ANNUAL REPORT 2021

INTRODUCTION

The Utah Governor’s Office of Economic Opportunity prepares an annual report for the Utah Legislature and the public. The report — published annually on October 1 for the previous fiscal year — details the programs, initiatives, and events for which the office is responsible. The 2021 Annual Report represents the period from July 2020 to June 2021, known as Fiscal Year (FY) 2021.

In 2020 and 2021, in addition to its regular work, the office managed numerous programs and initiatives as part of the state’s response to COVID-19. This report’s COVID-19 Response section includes the office’s coronavirus pandemic efforts during the 2021 fiscal year.

In its 2021 session, the Utah Legislature implemented numerous changes to Utah’s economic development initiatives outlined in H.B. 348. Most notably, the office’s name changed from the Governor’s Office of Economic Development to the Governor’s Office of Economic Opportunity. The office retired the GOED nickname and will use Go Utah moving forward.

ABOUT US

Under Gov. Spencer J. Cox’s direction, the Utah Governor’s Office of Economic Opportunity provides resources and support for business creation, growth, and recruitment. It also drives increased tourism, film production, outdoor recreation, and mixed martial arts in Utah. Utilizing state resources and private sector contracts, the office administers programs in economic areas that demonstrate the highest potential for development and the most opportunity for Utahns.

The office functions as a government-to-industry interface.

Learn more at business.utah.gov.

DAN HEMMERT Utah Governor’s Office of Economic Opportunity Executive Director

DAN HEMMERT Utah Governor’s Office of Economic Opportunity Executive Director

801-538-8769 danhemmert@utah.gov

EXECUTIVE DIRECTOR’S MESSAGE

June 2021

I’m six months into my role as executive director of the Utah Governor’s Office of Economic Opportunity. In that time, I’m proud that our office has engaged and proactively supported and administered Gov. Cox’s vision of economic opportunity for all Utahns.

The 2021 legislative session marked several changes for our office: a name change, a new Unified Economic Opportunity Commission, and modifications to advisory boards and committees (see H.B. 348). The state has wisely refocused its economic development priorities and reinforced communication and collaboration across the public and private sectors to ensure that Utah continues to be economically sound and prosperous.

Our office has a reputation for getting things done. That’s because we’re fortunate to work with dedicated, talented public servants who come to work every day to support Utah businesses and entrepreneurs. We’re focused on innovation in the state and continue to provide opportunities for homegrown companies to excel.

Utah’s business-friendly environment, entrepreneurial attitude, and sense of community — combined with a willingness to collaborate — continues to set the state apart and position us as economic leaders in the country and worldwide. We eagerly anticipate the development opportunities that await our great state and pledge to do our absolute best to deliver economic growth to all Utahns.

Sincerely,

Dan Hemmert

Dan Hemmert

VISION & MISSION

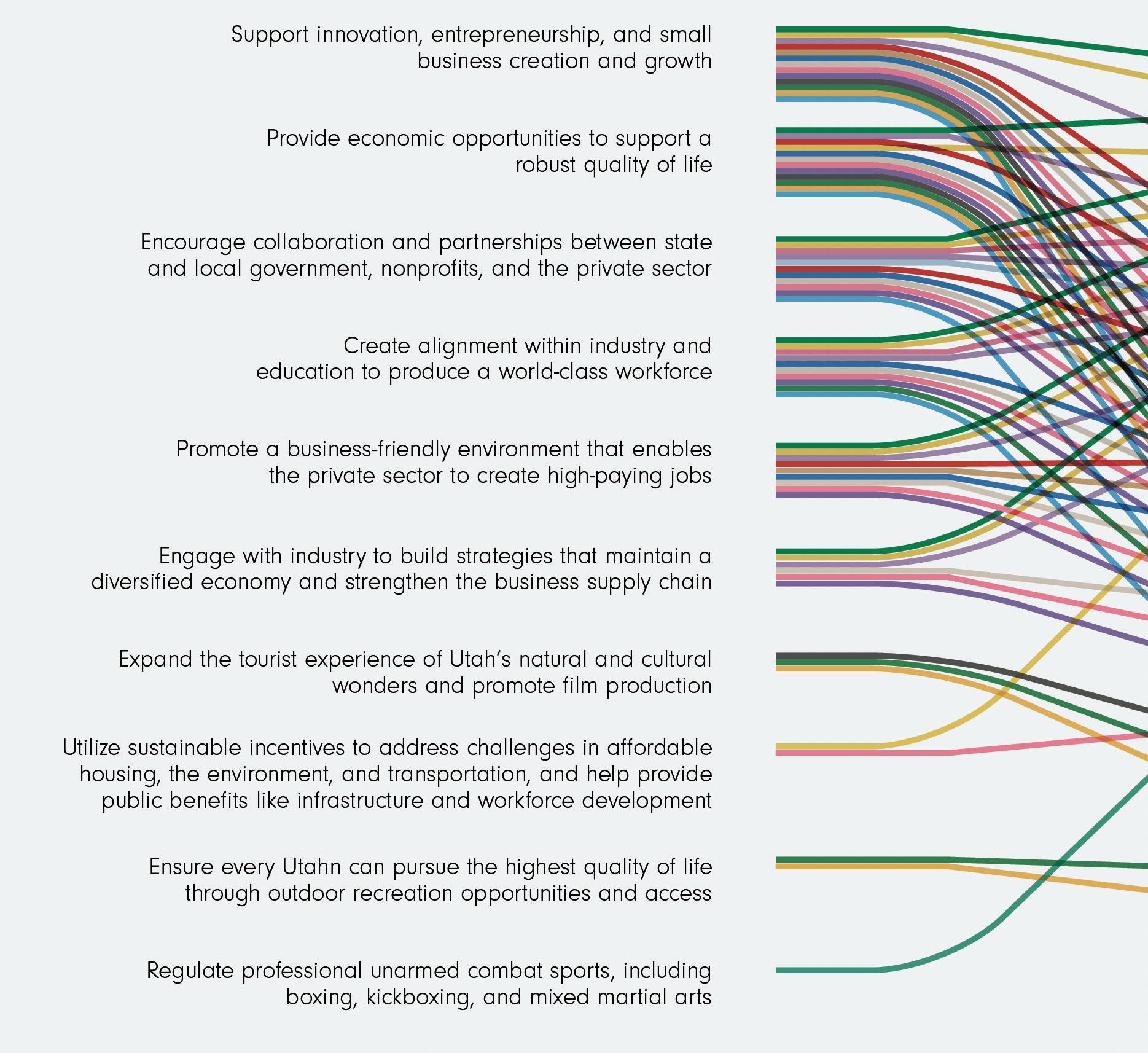

HOW WE ACCOMPLISH OUR VISION AND MISSION

What we do and the Go Utah teams and initiatives involved in the work

WHAT WE DO

VISION To create the world’s best economy and quality of life.

MISSION We cultivate economic prosperity.

UNIFIED ECONOMIC OPPORTUNITY COMMISSION

The Unified Economic Opportunity Commission develops, directs, and coordinates Utah’s statewide and regional economic development strategies. The commission informs policy decisions and works towards consensus building.

Gov. Spencer J. Cox chairs the commission. It includes senior-level managers from government offices and departments, education officials, state legislative leaders, and representatives focused on housing, cities, and rural counties, as well as several subject matter experts and non-voting members.

10-YEAR STRATEGIC PLAN

At the request of executive and legislative branch leaders, our office is engaged with the Unified Economic Opportunity Commission and its stakeholders to develop a new 10-year strategic economic development plan. The comprehensive plan will be available in November 2021.

We’ve included an outline of the plan approved by the commission at its September 9, 2021 meeting in this report’s section on the commission (page 54).

TEAMS

This table represents full-time Go Utah employees as of June 30, 2021. This data doesn’t include part-time or intern team members.

CONTACT INFO

See what programs and initiatives Go Utah employees cover, view team headshots, and access email, phone, and LinkedIn profiles from our staff directory available at go-utah.fyi/directory.

COVID-19 RESPONSE

In fiscal year 2021, the Go Utah team continued to play a valuable role in the state’s COVID-19 pandemic response. Team members supported the state’s economic recovery through Unified Command briefings, the governor’s weekly COVID-19 media briefing, and daily pandemic coordination meetings.

Since the pandemic began, Go Utah has distributed $185+ million in grant programs utilizing state and federal resources. The team also managed the Business Resources section of coronavirus.utah. gov and the multi-million dollar In Utah economic reactivation campaign (see inutah.org).

Go Utah administered the following COVID-19 response and grant programs during FY 2021:

In Utah — This campaign encouraged Utahns to shop, dine, stay, work, tour, and play in the state.

