Green Economy

Significant progress made with ambitious long-term targets

Rethinking how bottles are designed, collected, recycled and repurposed to minimise CCBA's carbon footprint

Long-term objective: 100% 2030 recycling rate by

2020: 58% recycling rate 2020: 76% replenishment rate

Returning to communities and nature the amount of clean water equivalent to the amount used in production

Long-term objective: 100% replenishment rate

Working with suppliers to ensure raw materials and ingredients are grown and produced sustainably

2020: 83% of raw materials locally sourced, exceeding global Coca-Cola target for 2022 of 80%

Long-term objective: Continued increase in the share of locally sourced materials

CO2

Increasing renewable energy usage and reducing carbon emission in line with 2015 Paris Climate Change Agreement

Long-term objective: Reduce emissions by by 2030 25% from 2015 levels.

Seeking to empower women in the workplace and their livelihood through community programmes Empowering young people and enabling their inclusion in the economy Focusing on sustainable impact and the wellbeing and upliftment of society

Consumer well being

The wellbeing of our consumers is critical

One hundred desks donated to Ilunga Secondary School in Mbeya, Tanzania.

Our water stewardship responsibilities are taken very seriously through supporting local water access projects that help bring safe, clean drinking water to communities in need.

Donation of classroom furniture and equipment to schools supports the creation of an improved education environment in rural areas

Our water security strategy has sent a number of water tankers with a capacity of 35 000 litres each to deliver relief water to under-resourced communities in South Africa.

We partner with local governments and health NGOs to provide vaccinations and other health care in the communities where we operate.

For too long, Africa has been a spectator on the global stage. But thanks to our thriving agricultural sector and vast natural resources, one could argue that we’ve always been green.

The challenge is finding and maintaining a link to skills development, so that the environment’s gain is also our economic gain. At long last, we’ve realised that these don’t need to be at odds. If we take care of our land and water, our crops and soil, our livestock and exports, we’re really ensuring our own future.

Above all, a green economy means more jobs, a better standard of living and a chance at creating a level playing field for all South Africans. It’s about time.

The Cold Press Media team and I are thrilled to play our small part in this initiative. We look forward to a green future.

08 Waste-to-energy opportunities largely untapped in South Africa

20 Different shades of green

24 Green investment trend creates opportunities for expanding SA SmEs

28 Waste management is a key driver of a green economy

42 Retailers role in building the green economy

44 Preserve Africa’s marine resources through a circular economy for plastic waste

47 Debunking the myths around mining and the circular economy

53 Asez’s living lab – a platform for greentech research and innovation

56 Why it pays to get a green bond

Jennifer Potter

The past few years have seen a global awakening as more and more people have turned towards natural health and wellness solutions. This approach seeks to move away from pharmaceuticals and chemical medical solutions in favour of treatments that utilise organic ingredients. One of the most prominent developments to have emerged from this worldwide shift is a growing awareness of the comprehensive health benefits offered by cannabinoids – the compounds found in marijuana.

Cannabis contains at least 144 unique cannabinoids, the most widely known of which are tetrahydrocannabinol (THC) and cannabidiol (CBD).

Many people may be wary of using marijuanabased products for fear of experiencing a ‘high’; however, the majority of cannabis healthcare products make exclusive use of CBD - a phytocannabinoid with zero psychoactive effects.

The medical merits of CBD have been extensively studied in recent years, with research reporting that CBD products could help in the treatment and management of a number of health conditions, including movement disorders, anxiety, depression, chronic pain disorders, epilepsy and arthritis. Furthermore, CBD has been shown to help in combating the adverse side effects of severe

medical treatments such as chemotherapy. These incredible benefits are far from surprising, with cannabis having been used in traditional medicine throughout history by civilisations all over the world, including Ancient Greece, China, Egypt and India.

The increasing use of CBD to address a wide range of medical problems has been a significant driving force in the blooming cannabis economy - a movement that has the potential to give rise to a massive shift from a synthetic, unsustainable world to one grounded in our abundant natural resources. In doing our part for the cannabis economy, Wellness Warehouse offers a comprehensive range of quality CBD-based products, including infused waters, teas, oils, capsules, coffees and even sweet treats. All our cannabis-based products are 100% free from THC, allowing you to enjoy the myriad benefits of CBD with full clarity of mind and body.

Revolution is no longer on the horizon. It’s here, and it’s waiting for you.

Phone: 021 003 3552

Email: support@wellnesswarehouse.com

Website: www.wellnesswarehouse.com

Visit any

Wellness Warehouse is South Africa’s leading health retailer, offering a comprehensive range of holistic wellbeing products complemented by personalised service for individuals looking to live life well. Our offering includes nutritional supplements, eco home products, wholesome health foods, gentle baby care, and nature-based personal care and beauty products.

When it comes to using biomass to create energy, South Africa lags behind many other countries.

This country has the capability, opportunity and infrastructure to generate bio-energy, and we have for some time, but we have lost momentum in recent years. One form of bio-energy is biogas, which can be created through agricultural or organic waste and wastewater treatment processes.

There are many examples where biogas projects have been developed for rural communities. And while some industries have also developed biogas projects, particularly in the automotive and food and beverage industries, these have been isolated cases. There have been significant developments in wastewater treatment technology for biogas production, but generally speaking, we have quite a long way to go until biogas becomes mainstream. Biogas is produced by the decomposition of organic waste separated at source. Plastics and wood undergo thermal treatment to produce energy.

Several municipalities are generating energy through waste, but this has been sporadic. The Ekurhuleni and eThekwini municipalities have developed landfill gas to electricity projects, but with more than 860 landfills in this country, this is the tip of the iceberg. The City of Johannesburg has long explored bio-energy through feasibility studies but is still to implement a project.

The leading players in waste-to-energy are Germany, Japan and India, among others. We have a long way to go to catch up. While there have been some successful projects in municipalities and private sector organisations, there needs to be an integrated, nationwide strategy.

One very successful example of a private-sector waste-to-electricity project is a partnership between BMW and industrial waste-toenergy company, Bio2Watt. The biogas twin-unit power station installed at its plant in Rosslyn has enabled BMW to generate up to 30% of its electricity requirements using renewable resources, primarily from agricultural or food waste.

This March, South African Breweries (SAB) also signed a powerpurchase agreement with Bio2Watt. The plant, once completed, will make use of waste collected from one of South Africa’s largest dairy farms, situated in Malmesbury in the Western Cape. This will come from slurry waste from more than 7 000 cows, as well as other waste from the surrounding region to produce electricity.

South Africa is blessed with an abundance of arable agricultural land, which presents almost limitless opportunities for the future

production of agricultural biogas. In addition, there are opportunities to harvest alien crops such as water hyacinth to produce energy.

We have massive potential in this country to scale up our capacity to generate energy from crop waste and from growing energy crops. I believe the vast tracts of land in Southern Africa which lay fallow present massive opportunities for bio-energy, which has important implications for job creation.

The isolated successes in biogas production in this country mean we have the technology, the know-how and the resources. I believe government needs to create more of an enabling environment to open up the field to other players.

One of the problems is a lack of alignment when it comes to policy and legislation. We have laws guiding the water management sector, the agricultural industry, electricity and the like, to reduce emissions, but

no overarching policy which would help develop our green economy more holistically.

The Integrated Resource Plan (IRP), which highlights the wide range of technology choices available in renewable energy generation, seems to over-emphasise wind energy.

Of course, there is solar too, but wind has been identified as the lower-cost option for renewable energy in the long run. I believe policy-making in this country has gotten too caught up in technology choices, but with a bias towards imported wind technology. Waste and agricultural-based technologies have not received as much attention.

There is also scope to develop the domestic/household biogas market, which includes small-scale farms and small holdings. Currently, there is no local manufacturer of biodigesters, meaning that individual homeowners or farmers have to import them. Another barrier, he says, is that in many communities, biogas is seen as a ‘poor man’s fuel’ and there is a perception that it is unhygienic.

A biodigester is a system that literally digests organic material but is a closed system and therefore does not emit odours or attract flies or other pests.

With our current power crisis, I believe there is massive scope for developing the biogas industry. This is especially true in poorer communities or rural areas where there would be huge benefits from decreasing dependence on the national energy grid. There is not enough being done to create awareness of this technology as a viable alternative for power generation, and there is no regulatory framework to support the development of the technology.

In 2016, a project was launched by the University of Fort Hare and the Eastern Cape local government that saw the installation of 28 biogas digesters in villages in the Alice district. Several similar projects have been launched in rural schools and communities around South Africa, with mixed long-term success.

