Real Estate and Municipal Law. Actively involved in the community,Joe serves on the Board ofDirectors for The Long Prairie Country Club, The CentraCare Health Foundation - Long Prairie and To dd County Pheasants Forever Chapter.

St. Cloud I Monticello I Long Prairie I Little Falls

Business owners Erin Lucas and Mateo Mackbee agree, vision and hard work matter, but you can’t succeed without the help of others.

38

YOU HAVE IT IN YOU

As companies continue to face major hiring challenges, looking internally at exisiting employees might be the solution.

42 IDEA RICH.

CASH POOR. NOW WHAT? Start with some resources, add in some advice, and cover with entrepreneurial spirit.

Main Phone: 320-251-2940

Automated Reservation Line: 320-656-3826

Hotline: 320-656-3825

President: Julie Lunning, ext. 104

Director of Marketing & Communications: Emily Bertram, ext. 109

Director of Programs & Events: Laura Wagner, ext. 131

Director of Downtown Planning & Development: Tyler Bevier, ext. 130

Membership Specialist: Antoinette Valenzuela, ext. 134

Administrative Assistant: Vicki Lenneman, ext. 122

Administrative Assistant: Shelly Imdieke, ext. 100

• A place to belong

• Hire the best without paying the most

• QR code comeback

• (New) Word on the Street

Main Phone: 320-251-4170

Executive Director: Rachel Thompson, ext. 128

Director of Sales: Nikki Fisher, ext. 112

Sales Manager: Craig Besco, ext. 111

Marketing Manager: Lynn Hubbard, ext. 129

and Special Events Manager: Mike Johnson, ext. 110

Emily Betram learns the proper way to dice an onion from Mateo Mackbee, Krewe Restaurant.

I had been dating my husband Kyle for just under a year when I first got the call. “Hey, my family is butchering a steer this weekend, want to come?” Spend a Saturday of my sophomore year of college processing beef with my boyfriend and his family?

I mean if that’s not love, I’m not sure what is.

Naturally, wanting to impress my fairly new man and also admittedly somewhat curious, I obliged. My husband was born and raised on a beef cattle farm in Spring Hill, Minnesota. His family processes all its own beef, chicken, pork and wild game, plus harvests and cans a plethora of produce from an expansive garden.

We get together to butcher several times a year. Most times this takes two to three days with his whole family pitching in – including some “help” from our kids.

My father-in-law Robert learned all the steps for processing various types of livestock from his father, who learned it from his father and so on. He has been passing on the knowledge to my husband and his two siblings over the years, and one day we plan to carry on the tradition with our own children.

While it’s a large time commitment and quite a bit of work, we look forward to these weekends. We get together as a family, spend the time sharing stories and laughing, and at the end go home with several hundred pounds of meat in our freezers for the rest of the year. We all have roles we take up naturally, and all pitch in to watch the little ones, help with lunch and dinner, and play rock-paper-scissors for who’s on cleanup duty. By the end of the day, we are usually exhausted but the sense of accomplishment is worth it.

Beyond the camaraderie during these weekends, there is satisfaction in knowing exactly where the food we put on our tables is coming from. The livestock is either from my in-laws’ farm or from a neighboring farm. We handle every single step of the process and we never make more than we need. I’m thankful that my kids can learn about the “circle of life” from these experiences, and that they’ll grow up appreciating that hard work has rewards. All in all, it’s a worthwhile experience, albeit an un-glamorous one. These kinds of life lessons can’t necessarily be taught in a classroom — sometimes you have to get your hands dirty. When Erin Lucas and Mateo Mackbee set out to start a restaurant with a purpose, they knew they wanted to teach others about food.

Model Citizen, the nonprofit farm started by the pair, is dedicated to education, sustainability, and creativity with what we eat. Check out page 32 and you’ll see their story is about so much more than a restaurant.

Even after 13 years as part of a farm family, there’s still a lot for me to learn, too. But hey, I’m always willing to try something new in the name of love.

Emily Bertram, Editor

I’m thankful that my kids can learn about the “circle of life” from these experiences, and that they’ll grow up appreciating that hard work has rewards.

Publisher Julie Lunning // Editor Emily Bertram Founding Editor Gail Ivers

Emily Bertram, St. Cloud Area Chamber of Commerce

Ashley Bukowski, Rinke Noonan

Doug Cook, Headwaters Strategic Succession Consulting

Dr. Fred E. Hill, St. Cloud State University

Gail Ivers, Founding Editor, Business Central Magazine

Mike Killeen, freelance writer Jeanine Nistler, freelance writer

Erin Perry, DAYTA Marketing

Dan Soldner, Vye

Nazimuddin Shaikh and Lynn MacDonald, St. Cloud State University

Jessie Storlien, Stearns History Museum

Associate Publisher/Sales

Melinda Vonderahe, Marketing Consultant

Ad Traffic & Circulation

Yola Hartmann, Hazel Tree Media

ART

Design & Production

Yola Hartmann, Hazel Tree Media

Cover Story Photography

Joel Butkowski, BDI Photography

WEBSITE

Vicki Lenneman, St. Cloud Area Chamber of Commerce

1411 West St. Germain Street, Suite 101,P.O. Box 487, St. Cloud, MN 56302-0487 Phone (320) 251-2940 Fax (320) 251-0081

BusinessCentral Magazine.com

For advertising information contact Melinda Vonderahe, (320) 656-3808

Editorial suggestions can be made in writing to: Editor, Business Central, P.O. Box 487, St. Cloud, MN 56302-0487. Submission of materials does not guarantee publication. Unsolicited materials will not be returned unless accompanied by a stamped, self-addressed envelope.

©

ST CLOUD AREA CHAMBER OF COMMERCE 2022-23 BOARD MEMBERS

Marilyn Birkland, SCTimes/LocaliQ

Ron Brandenburg, Quinlivan & Hughes

Doug Cook, Headwaters Strategic Succession Consulting LLC.

Tanja Goering, Board Vice Chair

Joe Hellie, CentraCare

Ray Herrington, Pioneer Place on Fifth Patrick Hollermann, InteleCONNECT

Hudda Ibrahim, Filsan Talent Partners

Kevin Johnson, K. Johnson Construction, Board Chair

Matt Laubach, West Bank

Bernie Perryman, Batteries Plus Bulbs, Past Board Chair

Laurie Putnam, St. Cloud School District 742 Paul Radeke, BerganKDV

Brenda Sickler, Theisen Dental

Donella Westphal, Jules’ Bistro

Dr. Jason Woods, St. Cloud State University Colleen Zoffka, Park Industries

Central is published six times a year by the

1411 West St. Germain Street, Suite 101, P.O. Box 487, St. Cloud,

(320) 251-2940 / Fax (320) 251-0081. Subscription rate: $18 for 1 year.

Understanding your needs and committing to self-care first can help you show up for others.

Reviewed by Dr. Fred Hill“If you’re having trouble connecting with those around you, you know that you’re not the only one. Adult friendships are tricky!!! Part manifesto, part guide, The Art of Showing Up is soul medicine for our modern tech-mediated age. Rachel Wilkerson Miller charts a course to kinder, more thoughtful, and more fulfilling relationships – and crucially she reminds us that ‘you can’t show up for others if you aren’t showing up for yourself first.’ In Miller’s work you will learn fearlessly to, 1. Define your needs, reclaim your time, and commit to self-care.

2. Ask for backup when times are tough – and take action when others are in crisis.

3. Meet and care for new friends, and gently end toxic relationships.

4. Help your people feel more seen (and more OK) overall.”

—From The Art of Showing Up: How to Be There for Yourself and Your People

“S howing up is what turns the people you know into your people,” author Miller said. “It’s at the core of creating and maintaining strong, meaningful bonds with friends, family, coworkers, and internet pals. Showing up is the act of bearing witness to people’s joy, pain, and

• Chapter 5: Showing up for yourself when s**t gets hard

Part II: Showing Up For Others

• Chapter 6: How to make friends

• Chapter 7: The care and keeping of friends

• Chapter 8: The art of noticing

• Chapter 9: When they’re going through hard s**t

Showing up is at the core of creating and maintaining strong, meaningful bonds with friends, family, coworkers, and internet pals.

true selves; validating their experiences; easing their load; and communicating that they are not alone in this life.”

