ANNUAL REPORT 20 22

We are filled with immense gratitude and appreciation for the unwavering support and contributions from our esteemed philanthropists, business units, and stakeholders. Your dedication to fostering endowment funds and businesses has been instrumental in enabling BPUDL to effectively fulfill its role.

As we reflect on the journey of BPUDL throughout 2022, it is evident that our commitment to excellence and dedication to sustainable practices have continued to drive our endeavours forward Despite the challenges posed by the Covid-19 pandemic, we remained steadfast in pursuing our strategic initiatives, ensuring that BPUDL remains a trusted and professional institution

The year began with the resurgence of Covid-19 cases in Indonesia, leading to the re-implementation of community activities restrictions enforcement (CARE) in several regions This situation did cause some delays in our strategic activities; however, we adapted and persevered through these challenging times As the government gradually relaxed the restrictions and the community's economy began to recover, BPUDL resumed the execution of its policies and programs

A significant achievement during this period was the establishment of PT Salam Kreasi Ganesha under PT LAPI, and the Indonesian Synergy Catalyst Factory under PT Rekacipta Inovasi ITB (RII) These developments are vital for business unit development and contribute to the overall asset growth and competitiveness of ITB

To ensure good governance in our operations, BPUDL formed an investment advisory board consisting of finance experts and experienced alumni This advisory board has been instrumental in providing valuable advice and contributions to managing the endowment funds, which have now reached IDR308 billion. The accumulation of these funds dates back to 2002 and includes proceeds from fundraising activities and reinvestment from endowment funds income.

Furthermore, the positive performance of our business units has proven to be a valuable source of additional funding for ITB. By managing these units professionally and adopting modern practices, BPUDL has successfully increased the value of ITB assets and provided essential funding to support the university's financial independence.

As we look to the future, we do so with optimism and determination, knowing that our collaborative efforts will shape a better and more sustainable world for generations to come.

Director of BPUDL“Investing for ITB’s Dreams”

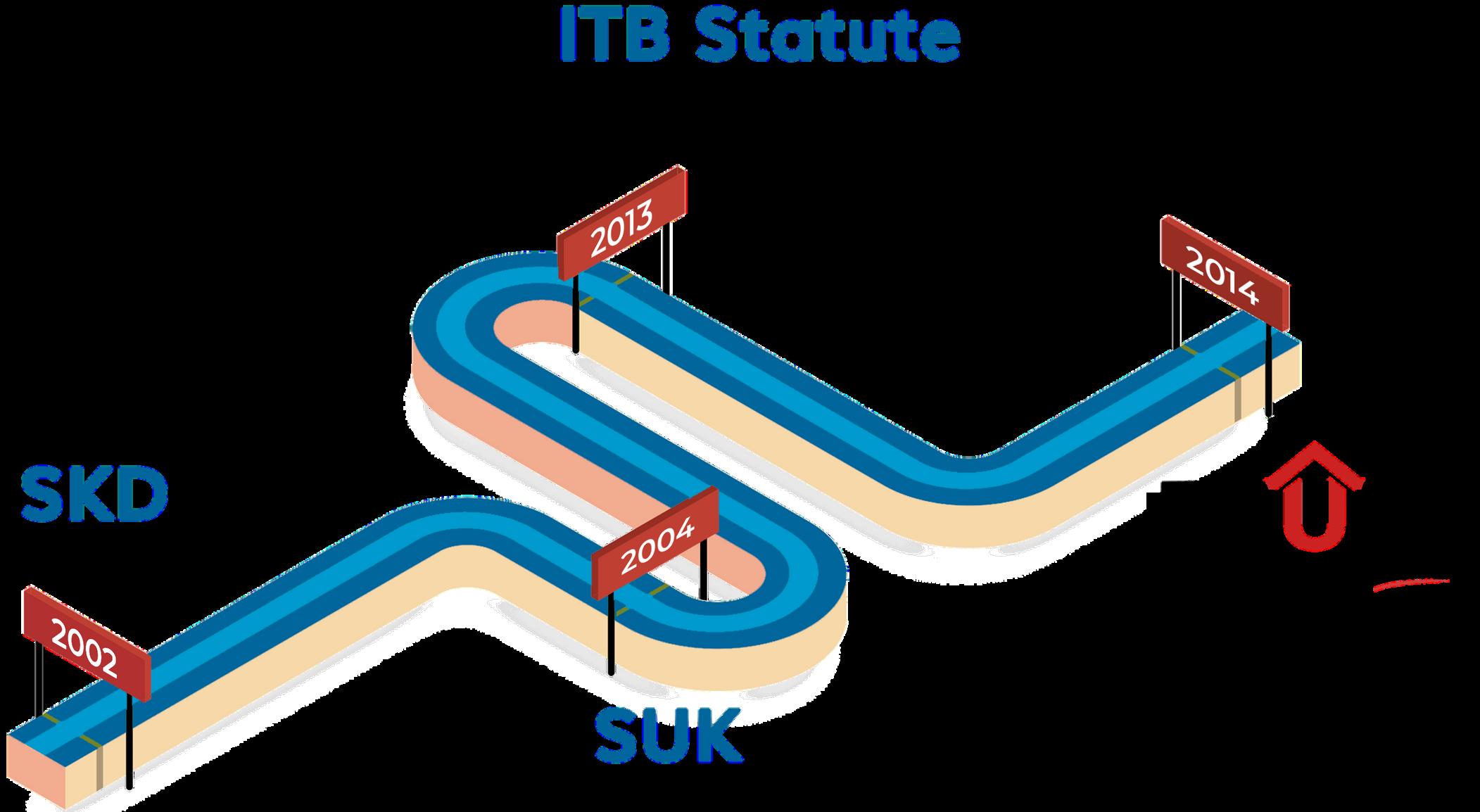

Institut Teknologi Bandung (ITB) took steps to reorganize its management structure and establish the Agency for University Business and Endowment Fund Management (BPUDL) as per the Government Regulation number 65 of 2013 concerning ITB Statutes Prior to this reorganization, ITB had two separate units, namely the Commercial Business Unit responsible for managing business units, and the Wealth and Funds Unit in charge of managing endowment funds

In 2014, ITB decided to merge these two units, SUK and SKD, into a single entity called BPUDL This consolidation was formalized through ITB Rector Decree No. 178/2014, which was issued on 22 July 2014. The decree laid out the establishment of the BPUDL, defining its roles and responsibilities in managing both business units and endowment funds within the institution This integrated approach likely aligns with the institution's commitment to sustainability and responsible financial practices, while also promoting better utilization of resources and fostering long-term growth and development

Become a leading and trusted institution in managing businesses and endowment funds in a professional and modern way in Indonesia, in 2025

It signifies that stakeholders trust BPUDL ITB to fulfill its responsibilities, commitments, and promises

Making the organization more efficient, prepared for growth, and better positioned to meet its objectives

IInvolving a systematic analysis and evaluation of investment opportunities in accordance with the principles of Good Corporate Governance

MIncreasing the size of a fund to provide numerous benefits

The ability to connect empathically with others in providing maximum benefits to society

ISO 9001:2015 is an internationally recognized standard for quality management systems, and achieving this certification demonstrates BPUDL's dedication to meeting high-quality standards in its operations and processes.

