CHARLESTON OFFICE MARKET REPORT

Q1 MARKET SNAPSHOT

15,526,243 SF

Q1 HIGHLIGHTS & TRENDS

• CONTINUED POPULATION GROWTH AND BUSINESS RELOCATIONS TO THE REGION ARE BRINGING FAVOR TO THE OFFICE MARKET.

• THE OFFICE MARKET SAW AN INCREASED AMOUNT OF TENANT ACTIVITY THROUGHOUT Q1.

• VACANCY IS DECREASING, RENTAL RATES ARE INCREASING AND DEVELOPMENT IS LIMITED.

• INVESTMENT VALUES ARE ADJUSTING TO THE HIGHER INTEREST RATES AND HIGHER OPERATING COSTS.

• TENANTS ARE FAVORING WELL-MAINTAINED, MODERN BUILDINGS WITH INTERNAL AMENITIES OR WITHIN WALKING DISTANCE TO AMENITIES.

• THE LATEST WAVE OF NEW CLASS “A” OFFICE BUILDINGS IN DOWNTOWN CHARLESTON ARE ACHIEVING RECORD RENTS AND HITTING HIGH OCCUPANCY LEVELS.

WWW.BRIDGE-COMMERCIAL.COM

Q1 2024 | CHARLESTON, SC

Inventory

Vacancy

Asking

Construction YTD

$30.68

13.3%

Rents

Deliveries

SF 69,130 SF 92,900 SF

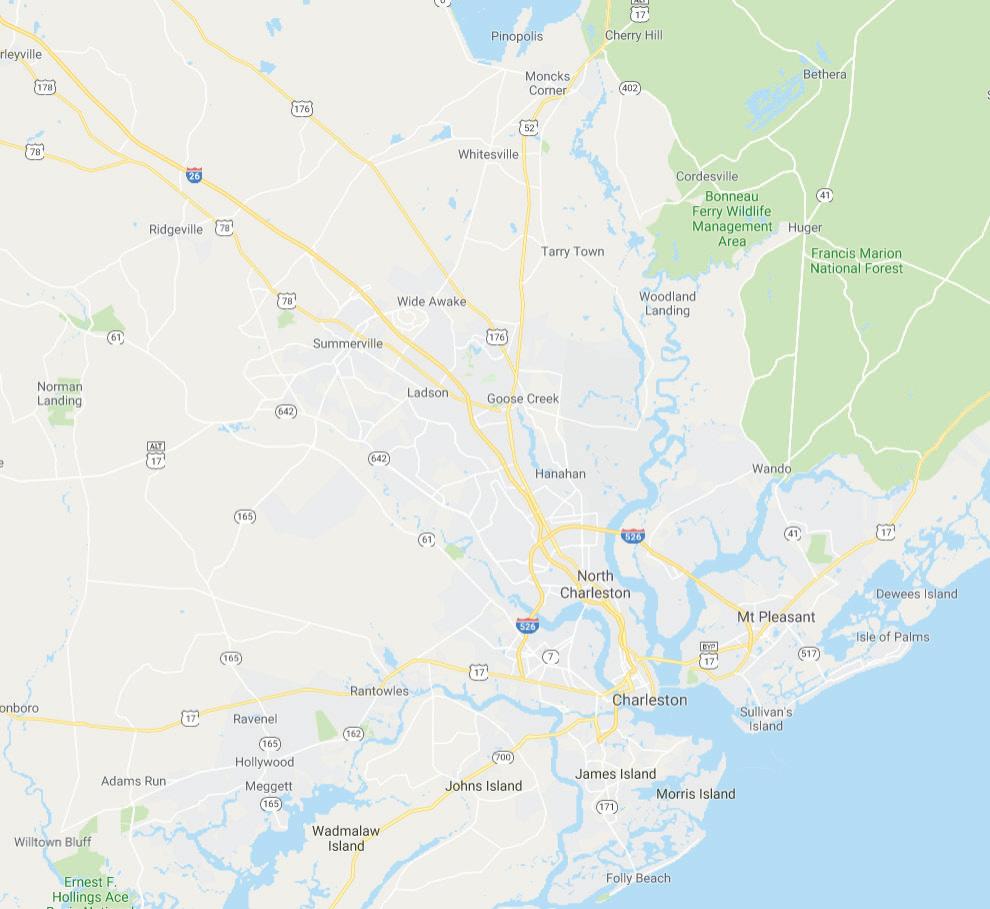

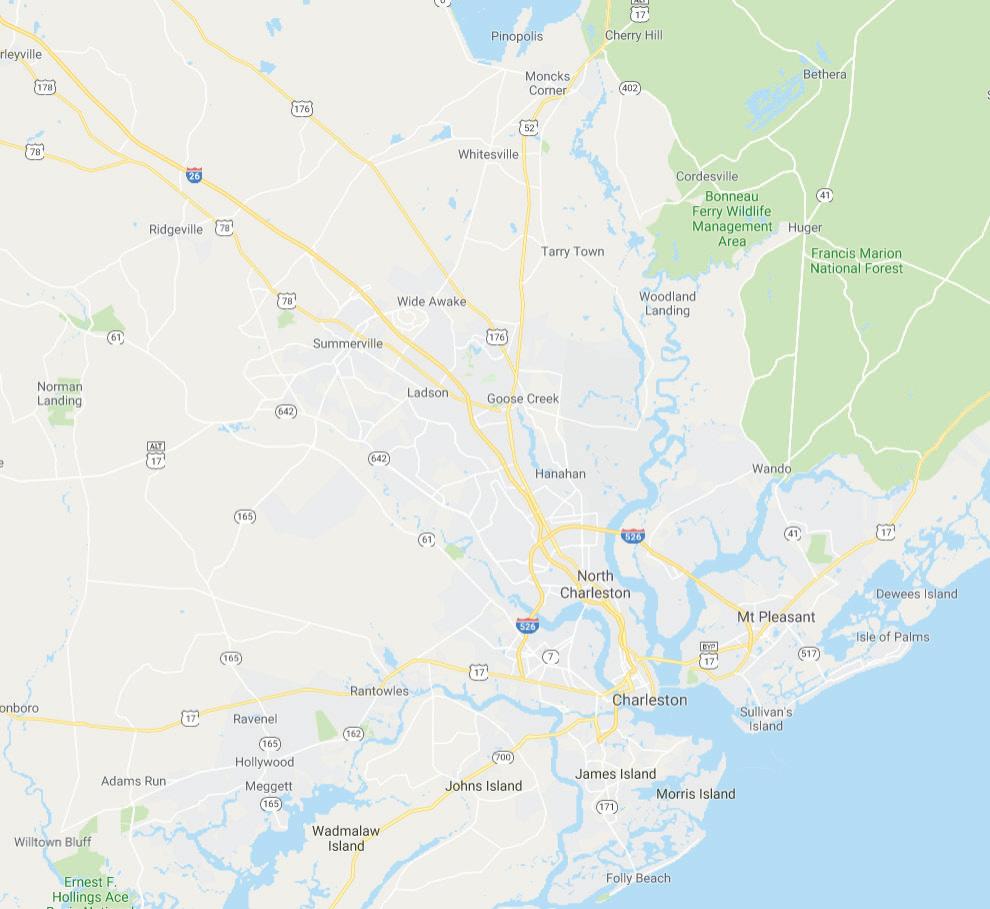

WWW.BRIDGE-COMMERCIAL.COM Lower North Charleston 3,161,108 405,039 39,906 444,945 $26.95 14.1% - 63,000 Upper North Charleston 2,499,810 250,393 15,000 265,393 $23.30 10.6% -Mount Pleasant 2,235,365 169,476 14,323 183,799 $30.54 8.2% -Summerville 1,021,427 27,735 25,300 53,035 $30.07 5.2% 