CUSTOMER SUCCESS STORY #3

CUSTOMER SUCCESS STORY #3

When people ask what makes Morris Hardware special, I start with our story. Founded in 1845, our store has served McConnelsville for 180 years and is one of the oldest family-owned hardware businesses in the country. Today, Tom Schanken—our founder’s sixth-generation descendant—and I are committed to carrying that legacy forward.

We’ve endured wars, depressions, pandemics, and the rise of big-box competitors, but our small-town spirit and commitment to neighbors have never wavered. Our customers — contractors, farmers, and DIYers—are the heart of Main Street, and we’re proud to serve them.

Still, even a historic business must adapt. When our previous supplier could no longer support our needs, we sought a partner who shared our values. We found that in Orgill. I first met the company through our rep, Jake Thompson, whose genuine, no-pressure approach made the decision easy when it came time to change.

Orgill helped modernize key departments, update assortments, and refine pricing while respecting our independence.

At 180 years and counting, Morris Hardware is stronger than ever—proof that personal service and community connection remain timeless, and that we’ve found the right partner to help us continue that legacy.

Shayna Roberts

Shayna Roberts Co-Owner, Morris Hardware | McConnelsville, Ohio

PRESIDENT/PUBLISHER

Patrick Adams padams@526mediagroup.com

VICE PRESIDENT

Shelly Smith Adams sadams@526mediagroup.com

PUBLISHER EMERITUS

Alan Oakes

MANAGING EDITOR

David Koenig • dkoenig@526mediagroup.com

SENIOR EDITOR

Sara Graves • sgraves@526mediagroup.com

COLUMNISTS

James Olsen, Kim Drew

CONTRIBUTORS

Dallin Brooks, Jeff Easterling, Jason Gesser, Brennah Hutchison, Andy Johnson, Paige McAllister, Dana Spessert

ADVERTISING SALES

(714) 486-2735

Chuck Casey • ccasey@526mediagroup.com

Nick Kosan • nkosan@526mediagroup.com

John Haugh • jhaugh@526mediagroup.com

DIGITAL SUPPORT

Katherine Williams kwilliams@526mediagroup.com

CIRCULATION/SUPPORT info@526mediagroup.com

151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626 Phone (714) 486-2735

CHANGE OF ADDRESS Send address label from recent issue, new address, and 9-digit zip to address below. POSTMASTER Send address changes to Building Products Digest, 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626. Building Products Digest (USPS 225) is published monthly at 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626 by 526 Media Group, Inc. Periodicals Postage paid at Santa Ana, CA, and additional post offices. It is an independently-owned publication for building products retailers and wholesale distributors in 37 states East of the Rockies. Copyright®2026 by 526 Media Group, Inc. Cover and entire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. We reserve the right to accept or reject any editorial or advertising matter, and assumes no liability for materials furnished to it. Opinions expressed are those of the authors or persons quoted and not necessarily those of 526 Media Group, Inc. Articles are intended for informational purposes only and should not be construed as legal, financial or business management advice, nor an endorsement of any company, product, service or individual referenced.

Volume 45 • Number 2

Update your subscription

A dealer’s guide to creating the ultimate outdoor living showroom

5 tips to drive deck fastener sales

4 actions to strengthen a

National Hardwood Lumber Association presents a deep dive into all the latest on hardwoods, including marketing efforts, a lumber grade breakdown, strategies to fight “greenwashing,” update on urban wood, and a sobering production report

ENDURE™ DOUBLE HUNG WINDOWS WITH INTERNAL GRIDS

HARBOR MILL™ SHINGLE SIDING IN SANDALWOOD

SADDLEWOOD SHAKE METAL ROOFING

WOODBRIDGE NATURAL CUT™ MANUFACTURED STONE

SIGNET® FIBERGLASS

DOOR WITH PRIVACY GLASS

BOARD ‘N BATTEN IN SANDALWOOD

ProVia is your one source for professional-class building products

Use the QR code to learn more about our premium building products and why it’s great to partner with ProVia.

DOORS | WINDOWS SIDING | STONE | ROOFING

------------ BY PATRICK ADAMS

RESILIENCE IS ONE of those words that gets used so often it risks losing its meaning. We tend to associate it with big moments—crises, downturns, setbacks that demand everything we have just to keep moving forward. But lately, I’ve been thinking that true resilience is usually quieter than that. Less dramatic. More consistent.

It shows up in the small, daily decisions to keep going when it would be easier not to. In choosing discipline over comfort. In showing up for work, for family, for one another—even when the path ahead isn’t perfectly clear.

Our industry understands this better than most.

I’ve spent years traveling the country meeting professionals in every corner of the market. Different regions, different challenges, different cycles—yet the same underlying character. This is an industry built on people who adapt without complaining, who solve problems without fanfare, and who take pride in producing something real and lasting.

Resilience isn’t about pretending things are easy. Anyone paying attention knows they aren’t. Costs fluctuate. Labor is tight. Regulations evolve. Markets shift. Some days feel heavier than others. But resilience is the refusal to let those realities define who we are or what we stand for.

I see it in the leaders who weathered past downturns and still find a way to invest in their people. In the managers who lead with steadiness instead of panic. In the sales professionals who don’t disappear when times get tough, but lean in harder. In the next generation entering this industry with curiosity, grit and a willingness to learn.

Resilience is also deeply personal.

Like many of you, I’ve had many chapters where the future felt uncertain—where the “what ifs” were louder than my confidence. In those moments, I’ve learned that resilience doesn’t come from having all the answers. It

comes from trusting the values that got you this far. From remembering who you are when circumstances try to tell you otherwise.

It’s easy to confuse resilience with toughness alone. But I believe it’s more than that. True resilience allows room for humility, for reflection, for learning. It acknowledges setbacks without surrendering to them. It’s knowing when to push forward—and when to pause, reassess and adjust course.

The strongest people I know aren’t the loudest. They don’t posture. They don’t need to prove anything. They simply keep doing the right things, consistently, over time. That quiet persistence is what builds companies, families, and communities that last.

And that’s what gives me confidence in this industry’s future.

We work with people who understand long-term thinking. Who know that what you build today should still matter tomorrow. Who recognize that resilience isn’t reactive—it’s foundational. You don’t wait for a storm to decide whether your structure is sound.

If there’s one thing I hope we all carry forward, it’s this: resilience is not just something we rely on in hard times. It’s something we cultivate every day—in how we lead, how we treat one another, and how we choose to show up when no one is watching.

I remain deeply grateful for the opportunity to serve an industry defined by perseverance, integrity, and pride of craft. You continue to remind me that no matter the challenges ahead, resilience—real resilience—is already part of who we are.

Thank you for what you do, for how you do it, and for the example you set for those coming behind you.

PATRICK S. ADAMS, Publisher/President padams@526mediagroup.com

ProWood combines the precision of a manufacturer with the flexibility of a distributor to keep your shelves stocked and your customers happy. Access ProWood® treated lumber, Deckorators® composite decking, and Edge® siding all in one place, backed by reliable fulfillment and merchandising support that helps you win.

Simplify your supply chain. Grow your business.

PROUD SUPPLIER OF:

Scan to learn more.

DESPITE SLOWING in some home improvement categories, demand for outdoor living products continues to grow. At the same time, decking, railings and accessories have transformed from commodities into high-margin, design-driven solutions.

A number of LBM dealers have capitalized on these trends by adding a dedicated showroom for decking and outdoor living products. These display areas can significantly increase sales, elevate customer experience, inspire new and larger projects, and strengthen relationships with contractors and homeowners alike.

A well-designed showroom does more than display products—it tells a story, simplifies the buying process, and positions the retailer as a trusted expert rather than just a supplier.

Consider that decking, railing, fasteners and outdoor lighting are notoriously difficult to sell from samples alone.

“There is significant benefit to seeing larger sections of composite decks boards since small samples don’t always show the variegation properly,” agrees Ben Braun, vice president of Braun Building Center, Manitowoc, Wi.

Color variations, texture, performance features, and compatibility between components can all require explanation. A showroom removes that friction.

By allowing customers to see, touch and compare products in realistic installations, dealers help prospects move from abstract decisions to confident purchases. They

are reassured that they are investing in a quality system. Full-scale displays demonstrate how decking boards interact with railings, how hidden fasteners affect appearance, and how lighting enhances safety and ambiance—all factors that drive upsell opportunities.

“I built our showroom to give contractors and homeowners the handson experience and expert guidance that turns confusing research into confident decisions,” explains James Bonham, who—before launching Utah Deck Supply, West Jordan, Ut., in 2023—spent a decade with Trex Co. learning the ins and outs of composite decking.

Bonham says visiting a decking showroom is a completely different experience from visiting a website.

“You can feel the texture and embossing of different boards, which online images can’t convey,” he says. You can “see how colors look in natural light, not just on a calibrated monitor. This helps avoid surprises once the deck is installed. (And you can) visualize scale. Full-size boards help you understand the real look and feel of your future deck.”

Showrooms also provide a destination for contractors to bring their customers to you. They’re a sales tool for both you and your pro customers. “A showroom helps customers see all the products together to compare and choose the products that best fit their needs,” suggests Anna Kaufmann, co-owner, Rock Solid Builders, McHenry, Il. “If a salesperson is only bringing samples into a customer’s home, they are limited on what they can sell.” A showroom adds to her customers’ excitement for their new outdoor living project.