We need to take the biogas industry to new heights in this country in service of a greener economy. The benefits are significant, not only in terms of reducing emissions but also in a more reliable form of power generation when we are experiencing increasing blackouts. Biogas digesters are applicable in rural communities and urban and suburban contexts for domestic and industrial use. A more decisive legislative framework, increased access to the technology, greater awareness and a change of mindset will help boost biogas production, which could be an energy game-changer in South Africa.

Photo by Judah EstradaThere is not enough being done to create awareness of this technology as a viable alternative for power generation, and there is no regulatory framework to support the development of the technology.”

Case studies across Africa demonstrate the positive impact that access to even the most basic mobile technology can offer smallholder farmers. This underscores the importance of driving inclusive access to digital technology, especially mobile-based, to help the continent’s farmers mitigate the impact of climate change.

This assertion is championed by Vodacom, Vodafone, Safaricom, and the United Nations Capital Development Fund in their co-authored report, Towards a Connected Climate. The paper is the third in a six-part series published as part of the Africa.connected initiative, established to help close digital divides

hindering sustainable progress in Africa’s key economic sectors, like agriculture.

Using technology to enable smallholder farmers to become more resilient is a matter of urgency, as they comprise such a large part of the farming sector. It is estimated that the continent is home to 250 million smallholder farmers. However, as McKinsey notes, despite Sub-Saharan Africa being home to a quarter of the world’s arable land, it only produces 10% of the world’s agricultural output.

“Sustainably increasing farming productivity is imperative and technology has a great role to play as a developmental tool. There is anecdotal

evidence of this development in those African markets in which Vodacom operates, within the continent where smartphone penetration remains low, but small-scale farmers are not outpaced,” says Takalani Netshitenzhe, External Affairs Director for Vodacom South Africa.

Across Africa, climate change presents a significant threat to agricultural development in the form of extreme weather conditions such as the increased intensity and frequency of droughts, extreme heat, erratic rainfall patterns, heavier storms, and flooding. Farmers in developing markets are typically more vulnerable to these changing weather patterns

than farmers in developed nations. The extreme and unpredictable weather conditions cause greater crop volatility, hamper livestock yields, and increase the likelihood of pest and disease outbreaks, which can have a massive impact on the economy. To this end, Vodacom remains committed to reducing its carbon emissions by 50% by 2025 to contribute to the climate change targets that governments of the markets in which we operate have made under the Paris Agreement on climate change.

“There’s no denying that the introduction of mobile-based technology must be complemented by access to low-cost devices, network coverage and affordable data, especially for people in underserviced and under-developed areas. To this end, government, the private sector, and civil society need to continue to collaborate on connecting underserved, rural areas ensuring that no one is left behind,” adds Netshitenzhe.

Vodacom has made great strides in heeding this call to action, increasing network coverage across rural areas in its markets and making affordable handsets available to millions of Africans to date. “Across the continent, where Vodacom operates, examples show how simple mobile-

based technology can unlock opportunities, even for farmers using entry-level feature phones, no matter where they are based,” says Netshitenzhe.

Inclusion for all also requires tailor-making products and services for each market segment and where smartphone penetration is still low, creating and making available innovative solutions that are not data-driven to pivot the developmental agenda. For instance, URL (Uniform Resource Locator) and USSD-based (unstructured supplementary service data) platforms that enable access to financial services and farming opportunities can easily connect small-scale farmers to the agricultural value chain.

In Tanzania, the M-Kulima mobile platform connects smallholder farmers to a wealth of information and resources via short message service (SMS), USSD, and interactive voice response (IVR). M-Kulima provides timely

weather forecasts that help farmers plan around climate change and offers important market information to help farmers get the best price for their products. It’s also integrated with the financial-services platform M-Pesa, to nurture financial inclusion by providing a mobile-phonebased money transfer service and enabling payments and micro-financing. Meanwhile, in Kenya, the end-to-end DigiFarm platform –available via USSD or app – provides everything from basic farming advice to more advanced and mechanised support, much like M-Kulima does.

In South Africa, Vodacom partnered with UN Women and South African Women in Farming (SAWIF) to establish and drive a Women Farmers Programme aimed at making agriculture more accessible and profitable for women by teaching them how to use apps to connect to potential customers and unlock enormous economic growth. The project has so far trained more than 2000 women, and the SAWIF database of farmers is now digitised and is easily accessible by all the women who have received computer literacy and basic business management training. This programme has resulted in testimonials by the beneficiaries of how embracing technology has changed their approach to technology adoption and farming. Examples like these highlight how mobile technology unlocks economic opportunities for the farmers and provides them with the confidence to use technology and assist their learner-children with homework using technology.

The Covid-19 pandemic has demonstrated that digital transformation is key to the developmental agenda. Therefore, information and communications technology companies need to accelerate the pace to remove barriers to access to communication focusing on mobile and fixed broadband roll-out, affordable devices, digital literacy and affordable data.

Towards a Connected Climate opens muchneeded conversation around sector challenges. “By pinpointing where farmers are struggling and proposing the path forward on the back of technology, we can make impactful, sustainable changes that promote climate-smart agriculture on the continent,” concludes Netshitenzhe.

Learn more about the Africa.connected initiative here.

The Gautrain Management Agency (GMA) is an entity of the Gauteng Provincial Government (GPG) mandated to manage the implementation of the Gautrain Project and the relationship with the Gautrain Concessionaire, the Bombela Concession Company, who operate the Gautrain System on behalf of the GMA. The Agency’s vision is to provide an integrated, innovative and efficient public transport system that promotes sustainable socio-economic growth in Gauteng GMA’s functions have been expanded to encompass other related projects and assist other organs of state to realise the integration and co-ordination of public transport within the region – essentially contributing to Smart Mobility.

Established in terms of the GMA Act, the GMA is a provincial public entity. The Agency is committed to good governance and constantly strives to improve its governance framework to align it with leading practice such as the application of the King Codes. In ensuring that the Gautrain operates in a sustainable manner, the GMA has a clear commitment to governance and is in support of the GPG’s economic and social imperatives.

As a government entity, the GMA plays a pivotal role in society and has shown the modernisation in public service and transformation of governance through the Gautrain. Through the Socio-Economic Development (SED) Charter of the Gautrain Project, the GMA contributes positively to the Gauteng society and economy. Since inception the Gautrain Project has been breaking new ground to ensure that specific socio-economic development objectives are

met. Gautrain has delivered a spectrum of jobs during its construction and operational phases. The SED deliverables directly demonstrate the benefits of the Gautrain in terms of amongst others: - skills transfer and shareholding by black persons and women, in particular procurement, subcontracting and employment equity elements.

Besides driving economic growth and creating jobs, the GMA continues to work towards economic, spatial and social transformation through the modernisation of the public transport infrastructure and urban development through Smart Mobility. As a purpose-led organisation, the GMA hopes to, among others, contribute to business and social impact at scale, create an ecosystem that drives and supports the creation of inclusive societies and create inclusive growth with equitable opportunities for all.

Part of the long-term growth plan is centred around building partnerships with taxi associations to create public transport channels to and from Gautrain stations. Currently the GMA has partnerships with various taxi industry. It has midibus operations at Marlboro, Sandton, Centurion and Hatfield Stations and these are operated by local taxi association. The midibus operations have proven successful in improving accessibility to public transport and integration of the Gautrain System with public transport services.

From a sustainability and governance perspective, the GMA has been operating a tight ship for the past decade, recently collecting their ninth clean audit from the AuditorGeneral, which is a major achievement. The Agency have also received international recognition for their role as a leading employer, while the Ethics Institute of South Africa applauded their innovative use of smart technology through their creation of a smartphone app that helps to foster impeccable ethics management by providing an instant method of registering any gifts received from suppliers, clients or stakeholders.

African

energy specialist SolarAfrica has launched a landmark offering that allows clients to go 100% off-grid using a suite of Capexfree, green power solutions.

The company now designs bespoke, long-term energy plans for businesses seeking a solution to power security, cost savings and carbon reduction. The holistic energy solutions are aimed at businesses consuming over 100kWp and will allow them to source 100% of their power from a mix of renewable energy sources such as solar PV, biogas, gas-to-power and wheeling, including battery storage and power trading options.

Critically, this solution comes at zero capital investment by the client and offers energy at a lower tariff than that provided by Eskom, which has intensified load shedding in recent months.

SolarAfrica now provides businesses with a unique combination of energy supply sources and services:

Solar PPAs and roof rental solutions require zero capital investment and provide monthly cost savings whilst reducing carbon footprint.

Biogas created from purpose-grown crops such as Vetiver and Spekboom offers a climate-friendly alternative to fossil fuels.

Gas-to-power can be integrated with solar PV to provide a reliable power security solution that provides additional electricity savings, enables demand reduction and allows peak shaving opportunities.

Battery energy storage systems provide immediate, uninterrupted power supply that keeps real-time operations live and avoids intermittent downtime from load shedding.