2021 Impacted Small Business Catalyst Grant — This $15 million grant program assisted small businesses, nonprofits, and other organizations that experienced significant revenue decline in 2020 compared to 2019.

PPP2 — This $325 billion federal aid package provided additional economic aid to the hardest-hit small businesses, nonprofits, and venues. In partnership with the U.S. Small Business Administration’s Utah District Office, Go Utah managed the outreach and communications to eligible Utah small businesses for the second round of the federal Paycheck Protection Program.

Learn & Work In Utah — The COVID-19 Displaced Worker Grant Program is a $16.5 million initiative to train workers displaced due to COVID-19 by funding the Utah Works program. Talent Ready Utah and the Utah System of Higher Education continue to manage the 2021 Learn & Work In Utah initiative.

*Applicants that qualified for additional funds for v2 and v3 did not have to reapply.

^In FY 2021, we received authority to spend $15M from ARPA funds during FY 2022.

Learn more at business.utah.gov/coronavirus.

SUPPORTING UTAH’S SMALL BUSINESSES

The office specifically targeted COVID-19 relief funds to help support the state’s small businesses (fewer than 250 employees). More than 99% of total pandemic relief funds Go Utah administered went to Utah small businesses, with 57% of total funds going to businesses with up to 10 employees.

Go Utah COVID-19 grant programs targeted the industries struggling the most during the pandemic, including food and beverage, leisure and hospitality, retail, and healthcare. Together, those industries accounted for 55% of grant funds distributed.

SUPPORTING UTAH’S RURAL BUSINESSES

Go Utah also focused pandemic relief funds on businesses headquartered in Utah’s rural counties. Summit and Washington counties collectively accounted for 40% of all rural awards.

27.3% - Awards in Rural Counties

30.2% - Funds Distributed in Rural Counties

FOCUS AREAS

SUPPORTING UTAH ENTREPRENEURS & BUSINESSES

RURAL UTAH SUPPORT

WORKFORCE INITIATIVES & TRAINING

INNOVATION

BROADBAND

CORPORATE RETENTION & RECRUITMENT

INTERNATIONAL TRADE & DIPLOMACY

TARGETED INDUSTRIES

TOURISM

FILM PRODUCTION

OUTDOOR RECREATION

UNARMED COMBAT SPORTS MANAGEMENT

SUPPORTING UTAH ENTREPRENEURS & SMALL BUSINESSES

Utah small business owners and entrepreneurs are the backbone of the state’s diverse economy, so supporting them is a top priority for Go Utah.

The Economic Opportunity office collaborates with state, federal, and local partners such as the U.S. Small Business Administration, Suazo Business Center, Women’s Business Center of Utah, and others to support Utah entrepreneurs and provide economic opportunities for all Utahns.

The Go Utah office compiled a list of business resources, including tips for financing and appropriate legal structures, to help business owners consider their options as they open their doors, grow, and expand. The list, available at business.utah.gov/business-resources, is dynamic and updated often.

The office has many programs and services that enable entrepreneurs and small businesses to pursue doing business in Utah, including:

CENTER FOR RURAL DEVELOPMENT

The center works with businesses in Utah’s rural counties, providing resources and programs to sustain business and improve employment opportunities. It also collaborates with local governments and other development partners to support rural economic growth.

CORPORATE RETENTION AND RECRUITMENT

This team manages Go Utah’s financial incentives for local and out-of-state companies seeking to expand or relocate to Utah. Incentives are available to select companies creating new, high-paying jobs that improve quality of life, increase the tax base, and diversify the economy. Incentives are offered as post-performance tax credit rebates or grants.

INTERNATIONAL BUSINESS AND DIPLOMACY

As Gov. Cox’s international outreach team, this group manages diplomatic meetings in Utah and internationally. They partner with World Trade Center Utah to promote the Utah business community and recruit foreign direct investment.

PROCUREMENT TECHNICAL ASSISTANCE CENTER

The center helps Utah businesses find, bid on, and win procurement opportunities with federal, state, and local government entities. Through one-on-one and group mentoring, PTAC educates and assists Utah businesses to compete more effectively in the government marketplace.

UTAH BROADBAND CENTER

This initiative advances economic opportunity, energy efficiency, telecommuting, education, and telehealth services that rely on broadband infrastructure. The Go Utah office works with broadband providers, local, state, and federal policymakers, consumers, community institutions, and other stakeholders to support broadband deployment throughout the state, improve efficiencies, and expand statewide access and usage.

UTAH FILM COMMISSION

The Film Commission supports Utah businesses involved in film, television, and commercial production, from caterers to equipment rental, by promoting and incentivizing film production around the state.

UTAH IMMIGRATION ASSISTANCE CENTER

This newly formed office is a one-stop resource for individuals and businesses seeking immigration guidance and information on Utah’s foreign labor rules and regulations. It coordinates with state and federal government partners to facilitate the successful use of foreign labor programs and coordinates with other entities engaged in international recruitment efforts.

UTAH INNOVATION CENTER

The center supports several of Utah’s targeted industries and assists Utah innovators in winning federal research and development dollars through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs. It’s a catalyst for technology innovation in the state and helps small businesses compete successfully and win non-dilutive research and development funding.

UTAH MAIN STREET PROGRAM

This program helps Utah communities revitalize their economy, appearance, and image of their downtown commercial districts.

UTAH OFFICE OF OUTDOOR RECREATION

The team advocates for Utah outdoor recreation services, guides, and products, supporting businesses across the state that help people experience uniquely Utah activities.

UTAH OFFICE OF TOURISM

Utah experiences are big business, and the Office of Tourism supports Utah entrepreneurs through the marketing and promotion of the Utah tourist experience.

UTAH OFFICE OF REGULATORY RELIEF

This new initiative allows businesses to experiment with products, production methods, or services on a temporary basis. It gives entrepreneurs a chance to see if their products work and are valued by customers even when they don’t fit within the current regulatory framework. The office also provides valuable information to policymakers about the appropriate scope and scale of regulation for new products, production methods, or services.

RURAL UTAH SUPPORT

Residents and businesses in rural Utah are instrumental in supporting the state’s healthy and diverse economy. Go Utah provides tax credit incentives, grants, and other resources to help local governments and businesses grow and prosper through the Center for Rural Development.

Examples of Center for Rural Development programs that serve rural Utah include:

• Enterprise Zone Tax Credits

• Main Street Program

• Rural County Grant

• Rural Coworking and Innovation Center Grant

• Rural Economic Development Incentive (REDI; also known as the Rural Employment Expansion Program)

• Targeted Business Tax Credit

• Utah Rural Jobs Program

BUSINESS EXPANSION AND RETENTION GRANT PROGRAM (BEAR)

The Business Expansion and Retention Program has issued grants in support of rural Utah communities. With S.B. 95’s passage, the Rural County Grant Program, the BEAR program was removed from statute and discontinued.

In FY 2021, one final grant award was reimbursed, totaling $63,687. The program is now closed and will no longer be issuing grants.

RURAL FAST TRACK GRANT PROGRAM

The Rural Fast Track grant program supports small companies in rural Utah by awarding post-

performance matching grants for investment directed toward improved production and creating highpaying jobs. The program’s objective is to identify and support eligible businesses ready to grow in rural Utah.

In FY 2021, Go Utah reimbursed $668,402 on 14 grants supporting a total of $1,689,111 in private capital investment and creating 16 new full-time, high-paying jobs.

Fourteen contracts are outstanding, all of which will terminate by the end of FY 2022. The program is now closed, and no future contracts will be issued.

RURAL COUNTY GRANT PROGRAM

State of Utah code 17-54-101 established the Rural County Grant Program.

The Utah Governor’s Office of Economic Opportunity administers the grant program through the Center for Rural Development. Rural counties in the State of Utah of the third, fourth, fifth, or sixth class are eligible to apply for the Rural County Grant.

This program places the responsibility and opportunity for economic development decisionmaking into the hands of rural county leadership to direct their unique planning and implementation. The grant is designed to address the economic development needs of rural counties, which needs may include:

• Business recruitment, development, and expansion

• Workforce training and development

• Infrastructure and capital facilities improvements for business development

Challenges & Achievements

As a new opportunity in its first year, only Part A was launched in FY 2021. All 24 rural counties were to receive $200,000 each. But, with budget cuts due to COVID-19, the grant funding was reduced to $95,833 per county. All rural counties applied for Part A funding despite the cut-back. As a result, total funding of $2.3 million was distributed. Part B of the grant was not launched in FY2021 as its funding was cut from the budget.

