LUXURY OUTLOOK

The uxury rea estate market in North Texas, encompass ng areas such as Dallas, Fort Worth, South ake and Fr sco, continues to thrive as one of the most dynamic and resi ent segments in the region and the nat on The h gh-end market remains anchored by strong demand, limited nventory n desirable ne ghborhoods and the ongo ng m gration o buyers seeking space, design exce ence and ifestyle-driven amen ties

Prices n the uxury segment here rose 3.5 percen year-over-year, outperform ng broader market sectors. Trophy properties are drawing interest,though average days on market have increased to 57 as inventory ba ances

Our suburban hubs such as South ake and Fr sco remain n high demand due to the qua ty of life and their prox m ty to execut ve employment centers In May 2025, Southlake?s median uxury home price was about $2 2 mi ion, whi e Fr sco?s stood at about $145 m lion, suppor ed by corporate anchors such as The Star and the Legacy business park

The luxury market is favoring se lers, but buyers are enjoying more cho ce and negot at ng room Cl ents are pr oritizing smart-home tech,wel ness and susta nab li y Success n this evo v ng market h nges on s rategic pr c ng,premium presentation and a sharp focus on arch ectura qua ity and l festyle value

Our expert adv sors are ready to ta k to you about any ? or al ? of that, anytime

Rocking M Ranch n St ephenvil e / Stone Creek Ranch in Gat esv e / Cedar H ll Farm in Cedar Hill / 4436 N Versa les Avenue n H gh and Park / 13 Cliff Trai in Fr sco / 3320 Co gate Avenue n Un versit y Park / 5910 Lupton Dr ve in Dal as / 4401Arcady Avenue n H gh and Park / 4229 Cochran Chapel Road n Dal as / 1805 M llstream Court n West lake / 3737 Aviemore Drive n Fort Wort h / 5108 Kn ghts Court n Flower Mound / 16 Cardona Drive in Wes ake

25%

Theestimated population explosion acrossDallasand Fort Worth (from 8 million now to 10 million)in the 2030s,which will make North TexastheNo.3 metro in theentireUnited States

Trend ng t owns and ne ghborhoods: Highland Park University Park, Westover Hil s, Preston Ho low, Bluffview, South ake, P ano Fr sco, Westlake/ Vaquero, Lakewood, Rivercrest

The market t his m nu e:

Beg nn ng in ate?2023 through May? 2025, North Texas uxury rea estate has entered a phase o hea thy maturation

Sellers w th standout, h gh-end propert es still command strong pricing Meanwhile, buyers benef t from deeper inventory, onger market windows and the ability to negotiate In this landscape, both parties can find success ? provided they a gn their strategies w th recent price trends, ne ghborhood va ue drivers and emerging lifes yle preferences.

ent s

6 An Eye on t he Market

Luxury property outperformed n ear y 2025 and may provide opportunit es for savvy buyers

17 Financ ng Opt ons

Many wealthy homebuyers prefer to pay cash for propert es; however, extra-low n erest rates for high-networth indiv dua s may prove appea ng

24 St eady Course

Wh le ar ff tensions and stock market

fluctua ions could temporarily s ow down sa es, real estate o fers luxury buyers a tang b e, secure asset

26 Recovery E fort s

The need-to-know facts on how market shifts and ncreasing natural d sas ers affec both homebuyers and se ers

36 Bespoke Insurance Trad tiona polic es may not pro ect your property in full? here?s what to watch out for

38 Luxury Rena ssance

The latest up-and-coming ocat ons for high-end iv ng

52 Propert y Index More about

Sotheby?s International Realty Chief Marketing Off cer A Bradley Nelson ntroduces the 2025 Mid-Year Luxury OutlookSM report

As he Sotheby?s Internat onal Realty brand re eases ts 2025 Mid-Year Luxury OutlookSM report, we ook ahead to the trends and developments affecting the g obal uxury real estate market

Luxury rea estate outperformed traditional rea estate markets hroughout 2024 and in he early months of 2025. The top half of the wealthies househo ds n the U S saw the greatest ga ns n rea estate value according to an April 2025 report from Realtor com® Upscale property transact ons slowed s ight y in response to g oba economic d srupt on in spr ng 2025 Sti l, there?s optim sm that the luxury rea estate market wil withstand financ al volatil ty as a perenn a safe haven

Econom c uncertaint es? espec al y stock market volat lity? can create opportunities For some peop e, his could be the moment they can catch a break n the storm of competit on from other buyers, compared to ust a few months ago

The 2025 Mid-Year Luxury Out ook report h gh ights factors that inf uence the endur ng importance of rea es ate as an asse c ass that contributes to the wealth of u tra-high-net-worth indiv dua s as part of a divers fied por folio Cont nued strong inventory in the upper end of the res dentia property sector, demograph cs that dr ve demand, and the res lience of the globa housing market prov de momentum even in the face of economic headwinds

Th s report ncludes nsights from Sotheby?s nternat onal Realty a fil ated agents from around the globe, who specia ze in transact ons in the US$10 mi ion and up pr ce category, along with data and ana ys s from UBS, J P Morgan, Moody?s, McKinsey and Company, Bain and Company, Cotality (former y CoreLogic), the Nat onal Associat on of REALTORS®and the Nat ona Associat on of Home Builders®

The content in the report ncorporates nsights nto financing options for luxury buyers and dives n o nsurance needs of h gh-net-worth nd viduals for their homes and other asse s, such as art and jewe ry The report also looks at pa hs to recovery for property markets after a natura

THERE?S OPTIMISM THAT THE LUXURY

ESTATE MARKET W ILL W ITHSTAND FINANCIAL

A BRADLEY NELSON chief marketingofficer Sotheby?sInternational Realty

disaster, such as he Los Angeles wildfires and ear hquakes in Southeast As a, as wel as how homeowners nav gate the decision to rebui d or relocate

F na ly the report turns a sharp eye on five key markets with an emerging? or reemerging? luxury resident al component: San Franc sco, Cal orn a; Salt Lake City, Utah; Puerto Rico Saud Arab a; and India Each profi e features information about what?s driv ng the h gh-end property market in these locations, inc ud ng new developments, growth in the high-end hous ng market and an appet te for luxury Globa demand for luxury property s unlikely o slow, g ven that real estate s an investment that you can actua y en oy wh le you own it That demand can be

ound among a d versity of family structures that acqu re luxury property

Se lers can cons der enhancing heir home?s appea to homebuyers by nvest gat ng loca regu at ons to see if a gues house can be added to ncrease versat lity n living arrangements or accommodate a multigenerationa ami y compound

Investors seek ng stabil ty whether in heir own country or another, may be ikely o consider real estate in the coming year n response o stock market vo at ity In add ion, currency fluctuations, which ed

o a surge of Americans buy ng property

n the U K in 2024 wi l kely cont nue

o dr ve cross-border purchasing

On the supp y side, the Sotheby?s nternat onal Realty brand anticipates

growth at the upper end of the market from both new construct on and existing propert es We saw an unprecedented level of transactions in 2020 and 2021 when some people were forced o make frenz ed dec sions As we come up to the f ve-year mark after those purchases, and as things begin to normalize again, we ant cipate a realignment in priorities that could trigger more sa es S multaneous y, new development is redef ning luxuryin some unexpected p aces L festyle-or ented markets cont nue to attract new upsca e deve opment and both ocal and out-of-state buyers

Read on to learn morevaluable ins ghts from he 2025 M d-Year Luxury Outlook report

The endur ng v ew of real estate as a stab e nvestment is antic pa ed to contribute to its cont nued appeal in 2025,with opportunities in global luxury proper y marke s persisting despite ongo ng concerns about tariff impacts and inflat on Data re eased by he Bureau of Labor Statist cs beat economists expectat ons according to a June 2025 report in The New York T mes, although ant cipation s growing that consumer price increases could peak n the fourth quarter of 2025 if tar ffs remain in place

?The uxury rea esta e market saw a strong finish in 2024,meet ng and even surpass ng expectations in several areas,?says Phil p A Wh te Jr , pres dent and CEO, Sotheby?s Internationa Realty ?The Sotheby?s International Realty brand?s U S sa es vo ume growth outpaced the broader marke n 2024,ach ev ng 9 4%, compared to the industry?s 5 2% overall market growth reported by the Nat onal Association of REALTORS®(NAR)?

Luxury property purchases n 2024 and ear y n 2025 outperformed the rest of the market because of the

continued appea of owning hard assets and the ab lity of upper bracket buyers to pay cash rather than borrow at higher interest rates, White says Gobally,the Sotheby?s Internat onal Rea ty brand achieved US$157 bil ion n 2024 sales volume, marking one of its best years ever, and its g oba referra network generated US$4.6 bil on.

?These numbers demonstrate the appeal of luxury real estate as an nvestment? something our discern ng c ients understand wel as they continue to seek exceptiona properties that offer both festy e benefits and reliab e port o io diversification across mu tip e countries and markets,?Wh e says ?Our per ormance ref ects the strength of the brand?s unpara eled global network the expert se of our a fi ated agents and our conic brand pos t on ng, a l of wh ch provide cl en s w th greater access o propert es, prospects and market insights? key differentiators that have enabled us to not just respond to the luxury rea estate andscape but act ve y he p shape it ?

Sales of propert es at US$10 m lion and above soared between February 1and May 1, 2025,compared to that

same period n 2024,according o analysis pub ished in May 2025 by The Wall Street Journal Sa es were up 50% in Pa m Beach, Flor da; 48% n Miami,Flor da; 44% in Aspen, Colorado 33% n Bever y H lls,Californ a; 29% in Los Ange es, Ca fornia; and 21% n Manhattan, New York,according to the report.

