16 minute read

Shopping: The New Normal

The New Normal

by Kylie Ross Sibert

Advertisement

itting in a coffee shop in Norfolk at 3 p.m. on a weekday, having a late working lunch with a colleague, I look around and find it hard to believe that the challenges and struggles over the last two years had ever transpired. Masks were nowhere to be found, social distancing certainly wasn’t a worry and of the 16 tables I counted, only one was empty. The atmosphere buzzed with chatter, laughter and upbeat music playing through the speakers.

Are we back to normal? On the surface, everything looked like it was back to normal but is that actually the case? I think you’ll agree with me when I say a resounding no. Look at your own shopping behavior. Has it returned to how you shopped prior to the pandemic? Are you one of the 15% of U.S. consumers who tried grocery delivery for the first time during the COVID-19 crisis? Did you find it easy and safe—possibly even enjoyable? You’re not alone. The vast majority who tried it, agree with you. Forty percent even intend to continue getting their groceries delivered after the crisis.1

One of the most overused words during the pandemic: pivot Luckily for all of us, most retailers are innovators. At the beginning of the pandemic, making changes that provided tangible benefit to consumers became vital.2 It was a matter of

1 McKinsey & Company, “Understanding and shaping consumer behavior in the next normal”, https://www. mckinsey.com/business-functions/marketing-and-sales/our-insights/understanding-and-shapingconsumer-behavior-in-the-next-normal 2 Retail Alliance, “Retail Pulse August 2021 Report”, https://retailalliance.com/retail-pulse-survey-results-localretailers-remain-confident-despite-rising-covid-19-cases-supply-chain-issues-and-labor-shortages/

How COVID-19 changed retail and consumer behavior

TARA CLARK

pivoting or closing (which many were forced to do). Unfortunately, numerous staff were laid off, but many business owners adapted their business models, using their staff in other functions, such as online ordering, delivery, curbside pickup, etc.

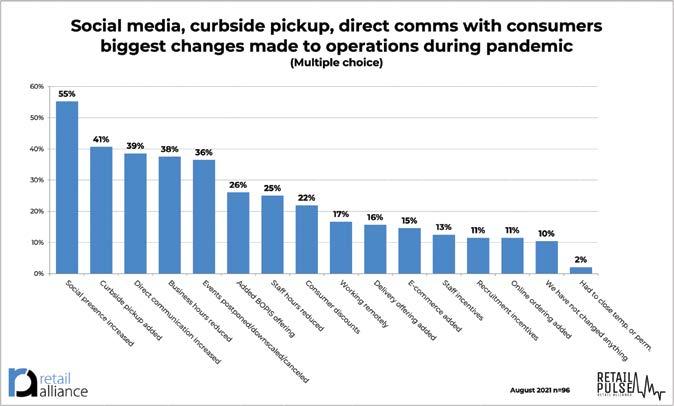

Among those changes made, development of e-commerce stores occurred in a matter of weeks, introduction of fast casual dining when dining rooms closed (curbside pickup, buy online pickup in-store— BOPIS) and local delivery introduced (either store associates or third party delivery partners). In-store classes became online classes, and social media provided a much-needed communication, promotion and sales platform for retailers. With the desire for these services to continue3, many retailers have permanently added them to their operations.

Success for some, not for others The pandemic not only changed how we shopped but what we purchased. As consumers spent less on services such as travel and restaurants and goods such as apparel, spending shifted to retailers who sold building materials, grocery, home appliances, home accessories, gardening supplies, sporting goods, boats, leisure wear, furniture and office supplies, due to the nature of people spending more time at home and needing to either work from home or wanting to work on their home, as well as to fill their spare time. As a sidenote, it was of no surprise that apparel was one of the categories hardest hit. No longer did people need to buy clothes for work or dress up for events. People only needed a nice top or shirt to show over Zoom. No longer did the apparel industry hold the power to create trends and drive demand for new products.

3 Square, “Future of Retail Trend Report: 2022 Edition”, pdf With the shift to goods from services, to what extent have people started reverting back? Even though we’ve seen mobility increase and people getting out there and being more active, we haven’t seen a major shift back to services yet. Did you cook more at home than eat out during the pandemic? You’re not alone. People became more comfortable cooking at home and becoming better cooks (practice makes perfect, right?). Eating at home was also more cost-effective and easier to make healthier food choices.

