by Zhao Bing

Children’s book publishing has long been a vital sector of the global publishing industry. However, in recent years, both the internal and external dynamics of this sector reshaping the global landscape. As a result, children’s book markets worldwide have transitioned from growth-oriented markets to mature markets. Since 2024, however, there in global children’s book themes, coupled with increasingly dynamic marketing strategies. Themes such as multiculturalism, peace, sustainable development, immigration culture, and health have gained considerable traction among international publishers. The industry’s focus on engaging storytelling, coupled with an emphasis on new media marketing, underscores a broader shift toward more diverse and dynamic development trends in the global children’s book publishing sector.

In China, children’s books are defined as those aimed at readers under the age of 18. With census data showing that over 300 million children and adolescents make up this demographic, the market for children’s books in China is vast. Over the years, China’s strong advocacy for widespread reading, along with the growing importance placed on children’s education by parents, has fueled robust growth and dynamic development of the children’s book publishing sector. In 2024, Chinese children’s book publishing stands out as an integral part of the global industry, offering rich diversity and inclusivity in content creation. Furthermore, marketing strategies have -

net. Chinese children’s book publishing market is witnessing a range of trends, presenting both opportunities and challenges.

1. Overview of the Children’s Book Market

The Chinese book retail market

years, largely influenced by external economic factors. As consumer spending has become more cautious, the market has been inevitably affected. According to data from Beijing OpenBook, in 2024, the total list price sales (calculated based on the original price of books regardless of discounts) of China’s book retail market declined by 1.52% compared to the previous year, with the overall market (excluding textbooks and educational materials) seeing a more significant drop of 4.83%. Total list price sales amounted to RMB 112.9 billion (approximately USD 15.45 billion), which represents 88% of the market size in 2019. Overall, China’s book retail market is navigating a critical phase of transformation and change.

Within this broader context, the children’s book market remains the largest segment by total list price sales. It is undergoing significant shifts in both content creation and marketing strategies. These changes

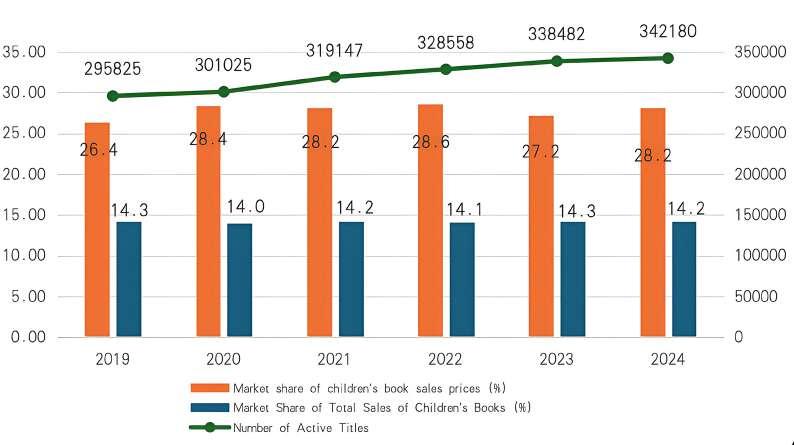

are not only evident in the evolution of readers’ consumption habits and distribution channels, but also in how the competitive landscape is developing, with shifts in market segmentation and emerging trends in bestselling books. In 2024, the total list price sales of children’s books (excluding textbooks and educational materials) reached RMB 31.76 billion, accounting for 28.16% of the overall book retail market, an increase of 0.95% from 27.21% in 2023. Over the pastsistently made up around 28% of the book retail market, with only a slight dip in 2023. There were 342,000 active titles, representing 14.4% of the total book market.

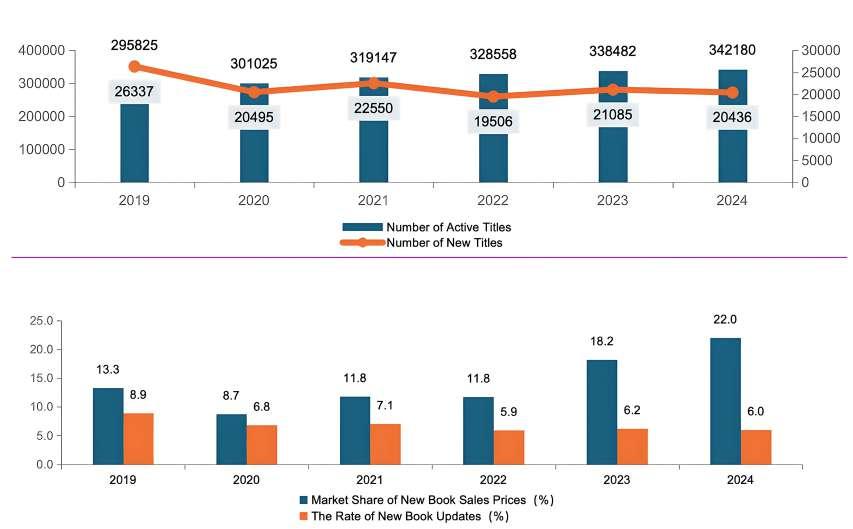

The release of new books remains one of the main drivers of the children’s book market. However, in recent years, the number of new children’s book titles in China has significantly decreased compared to 2019, with the trend remaining steady between 2022 and 2024. In 2024, the number of new active titles in the Chinese children’s book retail market was 20,436, with new books contributing approximately 22% to total list price sales, an increase of 3.8% compared to 2023. This highlights a key shift in the market. The focus has moved from rapid expansion to an emphasis on content quality. In essence, the market has transitioned from an incremental phase to a more competitive phase, where the quality of content is paramount.

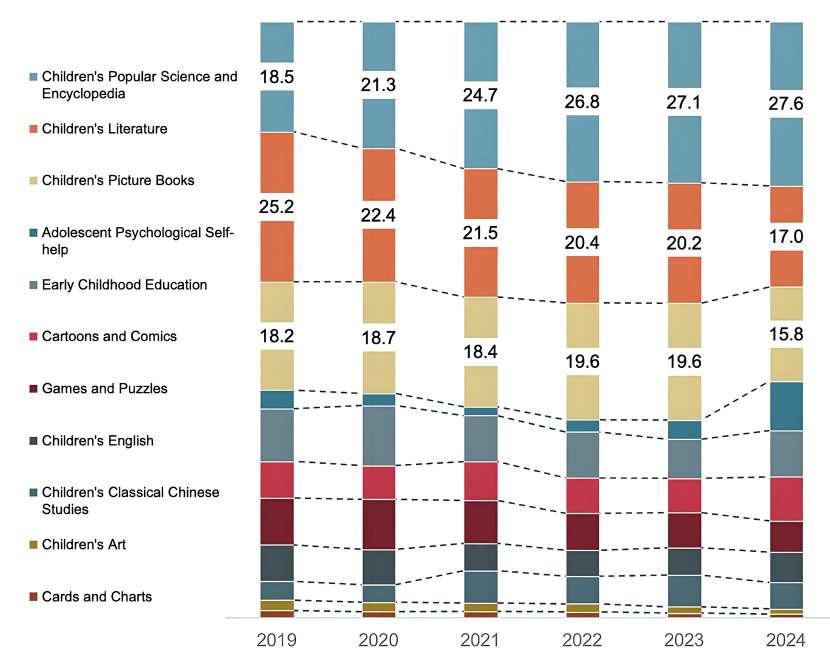

In terms of product structure, in 2024, the Chinese children’s book market has entered a phase of heightened competition, marked by a clear trend toward market segmentation. The three largest segments by list price sales (children’s popular science, children’s literature, and chil-

dren’s picture books) now together account for over 60% of the total market, making them the focal points of industry competition. Children’s popular science books have seen rapid growth in recent years, with their market share reaching 27.6% of total list price sales in 2024, an increase of 6.3% from 2020. This growth is driven by the strong integration of popular science content with academic education, fueling ongoing demand. Children’s literature, which accounts for 17% of list price sales, has faced challenges in recent years. The impact of new media and e-commerce platforms on this category has been relatively modest, contributing to a contraction in its market share. Meanwhile, children’s picture books, which made up 15.8% of list price sales, have experienced a notable slowdown in 2024, following several years of stable growth.

Looking at year-on-year changes in total list price sales across various market segments over the past three years, adolescent psychological self-help books stand out as the only category to show consistent positive growth over the period. In 2024, this segment’s growth rate surged by 50.1% compared to 2023 and by 84.5% compared to 2022. Additionally, early childhood education, children’s popular science, children’s English, and cartoons and comics were key drivers behind the overall growth of the children’s book market in 2024.

In terms of sales channels, the overall structure of China’s book sales channels in 2024 continued to be dominated by content e-commerce (which originally emerged through short video platforms). Physical bookstores, platform e-commerce, and vertical and other e-commerce channels all showed negative growth, with platform e-commerce experiencing a particularly pronounced decline compared to 2023. While content e-commerce still posted positive growth, its rate of expansion has noticeably slowed, which has di-

market. In the children’s book publishing sector, content e-commerce

grew by 32% year-on-year in 2024, while all other channels experienced varying degrees of decline.

The evolution of publishing channels has been a major topic of discussion in China’s publishing industry in recent years, creating new opportunities for publishers, while also presenting risks and challenges.

Short-video e-commerce has played a critical role in driving sales of children’s books, but the issue of deep discounting associated with this channel has raised concerns for Chinese children’s book publish -

and unsustainable development caused by high discounts became more pronounced, as the ability of ecommerce to scale sales weakened compared to previous years. Data shows that children’s books had the lowest discount levels in content ecommerce channels . In 2024, the average discount for children’s books in retail was 51%. The average discount for children’s books in content ecommerce was 64%, while platform e-commerce saw a 50% average discount, vertical and other e-commerce 44%, and physical bookstores 14%. Among categories, card and charts

saw the highest discounts across all channels except physical bookstores, with an average discount rate exceeding 80% in content e-commerce. Children’s classical Chinese studies and cartoons and comics also saw heavy discounts, averaging 70% in content e-commerce, while other categories ranged from 65% to 52% in short video e-commerce channels.

In 2024, the influence of topselling titles in the Chinese children’s book market continued to expand.

The top 1% of books, comprising 3,380 titles, achieved an average sales volume of 66,972 copies, collectively contributing 56.94% of the total list price sales in the children’s book market. This represents an increase of 8.17% from 48.77% three years ago. Furthermore, the top 100 bestsellers in the children’s book market contributed 13.06% of the total list price sales, up 4.85% from 8.21% in 2021.

