ACHIEVING

BUSINESS

EXCELLENCE

ONLINE

BusinessExcellence Weekly

ISSUE No. 48 | www.bus-ex.com

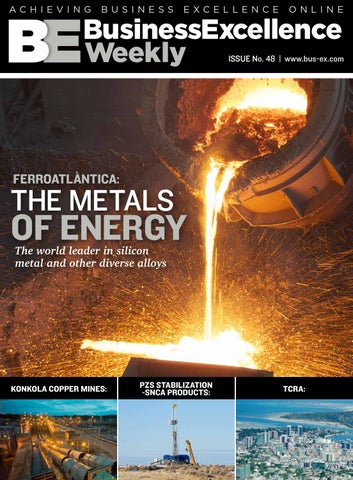

ferroatlÀntica:

The metals

of energy The world leader in silicon metal and other diverse alloys

konkola copper mines:

PZS Stabilization -SNCA Products:

TCRA: