18 minute read

A Computer Industry First...

Published Pricing - NOT - What the Gornplete Systelrrs as low

HARDWARE:

Wyse 150 teNninal

Barcode scarmer

Mag stripe reader

Oki 320 serial printer

Oki 321 serial printer

Oki OLE 400 LED printer

Texas Instrument Microlaser

Barcode printer

Star cash slip printers

Automatic cash drawer

Battery backup unit

Color VGA console

US RoboticsFA)Umodem

486150 computer

Pentium 90 MIIZ comput€r

1.0 gigabyte hard drive

16 port Maxpeed card

8 port Maxpeed card

Maxstation

250 meg tape drive

2.0 gigabyte dat drive

Dual floppy drive

Adaptec S CSI controller

This is the same equipment used by most of the competition.

Point-of-sale - Reprints for 2 years

General ledger lruty integrared to au systens)

Inventory maintenance

Payroll

Accounts payable - On-line history

Accounts receivable - 7 yr. history

Purchasing

Sales analysis

Word processing

Mailing list management

Kit sales (houses, decks, etc.)

Mill production

Takeoffs

Manufacturing (doors, windows, etc.)

Job costing (contract project mgmt.)

Custom programming @ $45/hr.

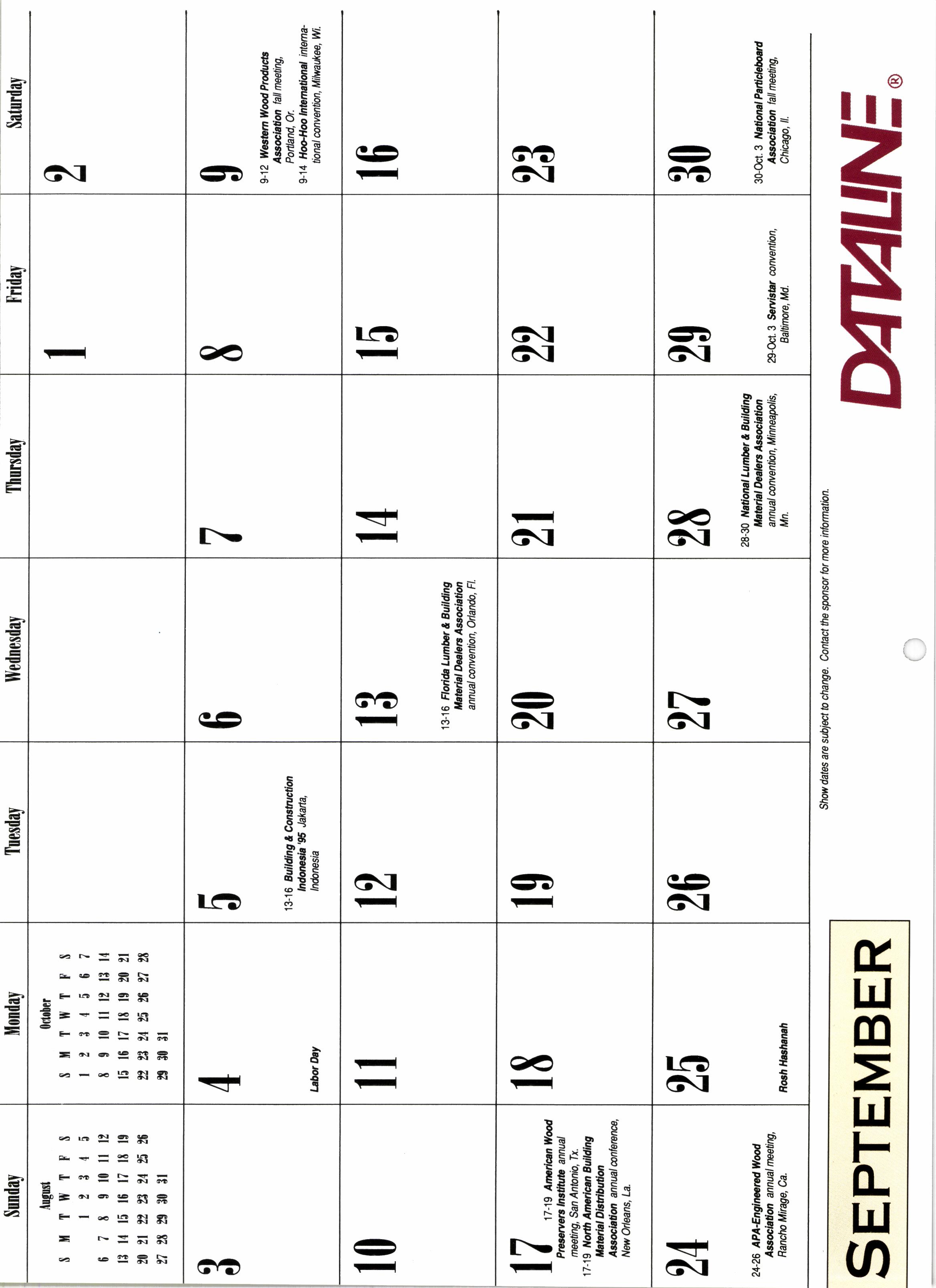

Vendor communications with:

Handy . Orgill Bros. Ace. Allied

Building Stores Coast to Coast. HWI

. Cotter True Value . ServiStar.

Henderson-Baird. South States .

House-Hasson Jensen-Byrd. TRW

Credit Srv and many others All

, fr wXS NoT A LONC, LONC TIM€ ACO, NOK IN A CALAXY FAK, FAK AWAY THAT TH€ IND€P€ND€NT LUMB€KYAKD K€IGN€D JUPK€M€. Y€T IN TH€ LA'T IO Y€AK5, TH€ INDU'TKY HA' B€€N OV€KTAK€N BY A STKANG€ N€W 5P€CI€5 KNOWN \5 ''TH€ WA.K€HOU5€ CIANT,'' PAC€D BY IT5 L€AD€K, ,TH€ HOM€ D€POT.' COUNTL€55 Y\KD5INCLUDINC FAMILY BUJIN€55€5 THAT HAD

'UKVIV€D THKOUCH WOKLD W\Ks AND A CK€\T D€PK€SSION - HAV€ GON€ UND€K.