Children’s books possess distinct characteristics compared to other genres. Parents, as the primary buyers, typically focus on bestsellers and trending topics, which often reflect their aspirations for their children’s holistic development and success. In China, parental expectations for children’s books have risen sharply, with mere entertainment no

As a result, publishers are increasingly prioritizing the educational value of children’s books, aiming to foster skills such as critical thinking, creativity, and problem-solving. In 2024, the themes of bestsellers in the Chinese children’s book market covered a broad range, addressing emotional intelligence, moral development, academic achievement, and intellectual growth. Publishers have also taken into account the psychological needs of children at various developmental stages. Furthermore, in consideration of children’s physical and mental development, books have been carefully categorized by reading difficulty, format, and medium. This includes graded reading products, bridge books, pop-up

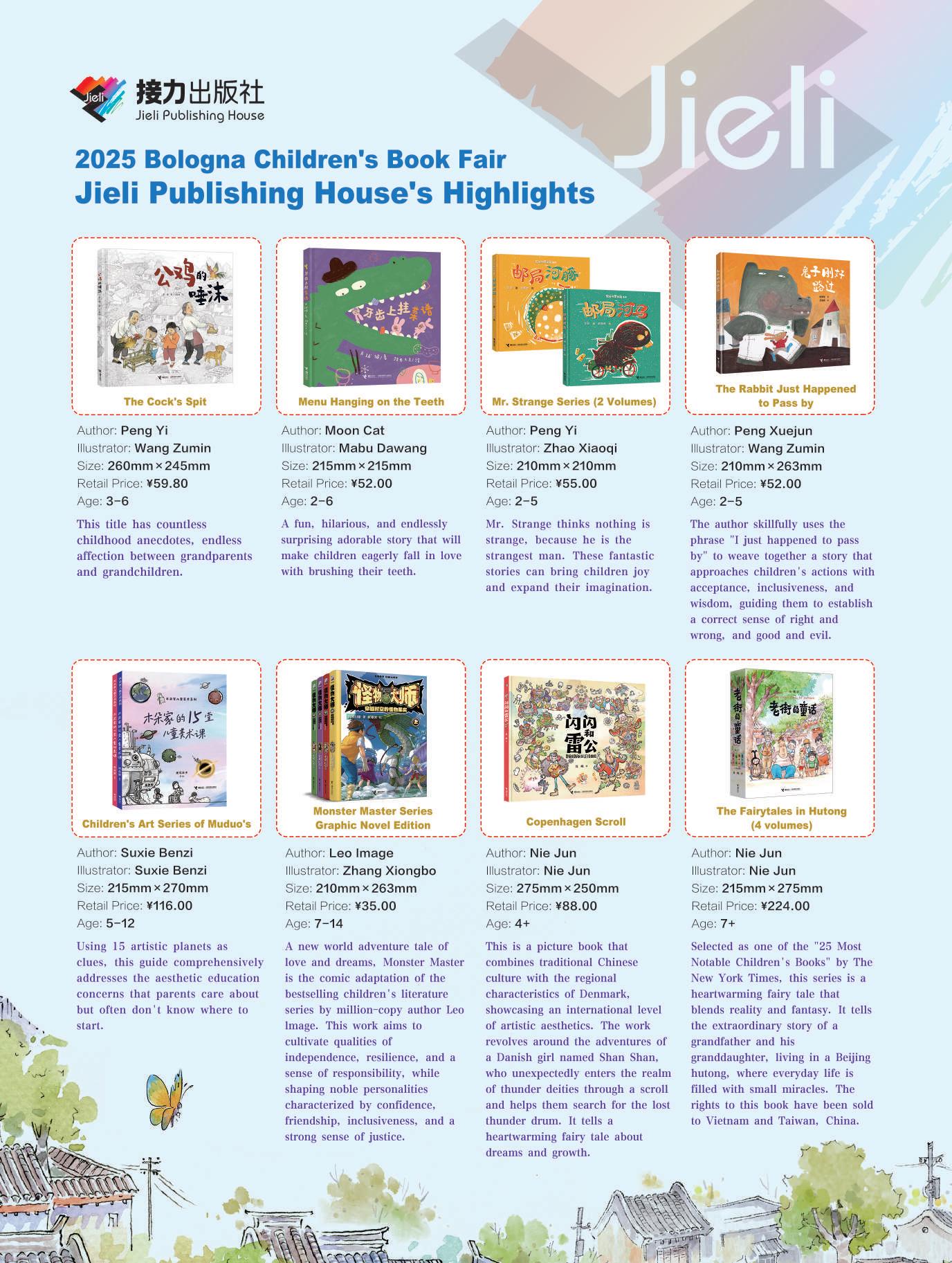

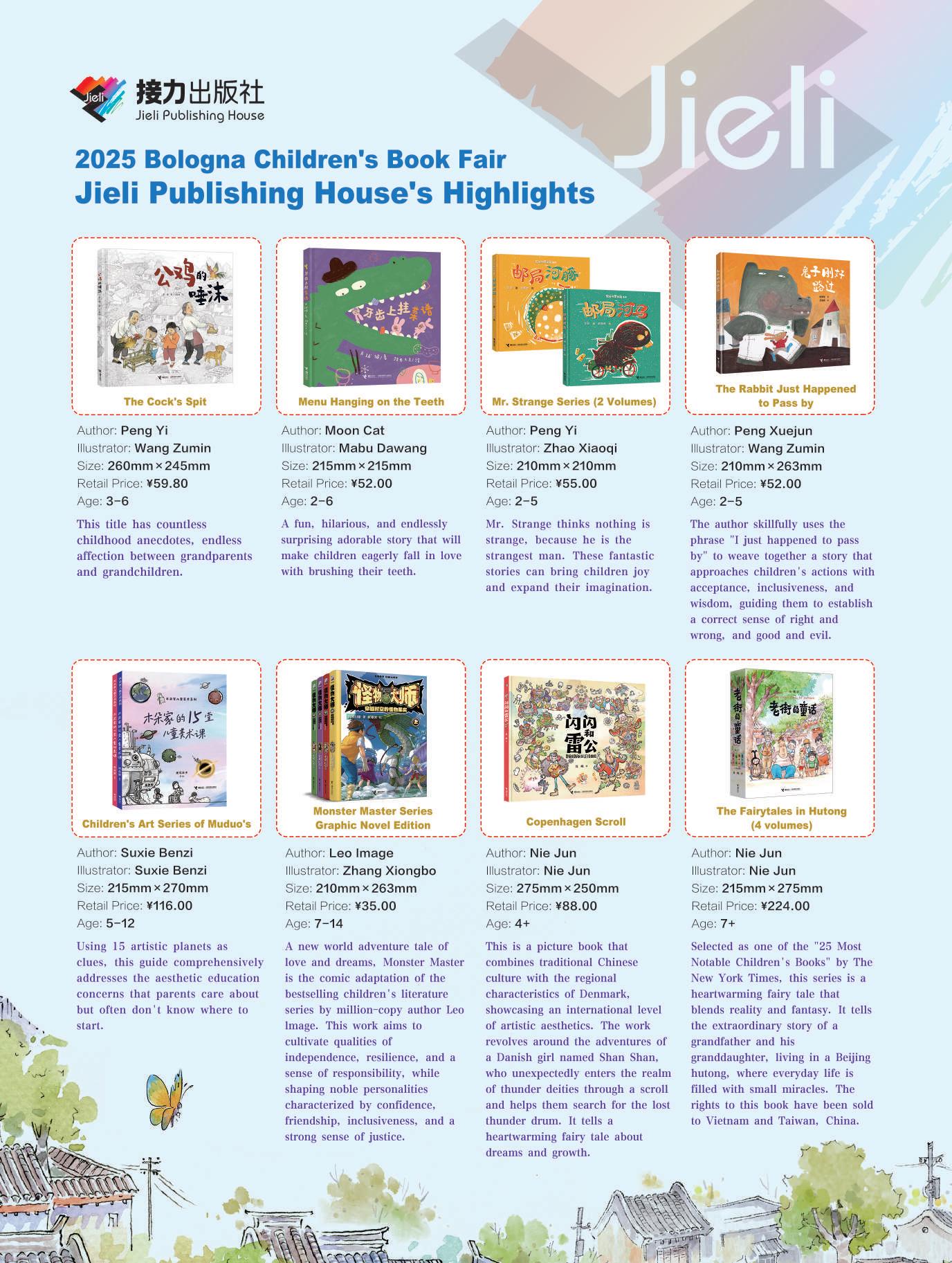

Bologna Children’s Book Fair

books, and touch-and-feel books, where formats are designed to encourage good reading habits from a young age.

The use of comics as a medium for conveying knowledge has become a major trend in the Chinese children’s book market in recent years. Given their entertainment value, comics naturally attract younger readers. In 2024, the “comics plus” format (a hybrid of comics and educational content) continued to evolve, gaining popularity across the market. Additionally, series of bestsellers have consistently dominated the rankings. Whether in the form of new installments to longrunning series or newly created series by publishers, these books have generated significant buzz. Publishers are increasingly focusing on building entire series of children’s books, extending their life cycles through IP-based content management strategies, ensuring sustained popularity. For example, the “Great China Treasure Hunt” series by 21st Century Publishing House has become a well-established brand in the children’s book market, thanks to a multifaceted promotional approach that includes books, animations, and games. In 2024, sales of this series through short-video e-commerce channels rose by 30% year-on-year. Similarly, Juvenile & Children’s Publishing House launched a series the “100,000 Whys” IP, boosting its

Additionally, the growth of the educational market has spurred the popularity of children’s books that align with school curricula and teaching standards. Some publishers have developed supplementary materials, online courses, and educational games to complement textbooks, offering integrated educational solutions for schools and families. These products not only improve children’s academic performance but also assist parents in better guiding their children’s studies.

From the perspective of authors, the top 10 authors in the Chinese children’s book market in 2024 included two international names (referring to creators of written con-

tent): Christian Jolibois from France, known for LesP’titesPoules(The LittleChicks), and Erin Hunter from the UK, known for the Warriors series. The remaining seven authors on the list were Chinese, with Bei Mao, author ofMiXiaoquan’sSchoolLife, ranking first; Lei Ou Huanxiang, author of Mo Duoduo’sAdventure, ranking second; and Shen Shixi, author of WolfTotem:King’sDream, ranking third.

As for imported children’s books, the majority in the 2024 market originated from the United States, the United Kingdom, Japan, as well as France, Germany, South Korea, and Italy, in terms of variety and scale. However, in terms of sales revenue, the top three sources of imported books were the United King-

dom, Japan, and the United States.

3. Competitive Landscape

The number of publishing houses entering the children’s book market in China has been steadily rising. By 2023, of the more than 580 publishing houses nationwide, 565 were involved in the production of children’s books, making this category the most competitive within China’s publishing industry.