Regarding governance and compliance with business regulations, BPUDL is collaborating with a law firm, Ery Yunasri & Partners Law firm provides valuable guidance on ensuring BPUDL's activities are compliant with relevant laws and regulations

As a support unit, BPUDL operates under the guidance and oversight of the ITB Rector, who plays a significant role in defining its responsibilities and scope of work The ITB Rector's Regulation outlines the specific details of BPUDL's organizational structure and functions, including its reporting lines, internal processes, and decision-making authori

Koesrindartoto Director

Koesrindartoto Director

The involvement of an advisory board and investment advisors consisting of experienced ITB alumni from the professional business world is a valuable addition to the structure of BPUDL These experienced advisors significantly benefit BPUDL in several ways such as strategic decision-making, risk management, objective evaluation, compliance and governance, continuous improvement, and reputation enhancement

Philia Wibowo ITB '94

Darwin Cyril Noerhadi ITB '79

Rinaldi Firmansyah ITB '79

Bernardus Djonoputro ITB '83

Edwin Utama ITB ' 95

Hanel Topada ITB '07

Novi Imelda ITB '86

Eko Priyo Pratomo ITB '82

Achmad Zaky ITB '04

Bernardus Setya A. Wijaya ITB '09

Philia Wibowo ITB '94

Darwin Cyril Noerhadi ITB '79

Rinaldi Firmansyah ITB '79

Bernardus Djonoputro ITB '83

Edwin Utama ITB ' 95

Hanel Topada ITB '07

Novi Imelda ITB '86

Eko Priyo Pratomo ITB '82

Achmad Zaky ITB '04

Bernardus Setya A. Wijaya ITB '09

The function of developing ITB's business activities in the context of commercializing competencies/skills, inventions, and innovations in various fields is a crucial role for BPUDL By focusing on commercialization, BPUDL aims to leverage the institution's intellectual assets and innovations to create sustainable revenue streams and further contribute to society and the economy.

BPUDL currently manage 12 commercial business units in the form of limited liability companies (LLCs) PT ITB Press is the last established LLC in September 2022 and is a transformation from a previous Supporting Business Unit BPUDL also manage a business cooperation unit, Bumi Sawunggaling Hotel

BPUDL manages 12 limited liability companies (LLCs) with varying ownership structures, including 6 LLCs with majority share ownership and 6 LLCs with minority share ownership. As the manager, BPUDL plays a dual role, acting as a mandate holder for ITB in carrying out shareholder functions and as a regulator providing input on the company's strategies, policies, and important decisions

Majority Share Ownership

ITB commercial business units are encouraged to expand their business

PT LAPI and PT Rekacipta Inovasi ITB have established a subsidiary, namely PT Salam Kreasi Ganesha, which is engaged in the creative industry, and PT Katalis Sinergi Indonesia, which is engaged in the energy security sector, and is a triple helix collaboration with PT Pertamina and PT Pupuk Kujang

Minority Share Ownership

Despite the challenges posed by the COVID-19 pandemic, ITB's business units have demonstrated resilience and adaptability, leading to an improvement in their performance throughout 2022 The reported increase in revenue by 10% compared to 2021 and a net profit growth of 18% on a year-onyear (YoY) basis showcase the successful efforts made by the company to navigate the pandemic's impact and achieve positive financial outcomes

Additionally, the growth in total assets to IDR206 3 billion indicates the companies ability to strengthen their financial position and expand their asset base during a challenging period. This growth in total assets have resulted from effective financial management, successful business strategies, and prudent investments

Being a recently established company, PT ITB Press might need some time to adjust its business activities and establish itself in the market Given that it was established in September 2022 and still in the process of business transformation, it is reasonable that the company has not yet recorded a profit The business transformation process that PT ITB Press is undergoing, with support from BPUDL, is aimed at optimizing its operations, refining its business model, and positioning itself to achieve positive performance in the following year

Dividends play a significant role in contributing to ITB's funding and are an important aspect of the company's financial activities

The dividend distribution policy for the year 2022 is determined through an agreement with shareholders at the General Meeting of Shareholders (GMS) This meeting is scheduled to be held in 2023, after the company's financial statements have been audited and published.

BPUDL, as the manager of the commercial business units and in charge of handling dividends, manages these funds independently. Part of the dividends received by BPUDL is allocated as an investment reserve fund. This fund is intended for investment in new companies and for reinvesting in existing companies within the business units' portfolio.

The dividend distribution for 2022 is determined based on the decision made at the General Meeting of Shareholders (GMS) held in 2021 During this meeting, the shareholders of the company, including ITB, discussed and agreed upon the amount of dividends to be distributed for the company's performance in 2020

BPUDL received a total dividend of IDR11 2 billion in 2020, net of tax From the total dividend received, BPUDL allocated IDR5 9 billion to ITB This contribution provides financial support to the institution and can be used for various academic, research, and infrastructure projects, enhancing ITB's mission and objectives.

A portion of the dividend, amounting to IDR3 6 billion, was allocated for investment reserves and the development of commercial business units managed by BPUDL BPUDL allocated IDR1 7 billion from the dividend for its operational costs. This allocation helps cover the expenses incurred by BPUDL in managing the commercial business units and performing its roles and responsibilities

https://wwwlapi-itbcom/ Jl GaneshaNo 15-BBandung40132

Basauli Umar Lubis Commissioner

Basauli Umar Lubis Commissioner

Established in 2004, PT LAPI ITB focuses on providing professional services, consultancy, and appropriate technology development Its services are aimed at benefiting the Indonesian government, national and regional stateowned enterprises, as well as national and international private companies By leveraging the expertise and knowledge of ITB, PT LAPI ITB contributes to various sectors by offering innovative and technology-driven solutions

By expanding into the creative industries through PT Salam Kreasi Ganesha, PT LAPI ITB is diversifying its portfolio and aligning with the evolving needs of the market The combination of expertise in appropriate technology development and creativity can enable PT LAPI ITB and its subsidiary to contribute to various sectors and promote sustainable growth and innovation in Indonesia

DirectorFounded in 1992, PT LAPI Ganeshatama Consulting (GTC) has been operating for several decades, accumulating valuable experience and building a reputation for delivering quality consulting services.

GTC plays a crucial role in supporting infrastructure development In addition, GTC offers consulting services in various areas, such as oil and gas, minerals, information systems, environment, and management This diverse expertise allows GTC to cater to a wide range of industries and address different challenges faced by its clients

https://rekaciptainovasiitbcom/ GedungSTPITB,Jl GaneshaNo 15FBandung

Established in 2016, PT Rekacipta Inovasi ITB (RII) plays a vital role in driving technological innovation, commercializing research outcomes, and fostering collaborations with industry partners By developing and marketing technological innovation products and providing project funding, PT RII contributes to Indonesia's innovation ecosystem and supports the practical application of research findings

The joint venture with PT Pertamina Lubricants and PT Pupuk Kujang through PT Katalis Sinergi Indonesia demonstrates the value of public-private partnerships in accelerating technology adoption and promoting industrydriven research and development Through such endeavors, PT RII reinforces ITB's reputation as a leading research institution contributing to the advancement of technology and innovation in Indonesia and beyond

Founded in 2008, PT Ganesha Jaya Sejahtera (PT Gajah) is engaged in multiple business fields, including mining, trading, services, and industry

Its involvement in management consultancy and the enhanced oill recovery (EOR) collaboration with PT Pertamina underscores its commitment to providing innovative solutions and contributing to the development of Indonesia's energy and industrial sectors

PT Elektro Informatika Utama (EIU) PT EIU plays a crucial role in various fields, including electrical engineering, information and communication technology (ICT), defense systems, and consulting and training in engineering

In 2022, PT EIU became one of the companies appointed by ITB to manufacture Diktiedu tablet devices. These tablets were intended for distance learning solutions in disadvantaged, frontier, and outermost areas as a response to the challenges posed by the Covid-19 pandemic This collaboration demonstrates PT EIU's role in leveraging its capabilities to support educational initiatives during challenging times

PT Inovasi Teknologi Bermedia Press (ITB Press) is established as a commercial entity on September 22, 2022, with 95% ownership of ITB shares and the remaining 5% owned by the LAPI Foundation This transformation signals BPUDL's effort to optimize the business's potential and revenue generation capabilities. By operating as a commercial entity, PT ITB Press can adopt market-driven strategies and practices to remain competitive in the publishing and printing industry

PT ITB Press also aims to support ITB academics by providing printing and publishing solutions This can be especially valuable for academic publications, research papers, and other scholarly works

PT ITB Press seeks to provide convenient access and a range of services for its customers To achieve this, PT ITB Press opened a store on the 1st floor of the Science & Tecno Park Building This store offers various printing and publishing services, ITB merchandise products, and electronic devices that support the needs of ITB academics and the general public

PT LAPI Divusi

PT Letmi ITB

PT Ganesa Patra Sejahtra (GPS)

PT Gada Energi

PT Ganesha

Environmental & Energy Services

PT LAPI Indowater (EPC)

SERVICES

Provides a wide range of products and services catering to specific subjects such as information technology consulting, telecommunications, system development, and creative products

Provides consulting services for industrial engineering, management, and other operational systems

Providing technology for enhanced oil recovery

Provides consulting services, product research, training, education, planning and development of energy resources and energy utilization

Provides consulting services for promoting a cleaner environment and sustainable energy solutions

Provides construction services for water-related infrastructure projects, with a focus on waste water and drinking water drainage systems

Bumi Sawunggaling Hotel holds significant historical and cultural value as one of the Dutch heritage buildings built in 1920, alongside the construction of the ITB campus Over the years, the building has served different functions, including being a dormitory for ITB female students until 1959, known as Dames Internat, and later as ITB's male dormitory, commonly referred to as Rumah E

As a cultural heritage building, Bumi Sawunggaling Hotel carries the responsibility of preserving its unique architecture and characteristics to maintain its historical significance. Under the management of BPUDL, the building is currently repurposed to offer residential services for the general public

http://www bumisawunggaling com/

Jl Sawunggaling No 13 Bandung 40116

Commissioner: Adi Mulyanto

Pres Director: Dion Lutvan P

Director: Tony Fadjar Mukli

Commissioner: Anang Zaini G

Pres Director: Mame Slamet

Director: Dian Nugroho

Commissioner: Arsegianto

Director: Wisnu Nugroho

Commissioner: Darmadi

Pres Director: Sudono

Director: Yuliana

Pres Commissioner: Bintang Budi Y

Commissioner: Budhi Mitra S

Pres Director: Gitta Melati

Director: Herni Laela Pratama

Commissioner: Ilyas Suratman

Pres Director: Suparno Satira

Director: Rusnandi Garsadi

Also known as true endowments, are funds that are donated to an organization with no specific restrictions or conditions on their use. Donors contribute to these funds with the understanding that ITB has the discretion to use the funds as needed to further its mission. The principal amount of the endowment is typically invested to generate income, and a portion of the investment returns is spent annually to support the ITB activities, programs, scholarships, or other initiatives.

Restricted endowments, are funds donated to an organization with specific conditions or restrictions on their use. Donors may stipulate how the funds should be used, such as supporting a particular program, scholarship, research, or facility. ITB is legally obligated to use the funds in accordance with the donor's specified purpose

1 2 3

The collected funds/donations are intended to be distributed or spent immediately or within a relatively short period. The purpose of these donations is to provide financial support for current needs or specific projects.

Donors designate the purpose of their contributions, and the organization is obliged to use the funds accordingly.

The principle of endowment funds is to preserve the initial principal and use only the returns or income generated from the fund's management. The goal is to ensure the fund's longevity and sustainability so that it can continue to support the organization's mission and activities over the long term

In 2022, IDR18 13 billion was raised through fundraising efforts and IDR2 61 billion was added from the portion of investment returns. With the addition these funds, the total value of the endowment funds increased to IDR308 41 billion This amount reflects the overall value of the endowment fund at the end of 2022

IDR16.08 B

Endowment Donors in 2022

IDR2.05 B

Restricted endowment

Managed Endowment Funds

Theprincipleofendowmentfundsistopreservetheinitial principalanduseonlythereturnsorincomegeneratedfrom thefund'smanagement Thetotalendowmentfund managedattheendof2021wasIDR28767billion,which servesastheinitialbalanceforthefundin2022

Total Receipt in 2022

Thetotalfundsundermanagementattheendof2022 amounttoIDR30580billion,consideringtheadditional receiptofIDR1813billionduringtheyear Thisnewtotal representsthecombinedvalueoftheinitialbalanceandthe fundsreceivedin2022

Aportionofinvestmentreturnsisreinvestedandaddedto thetotalmanagedfundwithanamountofIDR261billion

Total Managed Funds

Thetotalfundsundermanagementattheendof2022 amounttoIDR30841billion,consideringtheadditional receiptofIDR1813billionandreinvestmentfromthe portionofendowment returnofIDR261billionduringthe year

Individual Donors

IDR11.82 B

Corporate Donors

IDR4.74 B

Community Donors

IDR1.57 B

Restricted Endowment

ITB has established restricted endowment funds initiated by donors, as well as faculties/schools (F/S) and study programs within each F/S These restricted endowment funds have specific purposes, such as providing scholarships or supporting activities for ITB students In 2022, each of the 12 F/S at ITB has established their own endowment funds

The management of these endowment funds is centralized and overseen by BPUDL BPUDL is responsible for managing the funds and ensuring that the investment results align with the goals set by either the donors or beneficiary units, such as F/S or study programs This centralized approach allows for coordinated and strategic management of the endowment funds across different units within ITB

Returns from unrestricted endowment

IDR8.7 B

The return from unrestricted endowment is distributed according to policy priorities at ITB, which encompass various areas, including:

Education, Infrastructure, Research, Community Service, etc

RESTRICTED ENDOWMENT (IDR)

FTI - Teknik Industri FTMD

8,751,800,000 SF SITH

FTTM - Teknik Pertambangan FTTM - Teknik Geofisika

SBM 9,454,000

STEI - Teknik Elektro 700,000,000 Direktorat Kemahasiswaan 102,929,451

118,487,501 29,200,000 STEI 25,300,000

1,120,000,000 69,420,698 SAPPK

FSRD FTI

IDR1.3 B

100,000,000 9,300,000

22,500,000 2,100,000

10,600,000 2,000,000

2,700,000,000 171,071,684 FTSL FTTM

IDR10.0 B 50,000,0000,000 1,000,000,000 FITB - Teknik Geologi FMIPA

The return from restricted endowments at ITB is distributed directly to beneficiary units, i.e.:

Industrial Engineering Study Program

Dato Low Tuck Kwong - Purnomo Yusgiantoro Scholarship

Annual Report 2022 18

In 2019, a significant donation was made by Dato Low Tuck Kwong in collaboration with the Purnomo Yusgiantoro Center worth IDR100 billion The IDR50 billion donation is recorded as a restricted endowment fund, with the management proceeds used for scholarships These scholarships, known as the Dato' Low Tuck Kwong - Purnomo Yusgiantoro Scholarship and Purnomo Yusgiantoro - Dato' Low Tuck Kwong Scholarship, are awarded to study program students listed in the donation agreement

The remaining IDR50 billion of the donation is intended for the construction of a building and an enhance oil recovery laboratory Until the funds are used for their designated purpose in 2022 (construction process for a new building), they are managed and invested by BPUDL as a restricted fund The investment returns was then be used to increase the number of scholarships distributed BPUDL oversees the management of the funds to ensure that they are preserved and utilized according to the specified purpose designated by donors

The scholarship distribution covers two academic periods: 2nd semester 2021/2022 and 1st semester 2022/2023. The total disbursed fund for these two academic periods is IDR4.3 billion, and it supports 651 students.

