Bridge Commercial is pleased to present Pad 1 (the “Property”) of the Pine Hill Business Campus, located in the greater Charleston MSA. This a build to suit with the possibility to lease or potentially purchase the land and development phase. Also, an opportunity to acquire a premier development ready site within a Class A industrial park. The area is in a rapidly growing Summerville submarket as part of the Greater Charleston market. The Pine Hill Business Campus is unparalled in its infrastructure availability including immediate utility access, wide master-planned roads, and an amenity-rich park setting.

The site is well positioned for a wide variety of users including light assembly and manufacturing users relocating to the Charleston area. Auto manufacturing suppliers as well as suppliers to the EV, battery manufacturing and related businesses would locate here.

Housing for employees is supplied by the nearby Summers Corner and The Ponds subdivisions. This community includes new schools, walking parks and a number of differently priced communities.

The area boasts a highly skilled workforce, well known training programs, and a business friendly environment with the unionization rate well below the national average.

Nearby users include Brightline Extrusions, ShowaDenko Carbon, Robert Bosch, and Wabco Compressor Manufacturing Company.

INDUSTRIAL BUILD TO SUIT AVAILABLE

> Parcel P-1: 7.5 acres available for build to suit for lease or sale

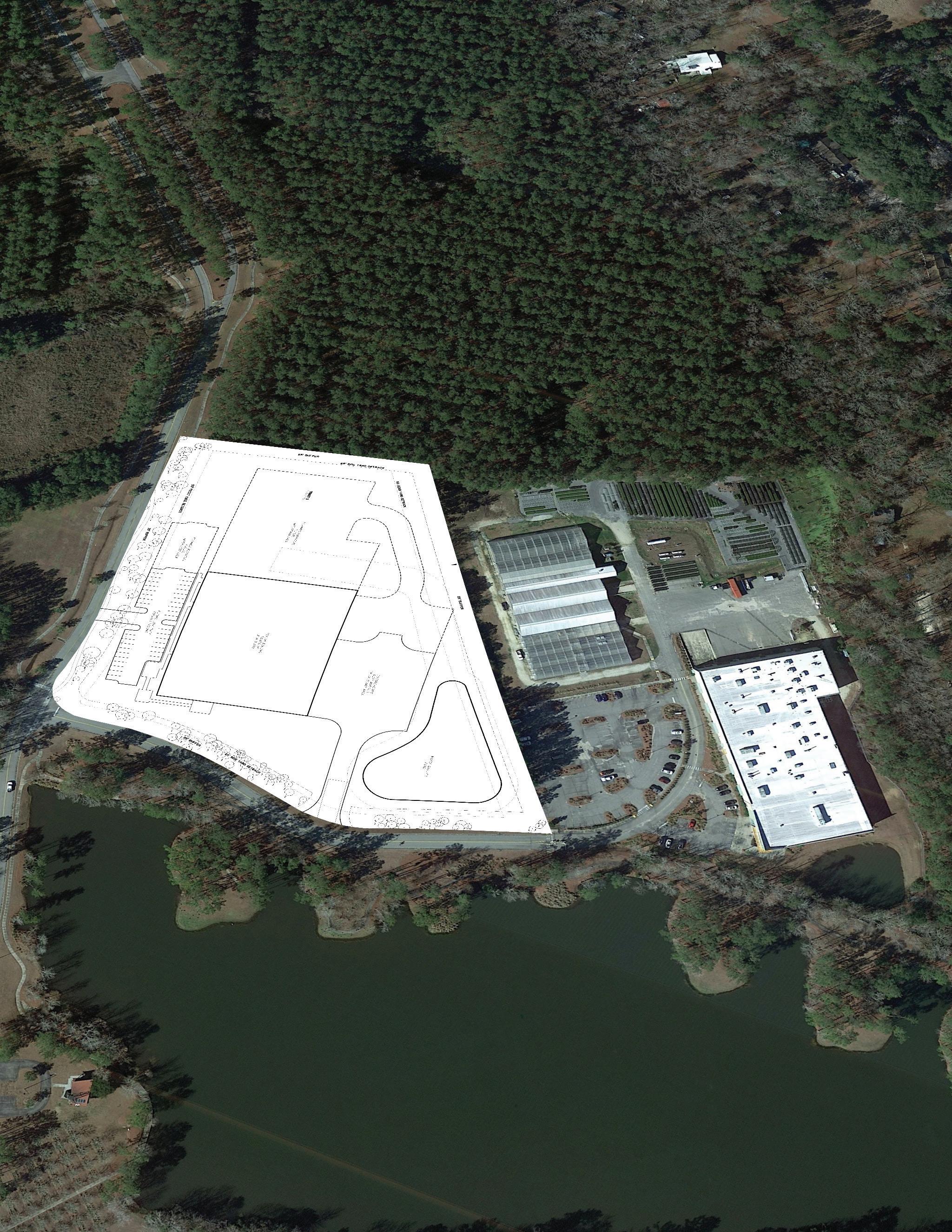

Pine Hill Business Campus features 372 scenic acres in a campus setting complete with walking trails and ponds. The first 135-acre phase is complete, and offers 8 industrial sites for sale. Able to accommodate light industrial uses, the sites can be modified to fit a user’s specific requirements.

> 370+ acres available in future phases in order to accommodate large users

> Located 10 miles from I-26/Highway 17A interchange in Summerville

> Adjacent to new community of Summers Corner, featuring a wide range of residential, business, recreation and educational opportunities

The amenity lake, with naturalized planting and ample walking trails, set the tone for Pine Hill Business Campus as an oasis and outdoor respite to the businesses that occupy.