Y€T iOM€ IND€P€ND€NTi, WH€TH€K DU€

TO TH€IK iKILL OK JUJT A LUCKY LOCATION, HAV€ €NTK€NCH€D D€€P€K, €V€N €XPAND€D. WHIL€ A F€W HAV€ 5€L€CTIV€LY

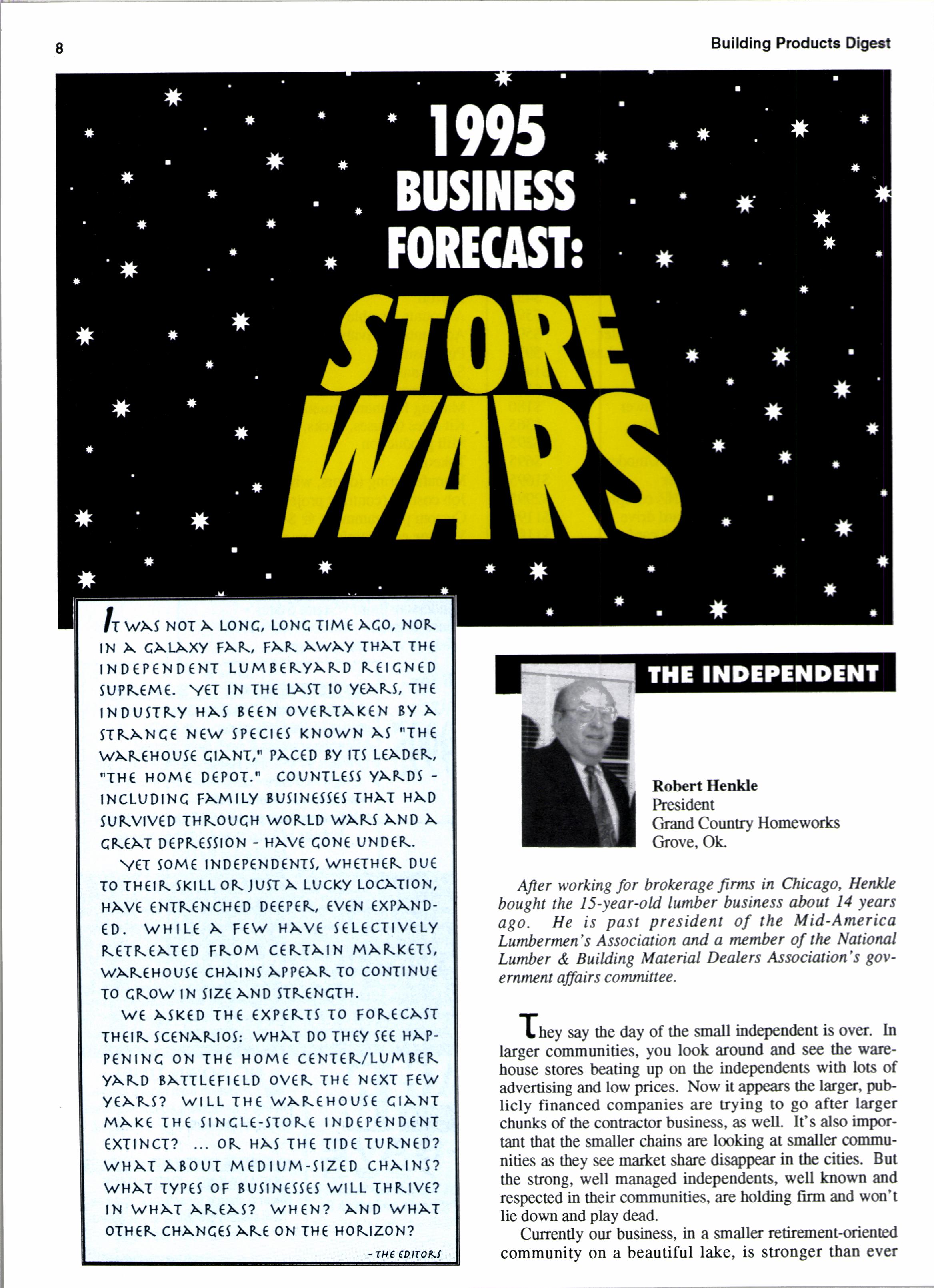

Robert Henkle

fte sident

Grrutd ('rtuttlrv IJtrtncu ork. Grore. Ok.

After vorkitt,4 .ft'tr brokerd'le .lirrrt.s in Chicuqc'. Hertkle bctttglrt tlre l5-tenr-old lurrher lrtr.tinc.i.i ubotl l1 veurt ug(). He i.r ptt.st pre.sitlt'nt tt.f tlte '\lid-'\'ntL'rit'a Lratbernen's A.i.scr6irrIrrrn ond u nu'ntber rt-f tlte .\'utit,rtul Lwnber & BuiIdin:1 .\luteriuI I)euIers '4'ssrtt'iulic'rt r ?()Ie rnilw nI ufl a ir.s t' tt trtrrtt| t e e.

W€ ASK€D TH€ €XP€KT5 TO FOK€CA'T

K€TK€\T€D FKOM C€KT\IN MAKK€T5, \^/AK€HoUi€ CHAINJ \PP€AK To CoNTINU€ TO CKOW IN iIZ€ AND 'TK€NCTH.

TH€lK 5C€N\KloJ: \^/H\I Do TH€Y J€€ H\P-

P€NINC ON TH€ HOM€ C€NT€K/LUMB€K

YAKD BATTL€FI€LD OV€K TH€ N€XT F€W

Y(AK'? \^/ILL TH€ W\K€HOUJ€ CI\NT

MAK€ TH€ iINCL€-JTOK€ IND€P€ND€NT

€XTINCT? ... OK HAs TH€ TID€ TUKN€D?

WH\T ABOUT M€DIUM-SIZ€D CH\IN5?

WHAT TYP€i OF BUJIN€5'€5 WILL THKIV€? IN WH\T AK€45? WH€N? AND WHAT

OTH€K CHANC€J AK€ ON TH€ HOKIZON?

IH( (DITOKt

TL ltcr sar tirc dltr ol thc :mall indcpcnclcnt is tlvcr. Itt larger contrnunitics. r'ou look lrround and scc thc rrltrchousc stores bcitting up oll thc rndcpcndcnts $itlt lots ol. advertising and lou priccs. \o* it appcars tltc lugcr. nublicll financcd cotnpanics arc trvinq to go aftcr lltrscr chunks of tlte conLractor husinc\\. 1' *gll. It's also itnrxrrtant ilrat tie sntaller chailts arc ltxlking at snlallcr c(rlnnlunities as thev scc market sharc disappcar in thc citics. But tle strong. ricll managcd indcpcndcnts. \\cll kntl*n ltttd respected in thcir cotnmunities. lLrc holding f-tnn :utd utrrt t lie down and play' dead.