The streng h of sales n the 2024 luxury real estate market continued n some markets n 2025,Wh te says w th propert es that were priced correctly se ling qu ck y The assurances felt around the uxury rea estate market stems from two main themes First,a vo at le g obal elec ion year is over, remov ng some elements of uncertainty for wealthy nd v dua s Second, whi e inventory is grow ng in some areas, an inventory shortage of luxury homes is ant cipated to continue to push prices higher, ncreas ng the va ue of property portfo os

In the U S ,the top half of the wea hiest househo ds saw he b gges gains in rea estate va ue among al homeowners n 2024,accord ng to an Apr l 2025 repor by Rea or com® Sa es of US$1-m ll on-plus propert es

18.7

made up 76% of a exis ing homesales n the U S in February 2025,compared o 5% n 2023 But among the 10% wealthiest househo ds,real estaterepresented 18 7% of the r to a assets in ate2024, down from 19 9% two years ear ier,desp te ga ns in va ue In late2024, 36 3% of the assets among hisgroup of househo ds compr sed corporate equ tiesand mutua fund shares,the h ghes share ever recorded.However,recent stock market vo ati ity slikely to havedropped that share back to one-th rd, s mi arto the end of 2023

The Realtor com®report also foundthat in early 2025, there werefewer propertiespriced over US$1mi ion being sted for sa ebu demand for expens ve homes remained h gh,w ththose homes se ling faster than med an-pr ced ones Pr ce cuts n the f rst few months of 2025 were morecommon for lower-priced homes, rising to 22 6%,whi e h gh-end properties stayed more stable, withonly as ght increase from 13% to 13 6%

The report also noted that volat lity n thestock market and geopo it cscould driveluxury homesales

higher ?Wh e 2025 s arted off strong, with bu l sh pred ct ons and record highs,markets grappled with on-then-off-again tar ffs and uncerta nty over the mpact of the current po icy dec sions Moves ke deregu at on and potentia tax cuts cou d help he economy and marke s but the unpredictabi ty is push ng some wealthy inves ors toward rea estate,wh ch fee s safer than stocks,?according o the report

Some of those potent al nvestors may face compet ion when seeking new properties Whi e one factor contr buting to the ack of supply in he overa l hous ng market is that not enough new homes have been bu lt in he past decade another s nteres rates,accord ng to research publ shed n February 2025 by J P Morgan Since mortgage rates began to rise n March 2022,homeowners w th a mortgage rate under 4% are cont nu ng to stay put for longer to avoid the need to borrow at a h gher rate for their next home,so hous ng stock at a eve s is not becom ng avai ab e to other buyers

Interest rates rema n ng at higher eve s for longer per ods have a so contributed o antic pated further price increases globa y at all price points,according to research pub ished by the nvestment bank UBS in September 2024 ?Uninten iona y,central banks have la d the

foundat ons for the next price boom,?noted the UBS 2024 Goba Real Estate Bubble Index report ?S nce the sharp r se in nterest rates thwarted the plans of many rea estate developers,new construct on has [dec ined] in many cities and ooks set to exacerbate the hous ng shortage,thereby eading to upward price pressure n the fu ure?

Mu tip e factors influence the performance of luxury real estate markets One of the most important is the confidence of h gh-net-worth individuals (HNW s)

Significant U S stock market gains? with the S&P 500 up 23% in 2024? boosted the wi ingness o affluent people to spend some of those profits on rea assets such as property The cont nued f nancia we l-be ng of HNWIs extends beyond real estate: in 2024, he top 10% of U S househo ds? those with an ncome of US$250,000 or more? accoun ed for approximate y 50% of all consumer spend ng,accord ng to a February 2025 artic e in The Wal Street Journa c ting data from U.S.f nancia serv ces company Moody?s The stock market f uctuated as the U S mposed and paused g oba tariffs,and concerns cont nued around inflation and a potentia ly softer economy The S&P 500 dropped 12 71% in mid-Apr 2025 from its record high n February 2025,although it had recovered by m d-May 2025 eras ng those osses and com ng w th n 4 2% of ts high point, according to a report by AP News in May

The gap n performance between the regu ar and luxury housing markets s antic pated to cont nue in 2025,am d headw nds caused by changing pol tical and economic dynam cs ?Everything n the economy s uncertain at the moment, but n the high-income wor d, that ranslates to opportun t es,?says Se ma Hepp,chief econom st, Cota ty,a property data ana yt cs f rm ?Many of the po icy changes prom sed by the new admin strat on in the U S ? such as tax cuts? are advantageous o HNW s In addit on wea th er househo ds have more resources and are less concerned about inflat on and unemployment

No one is mmune to uncertainty but it?s less of a concern for HNWIs because they have investments?

in more than two years Also in March 2025, Sylt Sotheby?s In erna iona Realty listed a castlese among 185 acres on Germany?sBaltic coast for US$201m ll on S nce N kki Fie d, g obalreal estateadv sor, Sotheby?s In erna iona Realty - East Side Manhattan Brokerage, and her team took over sales a 111West 57th S n m d-2024,theyhave acce era ed momentum at the conic tower The team sted the tallest ?Quadp ex?penthouse in the U S ? soaringover B ll onaire?s Row a morethan 1000 feet nthe air, witha of y price to match:US$110 m lion? andhad done over US$285 m lion in sales (cover ng bothc os ngs and contractssigned) As of May 2025,the team had s gned 10 contractsand announced that the building s 81% sold, ncluding a recent clos ng of Penthouse72 for US$46 9 mi lion

The Sotheby?sInternational Realty brand?s exper enceshows hat wel -pos ioned uxury properties cont nue to at ract buyers, especia y those offer ng d stinctive amenities,privacy and ifesty e bene ts that align w th evo ving luxury preferences, headds ?Wh le geopoliticsmay introduce uncerta nty,grow ng ? U S

Th s buffer means that act v ty in the uxury rea estate market s antic pated to cont nue at its current pace, with new luxury is ings coming to market at notab e pr ce po nts For example n March 2025,the former home o singer B ng Crosby in Lower North Hi sborough, Californ a, was sted by Golden Ga e Sotheby?s Internationa Realty and was qu ckly so d by June 2025 for US$25 mil ion, marking the h ghest sale n the region

?High-net-worth buyers rema n act ve y engaged, part cular yin the u ra-luxury realestate segment, where un quepropert es continueto command prem um prices,?Wh e says

The top concerns for homebuyers in 2025

Source: 2025 M d-Year Sotheby?s nternationa Rea ty agent survey

%

%

nventory and pent-up buyer demand signal positive market conditions Our exper ence te ls us hat nvestment port o o performance plays into the f nancia decisions of luxury property buyers,?

White adds ?However, f a deal pops up tha fits their needs they w l ikely act on t,regardless o o her factors For examp e,in March 2025, Dubai Sotheby?s Internat ona Realty achieved a record sa e for a v lla on Duba ?s upmarket Jumeirah Bay Is and of US$90 m l on,breaking ts own record? a US$65 5 m l on sa e n 2024?

Ita y?s most expens ve resident al rea estate sa e in h story? a 28-bedroom seafron vil a n Sard nia w h two private beaches, three poo s and two p ers? sold for US$172 8 mi ion n March 2025,w th both the buyer and the seller represented by Italy Sotheby?s International Rea ty ?HNWIs tend to fol ow the stock market and financial nd cators more closely than he other actors,?Wh te says ?However,we?re seeing a sustained pattern where cash buyers remain par icu ar y ac ive n the market, cont nu ng to engage in sign f cant transactions regard ess o o her factors Th s cash buyer resi ence has become a de n ng character st c of the uxury segment consistently dr v ng demand and transact on vo ume even as other market segments experience more volati ty?

Desp te the buoyancy of the luxury property market, the 2025 Mid-Year Sotheby?s International Realty agen survey revea ed tha the top concerns for homebuyers th s year are nflation and interest rates Other issues that may nf uence heir real estate dec sions inc ude the globa po it cal s uat on,climate change and tax reforms

Some observershave been concerned that tariffs and mmigra ionpol cies cou d harm the U S rea estate market (see p24),with analys s from The New York Times est mating nApr 2025 that, f fu y enforced, tar ffs and m ting imm gration would add 16% to abor costs and 31% to mater alscosts for homes Of course, hat estimate may changedepending on hespecific tariffs and how ong they ast, along w thimm gration enforcement po c es ?Tar fson bui d ng materia s and o her items used to build and furnishhomes ra se the cost of construct on, remode ingand even moving,?says Robert Dietz,ch ef econom st,Na iona Associat on of HomeBu lders (NAHB) ?NAHB est mates indicate that the initia rounds of the tariffswould raise the cos of cons ruction by up to US$10,000 for a typical single-family property and even more for h gh-endhomes?Tar ffs on construct on materia s a so increase thecost of rebu lding homes, which ult mate y w l raise insurancecosts or homeowners,D etz says ?But n t mes of uncer a nty, realestate becomes even more mportant as an asset,?Hepp says Wh le she doesn? t ant cipate ar ffs having as big an impact on uxury rea estateas has been suggested,she does think there may bea spike n prices for some uxury materia s as h gh-endhomes destroyed by wildfires n Cal fornia and oods in North Carol naand Flor da are rebu t (see p26 for more about the impact of natural d sasters on homebuyers) ?