Outcomes

The 24 rural counties engaged in many, varied economic development projects and activities, some of which were:

• Sub-grants to businesses for capital investments and job retention

• Funding economic development professional positions

• Creation of Community Redevelopment Agencies

• Event amenities and infrastructure improvements

• Buy-local sales promotions

• Owner and manager training in practical business skills and customer service

• Rebranding, marketing, and advertising support

• Business leadership and training academies

• Market research and feasibility studies

• Improvements to Business Resource Centers and Coworking spaces

• Startup support for new businesses

RURAL COWORKING AND INNOVATION CENTER GRANT

State of Utah code 63N-4-503 established the Rural Coworking and Innovation Center Grant.

The state has allocated $750,000 per fiscal year for this grant. An advisory committee, known as the Rural Online Working Hubs Grant Advisory Committee, comprises seven members representing diverse workforce and industry sectors. The committee reviews and scores applications, advises the office and makes recommendations regarding grant awards.

The Rural Coworking and Innovation Center Grant assists in creating facilities designed to provide individuals working within designated rural areas with the infrastructure and equipment needed to participate in the online workforce.

Qualifying activities of this grant are:

• Construction or renovation of a facility to create a Coworking and Innovation Center

• Extending or improving utilities and broadband service connections to a Coworking and Innovation Center

• Purchasing equipment, furniture, and security systems as part of a Coworking and Innovation Center

Challenges & Achievements

In FY 2021, we conducted two rounds of applications. The total pool of funding was $750,000. In the first round, nine applications were submitted, of which five were awarded grants. In the second round, 13 applications were submitted, of which only three were awarded grants. With the help of the advisory committee’s engagement in

applications review and scoring, the best of the applications were accepted. Those not awarded were advised on how to improve their applications for future grant opportunities.

Outcomes

Overall, a total of $537,418 was allocated in FY 2021 to rural coworking projects. Coworking and Innovation Centers are now under development in:

• Blanding, San Juan County

• Cedar City, Iron County

• Escalante, Garfield County

• Hanksville, Wayne County

• Moab, Grand County

• Monticello, San Juan County

• Price, Cardon County

We also celebrated the grand opening of three coworking facilities in FY 2021 that were awarded funding the previous year. They’re in:

• Panguitch, Garfield County

• Price, Carbon County

• Vernal, Uintah County

As the program is post-performance, reimbursement is made upon completion or partial completion of a project. To date, $295,490 has been paid out to grant awardees.

RURAL ECONOMIC DEVELOPMENT INCENTIVE (REDI)

State of Utah code 63N-4-401 established the Rural Employment Expansion Program - Rural Economic Development Incentive (REDI) grant.

The REDI program supports businesses that create new high-paying jobs in qualifying rural Utah counties. These jobs can be remote, online, in a satellite hub/office space, or physically located in the same county as the business. For each new position, businesses receive $4,000 to $6,000 based on the employee’s location.

Challenges & Achievements

In FY 2021, business operations were disrupted, and there was much uncertainty due to the pandemic. Several companies experiencing growth and planning to create new jobs in rural Utah paused or abandoned projects for expansion. Hiring was interrupted and often took significantly longer than anticipated. Despite challenges, businesses were resilient. A major healthcare company supported the governor’s efforts to create more high-paying rural jobs and accessed the REDI program to hire online remote workers in various rural Utah counties.

Outcomes

In FY 2021, 24 contracts were executed, projecting the creation of 114 new jobs in rural communities.

Grants were paid out to businesses in the following counties:

• Carbon

• Morgan

• Sanpete

• Sevier

• Wasatch

As the program is post-performance, reimbursement is made upon verification of new hires and the annual gross wage of the position at the end of 12 consecutive months. In FY 2021, $190,000 was paid out to grant awardees to create 30 new highsalaried jobs paying at least 110% of the county’s average wage.

ONE UTAH SUMMIT

The One Utah Rural Summit, produced by the Economic Opportunity office in conjunction with Southern Utah University and other partner organizations, is the premier gathering event for Utah’s top leaders and decision-makers to discuss rural Utah challenges and opportunities. The Summit supports Gov. Cox’s One Utah Roadmap initiative and addresses critical policy and infrastructure needs.

Go Utah considers all its programs and initiatives crucial to supporting Utah’s small businesses in rural Utah. A few examples include:

• Utah Office of Tourism promotes visitation, tourism, and uniquely Utah experiences across the state

• Utah Office of Outdoor Recreation manages initiatives and grant programs supporting enhanced quality of life for all Utahns

• Utah Film Commission supports and advances film production throughout the state

• Utah Innovation Center helps Utah small technology businesses to secure non-dilutive research and development funding

• Talent Ready Utah’s workforce training programs help Utahns retrain and reskill for enhanced economic prosperity

• Procurement Technical Assistance Center’s regional offices support Utah small businesses seeking government contracts

• Utah Broadband Center works to ensure broadband+ internet speeds throughout the state

• Pete Suazo Utah Athletic Commission supports and promotes unarmed combat sporting events throughout the state

• Corporate retention and recruitment, especially the state’s tax credit REDTIF program, for rural Utah businesses and companies locating in rural Utah

• Opportunity Zones located throughout rural Utah to encourage investment in economic revitalization

WORKFORCE INITIATIVES & TRAINING

The Talent Ready Utah team in the Governor’s Office of Economic Opportunity seeks to support education and industry partnerships, working collectively to build a highly skilled workforce while providing students with increased career and education opportunities. Programs designed to support the Talent Ready mission include Learn & Work In Utah, Utah Works, Talent Connection Grant, Pathways Programs, and Strategic Workforce Investments.

During the 2021 Legislative session, under statute 63N-1b-306, Talent Ready Utah received $2 million onetime funds to develop work-based learning and apprenticeship programs. At this time, there are no successes or challenges to report. To date, the Talent Ready Connections grant, rules, and applications have been developed. The grant opportunity opened in June 2021 and will close on Sept. 30, 2021. The Talent Ready Utah program anticipates awarding all $2 million to qualifying proposals approved by the Talent, Education, and Industry Alignment Subcommittee of the Unified Economic Opportunity Commission.

HIGHLIGHTS & RETURN ON INVESTMENT

LEARN & WORK IN UTAH

• $16.5M CARES Act funding

• $13.225M funded for institutional programs

• $3.275M in targeted marketing, advertising, and outreach

• Institutions funded: 14

• Programs funded: 163

• Total students enrolled: 5,756

• Total number of students who completed Learn & Work in Utah programs as of May 2021: 2,656

• Participants placed in jobs as of May 2021: 1,056

• In FY 2021, we received authority to spend $15M from ARPA funds during FY 2022

UTAH WORKS

• Funding allocated: $2,088,625

• Funding spent: $1,238,455 (COVID-19 impacted spending and hiring demands)

• 413 students trained

• 377 students completed training

• 371 participants placed

• 5 referrals from DWS

• All other referrals from marketing with education or industry partners

STRATEGIC WORKFORCE INVESTMENTS

• Stackable credentials and education articulations

• 12 new programs during the 2021 legislative session

• 34 currently funded programs

• Enrollment:

• Secondary: 7,416

• Post-Secondary: 14,019

• Students who completed pathway programs funded by SWI: 5,786

• Job placements: 1,412

• Talent Ready Utah’s marketing efforts include:

• LaunchMyCareer.org (managed by Davis Tech College) and cards containing QR codes distributed to prospective students and employers

• One-page flyers issued to prospective students, participating companies, and institutions; participating companies perform outreach with new employees

• Participating institutions market Utah Works on their websites

UTAH INNOVATION CENTER

The Utah Innovation Center supports several of Go Utah’s targeted industries. It assists Utah innovators in winning federal research and development monies through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs. The Utah Innovation Center is a catalyst for technology innovation by assisting small businesses to compete successfully, win research and development funding, and commercialize lifechanging technologies.

The team offers its services statewide, free of charge, giving Utah’s technology-oriented companies a distinct advantage in today’s competitive environment.

IT SUPPORTS TECHNOLOGY INNOVATION BY:

• Helping Utah companies access non-dilutive research and development funding, both grants and contracts, through federal SBIR and STTR programs

• Providing an overview of and agency-specific training on SBIR/STTR opportunities

• Mentoring and connecting small technology companies with resources to help them receive business counseling, find lab space, build prototypes, and grow their business

• Connecting small businesses with alternative funding, including angel and venture capital funding

• Organizing and sponsoring meetings with program officers from SBIR/STTR federal agencies

• Supporting and collaborating with industry sector associations and technology transfer offices at public and private universities in the state

UTAH BROADBAND CENTER

The Utah Broadband Center, housed within the Governor’s Office of Economic Opportunity, plays an integral role in ensuring all Utahns have broadband access.

The center coordinates the development and management of a broadband plan (Feb. 20, 2020) that outlines and addresses infrastructure deployment, bandwidth, adoption, digital inclusion, and literacy across the state. It encourages broadband expansion and uses among businesses, public entities, tribes, and anchor institutions, including education, libraries, healthcare, and households where remote work and learning rely on reliable internet connectivity.