69,130 14,400 West Ashley 1,175,284 70,559 13,228 83,787 $24.88 7.1% - 15,500 TOTAL SUBURBAN 11,971,730 1,158,459 457,823 1,616,282 $27.77 13.5% 69,130 92,900 TOTAL MARKET 15,526,243 1,537,959 524,681 2,062,640 $30.68 13.3% 69,130 92,900 Bridge tracks buildings 10,000 SF and greater, excluding medical office and user-owned buildings. Bridge uses only internal research within its Charleston office for its market research. Source: Bridge Commercial 26 526 17 17 52 17A 78 UPPER NORTH CHARLESTON 10.6% Vacant $23.30 FS MOUNT PLEASANT 8.2% Vacant $30.54 FS DANIEL ISLAND 31.2% Vacant $31.09 FS WEST ASHLEY 7.1% Vacant $24.88 FS LOWER NORTH CHARLESTON 14.1% Vacant $26.95 FS DOWNTOWN 12.6% Vacant $39.45 FS SUMMERVILLE 5.2% Vacant $30.07 FS UNDER CONSTRUCTION PROPOSED CONSTRUCTION Q1 2024 charleston OFFICE MARKET REPORT PG. 2

OFFICE TENANT ACTIVITY INCREASES

WAVE OF OFFICE BUILDINGS DOWNTOWN LEASING QUICKLY Q1 RECAP

• 2024 began with an increase in office tenant activity centered around growth in the homebuilding and financial service sectors due to more people moving to the Charleston region.

• Additionally, a movement of ‘back to office’ is happening as more remote workers shift from working from home to working back in the office.