Aside from po icy changes,generat onal trends among buyers and sellers demonstrate the increas ng importance of equ ty among purchasers,according to NAR?s 2025 Home Buyers and Se ers Generat ona Trends report Gen Xers (born between 1965 and 1980) had the highestearning homebuyers,with a median income of US$130,000 n 2023,and they purchased the largest homes, a ong with younger mi lennia s (born between 1990 and 1996),at a median of 2 000 square feet These younger generations a so had the most d verse family structures,w th Gen X

buyers he most ikely o purchase a multi-genera iona home at 21%,and younger mi lennia s hav ng the highest share of unmarried coup es buying homes at 13%

Sel ers hop ng to appea to these demograph cs need to know how to high ight the f ex b lity of the r properties ?Gen Xers are today?s sandwich genera ion,?says Jessica Lautz,NARdeputy ch ef econom st and v ce president of research,about he report?s f nd ngs ?They are purchasing multigenerat onal homes to accommodate ag ng re at ves,children over the age of 18 and even for cost savings While Gen X are purchas ng at the highest househo d incomes, they may st l feel the squeeze as they a m to nd a home that serves everyone?

The first two months of 2025 were among the bus est starts to he year seen n the New York C ty luxury property market n the pas 20 years, says Jul ette R Janssens, g oba real estate adv sor,Sotheby?s Internat onal Rea tyEast Side Manhattan Brokerage ?We saw momentum pick up after the e ect on due to pent up demand and ncreased l qu d ty from previous s ock market performance,?says A lison B Koffman g obal rea es ate advisor at the same off ce ?We have experienced bidding wars at every pr ce point, from US$2 m lion to US$10 mi ion and up?

Janssenssays condoson the Upper East S deare part cular ysought after,a ong w h those onthe Upper West S de and downtown ?Buyers favor condosbecause they?re essrestrict ve? you can rent them out or buy w th a trust or limited l ab lity company? un keco-ops Condos havebeen the favor e ch ld for awh le, espec al y for a new generation of buyerswho are ess concerned about being at a certain address than earl er generations?

In addition o prof ing from the stock market many New York C tybuyers in the financ al ndustry have used their recent bonuses to buy realestate, Koffman says ?New luxury bui d ngsa over the city havealready sold their best apartments ust from buyers look ngat floor plans?

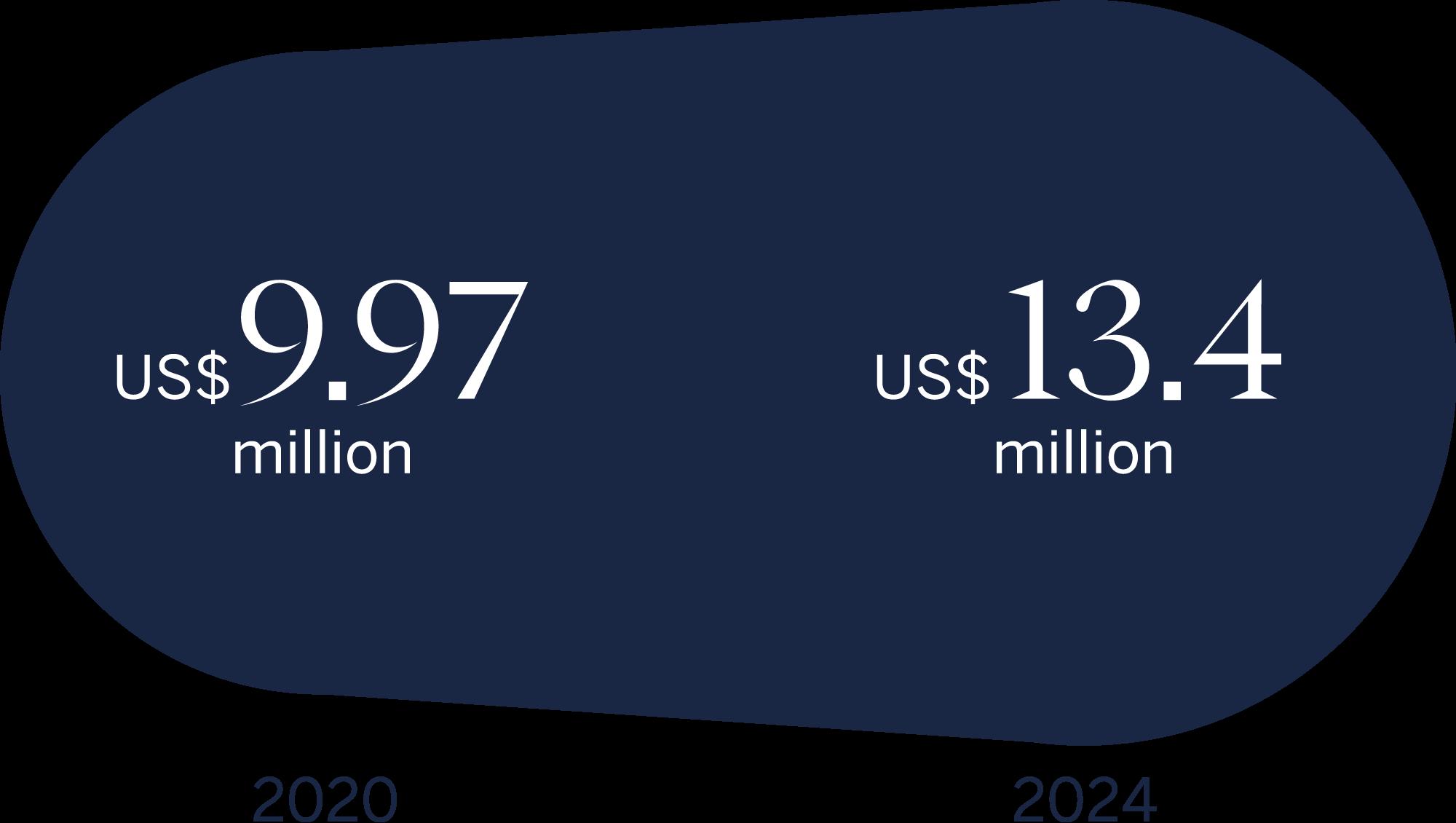

In Aspen,Colorado,a severe ackof inventory and restr ct onson new deve opment have kept pr ces high, says Tim Est n,g obalreal estateadv sor, Aspen Snowmass Sotheby?sInternat ona Rea ty.Land use ru es have restrictednew homes to a maximum of 9,250 square feet,andnew res r ct ons may reduce that to 8,750 squarefeet n 2026 ?Inventory is cons stent y 40% to 50% less than t was before the pandem c,? he adds In February 2019 there were382 un tsfor sa e n Aspen compared to 187 stings n February 2025 Est n a so notes that the ?bi ionaire effect? n Aspen keeps prices high ?Whenever we havea big h gh-end sale,the net e fect is that it pushes average pr ces h gher There?s a gravitationa force for prices to keep r s ng? The med an salepr ce for a s ngle-fam y homein Aspen was US$13 4m ll on in 2024,compared to US$9 97 mi lion n 2020 ?

In the Bay Area,Cal orn a,the housing market flattened in 2024 but started th s year w th new momentum and a new mayor,who is generat ng opt m sm,says Kara Warr n g obal real es ate advisor, Golden Gate Sotheby?s International Realty, serving Mar n County and San Francisco

?Our luxury property marke sn? t impacted by nterest ra es because 85% of transact ons are w th cash,? Warrin says ?Our team so d more than US$65 mi ion between October and December 2024,with an average sale price of US$6 mil ion The buyers tend to be ocal people who want someth ng bigger and better and have the cash to pay for t.?

Inventory s low n San Francisco and in nearby Marin County ocat ons w th ferry access to the city,such as Sausa ito,Tiburon,Be vedere and Mil Va ey, Warrin adds

One trend that he ps buyers in he area is less compet ion from foreign nvestors ?The s rong do lar and pol ical climate n the U S have kept our nterna iona buyer pool smaller,?she says ?Many of our buyers in the ech ndustry have done wel and need to be in he Bay Area, but we a so have a ?s ver wave?of sellers and buyers

They are usually long-term business owners or people who nherited money and want to downs ze now that they are n their 60s and 70s?

Both groups have lots of purchasing power, w th the o der buyers look ng for a penthouse with a view or sma ler sing e-leve l v ng and younger fami es look ng for singlefami y homes ?The uxury property market w ll likely stay extremely strong n the Bay Area,with homes sel ing qu ckly for what they are wor h but not at a crazy ra e of apprec ation,?Warr n says ?

When U S mortgage rates were histor ca y ow between 2009 and ear y 2021, savvy HNWIs jumped at the opportunity to nvest in rea es ate with ?umbo oans?This term refers to mor gages that exceed the limits set by the government-backed fund ng agencies Fannie Mae and Fredd e Mac In 2025,that means loans of US$806,500 or more n most markets, or US$1209,750 n high-cost oca t es Today wea thy homebuyers are st l just as ikely to nvest in property around the globe,but they are more likely to pay cash now that borrowing costs are higher Accord ng to the 2025 M d-Year Sotheby?s Internat onal Rea ty agent survey, 88% of HNWI cl ents across the globe prefer to purchase rea estate with cash ?Our market is 80% cash, but the few c ents who borrow funds to buy a property usua ly pay nteres rates we l be ow the standard rate,?says Dan Dockray,globa real estate adv sor,L V Sotheby?s Internat onal Rea ty in Co orado ?These are buyers who have a strong relationsh p with the r banks, wh ch wi l typically shave at least a po nt off the marke rate?

In ear y 2025 these borrowers typica ly paid 5% or ess on a jumbo loan,compared to near y 7% for other borrowers,he says ?Some cash buyers are ac ual y everag ng the r nvestments and may be pul ng US$2 mi lion or more out n cash against their assets?

Un ke a umbo oan,which can take weeks to access because of documentation requirements and can generate substantia borrower fees, oans aga nst investments can often be approved in one day, says Keith M Bloomf eld, founder and CEO of FFT Wealth Management a New York City?based firm that serves ultra-h gh-net-wor h individuals (UHNWIs)

?Our margin rates are ower than the preva ing umbo mortgage rate, and borrowers can leverage up o 50% of the r portfolio,?B oomfie d says

Top transact on methods for luxury property

?It?s al a numbers game based on nterest rates, the r return on investments and whether someone needs cap ta for their business or another expense?

