2 minute read

Raw material crisis

Higher raw material prices, energy and freight costs hitting manufacturers hard

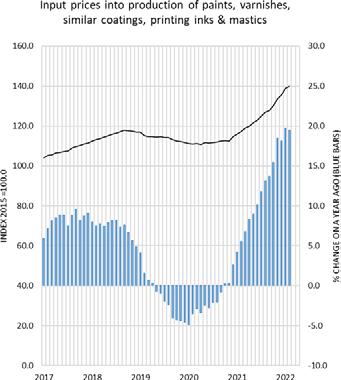

A new raft of higher raw material prices has again hit the decorative paints, industrial coatings, printing inks and wallcoverings industries in recent months with increased energy and freight costs adding further to manufacturers’ problems on top of growing concerns caused by the war in Ukraine and new uncertainties about the direction of the world economy.

Advertisement

According to the ONS, raw material prices in the sector are now up 20% compared with a year ago, easily outstripping the 15% increase for UK manufacturing as a whole, while many critical raw materials are up by more than three times this level or more.

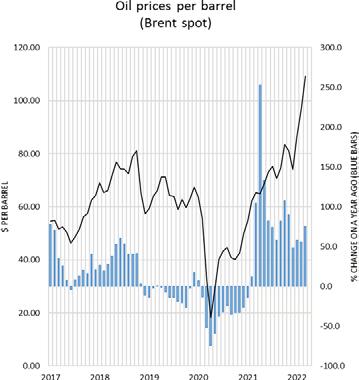

As of Q1 2022, Brent spot prices were up 75% on a year ago with materials such as n-butanol and xylene, for example, showing similar increases. Elsewhere, higher prices were seen for resins and related materials with epoxy resin prices up 110% in the last year and Nitrocellulose prices 40% higher.

For pigments, prices increased in most areas with titanium dioxide 22% higher in January at a new high of £2,836 per tonne. Packaging prices were also sharply higher in recent months with, for example, 2.5 litre round tins seeing an increase of 44% and with plastic containers up by a similar amount. consumer confidence this will further dampen demand in general over the next year. Tighter household and business budgets are also expected to see priority concentrated on essential areas of expenditure.

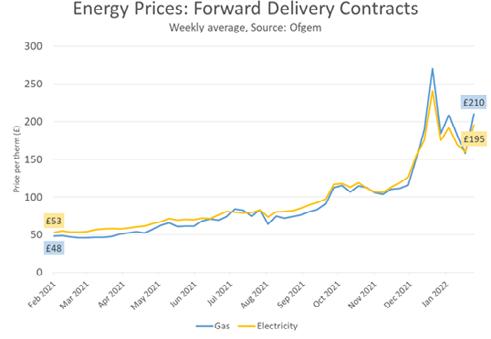

Much higher energy costs are also having a major impact with gas and electricity prices up by eyewatering amounts. According to the governor of the Bank of England, consumers are now facing an even bigger shock from energy prices this year than during the 1970s oil crisis.

Figures from Ofgem show gas prices per therm at £210 in January this year up from just $48 at the start of 2021 and with similar increases being seen for electricity prices. Member companies are also reporting plenty of cases where suppliers have applied energy surcharges.

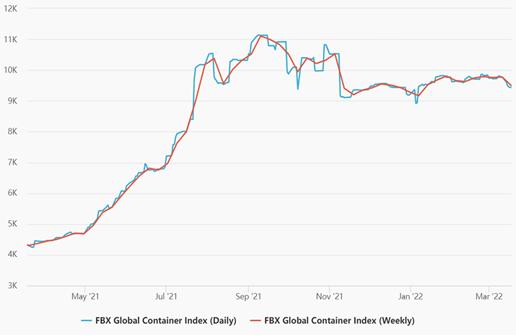

Adding to companies’ problems are supply issues relating to the availability of many raw materials with this continuing to be a major concern for all firms. This has been the case since the easing of Covid-19 restrictions earlier last year but now with these added issues and sharply higher freight costs adding further to manufacturers’ worries. Freight costs have more than doubled since this time last year.

Further complicating the current position is the situation in Ukraine which is now disrupting global markets in multiple areas. For example, with Russia and Ukraine being major sunflower oil growers the war is now having a knock on effect in alkyd resins. In addition, many minerals come from Russia, some of which cannot easily be substituted while export routes by land through Russia are also being disrupted.

In China, a new wave of Covid-19 lockdowns is reducing feedstocks available for the European market.

It all means a perfect storm with higher raw material prices, sharply rising energy costs, much higher freight costs and a huge amount of uncertainty caused by the worsening situation in Ukraine.

Global Container Freight Rate Index