• Executive office space, such as Concept and Office Evolution, are witnessing high occupancy rates as more small businesses are getting off the ground.

• These trends reflect the recent decrease in vacancy in the first quarter to 13.3%.

• Rental rates are also trending higher. Downtown rents are in the mid to high forties, full service, for new Class “A” space with parking costs of $165-$225 per space per month.

• Asking rents for office space in suburban submarkets are expected to follow suit with rent likely to rise during 2024-2025.

A CASE FOR NEW OFFICE DEVELOPMENT

• The majority of new office developments that commenced construction before or during COVID are close to full occupancy.

• Overall vacancy is showing a downward trend and development is limited, however, rental rates will need to continue to increase to justify new construction.

• The challenge for office development in the Charleston region is that development costs and operating expenses, specifically taxes and insurance, coupled with ongoing inflation, have dramatically increased over the last few years, while coinciding rental rates have not kept up the same pace.

CHARLESTON CONTINUES TO ATTRACT & EXPAND COMPANIES

• Recent announcements provided by Charleston Regional Development Alliance and other economic development initiatives have shown the resilience of the Charleston market in attracting new companies.

• The Charleston region witnessed companies bringing new technology and initiatives, as well as firms moving to the area that specialize in providing capital and financing options.

BRIDGE-COMMERCIAL.COM

Q1 2024 charleston OFFICE MARKET REPORT PG. 3

NEW

MORRISON YARD | 145,000 SF 93% LEASED THE MORRIS | 120,940 SF 71% LEASED THE QUIN | 110,000 SF TOTAL 68% LEASED 677 KING STREET | 68,000 SF 93% LEASED

Photo source: morrisonyardoffice.com

Photo source: themorrischarleston.com

Photo source: thequincharleston.com

Photo source: cbre.com

Q1 2024 charleston OFFICE MARKET REPORT www.bridge-commercial.com SIGN UP FOR MARKET REPORTS AT MARK A. MATTISON, CCIM, SIOR Executive Vice President mark.mattison@bridge-commercial.com COLBY FARMER Senior Associate colby.farmer@bridge-commercial.com BRIDGE COMMERCIAL 25 Calhoun Street, Suite 220 Charleston, SC 29401 Tel +1 843 535 8600 info@bridge-commercial.com OFFICE ADVISORS PETER FENNELLY, MCR, SIOR, SLCR President peter.fennelly@bridge-commercial.com Bridge Commercial uses only internal research within its Charleston office for its market data. Bridge Commercial makes no guarantees, representations or warranties of any kind, expressed or implied, including warranties of content, accuracy and reliability. Any interested party should do their own research as to the accuracy of the information. Bridge Commercial excludes warranties arising out of this document and excludes all liability for loss and damages arising out of this document. HAGOOD S. MORRISON, II, SIOR Executive Vice President hs.morrison@bridge-commercial.com INVESTMENT SALES THE HUB @NEXTON BUILDING 2 Summerville 50,000 SF Available FABER CROSSING North Charleston 2,566 SF Available OFFICE OPPORTUNITIES MICHAEL KELLY Brokerage Associate michael.kelly@bridge-commercial.com MEREDITH MILLENDER Vice President of Property Management meredith.millender@bridge-commercial.com PROPERTY MANAGEMENT BRIDGE OFFERS PROPERTY MANAGEMENT, ACCOUNTING & PROJECT MANAGEMENT SERVICES NEED PROPERTY MANAGEMENT EXPERTISE? COLBY FARMER Associate +1 978 998 9243 colby.farmer@bridge-commercial.com WWW.BRIDGE-COMMERCIAL.COM MARK MATTISON SIOR, CCIM Executive Vice President +1 843 437 1545 mark.mattison@bridge-commercial.com OFFICE SPACE FOR LEASE LOCATED IN HIGHLY SOUGHT-AFTER EXECUTIVE PARK AT FABER PLACE $28.00 RSF FULL SERVICE 2,032 RSF - 34,816 RSF CLASS A OFFICE 4105 FABER PLACE DRIVE, NORTH CHARLESTON, SC 29405 OFFICE SPACE FOR LEASE Developed, Leased and Managed by Holder Properties MICHAEL KELLY Associate +1 843 568 2970 michael.kelly@bridge-commercial.com FABER POINTE North Charleston 11,045 SF Available ATELIER Summerville 36,000 SF Available (Phase I) THE LANDING Daniel Island 15,978 SF Available DAYFIELD PARK @ NEXTON Summerville 20,485 SF Available (Phase I) 134 MEETING STREET Downtown 1,894 SF Available 40 CALHOUN Downtown 8,200 SF Available DANIEL PELLEGRINO Executive Vice President daniel.pellegrino@bridge-commercial.com