The amount disbursed for Dato' Low Tuck Kwong - Purnomo Yusgiantoro Scholarship is IDR3,438,062,500, and it benefits 491 students

The amount disbursed for Purnomo

Yusgiantoro - Dato' Low Tuck KwongScholarship is IDR860,450,000, and it benefits 160 students

Total accumulated funds disbursed up to the year 2022

IDR7.15 B

1,205 Students

Thedistributionforthe2021/2022academicperiodsisincreasing dueto theadditionalinvestmentyieldsresultsfrombuildingconstructiondonations

Dato'LowTuckKwong-Purnomo YusgiantoroScholarship PurnomoYusgiantoro-Dato'Low TuckKwongScholarship

TheproportionofDato'LowTuckKwong-PurnomoYusgiantoroScholarshipdanPurnomo Yusgiantoro-Dato'LowTuckKwongScholarshipcomplywiththetermsofthedonation agreement

These restricted funds play a vital role in promoting educational opportunities, enhancing research and innovation, and supporting community engagement at ITB.

The biggest restricted funds receipt in 2022 comes from the Extraordinary Scholarship Program initiated by young ITB alumni This program aims to provide financial support to students facing exceptional circumstances or challenges, enabling them to continue their studies at ITB. Other notable restricted funds receipts in 2022 include BIUS and YPM Salman scholarship, and Cianjur earthquake care

In 2022, ITB received a total distribution of restricted donations amounting to IDR 54,713,879,719. The allocation for this distribution comes from funds received in 2022 and the accumulated balance of restricted funds that have been managed by BPUDL from previous years

The flexibility of distributing restricted donation funds directly or according to the time of utilization allows ITB to effectively allocate the funds to meet the specific needs and timelines of various projects For instance, the restricted donation from Dato Low Tuck Kwong of IDR50 billion for the construction of a building, has just distributed in 2022 because the construction was carried out in early 2022

BIUS: 9

Beasiswa Luar Biasa: 15

YPM Salman: 2

FMIPA

BIUS: 16

Beasiswa Luar Biasa: 36

YPM Salman: 4

BIUS: 6

Beasiswa Luar Biasa: 7

YPM Salman: 2

BIUS: 14

Beasiswa Luar Biasa: 27

BIUS: 9

Beasiswa Luar Biasa: 16

BIUS: 8

Beasiswa Luar Biasa: 19

BIUS: 28

Beasiswa Luar Biasa: 16

SAPPK

BIUS: 7

Beasiswa Luar Biasa: 18

YPM Salman: 1

Beasiswa Luar Biasa: 6

YPM Salman: 2

BIUS: 8

YPM Salman: 2

Beasiswa Luar Biasa: 7

YPM Salman: 2

Beasiswa Luar Biasa: 21

BIUS: 6

Beasiswa Luar Biasa: 16

TOTAL MANAGED FUNDS IDR25.02 B

ITB Rector's Decree No 41/2013 has stipulated that there is a need to allocate PEB funds as compensation to non-civil servant permanent employees These funds are set aside to ensure that the institution can fulfill its obligations to provide PEB to eligible employees when they retire or complete their working period

The management of ITB's PEB funds is carried out independently by BPUDL The allocation of these funds is done with the aim of optimizing yields to meet the long-term needs of PEB fund allocation, ensuring that the funds are sufficient to provide PEB to employees in the future Additionally, the management of these funds also takes into account the liquidity needs to address short-term financial requirements related to PEB By managing the PEB funds in this manner, ITB aims to ensure the financial security and well-being of its employees after their working period, honoring its commitment to providing PEB as part of their overall compensation package

Total Disbursement

The total amount disbursed for PEB funds, which stands at IDR919,012,660, represents the financial support provided to eligible employees who have retired, passed away, or resigned from their positions at ITB in 2022

IDR919 million

12 employees

ITB Rector Regulation number 257 of 2014 outlines the principles and criteria that guide the investment decisions made by BPUDL for managing endowment funds It specifies the types of financial instruments in which the funds can be invested, including money markets, bonds, stocks, mutual funds, equity in business units, and property The investment policy is designed to strike a balance between generating expected income and managing investment risks Based on the investment criteria, bonds emerge as the primary choice for investment in endowment funds, which is targeted to make up a substantial portion, reaching up to 60% of the portfolio. This allocation strategy reflects a conservative approach, where a significant portion of the funds is invested in fixed-income securities to mitigate potential risks associated with market volatility

Having multiple sources of funds provides BPUDL with flexibility in managing investments and reduces the dependency on a single funding stream. The portfolio's diversification allows BPUDL to capture potential returns from various investment sources, potentially enhancing overall income generation Different investment instruments may have different risk-return profiles, and a well-diversified portfolio can optimize the balance between risk and return

By utilizing a combination of internal analysis, real-time data, direct coordination with experts, and software integration, BPUDL assures its modern and professional investment management This approach helps optimize investment performance, minimize risks, and ultimately contributes to the successful management of ITB's sustainable funds and other investment initiatives

The separate management of endowment investment funds, coupled with a focus on sustainability aspects, demonstrates BPUDL's commitment to responsible financial stewardship and ensuring that the investments made align with ITB's mission and vision By carefully managing these funds, BPUDL helps secure a solid financial foundation for ITB and supports the institution's ability to make a lasting and positive impact in the academic and wider community

Deposits

Mutual funds

Bonds

Others (stocks, property, etc )

BPUDL has implemented a range of innovative programs during 2022 to increase ITB's endowment assets such as donor recognition naming, digitizing fundraising, as well as "Give Back to Almamater" campaign organized by Salam Ganesha These programs not only contribute to financial growth but also showcase creative approaches to engage donors.

The main donors of the ITB endowment fund are predominantly alumni The "Give Back" culture nurtured by alumni creates a positive cycle of support, encouraging future graduates to continue the tradition of giving and building a strong and thriving educational institution. Their involvement not only provides financial support but also strengthens the bond between alumni and ITB

In addition, contributions from corporates, communities, and foundations also have a significant impact on the endowment fund Corporate donations often result from partnerships and collaborations between ITB and various businesses, reflecting a shared commitment to education and community development.

