10

16

Focus on Pro A/V

How three dealerships are tapping into the market by Brent Hoskins

Office Technology Magazine

Might you want to tap into the multibillion-dollar professional audiovisual (pro A/V) industry? This article includes profiles of three dealerships focused on their success with this diversification strategy. Perhaps the insight they share will provide you with some welcome guidance.

Pipeline Management

The best strategies for driving consistent growth by Kate Kingston

Kingston Training Group (KTG)

As those in the office technology industry gear up for the second half of 2025, effective pipeline management is crucial to driving consistent growth and hitting ambitious revenue targets. A robust pipeline ensures that your reps remain focused on qualified opportunities.

Time to Sell?

Positioning your dealership for an acquisition by Travis Sheffield

UBEO Business Services

Whether you are the CEO of a 100-yearold, multigenerational dealership or a newer company that you started on your own 10 years ago (or somewhere in between the two), you have possibly thought of what the future might hold for you and your business. 22

Q&A: DXone Executives

A brief look at this new Acumatica-powered ERP by Brent Hoskins

Office Technology Magazine

Increasingly, office technology dealerships are turning to the DXone ERP as a replacement for their legacy billing and field service systems. Recently, Office Technology magazine interviewed DXone CEO Alex Cribby and Executive Vice President of Business Development Gavin Williams.

AI Usage & PEO for Insurance

Members answer two questions from fellow dealers

Compiled by Elizabeth Marvel

Office Technology Magazine

This feature includes two questions submitted by dealer members as part of BTA’s Dealers Helping Dealers resource and many of the answers received. These answers and others can be found in the members-only section of the BTA website.

The Nondisclosure Agreement

It helps safeguard your proprietary information by Greg Goldberg

BTA General Counsel

This month, Legal Perspective takes a deep dive into a topic that has come up in many recent dealer inquiries: the nondisclosure agreement (NDA). An NDA is a contract that places restrictions on the use of confidential information.

The ‘Or What?’ Question

Examining the four levels of sales management by Troy Harrison

Troy Harrison & Associates

Recently, a sales manager asked me an interesting question: “What do I do when my top producer simply refuses to follow our new prospecting process?” It is a common problem and it brings us to what I call the “Or What?” question.

The New WorkForce® Enterprise AM Series.

Powered by PrecisionCore®, this marvel has less imaging parts than typical laser printers which can result in fewer slowdowns, breakdowns, and office meltdowns.

IExecutive Director/BTA Editor/Office Technology

Brent Hoskins brent@bta.org (816) 303-4040

Associate Editor

Elizabeth Marvel elizabeth@bta.org (816) 303-4060

Contributing Writers

Greg Goldberg, BTA General Counsel Business Technology Association

n this space, I occasionally like to share some about our BTA Dealers Helping Dealers Discussion Groups. The idea for the discussion groups grew in my front yard. Let me explain. It was May of 2020 — in the early days of the COVID-19 pandemic — when I was mowing my yard and thinking about the industry’s prevailing question of the day: “What do we do now?” I was also thinking about the then 94-year-old focus of BTA — dealers helping dealers — and about how the world had been thrust into the daily use of virtual meeting tools like Zoom. Without explaining further, you can see the result of the merger of these thoughts.

Today, there are six BTA Dealers Helping Dealers Discussion Groups that meet regularly via Zoom. Three of them are for owners and senior management, one is for sales managers and one is for service managers. (More on the sixth group in a moment.) For each of these groups, I strive to have noncompeting dealer participants. The format is very simple. When group members register for the next call, they are asked a simple question: “What questions or topics would you like the group to address during the call?” Those questions or topics either get the conversation started or fill the entire hour. (I should note that while the challenges of the pandemic were initially the sole topic of discussion in the groups, we now talk about everything but the pandemic.)

I like to keep track of the numbers. For the five groups noted above, there are currently 143 members. Collectively, there have been 366 calls to date with total attendance of 4,748. Two of the groups meet twice each month; just this morning, BTA Dealers Helping Dealers Discussion Group Two had its

117th call. The group first met on May 7, 2020. Group One also meets twice each month. The other three groups meet monthly. Using Group Two as an example, here are a few recent questions submitted for calls: How do you recognize high-performing employees in various departments? How do you like your CRM? What non-copier products do you like to sell? You get the idea, but that’s only part of it. The group participants also communicate between calls via email, asking questions of one another. It has also been rewarding to see members of the groups meet in person for the first time at BTA events.

The headline to this column gave it away, but I noted above that we now have a sixth group — the only one that is not limited to non-competing dealers. The inaugural call of the BTA e-automate Elevate Discussion Group took place on April 23. We had 38 attendees. Among the many topics addressed in the call: Migration pains when moving from e-automate on-premise to cloud; coding manufacturer credits back to deals in e-automate; and equipment inventory processes. This group was born out of the inperson BTA e-automate Elevate event that took place on March 6 in Orlando, Florida.

Why am I sharing all of this? Because we would like you to join us in one of the discussion groups. There is no cost; it’s part of your membership. And it’s simple. Just email me at brent@bta.org and I’ll email you a list of each group’s members by company, city and state. You can then pick the group or groups best for you. What are you waiting for? Wouldn’t you like to have your fellow dealers provide you with insight and guidance that could help you in your dealership? Join and you will soon see your group’s members as your virtual board of directors, supportive dealer friends or both. I look forward to hearing from you. n — Brent Hoskins

Troy Harrison, Troy Harrison & Associates www.troyharrison.com

Kate Kingston, Kingston Training Group www.kingstontraining.com

Travis Sheffield, UBEO Business Services https://ubeo.com

Business Technology Association 12411 Wornall Road Kansas City, MO 64145 (816) 941-3100 www.bta.org

Member Services: (800) 505-2821 BTA Legal Hotline: (847) 922-0945

Valerie Briseno Marketing Director valerie@bta.org

Brian Smith Membership Sales Representative brian@bta.org

Brooke Barker Administrative Assistant brooke@bta.org

Photo Credits: Adobe Stock. Cover created by Bruce Quade, Brand X Studio. ©2025 by the Business Technology Association. All Rights Reserved. No part of this publication may be reproduced by any means without the written permission of the publisher. Every effort is made to ensure the accuracy of published material. However, the publisher assumes no liability for errors in articles nor are opinions expressed necessarily those of the publisher.

The association’s magazine cover 48 years ago this month — the NOMDA Spokesman, May 1977.

T2024-2025 Board of Directors

President

Adam Gregory Advanced Business Solutions LLC St. Augustine, Florida adam@goabsinc.com