A dedicated outdoor living showroom also supports system selling. Instead of selling decking boards as a standalone product, dealers can showcase fascia, stairs, railing systems, fasteners and framing connectors, outdoor lighting, and all the bells and whistles.

When these products are displayed together, customers are far more likely to purchase the full package. Seeing how lighting integrates into railings or how fasteners improve aesthetics helps justify premium upgrades and increases average order value.

The outdoor living display area at Wisconsin’s Braun Building Center is centered around a 12-ft. by 16-ft. composite deck that presents a range of options. “We display eight different deck boards and three different brands in that space,” notes Ben Braun. “We also show seven types of composite and aluminum railing, all installed as it would be in the field. The deck boards are also fastened with three different types of concealed fasteners to show the different spacing provided by each.”

Adobe Lumber, American Canyon, Ca., unveiled its expansive 3,500sq. ft. decking showroom in 2021. In addition to composite decking, said purchasing manager Jarrod Moulton says, “we display lighting, railing, hardwood decking, and pergolas. We also have some tiny homes built in

Pitting the Showroom Experience vs. the Online Experience

Showroom Experience

Online Experience

Full-size board displays Small, often misleading swatches

See color in real light

Feel textures and finishes

Compare systems in context

Interactive, installed sections

Instant expert advice

Screen color only, subject to calibration

Flat images, no tactile feedback

Separate pages, hard to visualize together

Static product listings

Delayed email replies or generic FAQs – Info courtesy Utah Deck Supply

the middle of our showroom displaying various trim and siding, as well as using deck boards for siding or fencing.”

Here are tips on getting the most out of your outdoor living display space:

Design for realism, not volume. Limited on space? A few thoughtfully built displays are more effective than never-ending rows of samples. Use real-world layouts— stairs, corners, elevated decks, and railing transitions—to demonstrate performance and design flexibility.

Show comparisons side by side. Highlight differences between good, better and best options. Place capped composite next to uncapped boards, or standard railings next to premium aluminum or cable systems. Visual comparison shortens the sales cycle.

Educate through signage and storytelling. Clear signage explaining benefits such as low maintenance, fade resistance, hidden fastening, or code compliance helps customers self-educate and reinforces the salesperson’s message.

Integrate fasteners and lighting into the display. Fasteners and lighting are often overlooked add-ons. By visibly integrating them into deck and railing displays, retailers naturally increase attachment rates and reinforce their value.

Keep it current. Outdoor living trends change quickly. Refreshing displays periodically with the latest colors, textures or lighting options keeps the showroom relevant and encourages repeat visits from contractors.

Test and adjust. Different markets want different types of products. Find out what sells best and lean into it. “Our most-effective feature in our showroom are the timber frames,” says Utah Deck Supply’s Bonham. “Customers come in looking to create an outdoor space not thinking about or anticipating the beauty and elegance of our timber frames.”

“The most effective component of our showroom would be the decking floor itself,” Adobe Lumber’s Moulton says. “We have five of the major deck brands (Trex, AZEK/TimberTech, Fiberon, Eva-Last, and Envision), and put down three to five colors in various 10’x10’ areas.

Having customers feel the different textures of deck boards between brands, and also being able to see the deck colors in a larger sample size and actually stand on it helps the customer decide between colors.”

A showroom is only as effective as the people using it. Dealers should ensure sales teams are trained not just on product specs, but on how to guide customers through the showroom experience.

Encouraging contractors to bring clients into the showroom creates a win-win scenario. The retailer supports the contractor’s sales process, while the contractor drives higher-margin product sales through the retailer.

A showroom also helps to ease the constant pressure to compete on price. The option-filled surroundings help shift conversations away from price and toward value, design and performance. It positions the dealer as a destination—one that offers expertise, inspiration and complete solutions.

And, it’s the perfect place to close sales.

Your decking showroom doesn’t have to end with deck displays. If space permits, adjacent sales, stocking and customer gathering areas can benefit from the proximity.

Mitchell Construction Custom Decks built its first showroom in Frankfort, IL., outside of Chicago a year ago. The new showroom occupies approximately 500 sq. ft. of the inside of the 4,000-sq. ft. building they leased, with another 200 sq. ft. in the adjacent warehouse section. In addition to showcasing Trex, MoistureShield, TimberTech and Deckorators decking, the showroom has a designated area for meeting clients. Plans are underway to add cabinetry, an outdoor kitchen space, and updated company signage.

Mitchell Construction’s appointment-only showroom opens directly into a sectioned-off warehouse where pergolas, a louvered roof, and lighting options are visible. Privacy walls allow clients to see enough of the operation to understand its scale without being overwhelmed, said owner Mike Mitchell. He explained that walking out into the warehouse gives homeowners with larger projects in

mind the sense that “OK, they’re not just here for the weekend. They’re here to stay. They’re going to be here to service our project for a long time,” he says. “It gave us credibility. It made them feel more comfortable.”

ProBuilt Construction worked out of the Pacylowski family home in Highland, Md., for nearly 30 years before opening its first showroom 17 years ago. At the time, they felt like they were invading their customers’ private space by asking prospects to come and see their finished work. “We found it a whole lot more relaxing for everyone involved if it was in a setting that was more commercial looking versus going to someone’s home,” says ProBuilt owner/president Ed Pacylowski.

When building their first showroom, they realized they had more indoor space than they needed, says ProBuilt’s director of sales and design Christina Speiden. They scaled down the indoor space to 1,000 sq. ft. and created a larger yard. Outdoors, they built a community gathering place for the coffee-shop neighbors to enjoy their drinks, daycare children to play under the gazebo, and hair salon guests to relax on the patio chairs. The outdoor space was lit up at night, creating a 24-hour advertisement of their work for the cars driving by. Free manufacturing samples and company fliers were available to visitors.

Now, ProBuilt is in the process of moving their showroom 800 ft. from their first location to a 9-acre lot with a house and yard. Using an entire former home will enable the company to showcase its indoor remodeling as well as its outdoor living work. The company will be renovating the home’s indoor space with an updated kitchen and bathroom. The outdoor space will feature a screened-in porch, new walkway to the front door, an elevated deck with an underdeck drainage system, and the company’s signature curved stairs. Speiden says the home they are moving into is next door to a restaurant. They plan to collaborate with the restaurant owner to offer their outdoor space for the restaurant patrons to enjoy if there’s overflow.

Even if you’re not ready to add your own coffee shop, few additions can perk up your bottom line more than a dedicated outdoor living showroom. BPD

BY SARA GRAVES

AS OUTDOOR LIVING continues to evolve, lighting has blossomed into a defining feature that brings outdoor spaces to life. Builders and designers are using light not only for visibility but to shape emotion, movement and atmosphere. The result? Decks that feel immersive, cohesive, and intentional.

“Deck lighting isn’t just about brightness anymore—it’s about ambiance, design, integration and efficiency,” says in-lite’s Michelle Vilera. “We are stepping into a world where lighting will become part of your deck’s personality, an extension of interior design principles applied outdoors: layered, atmospheric, smart and expressive.”

Leif Wirtanen of Cascade Fence & Deck, Vancouver, Wa., adds homeowners are becoming more deliberate about how lighting transforms a space. “We’re seeing homeowners become more intentional about how lighting shapes the experience of a space, not just how it looks at night,” he says. “Instead of relying on overhead brightness, we’re designing layered systems that solve specific needs: step lights for safety, subtle wall washes that highlight texture or make vertical surfaces feel more expansive, and under-rail lighting that adds depth without glare.”

Premier Outdoor Living’s Catherine Lippincott says in south New Jersey and the Philadelphia area they’re incorporating slim, architectural fixtures that trace pergola beams, accent the geometry of railings, or glow softly from ceiling panels. Even twinkling overhead lights are strung with purpose, layered alongside pergolas or beams to add warmth and “a touch of magic.”

“Thoughtful lighting transforms a space from functional to unforgettable,” she says. “Every glow needs to be intentional. The trend is toward integrated, intentional lighting that makes each space not only feel safe but purposeful and dynamic.”

In more complex outdoor environments, balance is everything, she adds. “As outdoor spaces grow more complex, it can be a challenge to highlight features without creating glare or visual clutter,” says Lippincott. “We’ve found that layered lighting offers the solution.”

Combining soft under-rail glows, focused uplights on trees and textures, and accent lighting on architectural details can guide the eye naturally. “Lighting within pergolas and covered structures is just as important,” she adds. “Creating an indoor-style space isn’t enough. It needs illumination that feels welcoming and encourages people to step inside.”

This layered approach is expected to shape future lighting strategies as well. Vilera foresees a rise in layered and atmospheric lighting schemes, with builders installing multiple types of lighting to visually connect the deck to surrounding gardens or pathways using statement ceiling, wall, and ground fixtures.

For Wirtanen, the next few years will bring a major shift: “Lighting will no longer be treated as an afterthought. It’s becoming part of the core design conversation from day one,” he says.

He also sees lighting intersecting with wellness. “In the Pacific Northwest, lighting can transform how people ex-

perience their outdoor environments year-round,” he explains. “Something as simple as a subtle glow along a pathway or warm accents beneath seating can turn a deck into a relaxation destination after a long day.”

Beacon opened five new locations during the final weeks of last year, bringing to 26 the number of branches it added in 2023. Beacon also made nine acquisitions during the year.

Listings are often submitted months in advance. Always verify dates and locations with sponsor before making plans to attend.

Little, and its senior leadership team will continue to lead the business under the Kamco brand.

National Hardwood Lumber Association – Sept. 6-8, intro to hardwood grading course, Memphis, Tn.; www.nhla.com.