Buyers are more knowledgeable than ever before There’s a reason for this. Buyers learned how to research. Just a decade ago, it was incredibly common for customers to walk into a store having only a vague idea of what products they were interested in buying. For example, a first-home buyer might walk into a home appliances store asking about which style of dishwasher works best in a townhouse. These days, a new homeowner has probably spent hours researching dishwashers online, looking at sizes, energy efficiency, customer reviews and price comparisons before even speaking to a salesperson.

The National Retail Federation expects online sales to grow between 11% and 13% in 2022.

According to Google, 90% of consumers say they use multiple devices to complete everyday tasks, while 40% say they use their mobile device to conduct research prior to making a purchase. Although we know that digital commerce increasingly dominated retail sales prior to the pandemic, the pandemic accelerated this shift dramatically. In fact, the National Retail Federation

has released their forecast for 2022 with online sales expected to grow between 11% and 13%. But that does not mean they have quit shopping in brick-andmortar stores. Another study by Forbes Insights in conjunction with Synchrony Financial found that for more expensive items, 46% of customers prefer going to a physical location to actually make a purchase.

Differences in consumer behavior It is interesting to think about our economic trajectory prior to the pandemic. In 2019, we viewed the future of retail as experiential retail and discussed all of the things that retailers had to do to remain relevant to the consumer. This hasn’t changed, although it may have been heightened. It has created a new trajectory as it relates to the challenges and the opportunities for retailers and how they reach their consumers and how the consumer reacts to what retailers are doing. It will be interesting to see whether some of those pre-pandemic behaviors remain as we become post pandemic. We know that not everybody will return to the office and many organizations may not go back to five days a week in the office, changing the way that we live. As we spend more time at home, we put more pressure on our appliances, we increase the replacement cycle for those products, we spend more time furnishing our offices and buying computers, so it remains to be seen whether or not we are going to revert back to the consumer behavior we had ‘before.’

Does size matter? Are local retailers “rebounding” better than big box stores? No. There are prevalent issues across the board such as inflation, staffing shortages and supply chain delays. Local retailers usually offer more than minimum wage to their associates and with big boxes now increasing

Calling all CHIEF EVERYTHING OFFICERS

We’re open for your business

Whether you’re a restaurant, retailer, or other small business, we’re here for you. Join our community and level up with education & training, enjoy one-on-one advisor support, and expand your marketing reach.

retailalliance.com

their hourly wages to be equivalent to, or more than local retailers, along with offering incentives that local retailers cannot afford, retail across the board suffers from a labor shortage. Continuing financial difficulties remain a serious issue. Local retailers do not have the deep pockets of larger retailers and rely on regular cash flow to maintain operations. Without additional injection of financial assistance from the state or national level, financial difficulties will persist.

Was inflation the straw that broke the camel’s back? That’s not all. The Bureau of Labor Statistics recently released data that shows inflation levels have risen to a new 40-year high of 7.9% in February, 2022. Simply put, the relationship between supply, demand and price broke due to the unprecedented (another popular pandemic word) growth of demand in goods over the last couple of years (remember the shift from services to goods?). Incredible demand has put pressure on supply. Supply has increased but hasn’t increased fast enough. The impact of that equates to a rise in prices. Cars provide a good example of this. Most people know by now that manufacturers face a huge chip shortage. We didn’t sell more cars last year than the year before. We sold fewer new cars last year because of chip shortages and they couldn’t build enough new cars to fulfill demand, so this put pressure on used cars and drove prices up. Used auto sales went up 40% year over year. We see more money in the economy due to the stimulus money from the government ($3.5 trillion total), with $2.6 trillion more saved than normal due to not eating out, not needing to spend money on gas,

and not going on vacations, to name a few causes. Employees also create part of the supply chain. With the struggle to find enough employees to fill jobs, wages increased. People made more money, which resulted in more money circulating in the economy and more demand on goods, causing an upward pressure on prices.