President-Elect

Debra Dennis CopyPro Inc. Greenville, North Carolina ddennis@copypro.net

Vice President

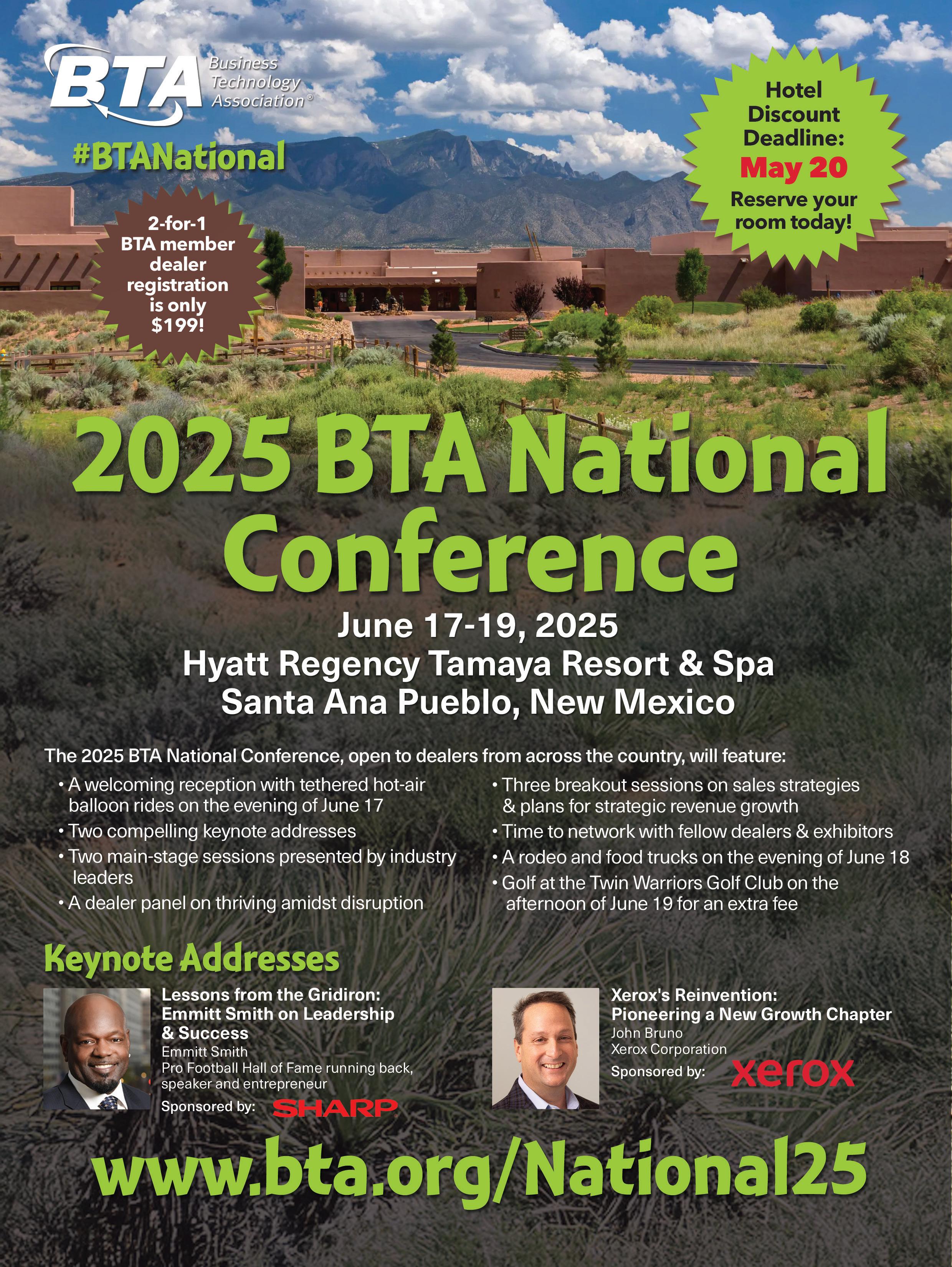

he Business Technology Association’s (BTA’s) future-forward 2025 BTA National Conference is shaping up to be one of the most memorable industry events in recent memory. This month, I’d like to share some more details about the June 17-19 conference, to be held at the Hyatt Regency Tamaya Resort & Spa in Santa Ana Pueblo, New Mexico. If you haven’t yet registered, I encourage you to keep reading for more details and sign up today — the discounted hotel room deadline is May 20.

To kick off the educational portion of the event on the morning of June 18, Emmitt Smith, Pro Football Hall of Fame running back, speaker and entrepreneur, will present a keynote address, “Lessons from the Gridiron: Emmitt Smith on Leadership & Success.” During this opening keynote, Smith will sit down with Sharp Imaging and Information Company of America President and CEO Mike Marusic for a “fireside chat,” where they will discuss adapting to change, overcoming obstacles, achieving goals, effective leadership and the importance of teamwork. He’ll address these topics while highlighting his journey as a football player, business owner and “Dancing with the Stars” champion. During the event, we’ll also be doing a drawing for a chance to win a Dallas Cowboys jersey autographed by Emmitt.

The second keynote address will be held that afternoon. John Bruno, president and COO of Xerox Corp., will present “Xerox’s Reinvention: Pioneering a New Growth Chapter.” In his keynote, John will reveal how Xerox is expanding beyond traditional print, investing in cutting-edge technologies and creating pathways for shared success with its dealer partners. You will learn how Xerox

is reshaping the future and providing dealers with the essential tools, solutions and support they need to thrive in a dynamic market.

The educational sessions at the national conference will also include two additional main-stage sessions, a dealer panel and three breakout sessions. To get detailed descriptions of the event’s educational sessions, visit www.bta.org/Natl25Education.

Over the years, many BTA dealers have said that networking is their favorite part of BTA events. For those of you who feel the same, the national conference schedule includes an array of opportunities for attendees to network with fellow dealers and the exhibiting sponsors. Not only will there be plenty of exhibit time during the educational portion of the event, but we’ll also be hosting three additional networking activities:

n On the evening of June 17, we’ll kick things off with an opening reception. The two-hour event will include cocktails and appetizers. And, with nearby Albuquerque, New Mexico, being the home of the Albuquerque International Balloon Fiesta, we’ll be offering tethered hot-air balloon rides to those who are ready to soar to new heights.

n On June 18, after the first day of education, we will head to the The Stables at Tamaya — a rehab center for rescue horses. There, you’ll enjoy dinner from savory and dessert food trucks, and see modern cowboys rope and ride during a rodeo.

n Finally, after the event wraps up on June 19, you can choose to stay and play a round of golf at the renowned Twin Warriors Golf Club for an additional fee.

If you’re ready to tackle what’s next for your business, I encourage you to attend this year’s BTA National Conference. To learn more, see the ad on pages two and three, and visit www.bta.org/National25 to register. I can’t wait to see you in New Mexico! n — Adam Gregory

Mike Boyle BASE Technologies Inc. Bethel, Connecticut mboyle@baseinc.com

Immediate Past President

Don Risser

DCS Technologies Corp. Franklin, Ohio don.risser@dcs-tech.com

BTA East

Joe Dellaposta Doing Better Business Hagerstown, Maryland jvd@doingbetterbusiness.com

Chip Denlinger DCS Technologies Corp. Franklin, Ohio chip.denlinger@dcs-tech.com

BTA Mid-America

Greg Quirk JQ Office Equipment Omaha, Nebraska gquirk@jqoffice.com

Brett Blake Corporate Business Systems LLC Madison, Wisconsin bblake@corpbussystems.com

BTA Southeast

Mike Hicks Electronic Business Machines Inc. Lexington, Kentucky mhicks@ebmky.com

Blake Renegar Kelly Office Solutions Winston-Salem, North Carolina tbrenegar@kellyofficesolutions.com

BTA West Kevin Marshall Copy Link Inc. Chula Vista, California kevin@copylink.net

Scott Reynolds Imagine Technology Group LLC Chandler, Arizona sreynolds@itgarizona.com

Ex-Officio/General Counsel

Greg Goldberg

Barta | Goldberg West Hollywood, California ggoldberg@bartagoldberg.com

The Avision experience and know-how in the realm of manufacturing printers, scanners and MFPs is extensive. Our popular, award-winning product arsenal spans everything from small desktop space savers to heavy-duty o ce and production MFP workhorses. We manufacture

The Avision experience and know-how in the realm of manufacturing printers, scanners and s is extensive. Our popular, award-winning product arsenal spans everything from small production MFP workhorses. We manufacture

the highest quality p ro d u c ts d eliveri n g to a multitude of manufacturers in many industries such as healthcare, banking, government and education. Our current diverse range worldwide receives consistent reliability, quality, and the Avision real-world guarantee.

the highest quality products delivering to a multitude of manufacturers in many industries such as healthcare, banking, government and education. Our current diverse range of partners worldwide receives consistent reliability, quality, and the Avision real-world guarantee.

Avision AM7650i A3 MFP with intelligent features MFP of partners

Avision AM4332iw Pro A4 MFP with 8’ Touchscreen 45ppm and 550 page Tray

Crop, De-skew, and Auto Orientation, all in one single step for the perfect copy

Drop ‘N Take intelligent features o er Crop, De-skew, and Auto Orientation, all in one single step for the perfect copy.

