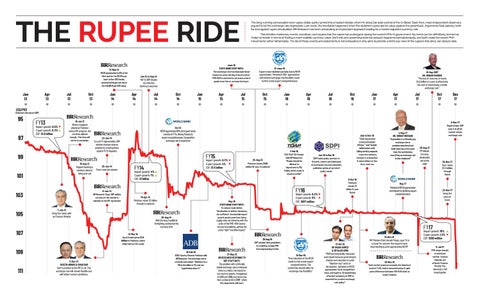

The long-running conversation over rupee-dollar parity turned into a heated debate when Mr. Ishaq Dar took control of the Q-Block. Back then, most independent observers argued to let the exchange rate depreciate. Last week, the inevitable happened when the stubborn rupee lost its value against the greenback. Arguments float aplenty, both for and against rupee devaluation. BR Research has been advocating an improvised approach leading to a market-adjusted currency rate. This timeline marks key events, narratives, and causes that the rupee has undergone during the current PML-N government. No event can be definitively termed as ‘make-or-break’ in terms of finding a more realistic currency value. Dar’s exit and worsening external account happened simultaneously, and both make the recent PKR movements rather fathomable. The list of these events and statements is not exhaustive; it only aims to provide a bird’s eye view of the rupee’s ride since Jan 2013 to date.

BRResearch 12-May-14 REER appreciates by 8% in the third quarter. For REER to go back to Dec-2013 levels, nominal exchange rate has to be at Rs105.8 per USD today.

Jan 13

Apr 13

Jul 13

Oct 13

Jan 14

June-15 STATE BANK STAFF NOTE: The exchange rate has disproportional impact on price-setting in local market. PKR-USD is watched to set prices even if goods have few or no imported input.

Jun-14 to Aug-14 MoF & SBP closely scrutinizing banking treasuries

Apr 14

Jul 14

Oct 14

Jan 15

Apr 15

Jul 15

12-June-15 Exports have declined partially due to REER appreciation. Persistent USD appreciation with limited exchange rate flexibility could further erode export competitiveness

Oct 15

Jan 16

18-Sep-2017 DR. WAQAR MASOOD "The loss of reserves of nearly $4.6 billion in a year is effectively the cost of maintaining a stable exchange rate."

Apr 16

Jul 16

Oct 16

Jan 17

Apr 17

Jul 17

Oct 17

Dec 17

USD/PKR

(Interbank rate; source: SBP)

95 97 99

FY13 Import growth: 0.5% Export growth: 0.3% CSF: $1.8 billion

BRResearch 10-Jul-13 History suggests whenever Pakistan enters IMF program, the currency adjusts sharply. This time will not be an exception.

Oct-14 REER appreciated 10% during last seven months of FY14, hitting Pakistan's export competitiveness. Competitive exchange rate is imperative

BRResearch 22-Jan-14 To curb FX depreciation, SBP window dresses reserve position by creating loans against FE25 deposits.

FY15 Import growth: 0.7%

BRResearch 19-Sep-13 Rupee’s beating is nowhere close to being over yet

101

20-Jan-14 Forex reserves weaken

Export growth: 4% CSF: $1.5 billion

FY14 Import growth: 4%

25-Sep-15 Pakistan issues $500 million 10-year Eurobonds

Export growth: 1% CSF: $1 billion

BRResearch 8-Jan-14 BR Research flags: SBP selling currency in the market in violation of the IMF agreement

103 105 107

111

BRResearch 25-Aug-14 With Dar busy in political firefighting, bankers let the currency drift

5-Dec-13 YASEEN ANWAR & ISHAQ DAR Govt's promise to the IMF in LoI: The exchange rate will remain flexible and will reflect market conditions.

6-Oct-16 Pakistan issues $1 billion 5-year Sukuk

BRResearch 27-May-15 BR RESEARCH RESPONDS TO SBP STAFF NOTE: The problem with artificially stable exchange rate is whenever there is a shock, the impact is too much to absorb. It happened in 1998 and 2008, and some may fear a crisis to hit in 2018 – when the repayments will start.

May-17 Pakistan’s REER appreciation contributed to declining export competitiveness

28-Aug-17 PM Abbasi: Currency devaluation not on the table

29-Nov-17 Govt raises $2.5 billion through Sukuk

22-Nov-17 Ishaq Dar goes on leave

FY17 Import growth: 18%

BRResearch 16-Feb-15 ADB’s Country Director Pakistan tells BR Research: The exchange rate is currently overvalued. Whether it is a 110 to the dollar or 115, one can hypothesise about it."

2-May-17 DR. ISHRAT HUSSAIN "Impossible to artificially peg exchange rate at predetermined level and build reserves at the same time. But just blaming everything on exchange rate is also misplaced"

Export growth: 9% CSF: $937 million

May-15 STATE BANK STAFF NOTE: To reduce trade deficit, "devaluation is neither necessary, nor sufficient. Sustainable export growth would come from fixing supply side, not tinkering with the price of the PKR. With severe structural problems, getting the price “right” has little impact"

13-Mar-14 Saudi Arabia gives $1.5 billion to Pakistan, which helps bail out the rupee

109

Jun-16 to Dec 16 SDPI holds policy seminar in Karachi, Lahore and Islamabad on exchange rate overvaluation; publishes series of op-eds & policy notes.

FY16 Import growth: 0.2%

10-Apr-14 Pakistan raises $2 billion through Eurobonds

7-Jun-13 Ishaq Dar takes oath as Finance Minister

1-Feb-16 CEO TDAP SM Muneer tells BR Research: “Rupee should be allowed to depreciate to 110, failing which exports would crumble”

July to Dec-16 * Debt repayments exceed scheduled inflows; * post-budget dollarisation amid falling banking deposits * exporters delaying receipts in anticipation & specualtions on low forex reserves

8-Dec-17 Rupee drops; SBP says it is all for market-driven exchange rate

25-Aug-15 SBP ‘advises’ bank presidents in a meeting, to keep PKR from depreciating further 10-Mar-16 "Overvaluation of the REER could further erode export competitiveness. The authorities should allow for exchange rate flexibility"

21-Oct-16 DR VAQAR AHMED & DR SAJID AMIN “PKR has historically remained overvalued because governments choose overvaluation to avoid “election-day” costs of devaluation. Episodes of REER appreciation hurts competitiveness, and exports. Strengthening effective autonomy of SBP is essential for prudent exchange rate policy”.

10-Nov-16 IMF Mission Chief, Harald Finger, says “It is a cause for concern that exports have been declining amid appreciating REER”

BRResearch 29-Nov-16 Kerb market premium exceeds the historical band of 1.5%; India’s demonetization & gold price difference between KHI-DXB cited as major reasons

Export growth: 1.3% CSF: $550 million 5-Jul-17 PKR drops sharply in interbank market. Various theories are offered; Finance Minister Dar demands a full investigation