We understand how complex

a

With Saturna, you can feel confident knowing you’re choosing the best plan at the best price, backed by experienced, top-tier support just around the corner.

Reach out to our team of specialists today for help with a

We understand how complex

a

With Saturna, you can feel confident knowing you’re choosing the best plan at the best price, backed by experienced, top-tier support just around the corner.

Reach out to our team of specialists today for help with a

Your local business news brought to you by

1-year subscription (6

Elisa Claassen

Jack McKissen

Tony Moceri

Mary Louise Van Dyke

Tyler Byrd

Justin Gross

Mark Harmsworth

Dana Rozier

Dann Mead Smith

ART DIRECTOR Heather Lea

PHOTOGRAPHY Sattva Photo

COPY EDITOR Matthew Anderson

Bellingham PR & Communications

WBA BOARD OF DIRECTORS:

BOARD CHAIR: Josh Wright, Partner, Acrisure

EXECUTIVE COMMITTEE: Pam Brady, Director NW

Gov’t & Public Affairs, bp Cherry Point; Jon Ensch, Regional Commercial Director, Peoples Bank; John Huntley, President/CEO, Mills Electric Inc.; Doug Thomas, President/CEO, Bellingham Cold Storage; Josh Turrell, Partner, Larson Gross PLLC

BOARD OF DIRECTORS: Jane Carten, President, Saturna Capital; Bryant Engebretson, Managing Principal, Tradewinds Capital; Mitch Faber, Partner, Faber Fairchild McCurdy LLP; Jim Haupt, General Manager, Hotel Bellwether; Sandy Keathley, Former Owner, K & K Industries; Tony Larson, Founder, WBA; Sarah Rothenbuhler, Owner/CEO, Birch Equipment; Patrick Schuppert, Commercial Banking Relationship Manager, Wells Fargo; Billy VanZanten, COO, Western Refinery Services

For editorial comments and suggestions, write info@ whatcombusinessalliance.com. The magazine is published bimonthly by the Whatcom Business Alliance at 2950 Newmarket St., Bellingham, WA. 360.746.0418. Yearly subscription rate is $30 (US). For digital subscription, visit businesspulse.com/subscribe or call 360.746.0418. Entire contents copyrighted ©2025 Business Pulse. All rights reserved. E&OE

POSTMASTER: Send address changes to Business Pulse, 2950 Newmarket St., #101-173, Bellingham, WA, 98226

Local businesses stay resilient, prioritizing community amid national uncertainty.

Borderview streamlines cross-border firearms shipping with decades of expertise.

Peoples Bank President and COO leads with a people-first approach, balancing career and community service.

Triple Wren Farms thrives, selling unique dahlias and supporting hybridizers.

Edaleen Dairy marks 50 years of fresh milk, ice cream and farm goods.

Axiom expands across the Northwest and beyond, preparing for long-term legacy.

BTC links local businesses with tailored corporate and continuing education.

Washington’s restrictive Growth Management Act limits land supply, worsening housing shortages and affordability.

Ensure stability by separating wealth, managing cash, investing and planning succession.

AI helps businesses save time, analyze data and spark ideas.

Twelve proposed Whatcom County amendments target transparency, accountability and planning.

Washington’s 2025 session passed 17 taxes and multiple fee hikes.

New WBA member Highline Construction excels in quality and community engagement.

Whatcom County has been my home for 30 years. Crossing into Canada for cheaper gas has never been on our local radar, but for the first time (thanks to Gov. Ferguson for signing the largest tax hike in Washington state history), gas is now $1.25 more per gallon than the national average. Adding in the 35% exchange rate could fuel a decision that might stretch our budgets even further. Whether it’s gasoline, groceries, or housing, costs are going up in our region.

According to the Washington Policy Center, our state fell 39 spots in its state tax-competitiveness rating, and Washington ranks as the country’s eighth-highest business failure rate over 10 years. We live in a beautiful region, but at what cost?

While business leaders are working hard to bring practical solutions to the table, legislators and agencies are burdening employers and families with new regulations and higher taxes as a solution to the government’s overspending problem. Washington already has the costliest workers’ compensation system and the second-highest unemployment insurance payments in the nation.

We all have a vested interest in such issues as hunger, homelessness, housing and the environment, and we also have

a desire to be a part of solving them. A local economy built on a shared goal of prosperity is a necessary part of solving these problems.

We need lawmakers with a plan to grow the economy, not tax the economy more. Let’s unleash the creative potential of businesses and entrepreneurs to build stronger communities and a stronger economy that works for all of Washington. It’s the best way to help make Washington a place where families, communities and the businesses that sustain them can afford to survive — and thrive. When a state becomes unaffordable, families feel it and businesses feel it. It is not a political statement to say that entrepreneurs and business leaders create economic opportunity. It is a fact. Policymakers can create programs that deliver economic relief, and those programs are important. Opportunity is the only thing that minimizes the need for relief. When someone has a job that pays a family-wage income while performing work that matters for a business that is an important part of their community, then they have achieved a level of success we used to take for granted. Our local government should believe in the transformational impact of economic growth. It is the only solution that delivers sustainable results. We need shovel-ready land to attract manufacturing to our region. We need workforce housing. We need the government to be a partner, not a barrier.

Following our popular “Top 100 Private Companies in Whatcom County” in the Jul/Aug issue, we are exploring both the local and national economic landscape, guided by insights from our

recent business survey.

As of mid-2025, business sentiment toward the economy is cautiously optimistic. On the positive side, the US Federal Reserve has signaled a potential easing of interest rates in September. Lower borrowing costs would ease pressure on capital investments and consumer spending — two key drivers of economic growth. Although the outlook is optimistic, our border community is suffering from economic strain, with significant decreases in Canadian cross-border shopping and vacationers that we depend on to supplement our local economy.

I encourage you to read this issue cover to cover and immerse yourself in the stories of local businesses Axiom Construction, Edaleen Dairy and Triple Wren Farms. According to our recent survey, Whatcom County businesses are bracing for uncertainty but expect the economy to improve. Our feature by Jack McKissen on the WBA Business Confidence Survey results includes a snapshot of the local, regional and national picture. James McCafferty looks at economic stressors in Whatcom County; Wells Fargo economists provide insight at the national level; and the Border Policy Research Institute navigates the turbulent uncertainty of border tensions.

Meet Borderview, a long-time Lynden business that specializes in niche cross-border needs. Valuable features in this issue include business succession planning and the cost of proposed charter amendments that will appear on the November ballot. Our Workforce Development section includes an interview with BTC, and our Technology section delves

into the “Whys of AI.” In the Policy section, Dann Mead Smith unravels the new tax impact recently signed into law. Don’t miss Personally Speaking with Peoples Bank President and COO, Lisa Hefter, and catch up on local business news in our Newsmakers section.

On behalf of the team here at Business Pulse, we hope you enjoy this issue. Thank you to all of our advertisers and sponsors for making this and every issue of this magazine possible. We could not do this without your ongoing support.

Don’t forget to vote early and enjoy the last days of our warm weather season!

16

more information: whatcombusinessalliance.com

Lynden Sheet Metal celebrates growth during 85th anniversary

Locally owned and operated since 1940, Lynden Sheet Metal is celebrating its 85th anniversary this year with a fourth generation of local ownership leading the way.

“Eighty-five years in business is a credit to all of Lynden Sheet Metal’s employees, past and present,” said Bobbi Kreider, co-owner and company president. “Our reputation is due to the excellent service that they’ve given our customers over the years.”

Majority owners Bobbi and Cory Kreider acquired their ownership stake in 2010 from Bob and Rose Crabtree, Bobbi’s parents. Since then, Phil and Stephanie VanderVeen and Ken and Joell Keck have become co-owners and annually increased their stake.

Ken Keck, a longtime Whatcom County resident and a Nooksack Valley High School graduate, started as a welder at Lynden Sheet Metal 15 years ago and is now CEO.

Phil VanderVeen joined the company in 2001 and now is COO. Born and raised in Lynden, VanderVeen took HVACR classes at Bellingham Technical College while working on a part-time basis at Lynden Sheet Metal.

Visit LyndenSheetMetal.com.

Port of Bellingham names new director of aviation at Bellingham International Airport

The Port of Bellingham has announced the appointment of Matthew Rodriguez as the new director of aviation at Bellingham International Airport (BLI). Rodriguez has been promoted through the ranks at the Port of Bellingham, starting as an airport res-

cue firefighter and operations specialist before serving as airport operations manager at BLI for the past five years.