BC Wood – Sept. 7-9, Global Buyers Mission, Whistler, B.C.; bcwood.com.

New locations are in Austell, Ga.; Marquette Heights, Il.; Des Moines, Ia.; North Charleston, S.C.; and Bastrop, Tx.

Do it Best – Sept. 8-11, fall market, Indianapolis, In.; www.doitbest.com.

Technology is adding new layers of personalization. “Adjustable color temperatures, smart controls, and weatherproof low-voltage systems allow homeowners to be the captain of the ship,” says Wirtanen. “They can shift from warm ambient tones for relaxation to brighter, functional light for entertaining.”

Hoo-Hoo International – Sept. 8-11, international convention, hosted by Cowichan Valley Club, Vancouver, B.C.; www.hoohoo.org.

North American Wholesale Lumber Association – Sept. 11-15, Fall Wood Basics Course, Peachtree City, Ga.; www.nawla.org.

GMS Inc., Tucker, Ga., has agreed to acquire Kamco Supply Corp., Brooklyn, N.Y., and affiliates. The deal is expected to close this spring.

Northwestern Lumber Association – Sept. 12-13, Legacy Group 2 roundtable, Jordan, Mn.; www.nlassn.org.

True Value – Sept. 13-16, Fall Reunion show, George R. Brown Convention Center, Houston, Tx.; www.truevaluecompany.com.

Vilera sees demand increasing for app-controlled and voice-compatible LED lighting that integrates with home automation systems and sensors. “Homeowners want full customization of their deck lighting experience by controlling the color, brightness, and schedules remotely to create inviting, modern and creative spaces,” she says.

Founded in 1939 by the Swerdlick family, Kamco is a leading supplier of ceilings, wallboard, steel, lumber, and other related construction products. The company operates five distribution facilities in the Greater New York City area and services the New York metro and tri-state area. During the last fiscal year, Kamco recorded revenues of approximately $245 million.

Northeast Lumber Manufacturers Association – Sept. 20-22, annual meeting, Samoset Resort, Rockport, Me.; www.nelma.org.

GMS expects to capitalize on cross-selling opportunities with Kamco and GMS’s other operations in the region, including the recently acquired Tanner Bolt and Nut, Inc. business.

Southern Pine Inspection Bureau – Sept. 26-27, planer operator course, Hilton, Pensacola Beach, Fl.; www.spib.org.

Serenity Porch, Wolf Perspective Decking, Fiberon Decking & Railing, Benjamin Obdyke, UFP-Edge, KeyLink, and fasteners.

Wallace Distribution Co. – Sept. 26-27, fall market, Sevierville Convention Center, Sevierville, Tn.; www.wallacedist.com.

Construction Suppliers Association – Sept. 27-29, annual conference & show, Lodge at Gulf State Park, Gulf Shores, Al.; www.gocsa.com.

Founded in 1971, GMS operates a network of over 300 distribution centers with extensive product offerings of wallboard, ceilings, steel framing and complementary products, plus more than 100 tool sales, rental and service centers.

Florida Building Material Alliance – Sept. 27-29, annual convention, Rosen Shingle Creek Resort, Orlando, Fl.; www.fbma.org.

United Hardware – Sept. 27-29, fall buying market, Mayo Civic Center, Rochester, Mn.; www.unitedhardware.com.

Midwest Building Suppliers Association – Sept. 28, annual MBSA Connect, Electric Works, Fort Wayne, In.; www.thembsa.org.

Southern Pine Inspection Bureau – Oct. 3-4, intro to lumber grading, Hilton, Pensacola Beach, Fl.; www.spib.org.

Blish-Mize – Sept. 15-16, fall market, Overland Park, Ks.; blishmize.com.

Kentucky Wood Expo – Sept. 15-16, Lexington, Ky.; www.kfia.org.

American Wood Protection Association – Sept. 17-21, fall technical committee meetings, Le Meridien Downtown, Denver, Co.; awpa.com.

Wolf Home Products, York, Pa., is expanding its distribution reach to service building product dealers in Michigan.

Lumbermen’s Association of Texas – Sept. 18-20, annual convention & expo, Live! By Lowe’s, Arlington, Tx.; www.lat.org.

North American Wholesale Lumber Association – Sept. 18, Texas regional meeting, Arlington, Tx.; Sept. 20, Northeast regional meeting, Samoset Resort, Rockport, Me.; www.nawla.org.

Deckorators’ Michelle Hendricks said the company is aligning its materials and accessories with this next wave of lighting design. “Home-

Kentucky Building Materials Assn. – Sept. 19-20, blueprint reading & material take-off class, Belterra Resort, Florence, In.; www.kbma.net.

Following the close of the deal, Kamco’s current president, Scott

“We’re thrilled to expand our geographical reach to service dealers in Michigan, empowering building professionals with access to our exceptional products and support,” said Jeremy Sellers, senior VP of sales at Wolf Home Products, “This expansion provides dealers a wider range of product choices with a streamlined ordering and delivery process to facilitate business growth.”

Window & Door Manufacturers Association – Oct. 4-5, executive management conference, Cambridge, Ma.; www.wdma.com.

National Hardwood Lumber Association – Oct. 4-6, annual convention & show, Omni Hotel, Louisville, Ky.; www.nhla.com.

Construction Suppliers Association – Oct. 8-10, roundtables, Jesup, Ga.; Oct. 15-17, Andover, N.J.; www.gocsa.com.

Michigan dealers will be serviced out of Wolf’s state-of-the-art, 1 million-sq. ft. distribution center in Wilmington, Il.

owners are looking for lighting that feels purposeful and reflects the way they want to live: calm, intentional and connected,” she says. “Many are drawn to designs that use light to create contrast, whether that means warm light against cool materials or soft glow that adds depth.”

Ace Hardware – Sept. 19-21, fall convention, Orange County Convention Center, Orlando, Fl.; www.acehardware.com.

In addition to its comprehensive portfolio, Wolf Home Products also brings a team of experienced, knowledgeable professionals who are dedicated to providing continued support and reliable service to the Michigan market.

World Millwork Alliance – Oct. 8-12, convention & show, Indianapolis, In.; www.worldmillworkalliance.com.

Dealers in the Michigan market now have access to Wolf’s expansive portfolio, including: Wolf Trim, Wolf Mouldings, Wolf Railing, Wolf

The next chapter of deck lighting

• Stain, scratch and fade resistant

• made of 95% recycled materials

• capped all 4 sides for maximum protection

• decking is dual-sided unlike most composites

Southern Pine Inspection Bureau – Oct. 12-13, quality control course; Oct. 17-18, dry kiln operator course, Hilton, Pensacola Beach, Fl.; www.spib.org.

U.S. demand for wood millwork is forecast to increase 1.9% yearly through 2027, according to a new Freedonia report.

is about artistry meeting intention. Builders are designing with atmosphere and emotion in mind, homeowners are seeking control and personalization, and manufacturers are stepping up with materials that enhance light rather than compete with it. Nowadays, lighting doesn’t just illuminate the deck, it defines it. BPD

Processing Technologies for the Forest & Biobased Products Industries Conference – Oct. 30-Nov. 1, King & Prince Bach & Golf Resort, St. Simons Island, Ga.; www.ptfbpi.com.

Lee Roy Jordan Lumber Company is now distributing

• 25 year transferrable warranty Lee Roy Jordan

AS DECKING materials evolve, so do fastening requirements. Retailers who educate their staff, merchandise fasteners strategically, and market the value of the right fastening system can drive higher ticket sizes while reducing jobsite callbacks and customer frustration.

1. Reframe Fasteners as a System, Not an Accessory

One of the most effective ways to sell more decking fasteners is to stop treating them as standalone SKUs. Decks cannot be built without them, so instead position fasteners as an essential part of a complete decking system that are every bit as important as the boards, framing and railing.

When customers understand that the wrong fastener can void a warranty, compromise performance, or detract from appearance, they are far more receptive to premium options. Signage, shelf talkers, and sales conversations should reinforce that fasteners are engineered to work with specific decking materials and applications.

Retailers can support this approach by:

• Bundling fasteners with decking quotes and takeoffs

• Including fastener recommendations on material lists and invoices

• Training staff to lead with “the right fastener for this deck” instead of “how many pounds do you need?”

2. Merchandise Fasteners Where the Decision Happens

Fasteners sell best when they are merchandised close to the decking materials they support. Too often, fasteners are relegated to a generic hardware aisle, disconnected from the decking purchase decision.

Best-in-class retailers use cross-merchandising to increase attachment rates:

• Place fasteners in end caps or bays adjacent to decking displays

• Create small, focused fastener sections within outdoor living showrooms

• Use comparison boards showing face-screwed vs. hidden-fastener installations

Clear, concise signage is critical. Customers should be able to quickly identify:

• Which fasteners work with wood, composite or PVC

• Hidden vs. face-fastening options

• Benefits such as corrosion resistance, color matching, and ease of installation

Visual merchandising, particularly installed samples, helps customers understand why premium fasteners are worth the investment.

Fasteners can be confusing, even for experienced DIYers and contractors. Gauge, length, coating, drive type, spacing requirements, and compatibility all factor into the decision. Retailers that simplify this process gain customer trust and close sales faster. Effective strategies include:

• Fastener selection charts posted in-store or provided as handouts

• QR codes linking to install videos or manufacturer guides

• Pre-calculated “per square foot” fastener recommendations

Sales associates should be trained to ask key questions:

• “What decking material are you using?”

