3 minute read

Wholesalers' fearless forecast

Alfflfffi'IdLli*T:"1,:;

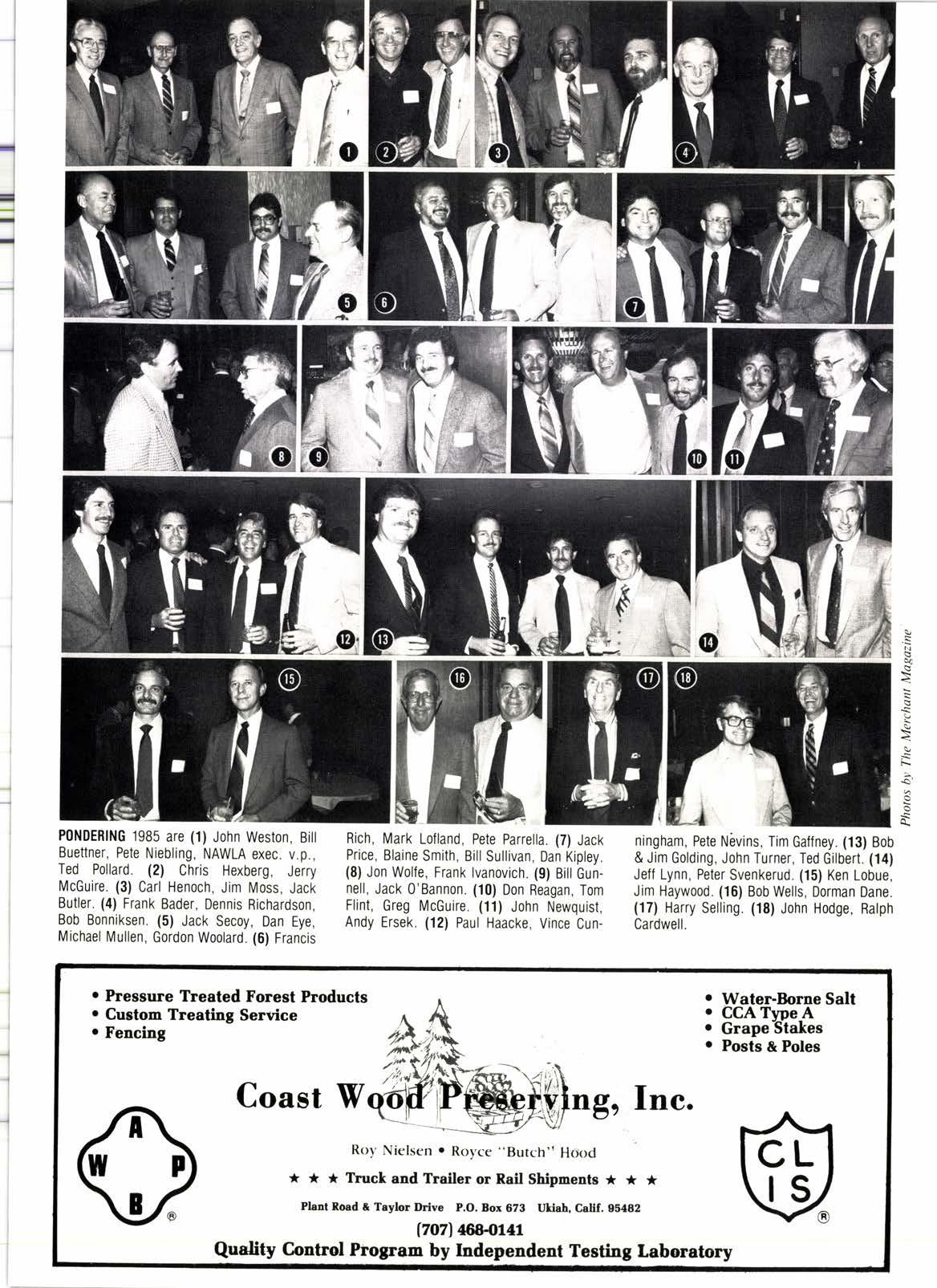

starts in 1985 has been made at a series of regional meetings of the North American Wholesale Lumber Association by its executive v.P. H.M. "Pete" Niebling. The gathering shown here, in Long Beach, Ca., was one of more than 20 held around the U.S. this fall.