Miller’s book consists of two parts and ten chapters.

Part I: Showing Up For Yourself

• Chapter 1: Getting to know yourself

• Chapter 2: Making space

• Chapter 3: Showing up for your body

• Chapter 4: Showing up for yourself every damn day

• Chapter 10: So, somebody f**ked up. Showing up can take on many forms. It’s paying attention to your people when they tell you to talk to a professional. It’s being a leader and/or friend in the age of flakiness. It’s listening and caring and doing.

Dr. Fred E. Hill is an emeritus professor at St. Cloud State University.

Blattner Company named No. 2 Solar Contractor Solar Power World ranked Blattner Company No. 2 out of 411 companies on the 2022 Top Solar Contractors List by number of kilowatts that were installed in the previous year.

The American Heart Association recognized 15 hospitals in Minnesota this year, including CentraCare in St. Cloud, for its work improving systems of care for heart disease and stroke patients. CentraCareSt. Cloud Hospital earned eight awards. Awards recognized hospitals across the country for consistently following up-to-date, research-based guidelines to ensure all patients have access to lifesaving care.

The Anderson Trucking Service (ATS) van fleet received a 2022 Quest for Quality Award from Logistics Management. The Quest for Quality Awards are the gold standard for customer satisfaction and performance excellence for carriers, ports and logistics providers worldwide.

Stearns Electric distributes $35,550; Siemers recognized by MREA

Through the Operation Round Up® program, Stearns Electric Association gives its memberconsumers the opportunity to give back to the community by rounding up their electric bill to the nearest dollar. The program contributed $35,550 to 56 area organizations in July 2022. Since the program’s inception in 1993, Operation Round Up (ORU) and Stearns Electric members have awarded over $2.8 million to 5,200 local nonprofit organizations and community service programs.

Stearns Electric Association lineman Mike Siemers recently earned a LIFEguard award through the Minnesota Rural Electric Association (MREA). MREA recognizes cooperative employees throughout the state who go above and beyond the expectations of keeping individuals safe through their LIFEguard program. Siemers is credited with speaking up and potentially saving the lives of two fencing contractors.

The Central Minnesota Community Foundation welcomed six new members to the board of directors, two of whom are from the organization’s Emerging Leaders Program. Joining the board are Hudda Ibrahim, Filsan Talent Partners; Julie Lunning, St. Cloud Area Chamber of Commerce; Cathy Julifs, AIS Planning; Todd Zaun, Farmers & Merchants State Bank of Pierz; and emerging leaders Antoinette Lee, No Limit Painting; and Tajudeen Popoola, Stearns County Department of Human Services.

“ Grab something to eat from the snack cupboard.”

Brian Bastian, American National Bank

“ Pet the dog, then get the mail.”

“ Say hello to my daughter, granddaughter and the cat.”

“ Help get dinner ready and turn on the news to see if I missed anything.”

Andy Miceli, Sturdi-Weld & Machine

“ Take off my work boots.”

TO KNOW

The following individuals have been elected to fill three-year

on the Board of Directors of the St. Cloud Area Chamber

Commerce.

What is the first thing you do when you get home from work?

Patrick Hollermann, InteleCONNECTTom Fenton, Sauk Rapids Herald –Star Publications

Tamara Mathies, Lifeflow Massage & Wellness

Magnifi Financial was awarded the SBA Lending Credit Union of Minnesota for the third year in a row! We are proud to be recognized as a top SBA-lending financial institution and are committed to providing exceptional SBA service to businesses within our communities and beyond.

The Initiative Foundation delivered 233 grants during the second quarter of 2022 totaling nearly $2.8 million. More than half of the grants went to businesses affected by the pandemic through a partnership with the Minnesota Department of Employment and Economic Development. Another $1 millionplus was awarded to regional nonprofits with support from the Otto Bremer Trust.

Local accounting firm Schlenner Wenner has promoted several individuals. Jim Fischer, Nicole Quade, Riann Harpster, Ali Sing, Ben Bierscheid, and Sydney Wittnebel have been promoted to supervisors. Olivia Johnson, Allison Popp, Jordan Schuett, and Emily Winkels have been promoted to senior associates.

INSIDE Public Accounting (IPA), publisher of an award-winning newsletter for the public accounting profession, recently announced its annual financial performance analysis and ranking of the nation’s largest 400 public accounting firms. BerganKDV Ltd. was ranked #63 nationally with more than $83 million in net revenue for the fiscal year 2021.

Falcon National Bank earns industry ranking

Falcon Equipment Finance, a division of Falcon National Bank, earned a spot on the Monitor Top 100 list. The Monitor 100 issue is known as a score card on the health of the equipment finance industry. The issue highlights net earning assets, new business volume, syndication and merger activity.

Morph Salon & Barbershop, hair salon and barbershop, 110 2nd Street S #110, Waite Park. Pictured: April Diederich, Natasha Sankey, Brady DeGagne.

Purpose Driven Realty, local real estate agency, 22 N Benton Drive, Sauk Rapids. Pictured: Brady DeGagne, Sam Lieser, Mike Haehn, April Diederich.

Erbauer Built, general contractor, 823 N Benton Drive, Sauk Rapids. Pictured: Tim Schmidt, Sharon Wilson, Berni Halaas, Randy Weiher, Paul Ravenberg.

North Creative Co., planning, design and implementing marketing. Pictured: Paul Ravenberg, Brittney Goebel, Tim Schmidt.

Newport Academy, healthcare for teens and young adults with co-occurring disorders, 1726 7th Ave. S, St. Cloud. Pictured: Donna Roerick, Jenna Binsfeld, Chelsey Hamen, Nancy WebsterSmith, Kelly Krueger, Emily Grams, Sheri Moran.

Busy Moms Cleaning Service, 14 7th Ave. N, ste. 135, St. Cloud. Pictured: Donna Roerick, Angela Curriel, Sheri Moran.

Minnesota Family, print magazine. Pictured: Clint Lentner, Kyla Burgess, JR Burgess, Jason Roering, Emily Carlson Goenner, Sheri Moran.

Tommy’s Express Car Wash, 17 2nd Ave. N, Waite Park. Pictured: Elijha Engle, Amanda Loberg, Shawny Camara, Jason Miller, Kyle Frieir, Gerry Carter, William Boeser, Josh Vraa, Bernie Perryman.

Oberg Roofing & Remodeling Inc., roofing, remodeling, decks, gutters, window and siding, 15 6th Ave. N, St. Cloud. Pictured: Jason Miller, Caleb Oberg, Tim McLean.

At Bremer Bank, every partnership starts with listening and learning, getting to know you, your business and what you want to accomplish. When we understand that, we can offer ideas and solutions to help you succeed on your terms. In a world where opportunities come and go in the blink of an eye, relationships matter more than ever.

Understanding is everything.

Mahowald Insurance Agency has been recognized by Insurance Business America Magazine as a 2022 Top Insurance Employer. This is the third consecutive year in which the St. Cloud agency has been named a Top Insurance Workplace by the publication. The honor comes after a nationwide evaluation of insurance employers in two phases, including an employee-response portion.

Melissa Staudinger has joined Wells, in Albany, Minn., as corporate counsel to its growing legal team. Staudinger will be instrumental in Wells’ contract negotiations, creating favorable terms for both Wells and its building partners, and will work closely with Wells’ Senior Vice President and Chief Financial Officer Ryan Stroschein to support dispute resolution and provide expert counsel for corporate legal matters. Staudinger comes with a strong background in negotiation and commercial transactions, as well as construction industry experience.

Convention and Visitors Bureau hires Hubbard

The St. Cloud Area Convention and Visitors Bureau (Visit Greater St. Cloud) hired Lynn Hubbard as marketing manager. In this role, Hubbard manages the marketing and social media efforts for Visit Greater St. Cloud, from blogging and video advertising to email campaigns, social media management and more. Hubbard has an extensive background in the radio industry locally.

Adapting to change kept Petters Furs and Fabrics in business for 90 years.

By Jessie StorlienThe Petters family tradition of tailoring goes back to Germany, where Charles Petters learned the trade from his father. Charles came to the United States in 1885, and a year later he opened his own business in St. Cloud on the corner of Sixth Avenue and St. Germain Street. Charles operated the business for nineteen years until he died of pneumonia at age 48, leaving his wife, Louise, and sons, William and Edward, to run the shop.

William was destined to be a tailor. “When [William] was little … grandpa always said, ‘I think he’s going to amount to something. He’s so nosy. He has to know everything about the sewing machine,’” William’s wife Henrica said during a 1978 interview with the Stearns County Historical Society.

The early 1900s were prosperous for the Petters’ business. The shop grew and eventually moved to 26 Fifth Avenue South.

William added furs to the business in 1931 through the acquisition of Wagar Fur Company. This was a natural fit since William was already making, repairing, and cleaning furs in the

Petters Tailoring Shop, St. Cloud, ca 1900

shop. That same year, Petters was declared to be “entering another phase of its advancement by the installation of a dry-cleaning plant, equipped with the latest and most scientific process machinery,” by the St. Cloud Times, 4 September 1931, pg. 5.

Business was booming, and at one point, Petters Furs and Fabrics employed up to 15 people. Each tailor had a specialty. There was a coat maker, a vest maker, and a trouser maker, along with those that were dedicated to alterations and repairs.

“I could make 25 suits a month, or about one a day,” William reported.

William served as a tailor to the area for 60 years. In 1963, he told the St. Cloud Times, “We made suits for

all the local prominent persons. There has been practically no banker or clergyman that I didn’t make a suit for, or prominent merchants.” The list of clientele included local automaker Sam

William Petters, tailor at Petters Furs and Fabrics, St. Cloud, ca 1963

Pandolfo and the St. Cloud police department. William’s dedication to excellence created a loyal local following. “We still have customers for whom we have made every garment and suit for 50 years,” he said.

This spirit of adaptability and identifying customer needs was kept alive when William’s son Fred took over the store in the 1950s. According to family lore, on the day Fred was born, his grandmother Louise looked at him and said, “This one’s for the shop.”

Much like his father, Fred altered the business to meet

patrons’ needs. A line of quality woolen material was added when Fred saw how many customers came in to buy bolts of fabric to make their own creations. In the 1950s the tailoring part of the business was mostly eliminated aside from William, who continued to serve as a tailor and suit maker until his death in 1966.

This would not be the last change for the family business. Fred eventually discontinued the fur department, as fur coats had fallen out of favor with a younger generation and there weren’t enough customers to support the furrier. Unfortunately, this closure was indicative of the general direction of consumers.

Times had changed. Americans were buying more ready-to-wear clothing. Teenagers started wearing blue jeans and stopped sewing, and more households with two working parents meant less time to sew at home. “Petters Fabrics seems to be a victim of unfortunate changes in American taste,” Fred told the St. Cloud Times in 1977.

After 90 years in business, third generation owner Fred Petters had no choice but to put down the scissors and in July 1977, close the doors for the last time.

Jessie Storlien is an archivist at the Stearns History Museum.

Local public safety officials agree that staffing is a major issue in law enforcement.

The Minnesota Public Transit Association (MPTA) held the Statewide Bus Roadeo in Austin, Minn. in July. Metro Bus had two small bus and three large bus operators present to compete on safety and service with over 30 other bus operators. All five Metro Bus employees placed in the top 10 in their respective competitions, with Fixed Route Operator Pete Mugg placing third overall in the large bus division.

St. Cloud State University received $550,000 in Minnesota Department of Employment and Economic Development training grants to partner with local companies in strengthening workforce knowledge and skills. SCSU received a $300,000 Minnesota Job Skills Partnership grant in partnership with Grede Casting and a $250,000 Minnesota Job Skills Partnership grant in partnership with SCR (formerly St. Cloud Refrigeration). The grants are intended for customized training to help companies maintain a competitive edge and meet future demands.

Your business is welcome to submit News Reel items. Send news releases, announcements, or anything you think is newsworthy to Emily, ebertram@stcloudareachamber.com, and we will try to include it in Business Central.

Staffing is one of the biggest challenges facing area law enforcement agencies. “When I applied to be a police officer, I was competing with 200-250 other applicants for the position,” Sauk Rapids Police Chief Perry Biese said. “Today, when I post a position, I get two to four applicants.” Those that do apply often cannot pass the psychological exams because they have a hard time being decisive or might be too heavy handed, neither of which are acceptable in an officer, according to Biese.

Biese was participating in a law enforcement panel discussion in August hosted by the St. Cloud Area Chamber’s Government Affairs Division. The panel

also featured chiefs of police Blair Anderson, St. Cloud; Dave Bentrud, Waite Park; Jim Hughes, Sartell; and Dwight Pfannenstein, St. Joseph. Stearns County Sheriff Steve Soyka also participated.

Panel members agreed that retention is also a struggle. Officers are choosing to leave the field sooner than in the past for a number of reasons and replacing them is not a fast process. Municipalities are working on benefits such as tax breaks and additional education for police officers to encourage people to go into and stay in the field.

Panelists repeatedly noted that support for law enforcement needs to come from the top down to be

successful. Support from the mayor, city council, elected officials and the community are vital in the success of police department operations. “None of these successes or the things we’ve been able to accomplish could be possible without support, and it always starts at the top,” Chief Anderson said.

When asked what the community can do to support law enforcement, specifically when it comes to hiring, Biese responded, “Say it out loud. Say it out loud that this is an honorable profession.”

All panel members agreed, there is more support for officers within the departments than there used to be. St. Cloud offers an anonymous peer counseling initiative with 20 peer support counselors to help officers talk through issues they’re facing. It is open to other municipalities as well.

With negative perceptions and recent national events at the forefront, cities are working on unique ways to engage with younger generations to pique career interest and create strong relationships. St. Cloud is implementing a law enforcement curriculum within St. Cloud school district this year. Stearns

County offers the Explorer Program for youth ages 15-21 to learn about the profession, and allows ride-alongs with deputies.

The St. Cloud COP (Community Outpost) House has received international recognition for its community engagement efforts, and Waite Park is working on a similar model.

The diverse makeup of populations in the region is

providing new engagement challenges to area departments.

“We’re 58 percent white, which means 42 percent of the population is another ethnicity,”

Chief Bentrud said of his city. “It creates tremendous opportunity, but also has some communication barriers that we have to overcome, and we have a lot of work to do in building relationships.”

Each chief acknowledged that they are successful because they collaborate with resources, training, community engagement and more. “We have a great working relationship amongst all of us here,” said Chief Hughes of Sartell. “When the unrest [related to George Floyd] happened, the call for help went out and nobody had any

issues sending resources in to help our partners.” The departments may not be huge individually, but when help is needed, they are all able to band together to help.

“We don’t have the opportunity to have any type of special response team,” St. Joseph’s Pfannenstein said. “We depend on the Sheriff’s Department and St. Cloud, and we’ve used them several times over the years.” There’s nothing that happens here that doesn’t happen anywhere else where there are people, the chiefs agreed, and “our people deserve a police force that is prepared.” —EB

“We do not strip human beings of their dignity. Not ever. Not even the ones who leave you no other choice. That’s why we’re professionals.”

– Chief Blair Anderson, City of St. Cloud

Choosing the right marketing mix is important to your customer experience and your bottom line.

By Erin PerryAt DAYTA Marketing, we encounter a lot of marketing misconceptions. We often run into well-meaning business owners who believe they can run a single type of ad and see new sales. Unfortunately, that is a rare outcome in today’s marketing world, primarily because the consumer journey has gotten longer, more complex, and way, way more crowded. Instead of running one ad campaign as a standalone effort, the key to marketing success today is to build multiple campaigns that work together to convert prospects into loyal, enthusiastic customers.

Let’s look at a potential campaign structure for a local auto dealer to illustrate how you can think through campaign structure and evaluation.

We begin by running a highlevel video awareness campaign focused on a specific vehicle model. Our metrics at this stage provide data on the number of viewers and the length of engagement.

It’s important to note that we don’t expect this initial video ad to directly drive sales. But we can reasonably expect that someone considering a vehicle purchase would stick around to watch some or all of the video. We’re looking for views at this stage, not conversions, and we’re accumulating data on those viewers.

Our next ad will target only the people who indicated their

interest by stopping their scrolling to watch some of the video. This ad dives deeper into the heart of the brand by addressing the challenges of the car-buying process and showing that the brand provides an experience customers actually enjoy. At this

We’ve now examined this strategy from a metrics-driven perspective, but it’s equally important to dig into these marketing tactics and measurements of success from a customer experience perspective.