Wheeling agreements allow industrial and commercial clients to source sustainable power from an off-site solar solution and at tariffs that are up to 50% cheaper than existing grid costs.

Bianca Swanepoel

Bianca Swanepoel

SolarAfrica

Electricity trading allows our clients to purchase cheaper, greener electricity from a bundle of renewable energy sources, with flexible contracting periods.

Certified renewable energy certificates accounts for a business’ renewable electricity generation and certifies whether power solutions have been installed on-premise or power is sourced remotely.

The cost of renewable power is expected to increase in the coming years, making the need for early intervention by businesses all the more urgent.

The renewable energy market globally is bottoming out and is unlikely to become cheaper in the short to medium term, so it is better to map out an energy plan for your business as soon as possible,” cautions SolarAfrica director Charl Alheit.

Head of Marketing and CommunicationsT +27 12 881 4800 C +27 81 446 7406 E bianca@solarafrica.com www.solarafrica.com

Alternative investments continue to grow in popularity, ushering in a new wave of investors. At Sanlam Investments, we’re looking ahead: Our expert alternative investment solutions deliver competitive capital returns and have a positive impact on society and our planet. Invest with confidence today and help create a more sustainable tomorrow.

#TheFUTUREisSustainability

Our private market expertise includes:

Allocators of capital and investors must take care when navigating the green economy and transitioning to net zero because there are countless terms and phrases they may trip over. A significant challenge in the evolving field is that words like ‘green infrastructure’ and the ‘green economy’ are poorly understood, as are the concepts of ‘transition’ versus ‘just transition’.

Green infrastructure can be defined as integrating construction and urban development with nature, for example, designing a building or industrial complex to be energy and water-efficient. It refers to installing new infrastructure to ensure that cities and urban environments have as green a footprint as possible.

The term is more applicable in city planning and construction, though financiers have some influence over green outcomes when funding large infrastructure projects.

Asset managers are more concerned with the green economy. The United Nations Environment Programme describes the green economy as ‘growth in employment and income driven by public and private investment into economic activities, infrastructure and assets that allow reduced carbon emissions and pollution; enhanced energy and resource efficiency; and prevention of the loss of biodiversity and ecosystem services’. The global green economy debate is currently centred around mitigating the impact of climate change by reducing carbon emissions. The goal is to limit the average annual global temperature rise to less than 1.5 °C by 2100.

The central theme at the 2021 United Nations Climate Change Conference, also called COP26, was for countries to achieve net-zero carbon emissions by transitioning from carbon-intensive economies into low carbon economies. This requires moving from coal and gas to renewable energy such as hydroelectric, solar and wind. Asset managers and other capital allocators will play a significant role in steering capital toward the green economy. However, they will have to do so within the socioeconomic construct of the countries and markets in which they operate.

The concept of net zero and the transition away from coal and oil presents unique challenges to emerging markets and South Africa

in particular. There are concerns, for example, that developed markets that have already pocketed the financial dividend of high emissions industrial activity are now expecting emerging economies to forego these benefits. This issue will be partly addressed through financial compensation and incentives. However, it will also require a relaxation of the zero-tolerance approach to fossil fuel projects in much of Europe.

The developed economies will have to support the net-zero transition in emerging economies like South Africa. We have an example of this type of commitment in the US$8.5-billion pledged to our country at COP26 recently. However, in the South African context, the asset management industry will have to steer this and other ‘green economy’ funding into projects with the most significant impact, with due consideration for systemic issues such as inequality, poverty and unemployment. South Africa’s transition to a net-zero or green economy needs to take the socioeconomic situation into context, and that is why we speak about a just transition.

The country will struggle to follow the likes of Germany and France by simply ‘flipping the switch’ on its coal-fired power plants. The just transition will require extending the life of many ailing coal-fired plants while ramping up the construction of renewables. Asset managers and capital allocators have a responsibility, in line with the policy framework set by the government, to ensure that South Africa’s just transition is being debated, discussed and implemented. We will have to allocate capital where we see the best possible outcomes from both an environment and social perspective.

Goal seven of the United Nations’ 17 Sustainable Development Goals (SDGs) calls for countries to ‘ensure access to affordable, reliable, sustainable and modern energy for all’. And this means the mammoth task of transitioning the country from coal-fired to sustainable power while simultaneously increasing its total electricity generating capacity. This offers a compelling backdrop for a discussion on the types and level of investment required to enable a just transition to a green economy.

The South African Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) has been around for more than a decade. Bid windows one through four resulted in 6400MW of ‘clean’ installed capacity at just over R200-billion. Bid windows

five and six are currently underway to secure 5000MW of installed capacity over the next two years. Further bid windows will follow as SA needs to install around 5000MW per year for at least seven or eight years. We are talking about capital investments of R100billion or thereabouts per annum into gas, solar, wind and other renewable alternatives. Investments in distribution infrastructure are also desperately needed.

Gas makes an interesting appearance in the latest bid windows as an important contributor to South Africa’s energy future and just transition. The Minister of Energy and Resources Gwede Mantashe views investments into gas as non-negotiable despite these being out of favour in the net-zero context. Gas is seen as a cleaner alternative to coals, but only just.

Another major bugbear is that allocators of capital find it incredibly difficult to determine what constitutes a green investment. A wind farm generating 500MW of electricity ticks all the boxes, but what about the 150kms of electricity transmission infrastructure needed to get this clean energy to the nearest town? Internationally, work is progressing on a green finance taxonomy that helps asset managers and project owners to understand what sort of investments constitute a green investment. To transition to a green economy, we will need consensus around what can be classified as green.

South Africa’s national infrastructure plan is a good starting point for domestic capital allocators on their journey to green economy outcomes. It sets out concrete steps and timelines for energy, transport, ICT and water investments that align with the ambitious goals in the national development plan. However, finding the investment for these plans requires an exemplary working relationship between the government and the private sector and may demand a bolder approach by the regulators. For example, why put a 100MW cap on independent power producers? A better ‘play’ is allowing the private sector to build projects as large as they can source funding.

Sanlam Investments is proud to be actively involved in the transition from a high carbon-intensive economy to a greener economy and will continue to lead in this area. We do, however, advocate for a just transition that weighs the social impact of each investment decision in addressing inequality, poverty and unemployment.

south africa’s national infrastructure plan is a good starting point for domestic capital allocators on their journey to green economy outcomes.”

What is Impact Investment?

Impact investments are defined by the deliberate intention to generate positive, measurable social and environmental impacts while generating a financial return.

It differs from the traditional investment approach in that it is not solely focused on financial gain.

Does Impact Investment deliver lower ROI?

The trade-off myth between impact and financial return persists in spite of the sector growing into a sophisticated investment and risk management approach.

Today a large body of academic research argues in favour of a holistic set of impact factors that actually enhance investment selection and lower overall portfolio volatility.

In the long run, impact investing is able to deliver market-rate returns.

Why should you choose Impact Investment?

This type of investing allows you to signal your commitment as a responsible investor without giving up returns.

It offers diverse and viable opportunities for the modern investor and continues to enjoy an ever-growing demand in the marketplace at both a private and institutional level.

Who else is making Impact Investments?

• Fund Managers

• Development finance institutions

• Diversified financial institutions and banks

• Private foundations

• Pension funds and insurance companies

• Family offices

• Individual investors

• NGOs

• Religious institutions

What is the Novare South Africa Impact Fund?

In early 2020 Novare Impact Investment Partners was established to manage the Novare South Africa Impact Fund.

It targets three sectors across the African continent:

1. Agriculture

2. Manufacture

3. Infrastructure

Reasons to invest:

• Measurable, deliberate impact objectives –delivered with each investment.

• En-commandite partnership structure –investors account to their respective tax status.

• Targeted IRR of CPI + 12%.

• Level 1 BBBEE Contributor - Black managed private equity Impact Fund with a highly experienced investment team

• Strong pipeline - including some well-advanced projects.

• Diversified investment portfolio - a blend of typically low risk real assets projects and highreturn propositions

• Support government initiatives - targets in similar sectors to assist in accelerating economic growth.

We are still fund raising!

Please get in touch with us if you would like to find out more about the n ovare s outh a frica i mpact fund.

Who is Novare?

Founded in 2000, Novare is a predominantly black-owned and truly diverse provider of investment solutions that has consistently realigned itself with the market by successfully evolving investment products to meet challenges and seize opportunities, making and impact for its investors and communities it operates in.

What do we believe?

We consider deliberate impact a key driver in maximising value for investors and enhancing the long-term sustainability of portfolio entities.

For us, impact has become a mindset embedded in how we invest and deploy capital, to deliver total value creation.

Our aim is always to unlock economic growth and employment opportunities wherever we are, and continuously strive to create sustainable prosperity, harmony, and environmentally friendly outcomes.