Google Optioned (P-5, P-6, P-7, P-8)

> Sewer Force Main 14” - Dorchester County Water & Sewer

> Gravity Sewer Main 10” - Dorchester County Water & Sewer

> Substation - 230kv Transmission Line - Dominion Energy

> Water Line 12” - Dorchester County Water Authority

> Natural Gas Transmission Line - Dominion Energy

PARCEL AREA: 7.5 Acres

BUILDING SIZE: 50,000 (Expandable to 100,000)

DIMENSIONS: 200’ x 250’ (Expandable)

CLEAR HEIGHT: 32’

DOCK HIGH DOORS: 5 (Expandable)

DRIVE-IN DOORS: 1 (Expandable)

TRUCK COURTS: 160’

TRAILER PARKING: 8 (Expandable)

Property is ideal for light manufacturing, biosciences, medical and data centers, this scenic business campus offers a deep pool of highly skilled workers.

Located on US Highway 17A, just 10 miles southwest of the Summerville exit 199 on I-26. The Charleston airport is 21 miles away and the Port of Charleston is 28 miles away.

Nearby users include Arbogen, Google’s newest Data Center, Walmart’s Regional Distribution Center, and South Carolina Ports Authority’s Ridgeville Campus.

Adjacent to new community of Summers Corner, featuring a wide range of residential, business, recreation and educational opportunities.

The area boasts a highly skilled workforce, well known training programs, and a business friendly environment with the unionization rate well below the national average.

Pristinely landscaped and nestled in the idyllic East Edisto region of Dorchester County just a short drive from I-26, Pine Hill Business Campus affords its users the powerful utility infrastructure of an industrial park, combined with the picturesque charm of a life-sciences campus. Pine Hill is currently home to ArborGen and Google, and Dorchester County proudly purchased the park in 2019. As the masterplanned East Edisto/Summers Corner communities continue to develop with shops, restaurants and thousands of homes, Pine Hill is the perfect spot for companies seeking operational strength in a tranquil location.

The strength of our diverse economy has allowed the Charleston region to be resilient. Before the pandemic, the Charleston region had a healthy, thriving economy. It is this foundation that will allow for a quick recovery.

