8 minute read

Administrqfion Signs New Housing Act of 1957

Eisenhower Displeosed Wirh

Ports of Bilf; NAHB Seeks

to lmplement lt ot Once

The 1957 Housing Act, passed by the Congress and signed into law luly 12 by the President, marks the most signilicant advance in the Federal Government's approach to our national housing problems since the establishment of the FHA in 1934. I am hopeful the Housing Agencies will go ahead immediately lvith their authorizations, said President George S. Goodyear of the National Association of Home Builders.

Congress, by authorizing lower down payments, has recognized that millions of families, veterans and non-veterans alike, can successfully meet the monthly cost of good homes out of income, but are unable to accumulate large sunrs of money for substantial down payments. The Act will have a profound effect on the kind and quantity of homes built in 1958 and succeeding vears.

We home builders naturally feel a great satisfaction in the enactment of legislation providing a more realistic schedule of FHA dorvn payments-a development r,vhich we have long advocated. But with this satisfaction there is also the sober realization that all of us concerned with the home building industry are now confronted with a great public responsibility. We must insure that the ne.lv FHA program results in lasting benefit to the entire home buying public, he said.

_.Every segment of this industry-builders, lenders, suppliers, and Government policy-makers in the field of housing -must prepare now to meet the responsibilities rvhich this legislation entails. We as an industry must make certain that the new communities which will'be built in the vears ahead are soundly planned and executed in the public interest. They must be communities rvhich can lte Dassecl on with pride to succeeding ger.rerations.

There still remains a tremendous need for an adequate and stable florv of mortgage credit at terms the a.'erage American family can afford. There must be ar.r increased supply of funds from the private lendins institutions which traditionally have beerr. and should be, the prime source of mortgage credit.

Nerv investment sources are slowly being developed among pension funds and other holders of public saving. We must intensify our drive to develop investment from these funds rvhich hitherto have not played a maior role in the mortgage market, the NAHB exeiutive actded.

Your national officers are redoubling their efforts to improve the supply of mortgage credit from existing lenders, who have a real obligation to fulfill, and to search out and open up new areas of financing. We strongly urge tl-rat the ofrficers and mortgage finance committees of each local affiliated home builders association join us rvholeheartedly in this drive to enlist financing support, rrot only for the nerv FHA program but for all housing, he declared.

Let's not close our eyes to some of the possiltle alternatives. If private capital fails to provide the credit needed to house America properly, there can be little doubt that advocates of direct Government lending will seek to force their own solutions.

The new FHA program also demands intensification of the home building industry's efforts to reduce the cost and price of new housing, while maintaining a high and sustained quality production that will truly meet the needs and the financial abilities of the mass market.

It is urgent that the industry concentrate its energies and its ingenuity on the solution of these problems, in cooperation rvith the manufacturers of building prod-

New Worlds to Conquer?

The Research department of the Southern California Plastering Institute, following a study of reproduction statistics and population trends, predicts a continuing high volume of residential construction for "at least another 20 years." The study r,vas to determine the extent to which usable land for residential building would be absorbed in Los Angeles, Ventura, Santa Barbara and Orange counties. "We will run out of land long before we will satisfy our longterm, 3O-year projected need," concludes the report.

ucts and with the federal, state and local authorities whose regulations so vitally affecthousing.

The Congress has now placed a serious responsibility upon the Federal Housing Administration to re-examine its orvn procedures, particularly with respect to the acceptance of vastly-improved materials and new techniques which have developed in the home-building industry. This would be an opportune time for FHA to revitalize the pioneering spirit of its early years and assume leadership in making these developments available to the home-buying pubtic.

The home-building industry can feel just pride in the ever-higher standards of professional performance with rvhich it has built the millions of ner,v homes since the end of World War II. We must further this professional resDonsibility to make certain that the American families u'ho-rvill be acquiring nerv homes will receive sound and lasting value for their housing dollars.

To attain the objectives I have cited rvill require all the energies and abilities of this industry. Within the ver.y near future, I intend to propose a broad industrv program, implernented rvitl-r specific recommendations, to carrv out our share of the job. I am confident it will receive the wholehearted support of every member of the National Association of Home Builders. President Goodvear concluded.

President Signs Housing Bill But Criticizes Congress for Provisions

President Eisenho'iver signed the Housing Bill Jdy 12 but, in a public statement criticized the Congress for:

(1) Discount controls,

(2) Requiring FNMA to pay prices above those prevailing in the private market for special assistance mortgages.

(3) For failure to increase the interest rate to 5 /o on VA-guaranteed mortgages,

(4) Failure to enact an adequatc interest rate formula for college housing loans, and

(5) For granting increased budgetary authority in excess of the amounts the President requested. (The Act provides for $1,990,000,@0 in ne.iv obligational authority, more than double the amounts requested).