Naming buildings after significant donors is a common and meaningful way for ITB to show appreciation and recognize the contributions of generous philanthropists

Their names on campus buildings serve as a testament to their dedication to advancing education and their invaluable support to ITB's future generations

Benny Subianto (Labtek V)

Theodore Permadi Rachmat (Labtek VI)

Yusuf Panigoro (Labtek VII)

Achmad Bakrie (Labtek VIII)

T P Rachmat II (Gedung Perpustakaan)

Benny Subianto II (Campus Center Timur)

Gedung Wardah Foundation (Gedung Kuliah Umum Barat)

Paragon Innovation (Gedung Kuliah Umum Timur)

Eddy K Sariaatmadja (Lantai 3 di Gedung CRCS)

ITB's continuation of the endowment fundraising program through building naming appreciation and the installation of names and/or logos on other ITB-owned facilities such as rooms, roads, floors, walls, and laboratories, is a strategic approach to engage philanthropists in supporting the ITB's growth and development. By providing various opportunities for donors to leave a mark on the campus environment, ITB enhances its appeal to potential contributors and promotes a sense of partnership and ownership between the donors and the institution

The tile naming program initiated is a creative way to raise endowment funds for ITB By offering donors the opportunity to have their names carved on unique and beautifully-arranged tiles just at the heart of ITB Ganesha campus, ITB provides a tangible and lasting form of recognition for their contributions

The program is divided into three categories, as follows:

Platinum: Donations of IDR200 million

Utama: Donations of IDR100 million

Medium: Donations of IDR50 million

This tile naming program not only raises funds for ITB's endowment but also creates a sense of community and shared pride among donors With around 90 donor names already carved in the ITB Rotunda area, and a total donation value of IDR9 billion, the program has made a significant impact on the institution's sustainable funding

DJOKO SANTOSO - GL’72

YAYASAN SOLIDARITY FOREVER

PRAMONO ANUNG - TA’82

FEBRIAN AGUNG - TK’02

RANDU SEKTI WIBOWO - TF’03

ASWIN LUBIS - EL’67

SUBAKAT HADI - KI’68

NURHAYATI SUBAKAT - SF’71

HARMAN SUBAKAT - KI’68

SALMAN SUBAKAT - EL’98 & DINI

ARDHI WARDHANI - TL’98

HATTA RAJASA - TM’73

EDDY JUNAEDY DANU - EL '70

IKATAN ALUMNI ITB'80

ACHMAD ZAKY - IF'04

WIZA HIDAYAT - TI'01

ADRIANTO DJOKOSOETONO - TI’95

TAMBANG'91

ARIFIN PANIGORO - EL'63

DEDDY PANIGORO - EL'65

YANI PANIGORO - EL’70

YUNAR

HERMAN A. KUSUMO - TA’68 PANIGORO - FT'76 YYS PENDIDIKAN AVICENNA PRESTASI - ITB 70 ITB 70 NYOMAN NUARTA - SR’73 RIDWAN KAMIL - AR’90 HILMI PANIGORO - GL'74 M FAJRIN & AMI - IF'04ITB 86 & MASTERS