In his new role, Rodriguez will oversee strategic initiatives aimed at enhancing BLI’s service offerings and infrastructure. Several large, federally funded capital projects are scheduled for the coming years, including a $15plus million runway repaving project and a $100-plus million airport traffic control tower replacement.

“Bellingham International Airport plays a vital role in our region’s transportation network, and I am honored to serve as the next director of aviation,” said Rodriguez. “There is tremendous potential for growth at BLI, and together with our dedicated team, we are committed to delivering on the port’s and airport’s shared vision — expanding access to unserved and underserved markets that our community desires. We also remain focused on supporting and strengthening our general aviation businesses and tenants, ensuring BLI continues to serve as a valuable and inclusive hub for all who rely on it.”

United Way of Whatcom County announces over $700,000 in Community Impact Grants for 2025-2026

United Way of Whatcom County recently completed its annual grant process, allocating $749,000 in community support for local nonprofit services and programs. Once the dollars have been collected, they are quickly returned to the community through grant investments supporting a collaborative network of local agencies working together to address financial hardship in Whatcom County.

A core focus of United Way of Whatcom County’s work is helping ALICE households.

ALICE is an acronym that stands for “asset limited, income constrained, employed.” It refers to hardworking individuals and families who earn more than the federal poverty level but not enough to afford the basic necessities in our community.

The most recent ALICE report revealed that 45% of Whatcom County households aren’t able to make ends meet. The data also shows disproportionate representation of ALICE households by a number of factors, including age, gender, race, and household composition.

“We know from the ALICE data that the need in our communities just keeps rising,” said United Way President and CEO Kristi Birkeland. “Despite working one or more jobs, nearly half of the households in Whatcom County still can’t get by. These dollars will help keep critical services available for hardworking folks in our community. Given the current landscape of rising costs combined with state and federal funding cuts, support for local programs is more important than ever.”

This year’s grant allocations range in amount from $15,000 to $45,000, with 24 local nonprofits receiving support.

United Way of Whatcom County’s main community fundraising effort runs from September through December of each year, and grant allocations happen in the spring.

Visit unitedwaywhatcom.org.

What fun is a 50th birthday if we can’t share it with others? Throughout 2025, Business Pulse magazine will celebrate its 50-year anniversary while highlighting companies that are also 50 years old (and older) and still doing business in Whatcom County. These are the leaders in our community, exemplifying business success and longevity, built from the ground up, formed and thriving across generations.*

*We gratefully acknowledge assistance from the Bellingham Chamber of Commerce when creating this list.

Blackburn Office Furniture & Design blkbrn.com

In 2019, Randy Grunhurd retired and his son, Shane, took over the family business. Blackburn moved from its iconic downtown location to Hannegan Square business park. The company continues to provide local businesses with great commercial-quality furniture. In 2023, Blackburn opened a commercial and residential moving division called Blackburn Moving Services.

In 1945, Chet and Hubert Blackburn began a small family-owned office machine dealership founded on the principal: “We service what we sell.” In 1962, Marvin Grunhurd purchased Blackburn Office Equipment and ran the business until 1992. It was then bought by James Olson and Randy Grunhurd, and they ran the business together until Jim died in 2010.

Brooks Manufacturing brooksmfg.com

Brooks Manufacturing is a certified womanowned business enterprise. Economist, Mary “Mimi” Brooks Ferlin and trained-attorneyturned-businessman John Ferlin openly laud their professionals and crew — including sawmill operators, financial investors and their board of directors — for Brooks’ staying power and stellar industry reputation.

& now

Established in 1915, Brooks Manufacturing is recognized as the industry leader of distribution crossarms and transmission framing components. The company is owned and operated by the Brooks family since 1935.

Brooks Manufacturing’s reputation has been earned through generations of active involvement working with utilities and industry associations. The company’s wood products originate from sustainable forests managed to meet the social, economic and ecological needs of present and future generations.

Mt. Baker Vision Clinic mtbakervision.com

The Myhre brothers opened Mt. Baker Vision Clinic in 1951. Twenty-seven years later, Dr. Wayne Musselman took over the practice, and in 1984, Dr. Jeff Larson joined the clinic. Mt. Baker Vision Clinic has served families in Bellingham, Lynden and Ferndale for seven decades. Initially, Mt. Baker Vision Clinic focused on glasses and contact lenses made of hard plastic, but it has since expanded to offer a wide range of services and treatments.

Over the years, Mt. Baker Vision Clinic has grown and currently employs 29 full-time staff members, which includes six doctors. Within the past five years, Musselman and Larson have retired, leaving behind a wonderful legacy of care for the community. Today, Mt. Baker Vision Clinic offers advanced diagnostics, personalized treatments and fashion-forward frames. The current Bellingham office is at 720 Birchwood Ave.

Pacific Continental Realty was founded in 1975 by Steve Moore in Orange County, California. The headquarters moved to Washington in 1990 as the first commercial brokerage in Whatcom County. In the early 2000s, Steve Moore sold the company to Jim Bjerke, a local commercial real estate broker who worked for PCR. In 2019, Jim Bjerke sold Pacific Continental Realty to longtime Whatcom County commercial real estate brokers KC Coonc and Ryan Martin.

Steve Moore, Pacific Continental Realty’s founder, on the cover of the September 1995 issue of Business Pulse magazine.

PCR has grown alongside its community and has managed to provide quality commercial brokerage services to its clients. In addition to sales and leasing, PCR also offers property management and in-house maintenance services for commercial and multifamily properties.