Exhibiting @ BTA National Santa Ana Peublo, NM

Exhibiting @ BTA National Santa Ana Pueblo, NM

June 17-19, 2025

June 17-19, 2025

To learn more about Avision, please visit www.avision.com/printer_MFP For Avision partnerships and private branding, please contact partners@avision-labs.com

by: Brent Hoskins, Office Technology Magazine

Might you want to tap into the burgeoning, multibillion-dollar professional audiovisual (pro A/V) industry? Following are profiles of three dealerships focused on their success with this diversification strategy. Perhaps the insight they share will provide you with some welcome guidance.

While it is only in its third year, The BOSS Company, based in Birmingham, Alabama, already fully embraces the pro A/V opportunity. The reasons are simple — Founder and President Troy McCawley had experience working with A/V while employed by another dealership, he wanted to make his dealership a “one-stop shop” for office technology, and he sees the value of the exciting world of A/V. “We do full audiovisual,” he says. “That’s everything from digital signage to interactive boards to monitors to video walls.”

customer spends money on technology, and we offer them products in a package. Ninety percent of my clients are not in the market for A/V. What we say is: ‘If I was able to get you a 200inch video wall with no change to your budget, would that interest you?’”

Yes, BOSS often includes A/V in a lease package at no charge. “I get my aftermarket residual by leading with A/V and incorporating it into the puzzle,” McCawley says. “So, while there is no residual from A/V, I get all of my residual business because I offer interactive boards, video walls, etc. That is, I’m taking my competitors’ imaging business because I’m offering the A/V products customers want.”

Exciting? Yes, McCawley says. “It is probably the most important part of my business,” he says. “A lot of the things that we sell don’t excite people. But A/V does. Think about how people like big TVs. For many it’s: ‘I see the latest and greatest 110-inch TV at Best Buy. I have an 86-inch TV. It’s plenty big, but I want the bigger one.’ So, A/V in the workplace kind of speaks to people. It is something that excites them.”

Is pro A/V then the most significant product category at BOSS in terms of revenue? “My guess is that it is going to stay at around 10% to 15% of our business,” McCawley says. “I sell way more MFPs than anything else ... A/V is not my source of residual income, but it is what I am running my business on because it’s the sexiest part of my business.”

As noted, BOSS, which stands for “Best of Sales and Services,” is positioned as a one-stop shop, offering not only A/V from such vendors as Clear Touch, PixelFLEX and NoviSign, but imaging products from Canon, Kyocera and Ricoh, as well as managed IT services, VoIP, website services and the resell of internet services. “We do an ‘optimization approach,’” McCawley says. “We go in and look at the way our

Currently, BOSS is poised to begin a new campaign in order to open additional doors by way of A/V. “We’re sending a marketing letter to some executive-level people we know,” McCawley says. “We’re gambling that if they will meet with us, we’ll offer them a $500 gift card or a 200-inch video wall at no cost that we bundle into their lease; they either pay the same price for services and we give them a video wall, or we reduce their price for services and they pay for a video wall, but with no net additional cost.”

The best prospects for A/V are “companies that are bringing customers into their offices,” McCawley says, citing a couple of recent examples. “We have a large real estate company in the process of building a new corporate office and we’re going to give them a 200-inch video wall, bundled in with all of their MFP and IT infrastructure. We also have a coffee company where we put in a 140-inch LED video wall in their training center, bundled in with a workflow document management, copy and print deal.”

Noting that A/V is an easier category to manage than other common diversification strategies, McCawley offers some key advice for other dealers to follow before moving forward with offering A/V. “Buy an interactive board, put it in your conference room and start getting comfortable with using it,” he says, noting the lengths BOSS has gone to in order to showcase A/V to customers visiting the dealership.

“We’ve got a 200-inch video wall in our help desk, and a 110-inch video wall, 86-inch interactive board and 60inch television with digital signage in our conference room. We have one MFP.”

Headquartered in Oklahoma City, Oklahoma, ImageNet Consulting was founded in 1956 as Southwest Typewriter Company. Today, with 18 offices in six states and more than 500 employees, the dealership primarily sells Canon and HP imaging devices, but in recent years has made significant strides with managed IT services and pro A/V solutions as well.

“I get my aftermarket residual by leading with A/V and incorporating it into the puzzle ... I’m taking my competitors’ imaging business because I’m offering the A/V products customers want.“

— Troy McCawley The BOSS Company

ImageNet consultant is having conversations with a customer and the customer needs A/V, the consultant is aligned with one of our branch-specific A/V presales specialists/ designers. We ‘run the play’ and then give it to them at the ‘one-yard line’ so that they can close the deal.”

It was around 2015 that ImageNet entered the A/V business when selling Samsung MFPs; the vendor required the dealership to expand its product offerings. So, Samsung TVs — sold as display screens — were added to the lineup, says Kyle Kempf, director of ImageNet’s Commercial A/V Division. Soon, the dealership’s leaders were “trying to figure out, ‘What do we put on these screens? We can’t just keep hanging these blank screens everywhere,’” he explains. “They began to look at all of the available digital signage software platforms, but didn’t find anything that was as flexible or customizable as they were used to providing customers on the print side.”

They “stumbled upon a development group in Hungary” that was working on a digital signage software product, but lacked funding to complete it, Kempf says. “ImageNet bought a majority stake in the company so the software, called Wallboard, could be completed,” he says. “We still own that today. We pair hardware with the software. We have approximately 200 vendor and distribution partners [including 20 preferred] in the A/V space. By having an extremely diversified pool of equipment to choose from, we can hit any budgetary and overall project size.”

ImageNet has hit its stride with pro A/V. In 2020, the dealership had four A/V employees. There are now 22, with plans to fill four more positions in the next six months, Kempf says. “In 2021, A/V was 2% of ImageNet’s revenue,” he says. “We’ve worked our way up to between 8% and 10% of revenues over the past four years. Some years we have had 50% to 60% growth year over year.”

While some of ImageNet’s pro A/V projects — all of them custom designed — have been more than $1-million deals, they average between $60,000 to $90,000, Kempf says. “We don’t have any dedicated A/V salespeople,” he says. “If a general

In terms of the need for A/V, “in this current environment, there is not a single industry that is not using some sort of A/V solution,” Kempf says. “Everybody needs some form of video conferencing [a majority of ImageNet A/V projects involve this] or a way to communicate their message. We focus on such markets as energy/utilities, state and local government, federal government, higher and lower education, and manufacturing.”

Some of ImageNet’s smaller A/V projects ultimately generate the most revenue for the dealership, Kempf says, noting that a $500,000 “ultra-premium” conference room may only be used by a small number of people. However, a lowercost project in a community space, for example, may be seen by more people, leading them to “reach out to us to solve their problems or create similar spaces for them,” he says. “Such projects have led to millions of dollars in other business. It is for this reason that we pursue every opportunity, regardless of size, with the same aggressive mentality, since our industry is very much a ‘who-you-know’ world.”

AVIXA, the global governing body for the industry, projects commercial A/V to grow at around an 8.5% compound annual growth rate (CAGR); it’s currently a $104-billion industry in North America, Kempf says. “We are looking at $50 million to $70 million in the coming years for our A/V division,” he says. “The goal at ImageNet is for the [declining] print business [now at about 77% of total revenues] and all other offerings [including A/V] to both contribute 50% to revenues.”

A legacy copier dealership established in 1989, it was not until 2020 that RITE Technology, based in Sarasota, Florida, took steps to diversify its product and services portfolio beyond copy and print. That year, the Sharp dealership established its Integrations Division, encompassing both pro A/V and security. “At the time, we had roughly 23 to 24 employees,” says CEO David Polimeni. “Today, we are closer to 30 employees.”

While the head count provides an indication of the company’s growth through diversification, the more substantial

Do your customers suffer from brownouts or random power anomalies they can't control?

Do your customers suffer from brownouts or random power anomalies they can't control?

Protect your investments with ESP/SurgeX non-sacrificial power management equipment.

indication is the revenue contribution. “Surprisingly, 20% of our total revenue came from this new division in its first year; it’s rapidly growing,” Polimeni says. “For 2024, it was about 45% of our revenue. The company grew 65% year over year in 2024 and, since our copier business is flat, all of that growth was from pro A/V and security. It is reshaping who we are as an organization.”