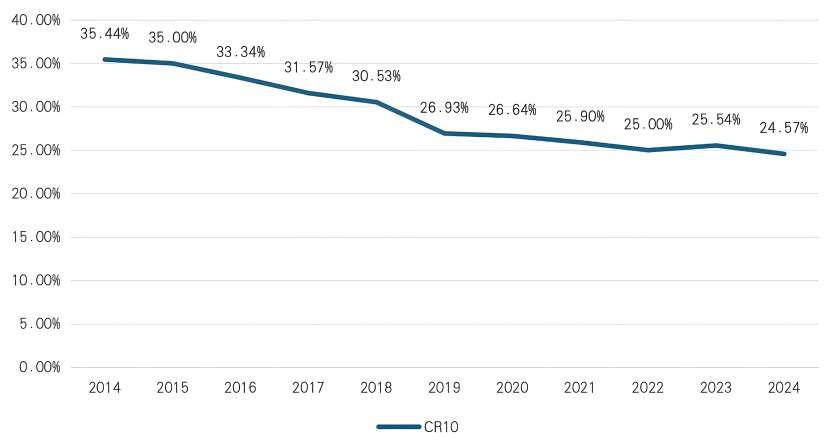

In 2024, China’s children’s book publishing sector has become even more fragmented. The combined market share of the top 10 publishing houses in the children’s book sector continued to shrink, accounting for just 24.57% of total sales revenue, a year-on-year decline. This marks a historically low level of

market concentration, with no single publisher dominating the space. The leading five publishers in China’s children’s book market in 2024 by their actual sales market shares were: 21st Century Publishing Group (4.9%), CITIC Publishing Group (2.92%), Changjiang Children’s Publishing House (2.63%), People’s Posts and Telecom Publishing House (2.38%), and Tomorrow Publishing House (2.2%). Notably, People’s Posts and Telecom Publishing House rose one spot compared to 2023, while Tomorrow Publishing House improved its ranking by three positions.

In recent years, China’s chil -

dren’s book publishing industry has witnessed significant transformations. Publishing houses have been under substantial pressure, facing challenges brought about by shifts in the sales channel landscape over the past few years and the resulting changes in the book pricing system. These challenges have strained both

content production and book sales. At the same time, a new wave of non-content producers, previously engaged in sales, marketing, internet operations, and other related sectors, has entered the children’s book market. Unlike the earlier wave of educational institutions that ventured into children’s book publishing, these

new entrants possess a stronger digital focus and a deeper understandingnels, and consumer behavior in the digital age. This shift has dramatically posed substantial competitive pressure on traditional children’s book publishing institutions and reshaped readers’ perception of chil-

dren’s books through the strategic use of new channels.

The central question now facing children’s book publishing institutions committed to producing high-quality content is how they can respond to these irreversible shifts, particularly changes in reading and purchasing habits resulting from evolving sales models. In the coming years, China’s children’s book publishing industry will undoubtedly face further challenges, making innovation and adaptation essential for survival. However, children’s books remain an indispensable part of childhood development, and ensuring the continued high-quality evolution of this sector is crucial for the growth and future of the next generation.

Looking ahead, several key trends are expected to shape the industry:

(1) Further transform children’s reading experiences through technology.

The growing demand for digital and interactive children’s books, such as e-books, audiobooks, and multimedia-enriched print books, continues to gain traction among both parents and children. Innovations like smart devices (point-andread pens and learning machines) are enhancing the reading experience and fostering greater engagement. For instance, in 2024, some publishers, like Sanhuan Publishing House, began experimenting with AI-powered children’s science books that integrate smart interactive features to enhance reading experience, such as voiceinteractive 3D cartoon AI robots. Additionally, many publishing houses are enriching the reading experience by incorporating multimedia elements like audio, video, and interactive games into children’s books to develop more immersive reading products. These innovations not only bolster the appeal of traditional print books but also open up new business avenues for publishers.

Looking further into the future, widespread digital technology adoption will continue to meet children’s reading needs across

variety of environments. As this occurs, publishing houses are expected to increase investments in digital content, harnessing AI, big data, and other technologies to offer personalized reading recommendations and educational services. To achieve this, traditional publishing houses may strengthen partnerships with tech technology-driven enterprises.

(2) Accelerate brand building in the children’s publishing sector.

Increasingly, China’s children’s publishing houses are recognizing the importance of brand development. Many are focusing on cultivating strong brand identities, often through the creation of high-quality content and strategic promotion, which helps improve both market influence and sales performance. In the future, the concentration of China’s children’s book market may further decrease, competition landscape. As market

tation continues, brand building and IP development will become even more critical. Publishers will pay greater attention to developing recognizable IPs and serialized content, leveraging high-quality production and consistent marketing to establish stable, loyal reader bases. In doing so, they will discover and nurture potential original IPs, expanding them into other media sectors suchchandising to achieve diversified IP development and maximize value, thereby expanding sales, enhancing competitive edge.

copyrights and more diverse international cooperation models

Despite the growing emphasis on original content, introducing high-quality overseas children’s books remains a vital strategy for Chinese publishers looking to expand their market share. For many non-professional children’s publishing institutions, especially those

with limited capacity for creating original content, acquiring international copyrights is crucial for enhancing their market presence in the children’s book market. As international cultural exchange continues to rise, Chinese

are innovating new cooperation models with foreign publishers. Beyond traditional copyright purchases, these partnerships now include joint publishing, co-creation, and copyright-sharing arrangements. For instance, publishers are working directly with prominent overseas authors and illustrators to develop content specifically tailored to the Chinese market or collaborating with foreign publishers to co-develop children’s book brands that have global reach.

by Zhou Haining

Recently, a new consumption trend has repeatedly made headlines in major media outlets, revealing how far young people will go to buy what they call “goods” (or “gu zi” in Chinese, from the Japanese / goods, referring to ACG merchandise) — from enthusiasts showcasing rooms

badges and cards (a practice known as “array display”), to someone spending over 80,000 yuan on a single acrylic merchandise item from “Haikyuu!!” (such rectangular acrylic pieces are called “mahjong tiles” within the merchandise community), shocking those outside the community. How ever, these are not isolated cases. On

badges, acrylic items, and other mer chandise are priced at thousands or even tens of thousands of yuan. Due to their high prices, these are typical

merchandise items, referred to as “sea view” or “lake view” merchandise.

On November 26, the topic “ACG Merchandise Economy Takes Off” went viral on Chinese social media. Stocks related to the “ACG Merchandise Economy” continued to surge, with companies like Guangbo Group and Shifeng Culture hitting their daily trading limits for five consecutive days. While many were surprised by this phenomenon, they were unfamiliar with the term “gu zi”. In fact, this term, originating from the Japanese word “ ” (a transliteration of “goods”), is used in the ACG community to refer to merchandise, with the act of buying such items known as “consuming gu zi”. Unlike conventional merchan dise, however, “gu zi” specifically refers to derivative products from ACGN (Animation, Comics, Games, and Novels) sources, such as popular

anime like “Haikyuu!!” and “Blue Lock”, games like “Genshin Impact” and “Arknights”, and novels like “The Grave Robbers’ Chronicles”. The current market also includes mer chandise from children’s animation, such as trading cards from “My Little Pony” and “Night Lolita”, as well as badges and cards featuring Disney and Sanrio character IPs, all of which fall under the category of “gu zi”.

In terms of product categories, merchandise is divided into “hard merchandise” (known in the industry as CORE HOBBY) and “soft merchandise” (known in the industry as LIGHT HOBBY). Hard merchandise includes items with limited practical value that are primarily for display and collection, such as gashapon (capsule toys),

which are typically more expensive. Soft merchandise, on the other hand, includes items like badges, stationery, keychains, and apparel, which are relatively more affordable. The term “gu zi” primarily refers to the latter

category. Common “gu zi” items in the market include badges, acrylic key

(known as “mahjong tiles”), shikishi (autograph boards), and instant photos, all featuring characters or logos from ACGN works.

With the rapid increase in

domestically and internationally, and the rise of ACG culture, the consumer base for merchandise continues to expand. According to the “2024 China ACG Industry User Analysis” report by the Forward Industry Research Institute, China’s ACG user base exceeded 500 million in 2023, with 60% actively purchasing merchandise, while 58% spent money on games and 47% bought manga. Against this backdrop, merchandise stores have been sprouting up like bamboo shoots after rain since 2023,

shopping malls. Examples include Joy City and Xi Fan Li in Beijing’s Wangfujing area, Tianfu Hong in Chengdu, Bailian ZX Creative Space

and Jing’an Joy City in Shanghai, and X118 in Wuhan.

In this merchandise consumption boom, an increasing number of publishing houses are joining in, successfully boosting their book sales by bundling publications with merchandise. These include early entrants to ACG content publishing such as Kadokawa Tianwen and Power Time Cultural, as well as newer players like CITIC Press, Motie Culture, and Booky Group. Many publishing houses have spun off their merchandise development and operations into separate businesses. Examples include Power Time’s subsidiary MANCOOL and Huawen Tianxia’s MR’L WORKSHOP. CITIC Press’s Animation Division has also established its own merchandise brand, assembling a professional team to develop merchandise for multiple IPs. On the retail side, besides book stores primarily focusing on ACG merchandise sales such as MAN COOL and Sakura Comic Bookshop, popular lifestyle bookstores including

Tsutaya Books, Fangsuo Bookstore, and Mi Bookstore have also started stocking merchandise. Even Xinhua Bookstore, which rarely ventured into this field before, has begun selling merchandise. Today, the merchandise sections in bookstores are expanding, with some stores collaborating with copyright hold ers to launch themed exhibitions or themed bookstores. In August 2024, CITIC Publishing Group’s themed bookstore launched its anime brand of its Shanghai Jiangwan Li location. Beyond selling domestic and interna tional ACG books and merchandise, rant, catering to ACG enthusiasts’ multiple “consumption needs”.

The series of strategic moves by the publishing industry demonstrates the enormous commercial potential of the merchandise market. Could merchandise become a new growth driver for the publishing industry? To better understand the merchandise market and the licensing and business logic behind merchandise development, Publishers Magazine interviewed persons in charge from various relevant institutions. They generally believe that the merchandise market is in a growth

Publishers with their expertise in content development and copyright

positioned for merchandise development. Bookstores offering both books and merchandise can provide ACG enthusiasts with a richer consumption experience. However, at this stage, offline channels are undergoing a period of restructuring, and significant investment in physical stores should be approached with caution.