Consumers reaction to inflation There are many different consumer strategies during inflation and probably first and foremost is that people seek promotions, something we’ve seen for years. That will only increase in times when we have inflation like we do and historically, at times of high inflation, we see consumers changing their shopping habits to shop more in discount stores and dollar stores. Consumers also buy in bulk. People stock up and, at times, overshop on certain categories, but when prices go up, consumers want to lock in as much as they can at the current price and while it’s still in stock. This only exacerbates the situation, creating more shortages and driving up prices. Substitution is also common, due both to shortages and pricing. If you bought name brands, maybe you now choose more cost-effective products, such as private label. For some consumers it’s difficult because of their challenging budgets and they already buy products near the bottom of the tier. In this situation, consumers may switch away from some of the previously bought products or cut back on some of the services that they might normally have purchased and switch those into higher-priced goods.

Is there a “new normal?” We may see a slight return to normal during summer, with an increase in people going on vacations, eating out and commuting to work, possibly resulting in a natural shift back to services away from goods. This will take some pressure off the supply chain and potentially make it less costly to produce these goods to get them shipped into the country and therefore much less costly when they appear on our shelves. The bad news is that consumers have really felt the pinch at the grocery store and at the pump. They buy what they need, whereas during the COVID-19 Pandemic, it was more about buying what they wanted. Their shopping trips and purchases have become more thought-out and are often not in person, as gas prices curtail shopping outings.

Are people being driven online? Online shopping continually grows and gas prices and inflation push more people online. Gone are the days customers must come to you. Now they can go online, 24 hours a day, and get pretty much anything they need or want. That poses the question, do people want convenience more than the experience? Time has become more valuable, with people having more of a work/life balance during the COVID-19 pandemic and not willing to go back to working 10-12 hour days. Consumers look for cheaper pricing, often including free shipping. Amazon has trained consumers to expect free shipping. They absorb a $7 billion loss (2017) even after incorporating Prime Membership income. Other big boxes like Walmart and Target have followed suit on qualified items or on a minimum spend or if you use their credit card. Even when smaller retailers adapt and introduce boxed deliveries or subscription models, they cannot afford to absorb the shipping costs, especially as supply chain issues have caused shipping costs to rise, inflation impacts cost of goods and minimum wage increasing overheads.

It’s not the end of storefronts That doesn’t mean people stopped shopping in person. Isolation with limited social interaction all through the pandemic have people looking for in-person/in-store experiences. As social creatures we want to be out and about to connect and be around other people.

SOAPS BODY BUTTERS SALT SCRUBS LOTION BARS BATH TRUFFLES BATH SALTS DEODORANTS LIP BALMS SALVES BEARD BALMS BEARD OILS

WE ALL WANT OUR SKIN TO FEEL AMAZING…Simplí.

SimpliArtisan.com

Gaelic for simple and straightforward

Small-batch artisan soaps and body products made in Virginia without dyes, parabens, phthalates, detergents and other chemicals found in many consumer skincare items. Using responsibly cultivated, quality ingredients.

If I want a pair of shoes, do I buy a range of sizes online (utilizing my money) not knowing if the sizing is right (we can be a 7 in one set of shoes and 8.5 in another), keep the one(s) that fit(s) or that I like, then send the rest back? Or do I want to go to a store and try them on, talk to the store associates, ask any questions, find the ones I like and feel good in, buying them right then and there? Warmer weather, implementation of vaccines and booster shots and declining cases of COVID-19 are positive signs for retailers and consumers. Retailers are organizing in-person events throughout summer and reintroducing events that they postponed during the pandemic. It is the perfect time for consumers to get back out, enjoy local events, watch your children play sports and support your local retailers and food establishments.

IVAN SAMKOV

Local business owners have invested in their businesses. They care about your shopping experience and managing your expectations.

Don’t let your support lag Local business owners need our continued support. During the first year of the pandemic, citizens and communities got behind local businesses and supported them in any way they could through purchase of gift vouchers, curbside pickup, promotion on social media, etc. But as the pandemic dragged on, the pleas to “save my business” that helped many local stores and restaurants keep afloat, lost their relevance and buy-local fatigue set in. Understandably so, as rising gas prices, inflation, global economic uncertainty and other issues have started impacting those same people. Now everyone is in the same boat, and it is even more crucial for us all to help and support each other as these issues drag on. Local business owners have invested in their businesses. With their livelihood on the line, making

Some of Hampton Roads store

openings in 2021 and 2022

• Beach Gold Assay in Virginia Beach relocated and expanded—February 2021 • Volcom opened in Lynnhaven Mall—February 2021 • The Industrial Cottage in Norfolk expansion—March 2021 • Philip Michael Fashion for Men relocated to Lynnhaven Mall in Virginia Beach—