In connection tvith the nerv obligational authoritv, the President said :

"However, these amounts do not have to be made a.i'ailable for obligations in the cnrrent fiscal year-accordingly, I have given instructions to limit the use bf the nerv authoiity provided by this Act during the fiscal year 19.58 to amounts consistent .ivith the overall budget program."

He called upon the Congress to repeal tl.re provision for discount controls and the provision requiring FNMA to pay more for special assistance mortgages than the market price. early in the next session.

In urging the Congress to authorize an increase in the

VA interest rate, he stated, "The real solution for inadequate mortgage funds and excessive discounts is to permit the interest rates on Federally insured and guaranteed mortgages to reflect the supply and demand for funds."

No mention was made in the President's statement concerning the authority for FHA to lou'er the minimum down payments so.it is reasonable to assume that this action meets rvith the President's approval. llorvever, the nerv law provides that before the ner'v terms are put into effect the FHA Commissioner "shall determine that such ratios are in the public interest after taking into consideration (1) the efiect of such ratios on the national economy and on conditions in the building industry, and (2) the availability or unavailability of residential mortgage credit assisted under tlre Servicemen's Readjustment Act of 1944, as amended." This rvould seem to require the Commissioner to make a studv upon which such a deterrnination can be ma<le, said the National Retail Lumber Dealers Association.

Provisions Of The Housing Act Of 1957

(H. R. 66se) down payments. No change is made in existing provisions for FHA Sec. 221, low-income housing. Extensive liberalization of this program was rejected.

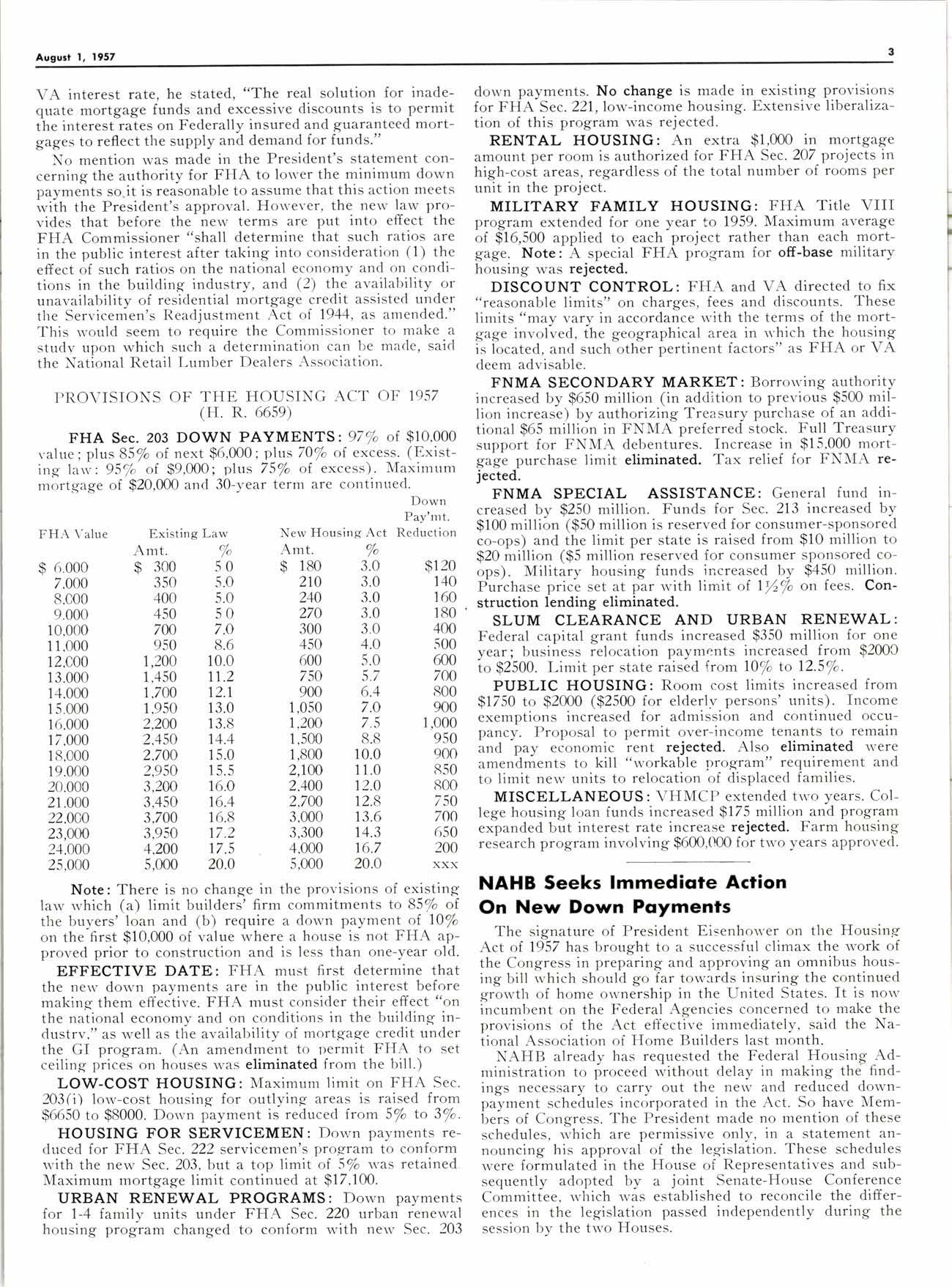

FHA Sec. 203 DOWN PAYMENTS:97/" of $10,000 value; plus 85/o of next $6,000; plus 70/o of excess. (Existirrg lau' 95/. of $9,000; plus 75/o ol excess). Maximum mortgage of $20,000 and 3O-year term are continttecl.