You don’t want payment to be a hassle. In a world of Venmo and Apple Pay, it’s important to be able to easily accept payment.

stage, we are expecting both views and some post engagement, such as comments or likes.

As we move into the third ad, we start retargeting from website visits. This third ad is designed to give the prospective customer further details to help them compare this brand’s offerings to competitors by spelling out some of its strengths. This is the point at which we begin expecting clickthroughs to visit the website.

Our final ad is the point at which we may expect some actual lead generation. We’re focused on specific vehicles that are in stock and currently for sale. We’re measuring clicks as well as what further actions consumers took from those clicks. This is the big pay-off that all the previous ads have been building toward. While this example is for an auto client, this type of campaign structure has proved effective across many different industries, especially when the product advertised is a higher-risk or higher-investment purchase.

At DAYTA, we begin with the customer’s Research stage. We want to make sure it’s easy to find your brand and get up-todate information. Your Google Business profile is often your first impression even before your website, so it’s vital to keep that profile updated and managed. We measure this through viewer volume data and potentially the volume of phone calls or requests for directions that are being driven by that profile.

When prospects are Comparing your brand to your competition, you want your brand to be the clear winner. How do we make it obvious that your customer experience is superior? By responding to reviews so prospects see that you’re paying attention to customer feedback and care enough to fix mistakes.

As our consumer gets closer to making their Choice, we want to make it easy for them to get their questions answered and to pay. Consider a chat function

on your website or social media in addition to your phone number. At this stage, we measure success by looking at the number of new contacts who have reached out, how long it takes them to purchase after contact, and other sales-funnel metrics for determining return on investment (ROI).

Once the consumer has chosen your brand, you don’t want payment to be a hassle. In a world of Venmo and Apple Pay, it’s important to be able to easily accept payment. In terms of ROI, you want something that will integrate with your bookkeeping system to make reconciliation and other finance operations easier.

Now we have a new customer and they’re Evaluating how they feel about us. But we’re evaluating them, too – namely their satisfaction with their experience. We want tools that make it easy to survey our customers and see the entirety of the customer’s experience in context. You should be asking for client reviews consistently. To do that, you need a process and, potentially, some supplementary software. The ROI of an evaluation tool is in

interpreting the data it provides to help you improve your processes and your business. All it takes is one big operational win, and it pays for itself.

Finally, we want to empower customers to be our brand Advocate. This can take many different forms: It could be an appreciative follow-up text, a mailed thank-you letter with “Tell a Friend” inserts, or a formal, paid program that rewards customers when they refer new ones. For most businesses, the best customers come from existing customers spreading the good word.

The modern marketing world is complicated, but it hasn’t changed in its goals — it’s just adapted to include tons of new tactics. This presents businesses with a lot of new ways to (potentially) waste money. By measuring and interpreting data in the right context throughout the entirety of your customers’ journey, you can weed out the tactics that don’t make sense for you and focus on what moves the needle. Those tactics will ultimately be unique to each business, but should typically put your customer experience first.

Here are 7 steps to implementing a true sales force transformation.

By Douglas CookMany dynamics can spark the need for changes in your sales team. Generally, it’s the realization of a need for your company to rise to the next level. In addition to providing the right incentives, expectations, and goal setting, leadership needs to consider additional support so staff have every chance to succeed and survive a change.

Here are 7 steps to implementing a true sales force transformation.

Unfortunately, you should prepare to lose a few employees due to mismatch of skillset, so form your contingency plan for turnover. Identify the skills needed for your ideal value-add candidate and write or modify the job description to fit. Determine how a new candidate will be sourced, how they will be trained in your new approach, and how you can make any turnover seamless for customers.

Staff understanding of change is important. Explain, and don’t sugarcoat your vision. Make sure they know you will provide the tools they need to be successful. And, while you will provide tools, reinforce they are the ones responsible for their own skills development.

Document value-added points that make you unique. Capture all product features, benefits, and specific value-added aspects of your company. These would be attributes that your customers value most and give you a competitive advantage. Peer presentations incorporating your complete value proposition are an effective way to drill these into your team and share different approaches to handling objections.

It’s important that other departments are aware of changes and how those departments might be affected. Consistency with all customer-facing communication

is necessary. Having support staff attend peer presentations will help solidify your overall message.

Find opportunities to personally educate customers while involving your staff. Successful change potentially hinges on this one aspect alone as it helps your sales team learn and emulate your vision for the future. Schedule customer appreciation days or facility tour events that gather your customers and sales team in one convenient location. These opportunities will allow you, or your sales managers, a better chance to coach and provide immediate feedback to the whole team, interaction by interaction.

6 Validation: Ongoing evaluation and communication of progress is key. Consistently review the metrics and validate specific individual and group wins to the whole team. It’s critical to provide the team with examples of how the new approach is being successful.

Continued on next page.

You prepared a plan for turnover – use it! Should it be necessary to let someone go, or they decide they are no longer a fit, don’t waste a minute before implementing your contingency plan. It will actually provide your team reassurance that a plan for replacement and for assisting customers during a transition has been thought out and swiftly executed.

Beyond these steps, only a repetitious expression of your vision and a relentless consistency in your actions will change the culture of your team. Enjoy the challenge and you’ll soon reap the benefits.

Deutsche Telekom, Orange, Telefónica and Vodafone are working with software developer MATSUKO to make holographic communication a reality. With the use of smartphones and virtual reality glasses, the hologram would act like a normal video call, but callers would see each other as digital holograms through the use of their VR glasses. 3D effects, such as visualizing the back of heads, would be delivered by AI. The goal is to provide a more immersive virtual experience with amazing realism, and to make it available on all platforms.

Finding fulfillment at work can help you work harder, maintain loyalty, and increase happiness.

Goals can range from small and short-term, like finish my monthly budget ahead of schedule, to big and long-term, like I want to make partner in my firm in three years. Start with

we surround ourselves with impact our happiness in many ways. When you have positive relationships within your networks, you’re able to bounce ideas off others easily, seek advice candidly, learn

When you have positive relationships within your networks, you’re able to bounce ideas off others easily, seek advice candidly, learn from professionals in similar positions, and gain confidence in yourself and your skills.

the small term goals and write them out a day in advance. Don’t pack your list too full, and make your goals achievable! The best part of a goal is reaching it, and that feeling of checking it off is satisfying in itself. Plus, it forms a good goal-setting habit as you work toward career fulfillment.

from professionals in similar positions, and gain confidence in yourself and your skills. How do you cultivate that network?

The average American spends 90,000 hours –one third of their life – working. (Gettsyburg.edu). When you’re spending that much time at a job, one can only hope that you genuinely enjoy what you’re doing. And beyond enjoyment, fulfillment is the true endgame. Whether you’re at a job you love already or somewhere you know isn’t quite a perfect fit, you can find fulfillment at work with these tips.

Start by writing a list of what

makes you feel happy. What is your favorite part of your day? What do you like to do in your free time? What is a subject you really enjoy talking about? Think about how all these things relate to your own personal values and personality traits, as well as your skills. These components make up your personal mission statement. A mission statement is essentially your “words to live by” – a reference point for making decisions and defining clear goals. If the time comes to look for a new career, it should align with this mission statement as well as your values.

Even if you’re not in your dream career currently, you can take steps to improve yourself. Learn new skills, tackle new tasks within your current job, and take initiative when it comes to projects you’re passionate about. Consider volunteer opportunities and how they can help you grow personally and professionally. Ask to take a course or attend a conference on a topic that interests you. You might discover something new that you enjoy doing.

The people and groups that

There are obvious channels such as LinkedIn, networking events, and industry events. But you can also simply reach out to existing acquaintances and offer help, thank them for their work, listen to them, and show genuine interest. You’ll be amazed at the positivity and fulfillment it brings – to everyone involved!

Feeling fulfilled in our professional lives is vital when it comes to career longevity. It’s hard to stay motivated at a job where we don’t feel fulfilled. While it can come from other sources such as personal lives and volunteering, implementing these ideas to help with fulfillment at work can further you on your journey with happiness.

