6 minute read

Page

2.8; big-window/outdoor banners, 2.6; shelf-talkers, 2.4; themed price tags, 2.5; live, in-store "how-to-do-it" customer seminars/shows, 2.5; ready-to-use TV commercials with dealer tag-line, 1.8; TV slides and script, 1.8; ready-taped radio commercials with provision for dealer tagJine,2.4; radio scripts only, 2.5.

Thirty-five percent of the respondents said contractors account for most of their business; the average customer mix of this group of dealers is 72t/o contractor and 28o/o consumer. Forty-four percent of the respondents indicated that consumers are their largest customer group (7290 consumer and 280/o contractor). The remaining dealers felt their customer mix was balanced (about 5090 each) between contractors and consumers.

Dealers responding suggested numerous topics for seminars, publications, and audio visual materials such as employee knowledge of products and their application in building and renovation; management tools; and employee training for increased proficiency in their specific jobs.

Hardwood Men Hit The Books

MacBeath Hardwood Co., Los Angeles, Ca., was the location of the practical work done during the recent short course sponsored by the Los Angeles Hardwood Lumbermen's Club. Classroom sessions were held at the nearby Holiday Inn, according to Dennis Johnston who coordinated the five day class, Aug. 29-Sept. 2.

31 News

Picture Frames

Quality Woodland frames are a pefect accent to give pictures the finishing touch. Constructed of all clear pine, they are custom embossed for that handcarued look

A popular retail item, receive a FREE Display Rack with your opening--orcler. Ask for the special picture frame assortment of Woodland's four most popular patterns THE

Like the Grand Canyon, we've been around a long time and we're very, very deep.

To serve your needs we are deep in the widest variety of Moulding, Jambs, Frames, Embossed Mouldings, Exotic Mouldings and Accessories.