Jack McKissen

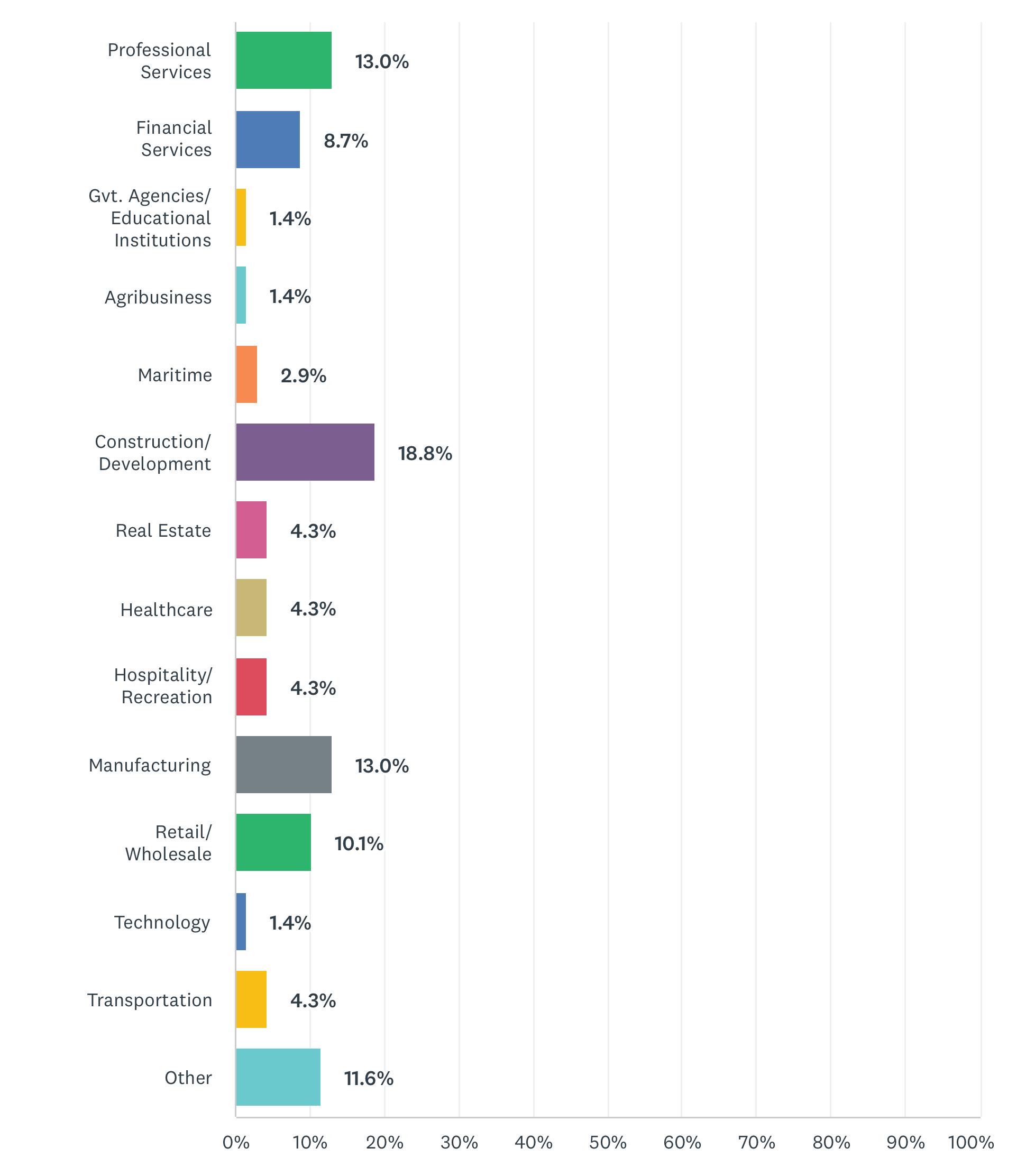

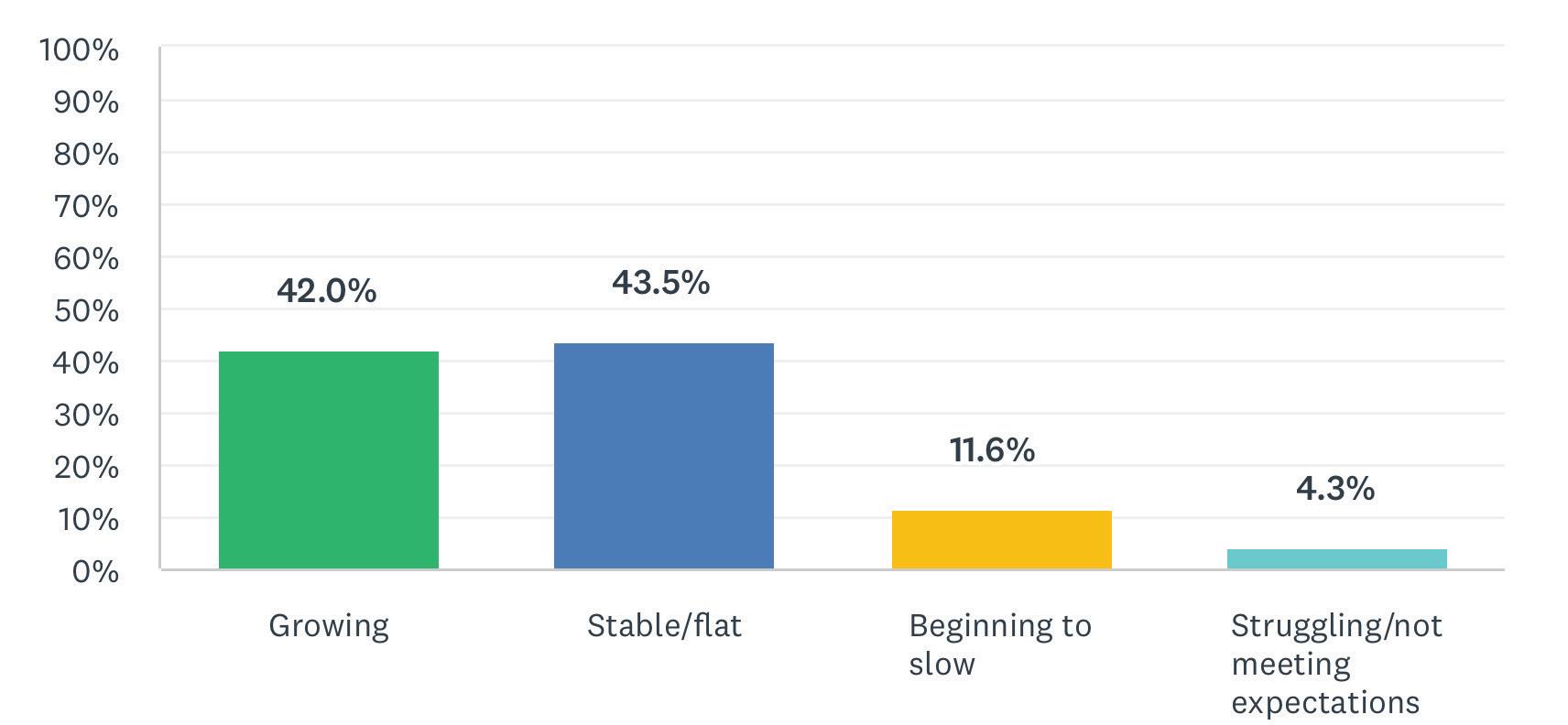

Editor’s note: In late spring, the Whatcom Business Alliance sent out a Business Confidence Survey to all WBA members — business owners and leaders in our community. The questions asked were designed to explore how the local economy and businesses are affected by recent tax increases, tariffs and threats of an impending recession.*

If you want to understand how the business community in Whatcom County feels about the economy in 2025, the results of the Whatcom Business Alliance’s latest Business Confidence Survey are a great place to start. The results are clear, and while there are threads of optimism locally, the national mood is one of cautious skepticism.

According to the survey, nearly 58% of respondents conduct business locally or regionally, with 57% of businesses operating on a national or international scale. Over 91% surveyed are concerned about their business as we move into 2026. That’s a pretty stark perspective on the national economic climate — and it mirrors what other economic surveys, including data from recent economic analyses, have shown.

But when it comes to the local economy, caution gives way to optimism. More than 85% of Whatcom County businesses are stable or growing, and less than 5% report they are struggling. Nearly 61% expect to invest in their business in the next 12 months, with only 22% unlikely to invest in equipment, expanding their facilities or launching projects — and that reflects local resiliency.

“Local businesses understand the national economy is facing headwinds, from inflation to labor shortages to regulatory uncertainty,” said Barbara Chase, executive director of the WBA. “But Whatcom County has proven time and again that it can weather national storms with strong community ties, responsible leadership and a work ethic that doesn’t quit.”

*Charts and data from the Whatcom Business Alliance Business Confidence Survey.

Let’s dig into the numbers. The 2025 WBA Business Confidence Survey had business respondents representing a solid cross-section of industries, from construction and agriculture to professional services and manufacturing.

A few statistics jump out:

• Business owners ranked inflation and the cost of living as their top concern — a number that tracks closely with concerns across the country.

• Labor availability remains a major challenge, with the majority of respondents citing hiring difficulties, despite the fact that Washington state’s unemployment rate remains relatively low.

• Most employers say it’s harder to find qualified applicants now, than it was five years ago.

• And yet, despite those real challenges, 85% of local business leaders expect their own business revenues to increase or stay the same in the coming year, with just 4% expecting a decrease.

In other words: Whatcom County employers are worried — but there is hope. There’s still a willingness to invest, to adapt and to build from the bottom up.

No concern

Slight concern Significant concern

There’s something very telling about the fact that confidence in local leadership and the local economy remains higher than confidence in the national economy or the federal government. That gap in trust isn’t new — but it is widening.

As one local manufacturing CEO told the WBA:

“We’re used to figuring things out on our own here. The fewer moving parts, the better. I trust my team. I trust my customers. I don’t trust Washington.”

That sentiment is echoed by business owners in Lynden, Ferndale and across rural areas of the county. Many of these employers have been through COVID-19, supply chain disruptions and changing tax policies — and they’re still standing.

That’s the story of the Whatcom County economy in 2025: We’re still standing.

Business owners aren’t asking for handouts or subsidies. They’re asking for predictability. They want lower regulatory burdens, fewer surprises from Olympia and Washington, D.C., and the space to run their operations without being second-guessed by people who’ve never signed a paycheck.

“The data shows us that local businesses are committed to staying here and growing here — but they need government to be a partner, not a barrier,” said WBA Executive Director Barbara Chase.

Nationally, economic signals are murky. The Federal Reserve is still walking the tightrope between controlling inflation and avoiding recession. Interest rates remain high compared to pre-2020 levels, and small businesses are feeling the squeeze. Even though national gross domestic product growth has avoided contraction, the cost of capital may be discouraging long-term investment.

Combine that with labor shortages, high insurance costs and uncertainty around health care and tax policy, and it’s easy to see why Whatcom County businesses have some hesitancy about the national economy.

In fact, some survey respondents commented that federal uncertainty is one of the top reasons they’re putting off expansion or hiring plans. That hesitation has consequences — not just for local businesses but for the workers who depend on them.

One local real estate executive said during a recent WBA roundtable:

“What we need is a consistent tax code, consistent regulatory approach, and a government that isn’t afraid to say ‘no’ to new spending when the debt is already crushing.”

That comment might not make national headlines — but it reflects the deeply pragmatic, fiscally cautious attitude that many in Whatcom County hold, regardless of political party.

One of the most constructive takeaways from the survey is that businesses are increasingly interested in developing homegrown talent. With the cost of higher education rising and student debt ballooning, many local employers are partnering with technical schools, high schools and job training programs to develop the next generation of workers.