• “Is this residential or commercial?”

• “Do you want a hidden or traditional fastener look?”

These questions position the associate as a problem-solver, not a clerk.

Price competition is intense in fasteners, but value-driven selling protects margins. Staff training should emphasize how premium fasteners reduce long-term costs by preventing issues such as corrosion, mushrooming, board movement, and squeaking.

Retailers should ensure their teams understand:

• Why stainless steel matters in coastal or treated lumber applications

• How proprietary coatings extend fastener life

• How hidden fasteners improve aesthetics and resale value

Short, focused training sessions—

often supported by manufacturers—can dramatically improve confidence and upsell rates at the counter.

Many fastener manufacturers offer such resources as branded displays, demo boards, product literature, and digital assets. Retailers should partner with suppliers to:

• Host contractor demo days focused on fastening

• Promote fasteners in seasonal deck marketing campaigns, as well as in social media, email newsletters, and project spotlights

In a competitive market, the most successful retailers sweat the details—and, as far as decks, few details matter more than what holds them all together. BPD

Unrivaled dealer support comes from understanding a high-quality product means nothing if it means headaches to get it on your shelves. For five decades now, we’ve built a trusted reputation for going above and beyond to deliver on the extras that make a difference. Like near-by facilities for timely product deliveries. A seasoned sales support team. Or stand-out advertising that drives higher demand for products. That’s just the beginning of a very long list that only we do. See all the other ways the YellaWood® brand has your back. Visit yellawood.com/for-dealers.

------------

BY JASON GESSER

EMPLOYERS IN Oregon’s building products sector are in a fairly good position when it comes to worker safety. This is evidenced by declining workers’ compensation claims overall in the state. In 2023 (the most recent year data’s available), claims for occupational injuries and diseases came in at a rate of 1.1 per 100 workers, versus a rate of 1.3 claims per 100 workers in 2022 and 2021.

Also notable? Oregon’s workers’ compensation premiums are among the lowest in the nation. The state’s Department of Consumer and Business Services has proposed a 3.3% drop in the pure premium rate for 2026, marking 13 years of decreases. This translates into an average payment by employers of 87¢ per $100 of payroll next year, down from 91¢.

This is still no time to breathe easy.

New workers file more claims than those with longer tenure, a concern for construction-related businesses given the persistent labor shortage amid an aging workforce. Close to half of claims in Oregon in 2023 where the worker tenure was known were from first-year employees. Plus, a new Experience Modification Rate (EMR) formula puts the focus on smaller and more frequent claims, which can impact premiums.

Maintaining those positive workers’ compensation trend lines requires employers to sharpen their focus on safety, benefiting workers and businesses overall. Consider four ways to foster and strengthen a culture of safety.

Maintaining and following a schedule for routine inspections of each worksite is a given. Potential safety hazards and risks should be identified and immediately addressed.

This includes general risks for contractors and in manufacturing facilities such as exposure to airborne dust (like wood or crystalline silica). Another: Slip, trip and fall hazards like wet surfaces and scaffolding work are leading causes of non-fatal injuries. Ergonomic injuries, for example, account for a third of worker injuries and cost employers about $50 billion annually. Staving them off takes consistently reinforcing ergonomic best practices, like lifting with your legs and not your back.

A culture of safety also focuses on employee wellness overall. That means being cognizant of and prepared to manage risky external conditions that can put workers at risk. During times of excessive heat, for example, mea-

sures should ensure outdoor workers remain hydrated, wear sunscreen, and are encouraged to take breaks in the shade. That requires supervisors to be trained to recognize and respond proactively to signs of heat stroke.

2.

It is essential to document work safety rules and ensure employees are familiar with best safety practices. This means training new employees on safe use of tools and equipment. Subsequent and ongoing training in safety protocols and regulations is helpful for all workers and ensures compliance with relevant labor laws.

It is worth introducing a daily check-in for workers so they can report any potential safety issues on the job that should be promptly addressed. This ensures open lines of communication and fosters trust between managers and workers.

Not only is pre-screening a valuable tool to reduce workers’ compensation claims, but it can help employers better evaluate where individuals are best—and most safely—utilized on the job.

Screenings can evaluate for strength, flexibility, balance, coordination, endurance and agility, and not just establish the physical capability to do specific work, but whether higher-risk jobs should be ruled out.

Such evaluations might best be undertaken by a third-party professional. They also should extend to the prospective employee’s medical history, including any

health issues that could affect their ability to perform certain tasks.

Stress and anxiety can heighten the risk of injury and illness. A wellness program can help, and does not have to be complicated or overly costly.

Options include stress management classes, along with providing access to mental health services for employees needing help with anxiety or depression. Regular breaks help people refresh mentally. Incentives for fitness activities can pay off, too. Personal issues outside of work can affect how safely the job is done, so providing resources such as grief counseling or financial advisory services helps everyone.

Not only do such offers provide support for those who are struggling, but they also demonstrate that the company cares about its workers. BPD

------------

BY JAMES OLSEN

THERE ARE A LOT of uninteresting and uninspired sales calls. Some examples:

Quotron: “Hello, Bob. I’ve got a load of 2x4 16’s I can get into you for $800/MBF. Whaddya think?

Quotron: “Hello, Susan, I can get a load of 2x6 12’s into you at $700/MBF….” Then silently waiting for a response.

Quotron: “Good morning, John. Are you low on anything right now?”

Quotron: “Good morning, Sarah. I’ve got a load of studs looking for a home. Can you give me a firm?”

These “sellers” push the “Kick Me” button. And they do get kicked around and treated badly. They invite and deserve bad treatment because they are wasting the customer’s time and bringing little value. In addition, and in some ways more importantly, these calls are plain boring. Customers do not want to be bored.

Humans have been around for 1.4 to 4 million years depending on who you talk to. The written word has been around for about 5,500 years, the Gutenberg press was invented in 1440 and even in the 1950s in America only 53% of the population was literate. Radio transmission for the masses began in the 1920s and exploded after WWII. The TV became widespread in the late ’40s and early 1950s.

All this is to say that we have been telling and listening to (verbal) stories long before storytelling became a product that is fed to us.

Stories Engage

When our customers are engaged, we are not guaranteed a sale, but we are guaranteed a solid listen to and consideration. A lot of sellers don’t get either. Telling a story is interesting. It leads the customers and is what the Master Seller does. Customers want to deal with an expert who takes them to the good deals in an interesting and exciting way. That’s what storytelling does.

The “similar story” close is a classic. We take a past sale or situation that applies to our customer’s needs and use it to tell a story about how a similar product or proposal will help our customer also. Our customers want and deserve proof. What’s the first thing we do before we purchase something online? We read the reviews. Our customers want the same thing. We use the “similar story” close to give them the proof they seek. Example:

Master Seller: “Good morning, Maria. We just bought a block of 2x4 Euro from a mill you love. We picked up 10 truckloads. Five of them were picked off right away by a national account who buys direct from everyone, so I know these are a good deal. How many do you want to put on?”

The beauty of the “similar story” is it doesn’t have to be our similar story. If someone on our team sells a good deal, we can say to our customers, “We just moved five of these.” We’re part of our team, so we say this truthfully.

Note: It’s called “similar story” not “similar lie.” We use true stories. Lying is bad (sales) karma.

If our customer missed a deal in the last sales cycle, we could bring it up again on objections.

Customer: “I think I’m going to hold off for now.”

Master Seller: “Sure. We can hold off. No pressure. I just want to remind you, Tom, that six weeks ago we held off and it cost us $150/MBF when the market moved. I assure you the market is moving up. Let’s at least put on two loads for insurance.”

Master Sellers use historical data to tell a story that makes sense and brings value to the customer. Example:

Master Seller: “Pete, I’ve got a great deal on five loads of 2x8 #2. The market is sloppy on some items but 2x8 has found a level. How many can you use?”

Customer: “I’m going to hold off for now.”

Master Seller: “Okay. But think about this. Six weeks ago, we were paying twice this number, so the market has really come back to us and bottomed out, so why don’t we pick up a couple?”

Customer: “Wow. That is a big move. Let’s do one.”

Similar story sells. BPD

JAMES OLSEN

Like the foods we buy, when it comes to decking, we want natural and real. Redwood is always available in abundance of options. So stock the shelves! Unlike mass-produced and inferior products, Redwood is strong, reliable and possesses many qualities not found in artificial products. They maintain temperatures that are comfortable in all climates.

Redwood Empire stocks several grades and sizing options of Redwood.

------------ BY PAIGE McALLISTER

CLIENTS ASK ME all of the time, “How much paid time off should we offer?” My answer is always “It depends.” In reality, there is not one right answer or formula for how much paid time off a company should offer as so many factors must be considered. The days of the standard two weeks off every year does not work for most employees and therefore it does not work for most companies.

When deciding to apply to or stay at a company, employees evaluate several aspects to determine the fit with their individual needs and lifestyle: total compensation (wages, paid time off, benefits), culture, and work-life balance. Companies which find the right balance as valued by their applicants and employees create a strategic advantage over other companies competing for the same employees; those that do not, create a disadvantage for themselves which may require finding another aspect to compete on so as to not lose good employees.

While wages are important, it is usually not practical or affordable to increase wages too far above market and studies show that the initial gratitude for a raise fades quickly. The reality is everyone needs to take time off from work to rest and recharge, to care for themselves or a loved one who is sick or injured, to mourn a family member, or to meet civic obligations such as serving on jury duty, voting, or serving as a volunteer fire rescue member. Additionally, those needs and priorities will vary from employee to employee.