The Utah Broadband Center:

• Facilitates the Broadband Advisory Council

• Maintains the statewide broadband availability map

• Administers the Broadband Access Grant program

• Develops a statewide digital connectivity plan

The legislature funded $10 million for a state broadband access grant during the 2021 Legislative session.

CORPORATE RETENTION & RECRUITMENT

The Governor’s Office of Economic Opportunity’s Corporate Retention and Recruitment team helps accelerate business growth and job creation through sustainable, targeted expansions and relocations. Financial incentives are available for select companies that:

• Create new, high-paying jobs,

• Help improve the standard of living,

• Increase the tax base,

• Attract and retain top-level management, and

• Diversify the state’s economy.

The team’s primary economic development tool is the state’s Economic Development Tax Increment Financing (EDTIF) program.

EDTIF FY 2021 HIGHLIGHTS

• 19 participating companies collectively projected to create 8,841 new jobs

• $438,795,800 in projected capital investment

Post-performance grants provide additional support and enticement to employers considering the state for expansion. These grants typically support infrastructure or workforce development. Currently, there are seven open contracts. We anticipate that all seven contracts will be fully utilized. Past notable recipients include companies such as Stadler Rail, L3 Technologies, Amer

Sports, and others. Only one company, Duncan Aviation, has drawn down funding this year.

Economic Opportunity grants serve communities and private sector partners as they need short-term funding support for projects that significantly benefit communities. These grants include legislative intent to pass through certain funding requests to specific organizations. There are currently seven open contracts with various organizations to support multiple economic opportunity initiatives. Only one contract has activity drawn funds. The office continues to monitor the others and expects a total drawdown of funds on all contracts. Outcomes for the Economic Opportunity grants include:

• Promotion of Utah’s economy

• Training for employers

• Development of federal grants

• Other similar opportunities

The Talent Ready Utah initiative, part of the Corporate Retention and Recruitment team, also plays a vital role in company expansions and relocations by helping businesses find and develop the qualified workforce they need. Additionally, the initiative’s Utah Works program provides new employees short-term training to companies experiencing a significant hiring demand.

Utah ranked #1 best economy

INTERNATIONAL TRADE & DIPLOMACY

The International Trade and Diplomacy team housed within the Governor’s Office of Economic Opportunity partners with international organizations in Utah, including World Trade Center Utah, to coordinate the state’s international business promotion activities, including trade missions, trade shows, and business workshops.

The team works to increase exports from Utah to foreign customers and increase foreign direct investment into Utah.

Gov. Cox’s diplomacy team communicates and coordinates with foreign government agencies to establish lasting relationships between the state of Utah and foreign governments, international organizations, and agencies. The group regularly hosts dignitaries and delegations, including ministers, ambassadors, consuls general, and consuls from around the world.

TARGETED INDUSTRIES

Utah works to create sustainable advantages around emerging and mature workforce sectors. The state convenes constituents and organizes strategies to support and build specific industries in its robust, diverse economy. Utah has five targeted industries selected for their potential and current contributions to the state’s growing economy.

ADVANCED MANUFACTURING

Utah’s advanced manufacturing industry includes cutting-edge companies dedicated to expanding the advanced materials, manufacturing, technology development, and design sectors. Manufacturing is one of Utah’s largest industries, making significant GDP contributions to the state.

AEROSPACE & DEFENSE

The aerospace and defense industry in Utah includes many well-known companies. It also includes specialized companies contributing to the commercial and defense supply chains. Utah’s aerospace industry accounts for over 950 entities and 34,000+ jobs and is projected to see over 20% growth in the next decade.

FINANCIAL SERVICES

Utah’s financial services industry and workforce are well-known for strength and excellence. This sector includes commercial and industrial banks, credit unions, fintech businesses, insurance organizations, and other financial services enterprises. Utah’s 14 industrial banks held $140.6 billion in assets in 2019, equating to 93.5% of the U.S. total for industrial banks and 0.8% of the U.S. total for any bank insured by the Federal Deposit Insurance Corporation.

LIFE SCIENCES & HEALTHCARE

Some of Utah’s largest employers are healthcare companies, such as Intermountain Healthcare and University of Utah Health. Utah’s life sciences industry develops, manufactures, and distributes the pharmaceuticals and medical devices that make modern healthcare possible, generating more than $9.6 billion in annual sales.

SOFTWARE & INFORMATION TECHNOLOGY

Since the 1980s, Utah has been home to cuttingedge information technology and software companies. Today, Silicon Slopes is a household name. Utah’s tech industry serves as an economic driver, with job growth averaging 3.6% per year (2007 to 2017), more than double the industry’s nationwide employment growth. In 2019, tech jobs in Utah grew by 4.6%.

TOURISM

The Utah Office of Tourism (UOT) plays an integral role in the success of the Governor’s Office of Economic Opportunity by stimulating traveler spending in Utah and helping destinations around the state manage and responsibly grow their tourism infrastructure and economy.

Utah’s tourism economy experienced an uneven recovery from the impacts of COVID-19, but the industry continues to generate significant revenue. For example, direct traveler spending in Utah reached $7.1 billion in 2020, despite a 30% decrease from 2019. Traveler spending provided $1.2 billion in state and local tax revenue. Without the tourism economy, every Utah household would pay $1,305 more in taxes or have an equivalent reduction in government services such as education and law enforcement.

In addition to generating income for the state, the Utah Office of Tourism inspires positive perceptions of Utah by promoting the Life

Elevated® brand through public relations, marketing campaigns, social media, and online written and video content.

In 2020, the UOT’s integrated marketing campaigns met the moment through strategic and nimble storytelling that addressed diverse traveler mindsets. The result was sustained interest in Utah as a destination and an industry that outpaced the region (38% decline) and nation (42% decline) in economic recovery. Community and partner relations helped destinations strengthen their identities and become more resilient. A grant from the Economic Development Administration launched industry training and regional Forever Mighty® responsible travel marketing.

As stewards of a healthy and sustainable tourism economy, the UOT is advancing its three-year Red Emerald Strategic Plan to responsibly grow Utah’s tourism industry while maintaining a high-quality experience for visitors and Utah residents.

FILM PRODUCTION

The Utah Film Commission plays a vital role in the success of the Governor’s Office of Economic Opportunity by marketing the state as a destination for film, television, and commercial production. Film production creates jobs in the creative sector while supporting local businesses and encouraging tourism across the state.

Utah is increasingly popular as a destination for television and feature film production, as evidenced by the growth in overall industry annual wages ($122 million in 2020 according to DWS data) and the size and quality of the productions that choose our state as a filming location.

Film production remains a reliable economic driver that impacts both the Wasatch Front and rural Utah. Each dollar of film incentive yields $14.20 of new GDP and $8.09 of new earnings in Utah (source: FY 2018 study by the Kem C. Gardner Policy Institute).

The Utah Film Commission also serves as a liaison to the broader entertainment industry by supporting local film organizations and events,

most notably the annual Sundance Film Festival, facilitating workforce development programs, and supporting production needs across the state. With thousands of productions created in-state since the 1930s, including Stagecoach, Butch Cassidy and The Sundance Kid, The Sandlot, and High School Musical, you’ll soon discover why we say “Utah. America’s Film Set.”®

ACHIEVEMENTS

• Since Utah’s current motion picture incentive program began in FY 2012, $447 million has been spent in-state by studios including Fox, AMC, Disney, HBO, ABC, NBC, Hallmark Channel, and Netflix.

• In FY 2021, 500+ film permits were approved across the state (58% were in rural Utah).

• $10.3 million in state film incentives was awarded during the past 12 months to 31 productions shooting in Utah, including a mix of local and out-of-state feature films and TV series, yielding a total estimated spend of $47 million.

OUTDOOR RECREATION

In 2013, Utah was the first state to create an office of outdoor recreation. Today, Utah continues to lead the nation as it supports the outdoor recreation economy.

The Utah Office of Outdoor Recreation embodies the state’s ongoing commitment to outdoor recreation as an economic driver and a way of life. It plays a crucial role in the exceptional quality of life that’s enjoyed across the state.

The Outdoor Recreation team works to ensure Utahns live healthy and active lifestyles through outdoor recreation. The office actively promotes recreational opportunities, educating partners and the public on recreational best practices, and providing resources to support outdoor infrastructure projects.

OUTDOOR RECREATION INITIATIVES INCLUDE:

• Utah Outdoor Recreation Grant — Supports outdoor recreation projects throughout the state; has distributed $23.86 million in the past seven years

• Utah Outdoor Recreation Summit — An annual gathering of recreation professionals and leaders from around the state and country

• Every Kid Outdoors Initiative — A program to help more of Utah’s kids live a healthy, active childhood filled with outdoor experiences and learning

• Support for corporate recruitment efforts in the outdoor recreation industry that help existing Utah-based companies and attract new businesses and industry events

In EDCUtah’s Know the Customer program, 69 out of 74 companies interviewed said outdoor lifestyle is one of the most significant advantages of doing business in Utah.