As one construction firm owner in Bellingham noted: “We’re done waiting for perfect résumés. We want people who are ready to work, and we’ll train them.”

This is where local innovation really shines. Whatcom County isn’t waiting for the state or federal government to fix the talent pipeline. Instead, it’s building its own. WBA has been a key convener in that space, helping connect business owners with workforce development resources and highlighting the success stories of local apprenticeships, internships and certification programs. This collaborative approach, driven by the business community, is a model for other counties looking to overcome similar challenges.

“Our business leaders know the long-term solution to workforce issues is investment in people,” Chase said. “That’s why we’re doubling down on training, partnerships and local talent.”

In reading the WBA survey results and talking with business owners throughout Whatcom County, a theme emerges: resilience over reliance. The national economy is still finding its legs. But here in Whatcom County, businesses are betting on themselves. They’re investing in their teams. They’re finding ways to grow — slowly, carefully and without the drama of headlines.

They’re also asking their local and state leaders to do one simple thing: Make it easier to build, grow and hire. That means being smart about regulation and consistent about implementation. When people stop believing in Washington, they start believing in their neighbors and their community. That’s what’s happening in Whatcom County — and it might just be the right formula for long-term success.

James McCafferty

Owning a business is a tricky proposition. The landscape is always changing while you strive to deliver the best widget in the market. Over the past seven months, however, it has become increasingly difficult to predict — let alone stay on top of — those changes. Tariffs, the labor market, supply chains, inflation, commodity prices and consumer confidence have offered one blow after another.

What is making business owners anxious? All of it, but more so the speed and unpredictability of it. Nearly all businesses have been impacted, necessitating both small and large adjustments to their business models. In most cases, the stress on the business owner is matched only by the stress on the bottom line.

The stress on consumers is clear in the data. Delinquencies are rising rapidly, but credit usage remains somewhat stable. The use of “buy now, pay later” is rising quickly, with significant increases in use for routine items such as groceries. None of these paints a robust picture of the general consumer segment. Consumer spending appears to be coming from a narrowing group of higher-income households.

The labor market is and will continue to be challenging. Labor force participation is declining because of an aging population and low birth rates. Can a business adapt with

less labor and very low unemployment through automation and/or pay higher wages to attract workers? Business models will need to change more quickly than what is comfortable.

Inflation affects different commodities in various ways. Can a business change its source materials to adapt? Change its product or service? Convince its customers they prefer something slightly different?

Some things are going well but are often lost in the stress of the moment. Washington continues to be ranked highly for its business-friendly environment. We are home to a highly skilled workforce with global trade access. Population and employment growth are on the rise. Our state is ranked in the top five for innovation, which underpins a thriving tech and entrepreneur ecosystem. Consumer confidence is starting to rebound, although some initial data says that may be because consumers are throwing up their hands over everything and just “getting on with their lives,” which is an interesting scenario with a lot of potential risk. Ultimately, it is the speed of disruptions and changes that lies at the root of business owners’ anxiety, and this trend shows no signs of slowing down.

James McCafferty is the director of Western Washington University’s Center for Economic and Business Research, where he bridges academia and real-world economics through consultative projects and published work. With an master’s degree in business administration from WWU and a Bachelor of Science in journalism and public relations from the University of Oregon, McCafferty brings expertise in national and regional economics, financial modeling, market analysis, tax and strategic operations. A Certified Global Business Professional, he serves as an officer of the Seattle Economics Council and previously held a board seat with the Association of University Business and Economic Research. Passionate about providing data-driven insights for both public and private sectors, McCafferty plays a key role in regional economic decision-making.

Dr. Laurie Trautman and Jennifer Bettis

The relationship between Canada and the US continues to navigate turbulent waters, and many businesses in Whatcom County are facing ongoing uncertainty associated with a shifting travel and trade landscape. For those who depend on Canadian trade relationships or Canadian visitors, there are two overarching concerns: a sharp decline in Canadian visitation and the uncertainty of tariffs.

In a typical year, Whatcom County welcomes roughly five million visits by Canadians, who support various aspects of our economy, from retail to tourism to business investment. The pandemic border restrictions halted most cross-border travel, with severe consequences on businesses that depend on Canadians, particularly in border communities such as Blaine and Point Roberts. Since then, cross-border travel was steadily increasing — until February 2025, when Canadian travelers, including some businesses and government entities, began to boycott not just US goods but US travel as well. As a result of this pushback against tariffs and comments about Canada becoming the 51st state, Canadian visits to Whatcom County fell by 29% in February 2025 compared to the previous year — a decline that grew to 51% by April and has since dropped to 43% in June.

In addition to changing cross-border travel patterns, the ongoing uncertainty of tariffs also is impacting Whatcom

businesses. While many Canadian goods are still exempt from tariffs under the United States-Mexico-Canada Agreement, tariffs as high as 50% on aluminum and steel impact local industries such as craft beer and ship building.

To better understand how our businesses perceive the impacts of tariffs and changes in Canadian cross-border travel, the Western Washington University Border Policy Research Institute and the Bellingham Regional Chamber of Commerce have been conducting an ongoing survey. To date, roughly half of respondents perceive the drop in Canadian visitors as causing damage to their operations. This sentiment is particularly prevalent with small or medium-sized businesses in retail or hospitality.

Small businesses also more frequently reported feeling that they are “somewhat” or “definitely” impacted by US tariffs and Canadian counter-tariffs, while many larger businesses reported little to no impact, indicating that cross-border changes are more disruptive to businesses with smaller operational capacity.

Full details of the survey responses can be found in BPRI’s most recent Border Policy Brief, available at cedar.wwu. edu/bpri_publications/143, with highlights accessible at bpri.wwu.edu/infographics.

Dr. Laurie Trautman is the director of WWU’s Border Policy Research Institute, where she engages in a range of research activities focused on the border between the US and Canada and the “Cascadia” region that encompasses parts of Washington state and British Columbia. Her latest (co-authored) book, “When the World Closed its Doors: The COVID-19 Tragedy and the Future of Borders,” explores the expanding use of international borders as a policy response to a growing range of crises — and the collateral damage to social and economic connections.

Jennifer Bettis serves as BPRI’s research and program manager. She leads fieldwork projects, conducts data and policy analysis, and pursues new research trajectories. She facilitates the publication of BPRI reports and briefs, manages media outreach and social media, and supervises student research assistants. She also collaborates with faculty and external researchers on a wide range of border-related topics.

years

Elisa Claassen

Several generations of the VanderHoek family of Lynden have created not one, not two, but three sporting goods businesses – so far – that have evolved from one generation to the next within the realm of sporting goods.

Make that four businesses, actually –but more on that later.

Jude’s Sporting Goods and Housewares and Dave’s Sports Shop were two of them. The latest enterprise, Borderview International Firearms Logistics, overseen by Joel VanderHoek, is focused on shipping sports firearms across borders.

“Ever since my Grandpa Jude (VanderHoek) started his business in 1957, our family has been involved with lawfully transferring sporting firearms to our Canadian neighbors,” Joel VanderHoek said. “As regulations increased over the years, they adapted – until around Sept. 11, 2001, after which the regulations and border environment tightened. Decades ago, Dad (as Dave’s Sports Shop) used to

be able to sell a rifle to a licensed Canadian and bring it to the border, where he’d hand it off, and the Canadian would fill out a form and pay a small fee.”

The events of 9/11 created a lot of changes for many people and businesses. Dave’s was one of them, as the company paused its cross-border gun sales until 2008.

“They stopped doing imports and exports around 9/11,” VanderHoek said, “until one day around 2007 my Dad called me while I was in college at Seattle Pacific University to ask if I could help figure out how to do the paperwork. I dug deep into all of the rules and regulations, and the rest is history.”

VanderHoek’s own résumé includes more than 14 years at his current company as the founder and president. Prior to that, he was the business development manager for Dave’s Sports Shop, the two-year board president for the Lynden Chamber of Commerce, and the founder and president

of GunsAbroad (formerly Northbound Sporting LLC), from November 2012 to December 2018.

Jude’s shop started in downtown Lynden and eventually moved to Fairway Shopping Center, where it continued to sell both sporting goods and homewares such as paint and garden supplies. Eventually, the business divided between partners to become what are now Ace Hardware and Dave’s Sports Shop, located side by side. Dave’s focuses on a full line of apparel, ammunition and gear for hunting and fishing. Borderview originally was part of Dave’s but became a separate legal entity in 2011, now conducting its US operations on Evergreen Street in Lynden, near the intersection between Main Street and Guide Meridian. Joel’s parents, Dave and Claudia VanderHoek, sold Dave’s Sports Shop in 2022 to Will and Jenn Lathrop, mentoring

them to make the transition as seamless as possible.