Numerous factors go into developing a company’s paid time off so what works for one company can be completely wrong for another. When working with a company to develop their time off policy, here are aspects I ask clients to consider:

Philosophy and culture: Some companies consider their paid time off benefits as an inconvenient necessity while others use it to differentiate themselves in the job market by making them more attractive to applicants and current employees. Some companies want to manage and account for every minute of an employee’s day and time off while others allow employees to use time off whenever they need to without tracking or approval. None of these deci-

sions are inherently right or wrong but, if contradictory to the company’s philosophy and culture, any can create more problems than the time off can fix.

Legal requirements: While there is no federal law mandating paid time off, many states require some paid time off in the form of sick time; general time off; bereavement; voting; jury duty; school activities; blood, organ, or bone marrow donation; time off due to being a victim of domestic violence, sexual assault, or stalking, etc. The paid time off policies of any company must at least meet all of the criteria of these laws including parameters of the amount of leave, how it is accrued, carryover, payout at separation, length of notice for use, and usage increments. It should also be noted that companies with employees working in multiple states must draft policies which satisfy the criteria of each state, even if you need to carve out exceptions for certain employees.

Industry and job responsibilities: Employee expectations for available time off vary by industry, job duties, demands, etc. While every employee needs time off, the reality is that employees in different industries and jobs often have differing expectations of and/or access to paid time off. For example, some general guidelines are:

In-person, service employees need to be in-person to meet client demands and needs and often work alone or in small groups so their absence has a bigger impact on operations. Typically, these are lower-waged jobs which correlates to lesser benefits. These companies tend to:

• offer only mandated time off with or without minimal time off in addition to that requirement;

• request significant notice periods but in reality, little to no notice may be able to be provided, especially if used for sick time; and

• usually keep sick and vacation separate to better control usage.

In-person hourly employees who work in a company’s facility and/or in larger groups who need to be in-person but, since there are other people in the same workplace,

it is easier to absorb the absence. They usually have very structured schedules, often with the whole company working established hours or shifts. Given the direct correlation between employees’ attendance and company operations and profitability, time off is a luxury many companies cannot afford to provide frivolously. These companies often offer additional time off following a traditional model such as starting at two weeks after six months or one year with annual totals increasing corresponding to added years of service. Again, these companies tend to keep sick and vacation separate for better tracking but may combine all into a paid time off (PTO) bank for easier record-keeping.

Professional and/or remote salaried employees often have more flexibility with their schedules and view time off as a basic part of their overall compensation package. These employees can often do their work at any time of the day or week as long as they are also available when coworkers and clients need them. These companies tend to offer more generous time off as a competitive advantage in the labor market. This time may be separated into sick and vacation but is often combined into PTO so employees can take time when they need it. Some companies go one step further and offer unlimited or unstructured PTO for eligible employees allowing them to take any time off they need as long as they meet the job requirements.

As you develop your paid time off philosophy, consider the following:

• What do employees expect? Is paid time off an extra or expectation? Is it a nice benefit or part of a comprehensive compensation package including salary, bonuses, commissions, insurance, etc.?

• Do you want to use paid time off as a competitive advantage over competitors for the same workforce, meet the market, or lag behind? Do you plan to use other aspects such as wages, other benefits, or flexibility to attract and retain good employees?

• Do you want to offer only traditional paid time off (sick, vacation) or differentiate your company by offering unconventional options (i.e., sick pet or pet bereavement, community service, mental health days, etc.)?

• What are the impacts on your operations and other employees if an employee takes a day off, and how can you accommodate this with offering more flexibility given how highly employees value workplace flexibility?

• What are the impacts on your budget, scheduling and service levels if employees take all the time off you offer?

Whatever your philosophy, ensure that your policies are comprehensive, cover the legal minimums, and address all necessary aspects such as accruals, usage, payout, carryover, borrowing, etc BPD

Paige McAllister, SPHR, SHRM-SCP, is vice president for compliance with The Workplace Advisors, Inc. Reach her at (877) 660-6400 or paige@theworkplaceadvisors.com.

BY JEFF EASTERLING

IN A MARKET shaped by shifting building trends, workforce challenges, evolving codes, and sustainability conversations, lumber retailers have an opportunity to be more than distributors. Today, retailers who position themselves as sources of certainty and confidence are the ones builders turn to first, because they remove uncertainty from decision-making.

One powerful example of this in action is eastern white pine, a species deeply rooted in North American building tradition and still widely used by builders across the North-

Eastern White Pine Sales Checklist

Use this quick checklist to help your customers make clear, confident material decisions.

1. Identify the Application

• Interior trim, paneling, or millwork

• Visible vs. concealed installation (appearance grade vs. framing)

2. Align Grade with Expectations

• Premium / D & Better Select = smoother appearance, tighter knots

• Standard = reliable performance where appearance is secondary

• Industrial = utility applications

3. Set Appearance Expectations

• Knot size and frequency

• Natural color variation and grain

4. Reinforce Performance Benefits

• Lightweight and easy to use

• Excellent machining and fastening

• Dimensionally stable for interior use

5. Reference Standards

• Explain grade stamps and inspection rules

• Use NELMA grading standards as a confidence tool

east, Great Lakes region, and beyond. The long history and enduring performance of eastern white pine make it a wood species worth knowing, and the perfect vehicle for retailers to build trust with their customers.

Eastern white pine isn’t just another softwood; it’s a species that helped shape American building. From early colonial homes and ship masts to today’s timber frames, millwork and finish carpentry, it remains an integral part of local industry in states like Maine, New York, and Massachusetts.

For a retailer, that heritage is more than trivia: this knowledge reinforces why the species continues to matter, why customers trust it, and why foundational knowledge about it gives retailers a foothold in conversations about performance, sustainability and suitability.

Confidence starts with clarity. When a builder hears “eastern white pine,” what do they really understand about it? Here’s a quick breakdown for your reading pleasure.

Eastern white pine is:

• Lightweight and easy to use, with a straight grain and even texture that makes it a favorite for millwork and finish applications.

• Dimensionally stable, with low shrinkage compared to many other species, which translates to better performance in trim, paneling, and interior applications.

• Available in graded standards that help customers know what they’re getting. NELMA defines multiple grades, from Industrial and Standard to Premium and D & Better Select, so retailers and builders speak the same language about quality expectations.

The qualities of eastern white pine aren’t abstract: A well-informed retailer can articulate how and why these traits matter on specific jobs. For example, explaining to a builder that a Premium grade board will offer tighter knots and a smoother finish for interior paneling, while Standard grade might be ideal where appearance is less critical.

That’s the kind of detail that turns uncertainty (“Which grade of pine should I use?”) into confidence.

Builders appreciate guidance that helps them choose, specify and install materials correctly. Retailers who understand species performance and grading rules can help eliminate guesswork from the order process, reducing callbacks, waste, and material mismatches on the jobsite.

A few practical ways retailers can accomplish the goal and deliver not just good wood, but confidence:

• Use product swatch guides and grade explanations at point of sale so customers can visually and physically compare material classes.

• Train yard staff on species characteristics: not just names and sizes, but how eastern white pine behaves in finish work and decorative appearance applications.

• Share application stories and examples from real projects where eastern white pine delivered the desired outcome, whether great finish work or smooth machining. (Lots of examples to help with this at www.nelma.org!)

When you engage as a retailer with a builder using this level of specifics, you can elevate the conversation to focus on purpose, performance, and peace of mind.

In uncertain times, customers don’t want surprises. Do any of us? Your customers want partners to understand their business challenges and guide them through options with confidence, knowledge, and clarity. By deepening

expertise (especially around well-established, performance-driven species like eastern white pine) retailers demonstrate reliability and true thought leadership.

This is where associations like NELMA play a critical role. NELMA provides the standards, grading rules, and educational resources to form the foundation of meaningful product conversations. Retailers who tap into our resources can stand apart by selling confidence, not just commodity.

Other specifics may grab the initial attention of your customers, but confidence closes the sale and builds loyalty. When builders know that a retailer can help them choose the right material for the right application, backed by solid grading standards and species knowledge, uncertainty fades and repeat business grows.

In today’s market, that’s one of the most powerful competitive advantages a lumber retailer can have. BPD

Diamond Hill Plywood, Darlington, S.C., officially transitioned to the Palmer-Donavin name effective Jan. 1, bringing its teams together under one unified brand. Grove City, Oh.-based Palmer-Donavin acquired Diamond Hill Plywood in April 2023.

Diamond Hill had operated five distribution centers in Tennessee, Virginia and the Carolinas, serving eight Southeastern states. In total, Palmer-Donavin now operates 13 locations that serve from Minnesota and Iowa down to Alabama and Georgia.

The name change reflects PalmerDonavin’s continued commitment to simplifying how it serves customers while preserving the trusted relationships built over decades.

“This transition is about clarity and consistency for our customers,” said CEO Robyn Pollina. “While the name Diamond Hill Plywood has a strong legacy we’re proud of, unifying under the Palmer-Donavin name allows us to better align our teams, resources, and service model without changing the people or values our customers rely on.”

Builders FirstSource has purchased the assets of Premium Building Components. The facilities in Ballston Spa and Queensbury, N.Y., become BFS’s first truss and wall operations in New York.

84 Lumber has plans to open an 85,000-sq. ft. door shop in Georgetown, Tx.

R.P. Lumber opened its 91st location Jan. 12 in Carlyle, Il. (Jim Golder, manager).