Coffee? Check. Laptop? Check. Diffuser loaded with rosemary essential oils? Check. You’re ready to start the day! At least that’s what Mark Moss, head of the Department of Psychology at Northumbria University is suggesting. It turns out, smelling the scents of rosemary along with sage and peppermint can be beneficial to cognition. In comparison, smelling lavender appears to impair memory and decrease reaction time –however it’s been effective in treating anxiety in dental and medical situations. So, why is that? Moss points to the high level of scent receptors that are present in the brain. The olfactory bulb – the structure in the brain that processes smells – has many more projections to structures in the brain than do vision or hearing. This suggests the importance that the sense of smell has had in our evolutionary history. Predictions for the future of this science range from scent erasers that can be used in cat litter boxes, to scents that travel to you at home through your television set. Smells … good! Source: BBC

Be careful that remote work has not blurred the lines between who is an employee and who is an independent contractor.

By Ashley BukowskiAs businesses adapt to changing labor markets, companies often modify the traditional employee-employer relationship. The modifications can raise questions regarding legal obligations. Employers must define the employment relationship.

Two common employment relationships are the traditional employee-employer relationship and the independent contractor

relationship. Remote work and flexible schedules may blur the lines between the two classifications.

The traditional employment relationship, between employee and employer, is the most common. In exchange for the employer dictating the hours and the manner in which the employee works, the employee receives benefits and protections under various laws.

This type of relationship is often easy to define, especially when workers are in person, working in the office, with the employer present.

Often much harder to define, especially as more workers move to remote settings, is the independent contractor relationship. Here, the employer tailors the contract to fit the needs of the parties. This relationship can result in cost savings to the business, as independent contractors will set their own schedules and often bring their own equipment to complete the tasks, as opposed to the employer providing the equipment in a traditional employment setting. The employer may also be able to avoid the tax liabilities and costs of employee benefits associated with traditional employees.

Minnesota courts will largely focus on five factors when defining an employment relationship:

1 A business’ right to control the manner of the worker’s performance.

2 How the worker is paid.

3 Who furnishes materials for the worker.

4 Who is in charge of the premises where the work by the worker is done.

5 The right of the business to discipline or discharge the worker.

Central to the analysis under this test is the amount of control a business has over a worker. As a general rule, if a business only controls the result of a worker’s work, that worker is likely an independent contractor. If the business is in control of the result and how that result is achieved, that party would likely be considered an employee.

As business relationships continue to evolve, courts may soon be faced with determining at what point an employee who is working a flexible schedule on their personal computer at their home, becomes an independent contractor. Using the analysis outlined above, this hypothetical employee would likely be an independent contractor because that employer is not in charge of how the final product is achieved, the worker is furnishing their materials, and the worker is in charge of the premises where the work is being done.

Ashley Bukowski is an attorney with Rinke Noonan, focusing in the areas of government law, criminal defense, personal injury, and probate and trust litigation.

Various situations may require greater focus on one of the factors discussed above. Failure to properly define the relationship can create significant consequences for a business, such as tax or workers’ compensation liabilities. As work settings continue to evolve, defining the employment relationship will become more critical.

If you’ve ever had the thought “If only my pizza was more high tech,” then you’re in luck. Picnic Works debuted its Picnic Pizza Station at the International Consumer Electronics Show, CES, in early 2020, and has been installing the high-tech pie making machines in restaurants, on campuses, at sports facilities and inside convention centers. The machine is intended to increase efficiency and consistency in ingredients, assembly and taste. It can put out hundreds of pizzas an hour and frees humans from the task of making pizzas so they can spend more time on customer service, marketing and delivery. The process automates the sauce, cheese and topping placement, and works well with other machines that take care of dough pressing and cooking. The future of pizza is here. Want a bite?

Source: CNet

You can see the Picnic Pizza Station in action at BusinessCentralMagazine.com

3709 Quail Road NE, Sauk Rapids, MN 56379 (320) 253-3524

www.alliancebuildingcorporation.com

research may offer some practical approaches to business resiliency after a challenging time.

While increasing cash on hand is a clear path to small business resiliency, recent data suggests that formal financing is not readily available to many small businesses that are struggling to make ends meet. A small business survey conducted in April 2020 found that roughly only a quarter of small businesses had access to formal financing, such as a loan or line of credit from a financial institution.

economic climate as a form of business resilience. Alertness for entrepreneurial opportunities to renew the business is imperative to business agility. Data from the small business survey supports the necessity of business transformation during a period of fragility. Of the small businesses in the survey that remained open following the onset of the pandemic, approximately 52 percent responded to the crisis by providing online services and 35 percent expanded digital payments.

Small businesses employ approximately 48 percent of U.S. workers, making them a crucial part of the economy. Recent economic research and survey results indicate that small businesses may experience more financial fragility than larger businesses.

A team of economists led by Alexander Bartik surveyed approximately 5,800 small businesses after the March 2020 mandated shutdown. The survey results led them to conclude that many small businesses are

financially fragile. This descriptor was based on the following: “the median business with more than $10,000 in monthly expenses had only about 2 weeks of cash on hand at the time of the survey. Three-quarters of respondents only had enough cash on hand to last 2 months or less.” Firms with more cash on hand were more optimistic that they would be able to remain open through the end of the year.

This financial fragility poses challenges toward achieving economic resilience. Recent

Nazimuddin Shaikh, is a 2022 St. Cloud State University economics graduate. Lynn MacDonald, Ph.D., is associate professor of economics at SCSU.

Financial vulnerability, coupled with the unique position small business owners face in being solely responsible for the success of their company, has motivated researcher Elias Hadjielias and team to understand how the resilience of the small business owner goes hand in hand with the resilience of the small business. Their research identifies three components.

They report that personalized communication on the part of the leader to better understand and support each worker’s needs promotes workplace collectivism and harmony. These two things are connected to a reduction in stressors in the workplace. Additionally, a team of researchers led by Chao Chen found that greater workplace harmony is associated with greater worker productivity.

The Hadjielias’ research team identified a leader’s willingness and ability to adapt to the current

The Hadjielias study also identified a business leader’s increased sense of responsibility to their business following a crisis, as a mark of leader resilience. Some of the business leaders who participated in the survey indicated feeling overwhelmed by their business responsibilities, which led them to ask their immediate family for financial support to help their businesses stay afloat. A research group led by Georgij Alekseev echoes this practice by finding that funds from friends and family are the second most prevalent form of informal funding (12.5 percent) for small business survey respondents.

While business resiliency and small business survival are affected by many factors, recent research highlights the importance of resiliency in leaders for improved outcomes.

For a list of sources used in this story, visit BusinessCentralMagazine.com

$0M

6 COMMUNITIES - ST. CLOUD,

AUGUSTA,

JOSEPH

RAPIDS,

TOTAL: $88,202,416

6 COMMUNITIES - ST. CLOUD, SAUK RAPIDS, SARTELL, WAITE

ST. AUGUSTA, ST. JOSEPH

TOTAL: $78,621,465

TOTAL: $59,480,913

TOTAL: $88,202,416

BUILDING PERMITS BY COMMUNITY

ST. CLOUD

$0M $20M

TOTAL: $78,621,465

TOTAL: $153,245,951

6 COMMUNITIES - ST. CLOUD, SAUK RAPIDS, SARTELL, WAITE PARK, ST. AUGUSTA, ST. JOSEPH

TOTAL: $171,433,019

TOTAL: $153,245,951

TOTAL: $137,532,948

$0M

2022 2021

Residential 2020 2021 2022 #/$ #/$ #/$ St. Cloud 765 777 350 $38,601,654 $31,498,210 $15,331,972 Sartell 560 477 861 $16,235,353 $28,930,350 $10,142,803 Sauk Rapids 236 252 813 $7,739,324 $9,116,510 $17,092,565 Waite Park 49 54 33 $2,336,431 $2,766,805 $909,653 St. Augusta 95 113 61 $10,023,126 $11,360,899 $6,766,461 St. Joseph 22 162 123 3,685,577 $4,529,642 $9,237,459

0 500

BUILDING PERMITS BY COMMUNITY

Commercial 2020 2021 2022 #/$ #/$ #/$

St. Cloud 246 282 172 $68,749,665 $105,238,005 $112,782,977 Sartell 309 158 161 $15,070,149 $18,230,359 $25,358,323 Sauk Rapids 8 56 51 $30,482,808 $12,310,906 $7,270,979 Waite Park 35 122 100 $5,556,423 $11,691,421 $18,253,002 St. Augusta 11 12 6 $9,754,200 $2,774,220 $237,150 St. Joseph 51 44 61 $7,919,703 $3,001,040 $7,530,588

2022 2021 2020

ST. CLOUD

$0

$0 $300k

Quiet

is a

engagement continues to drop. Quiet

is the idea that workers are less engaged and

above and beyond at work – they’re just

meeting their job descriptions. The trend seems

popular among

the

of 35.