How long has Novare been Impact Investing? Novare has always had a strong focus on ESG and total value creation ethos.

Having deployment much of our early property funds while taking into account a host of other outcomes beyond just financial investment returns, we proved that deliberate social and environmental outcomes did not come at the cost of returns.

In early 2019 we took a strategic decision to position the Novare group of companies as an active impact investor.

How has this benefitted our investors?

The benefit for investors has been a portfolio of quality assets that were developed under budget, are run efficiently, and have proven to be resilient in subsequent tough market conditions.

How has this benefitted our communities and the environment?

We continue to focus on the UN’s 17 Sustainable Development Goals 2030, primarily those aimed at ending poverty, protecting the planet, and ensuring prosperity for all.

Established in 2000, Novare is an investment solutions provider with operations across the African continent.

Our solutions range from Real Estate Funds, Impact Investing Funds, Multi Managed Funds and Implemented Investment Consulting across a range of asset classes.

We generate positive returns and create long term value for our clients while positively impacting the communities in which we invest and operate.

Novare is a proud Level 1 BBBEE contributor.

For info contact us on:

Johannesburg (HO) on +27 (0) 11 447 9605, or our Cape Town Office on +27 (0) 21 914 3944.

You can also get in touch with us via info@novare.com

The Global Impact Investing Network puts the global ESG (Environmental, Social, Governance) or Impact Investing market value at US$715-billion. For an industry in its infancy, its growth has been exponential. And on the African continent, South Africa is leading the charge. The most recent African Investing for Impact Barometer corroborates this. South Africa was found to be the country with the largest amount of fund assets being dedicated to at least one Investing for Impact (IFI) strategy. The proliferation of the sector brings indispensable opportunities for green small-and-medium-sized enterprises (SMEs) to access funding and become a key driver of change.

This impetus is fuelling SME financier, Business Partners, to continue its focus on providing finance for South African SMEs who demonstrate a commitment to reducing their carbon emissions, adopting renewable energy technologies and enhancing the environment. This focus expands the company’s commitment to green businesses following its establishment of a successful R300-million Green Fund in 2015.

Business Partners Limited is a specialist risk finance company for formal small and medium owner-managed businesses in South Africa and selected African countries. The company provides financing from R500 000 to R50-million.

“Our focus on green businesses forms part of a vision that we as a company have been invested in for several years. With the funding we provide, we have the opportunity to drive the country’s broader sustainability goals at a grassroots level by supporting small business as an important cornerstone of the South African economy. Through our green business focus, we hope to create a supportive and enabling environment for green entrepreneurship,” commented Mark Paper, Chief Operating Officer at Business Partners.

Green industries considered for finance include the energy, waste and water sectors. Financing applications for SMEs that meet several green criteria are granted access to loans between R500 000 and R50-million. Beyond those industries, Business Partners also has a particular interest in companies that can provide innovative solutions to the growing needs for a sustainable world.

Paper comments: “The calibre of applications that we have reviewed over the last year has impressed and inspired us. Already, we are seeing a number of South African SMEs using the finance they have accessed to build companies that we believe represent the future of business. What aspiring entrepreneurs must realise is that in an evolving world with challenges that are unique to this era but that will influence the future, there is a strong business case for sustainable solutions. Entrepreneurs who understand this and build their businesses around sustainability will be well-positioned for long-term success.”

Catering to small business owners who aspire to join the movement towards a greener business environment, Business Partners has established a technical assistance programme, offering technical assistance loans at zero interest, which can support SMEs in adopting green processes and policies. Mentorship by a team of external experts is fundamental to this initiative and is used as a means by which to educate and empower emerging entrepreneurs to enter the space.

As a result of the finance and support provided, Business Partners has seen its green SME clients demonstrating high levels of proactivity. Many have adopted solar energy to reduce their carbon emissions and mitigate the impact of loadshedding. Others have found creative ways to improve their water efficiency and adopt more effective recycling measures. These proactive decisions point to a promising future for the green SME sector in South Africa.

The green finance focus team is working fervently towards expanding its reach across South Africa and aims to gain significant ground by the end of 2023. The focus of Business Partners extends beyond the institutional character of emerging SMEs – the ultimate objective is to help boost the economy and tackle the country’s record-high unemployment rate.

Paper concludes: “The bigger picture is what we always bear in mind. And we’re more determined than ever to collaborate with local and international partners that have similar goals, and with public sector initiatives such as The Green Fund, which are aimed at supporting the South African transition towards a greener economy.”

Through our green business focus, we hope to create a supportive and enabling environment for green entrepreneurship”

The bigger picture is what we always bear in mind. and we’re more determined than ever to collaborate with local and international partners that have similar goals, and with public sector initiatives such as The Green fund, which are aimed at supporting the south african transition towards a greener economy.”

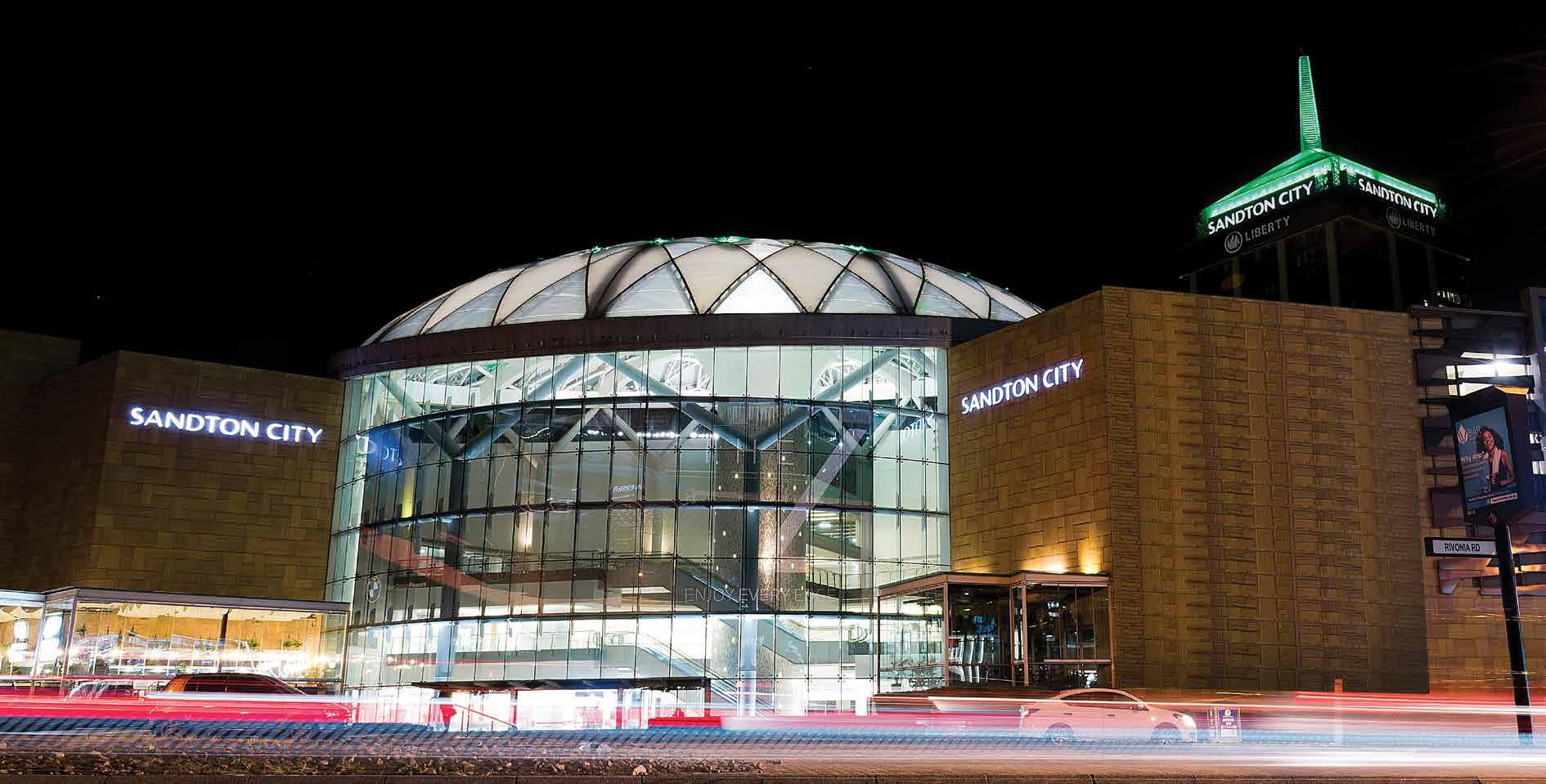

Responsible business is at the heart of what we do.