- Charleston Chamber of Commerce

Comprised of three counties – Berkeley, Charleston and Dorchester – the Charleston region is a highly diverse market, advantageously located on the Atlantic coast half-way between New York and Miami. The region, which covers more than 3,100 square miles (8,192 kilometers), combines a thriving economy, rich history and breathtaking environment to ofer an outstanding business climate and a quality of life that is second to none.

The Charleston metro’s economy has transformed over the past decade from service-based to STEM-based, thanks in large part, to Boeing, Mercedes, Volvo and many others calling our region home. Charleston ranks number 20 among the nation’s top 100 metros for growth in the Advanced Industry Sector, according to the Advanced Industries Study by the Brookings Institution, which examines growth in STEM-intensive occupations including logistics and transportation, advanced manufacturing and healthcare. The growth of this sector is helping to fuel the region’s overall economic growth and transform

the economy from a service-based to skills-based job market. Advanced Industry jobs are among the nation’s fastest growing and highest paying.

Charleston Harbor will soon be the deepest port on the East Coast of the U.S. – all in time to welcome Post Panamax ships 24/7. There is no question that the Charleston metro is a profoundly different place than it was 25 years ago when the economy was centered on the nation’s third largest Navy Base. And there is no doubt that we will be profoundly different a decade from now when Boeing, Volvo and Mercedes are all fully operational with their supply chains in place and our airport and port are offering thriving logistics and transportation options to reach the global supply chain. Charleston has earned its place on the global map as a visitor destination and now we are also recognized as a global business destination.

-Charleston Metro Chamber of Commerce

ON

|

Home to the world’s most advanced drive train testing facility at Clemson University Restoration Institute.

Charleston’s aerospace industry continues to develop.

No. 1 City in the U.S. for last 8 years.

7.4+ million visitors annually with $9.7 billion annual economic impact.

47,000 regional workforce.

Over 40,000 students enrolled across the region.

Home to Joint Base Charleston, operated by the Department of Defense.

20,000 active duty military and 15,000 retirees.

$10.8 billion economic impact.

Supports over 30,000 local jobs. Over 2,000 physicians in the Charleston metro.

Top 5 employer.

26,000+ regional workforce.

$3.2 billion economic impact.

2X

The SC Ports Authority is investing over $2.7 billion in infrastructure improvements to improve the efficiency and capacity of its terminals. These projects include deepening the harbor, building a new terminal to double capacity, building a transload rail terminal on site, and additional road infrastructure to reduce turn times for trucks on and off the terminal.

Charleston boasts a robust manufacturing presence with three major manufacturers (Boeing, Volvo, and Mercedes) taking a large presence in the market and spinning of tier 1, tier 2, and tier 3 suppliers across the market. Both Boeing and Volvo have announced plans to expand their current footprint to take on more projects in the market.

The defense sector is a large part of Charleston with $3-$5 Billion defense contracts coming from the NWIC base located in Hanahan. As such, some of the largest global defense contractors such as BAE Systems, SAIC, & Lockheed Martin have taken large footprints in the market to service the defense industry.

As the new Hugh K. Leatherman, Sr. Terminal, the only permitted new container terminal on the U.S. East and Gulf Coasts, opens its first phase in March 2021, the outlook is bright. At full build-out in 2033, the three-wharf terminal will double the South Carolina Ports’ current capacity, keeping the Port of Charleston one of the U.S.’s top ranked and one of the world’s most competitive ports. The Ports’ forecast for 2021 is for an increase of 6.7% in TEU (twenty-foot equivalent unit containers) activity compared to 2020, and 2022 will bring another 5% increase.

> Read Charleston’s Economic Scorecard

Walmrt commences construction on a 3 MSF distribution facility in Ridgeville. The anticipated completion date is early 2022. This will bring approximately 1,000 jobs to the region and increase port volumes by 5%. This will be one of Walmart’s largest distribution centers in the U.S. It will support six Walmart Distribution Centers and 850 Walmart and Sam’s Club stores across the southeast.

