4 minute read

The Big Ten Does lt Again

By Dwight Curran Contributing Editor The Merchant Magazine

prosperity. Coupled with stable interest rates, a plentiful supply of money and strong consumer demand, the housing industry continued to sop up record amounts of

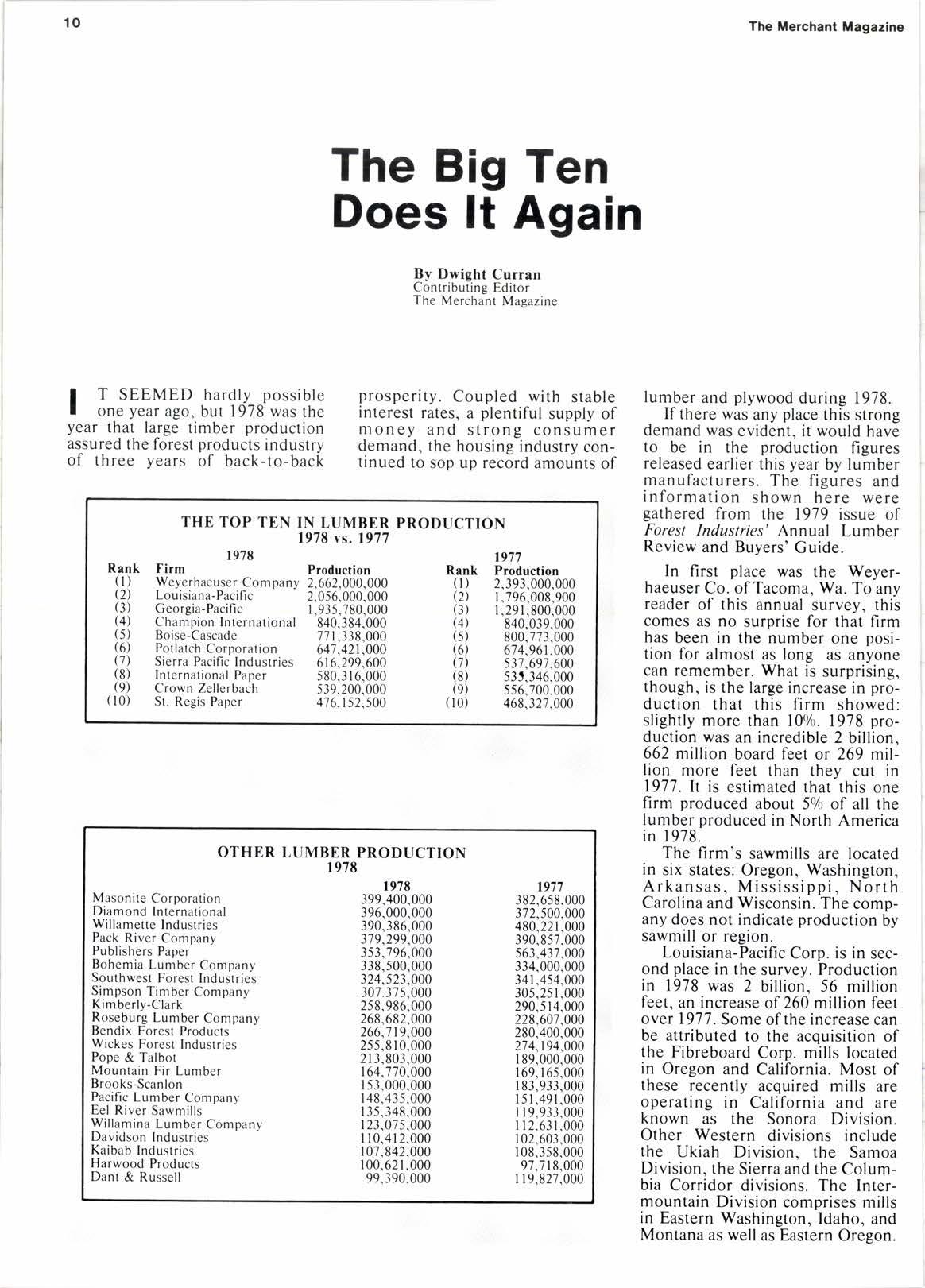

The Top Ten In Lumber Production

lumber and plywood during 1978.

If there was any place this strong demand was evident, it would have to be in the production figures released earlier this year by lumber manufacturers. The figures and information shown here were gathered from the 1979 issue of Forest Induslries' Annual Lumber Review and Buyers' Guide.