DIAN SISWARINI - EL '86

KOMISARIAT IA ITB 72

ZULHELFI ABIDIN - IF'82

ZULKIFLI ZAINI - SI'75

PT BANDUNG ECO SINERGI TEKNOLOGI

ELEKTRO 1981

ITB 2001

ALUMNI ITB ANGKATAN 1975

SUMARNI RIFEMI - MA'08

FAHMI BAAGIL - FT'05

SLAMET PS & NANING FI - IF'96

GIRI KUNCORO - EL'06

RAKHMADI A KUSUMO - SBM'04

RINALDI FIRMANSYAH - EL'79

PRIMARINI - TI'85

DOTHY - TI'90

RIRIEK ADRIANSYAH - EL'82

HENDRI S. SUARDI - EL'80

FAJRIN RASYID - IF'04

XINUC - IF'04

DANNIS & DAMIAAN MANGAN - IF'07 & IF'10

HENDRA KWIK PAYFAZZ - TK'08

IRAMA - SI'70 MOMMI - AR'65

EDDY ANTHONY - EL'81

PUTU SUARTIKA - EL'80

INDRA UTOYO - EL'80

ADJI RUKMANTARA - EL'80

RICO FRANS - EL'88

YOHAN FRANS - EL'91

MEILANI FRANS - TI'92

FORTUGA ITB 1973

ALUMNI ITB MIZAN

RADEN PARDEDE - TK'79

SEKOLAH AVICENNA

ALUMNI ITB REKIND

MUCHDAR UMAR - PL'79

MAHENDRA VITRANTO - EL'09

RENDRA PRANADIPA - FA'96

ANGELINA GUNAWAN - TK'98

YUI HASTORO - TI'83

SYAHRIL ANWAR - MS'63

IR R I J SOETOPO - TK'55

IR SOESRETNOWATI - TK'54

ARVIYAN ARIFIN - TI'83 DIDI - TA'88

RONALD GUNAWAN - TM'83

AMRI SIAHAAN - MS'84

KOMUNITAS S.A.S. ITB 1996

FORUM ITB 84

IKATSATU - ITB '71

SUYUS WINDAYANA - GD'86

IRFAN SETIAPUTRA/AYA - IF'82

DJOKO SARWONO - SI'79

AHMAD BAMBANG - IF'81

MADE DANA TANGKAS - TI'84

EMMA SRI MARTINI - IF'88

HONESTI BASYIR - TI'87

BENNY WENDRY - TK'89

DJATI POETRYONO D - MS'76

HASNUL SUHAIMI - EL'76

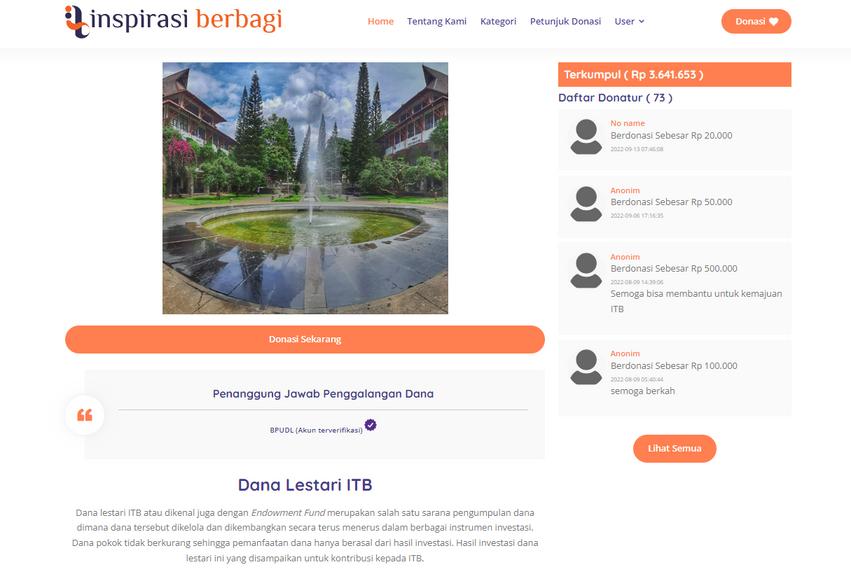

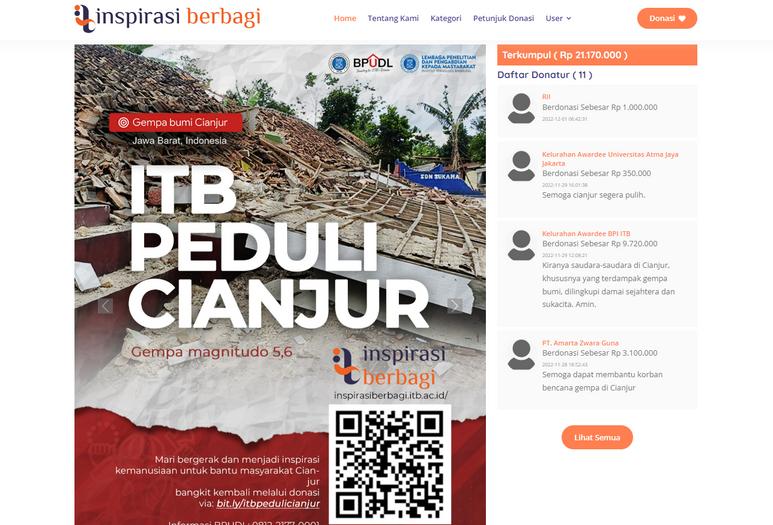

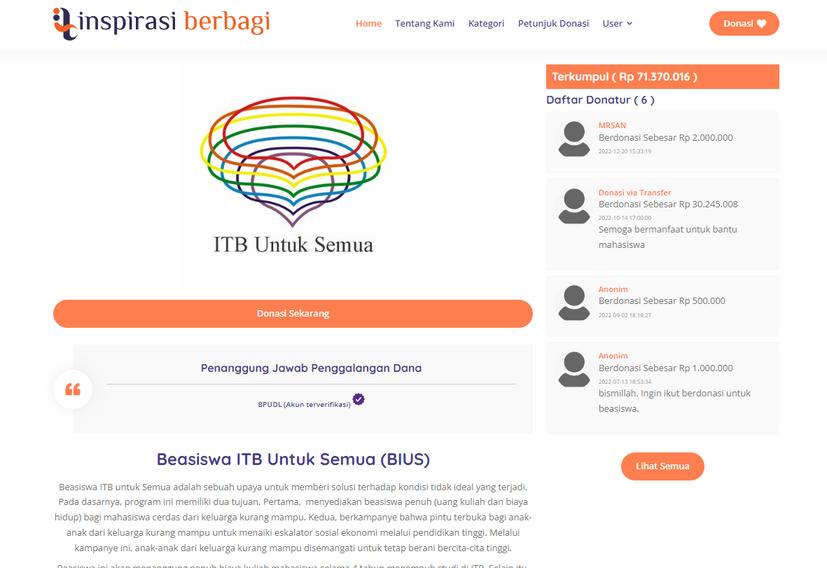

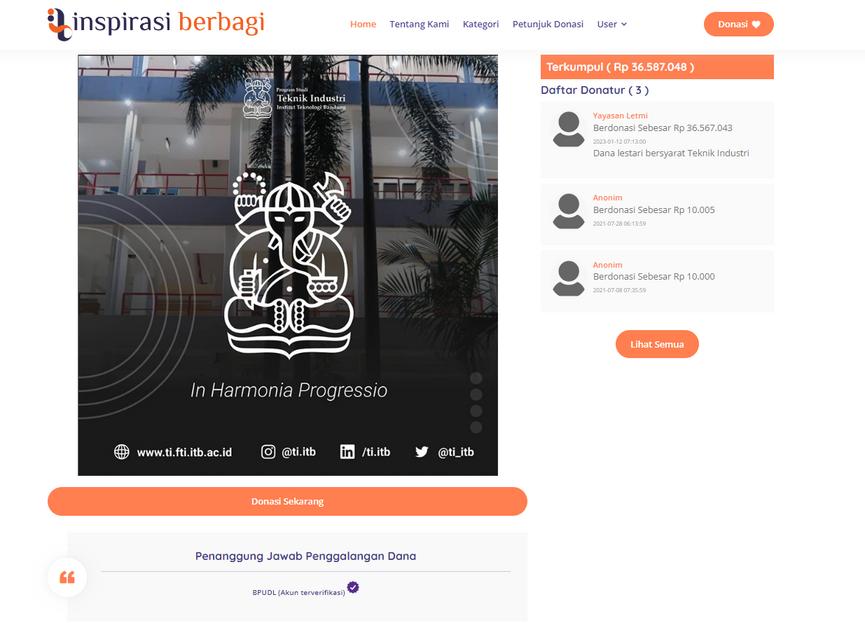

BPUDL creates "inspirasiberbagi" as an online fundraising platform, enabling secure and efficient donation processing. By utilizing this platform, donors can easily make contributions and support the university's initiatives, while BPUDL ensures transparency in managing and allocating the funds. In 2022, donations collected through this online platform amounted to IDR342,448,630, both for endowment and restricted donation funds.

This platform allows BPUDL to exemplify the values of community, cooperation, and compassion in fundraising This approach not only enhances support for ITB's activities but also nurtures a culture of giving and empathy, creating more interconnected community around the institution

https://inspirasiberbagi.itb.ac.id/

BeasiswaITBUntukSemua(BIUS) DanaLestariBersyarat-TeknikIndustri KontribusiAlmamateruntukPerpustakaanTeknikFisika KontribusiuntukAlmamater-FTSL DekanberlariuntukDanaLestariVol 2 ITBPeduliCianjur KontribusiAlmamaterProdiGeologi(FITB) DekanberlariuntukDanaLestari DanaLestariITBITB is planning and starting to build the Molecular Engineering and Functional Materials Building This was necessitated by the unfit conditions of the previous building, which was demolished in 2019

The new building will support the development of chemistry and its interdisciplinary impact on various fields Chemistry is a fundamental science that influences numerous industries and has wide-ranging applications in society. As such, the need for a research laboratory that meets high standards is essential to advance research, education, and development activities in molecular and materialbased disciplines

In addition, this building will be equipped with an Innovation Lab that serves as a dynamic and collaborative space where ITB academics can come together to develop and implement creative ideas, skills, engineering expertise, and knowledge into tangible and innovative products and services. Establishing the Innovation Lab aligns with ITB's vision of becoming a World Class University

Currently, BPUDL taking an active role in initiating funding for the construction of the Molecular Engineering and Functional Materials Building at ITB In recognition of generous donor contribution, ITB's provides counter-achievements, such as naming buildings, floors, rooms, and laboratories on this constructed building

PT Paragon Corp's commitment to providing funding worth IDR22 billion plays a crucial role in moving the construction project forward The counterachievement offered by ITB in the form of naming the 1st floor and 2 public rooms on the 1st floor after PT Paragon Corp reflects the university's gratitude for their contribution Such naming recognition establishes a lasting legacy for the donor within the building and inspire other potential donors to participate in supporting the construction of the building

"An education is the investment with the greatest returns"

-Benjamin Franklin-

PT ITB Press has been officially established as a limited liability company (22/09/2022) to transform its business model, which was previously operating as an ITB Supporting Business Unit This transformation will enable ITB Press to expand its activities and offerings, including publishing academic and scientific works.

Commissioner Edi Wahyu Sri Mulyono and Director Alga Indria are leading the company Their background as ITB alumni bring valuable insights into the needs and preferences of the academic community, researchers, and students, which can guide the direction of PT ITB Press's activities

BPUDL expressed its gratitude for Meditya Wasesa's contribution during his short leadership tenure as the Acting Head of ITB Press for the period March to September 2022 Under his leadership, ITB Press made significant strides in transitioning from a traditional university press model into a commercially oriented publishing entity.