Through our dedication to environmental excellence, we endeavour to lead the way forward by setting and achieving our ambitious environmental sustainability targets:

• We remain focused on our Net-Zero 2030 aspirations - Net-Zero waste ready during 2022 to attain certification in 2023, Net-Zero water (2025), Net-Zero carbon (2030).

• Our retail assets are green star rated, an SA industry first.

• We have established baseline data on water, energy and waste metrics to constantly provide a true north on improvements.

• We give preference to procuring products, materials and services that minimise the harmful effects on the environment arising from their production, transportation, use and disposal.

We strive to make a positive and transformative impact on sustainable socioeconomic and community development.

We are committed to good governance leading the Company to embed an ethical culture and ensure effective control, solid performance and legitimacy.

We remain grounded in property fundamentals and committed to executing our business in a sustainable manner, remaining adaptive as we rebuild for growth.

stakeholders.

SMART Spaces: We maximise insight obtained from smart data solutions, with opportunities to be delivered alongside traditional experiential strategies.

Good Spaces: We create robust assets that will benefit generations, allowing for agile and adaptable environments that align to net-zero goals.

Interactive Spaces: We have a vision to create vibrant and diverse spaces with experience at their heart.

Safe Spaces: We drive a clearly defined mall strategy that ensures the mall environments hold the highest standard of safety and security for tenants and shoppers.

Waste mismanagement can significantly impact health and the environment in an industrial economy. The large quantities of waste currently produced, coupled with the inability to break it down efficiently, means the drive to a greener economy is progressing at a much slower pace than what is needed.

Yet waste management is one of the leading sectors expected to drive South Africa’s green economy, making efficient waste management solutions a critical imperative.

The ultimate goal is Net-Zero waste status. This means ensuring waste avoidance, resource recovery, retrieval of recyclable materials before they enter the waste stream, reusing and recycling waste products, and the treatment and disposal of these. Products should be designed with materials that can be recycled and have reuse value through the waste value chain.

The journey to Net-Zero waste - reducing, reusing, and recovering waste streams to convert them into valuable resources with zero solid waste sent to landfills is aspirational.

A mind shift is required to achieve environmental sustainability, and commitment and boldness to achieve Net Zero. There is international scientific consensus that to prevent climate change, greenhouse gas emissions need to be as close to zero as possible. Liberty Two Degrees (L2D) is doing its part to contribute to the prevention of climate change. It aims to achieve Net Zero waste readiness by the end of 2022. Through the appointment of a waste partner in 2021, L2D, the real estate investment trust (REIT), made significant improvements to its waste management practices across its portfolio. It almost doubled its waste diversion rates, increasing from 35% to 75% by weight. This equates to

2 393 tonnes of recycled waste and includes 314 tonnes of organic waste.

Liberty Two Degrees achieved this by implementing innovative technologies at its properties, including waste composters, recycling hubs and recycling units. Once optimal levels of recycling, composting, and waste diversion from landfill is achieved per site, alternative waste treatment processes will be used on residual waste. This includes creating a circular economy for waste through the potential use of waste-toconcrete and waste-to-energy initiatives.

We can achieve zero waste and sustainable waste management through gradual improvement in production efficiency and consumer waste awareness. The installation of reverse vending machines at shopping centres such as Sandton City provides an innovative solution for the collection of waste at source and is a way for shoppers to tangibly contribute towards recycling and diversion from landfills tangibly. It has created public awareness and has provided incentives for waste management practices.

It’s clear that waste management is critical to the global transition to a low carbon and sustainable economy that can create large numbers of green jobs across many sectors of the economy. The way waste is produced, consumed and disposed of needs to be revisited to ensure an efficient and effective transition to a sustainable green economy.

Waste management is one of the leading sectors expected to drive south africa’s green economy, making efficient waste management solutions a critical imperative”

Sanlam Investments is committed to making a real, sustainable difference to its investors, society and the environment we live in. Our alternative investments are the future of investing, offering unique growth solutions with competitive returns. We’re devoted to making a sustainable impact, that’s why we’ve invested R2,25 billion of our own capital to help meet the needs of a wide range of our investors and beneficiaries. Our impact investment focuses on job creation, reducing inequality, and looking after the climate.

Our private market expertise includes:

The hydrogen economy needs a highly specialised workforce

The hydrogen economy will create several job opportunities throughout its value chain.

With the world turning to countries with optimal renewable energy resources to provide clean energy for the future, South Africa can revolutionise its economy by producing and supplying green hydrogen to meet the global demand.

Growth in the hydrogen sector will result in a significant number of new job opportunities for existing employees in the Oil & Gas sector and unemployed individuals, by re-skilling and upskilling training interventions and efforts.

Viren Sookhun, Managing DirectorGiven that labour and human resources are going to be the most critical part of growing the hydrogen and renewables economy, the value of using a TES provider lies in their comprehensive solutions:

Contact us to find the right solution for your renewable energy project.

087 135 8033 | info@oxyon.co.za | www.oxyon.co.za

By supporting 10 emerging farming businesses, we’ve helped create 117 new jobs in rural communities.

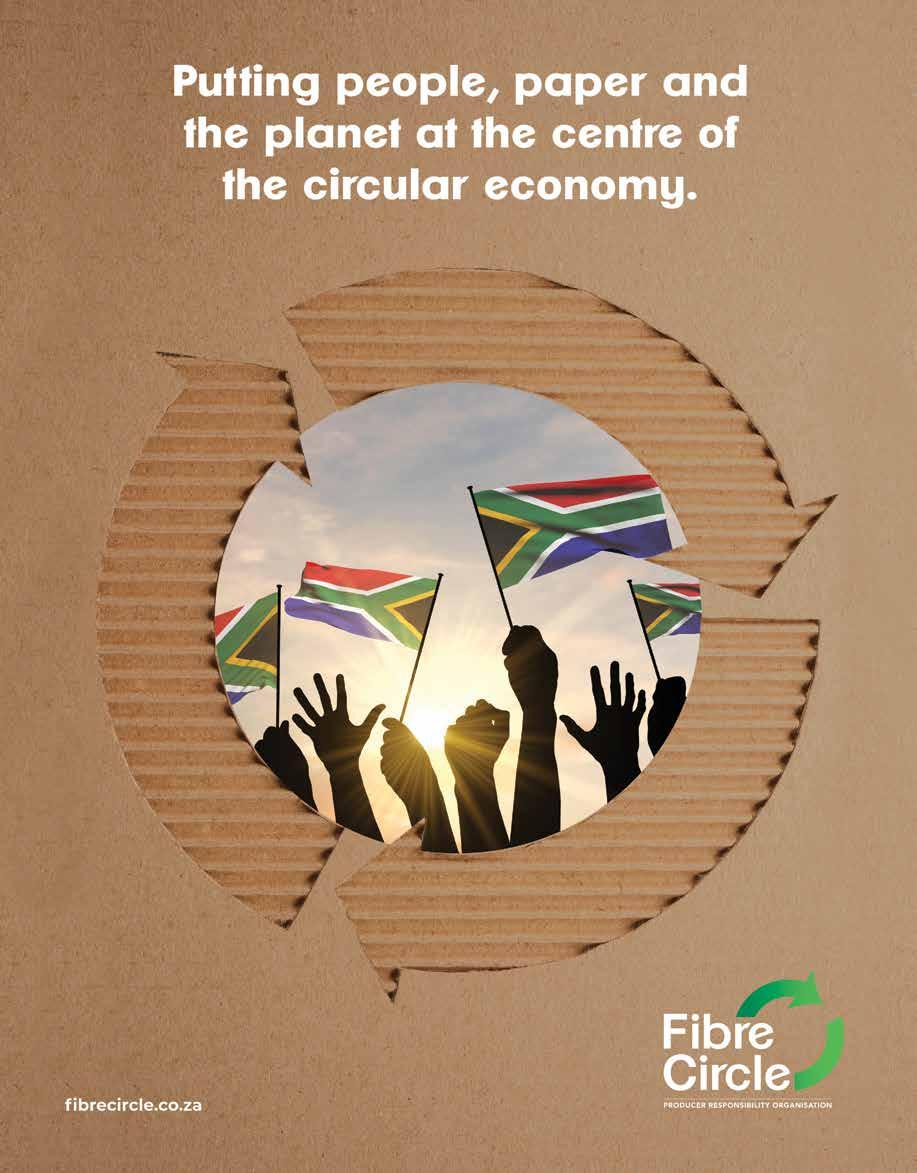

Nedbank is leading the change towards a low-carbon, resource-efficient economy while maximising social impact through its Green Economy CSI Strategy. We’re investing millions into developing jobs and emerging enterprises in four key sectors: agriculture, energy, water and waste. Our commitment to the green economy and drive to empower communities bear testament to how we see things not as they are, but as they should be.