“We

Looking at pro A/V in particular, Polimeni says he visited a dealer friend at his Charleston, South Carolina, dealership back in 2019. “I encountered what they were doing in the pro A/V space, and I became inspired,” he says. “What drew my attention was the fact that print decision makers are, by and large, the same decision makers influencing A/V decisions.”

Since moving forward with pro A/V, Polimeni has noticed

— Kyle Kempf ImageNet Consulting

an important distinction as compared to RITE’s imaging business. “We have strong growth plans on our copy and print side, and we believe that the segue into the ‘integrations’ aspect of what we are doing is the catalyst for the growth of our copy and print business,” he says. “However, in these last few years, we have garnered a significant amount of marketplace credibility that 30 years in the imaging business did not provide us. So, we see large-scale opportunities to expand RITE. It is possible that our Integrations Division, at some point, will dwarf our existing core business. That is not our goal; we endeavor to grow both sides of the business. But at this point, we’ve seen such demand on the A/V and security side that it does seem plausible that it could continue to scale faster.”

“In our marketplace, we have found a need for what we’re doing [with pro A/V] that is far greater than what we see on the print and copy side ... it also needs to be said ... pro A/V is far more complex ... “

— David Polimeni RITE Technology

Polimeni further emphasizes the distinction — along with a caveat — when comparing the imaging business to the A/V business. “In our marketplace, we have found a need for what we’re doing [with pro A/V] that is far greater than what we see on the print and copy side,” he says. “However, it also needs to be said — and this is not to minimize the complexity of the imaging industry — but pro A/V is far more complex and requires a level of knowledge that is not required in the imaging industry.”

RITE’s pro A/V field technicians, for example, must have a “depth of knowledge of electrical engineering,” Polimeni says. In fact, the industry’s complexities are reflected in the reality that “it’s a heavy certification line of business; it’s nonstop,” he says. “Before you can purchase some vendors’ products, you’re required to have a significant commitment to knowledge. I would say, don’t even consider pro A/V unless you’re interested in learning about this space, coaching and ultimately requiring your team members to become adapted to growth in a career-centric way.”

Polimeni notes that there is a “level of risk” involved in the necessary certifications. “This is a trade — a trade with portable certifications,” he says. “That is, you’re training employees to do things that they can take and do elsewhere. These are true, portable, lifetime-level certifications.”

C2C Resources has helped more than 40,000 businesses collect more than $500 million in past-due balances.

2002 C2C Resources has specialized in bad debt recovery using innovative technology and the most sophisticated collectors and investigators in the

Fortunately, there is plenty of support for dealerships seeking to optimize their levels of success with pro A/V and keep employees long term, Polimeni says. “The most meaningful support we’ve received has been through distribution partners like TD SYNNEX, Midwich and Exertis Almo, to name a few,” he says. “They have robust knowledge bases and employees within their organizations to support dealers. Our distribution partners have been an absolute staple in our success with pro A/V.” n Brent Hoskins, executive director of the Business Technology Association, is editor of Office Technology magazine. He can be reached at (816) 303-4040 or brent@bta.org.

by: Kate Kingston, Kingston Training Group

As those in the office technology industry gear up for the second half of 2025, effective pipeline management is crucial to driving consistent growth and hitting ambitious revenue targets. A robust pipeline ensures that your reps remain focused on qualified opportunities. Following are actionable strategies for sales managers to employ to keep pipelines full and their reps accountable for their workdays.

Embrace structured prospecting accountability daily. By 4:30 p.m. each day, the sales manager should send an email to his (or her) sales reps asking for the number of net-new meetings they scheduled and the number of processing touches they completed that day.

Salespeople should respond to the email at the end of each business day and reply in the subject line with how many touches and how many meetings they made that day. (e.g., “Kate Kingston — 28 touches, two meetings”). This will dramatically increase net-new meetings and enhance accountability with your team.

Calendar Review: Every Friday, have your sales reps send their next week’s calendar (fully populated) to their sales manager. Follow up promptly with those who fail to comply to maintain accountability.

Time management is key to maintaining a robust pipeline. Use the following schedule example to structure your sales reps’ weeks effectively:

Monday:

n 8 to 8:30 a.m.: Respond to emails, address customer issues

n 8:30 to 10 a.m.: Prospect via phone and email

n 10 to 10:30 a.m.: Prepare to leave for your day in the field

n 10:30 a.m. to 12:30 p.m.: Alternate between meetings and making three dials every time you get in the car

n 12:30 to 1 p.m.: Lunch and make three dials afterward

n 1:15 to 2 p.m.: Foot canvassing

n 2 to 4 p.m.: Alternate between meetings and making three dials during each car trip

n 4:30 to 5 p.m.: Address client issues back at the office

n 5 to 6 p.m.: Prospect via phone and email; prep for the next day

Each sales rep should end his day with an end-of-day checklist to ensure:

n Fifteen dials from the car

n At least 60 minutes of prospecting and paperwork

n Two client meetings

n Filing notes in the dealership CRM

From Tuesday through Friday, follow a similar structure tailored to specific activities like social selling, LinkedIn prospecting, foot canvassing and end-of-week planning.

Utilize the following Calendar Preparation Checklist as a guide to ensure your reps are calendarizing all their activities: Customer Care (for this week):

n Which customers do you need to reach out to this week to schedule partnership reviews?

n Which customers do you need to create a consultative touchpoint for (i.e., send an article, leave a voicemail or bring an innovative idea to their attention)?

n Which customers have partnership reviews you need to prepare for?

n Have you prepared for all upcoming installations?

n Which customers need training to be scheduled for their new technology?

n Which customers do you need to create or finalize proposals for?

Administrative Care:

Our motto in the office technology industry should be: “Salary for activity and commission for results.” In essence, reps are paid a salary for completing their administrative responsibilities, including the following:

n What notes do you have to finish putting into the CRM?

n What prep work do you need to finish for any internal

meetings (e.g., sales manager one-onones, company-wide sales meetings, etc.)?

Prospecting:

n Do you have to find and reach any additional prospects so you have 40 prospects researched and ready to go?

That research should include: understanding who the point people are at each company; knowing exactly how the companies make money; being knowledgeable about their specific compliances; being familiar with their document management needs and workflows so you can create customized communications for each one; knowing what innovations your dealership can bring to their industries through your solutions; and knowing if and how cybersecurity affects their industries.

At Kingston Training Group, we have found the best way to institute a successful phone blitz is to schedule it for two hours on Tuesday mornings and Thursday afternoons ...

n While reviewing your prospecting list, remember to take out any leads because of “nonresponse.”

n Have you scheduled prospecting into your daily calendar? Does that time slot need to be moved or adjusted because other responsibilities have popped up during the day?

n Do you have new leads in your car so you can make dials while the car is not moving?

n Have you identified “cold-calling-on-foot” opportunities that surround the meetings you have already scheduled for the week? Do you have the prospecting results from last week’s efforts ready to hand to management? Have you evaluated those results to review the prospecting process where you make the most meetings so you can adjust your process? Have you identified your “client success story” candidates for this month?

Social Selling:

n Have you looked at your LinkedIn profile and considered what you might add (e.g., an article, company brochure, white pages, referrals or testimonials)?

n Have you reviewed the people who have visited your profile this week so you can add them to your prospect list or confirm their interest?

n Have you posted on LinkedIn this week while tagging some of your prospects you have proposals for — or for their signatures — to create a value touch?

n Is there a LinkedIn group you can join to create additional opportunities?

n Can you find one LinkedIn connection you could help? Remember, it is always best to give first.

n Is there a new networking group you can join? Or, if you are in one, can you schedule a one-on-one with a member to learn more about his business and how you can help him?

You must establish mandatory team prospecting sessions.

At Kingston Training Group (KTG), we have found the best way to institute a successful phone blitz is to schedule it for two hours on Tuesday mornings and Thursday afternoons where each sales rep brings at least 40 prospects researched and ready to dial.

Each rep will call through his list and will not leave voicemails. If he has reached the end of that list of 40 before the two hours are up, he will start at the top of the list and call again.