1971

Penerbit dibentuk berdasarkan SK

Rektor No 24/SK/REK/ITB/1971

sebagai Unit Pelaksana Teknis UPT, yang bertujuan menunjang kegiatan akademik melalui penerbitan buku ajar dan diktat kuliah

2008

Status penerbit sebagai Unit Usaha Penunjang di bawah Satuan Unit Komersial (SUK)

2014

Status penerbit sebagai Unit Usaha Pendukung di bawah BPUDL dan proses transformasi menjadi unit usaha komersial

2022

Status sebagai Perseroan Terbatas (PT), dengan nama resmi PT Inovasi Teknologi Bermedia Press (ITB Press)

BPUDL organized a symposium with the theme "Building Financial Independence and Sustainability in Higher Education through the Management of Endowment Funds " Twenty two Legal Entity State Universities, represented by their Rectors, Vice Rectors, and internal endowment fund managers attended this event

The event involved panel discussions, presentations, and knowledge-sharing sessions from Prof Nizam (Acting Director General of Higher Education, Research, and Technology), Luky Alfirman (the Ministry of Finance), Irmawati (Indonesian Stock Exchange), Muhammad Oriza (Indonesia Endowment Fund for Education), Muhammad Nuh (Indonesian Waqf Agency), and other securities companies

This event appears to be an excellent initiative for universities to gain insights, exchange knowledge, and develop practical strategies for effectively managing endowment funds The collective efforts in governance, fundraising, and investment management are likely to contribute significantly to university financial independence and long-term sustainability

Within 3 different sessions, all participants are directed into exploring endowment fund source potentials, formulating governance, and discussing strategies to optimize the returns on endowment investments while managing risks appropriately

By recognizing the importance of professional endowment management and fostering an environment that encourages endowment fund raising, this forum raises university awareness to achieve financial independence, attract donors and benefactors, build long-term financial stability, and bolster a university's reputation

The response of ITB to the earthquake in the Cianjur (21/11/022), reflects the commitment to serving its community and contributing to disaster relief efforts. Coordinated by the Institute for Research and Community Services (LPPM), ITB took immediate action to assist the victims affected by the earthquake ITB's decision to mobilize its lecturers and students to apply appropriate technology for short, medium, and long-term countermeasures shows a proactive approach in addressing the immediate needs of the affected communities

BPUDL is actively supporting disaster management efforts by collecting funds from fundraising activities as well as from its operational funds amounting to IDR250 million. By channeling these funds through LPPM ITB, which has expertise in research and community services, the contributions can be directed efficiently to support disaster management efforts in Cianjur and other affected areas .

The inauguration of the ITB Press Store by ITB Rector, Prof Reini Wirahadikusumah, marks a significant step for the institution in promoting academic publishing and supporting the needs of academics and students (22/12/2022) By providing a dedicated store, ITB Press aims to streamline the process of accessing and acquiring academic publications, making it more convenient for both internal stakeholders and external customers. ITB Press is also appointed as the "single account" implementing unit for ISBN management by the National Library. Being entrusted with this responsibility reflects the recognition of ITB Press's competence and credibility in managing publication records and maintaining quality standards in the publishing process.

PT ITB Press extends its services beyond academic publishing to provide the production and distribution of official ITB-branded merchandise, such as t-shirts, hoodies, mugs, bags, and other

PT Wijaya Karya signs an agreement to build catalyst factory

The collaboration between PT Pertamina Lubricants, PT Pupuk Kijang, PT Rekacipta Inovasi ITB, and PT Wijaya Karya Engineering Construction to construct the Merah Putih Catalyst Factory indicates a strategic partnership that aims to create a state-of-theart catalyst factory

Surveillance audit ISO 9001:2015

The surveillance audits conducted by QSCert at BPUDL are part of BPUDL efforts in evaluating the effectiveness of BPUDL's quality management systems, ensuring compliance with established processes, and fostering a culture of continuous improvement

The construction of the Red and White Catalyst Factory with ITB's research success and Prof Subagjo's leadership serves as an exemplar of how academic institutions can drive technological advancements and contribute to national strategic projects. By promoting green fuel production and supporting Indonesia's renewable energy objectives, the factory represents a crucial step towards a more sustainable energy transition

BPUDL acknowledges the company's performance in 2021 and recognize their contribution to ITB through the distribution of dividends Dividends are a way for the companies to share their profits with ITB, providing valuable financial support

Apr

BPUDL & Bareksa initiate a strategic partnership

In order to support effective fund management, BPUDL & Bareksa initiate a strategic partnership to build an integrated information system which allows BPUDL to access realtime financial data This enables BPUDL in understanding market dynamics and making data-driven investment decisions

Ganesha

The establishment of PT Salam Kreasi Ganesha as a subsidiary of PT LAPI ITB indicates a strategic move that can have positive impacts for both PT LAPI and BPUDL in ITB independence and financial sustainability

May

The regular meetings between the ITB Board of Trustee funding committee and BPUDL are crucial for formulating effective strategies and executing funding opportunities for ITB's endowment The meetings also address funding opportunities related to the development of ITB business units.

A visit from Telkom University

The visit from the Directorate of Career Development, Alumni, and Endowment (CAE) of Telkom University (Tel-U) to BPUDL ITB for a comparative study on endowment fund management is a valuable opportunity for knowledge sharing and best practices exchange between the two institutions

Audits by Internal Control Committee

ITB Internal Control Committee function in undertaking financial and non-financial audits of BPUDL is important for promoting BPUDL accountability, transparency, and continuous improvement

Establishment of PT Salam KreasiThe visit of the Business Management Board of the University of Syiah Kuala to BPUDL aims to gain valuable insights from BPUDL's experience in managing commercial business units. Learning from BPUDL's experience can help the University of Syiah Kuala identify and optimize such assets for commercial opportunities

Visiting UI's business units exposes BPUDL to a variety of business ideas and opportunities This exposure can spark creativity and inspire BPUDL to explore new commercial ventures that align with ITB's strengths and expertise.

The friendly gathering hosted by BPUDL, coinciding with its eighth anniversary. This event serves as a meaningful and enjoyable occasion for commissioners, directors, and other stakeholders associated with BPUDL and ITB companies. It also creates a positive work environment within BPUDL and its affiliated companies

A visit from Yogyakarta State University (UNY)

A team from UNY led by Prof. Anwar Efendi visits BPUDL to gain valuable insights and learn from the best practices implemented at BPUDL

The discussion organized by BPUDL, inviting the Heads of Research Centers and Centers at ITB, on the topic "going nowhere or converge". Mr Gilarsi shares his experiences as Commissioner of PT Rekacipta Inovasi ITB on successful downstream research projects and the strategies implemented to bridge the gap between research and commercialization

A visit from Universitas Islam Internasional Indonesia (UIII)

This meeting represents a collaborative effort to explore innovative approaches to support higher education funding By leveraging business unit management and asset commercialization strategies, UIII aims to enhance its financial position and create sustainable revenue streams that can contribute to the university's growth and development.

A visit from Andalas University

The visit allows Andalas University's Vice Rector and staff to gain valuable insights and knowledge from BPUDL's experience in managing business units and commercialization activities

Forum group discussion on endowment fund management

Connected via the zoom application, this forum provides a valuable platform for universities in Indonesia to share endowment fund management experiences, best practices, and strategies.

A visit from Universitas Islam Malang

Rector of Universitas Islam Malang visits BPUDL to explore ways to translate research findings into commercial products or services that can benefit the community and contribute to the university's financial sustainability.