Applications submitted

145

Amount requested $14,000,000

Applications awarded

98

Amount awarded $7,500,445

Total projected investment in Utah’s outdoor recreation infrastructure $54,400,000.

UNARMED COMBAT SPORTS MANAGEMENT

Housed within the Utah Governor’s Office of Economic Opportunity, the Pete Suazo Utah Athletic Commission regulates unarmed combat sports.

The commission facilitates a safe, healthy environment for boxers, kickboxers, and mixed martial artists in Utah by actively pursuing ongoing training and updated technology to ensure the efficient and effective administration of the sport’s unified rules.

The commission is working on a new online licensing program for athletes, promoters, and officials.

The Pete Suazo Utah Athletic Commission aims to continue growing the number of events and participating athletes in Utah.

CONTRACT COMPLIANCE

The Go Utah compliance team provides reasonable assurance that companies receiving a tax credit or cash payment have met legislative, rule, and contractual requirements before receiving tax incentives.

The team includes accounting, finance, and economic-trained team members who use best practices to collect, verify, and store statutorily required performance metrics. The team strives to provide measurable and comparable outcome measures to stakeholders to ensure proper use of taxpayer funds and test the results of the economic theory of incentives.

Go Utah manages and executes contracts during the lifecycle of a tax incentive, pass-through appropriation, and other various economic incentive contracts. With assistance from the attorney general’s office, Go Utah ensures that contracts capture the legislative direction and intent and are legally sound.

The Economic Opportunity office awards are post-performance and require the company’s participation through accurate reporting, assisted by data-sharing agreements with the Department of Workforce Services and State Tax Commission.

The office utilizes the Salesforce platform to create contracts, collect electronic signatures, and retain them. Depending on legislative activity, Go Utah enters into an average of 200-300 contracts per year. However, because of the effects of the COVID-19 pandemic and the efforts of Utah governmental leaders to assist Utah businesses and individuals, the office managed over 1,500 contracts during FY 2020. During FY 2021, the office processed approximately 350 contracts.

BUDGET

FY 2021 OPERATIONS EXPENSE BY PROGRAM

$314,246,700

^Current expense includes 1x capital expense *Total expense includes operations and fund budgets **Includes CARES Act funding

Note: In FY 2021, Go Utah was highly responsive to local business financial impacts of the COVID-19 global pandemic. With the same staff, the office managed over three times its prior-year budget. This effort allowed $130 million in CARES Act and other state funding to be deployed quickly to Utah small businesses in need to help alleviate the negative fiscal impacts of the pandemic.

FY 2021 OPERATIONS BUDGET

$264,855,000

*Includes one-time and non-lapsing/carry-forward balances

**Restricted fund balances reported separately (see FY 2021 Fund Budget on pg. 38)

***Includes CARES Act funding

FY 2021 FUND BUDGET

$49,391,700

*Includes one-time and non-lapsing/carry-forward balances

FY 2021 INDUSTRIAL ASSISTANCE ACCOUNT CHANGE IN POSITION

$4,064,194

FY 2020 EXPENDITURE SUMMARY

FY 2021 EXPENDITURE SUMMARY

FUND CHANGE IN POSITION

Notes:

IAA expense is shown on a cash basis from July 1 to June 30 each year.

FY 2021 received $5.3 million of replenishment from GS2021 HB4, item 57.

In FY 2021, the final BEAR program payment was made. There’s no remaining encumberence.

Overall available balace change in position increased due to new funding and lapsing contracts.

ECONOMIC DEVELOPMENT TAX INCREMENT FINANCING

U.C.A. 63N-2-1

The Economic Development Tax Increment Financing (EDTIF) program helps foster and develop key industry sectors in Utah, provide additional employment opportunities, and improve the state’s economy. Used to help attract new companies and keep Utah companies here, it offers a tax rebate of up to 30% in urban areas and 50% for specific rural areas of new state taxes paid for up to 20 years to companies that create at least 50 jobs that pay wages of 110% of the county average for urban areas and 100% in rural areas. EDTIF contracts are post-performance, only providing a state tax credit if the company meets its obligations.

During the most recent fiscal year, the number of newly approved incentives for the EDTIF program set new records for job creation, capital investment, new state revenue, and new state wages. In FY 2021, 19 companies received approval from the GOED Board to participate in the EDTIF program. These participants are collectively projected to create 8,841 new jobs, $438,795,800 in capital investment, over $338,655,595 in new state revenue, and $5,456,878,418 in new state wages.

Large corporate expansion projects will be anchortype projects throughout the state. These projects, along with other company projects coming to Utah, will strengthen our state’s economic diversity and provide job opportunities and economic growth for many decades to come.

The EDTIF program supported the expansion of multiple companies that are significant employers within Utah’s strategic, targeted industries, including:

• Hexcel Corporation (Aerospace and Defense)

• Route App, Inc. ( Software and Information Technology)

• Denali Therapeutics, Inc. (Life Sciences)

• Armscor Precision International (Rural Utah)

CHALLENGES & ACHIEVEMENTS

Companies with active contracts experienced delays in submitting for and providing required documentation to claim a tax credit due to complications from Covid-19. This coupled with Go Utah required oversight efforts to administer and provide compliance support for business grants during summer and fall of 2020, the usual cycle of EDTIF compliance activity, resulted in some delays in assessing and issuing tax credits during FY2021. It is anticipated our office will be back on-track processing delayed annual reports during FY2022.

The Go Utah Board passed a motion supporting Go Utah’s staff recommendation to allow an EDTIF company the option to forgo a tax credit for 2020 in exchange for one additional year to claim the credit. Go Utah staff amended 20 EDTIF contracts in FY2021 to forgo reporting and claiming the tax credit in 2020.

OUTCOMES

In the calendar year 2019 (the most recent results available), there were 136 active EDTIF agreements. Of those 136 active projects, 53 companies submitted annual report data, and 38 have been assessed for a tax credit. Additionally, 16 assessments were completed for prior reporting years.

Of the remaining 15 companies, Go Utah is awaiting information from 11, and 4 applications are currently in-process or under final review (see Assessment Status, CY 2019).

Since the program’s 2005 inception, Go Utah’s Compliance team has assessed 123 companies and verified the creation of 32,482 new full-time jobs.

The number of new jobs is the sum of the data provided by each company that requested and completed an EDTIF assessment for the specific audit year. The calculation includes a count of employees for the audit period and subtracts the baseline (the employee count at the time of Go Utah Board approval) for the first year.

In subsequent years, the calculation includes the count of employees relative to the last reporting period, increasing or decreasing from the time the company last reported.

Completion of an assessment is contingent on the time and accuracy of the company provided data. The completion date of an assessment may impact data reported by the program in year-over-year comparisons. During the last reporting period, the program completed seven prior year assessments and five previous year adjustments.

For companies that did not have an assessment for an audit year, it is assumed for reporting purposes that there was no increase or decrease in employee count. Since this data represents incremental increases or decreases for each year, they can be added together to create the total cumulative job count.

View New Incremental Jobs CY 2005 to 2019 graph on page 43.

Based on the 38 companies that reported and were assessed in CY 2019, the program has verified 10,550 new high-paying jobs, paying an average of $106,716.30 per year.

New high-paying jobs have been verified across the Go Utah target industries. Information technology leads with 4,854 full time positions and an average annual salary of $136,818, which meets EDTIF’s highpaying job criteria.

REVENUE

Compliance receives a growing number of requests each year to calculate new state revenue for companies with an EDTIF award. New state revenue is calculated using paid and remitted employee withholdings, sales and use tax, and corporate tax that has increased from the time of Board approval, as verified using information from the Utah State Tax Commission. A percentage of these new state revenues can be credited through the EDTIF program if the company meets the contractually defined number of new, high-paying jobs for that period. The percentage by type of cumulative new state revenue and new state revenue for CY 2019 is in the chart below.

NEW STATE REVENUE CY 2019

Over the program’s history, EDTIF-assessed companies have created $731.1 million in new state revenue and $533.8 million in new state revenue after tax credits. The difference in these two amounts represents tax credits that have been awarded by the percentage of new state revenue incentivized by the EDTIF program of $197.2 million. The percentage of the award has been set in statute not to exceed 30% for urban counties and 50% in

rural counties. As legacy contracts come to full-term, we expect to reduce margins between new state revenue and new state revenue after rebate.