The reps are allowed to stop the phone blitz as soon as they have scheduled two net-new meetings, which is why it is called “Two or Two.” This way, sales reps can buy out of having to sit for the whole two hours if they have scheduled two meetings, but they have been given the placeholder for that success by the sales manager, who has scheduled these once- or twice-weekly sessions to keep their pipelines full of new prospects. This also allows for training opportunities for the sales manager.

The sales manager should be “working the room” and stopping at each rep’s desk to listen to those calls during the blitz, ensuring the prospecting skill base is intact. This fosters accountability and momentum.

Reps must regularly refresh their prospect lists and present them to sales managers weekly. KTG recommends that the average territory tenured sales rep should have at least 40 prospective companies researched and ready to go. A new hire should have at least 70.

To maximize sales time, have your reps adopt the practice of making three calls every time they sit in their cars before driving. This microaction builds prospecting consistency and compounds over time. It can add 75 dials to a sales rep’s day; to and from work is 30. A sales manager can ask that the first call of the day (staggered through his sales team) is to him so that he can provide immediate feedback to reps on their pitches. Grade their calls and provide the right feedback to increase their results.

n Monitor and recalibrate underperformers.

n Implement a structured “six-week better prospecting results program” for reps who fall below 70% of their monthly quota.

This weekly, manager-led training hour should address gaps in prospecting, discovery and closing, with managers providing ongoing support. Have the reps live or on a Teams

We provide office equipment dealers with best-in-class technology to help your customers work more efficiently.

Automate processes for creating and distributing data-driven transactional and promotional documents across print, web, email, and mobile channels with our OL Connect technology.

Simplify paper-intensive processes with automated data capture, OCR, data extraction, routing, and fax transmission securely from one place. Add AI-enhanced cloud capture and data management for maximum impact.

Eliminate time-consuming paperwork with document management and automated workflow solutions. Teams are enabled to easily create, route, process, and retrieve content.

Scan to learn about Upland products and our Partner Program

Let's get to work. Contact us for more information about our solutions and becoming an Upland Partner. partnerprogram@uplandsoftware.com

call with the manager making real calls to real prospects. The team environment will foster a collaboration culture and, most importantly, additional prospecting success. Once a sales rep has exceeded his quota, he can opt out of the program (once his six weeks are up).

This should happen at a consistent time every week; for example, at 3 p.m. on Fridays so the reps are working with managers from 3 to 4 p.m. After 4 p.m., hold a sales team weekly debrief and update focusing on prospecting success. This leaves time for reps to ensure their calendars are fully filled out and handed in to managers.

... The pipeline is not just a list of opportunities, it is a reflection of future revenue potential. A full, healthy pipeline is the lifeblood of any ... sales organization.

n Include prospecting evaluations in team meetings, offering immediate, actionable feedback.

The Role of Metrics in Pipeline Realism

Regularly assess:

n Conversion rates: Analyze how many leads are progressing through the sales funnel.

n Resource utilization: Ensure reps have the tools they need, such as updated prospect lists or CRM training.

n Team-wide trends: Use monthly and quarterly contests to foster healthy competition and identify high performers to model best practices.

For Sales Reps: Keeping a Full Pipeline

Master prospecting sequencing — Utilize a three-week cycle to engage leads:

n Week One: Identify key contacts and research their business needs. Follow companies on LinkedIn, set up Google Alerts and share relevant articles.

n Week Two: Reengage prospects through LinkedIn and personalized email outreach. Prepare call scripts based on your research.

n Week Three: Begin direct outreach by calling prospects using a personalized script. Then follow up with emails and subsequent calls, and log interactions in the CRM for visibility and strategy refinement.

Leverage LinkedIn and social selling:

n Maximize LinkedIn’s power for prospecting by building a complete professional profile with business-appropriate visuals. Join relevant groups to gain messaging privileges and expand your network. Research target prospects to uncover common interests or connections for personalized engagement. And post value-driven content, tagging prospects to increase visibility and engagement.

Prepare effectively for prospecting — Use this preparation checklist to ensure success:

n Identify customer care priorities: Schedule partnership

reviews, send articles to customers or prepare for training.

n Handle administrative tasks: Update CRM notes and prepare for meetings.

n Ensure your prospect list includes researched companies with compliance needs, workflow insights and cybersecurity considerations.

n Incorporate foot canvassing and on-the-go dials into your schedule.

Establish structures for accountability :

n Daily check-ins: Require reps to submit daily reports detailing net-new meetings and touchpoints by 4:30 p.m.

n Weekly calendar reviews: Ensure reps submit fully populated calendars every Friday and follow up with those who do not comply.

Foster momentum with structured team activities:

n Schedule weekly team prospecting sessions and live call evaluations so you can provide immediate feedback and refine techniques.

n Lead by example during quarterly sales blitzes, rewarding top performers and sharing best practices.

Leverage recognition and analytics:

n Implement monthly recognition programs to celebrate top performers and motivate underperformers.

n Evaluate pipeline metrics regularly, focusing on conversion rates, resource utilization and alignment with team goals.

For sales management, the pipeline is not just a list of opportunities, it is a reflection of future revenue potential. A full, healthy pipeline is the lifeblood of any technology sales organization. By combining structured daily practices, team-led initiatives and robust management oversight, sales teams can maintain consistent momentum. In the second half of 2025, let pipeline management be the cornerstone of your strategy, driving both individual and organizational success. n

For more than 25 years, Kate Kingston has been exclusively educating office technology sales executives on every type of prospect across 60-plus industries and how they proprietarily use technology. She is a recognized authority on lead generation, recruiting new hires from a prospecting skill-base perspective and new business development. Sales-driven, Kingston is an energized communicator who uses humor, audience participation, proven techniques, handouts and real-time phone calls in her training sessions.

She can be reached at kkingston@kingstontraining.com. Visit www.kingstontraining.com.

▪ Stop losing your website viewers If you don’t have detailed product information on your site, viewers will leave to find it!

▪ Don’t link viewers to your manufacturer They will click "where to buy" and see other dealers!

▪ Products automatically updated all year long Color brochures, videos, request a quote

▪ Guaranteed Co-op Reimbursement

by: Travis Sheffield, UBEO Business Services

Whether you are the CEO of a 100-year-old, multigenerational dealership or a newer company that you started on your own 10 years ago (or somewhere in between the two), you have possibly thought of what the future might hold for you and your business. If circumstances in your life have changed since those early days, or you are cautious of the needed investments to modernize your solutions offerings, the thought of selling your business may cross your mind.

You might wonder about where to start. Every business owner who thinks about selling begins with a few questions. What is involved in selling a company? How would you determine a realistic selling price? What would happen to your employees? Would you want to remain with the business for a period of time, or are you set to take that long crosscountry trip you have been dreaming of? Would a prospective buyer even be interested in your business? How do you find a buyer? And are there any steps that you could take to make your company more appealing to a prospective buyer?

These are all good — and important — questions. Regardless of the size of your company, there are several factors you should consider as you give this some thought.

As a general starting point, there are buyers in this marketplace on the lookout for companies to acquire. I am with a company that has completed more than 20 acquisitions in the office technology space in the last few years and am glad to share a few thoughts on how you can begin to prepare for an eventual acquisition.

From an acquiring company owner’s point of view, your company would need to make sense for his (or her) company’s geographic footprint and market. If your facility is in Portland, Oregon, for example, and an owner seeking an acquisition operates his company mostly in the southeast, then your company may not be an appealing prospect unless it has the size and scale to support an entirely new region. However, it does not mean that there aren’t any other owners who might be interested.

One item that might matter to many acquiring owners is whether your company’s values and culture align with

theirs. An acquisition is a bit like a marriage; both sides are in it for the long run. While bringing a new company into the fold can be very exciting for both parties, the process goes more smoothly when there are like minds concerning vision, mission and values in general. And, just as a prospective purchaser will perform his due diligence on your company, you should also interview the possible buyer to make sure it is a good fit both ways.

With that said, below are a few specific suggestions on preparing yourself and your business for a sale.