April 2021 • Philip Michael Fashion for Men relocated their store in Hampton—April 2021 • Shark City Naturals opened their second location in Norfolk—April 2021 • Mad Hatter Studio relocated from Norfolk to Virginia Beach and expanded space—May 2021 • Divine Scentervention in Virginia Beach—May 2021 • Mom & Me Boutique reopened in Virginia Beach under new ownership—June 2021 • Queens Lingerie opened in Norfolk—May 2021 • For All Handkind expanded their space and opened studios and gallery in

Norfolk—July 2021 • Fabric Shoppe opened in Suffolk—July 2021 • Nuleeu Nutrition in Chesapeake—July 2021 • Stark & Legum relocated and expanded in Norfolk—July 2021 • Freedom Boat Club in Norfolk—August 2021 • Allure Creperie & Café opened in Williamsburg—August 2021 • Fresh Dawgs in Norfolk—August 2021 • Ribbon cutting/grand opening for Yorktown Mercantile—September 2021 • Village Studio Arts in Newport News—September 2021 • Esprit Décor Bassett Benchmade Gallery grand opening in Chesapeake—

September 2021 • Wild Birds Unlimited in Chesapeake—October 2021 • Grow Depot in Virginia Beach—October 2021 • Nothing Bundt Cakes 3rd location in Virginia Beach—October 2021 • Coastal Edge opened an additional location in Lynnhaven Mall—November 2021 • ArtWorks by The Ability Center opened—November 2021 • Benny’s opened in Virginia Beach—November 2021 • Gelati Celesti opened second location in Virginia Beach—November 2021 • Chili Hill Food Market opened in downtown Smithfield—November 2021 • Granier European Bakery & Café opened in Virginia Beach—November 2021 • The Chipper opened in Virginia Beach—November 2021 • Soulivia’s Art + Soul opened in Chesapeake—December 2021 • Good Vibes opened in Newport News—December 2021 • Chicken Salad Chick opened in Hampton—December 2021 • Lovisa opened in Lynnhaven Mall—December 2021 • Fuddruckers opened in Virginia Beach—early 2022 • My Local Tax Pro opened in Virginia Beach—January 2022 • Matchsticks BBQ opened in Williamsburg—early 2022 • Clean Eatz franchise owner Dylan Richmond opened second store in

Chesapeake—early 2022 • Heart Felt Touch Massage Therapy opened in Mathews—February 2022 • Metal Supermarkets opened in Newport News—February 2022 • Pale Horse Coffee opened a location in Chesapeake—March 2022 • Taylor’s Do it Center opened their 12th location in Gloucester—March, 2022 • Say Cheezz opened in Newport News—early 2022 • Rooted Method opened expanded store—early 2022 • Cure Coffeehouse opened their third location in Portsmouth—April 2022, with

Newport News opening soon after • Legal Sea Foods, Nando’s and Madewell coming to Virginia Beach Town Center • Pedego Bikes Williamsburg opened—early 2022 • Freedom Boat Club Hampton—May 2022 sure they offer the best products and service to their customers becomes paramount. They care about your shopping experience and managing your expectations. Their responsiveness is second to none, you can talk to a person not a machine or waiting on hold for hours, they keep money in the community and they support local creators. You can also connect with the faces behind a business (and behind the masks). Knowing the area where you live, some of the same people you know, supporting youth sports teams and local charities, and selling products and services that fit the region, is something many of us overlook and do not appreciate. The local businesses in Hampton Roads make our neighborhoods, our cities and counties, and our region, unique.

The last word: evolve COVID-19 has created an unimaginable disruption of the retail industry, but it has also created a unique opportunity for the retail industry to evolve. Although an overused word during the pandemic, it perfectly describes how both retailers and consumers have adapted during the pandemic. And as I sit in this buzzing café, I know that although the future is not set in stone, there are signs of recovery and positivity that overshadow the doubts and uncertainty in my mind.

Kylie Ross Sibert serves as the vice president of corporate communications at Retail Alliance, Hampton Roads’ retail merchants association. Her 30 years in the communications and marketing industry across multiple countries and continents has provided invaluable insight into consumers, cultures and both multinational and small local businesses. Television networks, newspaper and magazine publications seek her out for her expertise and industry knowledge. Kylie lives in Virginia Beach with her husband and family.