Capps Home Building Center, Moneta, Va., is expanding into central Virginia with the acquisition of English’s – The Complete Home Center, Altavista, Va., founded in 1909. The location—#4 for Capps— has been renamed Capps Home Building Center – Altavista.

Remus Lumber Co., Remus, Mi., has been acquired by 26-unit Forge & Build after 60+ years of family ownership.

When Griffin Lumber set out to double their impact at their new Georgia facility, they partnered with CT Darnell to turn their bold ambition into reality.

The result? A state-of-the-art facility— combining a full-service lumberyard and a comprehensive 54,400 SF truss manufacturing plant—delivered through a seamless design-build process.

CT Darnell’s LBM expertise and creative design meant smarter storage, efficient SKU management, and optimized facility flow.

Lumber Plus, Sagamore Beach, Ma., suffered a late-night fire of undetermined origin on Jan. 9.

McCoy’s Building Supply will officially close its Plainview, Tx., location on Feb. 28.

Erie Materials added a branch in Poughkeepsie, N.Y. (John Rando, general manager).

McCoy True Value Hardware & Just Ask Rental, Indianola, Ia., shut down Jan. 31 after 140+ years.

Aubuchon Co. acquired 32-yearold Spangler’s Ace Hardware, Dover, Pa., from the Spangler family. The store—Aubuchon’s 134th—will continue to operate under the Spangler name with Ashley Spangler III as store leader.

Benjamin Bros. True Value Hardware, Tenafly, N.J., closed Jan. 31 after more than 80 years.

The Helpful Hardware Co., Cumming, Ga., has acquired Jones Hometown Hardware, Jackson, Ga., as its 21st hardware store location.

Schmuck Lumber Ace Hardware, Gettysburg, Pa., has added a greenhouse-enclosed garden center.

Lowe’s held grand openings Jan. 23 in Celina, Tx., and Jan. 30 in Manvel, Tx.

POWER PRESERVED GLULAM® FEATURES

• Manufactured with superior strength southern yellow pine MSR Lumber.

• Offered in two oil-borne preservative treatments: Permethrin / IPBC and Copper Naphthenate

• Fast, easy, one-piece installation that’s more efficient than bolting or nailing multi-ply dimension or structural composite lumber members together.

• Excellent choice for decks, boardwalks, pergolas, covered porches and demanding environments such as bridges, highway sound barriers, railroad cross ties, and floating docks.

• 25-year warranty from the treater.

Williamson Building Supply, Williamson, N.Y., and sister store Wolcott Building Supply & Home Center, Wolcott, N.Y., have been placed up for sale with the coming retirement of the owner.

Both stores are affiliated with True Value/Do-itBest and Emery Jensen, and have been in existence for well over 80 years. The businesses are listed with Synergy Business Brokers.

Owner/president Richard Mallory bought the Williamson store in 2002 and Wolcott in 2008. He has been in the industry for over 40 years.

Lumberjacks Hardwood Center, Chattanooga, Tn., suffered a devastating late night fire on Dec. 16 that claimed its office, warehouse and most of it inventory, equipment, tools and supplies. Damages were estimated at $500,000.

The company immediately began working to get another location up and running, which allowed it to resume order fulfillment shortly after Christmas, according to Julie Tyler, marketing and sales manager. She said no employees lost their jobs, and gradually operations were being transitioned to its sister company location, Lumberjacks Tree Service, which remained fully operational.

No one was injured, and the cause of the blaze is under investigation.

E.C. Barton & Co., Jonesboro, Ar., opened its newest Home Outlet store in Slidell, La.

The new location marked the seventh Home Outlet store added in 202, bringing the chain’s total store count to 110 across 21 states. Home Outlet has a goal of opening five to seven new stores each year and expects to continue that pace this year.

Burton Mill Solutions has acquired Southern Saw & Wood, Hamburg, Ar. Southern Saw & Wood specializes in reconditioning small- and large- diameter saws, chipper knives, guides, cutting tool design and solutions, and offers convenient pickup and delivery services.

The acquisition enhances Burton’s technical capabilities and strengthens its ability to provide exceptional service to primary wood producers. By integrating Southern Saw & Wood’s expertise into Burton’s network, it is expanding its comprehensive cutting tool reconditioning services and reinforcing its commitment to new product and process development for its partners and the wood processing industry.

Mark Burchell and his team will remain in place to ensure continuity of service and quality for customers. Additionally, Southern Saw & Wood’s operations will be relocated to Burton’s larger, state-of-the-art facility in West Monroe, La., providing unsurpassed resources without disrupting service.

Southern Saw & Wood will complement Burton’s existing network of saw and knife reconditioning service centers across North America, ensuring faster turnaround times and improved regional support.

MidTenn Supply, Columbia, Tn., has added on to its building to accommodate the addition of a full True Value hardware store. The expansion means all new racking, as well as interior and exterior signage.

The building materials and feed supplier offers lumber, roofing, siding, hardware, power tools, and livestock feed. Merchandising begins in March.

3Wood Wholesale, Greenville, Tx., added a branch in Lincolnton, N.C., headed by operations mgr. Jason Guffey.

Snavely Forest Products is now supplying Allura fiber cement siding and trim across North and SouthCentral Texas, including Dallas, Houston, San Antonio, and Austin, Tx., and Oklahoma City, Ok.

Atlantic Builders Supply, Greenland, N.H., is now distributing HercuWall panelized wall system in Massachusetts, Maine, New Hampshire and Rhode Island.

Edmund Allen Lumber Co., Momence, Il., is now selling Accoya modified wood, which it can custom mill and prefinish.

Cameron Ashley Building Products, in conjunction with Pacific Avenue Capital Partners, has acquired Therm-All, Westlake, Oh., from Incline Equity Partners. The fabricator and distributor of metal building insulation has 13 locations nationwide.

Adams Group, North Port, Fl., has acquired MillRite Woodworking, Pinellas Park, Fl., which will now operate as its Specialty Wood and Stone Division.

E.P. Gerber & Sons, Kidron, Oh., has acquired promotional products manufacturer Solid Dimensions, Norwalk, Oh., from co-founder Tim Parcher, who will stay on as general manager during the transition, then retire once a new leadership team is in place.

Metromont, Greenville, S.C., agreed to purchase precast concrete supplier Heldenfels Enterprises, San Marcos, Tx., from founder Fred Heldenfels IV.

PrimeSource Brands has acquired fence and gate hardware supplier Advantage Industries, Deerfield Beach, Fl.

Simpson Strong-Tie held a grand opening ceremony Jan. 15 for its new plant in Gallatin, Tn. The 500,250-sq. ft., $135-million facility will test and manufacture a range of anchors, fasteners and Quik Drive fastening tools.

Versatrim, Henderson, N.C., acquired flooring accessories manufacturer Artistic Finishes, Roseville, Mn.

Knauf Insulation has reportedly become the first fiberglass insulation manufacturer to be entirely formaldehyde-free across its product portfolio. Starting Jan. 1, the company began removing from its plants the last remaining equipment that used formaldehyde.

LBM Advantage announced its 2025 Vendors of the Year: Specialty Building Products (millwork), CertainTeed Gypsum (commodities), DAP (specialties), and Cabinetworks Group (kitchen & bath).

Clark Spitzer has retired after 30 years with Snavely Forest Products, Pittsburgh, Pa., the last three as president.

Andrew Kreofsky has been promoted to general mgr. of Maze Lumber, Peru, Il., succeeding Pete Loveland, who has retired after 42 years with the company. Amy Davenport replaces Kreofsky as operations mgr.

Brad Knighting has been promoted to chief operating officer of Madison Wood Preservers, Madison, Va.

Nick Fitzgerald has retired after 37 years in the industry, the last six as regional GM for Snavely Forest Products, overseeing branches in Dallas, Houston and Gonzales, Tx.

Jim Ruthemeyer, Falls City Lumber, Cincinnati, Oh., has retired after more than 50 years in the industry.

Jim Hershey, ex-Atlantic Wholesale, has rejoined the Brand-Vaughan Lumber division of US LBM, Tucker, Ga., as market VP of installation.

Larry Fetter, ex-Boise Cascade, is a new territory sales mgr. with Eastern Engineered Wood Products, Bethlehem, Pa. Josh Cavallo has been promoted to operations mgr. for EEWP in Belton, S.C.

T.J. Edwards, ex-Builders FirstSource, is new to outside sales at Tibbetts Lumber Co., covering northwest Florida.

John Hurd retired as sales mgr. for Builders FirstSource, Chesapeake, Va. He started in the industry 43 years ago with Norandex.

Leo Oei was named chief commercial officer for BlueLinx, Atlanta, Ga. He succeeds retiring Mike Wilson, who will serve as senior advisor to the CEO through Aug. 1. Mike Ackley is now with BlueLinx in Jacksonville, Fl., as engineered wood products mgr.

Gage Parten, ex-Maximus Building Supply, is new to Carter Lumber, Kent, Oh., as SYP buyer.

Curtis Pratt has joined Hancock Lumber, Casco, Me., as safety director.

Nevin Holly was named president of Elevate, Nashville, Tn., a division of Amrize’s Building Envelope business.

Rick Dennis, ex-US LBM, has joined the outside sales team at Elipticon Wood Products, Kimberly, Wi.

Justin Dishman, ex-McCoy Corp., has moved to LBM Advantage, Conroe, Tx., as forest products mgr.