Financ al nstitutions such as UBS

Morgan Stan ey and Raymond James have excel ent programs for financ ng property purchases for people who keep the r nvestment portfo o with them, says Brian Weiner,founder and CEO o the Fami y Of ce Resource Group,a wealth management firm that also serves UHNWIs ?The cha enge w th this approach s that securities port o ios tend to fluctuate?We ner says ?In the event of a serious market correc ion, the borrower may need to cover any shortfal Another concern is that you?re comm tted to that f nancia inst tut on, so making a change might not be so easy?

An a ternat ve option s an intra-fam y oan,often made via a trust or a m tediabi ity company,wh ch a ows UHNWIs to finance purchases made by other family members ?The rates for such loans are usual y much ower than traditional mortgages,wh ch can lead to amaz ng cost sav ngs,?We ner says

For examp e,as of March 2025,the nteres rate establ shed by the IRS for an intra- am y oan of more than nine years was 4 81% compared to 6 31% for a trad tiona mortgage

Econom c fac ors varyaccord ng o the leve of wealth o the c ient.?For UHNWIs, property purchasesand sa es are purely a ifesty e cho ce,?Dockray says ?At a ower pricepo nt, such as he US$5 m l on range,we tend o see more activ ty when the stock market rises Buyersbelow that point aremore ikely o pay attention to interest rates?

However, many entrepreneurs drive rea estatetransactions,so inflation or other economic factors hat impact their business cou d nf uence their realestate decis ons Successful transact ons often h nge on c ientssharing informat onabout heir banking relationsh psear y in the process Understanding whether financ al nstitutions can authorize andfac litate oans in specific markets? specifically n cross-border scenar os? can he p prevent compl cations

?Agents need to know wh ch enders can work with wealthy buyers and what hey can offer which changes often,? Dockray says When abuyer needs to nance their purchase, t?sbest to use oca enders whenever possib e The worst s tuation iswhen someonehas an out-of-state persona banker,who says hey can executein our market but at the ast minute they can? t It can deraila deal o ask asel er to wait while your buyer scramb es to rearrange heir financ ng?-

Economist Hepp also bel eves that fore gn inves ment n U S rea estate could be nf uenced n part by geopo t cal circumstances ?While some oreign buyers wi continue o be attracted to nvest ng in U S rea esta e because the country s cons dered a stable economy,others may be less l ke y to invest here because of changes n imm gration po cies,?she says. ?It w l probably balance out in the com ng years.?

In terms of cross-border uxury transactions there has been an increase in act v ty from U S buyers ooking to purchase properties in Europe, a trend that was a so seen during the pandemic,White says ?Market forecasts from our aff liate eaders remain pos t ve for the coming months Th s opt m sm s particu arly s rong in markets such as Italy,Portuga Duba the U K ,France and Spa n,as we as n countries offering f scal tax benefits and residency programs, such as Ma ta and Sw zerland?

Cross-border transactions were also driven by the strong performance of the U S do ar at the start o the year Outs de of Europe,U S luxury property buyers are seek ng homes n ocat ons such as Japan and Mex co due to currency advantages ?We are see ng a growing uxury market n Mexico that s attract ng more and more buyers from the U.S.,?Wh te says ?San Migue continues to grow substantia ly,as do other most y coastal markets, such as Los Cabos,P aya del Carmen and Puerto Va arta.

The pr mary mot vations for Amer cans buying overseas appear to be econom cs,pol tics, lifestyle,potentia nvestment oppor unit es and the favorable exchange rate,White says ?Demand from U S buyers was robust n 2024,part cularly in markets that aligned w th their mot vations Portugal cont nues to be a compel ing dest na ion,with U S buyers becoming the top fore gn national ty in 2024 In Ita y,the U S buyer share has significan ly increased since 2023,fueled by the strong dol ar and a new ump-sum tax reg me Our affi ate n Paris,France,Propriétés Parisiennes Sotheby?s Internat onal Rea ty,also noted that 70% of ts fore gn buyers were from the U S n 2024?

Demand for prime proper ies n centra Par s remains strong, says De ph ne Gbert Av tan, director, Propriétés Parisiennes Sotheby?s In ernationa Realty ?H gh-profi e sales have cont nued, particu arly in he most sought-after arrondissements,but buyers are showing increased se ectiv ty, favor ng properties that offer a un que architectural or histor ca character There?s a cont nued pre erence for propert es w th ou door spaces and terraces,along w th h gh demand for met culous y renovated turnkey res dences There?s also an ncreas ng focus on energy-efficient and historical y preserved propert es due to evolv ng regu at ons and buyer preferences?

In April 2025,Alexander V G Kraft,cha rman and CEO,Sotheby?s Internat onal Rea ty France and Monaco secured the Maybourne Res dences in Sa nt-Germaindes-Prés one of the most prestig ous areas of Par s The residences are exclus ve y isted by Propr étés Par s ennes Sotheby?s International Rea ty and are the first private homes n Paris that w l benef t from hotel services. They are also the most expensive,with a ?60,000 per square meter (US$5,750 per square oot) isting pr ce.?These developments offer Amer cans not ust proper ies but lifestyle exper ences n prest gious locations?White says The Par s res dences represent a g oba trend among luxury proper y buyers who are ooking for hotel- ike amen t es for their pr va e homes

Lower interest rates in Europe may encourage some HNWIs to re-enter the marke there Gbert Av tan adds, although cash transact ons dominate the ultra-luxury sector ?Geopo it ca uncertainty ends to re nforce the appeal of stable uxury markets such as Paris,London and major European capitals?

Sustained nterest in Paris among American buyers part cu arly those motivated by l esty e and long-term inves ment potentia , s ma ched by the appea of London ?Buyers in London in 2024 d d very we because there was lots o supply and he market was unsettled before our general elect on?says Becky Fatemi,executive partner, United K ngdom Sotheby?s Internat onal Realty ?There?s more clarity g obal y now hat the U S and U K e ections are behind us,and there are st l good opportunit es in the U K as we?ve exper enced a sign f cant exodus of foreign buyers?

Some wealthy peop e from Europe,the Middle East and Afr ca have left the U K s nce reforms in 2024 el minated ong-standing tax benefits for residents whose permanent home s outs de the U K In add tion, in November 2024 the new cen er-left U K government ?

PHILIP A W HITE JR.,president and CEO,Sotheby?sInternational Realty

mposed a 2% surcharge on home purchases made by non-res dents and an extra 5% on buyers who own more than one residentia property

In 2024,Americans made up 20% of fore gn buyers in the U K,according to Fatem The market segment between £2 m lion and £10 mi lion (US$2 6 m ll on to US$13 mil on) remains act ve, with fore gn buyers predom nant y purchas ng properties as a p ed-à-terre or nvestment assets for family members In add tion,interest rates are lower in he U K Robust bonuses for peop e n the f nancia sector a so ed to a boost in purchases at the end of 2024 and n early 2025

?One reason Americans were buy ng in the U K s the strength of he do ar compared to the pound,?

Fatem says ?Even though they might have to pay stamp duty of as much as 19%,the strength of the dol ar and ower nterest ra es offset the expense?She says pr ces are the h ghest they have ever been,so buyers rom Duba and Abu Dhabi are also look ng to London for nvestment oppor unit es

THERE?SMORE CLARITY GLOBALLY NOW THAT THE U.S.AND UK ELECTIONS ARE BEHIND US

Austra ia?s uxury real estate market a so showed robust performance in 2024 ?Sydney Sotheby?s In ernationa Realty achieved a record year in 2024,?

White says ?Our brand also has plans for continued expansion n Australia in the com ng months?

Sydney remains one o the wor d?s most expensive luxury property markets Other cap a markets in Melbourne,Perth and Brisbane represen attract ve alternat ves for luxury property buyers seek ng value and l estyle appeal

Mebourne Sotheby?s Internationa Realty set a record for the South Yarra neghborhood w th the sale of a contemporary home for ust under AU$26 m l ion (US$16 5 m l ion), he highest recorded price since 2018 and a new record per square meter at AU$41,000 (US$26,127) ?I bel eve we?l continue to see th s trend for strong demand for luxury rea estate by the ultra-r ch and nite supp y n h gh y sought-after suburbs of Melbourne,wh ch offer world-c ass

amenities?saysAntoinette N do,managingd rector, Melbourne Sotheby?sInternational Realty

In Australia?smajor cities, demand sbeing dr ven by UHNWIsand an increasing appet te for pres ige property investments Market forecasts from da a analytics firmsCotal ty and Domain suggest a 5 3% annua property valuegrowth ratefor 2025 compared to 2024,a ongw th sustained nterest n landmark res dences and brandeddevelopments Wh e fore gn purchases o existing homes areon hold for two years from Apri 1,2025 the samerestrictions do not apply to new deve opments,which represen ownershipand nvestment opportunit es for overseas purchasers ?n NewZealand,a significant market deve opment emerged nMarch 2025 w thupdates to the Ac ive Investor Plus V sa Scheme,?Wh te says ?Thispo icy change now perm s fore gners to own homesbased on e gibi ity related to nvestment thresho dsand physica presence requirements New Zealand Sotheby?s Internat ona Rea ty was invo ved n the top hree nat onalsa es in 2024 and sixof he top ten, suggesting strong under ying market momentum ??

