3 minute read

Panel industry looking healthy

By William T. Robison President American Plywood Association

ITHE U.S.

I structural panel industry is heading for its second successive record production year in 1984, and there is the likelihood of another quite strong production performance in 1985.

That these prospects amount to much less than Utopia for producers of plywood and other structural panels is an indication of the Paradox confronting producers of all typesthe challenge of relatively high demand offset by low profitability and continuing excess capacity.

Our latest APA estimate is that U.S. structural panel production for 1984 will be about 21.8 billion square feet, 3/8-inch basis, or about 590 above the 1983 record of 20.8 billion feet.

The association's original estimate of 1.7 million housing starts in 1984 is likely to be exceeded by as manY as 150,000 units, We now expect a total for the year in the range of 1.85 million, or 9 9o above 1983.

Concurrent with this quite vigorous housing performance which has helped keep many mills busy, if not Prosperous, the panel markets beyond housing have continued to advance.

Nearly 6090 of total 1984 Panel demand will be in the nonhousing marketsover-the+ounter sales for repair and remodeling; nonresidential construction; industrial applications' and exports. These markets are now receiving increased promotional attention, and will be even more significant in 1985.

APA sees a more restrained housing performance in the 1.5 million start range for most of the Year ahead. There is no question that the still mounting federal deficit and a continuing high dollar will curb panel demand in home building and exports.

The preliminary APA forecast for 1985 is for 20.9 billion square feet of production, a drop of 4s/o from 1984 to just about the 1983 level.

Panel industry health in the years ahead will rely to an increasing extent on our success in finding more diversified market outlets at home and abroad. This explains our continuing efforts to expand the nonhousing applications.

The overriding APA management objective for the next five years, as determined by the Board of Tfustees, is to expand the total marketplace for structural panel products of all types and close the present costly 2.8 billion

Story at a Glance

Panel production to be off onlY 4o/o ln'85 from a record '84. 1.5 million housing starts... nearly 60% of lotal panel demand now in nonhousing markets. .new promotions will expand usage.

square foot gap between industrY capacity and demand.

Projections by APA see the market for all panels rising to about 25.5 billion square feet by 1989, provided a substantial promotional attack on the total market is maintained.

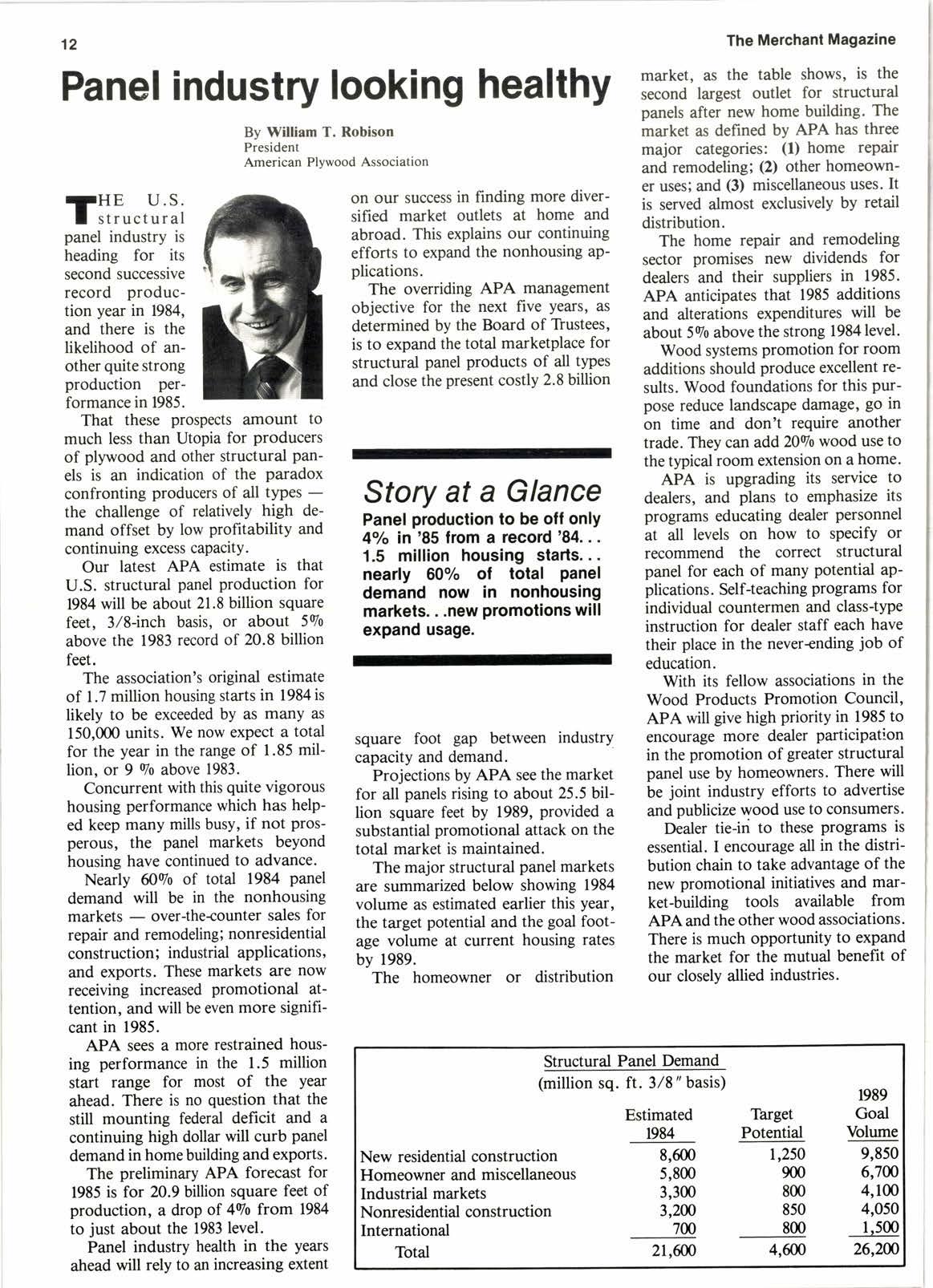

The major structural panel markets are summarized below showing 1984 volume as estimated earlier this year, the target potential and the goal footage volume at current housing rates by 1989.

The homeowner or distribution market, as the table shows, is the second largest outlet for structural panels after new home building. The market as defined bY APA has three major categories: (1) home repair and remodeling; (2) other homeowner uses; and (3) miscellaneous uses. It is served almost exclusively by retail distribution.

The home repair and remodeling sector promises new dividends for dealers and their suppliers in 1985. APA anticipates that 1985 additions and alterations expenditures will be about 590 above the strong 1984 level.

Wood systems promotion for room additions should produce excellent results. Wood foundations for this purpose reduce landscape damage, go in on time and don't require another trade. They can add 2090 wood use to the typical room extension on a home.

APA is upgrading its service to dealers, and plans to emPhasize its progr:rms educating dealer personnel at all levels on how to sPecifY or recommend the correct structural panel for each of many potential applications. Self-teaching programs for individual countermen and class-type instruction for dealer staff each have their place in the neverending job of education.

With its fellow associations in the Wood Products Promotion Council, APA wi[ give high priority in 1985 to encourage more dealer participatlon in the promotion of greater structural panel use by homeowners. There will be joint industry efforts to advertise and publicize wood use to consumers.

Dealer tie-in to these Programs is essential. I encourage all in the distribution chain to take advantage of the new promotional initiatives and market-building tools available from APA and the other wood associations. There is much opportunity to expand the market for the mutual benefit of our closely allied industries.