“From complex to surprisingly simple,” the Borderview website proclaims. It continues: “The government has created multiple barriers, making it extremely difficult for an average person to ship guns across the border. We agree that it’s too complicated. Bureaucracy and red tape shouldn’t get in the way of good people getting guns across the border for good reasons.”

In a video, VanderHoek explains the process to future customers: Borderview ships thousands of guns safely, legally and efficiently, providing in-person customs clearance. First, customers must fill out the import/export form and talk with staff to review the pricing and timeline and ask questions. Second, customers send the firearms and let Borderview’s staff do the rest. Third, customers review confirmation of approval and delivery across the border.

VanderHoek said in addition to the service of driving the company van to the border with the completed paperwork and product, the team has developed relationships with border personnel, and that has made a big difference.

“We know them and have built a sterling reputation of compliance,” he said.

Behind the scenes is where the work happens. Borderview staff have turned countless regulations and permits into a single form, because they do the needed paperwork and have the experience. The company also partners with Gunbroker.com, the National Shooting Sports Foundation, the National Rifle Association Business Alliance, Canadian Shooting Stars, CSAA Insurance Group, Project Childsafe, the Canadian Coalition for Firearm Rights, and others.

Joel’s company is on both sides of the border, with offices within a few miles of it on both sides. There isn’t much direct competition for these services, he said. Customers find him via online searches and by word of mouth, and he and his team also go to trade shows.

Business is impacted constantly by factors that can’t be controlled, including the COVID-19 pandemic, the 9/11 attack, economic disparities and tariffs.

VanderHoek, who has been watching the continuing changes with tariffs, acknowledges the uncertainty.

“We are working hard to be a source of clear, concise and trusted information on the actual impact of the tariffs on our product categories,” he said. “The changes have been so complicated and so back and forth that even legal and customs professionals that we engage with regularly have had a hard time tracking it all. For our business customers — Canadian retail stores, auction houses and manufacturers — their businesses rely on timely and accurate information. We have made it our goal to provide this to the very best of our ability. This builds trust with our customers but is frankly something we do just to help out.”

The only constant — perhaps especially in the gun import and export business — is change, he said.

“We face all of the impact of constantly changing gun laws in both the United States and Canada, as well as the rest of the implications and changes of foreign trade. The US underwent a major ‘export control reform’ effort culminating in a complete

overhaul of the export licensing jurisdiction and process for our goods in March of 2020. Then the pandemic hit, of course. Since then, Canada has banned many models of firearms, starting with a list in May 2020 then banning the importation and sale of all handguns in 2022, followed by additional model-specific ban lists issued in December 2024 and March 2025.”

Nearly 100% of Borderview’s business is with Canadians.

“We used to work more with Australia, New Zealand, the U.K. and beyond but about five years ago decided to focus nearly exclusively on US/Canada business. We ship both directions — export and import, to and from Canada.”

VanderHoek’s oldest son, Jude, just 8 years old, started his own related business in 2024: Jude’s Locker. Jude, named for his grandfather, provides locked storage for those wanting to safely store their firearms.

Joel VanderHoek said he respects his son’s work ethic and desire to be entrepreneurial. ■

Mary Louise Van Dyke

Lisa Hefter spends each workday at Peoples Bank in Bellingham overseeing the financial institution’s administrative and operational activities as president and chief operating officer.

The community bank operates on a “people first” philosophy. “We cannot be successful without our people, and we also cannot be successful without serving people well,” Hefter said. “I love the people I work with, and I love what I do.”

Some 400 employees assist customers of all ages at 23 branches located in

Whatcom, Skagit, Snohomish, King, Island, Chelan and Douglas counties.

Founded in 1921, the bank has assets of approximately $2.4 billion.

While growing up in Lynden, Hefter opened her first Peoples Bank account; her favorite college class was a course called managing financial institutions.

She graduated from Central Washington University in 1992 with a degree in business and finance and completed a graduate degree in bank management from Pacific Coast Banking School in 2009.

After graduation, she sampled life in Seattle and quickly decided it wasn’t for her. She moved back home.

“Peoples was the only job that I applied for,” she said, “because I thought it was a really great company.”

As a teller, Hefter enjoyed the busy challenges of dealing with customers at the Fairway and Lynden locations. That initial position led to eventually serving as chief financial officer before she became the president in 2022.

In her spare time, Hefter mentors in financial literacy and serves on the board

of the Whatcom Dispute Resolution Center, an organization focused on constructive conflict resolution.

She also is a board member for the Washington Bankers Association and CareerWork$, a Seattle-based nonprofit whose BankWork$ program offers free training to individuals, particularly those from under-resourced or low-income communities.

Business Pulse: From whom do you draw inspiration in your job?

I am inspired by the great leaders I work with every day. I am so fortunate to be mentored by Charles LeCocq, our chairman/CEO and majority owner.

Over the years, I’ve also worked with a lot of really impressive women. I’ve reflected a lot on the fact that, thankfully, my career has been in a company where I’ve never felt constrained. I know that hasn’t been the case for some women, even now as it’s the case in some companies.

BP: What is important to you in balancing your professional and private lives?

I believe that people perform their best when they are able to achieve happiness and balance between the different components of their lives.

My career has always been really a big part of who I am. I’ve been fortunate to be able to balance my career with my personal life, and I love spending time with family and friends (often at Seattle Mariners’ games).

I’m married. I have three children, and they’re grown and all doing pretty well in life now. That’s the biggest reward in life, when your kids are doing well.

What are your hopes for Peoples Bank today and in the future?

Peoples Bank remains the only bank headquartered in Whatcom County and one of only a few locally owned and operated in Washington state. We are deeply committed to supporting the

health and growth of our local economy, providing nearly 300 jobs in Whatcom County alone.

I am excited about our new standalone branch in Fairhaven (opening in January 2026) and by the recently completed extensive remodel of our downtown Bellingham office.

I also take great pride in the support Peoples Bank provides to so many local organizations and events in Whatcom County, including our $1 million contribution toward the PeaceHealth St. Joseph Medical Center expansion.

In the future, we plan to continue to grow sustainably and responsibly, extending our presence in Skagit, Island, Snohomish, King, Chelan and Douglas counties. Steady, measured growth and expansion will ensure we are here for the long term, providing for our employees and serving our communities and customers well. ■

Thanks to our Presidents Club members for helping to create a long-lasting impact and furthering the success of our local community.

Tony Moceri

Starting, growing and operating a business is the dream of many and the reality of few. For a business to succeed, many pieces need to go right, and there needs to be something that sets it apart from its competition.

Unless, of course, you have the creativity of Steve and Sarah Pabody, who looked at their potential competition and said, “Let’s help them thrive, too.”

The husband-and-wife team of dahlia farmers began their farming journey almost accidentally in 2012 when they agreed to maintain a friend’s apple orchard while they were away. Since they were moving to a farm and knew nothing about farming, Sarah Pabody decided to take their young kids to the library to browse the books. They walked out with “The Flower Farmer,” never having considered that there are people who farm flowers. With some of the extra space on the property, she decided to begin growing flowers as they maintained the apple orchard.

Steve Pabody continued working his off-farm job while the pair worked the ground. Sarah successfully grew some flowers and sold them. As the demand for her flowers began to grow, they decided to make selling flowers a real business. They created a name inspired by their children’s names, and Triple Wren Farms was born. Now with a business on their hands, the husband-and-wife team had to learn how to run a business together.

They divided tasks on the farm and

in the business based on their individual strengths and weaknesses, and their little business began to grow. They were mostly selling cut flowers and had carved out a business providing arranged flowers for weddings. When the pandemic hit, weddings came to a screeching halt. A few years prior, they had moved to their own property after a little luck allowed them to acquire a 22-acre farm. With the need to keep their business operating despite having dropped from sixty weddings on the books to one, they decided to go all in on dahlias, and this is where their creativity began to bloom.

Up to this point, they had been growing dahlias along with other flowers and had begun selling tubers online. Dahlias

are interesting in that one tuber can grow five to six plants underground, and in some climates, they are perennials. Another aspect of dahlias is that through hybridization, or crossbreeding, people can create new dahlia varieties, resulting in a continuous stream of unique-looking flowers. While Triple Wren Farms creates its own versions, the reality is that there is a community of hybridizers passionate about dahlias who also are creating beautiful blooms.