ENTERPRISE ZONE TAX CREDIT

U.C.A. 63N-2-3

Enterprise Zones are economic areas designated by local governments and approved by Go Utah. Eligible businesses within these Enterprise Zones can apply for state income tax credits to invest in depreciable assets, including machinery and equipment, create new, above-average wage jobs, and rehabilitate older facilities.

INITIATIVES

The Center for Rural Development works with the Go Utah compliance team to review and approve business applicant claims for Enterprise Zone Tax Credit certificates. The center and compliance team also cooperate with the Automated Geographic Reference Center (AGRC) to update and refine all Enterprise Zone designation maps throughout the year.

CHALLENGES AND ACHIEVEMENTS

The program is actively issuing tax credits incentivizing private investment, but activity in FY 2021 is slightly lower than in FY 2020. The lower activity could be attributed to legislative adjustments to the program starting in FY 2021. The tax credit percentage rate was reduced from 10% to 5% on qualified depreciable assets, and entities whose primary business is residential rental property are no longer eligible for tax credits. Additionally, no new Enterprise Zone designation applications were accepted after Dec. 31, 2020, which will ultimately lead to the sunsetting of the program.

OUTCOMES

1,091 Enterprise Zone Tax Credits were issued in FY 2021, compared with 1,227 tax credits in FY 2020. Applications are made available every January for the previous three calendar years. Go Utah provides eligible entities with a tax credit for the year the depreciable asset(s) were placed into service, as reported in the table below.

HOTEL CONVENTION TAX INCENTIVE

U.C.A. 63N-2-501

The Hotel Convention Tax Incentive encourages the development of co-located Utah hotel and convention spaces. It provides a post-performance tax rebate of up to $75 million for up to 20 years.

In October 2018, the Go Utah Board approved the developer, Salt Lake City CH, to receive a post-performance tax credit to build a new Salt Palace Convention Center hotel in Salt Lake City. The hotel broke ground in the spring of 2020. When completed in the fall of 2022, it will provide approximately 700 rooms and add 62,000 square feet of meeting space to attract larger conferences, meetings, and conventions.

With the assistance of a third-party auditor, Go Utah and the Utah State Tax Commission are actively validating and transferring the rates of state, county, and local sales taxes paid on the materials used in the hotel’s construction to the Convention Incentive Fund. Go Utah and the Tax Commission will have to successfully validate and process $3.8 million in sales tax for the hotel to

receive an incentive. After that amount is reached, the hotel will receive an incentive of 95% of sales tax paid, with 5% going to the Stay Another Day and Bounce Back Fund.

Go Utah and the Tax Commission have processed three-quarters of sales tax claims for 2020, totaling $411,000.

In FY 2022, Go Utah will formally adopt this claims process to mitigate the economic effects of the new hotel using the Hotel Mitigation Fund. This fund will allow affected hotels to claim up to $2.1 million per year for the first four years following the Salt Palace Convention Center hotel’s opening. Any additional funds not claimed in this annual process, and 5% of sales tax revenue generated from the hotel, will go toward the Stay Another Day and Bounce Back Fund to pay for the state’s tourism advertising, marketing, and branding. Salt Lake County is responsible for replenishing this account to a $2.1 million balance by providing supplemental funding in years two, three, and four.

TECHNOLOGY & LIFE SCIENCE ECONOMIC DEVELOPMENT ACT

U.C.A. 63N-2-801

The Technology and Life Science Economic Development Act, commonly known as the life sciences tax credit, encourages investment and job creation in Utah’s life sciences industry. It offers a post-performance tax credit of up to 35% of equity investments in life sciences companies for up to three years.

There was one tax credit claim in CY 2020 for $5,000 associated with a $50,000 investment in the life science industry.

MOTION PICTURE TAX CREDIT

U.C.A. 63N-8-101

The Motion Picture Tax Credit promotes the use of Utah locations, crew, and resources. It also provides incentives that allow Utah to compete with other states and develop a strong motion picture industry. The program receives ongoing annual funds of $6.79 million in tax credits (see page 27 for more information).

NEW MARKET TAX CREDIT

U.C.A. 63N-2-601

The New Market Tax Credit helps attract additional investment in the state’s most severely distressed areas. It’s a parallel state program to the federal New Market Tax Credit Program. The tax credit uses $50 million raised by private community investment firms, designated by the IRS as Community Development Entities (CDE), to invest in small businesses within distressed areas. Tax credits are provided to the investors of the program.

A prospective CDE applied to the state in 2014 to be authorized to raise their respective portion of the total $50 million. Advantage Capital, Enhanced Capital, and Stonehenge Capital received authorization in 2014 to raise one-third of the $50 million. The three CDEs had until December 2015 to invest at least 85% of their respective funds (or $14.2 million) with a six-month cure period if they did not meet this deadline.

Once approved by the state, the CDE raises its authorized amount by issuing 58% state income tax credits to the investors who invest in each CDE’s respective funds. The tax credits are funded through the premium tax collected on all insurance premiums in the state, and the credit is claimed against premium taxes owed to the state. Once each CDE has raised its authorized portion of the $50 million, it must invest 85% of the funds raised into eligible small businesses throughout the state, with no one business receiving more than $4 million in initial investment.

TO BE CONSIDERED ELIGIBLE, A COMPANY MUST:

• Be located in a distressed or severely distressed census tract according to the 2020 Census

• Fit the U.S. Small Business Association’s definition of a small business

• Not derive more than 15% of its profits from the sale of real estate

Additionally, the statute requires that each CDE reinvest portions of the interest or dividends earned from the investments made into other qualified small businesses in the state, resulting in 150% of the original allocation amount awarded to each CDE being invested by the end of seven years.

As of Dec. 2020, the three participating CDEs had made $79,380,424 of qualified investments into 33 small Utah businesses. Annual reports from the CDEs show 1,047 new jobs created from the time of investment. According to the statutory requirements, Go Utah issued an additional $5,450,000 in tax credits for CY 2020 commitments. The total amount of tax credits given to date is $29,000,000 of the $29,000,000 authorized.

Go Utah will finalize the program’s outcomes in fiscal year 2022 as the CDEs qualify to exit the program.

TARGETED BUSINESS INCOME TAX CREDIT

U.C.A. 63N-2-301

The Targeted Business Income Tax Credit program encourages private investment and new jobs in rural Utah counties with fewer than 25,000 people. The program offers up to $300,000 per year to businesses with eligible Community Investment Projects (CIP). The awards to qualifying businesses are refundable tax credits up to $100,000 per company.

INITIATIVES

The Center for Rural Development works with county economic development directors to identify businesses ready to make significant capital investments of at least $100,000 and create a substantial number of new jobs. This postperformance tax credit is given to the qualifying business after contracted benchmarks and commitments are completed.

CHALLENGES AND ACHIEVEMENTS

This program can be a helpful tool in reducing investment risk in counties where it may take longer to show a return on investment. Applications for the tax credit are competitive, and the Unified Economic Opportunity Commission’s working group on Rural Economic Growth helps determine awards based on the best project proposals. The program needs renewed marketing and outreach to incentivize rural business expansion further.

OUTCOMES

In FY 2021, three companies were approved and entered into a Targeted Business Income Tax Credit contract. We anticipate providing a tax credit, after post-performance, of $220,000 for the three projects with capital investments of approximately $1.2 million to create up to 15 new jobs in rural counties. No tax credits were awarded in FY 2021.

UTAH RURAL JOBS ACT

U.C.A. 63N-4-3

The Utah Rural Jobs Act provides flexible and affordable capital that enables an eligible small business located in rural Utah to expand and create high-wage jobs. Like the New Market Tax Credit program, tax credits are provided to investors in the program.

The program has three types of participants:

1. Investors who provide capital investment to a Rural Investment Company (RIC)

2. Rural Investment Companies that raise funds for investors to be invested in eligible small businesses

3. Eligible small businesses that may receive up to $5 million in capital for business development and expansion needs

In CY 2017, three Rural Investment Companies applied for and were given investment authority over approximately $42 million.

INITIATIVES

Businesses that fall within the following industry types are encouraged to connect with Rural Investment Companies as they consider making investments in their growth: •

OUTCOMES

The three RICs reached the investment needed to qualify for tax credits by the end of CY 2020 by providing $42,048,894 to 20 Utah businesses. Go Utah receives reports from an independent third party that includes two types of jobs creation metrics:

NEW ANNUAL JOBS

A statutory formula calculates aggregate new annual jobs reported in all prior annual reports to determine if recapture would be needed upon the RIC’s exit of the program.

The prorated net number of new high-paying jobs

After the June 30, 2021 closing of FY 2021, but before the issuance of its 2021 Annual Report, Go Utah provided the first of four years of tax credits to investors who provided capital investment to a RIC. The amount disbursed was $6,090,000.

