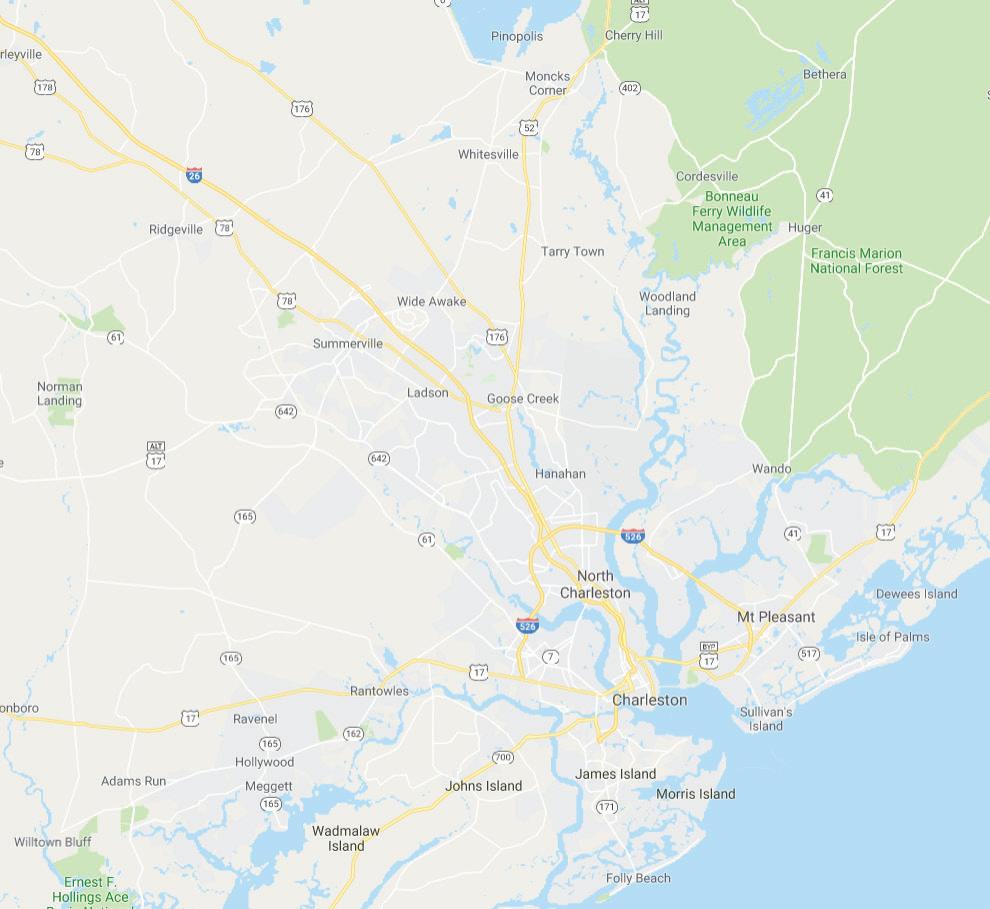

CHARLESTON OFFICE MARKET REPORT

Q3 MARKET SNAPSHOT Inventory

15,579,554 SF Vacancy 11.1% Asking Rents

$30.04 SF 30,000 SF 145,900 SF

Deliveries

Q3

HIGHLIGHTS & TRENDS

• CHARLESTON CONTINUES TO OUTPERFORM NATIONAL TRENDS, PARTICULARLY IN NET ABSORPTION. OVERALL ABSORPTION HAS BEEN POSITIVE IN 2024.

• CLASS A PRODUCT IS DRIVING MARKET RENTS TO RECORD HIGHS, SPECIFICALLY IN DOWNTOWN AND NEXTON, WHICH IS IN THE SUMMERVILLE SUBMARKET.

• THE CONVERSION OF CLASS B OFFICE SPACE IS ON THE RISE, ESPECIALLY IN THE NECK AREA OF THE PENINSULA AND NORTH CHARLESTON.

• NEW CONSTRUCTION, CURRENTLY LED BY THE MEDICAL SECTOR, HAS AND WILL LEAD TO NEW SALES FOR USER BUYERS.

• CURRENT COST OF DEBT AND HIGH CONSTRUCTION COSTS, COMBINED WITH THE UNCERTAINTY OF AN ELECTION YEAR HAS CAUSED A LACK OF NEW CLASS A OFFICE PRODUCT.

Q3 2024 KEY TRENDS

• Charleston’s lifestyle continues to attract more people and companies to the area, which is creating more demand for office space.

• Class A new deliveries such as Ice House and Dayfield Park are leasing quickly. The first phase of Dayfield Park in Nexton is approximately 88% leased within 90 days of delivery.

• With new construction in demand and very little new product in the pipeline, rents are increasing and vacancy is decreasing.

• Class A rates remain strong and have kept pace with inflation. We are seeing more full service rents in the $40 per square foot range, and above.

• The average transaction size has remained around 3,0006,000 SF, however, the volume of transactions has increased the last few quarters, significantly leading to continued positive absorption.

LEASING ACTIVITY GAINS MOMENTUM

• Faber Crossing and 4055 Faber Place Drive, second generation spaces, are fully leased as of Q3.

• The Morrison Yard and The Morris are now fully leased. Overall vacancy downtown has decreased to 9% in Q3.

• 201 Sigma saw two new leases this quarter, including SCRA and an undisclosed office user for a combined 10,000 SF leased.

• Non-traditional office space or multiple building, single-story projects are leasing quickly thanks to demand from the medical sector.

• There is a growing pent up demand for new office projects throughout the region, with many companies considering building their own facilities instead of waiting for new developers from the market.

INVESTMENT SALE ENVIRONMENT

• Investment sales are anticipated to pick up as national interest rates decline. Strong investment fundamentals in Charleston continue to support future income-producing sales.

• Office investors are taking advantage of larger markets that have been hit harder by the national office market decline. Charleston’s office market has stood strong and office cap rates are trading around 7% to 9%, compared to larger markets at 10% to 13%, which to the patient, more riskadverse investor, seems more favorable at this time.

• Lack of new development and an active redevelopment pipeline will continue to bring the U.S. office market into balance faster than many market participants may realize.

• We believe that the office investment market in Charleston is well underpriced at the moment given the strength of the underlying fundamentals.

WHY OFFICE PROJECTS IN NEXTON ARE SEEING SUCCESS

• Compared to traditional office developments in the region, Nexton has excelled both in absorption and pricing due to the overall community-based development.

• Instead of one large building, Nexton offers a community of several welldesigned office concepts.

• Nexton provides a complimentary mix of uses from office to residential and retail that are easily accessible or walkable.

DAYFIELD PARK

Stage I is 88% leased upon delivering in Q3. Now leasing Stage II.

THE HUB AT NEXTON Phase I is 45% leased, with only 50,000 SF remaining in Phase II.

ATELIER DOWNTOWN NEXTON Building 2 is ready for tenant build-out and Buildings 1 and 3 will deliver in 2025.