Currentl,v our business. in a smaller retirelnent-oricnted community on a beautiful lake, is stronger than cver

............$l h...rc..SectOiS...Wherg.rlirmsi'.can..'takei.redvanri rlgge::::of :::bUylhgrrr pqrileii:r::di$tilbuti0n:r::[oureri and] isoff iSticat&....teohn016gyl..lhe..ii]eigq...lirmsri,eie incteaSinsf ii:pu5hi!:!g::::ffiiri,$rnallei:: lin:ns:::0ut, ,,1n th6i Sddtbis..id.ornin.etdd blr llte.i.individuatieed :pi0duclsr oir::serviCes:r::rlhe: srnall,,,firrn remains king.' l

you're on your way down. It's inevitable.

Finally, there is one great disadvantage that's hard for an independent to overcome. That is financing. As rnnager of two of the larger stock brokerage offices in Chicago, I saw what public financing could do for companies. Sell stock and you're playing with someone else's money. Sell stock,

For the independent dealer, it's extremely important to be involved with strong, effective buying groups. We belong to Allied Building Stores and it's basically through Allied that we can maintain our competitive commodity pricing. I don't think we could survive without the benefits of Allied and Ace Hardware, through whom we purchase our hardlines. That combination has been tremendous for us. We use Ace advertising with John Madden continually; it brings people through the door.

Competition is everywhere. We see it from several surrounding conrmunities, even from 75 or 80 miles away. Our Wal-Mart, which has expanded several times and is one of their eady locations, is being transferred to a super center in a community of 4,500! In the cities they just keep building the big boxes, but I just can't see them all being profitable or even coming close. They opened a big HomeBase in Tulsa. Home Depot came in with two stores, Builders Square already had two and replaced one with a big new Builders Square II, and HomeBase was gone!

Strong independents have advantages they can build on. Many have tremendous comnunity involvement that has gone on for years. They have niches in which they can compete quite effectively. Knowledgeable personnel who can spend time and offer the benefits of years of experience mean a lot to a custromer who needs help. Customers are attracted to businesses that can provide quality produca, lmowledgeable sales assistance, the ability to get in and out of the store quickly, dependable installed sales, special areas of expertise and reasonably competitive prices. It's a big order but it is being done all over the country by independents who are serious about their businesses and are willing !o put in the long hours and hard work it takes to win.

Things shouldn't be a whole lot different in 1995. Unless they stop going up, I see interest rates affecting building more than is being predicted. The Fed is walking a tightrope. If they run rates too high, the national economy will sputter and our local economy (which needs to continue to atlract retirees) could be severely affected by growing concern for the economy. I've seen it happen before and things got presy dead, pretty fast.

It seems to me that a great many in our industry are complacenL Business has improved in the past few years, profits have grown, confidence is growing. You get too comfortable. But the economy is cyclical. You have to succeed and you can sell more stock. It's more and more of someone else's money and it's nuch easier to take a chance with and build another big box! Most independents don't have this ability and it really makes a difference. It's really a shame that many good opportunities can't be exploited due to lack of capital, tle kind of capital available to public companies. This problem will continue in 1995 in both cities and smaller communities across the countrv.

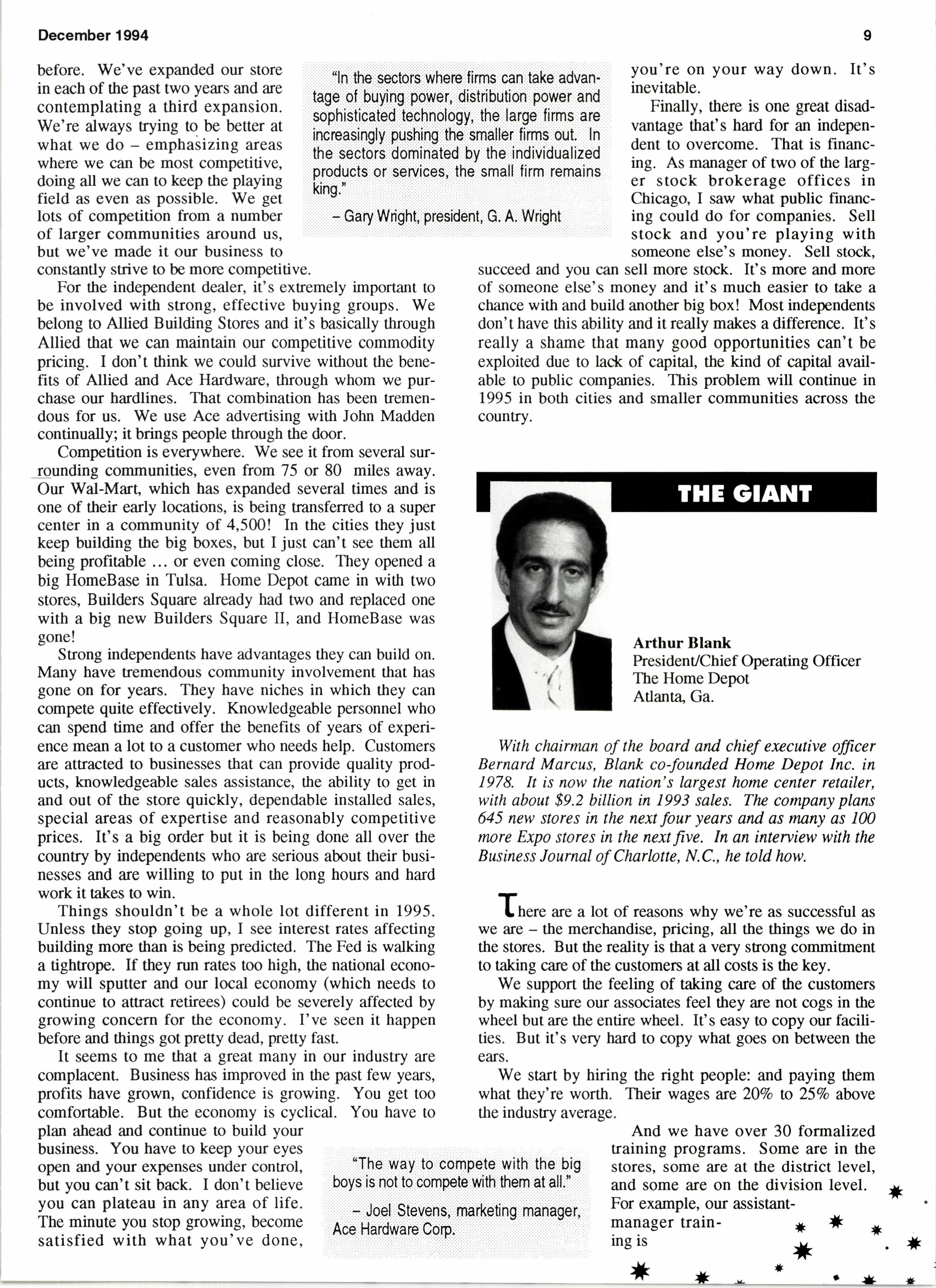

Arthur Blank President/Chief Operating Officer The Home Depot Atlanta Ga.