“If you don’t play games or buy merchandise, you can save saying in the ACG community may sound like a joke, but it’s not far from reality. In a recent discussion titled “How much do you spend on merchandise monthly?” initiated by a reporter on Xiaohongshu (also

called Rednotes, a popular Chinese social media platform), consumers in the comments section revealed their spending habits. Some claimed to spend over 10,000 yuan monthly on merchandise, while even those with limited disposable income reported spending hundreds of yuan per month. Some even admitted to “spending every penny of their living expenses” on merchandise. This high purchasing power perfectly explains the prosperity of offline merchandise stores. The merchandise economy is more closely aligned with the retail industry. Reports indicate that while chain food stores have an average

merchandise stores can achieve nearly 100 yuan per customer. Other reports suggest that many bookstores and stationery shops have experienced a “revival” through merchandise sales,

chain bookstore revealing that 35% of the store’s sales revenue from January to May 2024 came from newly added merchandise. Moreover, merchandise stores have shown remarkably high

themed brand CUCKOO SHOP for example: after opening in Beixinqiao in June 2021, the store relocated to a new location in the same area in January 2023, occupying more than triple the original space. In August and December of the same year,

CUCKOO SHOP opened additional branches in BOM Xi Fan Li Mall and Joy City Wangfujing, expanding both their number of stores and IP offerings.

Copyright holders and operators

the Chiikawa × MINISO partnership opened in Shanghai’s Jing’an Joy City, achieving sales of 2.68 million yuan within 10 hours. During the 11.11 Shopping Day, miHoYo’s store sold 700,000 items in seven days, ranking first in the overall toys and trendy items category, with their “Genshin Impact” flagship store alone selling over 400,000 items. Publishing houses have also seen impressive merchandise sales. By June 2024, two blind box series of “Siamese Cat Azuki San,” a popular Japanese IP exclusively licensed by Kadokawa Tianwen, sold over 400,000 units, with a single plush toy item reaching 50,000 units in sales. In March 2023, when Makoto Shinkai’s new film “Suzume” was released, merchandise developed by Kadokawa Tianwen achieved sales exceeding 5 million yuan, with one doll selling 30,000 units during the

Initially, publishers produced merchandise in small quantities mainly to show appreciation for fan support, with sales largely dependent on book sales. However, as the

merchandise market flourished, merchandise became a driver of book sales, particularly through “special editions” that bundle books with merchandise as bonus items. According to Chen Xi, Chief Publisher of CITIC Press Group’s Animation Division, their Moli brand’s publication of “Ruri Dragon” in early 2024 included both a standard edition and a special edition that came with two badges. The special edition has now outsold the standard version, and the two badges have even been exported back to Japan, creating a buzz in the ACG community. Kadokawa Tianwen has produced several successful special

“Delicious in Dungeon”, and “Blue Lock”, with sales reaching up to 10,000

4,000 copies often sell out immediately upon release. Huawen Tianxia’s special edition of “See You, My King” (two volumes) has accumulated sales of over 18,000 copies.

Is the ACG Merchandise Industry Highly

Unlike books that are com monly sold at a discount, most do mestic merchandise (Chinese “gu zi”) rarely offers discounts except for clearance sales, and some items in merchandise stores are even sold above their listed prices. Chen Xi

explains: “Merchandise follows the same channel logic and traits as other retail products. The concept of ‘low discounts’ barely exists in consumer goods, with books being the only ex ception. Moreover, the merchandise business. From purchasing copyrights to manufacturing products and chan all transactions are made in cash. Therefore, for distributors and retail ers, selling at full price is the only minimize inventory risks.”

With controlled pricing, how manufacturers? The reporter learned that the cost of a merchandise item primarily consists of manufacturing costs, labor costs, and copyright costs, with copyright costs taking up the largest portion. Taking badges as an example, the manufacturing process includes glossy lamination, gold stamping, laser printing, and double flash effects, with glossy lamination being the most basic technique. Through price inquiries

platform, the reporter found that customizing 100,000 pieces of

badges costs only 0.45 yuan each. If upgraded to silver sparkle double flash effect, the unit price increases to 1.55 yuan. By extension, whether choosing one of these techniques or combining two to three of them, the manufacturing cost of a single badge would not exceed 3 yuan, and this cost could be further reduced with increased production volume.

In terms of copyright costs, there are three types of IP licensing fees for merchandise: first, the minimum guarantee model, or the the guarantee deposit plus revenue guarantee with pure revenue sharing model. Japanese copyright holders typically prefer the guarantee deposit plus commission model, where the guarantee deposit is paid annually and the additional commission rate usually does not exceed 10%.

The guarantee deposit varies

according to factors such as the IP’s popularity, recognition, merchandise category, and the manufacturer’s

depth Industry Exchange Minutes on the Merchandise Economy”, Medialink Animation, a copyright management company that holds international IP rights for properties such as “Jujutsu Kaisen” and “Gintama”, sets a base price of 500,000 yuan for its relatively less popular IPs, while the minimum guarantee for popular IPs can reach 1.5 to 2 million yuan, but generally does not exceed 2 million yuan. Once production begins, the copyright holder’s commission is around 5%.

Different countries’ copyright holders have varying views on copy right fees, leading to differences in licensing costs. Chinese copyright holders tend to charge higher fees, aiming to maximize profits while the work is popular in the market. Japanese copyright holders typically charge lower fees, viewing copy right as a gold mine and believing that developing IPs without regard for quality, whether for animation or merchandise, would only damage the brand image and fail to secure sustainable revenue. Based on these factors, a rough calculation shows that with a guarantee deposit of 700,000 yuan for a less popular IP and a production run of 100,000 badges, the copyright cost per badge would be 7 yuan, with manufactur ing costs at 0.5 yuan and labor costs around 0.15 yuan, bringing the total cost per badge to approximately 7.65 yuan. The market price range for a single domestic badge typically falls between 10 and 30 yuan, with 20 yuan as the median reference price. Merchandise stores usually purchase stock at around 60% of the retail price. When these badges enter the distribution channel at this 60% rate, upfront costs account for about 60% of the selling price, and after deducting the 5% commission, gin of no less than 30%. With larger

effective manufacturing facilities, both licensing and production costs can be further reduced, as seen in trading card games where profit

margins can exceed 70%.

However, force majeure fac tors sometimes arise in controlling manufacturing and labor costs. Most Japanese copyright holders have slow licensing processes, increasing communication costs. Domestic com panies also differ in their production processes. Second, unpredictable time costs often arise during production, such as Japanese copyright holders monitoring the entire process out of concern for product quality, even con trolling extreme details like character skin tones. Even after supervision approval, the copyright holder might suddenly request secondary adjust ments or even complete redesigns.

The phenomenon of “consum ing merchandise” has long existed in China. However, since popular anime mainly came from Japan, their of pensive but limited in variety, forcing

priced items and domestic products, which to some extent exacerbated the proliferation of counterfeit merchan dise in China. In recent years, with the rise of domestic ACG games like “Genshin Impact” and “Arknights”, their merchandise has gradually transformed the market environment through popularity, quality, and value for money, changing Chinese con sumers’ stereotypical perceptions of domestic official merchandise. Ad ditionally, many commercial entities urgently needed merchandise stores with high turnover rates to attract

scale introduction of such stores and contributing to today’s flourishing

In ACG communities, there’s a which in Chinese is both a translitera tion of “goods” (merchandise) and a word for “grains” (food). Fans often joke by saying “I’ve stopped spending on gu zi, but I meant grains, not mer chandise”, referring to cutting back on daily necessities including food expenses just to buy merchandise. Fans are willing to invest substantial

cause of their passion. Merchandise serves as a way for them to express their emotions and obtain what they call emotional value.

Moreover, there are many other reasons why people are passionate about buying merchandise. According to the “2024 China ACG Industry User Analysis” report, students account for 46% of China’s ACG users, while corporate professionals group representing the largest proportion at 43.8%. Young people make up the primary consumer group for merchandise. Mu San, the director of a merchandise store collective in Qingdao and a former publishing industry employee, told the reporter that one major reason young people buy merchandise is to express their identity:”Young people are at an age where they like to label themselves. For example, if I wear a badge from ‘The Grave Robbers’ Chronicles’ and you have a keychain from the same series, we can immediately identify each other as fans. However, if we’re displaying merchandise from IPs that we don’t mutually recognize, we might not have much to talk about.”

Surprisingly, some consumers admit that they sometimes buy merchandise “just to spend money” even if they only have a slight interest in an IP and its characters. In the merchandise community, the most addictive practice is “blind drawing”, similar to blind boxes but replacing stands, or shikishi (decorative boards featuring character illustrations). The disappointment of not getting a desired character often motivates consumers to make additional purchases, leading community members to jokingly refer to this behavior as “gambling”.

In the merchandise commu nity, there’s also a phenomenon known as “returning to the pit” (hui keng): when consumers see new merchandise with attractive designs from manga, anime, or games they once loved but later abandoned, either in merchandise stores or on Xiaohongshu, they of ten return to that IP’s merchandise circle and may even start reading the manga or playing the games

again. This typically happens with

ing innovative artistic designs. The popular IP “Blue Lock” serves as a perfect example. Mu San recalls: “Initially, ‘Blue Lock’ wasn’t a its merchandise was released, it attracted many shoppers to offline stores. That collection of merchan dise was designed according to each character’s support colors, and when displayed as a complete set, it was visually stunning. This led many people to become fans of both the manga and anime of ‘Blue Lock’.”

“Blue Lock” was not among the top 10 manga sales in Japan’s Oricon rankings in 2021. In 2022, follow ing the anime’s premiere, the manga jumped to seventh place, becoming the only sports series in the rank ings. In 2023, driven by merchandise sales, the manga climbed to the top spot, with its sales volume increasing from over 3.5 million copies to more than 10 million copies, representing

The success of “Blue Lock” also reflects the absolute advantage of offline channels in shopping experience. On one hand, digital images cannot compare to physical often say, “the merchandise’s inherent beauty is the best decoration” (where “decoration” refers to the practice of using accessories to enhance merchandise). This suggests that made, it doesn’t need elaborate decoration, or even just simple

hand, offline stores offer a richer shopping experience with more diverse product options. “Take snack stores as an example, which typically have impressive SKU numbers in retail. Even though a snack store might be three times larger than my merchandise store, it only has around 800 SKUs, while a merchandise store can offer 2,400 SKUs. With more options, consumers naturally want to stay longer.” says Mu San. In reality, both Kadokawa Tianwen and CITIC Press’s Animation Division

The success of merchandise sections in bookstores follows the same logic. With people, products, and place being the three essential elements of trade, bookstores already have an established trading venue compared to merchandise stores. When consumers enter a bookstore and unexpectedly discover a merchandise section, it adds value to the bookstore’s appeal. Initiatives such as Sisyphe Bookstore selling IP collaboration merchandise, CITIC Publishing Group’s themed bookstores hosting specific anime IP exhibitions, and Tsutaya Books selling Japanese merchandise at original prices have all become major attractions for physical bookstores to draw consumers.