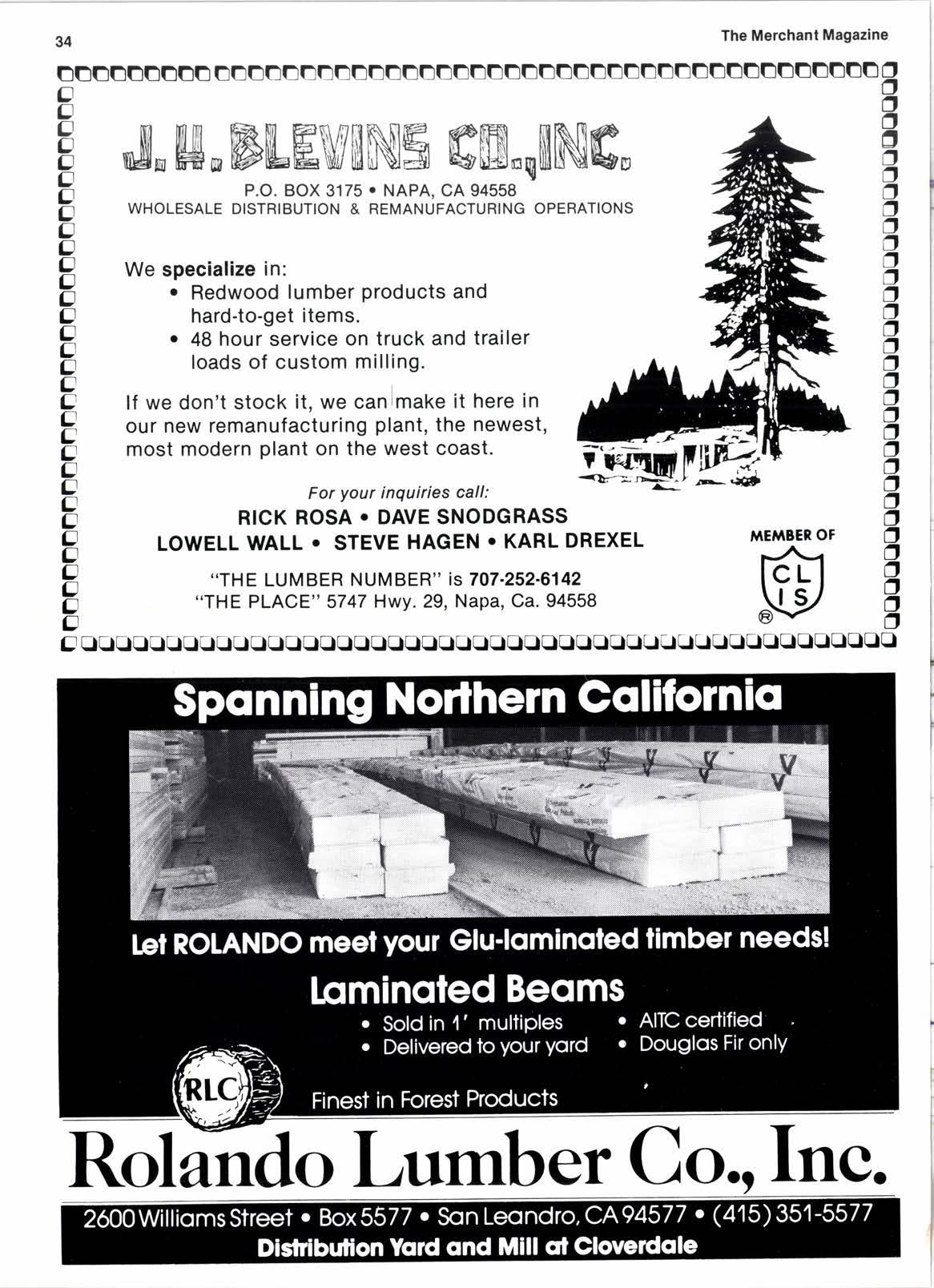

\l9orst Lumber Year Since'45

Final figures show that softwood production in 1982 totaled only 13.724 billion board feet, the lowest yearly output since 1945 when production came in at l2.l billion board feet. In comparison, 1982 totals were 7.790 below l98l's 14.869 billion board feet, and 31.5% below "normal 1979's" 20.025 billion board

Lumber Production

(Continued from page 14) market has slowed down some, but growth continues. According to Forest Industries, January's output of softwood lumber, the type most commonly used in construction, was 25.2s/o above December, 1982, and 43.1s/o higher than January,1982. Things fell back some in February, but production that month still was 38.590 above that ofa year earlier.

Because of delays in gathering and analyzing the market information, hard data for the second quarter of 1983 are not available, but the industry has been gaining momentum. The National Forest Products Association now projects total lumber production for 1983 at 32.6 billion board feet. That's not quite up to the halcyon days ofthe 1970s, but there aren't too many complaints.

Closer to home, the Western Wood Products Association in Portland, Or., reported that through the first 19 weeks of 1983, production in the 12 western states averaged 92t/o of normal. Normal is defined as the average weekly production rate for 728 active sawmills in the region, or 34O million board feet. The association is predicting 1.4 million housing starts this year.

This is not to say that everything is rosy. There still is some bad blood between U.S. and Canadian lumbermen over Canadian imports which have risen steadily over the past decade andnow take 3l9o of theU.S. market. A coalition of southern and western producers tried unsuccessfully to get a countervailing duty imposed on Canadian lumber. U.S. producers contend that the prices for Crown timber in Canada, which are

(Please turn to page 39) feet. All figures include redwood production.

In Oregon the production in 1982 dropped to 4.682 billion board feet, down 433 million feet from l98l figures. Other declines came in California, which fell 237 million feet to 2.987 billion feet; Washington, down 184 million feet to 3.059 billion; Montana, off 137 million to 895 million; Idaho, off 74 million to 1.245 billion, and Wyoming, which dropped 62 million board feet to 135 million feet in 1982.

Softwood production in New Mexico fell 27 million feet to total 182 million; Arizona dropped 26 million to ?A9 million; Colorado was down l0 million to ll8 million feet, and Utah was off only two million feet to 46 million.