BECKY FATEMI

Property markets in Ch na struggled n 2024, and measures have been taken to del ver stab lity ?The government has e im nated excessive stamp duties and ntroduced programs to attract wea hy nd viduals, fami y off ces and qual fied profess onals, encouraging a new wave of potentia buyers from the Chinese mainland, Southeast Asia and the M dd e East,?White says Singapore?s luxury housing market was not ceab y s ower unt l the summer of 2024, when interest rate cuts by the U.S. Federal Reserve encouraged economic confidence among homebuyers and investors, says Sueann Lye, global rea estate adv sor, L st Sotheby?s Internat ona Realty, S ngapore

?There was a not ceable ow of wealth nto the S ngapore market n 2024, indicated by higher sales in the second half of the year?Lye says ?On a per-square-foot bas s, the average pr ce of so-called ?good-class bunga ows?rose 4% year-over-year from 2023 o 2024 In 2025,we expect the good-c ass bungalow market o streng hen and pr ces to rise marg na ly due to the m ed supp y?A ?good-class bungalow?is a planning designation that ndicates a sing e-fam ly home ocated in one o 39 res dentia areas and on a ot of a east 1,400 square meters (15,070 square feet) They are typ cal y the most uxurious and costly homes in Singapore

However, uxury apartments did not perform as wel with total sales down 30% n 2024 compared to 2023, Lye says. She anticipates the current performance of apartments to remain the same in the second half of 2025 ?Th s cou d be attr buted to he ack of new uxury pro ects for sa e in 2024 and to the h ke n addit onal buyer?s stamp duty (ABSD) Since Apri 2023, fore gn buyers of resident al propert es have to pay 60% of the sa es price,which s a deterrent In addit on ABSD rates were ra sed for cit zens and permanent res dents buying second properties from 20% to 30% ?As a result, uxury proper ies n Singapore are increas ngly be ng purchased by citizens and permanent residents as the r pr mary residence ?We have noticed an ncreasing number of buyers from the U S , Norway and Sw zerland over the past two years,?Lye says ?Under their respect ve free trade agreemen s, nat onals and/or permanent residents from these three countr es who buy resident al properties n Singapore, as we l as those from Ice and and

L echtenste n wi be accorded the same tax treatment as Singaporean citizens,?Lye says More broad y n As a, the Sotheby?s Internat ona Rea ty brand opened an off ce n the Phi pp nes n March 2025 to widen its reach in the reg on ?The luxury res dentia rea estate sector in the Ph lippines has seen steady growth fue ed by ncreased demand from aff uent buyers and investors,?Wh te says ?As the f nancia center of the country and a key hub for mult nationa corporations, the c ty of Makat s the prime ocat on or high-end res dences offer ng premium amenit es and secur ty?

Despite ongoing g oba economic and geopolitica challenges,the uxury rea estate sector in the M ddle East rema ns robus ,says Zhanna Yerkozhanova general manager, Qatar Sotheby?s Internat ona Rea ty ?HNWIs are act ve y purchasing exclus ve proper ies n the top locations This year, foreign nvestment s antic pated to r se due to favorable exchange rates and government n tiatives attracting a fluent buyers?

Approx mately 6,700 mi ionaires are estimated to have m grated o homes n the UAE n 2024, w h Dubai recognized as a uxury property magnet Simi ar to other h gh-end markets, Dubai continues to strugg e to

keep up with demand An array o luxury mansions and penthouses that range in pr ce from US$60 mi ion to more than US$120 m ll on are under construct on or recently completed in Duba for buyers from Europe Asia and the Americas, accord ng to a February 2025 B oomberg report

Branded res dences n the Gu f Cooperat on Counci (GCC)? wh ch inc udes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the Un ted Arab Em rates? are antic pa ed to stay strong as buyers seek not just uxury but integrated exper entia l estyles ?Qatar s uniquely posit oned as a lead ng Midd e Eastern economy, benefiting from a strong banking system, no persona ncome tax and the poss bil ty or investors o obta n permanent residency,?Yerkozhanova says ?Qatar?s strateg c v s on and infrastructure inves men s position t for continued nterest and potent al growth n the uxury sector, a ong w th ts posit on as a ga eway between Europe and As a?

Oman, known as a tour sm destination for ts beautifu landscapes, a so has a stab e economy bolstered by o l reserves and progressive government pol cies, which has ed to its emergence as a hub for n ernational bus ness, capita transfer and imm grat on ?Our exclus ve pro ects? the Res dences at he St Reg s Marsa Arabia Is and, the Pearl? Qatar and the Residences a the St Regis A Mou Muscat Resort? cons stently a tract interna ional buyers,?Yerkozhanova says.

The luxuryproperty market has demons rated remarkab e strength even in the face of broader econom c cha lenges, as the Sotheby?s Internationa Rea ty brand demonstrated in 2024, Wh tesays ?Luxury rea estate has consistent y led the market and outperformed the industry Sa es are tak ng placea a steady pace, and we antic pate th s momentum to continue Affluent buyers rema nactive, and the demand for high-end propert es rema ns strong? In 2025 White ant cipates sales n the global uxury property marke w ll continue to show growth ?Act ve housing nventoryis ris ng in most markets on a yearover-year bas s,but some st ll remaint ght,?hesays

According to NARdata released at the end of May 2025, housing nventoryin he U S climbed near y 21% from a year ago ?Overall,we are opt m st c about he future of the g oballuxury property market The comb nation of strong demand, mpress ve sales growth and the resil ence of the uxury segmen pos tions it we l for cont nued success n the coming months?

As uxuryproperty buyers and sellerscontemp a e the r next movesfor 2025 and beyond,they are ke y to ocus attent on on marketsthat cons stently demonstrate res lience n any economic cl mate

Luxury real estatepresentsresilient opportunitiesamid market shifts,expertssay

On-again, o f-again tar ffs, stock market volatil ty, stubborn inflat on and currency uc uat ons are ke y to cont nue to affect g oba real estate markets in the coming mon hs, but they cou d stil present opportunit es for some buyers

?Despite elevated interest rates and slower overall sales activ ty, the high-end rea estate segment cont nues to show res ience,?says Odeta Kush , deputy chief economist, First Amer can F nancia Corp., a provider of t t e, settlement and risk so u ions for rea estate transactions ?Wea hy homebuyers are often mot vated by lifesty e, portfo io strategy or ong-term be s on a specific market, not ust short-term cost considerations And, wh le headwinds such as trade tens ons or f nancial marke volat lity may shift the pace or location of demand, they rare y erase it ?

The upper end of the hous ng market has cons stent y performed we l n the past few years,attributed n part to strong stock market performance,says Lawrence Yun, ch ef economist,Nationa Assoc at on of REALTORS®(NAR) While noting hat market dynam cs m ght temporarily s ow activ y, Yun remains optimistic about luxury real

estate?s ong-term tra ectory ?We?re start ng to see a l tt e hesitancy at the upper end, mostly because of the uncerta nty about where the stock market wi be n a month or next year,?Yun says ?But n the b g picture, there?s sizab e pent-up demand for trade-up buyers In addition,even w th a stock market correction, there?s p enty o household wea th being transferred to the next generat on that wil add to the demand for uxury hous ng?

?Res dential construct on costs, already more than 40% h gher than pre-pandemic levels, cou d be further strained by susta ned tar ffs?Kushi says Buyer preferences may shif toward turnkey homes that avoid the added cost and de ay of new construct on or major renova ions, she says ?f tariffs cont nue to increase construct on costs,that w l likely eopard ze profits on the a ready slim margins in the bu lding industry,?says Joel Berner,senior economist, Rea tor com® ?It?s kely more bu lders w l p vot to h gher-

end homes where the profit margins are a tt e bet er, which wou d increase the nventory of uxury homes?

?Among the top 10% of wealth est househo ds, real estate represents 18 7% of the r to al investment port o o, down from 19 9% two years ago,?accord ng to a Rea tor com®Apr 2025 report, Berner says That percentage may be higher after he most recent stock market correct on, he adds

Stock market volat lity can have a dua effect on the uxury hous ng market, Kushi says ?On one hand, sharp sw ngs n equit es can prompt some h gh-net-worth nd viduals to de ay b g purchases due to uncertainty,?she says ?On the other real estate? espec ally in pr me markets? might be seen as a safer, more tang b e store of va ue?

The US$1-mil on-plus segment has continued to grow n 2025, now compr s ng nearly 13% of a recent ex st ng-home sales, according o Apr l 2025 data from NAR, Kush po nts out ?This suggests many affluent buyers stil see rea estate as a safe p ace to park money, o fer ng both investment potentia and the value of a place to ive,?she adds

?When the stock market exper ences severe sw ngs, wealth er househo ds n the U S , and g oba ly, ook for a more tang b e, secure asset,?Yun says ?If the stock market con inues to be vo at e, peop e are more likely to nves n rea estate as a hedge against uncertainty,?he says

Berner antic pates the U S Federal Reserve Board (the Fed) to hold nterest rates steady at east unt l severa months of better inf at on numbersare reported Tar ffs are expected to driveprices h gher which works against owering n erest rates, hesays

However,slowdown r skshave risen due to evo ving rade po icies,Berner cont nues ?[It] sn? t necessarily bad for the housingmarket, w th the except on of the 2008-2010 housing- ed downturn Per ods of economic cooldowns usua ly generate lower interest rates,which has a posit veoverall mpact on the housing market, even the upper end?

nflation n May remained steady,accord ng to a June 2025 report n The New York Times,and most econom sts an ic pated that the Fed w ll con inue to hold nterest rates at 4 25%?4 5% for the rest of 2025 Meanwh le,trade wars ed to a weakeningdollar? down 9 07% for the year as of June 18, 2025,according to The Wa lStreet Journa n m d-May, off cia s n China and the U S agreed to a 90-day pause on new tariffs,according to a May 2025 report by AP News As part of the agreement, he U S dropped itstar ffs on China to 30% from the prev ous 145%,wh e China dropped itstariffs on U S produc s from 125% to 10%

Overseasinvestor purchases in the U S slowed when the dol ar was strengthen ng,wh ch madeit more costly o buy in he U S ,Yun says However, a weaker do ar cou d make he U S more attract ve to rea estate investors,Berner says

?When a localcurrency weakens,interna ional buyers w thstronger currenc es may find better value, effectively boost ng the r purchas ng power,?Kushi says ?But t?snot ust about pric ng? currency sh fts often re ect broader econom c s gnals?