Understanding ACG Culture: The Essential Prerequisite

Today, the demographics of merchandise store owners are becoming increasingly diverse. While early merchandise stores were mostly opened by ACG enthusiasts, now many people with connection to ACG culture are entering this field. Some consumers point out: “You can tell at a glance that the store owner isn’t into ACG culture.” Among many lack an understanding of ACG culture and have engaged in inappropriate business practices, strongly alienating ACG enthusiasts.

Consumers are calling for “riajuu” (a term used to describe people who are fulfilled in real life, ironically used here to mock those who pretend to understand ACG culture) to stop opening merchandise stores.

As a subculture, while ACG culture is inclusive and open, it still maintains an invisible barrier: to join the community, one must first genuinely engage with ACG works and understand the culture. Even those attempting to pose as anime or game fans are easily exposed through their behavior, such as confusing character names or misinterpreting plot points. Therefore, although the ACG community is becoming more mainstream, merchandise

development and sales remain inherently a business that serves a

This largely explains why merchandise stores are currently facing a wave of closures. In early 2024, merchandise stores began

cities, reaching a peak in June of the

off period in September. Many stores began liquidating and closing down, primarily because their owners understood neither retail operations nor ACG culture. As Mu San explains: “To run a merchandise store, you either need to be proficient in retail manage inventory, and conduct

of the market popularity of works and their characters, and whether there are any controversies surrounding these works. Otherwise, you’re likely to stock the wrong merchandise, leading to inventory backlog.”

Merchandise developers need to possess these same capabilities. During interviews, the reporter found that relevant personnel in publishing houses almost all know ACG culture, with some being veteran enthusiasts. Chen Xi notes that most employees in CITIC Press’s Animation Division have years of experience reading manga, following anime series, and playing games, with an average of more than two gaming consoles per person. For the publishing industry, which excels in content creation,

Mu San believes that publishers are the ideal candidates for merchandise development and are experts at serving niche markets, as books and merchandise have similar sales volumes. Chen Xi also points out that developing merchandise follows a similar process to publishing books, mainly involving “proposing topics, project approval, submitting proposals to copyright holders, signing contracts, design, sample making, production, and sales”. The only difference is that merchandise development doesn’t require the proofreading process, but instead adds copyright holder supervision

and approval, where copyright

In terms of licensing, publish ers have the advantage of rich copy right resources and a strong reputa tion. According to an article titled

Rules and Success Path of Japanese Anime IP Licensing published by “Game Daily”, Japanese copyright

Chinese partners. However, some Chinese companies blindly invest money without proper understand ing, which leads to Japanese part ners’ displeasure. Many publishing houses, with their years of opera tional history, have accumulated extensive licensing resources and established significant influence in the Chinese market, demonstrating

precisely the qualities that copyright holders are looking for.

The Time for Merchandise Business is Now

According to the 2024 Panoramic Analysis of China’s ACG Industry report, China’s ACG user base exceeded 500 million in 2023, providing a massive potential consumer group for the ACG merchandise market. In terms of consumption willingness, the proportion of merchandise and derivative products in the overall industry increased from 28.0% to 46.1% between 2016 and 2023. Moreover, with the emergence of

domestically and internationally, and the continuous improvement in the quality of original Chinese animation, the ACG content market is becoming increasingly diverse, with more IPs awaiting development. It’s foreseeable that the merchandise market will maintain its growth momentum.

However, despite publishers’ many advantages in merchandise development, few have actually made attempts to enter this field, which Mu San finds regrettable. “Many publishers have come to me for advice about developing merchandise. But after all this time, nothing has happened.” He discovered that publishers’ hesitation mainly stems

from their unfamiliarity with ACG culture, feeling uncertain about their ability to manage it and thus reluctant to enter the market. Yet in Japan, toy companies and booksellers are the primary players in merchandise development and sales. Mu San suggests that publishers should trust their judgment and maintain an open mindset to listen to and accept young people’s ideas while trying to understand ACG culture.

However, in competition with merchandise stores, physical book stores still struggle to match them in terms of product variety and pricing, thus requiring further optimization of merchandise selection and dif ferentiation strategies. Bookstores’ merchandise sales are also limited by stores naturally have high customer promote their merchandise, while extra effort in promotion. Additionally, bookstores need to evaluate the com patibility between merchandise cus tomers and the bookstore’s atmosphere. Mu San mentions that sometimes you can hear customers screaming in front of merchandise stores, “either because they got the character they wanted in a blind draw, or because they didn’t,” which contradicts the quiet reading atmosphere that bookstores strive to maintain. In response, bookstores can carefully consider which IPs and cat egories of merchandise to stock, while improving their management practices.

Nevertheless, while actively embracing the merchandise market, one must remain vigilant about vari ous risks and challenges. Currently, the merchandise market faces several issues, such as serious lack of product differentiation, lack of innovative designs leading to aesthetic fatigue among consumers, which has contrib uted to inventory backlog and operat ing losses in some merchandise stores.

competition in merchandise develop ment, manufacturers are caught in an excessive competition for creativity, such as shortening production cycles and developing new design concepts. However, Chen Xi believes there are no shortcuts to innovation beyond developing a deeper understanding

of user needs and IP content. Fur thermore, counterfeit products are rampant in the market, with many consumers reporting that merchandise in bookstores and stationery shops is of questionable authenticity. In online channels, some consumers’ limited understanding of the merchandise

ness of purchasing from authorized sellers, creating opportunities for counterfeit products.

On the consumer side, problems are constantly emerging. For ex ample, merchandise items originally priced at around 40 yuan are being hand market, with prices soaring to thousands or even tens of thousands

to be overseas purchasing agents disappear after receiving payment, drawing” system proves addictive, leading to excessive consumption... These various phenomena not only violate consumer rights but also foster unhealthy consumption habits and social trends. As manufacturers and retailers respectively, publishers and bookstores inevitably see their actual revenue and social reputation affected.

It is worth noting that inter

viewees generally indicate that the window of opportunity for either

fline merchandise retail channels

bookstores has passed. The suc

like MANCOOL and Sakura Comic Bookstore largely stems from their

ACG industry was experiencing rap id growth and physical retail spaces were eagerly seeking merchandise stores. Today, physical retailers have gained sufficient understanding of merchandise store operations, includ ing key metrics such as profit mar gins, inventory levels, and average customer transaction value, leading to shrinking profit potential for of

primarily focus on book sales and are unlikely to fail due to sluggish mer chandise sales, expanding business scale through merchandise operations is currently no easy task.

commerce platforms and physical

tinctive format worth exploring for

following psychology, stimulating purchasing desire and enthusiasm, but also helps control costs, as store deco

rations can be quickly changed and relocated, and licensing fees are lower than permanent retail establishments like themed restaurants. The recent

the market serves as strong evidence of this trend. According to NBD. com.cn, domestic ACG IP operator

up events in 2023, which surged to 40 events in 2024. Its founder Lian 2025.

China’s merchandise and trendy collectibles industry has been largely influenced by Japan. Currently, Ja pan’s merchandise and trendy collect ibles industry continues to see rapid growth under the “lipstick effect”, with IP products that carry emotional

cyclical characteristics. This gives us reason to remain optimistic about the prospects of China’s merchandise market. Therefore, despite the rela tive downturn in the physical retail economy, merchandise consumers’ purchasing power remains strong, and merchandise development continues to be a promising busi ness. In the future, more publishers may enter the field of merchandise development and sales, bringing higher quality merchandise and IP events to ACG enthusiasts.

Size: 288×275mm

Price: ¥382.00

Pages: 36-56

Age: 3-8

Date of Publication: Apr, 2024

Author

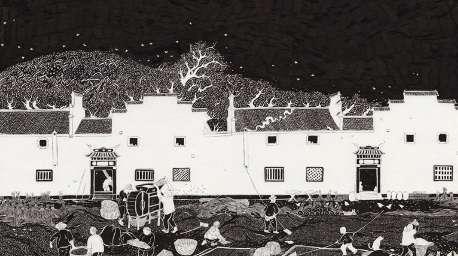

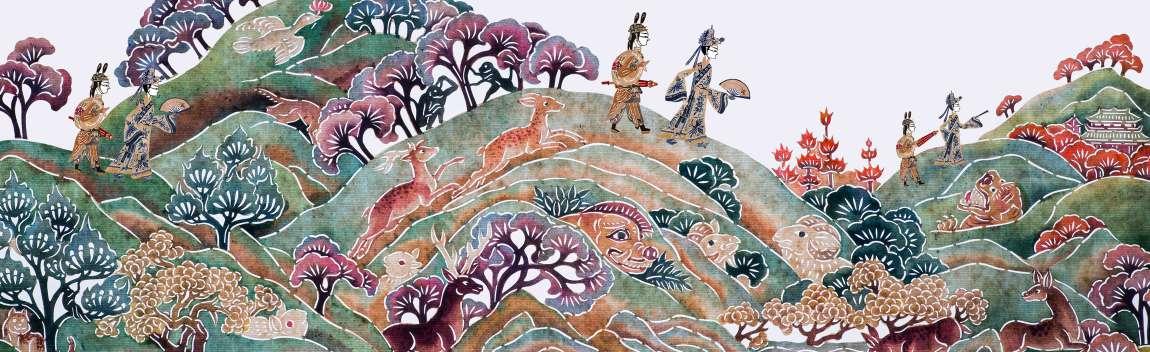

& Illustrator:

Cai Gao, Tadashi Matusi

Brief Introduction: These are representative works of Cai Gao, a leading figure among Chinese original picture-book artists. She is adept at using illustrations to tell classic traditional Chinese stories like Mulan, An Idyllic Land of PeachBlossom Spring, etc. Her works are full of educational significance and life philosophies, enhancing children's artistic perception and aesthetic ability.