The Pabodys joined the Whatcom County Dahlia Society and started making connections. As their community grew alongside their business, they conceived an idea that would not only provide their customers with access to

When you see these beautiful flowers in our field, there’s only one place on the planet where you can buy them. That’s us.

incredible dahlia options but also cultivate a community of hybridizers who could earn an income from their passion.

“A hallmark of our lives is that we want to be generous people, and so I think that it is important to us,” Sarah Pabody said. “These people are hybridizing beautiful dahlias by mixing pollen and collecting seeds at the end of the season, but some of them don’t really have a great way to attract customers, and they don’t have a way to handle customer service or shipping.”

To connect this talent with the demand, they created the Legacy Program, selling the tubers for the hybridizers, taking care of the logistics involved with the business and paying royalties to the individuals. This has somewhat revolutionized the

dahlia business, because it brings variety to the world.

In addition to their Whatcom County connections, the Pabodys are now reaching hybridizers and customers from all over North America. They recently started a farm across the border in Canada, and they are making connections in Europe as well. This creative approach to the dahlia business has allowed them to pay significant amounts of royalties and create a business and community that are uniquely their own.

“Being in business for yourself is great,” Steve Pabody said, “but you know what’s even better than being in business for yourself? Having a niche market. When you see these beautiful flowers in our field, there’s only one place on the planet

where you can buy them. That’s us.”

The Pabodys are excited about the future of Triple Wren Farms and the growing dahlia community locally and beyond. They host an annual dahlia festival in early to mid-September and may add more events in the coming year to get community members out to their farm. Top business priorities are seeing growth in their hybridizing program and fostering relationships between hybridizers and sellers.

To learn more about Triple Wren Farms, purchase tubers or cuttings, or join the Legacy Program, visit triplewrenfarms.com. The company also is active on social media at @triplewrenfarms. ■

For 50 years, Whatcom County residents and visitors have savored local Edaleen Dairy products, from fresh milk to delicious ice cream available in 40plus flavors.

Founders Ed and Aileen Brandsma launched their farm-to-store business in 1975 with a small herd of cows. Their motivation was fueled by Ed’s frustration with not having “a whole lot of voice” over the price at which he could sell milk to a local co-op, said Mitch Moorlag, general manager and the Brandsmas’ son-in-law.

The couple constructed a dairy and processing plant next to the family farm in north Lynden and added a dairy store on the Guide Meridian in Lynden. The name Edaleen combines their names.

The store originally focused on selling milk. Ice cream — including Fudgy Wudgy, Caramel Cashew, White Chocolate Raspberry and more than 37 other delicious flavors — was later added to the menu. Whatcom County residents and visitors from Canada and elsewhere quickly fell in love, lining up to buy ice cream available in cones, cups and gallon-sized buckets.

Today’s shoppers purchase ice cream and other items, including milk, butter, cheese, bread, eggs, sandwiches and Edaleen-themed souvenirs at the

business’s five stores, located in Blaine, Ferndale, Lynden and Sumas.

Ed and Aileen, now retired, were honored this past summer when they served as grand marshals for the Lynden Farmers Day Parade.

Moorlag keeps busy as he oversees farm and plant operations. These days, there are a lot more cows to keep happy and healthy and many more acres to care for, along with ensuring product quality control and sustainability.

“We milk just over a thousand cows, a mix of Holstein and Jersey cows,” he said.

The farm uses a robotic system that allows cows to be milked on demand. Within 24 hours, the fresh product travels about two miles to the plant for pasteurization and bottling or for a transformation into ice cream.

In total, the farm, processing plant and stores employ about 120 full-time and part-time workers. Moorlag stays in constant communication with managers and other employees to discuss daily needs and determine what steps are needed when planning next year’s crops or meeting other company requirements.

The dairy uses an anaerobic digester to create fertilizer and pathogen-free fiber bedding for the cows and to convert methane gases into electricity by burning biofuels.

Edaleen grows its own corn and grass to ensure total control over the cows’ diets. The farm also raises peas to sell in grocery stores, with leftover foliage turned into pea hay for the cows.

However, doing business in 2025 poses tough challenges that unfortunately can’t be easily solved, Moorlag said.

In the past, the Canadian quota system for how much dairy was produced resulted in higher prices for milk produced in British Columbia. In the 1980s and 1990s, Canadians crossed the border into Whatcom County to purchase items such

Since 1982

WRS is a specialty contractor doing business in the Pacific Northwest and beyond since 1982. We are proud to be our community’s trusted problem-solvers. From residential & commercial asphalt paving & sealcoating to civil construction, industrial maintenance to land-leveling & mass earthwork, and so much more, WRS proudly offers a wide range of services led by a trusted team of experts in their fields.

Contact WRS today by calling 360.366.3303, emailing info@wrsweb.com, or visiting us online at wrsweb.com. We look forward to working with you!

as milk, gas, beer and other products available at lower rates.

But the current exchange rate doesn’t favor Edaleen — or other Whatcom County businesses — especially at the company’s three main border stores in Blaine, Sumas and on the Guide, Moorlag said.

Increasing labor costs and ongoing maintenance and repair expenses impact the dairy’s bottom line.

“My greatest business concern is just really the overall ability to acquire and retain great employees with the rising costs associated with the costs of living in Whatcom County and Washington state,” Moorlag said.

The current Nooksack River Basin water adjudication legal process, with water rights for Whatcom County users yet to be determined, is a huge concern for Edaleen.

Asked what the future holds, Moorlag reflected: “Our hope would be that we would be in where we feel is a good spot for us to be. That we can remain a viable business that is able to give back to the communities that we do business in here in north Whatcom County.” ■

Matt Benoit

Tim Koetje says Whatcom County is a great place to be in the construction business. And at least part of that has little to do with how beautiful a place it is to reside.

“One of the best things about Whatcom County is our work ethic,” said Koetje, the president of Axiom Construction & Consulting. “What we call ‘average’ for a work ethic, other people in other places call ‘great.’ And I’m really proud of our county for that.”

Koetje founded Axiom in Lynden in January 2002, and the company is still proudly headquartered there.

As a full-service architectural sheet metal contractor and construction services manager, Axiom focuses on the siding and roofing aspects of a building’s exterior shell, or envelope. The company mostly tackles commercial, retail and industrial projects, but handles the occasional residential job as well.

In total, Axiom has completed over 130 projects, consisting of more than two million square feet of metal siding and roofing; Seattle’s Beacon Hill Li-

brary remains one of its most high-profile accomplishments. Its local handiwork includes aiding in the creation of Western Washington University’s Academic Instructional Center, as well as a rebuild of Bellingham’s State Street Key Bank location.

Axiom’s growth as a company, Koetje said, came from contractors recognizing the quality of Axiom’s work and employees, helping it expand into different facets of the contracting industry.

“From the beginning, I wanted this to be a company with no ceilings,” Koetje said. “We’ve mapped out a road plan that continues to evolve so that people have an opportunity, and those people that move up create a vacuum that helps people to grow. One of the things I enjoy most about my business is watching the employees grow, and I think it’s one of the best benefits that we offer as an employer.”

Both the personal growth of employees, and the overall growth of Axiom have allowed employees to transition not only into new roles but also new re-

gions in which to work. The company has Washington branches in Everett, Puyallup and Spokane and out-of-state offices in Portland, Oregon, and Bozeman, Montana.

Employees also have benefited from the company’s apprenticeship program, begun in 2016. It’s the only federally accredited program of its kind in Axiom’s industry, Koetje said, and continuing education for employees has helped the company continue marching upward and onward.

“Our goal is to be the best at what we do,” he said. “Continuing education is super important to us.”

Some of that education and growth includes the personal financial kind: Koetje said that every January, the company provides employees with an opportunity for free, one-on-one personal financial meetings with certified public accountants from Larson Gross, the Bellingham-based firm that provides accounting services for Axiom.

Although many Axiom employees spend a lot of time on the road, Koetje

Family is as important as work. We want our employees home as much as possible.

— Tim Koetje, owner of Axiom Construction & Consulting

said the goal is always to have everyone home by Thursday night for weekends at home.

“Family is as important as work,” he said. “We want our employees home as much as possible.”

The company tries to hire locally whenever it can but also continues its march outside of western Washington. A branch in Salt Lake City is planned for the next three years, with another office added somewhere in Colorado after that.

“We’re going to just keep growing east, and potentially north,” he said. “Canada is a great market for it, but we’re just not there yet.”

One of the company’s challenges has actually involved continuing to grow within western Washington. Though there is some uncertainty about the potential economic impacts of tariffs and continued inflation, Koetje said the supply chain volatility of 2020 — in which material prices sometimes increased overnight for contracts already in place — has somewhat prepared his company to deal with volatility in the near future.