?The Pres dent?s ?GoldCard?proposed visa program, which offers a path to c tizensh p for peop e who nvest US$5 m ll on,cou d potent ally boost h ghend demand for U S real estate,?Yunsays

Cont nued volatil ty on many fronts s ant cipated n 2025, but the luxuryhousing market s ke y to be a source of continued opportunity

W hat natural disastersand market shiftsmean for homebuyersand sellers

In January 2025, Californians witnessed the devastat ng mpact of 14 wi dfires hat swept through Los Angeles and San Diego Counties The destruct on was widespread and ABC News reported that, by March 2025, he fires had burned 37,000 acres of land and destroyed 16,000 bui d ngs before being contained

Meanwh e, thousands of m les away, a 77 magn tude earthquake struck Southeast As a that same month, cen ered just s x mi es rom the c ty of Sagaing n Myanmar In ear y Apr l 2025,a spokesman or the ru ng mil tary government said at least 3,649 people had been ki ed. The earthquake also af ected ne ghbor ng countr es, inc ud ng Tha land, Laos, Bang adesh, Ind a and Ch na

Both disasters served as stark rem nders of nature?s capacity to transform communities and reshape andscapes in a matter of days From hurr canes and wi dfires to floods and earthquakes, natural disasters are not on y dead y, but they a so exert a huge financ al toll In a year def ned by c imate vo a i ty, 2024 saw global natural catastrophes cause an es imated US$320 bil on n econom c osses, w th nsured osses reach ng between US$135 bi ion and US$140 bil on according to ana ys s published in January 2025 by the nsurance compan es Munich Re and Swiss Re These figures mark a stark departure from h stor c norms, s gn f cant y exceed ng the inflat on-adjus ed nsured oss averages of the past decade? and even the past 30 years

According to a January 2025 report by Moody?s, 2024 was the fifth consecut ve year in wh ch insured g oba losses from natural disasters surpassed US$100 bi ion, po nting to a sustained per od of climat c disrup ion The ma ority of the losses were weatherrelated, driven by powerfu natural events ncluding tropica cyclones, severe storms and flooding Notab y,

near y a thirdof the insured losses were attributed to major hurr canesmak ng landfal in the U S

The number of such damag ng natural disasters is growing Accordingto da a released in January 2025 by the National Centers for Env ronmental Information, part of the National Oceanic and Atmospheric Adm nistrat on, in 2024 theU S alone suffered 27natura disasters where the est mateddamage exceeded US$1b lion Th s trend shav ng profound consequences for h gh-end property marketsaround the world,re nforcing the increas ng impor anceof cons deringcl mate resil ence when investingin uxury real estate.

The recovery period after a d saster can also a fect the rea estate market,as homeownersnav gate insurance cla ms, changes to zoning aws andthe emo ional and f nancia costsof rebu lding or re ocat ng According to a May 2025 report from Bank of Amer ca nst ute,23% of U S homeownershave experienced property damage or oss in the past f ve years due to severe weather and 65% are prepar ngtheir homes to w thstand future even s

Homeownersaffected by natural disasters typ ca y have threema n options: rebui d ng heir property to its orig na specifications,reconstruct ng withenhanced cl mate res ienceor moving to a new location

Each optionimpacts housing nventory and uxury home pricesdif erent y? rebu lding or upgrad ng s ows the returnof homes to he market, im ting supply and potent al y driving up pr ces, wh lere ocat on can shift demand o new areas, putting upward pressure on pr ces n less-affected,high-demand regions These dynam cs can create loca zed surges or shortagesin luxuryrea estate inventory, depending on the paceand sca e of recovery We have outl ned the spec fic concerns and opportun iesre a ed to each option over eaf ?

THE NUMBER OF DAMAGING NATURAL DISASTERSISGROW ING? REINFORCING THE INCREASING IMPORTANCE OF CONSIDERING CLIMATE RESILIENCE W HEN INVESTING IN LUXURY REAL ESTATE

1980s 33 US$219 6 bn 299 1990s 57 US$335 3 bn 308

2000s 67 US$6213 bn 310

2010s 131 US$994 6 bn 523

2020-2024 115 US$746 7 bn 504

Source NOAA www nce noaa gov access bi l ons Time per od No of natura disas ers Cost (US$) Deaths

Losses from natural disasters

Overa osses (US$) Average nsu ed osses (US$)

Past 30 years US$181bn US$94 bn

Past 10 Years US$261bn US$94 bn

Past 5 Years US$261bn US$106 bn

2023 US$268 bn US$106 bn

2024 US$320 bn US$140 bn

Source Mun chRe and Sw ss Re

Rebu lding to spec? restoring a home to ts pre-d sas er condition? a lows homeowners to rega n some semb ance of normality It is also of en the most straightforward opt on, prov ded that any insurance payou s suffic ent to cover the construction costs and ocal regulations a ow for it

Accord ng to the 2025 Mid-Year Sotheby?s

Internat ona Realty agent survey, 46% o respondents said the top concern of clients who ved n areas hat had experienced weather-related damage was rebui d ng the r home to its or g nal state. Th s was followed c ose y by rebu lding to a more damage-resistant standard (21%) ?Many peop e are ook ng to bu ld exact y as before? says Joe Ci c, global rea estate adv sor, Sotheby?s Internat ona Realty - Pacific Pa isades Brokerage, although some leeway is being a lowed because many homeowners ost houses that were bu lt decades ago ?Fol ow ng the wi dfires, bu lding regulat ons have been relaxed so people can bu ld homes 10% b gger than what they had or to the current bu ding code, whichever s greater?

Pr ces of homes and and in the area have a so been affected by the fires ?The average sales pr ce for a s ng e family home in the Pacific Pa isades was US$4 6 mil on in 2024, and t is the same n 2025 However, there have not been many sa es o surv ving homes s nce the f re? only 11as of Apr l 2025 Interesting y, the average st price current y for surv ving homes is US$9 7 mi ion, which is a sign ficant ump from histor cal norms However th s s due to low nventory n the re- mpacted areas and a more typica inventory in the pr cies area of the Pal sades the R viera, which was arge y unaffected by the fires,?Cil c adds ?Pr or to the f re, we did not have many vacant land sales, and now we do, with current asking prices rang ng from US$750,000 to US$8 25 mi ion, and an average sa e pr ce of US$2 8 mil on In compar ng this to pre- re values of properties that were torn down to build, for examp e and va ue sa es, we have seen pr ces of land discounted between 20% and 35% compared o pre-fire sa es?

The new land sales a gn with estimated h stor c and va ues based on a ru e of thumb tha a p ot of and in Los Angeles is worth be ween 40% and 60% of a property?s overall va ue This calcu at on has h stor ca y been used to est mate land va ues even when few vacant parcels were avai ab e for sale Selma Hepp, chief economist for Co al y, told HousingWire in March 2025 that the cost of and in Los Angeles has already ncreased at tr p e the pace since he onset of the pandem c, wh le home pr ces have gone up about 50%

Wh e rebu ding efforts cont nue, the process is st ll evo ving, and many homeowners are work ng through the comp ex ties of both regulatory ad ustments and the shif ing real estate market ?Thus far, on y approximately 4% of the homes damaged or destroyed n the Pa isades F re have come to market, as of May 2025,?C lic says ?We expect that number o ncrease over the next couple of years to between 10% and 15%, but the vast ma or ty of owners intend to rebu d and many projects are already underway with plans subm tted or approva .?

However,rebui d ng to spec s not always feas b e Updated bui d ngcodes introduced by oca or national governments after ad saster m ght requ re a terationsto a home tha increase the cost of rebu lding beyond what the nsurancepayout wi cover AFebruary 2025 s udy by F rst S ree ,a companythat models the f nancia r sks caused by climate change, found that by 2055, climatedriven eventsw ll ncrease homeowner insurance premiums byan average of 29 4% nationwideand could result in thedestruction of US$147 ri lion n real estate In regionsprone to f ood ng such as par s o F orida, new regu at onsmay mandate elevated foundations to reduce the risk of uture damage According to he Federa Emergency Management Agency (FEMA),just one nch of f oodwater can cause up to US$25,000 n damage Nav gating these evolv ng bui d ng codes requ res homeowners to ba ance their des re for a similar home w th the real ty of new regu ations Whi e some may feel that rebu d ng o spec offers a sense of closure, t?s cruc al to weighthe financia easibi ity aga nst any regu a ory chal enges.?