With chairman of the board and chief exzcutive fficer Bernard Marcus, Blank co-founded Home Depot Inc. in 1978. k is now the nation's largest home center retailer, with about $9.2 billion in 1993 sales. The company plans 645 new stores in thc next four years and as flnny as IN more Expo stores in thc next five. In an inteniew with the Business Journal of Clnrlotte, N.C., he told lnw.

T plan ahead and continue !o build your business. You have to keep your eves open and your expense. unh"r "ont ot, litre way to cornpele.with the big but you can't sit back. I don't believe boys,,is,,hot,lb compgterrwithiirtham..ttialf:....: you can plateau in any area of life.

We support the feeling of taking care of the customers by making sure our associates feel they are not cogs in the wheel but are the entire wheel. It's easy to copy our facilities. But it's very hard to copy what goes on between the ears.

We start by hiring the right people: and paying them what they're worth. Their wages are 20Vo ta 25Vo a}rrrve the indusfy average.

'-

" '- -:;i

Lhere are a lot of reasons why we're as successful as we are - the merchandise, pricing, all the things we do in the stores. But the reality is that a very sEong commitment to taking care of the customers at all costs is the key.And we have over 30 formalized training programs. Some are in the stores, some are at the district level, and some are on the division level. For example, our assistantmanagertrain- * * * ing is *

* * * done by the senior staff of the company - our c.e.o. works with them for a day, I take a day, the executive vice presidents take a day...

There are some things we've had to let go due to our growth in size, and there are some things we can afford to get other people to do for us. But training's so important" we continue to be involved.

We also have the notion of giving back to the communities we serve.

We're developing new prototypes to compete as well as to grow. We never want to paint ounelves into a corner. We'd rather do expansion while we don't need the numbers, so we have new stores ready when we need them.

The Expo division has a strong commitment to decorator-quality business with wallcoverings and floors for the kitchen and bath. The base of customers is interior designers and builders.

Most people make the mistake that the rural markes would mean smaller stores. Not necessarily. The merchandise is different. It would be geared toward the famrer and rancher.

There is such a thing as too big. Marmoth hypermrkets such as Bigg's that do well in Europe have not taken off in many regions of the United States. If consumers are looking for a specific item, they don't want to get lost in aisle after aisle of warehouse.

By concentrating on what independents are good at, such as convenience for smaller projects, a fine-tuned prodwt selection with a focus on quality, excellent service and good employee raining, they can crrre a niche where they can thrive. We'rc already seeing this in stores and lumberyards with power deprtnents desigrpd to fit their customers' id€ntified needs.

? small rebiter cannd corn pete based solely on price because they will lose every time,::but they can go head to head with a laqe rehilerin otha waysand win."

- Michad Hensley, direc{or, Virginia Tech's Economic Development Assistance Center

A similar evolution of retailers took place in the grocery indusry wben many of the current chains moved into tbe market. Medirrm-sized stores that ran smaller versions of the chains and corner grocers couldn't compete on selection or price. Now those types of stores are virtually extincL

By looking at tbe snvivors, thougb, we can see many promising possibilities for tbe hardware industry.

Smaller convenience stores thrived by making necessity items available right around the corner, 24 hours a day. More recently, specialty stores such as coffee shops and bakeries, like Starhrcks Coffee and Mrs. Field's Cookies, have flornished. By having a broad selection in one category, these outlets have persuaded consumers to make a special stop for one item.

The key to their success isn't price or location. It's quality. Can you imagine someone sayrng, 'kt's meke a special stop at Starbucks. They've got a geat selection of low priced, off spec coffees!" Specidty stores, such as plunbing and electrical stores, and focused outlet$ like the Ace Interiors stores, re already breaking ground in this market.