First, give yourself some time to get used to the idea. The decision to sell a business can be emotional. Many owners consider their businesses “their babies,” having poured a lot of themselves into building their brands and products. Be certain that this is a direction you want to pursue.

Sales and acquisitions can sometimes turn around very quickly, but the seller who is methodical about the process may want to start preliminary planning up to five years before “signing on the dotted line.” Although, if you have prepared your company well, the acquisition process may only take four to five months.

Have a preliminary discussion about your plans with your

accountant and your attorney. Then consider how you want to go to market. Do you prefer to have direct conversations on your own with a potential acquirer or do you want to hire a broker to help you get organized and lead you through the process? Our industry has some great brokers and advisors with strong track records and specific industry knowledge. While an investment banker is also an option, a potential disadvantage here is that the banker may not know the industry as well as a specialized broker or advisor, who may be better able to offer a realistic opinion of the value of your business. Anecdotally, two-thirds of our acquisitions have been without brokers involved, but it is really a matter of what you might be most comfortable with.

Here are a few primary steps to consider:

Selling your business can be bittersweet, but with the right partner, it can be a rewarding experience for you, your employees and your legacy.

contracts, the better. Upgrade your contracts so that they are longer term and, ideally, without cancellation options. These stronger, solid, longer-term service contracts will increase the value of your business. If you have been somewhat lax in this area previously, now is the right time to upgrade. Doing so will yield success in the sales process.

(1) Changing the corporate structure of your business to an S corporation. Being either an S corporation or an LLC is generally more advantageous on both sides of the buying and selling process, allowing for a smoother transition when it comes to selling the assets of the business. If you are planning to sell your business down the road, make the changeover sooner rather than later. As always, discuss with your accountant, as this would require a five-year timeline.

(2) Examine your bookkeeping/accounting practices and your business operating system with a critical eye. A trusted advisor, such as your CPA, may prove invaluable here. Are your figures well organized and easy to follow? Are your accounting practices consistent, compliant and complete? Companies where the owner is busy running the day-to-day matters of the business may pay less attention to record-keeping, so it is best to examine this well before any potential sale discussions. A company may have an accurate income statement, but the balance sheets may not have shown depreciation of assets. Is the inventory managed correctly? Has any excessive obsolete inventory been dealt with both on paper and in terms of warehouse space?

Just as you do not like surprises in your business, neither will a potential buyer. A clean and efficient operating system will make it easy for a suitor to “understand the weeds” of your business with minimal distraction to you as an operator. If there are inconsistencies, it is better to iron them out early.

(3) Review — and wherever possible — upgrade your practices when it comes to service contracts. Are your contracts month to month with a 30-day cancellation option? Do you have service contracts for all your customers, or are some of these arrangements done “on a handshake”? From an acquirer’s point of view, the stronger the service

(4) Determine a realistic value of the business. A broker can help, as could other valuation professionals. Having knowledge of the actual potential worth of the business will put you in a stronger position when you go to market. There is that old saying that a business is worth what a buyer is willing to pay and a seller is willing to sell it for, but there are more accurate means available to determine value. Several factors help this determination, including profitability, the amount of recurring revenue, inventory, debt and real estate expenses, among others.

(5) Do some research on the companies in the market that are acquiring businesses. What do these companies look like? What is their reputation? How do they operate? Do they align with your values and with what you have built?

(6) Consider what the landscape will be like after any sale. What do you want the legacy of your business to be? Do you have employees you would like to see remain with the new company? Do you envision a transitioning role in the company for yourself? It is best to resolve these issues early in the discussions. Having valued employees in your organization — people with strong ties to your customer base or key in the operations of the business — can add to the appeal of your business.

(7) Confidentiality is key. Keep the news that you are considering selling your business to a small inner circle — your financial advisor, your accountant and few others. When you have reached the point of a signed purchase and sale, you can begin to roll out the news to the appropriate parties.

With all of the pieces in place, a sale can happen fairly quickly and smoothly. And that is especially true if you, as a seller, have your business systems operating smoothly and efficiently, and you have “done your homework” in preparation. Selling your business can be bittersweet, but with the right partner, it can be a rewarding experience for you, your employees and your legacy. n

Travis Sheffield is vice president of acquisitions at BTA member UBEO Business Services, one of the fastest-growing office technology companies in the country.

He can be reached at tsheffield@ubeo.com.

Visit https://ubeo.com.

by: Brent Hoskins, Office Technology Magazine

Increasingly, office technology dealerships are turning to the DXone ERP as a replacement for their legacy billing and field service systems. To date, around 10 BTA Channel dealerships have fully made the transition; another 30 to 40 dealerships are in the process.

Recently, Office Technology magazine interviewed DXone CEO Alex Cribby and Executive Vice President of Business Development Gavin Williams. Below are several of the questions asked and their responses.

OT: What was the genesis of DXone and how has it progressed since then?

Cribby: It has been about four years in the making, just from a development perspective. We weren’t going to build it from scratch. We wanted to partner with an enterprise ERP company that was born in this century and that was in the cloud. We were fortunate enough to get introduced to Acumatica. That’s where it all started — the platform on which we were going to build DXone.

In addition, we didn’t want to pay the “dummy tax,” making the mistakes of the past. Combined, Gavin and I have 60 years of channel experience. I would say that the first few steps we took were strategic, including going out and understanding the pain points, the needs of the industry. We also looked at what a modern ERP looks like today and what an ERP for this industry should look like in five years, 10 years or 20 years. So, it was partnering with Acumatica, building an executive team of people who came from the industry, understanding the channel and understanding the pain points of legacy systems that exist in the channel today.

The guiding question: How can we put the dealer first in every development and operational decision that we make? If the dealer comes first in all of our decision making — whether it’s development or operations or integrations or

partnerships — if we put the dealer community and the channel first, then we will succeed.

So, again, it started by partnering with Acumatica and several years of development and customizing on top of the Acumatica platform. Out of the box, from a functionality perspective, Acumatica delivers 80% of what the channel needs from the core modules of enterprise accounting, financials, inventory management, warehouse management, field service, contract management, dispatch support, etc. We just needed to go in and build on top of that to customize it specifically for this industry and focus on contract billing, inventory management and field service. So, first it was a journey of development. Now it’s execution time.

OT: What can you share about DXone in terms of the structure of the company, the size of the team, how it’s growing, etc.?

Cribby: From an executive team standpoint, I started by bringing on Gavin, plus two or three others who have significant channel and ERP experience. We’re currently in hypergrowth mode as far as the infrastructure from a resource perspective, primarily with the implementation team. We’ve added three implementation people in the last quarter. We’re bringing in three more this quarter. So, we’re scaling as we grow.

We recently added our new chief product and technology officer, who we brought in directly from Acumatica, to help lead from a development perspective, which was a huge pickup for us. He happens to have some industry experience, too, which was a reason why we targeted him. There are currently 15 people on the team; by the end of Q2, that will probably increase by about seven people.

From an investment standpoint, it’s kind of a mix. We’ve got a few VCs [venture capitalists] involved. Plus, Acumatica made a very large investment and joined our cap table at the first of the year. They [Acumatica’s leaders] believe in the opportunity and the mission of DXone. They also really support the channel. They show that every single day from a partnership standpoint and from an investment standpoint. I mean, they’re making heavy investments in DXone and the office

technology channel, making sure they’re showing that they stand behind DXone from a product perspective and stand behind the industry to make sure that the company brings a modern ERP to market that’s going to fit the channel’s needs.

OT: Will the DXone ERP do everything that e-automate does?

So far, every dealership we’ve converted to DXone has seen cost savings ... We have a very different pricing model that is advantageous for our industry.

Williams: That’s kind of a loaded question, right? Because “everything” is a big word. But, in essence, since you used the word, it does. The critical functionality for the industry is being able to accurately build a contract, manage a contract, the field service and things like that. That’s all the core functionality that we have customized by way of Acumatica for this industry.

The big difference between the environment of today and where dealers can go with DXone is they’re not forced to run their businesses just like every other dealership. With our product, dealers have the flexibility to have their own business processes and manage their processes the way they want to manage them, but with all the core functionalities taken care of by us that relate to the intricacies of our industry.