Greg Groenhout, product manager for CAMO Fasteners, Grand Rapids, Mi., has retired after 36 years with parent National Nail Corp., Grand Rapids, Mi.

Bill Withers was promoted to district mgr. of L&W Supply’s Northern Mid-Atlantic District, covering New Jersey, New York, Pennsylvania and Delaware. Ryan Donegan is now district mgr. of the New York Metro District.

T.J. Lyell, ex-International Paper, has moved to Hampton Lumber, Allendale, S.C., as procurement mgr.

John Schlitz has been promoted to mgr. of Voyageur Lumber, Ely, Mn.

Joe Feist has been named branch mgr. of Alamo Lumber Co., George West, Tx.

Pat O'Brien has joined the sales & marketing team at Nutmeg Forest Products, Fairfield, Ct.

Tim Lash, ex-OC Cluss Lumber, is now store mgr. of Stone & Co. Builders Supply, Plum, Pa.

Jeff Bryce, ex-Boise Cascade, has been appointed technical sales rep for North America with Nordic Structures.

John Wolk, eastern zone mgr., Rust-Oleum Corp., retired after 47 years in the industry.

Will Guerry was promoted to president of Guerry Lumber, Savannah, Ga., succeeding Steve Chick, who will remain with the company.

Joseph Guyette is now in outside sales with Neuens Lumber Co., Fredonia, Wi.

Shawn Winter has been appointed retail operations mgr. for Oxford Lumber Co., Oxford, Al.

Jose Gonzalez is a new account mgr. at Raymond Building Supply, Auburndale, Fl.

Bayne Keitsock has joined the inside sales team at Alpine Building Supply, Schuylkill Haven, Pa.

Michael Phillips, Tando Composites, has been promoted to regional sales mgr. for Michigan, Ohio and Pennsylvania.

Kaycee Casteel was appointed VP of human resources for LP Building Solutions, Nashville, Tn.

Aaron McGee is new to the sales staff of Reed Building Supply, Pittsburgh, Pa.

James Moore, ex-Lowe’s, has been appointed sales mgr. for Reidsville Building Supply, Burlington, N.C.

José Méndez-Andino has been promoted to executive vice president and chief innovation officer of Owens Corning, Toledo, Oh. Romain Trarieux, Charlotte, N.C., is now sourcing leader for roofing components & OC Lumber.

Vishal Singh, ex-Masco, was appointed president of windows & doors at Cornerstone Building Brands, Cary, N.C.

John Forbes, director of manufacturer services, National Wood Flooring Association, St. Charles, Mo., has retired after 11 years overseeing its National Oak Flooring Manufacturers’ Association certification program.

Tony Cook has been promoted to director of membership for BLD Connection.

Zack Champagne has joined Red Book Lumber Data, as mgr.-lumber data services.

Sharon Sheralike is in charge of the new co-op program at Mungus-Fungus Forest Products, Climax, Nv., report co-owners Hugh Mungus and Freddy Fungus.

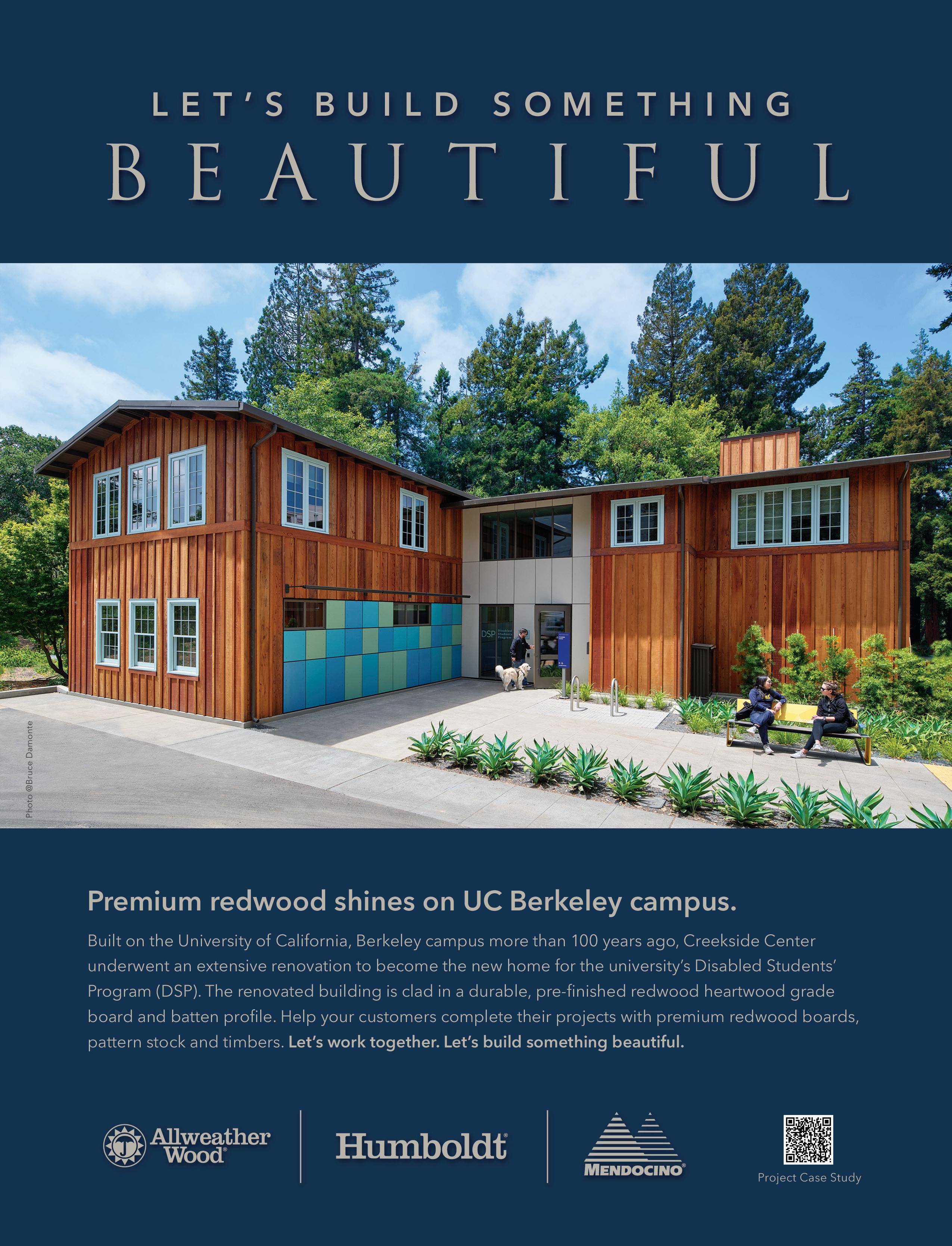

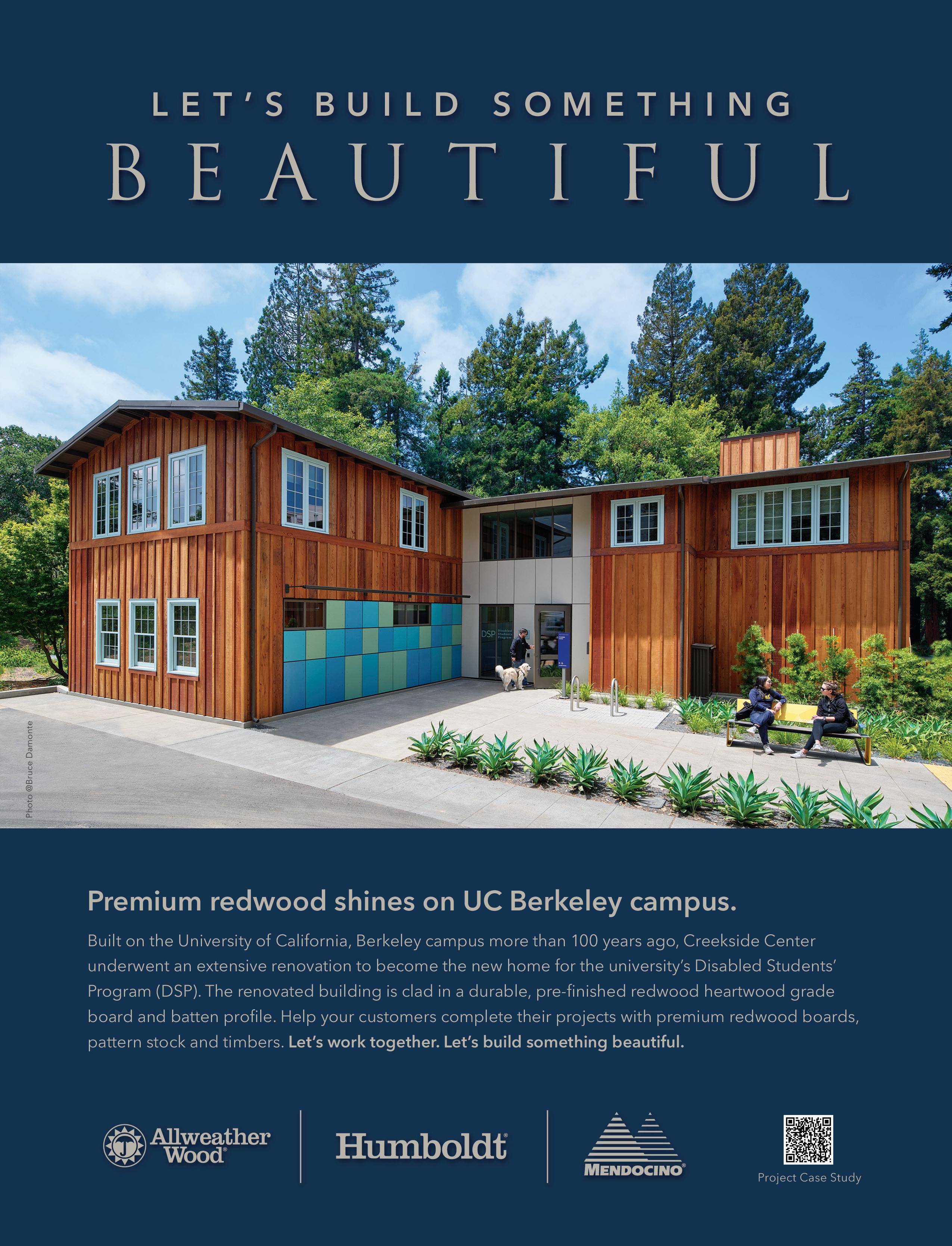

BEGINNING IN 2019, leaders across the hardwood industry recognized it was time to move beyond simply discussing the growing threat of wood-look alternatives and take coordinated action. Industry associations—local, regional, and national—were tasked with collaborating to combine resources and funding to raise awareness about the benefits, performance, and applications of real wood products. From this shared vision, the Real American Hardwood Coalition (RAHC) was formed.