#greenisthenewgold

By Takalani Netshitenzhe, Executive Director of External Affairs, Vodacom South Africa

By Takalani Netshitenzhe, Executive Director of External Affairs, Vodacom South Africa

Business success should not come at a cost to the environment. This principle guides Vodacom and has informed our commitment to halving our environmental impact by 2025 as we pursue our purpose to connect the next 100 million people. This purpose is underpinned by a strong Environmental, Social, and Governance framework that aligns with both government’s National Development Plan for creating a resilient Green Economy and with the United Nations (UN) Sustainable Development Goals (SDGs).

This alignment is important because businesses cannot operate in a vacuum, independent of national and global goals for a better future. Collaboration is vital if we are to bring to life the vision of a Green Economy, which is about establishing sustainable, ethical ways of working that prioritise people and the planet. The 17 SDGs the UN has put forward serve as guidelines for which targets society must prioritise to make this vision a reality. For our part, Vodacom focuses on eight of the SDGs where we believe we can make the most impact.

Through numerous ongoing projects, initiatives, and innovative digital solutions, we’ve woven the following SDGs into the very fabric of our purpose-led operations: SDG 3 Good Health and Well-Being, SDG 4 Quality Education, SDG 5 Gender Equality, SDG 8 Decent Work and Economic Growth, SDG 9 Industry, Innovation, and Infrastructure, SDG 11 Sustainable Cities and Communities, SDG 13 Climate Action, and SDG 17 Partnerships for the Goals.

To shape the kind of responsible, future-ready citizenship needed for tomorrow, we should focus our efforts on our youth, which is what Vodacom’s work at Early Childhood Development (ECD) centres across the country does.

The sad reality in many communities where these

ECDs are located is that people are not sure where their next meal is coming from. With the basic right to food not being met, other rights, such as education, often fall by the wayside. Adressing food security in a way that preserves the planet will have the knock-on effect of bettering educational outcomes. This is why our ECD Greening Project prioritises education around sustainable farming practices. It addresses the short-term goal of reducing food gaps in these communities and the long-term goal of creating sustainable food security that, in turn, supports children attending school. This is a shining example of how we uphold multiple SDGs – ensuring Good Health and Well-Being, prioritising Quality Education, shaping Sustainable Cities and Communities, and accelerating Climate Action.

Partnerships for the Goals is another SDG we put at front and centre of this project, which we rolled out in collaboration with local Non-Profit Organisations (NPOs) and private businesses at eight ECD centres within our education ecosystem. We have planted hardy and nutritious vegetable gardens and fruit trees to supply the children with healthy food through this project.

Complementing this, we have run educational workshops and training for educators and parents on sustainable farming practices, which is knowledge that can filter down to the children and other community members. Each ECD centre also has solar-energy panels and sustainable rainwater-collection tanks installed to create a space that reduces the environmental impact and sustains learners.

Education is bound to another aspect of the Green Economy – imparting digital-first skills of the future to learners, as these young minds are the ones who will be innovating, through technology, to further progress on the sustainable-development front. This also ties into SDG 8, which is about delivering decent work

opportunities to stimulate economic growth. The global shortage of digital skills required for this future must be addressed. Again, this presents an opportunity for businesses like ours, already entrenched in a digitally transformed way of working, to step up to the plate.

Vodacom South Africa invested R472 million in continuous skills development in the last financial year to help bridge this digital-skill divide. We have taken our commitment a step further through targeted training initiatives, such as the Women Farmers Programme in South Africa, which we launched in 2018 in partnership with UN Women and South African Women in Farming. Since inception, we have trained more than 1 600 female farmers in ICT skills. This upskilling, in turn, contributes to food security

through sustainable farming practices, thus aligning with SDGs 8 and 11. Gender Equality, the fifth SDG, is also prioritised in programmes like this, empowering women within communities to participate meaningfully in our economy.

Our Code Like a Girl programme is equally focused on promoting gender equality, alongside the goal to upskill our youth for future readiness in the Green Economy. We have trained 1 672 young girls on coding skills to date, further entrenching our work towards SDGs 4 and 8. Nurturing industry and innovation through infrastructure is yet another SDG we focus on in the context of learning by equipping schools in rural areas of the country with connectivity and devices they need, driving our goal to promote inclusive access to Quality Education.

I have cited former President Thabo Mbeki’s quote several times in the past. Still, it bears repeating: ‘A global human society, characterised by islands of wealth, surrounded by a sea of poverty, is unsustainable’. The only way to achieve the shared global vision of an inclusive, equitable and sustainable Green Economy is to join forces.

As a major driver of the economy and a link between producers and consumers, the retail sector can promote sustainability throughout the supply chain, but need actionable policies to drive and track change.

Globally, retailers are facing increased pressure to address and help mitigate the ongoing climate crisis. As well as implementing changes in internal operations, retailers are uniquely positioned to promote sustainable practices amongst their producers, suppliers and consumers, helping to grow the green economy.

As one of South Africa’s leading retailers, Woolworths takes it environmental responsibility seriously. Over the past 15 years, it has put ambitious targets in place to meet its vision of being one of the world’s most responsible retailers. Woolworths’ Good Business Journey programme places sustainability at the core of the business and impacts everything it does. It focuses on improving eight key business areas, including energy and climate change, water, packaging and waste, and sustainable farming – all backed up with measurable targets. To achieve these, Woolworths collaborates with various stakeholders on their sustainability journey. Last year it launched its new Good Business Journey strategy and goals, named Vision 2025+, core to this vision is its commitment

to achieve net zero carbon impact by 2040, with a 50% reduction by 2030. Woolworths has adopted a science-based target for its direct operations and is working with suppliers to set their own reduction targets.

Woolworths recently announced a South African retail first – the rollout of electric delivery vans to more than 70% of its fleet over the next 18 months to service online purchase deliveries in Gauteng, Cape Town and Durban. The electricity to power these vans will be sourced where possible from renewable sources maximising the opportunity to utilise existing solar installations and additional chargers co-located at strategic Woolworths store locations.”

The retailer is also using renewable energy – both solar and wind-powered – at several stores and distribution centres. Woolworths currently has close to 200 stores utilising technology that enables energy efficiency. The retail giant aims to obtain all its energy from renewable sources by 2030.

As well as making environmentally responsible changes to internal operations, Woolworths is working with its producers and suppliers to help underscore green practices. Thirteen years ago, Woolworths recognised the importance of regenerative agriculture and launched its Farming for the Future programme, which today

includes more than 480 of its suppliers. The programme helps suppliers take a data-driven approach to farming, which supports the science-based management of farms as part of a wider eco-system. The programme now includes fresh and frozen vegetables, fruit, wine, long-life milk, fresh juice and horticulture suppliers.

As the climate crisis worsens, consumers increasingly demand that retailers enable them to make sustainable shopping choices. Woolworths is helping through its commitment to ensuring that all packaging will be either reusable or recyclable. The retailer has already taken significant steps to achieve this. More than 300 of its stores are plastic shopping bag free. Paper board packaging is being utilised for popular fresh produce, and numerous other products such as frozen veg and frozen pot sticker dumplings have shifted to recyclable packaging.

Ultimately, the only way to bring about meaningful, enduring environmental progress is for retailers to purposefully address their operational practices and to collaborate with stakeholders at every touch point in the supply chain. Through its Good Business Journey programme, Woolworths is positioning itself at the forefront of sustainability leadership, spurred on by its commitment to the planet and its future.

last year Woolworths launched its new Good Business journey strategy and goals, named Vision 2025+, core to this vision is its commitment to achieve net zero carbon impact by 2040, with a 50% reduction by 2030.”

Our Good Business Journey Vision 2025+ sets out Woolworths’ bold new strategy to achieve our sustainability goals and aspirations, working together with all our partners to create a better future for everyone.

Since its inception in 2007, our groundbreaking Good Business Journey programme has been the driving force behind our vision of Woolworths becoming one of the world’s most responsible retailers.

Last year, we took stock of where we stand on our sustainability journey and announced the company’s next set of ambitious Good Business Journey sustainability goals – Vision 2025+. We also launched our Inclusive Justice Initiative as a bold aspiration and vision of inspiring inclusive growth for all our people. These goals don’t only stretch our business to do more, but also encourage others to join us on our journey.

We cannot do this on our own – profound, sustainable impact and progress requires deliberate collaboration amongst all our stakeholders, including industry leaders, our suppliers, customers, employees, government, business and NGO partners.

Our new goals are broad-reaching and focus on three key areas, including a commitment to the environment, a commitment to a fully transparent, traceable and ethical supply chain, and caring for people, employees, customers and communities.