Potential material cost increases can be incorporated into a bid upfront, leaving no surprises for clients. The company also plans annual cost of living increases for employees of roughly 3 to 5%.

Koetje, who is 49, has no plans to retire soon. His father still works full time at age 73. But his four children, who’ve all expressed an interest in being part of Axiom one day, may keep this Lynden-based company expanding when he does retire. Even if they don’t, Koetje said, the company is prepared to be around long into the future.

“Next man up, best man up,” Koetje said of the company’s succession plan. “My whole team knows it doesn’t have to be somebody in my family, but I did start this company to be a legacy company, and I want it to continue for generations.” ■

We’re not just moving — we’re growing with you.

Our Lynden team is excited to be expanding into a larger o ce space, just a few blocks away!

Construction is underway, and soon we’ll be welcoming you into a space built for better collaboration, conversation, and community.

Same

team, same values, more room to grow — together.

Business aviation works. Make it work for you.

Elisa Claassen

Professional development is no longer a luxury for small businesses — it is a fundamental necessity, according to the Bellingham Technical College website. It is essential to be able to see changes, pivot and remain sustainable. Rather than adopting a one-size-fits-all structure, BTC can customize training for employers who need to keep up with industry trends or new technologies. End results can include increasing morale by investing in employee growth and seeing increases in profitability and efficiency.

Anya Milton speaks clearly as she focuses on what her office at BTC has done and can do for local businesses. While Barron Heating, Andgar, Whatcom Transportation Authority, Technic Training Center and the Working Waterfront Coalition of Whatcom County have specific training programs for their businesses or affiliated industry businesses, what about achieving training for other small businesses within — or near — Whatcom County?

Milton, a community connector and workforce educator, has been the director of corporate and continuing education and work-based education at BTC for almost three years. She previously served as the executive director of the Ferndale Chamber of Commerce for three years — including during the pandemic, when she helped distribute CARES Act funds

to help provide pandemic relief within Ferndale. Her background also includes work in the nonprofit sector, and she is on target to complete a master’s degree in business administration in September 2025.

Milton wears several hats at BTC.

“I oversee programs that provide customized training and professional development to the business community,” she said. “This role involves developing partnerships, managing budgets and creating new opportunities to ensure the department is self-sufficient and responsive to market needs. I help bridge the gap between industry needs and workforce training.”

Milton cited a Washington legislative mandate (Revised Code of Washington 28B.50.020) for community and technical college systems to provide community training.

While the mandate exists, it doesn’t necessarily provide the funding, Milton said. Thus, those seeking training help might also need to find ways to pay for it, such as grants. While many people utilize the four-year colleges, there also are 34 community/technical colleges in Washington. While Milton is an employee of BTC, the program itself is self-sustaining, which means it must fund itself. She pointed out that Whatcom Community College has more personal development programs

— including the arts, yoga, beginning computer skills, etc. — and the technical colleges are geared toward a different direction: professional development.

BTC’s computer classes go beyond the basics, Milton said, covering more advanced Excel pivot tables, for example. BTC has in-depth and intense programs that may take one or two years and also shortened ones for certifications such as forklift driving or flagging.

While Milton is not doing hands-on training, she is the one making the connections by finding what the needs are and determining how to meet those needs with specialized instructors, who then create the curriculum. Industries are not stagnant, so it is important to stay connected. Milton coordinates 23 professional technical advisory committees at the college. These committees, she said, exist by state mandate to advise, assist and advocate for students, programs and the college as a whole.

“By coordinating these meetings and being able to listen to industry updates, this allows me the unique perspective of being able to identify trends, technological improvements and needs of business and industry,” she said.

BTC’s team works collaboratively with the ones at Skagit Community College and WCC as well. SCC has taken the lead, Mil-

ton said, on helping with the grant funding piece for businesses that need financial aid to achieve their goals.

An example: The city of Bellingham, which has 800-plus employees, came to Milton for a training solution that involved a hybrid approach. Given the size and scope, BTC and WCC joined forces to provide training in tandem, with equal responsibility and funding, Milton said.

A second example is the emerging industry company Group14 Technologies, which has a patented silicon-carbon composite to help batteries charge in minutes and lasts up to 50% longer. The company needed help quickly training 80 new employees, condensing a lot of information into a two-week primer. While the facility is technically in Woodinville, with another in Moses Lake, BTC worked with the company because its director of operations had graduated from BTC and believed in its programs, Milton said.

Employers interested in knowing more can contact Milton at cce@btc.edu or 360-752-8472. ■

Mark Harmsworth

Washington’s Growth Management Act, enacted in 1990, was designed to guide sustainable development, preserve natural resources, and curb urban sprawl. However, after over 40 years it’s obvious that GMA’s restrictive land-use policies have significantly contributed to the state’s ongoing housing crisis, limiting developable land and driving up costs. A recent report from the Building Industry Association of Washington, provides compelling data illustrating how the GMA’s framework has constrained land availability, exacerbated housing shortages and priced out many residents.

The GMA mandates that counties and cities designate Urban Growth Areas around cities borders to concentrate development, protect rural lands and preserve critical areas, like wetlands and farmlands. However, these restrictions have drastically reduced the supply of developable land. In King County, for example, only 26% of land is zoned for urban use, with the remainder locked away for rural or resource purposes. Statewide, just 14% of Washington’s land is available for development, despite growing population pressures. This artificial scarcity inflates land prices, making it harder for builders to create affordable housing.

The BIAW report notes that Wash-

ington’s population grew by 14.6% from 2010 to 2020, yet the supply of developable land has not kept pace. UGAs, intended to accommodate growth, are often drawn too tightly, leaving insufficient space for new housing. In Pierce County, the UGA covers only 12% of the county’s land, despite a 10% population increase over the same period. This mismatch forces developers to compete for scarce parcels, driving up costs that are ultimately passed on to homebuyers. The median home price in Washington reached $611,096 in 2025 (Source: Zillow), nearly double the national average — largely due to land constraints.

Critical areas ordinances restrict development near wetlands, streams and slopes, often requiring large buffers that further shrink usable land. In Snohomish County, for instance, up to 40% of potential building sites are rendered undevelopable due to these regulations. Combined with lengthy permitting processes, sometimes averaging 18 months to two years, these restrictions discourage new construction, stifling supply and fueling price increases.

Rural areas face their own challenges under the GMA. The act’s emphasis on preserving rural character limits subdivisions and development outside UGAs, leaving rural residents with few housing options. Land-use restrictions have reduced lot sizes and housing types, making it difficult for low and middle-income families to find affordable homes outside

urban centers. This has also strained infrastructure, as concentrated growth in UGAs overwhelms existing roads, schools and utilities.

The GMA’s one-size-fits-all approach fails to account for regional differences. Eastern Washington, with its vast open spaces, faces less development pressure than western Washington, yet both are subject to the same rigid rules. Reforming the GMA to allow more flexible UGA expansions and streamline permitting will unlock land for housing. For example, expanding UGAs by just 5% in highgrowth counties could add thousands of new homes over a decade, easing price pressures.

Ultimately, the GMA’s land-use restrictions have created a supply bottleneck that fuels Washington’s housing crisis. Policymakers must balance environmental goals with the urgent need for affordable housing by revising the GMA to increase land availability and reduce regulatory barriers. Without GMA reform, the dream of homeownership will remain out of reach for many Washingtonians. ■

Mark Harmsworth was elected in 2014 to the Washington State House of Representatives, where he served two terms. His focus was on transportation and technology, including serving as the ranking member on the House Transportation Committee. Mark works in the technology industry and is an owner of a small business after completing a long career at Microsoft and Amazon.

Justin Gross CFP

Running a business takes vision, grit and tenacity. While many owners focus on driving growth, operations and team development, planning for their own financial future may take a back seat. With a lack of clear plans for personal cash flow, investing and succession, owners risk missing important opportunities to build wealth, and they may even face financial instability as they look to step away from the business they have built.

The good news is that it’s never too late. Here are five strategies anyone can

implement to begin building a successful retirement.

1. Don’t let your business be your (whole) retirement plan

Assuming your business will successfully be sold or handed off when you’re ready to step away carries significant risk. Markets change. Buyers might not be able or willing to pay what you think the business is worth. Family members’ career aspirations change, and unforeseen life events could force a transition sooner than planned.

Avoid these risks by separating personal wealth from business wealth; this may include building investments such as retirement accounts, brokerage portfolios

or real estate holdings that don’t depend on your business’s performance. These assets, when coordinated as part of a holistic plan, can provide liquidity and stability, giving you more freedom in timing and structuring your exit.