A natural disaster can g ve property owners the opportunity to enhance their home?s res lience, and many are opt ng to do ust that For examp e, in wildfire-prone areas they m gh nsta l ember-resis ant vents n the roof and create andscaping w th open spaces free of any combust b e plants to act as a f rebreak In reg ons prone to storms and ocean surges, upgrades such as hurricanerated windows, structural reinforcement and improved dra nage systems are poss b e options

After he fires n Ca forn a, t became apparent that many of the surviving houses ncorporated some firepreservat on features, according to a January 2025 report by the Los Angeles Times. ?Some houses were better su ted to handle w df res so there wi be a push to ncorporate more res ience when rebuilding,?Ci c says This w ll also be the case for people looking to move to he affected areas and bu d new homes

This market sh ft is evident n the Pacific Pa isades ne ghborhood, where desp te an estimated US$22 b lion n rea estate losses, accord ng to a February 2025 report n the Los Angeles Times, many have reta ned their va ue Accord ng to data on the Pac c Palisades housing market trends by Realtor com®,the med an l st ng home pr ce n the Pac f c Pal sades neighborhood was US$6 2 m lion n March 2025, an 113% increase on the year before Sim lar y, although Altadena saw a loss of over US$78 bi ion n property va ue, his has not ed to a market co lapse The median ist price in Altadena in March 2025 was US$12 m ll on, according to Realtor com®, about n ne with its US$126 m ll on med an list pr ce one year ago ?People who elt they were priced out of Pacific Paisades are now entering the market,?Ci ic says.?The consensus is that the neighborhood wil be even more desirab e after the rebu ld because everything wi l be new Peop e feel l ke it?s going to be an even h gher-end uxury property market?

In fact,the post-disaster market is exper enc ng ncreased interest part cularly where there are opportun t es for rebui d ng or new construction An Apri 2025 report by The Wal Street Journal supports this and found that wea thy individua s cont nue to move to locat ons that are at r sk of c imate events and are ?setting homepr ce records when they get there? ndeed,despite recent storms,two cit es a ong Forida?s west coast,Naples and Tampa,were identified by advisor Henley & Partners as ?future wealth hotspots? n ts USAWea h Report 2024

The financ al toll of the Los Ange es wildfires

US$22 bill on n rea estate ost in Pacif c Pal sades

US$78 bi ion in real estate lost in A tadena

Source Los Ange es T mes

US$7.8B Altadena

One of the key advantages of rebu ding w th d sasterresistant eatures is the potent al for long-term financia benefits Homes built to withstand future d sasters attract reduced nsurance premiums and offer greater long-term value and peace o m nd for their owners Moreover,many mun cipalities now mandate better safety measures as part of the rebui d ng process

This trend s particu arly evident n coastal reg ons, where modern construction standards are p ay ng an increasing y sign f cant ro e n shaping rea estate markets ?The contrast between o der and newer homes in coasta markets has never been more apparent,?says Budge Huskey,pres dent and CEO,Prem er Sotheby?s Internat onal Realty,which has off ces n Forida and North Carolina

?In some cases a beachfront home may susta n catastroph c damage,while a neighbor ng s ruc ure bui t under more stringent regulations remains v rtua ly untouched Forida?s 50% ru e underscores this dynamic, requ ring that any home susta n ng damage exceeding 50% of the value of mprovements is rebu lt or rep aced to meet current codes Wh le his may seem r gid,it ensures the con inued enhancemen o coasta infrastructure,fos er ng a market where builders and buyers al ke can se ze the opportun ty to crea e resi ient res dences??

The recent impact of Hurricane Helene was ess pred ctable for homeowners n North Carolina For examp e, Biltmore Forest, among the most des rable upscale res dentia commun ties in Ashevil e, s est mated to have lost 100,000 trees, but on y 35 homes were damaged

?The event led to widely disparate outcomes, with some small vi ages along rivers destroyed, wh le other areas primarily suffered tree damage,?says Huskey ?Ashevil e experienced err b e destruction n some areas from he flooded r ver, but other places saw m ted or no damage whatsoever to structures?

The res ience in th s case app ies to the area?s market overa l, rather than nd vidua propert es. ?Clos ngs were delayed, yet most pend ng ransact ons moved forward. Most of the propert es that were damaged were repa red and returned to the market,w h the exception of the most h ghly mpacted areas Wh le the ev dence of He ene rema ns significant to this day,

months after the event, the vas major ty of homes on the market are undamaged?

Add tional y, a pat ern of market recovery emerged immed a e y following the hurr cane According to an October 2024 repor by HousingWire, new home l st ngs n the Ashevil e, North Caro ina metropo itan area ?snapped back sharply?c oser to normal levels in the week fo lowing Hurricane Helene, with sources report ng that ?ou -otown nvestors were among the most nterested buyers?

Coasta markets wor dw de have also implemented measures to mit gate the impact of natural d sasters and ensure long-term stab ity ?Phuket and Koh Samui n Tha land have been affected by ma or storms over the years, a though propert es there haven? t su fered as bad y as those battered by the hurricanes n the U S ,?says Fe ix Des ardins, g oba real estate advisor, List So heby?s International Rea ty, Thai and ?A particu arly catastroph c disaster was the 2004 Ind an Ocean tsunam , which severe y damaged arge

parts of the western coast of Phuket That location is thriv ng at the moment and is the most n-demand The government has tsunami alarm systems n p ace and estab ished safe evacua ion routes A though a tsunami of that strength s probab y a once- n-a- ifet me event, some buyers are avoiding the beachfront and opt ng for h llside ocat ons just n case.?

Th s cau ious approach by buyers mirrors a broader g obal trend, where both regulatory mprovemen s and shifting buyer pr orit es are shaping the future of uxury rea estate in d saster-prone regions ?Over the years, two key trends have emerged n response to natural events,?Huskey says ?First, mun cipa bu lding codes for new construct on cont nue to evo ve, re nforcing homes aga nst severe storms through elevated structural requirements Second, buyers are becoming ncreasingly selective, evaluat ng propert es not only for the r festyle appea but also for the r long-term nvestment viabi ty based on perceived r sk?

For some homeowners, he emot ona and financ a burden of rebuilding a ter a d saster? pa red with the uncerta nty of future events? eads them to consider relocating

In many cases moving ust a short distance can prov de a sa er l ving environment, wh le maintaining proximity to famil ar surround ngs ?We see many people moving away from the coast? but not too far away?says Mel nda

Gunther, global rea estate adv sor, Premier Sotheby?s

InternationalRealty n Nap es, Florida ?Beachfront peop e arehappy o ooktwo or three m les in and?

This shift in behavior has a d rect mpact on rea estate markets and underscores the grow ng nfluence of cl mate change on where and how people choose to live, w th someregions a ready seeing sh fts n buyer preferencesand housing demand

?Wh eNorth Caro na?s real esta e market has yet to exper ences gn f cant shifts due to recent storm act v ty F or da?s coasta reg ons are seeing nuanced changes in buyer behavior,?Huskey says ?The mpact of storm surges caused by recent hurr canes has prompted some long-term residents to consider transit oning to country c ub communit es or uxury condom n ums pr or t zing the convenience of a ?lockand-leave? festylewith reduced property ma n enance?

In other countr es, regions susceptible to natura disasters may differ from pr meluxury rea estate locations, as in Japan, where ma or earthquakesh t the southern sland of Kyushu n 2024 and 2025 ?In the Tokyo metropo tan area our ma n arget area,we have not seenany price hikesor dec nes due to natura disasters,?says Kantaro Aoki,g oba rea estate adv sor, Lis Sotheby?sInternat ona Realty, Japan ?Th s may be due to thefac that the areawas not near the epicenter of the recent earthquakes?

Interes ingly,re ocat oncan a so crea e new opportun t es When homeowners eave d saster-prone areas, their homes become ava lable to newcomers? somet mes making these regions more des rable n the long run ?In the weeksfol ow ng Hurr caneHelene, our ?

advisors in North Carolina faci itated two record-breaking sa es? sett ng new pr ce benchmarks for the ent re state,? Huskey says

One of these sa es? a 5,200-square- oot four-bedroom home on f ve acres in L nv le,North Caro ina,that only had generator power fol ow ng the storm? c osed for an mpressive US$14 m ll on ?As expected,market activity temporar y softened in the mmediate aftermath as buyers and se lers reassessed conditions,but the resil ence o the uxury sector rema ns evident, dr ven by a long-term v sion and confidence in these coveted markets.?

By adapt ng to evo v ng r sk actors and shift ng preferences both buyers and se lers are p aying a role n shaping the future of rea estate n disaster-prone areas

As climate-driven events become more common, rea estate markets are respond ng with a mix of resil ence, regulation and strategic decision-mak ng In high-impact areas inc ud ng Pacific Pa isades and Altadena, property values rema n strong desp te sign ficant osses, as many homeowners choose to rebuild with enhanced d sas erres stant features, often encouraged by more f ex b e bu d ng codes Meanwhi e, others are opting to relocate, fue ng demand n adjacent, less-a fected areas and reshap ng buyer behavior

For se lers, this means a potent a ly competit ve market if they stay and rebui d w th modern safety standards, ncreasing ong-term property appea For buyers the curren climate presen s opportun ties to enter prev ously inaccessible uxury property markets ? though often w th a higher emphas s on nsurance, structura resi ence and risk mit gat on Ult mately, whether stay ng or mov ng, homeowners mus we gh ifesty e preferences aga nst evo ving risks and he econom c realities of cl mate change -

Safeguarding wealth with specialized coverage

THE NEIGHBORHOOD W ILL BE EVEN MORE DESIRABLE AFTER THE REBUILD BECAUSE EVERYTHING W ILL BE NEW

JOE CILIC

global real estateadvisor,Sotheby?sInternational Rea ty

- PacificPalisadesBrokerage

Insurance po ic es to cover the possess ons and property of the wea thy are far from one-s ze-f ts-a Their assets may encompass everyth ng from mu timi ion-dol ar estates to rare cars, w ne cellars, yachts and price ess co lections of fine art, so h gh-net-worth indiv dua s (HNWIs) frequen ly turn to specia st nsurance professionals and companies ?When adv s ng cl ents on protecting their property, the first step is ensur ng they have a robus nsurance po icy tai ored to its value and un que features, ncluding coverage for h gh-end finishes, smart home technology and add tiona struc ures such as guest houses or poo s,?

says Chase Mizel g oba real estate advisor, At anta Fine Homes Sotheby?s Internat onal Realty ?I a so recommend consult ng a r sk management special st to exp ore excess abil ty coverage and flood nsurance, even f their property is not in a f ood zone?