The Woolworths Group’s environmental and supply chain goals include, amongst

others, targets to achieve net zero carbon impact by 2040; for all energy to be obtained from renewable sources by 2030; to have a fully traceable and transparent supply chain by 2025; for all of our packaging to be reusable or recyclable; and for all our private label fashion and home products to be designed to be reused, repaired, resold or recycled by 2025.

Alongside these environmental targets, Vision 2025+ also spotlights the need to bring about societal change, made even more urgent by the impact of the Covid-19 pandemic. Through the Inclusive Justice Initiative, Woolworths is underscoring its commitment to being a diverse and inclusive business focused on enhancing a sense of belonging for our employees, customers and communities.

Achieving these goals is imperative to future-proof our business, making Woolworths more resilient and enabling agility as we adapt to inevitable change, and will have a positive impact on the environment and society in general. The meaningful impact on our business has already been significant: our Good Business Journey has had a cumulative financial impact of almost R2 billion in savings since its inception, and we have received global and national recognition for our sustainability achievements.

While these ambitious Vision 2025+ goals elevate Woolworths into challenging, yet exciting sustainability territory, we are confident they will inspire collaboration, creativity and problem-solving amongst all

our stakeholders to ensure the greater good of the planet and its people.

- Woolworths became the first major South African retailer to sign the UN Women Empowerment Principles.

- We have committed to ensuring our people receive a Just Wage and are investing R120 million over the next 3 years to increase the hourly base rate.

- 174% improvement in Woolworths Group energy productivity from a 2005 baseline.

- Over the past 19 years, Woolworths has contributed R7.2 billion to alleviate hunger in South Africa through sustainable and impactful initiatives aligned with the UN Sustainable Development Goal 2.

- 6 renewable energy installations across Woolworths Group to date.

- Just over 300 Woolworths stores are single-use plastic shopping bag-free.

- 100% of cotton and cocoa used in Woolworths private label products are responsibly sourced.

- One of the first retailers to partner with Eskom on a renewable energy sourcing trial.

- The first South African retailer to publish its first tier Fashion, Beauty and Home supplier list.

- Almost 60% of Woolworths debt is now ESG-linked after recently completing numerous sustainability linked refinancing agreements with various South African banks.

The African Union has called the Blue Economy the ‘New Frontier of African Renaissance’, and with good reason.

As the United Nations Economic Commission for Africa has noted in a policy handbook for the Blue Economy, 38 out of the 54 African states are coastal. More than 90 percent of the continent’s imports and exports are conducted by sea, and some of the most strategic gateways for international trade are in Africa.

Maritime zones under Africa’s jurisdiction total about 13 million square kilometres, including territorial seas and approximately 6.5 million square kilometres of the continental shelf.

There is, as the UN Economic Commission for Africa puts it, ‘another Africa under the sea’.

These marine resources, including freshwater bodies and oceans, offer significant economic opportunities. Yet governance of aquatic ecosystems, goods and services is under-developed and underresourced, resulting in degradation of ecosystems and loss and waste of valuable resources.

As we marked World Oceans Day on June 8, 2022, it became increasingly clear that we must work together across the public and private sectors, and civil society, to make sustainable decisions to protect our marine ecosystems for future generations.

The issue of packaging waste features high on the list of priorities. While food and beverage packaging are an important part of our modern lives, the world has a packaging problem, which we, as Coca-Cola Beverages Africa (CCBA), together with The Coca-Cola Company, have a responsibility to help solve.

We have committed to investing in our planet and our packaging to help make the world’s packaging problem a thing of the past, working in partnership with The Coca-Cola Company, which launched a sustainable packaging initiative called World Without Waste in 2018.

We have the following goals in Africa:

• Help collect an equivalent of a bottle for every one we sell by 2030

• Focus on making all our packaging 100% recyclable by 2025

• Have 50% recycled content in our packaging by 2025, and

• Make 25% of our packaging reusable by 2030

We continued to make progress in 2020, despite the challenges from the Covid-19 pandemic. Plastic waste collection and recycling have bounced back remarkably from the disruption caused by Covid-19 restrictions, and CCBA achieved a 58% recycling rate for FY2021. The recyclability of our packaging is already at more than 95%, tracking ahead of the global target of 100% by 2025.

If we are to create genuine circular economies, where waste is minimised and reuse of materials is maximised, the starting point is understanding that our packaging materials have value. Importantly, we need to find ways to capture that value to prevent our packaging from becoming waste at the end of its life.

We are improving the recyclability of our packs through a strong emphasis on shifting to homogeneous and clear bottles and have made significant progress on this already. In addition, more than 20% of our revenues are already coming from returnable or refillable packs. We are strategically looking to increase the use of homogenous returnable packs in our portfolio – which has the added benefit of being environmentally friendly and decreasing the impact on our oceans.

Our biggest challenge when it comes to recycling is accelerating the collection of plastic bottles to increase polyethylene phthalate (PET) bottles feedstock for recycled PET supply to enable higher recycled content in our bottles. Consumer behaviour and accountability also remain a challenge. We encourage all consumers of our beverages to dispose of the packaging in an environmentally responsible manner, so that it can be collected and recycled for reuse.

In South Africa we are at 17% recycled PET content, and we have 17% recycled PET content in 2-litre bottles in Namibia, Mozambique, Botswana and Zambia. One example of how we are getting communities involved is in Kenya. Here we leveraged our partnerships to launch the Recycling PET Bottles initiative, getting 400 schools to participate in the collection of PET bottles. More than 90 000kg, or 4.5-million PET bottles, were collected and recycled due to this initiative.

Partnership across business, government and civil society is fundamental to scaling solutions and critical to achieving a circular economy. We remain committed to helping drive collective action, working with stakeholders, suppliers, non-profits, communities, customers and industry peers to invest in recycling innovation, facilities, organisations and initiatives.

In Africa and other developing markets, there is an additional layer of complexity in that the market for recycled plastic in many countries is too small to support investment in recycling plants. Yet, the rules governing the movement of plastic waste across borders inhibit the economies of scale needed to achieve optimal rates of recycling, limit waste going to landfill, and create employment in the circular economy.

Engagement with various governments’ International Trade Administration Ministries is critical to reviewing and revising policies guiding the movement of recyclable waste across countries through regional economic platforms such as the Southern African Development Community (SADC) and East African Business Council (EABC). CCBA remains committed to broader stakeholder engagement and collaboration to enable an efficient regional recycling industry.

With the right regulatory environment to enable higher rates of collection and recycling and continued commitment and collaboration across industry, across countries and with all interested partners, a World Without Waste is possible, protecting the marine environment and allowing for the sustainable development of Africa’s Oceans Economy.

Partnership across business, government and civil society is fundamental to scaling solutions and critical to achieving a circular economy.”

By Spencer Eckstein, Director of Business Development, Ukwazi

By Spencer Eckstein, Director of Business Development, Ukwazi

The terms ‘circular’ and ‘green’ are often used interchangeably when speaking about the economy. It is, however, important to distinguish between the two. The UN Environment Programme (UNEP) defines a green economy as ‘one that results in improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities’. A circular economy entails the recycling and reuse of materials and components, combined with the utilisation of sustainable inputs, such as renewable energy. While mining has been perceived, and rightfully so, as relatively linear from a value-chain perspective, several sector players have made deliberate efforts to capitalise on the benefits of a circular economy. Despite this, there are misconceptions surrounding mining companies and the role they play.

Guiding the world to a low-carbon future will require more minerals and metals rather than less. This was reiterated at the recent 2022 African Mining Indaba. Alarmingly, sector players anticipate a significant production deficit between 2030 and 2040, yet a steady supply of resources will be needed to achieve net-zero goals. Pertinent examples include metals that contribute to alternative and greener energy sources, such as battery metals and platinum group metals (PGMs), which underpin highly sought-after hydrogen fuel cell technology.

The Russia-Ukraine conflict, and the geopolitical shift to be less reliant on Russian commodities, present significant green opportunities for South Africa. Our country currently supplies 80% of the world’s platinum and 40% of all palladium. Going forward, mining companies will need to leverage strategic supply gaps and be selective in who they supply to if they are

to guarantee the sustainability of future end-products.

As mining is one of the world’s biggest waste generators, sector players are well-positioned to reimagine and redesign how they generate and capture economic value along their supply chains. The construction industry can use the waste rock to construct roads. Sludge from acid rock drainage treatment can be sold commercially for use in pigments. There are many more ways waste can be repurposed, such as the recycling and reuse of vehicle parts and other bi-products and the rehabilitation of mines into viable renewable energy or agricultural sites. Visibility and collaboration along supply networks will ensure that all value is adequately extracted downstream.