Utah ranked #1 best state for the middle class | SmartAsset — Nov. 2019

Utah ranked #1 best state for the middle class | SmartAsset — Nov. 2019

COMMISSIONS, BOARDS & COMMITTEES

UNIFIED ECONOMIC OPPORTUNITY COMMISSION

GO UTAH BOARD

TOURISM DEVELOPMENT BOARD

TALENT READY UTAH BOARD

UTAH CAPITAL INVESTMENT BOARD

PETE SUAZO UTAH

UNIFIED ECONOMIC OPPORTUNITY COMMISSION

U.C.A. 63N-1A-2

The Unified Economic Opportunity Commission develops, directs, and coordinates Utah’s statewide and regional economic development strategies. The commission informs policy decisions and builds consensus.

Gov. Spencer J. Cox chairs the commission. It includes senior leaders from Utah’s legislative and executive branches, education, local government, and subject matter experts.

The commission has several subcommittees and working groups specializing in various components of Utah’s economic development strategy. They are:

• Subcommittee on Business and Economic Development

• Subcommittee on Talent, Education, and Industry Alignment

• Working group on Rural Economic Growth

• Working group on Sustainable Community Growth

• Working group on Small Business and Entrepreneurism

• Working group on Multicultural Economic Empowerment

• Working group on International Relations, Trade, and Immigration

The following are essential requirements and objectives of the commission:

• Develop a 10-year statewide economic opportunity strategy

• Develop solutions and policies for the significant challenges facing the state

• Identify solutions for economic, infrastructure, and transportation growth

• Identify solutions for education, training, and workforce development

• Ensure the commission’s efforts are data-driven and evidence-based

10-YEAR STATEWIDE ECONOMIC DEVELOPMENT STRATEGY

The commission developed and approved a 10year statewide economic development strategy at its second meeting on September 9, 2021.

The strategy focuses on eight areas:

1. Education and talent pipeline

2. Community growth and economic planning alignment

3. Economic opportunity for all

4. Low regulations and low taxes

5. Strong targeted industries

6. Startup state

7. Rural affairs

8. International connections

Each of these has key metrics as indicated in the master document, found here. As this strategy is in its first year of implementation, metrics have been established and will be compared in subsequent years to determine progress and the need for directional change, if any.

The commission was established by HB 348 in the 2021 general legislative session. Its first meeting was on June 30, 2021, and its second meeting was held on September 9, 2021. In addition to convening stakeholders and commissioners as statutorily prescribed, the commission assembled two subcommittees and five working groups.

Those smaller groups have worked diligently to organize and cultivate solutions for their assigned focus. Some have even generated proposals that will be presented in the Legislature for consideration. These proposals include revisions to Utah’s Economic Development Tax Increment Financing strategy and procedure and the incorporation of the Commission on Housing Affordability as a subcommittee of the Unified Economic Opportunity Commission. Both of these proposals will require statutory changes.

At the time of this publication, other legislative proposals were being discussed and debated and are likely to be introduced in the 2022 general legislative session.

Commission members listed on next page »

COMMISSION MEMBERS

Gov. Spencer J. Cox Chair

Dan Hemmert Vice-Chair Executive Director Governor’s Office of Economic Opportunity

Casey Cameron Executive Director Department of Workforce Services

Carlos Braceras Executive Director Department of Transportation

Brian Steed Executive Director Department of Natural Resources

Margaret Busse Executive Director Department of Commerce

Craig Buttars Commissioner Department of Agriculture and Food

Sophia DiCaro Executive Director

Governor’s Office of Planning and Budget

Dave Woolstenhulme Commissioner of Higher Education

Sydnee Dickson State Superintendent of Public Instruction

President Stuart Adams (or designee) Utah State Senate

Speaker Brad Wilson (or designee) Utah House of Representatives

Claudia O’Grady VP of Multifamily Finance Utah Housing Corporation

Mayor Dawn Ramsey City of South Jordan

Commissioner Gage Froerer Weber County

NON-VOTING MEMBERS

Miles Hansen CEO World Trade Center Utah

Theresa Foxley CEO Economic Development Corporation of Utah

Stephen Lisonbee Gov. Cox’s Senior Advisor for Rural Affairs

GO UTAH BOARD

U.C.A. 63N-1-401

The Go Utah Board — identified in H.B. 348 as the Business and Economic Development Subcommittee of the Unified Economic Opportunity Commission — includes 15 members appointed to four-year terms by Gov. Cox. No more than eight members are from one political party, with membership representing diverse state regions.

The board promotes and encourages economic opportunity for all Utahns and the state’s commercial, financial, industrial, agricultural, and civic welfare.

Board members also advise office staff on the development, attraction, retention, and expansion of Utah’s businesses, industries, and commerce.

The board generally meets on the second Thursday of the month at the Governor’s Office of Economic Opportunity located at 60 East South Temple, Suite 300, Salt Lake City, Utah 84111. Board meetings follow the Utah public meetings policy.

MEMBERS

Carine Clark Go Utah Board Chair

Pelion Venture Partners General Partner

Tanner Ainge Banner Ventures Managing Partner

Stefanie Bevans Design to Print CEO & Owner

Brad Bonham Walker Edison CEO

Doug Dilley Parker Aerospace General Manager Commercial Flight Controls Division

Geri Gamber Southeastern Utah Association of Local Governments Executive Director

Susan Johnson Futura Industries CEO Emeritus

Heather Kahlert The Kahlert Foundation Executive Vice President

Roger Killpack Service Drug Owner

Annette Meier Superior Drilling Products President & COO

Andrea Moss Nelnet Bank President & CEO

Steve Neeleman Go Utah Incentives Committee Chair HealthEquity Founder & Vice Chairman

Kira Slawson

Blackburn & Stoll, LC Attorney

Jesse Turley Bank of America Private Bank Managing Director

Ted Wilson

Former UCAIR Executive Director

Former Salt Lake City Mayor

U.C.A. 63N-7-1, SECTIONS 101-103

The Board of Tourism Development consists of 13 members representing various geographical areas and segments of the tourism industry. Gov. Cox appoints members to advise the Utah Office of Tourism in planning, policies, and strategies on trends and opportunities for tourism development that may exist in various areas of the state.

The board has the authority to approve a tourism program consisting of out-of-state advertising, marketing, and branding, considering the long-term strategic plan, economic trends, and opportunities for tourism development statewide.

MEMBERS TOURISM DEVELOPMENT BOARD

Lance Syrett Board Chair

Co-Op Marketing Committee

Best Western Ruby’s Inn General Manager

Represents: Lodging Industry

Nathan Rafferty Board Vice-Chair

Marketing Committee Chair

Ski Utah President & CEO

Represents: Ski Industry

Jared Barrett (nominated)

Bluff Dwellings Owner

Represents: San Juan, Piute, Wayne, Garfield, Kane counties

Kym Buttschardt Co-Op Committee Chair

Roosters Brewing Company Co-Owner

Represents: Davis, Weber, Box Elder, Cache, Rich counties

Brent Chamberlain (nominated)

Kane County Commissioner

Represents: Utah Association of counties

Elaine Gizler Co-Op Committee

Grand County Economic Development and Tourism Director

Represents: Carbon, Emery, Grand, Duchesne, Daggett, Uintah counties

Brian Merrill

Marketing Committee

Western River Expeditions Inc. and Moab Adventure Center

CEO

Represents: Business Owners

Greg Miller

Larry H. Miller Group of Companies Board Member

Represents: Salt Lake, Tooele, Morgan counties

Glen Overton Co-Op Committee

Hotel Park City

Managing Partner

Represents: Restaurant Industry

Mike Taylor Co-Op Committee

Budget Car & Truck Rental of Utah

Vice President

Represents: Motor Vehicle Rental Industry

Sara Toliver Marketing Committee

Visit Ogden

President & CEO

Represents: Utah Tourism Industry Association

Jennifer Wesselhoff (nominated)

Park City Chamber of Commerce | Convention and Visitors Bureau

President and CEO

Represents: Utah, Summit, Juab, Wasatch counties

Shayne Wittwer Marketing Committee

Wittwer Hospitality CEO

Represents: Washington, Iron, Beaver, Sanpete, Sevier, Millard counties

St. George ranked #4 best-performing small city | Milken Institute — Feb. 2021

St. George ranked #4 best-performing small city | Milken Institute — Feb. 2021

TALENT READY UTAH BOARD

U.C.A. 63N-1B-3

The Talent Ready Utah Board is the Talent, Education & Industry Alignment Subcommittee of the Unified Economic Opportunity Commission. It addresses statewide workforce development by evaluating training and education programs and improving alignments to current and future workforce needs. The subcommittee works collectively to inform the commission on policy and change implementation for improved education alignment to talent development.