In first place was the Weyerhaeuser Co. of Tacoma. Wa. To anv reader of this annual survey, this comes as no surprise for that firm has been in the number one position for almost as long as anyone can remember. What is surprising, though. is the large increase in production that this firm showed: slightly more than 100/0. 1978 production was an incredible 2 billion662 million board feet or 269 million more feet than thev cut in 1977. lt is estimated that this one firm produced about 5olo of all the lumber produced in North America in 1978.

The firm's sawmills are located in six states: Oregon, Washington, Arkansas, Mississippi, North Carolina and Wisconsin. The company does not indicate production by sawmill or region.

Louisiana-Pacific Corp. is in second place in the survey. Production in 1978 was 2 billion, 56 million feet, an increase of 260 million feet over 1977. Some of the increase can be attributed to the acquisition of the Fibreboard Corp. mills located in Oregon and California. Most of these recently acquired mills are operating in California and are known as the Sonora Division. Other Western divisions include the Ukiah Division, the Samoa Division, the Sierra and the Columbia Corridor divisions. The Intermountain Division comprises mills in Eastern Washington, Idaho, and Montana as well as Eastern Oregon.

It is the Southern region, however, that includes the greatest number of mills. Louisiana-Pacific does sawing in l3 states.

Georgia-Pacific Corp. of Portland, Or., is in 3rd place with production of I billion, 936 million or 644 million ahead of the 1977 pace.

THE ALSO-RANS

Most of G.P.'s production is in the South. The firm produces studs at Coquille and Toledo, Or., and redwood and Douglas fir at Fort Bragg, Ca.

The Myers Flat site was shut down during the year, reportedly due to lack of timber. This was. in

When a Number is NotWhat it Seems

EW FACES appear on the feet in 1977. A strike at the Cloverdale, Ca., plant influenced things here.

ll top ten from time to time. And old friends back off. There have been many changes in the last decade. Let's look at them quickly.

Take this year's number 7, Sierra-Pacific Industries. The firm is a fine, well-managed company and the only independent in the top ten. But should it be there, at least this year?

Sometime last year, the firm purchased the Burney, Ca., plant that had been operated by Publishers Paper. At no time did Sierra-Pacific actually produce any lumber there. Nor is it doing so now.

But the Burney mill produced 88,748,000feet of lumber that put Sierra-Pacific in 7th place. That 88 million feet was produced under prior ownership. 527 million feet would more accurately reflect what really happened, which would drop Sierra-Pacific into 9th place.

Last year it was an also-ran, down in the teens somewhere. But, we did cite last year the acquisition of that plant as being a favorable omen to catapult them into the top ten, and so it did.