Since then, more than 30 organizations have worked together to reach both consumers and prosumers, with impressive results:

• The coalition launched the national “Build Your World” marketing campaign, supported by advertising on the Magnolia Network from 2023 through 2025.

• Total Build Your World TV and streaming impressions (launched 2023): 98 million

• Total Build Your World social media and digital impressions (launched 2023): 49 million

• Total RealAmericanHardwood.com consumer website views since 2022: 403,000

• Total RealAmericanHardwood.pro designer and architect website views since 2024: 104,000

While consumer promotion on the Magnolia Network concluded in 2025, its impact continues. Combined efforts have reached more than 147 million people, significantly increasing awareness of Real American Hardwood products. Moving forward, the RAHC continues to engage consumers through informative social media content, sharing

inspiring project photography that highlights the natural character and appeal of real hardwood products. Follow Real American Hardwood at facebook.com/RealAmericanHardwood and instagram.com/realamericanhardwood.

For design professionals, the RAHC has exhibited at numerous trade shows since 2023 and launched a new publication, Hardwood & Design. The first issue is available at HardwoodandDesign.com. Outreach to the design community will expand in 2026 following the coalition’s receipt of a $275,000 grant through the 2025 USDA Forest Service Wood Innovations Grant program—part of an $80 million nationwide investment aimed at promoting forest health and supporting rural communities through expanded and innovative markets for timber and wood products.

A robust forest industry, supported by strength across every sector of the supply chain, provides the infrastructure necessary to implement management practices that sustain and improve the health of national, state and private forestlands, as well as the rural communities tied to them.

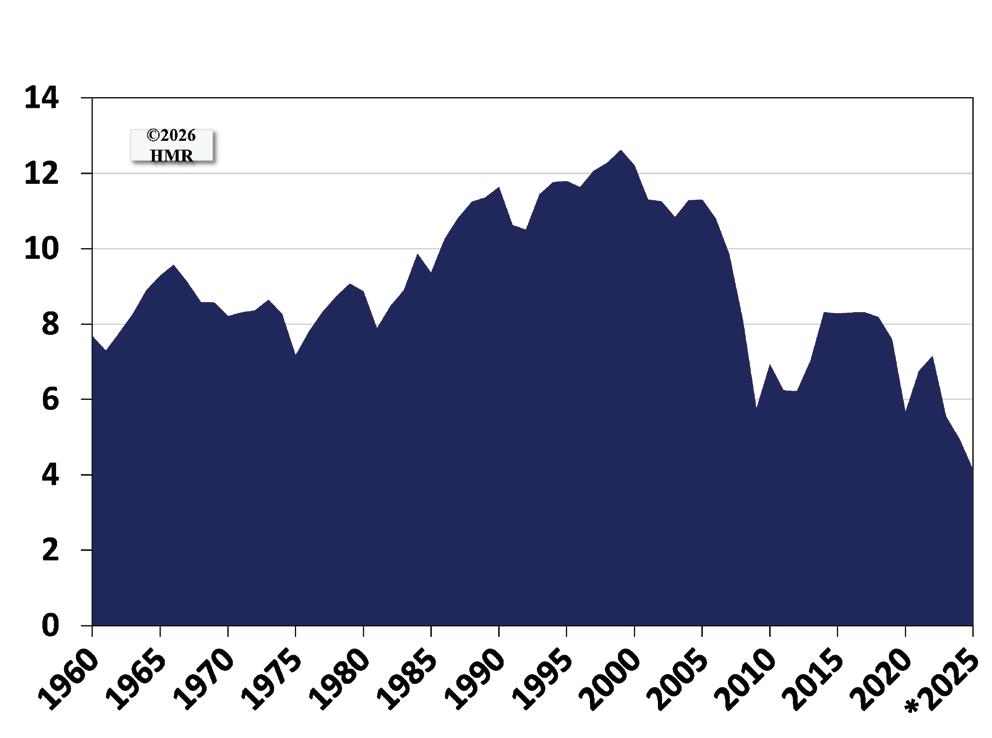

Over the past 25 years, U.S. hardwood lumber consumption has declined by more than 75%, due in large part to competition from unsustainably sourced and manufactured “wood-look” building, remodeling and furnishing products that have gained market share by misleading the public about the perceived benefits of non-wood alternatives.

With USDA Forest Service funding, the Real American Hardwood Coalition will educate, inspire, and mobilize architects, designers, and builders to increase awareness

and use of U.S. hardwoods. Planned initiatives include new and updated continuing education offerings focused on sustainable hardwood products, biophilic design, and hardwood cross-laminated and mass timber applications, as well as a series of hardwood design-build competitions for architecture and design students in partnership with U.S. universities.

This funding will also support expanded public awareness messaging around sustainability, specifically the connection between science-based forest management, sustainable manufacturing, and how consumer demand for Real American Hardwood products helps advance both.

“On behalf of the RAHC board of directors, we appreciate the USDA Forest Service for recognizing the role that vibrant markets play in supporting sustainable forest management,” said Dallin Brooks, chairman of the RAHC board. “We look forward to using this funding to promote increased utilization of domestically sourced and manufactured hardwood products.”

As noted by U.S. Secretary of Agriculture Brooke Rollins, the Trump Administration is “investing in innovation that ensures a steady, sustainable supply of American wood that not only supports jobs and fuels economies, but also protects the people and communities we serve, as well as the forest resources they depend on to survive and thrive.”

Reversing the trend toward imitation wood products requires collective industry effort. Manufac turers, distributors and specifiers can help by following Real American Hardwood on social media, sharing educational content, visiting both the consumer and professional websites, and ensuring staff are informed about the benefits of real wood. Substitutes may resemble wood, but they often carry higher environmen tal impacts, release microplastics, displace rural jobs, and contribute to long-term forest health challenges.

The Real American Hardwood Coalition is committed to supporting your efforts to sell more high-value hardwood products. By sharing and supporting this work, the entire hard wood industry benefits. BPD

------------ BY DANA SPESSERT

THE HARDWOOD INDUSTRY is unique within the broader wood products sector, as it is largely made up of smaller, often family-owned and multi-generational operations that trade primarily in raw materials and are typically located in rural areas.

Because hardwood lumber is traded as a raw material, it requires a standardized system for determining value. This is where the National Hardwood Lumber Association comes in. Founded in 1898, NHLA was established to develop and enforce rules for grading hardwood lumber.

The hardwood lumber grading system developed by NHLA has evolved over many years into one of the most effective grading systems in the world. It is based on the percentage of clear wood available in specified sizes and quantities, using standardized calculations to determine grade. These grades help match lumber to the parts of the industry best suited to use it and are designed to maximize the usable yield from each harvested tree.

One of the first things that needs to be obtained to grade a board is surface measure (SM). To get the SM, simply multiply the actual width by the standard length (rounded down to the nearest whole foot), then divide that number by 12, and round the result to the nearest whole number. The surface measure is what is used to determine the percentage of clear wood when grading.

Another important item is cutting units (CU), which are obtained by multiplying the width in inches by the length in feet. The total number of CUs is used to determine if the needed percentage is met on each board for that grade.

The highest grade in the standard hardwood lumber grading system is Firsts and Seconds (FAS). This grade is primarily used for doors, moldings, tabletops, and other applications that require large, wide, and long clear pieces of wood in manufacturing.

FAS has a minimum board size of 6" wide by 8 ft. long, with a minimum width of 5-3/4" allowed after kiln drying. To qualify as FAS, the board must yield at least 83-1/3% clear wood in cuttings of either 4" wide by 5 ft. long or 3" wide by 7 ft. long. The grade is determined from the poor side of the board, meaning the face that produces the lower yield when both faces are evaluated.

To verify the minimum 83-1/3% yield required for FAS, an inspector multiplies the surface measure by 10 to determine the number of cutting units needed. Additional limitations apply once the minimum yield is met, but a full explanation is beyond the scope of this article. These requirements are detailed in the NHLA Rules Book, which is available for free through the NHLA Rules app on Apple and Google app stores.

As was mentioned, this is the highest grade, the minimum standard only requires 83-1/3% yield, and it also contains all boards up to 100%.