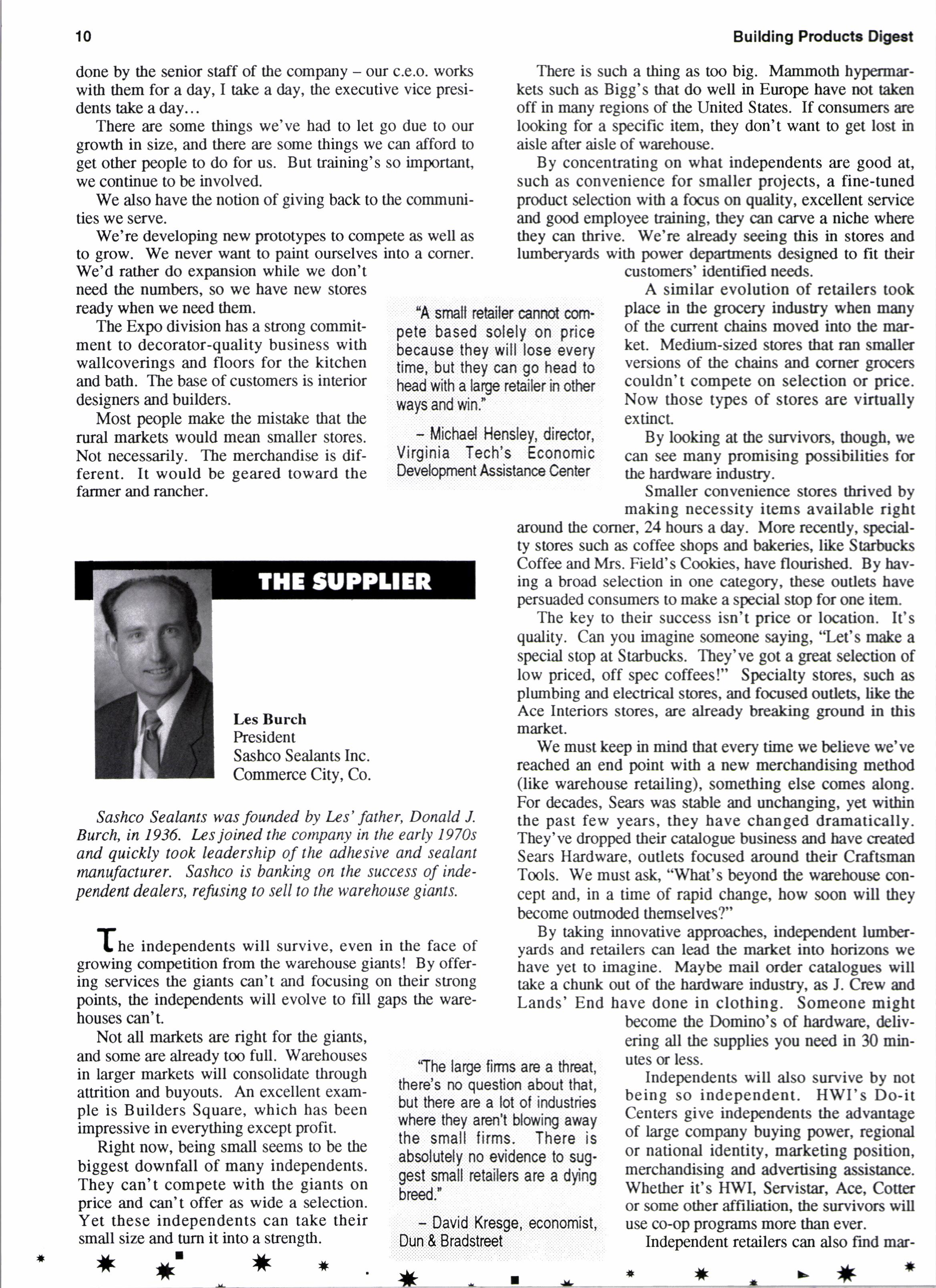

Sashco Sealnnts was founded by lzs' father, Donald J. Burch, in 1936. Les joincd the company in the early 1970s and quickly took leadership of the adhesive and sealant manufacturer. Sashco is banking on thc success of indeperdea dealcrs, refusing to sell to thc warelnuse giants.

Tt he independents will survive, even in the face of growing competition from the warehouse gians! By offering services the giants can't and focusing on their strong points, the independents will evolve to fill gaps the warehouses can't.

We must keep in mind that every time we believe we've reached an end point with a new merchandising method (like warehouse retailing), something else comes along. For decades, Sears was stable and unchanging, yet within the past few years, they have changed dramatically. They've drop@ their catalogue business and have qeated Sears Hardware, outlets focused around their Craftsrnan Tmls. We must ash "'What's beyond the wuebouse concept and, in a time of rapid change, how soon will they become ou0noded themselves?"

By taking innovative apprmches, independent lumberyards and retailers can lead the market into horizons we have yet to imagine. Maybe mail order catalogues will take a chunk out of the hardware industry, as J. Crew and Lands' End have done in clothing. Someone might become the Domino's of hardware, delivering all the supplies you need in lQ minutes (rless.

Not all markes are right for the giants, and some are already too full. Warehouses in larger markets will consolidate through ., "Tt laqe lims are a hteat, attrition and buyouts. An excellent exam- there s no queslion about lhat, pre is Build"rj square, which has been but there are a lot of industdes impressive in everyrhing exceptprofit being smau seema to be the biggelt downfall or many independents. aDsolulely no evloence lo sug' They can't compete with the giants on gest small relaibrs are a dying price and can't offer as wide a selection. breed'" Yet these independents can take their - David Kresge, economist, small size and turn it into a strength. Oun a BiaOsireet-

Independents will also sunrive by not being so independent. HWI's Do-it Centers give independents the advantage of large company buying power, rcgional or national identity, marketing position, merchandising and advertising assistance. Whether it's HWI, Servistar, Ace, Corer or some other affiliation, the sunrivors will use co-op progftuns more than ever.

Independent retailers can also find mar-

,.,.,ii',.fTffi,,axdQst9rl.:ofiiffimeieehtersi;lhiouEh fidi9805 and,into the 1990s allffi:i@0Surnei,$,:g r,:a :ioirp ucl$:,hat,,*ete,,lomefly::limited l0i..prcfessiofiali..:distiibut6:u. ,As,,,,a,,,rosUlti,,,do:itri6Urselleisi r ve:..6hilt lheirr :p0rcha$inCI rpiacticesr awey from :irdep.rtmehildiscount Ctorbs and hetd iClso...gfown to,: inclUde greater numhrsrrrofrr:Wom6n:,:who,,,ere ,more eomforbble in tre *arehouse setting ol a home,center:than the maleuorninai*..atmosnhec6r..mani::haidwere]:stoies:'..'

' - J.Chad Brown, The Fredonia Grcup ,

kets in the local contractor trade and industrial maintenance. They can design programs for individual needs in the region more readily than the giants can.

Better use of competitive tools, such as selling products not available or practical to warehouse giants, will also be imporanr Many independents tue already using Sashco's commitment not to sell our caulks Lexel and Big Stretch and our adhesive Glue Buddy to Home Depot, Builders Square and others. Since more suppliers are making simi lar commitments, independents can offer in many departments higber quality products that the warehouses can't.

Some independents that don't adapt to this new market will most certainly fail, but, overall, they will survive. We'll see fewer stores in the middle ground and some consolidation of warehouses as areas are over-built. In the end, we'll see some aggressive independents creating new markets and developing new strategies so that they not only sunrive the onslaught of warehouses, but also benefit from it.

chains will continue to gobble each other up in record numben.

Perhaps the best example is BMC West, the Boise, Id.-based contractor-oriented chain, which has acquired over 20 locations since going public in 1992. In the South, both Carolina Builders, Raleigh, N.C., and Pelican Companies, Conway, S.C., are scouting the countryside for independent businesses to buy.

In Chicago alone, Home Depot has taken over several stores from HoneBase. Even Canada's first entry into the world of big box retailing, Toronto-based Aikenhead, has fallen prey to Home Depot.

Forecast: The bigger companies will continue to expand, and the smaller operators who lack the capital, or don't have a firm marketing plan in place to drive growth, will either drop by the wayside or opt to sell out.