OT: What can you share about the time and cost associated with the conversion to DXone from another ERP?

Williams: We’re not going to sugarcoat it; for any business converting any major backend system, it’s not a fun experience. I mean, it has some pain in it. However, we have really focused on easing that pain for the dealer, and Acumatica itself provides tremendous functionality in that it has AI built into the data conversion process. What that means is it’s not replacing a lot of that functionality, but it’s using AI to analyze the data that’s coming in and taking away the human element of having to look at every bit of information that’s being put in, and making sure that it’s accurate and correct. It can easily identify everything it knows is correct and provides alerts of “here’s data that needs to be validated or should be looked at.” So, that component is a tremendous time saver when it comes to conversion.

The conversion time is a bit subjective, based on dealership size, right? The larger the dealership is, the longer it’s going to take because of the amount of data. We’ve also seen that larger dealerships have a lot more specific business processes. Those kinds of things take a little longer because they need to be integrated, making sure the business processes work correctly. So, the conversion time can be as quick as 30 days or as long as six months.

As far as a cost, we do a flat-rate engagement, so there are no hidden fees. We figure that all out ahead of time. Again,

going back to the fact that there are a finite number of systems in the industry, we always know what we’re in for when we’re beginning an implementation. The only thing that can change that is if the dealer wants to go above and beyond with additional customization.

OT: What can you share about the cost of DXone ERP?

Williams: We are very up front about our pricing. So far, every dealership we’ve converted to DXone has seen cost savings. That’s a pretty good indicator of the pricing there. We have a very different pricing model that is advantageous for our industry. We have an industry with a lot of overhead to manage in the back office. Our product was designed for that kind of environment. DXone allows for unlimited users and pricing is based on what volume the dealer is actually doing. Plus, depending on what other things the dealers are doing and what other systems they may have, some go away; they don’t need them because they’re built into the platform. One of the big things with DXone is that there are no up-front fees with our system. Yes, there is an implementation fee, but because of its model and being a SaaS-based platform, there are no up-front license fees.

OT: Does DXone incorporate managed IT into its ERP?

Williams: For dealers, this has been an issue in the industry since we started migrating to managed services. For dealerships that have more specific needs and want to do things themselves, there is built-in functionality within DXone for managed IT services, but for the majority of dealerships, we’re working with ConnectWise. The point of the integration between ConnectWise and DXone is consolidated billing and having proper financials. Ultimately, our vision is to have a single view of sales, service, financials and inventory for managed services, traditional imaging, office supplies, furniture and e-commerce.

OT: Does DXone have a mobile app for field service techs?

Williams: Field service is one of Acumatica’s big industries. That was a big check box for us when we were assessing ERPs. So, yes, there is a mobile app for field service, with built-in GPS tracking — and it’s not just for field service. It’s for the entire business. So, if someone is sitting on the beach and needs to access a purchase order, he (or she) can do that from his phone. n Brent Hoskins, executive director of the Business Technology Association, is editor of Office Technology magazine. He can be reached at brent@bta.org or (816) 303-4040.

Compiled by: Elizabeth Marvel, Office Technology Magazine

Following are two questions submitted by dealer members as part of BTA’s Dealers Helping Dealers resource and many of the answers received. These answers and others can be found in the members-only section of the BTA website. Visit www.bta. org/DealersHelpingDealers. You will need your username and password to access this member resource.

How are you using artificial intelligence (AI) in your dealership? Do you have an AI policy in place?

“We have AI integrated into several daily aspects of fulfillment. We have selected and provided AI [software] to the employee it would benefit the most.”

Shaun Easter, service operations manager Seminole Office Solutions, Longwood, Florida

“Only in CEO Juice.”

Jeffrey Taylor, president Kingsport Imaging Systems Inc., Kingsport, Tennessee

“We are looking into Formed AI for A/P processing. We use ChatGPT for various things, such as social media posts, marketing, emails and letter writing.”

Lynn Pickford, president Precision Copy Products Inc., Clairton, Pennsylvania

“We use Microsoft’s embedded AI. Some use ChatGPT. We have a policy in our handbook regarding safety and confidentiality.”

Christina Morgan, president TDS IT, Lowell, Arkansas

“All employees use Grok. All employees are going through AI training with Google. Numerous employees have earned certifications with AI automation providers.”

Jeffrey Foley, COO Apollo Office Systems, Alvin, Texas

“We use AI for administrative purposes (e.g., writing policies and procedures) and marketing. We use it in sales for writing and research. Yes, we have a policy.”

Stephen Valenta, president Offix, Gainesville, Virginia

“We just started using AI. We don’t have a policy yet.”

Chip Miceli, CEO Pulse Technology, Schaumburg, Illinois

Are any BTA members using a professional employer organization (PEO) for their dealership’s health insurance? I’d like to get their feedback on the experience.

“Yes, ADP TotalSource. Group benefits are included and onboarding is seamless. Costs are consistent with the open market.”

Edith DeCourcy, CFO Seminole Office Solutions Inc., Longwood, Florida

“We have been using Insperity as our PEO for the last three years. We were right at the point then when we exceeded 50 employees and the person who mostly handled HR internally started to get overwhelmed. Working with a PEO allowed us to offer Fortune 1000 benefits we could not have offered on our own. It has been a great retention and recruiting tool.”

Thomas Fimian, CEO Levifi, Charleston, South Carolina

“We have used Insperity, TriNet and now Questco. We historically had better health rates using them, but now I think we are large enough where we don’t need a PEO for lower health rates. They are still useful for HR help. I can direct employees to call the PEO instead of me having to spend time contacting our vendors on their behalf.”

Christina Morgan, president TDS IT, Lowell, Arkansas

“I recommend Questco PEO. We have used a PEO for 11 years and Questco for the last five years.”

Jeffrey Foley, COO Apollo Office Systems, Alvin, Texas

“No, we have a broker.”

Kim Valenta, vice president Offix, Gainesville, Virginia n Elizabeth Marvel is associate editor of Office Technology magazine. She can be reached at (816) 303-4060 or elizabeth@bta.org.

by: Greg Goldberg, BTA General Counsel

Each month, the BTA Legal Hotline receives dozens of inquiries from members across the country seeking information and advice on a broad range of subjects. One day, a member from California will email about an urgent employment matter. The next, a member from Florida will request feedback on an OEM agreement. When multiple members reach out about the same legal issue, it is almost always a good topic for a column. Chances are it means there are many other members with similar questions. This month, Legal Perspective takes a deep dive into a topic that has come up in many recent dealer inquiries: the nondisclosure agreement (NDA).

An NDA is a contract that places restrictions on the use of confidential information. NDAs are extremely common. Two companies considering entering into a transaction, like a merger or acquisition, may execute NDAs to prevent information about the deal — or even the fact that a transaction is being considered — from reaching the public domain. NDAs help safeguard proprietary information, such as trade secrets, algorithms and computer code. Famously, Coca-Cola Co. uses NDAs to protect the recipe for its signature soft drink because seeking a patent would require public disclosure of the 133-year-old formula. Organizations that rely heavily on sales utilize NDAs to protect customer lists and customer leads. Very often, NDAs are a component of legal settlements, particularly with respect to financial terms.

An NDA is effective when it satisfies two fundamental criteria. First, an NDA must prohibit the use of confidential information to obtain a competitive advantage. Second, an NDA must forbid the disclosure of confidential information to unauthorized parties. It is relatively easy to understand why. Suppose, for example, an employee at Apple Inc. becomes aware of the engineering specifications for a new iPhone that will not be released for several more months. Absent an NDA, the employee could share those specifications with manufacturers of smartphone cases or other peripherals so they could be first to market with new products ahead of the competition. Whether an NDA is enforceable depends on careful drafting and precise language. Most importantly, an NDA must clearly define what information is considered confidential. Vague terms like “trade secrets” or “proprietary information” are more difficult for courts to interpret than straightforward terms like “internal financial data” or “sales strategies.” The duration of an NDA should be tailored to the confidential information that is being protected. Terms lasting between two and 10 years are

the most common, although in some cases it may be reasonable for an NDA to continue in perpetuity. An NDA should be fundamentally fair — in other words, it should set forth obligations for all parties involved, not just one. Finally, an NDA must comply with the law. If an NDA states it is governed by New York law, then a New York attorney familiar with those laws should confirm the NDA complies with those standards.