• Myth 3 – Mines will always need large amounts of water to operate

An obvious area where mines can contribute

to a feasible circular economy is the efficient use of natural resources such as water. According to the African Circular Economy Alliance, mining is the second-largest water user in South Africa, after agriculture. But, what if little to no water was required to extract resources? While this seems almost impossible, the solution could be the creation of smart mines, where sustainability is built into the initial stages of the overall design process. In addition, improvement in water treatment technologies and the use of renewables, particularly solar for electrolysis, will help to create hydrogen for use on mines by splitting water, thus releasing oxygen instead of carbon-based emissions.

Mining has many facets that can drive circular economy thinking, which is also being driven by investor and consumer expectations and increasing regulatory pressures. By embracing the principles around smart mines, the mining sector can successfully build a resilient system that is good for business, stakeholders and the environment.

a circular economy entails the recycling and reuse of materials and components, combined with the utilisation of sustainable inputs, such as renewable energy”

The Development Bank of Southern Africa (DBSA) is a South African state-owned enterprise and a leading development finance institution working across the African continent. Established in 1983, its primary purpose is to promote economic development and growth, improve the quality of lives of people and promote regional integration through infrastructure finance and development.

At the core of its mandate, the DBSA seeks to play a catalytic role in delivering developmental infrastructure in South Africa and the rest of Africa. The Bank’s focus areas are the energy, water, transport and telecommunications sectors, with a secondary focus on health and education. The DBSA is actively involved in all phases of the infrastructure development value chain, from planning, preparation and

financing to implementation, delivery and maintenance.

The ultimate vision of the DBSA is to achieve a prosperous and integrated resourceefficient region, progressively free of poverty and dependence. Through infrastructure development, the Bank makes a meaningful contribution towards people’s social and economic upliftment while also promoting the sustainable use of scarce resources. The promotion of regional integration through infrastructure is a key pillar of Africa’s growth agenda. The DBSA plays an integral role in support of this objective by actively participating in programmes such as the South African Renewable Energy Independent Power Producer Programme (REIPPP) and the Programme for Infrastructure Development in Africa’s Priority Action Plan.

The ability to mobilise climate finance at scale requires innovative approaches such as the DBSA’s Climate Finance Facility

Since its establishment in 1983, the Development Bank of South Africa (DBSA) has rapidly advanced to become one of the crucial catalysts in the transition to a green economy.

One of the greatest challenges faced by many governments is how to green the current economy so that it remains resilient and globally competitive. The UN’s Sustainable Development Plan has also put pressure on countries, including South Africa, to respond to global goals and targets by 2030. South Africa is targeting clean energy, low-carbon transport, smart water, the circular economy and smart agriculture. But to do so requires substantial finance and depends largely on the ability of development finance institutions such as the DBSA to leverage available resources to attract private investment.

The DBSA works across sub-Saharan Africa to promote economic and social development by sourcing and providing mostly infrastructural financing. Climate change has become increasingly important, and as such, one of its priority focus areas is climate finance. According to Olympus Manthata, DBSA Head of Climate and Environmental Finance, the ability to mobilise climate finance at scale requires innovative approaches such as the DBSA’s Climate Finance Facility (CFF). This climate-related lending facility is a first in Africa and is based on the ‘Green Bank’ model.

The CFF uses a blended finance approach, combining public finance with private finance to address market constraints and fill market gaps. These funds are for private projects that have potential but cannot currently attract market-rate capital at scale without credit enhancement. The DBSA bridges this gap and catalyses private funding by co-funding alongside developmental and private sector financial institutions, with the aim to achieve a 1:5 leverage.

The DBSA’s initial debt funding of R2-billion is a rand-denominated facility directed purely at co-funding private sector projects in South Africa,

eSwatini, Lesotho and Namibia — countries in the common monetary union. It brings credit enhancement products in the form of a first loss or subordinated funding and tenor extension of up to 15 years, combined with concessional funding provided by the UN’s Green Climate Fund (GCF).

The DBSA, with support from the GCF, is currently developing various climate facilities such as the National Water Reuse programme, which it aims to finalise in the last quarter of this financial year. The DBSA will thereafter submit a funding proposal for US$150-million to the GCF for the concessional part of the finance facility. The bank aims to contribute significant co-financing for further credit enhancement.

“The package we are designing aims to make water reuse projects bankable. Water tariffs often limit how water is costed. Our solution is to target new and existing wastewater treatment plants that either need to be upgraded or expanded, and increase municipalities’ awareness of how to treat effluent water for reuse,” said Manthata.

“We are also taking a comprehensive approach because there is a tendency to look at such projects in isolation. However, municipalities generally experience the same challenges, and there are many lessons and benefits for all that partake in the programme. And, with a single programme in use, transaction costs will lower.”

This proved to be the case with the renewable energy programme once financiers became more familiar and comfortable with the conditions of the contracts.

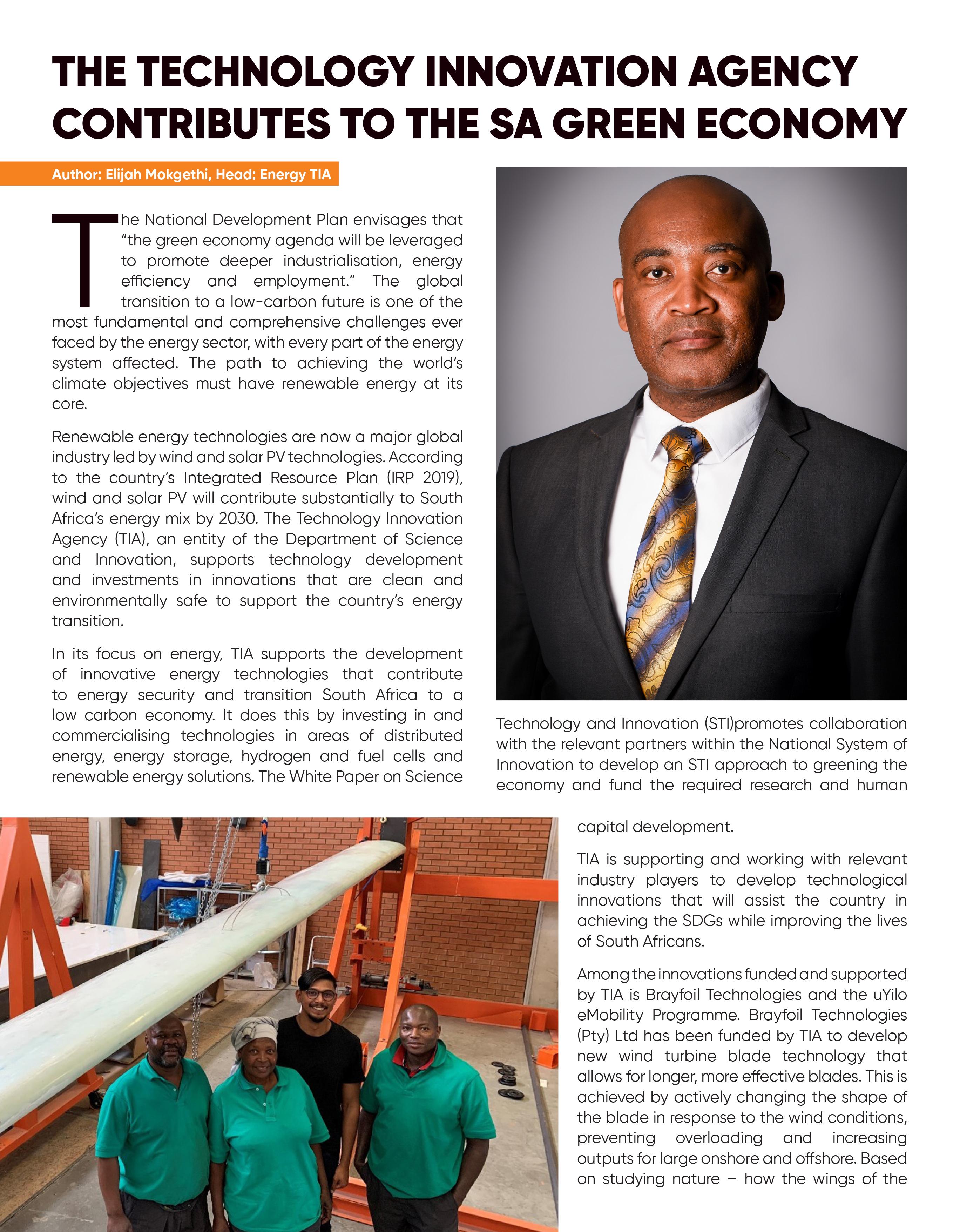

About 56% of South Africa’s wastewater plants are in poor or critical condition, said Manthata. The DBSA believes that it will take between 20 and 30 years to correct this, but again, it will require public and private sector buy-in. “If we can change the negative perceptions around water