Most refailers, and especially those in netro markets, are finding it increasingly difficult to serve multiple market segments. Few owners and managers possess both the merchant mentalig required to attract consumer trade, and the big ticket mentality required to successfully market to the professional contractor. As retailing becomes more focused, managers will find it exceedingly difficult to be all things to all people.

Forecast: More and more independents in the meEo areas will abandon the consumer and focus on the professional contractor. The pritnary exceptions will be in rural areas with populations that are insufficient to support a warehouse store. In cities with the highest concentrations of housing activity, building material distribution will become even more specialized. Framing yards, millwork specialty houses and hard material yards will be more and more prevalenl

The medium-size chains such as Moore's, Roanoke, Va.; Grossman's, BrainEee, Ma., and Payless Cashways, I,,,Consumer spending is very irnportani o me,econffi and the go,vernment cani.;:,;411o16,.ic...,let.,..it.,.:CeClinE'r' , f,nerfoie,e

..,.,.'.'.......1Pe6,p,|9...0o,..10, ,.see.Whal kihd,,of priCes they have and iitlthat:::kind:::6l.::ill6tC$andiSe 'they,,,ha-ve,' But they come Hbkr"

.i...i......i.,.*,.rEmie....Mff nAi...gmilOf l. ::::eeiiifi$Sf s,:8ttiHin0,:SuPdY, [-rledhsast,,,,ll Paso; Ti, notr::ring:,rlMt,:,biu$irte$s:,:SUff eteU, a, 1 5%':,,diop:':.:.:whdn,Home Deoot$: rnovd : in::on tre east and,,,,,west,s,idbC,' of,'loWn, :,,tlrcu$h: business :has': itafied ke Resources is a consulting, training, recruiting and psychological testing ftrm dedicated to helping improve organizational productivity in the building supply irtdustry. that's afoot in the home center/lumberyard battlefield that will certainly pick up steam over the next few years is consolidation. Independent operatofs as well as warehouse

2' An aging popularion resrilts in:not::only :,the problem of ,declining Consumei spending Uut the,,,pioblbm of, fiaWa.,,ehry*leVelr: w.or\4qi:....lthelel..wilt..mr,,glgSt pressur-9:, ,to..sorve,bott.,df..ftt," rro- temsu'im.'f u0.01...''.,......,,.,.,.,..,,......

J: ThO ratio of single to,, ,tousetol&r:cohtiniie$rtCI:.:r,, incfease. Thus, there is a higher:;level of ndw housoiold, formation per capita than, Sas 6l5tbrically pie*ailed::, *tn..u*n*.."ttu,,ffTt.nou t.lllll.ll...,...,,,,lll

4 ,Ao increase in the nq4be,r of, ol,rler peorple receining, rSocial,,:securi$,,,and,,a,d,9 aS&riini.the.inumbei;:1ofiiiybungefiiiiii ,,do, utin$,:lio.: al:::secUntl:::1v,illiirc$ultiiiini:9efl'iiiii .SuieSi.bikeeb..more..p9o6,,,in,,,ther,,w.$p.$:,fuctr;.longCi;,,,:iSffi,,,, likely,,,ioIution:IiS:|:exte,nf,illg:rtherrietir,e.menurfa'gs.:]]r]firiSiiwiiliii], ,"tu,,,**n,*uFlu,, inellt*g'*i..lilllliiiii.i...ll*.,llllll..l., i.i.iiii..'.' .i 5,,,,, ifestyle,,clanges,and improving lezuth are. keeping .....ffi"p'l9.eduse..1ry..fid..io ..**..sFnffi3l.......l.r.i,........... ',t:,t,.,i,6t*,,,,**hlpiei.idenh::6.;:!firi:WitEAC..fne;.'...i:'....i.'.........,..

,,,,,,',,,3t.:,sti!l rthihk,,smaller locationS are p[cking up cedain business, lf yrcxr are doing a big projecl, you pick up items at a Home Depot or an Ea$l6.r But if pu loroet a screw, you go to the local,hedrare stdre.'

Kansas City, Mo., will find that their smaller fomrats cannot successfully compete with the rapid expansion of the industry players who have invested in large-store fomrats averaging well over 100,000 square feet. These smaller chains must decide: Are we fish or fowl?

Forecast: Themid-sized chains will begin fielding a larger contractor sales force as they shift their customer mix toward the professional. In markets where they cannot make this transition, stores will be shuttered.

Mary Fleckenstein,

The Home Depot has published that they plan to captue 25Vo of the U.S. home center market by the year 2000. Although they enjoy only an 8Vo r].€lrket share today, the odds are good that they will be successful in achieving their market share goals. Home Depot is a master at innovation. They are always experimenting with new concepts. But even though they will continue !o experiment with outside salespeople to service builders, I believe that they will achieve only marginal success servicing builders out of a big box store.

Forecasc As the nation's big box retailers (especially Home Depo| jockey to dominate specific geographical markes, they will speed up expansion by cannibalizing each other. We can also expect to see Home Depot introduce smaller format stores gearcd to serve smaller markets. I also predict that like Lowe's, Home Depot will soon realize that to successfully service builders, they must create large contractor-only yards.

"Thosa challenges mean we're going to have to innovate, we re going to have to find things that differentiate us, we're going to have to find things that bring more products and services to our custorners."

- Frank Doczi, president and ceo, HonB Quailers Ware house lnc., Virginia Beach, Va., speculat: ing on the overabundance of home improvement stores in ttteU.S.

Innovative independents will begin to market building materials in new and different ways. Several dealers in California and Ohio are already beginning to sell building contractors framing and rim packages on an installed basis.

Sunmary: Independens who are innovative and willing to adjust the way they do business to accommodate local market conditions will continue to be srong players. However, many of the independents who are unwilling to make necessary changes in the way they go to market will find it increasingly difficult to compete.

The retailers in our industry who have the brightest future are those who have developed a strategic marketing advantage. Whether it's consumer or contractor trade, customers always buy from the retailer that they perceive is offering the greatest value. The company that knows its customer's needs the best will have the edge.

So ask yourself two questions: How close are we to our customers? AnG what is our company's strategic marketing advantage? Don't allow your competitors to beat you to the Punch. r

After three years as executive director of the Minne son-Dakotas Renil Hardware Associatiott Jolnson joined tlv National Renil Hardware Association in 1987 as director of educatiotdrumber services and executive director of tlw Home Center Instituu. Under Ns direaion, NRHA ard HCI Inve added or ufiued over 60 taining proSruns.