He foresees a slight decline in interest rates in 1985, some action late in the year on the federal deficit by the Congress, and a better balance between supply and demand for lumber producing somewhat higher prices.

More multifamily housing next year is expected to produce reduced demand for lumber and other wood products. Demand will essentially "be blah," Niebling said.

The success of the NAWLA schools was graphically presented at most of the meetings in the form of a new video tape made from school proceedings. The tapes are now being made available to members as an educational tool for their employees.

The Southern California meeting also featured an illustrated presentation on the Mount Saint Helens'eruption and its effect on the lumber industry by Dr. Barney Pipkin, an expert in geology.

PONDERING 1985 are (1) John Weston, Bitl Buettner, Pete Niebling, NAWLA exec. v.p., Ted Pollard. (2) Chris Hexberg, Jerry McGuire. (3) Carl Henoch, Jim Moss, Jack Butler. (4) Frank Bader, Dennis Richardson, Bob Bonniksen. (5) Jack Secoy, Dan Eye, Michael Mullen, Gordon Woolard. (6) Francis

Rich, Mark Lofland, Pete Parrella. (7) Jack Price, Blaine Smith, Bill Sullivan, Dan Kipley. (8) Jon Wolle, Frank lvanovich. (9) Eill Gunnell, Jack 0'Bannon. (10) Don Reagan, Tom Flint, Greg McGuire. (11) John Newquist, Andy Ersek. (12) Paul Haacke, Vince Cun- ningham, Pete Nbvins, Tim Gaflney. (13) Bob & Jim Golding, John Turner, Ted Gilbert. (14) Jeff Lynn, Peter Svenkerud. (15) Ken Lobue, Jim Haywood. (16) Bob Wells, Dorman Dane. (17) Harry Selling. (18) John Hodge, Ralph Cardwell.

Housing Level In 85

(Continued from Page 30) pressure to the trend of interest rates in the immediate period ahead.

The financing side of the housing industry should be relatively favorable. We expect mortgage rates on 3Gyear fixed-rate loans to average 13.28s/o in 1985 and 13.8490 in 1986, compared with an average of 13.9090 in 1984. Our forecast shows mortgage rates dropping to a low of l39o in the spring of 1985 and then gradually rising to l49o by the end of 1986. knders have become more conservative in the initial terms offered on adjustable-rate mortgages, but these instruments will continue to play an important role in underwriting housing activity.

Three primary forces are likelY to restrain housing from even higher totals in 1985-86. Ttre level of home prices and mortgage rates will still imply prohibitive financing costs for various potential homebuyers. Two years of strong housing construction have also produced an overhang of units in certain areas, such as the southern part of the U.S., which will need to be absorbed. Finally, in contrast to the situation of the 190s, housing will not be purchased primarily as a hedge against inflation. We expect home prices to rise about 4.590 in 1985 and 5-5.590 in 1986.

Housing should reach its highest point next spring at the low point of mortgage rates, with a gradual decline occurring thereafter. On balance, we look for the homebuilding industry to perform relatively well in 1985 and 1986, with the welcome absence of the wide swing of recent years.

Production Problems

(Continued from page 30) to stock inventories in advance of real need. It should follow that price levels of wood products should continue to be depressed with some seasonal fluctuation.

All in all, the year will be one that will require the ingenuity of management in developing improved methods of asset utilization, better product management and improved marketing outreach. In so doing, 1985 can be made to be reasonably acceptable and even better than the year just passed.

British OKWestern Lumber Use

Western lumber has pierced the British market a little more with the publication of a revised code of practice for wood construction.

Slated to be the standard guide in the United Kingdom on how to use wood in construction, the information, published by the British Standards Institute, BS 5268: Part 2, lists the U.S. visually graded species for the first time.

The Timber Research and DeveloPment Association, a British industry trade group, also has released a wood information sheet on North American machine stress-rated lumber. Both publications should help encourage more demand for western lumber in England, Craig Larsen, Western Wood Products Association exPort manager, notes.

Hardware Sales Headed UP

The business climate is terrific in the Southwest with excellent sales in the first part of the Year, forecasts a National Wholesale Hardware Association executive.