The

The

Gen

The

Source:

https://www.gallup.com/workplace/398306/

Savings rates are on the rise, it’s a great time to develop a savings growth strategy.

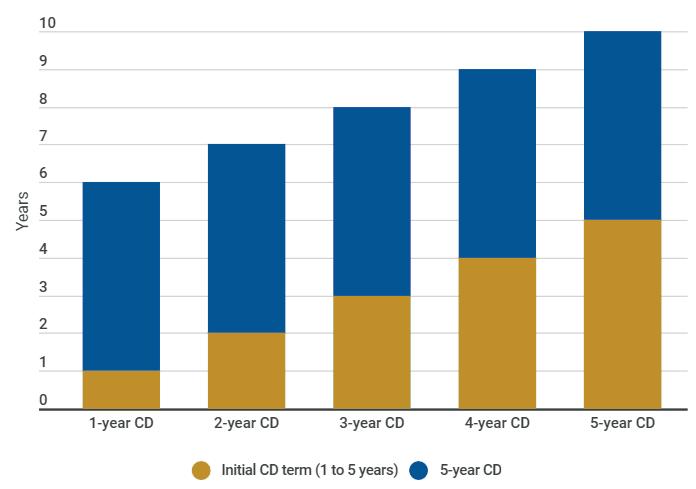

Article by Bob Gerads SVP, Retail Banking

We frequently discuss savings rates with our customers. Through most of the last decade savers were forced to settle for lower yields on deposits, stuck in a low-rate environment. Even those fortunate to lock in higher returns during the brief market up-ticks grew weary of the feast or famine situation. There is a simple diversification method to increase your savings returns over the long term. Remember the old saying “don’t put all your eggs in one basket.” A CD ladder is as simple as that. A CD ladder allows savers to decrease their interest rate risk and balance their savings rate of return as the rate environment changes. This method can be particularly effective during periods of extreme rate volatility (hint-hint). It also provides the combined advantages of, generally, higher rates of return and regular funds availability. With this strategy, you’ll cash in on funds more frequently, yet still obtaining some long-term benefits.

Let’s say you want to build a five-year CD ladder with five rungs. If you have $5,000 to invest, then you would divide the funds into five CDs across 5 different terms:

• $1000 into a 1yr CD at 2.25% APY.

• $1000 into a 2yr CD at 2.50% APY.

• $1000 into a 3yr CD at 2.65% APY.

• $1000 into a 4yr CD at 2.85% APY.

• $1000 into a 5yr CD at 3.15% APY.

NOTE: For illustration purposes only. Rates do not reflect current offer. When the first CD matures, you can cash out or continue to build your ladder by reinvesting the funds into a new five-year CD with a higher yield. Then, when the two-year CD matures, use the proceeds from that account to open a new five-year CD. Continue the process each year for as long as you want to maintain the CD ladder.

Jump start your savings strategy with great CD rates at Falcon National Bank. Scan code to see rates and open an account.

Erin Lucas and Mateo Mackbee have a vision. They want to use their love of food to feed their passion for helping the hungry. They want to use their knowledge of food preparation to fight food depravation. Their vision literally starts from the ground up. They own a one-acre farm in rural Paynesville and they plan to use it to teach youth about food cycles, food preparation, entrepreneurism, and hope.

food, work, and their mutual desire to find work with a mission.

Lucas grew up in Orono, Minn. “Food was always important in my life,” she said. “Eating was my favorite thing to do. Snacking ... cooking with my mom and grandparents ... so at a young age I knew I needed to be surrounded by food.”

road aren’t struggling ... that became important to me.” She realized that if she was going to run a restaurant, it needed to be one with a mission.

Lucas owns Flour & Flower, a bakery in St. Joseph, Minn. Mackbee owns Krewe, a New Orleans style restaurant, also located in St. Joe. They are partners in business and in life and they came together through

While in high school, Lucas and her volleyball team volunteered for the “363 Days Food Program” in Minneapolis, run by retired teacher Allen Law. “He talked about how the food banks are open two days a year, but what about the other 363 days of the year,” Lucas said. “So we made sandwiches for the homeless and got to go down and hand out the food. To see the kids and the middle-schoolers and understand that just because people in my community aren’t struggling doesn’t mean that people 20 minutes down the

By the time she graduated from high school she knew her goal was to attend the Culinary Institute of America (CIA) in New York. In order to gain the requisite six months of culinary experience required by the CIA she enrolled in a technical program in West Virginia where she studied culinary arts and worked part-time at a restaurant. After a year in West Virginia, she moved to New York and in 2014 graduated from CIA with an Associate in Arts degree in culinary arts.

“I always loved baking,” Lucas said, “but cooking came more naturally to me. In the back of my head I think I always knew I wanted to open up some type of bakery-style space or cafe, not

Erin’s Story

Business owners Erin Lucas and Mateo Mackbee agree, vision and hard work matter, but you can’t succeed without the help of others.

Erin Lucas and Mateo Mackbee

FUN FACT

Both Lucas and Mackbee enjoy watching reality cooking shows. “They’re fun, and they can be inspiring.”

Erin Lucas and Mateo Mackbee

FUN FACT

Both Lucas and Mackbee enjoy watching reality cooking shows. “They’re fun, and they can be inspiring.”

Fun Facts: Mackbee’s mother, Mary, was in education for 51 years in St. Paul. When she retired after 26 years as principal of St. Paul Central, she was the longest tenured principal in the nation. His father, Earsell, was a cornerback for the Minnesota Vikings and played in Super Bowl IV.

necessarily a full-blown restaurant.” She returned to Minnesota and found a part-time job in a bakery in south Minneapolis. “That’s where I learned all of my knowledge on artisan breads, and pastries, and pie crusts.”

While working at the bakery, she also was working at Mozza Mia in Edina. “I was cooking, serving, and baking at the same time. And Mozza Mia is where Mateo and I met.”

I was one of about 60 black kids in the entire high school system.”

Like Lucas, he grew up loving food and cooking with his mother and grandfather. “My grandfather was a merchant marine chef on a cargo ship out of New Orleans,” Mackbee said. “My mom was one of nine children who grew up in New Orleans.” She moved to Minneapolis for college and received her master’s degree in education from the University of Minnesota.

Mackbee played soccer at the University of Wisconsin-Parkside and graduated in 1996 with a degree in communications. Though he liked to cook, he didn’t see it as a career. Instead, between 1996 and 2008 Mackbee worked a variety of jobs, including retail management for six years. His last job in 2008 was working IT for a printing company before being laid-off due to the recession. “I was really distraught. I had a child at the time that I needed to take care of. I thought ‘If I’m getting laid-off from this job, what’s the next step?’ ” He decided to pursue what he really loved – cooking.

He enrolled in the culinary program at the Art Institutes of Minneapolis.

“I was in the first class of nights and weekends, so I went and got a day job and then took classes on nights and weekends. I graduated in 2010 and have been working in kitchens ever since.”

His first job after finishing school was at Lucia’s in Uptown. “Lucia was kind of the original ‘farm-to-table’ person in the Twin Cities,” according to Mackbee. This was just one stop for Mackbee as he worked his way through a variety of fine-dining restaurants in the Twin Cities, including working for a number of James Beard Award-nominated chefs.