\zan independent lumberyads and mid-size home center companies compete against large cheins? The short answer is yes. Many are, and doing so successfully.

We at the Home Crnter Institute believe, as we have for many yqus, that the hardware/home improvement industry is big enough, diverse enough to offer opportunity for small and mid-size companies as well as large ones. We are realistic enough to admit that not every independent lumberyard will survive, nor will every mid-size home center. However, they ae not endangered species.

Our research tells us tbat, altbougb storc mit counts are stabilizing, sales dollars are not. We estimate total industry sales (which include banlware stfr€s as well as lumberyards and home centers) in 1994 will lop 1993 by ll%; lumberyad sales are estimated !o increase l2A%.

Further evidence of the ability of independent lumber ret ilers to compete comes from financial data provided by retailers who participated in HCI's 1994 cost of doing business study, which reporB 1993 performance. These lumber retailers reported sales up 15.2% in 1993, compared to an increase for all stores of 9.8%.

Our projections for the next five yean call for a cmpound annual growth rate of 8.2% for the industry as a whole, an 8.87o rate for lumberyards.

Growth will not come easily for independent lumberyards and mid-size home cent€r chains. A sudy released earlier this year by G. A. Wright Inc. and Dun & Bradstreet Information Services lays out the challenges.

This study evaluated lumberyards on the basis of employmenL The researchers found that lumb€r retailing was one of five retail sectms where large companies werc gaining in employment market share at the expense of smaller conpanies.

In addition o point'lfs tre littb hingswe do Utat ing out the challenge, keep our customers coming the study also suggestback.' ed answers: specializa-

^ -.K"lth. vayglran, manaser, nL*

Q.urtis Paint & Hardware Co., .r*rror-ioo"pendents

Their strategy is to concenfate on what they do bestsell lumber and building materials to professional and contractof customers. HCI's cost of doing business study shows a trend in that direction. The percentage of lumberyard sales in lumber and building materials categories has been increasing in recent years. So has the proportion of sales to contractors and professional customers.

At the same time, profitability - net before tax profits and retum on investrnent - is showing improvement.

The large chains are powerful competitors. But they do not dominate the hardware/home improvement industry as they do in other lines of rade. The top 25 chains (in sales volume) control less than one-third of the sales in this channel.

There is, and will continue to be, room for aggressive and well-managed small and mid-size companies.

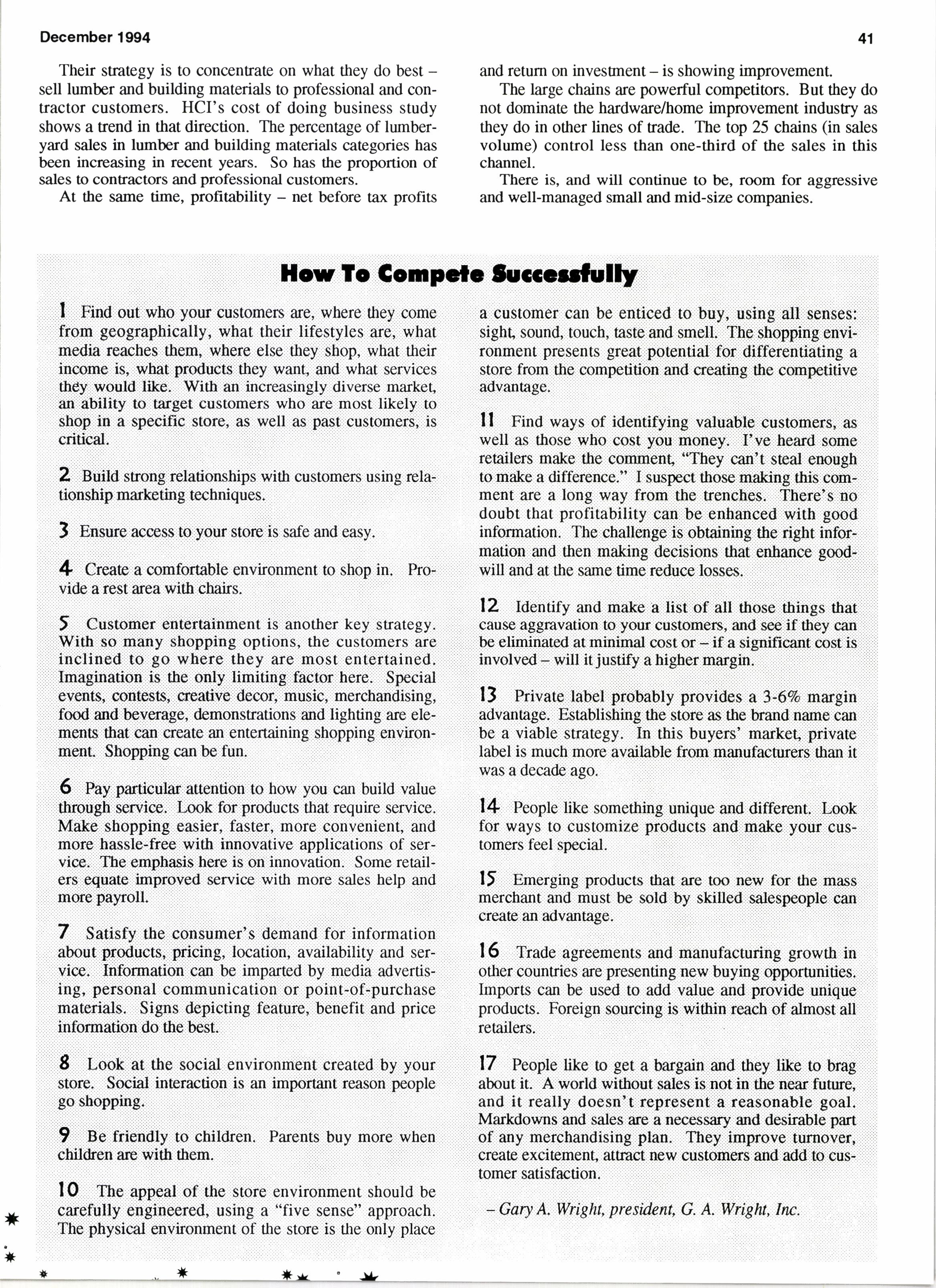

tlCw..:.te,:l.GCmp c, ef,"ffiI

I find oui'wno your Cusbmers are, where they come .frofirr geographipally;,:.:what, their.r,lifestyle'S.,.are, what media reachesithem, *here else tley, Shiop, what their in r,:i$,r:::lvhat:!:p.fodUcts:,:,they Want,:,:,and,,:what,:,services thgt!',woulcl...:lite;.,.,.,..rtrith:..an,.,increaSingltr,:diverse market, an abiliti to targei customers who are most likely to snbp in a specifiC store, as well as pasi customers, is

2iii.i.iBuiid iSftduCii#rafio*nips *itl "urto*".. usins,,rcit lonshin *8tdhntouda:..'.. . ...., ' '. u....n*n*u..n'mssovour$toe..iscarean0.easy;

4 Create a comforuble enviionment to shop in. Pro; tidei.a..fest..areu'.*,* ii.'.i.............'.......l.. ..........iiiiii,......