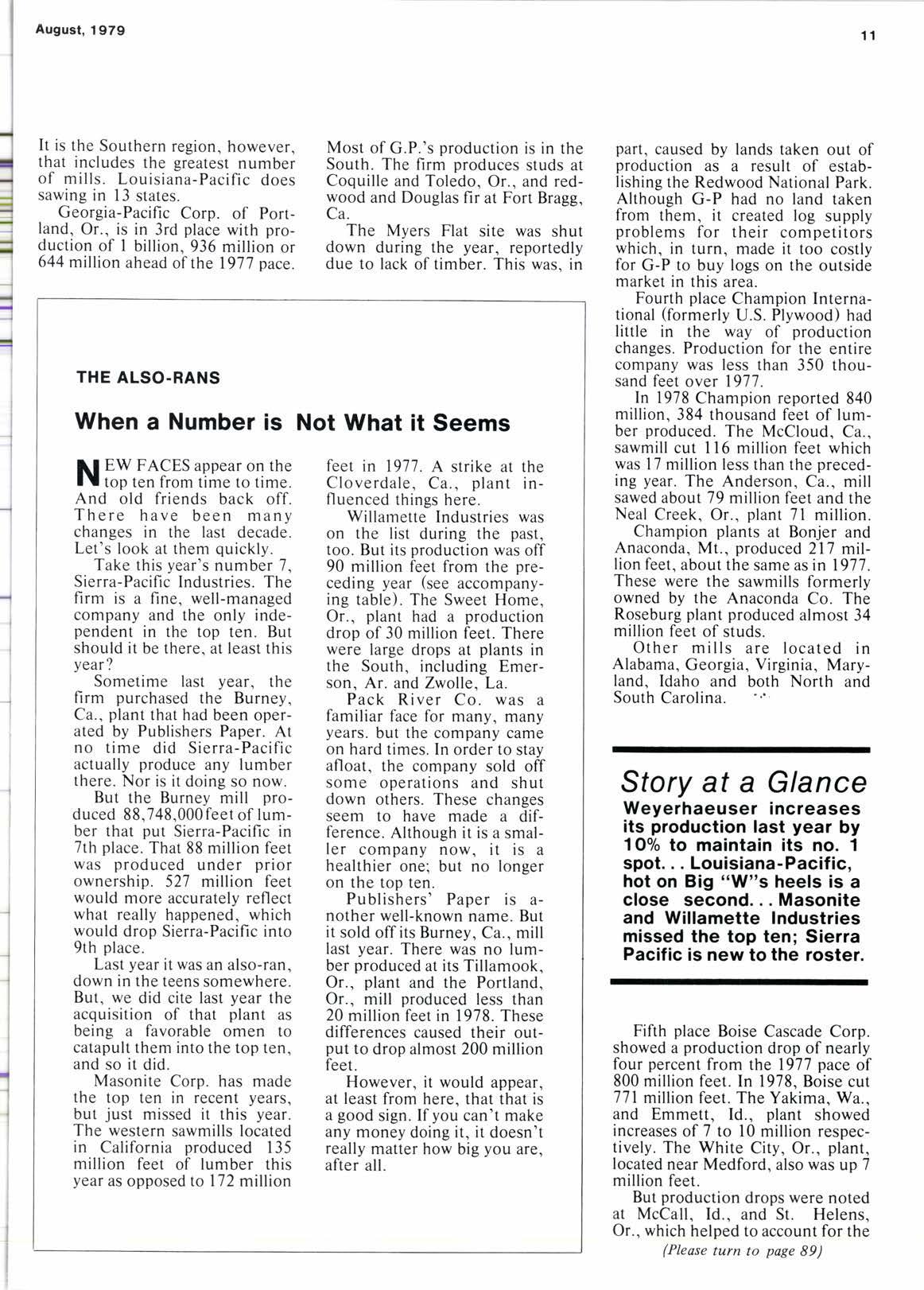

Masonite Corp. has made the top ten in recent years, but just missed it this year. The western sawmills located in California produced 135 million feet of lumber this year as opposed to 172 million part, caused by lands taken out of production as a result of establishing the Redwood National Park. Although G-P had no land taken from them, it created log supply problems for their competitors which, in turn, made it too costly for G-P to buy logs on the outside market in this area.

Willamette Industries was on the list during the past, too. But its production was off 90 million feet from the preceding year (see accompanying table). The Sweet Home, Or., plant had a production drop of 30 million feet. There were large drops at plants in the South, including Emerson, Ar. and Zwolle, La.

Pack River Co. was a familiar face for many, many years. but the company came on hard times. In order to stay afloat, the company sold off some operations and shut down others. These changes seem to have made a difference. Although it is a smal- ler company now, it is a healthier one; but no longer on the top ten.

Publishers' Paper is another well-known name. But it sold off its Burney, Ca., mill last year. There was no lumber produced at its Tillamook, Or., plant and the Portland, Or., mill produced less than 20 million feet in 1978. These differences caused their output to drop almost 200 million feet.

However, it would appear, at least from here, that that is a good sign. If you can't make any money doing it, it doesn't really matter how big you are, after all.

Fourth place Champion International (formerly U.S. Plywood) had little in the way of production changes. Production for the entire company was less than 350 thousand feet over 1977.

In 1978 Champion reported 840 million, 384 thousand feet of lumber produced. The McCloud, Ca., sawmill cut ll6 million feet which was l7 million less than the preceding year. The Anderson, Ca., mill sawed about 79 million feet and the Neal Creek, Or., plant 7l million.

Champion plants at Bonjer and Anaconda, Mt., produced 217 million feet, about the same as in 1977. These were the sawmills formerly owned by the Anaconda Co. The Roseburg plant produced almost 34 million feet of studs.

Other mills are located in Alabama, Georgia, Virginia, Maryland, Idaho and both North and South Carolina.

Sfory at a Glance Weyerhaeuser

increases its production last year by l Oolo to maintain its no. 1 spot. . . Louisiana-Pacific, hot on Big "W"s heels is a close second... Masonite and Willamette Industries missed the top ten; Sierra Pacific is new to the roster.

Fifth place Boise Cascade Corp. showed a production drop of nearly four percent from the 1977 pace of 800 million feet. In 1978, Boise cut 771 million feet. The Yakima, Wa., and Emmett, Id., plant showed increases of 7 to l0 million respectively. The White City, Or., plant, located near Medford, also was up 7 million feet.

But production drops were noted at McCa,ll. Id., and St. Helens, Or., which helped to account for the (Please turn to page 89)