> Read article (Charleston Business)

TOP 10 & FASTEST GROWING CONTAINER PORT in the U.S. for the last 10 years

no. 8 SEAPORT in dollar value of goods (2019)

52’ DRAFT by 2021; deepest in Southeast by 2022

3 PORT LOCATIONS Charleston and inland ports in Greer and Dillon

$63.4b

ECONOMIC IMPACT in the state

3 PREMIERE SERVICE FROM ALL 3 top ocean carrier alliances

1 DAY RAIL to inland port Greer

100 FOREIGN PORTS served directly <60 MINUTE two-way truck turn

The Opportunity Zone program offers tax benefits to investors making qualified investment in designated Opportunity Zones. The investment, made through Opportunity Funds, is eligible for deferred and eliminated capital gains tax.

A taxpayer with realized capital gains must invest those gains within 180 days into a Qualified Opportunity Fund (QOF). The QOF then must deploy 90% of the funds into a qualified opportunity zone property or businesses within six months.

1. Investors can defer tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged, or December 31, 2026.

2. If the QOF investment is held for five years or longer, they may receive a 10% step-up-in-basis for the deferred gains.

3. If the investor holds the investment in the Opportunity Fund for at least 10 years, the investor pays no capital gains on the appreciation.

Source:

Opportunity Funds are a new class of investment vehicle that must be organized as a corporation or a partnership.

The funds will specialize in attracting investors with similar risk/reward profiles to aggregate and deploy their capital in rural and lowincome urban communities. Opportunity Funds will be comprised of private capital and guided by market principals. The funds must invest 90% of their assets in opportunity zone assets. Funds may invest in opportunity zones via stock, partnership interests, or business property.

Fund assets must create new business activity. If invested in an existing business, the fund must double the investment basis over 30 months. The funds can create new businesses, or new real estate or infrastructure. Funds may not be invested in certain types of business like golf courses, country clubs, gambling establishments, and a few other specifically excluded types of business.

In June 2019, an individual investor in the highest tax bracket sells 1,000 shares of XYZ stock that the individual purchased in 2013 for $250,000. The sale at $1,250 per share results in a $1 million capital gain. Instead of paying the $238,000 in Federal income tax on this sale, the individual invests $1 million into a QOF within 180 days. The investment in the QOF must be an equity investment. The QOF invests the capital in newly issued preferred stock shares of various operating businesses located in Opportunity Zones. The individual plans to sell the QOF in 2030. The value of this investment in 2030 is $2.5 million. The benefits received by this investor include:

1. Investing $1 million instead of paying $238,000 in Federal income tax.

2. Paying taxes on $850,000 of gains in 2026 instead of paying $238,000 on $1 million in gains in 2019.

3. Owing no additional tax on the $1.5 million in gains on the QOF investment realized in 2030.

To qualify for the investor benefits described above, a QOF must:

• Be organized as a corporation or partnership for the purpose of investing in Qualified Opportunity Zone property, and file IRS Form 8996 with its tax return.

• Hold at least 90% of its assets in Qualified Opportunity Zone property. (Qualified Opportunity Zone property includes newly issued stock, partnership interests, or business property in a Qualified Opportunity Zone business).

There are additional requirements for Qualified Opportunity Zone Businesses and qualifications for Qualified Opportunity Zone Business Property that must be met under the statute and regulations.

HAGOOD MORRISON SIOR, MBA, CRE

Executive Vice President

+1 843 270 5219 hagood.morrison@bridge-commercial.com

HAGOOD S. MORRISON (HAGOOD II) SIOR

Executive Vice President

+1 843 830 9108 hs.morrison@bridge-commercial.com

JOHN BEAM SIOR

Vice President

+1 843 810 6868 john.beam@bridge-commercial.com

BROOKS COURTNEY

Associate Vice President

+1 859 327 8749 brooks.courtney@bridge-commercial.com

This document has been prepared by Bridge Commercial for advertising and general information only. Bridge Commercial makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Bridge Commercial excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. This publication is the copyrighted property of Bridge Commercial and/or its licensor(s). ©2024. All rights reserved.