2. Maximize & monitor your cash flow

Healthy cash flow is the lifeblood of your business and personal finances. Yet many owners treat personal income as an afterthought, pulling money from the business when it’s most convenient or available. This lack of strategy does nothing to help build discipline around long-term wealth and could even have unintended tax consequences..

Instead, pay yourself a consistent and planned income as much as possible. This may be a mix of salary, distributions or dividends, ideally structured with the help of a tax professional. Then, treat your personal finances like you would a business: Track income and expenses, build a budget and set targets for saving and investing.

Consider your short- and long-term liquidity needs. Do you have enough cash set aside to weather a downturn or seize an investment opportunity? An emergency fund and capital buffer are essential for both your business and your household.

Keeping business and personal finances separate prevents using your business as a personal ATM, protecting its perceived value for future buyers.

3. Start investing — even if you don’t think you’re an “investor”

Many business owners say, “I reinvest everything back into my business.” Reinvestment is important but can lead to overconcentration in a single asset — your company. Diversification through a long-term investment portfolio provides balance, tax efficiency and growth outside the company.

For those just starting out, a basic strategy is to use retirement accounts like 401(k) plans, SIMPLE IRAs, solo 401(k) plans or defined benefit plans to reduce current taxes and build wealth. A trusted financial adviser can help design and implement a retirement plan that leverages your business and personal goals while building a diversified portfolio tailored to your risk tolerance.

Remember that investing isn’t about getting rich quick. It’s about aligning your money with your long-term objectives.

4. Plan early — even if you’re not ready to step away

Succession planning isn’t just about choosing a successor. It’s a process of ensuring your business and family can thrive when you’re no longer at the helm of the company.

Ask yourself:

• Who will lead the business when I

retire or am no longer able to work?

• What financial arrangements need to be in place for a smooth transition?

• How can I fairly treat children who are involved in the business and those who are not?

• Do I have the legal documents (buysell agreements, estate plans, etc.) to ensure a smooth transition?

Succession planning takes time, and conversations around family, leadership and legacy can be emotionally charged. Start early and involve advisers (legal, financial and business) who can help create a structure that supports your values and goals.

You don’t have to do this alone. Most successful business owners build teams of professionals — including a financial planner, certified public accountant, attorney and business consultant — who work together to coordinate strategies. A trusted team ensures that tax, insurance, estate, investment and succession plans are aligned while freeing the business

owner to focus on the priorities of the business. Look specifically for advisers who understand the nuances of family businesses and can help you navigate personal wealth planning and the relationship dynamics of the next generation.

Owning a business provides tremendous opportunities but also unique financial challenges. By taking time to plan intentionally, you can set yourself and your family up for long-term success and move forward with purpose and peace of mind.

Your business is a legacy. Make sure your personal finances tell the same story. ■

Justin Gross is a certified financial planner, fee-only advisor and partner at Financial Plan. He specializes in helping high-performing professionals, business owners and their families build, protect and grow wealth through life’s most pivotal transitions.

Dana Rozier

Imagine a genius-level intern who just started work at your company. This person doesn’t know your business yet, so you assign a low-risk task: Read a 50page industry report and distill it into an executive summary with a few actionable bullet points.

You figure that’ll keep the intern busy for a few hours.

Instead, the intern delivers a high-quality summary in under a minute and offers to turn it into a podcast you can listen

to on the way to your next meeting. The podcast would take just five minutes to create.

To most Whatcom leaders, this might sound far-fetched. But it’s exactly what artificial intelligence can do today.

You’ve heard the AI buzz and wondered if it’s just hype. As an AI consultant who trains non-technical teams, I assure you it’s not. AI is one of the most practical business tools available right now. And it’s ready to help.

Over the past two years, AI has moved from experimental to essential. Recent reports, such as Microsoft’s Work Trend Index, mark 2025 as the critical year for businesses to move from casual AI use to strategic integration. As we approach the fourth quarter of 2025, the real question is: Are you ready?

Think back a few years when having a professional website went from “nice to

Jacob Marr

Owner

Jacob@marrsheating.com

1677 Mt. Baker Hwy, Bellingham, WA 98226

OFFICE: 360-734-4455

ww w marrshea t ing .c o m

www.summitbkpg.com summit@summitbkpg.com

have” to “must have.” We’re at a similar moment with AI. Your competitors are already using AI to draft marketing copy, analyze customer feedback and spot sales trends. Doing nothing now means choosing to fall behind. Luckily, getting started with AI is simpler than you might think.

Tools like ChatGPT and Microsoft Copilot act as genius-level interns ready to streamline your everyday tasks. Here’s how:

1. Reclaim your time: the AI summarizer

If you spend hours a week reading long reports or complex email chains, reclaim half that time by using an AI tool as your high-speed analyst. Upload a document and ask: “Summarize the key findings of this report in five bullet points” or “What’s the main conclusion of this email thread, and what’s required of me?” You’ll get quick and clear takeaways so you can make informed decisions faster.

2. Unlock your data’s secrets: the AI analyst

Small businesses often have valuable data locked in spreadsheets but lack the time or tools to analyze it. With AI, you can upload your sales data and ask plain-English questions, such as, “Which three products saw the biggest sales increase in Q4 last year?” AI can turn static numbers into useful insights.

3. Spark new ideas: The AI brainstorming partner

Ever feel stuck on a campaign idea? AI is a brainstorming partner that never runs out of ideas. Try something like, “Act as a marketing expert for a local retail shop in Lynden, WA. Suggest five low-cost ideas to attract more fall foot traffic.” You’ll get a starting point you can then refine with your team, saving creative energy and time.

Getting started with AI can feel overwhelming. The key is to start small, but start.

1. Choose just one tool (for now)

Pick a user-friendly platform such as ChatGPT, Claude, Gemini or Copilot. They all have free versions that are more than powerful enough. Stick with one tool for a few weeks and get comfortable.

2. Identify one low-stakes, repetitive task

Start with something you already do regularly, such as writing meeting agendas or drafting social media posts. These are low-risk ways to practice giving clear instructions and reviewing AI output.

3. Think “manager,” not “magician”

Success with small tasks builds the confidence needed to tackle more complex

ones. As you keep going, remember to treat the AI like a new intern, not a mind reader. You are the manager. Provide clear instructions, give context and review the output. The more you practice this collaborative conversation, the more you’ll see where AI fits into your daily workflows.

Don’t wait. Start building your AI future today

Ultimately, the goal of AI is simple: Reduce the time your team spends on mundane tasks so they can focus their energy on the higher-value activities that truly drive your business forward. By starting small and building momentum, you can position your business for a more efficient and innovative future.

So, Whatcom County leaders, don’t wait for the future to happen. Start shaping it now. ■

This fall, Whatcom County voters will see 12 proposed amendments to our county charter on the November ballot, each with the potential to shift how local government functions in meaningful ways.

The Charter Review Commission, after 19 public meetings and more than 40 proposals, has advanced 12 amendments for voter consideration. High-profile ideas such as ranked-choice voting and eliminating atlarge council seats didn’t make it through. What’s left is a group of proposals that could significantly influence how our local government works.

Some of these changes are necessary. Some are expensive. And several, while well-meaning, will require careful planning and potential trade-offs.

As a county councilmember, I’ve reviewed these proposals in detail. A few could lead to stronger transparency and accountability, which we need. Others, while well-intentioned, come with real costs and possible complications.

Two amendments zero in on financial oversight, and they could make a real difference in how we manage public funds and accountability.

One would block the Whatcom County Council from approving supplemental budget requests if the executive is late in submitting the quarterly financial reports. Currently, these reports are required by the charter and county code, but there is no penalty or recourse if they are not provided. Previously, this wasn’t an issue, but in the last couple of years, the reports often have been late and, in some cases, never delivered at all. Since the executive regularly proposes tens of millions in additional spending each year, it’s important that the County Council have accurate and current numbers before we vote. It’s just common sense.

Another amendment would move up some of the budget timelines to earlier in the year. It would require the county executive to publish draft documents and post planning materials publicly. That gives both the council and residents more time to review, provide feedback and propose changes. But there’s a catch. The council office has staff equivalent to 11 1/2 full-time

positions, including the seven elected councilmembers. We’re already stretched thin, and more time doesn’t change the fact that we simply don’t have the staffing support needed to develop thorough alternatives or deep analyses.

One of the amendments I strongly support would require an analysis of how proposed land use or construction code changes might affect land supply and building costs.

This is a tool we’ve been missing. Every zoning or permitting change can impact how much land is available for development and how expensive it becomes to build. Without this kind of analysis, we’re often guessing. Understanding those impacts could help reduce housing costs, speed up permitting and support smarter growth.