For luxury homeowners, rebuilding a home fo lowing a d saster can be compl cated Many HNWIs nvest heav y n bespoke arch tec ure, custom f nishes and rare ma er als that can be hard to source or rep icate Luxury homes a so often come with bespoke features such as extensive landscaping, indoor swimming poo s and advanced home technology, a l of which can significantly ncrease the rebu lding cost Trad t ona home insurance pol cies, such as the state-sponsored Cal orn a Fair Access to Insurance Requirements (FAIR) Plan, wh ch has a max mum coverage of US$3 mi ion, may not adequately cover these assets Luxury homeowners may

need po ic es that account for the cost of rebuilding w th higher-qual ty materia s and design services

One mportant opt on is a guaranteed or extended replacemen cost po cy ?Guaranteed replacement cost provides more coverage than standard replacement cost,?says Carolyn Bor s,v ce president and product development manager,personal risk services,for insurance company Chubb ?In general,guaranteed replacement cos means the nsurer w ll repair,rep ace or rebui d damaged property to the same or similar design,us ng materials and workmansh p of comparable quality Depending on the insurer and the state where he property is located,the cost to repa r,replace or rebu ld may exceed the amount stated n a standard rep acement cost po cy?It can even cover an unl m ted amount or a spec f ed percentage over he po icy amount,Boris adds Wh e policies like these come at a premium they offer valuable peace of mind Guaranteed replacement cost coverage ensures that the homeowner won? t be eft to cover the difference should rebuilding costs exceed the po icy?s limit ?Al insurers that spec alize n insur ng h gh-value homes offer some form of

guaranteed replacement cost coverage, though they may have different names for t, such as extended or enhanced rep acement cost coverage,?says Boris Items such as f ne art, rare ant ques, des gner c othing, high-end ewelry and uxury watches are just some o the objec s tha can be damaged when a home s destroyed Standard insurance pol cies often a l to account for the true value of such items, which is where specia zed polic es come into play Any valuable item shou d be appraised by an expert to determ ne its current market value Once the va ue s agreed upon a spec a ized nsurance po icy can be created to ensure the asset is suff cient y protected ?We recommend that col ectors update any appra sa s on a regu ar basis to ensure items are nsured n line w h the market,?says Laura Doy e, senior v ce pres dent of fine art and va uab e co lections product manager at Chubb

?For most va uab e objects, the recommended t me frame for reappraisal s every three to f ve years In more dynamic markets, such as post-war and contemporary ar , we recommend rev ew ng va ues every one o three years Insurance schedules should be updated

with the most current values Appraisal feesshould be based on an hour y rate and never t ed to the va ue of an item ? Wealthyindiv dua s often hold their proper y in rusts to preserve wealth through generat ons and to mit gate tax iabil ies. However, when it comes to nsurance, the structure of the property ownership can add an extra ayer of complexity A common mistakeamong HNWIsis neg ect ng to havethe rust named as the owner on he nsurance pol cy This overs ght can create potent al egal and financia prob emsif someth ng were to happen to the property ?Ho d nga res dence in a trust offers pr vacy,estate planning benef ts and asset protection,?Mizel says ?It allows the owner to control how the property s managed and ransferred,whi e avo d ng probate and potentia ly reducing esta e tax exposure It is crit cal that the trust scorrect y listed as the owner on the nsurance po icy Many nsurers require additional endorsements or spec fic anguage n the po icy to ensure proper coverage Clientsshould work c ose y with the r estate a torney and insurance provider to structure the trust appropr ate y and avo d coverage gaps?-

A look at thelocationsthat arebecoming or re-emerging ascentersfor high-end living

Demand for h gh-end goods and real estate m ght not run in tandem, but they are both good indica ors of emerging or mproving uxury markets n February 2025, for example, Sotheby?s held ts first internat ona auct on in Saudi Arabia

The sale in the histor c town of D riyah ncluded fine art, watches, ewelry, handbags and sports memorabi ia In downtown San Franc sco, Ca forn a, meanwhi e, esteemed interna ional brands are mov ng into premises that had been vaca ed due to the c ty?s cha lenges fo ow ng the pandemic India?s h ghnet-worth individuals? whose numbers are ncreasing? are also develop ng an appetite for expens ve branded products and propert es, while Puerto Rico s becom ng a popular ocat on for wealthy peop e seek ng vacat on properties or second homes

In 2024, the g obal market for persona uxury goods experienced its first correction n 15 years A though sales were down by lit le more than a percentage po nt from the prev ous year, some analysts believe the change cou d signa a potent al slowdown in the luxury marke overall ?A of the industry?s growth-driv ng eng nes have stalled,?was he assessment of consultancy McKinsey & Company in ts January 2025 repor The State of Luxury: How to Nav gate a Slowdown

However, analysts at fel ow consultancy Bain & Company believe the ong-term rend for luxury spending remains posit ve, though there has been a significant sh t in consumer preferences, accord ng to a press re ease from November 2024 ?Luxury spend ng has shown remarkab e stabil ty his year despite macroeconomic uncerta nty, arge y dr ven by consumers?appetite for luxury experiences,?said Claudia D?Arpiz o, Bain & Company partner and ead author of the company?s annual Luxury Goods Report

Ba n?s tracking encompasses nine categor es, ncluding cars,hosp ta ity, personal goods and art There was a notable shift towards categories such as gourmet food and fine dining (up 8%) and private yachts and ets,with spend ng up by 13% The market for cru ses grew by 30% Meanwhile, he 2025 M d-Year Sotheby?s International Rea ty agent survey identified art and cars as the eading luxury products h gh-end homeowners a so nvest n Luxury consumer behavior doesn? t stop at goods and experiences? t has fundamental y reshaped expectations n high-end rea estate markets as we l.

The shift toward ?exper entia luxury? s an evolv ng consumer tra t that has become prom nent n rea estate, particu arly at prem um price po nts ?What?s dr ving today?s high-end market is the fee ng a home de vers as much as ts address,?says Tammy Fahmi, sen or v ce pres dent of globa servic ng and s rategy

Sotheby?s International Rea ty ?What we?re witnessing n luxury rea estate sn? t ust a trend? t?s a fundamental redefinition of value This exper entia revolution transcends cultural boundaries, with buyers w ll ng to pay substantial prem ums for propert es that offer exceptiona fea ures that ref ect the r l estyles?

This is backed up by findings in the 23rd edit on of the annua Luxury Study, re eased in January 2025 by Bain & Company and Fondazione A tagamma, the rade association of Ita ian uxury goods manufacturers Accord ng to the report desp te a s ight decrease of 1% to 3% in overa l uxury spending in 2024, wh ch totaled ?148 tr lion g oba ly compared to the year before, ?luxury exper ences mainta ned faster-thanaverage growth as consumers continued to move the r spend ng to ravel and soc al events?Look ng ahead, the study?s research ?suggests a sl ghtly improving context throughout 2025? though th s is highly dependent on the unfo d ng macroeconomic scenarios in key regions Looking oward 2030, the market will likely embark on a long-term pos ive trajectory, with a growing addressable consumer base?

Across each of the fo lowing marke s, we observe d st nct patterns n how luxury property and goods evo ve together In some regions, rea estate nvestment precedes reta growth while in others, established luxury experiences attract wealthy property buyers, demonstrating how these tw n markets reflect and re nforce ocal wealth creation ?

Top passion investments made by luxury homeowners

Source: 2025 M d-Year Sotheby?s nternationa Rea ty agent survey

LUXURY SPENDING HASSHOWN REMARKABLE STABILITY THISYEAR DESPITE MACROECONOMIC UNCERTAINTY,LARGELY DRIVEN BY CONSUMERS? APPETITE FOR LUXURY

In Saudi Arabia, the phrase ?g ga-pro ect?

s finding ts way nto real estate conversat ons as new urban and resort developments w th the potential to change the concept of luxury ving ake shape As recent y as 10 years ago, luxury propert es n Saudi Arabia had few amenit es, says Er ck Kna der, managing partner Saud Arabia Sotheby?s nternat onal Realty ?But with the country open ng up and the Saud Vis on 2030 init at ve, coupled with an

inf ow of execut ves and fore gn compan es, demand for upsca e deve opments with amen ties has been on the r se?Saud Vis on 2030 is a mu t -year b ueprint to diversify the economy and crea e a dynamic environment for bo h loca and internat ona investors Now in its second phase, t has sparked a number of o her g ga-pro ects

A mass ve new deve opment at Diriyah, near the capital, Riyadh, is ushering in a fresh understanding o urban luxury ?This project s not just a bu d ng,? Knaider exp a ns W h state-of-the-ar infrastructure, branded and non-branded

high-end residences, commerc al spaces, restaurants, schools and univers ties, it is bas ca y a city within a city ?You never need o eave unless you?re go ng to he a rport,?Knaider says ?Even the non-branded resident al components are bu lt to a comp ete y different standard Every brand under the sun w ll be there, whether it?s Ritz-Carlton Ra fles, Baccarat or Cor nth a res dences Even Aman s sett ng up a deve opment ? Accord ng to Knaider, wealthy Saud s are fami ar with the assurance of white-glove serv ce and the superior qual ty a brand de vers High-net-worth

consumers brings m lar expectat ons o uxury goods A divers ed economy s one aspect of the Saud Vision 2030 nit ative that ?has led to a rise in uxury reta l spaces and ncreased opportun ties or global luxury brands to enter the Saudi Arab a market,?accord ng to a report pub shed n December 2024 by Ken Research, a global market nte igence consu tancy