The discussion is organized by BPUDL to optimize ITB's asset management, particularly the Sawunggaling Hotel. By bringing together relevant stakeholders, BPUDL aims to explore strategies to maximize the potential of the Sawunggaling Hotel and enhance its overall asset management

DJPPR explains Cash Waqf Linked Sukuk (CWLS)

Directorate General of Financing and Risk Management (DJPPR) of the Ministry of Finance explains the possibility of CWLS to be explored as a type of investment that may offer advantages in terms of financial management and long-term stability

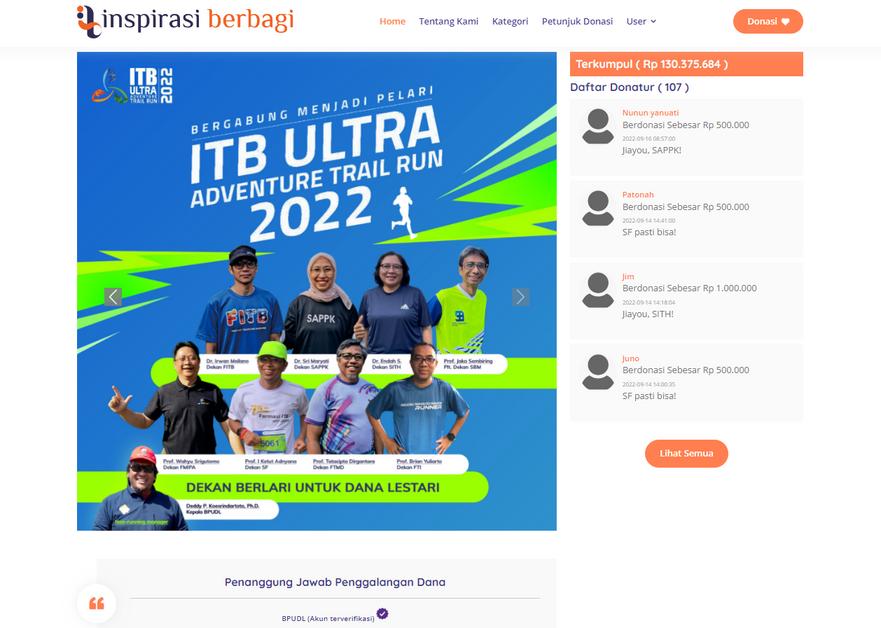

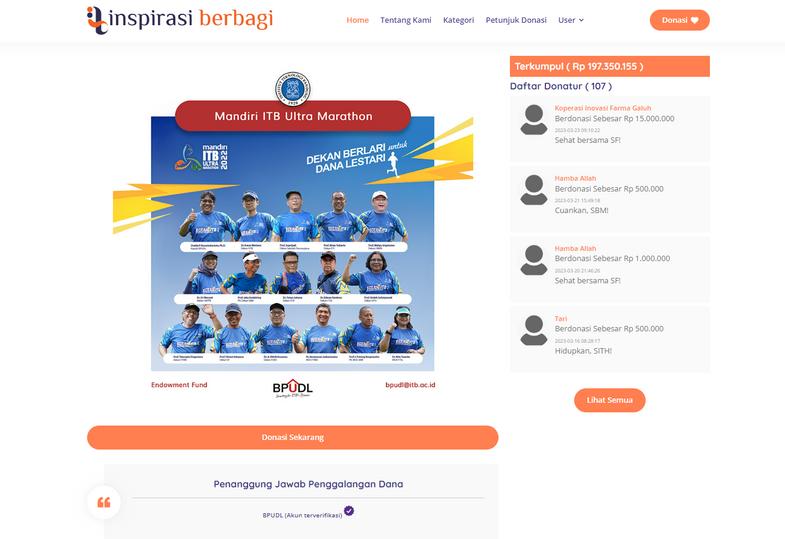

Deans raise endowment funds through running event

The "Dean Running for Endowment Funds" campaign featuring the participation of 8 Deans of Faculties at ITB in the "Ultra Trail Run" event The impressive outcome of the campaign, with funds raised amounting to IDR 130,375,684, signifies the success of the initiative in mobilizing resources and generating support from participants, sponsors, and donors.

Establishment of PT ITB Press

On September 22, 2022, ITB established a new Commercial Business Unit, PT ITB Press By establishing PT ITB Press, ITB aims to expand its publishing and printing services to better serve the academic community and the public.

Distribution of extraordinary scholarship

The Extraordinary Scholarship Foundation generously donated IDR480,032,500 to support ITB students The funds received by BPUDL will contribute significantly to the wellbeing and success of deserving students. It may also boost their morale, motivate academic achievement, and encourage a sense of gratitude and responsibility towards giving back in the future

A visit from Semarang State University

Head of Semarang State University Business Development Agency, Dr Amir Mahmud and his team paid a visit to BPUDL in order to discuss business unit management.

Zakat donation by Rumah Amal Salman

BPUDL received donations collected from zakat funds by Rumah Amal Salman The donation amount of IDR60,340,000 will be channeled to support ITB students by helping to pay for their education costs

A visit from Universitas Negeri Sebelas Maret (UNS)

UNS sent a team to BPUDL to compare business practices with those of BPUDL and PT LAPI ITB

A Meeting between BPUDL & PT Telkom

The meeting between BPUDL and Digital Director of PT Telkom fosters mutual recognition and understanding between both organizations, paving the way for a fruitful and sustainable partnership.

A meeting between BPUDL, April Group and Tanoto Foundation

BPUDL visited April Group and Tanoto Foundation to present and submit a proposal for the construction of molecular engineering and functional materials building The meeting also touch upon the corporate social responsibility initiatives of the April Group and the Tanoto Foundation, indicating their dedication to supporting education at ITB.

A meeting between BPUDL and PT Chandra Asri Petrochemical

BPUDL subsequently visited PT Chandra Asri Petrochemical to present and submit a proposal for the construction of molecular engineering and functional materials building

A meeting with T.P. Rachmat

The meeting was set up between BPUDL and T P Rachmat, one of ITB's philanthropists and alumni, who is consistently support through endowment fund donations. This meeting also open other opportunities for endowment fundraising

A visit from Universitas Gadjah Mada

The meeting, which also involved PT LAPI ITB, focused on discussing the management of university business units The visit allowed UGM to learn from BPUDL's expertise in managing business units and optimizing endowment funds, while BPUDL could benefit from UGM's insights and practices

The discussion forum is organized by BPUDL ITB with endowment fund managers from 22 legal entity state universities. The forum provides a platform for these institutions to collaborate, share insights, and develop creative strategies for fundraising and managing endowment funds.

Donation from Indonesian Education Scholarship awardees

The donation received from the Indonesian Education Scholarship awardees reflects the spirit of solidarity and compassion towards those affected by the earthquake in Cianjur It shows how individuals, even scholarship recipients, are willing to contribute to disaster relief efforts.

The grand opening of the ITB Press Store at the STP Building, Ganesha Bandung on December 22, 2022, marks a significant milestone in the development of ITB Press as a commercial business unit. The event was inaugurated by ITB Rector, Prof Reini Wirahadikusumah The store's physical presence provides ITB Press with an avenue to directly engage with its target audience.

For the year ended Dec 31, 2022 and 2021

*ThedecreaseinassetsduetotheestablishmentoftheITBPressasasubsidiarycompany,provisionfornon-bankinvestments(AparkostJatinangorandYellowDome),as wellasacashtransferofIDR50billiontoITB'sDirectorateofFinanceforbuildingconstruction

TheBPUDLFinancialStatementsarepartofITB'sfinancialstatementsandhavebeenauditedbyPricewaterhouseCoopers(PwC)withaFairUnmodified Opinion