Kaishu Story Series·Journey to the West

Size: 165×240mm

Price: ¥ 350.00

Pages: 1920

Age: 7-12

Date of Publication: Oct, 2019

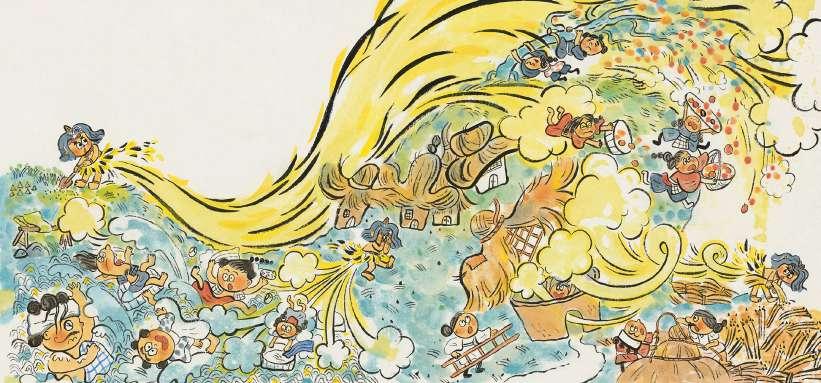

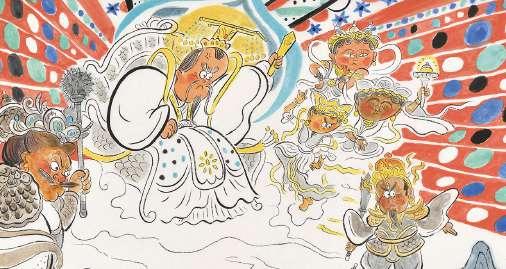

Compiler & Author: Kaishu Illustrator: Tian Yu

Brief Introduction: This is an edition of Journey to the West suitable for children. The story is full of imagination. Between the lines, it conveys positive and optimistic energy, and endows children with the ability to think independently. Novel in form and full of childlike fun, the series presents Chinese-style fantasy stories to children.

Size: 145×210mm

Price: ¥ 178.80

Pages: 808

Age: 7-12

Date of Publication: Oct, 2024

Author: DoDoRo

Brief Introduction: This is a series of super-popular original Chinese scientific detective stories that have been played 5.2 billion times on an audio book platform in China. The books contain rich knowledge of biology, geography, chemistry, and physics. They cultivate children's abilities to observe, think, and make logical inferences, guiding them to solve detective puzzles with science.

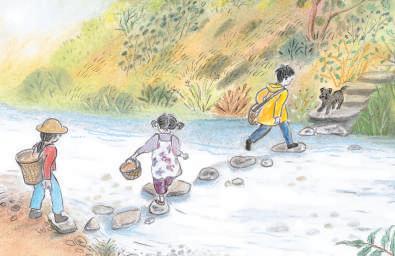

Little Literacy Masters: Cultivating Early Reading Skills (6 volumes)

Size: 210 mm ×280 mm

Price:¥ 228.00

Pages: 752

Age: 3-6

Date of Publication: Oct, 2020

Author: Zhang Dandan, Huang Jianjun

Brief Introduction: These volumes are designed for preschoolers, aligning with their developmental stages to foster their passion for reading and build solid literacy habits. Each volume introduces commonly used Chinese characters, integrating words, phrases, idioms, poems, and stories. The books enhance literacy and introduce Chinese culture, with teaching methods for parents on how to guide children effectively. They prepare preschoolers for lifelong learning and enable a smooth transition to primary education.

Size: 210×285mm

Price: ¥ 498.00

Pages: 1324

Age: 1-9

Date of Publication: Oct, 2022

Playful Poetry: Learning Through Games (3-year-olds edition/ 5-year-olds edition)

Kaishu Story Series·Journey to the West Original

Author: Zhang Dandan

Brief Introduction: This book set introduces 5 Chinese classics—Rhythm Enlightenment, Three Character Classic, Hundred Family Surnames, Thousand Character Primer, and Golden Treasury of Quatrains and Octaves. Simplified by the phonetic system of Pinyin, vivid storytelling, child-friendly explanations, and 400 artworks, the texts expose children to beautiful traditional Chinese literature and improve their literacy skills. Cultural and easy, this work nurtures early interest in Chinese philosophy and poetic artistry.

Size: 210×270mm

Price: ¥ 138.00 per edition

Pages: 252 per edition

Age: 3-5

Date of Publication: Mar, 2021

Author: Zhang Dandan

Brief Introduction: This book set features 113 classic Chinese poems from primary school textbooks, each paired with a hand-drawn illustration and an interactive game. The imaginative visuals help children grasp poetic meanings, while games—ranging from memory maps to puzzles—enhance memory, focus, and logical thinking. Blending traditional poetry with modern aesthetics and engaging activities, the fun books foster a deeper understanding and love for classic literature.

is a original stories billion platform rich geography, They to logical solve

What Did Prehistoric Creatures Eat: A Culinary Journey Through the Dinosaur Era

Size: 185×175mm

Price: ¥ 78.00

Pages: 164

Age: 3-12

Date of Publication: Sep, 2024

SI WU KUAI DU: Ordinary Children’s Literacy Textbook volumes)

volumes aligning foster solid introduces characters, idioms, enhance culture, parents effectively. lifelong transition

set from paired and imaginative poetic from puzzles—enhance thinking. modern the understanding

Author & Illustrator: Cai Qin

Brief Introduction:Synopsis: What did dinosaurs love to eat?

Countless children are fascinated by this question. This book offers a detailed exploration of dinosaur dietary habits, covering aspects such as their feeding mechanisms, food preferences, and hunting behaviors. Featuring vibrant anthropomorphic dinosaur illustrations, it simplifies readers while delivering a whimsical and engaging reading experience.

The Young Scientist

Size: 225×210mm

Price: ¥ 350.00

Pages: 520

Age: 6-11

Date of Publication: Dec, 2024

Author: Yuan Lanfeng

Illustrators: Liang Chen, Li Xiaotian, Su Yiyian

Brief Introduction:The Young Scientist is a series of cutting-edge science and technology enlightenment picture books tailored for children. The series consists of 10 volumes, each carefully selected to cover 10 highly anticipated and potentially limitless frontier technology themes, including gene editing, chip technology, future energy, space colonization and more. Each theme showcases the development trends of technology and potential future application scenarios to children, igniting their boundless imagination and desire for exploration.

Original Series:Children’s Picture Book of China in New Era

Size: 250×250mm; 210×285mm

Price: ¥ 38.00 per book

Pages: 40

Age: 3-10

Date of Publication: Jun, 2024

Authors: Wang Yining, Jia Xiaotong, Zou Yirui, etc.

Brief Introduction:Compared to existing picture books for children, this series not only focuses on the development of children's cognitive, linguistic, and other abilities but also emphasizes the expression of Chinese stories and elements. The works are imbued with Chinese aesthetics, leading children to sensory and emotional experiences that expose them to the wisdom and beauty rooted in Chinese culture.

Size: 185×260mm

Price: ¥ 211.40

Pages: 552

Age: 4-7

Date of Publication: Oct, 2021

Author:Yang Qiduo

Brief Introduction:This is a set of best-selling books that allows preschool children to quickly learn Chinese characters. It enables children to easily master commonly used Chinese characters and develop the ability to read independently, starting from recognizing characters, words, and phrases, and then reading sentences, short articles, and stories.

Dancing in the Breeze by the Rain Altar: A Journey Through the Yuan Dynasty's Capital Dadu

Size: 180×250mm

Price: ¥ 108.00

Pages: 132

Age: 18-60

Date of Publication: August, 2024

Authors: Li Ling, Zhang Nanjin, Wang Ruizhi

Brief Introduction:This book is an academic and historical-geographical exploration of Beijing, presented in an engaging and accessible manner. It revolves around three core issues: The Central Axis, The Water Systems of Dadu, The Fifty Neighborhoods of Dadu.

Zhao Yuanren's Homophonic Text Ink Wash Painting Picture Books (Complete Set of Three Volumes)

Size: 210mm×285mm

Price: 198 yuan for a set

Pages: 108

Age: 5-8

Date of Publication: April, 2023

Authors: Original Work by Zhao Yuanren, Compiled and Written by BAZHUAYU, Illustrated by PAZI

Brief Introduction:Zhao Yuanren's Homophonic Text Ink Wash Painting Picture Books adapts three iconic texts—"The Story of Shi Eating Lions," "Xi Playing with a Rhinoceros," and "Ji Striking the Chicken"— into child-friendly ink wash painting books. Using characters with identical or similar

on modernizing classical Chinese. Through dynamic illustrations and humor, the series introduces young readers to Chinese language and culture, bridging tradition and modernity.