RENTAL HOUSING: An extra $1,000 in mortgaS;e amount per room is authorized for FHA Sec.207 projects in high-cost areas, regardless of the total number of rooms per unit in the project.

MILITARY FAMILY HOUSING: FHA TitIC VIII program extended for one year to 1959. Maximum average of $16,500 applied to each project rather than each mortgage. Note: A special FHA program for off-base military housing was reject€d.

DISCOUNT CONTROL: FHA and VA directed to fix "reasonable limits" on charges, fees and discounts. These limits "may vary in accordance with the terms of the mortgage involved, the geographical area in 'n'hich the housing is located, and such other pertinent factors" as FHA or VA deem advisable.

FNMA SECONDARY MARKET: Borro'iving authority increased by $650 million (in ad<iition to previous $500 m!!lion increase) by authorizing Treasury purchase of an additional $65 million in FNMA preferred stock. Full Treasttry support for FNMA debentures. fncrease in $15,000 mortgage purchase limit eliminated. Tax relief for FNN A rejected.

FNMA SPECIAL ASSISTANCE: General fund increased by $250 million. Funds for Sec. 213 increased by $100 million ($50 million is reserved for consumer-sponsored co-ops) and the limit per state is raised from $10 million to $20 million ($5 million reserved for consumer sponsored coops). Military housing funds increased by $45O million. Purchase price set at par r,vith limit of lfu/o on fees. Con. struction lending eliminated.

SLUM CLEARANCE AND URBAN RENEWAL: Federal capital grant funds increased $350 million for one year; business ielocation payments increased from $200C to $2500. Limit per state raised lrom l0/o to I2.5/o.

PUBLIC HOUSING: Room cost limits increased from $1750 to $2000 ($2500 for elderlv persons' units). Income exemptions increased for admission and continued occupancy. Proposal to permit over-income tenants to remain and pay economic rent rejected. Also eliminated '"r'ere amendments to kill "rvorkable Drogram" requirement and to limit new units to relocation of displaced families.

MISCELLANEOUS: VHMCP extended tu'o years. College housing loan funds increased $175 million and program expanded but interest rate increase rejected. Farm housing research program involving $600,mO for tlvo years approved.

Note: There is no change in the provisions of existing law rvhich (a) limit builders' firm commitments to 85,Vo of the buyers' loan and (b) require a dorvn payment ol 10/. on the first $10,000 of value where a house is not FHA approved prior to construction and is less than one-year old.

EFFECTIVE DATE: FHA must first determine that the nelv dorvn payments are in the public interest before making them effective. FHA must consider their effect "on the national economy and on conditions in the building industrv," as well as the availability of mortgage credit under the GI program. (An amendment to permit FHA to set ceiling prices on houses was eliminated from the bil1.)

LOW-COST HOUSING: Maximum limit on FHA Sec. 203(i) low-cost housing for outlying areas is raised from $6650 to $8000. Dorvn payment is reduced from 5/o to 3/o.

HOUSING FOR SERVICEMEN: Down payments reduced for FHA Sec. 222 servicemen's program to conform rvith the new Sec. 203, but a top limit ol 5% r,r'as retained Maximum mortgage limit continued at $17,100.

URBAN RENEWAL PROGRAMS: Down payments for l-4 family units under FHA Sec. 220 urban renewal housing program changed to conform with nelv Sec. 203

NAHB Seeks lmmediote Action On New Down Poymenls

The signature of President Eisenho\\,er on the Housing Act of 7957 has brought to a successful climax the r,vork of the Congress in preparing and approving an omnibus housing bill rvhich should go far towerds insuring the continued growth of home or.vnership in the United States. It is norn' incumbent on the Federal Agencies concerned to make the provisions of the Act effective immediately, said the National Association of Home Builders last month.

NAHB already has requested the Federal Housing Administration to proceed without delay in making the- findings necessary to carry out the nerv and reduced downoavment schedules incoroorated in the Act. So have MemLeis of Congress. The Piesident made no mention of these schedules, rvhich are permissive only, in a statement announcing his approval of the legislation. These schedules rvere formulated in the House of Representatives and subsequently adopted byajoint Senate-House Conference Committee. t'hich rvas established to reconcile the differences in the legislation passed independently during the session by the tu''o llouses.