Mackbee grew up in Bloomington. He went to college on a soccer scholarship and had what he calls a typical suburban up-bringing. “Except for the fact that

In 2012 Mackbee started running a food truck in Minneapolis and Florida for Andrew Zimmern, restaurateur and host of the Travel Channel television series Bizarre Foods with Andrew Zimmern. “It was a really good opportunity and really good money, so I left here and went down

MATEO MACKBEE, 49 Chef/Owner, Krewe Restaurant, St. Joseph, Minn. Hometown: Bloomington, Minn. Education: Bachelor of Arts in communication, University of Wisconsin - Parkside, Kenosha, Wisc.; Associate of Arts in culinary studies, Art Institutes of Minneapolis Work History: Six years in retail sales and management; cooking in a number of restaurants in the Twin Cities Family: Parents Mary and Earsell Mackbee; brothers Myles and Mylo; sister Marcee Harris; son Makil Mackbee Hobbies: Golf, bowling, old cars, RC cars, motorcycles, most things outdoorsto Florida for about a year-and-a-half,” he said. Having never lived in Florida, the experience appealed to Mackbee’s desire for challenge. “I had to figure out food truck laws, where do I source food, where does the truck get fixed, managing four to five employees, figuring out how to pack all the people and the food on the truck and drive it 200 miles to go to some event. It was kind of nuts.”

The challenge was made even greater because Zimmern’s concept was bizarre foods. “We were sourcing these ingredients from all around the country,” Mackbee said. “We did a lot of goat, so I got goat from New Jersey that I had to order 300 pounds at a time to make it worthwhile and then figure out what to do with it when I got it. There were all these interesting Vietnamese dishes with ingredients I had to find. All of his favorite dishes from around the world were on this truck.”

When Mackbee returned to Minnesota in 2014, he started working at Mozza Mia where he met Lucas.

One of the things that Lucas and Mackbee discovered they had in common was their frustration with the amount of food being wasted in Minneapolis restaurants. “That

became something we wanted to tackle when we opened our own place,” Lucas said. “When we met we spent time talking about our goals and dreams and realized that creating a restaurant with a mission was what we were both destined to do. Our process may be a little different, but our end goal is the same, teaching children about food cycles, getting students outside their normal concrete neighborhoods so they can see that possibilities are endless, and not just being told what they’re supposed to do.”

Mackbee left Mozza Mia to become the executive chef at 7th Street Social in St. Paul. In an effort to keep their schedules somewhat similar, Lucas also left Mozza Mia to work at 7th Street Social. While working there Mackbee met a pastor from Paynesville who was intrigued by their vision.

For four years Mackbee and the pastor kept in touch. Finally Mackbee and Lucas took a one-day tour of New London, Spicer, Willmar and Paynesville. One of the people they met owned Goat Ridge Brewery in New London. “They were on the edge of deciding if they were going to put in a kitchen or hire a chef to work for them,” Lucas said. “Through conversation with them over about nine months we decided, let’s just pack up and move to rural Minnesota and see what we can

1996 / Mackbee graduates from college with a bachelor's degree in communication.

1996 - 2008 / Mackbee works a variety of jobs, including retail sales and management, and information technology.

2010 / Mackbee graduates from the culinary arts program offered by the Art Institutes of Minneapolis. He helps a local church begin an urban farm and is shocked to meet 13-year-olds who had never put their hands in dirt. He is inspired to try to develop an agricultural learning center for youth.

2011 / Erin Lucas graduates from Orono, Minn. high school and moves to West Virginia to begin studying culinary arts.

2012 / Lucas moves to New York to attend the Culinary Institute of America. Mackbee begins running a food truck in Minneapolis and Florida for Bizarre Foods celebrity chef Andrew Zimmern.

2014 / Lucas moves back to Minnesota and begins working part-time in a bakery and part-time as a server in Mozza Mia in Edina. Mackbee returns to Minnesota and begins working at Mozza Mia where he and Lucas meet.

—Mike

Owner/Baker, Flour & Flower Bakery, St. Joseph, Minn.

Hometown: Orono, Minn.

Education: Associate degree from the Culinary Institute of America in New York

Work History: Mozza Mia restaurant; Sunstreet Breads; 7th Street Social

Family: Parents Leslee Halsted and Joe Lucas; brother Ben, sister-in-law Erin, two nephews

Hobbies: Playing with our chocolate lab, golfing with Mateo, walking, reading, bowling

Fun Fact: Owner Erin Lucas buys her flower bouquets from a local woman grower, allowing Lucas to create a boutique floral shop inside her custom, from-scratch bakery.

do.” In 2018 they opened Model Citizen restaurant inside Goat Ridge Brewery.

Meanwhile, a developer was about to begin construction on an apartment building in the city of St. Joseph, Minn., and was thinking about adding a restaurant on the ground level. “He had always dreamed of having a New Orleans style restaurant on the ground floor of the apartment building,” Lucas said. “He got word that we had jambalaya and red beans and rice on our menu. So he came out and tried the jambalaya and immediately offered the space to us.”

After a trip to New Orleans and a few months of consideration, Lucas and Mackbee decided to give it a try. “We

bounced through three different banks before we found someone who was willing to give us a try,” Mackbee said. “We’d never taken out a loan of that size or on a commercial scale.” Their banker suggested visiting the Small Business Development Center for help writing a business plan. “I didn’t know what went into a business plan or what information the bank needed to make their decisions,” Mackbee said. “Our business development person, Bernie, really, really helped us.”

In the fall of 2019, with finances secured, construction began on Krewe Restaurant, finishing in February 2020 just in time to be shut down by COVID-19. “Luckily we had no inventory or anything,” Lucas said. “Of course, everything was stalled at that point. The oven for the bakery was stuck in Customs for six months, so we didn’t get that until the end of April. Then we opened the bakery the end of May, and that was always to-go, so we didn’t have to change the business plan there. And then we opened the restaurant a week or so later.”

“Erin and I both worked,” Mackbee said. “We had two other people we were paying at that time, one in the front of the house and the rest of us were in the kitchen.” The restaurant was only to-go for the first month, then at half capacity beginning in July.

“We shut down Krewe in winter because some employees got COVID,” Lucas said, “and I think the governor shut down restaurants again, so we went back to to-go in November and then in February went back to halfcapacity. Finally last summer we were open at 100 percent.”

In 2016 Mackbee and Lucas established a non-profit organization called Model Citizen Inc., a one-acre farm operating out of Paynesville. “Everything we do, literally, is to try and propel this non-profit,” Mackbee said. That means

Delegate. Handing over control is not a weakness - it will only help you grow stronger as a business. You cannot do it all on your own.

farming one acre of land with a 40’x 100’ high tunnel for growing produce that is used in the restaurant. “We’re hoping the next phase is to add another seven or eight acres.”

Lucas still holds onto her goal to work with students. “The goal has changed a little bit from what I thought I wanted to do, but we have had the opportunity to work with students over the past few years,” she said. The Willmar High School English secondlanguage learner class visited the Paynesville farm during the fall of 2021.

“We did plant identification with them to help them learn the alphabet,” Mackbee said. “What do you see around here that starts with an A or a B or a C. We incorporated agriculture with learning English for about a half a day. That was really fun.”

The vision, according to Mackbee, is for Model Citizen to create a fully-sustainable alternative energy powered community space with a commercial kitchen for food incubators, a place for farmers to learn, and a space for middle-school students to visit on day trips.

“We want the students to come and spend time with us and learn where their food comes from and watch it go through its cycle all the way from a seed, to help it grow, maintain it, then at harvest time, what do you do with it.” This winter, Lucas and Mackbee plan to develop a composting initiative, saving food

scraps from the restaurant and bakery and taking them to the farm for composting.

“These things have become such monsters,” Mackbee said, referring to the restaurant and bakery. “We now realize we need to find partners to help us build the next phases of what we want to do with the farm.” Their vision needs partners who appreciate their venue, and who are already working in agriculture and skill-building programs for middle school students, and can provide existing curriculum, he said.

They also recognize that to achieve their vision for Model Citizen, they have to nurture Krewe and Flour & Flower, since the success of Model Citizen is dependent on the success of the restaurant and bakery. So far, that seems to be working.

“The response that we're getting to the restaurant and bakery in this community has been really amazing,” Mackbee said. “I dreamed about this restaurant since I started cooking, but I did not intend for it to be in a rural community. I believe that the community around here called us to be here. I can’t tell you the number of people who say ‘Thank you. Thank you for bringing this type of restaurant to the area.’ ”

Gail Ivers recently retired as vice president of the St. Cloud Area Chamber of Commerce. She is the founding editor of Business Central Magazine.

