Q4 MARKET SNAPSHOT

15,635,554 SF

11.1% Asking Rents

YTD Deliveries $30.24 SF 30,000 SF 145,900 SF

Q4

• CHARLESTON’S OFFICE MARKET REMAINED STRONG THROUGHOUT 2024 WITH RENTAL RATES INCREASING AND VACANCY RATES DECREASING.

• MORE COMPANIES ARE IMPLEMENTING BACK TO OFFICE WORK POLICIES IN 2025 TO INCREASE PRODUCTIVITY AND COLLABORATION.

• THE PREFERENCE FOR CLASS A OFFICE SPACE IN AMENITYRICH AND WELL-MANAGED LOCATIONS CONTINUES.

• THROUGHOUT THE REGION, NEW CONSTRUCTION AND INVESTMENT SALES HAVE BEEN LIMITED DUE TO HIGH INTEREST RATES, HIGH CONSTRUCTION COSTS, AND LONG ENTITLEMENT PROCESSES.

• NEW CONSTRUCTION AND DEVELOPMENT OF QUALITY BUILDINGS IS IN DEMAND FOR CHARLESTON’S OFFICE MARKET TO CONTINUE TO GROW.

• At the conclusion of 2024, Charleston’s office market was impacted by local, national, and international marketplace changes including:

Hybrid and Remote Work Policies: The ‘Back to Office’ trend continues with more companies offering incentives or mandating requirements to get their employees back to the physical office.

Inflation: In 2024, many markets saw significant increases, not only in construction costs, but all operating expenses such as taxes, insurance, utilities, and labor-related expenses.

Interest Rates: The higher than normal interest rate market in 2024 put significant pressure on commercial loans that needed to be renewed. The new normal for exit caps have hit new highs for all office classes.

Election Year: The highly debated presidential election has put companies at a crossroads, uncertain which policies a new administration will implement.

• Despite challenges in 2024, Charleston’s office market has shown resilience. The market saw record rents of $55 full service on select new construction and overall vacancy rates continued to decrease to approximately 11.1% at the end of 2024.

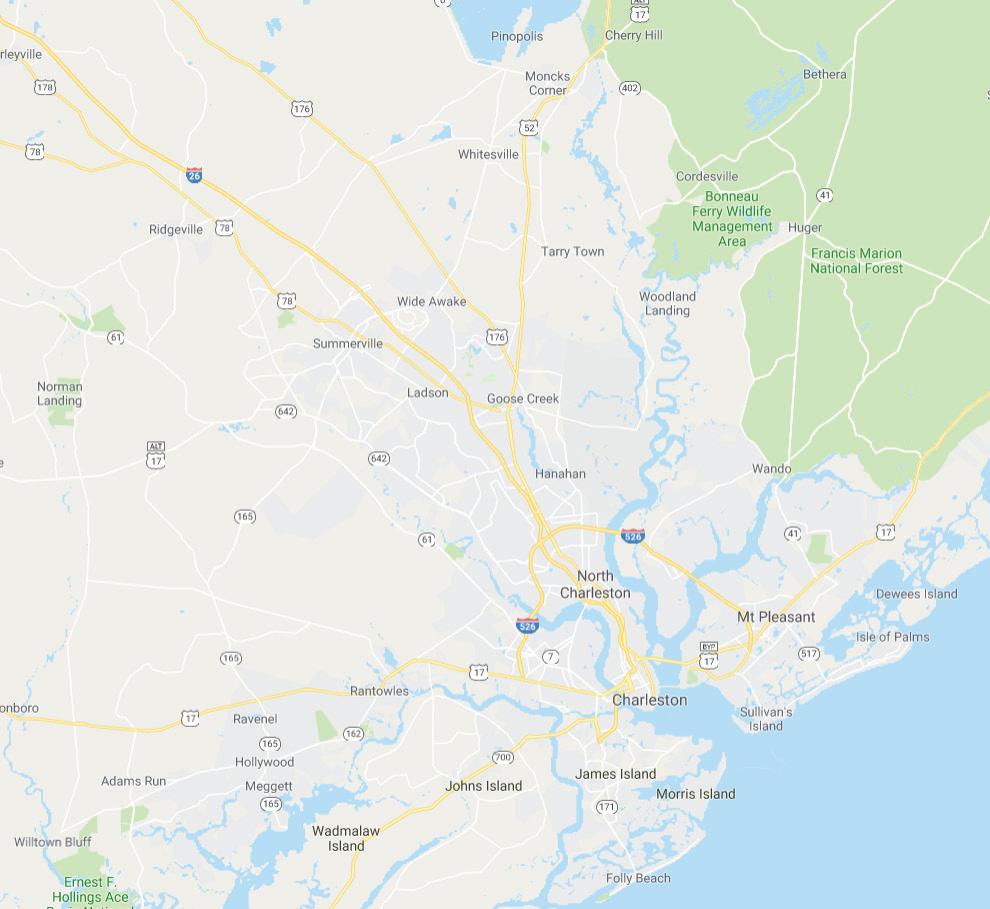

• The year ends with positive demand and absorption for quality space, specifically, the Downtown, Mount Pleasant, and Summerville submarkets where demand has outpaced supply.

• Additionially, suburban projects like Dayfield Park in Nexton, Navy Yard near Park Circle, and Pointe Hope off Clements Ferry blend office, residential, and retail spaces to meet the demand for livework-play enviornments.

• With limited new construction and few new developments, the market can anticipate positive absorption of existing space for the upcoming year; thus signaling a need for new office product.

• Aerospace, advanced manufacturing, and port-related logistics continue to anchor the region’s economy, fostering corporate expansions that buoy the office sector. This mix, coupled with Charleston’s lifestyle, positions the city for continued office market resilience.

• Even as remote and hybrid work remain prevalent nationwide, Q4 saw an increase in companies recommitting to physical office footprints, driven by improving labor markets and the need for collaborative spaces.

• For example, Amazon is emphasizing a return to office as of 2025 to boost productivity and collaboration. While some, like JP Morgan are mandating a return to full time office work.

• To incentivize employee return, companies are choosing environments with shared amenities that are walking distance to restaurants, retailers, hotels, and other experiences.

• Nexton, located in Summerville, has several office developments that have been successful based on this amenity-rich model.

FLIGHT TO QUALITY TREND CONTINUES INTO 2025

Leasing activity continued into Q4 with tenants prioritizing flexibility, parking availability and upgraded building finishes. This flight to quality trend will continue into 2025.

M.C. DEAN

M.C. Dean opened the doors to its newest 25,000-square-foot office in North Charleston during a ribbon-cutting ceremony on Thursday, December 12. This newly constructed facility will bring more than 125 new job opportunities in the state.

Global game developer PTW will relocate to Booz Allen Hamilton’s former office space at 2387 Clements Ferry Road on Daniel Island.

SYNOVUS

The Morris, located at 1080 Morrison Drive, secures Synovus Bank as its final tenant. The financial services company is leasing 17,470 square feet on the 3rd floor for its new corporate headquarters.