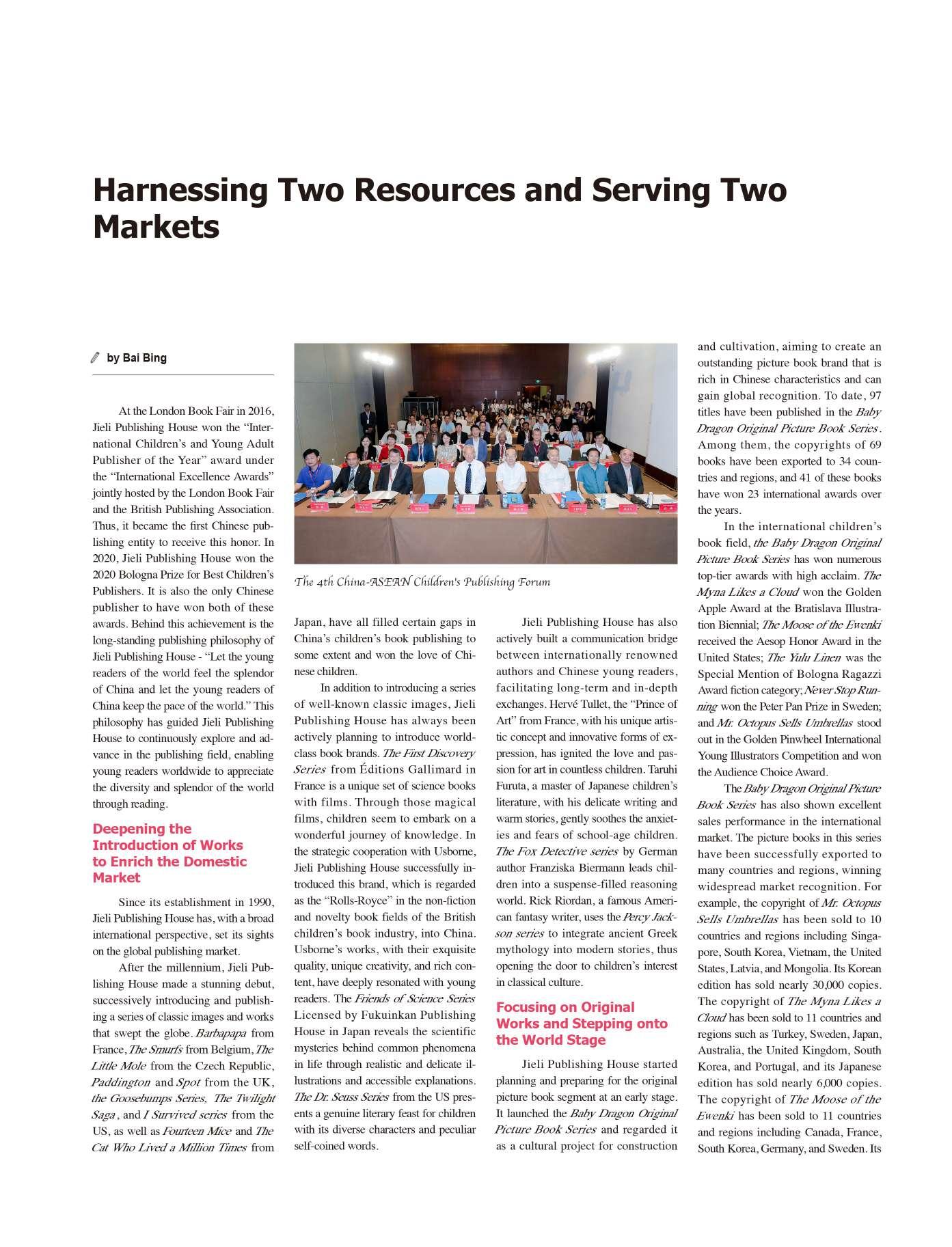

Bologna Children’s Book Fair

Jointly organized by BolognaFiere and China South Publishing and Media Group Co., Ltd., and hosted byChinaPublisherMagazine and Beijing Thinking Culture Communication Co., Ltd., the “Chinese Excellence in Children’s Illustration” selection at the Bologna Children’s Book Fair has un

At the 2025 Bologna Children’s Book Fair, the “Chinese Excellence in Children’s Illustration” exhibition will be held, showcasing both the long as an artistic bridge connecting them with the global stage.

surname): Agen, Ase, Fu Wenzheng, Guituzi, Heimi, Jiu’er, Leng Xiaoyu, Li Ning, Li Yao, Li Zhuoying, Liang Peilong, Qi Jiaona, Tian Yu, Wanwan,

Pan Liping , known by the pseudonym and a member of the Animation Art Committee of the China Artists Association. She has served as a judge for prestigious competitions such as the Tsai Chih Chung Comic Award and the

China Animation & Comic Competition Golden Dragon Award. Her representative works include The Last Hundred Birds’Feather Robe and Honest Chancellor Lu Zhi. Her picture books and comics have achieved a total circulation of over one million copies. Several of her works have

received more than 40 awards at domestic and international art exhibitions, including the China Fine Arts Award and the International Manga Award in Tokyo, Japan. The overseas publishing rights for her works have been licensed in multiple languages, including English and French.

Yao Jianjiang , known by the pseudonym Ase, is a Chinese teacher at a tricate detail and diverse materials. His comics have been published in maga zines such as SC,STRAPAZIN, and Le Monde Diplomatique. His debut work Goodbye,Children was first featured in SC3: Special Comix, which won the Prix de la Bande Dessinée Alternative award at the 2010 Angoulême Interna tional Comics Festival. He has also published children’s literature, including DarkDriedVegetableandRice, as well as picture books such as TheBright Moon and TheGiantGoldenMelon

Fu Wenzheng , a picture book author, is also a dis tinguished expert at Zhongbolian Think Tank (Shenzhen) Technology Co., Ltd, a visiting professor at universities, and a council member of the Children’s Section of the Library So ciety of China. She has created works such as AYuan’sHome and HeGreatJoyoftheDragonKingFamily. Some of her works have won prestigious awards, including the Guiguan Children’s Book Award and the Youth Recommended Out standing Published Reading Award by The State Administra tion of Press, Publication, Radio, Film and Television of the People’s Republic of China. Her works have been translated into multiple languages and published in mainstream book markets in many countries including China, France, the Unit ed States, the United Kingdom, Australia, and Russia.

Guituzi, a picture book artist, is also a member of the China Artists Association, and a member of the Art Illustration Committee of the Aesthetic Development Fund of the Chi na Literature and Art Foundation. She has created works such as NotVeryBig , Between theLines, and BigBoat, with some of her works having been published and distributed in countries including the United States, Russia, and Italy. Her works have won a lot of awards, including the 2014 and 2023 Guiguan Children’s Book Award, the 2015 China’s Most Beautiful Picture Book, and the 2018 Bing Xin Children New Literary Award, and also been selected for major exhibitions and awards, including the 13th National Fine Art Exhibition and the 58th Bologna Children’s Book Fair Illustrators Exhibition.

Heimi, is a picture book author, illustrator, and young print artist. Her works include Braids and ThePallas’sCatWhoWantedEverything, and some of her works have received prestigious awards, including the Golden Apple Award at the 25th Biennial of Illustrations Bratislava (BIB), the 2016 Chen BoChui Children’s Literature Development Foundation for books (picture books), and the do mestic Gold Award at the 2018 Golden Pinwheel Young Illustrators Competition. Additionally, her works have been featured in several important exhibitions, such as the 2024 China Original Illustration Exhibition at the 58th Bologna Children’s Book Fair.

Jiu’er, a sculptor and picture book author. Her representative works includeTheBigPumpkinofMySister and MonsterMountain. Several of her works have been published in countries such as France, the United States, Germany, Switzerland, Canada, Sweden, India, and South Korea. Some of her works have won a lot of awards, including the China Good Book Award, the Wen Jin Book Award of The National Library of China, the Feng Zikai Chinese Children’s Picture Book Award Excellence Award, the Picture Book Times Prize Gold Award, and the Chen BoChui Children’s Literature Development Foundation for books (picture books). In addition, she has served as a judge for the Zhang Leping Picture Book Award and the Golden Pinwheel Young Illustrators Competition.

Leng Xiaoyu, a freelance illustrator. Her works have been featured in magazines such as MarieClaire,Duzhe,PSYCHE, Colorful Yuwen, and OC TOBER the Children’s Literature. She has established collaborations with do mestic and international publishers, including Lelequ, CITIC Press, Penguin Random House China, and FAMILIUS. Her works have won several awards, including the Excellence Award at the China Illustration Biennia (lCIB7) and the Best Work Award at the 7th Hiii Illustration International Competition. She has also been selected for various competitions and exhibitions, such as the CCBF Golden Pinwheel Young Illustrators Competition and the Ananas International Illustration Exhibition.

Li Ning , known by the pseudonym Xinian, is a freelance illustrator and original picture book author. With over a decade of experience in illustration, he has published picture books such as ADayintheLifeofaLittleMonster, The Mature Season of White Cat, and . His children’s literature works have been short listed for the China Good Book Award, selected as one of CCTV’s Top 10 Children’s Books of 2023, and featured in the Guiguan Children’s Book List and the National “Hundred Classes, Thousand Students” Reading Program for multiple times. Additionally, he contributed to a key publication under the 2023 Thematic Publishing Initiative of the Publicity Department of the CPC Central Committee.

Li Yao, a cartoonist and picture book illustrator with over 30 years of experience in picture book creation. His ma jor works include BreakingintotheMartialWorld, Sweeping AcrosstheLand, and . He has published more than 70 books, including comics, picture books, and art collections, many of which have been released in multiple countries, including France and Italy. His works have received numerous domestic and international awards and have been selected multiple times for the National Press and Publica tion Administration’s publishing support programs. In 2024, he won the Gold Award for Comprehensive Comics at the “Golden Monkey King” Awards and was shortlisted for the 2020 Interna tional Silent Book Contest.

Li Zhuoying, a picture book author. Her representative works in clude How Does a Princess Pick Her Nose?, , The WanderingChicken, and OnceUponaTime,ThereWasaSomersault Cloud. Among them, is the theater adaptation of How Does a Princess PickHerNose? embarked on a nationwide tour in 2024. Her works have received several awards, including the Bronze Award at the JIA Illustra tion Award and the Excellence Award at the 2nd Little Hakka Internation al Picture Book Award. Additionally, her books have been selected for the “Wen Jin” Book Award of The National Library of China recommended Mud Children’s Book List TOP10.

Liang Peilong, a member of the China Artists Association, a council member of the Guangdong Artists Association, and the deputy director of the Children’s Art Committee of the Guangdong Artists Association. His representative works includeMoonlight and ChessGame. He was recognized as one of the top ten Chinese artists specializing in children’s themes since the founding of the People’s Republic of China, and he has held numerous solo exhibitions both domestically and internationally. His works have received several prestigious awards, including the 2006 Outstanding Illustration Award from the International Board on Books for Young People (IBBY) in Austria and the Gold Award at the 2nd and 4th “China Painting and Calligraphy Competition for Overseas and Domestic Chinese” in Shanghai.

Qi Jiaona, a member of the China Jour nalistic Caricature Society and a committee member of the Chinese Painting Art Committee of the Fengxian Artists Association in Shang hai. She has been selected for the 7th National Standalone Comic Exhibition organized by the China Artists Association and was nominated for the Young Cartoonist Award at the 3rd Chi na Animation Museum Awards. Her represent able works include RollingLantern and IAm Big,IAmSmall. Her comics are frequently published in newspapers, and her picture books have been shortlisted for the 10th and 11th Bo logna International Silent Book Awards. Addi tionally, her works were selected as part of the 2023 Key Publications for Thematic Publishing ment of the CPC Central Committee.

Tian Yu , a picture book author and a graduate of the Academy of Arts & Design at Tsinghua University. He is the founder of Tian Yu Picture Book Studio and serves as a quality control expert at Kaishu Story. Previously, he taught at the Picture Book Creation Studio of the Central Academy of Fine Arts. His published works include CaptainPanda, KnockingBear, OnceUponaMountain, KingoftheFlies, IDefeatedtheSleepMonsterwith32Farts, and I Defeated MyMomwith32SleepMonsters.

Wanwan, graduated from the Central Academy of Fine Arts majoring in home product design. Her representative works include ChildhoodMemories, , and SpringBanquet. She has received several accolades, including the Outstanding Work Award at the Second Hsin Yi Picture Book Award, the Best Picture Book Award at the Zhang Leping Picture Book Awards, and the title of “Most Beautiful Bologna Children’s Book Fair and the Tehran International Book Fair’s Chinese Original Il lustration Exhibition. Several of her works have also been included in the Ministry of Edu cation’s recommended reading list.