The Talent Ready Utah program helps further the mission of the Talent Subcommittee through the convening of education, industry, and state agencies to coordinate the development of new education programs aligned with industry demand while providing outreach to businesses and educational partnerships.

MEMBERS

Dan Hemmert Go Utah Executive Director Board Chair

Senator Ann Millner State Senator – District 18 Board Vice-Chair

Andrea Moss Nelnet Bank President & CEO

Aaron Skonnard Pluralsight CEO

Chuck Taylor Metalcraft Technologies, Inc. Vice President

Cory Maloy Maloy PR, LLC Founder/Principal, Public Relations and Communications Strategist

Dave Woolstenhulme Higher Education Interim Commissioner

Derek Miller Salt Lake Chamber President and CEO

Jeff Nelson Nelson Laboratories President

Mark Steinagel Utah Division of Occupational and Professional Licensing Director

Sydnee Dickson Utah State Superintendent of Public Instruction

Greg Paras Utah Department of Workforce Services Deputy Director

Brittney Cummins

Office of Gov. Spencer J Cox Senior Advisor for Education

Karen Peterson

Office of Gov. Spencer J. Cox

Director of Legislative Affairs

Margaret Busse

Office of Gov. Spencer J. Cox

Executive Director, Commerce

Wes Smith

Western Governors University

Senior Vice President, Policy and Public Affairs

UTAH CAPITAL INVESTMENT BOARD

Utah Capital Investment Corporation (UCIC) is a nonprofit organization that manages a $122 million state economic development program that mobilizes venture capital for investments that create jobs and diversify Utah’s economy.

Two boards govern the UCIC:

1. Utah Capital Investment Board

a. Administers contingent tax credits to ensure appropriate value to the state (the tax credits were retired in 2020)

b. Consists of five members: Go Utah’s executive director, the state treasurer, and three members appointed by Gov. Cox and confirmed by the Utah Senate

2. Utah Capital Investment Corporation Board

a. Responsible for oversight of day-to-day business activities

Utah Capital Investment Corporation Highlights

• $0 cost to Utah taxpayers

• $18 million of Utah Capital portfolio funds invested in 78 Utah companies

• $25 million invested in 18 Utah companies through Utah Capital’s economic activities

• $50 million in commitments in 2021, with approximately 50% planned for investment in Utah businesses

• 21 consulting sessions during the reporting period

• 42 events promoting Utah’s entrepreneurs and companies

• 12 community events supported during 2020

MEMBERS

Sam Straight, Board Chair; shareholder, Ray Quinney & Nebeker PC

Marlo Oaks, Utah State Treasurer

Dan Hemmert, Executive Director, Utah Governor’s Office of Economic Opportunity

Derek Miller, President and CEO, Salt Lake Chamber

Note: There’s one vacancy on this board, which will be filled soon.

PETE SUAZO UTAH ATHLETIC COMMISSION BOARD

The Pete Suazo Athletic Commission Board includes five people, three appointed by Gov. Cox, one by the Speaker of the House, and one by the Senate President. Each appointed member’s term lasts four years. The commission is named after the late Utah State Senator Eliud “Pete” Suazo. Pete Suazo was an advocate for youth and minorities and a boxing enthusiast. He was integral to establishing Utah’s Unified Rules of Boxing, set forth by the Association of Boxing Commissions.

The commission regulates professional and amateur unarmed combat sports in Utah, including kickboxing, mixed martial arts, and professional boxing. Under the Utah Professional Athletic Commission Act, promoters, managers, contestants, seconds, referees, and judges must be licensed by the commission.

Regulation of unarmed combat includes maintaining medical clearances for athletes to ensure the safety and integrity of each respective sport. Implementation and enforcement of administrative rules provide a stable and fair environment for athletes and the public.

The commission adheres to the national standards set forth by the Association of Boxing Commissions.

MEMBERS

Troy Walker Board Chair Attorney

Bruce Baird

Bruce R. Baird, PC Owner

Mike Deaver Strategies 360 Senior Vice President

Tamara Leavitt Public Relations and Communications Consultant and Contractor

Brian Miller Utah County Prosecutor

OUTDOOR RECREATION ADVISORY COMMITTEE

The Utah Outdoor Recreation Advisory Committee consists of 26 members nominated by the Utah Office of Outdoor Recreation director. The committee supports and advises the Utah Office of Outdoor Recreation with its mission to ensure all Utahns can live a healthy and active lifestyle through outdoor recreation.

The committee includes leaders from various industry segments, including human- and motor-powered recreation, land management agencies, conservation groups, businesses, and organizations that support everyone getting outside regardless of skin color, ethnicity, age, outdoor background, and physical ability or recreation preference.

Each committee member is part of a subcommittee that collaborates with outdoor recreation industry stakeholders, including rural and urban representatives, brands, guides and outfitters, nonprofits, and more. There are four subcommittees:

1. Every Kid Outdoors

2. Inclusion, Diversity, Equity & Accessibility

3. Outdoor Industry

4. Stewardship, Visitor Management & Responsible Recreation

The advisory committee supports and advises the office with its duties to:

• Coordinate outdoor recreation policy, management, and promotion among state and federal agencies and local government entities in the state (with the Public Lands Policy Coordinating Office if public land is involved)

• Promote economic opportunity in Utah by coordinating with outdoor recreation stakeholders, improving recreational opportunities, and recruiting outdoor recreation business

• Recommend to Gov. Cox and members of the Legislature policies and initiatives to enhance recreational amenities and experiences in the state and help implement those policies and initiatives

• Develop data regarding the impacts of outdoor recreation in the state

• Promote the health and social benefits of outdoor recreation, especially for young people

The Utah Office of Outdoor Recreation is grateful for the committee’s service and dedication to our shared outdoor recreation ideals.

MEMBERS

Pitt Grewe

Utah Office of Outdoor Recreation Director

Abbie Jossie Bureau of Land Management

Every Kid Outdoors Subcommittee

Alex Adema DPS Skis Outdoor Industry Subcommittee

Ashley Cleveland Salt Lake City and Outdoor AFRP Inclusion, Diversity, Equity & Accessibility Subcommittee

Betsy Byrne NPS Rivers, Trails & Conservation Assistance Program

Stewardship, Visitor Management & Responsible Recreation Subcommittee

Bianca Lyon Utah Office of Tourism Every Kid Outdoors Subcommittee

Chris Hartman U.S. Forest Service Stewardship, Visitor Management & Responsible Recreation Subcommittee

Cory MacNulty National Parks Conservation Association

Stewardship, Visitor Management & Responsible Recreation Subcommittee

Derek Miller Salt Lake Chamber Outdoor Industry Subcommittee

Elizabeth Jahp Wasatch Adaptive Sports Inclusion, Diversity, Equity & Accessibility Subcommittee

Hilary Lambert Wasatch Mountain Institute

Every Kid Outdoors Subcommittee

Jared Tanner Sportsman’s Warehouse

Every Kid Outdoors Subcommittee

Jeff Rasmussen Utah State Parks Stewardship, Visitor Management & Responsible Recreation Subcommittee

Jess Powell

Black Diamond

Every Kid Outdoors Subcommittee

Jim Ireland National Park Service Inclusion, Diversity, Equity & Accessibility Subcommittee

Keane Horner Ski Utah Outdoor Industry Subcommittee

Leslie Fonger

Greater Zion Convention & Tourism Office

Outdoor Industry Subcommittee

Lindsey Davis Outdoor Recreation Roundtable

Outdoor Industry Subcommittee

Marc Norman USA Climbing Stewardship, Visitor Management & Responsible Recreation Subcommittee

Monique Beeley Discover Utah Magazine Inclusion, Diversity, Equity & Accessibility Subcommittee

Phil Rawlings Salt Lake Off-Road Expo Outdoor Industry Subcommittee

Rebecca Chavez-Houck Hecho Inclusion, Diversity, Equity & Accessibility Subcommittee

Robin Goodman Utah Division of Wildlife Resources Stewardship, Visitor Management & Responsible Recreation Subcommittee

Stephanie Pack EDCUtah Outdoor Industry Subcommittee

Tim Gaylord Holiday River Expeditions Stewardship, Visitor Management & Responsible Recreation Subcommittee

Tom Adams Petzl Outdoor Industry Subcommittee

Brett Prettyman Trout Unlimited

APPENDIX

STATUTE CONTENT LOCATOR

Annual Report statue requirements are listed alphabetically by topic along with the corresponding 2021 Annual Report page(s) that address the statutory requirements. TOPIC PAGE(S)

Annual Report

63N-1a-306 — Annual report — Content — Format.

1. The office shall prepare and submit to the governor and the Legislature, by October 1 of each year, an annual written report of the operations, activities, programs, and services of the office, including the divisions, sections, boards, commissions, councils, and committees established under this title, for the preceding fiscal year.