Boards for Barter

Bartering has been reborn in the Northwest wood products industry to provide the industry with the opportunity to obtain goods on a non-cash basis by utilizing portions of its unused production capacity.

Barter Systems International, with 96 offices nationwide and $370 million in non+ash transactions in 1982, has contracted with an unidentified Northwest timber producer to trade finished lumber for paint, roofing materials, truck tires, and a variety of other goods needed in day-to-day operations.

James Mason, lumber manager in Barter Systems' Portland, Or., office, hopes to trade between 2 and 3 million board feet of lumber per month through the network. According to him, companies trading through barter are essentially exchanging goods and services at the producer-price level, because barter transactions eliminate built-in profit margins.

$8 Billion Spent On Fix-Up

Dollars spent for home improvement and maintenance in the first quarter of 1983 totaled $46.2 billion at the seasonally adjusted annual rate, about 890 higher than the same period, 1982, but $4 billion less than fourth quarter of that year.

The U.S. Department of Commerce reports that expenditures for residential upkeep and maintenance dropped from a revised fourth quarter high of $50.2 billion. This followed a 22t/o spending increase from the 1982 third quarter low of $41.3 billion.

Actual first quarter spending was $8.9 billion. Sixtytwo percent or $5.5 billion of this was spent by resident property owners with one to four units. Non resident owners with one to four units and all owners with five units or more spent the remaining $3.4 billion.

A further breakdown of figures showed spending for improvements dropping l49o from the fourth quarter, to $27.9 billion from $32.4 billion. Maintenance and repair expenditures increased 390 from $17.8 billion to $18.3 billion.

When compared with first quarter 1982 spending on improvements, 1983 expenditures were 10.790 higher, rising from $25.2 billion to $27.9 billion. Maintenance spending rose from $17.4 billion to $18.3 billion for a 590 gain.

WoodFoundation Use Up

Production of foundation treated lumber and plywood used for wood foundations during the first seven months of 1983 increased 5090 and 6990 respectively from the same period last year, according to the American Wood Preservers Bureau.

Total lumber production for foundations from January through July was sufficient to build approximately 6,700 wood foundation homes. July's 236 million board feet was the largest single month's total in recorded history for production of lumber treated with waterborne preservatives.

Total AWPB production for the first seven months of 1983 was 1.187 billion board feet of lumber.

Whether

Point Of Purchase

(Continued from page 3I) tive, uncluttered selling environment. Merchandising units also can organize small packages on retail counter tops. They can be designed to meet specific retail marketing objectives, such as promoting a seasonal sale or helping to make certain products more pilfer-resistant.

In today's retail environment, where space as well as sales help is at a premium, retailers can make the most of available space by selling several products at once. Successful cross-merchandising tie-ins run the gamut.

When shoppers are able to find the products they are looking for, they spend more money. But, like a good salesperson, a point of purchase display also serves to convince shoppers to buy products they did not set out to buy. The king of impulse sales, it creates incremental sales, particularly for consumed items, and stimulates retail sales.

The era of personalized sales help in stores may be gone forever, but the time for strong merchandising support at retail has never been better. In-store merchandising is the key to reviving retail sales, and smart marketers are betting big bucks that the silent salesperson will bring about a retail renaissance.

It's a Crime

It's a crime to discriminate against a job applicant because of a criminal record. However, a job can be denied if the crime was related to the position the applicant seeks.

Lumber Production

(Continued from page 35) lower than comparable U.S. prices, represent an unfair subsidy. The Canadians disagree.

The biggest worry concerns interest rates, now 140/o on home mortgages, high by traditional standards.

Everyone is looking nervously at the federal deficit and wondering if it will push interest rates back up to the point where the housing recovery will die aborning.

One expert, Dr. John Muench of the National Forest Products Association, told his group that the federal deficit should not adversely affect housing this year, according to Forest Industries, but that it will be necessary to get the debt under control and that federal monetary policy will determine how long we can sustain economic recovery.

After what they have been through, the survivors in the lumber industry understandably are nervous, and there are frequent glances over the shoulder.