Wang Xiaoxu, known by the pseudonym DongShanxu, is a picture book author and illustrator. He has published several picture books, including , The Stars’BestFriend, TheStubbornSnail, and TheWobblingTail. His works have received numerous accolades, such as the Jury Award at the 6th Hiii Illustration International Competition, Second Prize at the 6th Chen BoChui Children’s Literature Development Foundation for Original Illustration, and the Expert Recommendation Award at the 2024 BIBF International Illustration Competition. Additionally, he was selected for the 2025 Chinese Excellence in Children’s Illustra

Wen Aining , a picture book author and editor specializing in musical picture books. She has pub lished several works, including The Musical Forest and TheSongoftheSpirits . Her illustrations were se

hibition, and she has received prestigious awards such as the iJUNGLE Illustration Award (UK) and the 2022 Premio Apila Primera Impresión (Spain). In addition to her creative work, she has curated and edited musi cal picture books likeTheMagicalSymphony and The SingingVegetables, which have been translated into multiple languages, including English, Spanish, and French, and distributed globally.

Xiao Aozi

Design, Hunan University. Her representative works include Grandma’s FabricMagic and TheFrogLaughedOutLoud. She’s passionate about children’s picture book creation and actively promotes integrating picture book design into university education. She has also established a picture book library to advocate for children’s reading. Her works have received numerous accolades, including the Excellence Picture Book Award at Lit & Illustration Award, and the 30th Chen BoChui Children’s Literature Development Foundation for Best Picture Book.

Xiong Liang, a painter, writer, picture book poet, and artist. He has created numerous works, including SwimmingwiththeMoonlight, TheSleepBus, and TheBraveLittleGhost. He was nominated for the Hans Christian Andersen Award (China) in 2014, 2018, and 2022, and in 2018, he made it to the final shortlist of the Astrid Lindgren Memorial Award in 2020 and 2024 and won the Chen BoChui Children’s Literature De velopment Foundation for Picture Book of the Year. In Award for Prose.

Yu Hongcheng

picture book author and illustrator. She gradu ated from the Central Academy of Fine Arts in 2011, receiving the National Scholarship in 2010. In 2013, she pursued further studies in illustration and printmaking in the UK. After

the creation and innovation of original Chinese picture books. Her published works include The ButterflyLovers, Food, HouseofFlyingDag gers, and AliceThroughtheLookingGlass

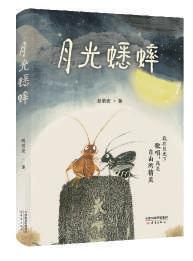

A warm and poetic story of two cricket friends, Jade and Iron. They are good at fighting and have beautiful singing voices. But one day, when captured by the cricket hunter, they were separated...Face upon them, is the choice of destiny and the infinite hope of home and freedom.

Eight scarecrows who get life one day realized the ideal of going to the outside world to have a look, and went through a series of ironic adventures. They overcame many difficulties, learned the meaning of cooperation, gained pure friendship, and saw a variety of world.

This summer,the boy Zhang Yuan, came to Beijing gathering with his parents, who are both delivery person. The boy observed their special experience of daily hard work and recognized the prosperous city with his new friends. Gradually he gained the strength and warmth from the life and the precious friendship.

A "Classroom" of Chinese traditional culture crafted by experts and scholars, embracing the multifaceted and dazzling Beauty of Chinese Civilization. From ancient times to the present, from the small to the great, experience the beauty of Chinese Civilization in its entirety.

One Word, One World

The Memory of National Treasures for 8000 Years

A Million Years of Ancient Humanity

5000 Years of Chinese Place Names

A Brief History of Life Over Ten Thousand Years

This series consists of four original fairy tale picture books, aiming to convey positive values such as friendship, courage, and sincerity through warm stories and exquisite hand-drawn illustrations, helping children gain strength in their growth process.

The Promise of Dandelions

The Birthday Party of Change

Found It!

The Taste of Growing Up

Grandpa Wen took his orange cat to his ancestral home in the mountains to write a book. He and the villagers helped each other and became close friends. Following the traces of history and memory, he witnessed the splendour and prosperity of the centuryold stone village and found traces of his ancestors’ lives.

This series is a collection of picture books themed around China's cultural heritage, aims to showcase the rich and unique cultural heritage and the charm of traditional Chinese culture to young readers through lively and interesting stories, as well as exquisite illustrations.

The Round House

A Treasure Cave in the Desert

A boy playing the clay

The Pontoon Bridge

The Water Window

The Millennia-old Dujiangyan

This series is a set of fun and educational picture books for children, featuring diverse topics and vivid characters. Through lively stories and exquisite illustrations, it conveys a wealth of scientific knowledge, cultural insights, and life wisdom to young readers.

Volume 1: Nature Exploration

8 titles about: Mountains, Deserts, Caves, Deep Sea

Volume 2: Insect World

8 titles about: Bees, Ants, Mantis, Butterflies

Volume 3: Space Adventure

8 titles about: Solar System, Moon, Universe

by Kang Qinxin

Hunan Juvenile & Children’s Publishing House (HJC), a leading Chinese children’s publisher, has cultivated a comprehensive portfolio across four decades, spanning children’s literature, popular science, early education, and textbooks. In 2024, it released 2,085 titles (544 new), demonstrating robust publishing capabilities.. Through innovative collaborations, cultural integration, and global engagement, HJC has

1. From Copyright Trade to CoPublishing: Diversifying Collaboration

In 2024, HJC expanded beyond traditional copyright sales, adopting co-publishing models to reduce costs released 18 titles, including China’s IntangibleCulturalHeritage (Brazil, Italy), TangSulan’sPicture Books (Italy), TheFloatingHouse

on the Moon River (Sri Lanka), and Silhouette Stories (Slovakia). Notably, Silhouette Stories debuted in Slovak before its Chinese edition, while the UNESCO-endorsed Let’s Retrace the Silk Roads will launch multilingually at the Bologna Book Fair. Collaborating with Sri Lanka’s Neptune Publications, HJC co-created 13 titles on Chinese festivals and folklore for donation, reflecting its commitment to cultural exchange.

2. Bidirectional Collaboration: Spotlighting Global Talent

HJC’s global strategy emphasizes nurturing talent and leveraging award-winning content. Illustrator Cai Gao, renowned for her depictions of rural Chinese life and traditional tales, was shortlisted for the 2024 Hans Christian Andersen Award (Illustrator). A pioneer in Chinese children’s art, Cai’s recent works like Blazing City1938 and Beautiful Chinese Folk Tales highlight her enduring creativity. HJC also secured works

by Andersen laureates Roger Mello and Quentin Blake, curating a Hans Christian Andersen Award Picture Book Series. Additionally, it collaborates with winners of the “Chinese Excellence in Children’s Illustration” award, enriching its international catalog.

3. Awards & Recognition: Validating Excellence

HJC’s 2024 titles garnered domestic and global acclaim. ResearchSeriesofChinese Children’s Literature entered the National Publishing Foundation Project, while EmbroiderTiger (a novel on Hunan embroidery) was shortlisted for key thematic publishing by the Publicity Department of the CPC Central Committee. Multiple titles, including JiangnanMemories:My Grandmother’s House, featured in China’s monthly Good Books lists. Internationally, the Armenian edition of My Homeland and Me received translation funding via the China Classics International Publishing Project. HJC’s China’s IntangibleCulturalHeritage series was hailed as a “Belt and Road” publishing benchmark, earning the China Publishing Promotion Association’s “International Influence Award.” The press also ranked among China’s top 100 overseas-influential publishers for seven consecutive years.

HJC highlights three standout

works for global partnership: EmbroiderTiger: A novel by Tang Sulan centering on Hunan embroidery’s intangible heritage, following a disabled boy’s journey to self-worth. Award-winning and critically acclaimed, it exemplifies HJC’s literary depth.

CaiGao’sWorks: From BlazingCity1938 to TheLittleMermaid, Cai’s diverse portfolio blends tradition with modernity. Her Andersen Award nomination underscores global appeal.

China’sIntangibleCultural HeritageSeries: This award-winning picture book series, publisheding, cultural knowledge, and crafts. HJC invites partners to co-develop a WorldIntangibleCulturalHeritage series, celebrating global traditions.

HJC remains committed to open collaboration, fostering crosscultural dialogue through events at major book fairs (Bologna, Frankfurt, Beijing, Shanghai etc.). By integrating Chinese childhood’s beauty into global narratives and sharing international gems domestically, HJC aims to nourish young minds worldwide. The publisher welcomes partnerships to advance children’s literature and safeguard humanity’s cultural treasures.

(Kang Qinxin, Director of International Department, Hunan Juvenile & Children’s Publishing House)

by Liping Xie

Foreign Language Teaching and Research Press (FLTRP),

Foreign Studies University (BFSU), has grown into a leading cultural and educational publishing organization in China. With a strong focus on foreign language and educational publishing, FLTRP has earned a stellar reputation worldwide through extensive international cooperation.

This legacy of excellence is reflected in ReadingJourney,

level reading series designed specifically for children aged 3 to 12 learning English as a foreign language. Published by FLTRP, this comprehensive program is the result of collaboration among nearly 100 professional authors from Europe and North America. Grounded in second language acquisition theories, Reading Journey focuses on vocabulary development and is meticulously structured to guide children from beginner levels to becoming confident, independent readers of authentic English works.

The program provides abundant, comprehensible language input, helping children build listening vocabulary, master phonics, and transition seamlessly to reading bridge books and chapter books. With a scientifically designed vocabulary progression, Reading Journey ensures that children can learn step by step while enjoying the process. Through engaging stories, children gain the skills and confidence to navigate the world of English reading with ease and joy.

What makes Reading Journey truly special is its perfect

combination of scientific methodology, systematic vocabulary development, and captivating content. The series covers a wide range of topics and themes that resonate with young readers, such as adventure and fantasy, and integrating subjects like nature, history, geography, and art. With delightful illustrations and exciting storylines, the program sparks children’s imaginations and fosters a lifelong passion for reading.

To further enrich the reading experience, Reading Journey incorporates audio recordings

dimensional and immersive learning experience. Children can read, listen, and explore, all while gaining new knowledge and cultivating critical and creative thinking skills.

Why ReadingJourney?

Scientifically Designed for Natural Learning: The program is grounded in the principles of second language acquisition, ensuring that children progress naturally and effectively through each stage of learning.

Growth: From 1,000 listening words to 5,000 reading words, the program provides a structured and systematic approach to building a strong vocabulary foundation.

Development of Creative and Critical Thinking: Through a carefully curated blend of fiction, themes, children are encouraged to think critically, explore creatively, and make meaningful connections between ideas.

A Wealth of Leveled Books for a Complete English Journey: With 312 books already published

and 188 more in development, this series offers an unparalleled breadth of reading material, immersing children in captivating stories and meaningful language input, allowing them to naturally master English just as they did with their first language!