FLOUR & FLOWER 26 College Ave. N Ste 104, St. Joseph, MN 56374 (320) 557-0170 // flourandflowerbakery.com

Owner/Baker: Erin Lucas

Business Description: A local bakery providing a wide variety of pastries and artisan baked goods — both sweet and savory — made fresh daily, using local ingredients whenever possible; plus fresh flower bouquets in season.

Number of employees: 2 full-time, 4 part-time

2016 / Mackbee and Lucas establish a not-for-profit organization called Model Citizen. The vision is a multifunctional farm and agricultural education center that provides hands-on curriculum, exposing students to small farm animals and the life cycle of food, including a teaching kitchen, the use of current farming technology, and lessons in entrepreneurship.

2017-2018 / Lucas and Mackbee move to New London, Minn. and open Model Citizen restaurant inside the Goat Ridge Brewery.

Fall 2019 / Lucas and Mackbee secure financing to open a restaurant in St. Joseph, Minn., scheduled to open in February 2020. The restaurant is finished, but COVID-19 restrictions keep it closed temporarily.

March 2020 / Lucas and Mackbee close Model Citizen restaurant.

May 2020 / With the lifting of COVID-19 restrictions, Lucas opens Flour & Flower Bakery and Mackbee opens Krewe Restaurant, both providing to-go services.

July - Nov 2020 / Krewe opens at ½ capacity. Flour & Flower, with a to-go business model, is able to continue in business as planned.

Nov 2020- Jan 2021 / Krewe closes temporarily, reopening in February with to-go meals.

Summer 2021 / Krewe opens for regular full-capacity business.

Sign-on Bonus!

Training Provided!

You’ve seen the cries for help in shop windows, on billboards and online.

“We hear every day from our member companies – of every size and industry, across nearly every state – they’re facing unprecedented challenges trying to find enough workers to fill open jobs,” Stephanie Ferguson from the U.S. Chamber of Commerce wrote in a recent blog post.

What’s happening nationally is happening here.

“St. Cloud is experiencing a workforce shortage like many parts of the country,” said Jill Magelssen, Express Employment Professionals. “Industries most impacted locally are manufacturing and the service industry.”

Tammy Biery of Career Solutions echoes Magelssen and adds a couple of industries to the list. “About 99 percent of all the employers Career Solutions serves are experiencing recruitment challenges. Health care, manufacturing,

construction, and transportation are some of the industries hit hardest in our area,” Biery said.

“We are still seeing the effects of COVID-19 in the health care industry with care facilities needing more workers because of the demands of the pandemic, while some people are still not sure about wanting to work in the field because of COVID-19,” she said. “Many jobs in manufacturing, construction, and transportation have regulations with age and other restrictions, which can limit the applicant pool. Skilled labor is not taken for granted.”

When looking for employees, Harvard Business Review recommends a new approach:

Make it easier for employees who commute by focusing on attracting local talent, adjusting work hours so those who come from farther away don’t have to drive during rush hour, and offering four 10-hour shifts to reduce commuting time by 20 percent.

Help employees juggle their work and home responsibilities by partnering with child care, or after school and drop-off/ pick-up services.

Look for workers where other businesses are not by considering older workers, new grads, and people with disabilities.

As companies continue to face major hiring challenges, looking internally at existing employees might be the solution.

In 2021, businesses across the country added an unprecedented 3.8 million jobs, yet workforce participation remains below prepandemic levels, according to the U.S. Chamber. Locally, Biery said, there are two openings for every person seeking a job. “With ratios like that,” she said, “every industry is affected.”

Coldspring is one of the St. Cloud-area companies that have added jobs. “Over the last couple years, we’ve seen strong growth in the markets we serve, which has created additional opportunities for employment within our company,” said Human Resources Director Scott Piecek. “While our efforts to fill these positions have led to the addition of many great new hires, we continue to find that filling all of our open roles with the right people is a bottleneck to meeting the demand we have from our customers.”

The workforce shortage problem is clear and widespread. So, what can be done?

For many business leaders, the answer is “upskilling” or “reskilling.” Definitions of these terms vary, but suffice it to say they mean teaching existing employees advanced skills that are relevant to their jobs or preparing them for entirely new positions with the same employer.

Among area companies, Magelssen is seeing “more of a focus on reskilling current workers for new challenges, offering company-led training sessions or programs, providing on-the-job training, and partnering with a third party that offers trainings or courses. Training costs money in the short term, but pays for itself through increased retention and productivity.

“Across the company we are using multiple methods to upskill and help our team members

and the company grow,” said Coldspring’s Piecek. “In many areas of the business, we use cross-training to help increase productivity and give individuals more experience in all areas of production. In doing this, we can shift people around based on the needs and the time, and while some positions are more physical in nature, this gives them the opportunity for breaks throughout the day and week.” Coldspring will pay for qualified

employees “to take college courses based on the skills needed in their role, or to attend conferences to further their education,” Piecek said.

Internally, Coldspring offers two programs as opportunities for employees to grow. Coldspring U is an internal school system that educates staff in areas including marketing, human resources, legal, strategy, math, and information systems. Another

program encourages employee engagement and development of leadership skills.

Many area companies tap local resources such as Career Solutions and Express Employment Professionals for help. Career Solutions’ Incumbent Worker Training Program reimburses employers for training team members to avoid laying people off and to improve the business’ competitive position.

“We used Career Solutions Incumbent Worker Training Program to provide additional welding and computer skills training to our workforce,” said Angela Mortezaee, human resources manager at St. Cloud Industrial Products. “Not only are we able to offer additional skill sets to our customers thanks to the welding training, but our team members are also more efficient on the computer. Thanks to the IWT program, we were able to get assistance with costs so we could offer the training to more team members and earlier than we might have been able to had we not had the additional funding.”

Another Career Solutions program, On-the-Job Training, is designed to address any gaps

“Be creative in how and where you recruit talent, think outside of mainstream ideas. Make sure your company is a place employees like to work and share what you provide to employees ongoing.”

—Jill Magelssen, Express Employment Professionals

between new employees’ skills and the required job skills. Businesses are reimbursed 50 percent of the new employee’s wage for the length of the company’s contract with Career Solutions. “It gives new hires a chance to learn occupational skills and earn a wage at the same time,” Biery said. Funding comes from state and federal employment and training programs.

additional skills can also make the employee more marketable, which can open more career options outside the business. For a company making the investment in training, one of the goals is employee retention.”

“We believe in hiring based on hard skills and soft skills,” Coldspring’s Piecek said. “If a candidate for a role has the soft skills, we believe we can teach the hard skills to help

starts with acknowledging that you won’t solve your current hiring challenges by applying the solutions of the past,” advises the Harvard Business Review.

Magelssen agrees. “Be creative in how and where you recruit talent,” she said. “Think outside of mainstream ideas. Make sure your company is a place employees like to work and share what you provide to employees ongoing. Keep communication channels open and positive. Evaluate referral programs and connect with many outlets in the community.”

“Many companies realize that youth are the next generation of the workforce,” Biery said. These businesses are volunteering in schools, making presentations about career opportunities in

their industries, conducting mock interviews, and offering tours and work experiences to high school students.

Coldspring, for example, partners with several area schools, giving high school juniors and seniors an opportunity to gain experience and college credit in the company’s facilities. Coldspring also financially supports local elementary to senior high school robotics teams, Piecek said, “as we know this is the next generation of manufacturers.”

Jeanine Nistler is a St. Cloudbased writer who has worked in health care, higher education, state government and as a daily newspaper reporter and editor.

By Mike Killeen

By Mike Killeen

Larry Logeman had a dream to start his own business, but there was one problem. “I had no money. That creates challenges,” he said, chuckling.

Using good banking relationships developed through his previous work, Logeman received a loan through his bank from the Small Business Administration (SBA). With that start, Logeman bought Executive Express 18 years ago. Now, he is owner/president of the company based in St. Joseph, which offers “black car service” to customers – a door-to-door, private service that

takes customers anywhere they need to go.

Logeman’s approach mirrored a game-plan that new business owners follow to one degree or another. And it’s a path that holds true today.

“That was my very first experience, not only with a small business loan, but also with the SBA,” Logeman said. “There are positive things to SBA loans for a lot of people. It’s better for the bank because the bank doesn’t have the whole risk. And it’s better for the person receiving the funds, because normally with

Start with some resources, add in some advice, and cover with entrepreneurial spirit.