The breach of an NDA can be highly damaging. The fact is, once confidential information becomes public, it is impossible to recover. If one party to an NDA suspects another party is in violation, there are several enforcement options. First, the enforcing party should send a formal written notice (i.e., a demand letter) to the violating party. The letter should identify the breach and specify the steps necessary to reestablish compliance.

If a formal notice from the enforcing party to the violating party is ineffective or an injury to the enforcing party is too severe, a lawsuit may be necessary. In litigation, the enforcing party may seek monetary damages to compensate for a loss or injunctive relief preventing further violations. Although parties may be tempted to include penalty clauses in NDAs to discourage violations, courts will likely decline to enforce those provisions if the penalty amounts are purely punitive.

If you have questions about NDAs, take advantage of the BTA Legal Hotline or the members-only templates available at www.bta.org/LegalDocuments. n

Greg Goldberg, partner at Barta | Goldberg, is general counsel for the Business Technology Association. He can be reached at ggoldberg@bartagoldberg.com or (847) 922-0945.

BTA would like to welcome the following new members to the association:

Business Complete Solutions, Poway, CA

Southwest Office Solutions Inc., Los Alamos, NM

Vendor Members

HID Global, Austin, TX

For full contact information of these new members, visit www.bta.org.

Learn how the powerful combination of Profit Maximizer, InfoMax Collection System and Legal Forwarding Edge can help your company be more effective with your in-house collecting and maximize recovery of accounts turned over for collection.

Explore how communication options provided by C2C Resources keep you up to date as it makes progress on your accounts, as well as how its weekly remittance program gets you money quickly once it does collect. Most importantly, learn how licensing helps protect your business during the recovery process. C2C Resources is an excellent choice for a collection partnership and BTA members receive a discounted rate.

For more information, visit www.bta.org/CollectionServices.

For information on BTA member benefits, visit www.bta.org/MemberBenefits.

For the benefit of its dealer members, each month BTA features two of its vendor members.

ELATEC is a leading global provider of solutions related to short-range wireless readers/writers. As a reliable partner, it offers the best products, processes and services for your business.

ELATEC’s TWN4 Series of RFID card and smartphone readers are the most advanced available today for secure printing. Their flexible architecture and open API enables customization for application needs, security requirements and updating as market conditions evolve. Do not settle for less — provide “future-proof” user authentication and access control for your customers.

www.elatec-rfid.com

Peak Performance Partners LLC doesn’t just offer training; it unlocks the full spectrum of your business development capabilities by using the robust backbone of the Sandler Selling System, a methodology that has been behind numerous success stories for more than 50 years. This system provides you with the tools to boost revenue, enhance confidence, propel business growth and refine professional skills. The system, based on mutual respect and clear decisions, is a seven-step approach that puts the salesperson in control of the discovery process.

https://go.sandler.com/performance A full list of BTA vendor members can be found online at www.bta.org.

by: Troy Harrison, Troy Harrison & Associates

Recently, a sales manager asked me an interesting question: “What do I do when my top producer simply refuses to follow our new prospecting process?” It is a common problem and it brings us to what I call the “Or What?” question. You see, whenever you tell salespeople to change their behavior, they are thinking (even if they do not say it out loud) “Or what? What are you going to do about it if I don’t?”

Here is the thing: There are four distinct levels of control available to sales managers and they should be used in a specific order. Let me explain.

n Level One — Authority and Respect: This is where you should start, and it is more powerful than most managers realize. When you have earned your team’s respect through your expertise and leadership, many behavioral changes can happen through simple influence. “Based on my experience, this new approach will improve your results” can be surprisingly effective when it comes from a leader the team trusts. In other words, at this level, you are selling behavioral change to your people. They do it because you want them to do it.

But here is the catch — you need a clear answer to the “Or what?” question, even at this level. You do not have to use it proactively, but you have to have it ready to use if you are challenged. The consequence here is primarily the loss of your good opinion and support. Do not underestimate this. In sales, your future opportunities often depend on your manager’s recommendations and backing. I once worked with a sales organization where the top performer had amazing numbers but could not get promoted because his past managers would not endorse him. His disregard for their guidance had cost him tens of thousands in potential earnings and a different career path that he very much wanted.

n Level Two — Activity Management: Let’s say you have a salesperson who is not buying in through respect alone. The next step is implementing specific activity metrics. For instance, if you need more focus on new accounts, you might require tracking of daily prospecting calls. Or, if you are trying to emphasize the investigation phase of the buyer’s journey, you might track discovery meetings that include technical resources.

The beauty of activity management is that it creates accountability without feeling punitive. The “Or what?” here is straightforward: fail to hit the metrics and you will find yourself in daily coaching sessions, reviewing call logs and having documented performance discussions. I recently saw a manager turn a struggling rep around by implementing simple

tracking of the number of C-level conversations per week. Within two months, not only were the activities up, but the rep’s pipeline had doubled.

n Level Three — Compensation Adjustments: This is where things get serious, and I have seen too many managers jump straight to this level — usually with poor results. Changing compensation should be your third option, not your first. You might adjust territory assignments, modify commission structures or implement specific bonuses for desired behaviors.

The “Or what?” is obvious here: do not adapt, earn less money. But be careful. I once saw a company adjust its compensation plan to drive new account acquisition, only to watch its account retention plummet as its best relationship managers chased new business instead of maintaining existing accounts. They had to do a midyear compensation adjustment to fix the problem, which created even more chaos. One of the worst things you can do with salespeople is constantly mess with their money; therefore, any compensation change should be something you are willing to commit to for a few years, not a few weeks or months.

Another company I worked with tried to use compensation to force adoption of its new CRM system, cutting commission rates for deals not properly documented in the system. The company’s top performers started looking for new jobs and their mid-tier performers began entering fake data just to check the boxes. As I have noted before, CRM adoption can be made relatively easy and painless through effective management and training. Remember, compensation changes are like surgery — necessary sometimes, but not your first treatment option.

n Level Four — Direct Mandate: This is your nuclear option. “This is no longer optional. This is how we’re doing it.” Simple, direct and usually a sign that you have bigger problems than just the behavior you are trying to change.

The “Or what?” here is crystal clear: comply or face progressive discipline, up to and including termination. If you are at this point, you are probably dealing with either a critical compliance issue or a complete breakdown in the manager/employee relationship.

I recently consulted with a company that had to take this approach with its entire sales team regarding a new pricing structure. The results were not pretty — the company lost three reps and had to spend six months rebuilding its pipeline.

Here is the key point: Many sales managers start at level three or four, jumping straight to compensation changes or mandates. This is a mistake. Start with influence through earned respect. If needed, move to activity management. Use compensation changes sparingly and strategically. Save direct mandates for true emergencies or when all else has failed.

Remember, at each level, you must have a clear answer to the “Or what?” question before you start. Your salespeople will test you — maybe not explicitly, but they will probe to see if you are serious about the change you are requesting. Having

your progression of consequences clearly thought out in advance is not just good management — it is survival.

One final thought: The best sales managers rarely need to go past level two. If you find yourself frequently resorting to compensation changes or mandates, it might be time to look at your hiring process or your own leadership style, because in sales management — like in sales itself — the best solutions usually do not require force. I worked with one sales manager who had not needed to make a single compensation adjustment in five years. His secret? He hired well, led by example and had built such strong relationships with his team that his influence alone was usually enough to drive change. That is not just good management — that is sales leadership at its finest. n

Troy Harrison is the author of “Sell Like You Mean It” and “The Pocket Sales Manager.” He helps companies navigate the elements of sales on their journeys to success. To schedule a free 45-minute Sales Strategy Review, call (913) 645-3603 or email troy@troyharrison.com. Visit www.troyharrison.com.