5 Customer enteitainment is another key strategy. illithr:,:So,,rman'{i:r:Shop'pingr:,opdons" :th0::cir,stomers are fnblinred rto,ii,gd..ilwhereiii,thei'r afe::::moS,t,,,,e,n;teitained, Ifieginetion...is,...the...o.$l'y....limifin$....facfor..:heie,::::':Speeial elenf$r.::ConteBt$,i..i,er,gAtiv€....dgcofr,,.fiusic,,,,,merchandiSing, {ffi,,,bevgpge,:::demonSftation- -d,,rlighting,arp:::elements:.:thfltr: :rueab,rfi,,,entenaining:.:ifuppin$:enniionmenti.....snom*9.,,**,.tt"..,,,,:,.................

6 fay par,ticular,,attention to horv you can build value ft r,ou ,,,s0rviee,,,r,,,! k fot,,p.iMuc ts,:that rqqu iie sOrvice,, M4|gg..lshOpphg ea$ior,i':f ter,,,more,oonVenient, and fiof:.e:::lresslelfr,e'e:::with innovativ€ applieations,::of seiJ vicei.....The.,enn$ati$i.here iS,r,on:!innoVation:,,,,,Some retail: €rs::i:pquatg:::rimp.fov€di::,servic€::::wi0r moier:,s"les help anO morb payroll. '

7 Satisfy,the,coniumer's demand'for information about pioducts, pricing, tocation, availabitity and service. informatibn can be imparted by me0ia advertising, perConal communication: oi point-of-purchase matdalsil.,.;,Si94s,.depioting iifeature;:!:Uenefi trrrrend r price ihformation do thebeSf. r

8 ,fooi ai tue iociat Jnvironm'bnt created by :your slore, Social interaction is an impo t reason people goshopping.'.''.''.'.'.

9::: :Be frienuty to bniior-en, Parents'buy more:when'

I 0.:.:.: .fie.:ao;gatiiiio?.:ift istoi6,,,enVin nment,,,should bc carefuity engineered, using a "five sense" approach. Therrrpht$ical *iionment of..lhe store::iis the,only place a.:.!cu,Stomef.r.rcen be ent!ggd,,,:to bty;,,,,u$in$.'..a11...$en.ses.;:':. ,sigh [, sound,,iit0ud_h, ASte,,aux,,sm0ni. The:: $,ho ng'.CInv,i r.l ionmeilt,presents great,,,[otentiat...for.. Uiff ordnfiating' a Ctore,f,rom!::the, CO.mpetition',andcr.6ating:::theriC0trnBgtitive!:: advantage.' tt Find ways of identifying ualuabte'Customers,,as weU as::r:fhose,,,,*hO,,,,COSt,,,yOurrrmOngJ:::::r:,:Ilve:::heafd:::Sbnte: reaineis make,r:rfllerc6. e'ng,'They,,,,ca$ltr:r$Fd,r:cnongh,::i to make a difference." I suspgct those, ng this com. ment.are a long.'.way.,,,f.iom..!'tne,..UenCheC;.:,.,There's'no' doubt tha[ pio'fitability:i,idan:] be.enhanaecrr::wilh good:, information. ttre challeng* is obtaining,the ri]gbt infor-, mation..'an0 *len ..fiaking dee,is,iffi$.:.tha[:lleftance goSd,: wilt anO at the same time reduce tosro,,......, l'' -

12 toentiry and make " iiSt,"r:;air rhose things that cause aggravurto; 19 your cus6mers; and See if they can .be eliqlinated.'at.mini ,codt.or..r.!f'.&isiguifi ..oosl.'xs..,l involved - will it juatift a higher margin. ' ' ' t3 Private:,label ,proually provides,a 3il67o mrgin ,adVantage, r,EStablishind:,$e Store: as:,the,@pd:name carr, be a viable strategy;: :tn this buyets' m4rkeq,.piivate label::ismucE::,more::availabfeffm.manufae,,than.it'': was a decade ago.

14, : Feople titce sometning unique and different,,,,Look f6i., .ways to, eustorti2e,,,ptoiluCts,,,,and.,.m*C.,.,!our cusl,.,

.15...,..b iiiag.,.,piodncts.ith[i'.'arC.'.tm..n ,'fod..,the...mds.... merC.hant,. and,,,mus{,,be soltl,,,b,i, Skined,'.'salespeople Can creatC an advanuge. ,, ,;; , t 6 Trade agreements and manufacturing growth in other countries'are presenting ne* buying opeortuni-ties. hnpofts can;,;be,,,:usd,,,,to add value and prNiOellluni(Ue.... prodiCts., Foreign,,,sourcingr.iS rvithin::r.ea .:ofral lostrd!::: retailers. "' '

17 People nke to get a UatCain,anO tney fike to Ur4g aboui it. A,world without sal,es is not in the near funne, andr:rit :ieatly,,doesnirt,r:repfeSent::r,a:r.rrCASonhbla'::::goal::,, Markdowns and sales,arc a ngqgqsqy and dcsirable part of any,meidhandisinC phn. They, impibve turnover, Create eicitemenL attl4qt new custoners and add,,to:Cus. tomer Satisfaction; : :

,,,,- G-aryAi WtWltt, pre$i it, G A. WljElrt,;,.trnc.

LUED laminated beams have lfprovided good nr,argins for renilers since they were inroduced as the first engineered lumber products over 40 years ago. Now, a new generation of retailers is generating big-ticket, profitable sales volume in laninated headers, ridge beams and floor beams.

Although laminated veneer lumber (LVL) and I-joists have received a lot of recognition, structural glued laminated timber (glulam) still fills an important niche where longer spans and extra srength are needed.

Glued laminated timbrs are often